Analysis: Intl. Trade Finance & Foreign Direct Investments

VerifiedAdded on 2022/08/25

|12

|2757

|7

Report

AI Summary

This report provides a comprehensive analysis of how global firms manage international trade finance and foreign direct investments. It delves into crucial aspects such as funding options, including international bonds, debt-equity mix, and equity markets, highlighting the importance of optimizing capital structure. The report also examines international trade finance, covering the management of affiliated and unaffiliated buyers, currency risk, and the use of export credit. Furthermore, it explores foreign direct investments (FDIs), discussing competitive advantages, location-specific advantages, and proactive and reactive financial strategies. The report also addresses capital budgeting in multinational contexts, emphasizing the need to consider parent cash flows, inflation, and foreign exchange risks. Overall, the report underscores the significance of these elements in enabling global firms to effectively manage their international trade finance and foreign direct investments.

Running head: MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN

DIRECT INVESTMENTS

Management of International Trade Finance and Foreign Direct Investments

Name of the Student

Name of the University

Author’s Note

DIRECT INVESTMENTS

Management of International Trade Finance and Foreign Direct Investments

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Table of Contents

Process to manage international trade finance and foreign direct investments by global firms......2

Funding of Global Firms.............................................................................................................2

International Trade Finance.........................................................................................................4

Foreign Direct Investments..........................................................................................................5

Capital Budgeting in Multinational Level...................................................................................7

References........................................................................................................................................9

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Table of Contents

Process to manage international trade finance and foreign direct investments by global firms......2

Funding of Global Firms.............................................................................................................2

International Trade Finance.........................................................................................................4

Foreign Direct Investments..........................................................................................................5

Capital Budgeting in Multinational Level...................................................................................7

References........................................................................................................................................9

2

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Process to manage international trade finance and foreign direct investments by global

firms

Business finance can be considered as the money and credit that the businesses employ

for the purpose of business and wide use of this practice can be seen in the multinational

business organizations. Proper management of international trade finance and foreign direct

investment is a crucial part of business finance for the multinational corporations and this

requires these corporations to take into account all the relevant aspects (Müllner, 2017). The

main aim of this essay is to shed light on how multinational companies or global firms manage

their international trade finance and foreign direct investments by putting special emphasis on

the aspects like funding of multinational firms, international trade finance, foreign direct

investment as well as political risk and multinational capital budgeting and cross-border

acquisition.

Funding of Global Firms

Funding of the global firms is considered as a crucial step in managing international trade

finance and foreign direct investments. There are different types of funding options are available

to the global firms and they can be used for raising the required funds. It is required for most of

the global firms to commence raising the required funds with the issue of international bonds as

this helps in gaining recognition in the international financial markets (Drover et al., 2017). This

strategy can be implemented through the issue of international bond in the target market or in the

Eurobond market. For example, a firm resident in United States issues a bond that is

denominated in U.S. dollars, but then he sells the same bond to Europe and Japan, not to the

investors of U.S; this is considered as Eurobond. Global firms are required to mix the debt and

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Process to manage international trade finance and foreign direct investments by global

firms

Business finance can be considered as the money and credit that the businesses employ

for the purpose of business and wide use of this practice can be seen in the multinational

business organizations. Proper management of international trade finance and foreign direct

investment is a crucial part of business finance for the multinational corporations and this

requires these corporations to take into account all the relevant aspects (Müllner, 2017). The

main aim of this essay is to shed light on how multinational companies or global firms manage

their international trade finance and foreign direct investments by putting special emphasis on

the aspects like funding of multinational firms, international trade finance, foreign direct

investment as well as political risk and multinational capital budgeting and cross-border

acquisition.

Funding of Global Firms

Funding of the global firms is considered as a crucial step in managing international trade

finance and foreign direct investments. There are different types of funding options are available

to the global firms and they can be used for raising the required funds. It is required for most of

the global firms to commence raising the required funds with the issue of international bonds as

this helps in gaining recognition in the international financial markets (Drover et al., 2017). This

strategy can be implemented through the issue of international bond in the target market or in the

Eurobond market. For example, a firm resident in United States issues a bond that is

denominated in U.S. dollars, but then he sells the same bond to Europe and Japan, not to the

investors of U.S; this is considered as Eurobond. Global firms are required to mix the debt and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

equity in such a manner so that the overall cost of capital of their business is minimized. It is

considered that the multinational business organizations are in better place than the national

firms for supporting higher debt ratios because of the presence of their diversified cash flows

internationally. For this reason, multinational business organizations can use greater amount of

debt in their capital structure as a part of managing international trade.

