Shell's Competitive Position in Oil & Gas

VerifiedAdded on 2020/06/06

|2

|3960

|35

AI Summary

This assignment examines the competitive landscape of Royal Dutch Shell, a leading player in the oil and gas industry. It utilizes Porter's Five Forces model to analyze the company's position, considering rivalry, barriers to entry, threat of substitutes, bargaining power of buyers and suppliers, and Shell's own strengths and strategies for maintaining its market dominance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business essential extended project

INTRODUCTION British Petroleum Cairn

Oil and gas industry is also known as petroleum sector whose main

objective is to explore, extraction, refining and promotion of petroleum

goods. However overall industry is segmented into three different parts

such as; upstream, midstream and downstream. Mainly, this poster is

going to highlight the overview of four different companies in oil industry

and their current positioning at marketplace with the help of Porter Five

force model.

BP plc is a officially denoted as a British multinational

company in petroleum industry by having its headquartered in

London, England and seen as a world's seven largest organization.

In fact, according to survey report it has been observed that as per

performance in 2012 BP is seeing as a sixth largest company

because of their goods or services. However, according to past

two years of report this firm was expanded across the international

boundaries and established their branches in almost 72 countries.

Therefore, turnover of an organization get increases day by day

due to increment in consumer demand.

According to this factor of this theory various major

competitors of an organization is explained in order to analyse

competition level at marketplace. For example; major rivalry of

BP are Royal Dutch Shell, Cairn and so on. As a result they are

also coming with various ideas or methods of running a business

entity which may influence the success of a company in every

manner.

Oil and gas industry is growing in a rapid way due to

creation of modern world as well as few people seen it as a major

source of income generation. Therefore, it is analysed that various

other companies are establishing their branches at European

market for gaining maximum return on their investment. Hence,

in this factor of porter five forces an association can easily analyse

the danger from new emerging companies in order to make plans

as per requirement.

Environment friendly products in oil industry is major

threat in terms of close substitutes for BP because it aids in

reducing pollution.

In this sector purchasers are not having that any

authority to bargain or to do negotiation on price.

Bargaining power of supplier:- According to this factor an

association is facing number of suppliers in order to attain their set

objectives or goals.

Hence it has been analysed that in recent time BP is

having a turnover of almost US$183.0 billion which shows their

current positioning at marketplace and its overall scenario. In fact,

they are having a very positive goodwill due to which they get

succeeded in acquiring loyalty or trust of consumers in an

appropriate manner by satisfying their needs or demands at the

time of requirement. Moreover, considered as a very a strong

brand which makes them more successful or developed.

Company overview:- One of the successful company in oil industry which

is listed on London stock exchange and get succeeded in establishing their

number of locations in several other nations. Basically, Sir Bill Gammel

was a founder of Cairn in almost 1981 who is a international Rugby player

and acquired various other companies in order to become one of the largest

operators of oil or refinery. In fact they are focussing on expansion by

acquiring various other small companies for enhancing turnover of an

association. Hence, usage of porter five force model is describing is

describing below:-

Analysis of competitors aids in designing company schemes or

strategies in order to defend company from rivalries. In fact as per porter

rules it is essential to study the plan of other companies because it helps in

protecting Cairn.

Porters shows that industries are expanding across international

boundaries because of consumer demand which resulted in increase in threat

from new entrants. However, Cairn is facing a major issue from entry of

new companies which create a problem for selected business entity while

launching a new branch.

Society is worrying about their goodwill due to which sometime

get affected by availability of close substitutes.

Absence of consumer potentiality to negotiate.

Affected by raw materials suppliers of an organization because

they are liable for offering appropriate commodity to attain set objectives or

goals.

