Financial Management and Accounting Systems

VerifiedAdded on 2020/07/22

|16

|5094

|65

AI Summary

This assignment delves into the complexities of a business's financial management system. It highlights various financial problems that arise in a business and discusses how they can be addressed through managerial accounting. The document draws from academic sources, including books and journals, to provide a comprehensive understanding of these issues.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1 Management accounting systems......................................................................................2

P2 Methods of management accounting reporting.................................................................5

TASK 2............................................................................................................................................6

P3 Difference between income statement made through marginal and absorption costing...6

TASK 3............................................................................................................................................8

P4 Advantages and disadvantages of planning tools which are used for budgetary control..8

TASK 4..........................................................................................................................................11

P5 Adopting management accounting systems for responding financial troubles...............11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1 Management accounting systems......................................................................................2

P2 Methods of management accounting reporting.................................................................5

TASK 2............................................................................................................................................6

P3 Difference between income statement made through marginal and absorption costing...6

TASK 3............................................................................................................................................8

P4 Advantages and disadvantages of planning tools which are used for budgetary control..8

TASK 4..........................................................................................................................................11

P5 Adopting management accounting systems for responding financial troubles...............11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

Report

From: Management Accounting Officer

To: General Manager

Subject: To write a report to GM covering management accounting and management accounting

system together with different costing techniques and reporting to enable the organization

implement them.

1

From: Management Accounting Officer

To: General Manager

Subject: To write a report to GM covering management accounting and management accounting

system together with different costing techniques and reporting to enable the organization

implement them.

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Management and accounting both terms are differ from each other and it is essential for

an association to make things correct and appropriate in nature in order to get sustain at market

for long term purpose (Burritt, Schaltegger and Zvezdov, 2011). Management is concerned with

diverse activities of business on the other hand accounting stated about detail description about

an association performance. Taj stores is a small business retail whom are dealing in household

materials. Management accounting support business managers to determine all deviations on

short term basis and take suitable steps so that such things and issues get deal properly. In this

project which is based on Taj stores need to determine and understand this concept of

management accounting as well as various MA system. Along with this, financial accounting

and managerial accounting both concepts are differ from each other on which association

authority have to make an appropriate differentiation. Moreover, there are different methods of

accounting are also determine which will get understand at the end of this project. Marginal

costing and absorption costing are two types of cost which support in analysing net profit of a

business. It also constitutes advantages and disadvantages of various budget planning tools and

their response towards various financial problems.

TASK 1

P1 Management accounting systems

It is not easy for a manager to take an adequate judgement within less time. For this

purpose, they will use management accounting system as these will assist to sort out each and

every kind of troubles related with financial and in addition non – financial (Dillard, 2014). It

will be typical for tiny organisations to raise funds easily. In this context, Taj stores is doing their

operations at small scale; therefore, they always try to acquire loan at less prices. Along with

this, they have to allocate fund correctively so that they will acquire higher returns. With

assistance of financial accounts manager will take an adequate judgement. Fundamentally, they

focus to record information appropriately; thus, this will be beneficial for superiors. There are

some distinctions amongst financial and managerial accounting which is stated as below:

Financial Accounting Managerial Accounting

This sort of accounts are formulated for Basically it is for intrinsic people such as staff

2

Management and accounting both terms are differ from each other and it is essential for

an association to make things correct and appropriate in nature in order to get sustain at market

for long term purpose (Burritt, Schaltegger and Zvezdov, 2011). Management is concerned with

diverse activities of business on the other hand accounting stated about detail description about

an association performance. Taj stores is a small business retail whom are dealing in household

materials. Management accounting support business managers to determine all deviations on

short term basis and take suitable steps so that such things and issues get deal properly. In this

project which is based on Taj stores need to determine and understand this concept of

management accounting as well as various MA system. Along with this, financial accounting

and managerial accounting both concepts are differ from each other on which association

authority have to make an appropriate differentiation. Moreover, there are different methods of

accounting are also determine which will get understand at the end of this project. Marginal

costing and absorption costing are two types of cost which support in analysing net profit of a

business. It also constitutes advantages and disadvantages of various budget planning tools and

their response towards various financial problems.

TASK 1

P1 Management accounting systems

It is not easy for a manager to take an adequate judgement within less time. For this

purpose, they will use management accounting system as these will assist to sort out each and

every kind of troubles related with financial and in addition non – financial (Dillard, 2014). It

will be typical for tiny organisations to raise funds easily. In this context, Taj stores is doing their

operations at small scale; therefore, they always try to acquire loan at less prices. Along with

this, they have to allocate fund correctively so that they will acquire higher returns. With

assistance of financial accounts manager will take an adequate judgement. Fundamentally, they

focus to record information appropriately; thus, this will be beneficial for superiors. There are

some distinctions amongst financial and managerial accounting which is stated as below:

Financial Accounting Managerial Accounting

This sort of accounts are formulated for Basically it is for intrinsic people such as staff

2

extrinsic parties such as bondholders. members, employer and so on.

For this, past data will be used and manager

will take some extra time for preparation.

It has to be present on time and in addition

related with future.

Reporting is associated with entire firm. Specific area reporting.

With assistance of this, financial records will

be measured.

Examination of operational is done.

It is must for a public firm to prepare it as they

have to accomplish legal needs.

No legal bounding on company for formulation

of it.

Small organisations need to utilize various system of management accounting due to

numerous benefits (DRURY, 2013). Basically, tiny association has limited resources as well as

fund; therefore, they cannot bear huge waste. To determine faults employer has to utilize

procedure of management accounting; so that, they will make their business operations more

adequate. This aids to reduce confusion between various units; as a result, they will accomplish

their work within limited period of time. It is must for them to allocate resources effectively as

this will decrease unwanted cost. Following is explanation of procedures:

Inventory management system: If company stores goods in excessive range at storage

then, this will enhance their some expenditures, such as carrying cost. Along with this, if stock is

not sufficient as per requirement then, this will provide impact to supply chain and clients will

not able to fulfil their demands within limited period of time. Enterprise will utilize a software to

manage their entire inventory system; therefore, they can easily track their orders, determine

availability of stock etc. Manager will utilize EOQ methodology to identify correct time as well

as order quantity. As a result, wastage will get reduced and organisation will run in a smooth

manner. Instead of this, many firms maintain their records as per margin. If selling of an item is

high then, this will assist company to improve their revenues.

