Capital Market Analysis: Ordinary and Preference Share Analysis

VerifiedAdded on 2023/01/17

|14

|3485

|56

Report

AI Summary

This report provides a detailed analysis of ordinary and preference shares, crucial financial instruments within capital markets. It begins by outlining the fundamental differences between ordinary (equity) shares and preference shares, including shareholder rights, dividend payments, and voting privileges. The report then delves into the various types of preference shares, such as cumulative, non-cumulative, convertible, and redeemable shares, contrasting them with equity shares. It explores the advantages and disadvantages of both share types for companies and investors, highlighting considerations like risk, return, and control. The report also includes a comparison table summarizing key differences and similarities, offering a clear overview of the subject. The report further explores the types of equity shares and preference shares, which includes authorized share capital, issued share capital, and paid-up capital. The report concludes with a discussion on the role of these financial instruments in capital structure and investment decisions, making it a valuable resource for finance students and professionals alike.

Running Head: MANAGEMENT 0

Money and capital market analysis

Money and capital market analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 1

Table of Contents

Introduction................................................................................................................................2

Difference between ordinary and preference share....................................................................2

Types of preference shares v/s equity shares.............................................................................6

Illustration..................................................................................................................................9

WOW per Share.....................................................................................................................9

WOW Capital Structure (as on 7 May 2019).......................................................................10

Conclusion................................................................................................................................11

References................................................................................................................................12

Table of Contents

Introduction................................................................................................................................2

Difference between ordinary and preference share....................................................................2

Types of preference shares v/s equity shares.............................................................................6

Illustration..................................................................................................................................9

WOW per Share.....................................................................................................................9

WOW Capital Structure (as on 7 May 2019).......................................................................10

Conclusion................................................................................................................................11

References................................................................................................................................12

MANAGEMENT 2

Introduction

Finance is one of the major aspects for a company to initiate and to run business. It is

important for the company to make appropriate decision regarding raising money for the

business. Financial market consists of two major markets that are capital market and money

market. For the short term purpose of borrowing or lending money, money markets are the

appropriate place with effective financial instruments (Chang & Liu, 2009). Capital market is

the appropriate place to raise money for long term security and they affect the capital of the

company directly or indirectly. The report will discuss one of the major instruments of capital

market that is “Shares.”

Shares are the units of personal owner interest in financial assets that would include

distribution of profit in corporations and returns from these instruments are in form of

dividend. The shareowners are said to be shareholders of the company and their control over

the company’s management depends on type of share they are holding in the company (Chari

& Chang, 2009). The two major shares are preferred shares and ordinary shares also

identified as equity shares. These two shares and their differentiation would be discussed in

report further.

Difference between ordinary and preference share

It is true that before beginning any business, it is required by the entrepreneur to raise

the capital, resource, or investment. The amount of capital depends on project as well as size

of the firm. Equity shares are also called as ordinary share. There are times when ordinary

shares are known as the common stock. Shareholders having ordinary shares indicate they are

having the ownership in company based on the portion amount of shares. For example- of a

person has purchased 30 shares from the 100 shares from ABC Company, it means they have

total 30% stock of the organisation. These shareholders also hold the voting right in the

organisation. In the general meeting of the organisation, these shareholders get the privilege

to cast their vote. They also have the authority to remove as well as appoint the auditors as

well as directors in the company. Each of the shareholders has the right to gain the profit that

company has earned. In the case of profit, ordinary shareholders also get the right to receive

Introduction

Finance is one of the major aspects for a company to initiate and to run business. It is

important for the company to make appropriate decision regarding raising money for the

business. Financial market consists of two major markets that are capital market and money

market. For the short term purpose of borrowing or lending money, money markets are the

appropriate place with effective financial instruments (Chang & Liu, 2009). Capital market is

the appropriate place to raise money for long term security and they affect the capital of the

company directly or indirectly. The report will discuss one of the major instruments of capital

market that is “Shares.”

Shares are the units of personal owner interest in financial assets that would include

distribution of profit in corporations and returns from these instruments are in form of

dividend. The shareowners are said to be shareholders of the company and their control over

the company’s management depends on type of share they are holding in the company (Chari

& Chang, 2009). The two major shares are preferred shares and ordinary shares also

identified as equity shares. These two shares and their differentiation would be discussed in

report further.

Difference between ordinary and preference share

It is true that before beginning any business, it is required by the entrepreneur to raise

the capital, resource, or investment. The amount of capital depends on project as well as size

of the firm. Equity shares are also called as ordinary share. There are times when ordinary

shares are known as the common stock. Shareholders having ordinary shares indicate they are

having the ownership in company based on the portion amount of shares. For example- of a

person has purchased 30 shares from the 100 shares from ABC Company, it means they have

total 30% stock of the organisation. These shareholders also hold the voting right in the

organisation. In the general meeting of the organisation, these shareholders get the privilege

to cast their vote. They also have the authority to remove as well as appoint the auditors as

well as directors in the company. Each of the shareholders has the right to gain the profit that

company has earned. In the case of profit, ordinary shareholders also get the right to receive

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT 3

some part of the dividends (Tappeiner et al, 2012). At the initial stage of the company, they

do not pay the dividend. The whole money that is achieved is reinvested in the business for

bringing development. Sometimes, after paying the liability, some of the amounts is paid to

the shareholders. However, it is found that equity shareholders have no right to achieve the

arrears dividend for the past ages. At the time of winding up of the firm, the company is

required to pay the salaries, taxes, costs and statutory assistances monitored by its creditors.

After paying to the entire creditors, the capital that is remained allocated to the shareholders.

After paying to the preference shareholders, ordinary shareholders receive the share in

capital. It is also found that the weight of each shareholder vote depends on the percentage of

ownership that they have in the company (Barclay, Holderness & Sheehan, 2008).

Preference shares signify the stake of ownership in the organisation, which is known

as preferred stock. Preference shares have both debts as well as equity characteristics. These

also have the priority claim over the earning and asset of the company. The preference

shareholders do not carry voting rights in the company. However, they can vote on those

matters that directly affect the right such as resolution of the winding up of company. In

addition, preference shareholders also have the right to claim for the dividend that is not paid

for not more than the 12 months. Preference shareholders also enjoy the first priority for

paying the dividend and profit. They are also paid at the first as company is also required to

pay the liabilities. Apart from this, they are paid before the equity shareholders of the

organisation. During the windup of the organisation, preference shareholders have the right to

receive capital payment after paying off the claim of creditors during liquidation time

(Cheng, Fung & Leung, 2009). There are several advantages associated with ordinary or

equity shares. It helps in providing the confidence as well as creditworthiness to the

company. Some investors like to take a higher risk. Equity share is the best option of such

investors. It also proves to be best for the company as it is not essential to pay to the equity

shares. It also has various disadvantages associated with the equity shares such as investors

who give more emphasis on the regular income may not prefer the shares. Besides this,

equity shares also have a high cost than raising fund form any other source. In addition to

this, many procedural delays and formalities are involved in the equity shares.

Preferences shares also have several merits and demerits. Firstly, they get the fix rate

of safety and return of the investment (Cronqvist & Fahlenbrach, 2008). It also does not

impact the equity shareholders control over the administration. It is because these

shareholders do not have the voting right. The biggest benefit attached to the preference

some part of the dividends (Tappeiner et al, 2012). At the initial stage of the company, they

do not pay the dividend. The whole money that is achieved is reinvested in the business for

bringing development. Sometimes, after paying the liability, some of the amounts is paid to

the shareholders. However, it is found that equity shareholders have no right to achieve the

arrears dividend for the past ages. At the time of winding up of the firm, the company is

required to pay the salaries, taxes, costs and statutory assistances monitored by its creditors.

