Management Accounting Report: Financial Problem Solving for Toyota

VerifiedAdded on 2020/07/23

|16

|5048

|155

Report

AI Summary

This report delves into the realm of management accounting, exploring its significance and application within the context of Toyota Automotive. It begins by defining management accounting and highlighting the essential requirements of various management accounting systems, including cost accounting, job costing, process costing, and throughput accounting. The report then examines different methods used for management accounting reporting, such as cost reports, budget reporting, income statements, and account receivable reporting. Furthermore, it discusses absorption and marginal costing approaches, analyzing their implications for financial decision-making. The report also explores the advantages and disadvantages of different planning tools for budgetary control and investigates the adoption of management accounting systems to effectively respond to financial problems within the organization. The report is a comprehensive analysis of management accounting tools and techniques, offering insights into how Toyota can leverage these strategies to improve its financial performance and address its financial challenges.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P.1. Explain the management accounting and give he essential requirements of different kinds

of management accounting systems............................................................................................1

P.2. Different methods used for management accounting reporting...........................................4

TASK 2............................................................................................................................................6

P.3. Absorption and marginal costing approached .....................................................................6

TASK 3............................................................................................................................................8

P.4. Advantage and disadvantage of using different planning tools that could be used for

budgetary control at workplace...................................................................................................8

P.5. Adoption of management accounting systems to respond to financial problems..............10

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P.1. Explain the management accounting and give he essential requirements of different kinds

of management accounting systems............................................................................................1

P.2. Different methods used for management accounting reporting...........................................4

TASK 2............................................................................................................................................6

P.3. Absorption and marginal costing approached .....................................................................6

TASK 3............................................................................................................................................8

P.4. Advantage and disadvantage of using different planning tools that could be used for

budgetary control at workplace...................................................................................................8

P.5. Adoption of management accounting systems to respond to financial problems..............10

REFERENCES..............................................................................................................................13

INTRODUCTION

This research, define about to different kind of management accounting tools and

techniques which can be used for the business in order to resolve their financial problem

effectively and there are some of other financial issues which could also be removed efficiently.

Toyota automotive business need to different management accounting system which could use

for resolve manufacturing cost of the business effectively. We will discuss about to different

process used for management accounting reporting like budget reporting, income statement, job

costing reporting and account receivable reporting that can help to identify financial issues of

Toyota automotive business and also resolve them effectively. We will discuss marginal and

absorption approaches to identify proper expenses in the business and also find out the best

techniques to resolve them effectively. We will also discuss the different kinds of tools for

planning and their advantage and disadvantages as well. Ultimately, we will discuss about

various kind of management accounting system such as key performance indicators, balanced

score card and financial governance tools helps Toyota automotive company to effective

response their financial problems within the firm effectively.

TASK 1

P.1. Explain the management accounting and give he essential requirements of different kinds of

management accounting systems

To,

The General manager of Toyota Automotive, Japan. Date: 15th February 2018.

Sub: Management accounting systems and their significance.

Management accounting in which financial data of an organisation is measured, identified,

interpreted, analysed and communicated in the context of accomplishing company's financial

goals and objectives effectively (Zimmerman, and Yahya-Zadeh, 2011). This accounting

process is also concerned with cost accounting system. The major differences between cost

accounting and management accounting is that management accounting assist the

organisational manager by providing appropriate financial analytical information while major

decision making process within the firm. In addition, financial accounting provides proper

information about outside function of a company. The methodology of formulating

management accounting project and report is that furnish proper and faithful statistics analytical

1

This research, define about to different kind of management accounting tools and

techniques which can be used for the business in order to resolve their financial problem

effectively and there are some of other financial issues which could also be removed efficiently.

Toyota automotive business need to different management accounting system which could use

for resolve manufacturing cost of the business effectively. We will discuss about to different

process used for management accounting reporting like budget reporting, income statement, job

costing reporting and account receivable reporting that can help to identify financial issues of

Toyota automotive business and also resolve them effectively. We will discuss marginal and

absorption approaches to identify proper expenses in the business and also find out the best

techniques to resolve them effectively. We will also discuss the different kinds of tools for

planning and their advantage and disadvantages as well. Ultimately, we will discuss about

various kind of management accounting system such as key performance indicators, balanced

score card and financial governance tools helps Toyota automotive company to effective

response their financial problems within the firm effectively.

TASK 1

P.1. Explain the management accounting and give he essential requirements of different kinds of

management accounting systems

To,

The General manager of Toyota Automotive, Japan. Date: 15th February 2018.

