Managerial Accounting: Activity Based Costing (ABC) Analysis Report

VerifiedAdded on 2020/11/23

|14

|3754

|431

Report

AI Summary

This report provides a detailed executive summary on Activity Based Costing (ABC) within the context of managerial accounting. It begins by defining management accounting and outlining the core principles of ABC, which focuses on assigning overhead costs based on actual consumption. The report then presents two scholarly articles examining ABC, its procedures, significance, and implementation in business entities. It highlights the importance of accounting ratios for financial performance and emphasizes the benefits of implementing ABC for various organizations. The report discusses the objectives, applicability, and implementation of ABC, including a step-by-step procedure. It also presents findings from two studies, comparing and contrasting the results, with the first study focusing on the impact of ABC on firm performance and the second investigating the cost hierarchy, production policies, and firm profitability. The report includes research questions, findings, and lessons learned from both studies, highlighting implications for management accountants. The overall conclusion emphasizes the value of ABC in enhancing cost management and decision-making within businesses.

MANAGERIAL

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

It helps in encompassing each field of accounting whose objective is to inform metrics of

management's business operations. The present study would discuss about activity based

costing which helps in assigning and determination of overhead activities cost according to

actual consumption. It would be choosing two scholarly articles based on ABC. In the same

series, it will be explaining ABC in detailed aspect with its procedure, significance and

implementation in business entity. It could be reflected by stating that accounting ratio are very

important for gaining financial performance and wealth of business entity. Further, it could be

summed up by giving huge importance for implementing activity based costing which is

beneficial for each business entity.

It helps in encompassing each field of accounting whose objective is to inform metrics of

management's business operations. The present study would discuss about activity based

costing which helps in assigning and determination of overhead activities cost according to

actual consumption. It would be choosing two scholarly articles based on ABC. In the same

series, it will be explaining ABC in detailed aspect with its procedure, significance and

implementation in business entity. It could be reflected by stating that accounting ratio are very

important for gaining financial performance and wealth of business entity. Further, it could be

summed up by giving huge importance for implementing activity based costing which is

beneficial for each business entity.

TABLE OF CONTENTS

INTRODUCTION..............................................................................................................................1

A. Activity Based Costing...........................................................................................................1

B. Purpose of both the studies with their research questions..................................................3

C. Discussion about similarities and differences in context of findings of both the studies......4

D. Stating outcomes and lessons learnt with both the studies with reference to management

accountants...............................................................................................................................7

CONCLUSION................................................................................................................................. 9

REFERENCES................................................................................................................................. 10

INTRODUCTION..............................................................................................................................1

A. Activity Based Costing...........................................................................................................1

B. Purpose of both the studies with their research questions..................................................3

C. Discussion about similarities and differences in context of findings of both the studies......4

D. Stating outcomes and lessons learnt with both the studies with reference to management

accountants...............................................................................................................................7

CONCLUSION................................................................................................................................. 9

REFERENCES................................................................................................................................. 10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is referred as the process of analysing, measuring, identifying

and communicating information to its managers for accomplishing goals and objectives of

business entity. It helps in encompassing each field of accounting whose objective is to inform

metrics of management's business operations. Present study would discuss about activity based

costing which helps in assigning and determination of overhead activities cost according to the

actual consumption. It would be choosing two scholarly articles based on ABC. In the same

series, it will be explaining ABC in detailed aspect with its procedure, significance and

implementation in business entity. It will also articulate similarities and variations from the

findings of both studies. Study 1 of this report is “The impact of Activity Based Costing

technique on firm’s performance” and study 2 is “The Activity based cost Hierarchy, Production

Policies and Firm’s Profitability”. Further, it would also specify outcomes and lessons from its

research findings which are useful for various management accountants in context of Australian

companies.

A. Activity Based Costing

It is the method in which overhead costs are assigned to processes or products that

generate or consume value. In other words, it is a way to allocate indirect overhead costs to

products or departments that generate these values in the production process (Activity based

costing, 2018).

It's Objectives:

With the use of activity based costing method, any company can easily estimate the cost

elements of all products.

Eliminates products and services which are less profitable.

This methodology assigns an organization's resource cost through activities such as

products and services which are provided to its customers.

Support strategic decisions such as pricing, outsourcing, measurement and identification

of process improvement initiatives.