Cost accounting system: This is foremost significant aspect of system of management

accounting (Elbashir, Collier and Sutton, 2011). With assistance of this, they will decrease their

wastage. Fundamentally, this deal in the manufacturing unit but it has wider extent. Some

employer utilize it; so that, they can examine their revenues. There are some areas which needs

concentrate, such as material, labour and so on.

3

For this, past data will be used and manager

will take some extra time for preparation.

It has to be present on time and in addition

related with future.

Reporting is associated with entire firm. Specific area reporting.

With assistance of this, financial records will

be measured.

Examination of operational is done.

It is must for a public firm to prepare it as they

have to accomplish legal needs.

No legal bounding on company for formulation

of it.

Small organisations need to utilize various system of management accounting due to

numerous benefits (DRURY, 2013). Basically, tiny association has limited resources as well as

fund; therefore, they cannot bear huge waste. To determine faults employer has to utilize

procedure of management accounting; so that, they will make their business operations more

adequate. This aids to reduce confusion between various units; as a result, they will accomplish

their work within limited period of time. It is must for them to allocate resources effectively as

this will decrease unwanted cost. Following is explanation of procedures:

Inventory management system: If company stores goods in excessive range at storage

then, this will enhance their some expenditures, such as carrying cost. Along with this, if stock is

not sufficient as per requirement then, this will provide impact to supply chain and clients will

not able to fulfil their demands within limited period of time. Enterprise will utilize a software to

manage their entire inventory system; therefore, they can easily track their orders, determine

availability of stock etc. Manager will utilize EOQ methodology to identify correct time as well

as order quantity. As a result, wastage will get reduced and organisation will run in a smooth

manner. Instead of this, many firms maintain their records as per margin. If selling of an item is

high then, this will assist company to improve their revenues.

Cost accounting system: This is foremost significant aspect of system of management

accounting (Elbashir, Collier and Sutton, 2011). With assistance of this, they will decrease their

wastage. Fundamentally, this deal in the manufacturing unit but it has wider extent. Some

employer utilize it; so that, they can examine their revenues. There are some areas which needs

concentrate, such as material, labour and so on.

3

Job costing: It is entirely distinguish system where it is must to examine capacity to

generate revenue. This, this is required for an enterprise to enhance their job number as this will

assist them to provide maximum benefit; as a result, profits of association will get improved.

This sort of method is used by firm when demand gets hike. Therefore, they can accomplish

requirements and demands of their users in an effective manner.

Price optimisation: Price of any product will depend on its demand. Hence, with

assistance of this tool correct value of goods will identified on which it has to be provide to

people. It is must for company to set affordable price of their goods and services. If it high then,

buyer will not purchase it and in addition it will provide adverse affect on firm. Rather than this,

if it is less then, this will lead to loss as clients will pay more for the product. Henceforth, price

optimisation methodology will aid to decide an adequate value of an item.

4

Management

Accounting

system

Inventory

management

System

Cost

Accounting System

Job Costing

Price

Optimisation

generate revenue. This, this is required for an enterprise to enhance their job number as this will

assist them to provide maximum benefit; as a result, profits of association will get improved.

This sort of method is used by firm when demand gets hike. Therefore, they can accomplish

requirements and demands of their users in an effective manner.

Price optimisation: Price of any product will depend on its demand. Hence, with

assistance of this tool correct value of goods will identified on which it has to be provide to

people. It is must for company to set affordable price of their goods and services. If it high then,

buyer will not purchase it and in addition it will provide adverse affect on firm. Rather than this,

if it is less then, this will lead to loss as clients will pay more for the product. Henceforth, price

optimisation methodology will aid to decide an adequate value of an item.

4

Management

Accounting

system

Inventory

management

System

Cost

Accounting System

Job Costing

Price

Optimisation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

P2 Methods of management accounting reporting

Each and every kind of company has to prepare various kind of report; therefore, they can

easily examine their work which is completed by them previously. In this context, there are

various methodologies which can be utilized by an affiliation are mentioned as beneath:

Inventory control reporting: With assistance of this report investigation will be done

that inventory is managed in an adequate manner or not and determine those areas which needs

improvement in future; therefore, real issues associated with merchandise will found out

(Flamholtz, 2012). For example: over as well as under stock can be settled without getting

postponed. With help of this report it will be determined that how much products need to be

present in firm recently and sales of company for a specific period of time. This technique is

using by Taj stores as it will aid them in reducing carrying expenditure. Along with this, it will

be determined that how much merchandise will need to be show in outlets. Various kinds of

items are selling by enterprise; thus, they are much able to fulfil requirement of firm. Entire work

will be completed through determining past faults.

Account receivable reporting: Mentioned organisation is doing their business in London

from past times. Thus, they are having numerous permanent clients who purchase product on

credit from them. Manager will make a report in which they recorded all credit amount which is

provided by them to people (Granlund, 2011). With help of it, employer will know that how

much amount they have to take from their creditors. This will be prepared on monthly, weekly or

quarterly basis. This report also helps them to determine those individuals who are paying their

remaining amount on time.

Performance reporting: With assistance of this, manager will easily examine their

performance of various departments. Taj stores is doing their business on small scale; therefore,

there are not much division. It doesn't mean that there is no requirement for them to develop this

report. They will formulate this, as it helps them to identify distinction amongst their actual as

well as expected performance. Mistakes and in addition good work, both has to be include in this

kind of report. It will aid superior to find out info related to their staff members; as a result, they

can decide their incentives.

Account payable reporting: By using this document manager of firm will determine the

amount which they have to pay suppliers. It is fundamental for employer of company to pay their

5

Each and every kind of company has to prepare various kind of report; therefore, they can

easily examine their work which is completed by them previously. In this context, there are

various methodologies which can be utilized by an affiliation are mentioned as beneath:

Inventory control reporting: With assistance of this report investigation will be done

that inventory is managed in an adequate manner or not and determine those areas which needs

improvement in future; therefore, real issues associated with merchandise will found out

(Flamholtz, 2012). For example: over as well as under stock can be settled without getting

postponed. With help of this report it will be determined that how much products need to be

present in firm recently and sales of company for a specific period of time. This technique is

using by Taj stores as it will aid them in reducing carrying expenditure. Along with this, it will

be determined that how much merchandise will need to be show in outlets. Various kinds of

items are selling by enterprise; thus, they are much able to fulfil requirement of firm. Entire work

will be completed through determining past faults.

