Management Accounting Assignment Example

VerifiedAdded on 2021/06/17

|16

|1993

|20

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

MANAGEMENT ACCOUNTING

Table of Contents

Answer to Part A.............................................................................................................................2

Incorporation of Master Budget...................................................................................................2

Answer to Part B............................................................................................................................10

Analysis of Production Plan......................................................................................................10

Answer to Part C............................................................................................................................13

Analysis of Participative and Imposed Budgets........................................................................13

Reference.......................................................................................................................................15

MANAGEMENT ACCOUNTING

Table of Contents

Answer to Part A.............................................................................................................................2

Incorporation of Master Budget...................................................................................................2

Answer to Part B............................................................................................................................10

Analysis of Production Plan......................................................................................................10

Answer to Part C............................................................................................................................13

Analysis of Participative and Imposed Budgets........................................................................13

Reference.......................................................................................................................................15

2

MANAGEMENT ACCOUNTING

Answer to Part A

Incorporation of Master Budget

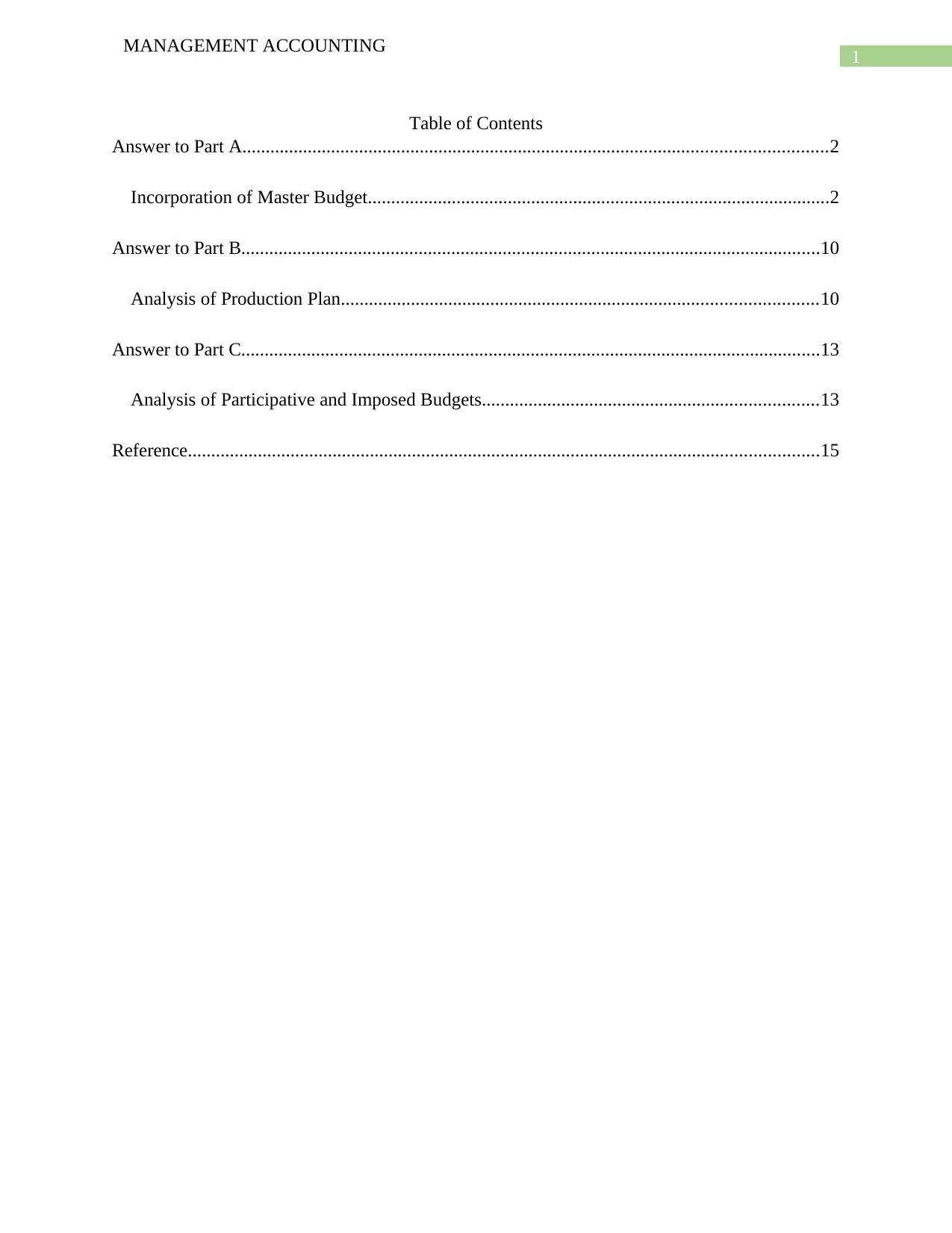

Figure 1: (Image showing Sales Budget)

Source: (Created by Author)

Figure 2: (Image showing Production Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Answer to Part A

Incorporation of Master Budget

Figure 1: (Image showing Sales Budget)

Source: (Created by Author)

Figure 2: (Image showing Production Budget)

Source: (Created by Author)

3

MANAGEMENT ACCOUNTING

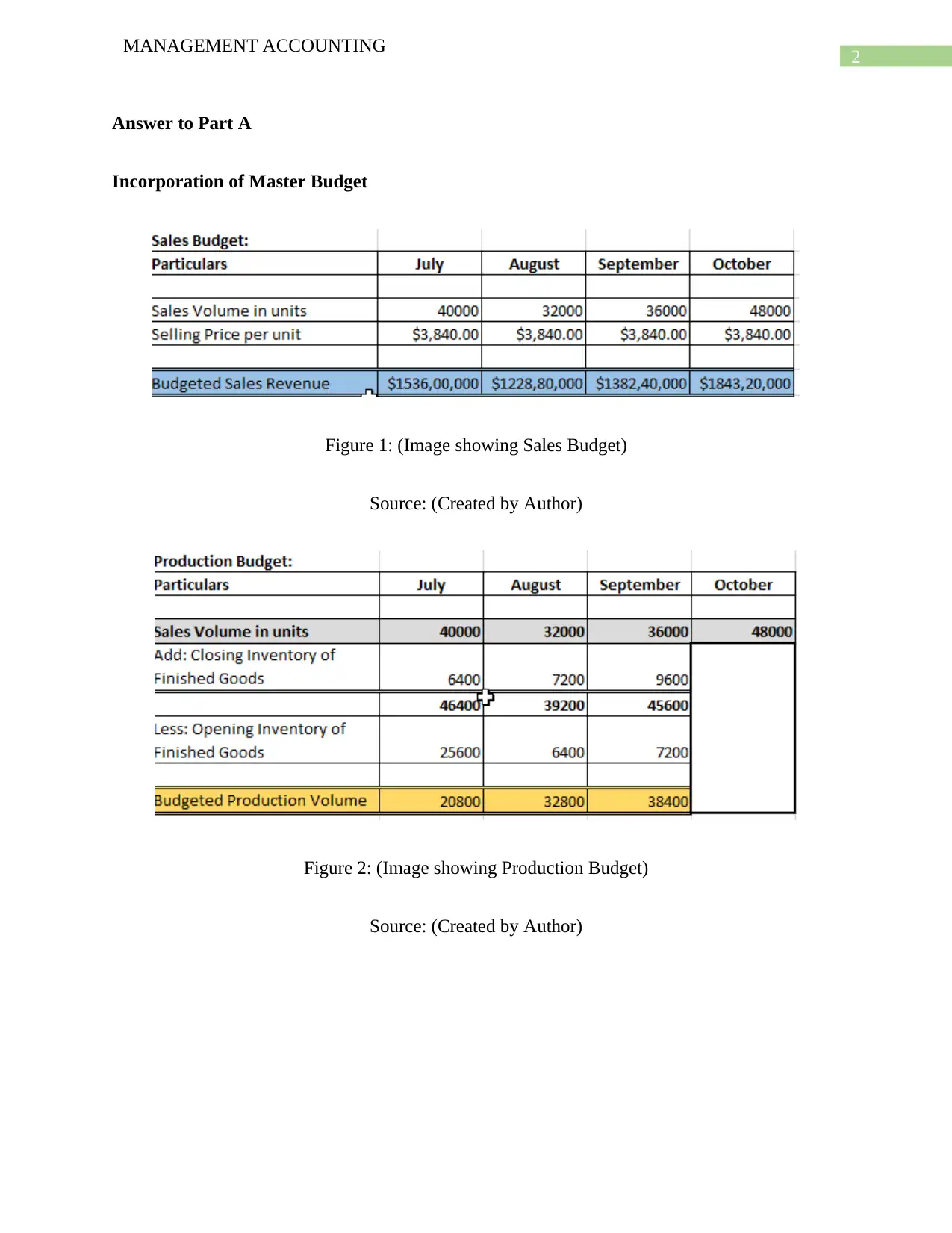

Figure 3: (Image showing Direct Labor Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Figure 3: (Image showing Direct Labor Budget)