It's Applicability

It is applicable throughout company for financing, accounting and costing.

1

Management accounting is referred as the process of analysing, measuring, identifying

and communicating information to its managers for accomplishing goals and objectives of

business entity. It helps in encompassing each field of accounting whose objective is to inform

metrics of management's business operations. Present study would discuss about activity based

costing which helps in assigning and determination of overhead activities cost according to the

actual consumption. It would be choosing two scholarly articles based on ABC. In the same

series, it will be explaining ABC in detailed aspect with its procedure, significance and

implementation in business entity. It will also articulate similarities and variations from the

findings of both studies. Study 1 of this report is “The impact of Activity Based Costing

technique on firm’s performance” and study 2 is “The Activity based cost Hierarchy, Production

Policies and Firm’s Profitability”. Further, it would also specify outcomes and lessons from its

research findings which are useful for various management accountants in context of Australian

companies.

A. Activity Based Costing

It is the method in which overhead costs are assigned to processes or products that

generate or consume value. In other words, it is a way to allocate indirect overhead costs to

products or departments that generate these values in the production process (Activity based

costing, 2018).

It's Objectives:

With the use of activity based costing method, any company can easily estimate the cost

elements of all products.

Eliminates products and services which are less profitable.

This methodology assigns an organization's resource cost through activities such as

products and services which are provided to its customers.

Support strategic decisions such as pricing, outsourcing, measurement and identification

of process improvement initiatives.

It's Applicability

It is applicable throughout company for financing, accounting and costing.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Applicable to full scope as well as for partial views.

Helps in identifying inefficient products, activities and departments (Fitó Bertran, Llobet

and Cuguero, 2018).

Helps in allocating more resources.

Eliminates unnecessary costs. Assists in fixing price of a product or service with any desired analytical resolution.

Reasons for implementing Activity Based Budgeting

For better management

For budgeting and measuring performance

For calculating costs more accurately

Ensuring product

Evaluating investments in new technologies

Managing costs Responding to increase in overheads

It's implementation in an organization

Firstly, it needs commitment of senior management then it requires visionary leadership

to sustain long term cost effectiveness in the business operations. Hence, it is required that

senior management has comprehensive awareness of how activity based costing works.

Secondly, before implementing it for the whole organization, it is always a great idea to do a

pilot run. Among all pilot run candidates from different departments, whom so ever is best

would be assigned with the department that suffers from profit making deficiencies (Hiebl,

2018).

Lastly, if no cost savings occurs after the pilot study is implemented, it is likely that the

model has not been properly enforced or it does not suit department or company as a whole.

Its procedure

The procedure of activity based costing is stated as below to generate huge revenue:

Firstly, team which is responsible for implementing activity based costing is identified.

2

Helps in identifying inefficient products, activities and departments (Fitó Bertran, Llobet

and Cuguero, 2018).

Helps in allocating more resources.

Eliminates unnecessary costs. Assists in fixing price of a product or service with any desired analytical resolution.

Reasons for implementing Activity Based Budgeting

For better management

For budgeting and measuring performance

For calculating costs more accurately

Ensuring product

Evaluating investments in new technologies

Managing costs Responding to increase in overheads

It's implementation in an organization

Firstly, it needs commitment of senior management then it requires visionary leadership

to sustain long term cost effectiveness in the business operations. Hence, it is required that

senior management has comprehensive awareness of how activity based costing works.

Secondly, before implementing it for the whole organization, it is always a great idea to do a

pilot run. Among all pilot run candidates from different departments, whom so ever is best

would be assigned with the department that suffers from profit making deficiencies (Hiebl,

2018).

Lastly, if no cost savings occurs after the pilot study is implemented, it is likely that the

model has not been properly enforced or it does not suit department or company as a whole.

Its procedure

The procedure of activity based costing is stated as below to generate huge revenue:

Firstly, team which is responsible for implementing activity based costing is identified.

2

This team identifies and assesses the activities that are involved in products and

services.

Then team selects a subset of activities that should be taken for activity based costing.

Elements of selected activities are then identified by team that cost too much money for

the organization.

Identification of fixed and variable cost is done.

The gathered cost information is then entered to Activity Based Costing software.

Then calculation and reports are produced by the software to support management

decisions.

