Managerial Accounting Assignment: Keep or Buy, Special Order, Make/Buy

VerifiedAdded on 2022/12/22

|7

|1943

|29

Homework Assignment

AI Summary

This document provides a comprehensive solution to a managerial accounting assignment, addressing three key decision-making scenarios: keep or buy, special order, and make or buy. The keep or buy decision analyzes the costs of restoring an old motorcycle versus purchasing a new one, concluding that buying is more cost-effective. The special order decision assesses whether a company should accept a special order, considering both quantitative and qualitative factors like incremental profit and the impact on regular sales. Finally, the make or buy decision compares the costs of in-house production of implants with purchasing them from an external source, recommending the latter. The document includes detailed cost analyses, working notes, and discussions of relevant qualitative factors, such as sunk costs, supplier reliability, and long-term strategic considerations.

MANAGERIAL ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 1: Keep or Buy Decision

Part a)

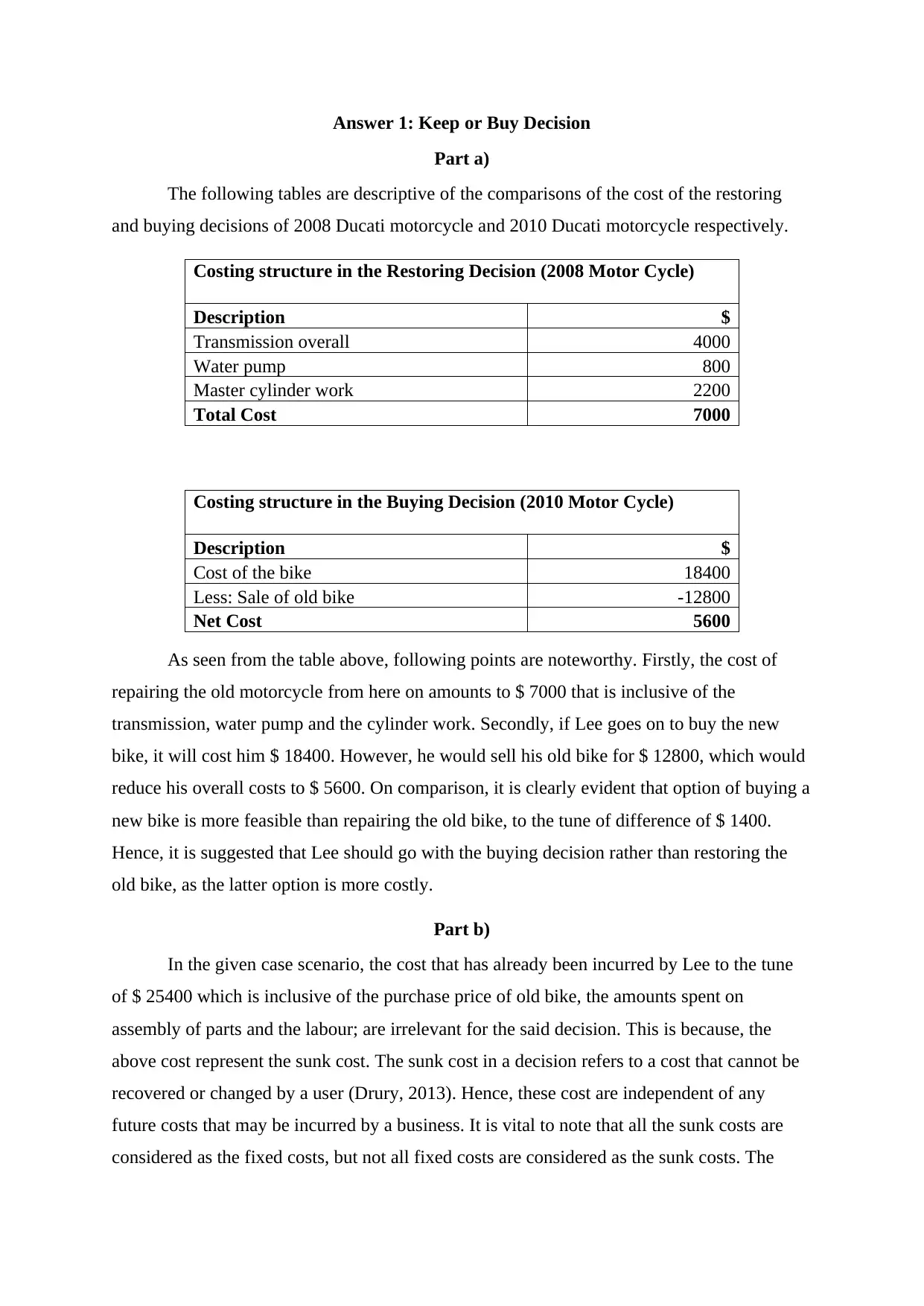

The following tables are descriptive of the comparisons of the cost of the restoring

and buying decisions of 2008 Ducati motorcycle and 2010 Ducati motorcycle respectively.