After paying to the entire creditors, the capital that is remained allocated to the shareholders.

After paying to the preference shareholders, ordinary shareholders receive the share in

capital. It is also found that the weight of each shareholder vote depends on the percentage of

ownership that they have in the company (Barclay, Holderness & Sheehan, 2008).

Preference shares signify the stake of ownership in the organisation, which is known

as preferred stock. Preference shares have both debts as well as equity characteristics. These

also have the priority claim over the earning and asset of the company. The preference

shareholders do not carry voting rights in the company. However, they can vote on those

matters that directly affect the right such as resolution of the winding up of company. In

addition, preference shareholders also have the right to claim for the dividend that is not paid

for not more than the 12 months. Preference shareholders also enjoy the first priority for

paying the dividend and profit. They are also paid at the first as company is also required to

pay the liabilities. Apart from this, they are paid before the equity shareholders of the

organisation. During the windup of the organisation, preference shareholders have the right to

receive capital payment after paying off the claim of creditors during liquidation time

(Cheng, Fung & Leung, 2009). There are several advantages associated with ordinary or

equity shares. It helps in providing the confidence as well as creditworthiness to the

company. Some investors like to take a higher risk. Equity share is the best option of such

investors. It also proves to be best for the company as it is not essential to pay to the equity

shares. It also has various disadvantages associated with the equity shares such as investors

who give more emphasis on the regular income may not prefer the shares. Besides this,

equity shares also have a high cost than raising fund form any other source. In addition to

this, many procedural delays and formalities are involved in the equity shares.

Preferences shares also have several merits and demerits. Firstly, they get the fix rate

of safety and return of the investment (Cronqvist & Fahlenbrach, 2008). It also does not

impact the equity shareholders control over the administration. It is because these

shareholders do not have the voting right. The biggest benefit attached to the preference

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 4

shareholder is that it does not charge anything against the company asset. These shareholders

also do not have the complete surety that they will receive the payment. It is because these

shareholders are paid only when the company earn the profit. At a fixed percentage, company

pay the dividend to the preference shareholders.

There are companies that have only one type of shares. These shares are known as

ordinary or equity shares. Various companies also chose to have two or more various type of

shares that are known as alphabet shares. (John, Knyazeva & Knyazeva, 2008)

Equity and preference share also have various similarities. The first similarity

between both the shares is that both the finance earns the dividend. Equity shareholders

receive the dividend after the preference shareholders, debenture holders and equity

shareholders. The second similarity is that both these shareholders form the share capital by

paying some amount in the form of monetary value. Apart from the difference in terms and

condition, they pay the share capital (Xu & Zhang, 2008). Equity, as well as preference

shareholders, face some kind of difficulty in raising the amount. It is because every company

has some kind of formalities that these shareholders are required to comply. Both the shares

are not secured finance. As equity shareholders receive after paying all the dividend to other

shareholders and creditors. For the preference shareholders, it leads to a higher cost as

compared to the debt for issuing. Equity, as well as preference shareholders, have the long-

term finance.

