ACT202: Management Accounting Assignment

VerifiedAdded on 2021/05/31

|24

|2209

|47

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING

MANAGEMENT ACCOUNTING

Name of the Student:

Name of the University:

Author’s Note:

MANAGEMENT ACCOUNTING

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

MANAGEMENT ACCOUNTING

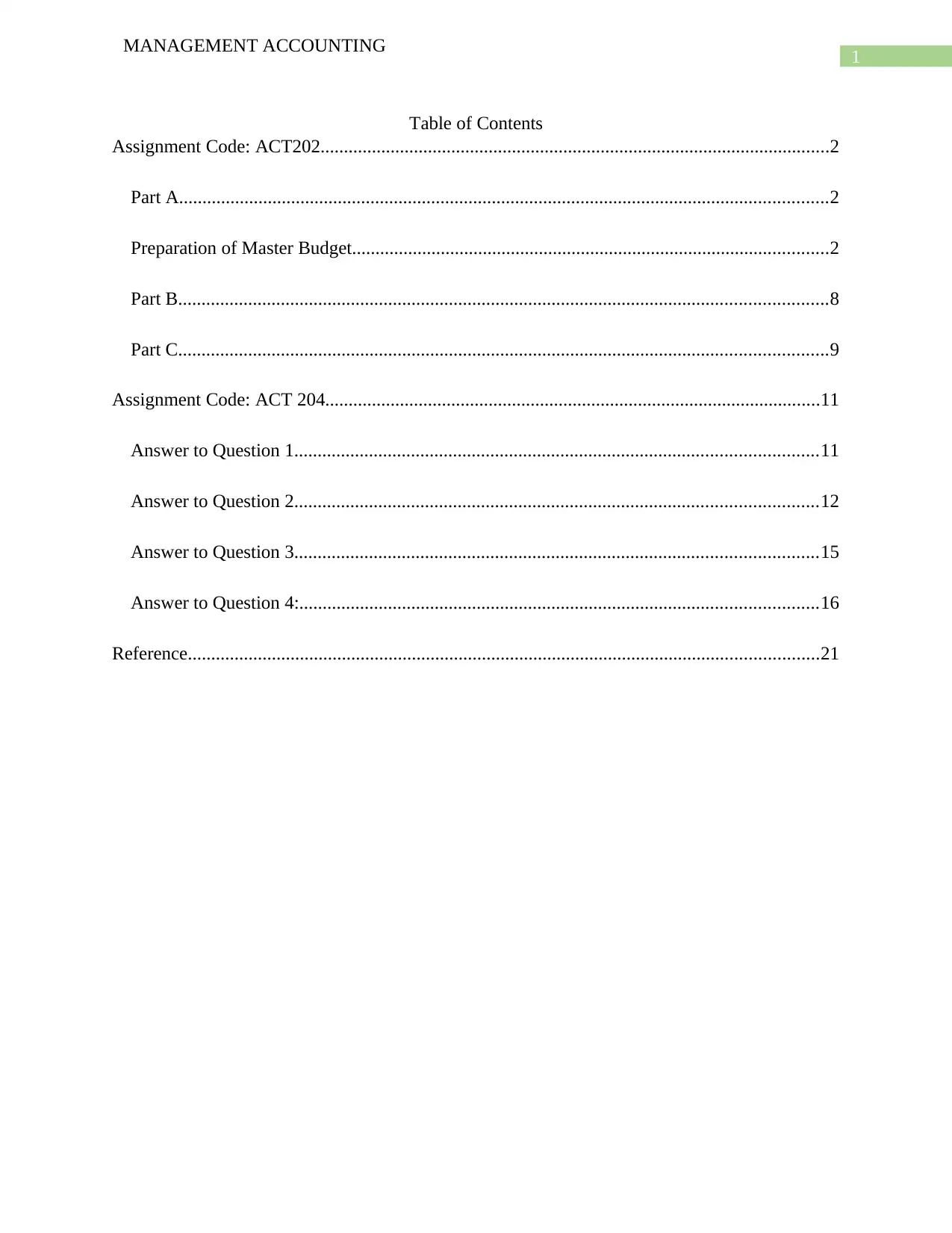

Table of Contents

Assignment Code: ACT202.............................................................................................................2

Part A...........................................................................................................................................2

Preparation of Master Budget......................................................................................................2

Part B...........................................................................................................................................8

Part C...........................................................................................................................................9

Assignment Code: ACT 204..........................................................................................................11

Answer to Question 1................................................................................................................11

Answer to Question 2................................................................................................................12

Answer to Question 3................................................................................................................15

Answer to Question 4:...............................................................................................................16

Reference.......................................................................................................................................21

MANAGEMENT ACCOUNTING

Table of Contents

Assignment Code: ACT202.............................................................................................................2

Part A...........................................................................................................................................2

Preparation of Master Budget......................................................................................................2

Part B...........................................................................................................................................8

Part C...........................................................................................................................................9

Assignment Code: ACT 204..........................................................................................................11

Answer to Question 1................................................................................................................11

Answer to Question 2................................................................................................................12

Answer to Question 3................................................................................................................15

Answer to Question 4:...............................................................................................................16

Reference.......................................................................................................................................21

2

MANAGEMENT ACCOUNTING

Assignment Code: ACT202

Part A

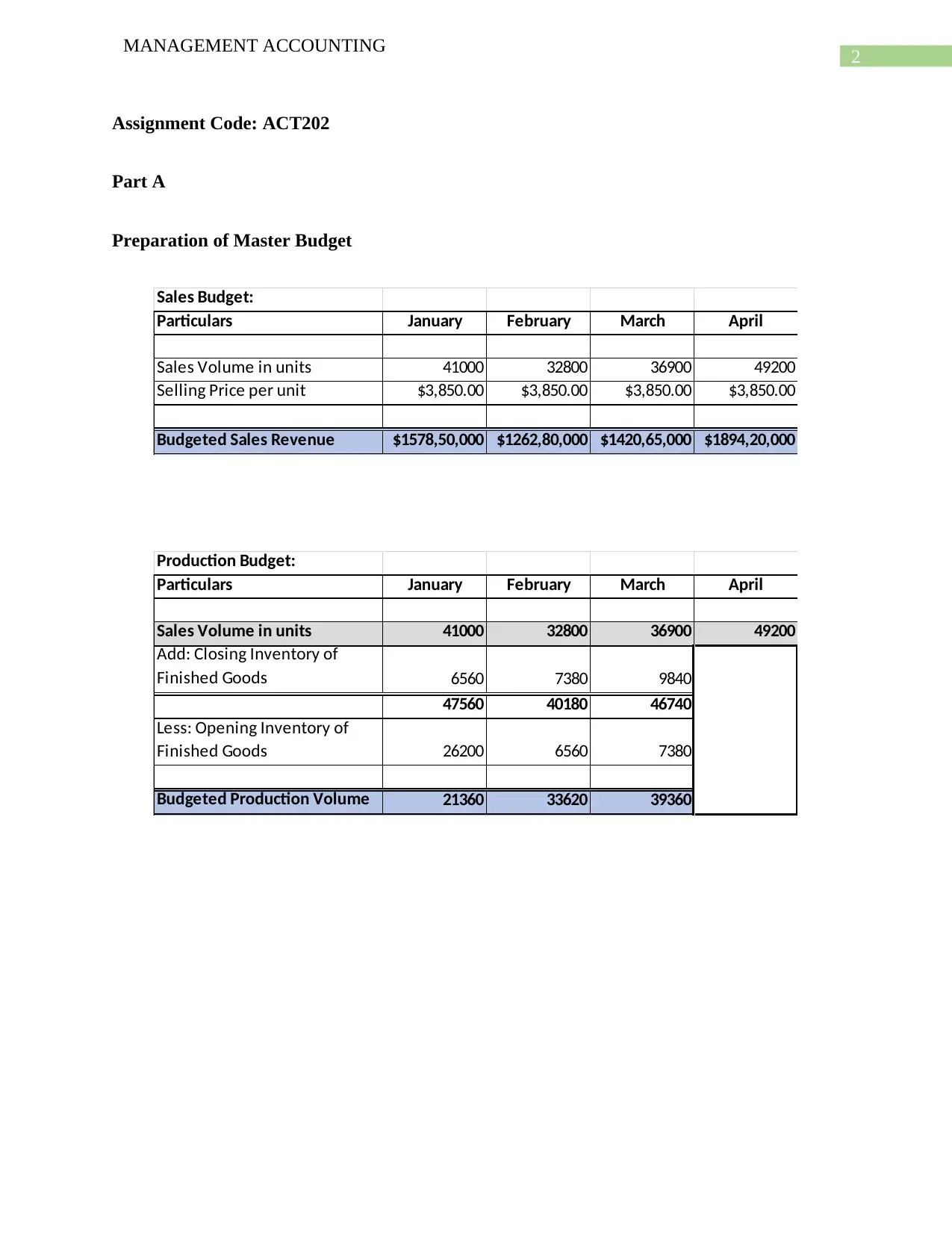

Preparation of Master Budget

Sales Budget:

Particulars January February March April

Sales Volume in units 41000 32800 36900 49200

Selling Price per unit $3,850.00 $3,850.00 $3,850.00 $3,850.00

Budgeted Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000 $1894,20,000

Production Budget:

Particulars January February March April

Sales Volume in units 41000 32800 36900 49200

Add: Closing Inventory of

Finished Goods 6560 7380 9840

47560 40180 46740

Less: Opening Inventory of

Finished Goods 26200 6560 7380

Budgeted Production Volume 21360 33620 39360

MANAGEMENT ACCOUNTING

Assignment Code: ACT202

Part A

Preparation of Master Budget

Sales Budget:

Particulars January February March April

Sales Volume in units 41000 32800 36900 49200

Selling Price per unit $3,850.00 $3,850.00 $3,850.00 $3,850.00

Budgeted Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000 $1894,20,000

Production Budget:

Particulars January February March April

Sales Volume in units 41000 32800 36900 49200

Add: Closing Inventory of

Finished Goods 6560 7380 9840

47560 40180 46740

Less: Opening Inventory of

Finished Goods 26200 6560 7380

Budgeted Production Volume 21360 33620 39360

3

MANAGEMENT ACCOUNTING

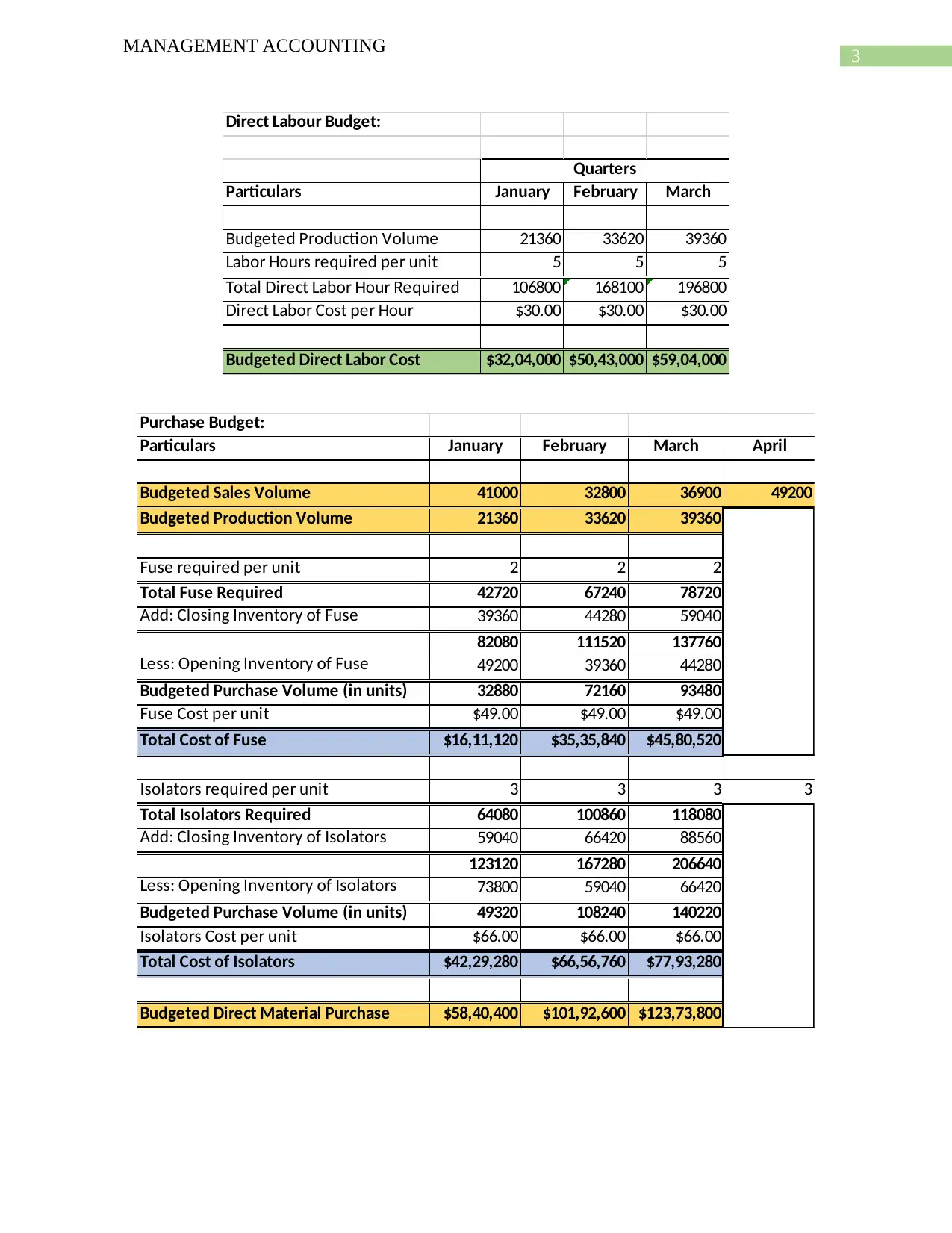

Direct Labour Budget:

Particulars January February March

Budgeted Production Volume 21360 33620 39360

Labor Hours required per unit 5 5 5

Total Direct Labor Hour Required 106800 168100 196800

Direct Labor Cost per Hour $30.00 $30.00 $30.00

Budgeted Direct Labor Cost $32,04,000 $50,43,000 $59,04,000

Quarters

Purchase Budget:

Particulars January February March April

Budgeted Sales Volume 41000 32800 36900 49200

Budgeted Production Volume 21360 33620 39360

Fuse required per unit 2 2 2

Total Fuse Required 42720 67240 78720

Add: Closing Inventory of Fuse 39360 44280 59040

82080 111520 137760

Less: Opening Inventory of Fuse 49200 39360 44280

Budgeted Purchase Volume (in units) 32880 72160 93480

Fuse Cost per unit $49.00 $49.00 $49.00

Total Cost of Fuse $16,11,120 $35,35,840 $45,80,520

Isolators required per unit 3 3 3 3

Total Isolators Required 64080 100860 118080

Add: Closing Inventory of Isolators 59040 66420 88560

123120 167280 206640

Less: Opening Inventory of Isolators 73800 59040 66420

Budgeted Purchase Volume (in units) 49320 108240 140220

Isolators Cost per unit $66.00 $66.00 $66.00

Total Cost of Isolators $42,29,280 $66,56,760 $77,93,280

Budgeted Direct Material Purchase $58,40,400 $101,92,600 $123,73,800

MANAGEMENT ACCOUNTING

Direct Labour Budget:

Particulars January February March

Budgeted Production Volume 21360 33620 39360

Labor Hours required per unit 5 5 5

Total Direct Labor Hour Required 106800 168100 196800

Direct Labor Cost per Hour $30.00 $30.00 $30.00

Budgeted Direct Labor Cost $32,04,000 $50,43,000 $59,04,000

Quarters

Purchase Budget:

Particulars January February March April

Budgeted Sales Volume 41000 32800 36900 49200

Budgeted Production Volume 21360 33620 39360

Fuse required per unit 2 2 2

Total Fuse Required 42720 67240 78720

Add: Closing Inventory of Fuse 39360 44280 59040

82080 111520 137760

Less: Opening Inventory of Fuse 49200 39360 44280

Budgeted Purchase Volume (in units) 32880 72160 93480

Fuse Cost per unit $49.00 $49.00 $49.00

Total Cost of Fuse $16,11,120 $35,35,840 $45,80,520

Isolators required per unit 3 3 3 3

Total Isolators Required 64080 100860 118080

Add: Closing Inventory of Isolators 59040 66420 88560

123120 167280 206640

Less: Opening Inventory of Isolators 73800 59040 66420

Budgeted Purchase Volume (in units) 49320 108240 140220

Isolators Cost per unit $66.00 $66.00 $66.00

Total Cost of Isolators $42,29,280 $66,56,760 $77,93,280

Budgeted Direct Material Purchase $58,40,400 $101,92,600 $123,73,800

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

MANAGEMENT ACCOUNTING

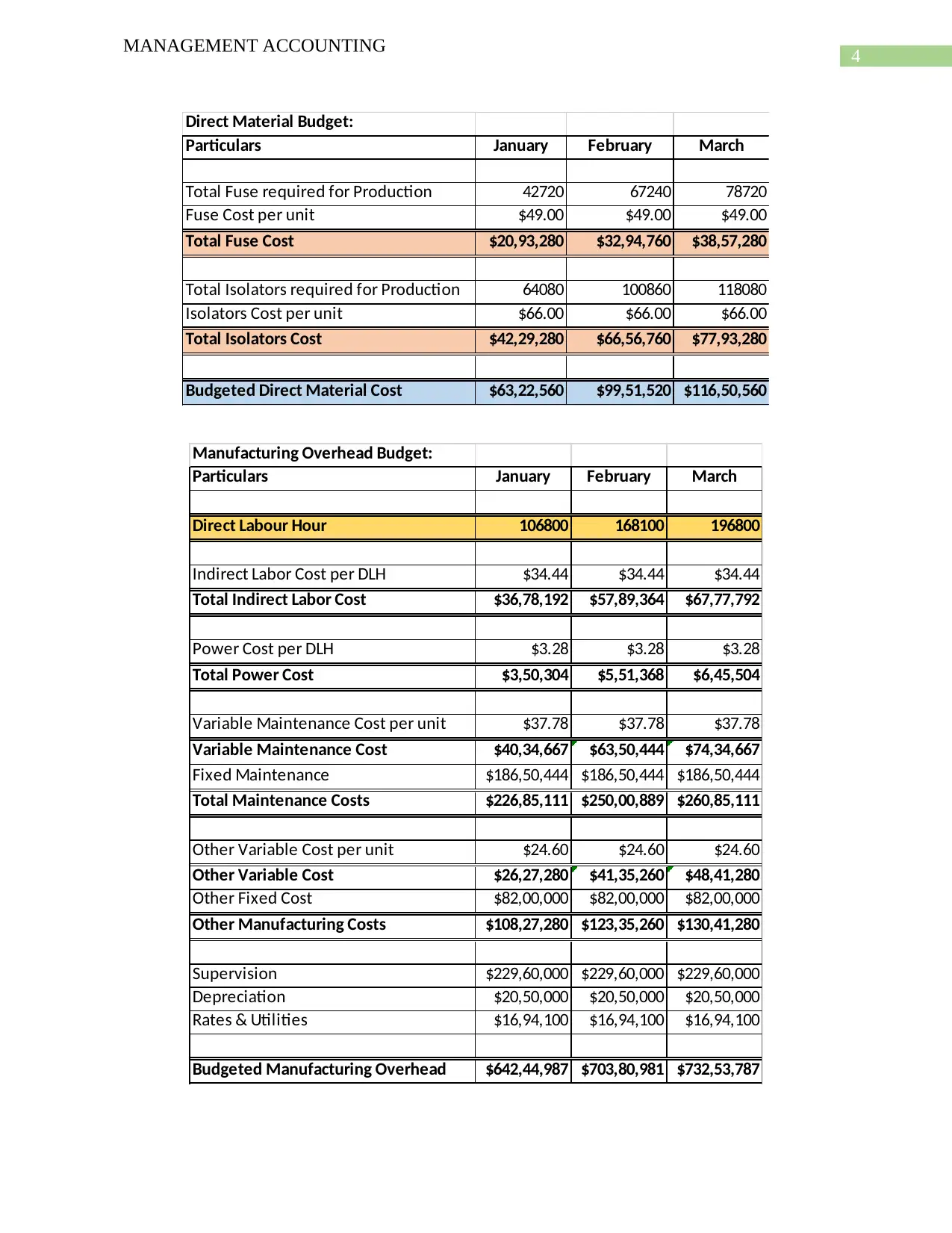

Direct Material Budget:

Particulars January February March

Total Fuse required for Production 42720 67240 78720

Fuse Cost per unit $49.00 $49.00 $49.00

Total Fuse Cost $20,93,280 $32,94,760 $38,57,280

Total Isolators required for Production 64080 100860 118080

Isolators Cost per unit $66.00 $66.00 $66.00

Total Isolators Cost $42,29,280 $66,56,760 $77,93,280

Budgeted Direct Material Cost $63,22,560 $99,51,520 $116,50,560

Manufacturing Overhead Budget:

Particulars January February March

Direct Labour Hour 106800 168100 196800

Indirect Labor Cost per DLH $34.44 $34.44 $34.44

Total Indirect Labor Cost $36,78,192 $57,89,364 $67,77,792

Power Cost per DLH $3.28 $3.28 $3.28

Total Power Cost $3,50,304 $5,51,368 $6,45,504

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $40,34,667 $63,50,444 $74,34,667

Fixed Maintenance $186,50,444 $186,50,444 $186,50,444

Total Maintenance Costs $226,85,111 $250,00,889 $260,85,111

Other Variable Cost per unit $24.60 $24.60 $24.60

Other Variable Cost $26,27,280 $41,35,260 $48,41,280

Other Fixed Cost $82,00,000 $82,00,000 $82,00,000

Other Manufacturing Costs $108,27,280 $123,35,260 $130,41,280

Supervision $229,60,000 $229,60,000 $229,60,000

Depreciation $20,50,000 $20,50,000 $20,50,000

Rates & Utilities $16,94,100 $16,94,100 $16,94,100

Budgeted Manufacturing Overhead $642,44,987 $703,80,981 $732,53,787

MANAGEMENT ACCOUNTING

Direct Material Budget:

Particulars January February March

Total Fuse required for Production 42720 67240 78720

Fuse Cost per unit $49.00 $49.00 $49.00

Total Fuse Cost $20,93,280 $32,94,760 $38,57,280

Total Isolators required for Production 64080 100860 118080

Isolators Cost per unit $66.00 $66.00 $66.00

Total Isolators Cost $42,29,280 $66,56,760 $77,93,280

Budgeted Direct Material Cost $63,22,560 $99,51,520 $116,50,560

Manufacturing Overhead Budget:

Particulars January February March

Direct Labour Hour 106800 168100 196800

Indirect Labor Cost per DLH $34.44 $34.44 $34.44

Total Indirect Labor Cost $36,78,192 $57,89,364 $67,77,792

Power Cost per DLH $3.28 $3.28 $3.28

Total Power Cost $3,50,304 $5,51,368 $6,45,504

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $40,34,667 $63,50,444 $74,34,667

Fixed Maintenance $186,50,444 $186,50,444 $186,50,444

Total Maintenance Costs $226,85,111 $250,00,889 $260,85,111

Other Variable Cost per unit $24.60 $24.60 $24.60

Other Variable Cost $26,27,280 $41,35,260 $48,41,280

Other Fixed Cost $82,00,000 $82,00,000 $82,00,000

Other Manufacturing Costs $108,27,280 $123,35,260 $130,41,280

Supervision $229,60,000 $229,60,000 $229,60,000

Depreciation $20,50,000 $20,50,000 $20,50,000

Rates & Utilities $16,94,100 $16,94,100 $16,94,100

Budgeted Manufacturing Overhead $642,44,987 $703,80,981 $732,53,787

5

MANAGEMENT ACCOUNTING

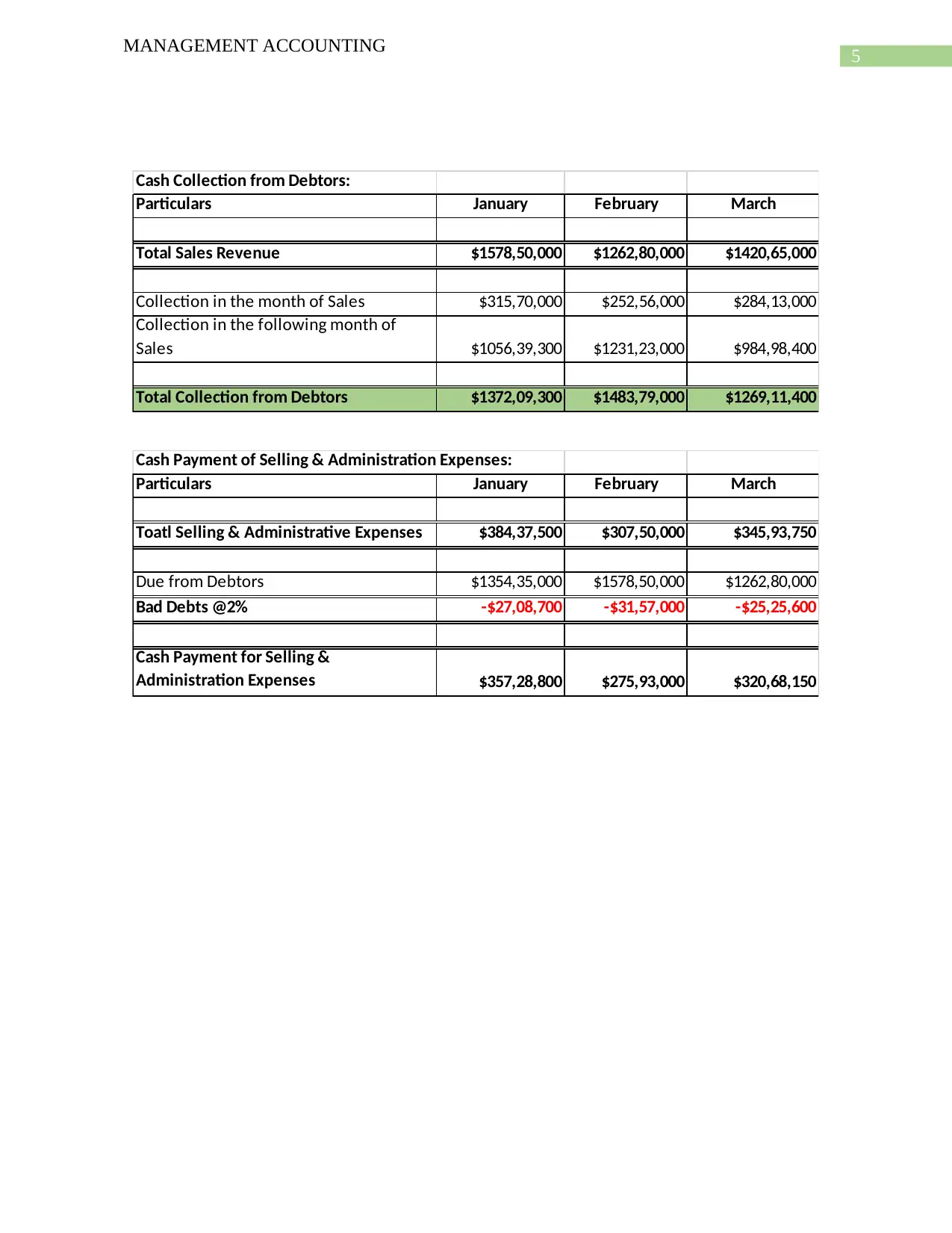

Cash Collection from Debtors:

Particulars January February March

Total Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000

Collection in the month of Sales $315,70,000 $252,56,000 $284,13,000

Collection in the following month of

Sales $1056,39,300 $1231,23,000 $984,98,400

Total Collection from Debtors $1372,09,300 $1483,79,000 $1269,11,400

Cash Payment of Selling & Administration Expenses:

Particulars January February March

Toatl Selling & Administrative Expenses $384,37,500 $307,50,000 $345,93,750

Due from Debtors $1354,35,000 $1578,50,000 $1262,80,000

Bad Debts @2% -$27,08,700 -$31,57,000 -$25,25,600

Cash Payment for Selling &

Administration Expenses $357,28,800 $275,93,000 $320,68,150

MANAGEMENT ACCOUNTING

Cash Collection from Debtors:

Particulars January February March

Total Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000

Collection in the month of Sales $315,70,000 $252,56,000 $284,13,000

Collection in the following month of

Sales $1056,39,300 $1231,23,000 $984,98,400

Total Collection from Debtors $1372,09,300 $1483,79,000 $1269,11,400

Cash Payment of Selling & Administration Expenses:

Particulars January February March

Toatl Selling & Administrative Expenses $384,37,500 $307,50,000 $345,93,750

Due from Debtors $1354,35,000 $1578,50,000 $1262,80,000

Bad Debts @2% -$27,08,700 -$31,57,000 -$25,25,600

Cash Payment for Selling &

Administration Expenses $357,28,800 $275,93,000 $320,68,150

6

MANAGEMENT ACCOUNTING

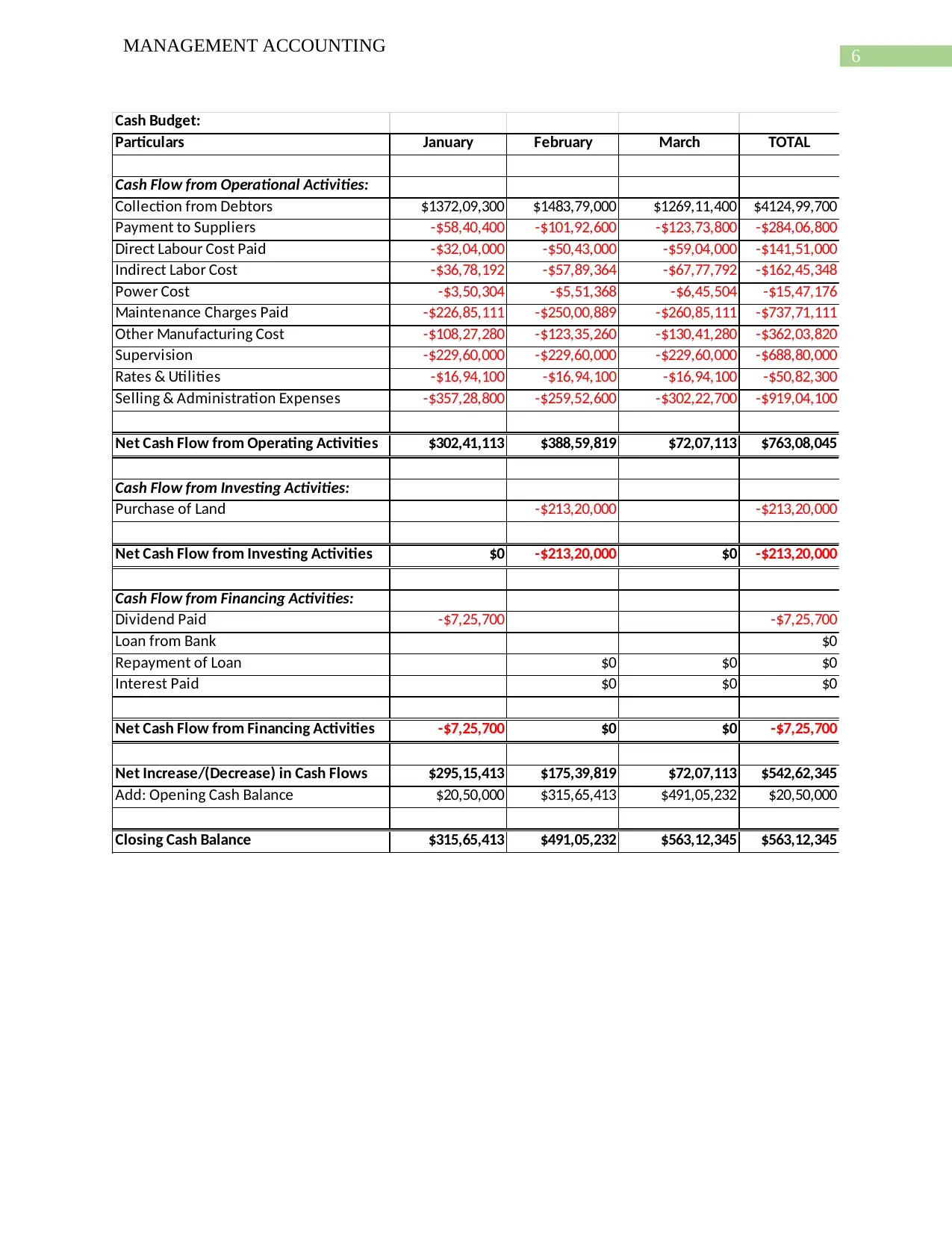

Cash Budget:

Particulars January February March TOTAL

Cash Flow from Operational Activities:

Collection from Debtors $1372,09,300 $1483,79,000 $1269,11,400 $4124,99,700

Payment to Suppliers -$58,40,400 -$101,92,600 -$123,73,800 -$284,06,800

Direct Labour Cost Paid -$32,04,000 -$50,43,000 -$59,04,000 -$141,51,000

Indirect Labor Cost -$36,78,192 -$57,89,364 -$67,77,792 -$162,45,348

Power Cost -$3,50,304 -$5,51,368 -$6,45,504 -$15,47,176

Maintenance Charges Paid -$226,85,111 -$250,00,889 -$260,85,111 -$737,71,111

Other Manufacturing Cost -$108,27,280 -$123,35,260 -$130,41,280 -$362,03,820

Supervision -$229,60,000 -$229,60,000 -$229,60,000 -$688,80,000

Rates & Utilities -$16,94,100 -$16,94,100 -$16,94,100 -$50,82,300

Selling & Administration Expenses -$357,28,800 -$259,52,600 -$302,22,700 -$919,04,100

Net Cash Flow from Operating Activities $302,41,113 $388,59,819 $72,07,113 $763,08,045

Cash Flow from Investing Activities:

Purchase of Land -$213,20,000 -$213,20,000

Net Cash Flow from Investing Activities $0 -$213,20,000 $0 -$213,20,000

Cash Flow from Financing Activities:

Dividend Paid -$7,25,700 -$7,25,700

Loan from Bank $0

Repayment of Loan $0 $0 $0

Interest Paid $0 $0 $0

Net Cash Flow from Financing Activities -$7,25,700 $0 $0 -$7,25,700

Net Increase/(Decrease) in Cash Flows $295,15,413 $175,39,819 $72,07,113 $542,62,345

Add: Opening Cash Balance $20,50,000 $315,65,413 $491,05,232 $20,50,000

Closing Cash Balance $315,65,413 $491,05,232 $563,12,345 $563,12,345

MANAGEMENT ACCOUNTING

Cash Budget:

Particulars January February March TOTAL

Cash Flow from Operational Activities:

Collection from Debtors $1372,09,300 $1483,79,000 $1269,11,400 $4124,99,700

Payment to Suppliers -$58,40,400 -$101,92,600 -$123,73,800 -$284,06,800

Direct Labour Cost Paid -$32,04,000 -$50,43,000 -$59,04,000 -$141,51,000

Indirect Labor Cost -$36,78,192 -$57,89,364 -$67,77,792 -$162,45,348

Power Cost -$3,50,304 -$5,51,368 -$6,45,504 -$15,47,176

Maintenance Charges Paid -$226,85,111 -$250,00,889 -$260,85,111 -$737,71,111

Other Manufacturing Cost -$108,27,280 -$123,35,260 -$130,41,280 -$362,03,820

Supervision -$229,60,000 -$229,60,000 -$229,60,000 -$688,80,000

Rates & Utilities -$16,94,100 -$16,94,100 -$16,94,100 -$50,82,300

Selling & Administration Expenses -$357,28,800 -$259,52,600 -$302,22,700 -$919,04,100

Net Cash Flow from Operating Activities $302,41,113 $388,59,819 $72,07,113 $763,08,045

Cash Flow from Investing Activities:

Purchase of Land -$213,20,000 -$213,20,000

Net Cash Flow from Investing Activities $0 -$213,20,000 $0 -$213,20,000

Cash Flow from Financing Activities:

Dividend Paid -$7,25,700 -$7,25,700

Loan from Bank $0

Repayment of Loan $0 $0 $0

Interest Paid $0 $0 $0

Net Cash Flow from Financing Activities -$7,25,700 $0 $0 -$7,25,700

Net Increase/(Decrease) in Cash Flows $295,15,413 $175,39,819 $72,07,113 $542,62,345

Add: Opening Cash Balance $20,50,000 $315,65,413 $491,05,232 $20,50,000

Closing Cash Balance $315,65,413 $491,05,232 $563,12,345 $563,12,345

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGEMENT ACCOUNTING

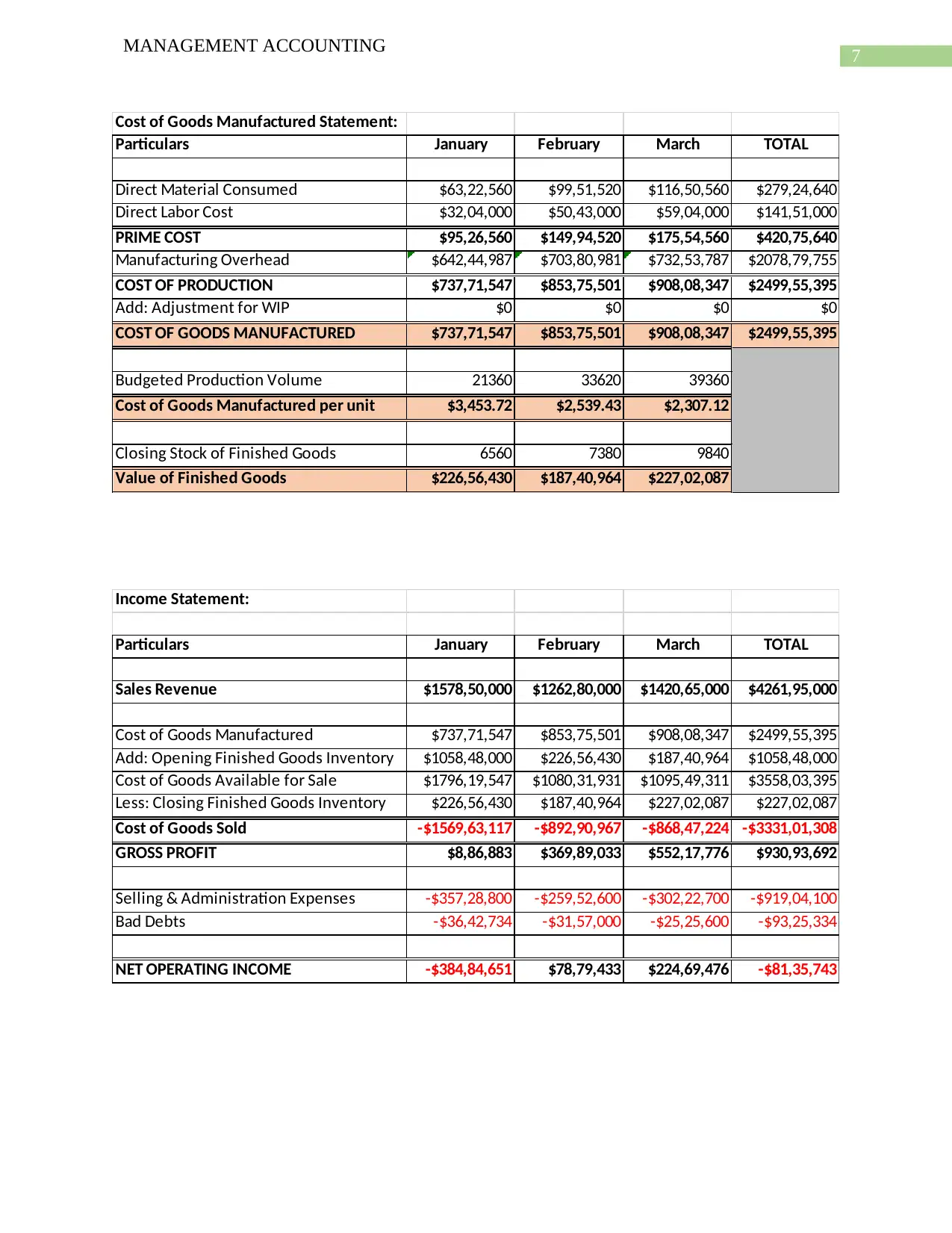

Cost of Goods Manufactured Statement:

Particulars January February March TOTAL

Direct Material Consumed $63,22,560 $99,51,520 $116,50,560 $279,24,640

Direct Labor Cost $32,04,000 $50,43,000 $59,04,000 $141,51,000

PRIME COST $95,26,560 $149,94,520 $175,54,560 $420,75,640

Manufacturing Overhead $642,44,987 $703,80,981 $732,53,787 $2078,79,755

COST OF PRODUCTION $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Add: Adjustment for WIP $0 $0 $0 $0

COST OF GOODS MANUFACTURED $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Budgeted Production Volume 21360 33620 39360

Cost of Goods Manufactured per unit $3,453.72 $2,539.43 $2,307.12

Closing Stock of Finished Goods 6560 7380 9840

Value of Finished Goods $226,56,430 $187,40,964 $227,02,087

Income Statement:

Particulars January February March TOTAL

Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000 $4261,95,000

Cost of Goods Manufactured $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Add: Opening Finished Goods Inventory $1058,48,000 $226,56,430 $187,40,964 $1058,48,000

Cost of Goods Available for Sale $1796,19,547 $1080,31,931 $1095,49,311 $3558,03,395

Less: Closing Finished Goods Inventory $226,56,430 $187,40,964 $227,02,087 $227,02,087

Cost of Goods Sold -$1569,63,117 -$892,90,967 -$868,47,224 -$3331,01,308

GROSS PROFIT $8,86,883 $369,89,033 $552,17,776 $930,93,692

Selling & Administration Expenses -$357,28,800 -$259,52,600 -$302,22,700 -$919,04,100

Bad Debts -$36,42,734 -$31,57,000 -$25,25,600 -$93,25,334

NET OPERATING INCOME -$384,84,651 $78,79,433 $224,69,476 -$81,35,743

MANAGEMENT ACCOUNTING

Cost of Goods Manufactured Statement:

Particulars January February March TOTAL

Direct Material Consumed $63,22,560 $99,51,520 $116,50,560 $279,24,640

Direct Labor Cost $32,04,000 $50,43,000 $59,04,000 $141,51,000

PRIME COST $95,26,560 $149,94,520 $175,54,560 $420,75,640

Manufacturing Overhead $642,44,987 $703,80,981 $732,53,787 $2078,79,755

COST OF PRODUCTION $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Add: Adjustment for WIP $0 $0 $0 $0

COST OF GOODS MANUFACTURED $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Budgeted Production Volume 21360 33620 39360

Cost of Goods Manufactured per unit $3,453.72 $2,539.43 $2,307.12

Closing Stock of Finished Goods 6560 7380 9840

Value of Finished Goods $226,56,430 $187,40,964 $227,02,087

Income Statement:

Particulars January February March TOTAL

Sales Revenue $1578,50,000 $1262,80,000 $1420,65,000 $4261,95,000

Cost of Goods Manufactured $737,71,547 $853,75,501 $908,08,347 $2499,55,395

Add: Opening Finished Goods Inventory $1058,48,000 $226,56,430 $187,40,964 $1058,48,000

Cost of Goods Available for Sale $1796,19,547 $1080,31,931 $1095,49,311 $3558,03,395

Less: Closing Finished Goods Inventory $226,56,430 $187,40,964 $227,02,087 $227,02,087

Cost of Goods Sold -$1569,63,117 -$892,90,967 -$868,47,224 -$3331,01,308

GROSS PROFIT $8,86,883 $369,89,033 $552,17,776 $930,93,692

Selling & Administration Expenses -$357,28,800 -$259,52,600 -$302,22,700 -$919,04,100

Bad Debts -$36,42,734 -$31,57,000 -$25,25,600 -$93,25,334

NET OPERATING INCOME -$384,84,651 $78,79,433 $224,69,476 -$81,35,743

8

MANAGEMENT ACCOUNTING

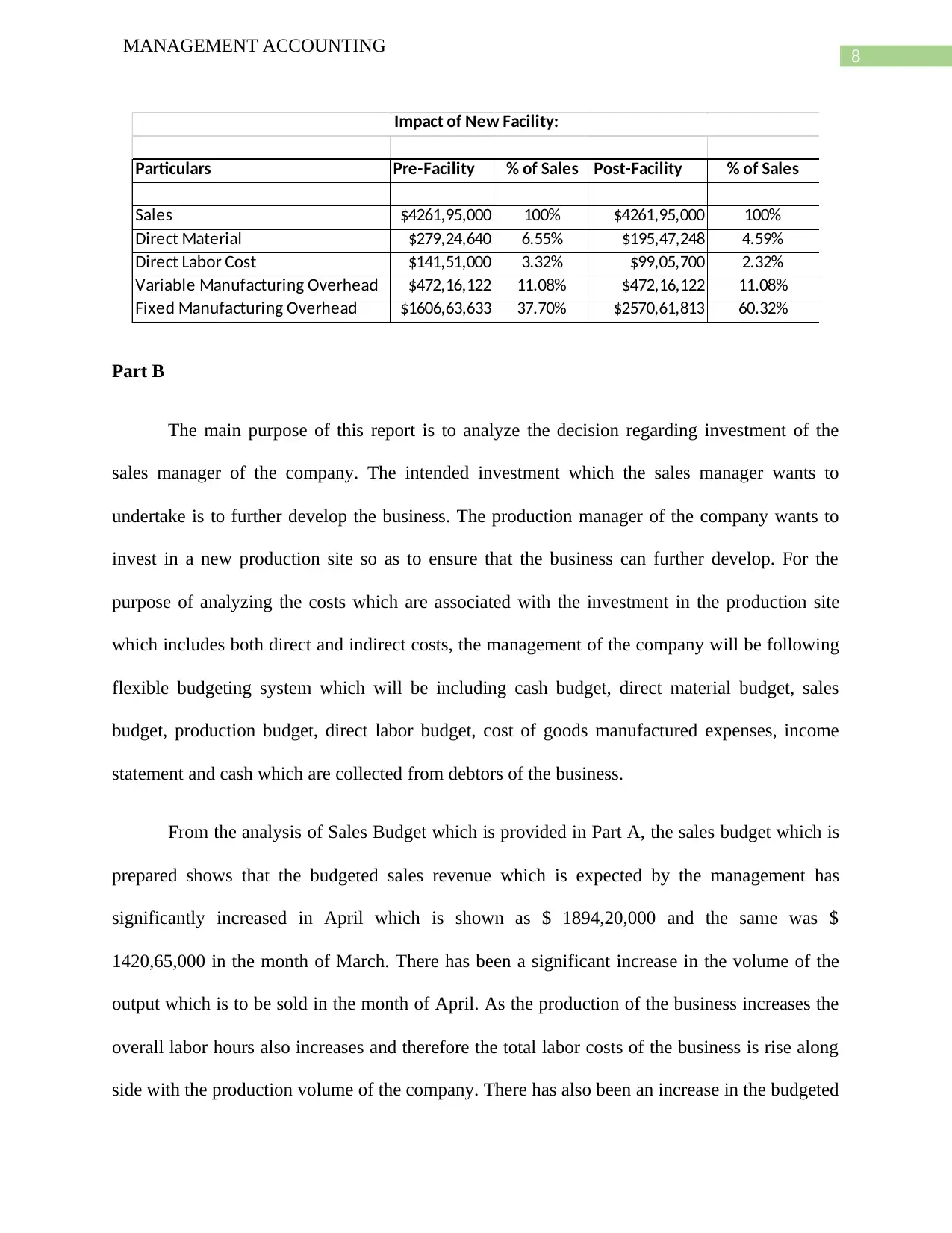

Particulars Pre-Facility % of Sales Post-Facility % of Sales

Sales $4261,95,000 100% $4261,95,000 100%

Direct Material $279,24,640 6.55% $195,47,248 4.59%

Direct Labor Cost $141,51,000 3.32% $99,05,700 2.32%

Variable Manufacturing Overhead $472,16,122 11.08% $472,16,122 11.08%

Fixed Manufacturing Overhead $1606,63,633 37.70% $2570,61,813 60.32%

Impact of New Facility:

Part B

The main purpose of this report is to analyze the decision regarding investment of the

sales manager of the company. The intended investment which the sales manager wants to

undertake is to further develop the business. The production manager of the company wants to

invest in a new production site so as to ensure that the business can further develop. For the

purpose of analyzing the costs which are associated with the investment in the production site

which includes both direct and indirect costs, the management of the company will be following

flexible budgeting system which will be including cash budget, direct material budget, sales

budget, production budget, direct labor budget, cost of goods manufactured expenses, income

statement and cash which are collected from debtors of the business.

From the analysis of Sales Budget which is provided in Part A, the sales budget which is

prepared shows that the budgeted sales revenue which is expected by the management has

significantly increased in April which is shown as $ 1894,20,000 and the same was $

1420,65,000 in the month of March. There has been a significant increase in the volume of the

output which is to be sold in the month of April. As the production of the business increases the

overall labor hours also increases and therefore the total labor costs of the business is rise along

side with the production volume of the company. There has also been an increase in the budgeted

MANAGEMENT ACCOUNTING

Particulars Pre-Facility % of Sales Post-Facility % of Sales

Sales $4261,95,000 100% $4261,95,000 100%

Direct Material $279,24,640 6.55% $195,47,248 4.59%

Direct Labor Cost $141,51,000 3.32% $99,05,700 2.32%

Variable Manufacturing Overhead $472,16,122 11.08% $472,16,122 11.08%

Fixed Manufacturing Overhead $1606,63,633 37.70% $2570,61,813 60.32%

Impact of New Facility:

Part B

The main purpose of this report is to analyze the decision regarding investment of the

sales manager of the company. The intended investment which the sales manager wants to

undertake is to further develop the business. The production manager of the company wants to

invest in a new production site so as to ensure that the business can further develop. For the

purpose of analyzing the costs which are associated with the investment in the production site

which includes both direct and indirect costs, the management of the company will be following

flexible budgeting system which will be including cash budget, direct material budget, sales

budget, production budget, direct labor budget, cost of goods manufactured expenses, income

statement and cash which are collected from debtors of the business.

From the analysis of Sales Budget which is provided in Part A, the sales budget which is

prepared shows that the budgeted sales revenue which is expected by the management has

significantly increased in April which is shown as $ 1894,20,000 and the same was $

1420,65,000 in the month of March. There has been a significant increase in the volume of the

output which is to be sold in the month of April. As the production of the business increases the

overall labor hours also increases and therefore the total labor costs of the business is rise along

side with the production volume of the company. There has also been an increase in the budgeted

9

MANAGEMENT ACCOUNTING

sales volume and budgeted production volume. The direct material budget shows that the total

fuse production has increased over the months and the consumption of direct material for the

month of March is Maximum. The manufacturing expenses which are predicted by the business

have also increased from January which was $ 642,44,987 and it is shown as $ 732,53,787 in the

month of march. The increase in the labor hours which are indirect in nature have contributed to

the increasing manufacturing overhead. It is estimated by the management that the management

will be selling its products in credit as well for which a suitable debtors collection policy is to be

adopted. However, it is estimated collection from debtors will take place a part in the\ month of

January and another part in the month of February. The cash budget which is prepared by the

management shows that the cash generated from operations has reduced in the month of March

which is shown as $ 72,07,113. The closing cash balance shows that the cash balance has

increased from $ 491,05,232 in February to $ 563,12,345 in the month of March. The income

statement which is prepared by the management in respect for month of January shows a

significant amount of loss and the aggregate results for the month of January, February and

March shows a loss figure of $ 81,35,743.

Even though some of the expenses are reduced, however the income statement shows that

the combined results for the first three months will bring about a loss on an aggregate. Therefore,

the business should not invest in the plan as it is not profitable.

Part C

Participative Budgets are prepared considering the people who are impacted or likely to

be impacted with the budget are involved in the preparation of the budget (Heinle, Ross and

Saouma 2013). The general benefits which a participatory budget has is reflected in the overall

MANAGEMENT ACCOUNTING

sales volume and budgeted production volume. The direct material budget shows that the total

fuse production has increased over the months and the consumption of direct material for the

month of March is Maximum. The manufacturing expenses which are predicted by the business

have also increased from January which was $ 642,44,987 and it is shown as $ 732,53,787 in the

month of march. The increase in the labor hours which are indirect in nature have contributed to

the increasing manufacturing overhead. It is estimated by the management that the management

will be selling its products in credit as well for which a suitable debtors collection policy is to be

adopted. However, it is estimated collection from debtors will take place a part in the\ month of

January and another part in the month of February. The cash budget which is prepared by the

management shows that the cash generated from operations has reduced in the month of March

which is shown as $ 72,07,113. The closing cash balance shows that the cash balance has

increased from $ 491,05,232 in February to $ 563,12,345 in the month of March. The income

statement which is prepared by the management in respect for month of January shows a

significant amount of loss and the aggregate results for the month of January, February and

March shows a loss figure of $ 81,35,743.

Even though some of the expenses are reduced, however the income statement shows that

the combined results for the first three months will bring about a loss on an aggregate. Therefore,

the business should not invest in the plan as it is not profitable.

Part C

Participative Budgets are prepared considering the people who are impacted or likely to

be impacted with the budget are involved in the preparation of the budget (Heinle, Ross and

Saouma 2013). The general benefits which a participatory budget has is reflected in the overall

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

MANAGEMENT ACCOUNTING

performance of the budget preparers. The implications which a participatory budget has on the

behavior is measured in terms of communication, goal congruence and motivation level of the

employees. The involvement of employees and collective collaboration in the preparation of the

budget is one of the major advantages of participatory budget (Derfuss 2016). Such type of

budgeting approach focuses on undesirable behavior prevention and encouraging congruence of

goals.

Imposed Budgeting Approach refers to the budgeting system which is imposed by the

senior management of the company and various performance standards and targets are

incorporated in such a budget. The basic calculations which are required in a budget are done by

the middle level and lower level management (Chohan and Jacobs 2017). The lower level

management and middle level management does not have any inputs in the budget preparation

process which is set by the top-level management.

From the above discussion it is clear that participative budgets are more effective in

addressing behavioral implications whereas imposed budgets is not much effective in this aspect

as there is not much two way communication between the top level management and even

between departments. Preparation of budget by involving staffs from lower to upper

management will help the management to produce an overall positive result.

MANAGEMENT ACCOUNTING

performance of the budget preparers. The implications which a participatory budget has on the

behavior is measured in terms of communication, goal congruence and motivation level of the

employees. The involvement of employees and collective collaboration in the preparation of the

budget is one of the major advantages of participatory budget (Derfuss 2016). Such type of

budgeting approach focuses on undesirable behavior prevention and encouraging congruence of

goals.

Imposed Budgeting Approach refers to the budgeting system which is imposed by the

senior management of the company and various performance standards and targets are

incorporated in such a budget. The basic calculations which are required in a budget are done by

the middle level and lower level management (Chohan and Jacobs 2017). The lower level

management and middle level management does not have any inputs in the budget preparation

process which is set by the top-level management.

From the above discussion it is clear that participative budgets are more effective in

addressing behavioral implications whereas imposed budgets is not much effective in this aspect

as there is not much two way communication between the top level management and even

between departments. Preparation of budget by involving staffs from lower to upper

management will help the management to produce an overall positive result.

11

MANAGEMENT ACCOUNTING

Assignment Code: ACT 204

Answer to Question 1

Requirement A

As per para 6 of AASB 136 “Impairment of Assets”, a cash generating unit may be

defined as the smallest group of assets which are identifiable which are capable of generating

cash and are independent from other groups of assets (Bond, Govendir and Wells 2016).

Requirement B

The impairment test for any asset requires comparison of the recoverable amount of asset

with higher of assets value in use and fair value from which the cost of disposals is excluded.

Value in use requires an accurate estimate of the future cash flows which can be derived

from the asset, expectations of the timings of the cash inflows and the price for bearing the

uncertainty inherent in the use of asset. It is to be considered that the cash flows are based on the

financial forecasts and budgets. The reason for conducting impairment tests on the basis of cash

generating units is because some assets are not able to generate cash flows independently unless

they are combined in a group (Baboukardos and Rimmel 2014). For example, in a dairy farm, a

milking machine and a machine which can separate milk from cream cannot generate cash flows

of their own unless they are used together for the production of some dairy product. The value in

use of such machinery us much greater than independent value that is if they are sold off

independently.