Account receivable reporting: Mentioned organisation is doing their business in London

from past times. Thus, they are having numerous permanent clients who purchase product on

credit from them. Manager will make a report in which they recorded all credit amount which is

provided by them to people (Granlund, 2011). With help of it, employer will know that how

much amount they have to take from their creditors. This will be prepared on monthly, weekly or

quarterly basis. This report also helps them to determine those individuals who are paying their

remaining amount on time.

Performance reporting: With assistance of this, manager will easily examine their

performance of various departments. Taj stores is doing their business on small scale; therefore,

there are not much division. It doesn't mean that there is no requirement for them to develop this

report. They will formulate this, as it helps them to identify distinction amongst their actual as

well as expected performance. Mistakes and in addition good work, both has to be include in this

kind of report. It will aid superior to find out info related to their staff members; as a result, they

can decide their incentives.

Account payable reporting: By using this document manager of firm will determine the

amount which they have to pay suppliers. It is fundamental for employer of company to pay their

5

credits on time as this will assist them to maintain their relations with others in an adequate

manner. As manager is paying their amount on or before time; hence, distributor will give some

discount to them. There is no particular time in production of this report, this will be prepared as

per the company's policy. Along with this, it also help to find out cash balance which is needed

by them in forthcoming time.

Budget reporting: It is necessary for company to develop an effective budget for their

business; as this will aid them to allocate fund to many units. This will help to make comparison

amongst actual as well as budgeted performance (Jaber, 2016). It will be related to a specific

year and it consists expenditure as well as income for a period. An adequate report of budget

helps to present performance of entire enterprise. With assistance of this report, confusion from

the worker's mind will get eliminated. As a result, they will accomplish coveted targets within

limited time span. It will contain some extra cost but this kind of expenditure will be much

beneficial for firm. By making budget, employees will use resources in a proficient way.

TASK 2

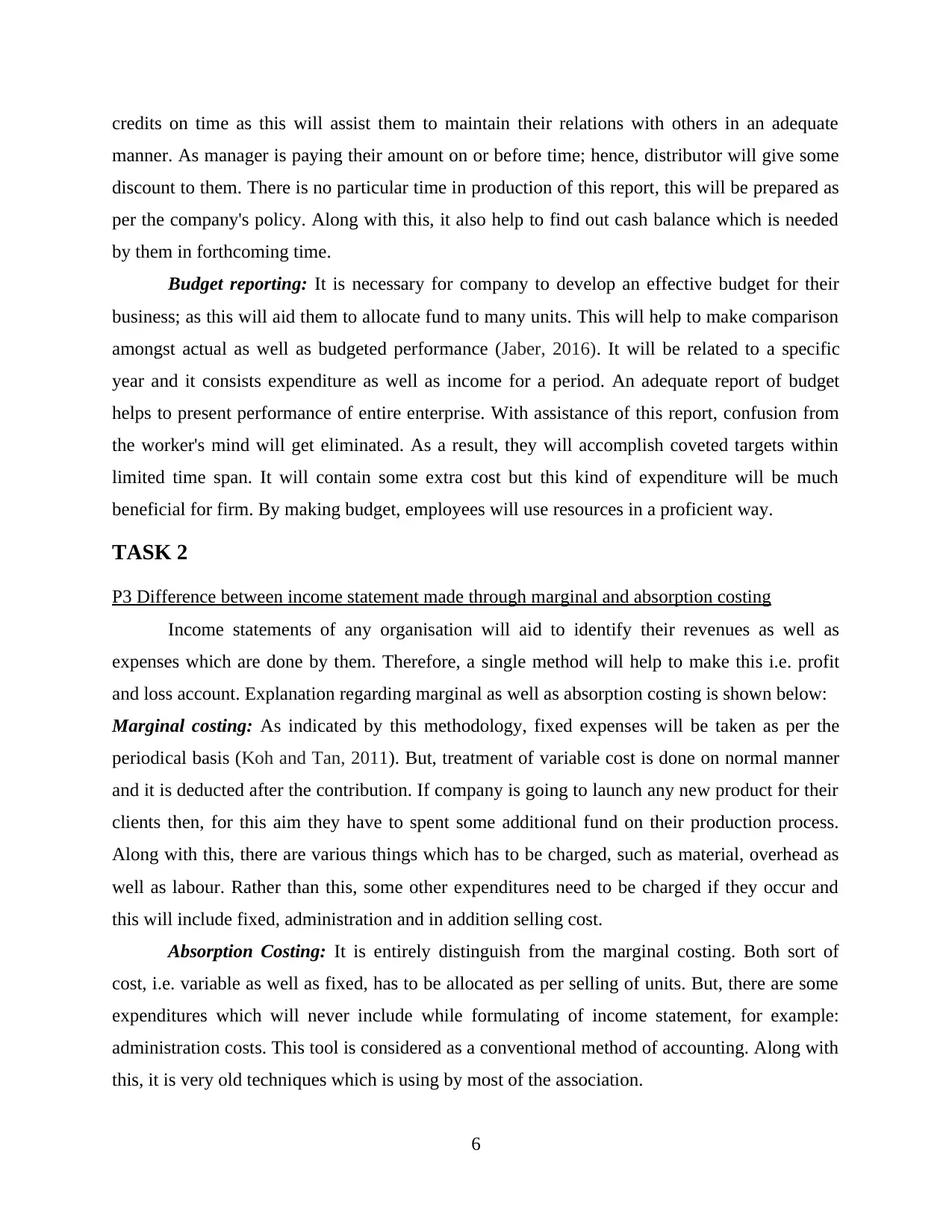

P3 Difference between income statement made through marginal and absorption costing

Income statements of any organisation will aid to identify their revenues as well as

expenses which are done by them. Therefore, a single method will help to make this i.e. profit

and loss account. Explanation regarding marginal as well as absorption costing is shown below:

Marginal costing: As indicated by this methodology, fixed expenses will be taken as per the

periodical basis (Koh and Tan, 2011). But, treatment of variable cost is done on normal manner

and it is deducted after the contribution. If company is going to launch any new product for their

clients then, for this aim they have to spent some additional fund on their production process.

Along with this, there are various things which has to be charged, such as material, overhead as

well as labour. Rather than this, some other expenditures need to be charged if they occur and

this will include fixed, administration and in addition selling cost.