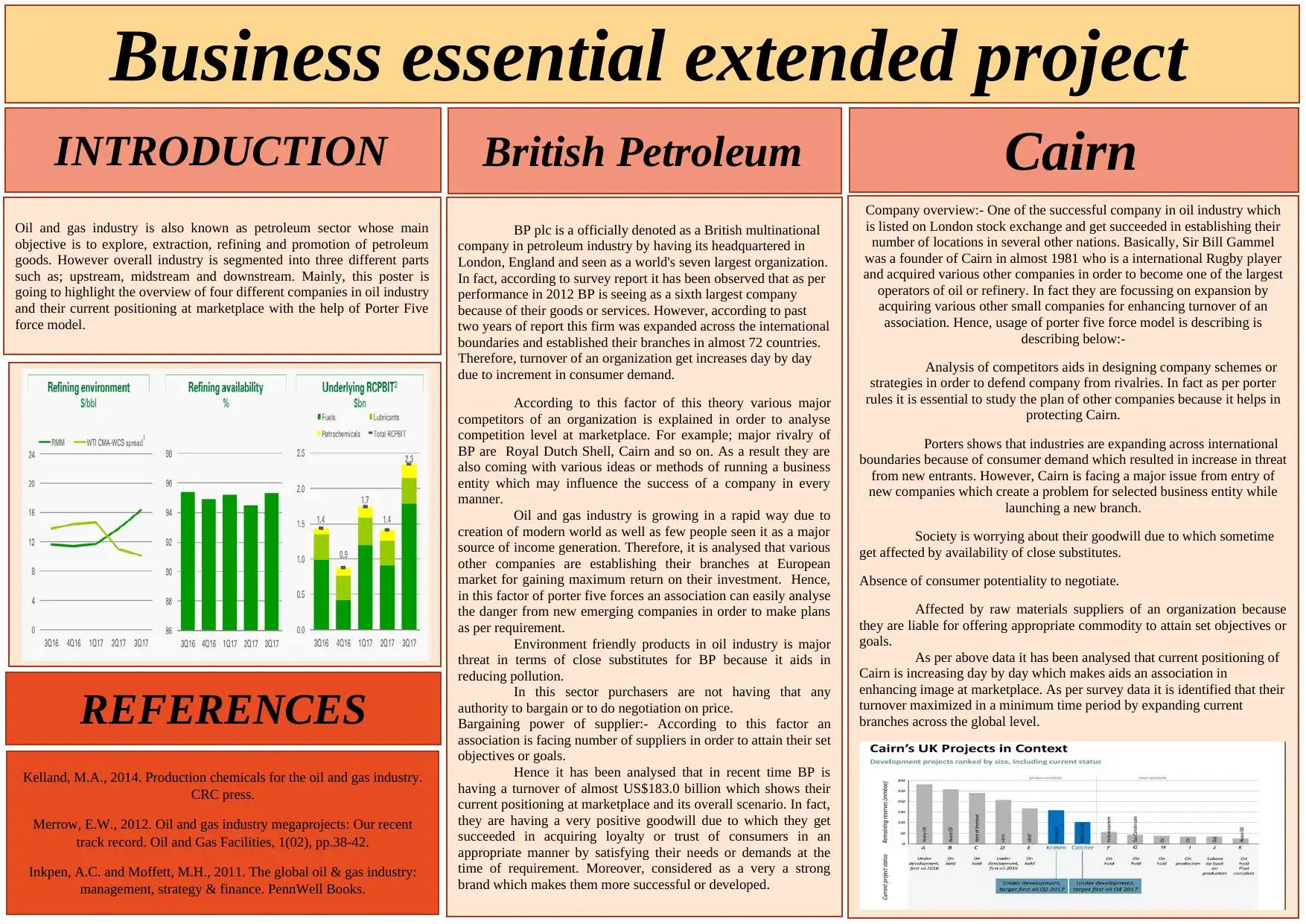

As per above data it has been analysed that current positioning of

Cairn is increasing day by day which makes aids an association in

enhancing image at marketplace. As per survey data it is identified that their

turnover maximized in a minimum time period by expanding current

branches across the global level.REFERENCES

Kelland, M.A., 2014. Production chemicals for the oil and gas industry.

CRC press.

Merrow, E.W., 2012. Oil and gas industry megaprojects: Our recent

track record. Oil and Gas Facilities, 1(02), pp.38-42.

Inkpen, A.C. and Moffett, M.H., 2011. The global oil & gas industry:

management, strategy & finance. PennWell Books.