Costing structure in the Restoring Decision (2008 Motor Cycle)

Description $

Transmission overall 4000

Water pump 800

Master cylinder work 2200

Total Cost 7000

As seen from the table above, following points are noteworthy. Firstly, the cost of

repairing the old motorcycle from here on amounts to $ 7000 that is inclusive of the

transmission, water pump and the cylinder work. Secondly, if Lee goes on to buy the new

bike, it will cost him $ 18400. However, he would sell his old bike for $ 12800, which would

reduce his overall costs to $ 5600. On comparison, it is clearly evident that option of buying a

new bike is more feasible than repairing the old bike, to the tune of difference of $ 1400.

Hence, it is suggested that Lee should go with the buying decision rather than restoring the

old bike, as the latter option is more costly.

Part b)

In the given case scenario, the cost that has already been incurred by Lee to the tune

of $ 25400 which is inclusive of the purchase price of old bike, the amounts spent on

assembly of parts and the labour; are irrelevant for the said decision. This is because, the

above cost represent the sunk cost. The sunk cost in a decision refers to a cost that cannot be

recovered or changed by a user (Drury, 2013). Hence, these cost are independent of any

future costs that may be incurred by a business. It is vital to note that all the sunk costs are

considered as the fixed costs, but not all fixed costs are considered as the sunk costs. The

Costing structure in the Buying Decision (2010 Motor Cycle)

Description $

Cost of the bike 18400

Less: Sale of old bike -12800

Net Cost 5600

Part a)

The following tables are descriptive of the comparisons of the cost of the restoring

and buying decisions of 2008 Ducati motorcycle and 2010 Ducati motorcycle respectively.

Costing structure in the Restoring Decision (2008 Motor Cycle)

Description $

Transmission overall 4000

Water pump 800

Master cylinder work 2200

Total Cost 7000

As seen from the table above, following points are noteworthy. Firstly, the cost of

repairing the old motorcycle from here on amounts to $ 7000 that is inclusive of the

transmission, water pump and the cylinder work. Secondly, if Lee goes on to buy the new

bike, it will cost him $ 18400. However, he would sell his old bike for $ 12800, which would

reduce his overall costs to $ 5600. On comparison, it is clearly evident that option of buying a

new bike is more feasible than repairing the old bike, to the tune of difference of $ 1400.

Hence, it is suggested that Lee should go with the buying decision rather than restoring the

old bike, as the latter option is more costly.

Part b)

In the given case scenario, the cost that has already been incurred by Lee to the tune

of $ 25400 which is inclusive of the purchase price of old bike, the amounts spent on

assembly of parts and the labour; are irrelevant for the said decision. This is because, the

above cost represent the sunk cost. The sunk cost in a decision refers to a cost that cannot be

recovered or changed by a user (Drury, 2013). Hence, these cost are independent of any

future costs that may be incurred by a business. It is vital to note that all the sunk costs are

considered as the fixed costs, but not all fixed costs are considered as the sunk costs. The

Costing structure in the Buying Decision (2010 Motor Cycle)

Description $

Cost of the bike 18400

Less: Sale of old bike -12800

Net Cost 5600

reason for the ignorance of the sunk costs in a business decision is that the said costs do not

affect the future course of business. As Lee cannot retrieve the amount already incurred on

the purchase of bike and amounts spent on assembling its parts, the said costs should be

ignored. Thus, it can be concluded that the sunk costs are irrelevant in the decision making

because the decisions are based on the future courses of actions of the businesses.

Answer 2: Special Order Decision

Part a)