Absorption Costing: It is entirely distinguish from the marginal costing. Both sort of

cost, i.e. variable as well as fixed, has to be allocated as per selling of units. But, there are some

expenditures which will never include while formulating of income statement, for example:

administration costs. This tool is considered as a conventional method of accounting. Along with

this, it is very old techniques which is using by most of the association.

6

manner. As manager is paying their amount on or before time; hence, distributor will give some

discount to them. There is no particular time in production of this report, this will be prepared as

per the company's policy. Along with this, it also help to find out cash balance which is needed

by them in forthcoming time.

Budget reporting: It is necessary for company to develop an effective budget for their

business; as this will aid them to allocate fund to many units. This will help to make comparison

amongst actual as well as budgeted performance (Jaber, 2016). It will be related to a specific

year and it consists expenditure as well as income for a period. An adequate report of budget

helps to present performance of entire enterprise. With assistance of this report, confusion from

the worker's mind will get eliminated. As a result, they will accomplish coveted targets within

limited time span. It will contain some extra cost but this kind of expenditure will be much

beneficial for firm. By making budget, employees will use resources in a proficient way.

TASK 2

P3 Difference between income statement made through marginal and absorption costing

Income statements of any organisation will aid to identify their revenues as well as

expenses which are done by them. Therefore, a single method will help to make this i.e. profit

and loss account. Explanation regarding marginal as well as absorption costing is shown below:

Marginal costing: As indicated by this methodology, fixed expenses will be taken as per the

periodical basis (Koh and Tan, 2011). But, treatment of variable cost is done on normal manner

and it is deducted after the contribution. If company is going to launch any new product for their

clients then, for this aim they have to spent some additional fund on their production process.

Along with this, there are various things which has to be charged, such as material, overhead as

well as labour. Rather than this, some other expenditures need to be charged if they occur and

this will include fixed, administration and in addition selling cost.

Absorption Costing: It is entirely distinguish from the marginal costing. Both sort of

cost, i.e. variable as well as fixed, has to be allocated as per selling of units. But, there are some

expenditures which will never include while formulating of income statement, for example:

administration costs. This tool is considered as a conventional method of accounting. Along with

this, it is very old techniques which is using by most of the association.

6

There are various differences amongst marginal and in addition absorption costing which

is stated as beneath:

Basis Marginal Costing Absorption Costing

Use This methodology will utilize

by employer of firm to take

decision in an appropriate

manner.

This will be used in extrinsic

report.

Accounting standards When manager is doing

valuation of their stock then,

they cannot use this sort of

method as per rules which is

described in accounting

regulation.

As indicated by the regulation

of international accounting, an

organisation will utilize this

tool at the time of valuation of

their merchandise.

Fixed cost According to this attribute, it is

must to deduct fixed

expenditure from contribution.

This will done if products are

sold out at same year.

This value will occur if items

are sell out at the similar year.

Inventory valuation It is essential to consider

variable cost if manager is

valuing their stock.

Whereas, according to this

tool, they have to consider

entire cost for this purpose.

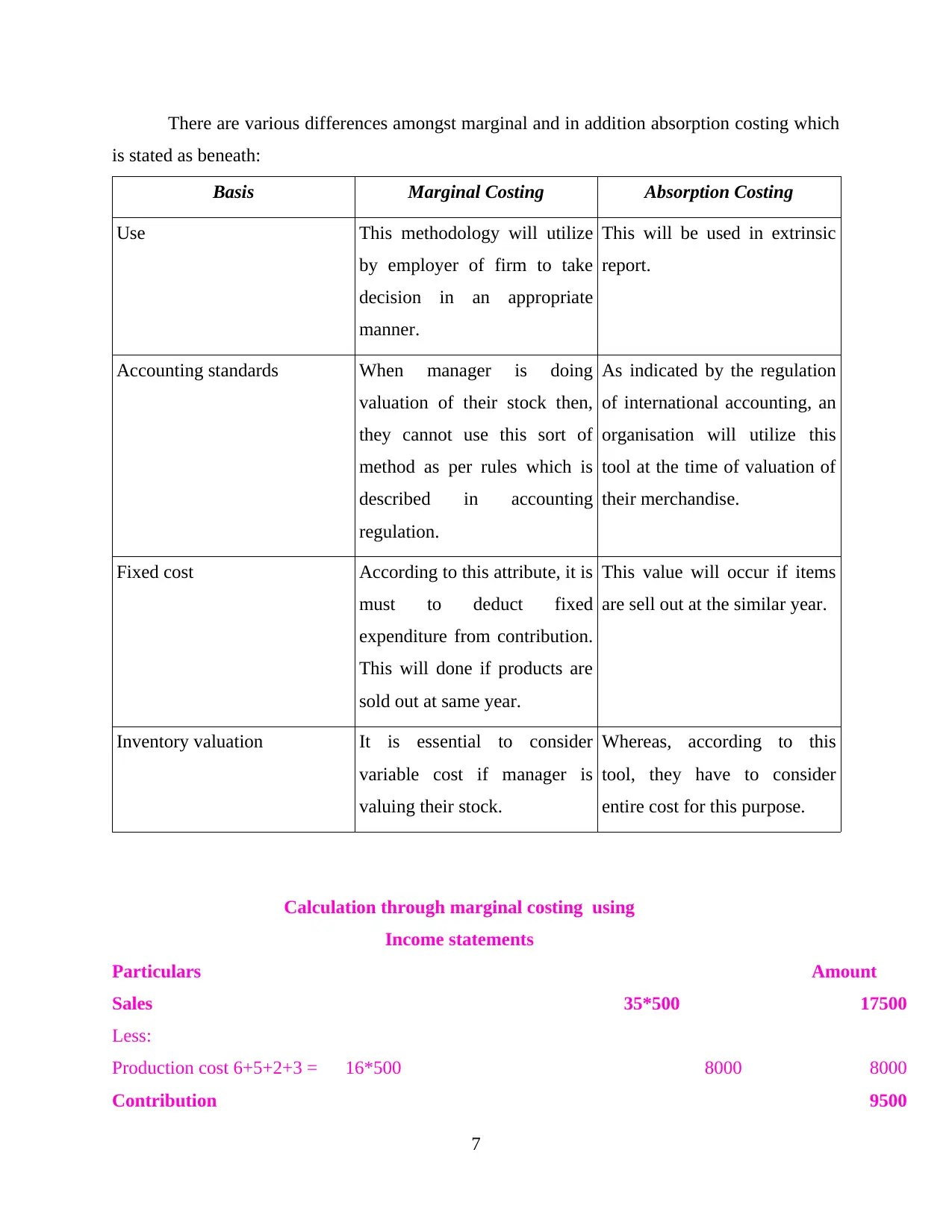

Calculation through marginal costing using

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2+3 = 16*500 8000 8000

Contribution 9500

7

is stated as beneath:

Basis Marginal Costing Absorption Costing

Use This methodology will utilize

by employer of firm to take

decision in an appropriate

manner.