INTRODUCTION British Petroleum Cairn

Oil and gas industry is also known as petroleum sector whose main

objective is to explore, extraction, refining and promotion of petroleum

goods. However overall industry is segmented into three different parts

such as; upstream, midstream and downstream. Mainly, this poster is

going to highlight the overview of four different companies in oil industry

and their current positioning at marketplace with the help of Porter Five

force model.

BP plc is a officially denoted as a British multinational

company in petroleum industry by having its headquartered in

London, England and seen as a world's seven largest organization.

In fact, according to survey report it has been observed that as per

performance in 2012 BP is seeing as a sixth largest company

because of their goods or services. However, according to past

two years of report this firm was expanded across the international

boundaries and established their branches in almost 72 countries.

Therefore, turnover of an organization get increases day by day

due to increment in consumer demand.

According to this factor of this theory various major

competitors of an organization is explained in order to analyse

competition level at marketplace. For example; major rivalry of

BP are Royal Dutch Shell, Cairn and so on. As a result they are

also coming with various ideas or methods of running a business

entity which may influence the success of a company in every

manner.

Oil and gas industry is growing in a rapid way due to

creation of modern world as well as few people seen it as a major

source of income generation. Therefore, it is analysed that various

other companies are establishing their branches at European

market for gaining maximum return on their investment. Hence,

in this factor of porter five forces an association can easily analyse

the danger from new emerging companies in order to make plans

as per requirement.

Environment friendly products in oil industry is major

threat in terms of close substitutes for BP because it aids in

reducing pollution.

In this sector purchasers are not having that any

authority to bargain or to do negotiation on price.

Bargaining power of supplier:- According to this factor an

association is facing number of suppliers in order to attain their set

objectives or goals.

Hence it has been analysed that in recent time BP is

having a turnover of almost US$183.0 billion which shows their

current positioning at marketplace and its overall scenario. In fact,

they are having a very positive goodwill due to which they get

succeeded in acquiring loyalty or trust of consumers in an

appropriate manner by satisfying their needs or demands at the

time of requirement. Moreover, considered as a very a strong

brand which makes them more successful or developed.

Company overview:- One of the successful company in oil industry which

is listed on London stock exchange and get succeeded in establishing their

number of locations in several other nations. Basically, Sir Bill Gammel

was a founder of Cairn in almost 1981 who is a international Rugby player

and acquired various other companies in order to become one of the largest

operators of oil or refinery. In fact they are focussing on expansion by

acquiring various other small companies for enhancing turnover of an

association. Hence, usage of porter five force model is describing is

describing below:-

Analysis of competitors aids in designing company schemes or

strategies in order to defend company from rivalries. In fact as per porter

rules it is essential to study the plan of other companies because it helps in

protecting Cairn.

Porters shows that industries are expanding across international

boundaries because of consumer demand which resulted in increase in threat

from new entrants. However, Cairn is facing a major issue from entry of

new companies which create a problem for selected business entity while

launching a new branch.

Society is worrying about their goodwill due to which sometime

get affected by availability of close substitutes.

Absence of consumer potentiality to negotiate.

Affected by raw materials suppliers of an organization because

they are liable for offering appropriate commodity to attain set objectives or

goals.

As per above data it has been analysed that current positioning of

Cairn is increasing day by day which makes aids an association in

enhancing image at marketplace. As per survey data it is identified that their

turnover maximized in a minimum time period by expanding current

branches across the global level.REFERENCES

Kelland, M.A., 2014. Production chemicals for the oil and gas industry.

CRC press.

Merrow, E.W., 2012. Oil and gas industry megaprojects: Our recent

track record. Oil and Gas Facilities, 1(02), pp.38-42.

Inkpen, A.C. and Moffett, M.H., 2011. The global oil & gas industry:

management, strategy & finance. PennWell Books.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Royal Dutch Shell Texaco

Oil industry has seen remarkable growth in past few years but

this does not mean that they have not gone through ups and downs. In

present scenario, this industry is on recovery mode as the war of oil

prices ending in gulf and other nations. Shell is a considered as one of

the most successful company of Oil and Gas sector. This organisation

earned profit of almost 234 billion US dollars in 2016. They are listed

among most valuable enterprises in this world. Below is porter's five

forces of Royal Dutch Shell:

In different part of this world, this firm has various rivals who

have similar financial position and organisational structure. This means

that competitive rivalry is high as competitors of this company always

try to capture untouched economy and steal market share of Shell. Exxon

mobile, Chevron from USA and BP from UK are other significant player

of this industry who have capacity to influence revenue of this enterprise.