Sub: Management accounting systems and their significance.

Management accounting in which financial data of an organisation is measured, identified,

interpreted, analysed and communicated in the context of accomplishing company's financial

goals and objectives effectively (Zimmerman, and Yahya-Zadeh, 2011). This accounting

process is also concerned with cost accounting system. The major differences between cost

accounting and management accounting is that management accounting assist the

organisational manager by providing appropriate financial analytical information while major

decision making process within the firm. In addition, financial accounting provides proper

information about outside function of a company. The methodology of formulating

management accounting project and report is that furnish proper and faithful statistics analytical

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

approach and financial data which is needed for company's manager to set up to daily and short

term decisions of a firm. Toyota automotive business can utilise of management accounting

approaches to reduce its manufacturing and services cost within the business effectively.

Moreover, basically accounting is a process in which financial and economic data is recognised,

measured and communicated to make better decision and opinion to the manager of Toyota

automotive corporation in terms of making their decision towards the organisational

manufacturing and other cost reduction efficiently.

There are important requirements of different kinds of management accounting system Cost accounting system: Cost accounting system is also called costing system which is

used by most of manufacturing companies in order to formulate outline by approximate

the cost of their production for inventory assessment, profit examination and over

costing control on production and service cost of the business. In this cost accounting

approach, portion of costing is functioning on exercise based cost accounting system

and traditional approach of costing system as well (Macintosh and Quattrone, 2010).

Cost accounting is an approach in which organisational production cost is computed by

which calculating cost of each input production cost and fixed cost such as capital

equipment depreciation as well. In this costing system individual input costing is

measured by comparison of input costing and actual costing of products for assess the

actual value of financial performance and fluctuation of financial data within the

business. In the cost accounting process budgetary control, marginal costing, standard

costing and operational and inventory control is implemented in the business in terms of

cost reduction of Toyota automotive corporation effectively. Job costing system: Job costing system in the process which includes the method for

gathering the information about to the cost connected with the particular production and

service cost within the firm effectively (Baldvinsdottir, Mitchelland Nørreklit, 2010).

Toyota automotive business acquire several kinds of specific customised products at the

workplace. Due to various type of customised products, there is needed to specify each

product and services cost in the firm. This approach is also assisted the business to find

out accuracy level of business in order to achieve its estimate targets within the

business. Toyota automotive required to categorised their each customised product at

the workplace according to different product lines and fix each product costing within

2

term decisions of a firm. Toyota automotive business can utilise of management accounting

approaches to reduce its manufacturing and services cost within the business effectively.

Moreover, basically accounting is a process in which financial and economic data is recognised,

measured and communicated to make better decision and opinion to the manager of Toyota

automotive corporation in terms of making their decision towards the organisational

manufacturing and other cost reduction efficiently.

There are important requirements of different kinds of management accounting system Cost accounting system: Cost accounting system is also called costing system which is

used by most of manufacturing companies in order to formulate outline by approximate

the cost of their production for inventory assessment, profit examination and over

costing control on production and service cost of the business. In this cost accounting

approach, portion of costing is functioning on exercise based cost accounting system

and traditional approach of costing system as well (Macintosh and Quattrone, 2010).

Cost accounting is an approach in which organisational production cost is computed by

which calculating cost of each input production cost and fixed cost such as capital

equipment depreciation as well. In this costing system individual input costing is

measured by comparison of input costing and actual costing of products for assess the

actual value of financial performance and fluctuation of financial data within the

business. In the cost accounting process budgetary control, marginal costing, standard

costing and operational and inventory control is implemented in the business in terms of

cost reduction of Toyota automotive corporation effectively. Job costing system: Job costing system in the process which includes the method for

gathering the information about to the cost connected with the particular production and

service cost within the firm effectively (Baldvinsdottir, Mitchelland Nørreklit, 2010).

Toyota automotive business acquire several kinds of specific customised products at the

workplace. Due to various type of customised products, there is needed to specify each

product and services cost in the firm. This approach is also assisted the business to find

out accuracy level of business in order to achieve its estimate targets within the

business. Toyota automotive required to categorised their each customised product at

the workplace according to different product lines and fix each product costing within

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the firm in terms of helping manager to better assessment of job costing which help to

proper decision making process within the firm effectively. Process Costing: Process costing is an approach in which each product line is identified

effectively in order to recognised all additional cost of the firm which being cause of

raising cost of production within the firm (Hilton and Platt, 2013). In the job costing

process, costing of each product is associated and additional expenses and cost also

added to determine the overall production costing in the manufacturing process and

manager comes to know about over costing rate of each product and make their decision

towards reducing cost f Toyota automotive business effectively. Toyota automotive

company's manager must use this approach at their workplace in terms of better

manager their over costing within the business efficiently. Because of different kinds of

product and services are providing by Toyota automotive company like luxury and

commercial vehicle and other customised product which is needed to be provided

particular product range and costing to easily identify their product range by which

business can identify their product costing range in which they can measure their

expenses and costing range as well in order to identify their profitability and

productivity in the business(Ward, 2012).