Source: (Created by Author)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

MANAGEMENT ACCOUNTING

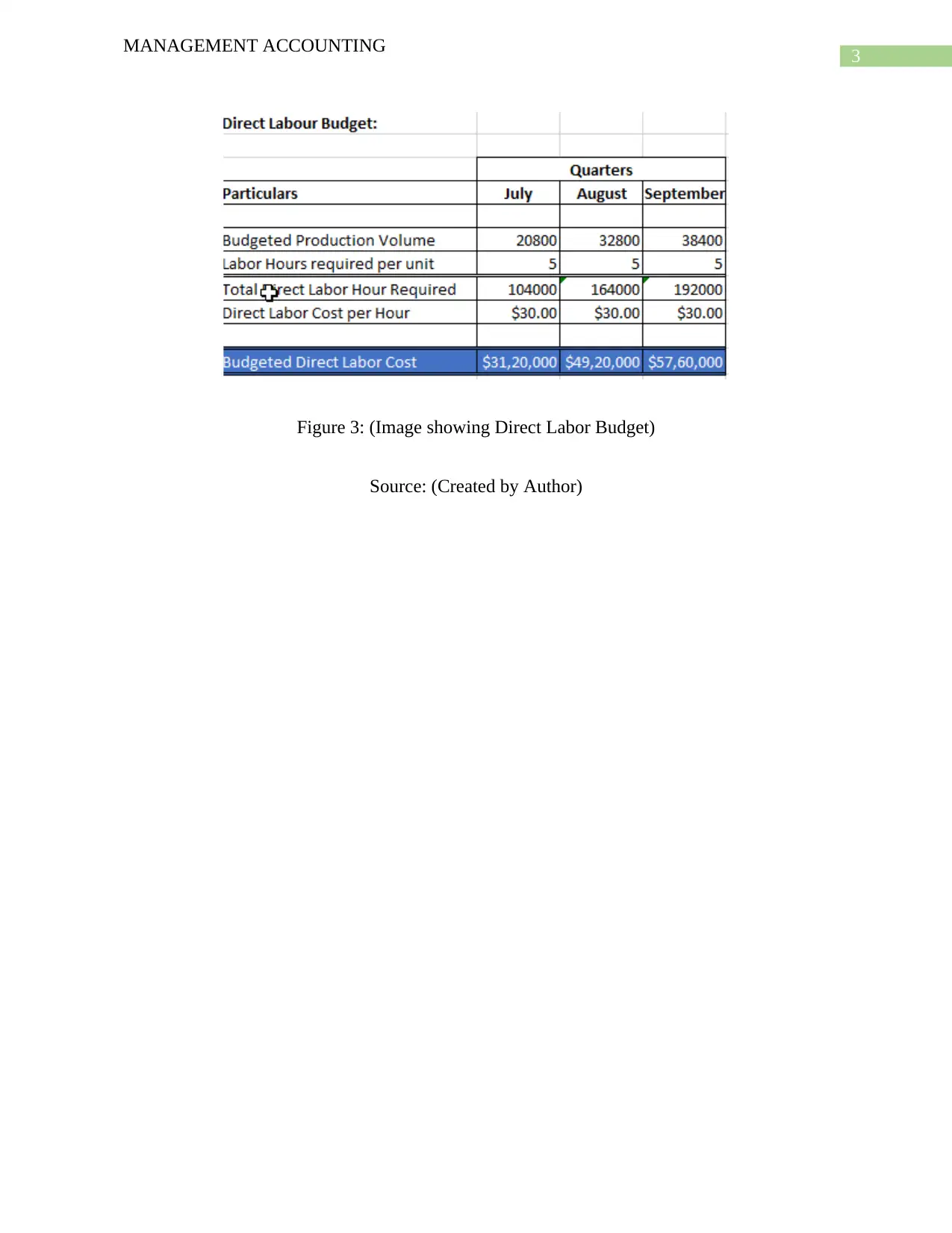

Purchase Budget:

Particulars July August September October

Budgeted Sales Volume 40000 32000 36000 48000

Budgeted Production Volume 20800 32800 38400

Fuse required per unit 2 2 2

Total Fuse Required 41600 65600 76800

Add: Closing Inventory of Fuse 38400 43200 57600

80000 108800 134400

Less: Opening Inventory of Fuse 48000 38400 43200

Budgeted Purchase Volume (in units) 32000 70400 91200

Fuse Cost per unit $48.00 $48.00 $48.00

Total Cost of Fuse $15,36,000 $33,79,200 $43,77,600

Isolators required per unit 3 3 3 3

Total Isolators Required 62400 98400 115200

Add: Closing Inventory of Isolators 57600 64800 86400

120000 163200 201600

Less: Opening Inventory of Isolators 72000 57600 64800

Budgeted Purchase Volume (in units) 48000 105600 136800

Isolators Cost per unit $64.00 $64.00 $64.00

Total Cost of Isolators $39,93,600 $62,97,600 $73,72,800

Budgeted Direct Material Purchase $55,29,600 $96,76,800 $117,50,400

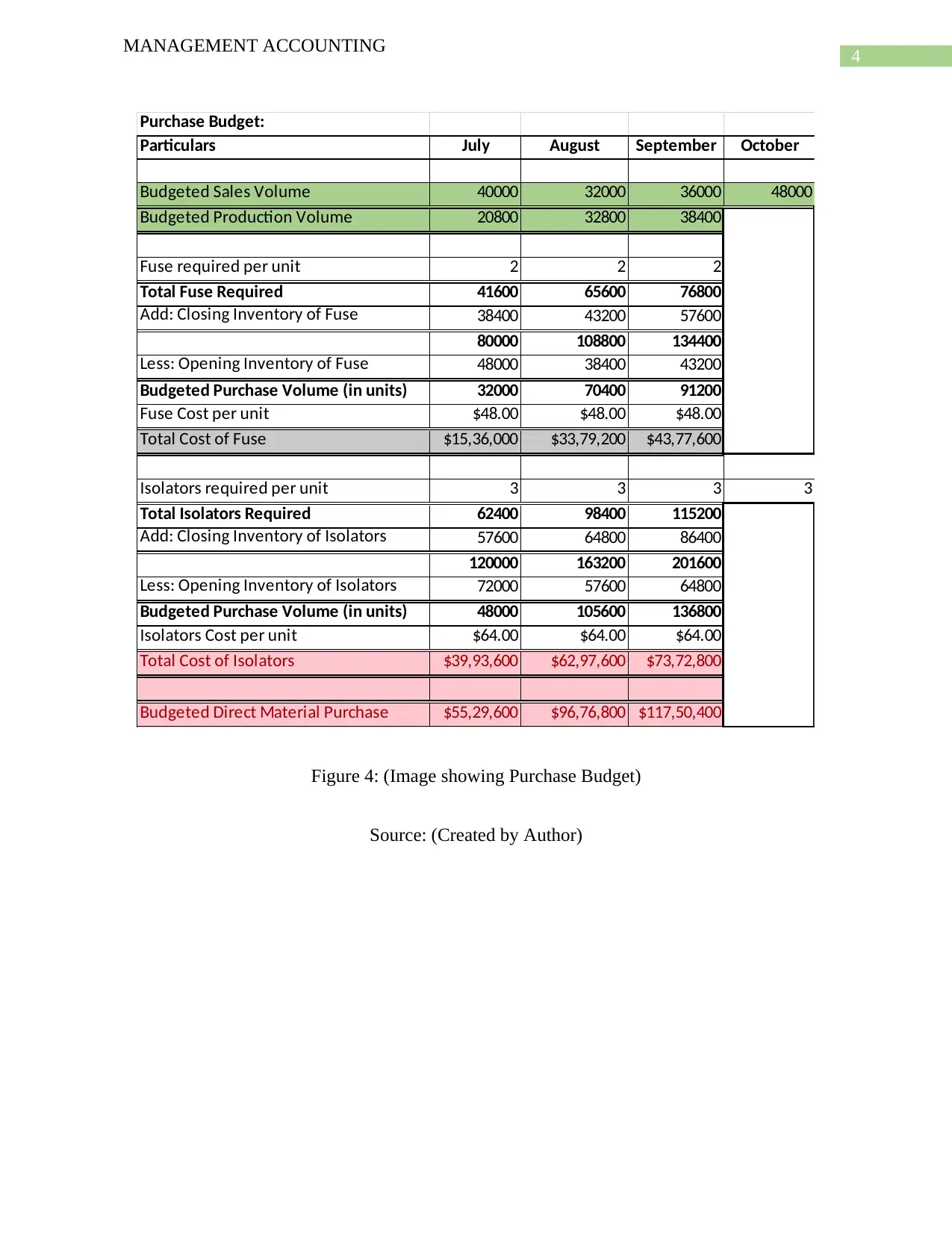

Figure 4: (Image showing Purchase Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Purchase Budget:

Particulars July August September October

Budgeted Sales Volume 40000 32000 36000 48000

Budgeted Production Volume 20800 32800 38400

Fuse required per unit 2 2 2

Total Fuse Required 41600 65600 76800

Add: Closing Inventory of Fuse 38400 43200 57600

80000 108800 134400

Less: Opening Inventory of Fuse 48000 38400 43200

Budgeted Purchase Volume (in units) 32000 70400 91200

Fuse Cost per unit $48.00 $48.00 $48.00

Total Cost of Fuse $15,36,000 $33,79,200 $43,77,600

Isolators required per unit 3 3 3 3

Total Isolators Required 62400 98400 115200

Add: Closing Inventory of Isolators 57600 64800 86400

120000 163200 201600

Less: Opening Inventory of Isolators 72000 57600 64800

Budgeted Purchase Volume (in units) 48000 105600 136800

Isolators Cost per unit $64.00 $64.00 $64.00

Total Cost of Isolators $39,93,600 $62,97,600 $73,72,800

Budgeted Direct Material Purchase $55,29,600 $96,76,800 $117,50,400

Figure 4: (Image showing Purchase Budget)

Source: (Created by Author)

5

MANAGEMENT ACCOUNTING

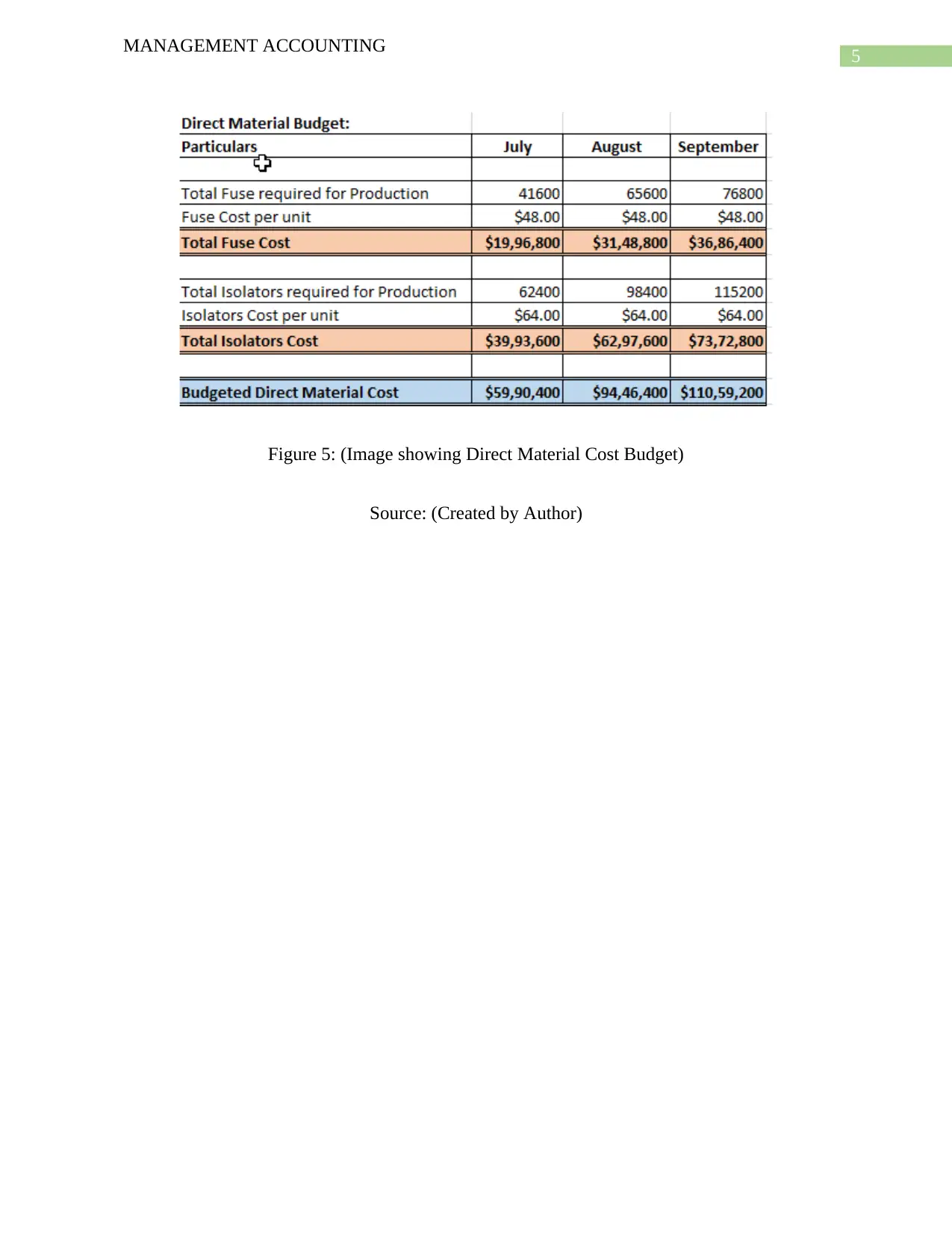

Figure 5: (Image showing Direct Material Cost Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Figure 5: (Image showing Direct Material Cost Budget)

Source: (Created by Author)

6

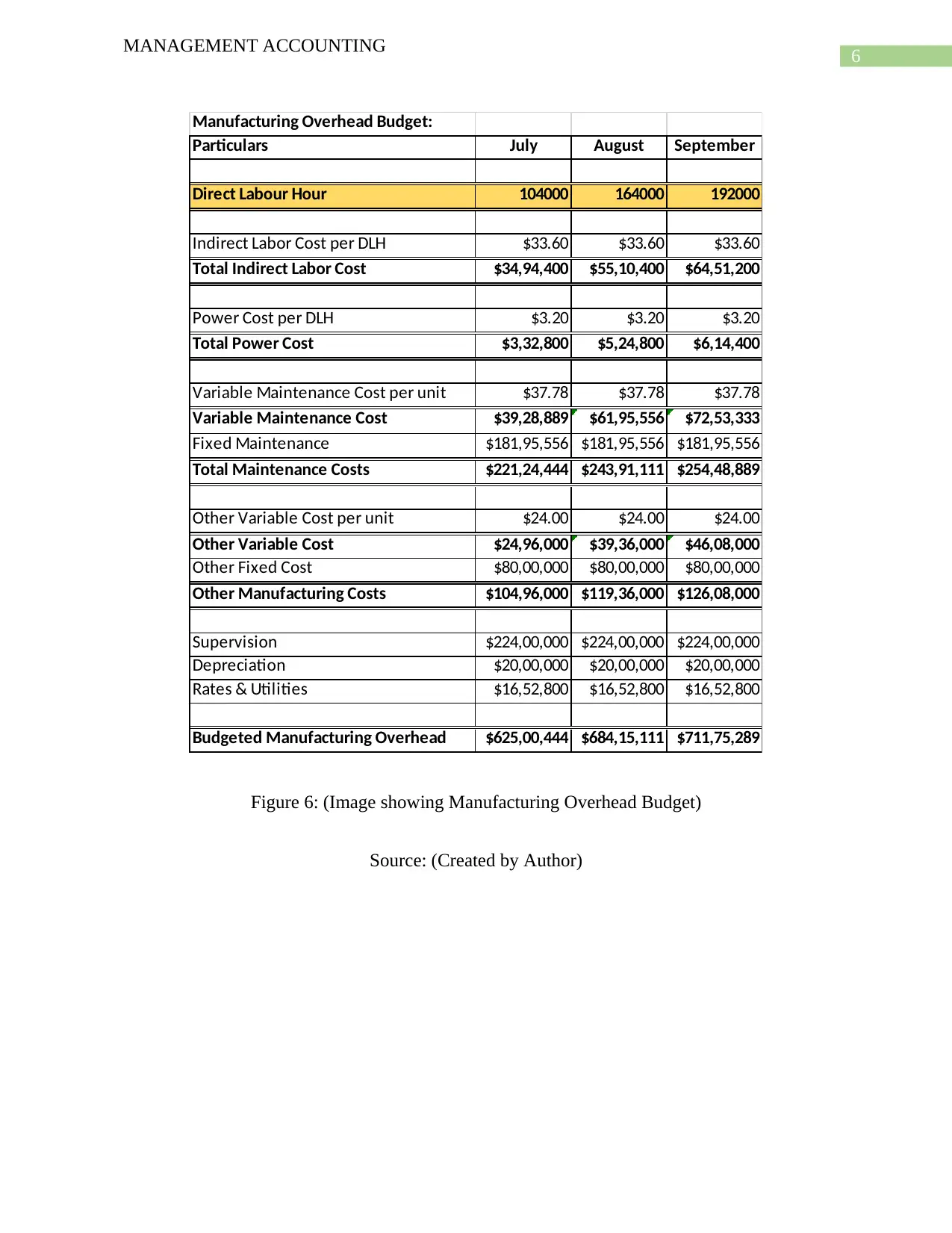

MANAGEMENT ACCOUNTING

Manufacturing Overhead Budget:

Particulars July August September

Direct Labour Hour 104000 164000 192000

Indirect Labor Cost per DLH $33.60 $33.60 $33.60

Total Indirect Labor Cost $34,94,400 $55,10,400 $64,51,200

Power Cost per DLH $3.20 $3.20 $3.20

Total Power Cost $3,32,800 $5,24,800 $6,14,400

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $39,28,889 $61,95,556 $72,53,333

Fixed Maintenance $181,95,556 $181,95,556 $181,95,556

Total Maintenance Costs $221,24,444 $243,91,111 $254,48,889

Other Variable Cost per unit $24.00 $24.00 $24.00

Other Variable Cost $24,96,000 $39,36,000 $46,08,000

Other Fixed Cost $80,00,000 $80,00,000 $80,00,000

Other Manufacturing Costs $104,96,000 $119,36,000 $126,08,000

Supervision $224,00,000 $224,00,000 $224,00,000

Depreciation $20,00,000 $20,00,000 $20,00,000

Rates & Utilities $16,52,800 $16,52,800 $16,52,800

Budgeted Manufacturing Overhead $625,00,444 $684,15,111 $711,75,289

Figure 6: (Image showing Manufacturing Overhead Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Manufacturing Overhead Budget:

Particulars July August September

Direct Labour Hour 104000 164000 192000

Indirect Labor Cost per DLH $33.60 $33.60 $33.60

Total Indirect Labor Cost $34,94,400 $55,10,400 $64,51,200

Power Cost per DLH $3.20 $3.20 $3.20

Total Power Cost $3,32,800 $5,24,800 $6,14,400

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $39,28,889 $61,95,556 $72,53,333

Fixed Maintenance $181,95,556 $181,95,556 $181,95,556

Total Maintenance Costs $221,24,444 $243,91,111 $254,48,889

Other Variable Cost per unit $24.00 $24.00 $24.00

Other Variable Cost $24,96,000 $39,36,000 $46,08,000

Other Fixed Cost $80,00,000 $80,00,000 $80,00,000

Other Manufacturing Costs $104,96,000 $119,36,000 $126,08,000

Supervision $224,00,000 $224,00,000 $224,00,000

Depreciation $20,00,000 $20,00,000 $20,00,000

Rates & Utilities $16,52,800 $16,52,800 $16,52,800

Budgeted Manufacturing Overhead $625,00,444 $684,15,111 $711,75,289

Figure 6: (Image showing Manufacturing Overhead Budget)

Source: (Created by Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

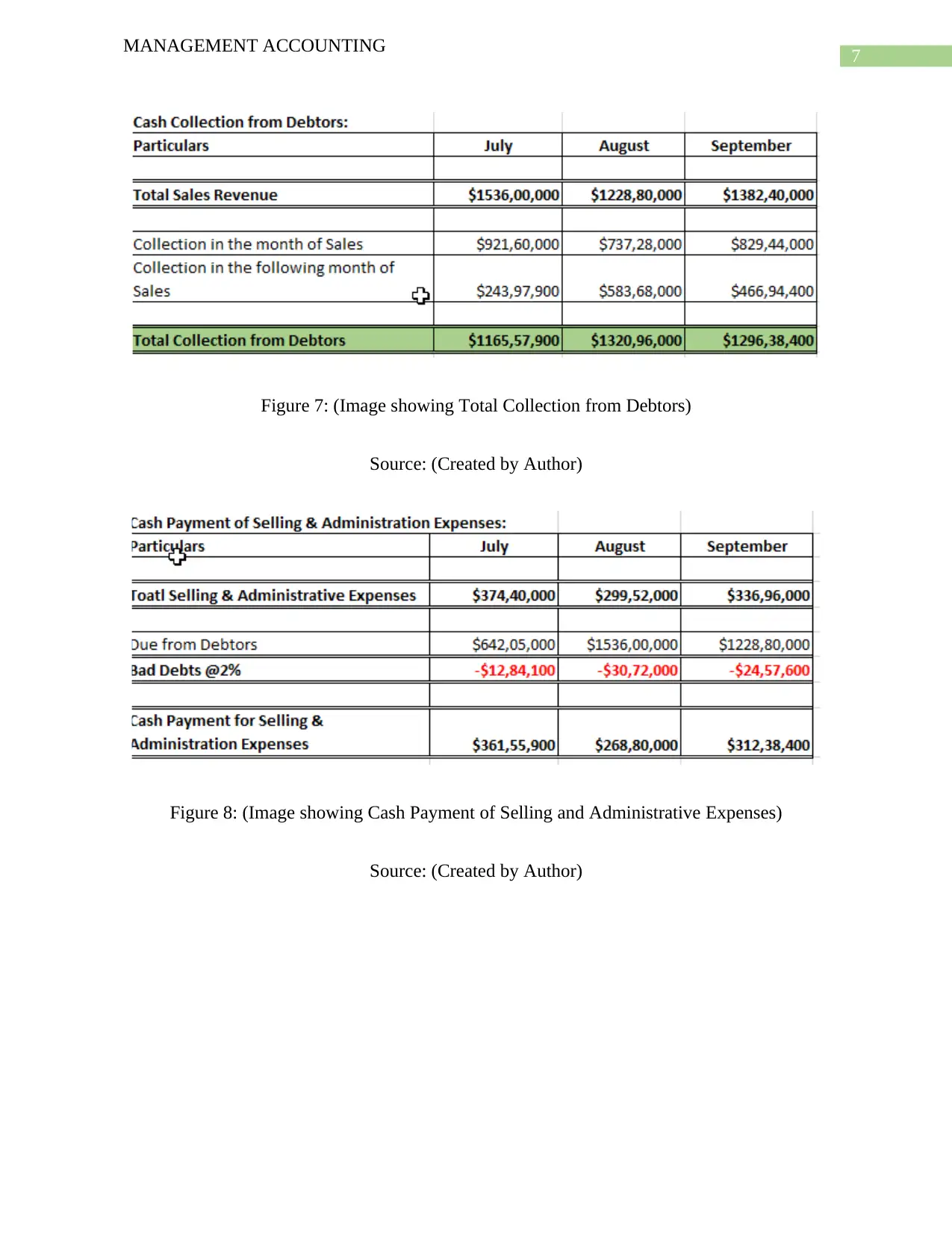

MANAGEMENT ACCOUNTING

Figure 7: (Image showing Total Collection from Debtors)

Source: (Created by Author)

Figure 8: (Image showing Cash Payment of Selling and Administrative Expenses)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Figure 7: (Image showing Total Collection from Debtors)

Source: (Created by Author)

Figure 8: (Image showing Cash Payment of Selling and Administrative Expenses)

Source: (Created by Author)