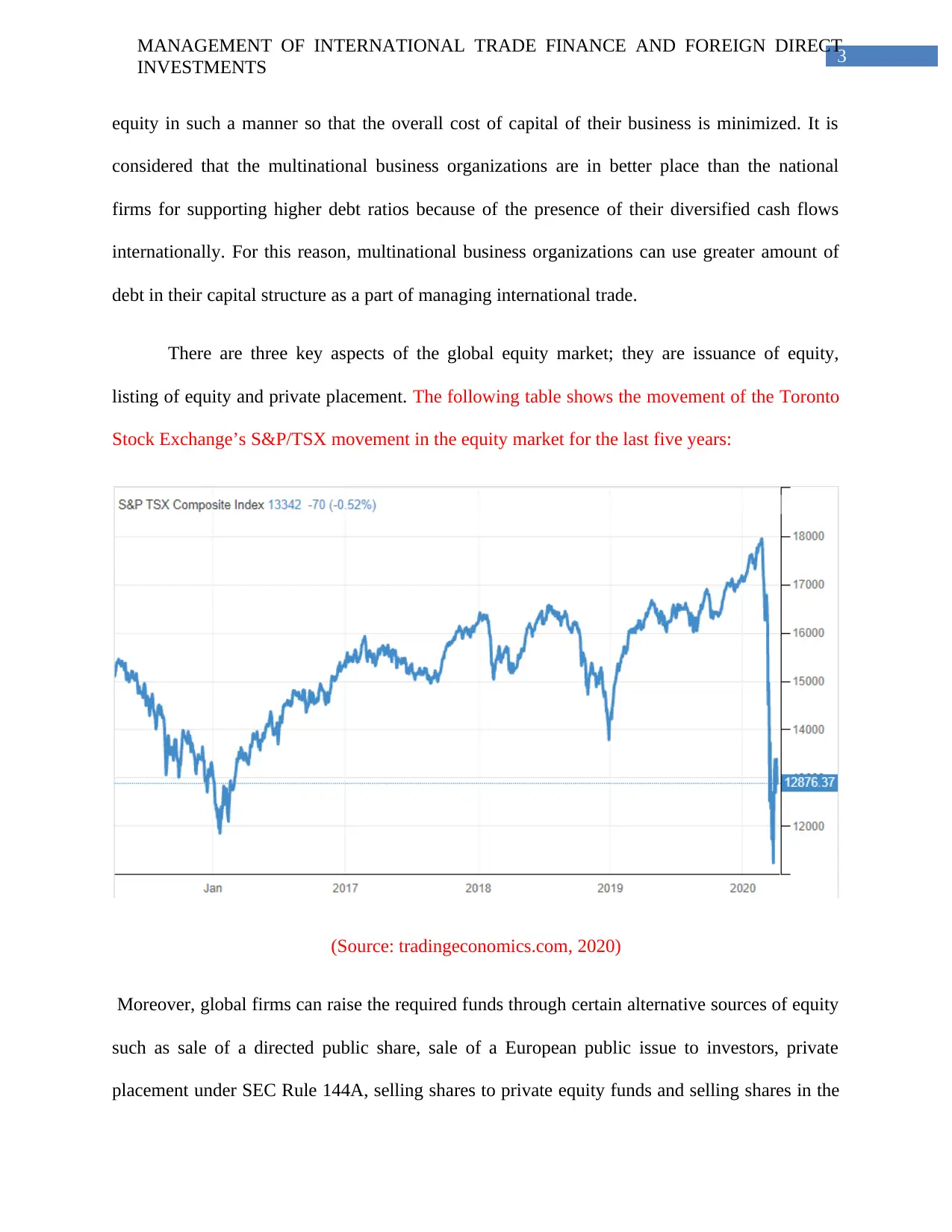

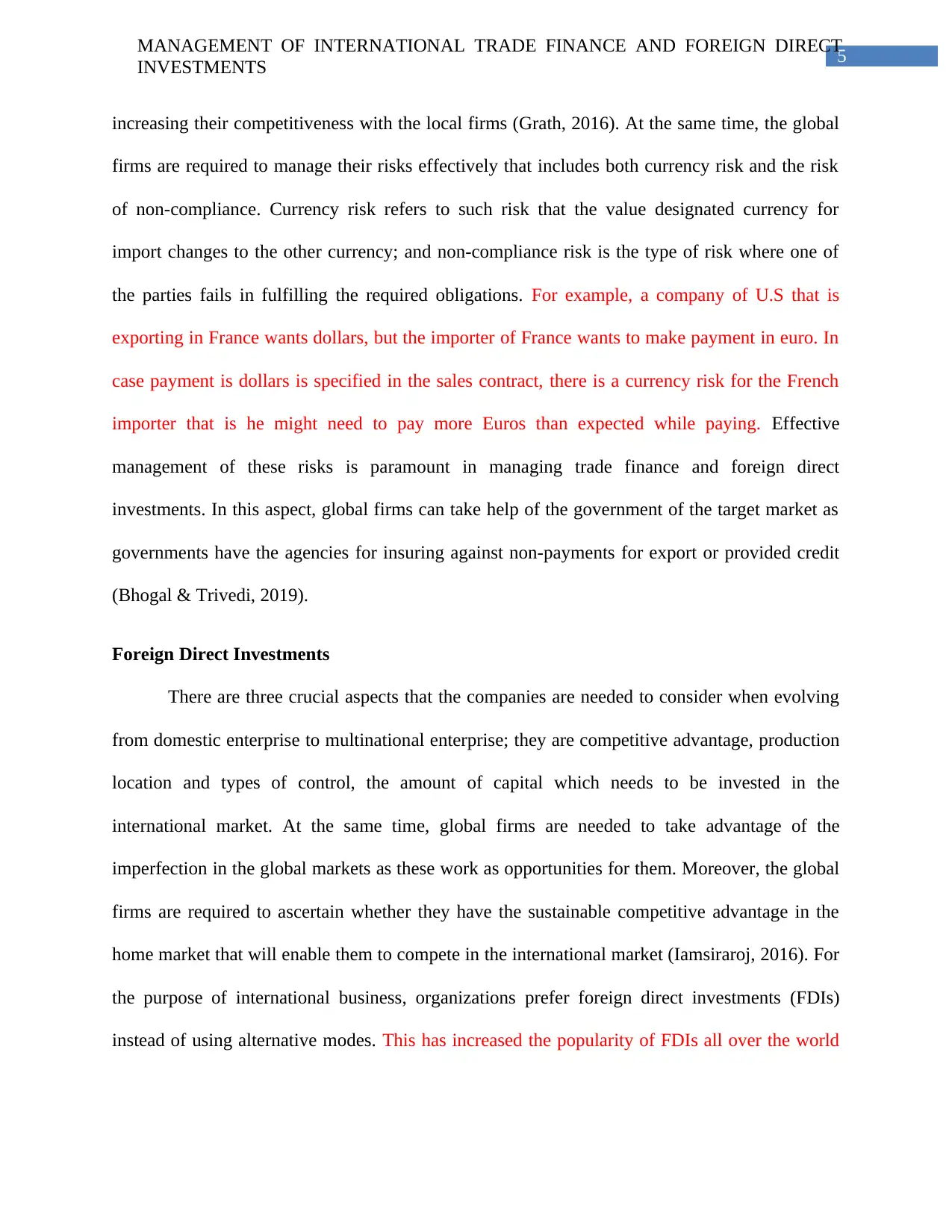

There are three key aspects of the global equity market; they are issuance of equity,

listing of equity and private placement. The following table shows the movement of the Toronto

Stock Exchange’s S&P/TSX movement in the equity market for the last five years:

(Source: tradingeconomics.com, 2020)

Moreover, global firms can raise the required funds through certain alternative sources of equity

such as sale of a directed public share, sale of a European public issue to investors, private

placement under SEC Rule 144A, selling shares to private equity funds and selling shares in the

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

equity in such a manner so that the overall cost of capital of their business is minimized. It is

considered that the multinational business organizations are in better place than the national

firms for supporting higher debt ratios because of the presence of their diversified cash flows

internationally. For this reason, multinational business organizations can use greater amount of

debt in their capital structure as a part of managing international trade.

There are three key aspects of the global equity market; they are issuance of equity,

listing of equity and private placement. The following table shows the movement of the Toronto

Stock Exchange’s S&P/TSX movement in the equity market for the last five years:

(Source: tradingeconomics.com, 2020)

Moreover, global firms can raise the required funds through certain alternative sources of equity

such as sale of a directed public share, sale of a European public issue to investors, private

placement under SEC Rule 144A, selling shares to private equity funds and selling shares in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

foreign firms (Cao et al., 2017). Global firms can enjoy certain advantages by raising the funds

through foreign equity listing such as improved liquidity of present shares, increase in share

price, and increase in visibility and acceptance of the firms, establishment of secondary market

and others. Apart from these, other effective options for the global firms for funding themselves

include bank taking loans and securitized debts, issuing international debt instruments such as

syndicated loans, Euronotes, Euro-commercial paper, issuing foreign bonds and Eurobonds

(Gourinchas, Rey & Sauzet, 2019).