Throughput accounting system: This is called as modern accounting system and under

this approach the main centring the cost control can accomplishing through improving

business operational level effectively within the business. This is the accounting system

which is developed by Israeli business man and now it has become popular system of

management accounting nowadays. Many of the firms are using these approaches in

order to reducing their costing within the firm and also resolving their financial issues

and problems within the firm effectively (Renz and Herman, eds., 2016). This approach

identifies the factors which is most needed for fluctuate in better manner within the

business and it focuses on the areas in which business manager need to be more focus in

order to develop their areas more effectively towards the financial growth of the

business.

3

proper decision making process within the firm effectively. Process Costing: Process costing is an approach in which each product line is identified

effectively in order to recognised all additional cost of the firm which being cause of

raising cost of production within the firm (Hilton and Platt, 2013). In the job costing

process, costing of each product is associated and additional expenses and cost also

added to determine the overall production costing in the manufacturing process and

manager comes to know about over costing rate of each product and make their decision

towards reducing cost f Toyota automotive business effectively. Toyota automotive

company's manager must use this approach at their workplace in terms of better

manager their over costing within the business efficiently. Because of different kinds of

product and services are providing by Toyota automotive company like luxury and

commercial vehicle and other customised product which is needed to be provided

particular product range and costing to easily identify their product range by which

business can identify their product costing range in which they can measure their

expenses and costing range as well in order to identify their profitability and

productivity in the business(Ward, 2012).

Throughput accounting system: This is called as modern accounting system and under

this approach the main centring the cost control can accomplishing through improving

business operational level effectively within the business. This is the accounting system

which is developed by Israeli business man and now it has become popular system of

management accounting nowadays. Many of the firms are using these approaches in

order to reducing their costing within the firm and also resolving their financial issues

and problems within the firm effectively (Renz and Herman, eds., 2016). This approach

identifies the factors which is most needed for fluctuate in better manner within the

business and it focuses on the areas in which business manager need to be more focus in

order to develop their areas more effectively towards the financial growth of the

business.

3

P.2. Different methods used for management accounting reporting

Management accounting major focus on internal data analysis which is gathered by

various financial accounting tools and techniques within the business effectively (Scapens and

Bromwich, 2010). Management accounting helps the manager of Toyota automotive business in

terms of effective managing, controlling and decision making process towards financial growth

of the business in industry. Management accounting totally depend on analytical approaches in

which financial data such as balance sheet, income statement and cash flow statements compared

to each other to assessment of financial details in deep to find out the best solution of over

costing rate within the business. Moreover, these are also used for preparing different kinds of

management accounting reporting by examining several financial information.

There are some method of management accounting reporting which is as following: Cost reports: Management accounting computes the various cost within the business

while they are manufacturing a product. There are several kinds of cost of different input

such as overhead, costs, labour and others cost considered in terms of preparing cost

reporting at the workplace. Job costing provide about each expenses cost while

manufacturing a product within the business (Christ and Burritt, 2013). There are several

kinds of automotive products producing by Toyota automotive business and all cost are

calculated by its management financial officer in terms of preparing a proper costing

reporting knowing about to each product line costing and other additional costing of

product and services within the fir. So manager of Toyota automotive business can make

their effective decision in context of reducing cost of every products within the business.

Toyota automotive firm could recognise each product line costing effectively with the

help of cost reporting and effective reduce them as well. Budgets reporting: Budget reporting is the process of management in which comparison

of estimate value from actual vale of financial data is done in a given period within the

business effectively (Pipan and Czarniawska, 2010). Usually, budget reporting is

formulated by manager in order to achieve actual performance of financial data of the

firm from their estimation value during accounting time period of the business. These

process is done in yearly basis in which manager of Toyota automotive take assessment

of their financial performance within the business from their past year financial

fluctuation and their estimation targets of financial achievement to know about to

4

Management accounting major focus on internal data analysis which is gathered by

various financial accounting tools and techniques within the business effectively (Scapens and

Bromwich, 2010). Management accounting helps the manager of Toyota automotive business in

terms of effective managing, controlling and decision making process towards financial growth

of the business in industry. Management accounting totally depend on analytical approaches in

which financial data such as balance sheet, income statement and cash flow statements compared

to each other to assessment of financial details in deep to find out the best solution of over

costing rate within the business. Moreover, these are also used for preparing different kinds of

management accounting reporting by examining several financial information.