After getting reports, management can identify the steps that should be taken in order

to increase profit margins to make activities more efficient.

The taken steps and decisions after activity based costing experience are generally

known as Activity Based Management (Laviana and et.al., 2018).

Importance

Activity based costing helps in reliability and accuracy for determining cost by laying

special emphasis on cause and effect relationship in incurring cost. It has also recognised its

activities which have concern about cost but not with products which had performed various

activities. It also identifies numerous activities which do not add value to any of the product and

nature of behaviour of cost helps for decreasing cost. Multiple cost drivers are used through

ABC which is fully based on transactions instead of volume of product. It has concern with each

activity in and beyond factory for recording its more overheads as compared to products.

In the similar aspect, it records cost to specific area of responsibility of manager,

customers, responsibility and departments which are beside cost of product. The most

important factor is stated as it helps in decision making of manager which could be applicable

for reliable product cost data. The rate of cost driver and information related to volume of

transaction has been provided which is essential to management for performance appraisal and

cost management for different responsibility centres. It is working only in context of task as it

could take quality decision by knowing each activity's nature. It gives better information of

3

services.

Then team selects a subset of activities that should be taken for activity based costing.

Elements of selected activities are then identified by team that cost too much money for

the organization.

Identification of fixed and variable cost is done.

The gathered cost information is then entered to Activity Based Costing software.

Then calculation and reports are produced by the software to support management

decisions.

After getting reports, management can identify the steps that should be taken in order

to increase profit margins to make activities more efficient.

The taken steps and decisions after activity based costing experience are generally

known as Activity Based Management (Laviana and et.al., 2018).

Importance

Activity based costing helps in reliability and accuracy for determining cost by laying

special emphasis on cause and effect relationship in incurring cost. It has also recognised its

activities which have concern about cost but not with products which had performed various

activities. It also identifies numerous activities which do not add value to any of the product and

nature of behaviour of cost helps for decreasing cost. Multiple cost drivers are used through

ABC which is fully based on transactions instead of volume of product. It has concern with each

activity in and beyond factory for recording its more overheads as compared to products.

In the similar aspect, it records cost to specific area of responsibility of manager,

customers, responsibility and departments which are beside cost of product. The most

important factor is stated as it helps in decision making of manager which could be applicable

for reliable product cost data. The rate of cost driver and information related to volume of

transaction has been provided which is essential to management for performance appraisal and

cost management for different responsibility centres. It is working only in context of task as it

could take quality decision by knowing each activity's nature. It gives better information of

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

costing and helps management for managing finance efficient aspect and to attain appropriate

understanding of competitive advantage of business entity (Wahab, Mohamad and Said, 2018).

B. Purpose of both the studied with their research questions

Study 1 [The Impact of Activity based costing techniques on firm performance]

The initial purpose of this study is to observe whether the documented successful

implementation case study of activity based costing is translated averagely into performance of

superior stock or not. It has reflected choice of management accounting system like ABC which

might give appropriate impact on the value of firm. In the similar aspect, it has shown

information about firms which are adopting activity based techniques and have outperformed

matched with non-activity based costing firms (Kennedy and Affleck-Graves, 2001).

Study 2 [The Activity based cost Hierarchy, Production Policies and Firm Profitability]

The main objective of this study is to investigate its common measures of activity of

manufacturing which are linked to classification of cost hierarchy which is proposed in ABC. It

has also identified the extent to which its operational measures are corresponding to particular

hierarchy for explanation of both; revenue and cost (Ittner, Larcker and Randall, 1997).

Research questions set out for exploring the study:

Study 1

Is the activity necessary?

Is the activity performed in efficient manner or not?

Study 2

At what extent, common measures of manufacturing activities are corresponded to

classification of cost hierarchy?

How association among classification of cost hierarchy is affected through production

policy of firm?

At what extent, cost hierarchy classification helps in explanation for variations among

profit, revenue and cost?

C. Discussion about similarities and differences in context of findings of both the studies

Findings of study 1

4

understanding of competitive advantage of business entity (Wahab, Mohamad and Said, 2018).