8

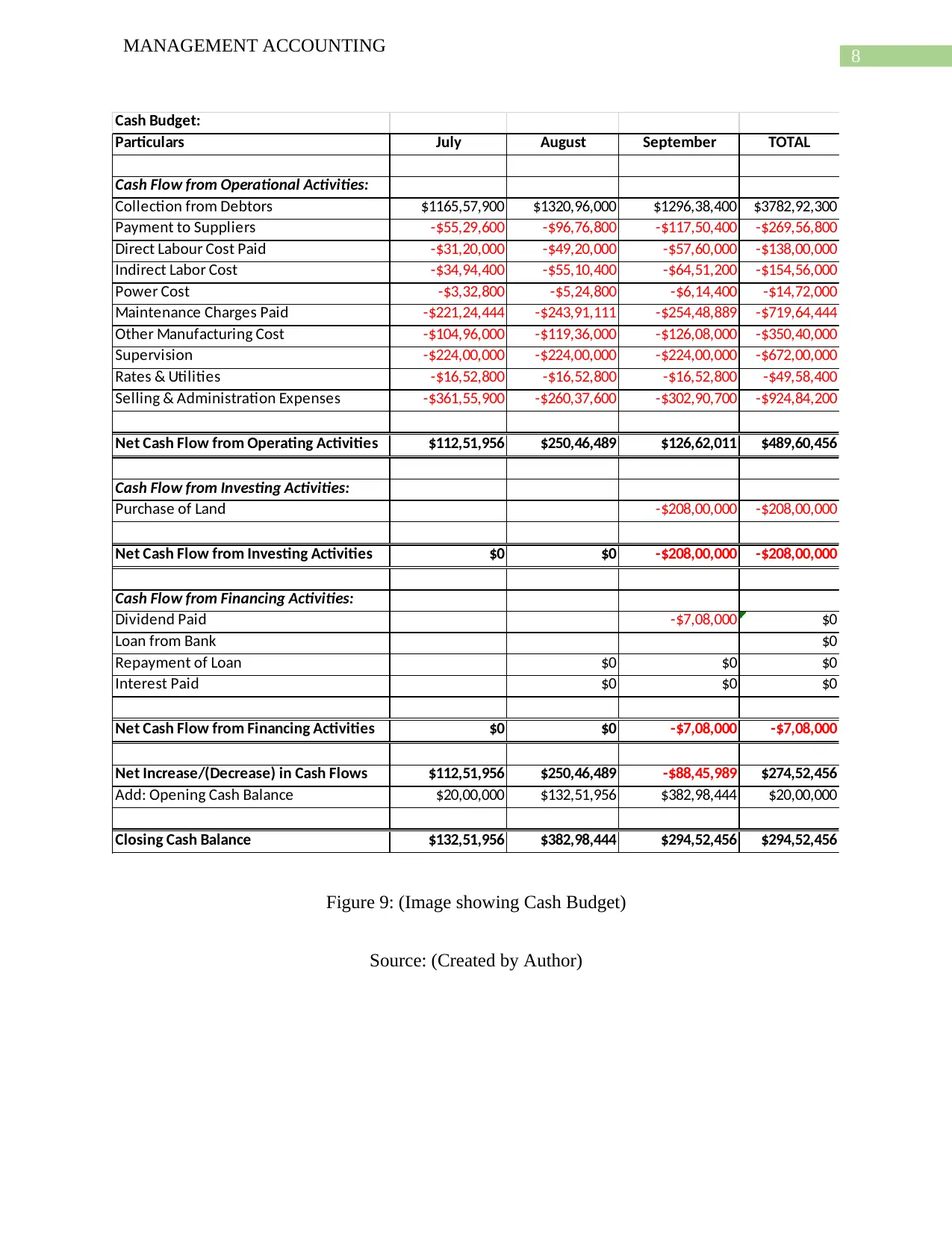

MANAGEMENT ACCOUNTING

Cash Budget:

Particulars July August September TOTAL

Cash Flow from Operational Activities:

Collection from Debtors $1165,57,900 $1320,96,000 $1296,38,400 $3782,92,300

Payment to Suppliers -$55,29,600 -$96,76,800 -$117,50,400 -$269,56,800

Direct Labour Cost Paid -$31,20,000 -$49,20,000 -$57,60,000 -$138,00,000

Indirect Labor Cost -$34,94,400 -$55,10,400 -$64,51,200 -$154,56,000

Power Cost -$3,32,800 -$5,24,800 -$6,14,400 -$14,72,000

Maintenance Charges Paid -$221,24,444 -$243,91,111 -$254,48,889 -$719,64,444

Other Manufacturing Cost -$104,96,000 -$119,36,000 -$126,08,000 -$350,40,000

Supervision -$224,00,000 -$224,00,000 -$224,00,000 -$672,00,000

Rates & Utilities -$16,52,800 -$16,52,800 -$16,52,800 -$49,58,400

Selling & Administration Expenses -$361,55,900 -$260,37,600 -$302,90,700 -$924,84,200

Net Cash Flow from Operating Activities $112,51,956 $250,46,489 $126,62,011 $489,60,456

Cash Flow from Investing Activities:

Purchase of Land -$208,00,000 -$208,00,000

Net Cash Flow from Investing Activities $0 $0 -$208,00,000 -$208,00,000

Cash Flow from Financing Activities:

Dividend Paid -$7,08,000 $0

Loan from Bank $0

Repayment of Loan $0 $0 $0

Interest Paid $0 $0 $0

Net Cash Flow from Financing Activities $0 $0 -$7,08,000 -$7,08,000

Net Increase/(Decrease) in Cash Flows $112,51,956 $250,46,489 -$88,45,989 $274,52,456

Add: Opening Cash Balance $20,00,000 $132,51,956 $382,98,444 $20,00,000

Closing Cash Balance $132,51,956 $382,98,444 $294,52,456 $294,52,456

Figure 9: (Image showing Cash Budget)

Source: (Created by Author)

MANAGEMENT ACCOUNTING

Cash Budget:

Particulars July August September TOTAL

Cash Flow from Operational Activities:

Collection from Debtors $1165,57,900 $1320,96,000 $1296,38,400 $3782,92,300

Payment to Suppliers -$55,29,600 -$96,76,800 -$117,50,400 -$269,56,800

Direct Labour Cost Paid -$31,20,000 -$49,20,000 -$57,60,000 -$138,00,000

Indirect Labor Cost -$34,94,400 -$55,10,400 -$64,51,200 -$154,56,000

Power Cost -$3,32,800 -$5,24,800 -$6,14,400 -$14,72,000

Maintenance Charges Paid -$221,24,444 -$243,91,111 -$254,48,889 -$719,64,444

Other Manufacturing Cost -$104,96,000 -$119,36,000 -$126,08,000 -$350,40,000

Supervision -$224,00,000 -$224,00,000 -$224,00,000 -$672,00,000

Rates & Utilities -$16,52,800 -$16,52,800 -$16,52,800 -$49,58,400

Selling & Administration Expenses -$361,55,900 -$260,37,600 -$302,90,700 -$924,84,200

Net Cash Flow from Operating Activities $112,51,956 $250,46,489 $126,62,011 $489,60,456

Cash Flow from Investing Activities:

Purchase of Land -$208,00,000 -$208,00,000

Net Cash Flow from Investing Activities $0 $0 -$208,00,000 -$208,00,000

Cash Flow from Financing Activities:

Dividend Paid -$7,08,000 $0

Loan from Bank $0

Repayment of Loan $0 $0 $0

Interest Paid $0 $0 $0

Net Cash Flow from Financing Activities $0 $0 -$7,08,000 -$7,08,000

Net Increase/(Decrease) in Cash Flows $112,51,956 $250,46,489 -$88,45,989 $274,52,456

Add: Opening Cash Balance $20,00,000 $132,51,956 $382,98,444 $20,00,000

Closing Cash Balance $132,51,956 $382,98,444 $294,52,456 $294,52,456

Figure 9: (Image showing Cash Budget)

Source: (Created by Author)

9

MANAGEMENT ACCOUNTING

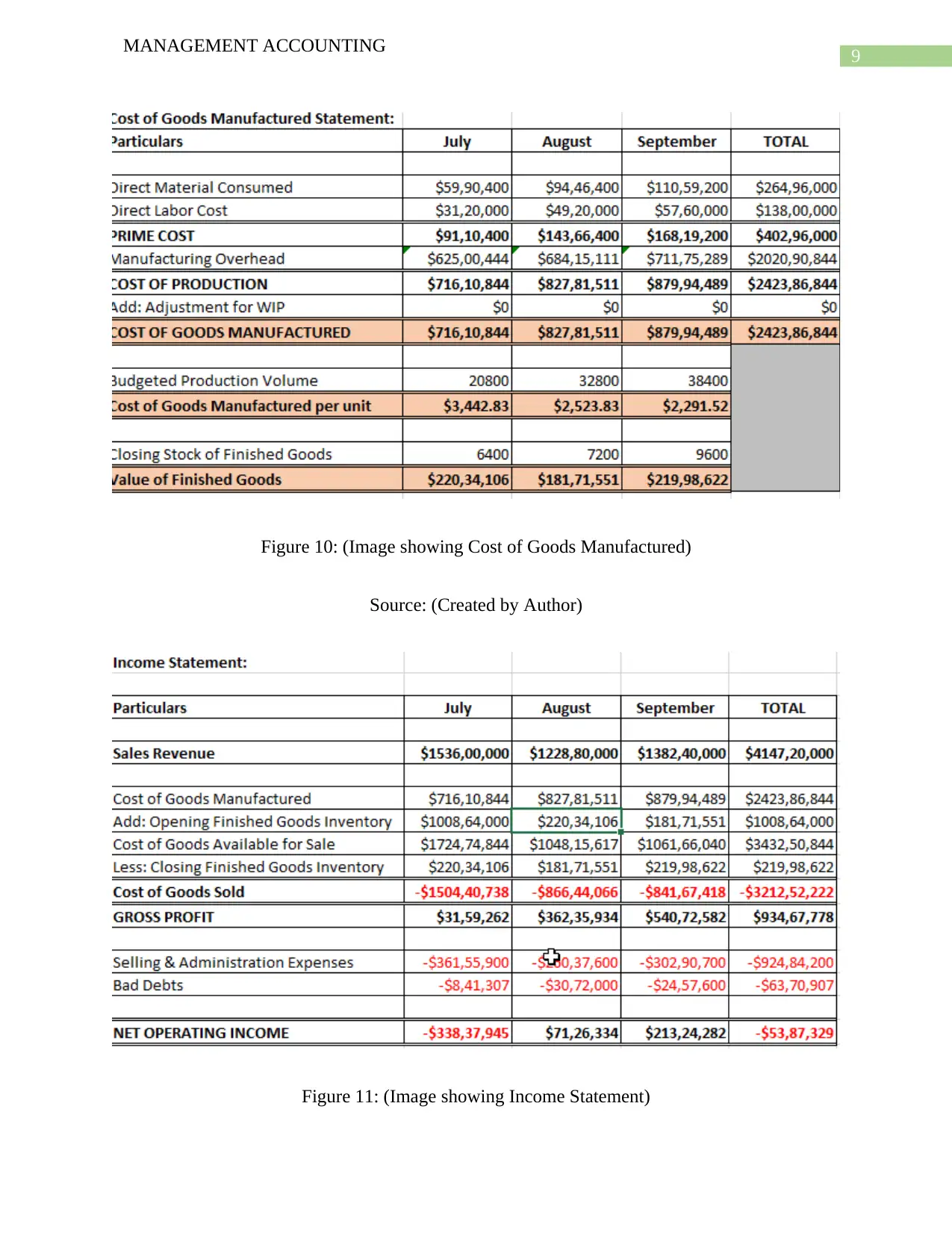

Figure 10: (Image showing Cost of Goods Manufactured)