This will be used in extrinsic

report.

Accounting standards When manager is doing

valuation of their stock then,

they cannot use this sort of

method as per rules which is

described in accounting

regulation.

As indicated by the regulation

of international accounting, an

organisation will utilize this

tool at the time of valuation of

their merchandise.

Fixed cost According to this attribute, it is

must to deduct fixed

expenditure from contribution.

This will done if products are

sold out at same year.

This value will occur if items

are sell out at the similar year.

Inventory valuation It is essential to consider

variable cost if manager is

valuing their stock.

Whereas, according to this

tool, they have to consider

entire cost for this purpose.

Calculation through marginal costing using

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2+3 = 16*500 8000 8000

Contribution 9500

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Less:

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

Computation of Net profit by using absorption costing

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

Gross profit 11000

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

Therefore, as indicated by above statement it has been understood that marginal costing

need to be utilized by company; therefore, they will prepare income statement. Because, with

assistance of this, they will gain maximum revenues i.e. £7800. Whereas, if they apply

absorption costing into their business then, revenues get diminished by £300. This difference

occurs due to the handling of fixed value. When enterprise uses marginal costing then, there

entire fixed expenses get deducted from the contribution so that they can find out their profits.

As an organisation will easily register their maximum revenues if they are using marginal

costing; therefore, this is the best approach which is used by Taj Stores.

8

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

Computation of Net profit by using absorption costing

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

Gross profit 11000

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

Therefore, as indicated by above statement it has been understood that marginal costing

need to be utilized by company; therefore, they will prepare income statement. Because, with

assistance of this, they will gain maximum revenues i.e. £7800. Whereas, if they apply

absorption costing into their business then, revenues get diminished by £300. This difference

occurs due to the handling of fixed value. When enterprise uses marginal costing then, there

entire fixed expenses get deducted from the contribution so that they can find out their profits.

As an organisation will easily register their maximum revenues if they are using marginal

costing; therefore, this is the best approach which is used by Taj Stores.

8

TASK 3

P4 Advantages and disadvantages of planning tools which are used for budgetary control

It is fundamental for an organisation to prepare budget for their business; therefore, they

can easily control their income as well as expenses in an adequate manner (Laudon and Laudon,

2016). With assistance of this, manager will check out that, staff members are doing their task as

per the planned manner or not. If there is any requirement of alterations then, this will be done.

Therefore, there are some techniques of planning which will be utilized by Taj Stores to control

budget and this is discussed as beneath:

Cash Budget: Fundamental aim of formulating budget is to cater data and information

which is related to cash. With assistance of this, need of cash will be examined. Along with this,

inflow as well as outflow of cash will also identified by this budget (Liao, Chu and Hsiao, 2012).

To run association in a smooth manner, it is required for them to use cash in correct manner.

There are various advantages which are associated with this method. It assists to decrease

hazards related to bad debts and in addition employer will make sure that organisation is

receiving remaining fund within limited period of time. Additionally, they are paying their entire

credits as per the time limit. As a result, firm will easily keep up good relations with their

shareholders and other institutions. They will also get assured that they are doing their

operational activities in a right way.

Rather than this, some of disadvantages which are connected with cash methodology.

Cash budget accuracy is much less as this will fluctuate as per the nature of environment. Thus,

it is not easy for manager to make adequate budget. This spending plan always developed by

taken into under consideration previous year data and information.

Master Budget: With help of this, an association can allocate distinguish resources to

various units of company. It never concentrate on a particular division but focus to achieve

organisational targets and objectives in an effective way. Instead of this, it can be portrays that it

is total or each and every budget which will be developed by company.

If superior prepare this kind of budget then, they can easily get ensured that they are

using resources adequately (Petty and et. al., 2015). As a result, unwanted cost will get decreased

which assist them to enhance their profits. Along with this, each worker know their roles and

responsibility in enterprise; therefore, it removes confusion amongst them. By getting right

direction they will accomplish their work within limited period of time.

9

P4 Advantages and disadvantages of planning tools which are used for budgetary control

It is fundamental for an organisation to prepare budget for their business; therefore, they

can easily control their income as well as expenses in an adequate manner (Laudon and Laudon,

2016). With assistance of this, manager will check out that, staff members are doing their task as

per the planned manner or not. If there is any requirement of alterations then, this will be done.

Therefore, there are some techniques of planning which will be utilized by Taj Stores to control

budget and this is discussed as beneath:

Cash Budget: Fundamental aim of formulating budget is to cater data and information

which is related to cash. With assistance of this, need of cash will be examined. Along with this,

inflow as well as outflow of cash will also identified by this budget (Liao, Chu and Hsiao, 2012).

To run association in a smooth manner, it is required for them to use cash in correct manner.

There are various advantages which are associated with this method. It assists to decrease

hazards related to bad debts and in addition employer will make sure that organisation is

receiving remaining fund within limited period of time. Additionally, they are paying their entire

credits as per the time limit. As a result, firm will easily keep up good relations with their

shareholders and other institutions. They will also get assured that they are doing their

operational activities in a right way.

Rather than this, some of disadvantages which are connected with cash methodology.

Cash budget accuracy is much less as this will fluctuate as per the nature of environment. Thus,

it is not easy for manager to make adequate budget. This spending plan always developed by

taken into under consideration previous year data and information.

Master Budget: With help of this, an association can allocate distinguish resources to

various units of company. It never concentrate on a particular division but focus to achieve

organisational targets and objectives in an effective way. Instead of this, it can be portrays that it

is total or each and every budget which will be developed by company.