B. Purpose of both the studied with their research questions

Study 1 [The Impact of Activity based costing techniques on firm performance]

The initial purpose of this study is to observe whether the documented successful

implementation case study of activity based costing is translated averagely into performance of

superior stock or not. It has reflected choice of management accounting system like ABC which

might give appropriate impact on the value of firm. In the similar aspect, it has shown

information about firms which are adopting activity based techniques and have outperformed

matched with non-activity based costing firms (Kennedy and Affleck-Graves, 2001).

Study 2 [The Activity based cost Hierarchy, Production Policies and Firm Profitability]

The main objective of this study is to investigate its common measures of activity of

manufacturing which are linked to classification of cost hierarchy which is proposed in ABC. It

has also identified the extent to which its operational measures are corresponding to particular

hierarchy for explanation of both; revenue and cost (Ittner, Larcker and Randall, 1997).

Research questions set out for exploring the study:

Study 1

Is the activity necessary?

Is the activity performed in efficient manner or not?

Study 2

At what extent, common measures of manufacturing activities are corresponded to

classification of cost hierarchy?

How association among classification of cost hierarchy is affected through production

policy of firm?

At what extent, cost hierarchy classification helps in explanation for variations among

profit, revenue and cost?

C. Discussion about similarities and differences in context of findings of both the studies

Findings of study 1

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In context of earning profit, it has examined the relationship among adoption of activity

based costing and value of shareholder via raised margin. The organization which has adapted

ABC has outperformed FTSE index by approx. 20%. They failed for capturing risk differences

which had elaborated superior performance of ABC firms. It has signified minimum variations in

the performance of specified two groups in study. In the similar aspect, they have observed

performance of ABC firm which replicates superior operating performance with sum of

attaining good return of stock performance. There is huge preference for measuring

performance on the basis of operating income instead of earnings as they concede

inconsequential choice. They had laid special emphasis on two accounting performance

measures, operating profit margin and return on shareholder's equity. They have also reported

various other accounting based measures for identifying the drivers of difference which were

observed in performance of stock market.

With review of measure on the basis of accounting, it has confirmed about the best

performance of ABC business entity. It had suggested on the basis of debt ratio that activity

based costing should be adopted through firms and it must sustain high leverage profile as

compared to firms with non ABC. Overall, accounting ratio has suggested main features of firm

of Activity Based Costing as cost control, financial management and asset utilization are

contributed for superior performance of business entity. Their main objective for addressing

this concern was about superior performance of firms with activity based costing technique due

to confounding innovation of management as increased new capital and acquisition. While

identifying this activity as percentage of market capitalization of business entity, there is

absence of differences among Activity Based Costing firms along with matched counterparts as

it might be after or before introducing activity based costing. The evidence of return from

superior stock is followed through adoption which recommends perceptions about organization

with justification of financial benefit.

Findings of study 2

In this study, it has examined association within activity based cost hierarchy

classification and relationship among manufacturing cost and classification through time series

data. It has presence of a wide variety of its operational measures which signify measures as it

5

based costing and value of shareholder via raised margin. The organization which has adapted

ABC has outperformed FTSE index by approx. 20%. They failed for capturing risk differences

which had elaborated superior performance of ABC firms. It has signified minimum variations in

the performance of specified two groups in study. In the similar aspect, they have observed

performance of ABC firm which replicates superior operating performance with sum of

attaining good return of stock performance. There is huge preference for measuring

performance on the basis of operating income instead of earnings as they concede

inconsequential choice. They had laid special emphasis on two accounting performance

measures, operating profit margin and return on shareholder's equity. They have also reported

various other accounting based measures for identifying the drivers of difference which were

observed in performance of stock market.

With review of measure on the basis of accounting, it has confirmed about the best

performance of ABC business entity. It had suggested on the basis of debt ratio that activity

based costing should be adopted through firms and it must sustain high leverage profile as

compared to firms with non ABC. Overall, accounting ratio has suggested main features of firm

of Activity Based Costing as cost control, financial management and asset utilization are

contributed for superior performance of business entity. Their main objective for addressing

this concern was about superior performance of firms with activity based costing technique due

to confounding innovation of management as increased new capital and acquisition. While

identifying this activity as percentage of market capitalization of business entity, there is

absence of differences among Activity Based Costing firms along with matched counterparts as

it might be after or before introducing activity based costing. The evidence of return from

superior stock is followed through adoption which recommends perceptions about organization

with justification of financial benefit.