Source: (Created by Author)

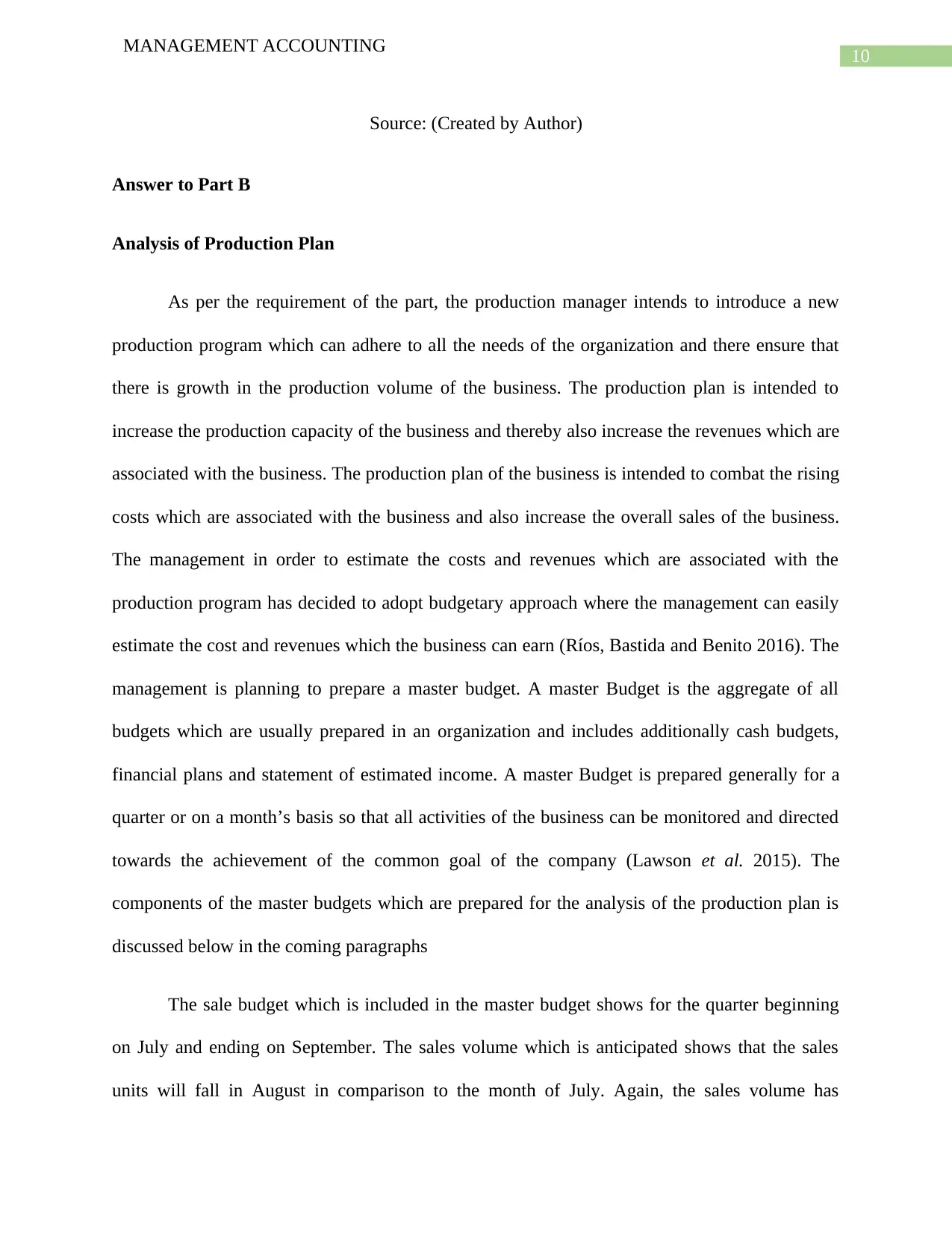

Figure 11: (Image showing Income Statement)

MANAGEMENT ACCOUNTING

Figure 10: (Image showing Cost of Goods Manufactured)

Source: (Created by Author)

Figure 11: (Image showing Income Statement)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

MANAGEMENT ACCOUNTING

Source: (Created by Author)

Answer to Part B

Analysis of Production Plan

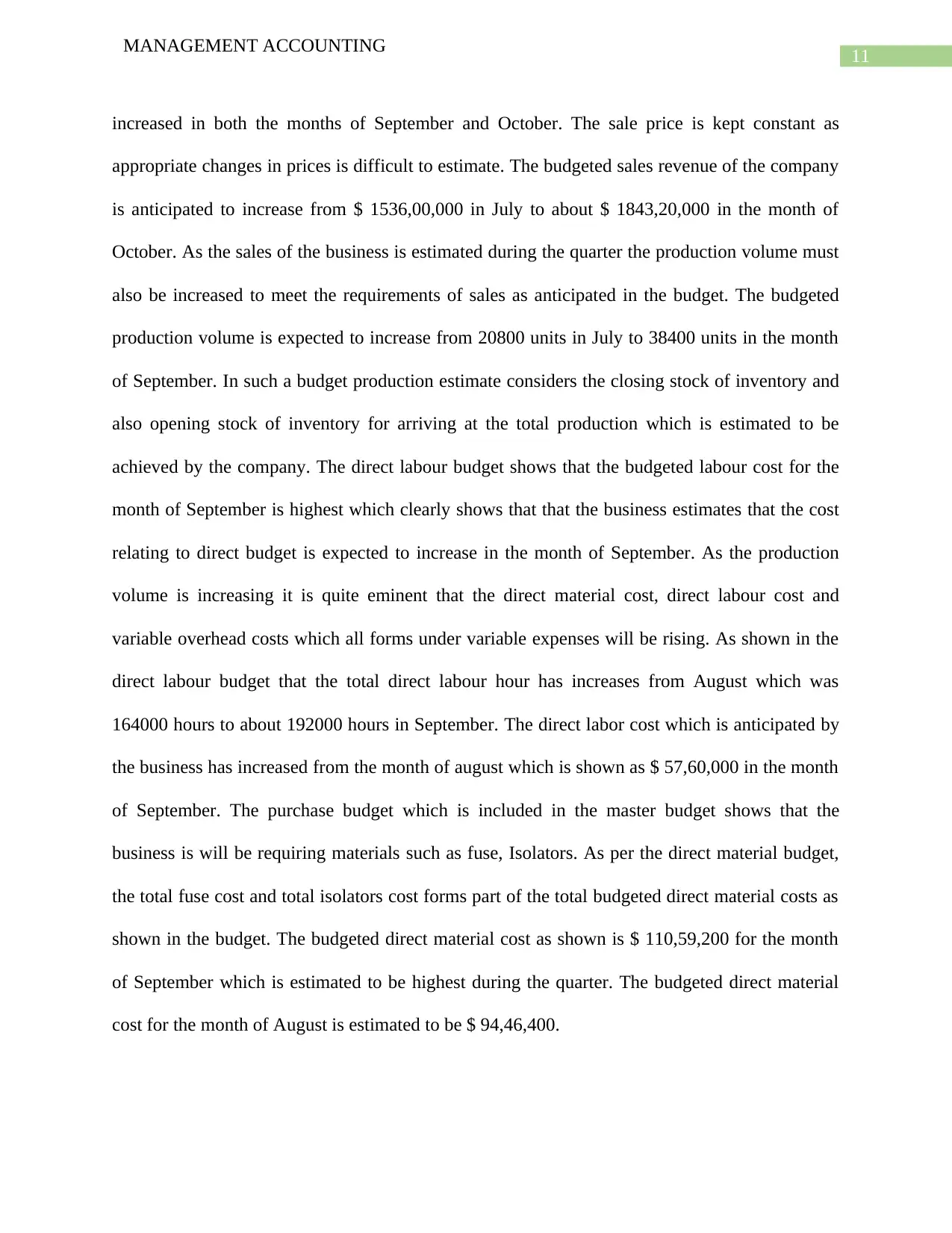

As per the requirement of the part, the production manager intends to introduce a new

production program which can adhere to all the needs of the organization and there ensure that

there is growth in the production volume of the business. The production plan is intended to

increase the production capacity of the business and thereby also increase the revenues which are

associated with the business. The production plan of the business is intended to combat the rising

costs which are associated with the business and also increase the overall sales of the business.