There are some method of management accounting reporting which is as following: Cost reports: Management accounting computes the various cost within the business

while they are manufacturing a product. There are several kinds of cost of different input

such as overhead, costs, labour and others cost considered in terms of preparing cost

reporting at the workplace. Job costing provide about each expenses cost while

manufacturing a product within the business (Christ and Burritt, 2013). There are several

kinds of automotive products producing by Toyota automotive business and all cost are

calculated by its management financial officer in terms of preparing a proper costing

reporting knowing about to each product line costing and other additional costing of

product and services within the fir. So manager of Toyota automotive business can make

their effective decision in context of reducing cost of every products within the business.

Toyota automotive firm could recognise each product line costing effectively with the

help of cost reporting and effective reduce them as well. Budgets reporting: Budget reporting is the process of management in which comparison

of estimate value from actual vale of financial data is done in a given period within the

business effectively (Pipan and Czarniawska, 2010). Usually, budget reporting is

formulated by manager in order to achieve actual performance of financial data of the

firm from their estimation value during accounting time period of the business. These

process is done in yearly basis in which manager of Toyota automotive take assessment

of their financial performance within the business from their past year financial

fluctuation and their estimation targets of financial achievement to know about to

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

efficiencies of the business. Budget reporting must be formulated in accurate form

through which manager of company will be able to examine actual fluctuation of

financial data and know about to the profitability and over cost of manufacturing process

(Banerjee, 2012). With the help of these reporting manager of Toyota automotive can

make decision towards the business in terms of improve their financial performances in

the firm. Income statement: Detailed information of financial statements are assessed in this

approach, with the help of income statement manager of Toyota automotive business can

analyse the actual value of their all expenses in the manufacturing process (Herbert and

Seal, 2012). Income statements are made with the help of management accounting officer

at the workplace on quarterly basis in order to compare their financial statements from

past income statements to know about to overall outcomes of the business. It helps to

know about the section which gives strong performance in the business and which section

of business can weak performance in the company. According to this reporting

management accounting officer of Toyota automotive make their decision to improve

financial performance of the business effectively. The main limitation of this approach is

that this do not show the separation of marketing expenses in the firm and it can not be

recognised by looking at income statements of marketing disbursals in the business

effectively.

Account receivable reporting: Account receivable reporting in another kind of reporting

of management accounting in which account receivable are computed in the books of the

accounts (Bouten and Hoozée, 2013). And with the assistance of this techniques Toyota

automotive business manager get to know about to how much receivable are being goes

for bed debt into the account and how much receivable is occurring in the business for

short duration of the firm effectively. Cash management strategy is made in better

manner on the cash accounting reporting approach. Thus, there is highly significance of

accounting receivable reporting in the business. Toyota automotive company need to

update time to time account receivable reporting preparation in better manner. Because of

most of the time debtors rate increase in the business in very rapid manner and there are

huge need of this reporting effectively in the firm in order to decrease the rate of debtors

and increase the profitability of the business efficiently.

5

through which manager of company will be able to examine actual fluctuation of

financial data and know about to the profitability and over cost of manufacturing process

(Banerjee, 2012). With the help of these reporting manager of Toyota automotive can

make decision towards the business in terms of improve their financial performances in

the firm. Income statement: Detailed information of financial statements are assessed in this

approach, with the help of income statement manager of Toyota automotive business can

analyse the actual value of their all expenses in the manufacturing process (Herbert and

Seal, 2012). Income statements are made with the help of management accounting officer

at the workplace on quarterly basis in order to compare their financial statements from

past income statements to know about to overall outcomes of the business. It helps to

know about the section which gives strong performance in the business and which section

of business can weak performance in the company. According to this reporting

management accounting officer of Toyota automotive make their decision to improve

financial performance of the business effectively. The main limitation of this approach is

that this do not show the separation of marketing expenses in the firm and it can not be

recognised by looking at income statements of marketing disbursals in the business

effectively.