Findings of study 2

In this study, it has examined association within activity based cost hierarchy

classification and relationship among manufacturing cost and classification through time series

data. It has presence of a wide variety of its operational measures which signify measures as it

5

is similar to classification of cost hierarchy. It has indicated numerous production order,

processed number of parts and production batches which are directly associated with similar

underlying factor as volume of production which recommends variables as they might be

defined accurately as measured at unit level in this particular operation.

Multiple batches are directly loaded on unit factor, average and variability in batch size

is load on batch. Both loadings are satisfied with claim of management which had captured size

and number of batch with two different dimensions of activity associated with batch such as

fixed set up and variable batch related activity. In fixed setup, activity is traced through

production of numerous batch with requirement of each and other dimension always fluctuate

with size of batch. The fixed activities are directly linked to every batch as these do not vary

from its size along with performance of certain variable activities. There is less requirement of

replenishing and monitoring small batches as compared to large. The analysis of principal

components is indicated according to measures of batch related tasks which reflect distinct

dimension of activity of production.

There are several measures which have presence of high cross loadings on the basis of

two factors. The inventory holding cost is minimised along with introducing innovative raw

material and suppliers with extension of product line. The negative link in between product and

batch is consistent with EOQ model in environment of multi-product which shows sum of

production system as it faces budgetary and capacity constraints for decrement of optimal size

of batch. It had been extracted that unit factor is not associated statistically with different other

factors but batch and product has exhibited appropriate negative correlation as it signifies

various decisions about production. The product offerings and batch size are interrelated as it

provides impact linked operation at different level of cost hierarchy.

It has indicated that there is huge need of purchasing activity for large batches. Batch is

not directly linked with cost in different non production or production cost pools with total

costs. If new production line was introduced which led to increment in short term cost which is

not accounted for alterations in batch size or volume of production. There is a positive

association of product because of great inventory congestion. In simple words, introduction of

new product line is formed with requirement of hiring new planning and managers and

6

processed number of parts and production batches which are directly associated with similar

underlying factor as volume of production which recommends variables as they might be

defined accurately as measured at unit level in this particular operation.

Multiple batches are directly loaded on unit factor, average and variability in batch size

is load on batch. Both loadings are satisfied with claim of management which had captured size

and number of batch with two different dimensions of activity associated with batch such as

fixed set up and variable batch related activity. In fixed setup, activity is traced through

production of numerous batch with requirement of each and other dimension always fluctuate

with size of batch. The fixed activities are directly linked to every batch as these do not vary

from its size along with performance of certain variable activities. There is less requirement of

replenishing and monitoring small batches as compared to large. The analysis of principal

components is indicated according to measures of batch related tasks which reflect distinct

dimension of activity of production.

There are several measures which have presence of high cross loadings on the basis of

two factors. The inventory holding cost is minimised along with introducing innovative raw

material and suppliers with extension of product line. The negative link in between product and

batch is consistent with EOQ model in environment of multi-product which shows sum of

production system as it faces budgetary and capacity constraints for decrement of optimal size

of batch. It had been extracted that unit factor is not associated statistically with different other

factors but batch and product has exhibited appropriate negative correlation as it signifies

various decisions about production. The product offerings and batch size are interrelated as it

provides impact linked operation at different level of cost hierarchy.

It has indicated that there is huge need of purchasing activity for large batches. Batch is

not directly linked with cost in different non production or production cost pools with total

costs. If new production line was introduced which led to increment in short term cost which is

not accounted for alterations in batch size or volume of production. There is a positive

association of product because of great inventory congestion. In simple words, introduction of

new product line is formed with requirement of hiring new planning and managers and

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

administrators for considering additional space. Hence, it helps in raising expenditure in

planning and simultaneously, expenses are increased in planning and general administrative

cost pools.

While analysing revenue and profit, it has examined association among organization's

revenue and profit with classification of cost hierarchy. It has recommended that variety of

products with increment in profit and revenue up to the point. It does not indicate association

of revenue with batch level activities as it maintains consistency with model of cost and profit.

They did not find any relation in between revenue and batch. The outcome of unit has indicated

that revenue is increased as more products are sold. In the similar aspect, there is a positive

relation in between product and margin which implies increment in revenue with broad

product line. Thus, classification of cost hierarchy not only gives explanatory power in cost

model but it also provides explanation in alteration of revenue in particular business entity.