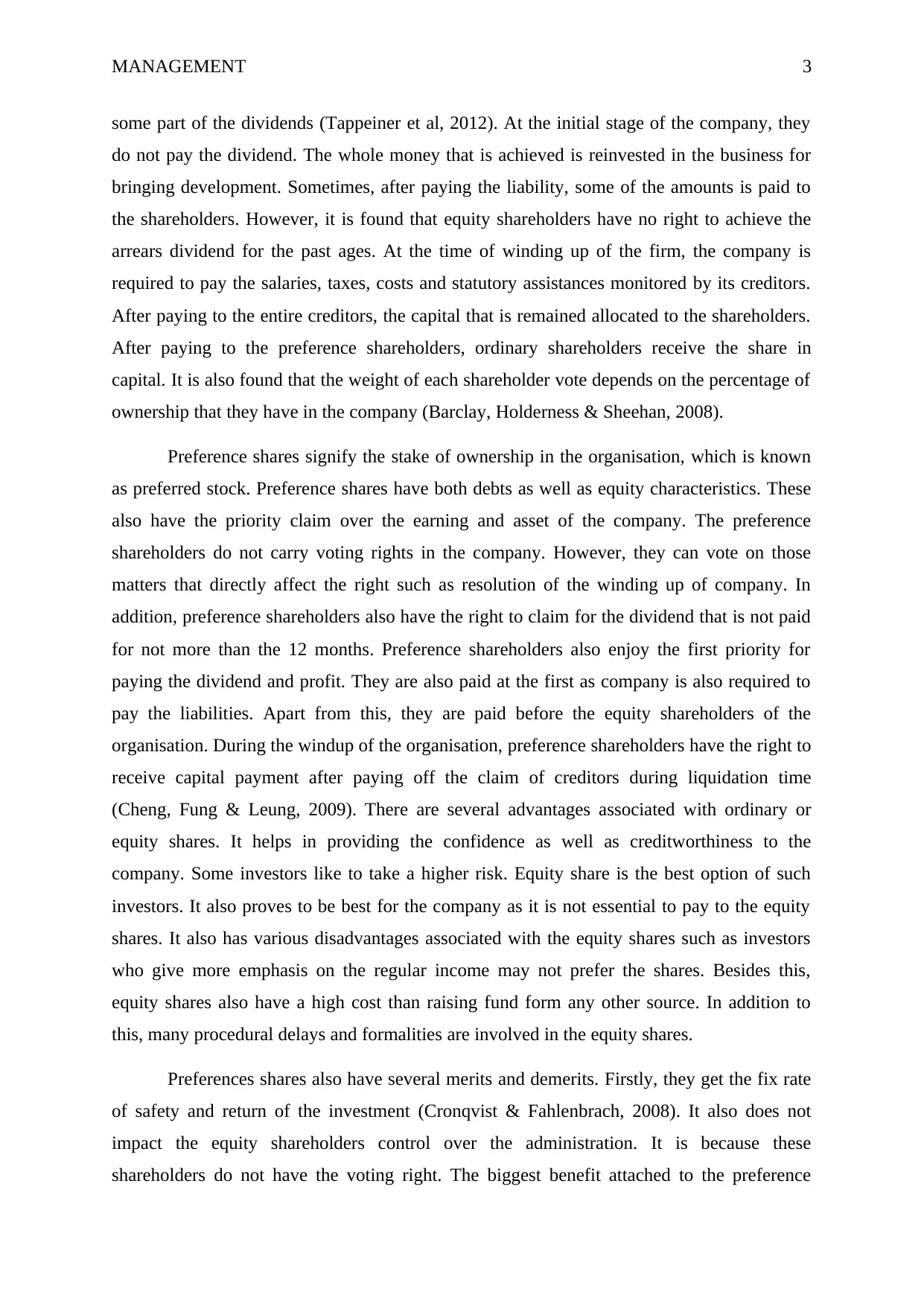

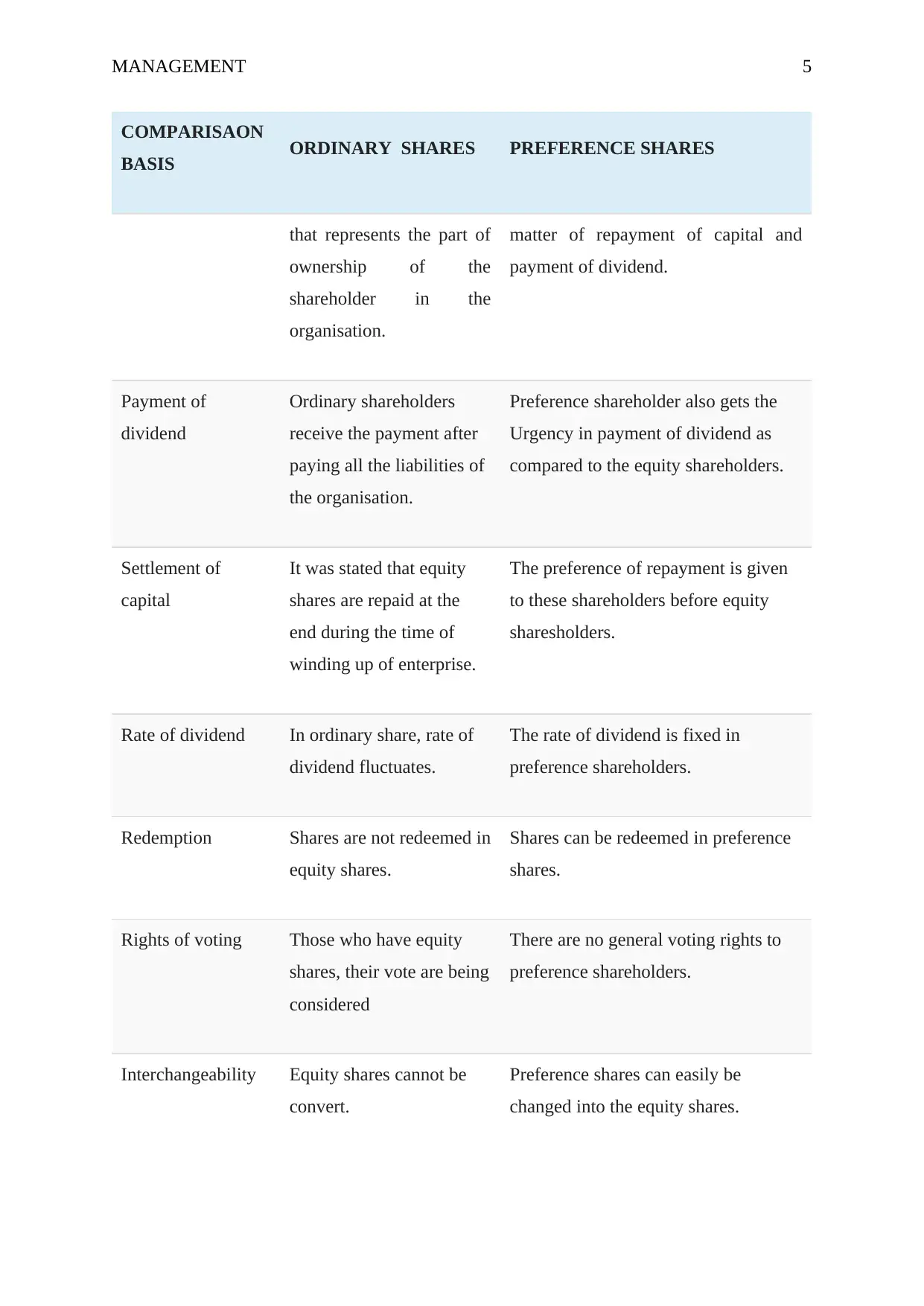

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

Define Ordinary shares are the

equity shares of the firm

Preference shares are the shares that

have the desired rights related to the

shareholder is that it does not charge anything against the company asset. These shareholders

also do not have the complete surety that they will receive the payment. It is because these

shareholders are paid only when the company earn the profit. At a fixed percentage, company

pay the dividend to the preference shareholders.

There are companies that have only one type of shares. These shares are known as

ordinary or equity shares. Various companies also chose to have two or more various type of

shares that are known as alphabet shares. (John, Knyazeva & Knyazeva, 2008)

Equity and preference share also have various similarities. The first similarity

between both the shares is that both the finance earns the dividend. Equity shareholders

receive the dividend after the preference shareholders, debenture holders and equity

shareholders. The second similarity is that both these shareholders form the share capital by

paying some amount in the form of monetary value. Apart from the difference in terms and

condition, they pay the share capital (Xu & Zhang, 2008). Equity, as well as preference

shareholders, face some kind of difficulty in raising the amount. It is because every company

has some kind of formalities that these shareholders are required to comply. Both the shares

are not secured finance. As equity shareholders receive after paying all the dividend to other

shareholders and creditors. For the preference shareholders, it leads to a higher cost as

compared to the debt for issuing. Equity, as well as preference shareholders, have the long-

term finance.

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

Define Ordinary shares are the

equity shares of the firm

Preference shares are the shares that

have the desired rights related to the

MANAGEMENT 5

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

that represents the part of

ownership of the

shareholder in the

organisation.

matter of repayment of capital and

payment of dividend.

Payment of

dividend

Ordinary shareholders

receive the payment after

paying all the liabilities of

the organisation.

Preference shareholder also gets the

Urgency in payment of dividend as

compared to the equity shareholders.

Settlement of

capital

It was stated that equity

shares are repaid at the

end during the time of

winding up of enterprise.

The preference of repayment is given

to these shareholders before equity

sharesholders.

Rate of dividend In ordinary share, rate of

dividend fluctuates.

The rate of dividend is fixed in

preference shareholders.

Redemption Shares are not redeemed in

equity shares.

Shares can be redeemed in preference

shares.

Rights of voting Those who have equity

shares, their vote are being

considered

There are no general voting rights to

preference shareholders.

Interchangeability Equity shares cannot be

convert.

Preference shares can easily be

changed into the equity shares.

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

that represents the part of

ownership of the

shareholder in the

organisation.

matter of repayment of capital and

payment of dividend.

Payment of

dividend

Ordinary shareholders

receive the payment after

paying all the liabilities of

the organisation.

Preference shareholder also gets the

Urgency in payment of dividend as

compared to the equity shareholders.

Settlement of

capital

It was stated that equity

shares are repaid at the

end during the time of

winding up of enterprise.

The preference of repayment is given

to these shareholders before equity

sharesholders.

Rate of dividend In ordinary share, rate of

dividend fluctuates.

The rate of dividend is fixed in

preference shareholders.

Redemption Shares are not redeemed in

equity shares.

Shares can be redeemed in preference

shares.

Rights of voting Those who have equity

shares, their vote are being

considered

There are no general voting rights to

preference shareholders.

Interchangeability Equity shares cannot be

convert.

Preference shares can easily be

changed into the equity shares.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT 6

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

Arrears of

Dividend

The equity shareholders

do not have the right to get

the right of arrears related

to the dividend of past

years.

These shareholders usually get the

arrears of dividend in align with

present year dividend, if not paid in the

last previous year, excluding in the

case of non-cumulative preference

shares (Kalouptsidi, 2012).