International Trade Finance

Managing trade finance is considered as another crucial part in managing international

trade finance and foreign direct investments. The presence of two types of buyers can be seen in

global trade finance; they are unaffiliated buyers and affiliated buyers; and it is a key job of the

global firms to manage these two types of buyers effectively (Bhogal & Trivedi, 2019). As

unaffiliated buyers can be new and experienced, they pose credit risk as the exporter may face

issues in assessing their creditworthiness because of the factors like geographical distance, lack

of record, language and others. Therefore, this risk is managed by the global companies through

issuing letter of credit accompanied by other documents so that the exporter can rely on the

bank’s credit standing. On the other hand, standard international trade documents are used by the

global firms for affiliated buyers as they has no credit risk as both the importer and exporter are

the part of the same corporate unit (Antras & Foley, 2015).

In the present situation, intra-firm trade is gaining more popularity than trading with non-

affiliated exporters and importers in the management of trade finance; and the main reason of

this is that the global firms are now manufacturing as well as selling their products in the

international market concurrently which is contributing towards lowering the costs while

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

foreign firms (Cao et al., 2017). Global firms can enjoy certain advantages by raising the funds

through foreign equity listing such as improved liquidity of present shares, increase in share

price, and increase in visibility and acceptance of the firms, establishment of secondary market

and others. Apart from these, other effective options for the global firms for funding themselves

include bank taking loans and securitized debts, issuing international debt instruments such as

syndicated loans, Euronotes, Euro-commercial paper, issuing foreign bonds and Eurobonds

(Gourinchas, Rey & Sauzet, 2019).

International Trade Finance

Managing trade finance is considered as another crucial part in managing international

trade finance and foreign direct investments. The presence of two types of buyers can be seen in

global trade finance; they are unaffiliated buyers and affiliated buyers; and it is a key job of the

global firms to manage these two types of buyers effectively (Bhogal & Trivedi, 2019). As

unaffiliated buyers can be new and experienced, they pose credit risk as the exporter may face

issues in assessing their creditworthiness because of the factors like geographical distance, lack

of record, language and others. Therefore, this risk is managed by the global companies through

issuing letter of credit accompanied by other documents so that the exporter can rely on the

bank’s credit standing. On the other hand, standard international trade documents are used by the

global firms for affiliated buyers as they has no credit risk as both the importer and exporter are

the part of the same corporate unit (Antras & Foley, 2015).

In the present situation, intra-firm trade is gaining more popularity than trading with non-

affiliated exporters and importers in the management of trade finance; and the main reason of

this is that the global firms are now manufacturing as well as selling their products in the

international market concurrently which is contributing towards lowering the costs while

5

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

increasing their competitiveness with the local firms (Grath, 2016). At the same time, the global

firms are required to manage their risks effectively that includes both currency risk and the risk

of non-compliance. Currency risk refers to such risk that the value designated currency for

import changes to the other currency; and non-compliance risk is the type of risk where one of

the parties fails in fulfilling the required obligations. For example, a company of U.S that is

exporting in France wants dollars, but the importer of France wants to make payment in euro. In

case payment is dollars is specified in the sales contract, there is a currency risk for the French

importer that is he might need to pay more Euros than expected while paying. Effective

management of these risks is paramount in managing trade finance and foreign direct

investments. In this aspect, global firms can take help of the government of the target market as

governments have the agencies for insuring against non-payments for export or provided credit

(Bhogal & Trivedi, 2019).

Foreign Direct Investments

There are three crucial aspects that the companies are needed to consider when evolving

from domestic enterprise to multinational enterprise; they are competitive advantage, production

location and types of control, the amount of capital which needs to be invested in the

international market. At the same time, global firms are needed to take advantage of the

imperfection in the global markets as these work as opportunities for them. Moreover, the global

firms are required to ascertain whether they have the sustainable competitive advantage in the

home market that will enable them to compete in the international market (Iamsiraroj, 2016). For

the purpose of international business, organizations prefer foreign direct investments (FDIs)