Overall, the analysis of profitability helps in implying that increment in cost with alterations in

manufacturing activity has presence of small effect on profitability after accounting on the basis

of increment in revenues.

Similarities and differences

The study 1 and 2; both have performed quantitative analysis for exploring its research

question. Both these studies are focussing on attaining profitability by following activity based

costing. These studies are suggesting activity as in study 1 it adds value of business entity by

proper cost control and for optimising asset which was paired with implications of financial

leverage. In study 2, cost and revenue implications for assessing the performance consequences

of activities are considered which are directly related to hierarchy of cost. Their main aim was

to cut cost and to generate huge profit. In study 2, it has focused on unit cost and in study 1, it

has reflected superior market return through shareholder’s value. Manufacturing activities are

considered with batch production in study 2 and similar overheads in study 1.

D. Stating outcomes and lessons learnt with both the studies with reference to management

accountants

Study 1 Study 2

7

planning and simultaneously, expenses are increased in planning and general administrative

cost pools.

While analysing revenue and profit, it has examined association among organization's

revenue and profit with classification of cost hierarchy. It has recommended that variety of

products with increment in profit and revenue up to the point. It does not indicate association

of revenue with batch level activities as it maintains consistency with model of cost and profit.

They did not find any relation in between revenue and batch. The outcome of unit has indicated

that revenue is increased as more products are sold. In the similar aspect, there is a positive

relation in between product and margin which implies increment in revenue with broad

product line. Thus, classification of cost hierarchy not only gives explanatory power in cost

model but it also provides explanation in alteration of revenue in particular business entity.

Overall, the analysis of profitability helps in implying that increment in cost with alterations in

manufacturing activity has presence of small effect on profitability after accounting on the basis

of increment in revenues.

Similarities and differences

The study 1 and 2; both have performed quantitative analysis for exploring its research

question. Both these studies are focussing on attaining profitability by following activity based

costing. These studies are suggesting activity as in study 1 it adds value of business entity by

proper cost control and for optimising asset which was paired with implications of financial

leverage. In study 2, cost and revenue implications for assessing the performance consequences

of activities are considered which are directly related to hierarchy of cost. Their main aim was

to cut cost and to generate huge profit. In study 2, it has focused on unit cost and in study 1, it

has reflected superior market return through shareholder’s value. Manufacturing activities are

considered with batch production in study 2 and similar overheads in study 1.