It is low. Entering in oil and gas sector require huge amount of

capital which cannot be afford by most of the business organisation and

government of some nations. If any firm even have the money to invest,

then technology will be other constraint which will stop them. In

developing economy, some new companies are trying to enter in this

sector but they do not have capacity to harm business of Shell

organisation.

It is also low. Firms like Tesla and other auto-mobile

companies may focus on selling electric vehicle but they cannot be

considered as substitute of oil and gas. Hydrogen, coal and nuclear

energy are some other alternative source of energy but in present

scenario they are not reliable there is a big question mark on their

performance.

User of oil and gas do not have much power. Companies in

this sector decide price of their products and because of almost similar

price, customer do not have much option. They cannot switch to new

seller, if they are not happy with current one, because price and quality

of product is almost same.

Shell is not dependent on any suppliers because they have

their own sources of oil and they operate in different countries. This

proves that suppliers do not have any power and they cannot impact

growth of this firm.

This organisation is using latest technology for extracting oil

and gases. This is reducing their cost of production. Another factor

which is helping this company in gaining competitive advantage is that

they know that demand of petrol and diesel will decrease in long run.

This is the prime reason that they are concentrating on new types of fuel

which people will environment friendly and sustainable. Brad value of

Shell is among best in the world. Their high poplar decreases number of

challenges which they have to face at the time of entering in new market.

It is an American oil industry whose main objective is to

serve fuel for domestic as well as foreign clients with the help of

various appropriate facilities. In fact, Texas fuel company is an

independent company that was founded in almost 1901 by Joseph S.

Cullinan. In fact, this was only organization which is engaged in

selling gasoline under the name of similar brand in around 50 states of

US along with Canada also. Moreover trying to establish this

organization as a most famous or successful brand across the nation

and make it best amongst competitors. Apart from this, Texas fuel is

consider as a part of seven sisters which succeeded in dominating in

global petroleum industry from medieval of 1940s till 1970s .

additionally, recent feature in logo of this company is white star in a

red circle which signifies as a “star of the American road”. Therefore,

usage of porter five forces in this organization is describing

underneath:-

Texaco is serving almost in most of the countries due to

which their rivalry are also increases day by day as per development

in oil or gas industry. It means, company is facing a large competitive

environment in which overall company are facing a numerous of

issues due to emergence of several competitors.

Entrepreneurs or people of high income group are trying

to involve in a oil or gas industries because earnings are much more

higher in this sector as compare to others. Therefore, it may influence

the success or development of an association due to which analysis of

new entrants is indispensable.

Emerging companies are coming with numerous of ideas or

thoughts for gaining competitive advantage which act as a major

threat for existing firms.

Lack of consumer authority to bargain in this industry but

few consumers are trying but they get failed due to togetherness in

decision making process.

Suppliers are offering best possible products to their

business partners or competitors but chances of bargaining are depend

various external or internal factors. For example; current market rate,

pricing strategy, currency rate, consumer demand, inflation or

deflation and so on.