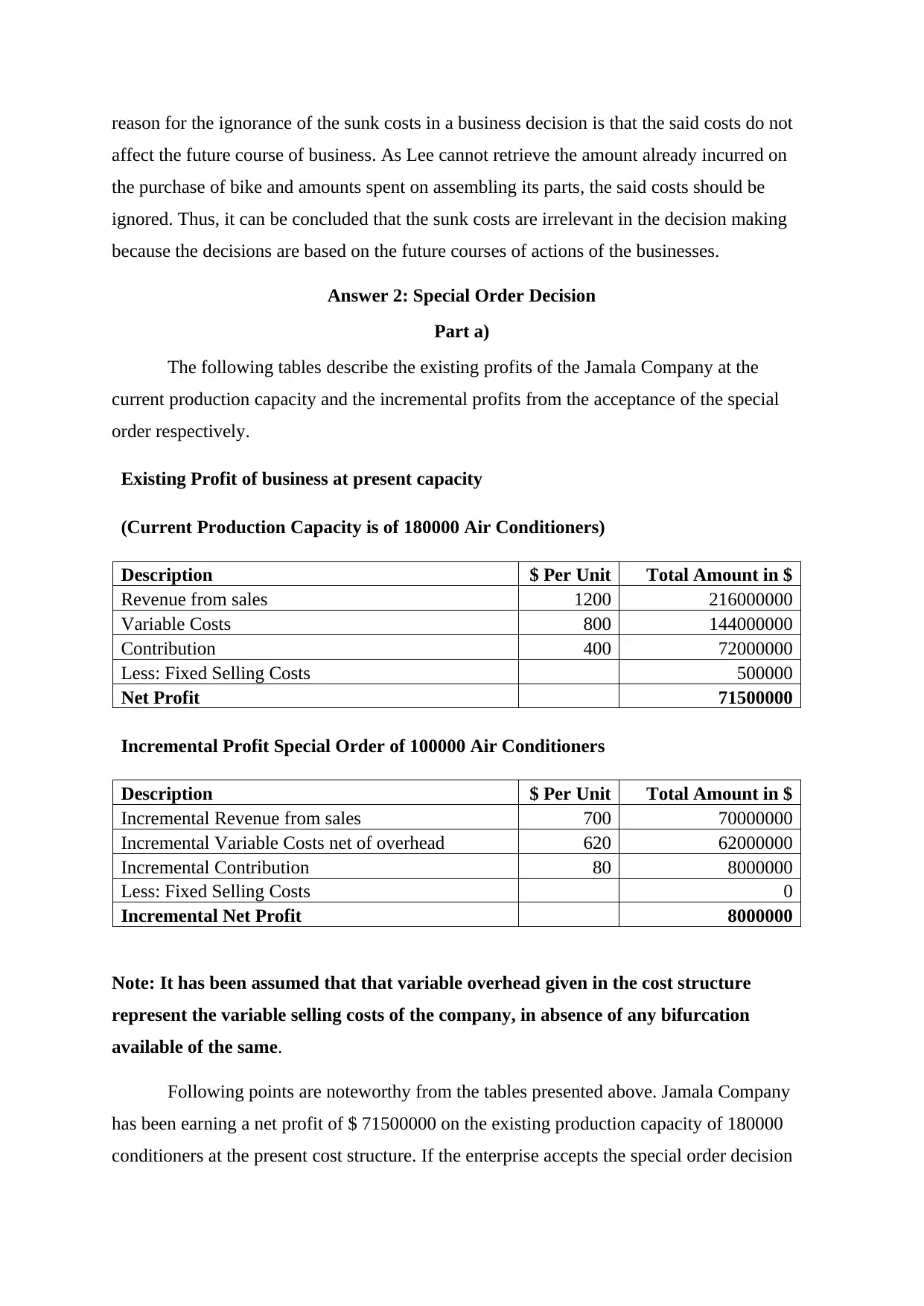

The following tables describe the existing profits of the Jamala Company at the

current production capacity and the incremental profits from the acceptance of the special

order respectively.

Existing Profit of business at present capacity

(Current Production Capacity is of 180000 Air Conditioners)

Description $ Per Unit Total Amount in $

Revenue from sales 1200 216000000

Variable Costs 800 144000000

Contribution 400 72000000

Less: Fixed Selling Costs 500000

Net Profit 71500000

Incremental Profit Special Order of 100000 Air Conditioners

Description $ Per Unit Total Amount in $

Incremental Revenue from sales 700 70000000

Incremental Variable Costs net of overhead 620 62000000

Incremental Contribution 80 8000000

Less: Fixed Selling Costs 0

Incremental Net Profit 8000000

Note: It has been assumed that that variable overhead given in the cost structure

represent the variable selling costs of the company, in absence of any bifurcation

available of the same.

Following points are noteworthy from the tables presented above. Jamala Company

has been earning a net profit of $ 71500000 on the existing production capacity of 180000

conditioners at the present cost structure. If the enterprise accepts the special order decision

affect the future course of business. As Lee cannot retrieve the amount already incurred on

the purchase of bike and amounts spent on assembling its parts, the said costs should be

ignored. Thus, it can be concluded that the sunk costs are irrelevant in the decision making

because the decisions are based on the future courses of actions of the businesses.

Answer 2: Special Order Decision

Part a)

The following tables describe the existing profits of the Jamala Company at the

current production capacity and the incremental profits from the acceptance of the special

order respectively.