Account receivable reporting: Account receivable reporting in another kind of reporting

of management accounting in which account receivable are computed in the books of the

accounts (Bouten and Hoozée, 2013). And with the assistance of this techniques Toyota

automotive business manager get to know about to how much receivable are being goes

for bed debt into the account and how much receivable is occurring in the business for

short duration of the firm effectively. Cash management strategy is made in better

manner on the cash accounting reporting approach. Thus, there is highly significance of

accounting receivable reporting in the business. Toyota automotive company need to

update time to time account receivable reporting preparation in better manner. Because of

most of the time debtors rate increase in the business in very rapid manner and there are

huge need of this reporting effectively in the firm in order to decrease the rate of debtors

and increase the profitability of the business efficiently.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P.3. Absorption and marginal costing approached

6

P.3. Absorption and marginal costing approached

6

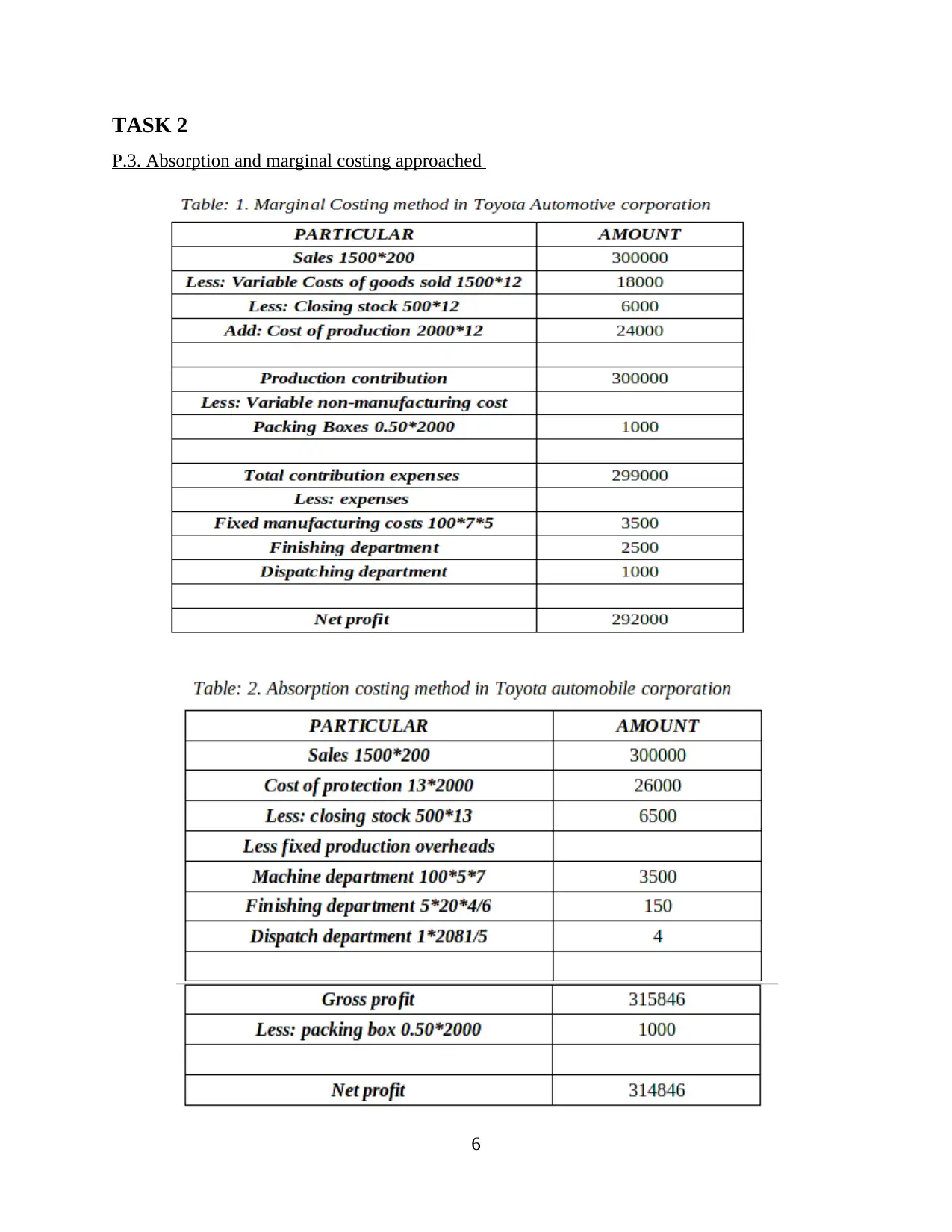

Above table describe about to financial fluctuation of Toyota automotive in which two

kind of financial data analytical approaches has implemented. Absorption and marginal costing

method has been applied for know actual fluctuation of financial performances of Toyota

automotive business. In condition of absorption approach, it shoes the net profitability which is