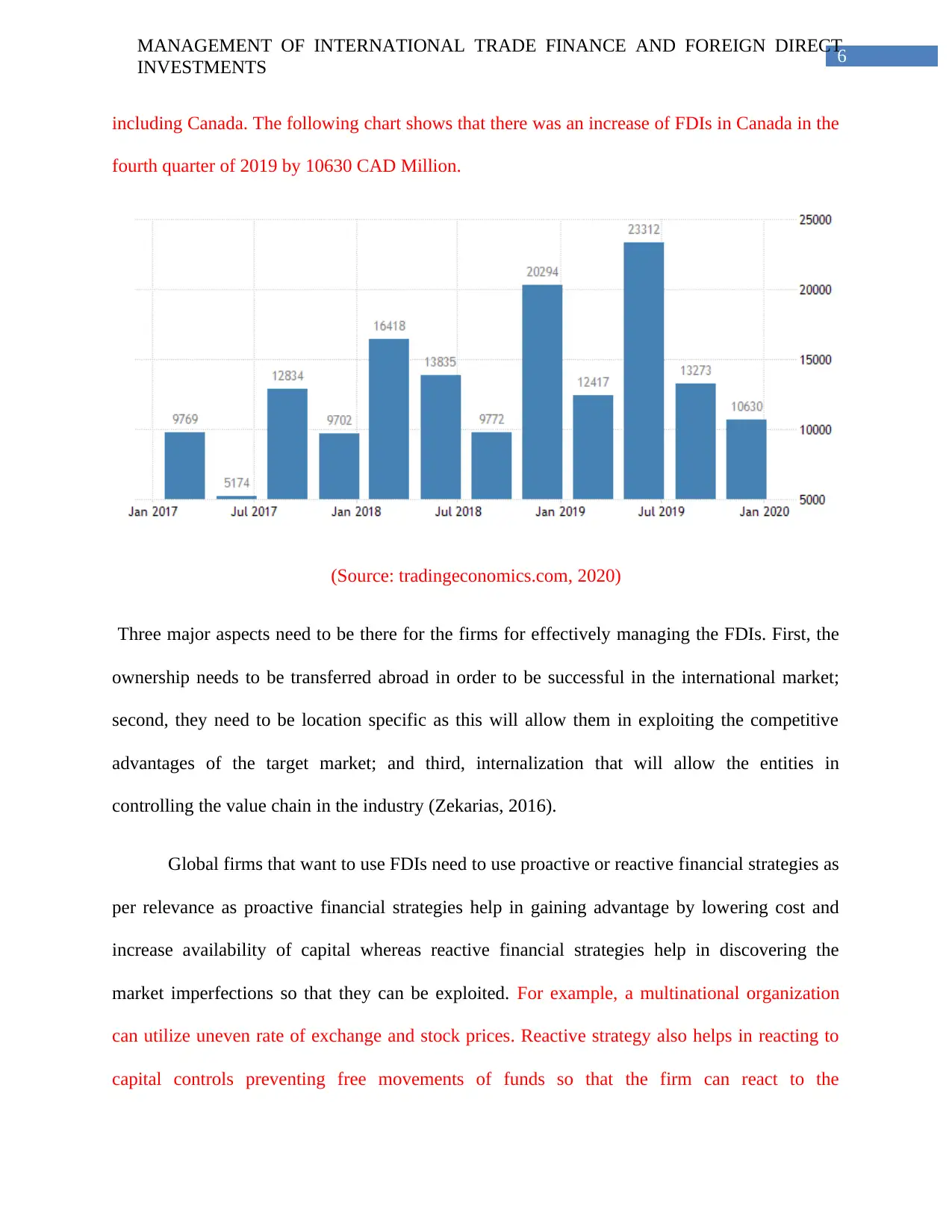

instead of using alternative modes. This has increased the popularity of FDIs all over the world

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

increasing their competitiveness with the local firms (Grath, 2016). At the same time, the global

firms are required to manage their risks effectively that includes both currency risk and the risk

of non-compliance. Currency risk refers to such risk that the value designated currency for

import changes to the other currency; and non-compliance risk is the type of risk where one of

the parties fails in fulfilling the required obligations. For example, a company of U.S that is

exporting in France wants dollars, but the importer of France wants to make payment in euro. In

case payment is dollars is specified in the sales contract, there is a currency risk for the French

importer that is he might need to pay more Euros than expected while paying. Effective

management of these risks is paramount in managing trade finance and foreign direct

investments. In this aspect, global firms can take help of the government of the target market as

governments have the agencies for insuring against non-payments for export or provided credit

(Bhogal & Trivedi, 2019).

Foreign Direct Investments

There are three crucial aspects that the companies are needed to consider when evolving

from domestic enterprise to multinational enterprise; they are competitive advantage, production

location and types of control, the amount of capital which needs to be invested in the

international market. At the same time, global firms are needed to take advantage of the

imperfection in the global markets as these work as opportunities for them. Moreover, the global

firms are required to ascertain whether they have the sustainable competitive advantage in the

home market that will enable them to compete in the international market (Iamsiraroj, 2016). For

the purpose of international business, organizations prefer foreign direct investments (FDIs)

instead of using alternative modes. This has increased the popularity of FDIs all over the world

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

including Canada. The following chart shows that there was an increase of FDIs in Canada in the

fourth quarter of 2019 by 10630 CAD Million.