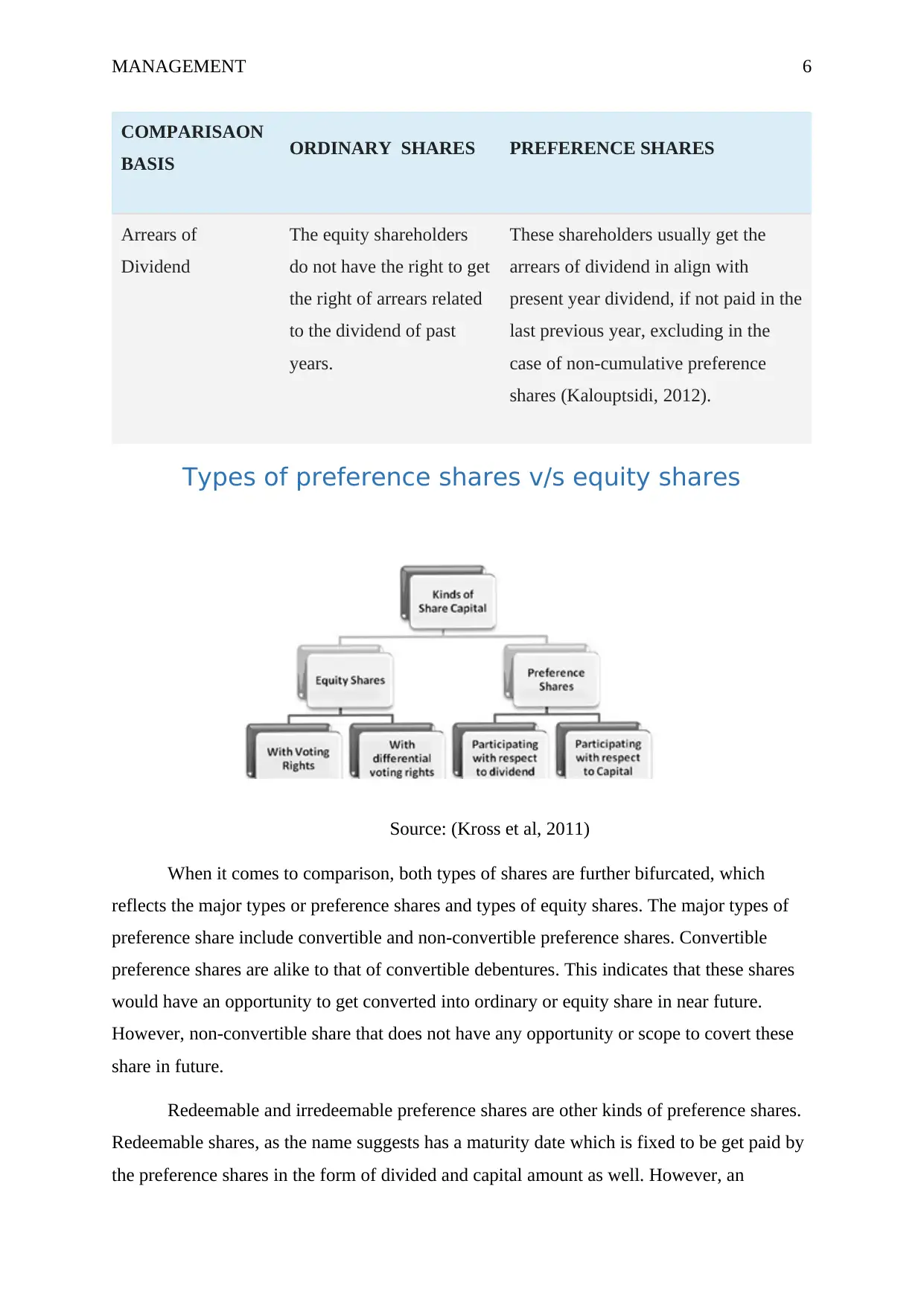

Types of preference shares v/s equity shares

Source: (Kross et al, 2011)

When it comes to comparison, both types of shares are further bifurcated, which

reflects the major types or preference shares and types of equity shares. The major types of

preference share include convertible and non-convertible preference shares. Convertible

preference shares are alike to that of convertible debentures. This indicates that these shares

would have an opportunity to get converted into ordinary or equity share in near future.

However, non-convertible share that does not have any opportunity or scope to covert these

share in future.

Redeemable and irredeemable preference shares are other kinds of preference shares.

Redeemable shares, as the name suggests has a maturity date which is fixed to be get paid by

the preference shares in the form of divided and capital amount as well. However, an

COMPARISAON

BASIS ORDINARY SHARES PREFERENCE SHARES

Arrears of

Dividend

The equity shareholders

do not have the right to get

the right of arrears related

to the dividend of past

years.

These shareholders usually get the

arrears of dividend in align with

present year dividend, if not paid in the

last previous year, excluding in the

case of non-cumulative preference

shares (Kalouptsidi, 2012).

Types of preference shares v/s equity shares

Source: (Kross et al, 2011)

When it comes to comparison, both types of shares are further bifurcated, which

reflects the major types or preference shares and types of equity shares. The major types of

preference share include convertible and non-convertible preference shares. Convertible

preference shares are alike to that of convertible debentures. This indicates that these shares

would have an opportunity to get converted into ordinary or equity share in near future.

However, non-convertible share that does not have any opportunity or scope to covert these

share in future.

Redeemable and irredeemable preference shares are other kinds of preference shares.

Redeemable shares, as the name suggests has a maturity date which is fixed to be get paid by

the preference shares in the form of divided and capital amount as well. However, an

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 7

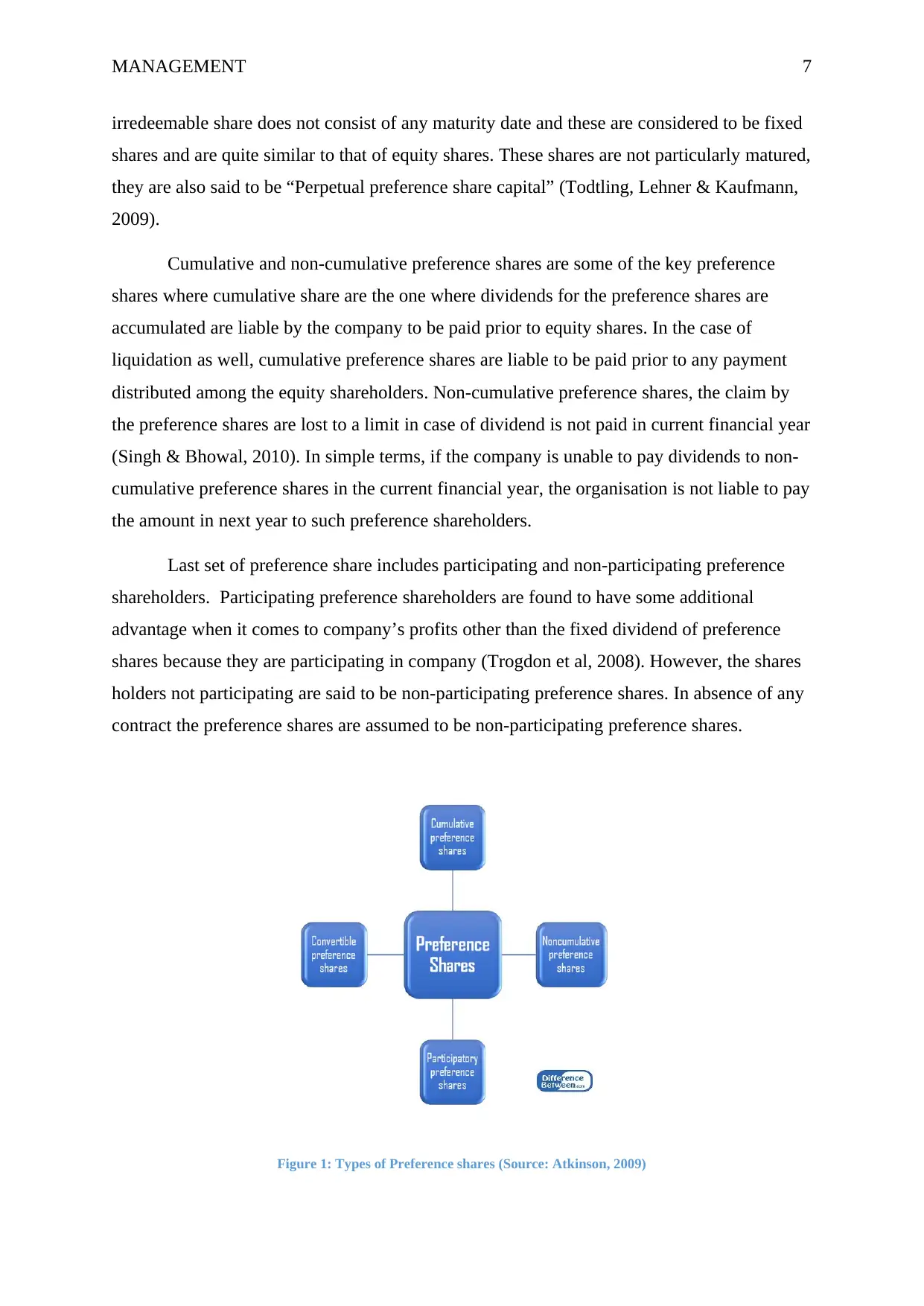

irredeemable share does not consist of any maturity date and these are considered to be fixed

shares and are quite similar to that of equity shares. These shares are not particularly matured,

they are also said to be “Perpetual preference share capital” (Todtling, Lehner & Kaufmann,

2009).