If superior prepare this kind of budget then, they can easily get ensured that they are

using resources adequately (Petty and et. al., 2015). As a result, unwanted cost will get decreased

which assist them to enhance their profits. Along with this, each worker know their roles and

responsibility in enterprise; therefore, it removes confusion amongst them. By getting right

direction they will accomplish their work within limited period of time.

9

Utilization of this tool is much expansive as Taj stores is doing their working at a small

scale; thus, it is not easy for them to afford this. They are having limited fund which is required

by them to run their business operations in an appropriate way. This is a tiny association; hence,

they can easily eliminate confusion without utilizing any kind of method.

Capital Expenditure Budget: This sort of spending plan has to be prepare by company;

therefore, they can easily manage their financial assets effectively as well as efficiently. As a

result, they can easily purchase new equipment or building for their business. This will not

develop any sort of financial burden on firm (Roy and et. al., 2011). There are many kind of

strategies need to be prepare under it, such as long haul loans, borrowings and so on. It is

essential for each and every type of enterprise to formulate this budget as with assistance of this,

they can easily know that they will get success and growth in future or not.

It will aid to know the hazards which is related with judgement of investment. Along with

this, it helps to find out that which one is the best investment alternative for them and gives

higher return. This will also help to control entire expenditures which is associated with project

in a proficient manner.

It is formulated for the period of long term; therefore, it is much difficult for company to

make any alterations in it. Henceforth, level of certainty is much less. It has been comprehended

that strategy which is prepared in recent period of time is not relevant for future.

Zero based Budgeting: As indicated by this, at present it is must for company to

formulate new budget through evaluating each functions of firm. Manager never consider

previous budget. The base of this technique is begin with zero only.

Accuracy level is high of this spending plan and this plays an important part in procedure

of reduction of value. This will be done if allocation of resources is done in an adequate way. As

Taj stores are doing their business at small scale; therefore, they can easily adopt this tool of

budgeting. Along with this, manager will decrease entire unnecessary exercises with assistance

of this method.

If an enterprise is using this technique then, they need maximum workforce and it will

takes more time. If any tiny association is utilizing this tool into their business then, it will be

must for them to cater training to their staff members. This will help them to make expertise.

Activity based budgeting: According to this aspect, records related to previous data is

neglected and then, formation of budget is done with help of activities. It is required to examine

10

scale; thus, it is not easy for them to afford this. They are having limited fund which is required

by them to run their business operations in an appropriate way. This is a tiny association; hence,

they can easily eliminate confusion without utilizing any kind of method.

Capital Expenditure Budget: This sort of spending plan has to be prepare by company;

therefore, they can easily manage their financial assets effectively as well as efficiently. As a

result, they can easily purchase new equipment or building for their business. This will not

develop any sort of financial burden on firm (Roy and et. al., 2011). There are many kind of

strategies need to be prepare under it, such as long haul loans, borrowings and so on. It is

essential for each and every type of enterprise to formulate this budget as with assistance of this,

they can easily know that they will get success and growth in future or not.

It will aid to know the hazards which is related with judgement of investment. Along with

this, it helps to find out that which one is the best investment alternative for them and gives

higher return. This will also help to control entire expenditures which is associated with project

in a proficient manner.

It is formulated for the period of long term; therefore, it is much difficult for company to

make any alterations in it. Henceforth, level of certainty is much less. It has been comprehended

that strategy which is prepared in recent period of time is not relevant for future.

Zero based Budgeting: As indicated by this, at present it is must for company to

formulate new budget through evaluating each functions of firm. Manager never consider

previous budget. The base of this technique is begin with zero only.

Accuracy level is high of this spending plan and this plays an important part in procedure

of reduction of value. This will be done if allocation of resources is done in an adequate way. As

Taj stores are doing their business at small scale; therefore, they can easily adopt this tool of

budgeting. Along with this, manager will decrease entire unnecessary exercises with assistance

of this method.

If an enterprise is using this technique then, they need maximum workforce and it will

takes more time. If any tiny association is utilizing this tool into their business then, it will be

must for them to cater training to their staff members. This will help them to make expertise.

Activity based budgeting: According to this aspect, records related to previous data is

neglected and then, formation of budget is done with help of activities. It is required to examine

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

each exercise adequately (Stair and et. al., 2011). Along with this, it is must to examine it; thus,

allocation of resources will be done in a proficient manner.

Instead of all of this, it will help remove inappropriate work which is enhancing business

cost and revenues are get diminished. By using this kind spending plan, manager will develop an

effective interaction amongst all units. As a result, this will aid to concentrate on entire

affiliation.

Utilization of this budget is much typical as it takes maximum money as well as time. As

Taj stores is doing their business at small scale so that functions which are performing by them is

less. Therefore, it is must for them to spend lots of fund on complex budget tools.