(Source: tradingeconomics.com, 2020)

Three major aspects need to be there for the firms for effectively managing the FDIs. First, the

ownership needs to be transferred abroad in order to be successful in the international market;

second, they need to be location specific as this will allow them in exploiting the competitive

advantages of the target market; and third, internalization that will allow the entities in

controlling the value chain in the industry (Zekarias, 2016).

Global firms that want to use FDIs need to use proactive or reactive financial strategies as

per relevance as proactive financial strategies help in gaining advantage by lowering cost and

increase availability of capital whereas reactive financial strategies help in discovering the

market imperfections so that they can be exploited. For example, a multinational organization

can utilize uneven rate of exchange and stock prices. Reactive strategy also helps in reacting to

capital controls preventing free movements of funds so that the firm can react to the

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

including Canada. The following chart shows that there was an increase of FDIs in Canada in the

fourth quarter of 2019 by 10630 CAD Million.

(Source: tradingeconomics.com, 2020)

Three major aspects need to be there for the firms for effectively managing the FDIs. First, the

ownership needs to be transferred abroad in order to be successful in the international market;

second, they need to be location specific as this will allow them in exploiting the competitive

advantages of the target market; and third, internalization that will allow the entities in

controlling the value chain in the industry (Zekarias, 2016).

Global firms that want to use FDIs need to use proactive or reactive financial strategies as

per relevance as proactive financial strategies help in gaining advantage by lowering cost and

increase availability of capital whereas reactive financial strategies help in discovering the

market imperfections so that they can be exploited. For example, a multinational organization

can utilize uneven rate of exchange and stock prices. Reactive strategy also helps in reacting to

capital controls preventing free movements of funds so that the firm can react to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

opportunities for minimizing worldwide taxation. Moreover, the global firms are required to

consider the behavioral factors of FDI for deciding where to invest (Agrawal, 2015). Moreover,

global firms can adopt the strategy to export instead of producing in abroad as exporting

provides them with many advantages such as avoiding facing the unique risks in FDI, strategic

alliances, joint ventures and others and reducing the agency costs. At the same time, business

organizations that want to operate in foreign market need to adopt the strategy of licensing and

management contracts instead of producing in abroad. All these help in managing the foreign

direct investments in better manner (Iamsiraroj & Ulubaşoğlu, 2015).

Capital Budgeting in Multinational Level

In case of the foreign projects, the same capital budgeting framework is used that is used

for the domestic products involving steps like identification of initial capital invested, estimation

of cash flows, identification of appropriate discount rate and application of traditional capital

budgeting (Andor, Mohanty & Toth, 2015). However, there are certain complexities in the

foreign projects that need to be managed by the global firms; such as the need of distinguishing

the parent cash flows from project cash flows, explicit recognition of remittance of funds by the

parent company because of different tax system and others constrains; anticipation of different

rates of national inflation; consideration of the possibility of uncertain change in foreign

exchange; evaluation of potential risks; estimation of terminal value which is a difficult task and

others (Andor, Mohanty & Toth, 2015). Moreover, a foreign project needs to be evaluated from

both the projected and parent viewpoint. It is needed for the global firms to take into

consideration that they need to investment only in case they can earn a risk-adjusted return that is

higher locally based competitors as earn on the same project (Rigopoulos, 2015).

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

opportunities for minimizing worldwide taxation. Moreover, the global firms are required to

consider the behavioral factors of FDI for deciding where to invest (Agrawal, 2015). Moreover,

global firms can adopt the strategy to export instead of producing in abroad as exporting

provides them with many advantages such as avoiding facing the unique risks in FDI, strategic

alliances, joint ventures and others and reducing the agency costs. At the same time, business

organizations that want to operate in foreign market need to adopt the strategy of licensing and

management contracts instead of producing in abroad. All these help in managing the foreign

direct investments in better manner (Iamsiraroj & Ulubaşoğlu, 2015).