Cumulative and non-cumulative preference shares are some of the key preference

shares where cumulative share are the one where dividends for the preference shares are

accumulated are liable by the company to be paid prior to equity shares. In the case of

liquidation as well, cumulative preference shares are liable to be paid prior to any payment

distributed among the equity shareholders. Non-cumulative preference shares, the claim by

the preference shares are lost to a limit in case of dividend is not paid in current financial year

(Singh & Bhowal, 2010). In simple terms, if the company is unable to pay dividends to non-

cumulative preference shares in the current financial year, the organisation is not liable to pay

the amount in next year to such preference shareholders.

Last set of preference share includes participating and non-participating preference

shareholders. Participating preference shareholders are found to have some additional

advantage when it comes to company’s profits other than the fixed dividend of preference

shares because they are participating in company (Trogdon et al, 2008). However, the shares

holders not participating are said to be non-participating preference shares. In absence of any

contract the preference shares are assumed to be non-participating preference shares.

Figure 1: Types of Preference shares (Source: Atkinson, 2009)

irredeemable share does not consist of any maturity date and these are considered to be fixed

shares and are quite similar to that of equity shares. These shares are not particularly matured,

they are also said to be “Perpetual preference share capital” (Todtling, Lehner & Kaufmann,

2009).

Cumulative and non-cumulative preference shares are some of the key preference

shares where cumulative share are the one where dividends for the preference shares are

accumulated are liable by the company to be paid prior to equity shares. In the case of

liquidation as well, cumulative preference shares are liable to be paid prior to any payment

distributed among the equity shareholders. Non-cumulative preference shares, the claim by

the preference shares are lost to a limit in case of dividend is not paid in current financial year

(Singh & Bhowal, 2010). In simple terms, if the company is unable to pay dividends to non-

cumulative preference shares in the current financial year, the organisation is not liable to pay

the amount in next year to such preference shareholders.

Last set of preference share includes participating and non-participating preference

shareholders. Participating preference shareholders are found to have some additional

advantage when it comes to company’s profits other than the fixed dividend of preference

shares because they are participating in company (Trogdon et al, 2008). However, the shares

holders not participating are said to be non-participating preference shares. In absence of any

contract the preference shares are assumed to be non-participating preference shares.

Figure 1: Types of Preference shares (Source: Atkinson, 2009)