D. Stating outcomes and lessons learnt with both the studies with reference to management

accountants

Study 1 Study 2

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

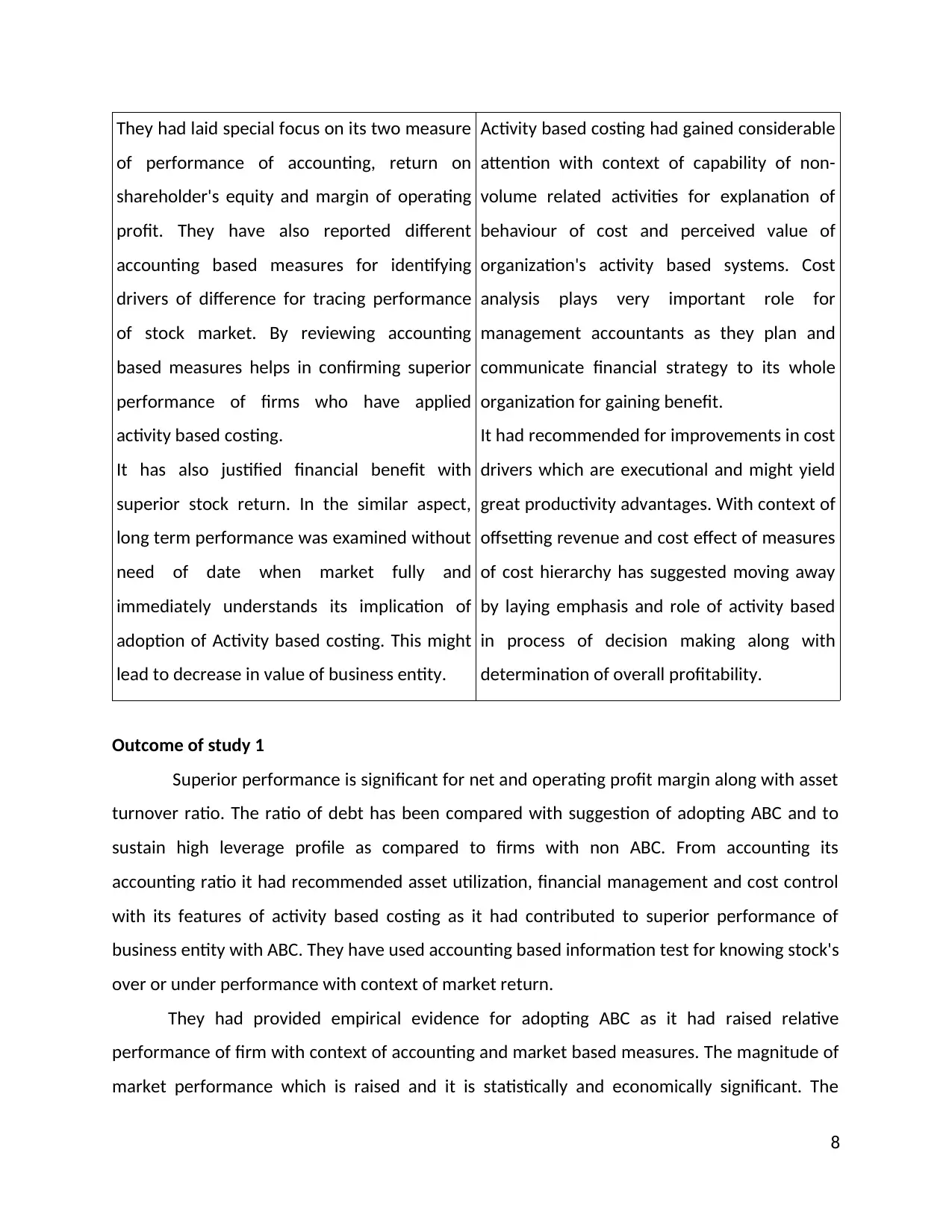

They had laid special focus on its two measure

of performance of accounting, return on

shareholder's equity and margin of operating

profit. They have also reported different

accounting based measures for identifying

drivers of difference for tracing performance

of stock market. By reviewing accounting

based measures helps in confirming superior

performance of firms who have applied

activity based costing.

It has also justified financial benefit with

superior stock return. In the similar aspect,

long term performance was examined without

need of date when market fully and

immediately understands its implication of

adoption of Activity based costing. This might

lead to decrease in value of business entity.

Activity based costing had gained considerable

attention with context of capability of non-

volume related activities for explanation of

behaviour of cost and perceived value of

organization's activity based systems. Cost

analysis plays very important role for

management accountants as they plan and

communicate financial strategy to its whole

organization for gaining benefit.

It had recommended for improvements in cost

drivers which are executional and might yield

great productivity advantages. With context of

offsetting revenue and cost effect of measures

of cost hierarchy has suggested moving away

by laying emphasis and role of activity based

in process of decision making along with

determination of overall profitability.

Outcome of study 1

Superior performance is significant for net and operating profit margin along with asset

turnover ratio. The ratio of debt has been compared with suggestion of adopting ABC and to

sustain high leverage profile as compared to firms with non ABC. From accounting its

accounting ratio it had recommended asset utilization, financial management and cost control

with its features of activity based costing as it had contributed to superior performance of

business entity with ABC. They have used accounting based information test for knowing stock's

over or under performance with context of market return.

They had provided empirical evidence for adopting ABC as it had raised relative

performance of firm with context of accounting and market based measures. The magnitude of

market performance which is raised and it is statistically and economically significant. The

8

of performance of accounting, return on

shareholder's equity and margin of operating

profit. They have also reported different

accounting based measures for identifying

drivers of difference for tracing performance

of stock market. By reviewing accounting

based measures helps in confirming superior

performance of firms who have applied

activity based costing.

It has also justified financial benefit with

superior stock return. In the similar aspect,

long term performance was examined without

need of date when market fully and

immediately understands its implication of

adoption of Activity based costing. This might

lead to decrease in value of business entity.