292000 and marginal costing approach show the new profit values is 314846. And both values

are different from each other in this assessment. In both tables are showing their different-

different values of profitability within the business effectively. We can see that profitability is

higher in context of marginal costing approach (Cooper, Ezzamel and Qu, 2017). Both

approaches marginal costing approach and absorption costing approach is different from each

other. In the situation of marginal costing method, there are several variable disbursal is taken

into account in the table of marginal approach in order to calculating overall costing of each

product and services line of Toyota automotive corporation efficiently. In other side, absorption

approach is totally different from marginal costing method. In the absorption costing method

foxed and variable expenses of each product and service line of Toyota automotive business is

taken into accounting book to evaluation of profitability and overall costing of the firm as well.

With the assistance of this costing approach it could be said that corporation revenue and

profitability could be calculated efficiently and with the help of both income statements Toyota

automotive company's manager get to know about to overall costing of production and also get

some ideas about implementing some effective cost reduction approach into the account so cost

of manufacturing can be reduced effectively within the business (Ramljak and Rogošić, 2012).

Manger of Toyota automotive can make more efficient decision in terms of cost reduction and

also modify the financial growth of the business as well. In these methodologies, there are some

negative and positive account is associated with these approaches. Toyota automotive manager

should observe the financial increment of the business through both techniques of costing within

the firm so effective decision can be made with the help of assessment of financial data within

the business. Basically, there are variable expenses in the firm occurred by large amount of

expenses on production and when computing cost in the business manager comes to know about

major issues which is, which costing approach they should utilise for effective calculation of

costing within the business. There is better option of marginal costing within the business

because of involvement of fixed expenses in the firm is not making any sense. Furthermore, in

context of marginal costing in the business, fixed expenses are not computing directly in order to

7

kind of financial data analytical approaches has implemented. Absorption and marginal costing

method has been applied for know actual fluctuation of financial performances of Toyota

automotive business. In condition of absorption approach, it shoes the net profitability which is

292000 and marginal costing approach show the new profit values is 314846. And both values

are different from each other in this assessment. In both tables are showing their different-

different values of profitability within the business effectively. We can see that profitability is

higher in context of marginal costing approach (Cooper, Ezzamel and Qu, 2017). Both

approaches marginal costing approach and absorption costing approach is different from each

other. In the situation of marginal costing method, there are several variable disbursal is taken

into account in the table of marginal approach in order to calculating overall costing of each

product and services line of Toyota automotive corporation efficiently. In other side, absorption

approach is totally different from marginal costing method. In the absorption costing method

foxed and variable expenses of each product and service line of Toyota automotive business is

taken into accounting book to evaluation of profitability and overall costing of the firm as well.

With the assistance of this costing approach it could be said that corporation revenue and

profitability could be calculated efficiently and with the help of both income statements Toyota

automotive company's manager get to know about to overall costing of production and also get

some ideas about implementing some effective cost reduction approach into the account so cost

of manufacturing can be reduced effectively within the business (Ramljak and Rogošić, 2012).

Manger of Toyota automotive can make more efficient decision in terms of cost reduction and

also modify the financial growth of the business as well. In these methodologies, there are some

negative and positive account is associated with these approaches. Toyota automotive manager

should observe the financial increment of the business through both techniques of costing within

the firm so effective decision can be made with the help of assessment of financial data within

the business. Basically, there are variable expenses in the firm occurred by large amount of

expenses on production and when computing cost in the business manager comes to know about

major issues which is, which costing approach they should utilise for effective calculation of

costing within the business. There is better option of marginal costing within the business

because of involvement of fixed expenses in the firm is not making any sense. Furthermore, in

context of marginal costing in the business, fixed expenses are not computing directly in order to

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

production process and fixed expenses if incurred in the firm and business have to manage their

cost over the cash flows of the business (France, 2010). Hence, it could be said both costing

approaches must be used by Toyota automotive business effectively in order to examination of

costing. The benefits of using these techniques because of if marginal costing is used by manager

of Toyota automotive business then they can easily find out that how much profit earned by the

business if large expenses are taken into accounting which is making heavy contribution in the

production procedure of the firm. Hence, it could be said that both techniques can be used for

better evaluation of costing and expenses over the business production process and better

decision could be made by managers with the help of both approaches and operational activities

of Toyota automotive corporation could be governed effectively.