Requirement C

MANAGEMENT ACCOUNTING

Assignment Code: ACT 204

Answer to Question 1

Requirement A

As per para 6 of AASB 136 “Impairment of Assets”, a cash generating unit may be

defined as the smallest group of assets which are identifiable which are capable of generating

cash and are independent from other groups of assets (Bond, Govendir and Wells 2016).

Requirement B

The impairment test for any asset requires comparison of the recoverable amount of asset

with higher of assets value in use and fair value from which the cost of disposals is excluded.

Value in use requires an accurate estimate of the future cash flows which can be derived

from the asset, expectations of the timings of the cash inflows and the price for bearing the

uncertainty inherent in the use of asset. It is to be considered that the cash flows are based on the

financial forecasts and budgets. The reason for conducting impairment tests on the basis of cash

generating units is because some assets are not able to generate cash flows independently unless

they are combined in a group (Baboukardos and Rimmel 2014). For example, in a dairy farm, a

milking machine and a machine which can separate milk from cream cannot generate cash flows

of their own unless they are used together for the production of some dairy product. The value in

use of such machinery us much greater than independent value that is if they are sold off

independently.

Requirement C

12

MANAGEMENT ACCOUNTING

The factors which are to be considered by the Chief financial officer while determining a

CGU for Wentnor Dairy company are given below in point form:

The cash generating units will be identified from time period to period consistently for a

particular asset unless there are some changes.

The recognition of cash generating unit requires judgement on the part of the

management. It is mentioned in AASB 136 that if a recoverable amount of an asset

cannot be identified than the management should consider the recoverable amount of the

CGU (Capalbo 2013).

The role of the management in monitoring the operations of the entity such as product

liens, individual locations, district or regional area. The Chef financial offer is to decide

how would he classify the activities of the business which may be on the basis of factory,

dairy district or by product.

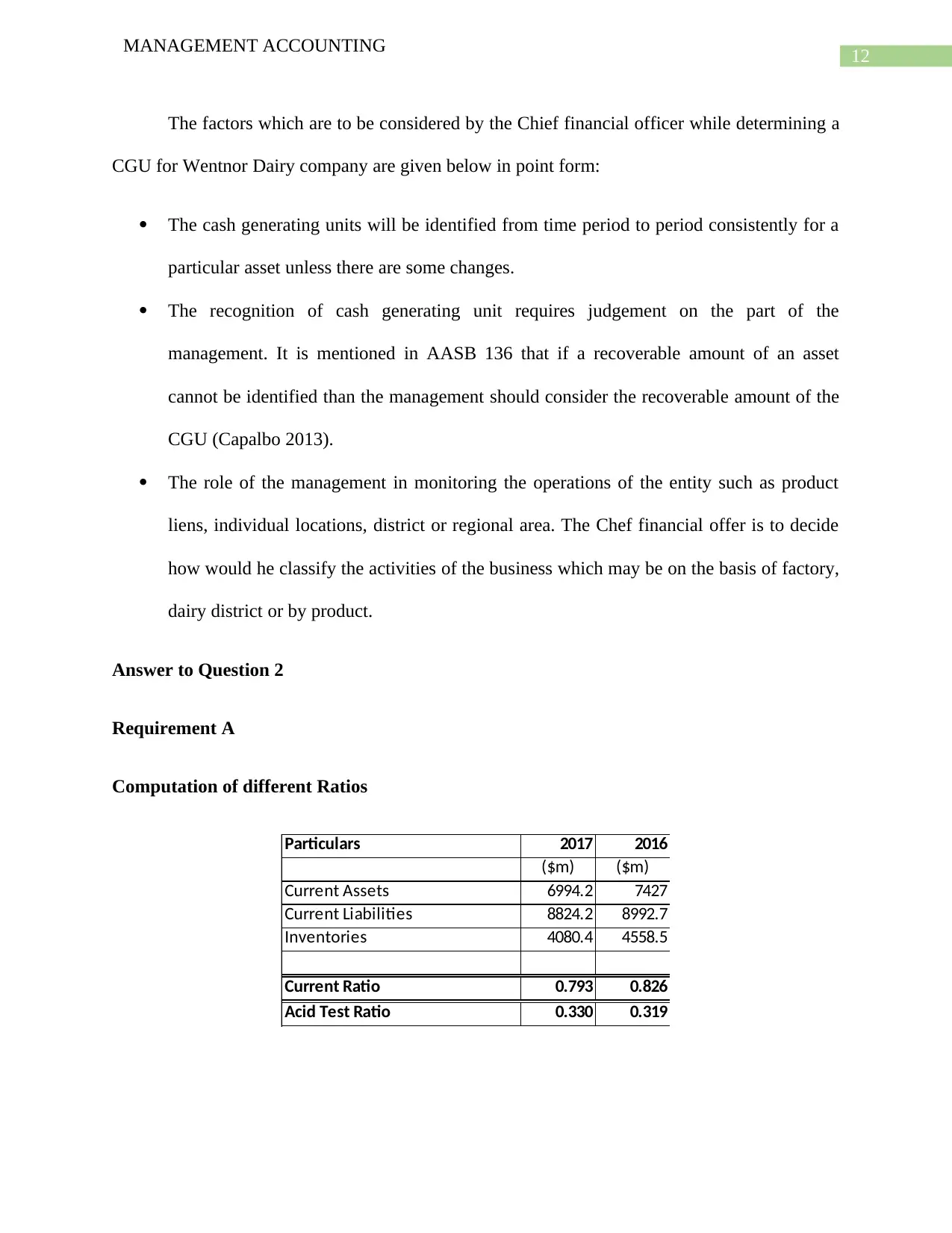

Answer to Question 2

Requirement A

Computation of different Ratios

Particulars 2017 2016

($m) ($m)

Current Assets 6994.2 7427

Current Liabilities 8824.2 8992.7

Inventories 4080.4 4558.5

Current Ratio 0.793 0.826

Acid Test Ratio 0.330 0.319

MANAGEMENT ACCOUNTING

The factors which are to be considered by the Chief financial officer while determining a

CGU for Wentnor Dairy company are given below in point form:

The cash generating units will be identified from time period to period consistently for a

particular asset unless there are some changes.

The recognition of cash generating unit requires judgement on the part of the

management. It is mentioned in AASB 136 that if a recoverable amount of an asset

cannot be identified than the management should consider the recoverable amount of the

CGU (Capalbo 2013).

The role of the management in monitoring the operations of the entity such as product

liens, individual locations, district or regional area. The Chef financial offer is to decide

how would he classify the activities of the business which may be on the basis of factory,

dairy district or by product.

Answer to Question 2

Requirement A

Computation of different Ratios

Particulars 2017 2016

($m) ($m)

Current Assets 6994.2 7427

Current Liabilities 8824.2 8992.7

Inventories 4080.4 4558.5

Current Ratio 0.793 0.826

Acid Test Ratio 0.330 0.319

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

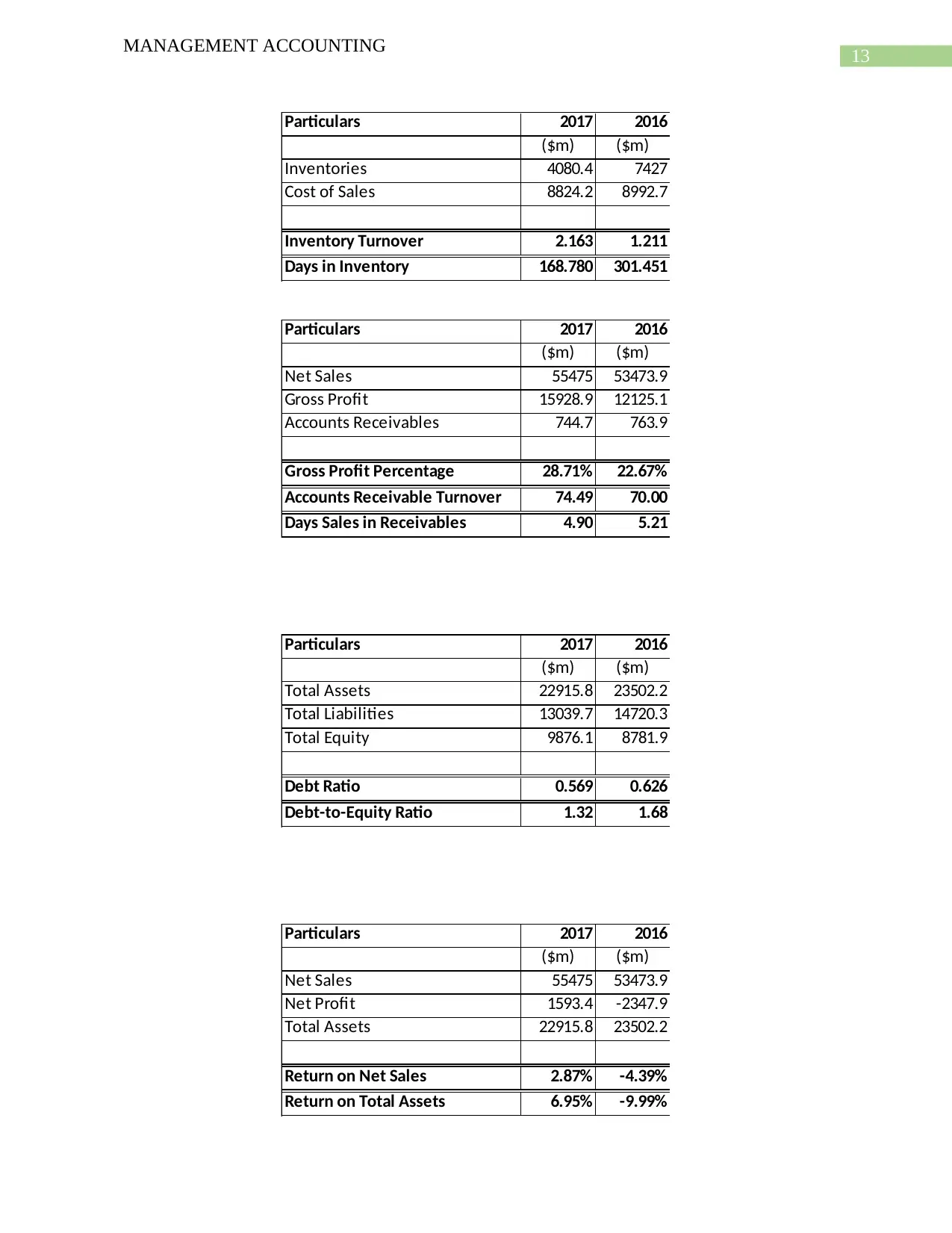

MANAGEMENT ACCOUNTING

Particulars 2017 2016

($m) ($m)

Inventories 4080.4 7427

Cost of Sales 8824.2 8992.7

Inventory Turnover 2.163 1.211

Days in Inventory 168.780 301.451

Particulars 2017 2016

($m) ($m)

Net Sales 55475 53473.9

Gross Profit 15928.9 12125.1

Accounts Receivables 744.7 763.9

Gross Profit Percentage 28.71% 22.67%

Accounts Receivable Turnover 74.49 70.00

Days Sales in Receivables 4.90 5.21

Particulars 2017 2016

($m) ($m)

Total Assets 22915.8 23502.2

Total Liabilities 13039.7 14720.3

Total Equity 9876.1 8781.9

Debt Ratio 0.569 0.626

Debt-to-Equity Ratio 1.32 1.68

Particulars 2017 2016

($m) ($m)

Net Sales 55475 53473.9

Net Profit 1593.4 -2347.9

Total Assets 22915.8 23502.2

Return on Net Sales 2.87% -4.39%

Return on Total Assets 6.95% -9.99%

MANAGEMENT ACCOUNTING

Particulars 2017 2016

($m) ($m)

Inventories 4080.4 7427

Cost of Sales 8824.2 8992.7

Inventory Turnover 2.163 1.211

Days in Inventory 168.780 301.451

Particulars 2017 2016

($m) ($m)

Net Sales 55475 53473.9

Gross Profit 15928.9 12125.1

Accounts Receivables 744.7 763.9

Gross Profit Percentage 28.71% 22.67%

Accounts Receivable Turnover 74.49 70.00

Days Sales in Receivables 4.90 5.21

Particulars 2017 2016

($m) ($m)

Total Assets 22915.8 23502.2

Total Liabilities 13039.7 14720.3

Total Equity 9876.1 8781.9

Debt Ratio 0.569 0.626

Debt-to-Equity Ratio 1.32 1.68

Particulars 2017 2016

($m) ($m)