Capital Budgeting in Multinational Level

In case of the foreign projects, the same capital budgeting framework is used that is used

for the domestic products involving steps like identification of initial capital invested, estimation

of cash flows, identification of appropriate discount rate and application of traditional capital

budgeting (Andor, Mohanty & Toth, 2015). However, there are certain complexities in the

foreign projects that need to be managed by the global firms; such as the need of distinguishing

the parent cash flows from project cash flows, explicit recognition of remittance of funds by the

parent company because of different tax system and others constrains; anticipation of different

rates of national inflation; consideration of the possibility of uncertain change in foreign

exchange; evaluation of potential risks; estimation of terminal value which is a difficult task and

others (Andor, Mohanty & Toth, 2015). Moreover, a foreign project needs to be evaluated from

both the projected and parent viewpoint. It is needed for the global firms to take into

consideration that they need to investment only in case they can earn a risk-adjusted return that is

higher locally based competitors as earn on the same project (Rigopoulos, 2015).

8

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

In the presence of both operating and financing cash flows, operating cash flows are

preferred for domestic capital budgeting where financing cash flows are preferred for

international projects. Foreign firms are required to consider the anticipated internal rate of

return because of the fact that the risk-adjusted foreign projects will be of higher risk as

compared to the domestic projects (Batra & Verma, 2017). Foreign subsidiary companies does

not have independent cost of capital and therefore, calculation of hypothetical cost of capital

needs to be taken into consideration for the estimation of discounted rate for a comparable host-

country company. In case a global firm wants to involve in merger and acquisition, it needs to

take into consideration the primary drivers of merger and acquisition in the international market;

they are global competitive environment and industry as well as firm level forces and actions

driving the value of the individual firms (Batra & Verma, 2017). All these aspects need to be

taken into consideration when managing international trade finance.

Therefore, it can well be observed from the above analysis that the global firms can

effectively manage international trade and foreign direct investments by taking into account

business funding options, trade finance, foreign direct investments and capital budgeting in

multinational situations. Consideration of funding options helps the multinational corporations in

developing their capital structure mix in the most optimal manner through the inclusion of debt,

equity and other options. Consideration of international trade finance shows the path to the

multinational organizations to manage credit risks when they are dealing with non-affiliated

exporters. It also shows that the global firms can take assistance of the governments of the target

country for using the facility of export credit. Analysis of different facets of foreign direct

investments assists the global firms taking into account the factors while investing in FDIs.

Considering the aspects of multinational capital budgeting assists the global firms in analysis the

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

In the presence of both operating and financing cash flows, operating cash flows are

preferred for domestic capital budgeting where financing cash flows are preferred for

international projects. Foreign firms are required to consider the anticipated internal rate of

return because of the fact that the risk-adjusted foreign projects will be of higher risk as

compared to the domestic projects (Batra & Verma, 2017). Foreign subsidiary companies does

not have independent cost of capital and therefore, calculation of hypothetical cost of capital

needs to be taken into consideration for the estimation of discounted rate for a comparable host-

country company. In case a global firm wants to involve in merger and acquisition, it needs to

take into consideration the primary drivers of merger and acquisition in the international market;

they are global competitive environment and industry as well as firm level forces and actions

driving the value of the individual firms (Batra & Verma, 2017). All these aspects need to be

taken into consideration when managing international trade finance.

Therefore, it can well be observed from the above analysis that the global firms can

effectively manage international trade and foreign direct investments by taking into account

business funding options, trade finance, foreign direct investments and capital budgeting in

multinational situations. Consideration of funding options helps the multinational corporations in

developing their capital structure mix in the most optimal manner through the inclusion of debt,

equity and other options. Consideration of international trade finance shows the path to the

multinational organizations to manage credit risks when they are dealing with non-affiliated

exporters. It also shows that the global firms can take assistance of the governments of the target

country for using the facility of export credit. Analysis of different facets of foreign direct

investments assists the global firms taking into account the factors while investing in FDIs.

Considering the aspects of multinational capital budgeting assists the global firms in analysis the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

complexities in capital budgeting in foreign projects. All these together assist the global firms in

effective management of international trade finance and foreign direct investments.

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

complexities in capital budgeting in foreign projects. All these together assist the global firms in

effective management of international trade finance and foreign direct investments.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

References

Agrawal, G. (2015). Foreign direct investment and economic growth in BRICS economies: A

panel data analysis. Journal of Economics, Business and Management, 3(4), 421-424.

Andor, G., Mohanty, S. K., & Toth, T. (2015). Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, 148-172.

Antras, P., & Foley, C. F. (2015). Poultry in motion: a study of international trade finance

practices. Journal of Political Economy, 123(4), 853-901.

Batra, R., & Verma, S. (2017). Capital budgeting practices in Indian companies. IIMB

Management Review, 29(1), 29-44.

Bhogal, T., & Trivedi, A. (2019). International trade finance: A pragmatic approach. Springer

Nature.