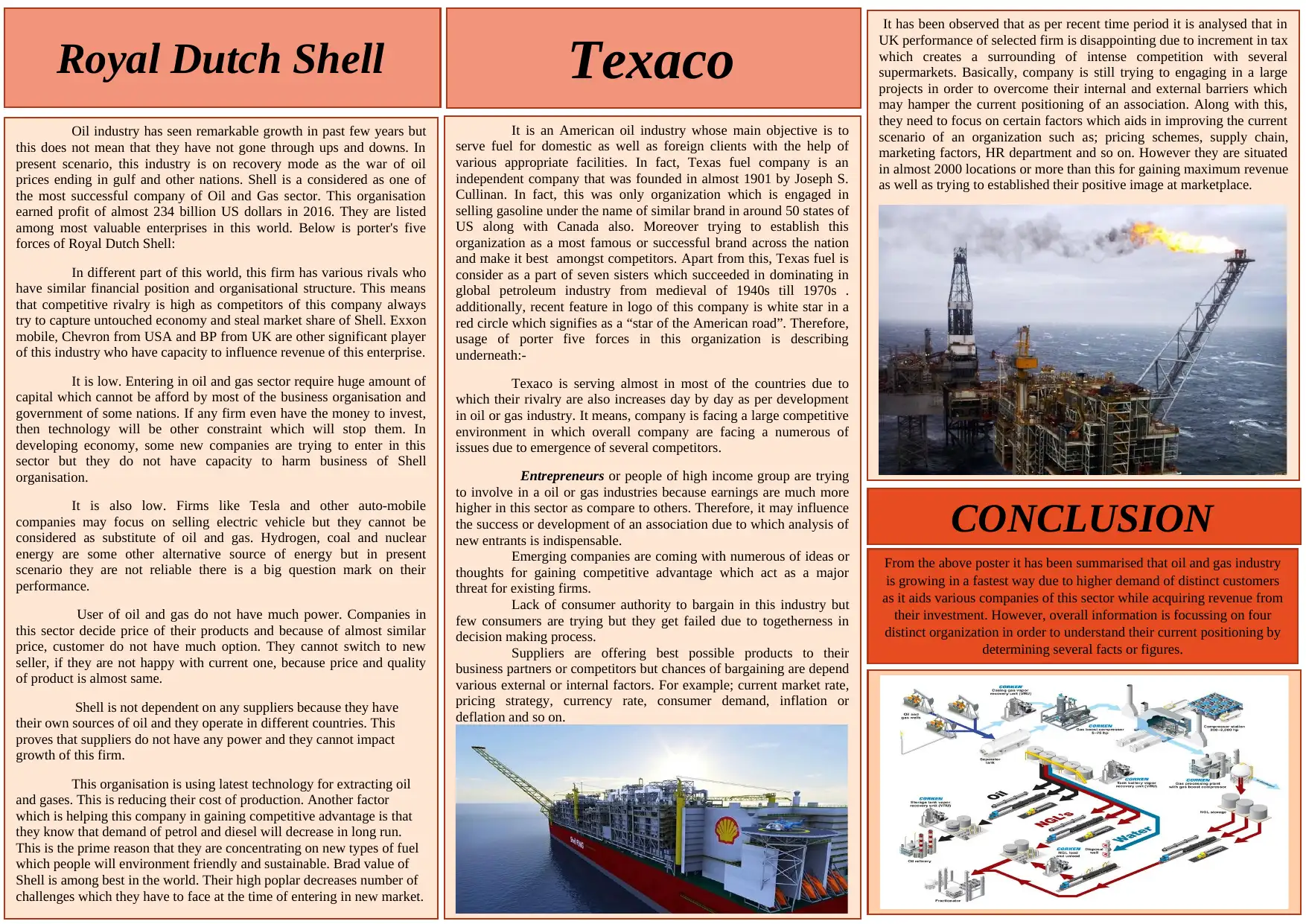

It has been observed that as per recent time period it is analysed that in

UK performance of selected firm is disappointing due to increment in tax

which creates a surrounding of intense competition with several

supermarkets. Basically, company is still trying to engaging in a large

projects in order to overcome their internal and external barriers which

may hamper the current positioning of an association. Along with this,

they need to focus on certain factors which aids in improving the current

scenario of an organization such as; pricing schemes, supply chain,

marketing factors, HR department and so on. However they are situated

in almost 2000 locations or more than this for gaining maximum revenue

as well as trying to established their positive image at marketplace.

CONCLUSION

From the above poster it has been summarised that oil and gas industry

is growing in a fastest way due to higher demand of distinct customers

as it aids various companies of this sector while acquiring revenue from

their investment. However, overall information is focussing on four

distinct organization in order to understand their current positioning by

determining several facts or figures.

Oil industry has seen remarkable growth in past few years but

this does not mean that they have not gone through ups and downs. In

present scenario, this industry is on recovery mode as the war of oil

prices ending in gulf and other nations. Shell is a considered as one of

the most successful company of Oil and Gas sector. This organisation

earned profit of almost 234 billion US dollars in 2016. They are listed

among most valuable enterprises in this world. Below is porter's five

forces of Royal Dutch Shell:

In different part of this world, this firm has various rivals who

have similar financial position and organisational structure. This means

that competitive rivalry is high as competitors of this company always

try to capture untouched economy and steal market share of Shell. Exxon

mobile, Chevron from USA and BP from UK are other significant player

of this industry who have capacity to influence revenue of this enterprise.