MANAGEMENT 8

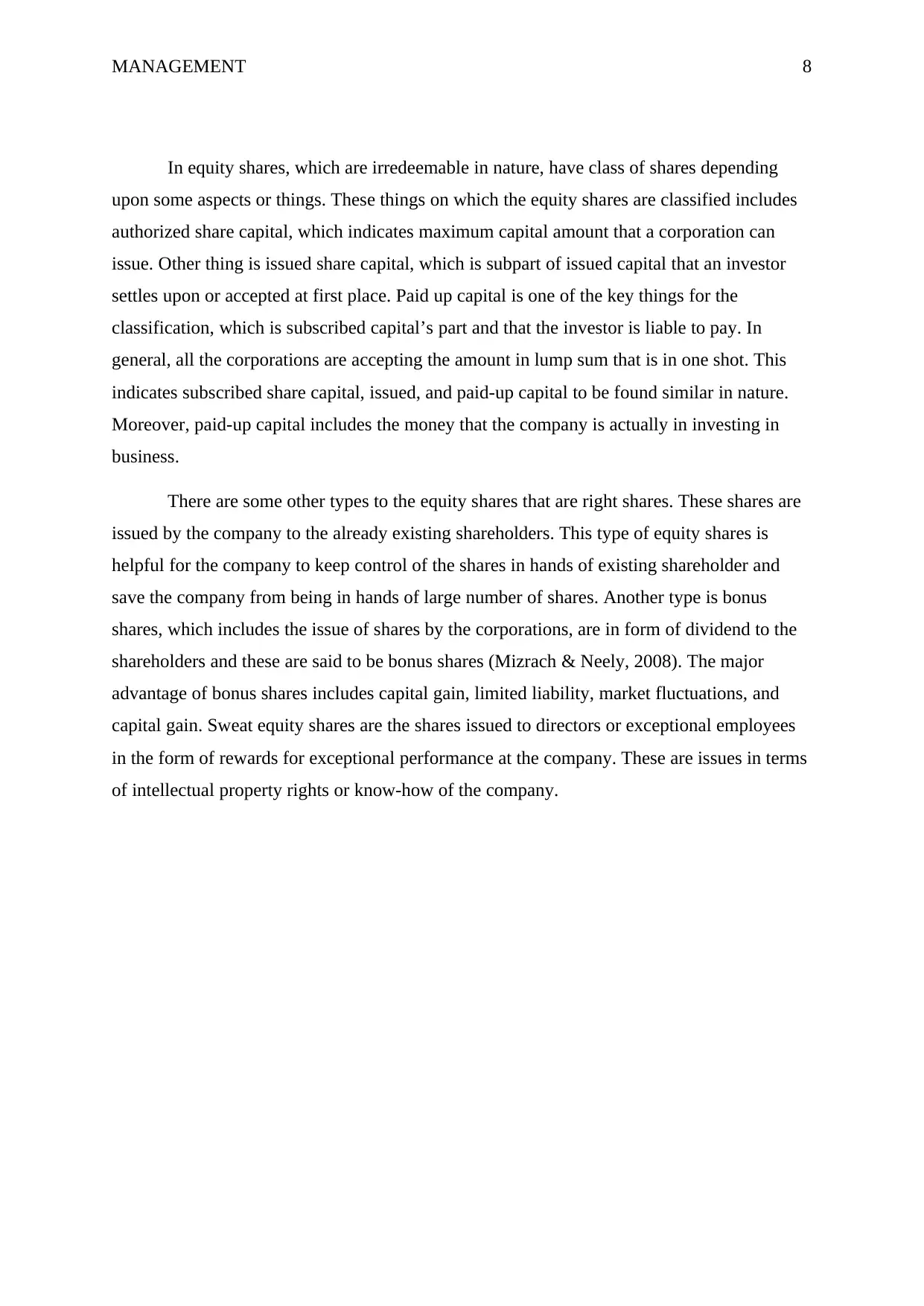

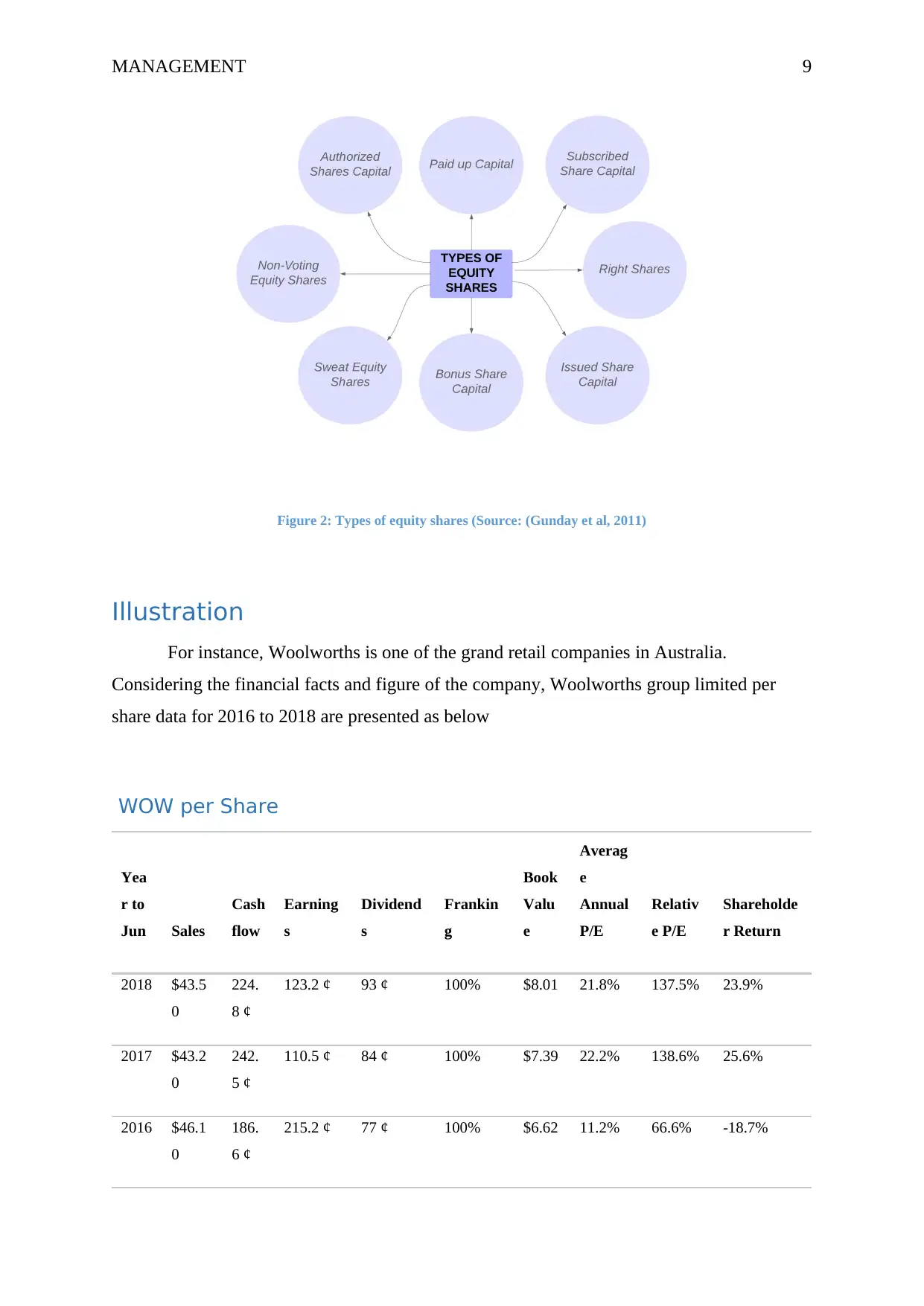

In equity shares, which are irredeemable in nature, have class of shares depending

upon some aspects or things. These things on which the equity shares are classified includes

authorized share capital, which indicates maximum capital amount that a corporation can

issue. Other thing is issued share capital, which is subpart of issued capital that an investor

settles upon or accepted at first place. Paid up capital is one of the key things for the

classification, which is subscribed capital’s part and that the investor is liable to pay. In

general, all the corporations are accepting the amount in lump sum that is in one shot. This

indicates subscribed share capital, issued, and paid-up capital to be found similar in nature.

Moreover, paid-up capital includes the money that the company is actually in investing in

business.

There are some other types to the equity shares that are right shares. These shares are

issued by the company to the already existing shareholders. This type of equity shares is

helpful for the company to keep control of the shares in hands of existing shareholder and

save the company from being in hands of large number of shares. Another type is bonus

shares, which includes the issue of shares by the corporations, are in form of dividend to the

shareholders and these are said to be bonus shares (Mizrach & Neely, 2008). The major

advantage of bonus shares includes capital gain, limited liability, market fluctuations, and

capital gain. Sweat equity shares are the shares issued to directors or exceptional employees

in the form of rewards for exceptional performance at the company. These are issues in terms

of intellectual property rights or know-how of the company.

In equity shares, which are irredeemable in nature, have class of shares depending

upon some aspects or things. These things on which the equity shares are classified includes

authorized share capital, which indicates maximum capital amount that a corporation can

issue. Other thing is issued share capital, which is subpart of issued capital that an investor

settles upon or accepted at first place. Paid up capital is one of the key things for the

classification, which is subscribed capital’s part and that the investor is liable to pay. In

general, all the corporations are accepting the amount in lump sum that is in one shot. This

indicates subscribed share capital, issued, and paid-up capital to be found similar in nature.

Moreover, paid-up capital includes the money that the company is actually in investing in

business.

There are some other types to the equity shares that are right shares. These shares are

issued by the company to the already existing shareholders. This type of equity shares is

helpful for the company to keep control of the shares in hands of existing shareholder and

save the company from being in hands of large number of shares. Another type is bonus

shares, which includes the issue of shares by the corporations, are in form of dividend to the

shareholders and these are said to be bonus shares (Mizrach & Neely, 2008). The major

advantage of bonus shares includes capital gain, limited liability, market fluctuations, and

capital gain. Sweat equity shares are the shares issued to directors or exceptional employees

in the form of rewards for exceptional performance at the company. These are issues in terms

of intellectual property rights or know-how of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT 9

Figure 2: Types of equity shares (Source: (Gunday et al, 2011)