Existing Profit of business at present capacity

(Current Production Capacity is of 180000 Air Conditioners)

Description $ Per Unit Total Amount in $

Revenue from sales 1200 216000000

Variable Costs 800 144000000

Contribution 400 72000000

Less: Fixed Selling Costs 500000

Net Profit 71500000

Incremental Profit Special Order of 100000 Air Conditioners

Description $ Per Unit Total Amount in $

Incremental Revenue from sales 700 70000000

Incremental Variable Costs net of overhead 620 62000000

Incremental Contribution 80 8000000

Less: Fixed Selling Costs 0

Incremental Net Profit 8000000

Note: It has been assumed that that variable overhead given in the cost structure

represent the variable selling costs of the company, in absence of any bifurcation

available of the same.

Following points are noteworthy from the tables presented above. Jamala Company

has been earning a net profit of $ 71500000 on the existing production capacity of 180000

conditioners at the present cost structure. If the enterprise accepts the special order decision

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of production of additional 100000 air conditioners, the incremental revenue would be $ 700

per unit or $ 70000000. The total incremental variable costs would be slightly lower as

compared to the normal variable costs, because the buyer will pay the transportation costs.

Hence incremental variable costs after deduction of the variable overhead (assumed to be

variable selling costs) amounts to $ 620 per unit. Accordingly the contribution or the net

profit is worked out to be $ 8000000. Hence, on the presence of the incremental profit of $

8000000 from the special order, it is recommended to the entity Jamala Company to accept

the special order decision. It is vital to note that the fixed selling expenses to the tune of $

500000 per year have not been considered in the special order decision, because the said costs

are irrelevant. The reason for the irrelevancy of the fixed costs from the special order

decisions is that the fixed costs would be paid by an entity irrespective of the acceptance or

rejection of the special order decision.

Part b)

It is vital to note that the first stage of the special order selection is the examination of

the quantitative factors. However, the quantitative factors cannot be the only criteria to base

the decision thereon. The qualitative factors refers to the results or impacts that cannot be

measured in the numbers by an entity. The qualitative factors that can affect the decision of

an enterprise in case of special order decisions are listed as follows. The first qualitative

factor is the impact of the special order on sales to regular customers. Thus, there are certain

special orders which when accepted can increase the regular sales of the enterprise (Fullerton,

Kennedy & Widener, 2013). In addition, the second qualitative factor is that the certain

special orders hold the potential to lead the company into new area of the revenues. Further,

the last qualitative factor is the ability of the customer of maintaining a consistent relationship

which is comprised of good ordering and paying practices. While the regular customer may

have good paying practices and the company is aware of the ongoing business practices, the

new customer with the special order may or may not have the same. The yet another

qualitative factor for consideration is the labour demands. It has to be examined whether the

special order be completed in normal hours or would extra hours have to be paid to workers.

Answer 3: Make or Buy Decision

Part a)

Working Note 1

per unit or $ 70000000. The total incremental variable costs would be slightly lower as

compared to the normal variable costs, because the buyer will pay the transportation costs.

Hence incremental variable costs after deduction of the variable overhead (assumed to be

variable selling costs) amounts to $ 620 per unit. Accordingly the contribution or the net

profit is worked out to be $ 8000000. Hence, on the presence of the incremental profit of $

8000000 from the special order, it is recommended to the entity Jamala Company to accept

the special order decision. It is vital to note that the fixed selling expenses to the tune of $

500000 per year have not been considered in the special order decision, because the said costs

are irrelevant. The reason for the irrelevancy of the fixed costs from the special order

decisions is that the fixed costs would be paid by an entity irrespective of the acceptance or

rejection of the special order decision.

Part b)

It is vital to note that the first stage of the special order selection is the examination of

the quantitative factors. However, the quantitative factors cannot be the only criteria to base

the decision thereon. The qualitative factors refers to the results or impacts that cannot be

measured in the numbers by an entity. The qualitative factors that can affect the decision of

an enterprise in case of special order decisions are listed as follows. The first qualitative

factor is the impact of the special order on sales to regular customers. Thus, there are certain

special orders which when accepted can increase the regular sales of the enterprise (Fullerton,

Kennedy & Widener, 2013). In addition, the second qualitative factor is that the certain

special orders hold the potential to lead the company into new area of the revenues. Further,

the last qualitative factor is the ability of the customer of maintaining a consistent relationship

which is comprised of good ordering and paying practices. While the regular customer may

have good paying practices and the company is aware of the ongoing business practices, the

new customer with the special order may or may not have the same. The yet another

qualitative factor for consideration is the labour demands. It has to be examined whether the

special order be completed in normal hours or would extra hours have to be paid to workers.