TASK 4

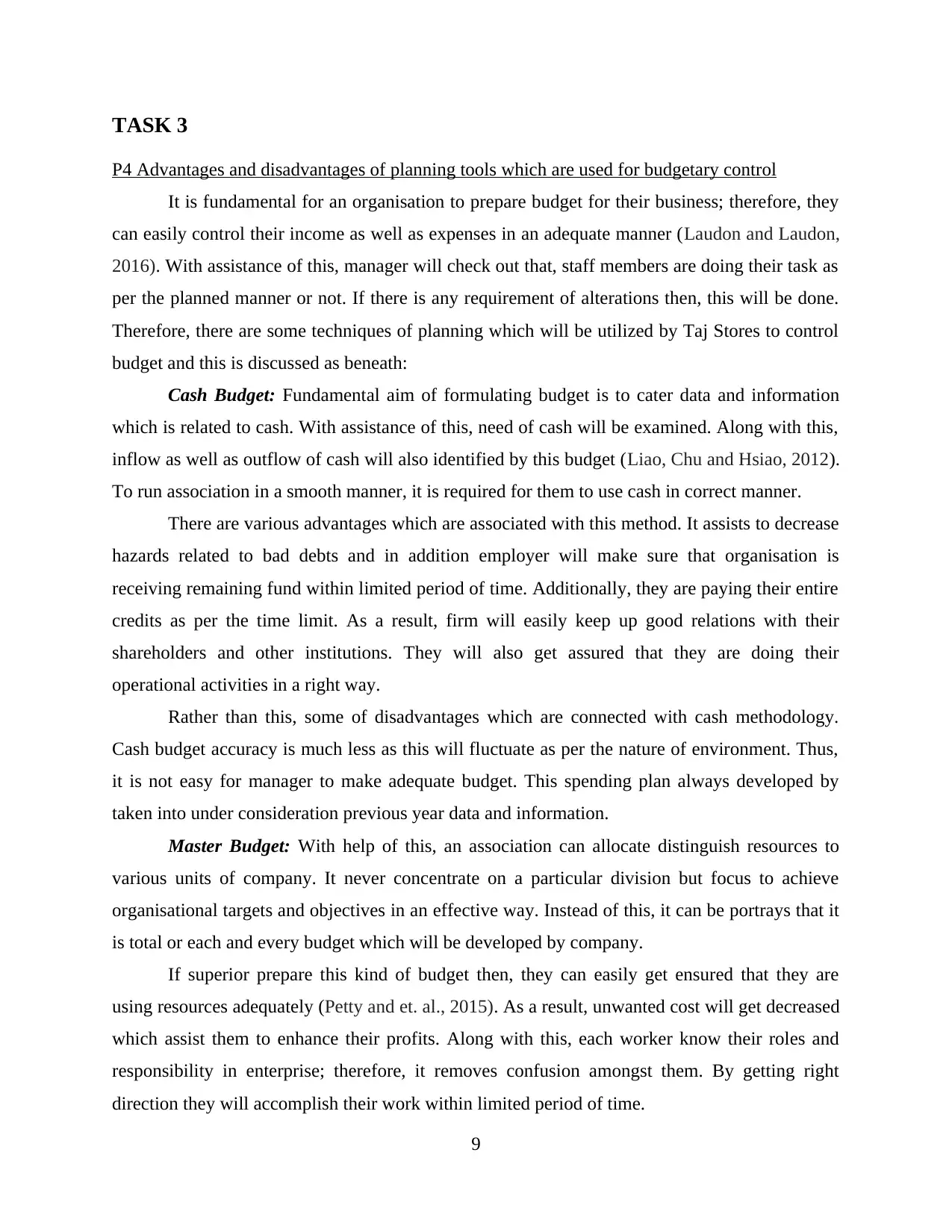

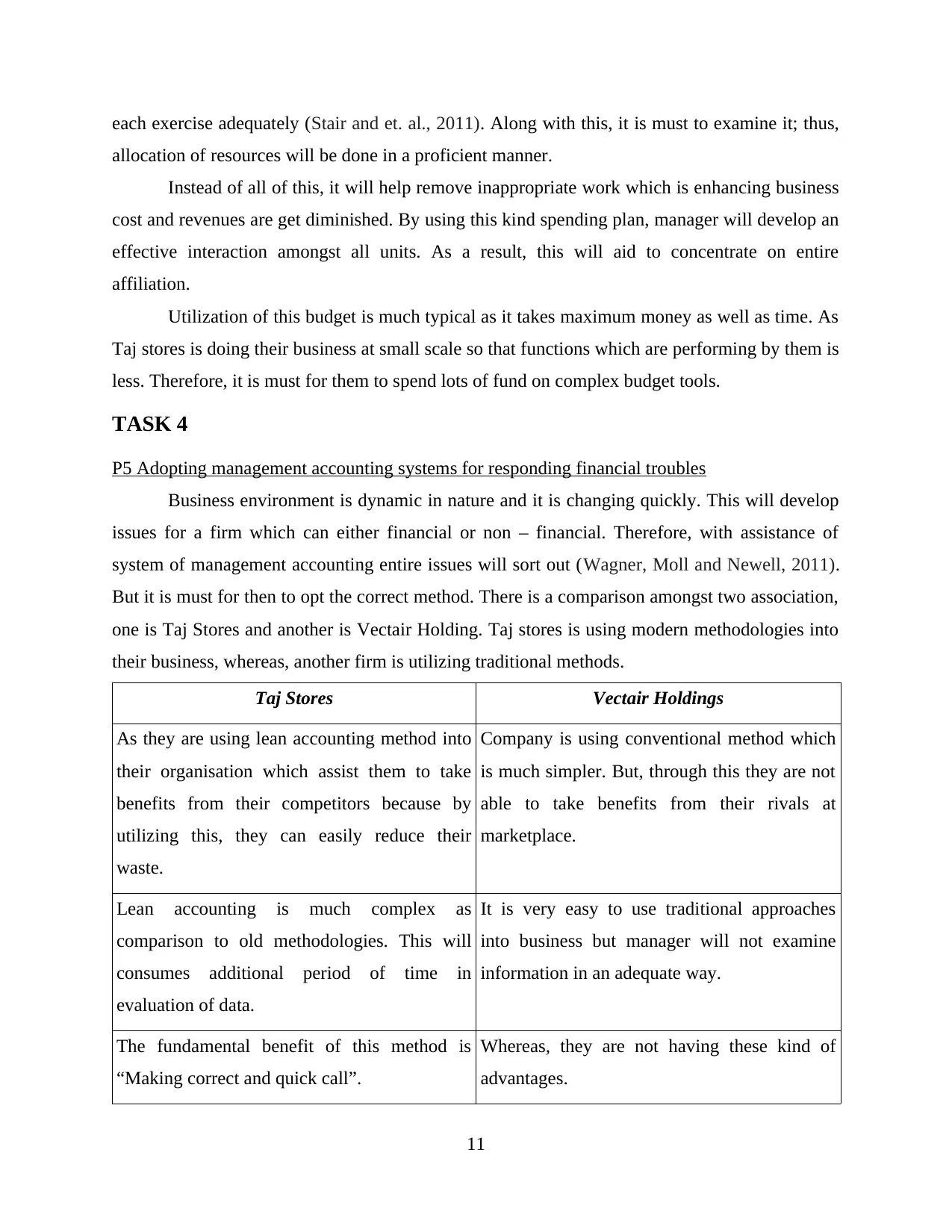

P5 Adopting management accounting systems for responding financial troubles

Business environment is dynamic in nature and it is changing quickly. This will develop

issues for a firm which can either financial or non – financial. Therefore, with assistance of

system of management accounting entire issues will sort out (Wagner, Moll and Newell, 2011).

But it is must for then to opt the correct method. There is a comparison amongst two association,

one is Taj Stores and another is Vectair Holding. Taj stores is using modern methodologies into

their business, whereas, another firm is utilizing traditional methods.

Taj Stores Vectair Holdings

As they are using lean accounting method into

their organisation which assist them to take

benefits from their competitors because by

utilizing this, they can easily reduce their

waste.