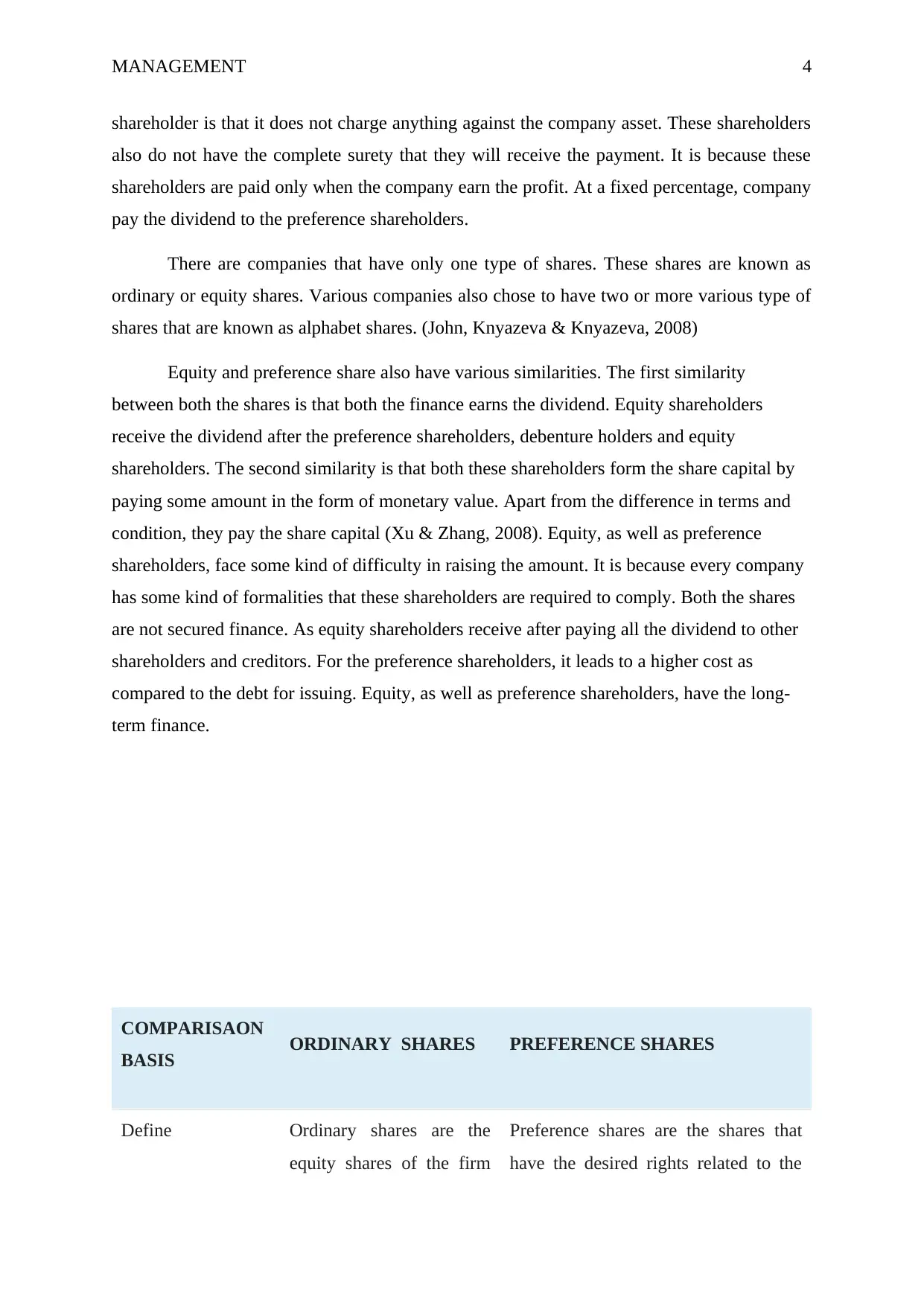

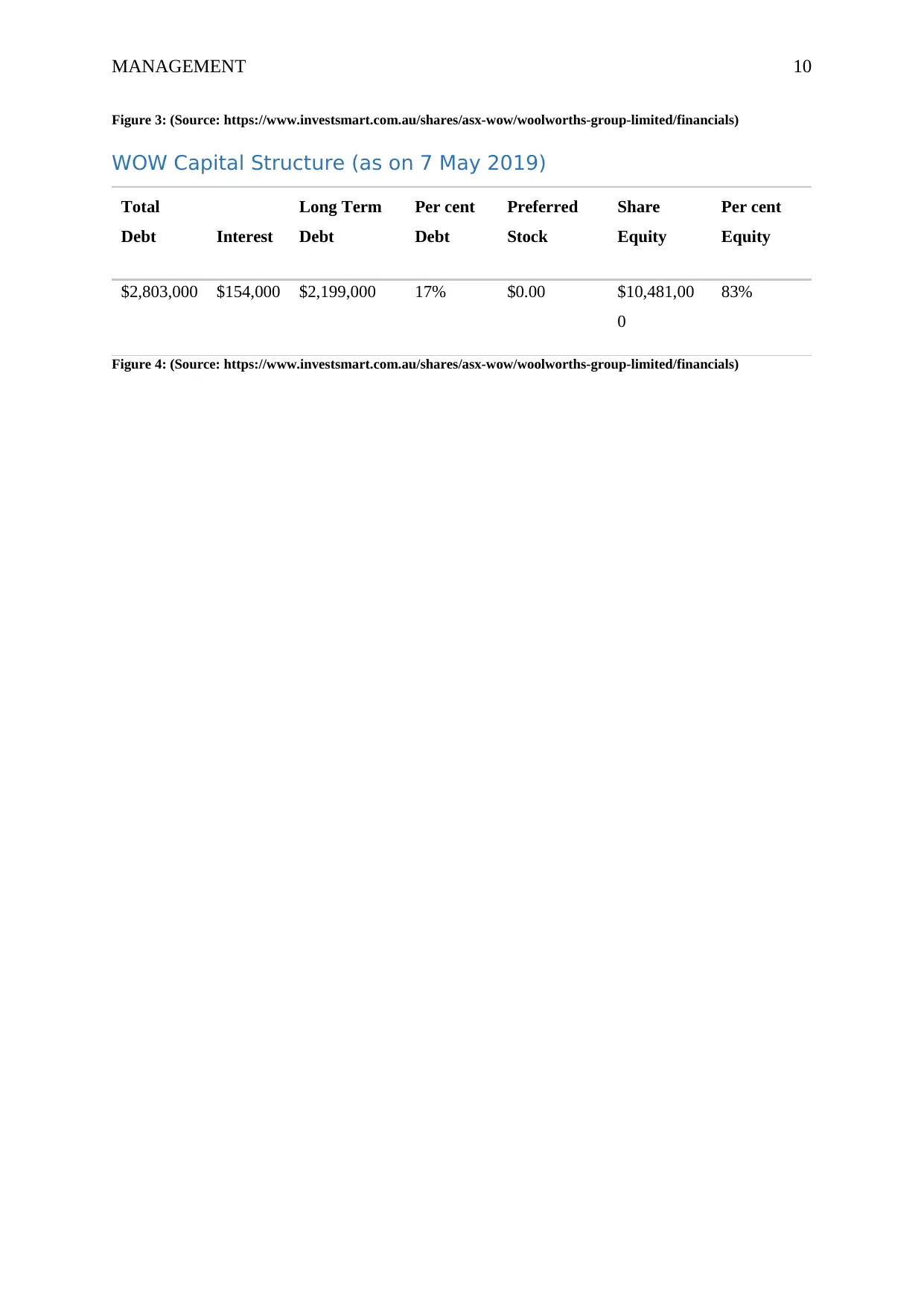

Illustration

For instance, Woolworths is one of the grand retail companies in Australia.

Considering the financial facts and figure of the company, Woolworths group limited per

share data for 2016 to 2018 are presented as below

WOW per Share

Yea

r to

Jun Sales

Cash

flow

Earning

s

Dividend

s

Frankin

g

Book

Valu

e

Averag

e

Annual

P/E

Relativ

e P/E

Shareholde

r Return

2018 $43.5

0

224.

8 ¢

123.2 ¢ 93 ¢ 100% $8.01 21.8% 137.5% 23.9%

2017 $43.2

0

242.

5 ¢

110.5 ¢ 84 ¢ 100% $7.39 22.2% 138.6% 25.6%

2016 $46.1

0

186.

6 ¢

215.2 ¢ 77 ¢ 100% $6.62 11.2% 66.6% -18.7%

Figure 2: Types of equity shares (Source: (Gunday et al, 2011)

Illustration

For instance, Woolworths is one of the grand retail companies in Australia.

Considering the financial facts and figure of the company, Woolworths group limited per

share data for 2016 to 2018 are presented as below

WOW per Share

Yea

r to

Jun Sales

Cash

flow

Earning

s

Dividend

s

Frankin

g

Book

Valu

e

Averag

e

Annual

P/E

Relativ

e P/E

Shareholde

r Return

2018 $43.5

0

224.

8 ¢

123.2 ¢ 93 ¢ 100% $8.01 21.8% 137.5% 23.9%

2017 $43.2

0

242.