Answer 3: Make or Buy Decision

Part a)

Working Note 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

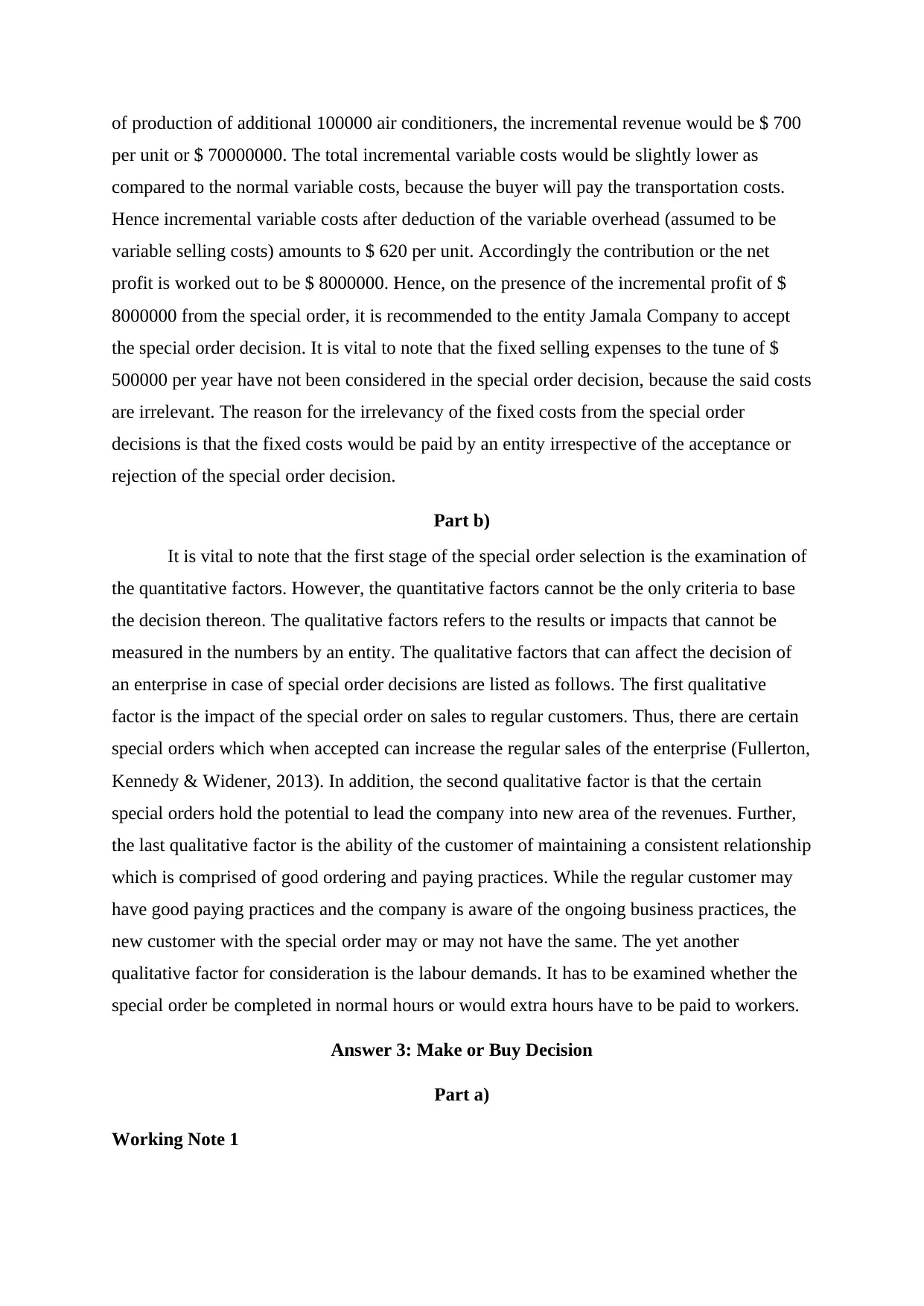

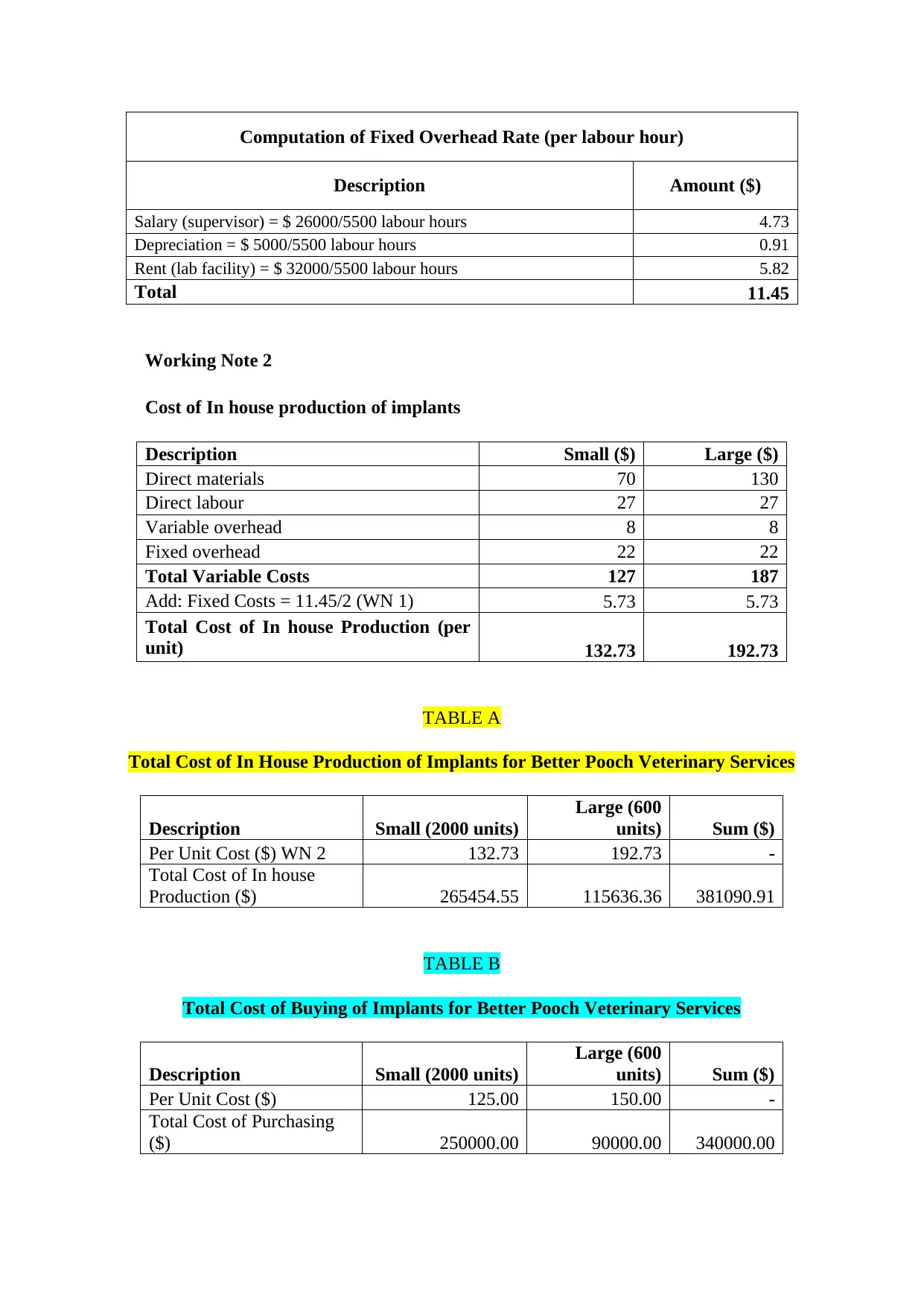

Computation of Fixed Overhead Rate (per labour hour)

Description Amount ($)

Salary (supervisor) = $ 26000/5500 labour hours 4.73

Depreciation = $ 5000/5500 labour hours 0.91

Rent (lab facility) = $ 32000/5500 labour hours 5.82

Total 11.45

Working Note 2

Cost of In house production of implants

Description Small ($) Large ($)