Activity based costing had gained considerable

attention with context of capability of non-

volume related activities for explanation of

behaviour of cost and perceived value of

organization's activity based systems. Cost

analysis plays very important role for

management accountants as they plan and

communicate financial strategy to its whole

organization for gaining benefit.

It had recommended for improvements in cost

drivers which are executional and might yield

great productivity advantages. With context of

offsetting revenue and cost effect of measures

of cost hierarchy has suggested moving away

by laying emphasis and role of activity based

in process of decision making along with

determination of overall profitability.

Outcome of study 1

Superior performance is significant for net and operating profit margin along with asset

turnover ratio. The ratio of debt has been compared with suggestion of adopting ABC and to

sustain high leverage profile as compared to firms with non ABC. From accounting its

accounting ratio it had recommended asset utilization, financial management and cost control

with its features of activity based costing as it had contributed to superior performance of

business entity with ABC. They have used accounting based information test for knowing stock's

over or under performance with context of market return.

They had provided empirical evidence for adopting ABC as it had raised relative

performance of firm with context of accounting and market based measures. The magnitude of

market performance which is raised and it is statistically and economically significant. The

8

superior performance of firms who have adopted ABC has provided tangential support to study

which is related to benefits and impact of ABC.

With significance of various corporate events for duration of adopting ABC for both

firms which are matched to its counterparts. This had addressed concern of superior

performance of ABC which might be management innovation, acquisition and raising new

capital. It had documented both numerous firms which are directly involved in every activity

which is expressed in percentage of business entity's market capitalization. There is absence of

evidence of significant variation among ABC and non ABC firms which are involved either after

or before adopting this technique.

Outcome of study 2

With context of production activity, as it has adjusted high mean as compared to non-

production activity. The total cost is raised with numerous unit related cost driver with its

offerings as it has raised individual cost pool expenditure along with size of batch and variability

in its size. It is aggregated to different operation research model which helps in indicating

consequences of applicability and performance of level of cost hierarchy which varies with

policies of inventory and production. It had recommended that analyse of cost driver should be

customised with manufacturing environment.

There is possible explanation about associations which are limited among cost and

measures of non-unit and spending is not adjusted for matching resource consumption of

particular activities. It had limited outcome with context of operation. Planning, accounting and

marketing activities are directly charge to administrative and general account. Further, the

stated cost in accounts instead G&A must reflect closely for consumption of resources related

to operations. The number of offerings of product was considered as significant predictor of

both total revenue and costs.

CONCLUSION

From the above report, it has been concluded that management accounting plays a vital

role in any business entity. It has shown activity based costing which signifies actual

consumption through organization. It has been articulated that numerous firms are looking for

cutting cost but simultaneously to earn profit in increment aspect. Furthermore, study 1 and 2

9

which is related to benefits and impact of ABC.

With significance of various corporate events for duration of adopting ABC for both

firms which are matched to its counterparts. This had addressed concern of superior

performance of ABC which might be management innovation, acquisition and raising new

capital. It had documented both numerous firms which are directly involved in every activity

which is expressed in percentage of business entity's market capitalization. There is absence of

evidence of significant variation among ABC and non ABC firms which are involved either after

or before adopting this technique.

Outcome of study 2

With context of production activity, as it has adjusted high mean as compared to non-

production activity. The total cost is raised with numerous unit related cost driver with its

offerings as it has raised individual cost pool expenditure along with size of batch and variability

in its size. It is aggregated to different operation research model which helps in indicating

consequences of applicability and performance of level of cost hierarchy which varies with

policies of inventory and production. It had recommended that analyse of cost driver should be

customised with manufacturing environment.

There is possible explanation about associations which are limited among cost and

measures of non-unit and spending is not adjusted for matching resource consumption of

particular activities. It had limited outcome with context of operation. Planning, accounting and

marketing activities are directly charge to administrative and general account. Further, the

stated cost in accounts instead G&A must reflect closely for consumption of resources related

to operations. The number of offerings of product was considered as significant predictor of

both total revenue and costs.

CONCLUSION

From the above report, it has been concluded that management accounting plays a vital

role in any business entity. It has shown activity based costing which signifies actual

consumption through organization. It has been articulated that numerous firms are looking for

cutting cost but simultaneously to earn profit in increment aspect. Furthermore, study 1 and 2

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.