5 ¢

110.5 ¢ 84 ¢ 100% $7.39 22.2% 138.6% 25.6%

2016 $46.1

0

186.

6 ¢

215.2 ¢ 77 ¢ 100% $6.62 11.2% 66.6% -18.7%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 10

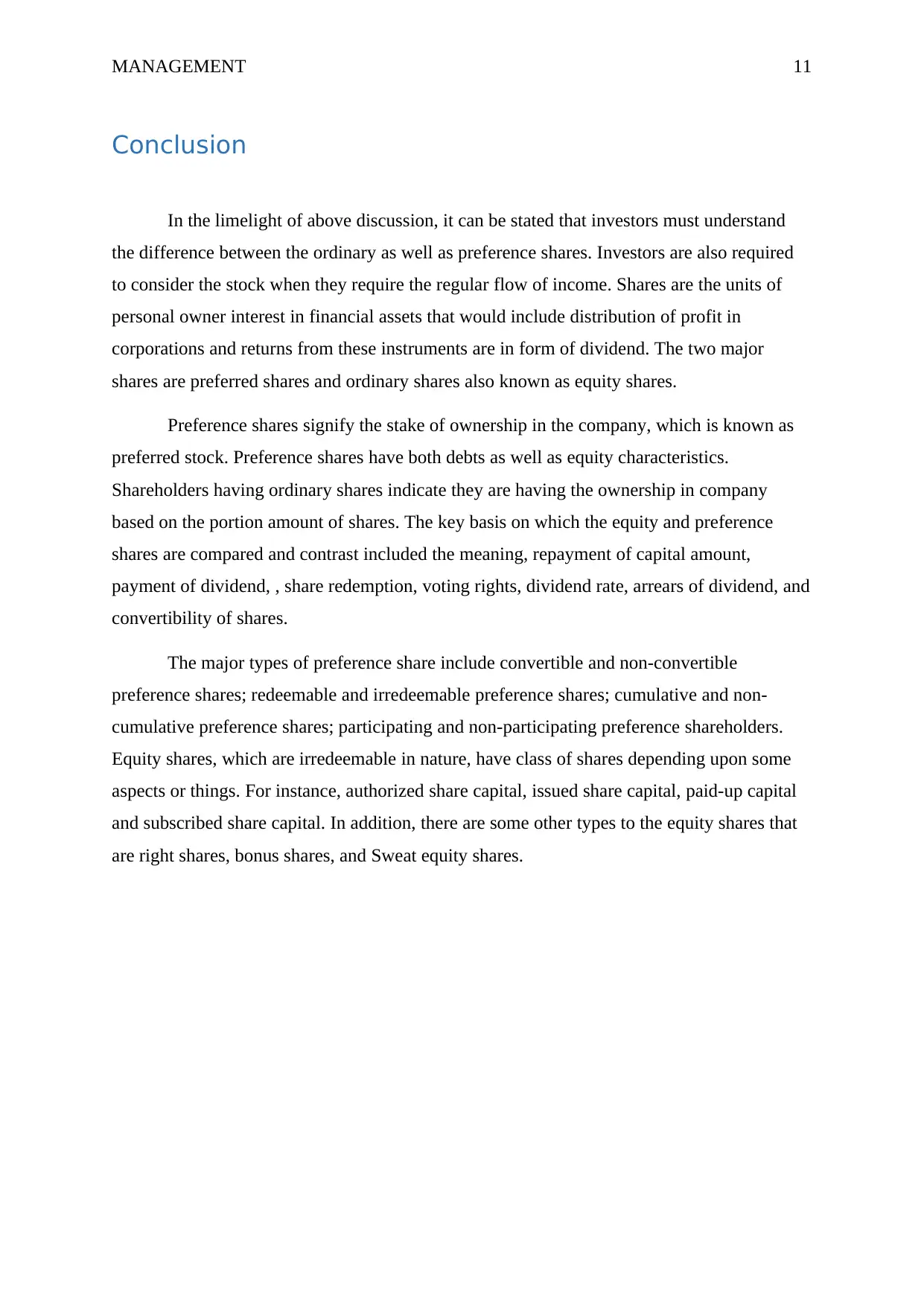

Figure 3: (Source: https://www.investsmart.com.au/shares/asx-wow/woolworths-group-limited/financials)

WOW Capital Structure (as on 7 May 2019)

Total

Debt Interest

Long Term

Debt

Per cent

Debt

Preferred

Stock

Share

Equity

Per cent

Equity

$2,803,000 $154,000 $2,199,000 17% $0.00 $10,481,00

0

83%

Figure 4: (Source: https://www.investsmart.com.au/shares/asx-wow/woolworths-group-limited/financials)

Figure 3: (Source: https://www.investsmart.com.au/shares/asx-wow/woolworths-group-limited/financials)

WOW Capital Structure (as on 7 May 2019)

Total

Debt Interest

Long Term

Debt

Per cent

Debt

Preferred

Stock

Share

Equity

Per cent

Equity

$2,803,000 $154,000 $2,199,000 17% $0.00 $10,481,00

0

83%

Figure 4: (Source: https://www.investsmart.com.au/shares/asx-wow/woolworths-group-limited/financials)

MANAGEMENT 11

Conclusion

In the limelight of above discussion, it can be stated that investors must understand

the difference between the ordinary as well as preference shares. Investors are also required

to consider the stock when they require the regular flow of income. Shares are the units of

personal owner interest in financial assets that would include distribution of profit in

corporations and returns from these instruments are in form of dividend. The two major

shares are preferred shares and ordinary shares also known as equity shares.

Preference shares signify the stake of ownership in the company, which is known as

preferred stock. Preference shares have both debts as well as equity characteristics.

Shareholders having ordinary shares indicate they are having the ownership in company

based on the portion amount of shares. The key basis on which the equity and preference

shares are compared and contrast included the meaning, repayment of capital amount,

payment of dividend, , share redemption, voting rights, dividend rate, arrears of dividend, and

convertibility of shares.

The major types of preference share include convertible and non-convertible

preference shares; redeemable and irredeemable preference shares; cumulative and non-

cumulative preference shares; participating and non-participating preference shareholders.

Equity shares, which are irredeemable in nature, have class of shares depending upon some

aspects or things. For instance, authorized share capital, issued share capital, paid-up capital

and subscribed share capital. In addition, there are some other types to the equity shares that

are right shares, bonus shares, and Sweat equity shares.

Conclusion

In the limelight of above discussion, it can be stated that investors must understand

the difference between the ordinary as well as preference shares. Investors are also required

to consider the stock when they require the regular flow of income. Shares are the units of

personal owner interest in financial assets that would include distribution of profit in

corporations and returns from these instruments are in form of dividend. The two major

shares are preferred shares and ordinary shares also known as equity shares.

Preference shares signify the stake of ownership in the company, which is known as

preferred stock. Preference shares have both debts as well as equity characteristics.

Shareholders having ordinary shares indicate they are having the ownership in company

based on the portion amount of shares. The key basis on which the equity and preference

shares are compared and contrast included the meaning, repayment of capital amount,

payment of dividend, , share redemption, voting rights, dividend rate, arrears of dividend, and

convertibility of shares.

The major types of preference share include convertible and non-convertible

preference shares; redeemable and irredeemable preference shares; cumulative and non-

cumulative preference shares; participating and non-participating preference shareholders.

Equity shares, which are irredeemable in nature, have class of shares depending upon some

aspects or things. For instance, authorized share capital, issued share capital, paid-up capital

and subscribed share capital. In addition, there are some other types to the equity shares that

are right shares, bonus shares, and Sweat equity shares.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.