It is low. Entering in oil and gas sector require huge amount of

capital which cannot be afford by most of the business organisation and

government of some nations. If any firm even have the money to invest,

then technology will be other constraint which will stop them. In

developing economy, some new companies are trying to enter in this

sector but they do not have capacity to harm business of Shell

organisation.

It is also low. Firms like Tesla and other auto-mobile

companies may focus on selling electric vehicle but they cannot be

considered as substitute of oil and gas. Hydrogen, coal and nuclear

energy are some other alternative source of energy but in present

scenario they are not reliable there is a big question mark on their

performance.

User of oil and gas do not have much power. Companies in

this sector decide price of their products and because of almost similar

price, customer do not have much option. They cannot switch to new

seller, if they are not happy with current one, because price and quality

of product is almost same.

Shell is not dependent on any suppliers because they have

their own sources of oil and they operate in different countries. This

proves that suppliers do not have any power and they cannot impact

growth of this firm.

This organisation is using latest technology for extracting oil

and gases. This is reducing their cost of production. Another factor

which is helping this company in gaining competitive advantage is that

they know that demand of petrol and diesel will decrease in long run.

This is the prime reason that they are concentrating on new types of fuel

which people will environment friendly and sustainable. Brad value of

Shell is among best in the world. Their high poplar decreases number of

challenges which they have to face at the time of entering in new market.

It is an American oil industry whose main objective is to

serve fuel for domestic as well as foreign clients with the help of

various appropriate facilities. In fact, Texas fuel company is an

independent company that was founded in almost 1901 by Joseph S.

Cullinan. In fact, this was only organization which is engaged in

selling gasoline under the name of similar brand in around 50 states of

US along with Canada also. Moreover trying to establish this

organization as a most famous or successful brand across the nation

and make it best amongst competitors. Apart from this, Texas fuel is

consider as a part of seven sisters which succeeded in dominating in

global petroleum industry from medieval of 1940s till 1970s .

additionally, recent feature in logo of this company is white star in a

red circle which signifies as a “star of the American road”. Therefore,

usage of porter five forces in this organization is describing

underneath:-

Texaco is serving almost in most of the countries due to

which their rivalry are also increases day by day as per development

in oil or gas industry. It means, company is facing a large competitive

environment in which overall company are facing a numerous of

issues due to emergence of several competitors.

Entrepreneurs or people of high income group are trying

to involve in a oil or gas industries because earnings are much more

higher in this sector as compare to others. Therefore, it may influence

the success or development of an association due to which analysis of

new entrants is indispensable.

Emerging companies are coming with numerous of ideas or

thoughts for gaining competitive advantage which act as a major

threat for existing firms.

Lack of consumer authority to bargain in this industry but

few consumers are trying but they get failed due to togetherness in

decision making process.

Suppliers are offering best possible products to their

business partners or competitors but chances of bargaining are depend

various external or internal factors. For example; current market rate,

pricing strategy, currency rate, consumer demand, inflation or

deflation and so on.

It has been observed that as per recent time period it is analysed that in

UK performance of selected firm is disappointing due to increment in tax

which creates a surrounding of intense competition with several

supermarkets. Basically, company is still trying to engaging in a large

projects in order to overcome their internal and external barriers which

may hamper the current positioning of an association. Along with this,

they need to focus on certain factors which aids in improving the current

scenario of an organization such as; pricing schemes, supply chain,

marketing factors, HR department and so on. However they are situated

in almost 2000 locations or more than this for gaining maximum revenue

as well as trying to established their positive image at marketplace.

CONCLUSION

From the above poster it has been summarised that oil and gas industry

is growing in a fastest way due to higher demand of distinct customers

as it aids various companies of this sector while acquiring revenue from

their investment. However, overall information is focussing on four

distinct organization in order to understand their current positioning by

determining several facts or figures.

1 out of 2

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.