TASK 3

P.4. Advantage and disadvantage of using different planning tools that could be used for

budgetary control at workplace

Some management planning tools and techniques are utilised by the corporations and all

the planning tool have several advantages and disadvantages. Numbers of tools that are presented

here for business corporations. Some of them are budget and capital budgeting methodologies. In

terms of budget categorised could be completed (Callahan, Stetz and Brooks, 2011). Cash budget: This is the most essential kind of budget process which is formulated by all

kind of corporations. In this cash budgeting process estimation can be made upon inflow

and outflow of the firm which can be recognised on the ground of net availability of

balance in the business. In the cash budgeting planning id formulated on the basis of

expenditures made in the business in a year (Shields, 2015). Moreover, it could be said

that planning is made upon determination of limits of expenses in the business and

according to this process effective plan in made within the business. It could be said that

cash budgeting is one of the most tools for the business and there are various advantage

and disadvantage of the cash budgeting which is as following:

Advantage:

With the help of cash budgeting some expenses within the business can be effectively

managed in appropriate form. This will raise the profitability of the corporation.

8

cost over the cash flows of the business (France, 2010). Hence, it could be said both costing

approaches must be used by Toyota automotive business effectively in order to examination of

costing. The benefits of using these techniques because of if marginal costing is used by manager

of Toyota automotive business then they can easily find out that how much profit earned by the

business if large expenses are taken into accounting which is making heavy contribution in the

production procedure of the firm. Hence, it could be said that both techniques can be used for

better evaluation of costing and expenses over the business production process and better

decision could be made by managers with the help of both approaches and operational activities

of Toyota automotive corporation could be governed effectively.

TASK 3

P.4. Advantage and disadvantage of using different planning tools that could be used for

budgetary control at workplace

Some management planning tools and techniques are utilised by the corporations and all

the planning tool have several advantages and disadvantages. Numbers of tools that are presented

here for business corporations. Some of them are budget and capital budgeting methodologies. In

terms of budget categorised could be completed (Callahan, Stetz and Brooks, 2011). Cash budget: This is the most essential kind of budget process which is formulated by all

kind of corporations. In this cash budgeting process estimation can be made upon inflow

and outflow of the firm which can be recognised on the ground of net availability of

balance in the business. In the cash budgeting planning id formulated on the basis of

expenditures made in the business in a year (Shields, 2015). Moreover, it could be said

that planning is made upon determination of limits of expenses in the business and

according to this process effective plan in made within the business. It could be said that

cash budgeting is one of the most tools for the business and there are various advantage

and disadvantage of the cash budgeting which is as following:

Advantage:

With the help of cash budgeting some expenses within the business can be effectively

managed in appropriate form. This will raise the profitability of the corporation.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Another advantage is that cash budget is easy to formulate at the workplace and for this it

is not necessary to higher skilled accounting professionals to set up this budget (Suomala

and Lyly-Yrjänäinen, 2012).

Disadvantage: The main disadvantage of cash budgeting is that it is totally depended on the future

estimation and several times estimation goes wrong. There are huge chances of wrong

decision made according to wrong information about budgeting process.

Fixed budget: Fixed budget is another kind of budgeting process which is available for

several kinds of manufacturing business. This in totally inverse on the cash budgeting and

in this system factors of budget in made in changeless form. It never changes in specific

situation.

There are some advantage and disadvantages of fixed budgeting as below:

Advantage:

Fixed budgeting value always remain same and it never gets changed in particular

situation of the business. Thus, Business manager must appropriate attention when they

are making fixed budgeting in the corporation. The major advantage of fixed budgeting is that this budget is beneficial for the business

or not even conspirational circumstances are changing continuously.

Disadvantage: The major disadvantage of fixed budgeting is that it is difficult to implementation in the

business, because of organisational circumstances are changing rapidly and there changes

of not proper formulation of fixed budgeting in the business effectively (Bebbington,

Unerman and O'Dwyer, eds., 2014). If this budgeting process is implemented in the

business then wrong decision can be made by firm's manager. Zero cash budgeting: This is totally different method of preparing budget in which no

portion of budget is made under the departmental professional till then manager do not

present own departmental budget for the front of senior manager within the business.

There are several advantages and disadvantages of zero cash budgeting are as following:

Advantage:

9

is not necessary to higher skilled accounting professionals to set up this budget (Suomala

and Lyly-Yrjänäinen, 2012).

Disadvantage: The main disadvantage of cash budgeting is that it is totally depended on the future

estimation and several times estimation goes wrong. There are huge chances of wrong

decision made according to wrong information about budgeting process.