Direct materials 70 130

Direct labour 27 27

Variable overhead 8 8

Fixed overhead 22 22

Total Variable Costs 127 187

Add: Fixed Costs = 11.45/2 (WN 1) 5.73 5.73

Total Cost of In house Production (per

unit) 132.73 192.73

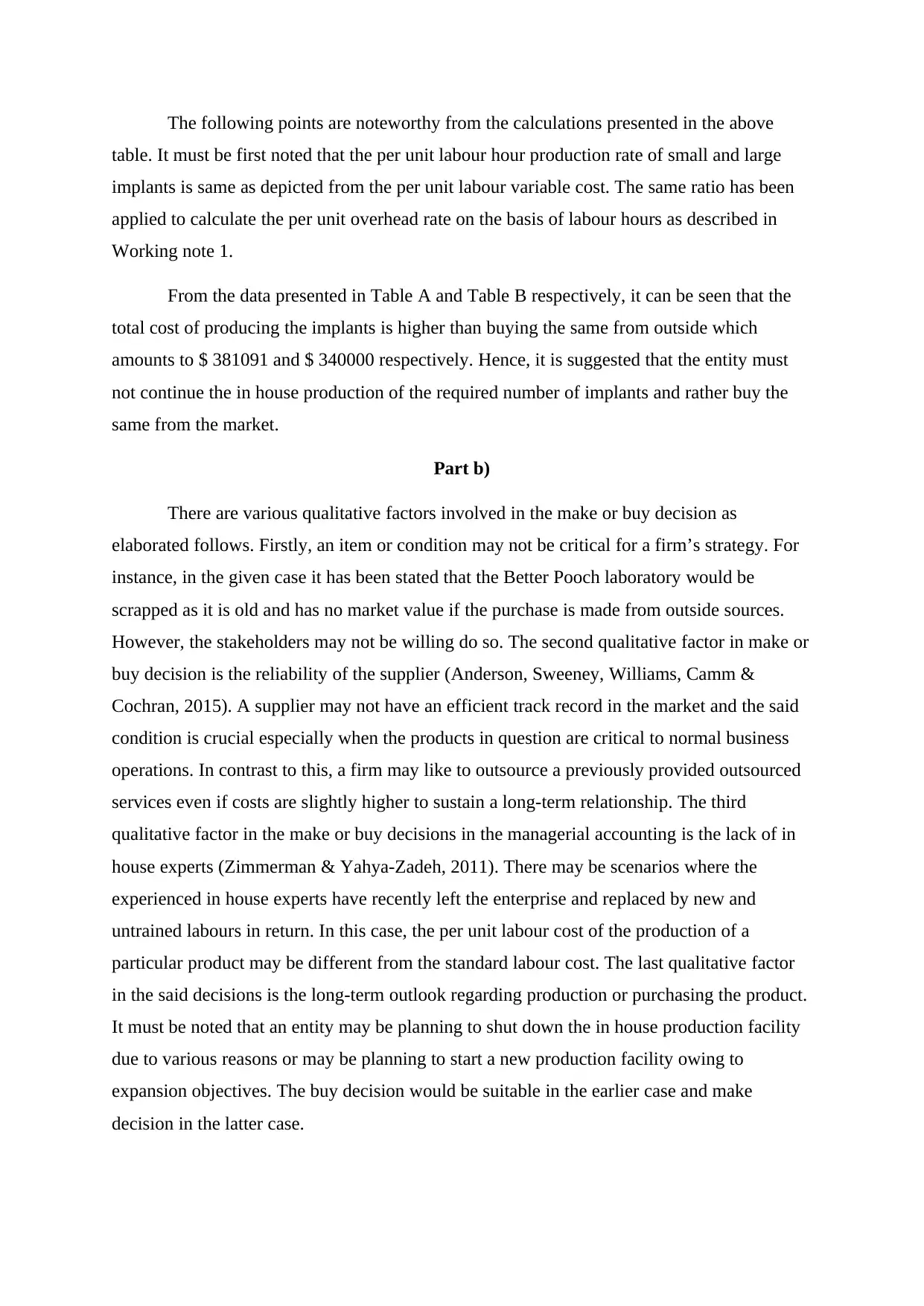

TABLE A

Total Cost of In House Production of Implants for Better Pooch Veterinary Services

Description Small (2000 units)

Large (600

units) Sum ($)

Per Unit Cost ($) WN 2 132.73 192.73 -

Total Cost of In house

Production ($) 265454.55 115636.36 381090.91

TABLE B

Total Cost of Buying of Implants for Better Pooch Veterinary Services

Description Small (2000 units)

Large (600

units) Sum ($)

Per Unit Cost ($) 125.00 150.00 -

Total Cost of Purchasing

($) 250000.00 90000.00 340000.00

Description Amount ($)

Salary (supervisor) = $ 26000/5500 labour hours 4.73

Depreciation = $ 5000/5500 labour hours 0.91

Rent (lab facility) = $ 32000/5500 labour hours 5.82

Total 11.45

Working Note 2

Cost of In house production of implants

Description Small ($) Large ($)

Direct materials 70 130

Direct labour 27 27

Variable overhead 8 8

Fixed overhead 22 22

Total Variable Costs 127 187

Add: Fixed Costs = 11.45/2 (WN 1) 5.73 5.73

Total Cost of In house Production (per

unit) 132.73 192.73

TABLE A

Total Cost of In House Production of Implants for Better Pooch Veterinary Services

Description Small (2000 units)

Large (600

units) Sum ($)

Per Unit Cost ($) WN 2 132.73 192.73 -

Total Cost of In house

Production ($) 265454.55 115636.36 381090.91

TABLE B

Total Cost of Buying of Implants for Better Pooch Veterinary Services

Description Small (2000 units)

Large (600

units) Sum ($)

Per Unit Cost ($) 125.00 150.00 -

Total Cost of Purchasing

($) 250000.00 90000.00 340000.00

The following points are noteworthy from the calculations presented in the above

table. It must be first noted that the per unit labour hour production rate of small and large

implants is same as depicted from the per unit labour variable cost. The same ratio has been

applied to calculate the per unit overhead rate on the basis of labour hours as described in

Working note 1.