Company is using conventional method which

is much simpler. But, through this they are not

able to take benefits from their rivals at

marketplace.

Lean accounting is much complex as

comparison to old methodologies. This will

consumes additional period of time in

evaluation of data.

It is very easy to use traditional approaches

into business but manager will not examine

information in an adequate way.

The fundamental benefit of this method is

“Making correct and quick call”.

Whereas, they are not having these kind of

advantages.

11

allocation of resources will be done in a proficient manner.

Instead of all of this, it will help remove inappropriate work which is enhancing business

cost and revenues are get diminished. By using this kind spending plan, manager will develop an

effective interaction amongst all units. As a result, this will aid to concentrate on entire

affiliation.

Utilization of this budget is much typical as it takes maximum money as well as time. As

Taj stores is doing their business at small scale so that functions which are performing by them is

less. Therefore, it is must for them to spend lots of fund on complex budget tools.

TASK 4

P5 Adopting management accounting systems for responding financial troubles

Business environment is dynamic in nature and it is changing quickly. This will develop

issues for a firm which can either financial or non – financial. Therefore, with assistance of

system of management accounting entire issues will sort out (Wagner, Moll and Newell, 2011).

But it is must for then to opt the correct method. There is a comparison amongst two association,

one is Taj Stores and another is Vectair Holding. Taj stores is using modern methodologies into

their business, whereas, another firm is utilizing traditional methods.

Taj Stores Vectair Holdings

As they are using lean accounting method into

their organisation which assist them to take

benefits from their competitors because by

utilizing this, they can easily reduce their

waste.

Company is using conventional method which

is much simpler. But, through this they are not

able to take benefits from their rivals at

marketplace.

Lean accounting is much complex as

comparison to old methodologies. This will

consumes additional period of time in

evaluation of data.

It is very easy to use traditional approaches

into business but manager will not examine

information in an adequate way.

The fundamental benefit of this method is

“Making correct and quick call”.

Whereas, they are not having these kind of

advantages.

11

Organisation is using new or latest methods as

well as updated software; as a result, they will

accomplish their task in more effective

manner.

They maintain their accounts manually only.

Therefore, there are some issues which will be face by Taj Stores if they do not use

appropriate methods. Problem will be associated with profitability, price maximisation, cost

efficiency, performance and control and so on. To resolve them efficiently it is must for manager

to use and develop best strategies or tools which are mentioned as beneath:

Key Performance indicators: With assistance of this, employer will keep up

appropriateness of their firm which will help them to attain long term targets in an adequate way.

To resolve issues which are associated with finance, it is must to set SMART objectives. As a

result, company can decrease their debts proficiently. Rather than this, by setting their goals in an

particular way they reduced their debts by 15% which assist them to improve their goodwill at

marketplace. Objectives need to be measurable; therefore, this can be easily compared from

previous data and information and in addition it has to be real; so that it will achieve efficiently.

Like, Taj stores wants to reduce their overall debts in next 5 years which will not cater any kind

of burden on them and they will accomplish their entire work proficiently.

Benchmarking: This has to be present in each and every kind of enterprise. It is must for

superior to set some standard for their goods and services; therefore, they will do their

production by maintaining quality. Along with this, they can easily cope up from financial

difficulties. As a result, this will help to decrease influence of unfavourable circumstances which

is related with firm.

Financial Governance: It is required for company to do intrinsic audit and follow each

and every laws or regulations which are formulated by regulatory body. Therefore, an enterprise

will run their business in an adequate manner. Along with this, entire issues will sort out within

limited period of time which help them to maintain their revenues.

CONCLUSION

It get concluded from the project that managerial accounting is an essential and important

concept for business through which an organisation become able to deal with various problems

which arise in short period of time. There are various methods and system are identify which are

12

well as updated software; as a result, they will

accomplish their task in more effective

manner.

They maintain their accounts manually only.

Therefore, there are some issues which will be face by Taj Stores if they do not use

appropriate methods. Problem will be associated with profitability, price maximisation, cost

efficiency, performance and control and so on. To resolve them efficiently it is must for manager

to use and develop best strategies or tools which are mentioned as beneath:

Key Performance indicators: With assistance of this, employer will keep up

appropriateness of their firm which will help them to attain long term targets in an adequate way.

To resolve issues which are associated with finance, it is must to set SMART objectives. As a

result, company can decrease their debts proficiently. Rather than this, by setting their goals in an

particular way they reduced their debts by 15% which assist them to improve their goodwill at

marketplace. Objectives need to be measurable; therefore, this can be easily compared from

previous data and information and in addition it has to be real; so that it will achieve efficiently.

Like, Taj stores wants to reduce their overall debts in next 5 years which will not cater any kind

of burden on them and they will accomplish their entire work proficiently.

Benchmarking: This has to be present in each and every kind of enterprise. It is must for

superior to set some standard for their goods and services; therefore, they will do their

production by maintaining quality. Along with this, they can easily cope up from financial

difficulties. As a result, this will help to decrease influence of unfavourable circumstances which

is related with firm.

Financial Governance: It is required for company to do intrinsic audit and follow each

and every laws or regulations which are formulated by regulatory body. Therefore, an enterprise

will run their business in an adequate manner. Along with this, entire issues will sort out within

limited period of time which help them to maintain their revenues.

CONCLUSION

It get concluded from the project that managerial accounting is an essential and important

concept for business through which an organisation become able to deal with various problems

which arise in short period of time. There are various methods and system are identify which are

12

related with business association. On the basis of these methods and system, management

become able to deal with diverse problems and issues of an organisation which are harmful for

business. Managerial and absorption costing both enables an association to determine their net

profit. There are various advantages and disadvantages are determine which are related with

budgetary tools so that association become able to frame such budget which facilitate long term

growth and resolve all minimum problems of a business. There are various financial problems

and issues arise in a business which get respond only by applying relevant approach which is

managerial accounting.

13

become able to deal with diverse problems and issues of an organisation which are harmful for

business. Managerial and absorption costing both enables an association to determine their net

profit. There are various advantages and disadvantages are determine which are related with

budgetary tools so that association become able to frame such budget which facilitate long term

growth and resolve all minimum problems of a business. There are various financial problems

and issues arise in a business which get respond only by applying relevant approach which is

managerial accounting.

13

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.