The management in order to estimate the costs and revenues which are associated with the

production program has decided to adopt budgetary approach where the management can easily

estimate the cost and revenues which the business can earn (Ríos, Bastida and Benito 2016). The

management is planning to prepare a master budget. A master Budget is the aggregate of all

budgets which are usually prepared in an organization and includes additionally cash budgets,

financial plans and statement of estimated income. A master Budget is prepared generally for a

quarter or on a month’s basis so that all activities of the business can be monitored and directed

towards the achievement of the common goal of the company (Lawson et al. 2015). The

components of the master budgets which are prepared for the analysis of the production plan is

discussed below in the coming paragraphs

The sale budget which is included in the master budget shows for the quarter beginning

on July and ending on September. The sales volume which is anticipated shows that the sales

units will fall in August in comparison to the month of July. Again, the sales volume has

MANAGEMENT ACCOUNTING

Source: (Created by Author)

Answer to Part B

Analysis of Production Plan

As per the requirement of the part, the production manager intends to introduce a new

production program which can adhere to all the needs of the organization and there ensure that

there is growth in the production volume of the business. The production plan is intended to

increase the production capacity of the business and thereby also increase the revenues which are

associated with the business. The production plan of the business is intended to combat the rising

costs which are associated with the business and also increase the overall sales of the business.

The management in order to estimate the costs and revenues which are associated with the

production program has decided to adopt budgetary approach where the management can easily

estimate the cost and revenues which the business can earn (Ríos, Bastida and Benito 2016). The

management is planning to prepare a master budget. A master Budget is the aggregate of all

budgets which are usually prepared in an organization and includes additionally cash budgets,

financial plans and statement of estimated income. A master Budget is prepared generally for a

quarter or on a month’s basis so that all activities of the business can be monitored and directed

towards the achievement of the common goal of the company (Lawson et al. 2015). The

components of the master budgets which are prepared for the analysis of the production plan is

discussed below in the coming paragraphs

The sale budget which is included in the master budget shows for the quarter beginning

on July and ending on September. The sales volume which is anticipated shows that the sales

units will fall in August in comparison to the month of July. Again, the sales volume has

11

MANAGEMENT ACCOUNTING

increased in both the months of September and October. The sale price is kept constant as

appropriate changes in prices is difficult to estimate. The budgeted sales revenue of the company

is anticipated to increase from $ 1536,00,000 in July to about $ 1843,20,000 in the month of

October. As the sales of the business is estimated during the quarter the production volume must

also be increased to meet the requirements of sales as anticipated in the budget. The budgeted

production volume is expected to increase from 20800 units in July to 38400 units in the month

of September. In such a budget production estimate considers the closing stock of inventory and

also opening stock of inventory for arriving at the total production which is estimated to be

achieved by the company. The direct labour budget shows that the budgeted labour cost for the

month of September is highest which clearly shows that that the business estimates that the cost

relating to direct budget is expected to increase in the month of September. As the production

volume is increasing it is quite eminent that the direct material cost, direct labour cost and

variable overhead costs which all forms under variable expenses will be rising. As shown in the

direct labour budget that the total direct labour hour has increases from August which was

164000 hours to about 192000 hours in September. The direct labor cost which is anticipated by

the business has increased from the month of august which is shown as $ 57,60,000 in the month

of September. The purchase budget which is included in the master budget shows that the

business is will be requiring materials such as fuse, Isolators. As per the direct material budget,

the total fuse cost and total isolators cost forms part of the total budgeted direct material costs as

shown in the budget. The budgeted direct material cost as shown is $ 110,59,200 for the month

of September which is estimated to be highest during the quarter. The budgeted direct material

cost for the month of August is estimated to be $ 94,46,400.

MANAGEMENT ACCOUNTING

increased in both the months of September and October. The sale price is kept constant as

appropriate changes in prices is difficult to estimate. The budgeted sales revenue of the company

is anticipated to increase from $ 1536,00,000 in July to about $ 1843,20,000 in the month of

October. As the sales of the business is estimated during the quarter the production volume must

also be increased to meet the requirements of sales as anticipated in the budget. The budgeted

production volume is expected to increase from 20800 units in July to 38400 units in the month

of September. In such a budget production estimate considers the closing stock of inventory and

also opening stock of inventory for arriving at the total production which is estimated to be

achieved by the company. The direct labour budget shows that the budgeted labour cost for the

month of September is highest which clearly shows that that the business estimates that the cost

relating to direct budget is expected to increase in the month of September. As the production

volume is increasing it is quite eminent that the direct material cost, direct labour cost and

variable overhead costs which all forms under variable expenses will be rising. As shown in the

direct labour budget that the total direct labour hour has increases from August which was

164000 hours to about 192000 hours in September. The direct labor cost which is anticipated by

the business has increased from the month of august which is shown as $ 57,60,000 in the month

of September. The purchase budget which is included in the master budget shows that the

business is will be requiring materials such as fuse, Isolators. As per the direct material budget,

the total fuse cost and total isolators cost forms part of the total budgeted direct material costs as

shown in the budget. The budgeted direct material cost as shown is $ 110,59,200 for the month

of September which is estimated to be highest during the quarter. The budgeted direct material

cost for the month of August is estimated to be $ 94,46,400.

12

MANAGEMENT ACCOUNTING

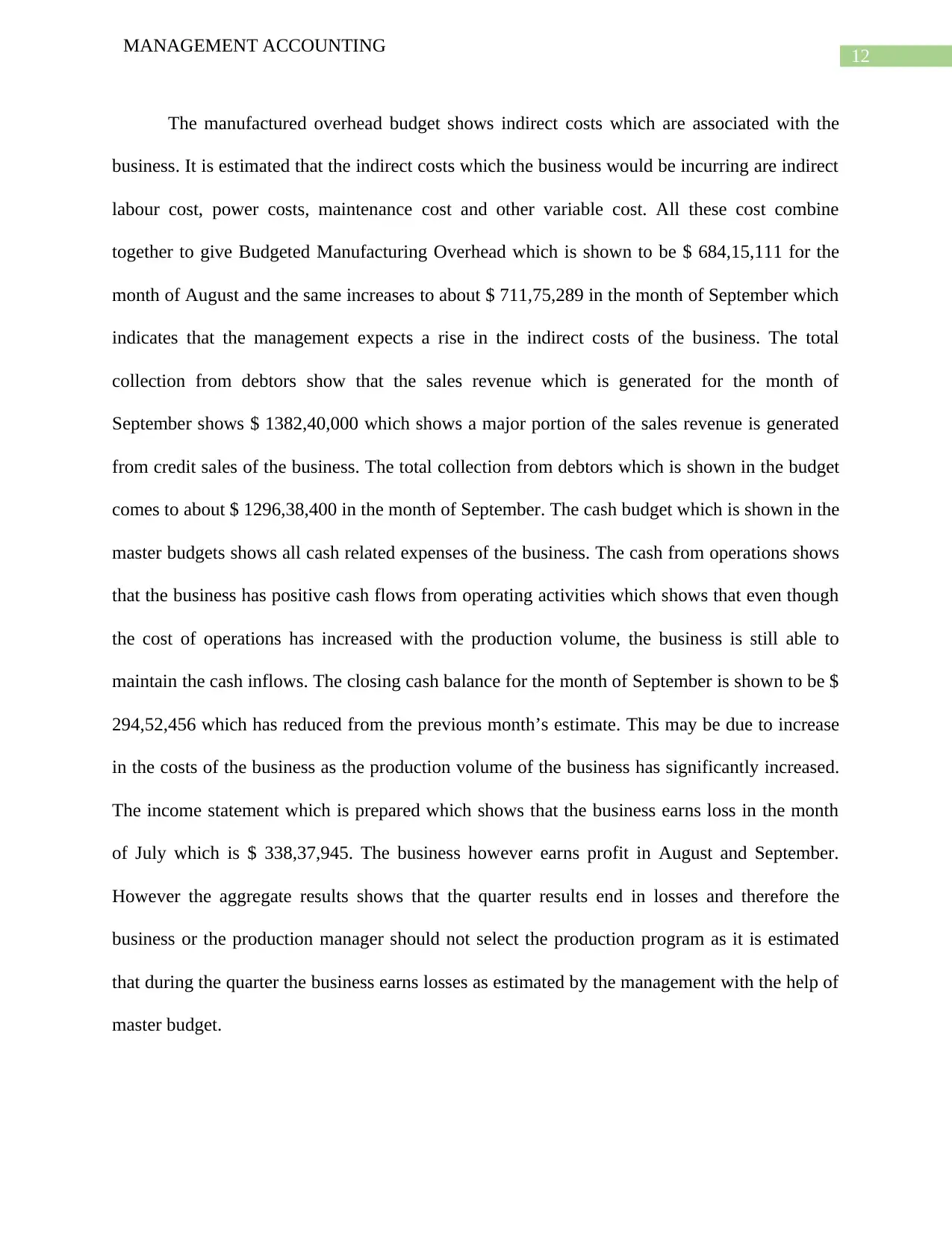

The manufactured overhead budget shows indirect costs which are associated with the

business. It is estimated that the indirect costs which the business would be incurring are indirect

labour cost, power costs, maintenance cost and other variable cost. All these cost combine

together to give Budgeted Manufacturing Overhead which is shown to be $ 684,15,111 for the

month of August and the same increases to about $ 711,75,289 in the month of September which

indicates that the management expects a rise in the indirect costs of the business. The total

collection from debtors show that the sales revenue which is generated for the month of

September shows $ 1382,40,000 which shows a major portion of the sales revenue is generated

from credit sales of the business. The total collection from debtors which is shown in the budget

comes to about $ 1296,38,400 in the month of September. The cash budget which is shown in the

master budgets shows all cash related expenses of the business. The cash from operations shows

that the business has positive cash flows from operating activities which shows that even though

the cost of operations has increased with the production volume, the business is still able to

maintain the cash inflows. The closing cash balance for the month of September is shown to be $

294,52,456 which has reduced from the previous month’s estimate. This may be due to increase

in the costs of the business as the production volume of the business has significantly increased.