From the data presented in Table A and Table B respectively, it can be seen that the

total cost of producing the implants is higher than buying the same from outside which

amounts to $ 381091 and $ 340000 respectively. Hence, it is suggested that the entity must

not continue the in house production of the required number of implants and rather buy the

same from the market.

Part b)

There are various qualitative factors involved in the make or buy decision as

elaborated follows. Firstly, an item or condition may not be critical for a firm’s strategy. For

instance, in the given case it has been stated that the Better Pooch laboratory would be

scrapped as it is old and has no market value if the purchase is made from outside sources.

However, the stakeholders may not be willing do so. The second qualitative factor in make or

buy decision is the reliability of the supplier (Anderson, Sweeney, Williams, Camm &

Cochran, 2015). A supplier may not have an efficient track record in the market and the said

condition is crucial especially when the products in question are critical to normal business

operations. In contrast to this, a firm may like to outsource a previously provided outsourced

services even if costs are slightly higher to sustain a long-term relationship. The third

qualitative factor in the make or buy decisions in the managerial accounting is the lack of in

house experts (Zimmerman & Yahya-Zadeh, 2011). There may be scenarios where the

experienced in house experts have recently left the enterprise and replaced by new and

untrained labours in return. In this case, the per unit labour cost of the production of a

particular product may be different from the standard labour cost. The last qualitative factor

in the said decisions is the long-term outlook regarding production or purchasing the product.

It must be noted that an entity may be planning to shut down the in house production facility

due to various reasons or may be planning to start a new production facility owing to

expansion objectives. The buy decision would be suitable in the earlier case and make

decision in the latter case.

table. It must be first noted that the per unit labour hour production rate of small and large

implants is same as depicted from the per unit labour variable cost. The same ratio has been

applied to calculate the per unit overhead rate on the basis of labour hours as described in

Working note 1.

From the data presented in Table A and Table B respectively, it can be seen that the

total cost of producing the implants is higher than buying the same from outside which

amounts to $ 381091 and $ 340000 respectively. Hence, it is suggested that the entity must

not continue the in house production of the required number of implants and rather buy the

same from the market.

Part b)

There are various qualitative factors involved in the make or buy decision as

elaborated follows. Firstly, an item or condition may not be critical for a firm’s strategy. For

instance, in the given case it has been stated that the Better Pooch laboratory would be

scrapped as it is old and has no market value if the purchase is made from outside sources.

However, the stakeholders may not be willing do so. The second qualitative factor in make or

buy decision is the reliability of the supplier (Anderson, Sweeney, Williams, Camm &

Cochran, 2015). A supplier may not have an efficient track record in the market and the said

condition is crucial especially when the products in question are critical to normal business

operations. In contrast to this, a firm may like to outsource a previously provided outsourced

services even if costs are slightly higher to sustain a long-term relationship. The third

qualitative factor in the make or buy decisions in the managerial accounting is the lack of in

house experts (Zimmerman & Yahya-Zadeh, 2011). There may be scenarios where the

experienced in house experts have recently left the enterprise and replaced by new and

untrained labours in return. In this case, the per unit labour cost of the production of a

particular product may be different from the standard labour cost. The last qualitative factor

in the said decisions is the long-term outlook regarding production or purchasing the product.

It must be noted that an entity may be planning to shut down the in house production facility

due to various reasons or may be planning to start a new production facility owing to

expansion objectives. The buy decision would be suitable in the earlier case and make

decision in the latter case.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Anderson, D. R., Sweeney, D. J., Williams, T. A., Camm, J. D., & Cochran, J. J. (2015). An

introduction to management science: quantitative approaches to decision making. Boston

MA: Cengage learning.

Drury, C. M. (2013). Management and cost accounting. UK: Springer.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2013). Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society, 38(1), 50-71.

Zimmerman, J. L., & Yahya-Zadeh, M. (2011). Accounting for decision making and control.

Issues in Accounting Education, 26(1), 258-259.

Anderson, D. R., Sweeney, D. J., Williams, T. A., Camm, J. D., & Cochran, J. J. (2015). An

introduction to management science: quantitative approaches to decision making. Boston

MA: Cengage learning.

Drury, C. M. (2013). Management and cost accounting. UK: Springer.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2013). Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society, 38(1), 50-71.

Zimmerman, J. L., & Yahya-Zadeh, M. (2011). Accounting for decision making and control.

Issues in Accounting Education, 26(1), 258-259.

1 out of 7

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.