Net Sales 55475 53473.9

Net Profit 1593.4 -2347.9

Total Assets 22915.8 23502.2

Return on Net Sales 2.87% -4.39%

Return on Total Assets 6.95% -9.99%

14

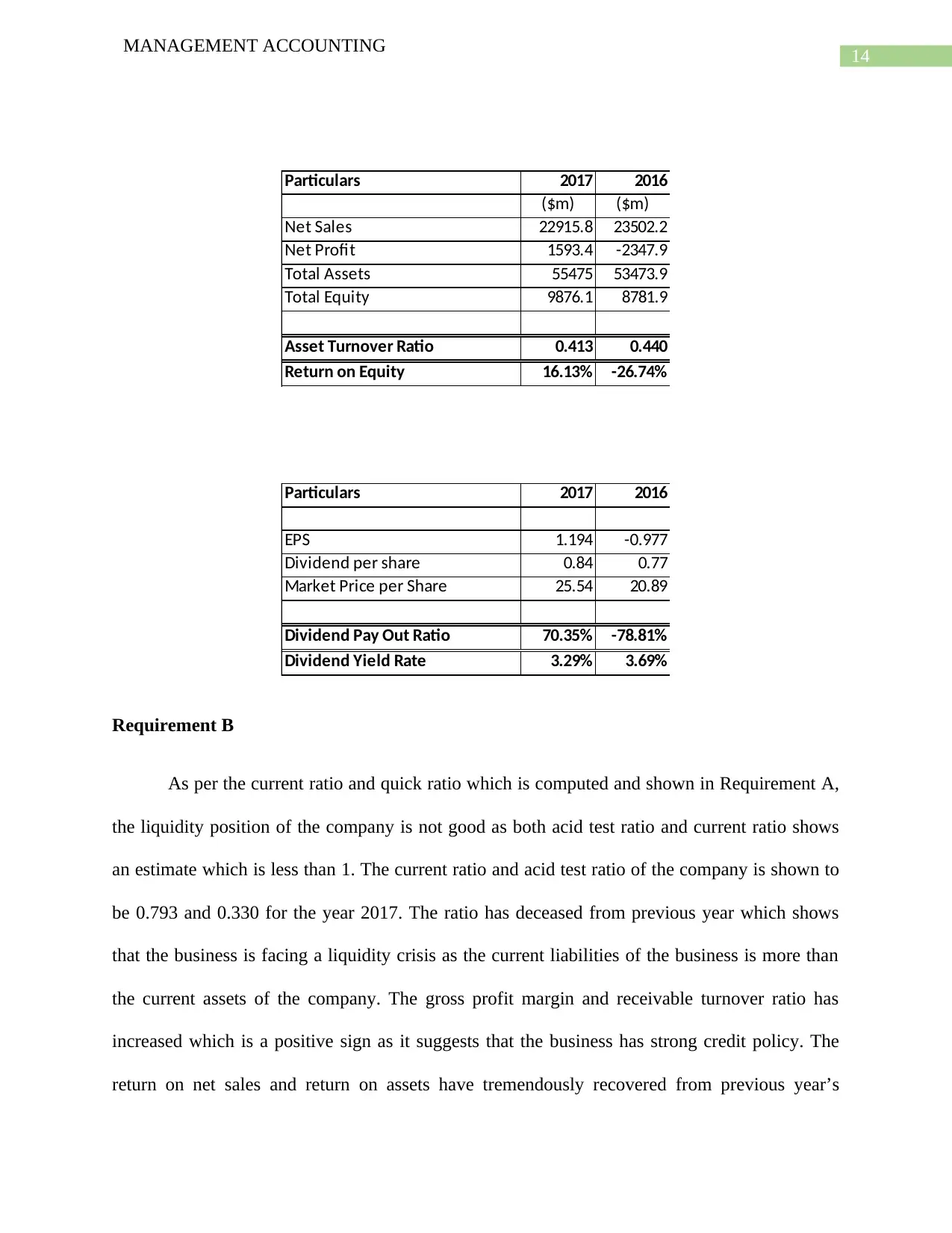

MANAGEMENT ACCOUNTING

Particulars 2017 2016

($m) ($m)

Net Sales 22915.8 23502.2

Net Profit 1593.4 -2347.9

Total Assets 55475 53473.9

Total Equity 9876.1 8781.9

Asset Turnover Ratio 0.413 0.440

Return on Equity 16.13% -26.74%

Particulars 2017 2016

EPS 1.194 -0.977

Dividend per share 0.84 0.77

Market Price per Share 25.54 20.89

Dividend Pay Out Ratio 70.35% -78.81%

Dividend Yield Rate 3.29% 3.69%

Requirement B

As per the current ratio and quick ratio which is computed and shown in Requirement A,

the liquidity position of the company is not good as both acid test ratio and current ratio shows

an estimate which is less than 1. The current ratio and acid test ratio of the company is shown to

be 0.793 and 0.330 for the year 2017. The ratio has deceased from previous year which shows

that the business is facing a liquidity crisis as the current liabilities of the business is more than

the current assets of the company. The gross profit margin and receivable turnover ratio has

increased which is a positive sign as it suggests that the business has strong credit policy. The

return on net sales and return on assets have tremendously recovered from previous year’s

MANAGEMENT ACCOUNTING

Particulars 2017 2016

($m) ($m)

Net Sales 22915.8 23502.2

Net Profit 1593.4 -2347.9

Total Assets 55475 53473.9

Total Equity 9876.1 8781.9

Asset Turnover Ratio 0.413 0.440

Return on Equity 16.13% -26.74%

Particulars 2017 2016

EPS 1.194 -0.977

Dividend per share 0.84 0.77

Market Price per Share 25.54 20.89

Dividend Pay Out Ratio 70.35% -78.81%

Dividend Yield Rate 3.29% 3.69%

Requirement B

As per the current ratio and quick ratio which is computed and shown in Requirement A,

the liquidity position of the company is not good as both acid test ratio and current ratio shows

an estimate which is less than 1. The current ratio and acid test ratio of the company is shown to

be 0.793 and 0.330 for the year 2017. The ratio has deceased from previous year which shows

that the business is facing a liquidity crisis as the current liabilities of the business is more than

the current assets of the company. The gross profit margin and receivable turnover ratio has

increased which is a positive sign as it suggests that the business has strong credit policy. The

return on net sales and return on assets have tremendously recovered from previous year’s

15

MANAGEMENT ACCOUNTING

estimate which suggest that the business has recovered from negative returns to appropriate and

favorable returns. The return on equity also shows favorable result for the year 2017 which

signifies that the business meets the need of the shareholders effectively. Thus, from the above

discussions it is clear that the business is favorable for making investments and the investor

should invest in the shares of the company (Al Karim and Alam 2013). The company however

needs to maintain and improve the liquidity position of the company and thereby ensure that the

business does not face any liquidity crisis. Thus, it can be said the investor should invest in the

shares of the company.

Requirement C

As per the computation of ratios which is shown in Requirement A, the current ratio and

the acid test ratio of the company shows that the business does not have favorable ratio for the

year 2017 which is shown as 0.793 and 0.330 respectively. The ratio does not match to the

standard which is considered to be ideal estimates which suggests that the business might be

facing liquidity problems (Delen, Kuzey and Uyar 2013).

Answer to Question 3

As per the para which is provided in the question, deals with the translation of foreign

currency in Australian dollars. The paragraph signifies that Qantas limited has engaged in

foreign trade during the year and thus in order to record the income the business needs to convert

the amount of foreign currency in Australian dollars (Machlup 2013). The most used technique

which is used for the purpose of translation is current rate method which is applied by most of

the companies (Pym 2014).

MANAGEMENT ACCOUNTING

estimate which suggest that the business has recovered from negative returns to appropriate and

favorable returns. The return on equity also shows favorable result for the year 2017 which

signifies that the business meets the need of the shareholders effectively. Thus, from the above

discussions it is clear that the business is favorable for making investments and the investor

should invest in the shares of the company (Al Karim and Alam 2013). The company however

needs to maintain and improve the liquidity position of the company and thereby ensure that the

business does not face any liquidity crisis. Thus, it can be said the investor should invest in the

shares of the company.

Requirement C

As per the computation of ratios which is shown in Requirement A, the current ratio and

the acid test ratio of the company shows that the business does not have favorable ratio for the

year 2017 which is shown as 0.793 and 0.330 respectively. The ratio does not match to the

standard which is considered to be ideal estimates which suggests that the business might be

facing liquidity problems (Delen, Kuzey and Uyar 2013).

Answer to Question 3

As per the para which is provided in the question, deals with the translation of foreign

currency in Australian dollars. The paragraph signifies that Qantas limited has engaged in

foreign trade during the year and thus in order to record the income the business needs to convert

the amount of foreign currency in Australian dollars (Machlup 2013). The most used technique

which is used for the purpose of translation is current rate method which is applied by most of

the companies (Pym 2014).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

MANAGEMENT ACCOUNTING

The reason due to which foreign exchange transaction arise is due to the fluctuation the

rate of foreign currency in terms of home currency. This may be due to a number of factors such

as governmental policies, inflation in home and foreign country and other factors as well. The

difference which arises due to translation is recorded in comprehensive income statement which

is prepared separately by companies and any gain arising from the same is transferred to foreign

currency translation reserve (Judge 2015).

MANAGEMENT ACCOUNTING

The reason due to which foreign exchange transaction arise is due to the fluctuation the

rate of foreign currency in terms of home currency. This may be due to a number of factors such

as governmental policies, inflation in home and foreign country and other factors as well. The

difference which arises due to translation is recorded in comprehensive income statement which

is prepared separately by companies and any gain arising from the same is transferred to foreign

currency translation reserve (Judge 2015).

17

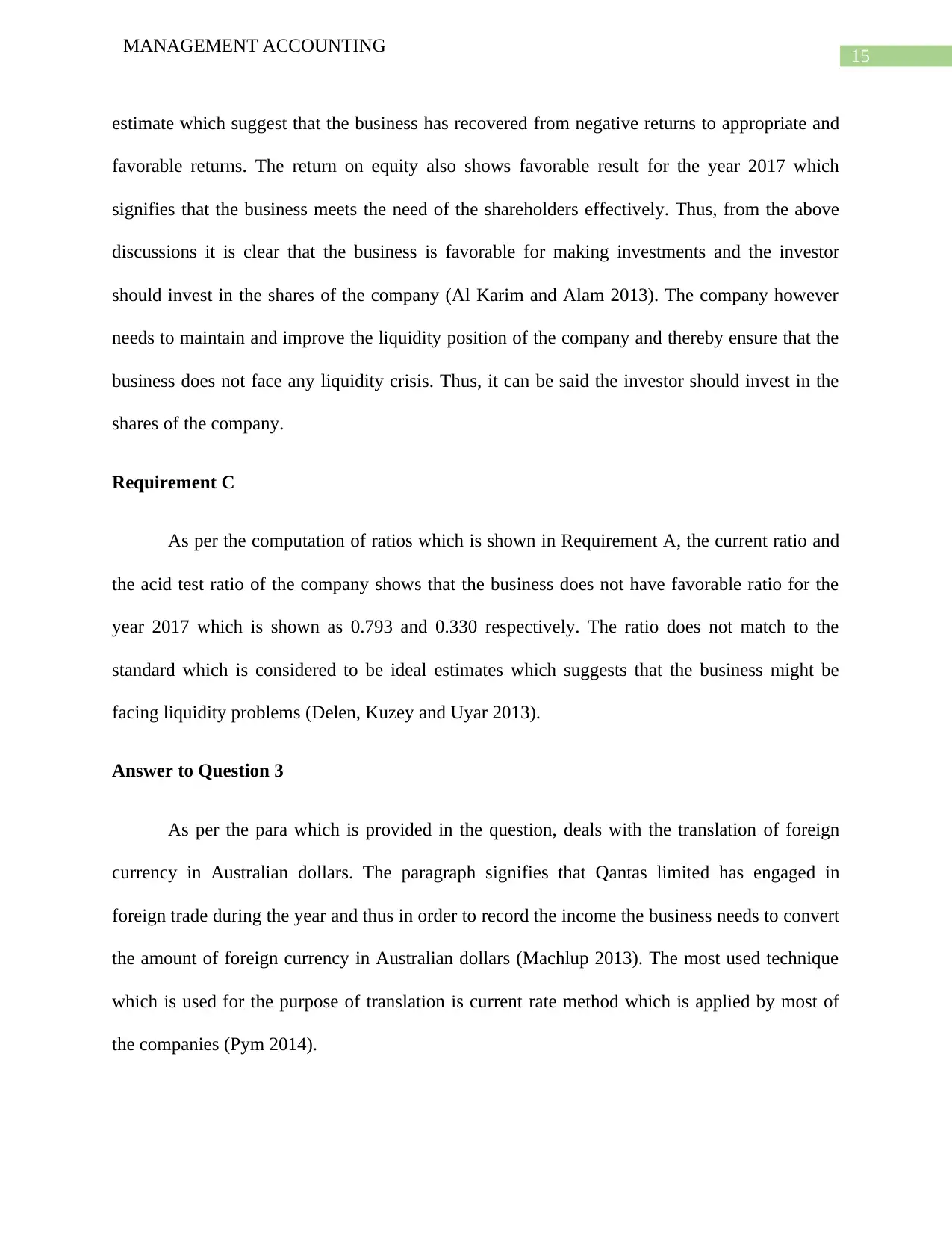

MANAGEMENT ACCOUNTING

Answer to Question 4:

Particulars Amount

Cash Flow from Operational Activities:

Cash Receipts from Debtors $2,45,341

Cash Payment to Suppliers -$1,23,156

Salaries & Wages Expenses -$1,29,852

Income Tax Paid -$4,532

Net Cash Flow from Operational Activities -$12,199

Cash Flow from Investing Activities:

Purchase of Plant -$24,180

Proceeds from Sale of Furniture $2,470

Net Cash Flow from Investing Activities -$21,710

Cash Flow from Financing Activities:

Issue of Shares $26,000

Dividend Paid -$10,400

Net Cash Flow from Financing Activities $15,600

Net Increase/(Decrease) in Cash Flow -$18,309

Add: Opening Balance of Cash & Cash Equivalent -$3,549

Closing Balance of Cash & Cash Equivalents -$21,858

In the books of Flash in the Pan Ltd.

Statement of Cash Flows

for the period ended 30th June 2019

Relevant Notes:

MANAGEMENT ACCOUNTING

Answer to Question 4:

Particulars Amount

Cash Flow from Operational Activities:

Cash Receipts from Debtors $2,45,341

Cash Payment to Suppliers -$1,23,156

Salaries & Wages Expenses -$1,29,852

Income Tax Paid -$4,532

Net Cash Flow from Operational Activities -$12,199

Cash Flow from Investing Activities:

Purchase of Plant -$24,180

Proceeds from Sale of Furniture $2,470

Net Cash Flow from Investing Activities -$21,710

Cash Flow from Financing Activities:

Issue of Shares $26,000

Dividend Paid -$10,400

Net Cash Flow from Financing Activities $15,600

Net Increase/(Decrease) in Cash Flow -$18,309

Add: Opening Balance of Cash & Cash Equivalent -$3,549

Closing Balance of Cash & Cash Equivalents -$21,858

In the books of Flash in the Pan Ltd.