Fixed budget: Fixed budget is another kind of budgeting process which is available for

several kinds of manufacturing business. This in totally inverse on the cash budgeting and

in this system factors of budget in made in changeless form. It never changes in specific

situation.

There are some advantage and disadvantages of fixed budgeting as below:

Advantage:

Fixed budgeting value always remain same and it never gets changed in particular

situation of the business. Thus, Business manager must appropriate attention when they

are making fixed budgeting in the corporation. The major advantage of fixed budgeting is that this budget is beneficial for the business

or not even conspirational circumstances are changing continuously.

Disadvantage: The major disadvantage of fixed budgeting is that it is difficult to implementation in the

business, because of organisational circumstances are changing rapidly and there changes

of not proper formulation of fixed budgeting in the business effectively (Bebbington,

Unerman and O'Dwyer, eds., 2014). If this budgeting process is implemented in the

business then wrong decision can be made by firm's manager. Zero cash budgeting: This is totally different method of preparing budget in which no

portion of budget is made under the departmental professional till then manager do not

present own departmental budget for the front of senior manager within the business.

There are several advantages and disadvantages of zero cash budgeting are as following:

Advantage:

9

The main advantage of this budgeting process is that respective method is used by

manager of the company in order to formulation of zero cash budget. This is most

appropriate budget for the business which is necessary to prepared within the firm.

Disadvantage: The most of disadvantage of zero cash budgeting is that it is highly time taking process

and length as well in terms of preparation of it.

Capital budgeting process: In the process of capital budgeting process assessment is

completed on the ground of different kind of methodologies such as internal rate of return

and net present value approach as well.

Several advantages and disadvantage of capital budgeting is as following:

Advantage: Capital budgeting process has advantage like it is made upon all expenses that is made in

the business effectively (Abernethy, Bouwens and Van Lent, 2010). Thus, there are

several kinds of stages made under this formulation of this project.

Disadvantage:

Capital budgeting process is difficult to prepared in the business, because it raises the

cost and expenses for the business and it takes quality of times for the business.

P.5. Adoption of management accounting systems to respond to financial problems

There are several kinds of financial issues and problems are facing by most of the top

business in the country. Management accounting is the process in which is majorly used for most

of the businesses in order to resolve their financial issues effectively within the corporation.

There are some management accounting system which could be utilised for respond the financial

problems within the business is as below: Key performance indicators: Key performance indicators in most important tool which

could be useful for effective resolution of financial problems within the corporation.

Toyota automotive firm is facing financial issues such fewer availability of capital in the

business and other financial problems as well (Belfo and Trigo, 2013). KPI tool can be

used for comparison of standard value to their actual performance value in order to

recognise their financial performances and fluctuation effectively. With the assistance of

this tool financial issues of Toyota automotive business can be easily find out and

effective decision can be made by manager of the business. This technique assists the

10

manager of the company in order to formulation of zero cash budget. This is most

appropriate budget for the business which is necessary to prepared within the firm.

Disadvantage: The most of disadvantage of zero cash budgeting is that it is highly time taking process

and length as well in terms of preparation of it.

Capital budgeting process: In the process of capital budgeting process assessment is

completed on the ground of different kind of methodologies such as internal rate of return

and net present value approach as well.

Several advantages and disadvantage of capital budgeting is as following:

Advantage: Capital budgeting process has advantage like it is made upon all expenses that is made in

the business effectively (Abernethy, Bouwens and Van Lent, 2010). Thus, there are

several kinds of stages made under this formulation of this project.

Disadvantage:

Capital budgeting process is difficult to prepared in the business, because it raises the

cost and expenses for the business and it takes quality of times for the business.

P.5. Adoption of management accounting systems to respond to financial problems

There are several kinds of financial issues and problems are facing by most of the top

business in the country. Management accounting is the process in which is majorly used for most

of the businesses in order to resolve their financial issues effectively within the corporation.

There are some management accounting system which could be utilised for respond the financial

problems within the business is as below: Key performance indicators: Key performance indicators in most important tool which

could be useful for effective resolution of financial problems within the corporation.

Toyota automotive firm is facing financial issues such fewer availability of capital in the

business and other financial problems as well (Belfo and Trigo, 2013). KPI tool can be

used for comparison of standard value to their actual performance value in order to

recognise their financial performances and fluctuation effectively. With the assistance of

this tool financial issues of Toyota automotive business can be easily find out and

effective decision can be made by manager of the business. This technique assists the

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.