The income statement which is prepared which shows that the business earns loss in the month

of July which is $ 338,37,945. The business however earns profit in August and September.

However the aggregate results shows that the quarter results end in losses and therefore the

business or the production manager should not select the production program as it is estimated

that during the quarter the business earns losses as estimated by the management with the help of

master budget.

MANAGEMENT ACCOUNTING

The manufactured overhead budget shows indirect costs which are associated with the

business. It is estimated that the indirect costs which the business would be incurring are indirect

labour cost, power costs, maintenance cost and other variable cost. All these cost combine

together to give Budgeted Manufacturing Overhead which is shown to be $ 684,15,111 for the

month of August and the same increases to about $ 711,75,289 in the month of September which

indicates that the management expects a rise in the indirect costs of the business. The total

collection from debtors show that the sales revenue which is generated for the month of

September shows $ 1382,40,000 which shows a major portion of the sales revenue is generated

from credit sales of the business. The total collection from debtors which is shown in the budget

comes to about $ 1296,38,400 in the month of September. The cash budget which is shown in the

master budgets shows all cash related expenses of the business. The cash from operations shows

that the business has positive cash flows from operating activities which shows that even though

the cost of operations has increased with the production volume, the business is still able to

maintain the cash inflows. The closing cash balance for the month of September is shown to be $

294,52,456 which has reduced from the previous month’s estimate. This may be due to increase

in the costs of the business as the production volume of the business has significantly increased.

The income statement which is prepared which shows that the business earns loss in the month

of July which is $ 338,37,945. The business however earns profit in August and September.

However the aggregate results shows that the quarter results end in losses and therefore the

business or the production manager should not select the production program as it is estimated

that during the quarter the business earns losses as estimated by the management with the help of

master budget.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

MANAGEMENT ACCOUNTING

Answer to Part C

Analysis of Participative and Imposed Budgets.

A participative budget utilizes all the inputs which are provide for the preparation of the

budget by all level of employee. In other words, it means that it provides the business to

incorporate the views of the staff and employees of the business in the preparation of the budget

(Rahman 2013). The basic advantage of using such a budget in the business is that it brings about

unity and collaboration in management. The employees are more motivated in case of the

participative budgets. The quality of budget is also improved when it comes to forecasting of

results as it is being forecasted by respective departments who are involved in day to day

business operations. In addition to this, this type of budgets is known as bottom up budgets

which tends to reflect the forecasted results in a more effective manner as compared to top to

bottom budget (Derfuss 2016). The only drawback which can be identified is that the preparation

of the budget takes a long time as there are large number of employees in the business and a

number of key departments which have a vital role to play in case of a participative budget

(Mah'd et al. 2013).

An imposed budget is also known as top to bottom budgets where all the policies and

objectives of the business are set by the senior managers. As the budgets are set, it is send to

various departments so that it can be followed and every department is expected to achieve the

targets which are set by the top-level management (Johansson and Siverbo 2014). In this type of

budget, the senior management takes decisions on their own and no information is collected from

the from the operational staff of the business. In such a budget the targets are broken in smaller

targets based on each department (Martin 2014).

MANAGEMENT ACCOUNTING

Answer to Part C

Analysis of Participative and Imposed Budgets.

A participative budget utilizes all the inputs which are provide for the preparation of the

budget by all level of employee. In other words, it means that it provides the business to

incorporate the views of the staff and employees of the business in the preparation of the budget

(Rahman 2013). The basic advantage of using such a budget in the business is that it brings about

unity and collaboration in management. The employees are more motivated in case of the

participative budgets. The quality of budget is also improved when it comes to forecasting of

results as it is being forecasted by respective departments who are involved in day to day

business operations. In addition to this, this type of budgets is known as bottom up budgets

which tends to reflect the forecasted results in a more effective manner as compared to top to

bottom budget (Derfuss 2016). The only drawback which can be identified is that the preparation

of the budget takes a long time as there are large number of employees in the business and a

number of key departments which have a vital role to play in case of a participative budget

(Mah'd et al. 2013).

An imposed budget is also known as top to bottom budgets where all the policies and

objectives of the business are set by the senior managers. As the budgets are set, it is send to

various departments so that it can be followed and every department is expected to achieve the

targets which are set by the top-level management (Johansson and Siverbo 2014). In this type of

budget, the senior management takes decisions on their own and no information is collected from

the from the operational staff of the business. In such a budget the targets are broken in smaller

targets based on each department (Martin 2014).

14

MANAGEMENT ACCOUNTING

In the case of the company, the management should adopt participative budget approach

as it facilitates free flow of information and empowers the employee to paly a significant role in

the preparation of the budget. Where as in case of Imposed budgets, the senior management sets

and imposes the budget targets on each department and the communication between top level

management and lower staff is not present in case of such a budget. Therefore, the management

should select Participative Budgets.

MANAGEMENT ACCOUNTING

In the case of the company, the management should adopt participative budget approach

as it facilitates free flow of information and empowers the employee to paly a significant role in

the preparation of the budget. Where as in case of Imposed budgets, the senior management sets

and imposes the budget targets on each department and the communication between top level

management and lower staff is not present in case of such a budget. Therefore, the management

should select Participative Budgets.

15

MANAGEMENT ACCOUNTING

Reference

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and industry

influences. The British Accounting Review, 48(1), pp.17-37.

Johansson, T. and Siverbo, S., 2014. The appropriateness of tight budget control in public sector

organizations facing budget turbulence. Management Accounting Research, 25(4), pp.271-283.

Lawson, R.A., Blocher, E.J., Brewer, P.C., Morris, J.T., Stocks, K.D., Sorensen, J.E., Stout, D.E.

and Wouters, M.J., 2015. Thoughts on competency integration in accounting education. Issues in

Accounting Education, 30(3), pp.149-171.

Mah'd, O., Al-Khadash, H., Idris, M. and Ramadan, A., 2013. The impact of budgetary

participation on managerial performance: Evidence from Jordanian university

executives. Journal of Applied Finance and Banking, 3(3), p.133.

Martin, R.L., 2014. The big lie of strategic planning. Harvard business review, 92(1/2), pp.3-8.

Rahman, A.R., 2013. The Australian Accounting Standards Review Board (RLE Accounting):

The Establishment of Its Participative Review Process. Routledge.

Ríos, A.M., Bastida, F. and Benito, B., 2016. Budget transparency and legislative budgetary

oversight: An international approach. The American Review of Public Administration, 46(5),

pp.546-568.

MANAGEMENT ACCOUNTING

Reference

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and industry

influences. The British Accounting Review, 48(1), pp.17-37.

Johansson, T. and Siverbo, S., 2014. The appropriateness of tight budget control in public sector

organizations facing budget turbulence. Management Accounting Research, 25(4), pp.271-283.

Lawson, R.A., Blocher, E.J., Brewer, P.C., Morris, J.T., Stocks, K.D., Sorensen, J.E., Stout, D.E.

and Wouters, M.J., 2015. Thoughts on competency integration in accounting education. Issues in

Accounting Education, 30(3), pp.149-171.

Mah'd, O., Al-Khadash, H., Idris, M. and Ramadan, A., 2013. The impact of budgetary

participation on managerial performance: Evidence from Jordanian university

executives. Journal of Applied Finance and Banking, 3(3), p.133.

Martin, R.L., 2014. The big lie of strategic planning. Harvard business review, 92(1/2), pp.3-8.

Rahman, A.R., 2013. The Australian Accounting Standards Review Board (RLE Accounting):

The Establishment of Its Participative Review Process. Routledge.

Ríos, A.M., Bastida, F. and Benito, B., 2016. Budget transparency and legislative budgetary

oversight: An international approach. The American Review of Public Administration, 46(5),

pp.546-568.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.