Statement of Cash Flows

for the period ended 30th June 2019

Relevant Notes:

18

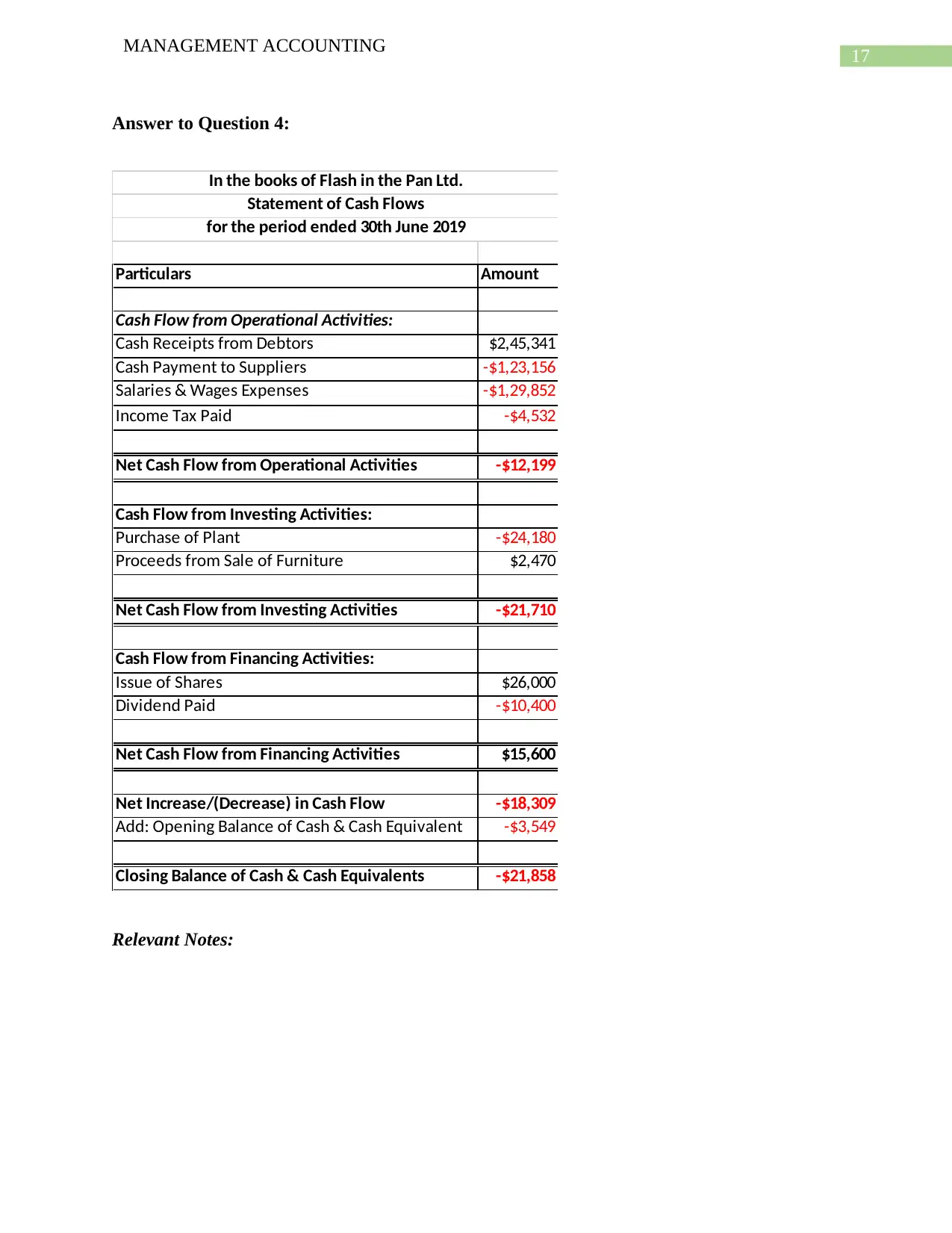

MANAGEMENT ACCOUNTING

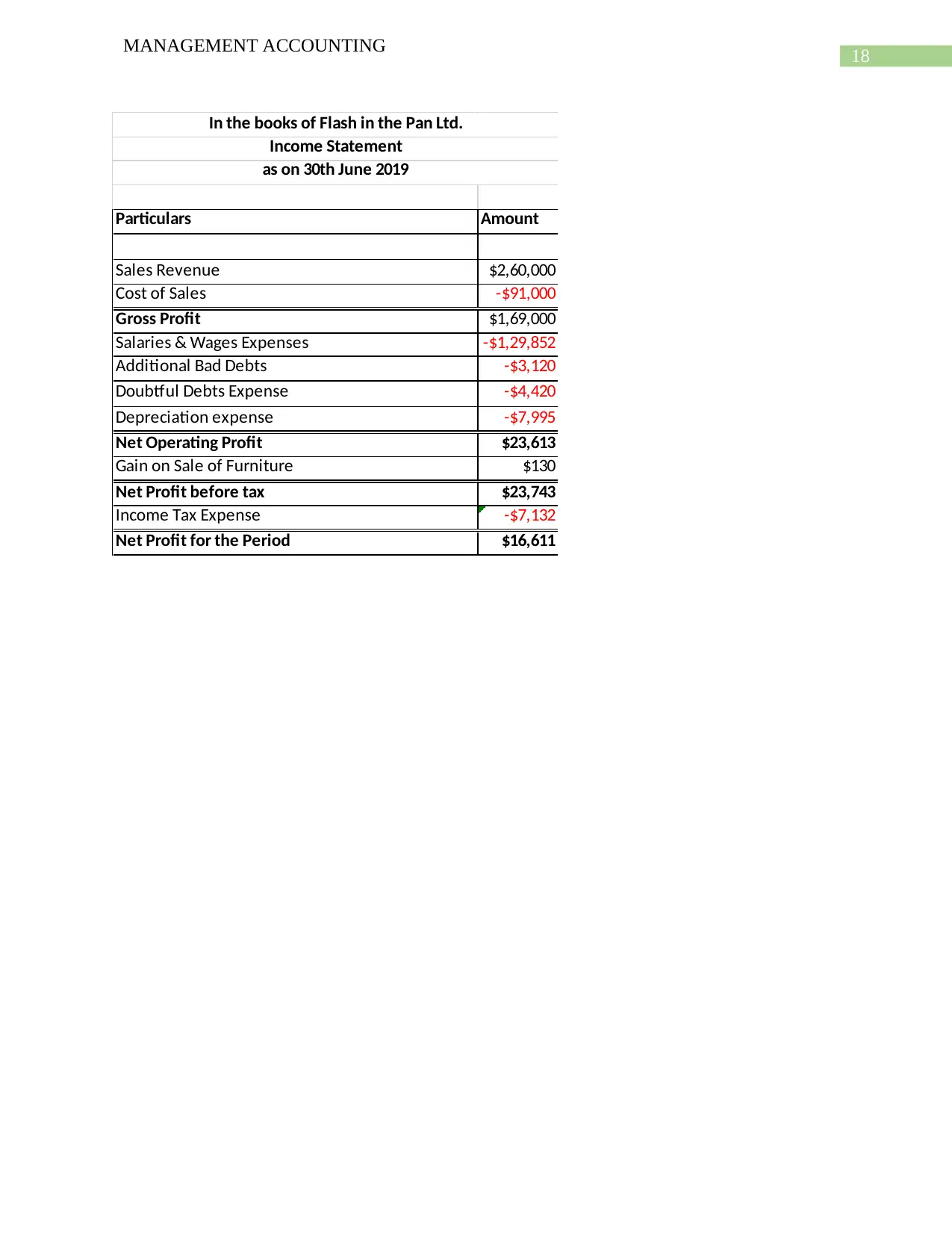

Particulars Amount

Sales Revenue $2,60,000

Cost of Sales -$91,000

Gross Profit $1,69,000

Salaries & Wages Expenses -$1,29,852

Additional Bad Debts -$3,120

Doubtful Debts Expense -$4,420

Depreciation expense -$7,995

Net Operating Profit $23,613

Gain on Sale of Furniture $130

Net Profit before tax $23,743

Income Tax Expense -$7,132

Net Profit for the Period $16,611

In the books of Flash in the Pan Ltd.

Income Statement

as on 30th June 2019

MANAGEMENT ACCOUNTING

Particulars Amount

Sales Revenue $2,60,000

Cost of Sales -$91,000

Gross Profit $1,69,000

Salaries & Wages Expenses -$1,29,852

Additional Bad Debts -$3,120

Doubtful Debts Expense -$4,420

Depreciation expense -$7,995

Net Operating Profit $23,613

Gain on Sale of Furniture $130

Net Profit before tax $23,743

Income Tax Expense -$7,132

Net Profit for the Period $16,611

In the books of Flash in the Pan Ltd.

Income Statement

as on 30th June 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

MANAGEMENT ACCOUNTING

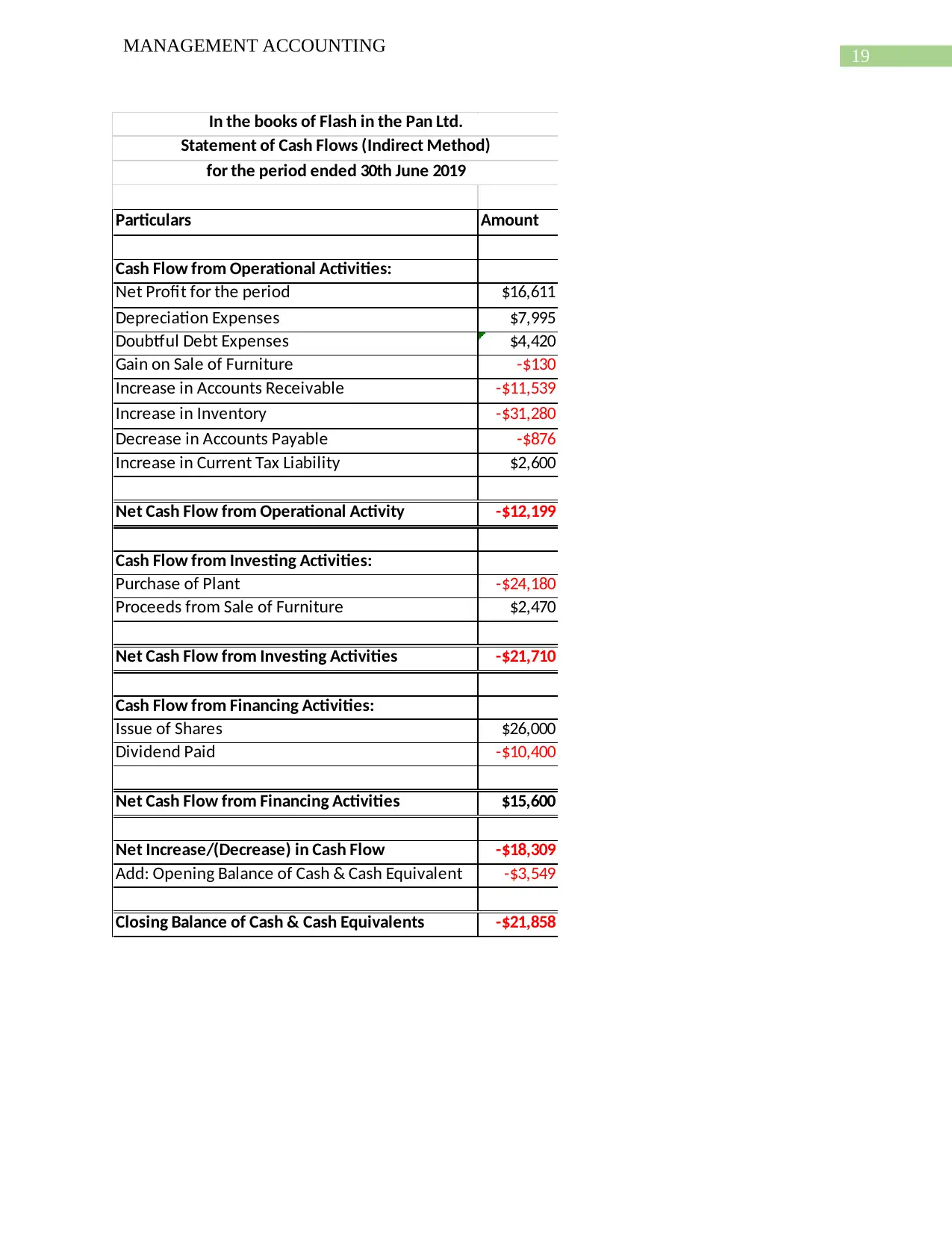

Particulars Amount

Cash Flow from Operational Activities:

Net Profit for the period $16,611

Depreciation Expenses $7,995

Doubtful Debt Expenses $4,420

Gain on Sale of Furniture -$130

Increase in Accounts Receivable -$11,539

Increase in Inventory -$31,280

Decrease in Accounts Payable -$876

Increase in Current Tax Liability $2,600

Net Cash Flow from Operational Activity -$12,199

Cash Flow from Investing Activities:

Purchase of Plant -$24,180

Proceeds from Sale of Furniture $2,470

Net Cash Flow from Investing Activities -$21,710

Cash Flow from Financing Activities:

Issue of Shares $26,000

Dividend Paid -$10,400

Net Cash Flow from Financing Activities $15,600

Net Increase/(Decrease) in Cash Flow -$18,309

Add: Opening Balance of Cash & Cash Equivalent -$3,549

Closing Balance of Cash & Cash Equivalents -$21,858

In the books of Flash in the Pan Ltd.

Statement of Cash Flows (Indirect Method)

for the period ended 30th June 2019

MANAGEMENT ACCOUNTING

Particulars Amount

Cash Flow from Operational Activities:

Net Profit for the period $16,611

Depreciation Expenses $7,995

Doubtful Debt Expenses $4,420

Gain on Sale of Furniture -$130

Increase in Accounts Receivable -$11,539

Increase in Inventory -$31,280

Decrease in Accounts Payable -$876

Increase in Current Tax Liability $2,600

Net Cash Flow from Operational Activity -$12,199

Cash Flow from Investing Activities:

Purchase of Plant -$24,180

Proceeds from Sale of Furniture $2,470

Net Cash Flow from Investing Activities -$21,710

Cash Flow from Financing Activities:

Issue of Shares $26,000

Dividend Paid -$10,400

Net Cash Flow from Financing Activities $15,600

Net Increase/(Decrease) in Cash Flow -$18,309

Add: Opening Balance of Cash & Cash Equivalent -$3,549

Closing Balance of Cash & Cash Equivalents -$21,858

In the books of Flash in the Pan Ltd.