Canada Foreign Direct Investment | 1981-2019 Data | 2020-2022 Forecast | Historical .

(2020). Tradingeconomics.com. Retrieved 2 April 2020, from

https://tradingeconomics.com/canada/foreign-direct-investment

Canada S&P/TSX Toronto Stock Market Index | 1979-2020 Data | 2021-2022 Forecast .

(2020). Tradingeconomics.com. Retrieved 2 April 2020, from

https://tradingeconomics.com/canada/stock-market

Cao, Y., Myers, L. A., Tsang, A., & Yang, Y. G. (2017). Management forecasts and the cost of

equity capital: international evidence. Review of Accounting Studies, 22(2), 791-838.

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

References

Agrawal, G. (2015). Foreign direct investment and economic growth in BRICS economies: A

panel data analysis. Journal of Economics, Business and Management, 3(4), 421-424.

Andor, G., Mohanty, S. K., & Toth, T. (2015). Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, 148-172.

Antras, P., & Foley, C. F. (2015). Poultry in motion: a study of international trade finance

practices. Journal of Political Economy, 123(4), 853-901.

Batra, R., & Verma, S. (2017). Capital budgeting practices in Indian companies. IIMB

Management Review, 29(1), 29-44.

Bhogal, T., & Trivedi, A. (2019). International trade finance: A pragmatic approach. Springer

Nature.

Canada Foreign Direct Investment | 1981-2019 Data | 2020-2022 Forecast | Historical .

(2020). Tradingeconomics.com. Retrieved 2 April 2020, from

https://tradingeconomics.com/canada/foreign-direct-investment

Canada S&P/TSX Toronto Stock Market Index | 1979-2020 Data | 2021-2022 Forecast .

(2020). Tradingeconomics.com. Retrieved 2 April 2020, from

https://tradingeconomics.com/canada/stock-market

Cao, Y., Myers, L. A., Tsang, A., & Yang, Y. G. (2017). Management forecasts and the cost of

equity capital: international evidence. Review of Accounting Studies, 22(2), 791-838.

11

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A

review and road map of entrepreneurial equity financing research: venture capital,

corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of

management, 43(6), 1820-1853.

Gourinchas, P. O., Rey, H., & Sauzet, M. (2019). The international monetary and financial

system. Annual Review of Economics, 11, 859-893.

Grath, A. (2016). The handbook of international trade and finance: the complete guide for

international sales, finance, shipping and administration. Kogan Page Publishers.

Iamsiraroj, S. (2016). The foreign direct investment–economic growth nexus. International

Review of Economics & Finance, 42, 116-133.

Iamsiraroj, S., & Ulubaşoğlu, M. A. (2015). Foreign direct investment and economic growth: A

real relationship or wishful thinking?. Economic Modelling, 51, 200-213.

Müllner, J. (2017). International project finance: review and implications for international

finance and international business. Management Review Quarterly, 67(2), 97-133.

Rigopoulos, G. (2015). A review on real options utilization in capital budgeting

practice. International Journal of Information, Business and Management, 7(2), 1.

Zekarias, S. M. (2016). The impact of foreign direct investment (FDI) on economic growth in

Eastern Africa: Evidence from panel data analysis. Applied Economics and Finance, 3(1),

145-160.

MANAGEMENT OF INTERNATIONAL TRADE FINANCE AND FOREIGN DIRECT

INVESTMENTS

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A

review and road map of entrepreneurial equity financing research: venture capital,

corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of

management, 43(6), 1820-1853.

Gourinchas, P. O., Rey, H., & Sauzet, M. (2019). The international monetary and financial

system. Annual Review of Economics, 11, 859-893.

Grath, A. (2016). The handbook of international trade and finance: the complete guide for

international sales, finance, shipping and administration. Kogan Page Publishers.

Iamsiraroj, S. (2016). The foreign direct investment–economic growth nexus. International

Review of Economics & Finance, 42, 116-133.

Iamsiraroj, S., & Ulubaşoğlu, M. A. (2015). Foreign direct investment and economic growth: A

real relationship or wishful thinking?. Economic Modelling, 51, 200-213.

Müllner, J. (2017). International project finance: review and implications for international

finance and international business. Management Review Quarterly, 67(2), 97-133.

Rigopoulos, G. (2015). A review on real options utilization in capital budgeting

practice. International Journal of Information, Business and Management, 7(2), 1.

Zekarias, S. M. (2016). The impact of foreign direct investment (FDI) on economic growth in

Eastern Africa: Evidence from panel data analysis. Applied Economics and Finance, 3(1),

145-160.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.