Statement of Cash Flows (Indirect Method)

for the period ended 30th June 2019

20

MANAGEMENT ACCOUNTING

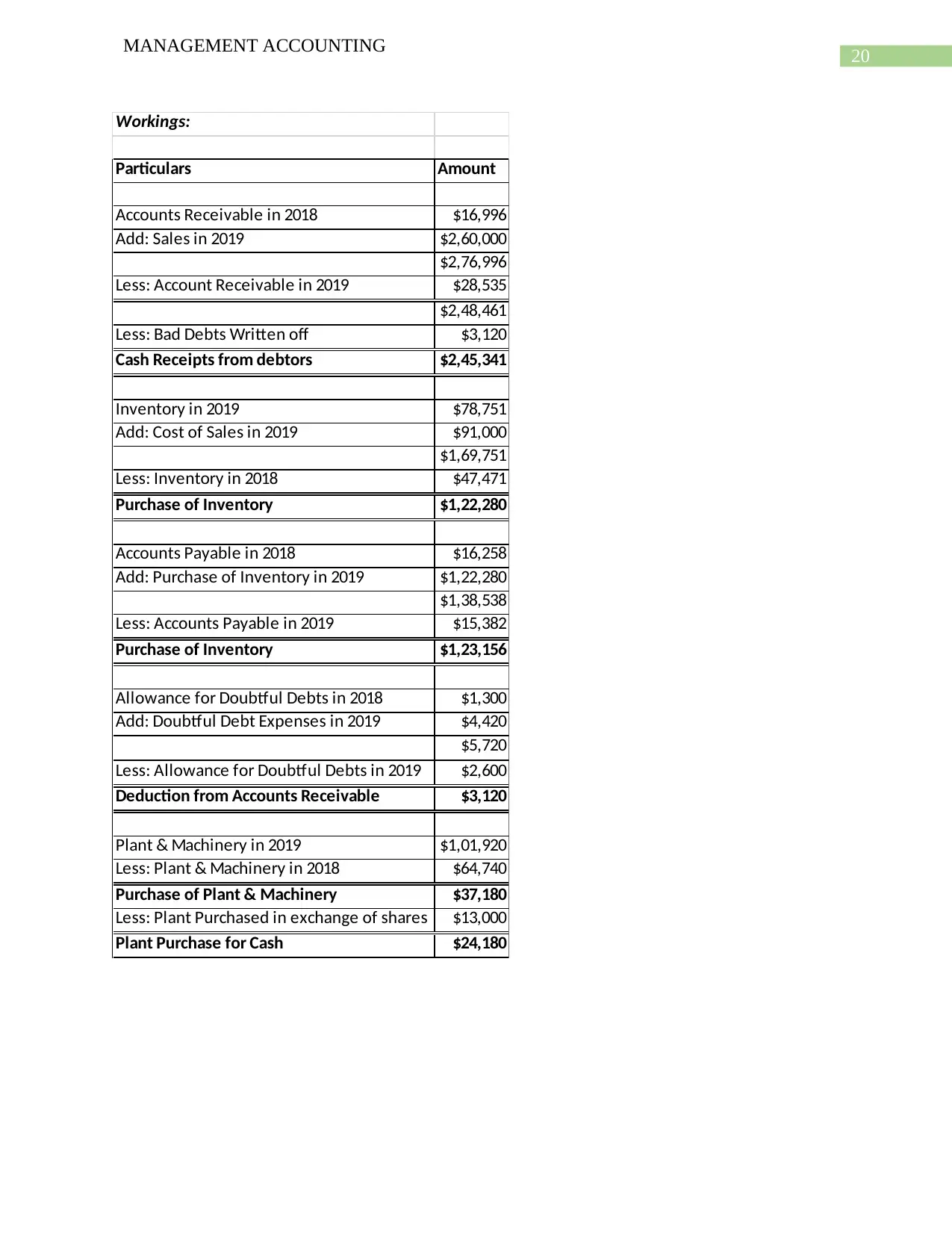

Workings:

Particulars Amount

Accounts Receivable in 2018 $16,996

Add: Sales in 2019 $2,60,000

$2,76,996

Less: Account Receivable in 2019 $28,535

$2,48,461

Less: Bad Debts Written off $3,120

Cash Receipts from debtors $2,45,341

Inventory in 2019 $78,751

Add: Cost of Sales in 2019 $91,000

$1,69,751

Less: Inventory in 2018 $47,471

Purchase of Inventory $1,22,280

Accounts Payable in 2018 $16,258

Add: Purchase of Inventory in 2019 $1,22,280

$1,38,538

Less: Accounts Payable in 2019 $15,382

Purchase of Inventory $1,23,156

Allowance for Doubtful Debts in 2018 $1,300

Add: Doubtful Debt Expenses in 2019 $4,420

$5,720

Less: Allowance for Doubtful Debts in 2019 $2,600

Deduction from Accounts Receivable $3,120

Plant & Machinery in 2019 $1,01,920

Less: Plant & Machinery in 2018 $64,740

Purchase of Plant & Machinery $37,180

Less: Plant Purchased in exchange of shares $13,000

Plant Purchase for Cash $24,180

MANAGEMENT ACCOUNTING

Workings:

Particulars Amount

Accounts Receivable in 2018 $16,996

Add: Sales in 2019 $2,60,000

$2,76,996

Less: Account Receivable in 2019 $28,535

$2,48,461

Less: Bad Debts Written off $3,120

Cash Receipts from debtors $2,45,341

Inventory in 2019 $78,751

Add: Cost of Sales in 2019 $91,000

$1,69,751

Less: Inventory in 2018 $47,471

Purchase of Inventory $1,22,280

Accounts Payable in 2018 $16,258

Add: Purchase of Inventory in 2019 $1,22,280

$1,38,538

Less: Accounts Payable in 2019 $15,382

Purchase of Inventory $1,23,156

Allowance for Doubtful Debts in 2018 $1,300

Add: Doubtful Debt Expenses in 2019 $4,420

$5,720

Less: Allowance for Doubtful Debts in 2019 $2,600

Deduction from Accounts Receivable $3,120

Plant & Machinery in 2019 $1,01,920

Less: Plant & Machinery in 2018 $64,740

Purchase of Plant & Machinery $37,180

Less: Plant Purchased in exchange of shares $13,000

Plant Purchase for Cash $24,180

21

MANAGEMENT ACCOUNTING

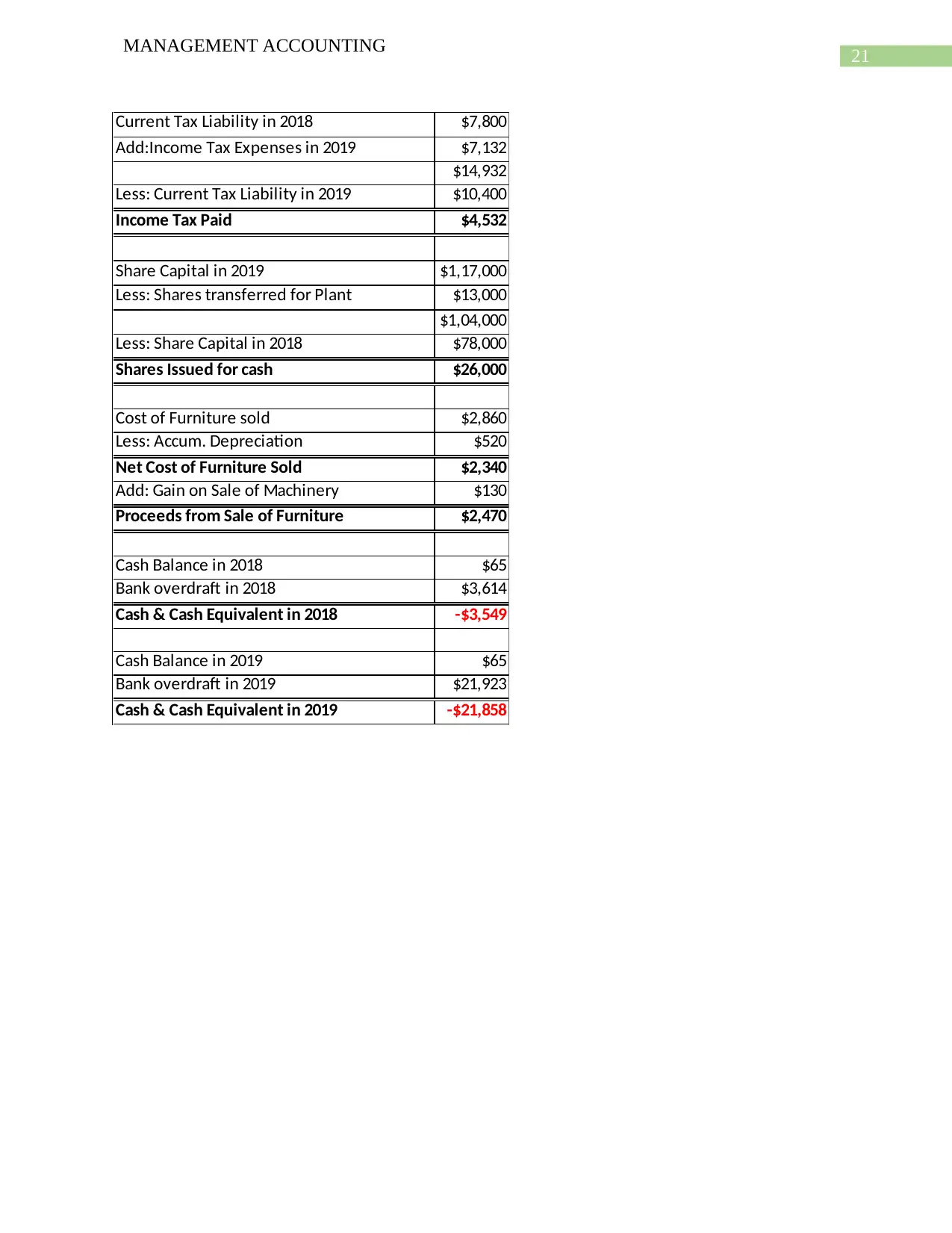

Current Tax Liability in 2018 $7,800

Add:Income Tax Expenses in 2019 $7,132

$14,932

Less: Current Tax Liability in 2019 $10,400

Income Tax Paid $4,532

Share Capital in 2019 $1,17,000

Less: Shares transferred for Plant $13,000

$1,04,000

Less: Share Capital in 2018 $78,000

Shares Issued for cash $26,000

Cost of Furniture sold $2,860

Less: Accum. Depreciation $520

Net Cost of Furniture Sold $2,340

Add: Gain on Sale of Machinery $130

Proceeds from Sale of Furniture $2,470

Cash Balance in 2018 $65

Bank overdraft in 2018 $3,614

Cash & Cash Equivalent in 2018 -$3,549

Cash Balance in 2019 $65

Bank overdraft in 2019 $21,923

Cash & Cash Equivalent in 2019 -$21,858

MANAGEMENT ACCOUNTING

Current Tax Liability in 2018 $7,800

Add:Income Tax Expenses in 2019 $7,132

$14,932

Less: Current Tax Liability in 2019 $10,400

Income Tax Paid $4,532

Share Capital in 2019 $1,17,000

Less: Shares transferred for Plant $13,000

$1,04,000

Less: Share Capital in 2018 $78,000

Shares Issued for cash $26,000

Cost of Furniture sold $2,860

Less: Accum. Depreciation $520

Net Cost of Furniture Sold $2,340

Add: Gain on Sale of Machinery $130

Proceeds from Sale of Furniture $2,470

Cash Balance in 2018 $65

Bank overdraft in 2018 $3,614

Cash & Cash Equivalent in 2018 -$3,549

Cash Balance in 2019 $65

Bank overdraft in 2019 $21,923

Cash & Cash Equivalent in 2019 -$21,858

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22

MANAGEMENT ACCOUNTING

Reference

Al Karim, R. and Alam, T., 2013. An evaluation of financial performance of private commercial

banks in Bangladesh: Ratio analysis. Journal of Business Studies Quarterly, 5(2), p.65.

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairments by Australian

firms and whether they were impacted by AASB 136. Accounting & Finance, 56(1), pp.259-288.

Chohan, U.W. and Jacobs, K., 2017. Public value as rhetoric: a budgeting approach.

International Journal of Public Administration, pp.1-11.

Heinle, M.S., Ross, N. and Saouma, R.E., 2013. A theory of participative budgeting. The

Accounting Review, 89(3), pp.1025-1050.

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and industry

influences. The British Accounting Review, 48(1), pp.17-37.

Capalbo, F., 2013. Impairment of Assets.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), pp.3970-3983.

Machlup, F., 2013. The theory of foreign exchanges. In International Monetary Economics (pp.

19-62). Routledge.

Pym, A., 2014. Method in translation history. Routledge.

Judge, A., 2015. The determinants of foreign currency hedging by UK non-financial firms.

MANAGEMENT ACCOUNTING

Reference

Al Karim, R. and Alam, T., 2013. An evaluation of financial performance of private commercial

banks in Bangladesh: Ratio analysis. Journal of Business Studies Quarterly, 5(2), p.65.

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairments by Australian

firms and whether they were impacted by AASB 136. Accounting & Finance, 56(1), pp.259-288.

Chohan, U.W. and Jacobs, K., 2017. Public value as rhetoric: a budgeting approach.

International Journal of Public Administration, pp.1-11.

Heinle, M.S., Ross, N. and Saouma, R.E., 2013. A theory of participative budgeting. The

Accounting Review, 89(3), pp.1025-1050.

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and industry

influences. The British Accounting Review, 48(1), pp.17-37.

Capalbo, F., 2013. Impairment of Assets.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), pp.3970-3983.

Machlup, F., 2013. The theory of foreign exchanges. In International Monetary Economics (pp.

19-62). Routledge.

Pym, A., 2014. Method in translation history. Routledge.

Judge, A., 2015. The determinants of foreign currency hedging by UK non-financial firms.

23

MANAGEMENT ACCOUNTING

Baboukardos, D. and Rimmel, G., 2014, March. Goodwill under IFRS: Relevance and

disclosures in an unfavorable environment. In Accounting Forum (Vol. 38, No. 1, pp. 1-17).

Elsevier.

MANAGEMENT ACCOUNTING

Baboukardos, D. and Rimmel, G., 2014, March. Goodwill under IFRS: Relevance and

disclosures in an unfavorable environment. In Accounting Forum (Vol. 38, No. 1, pp. 1-17).

Elsevier.

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.