Managerial Accounting Consolidation Worksheet

VerifiedAdded on 2023/01/16

|8

|916

|96

AI Summary

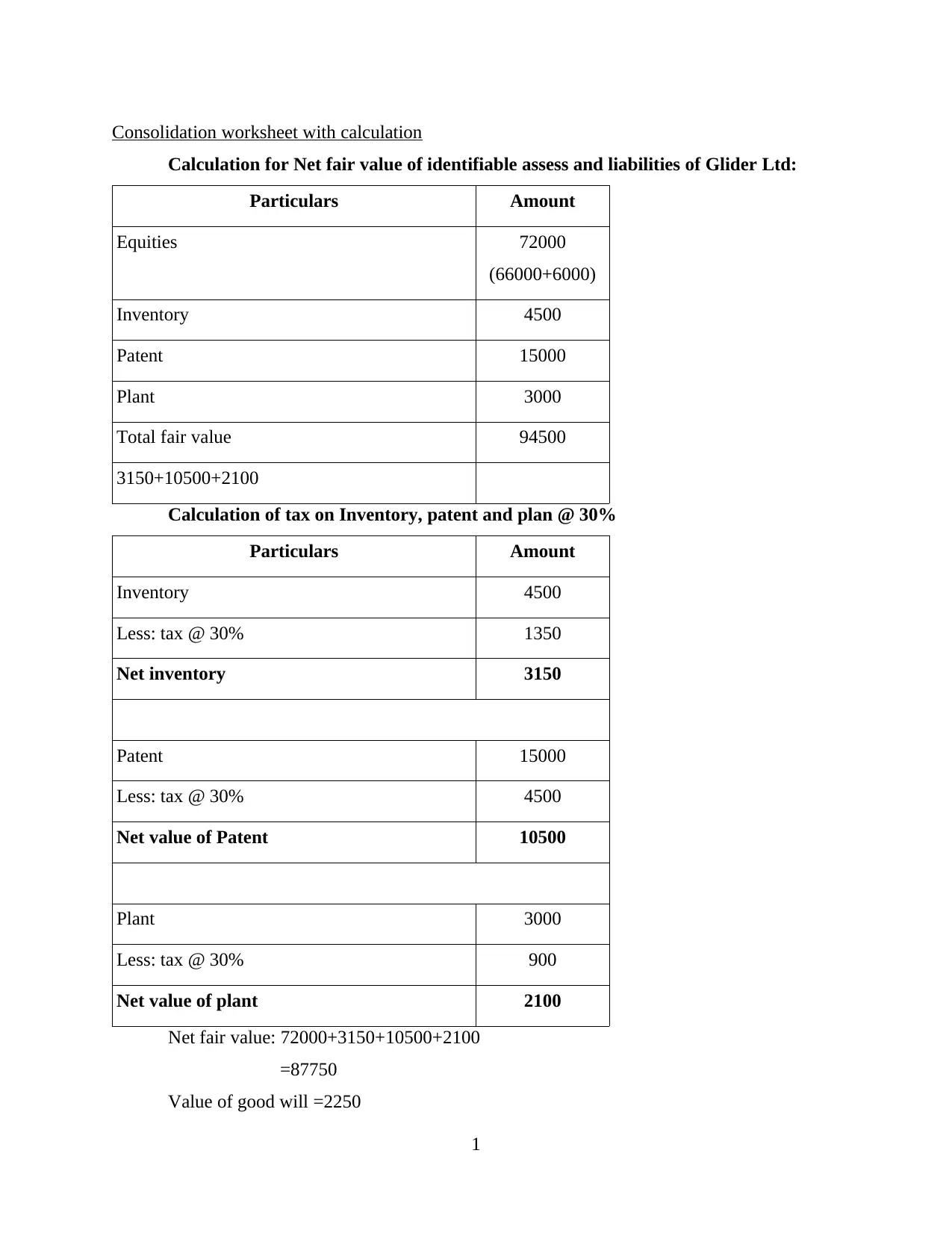

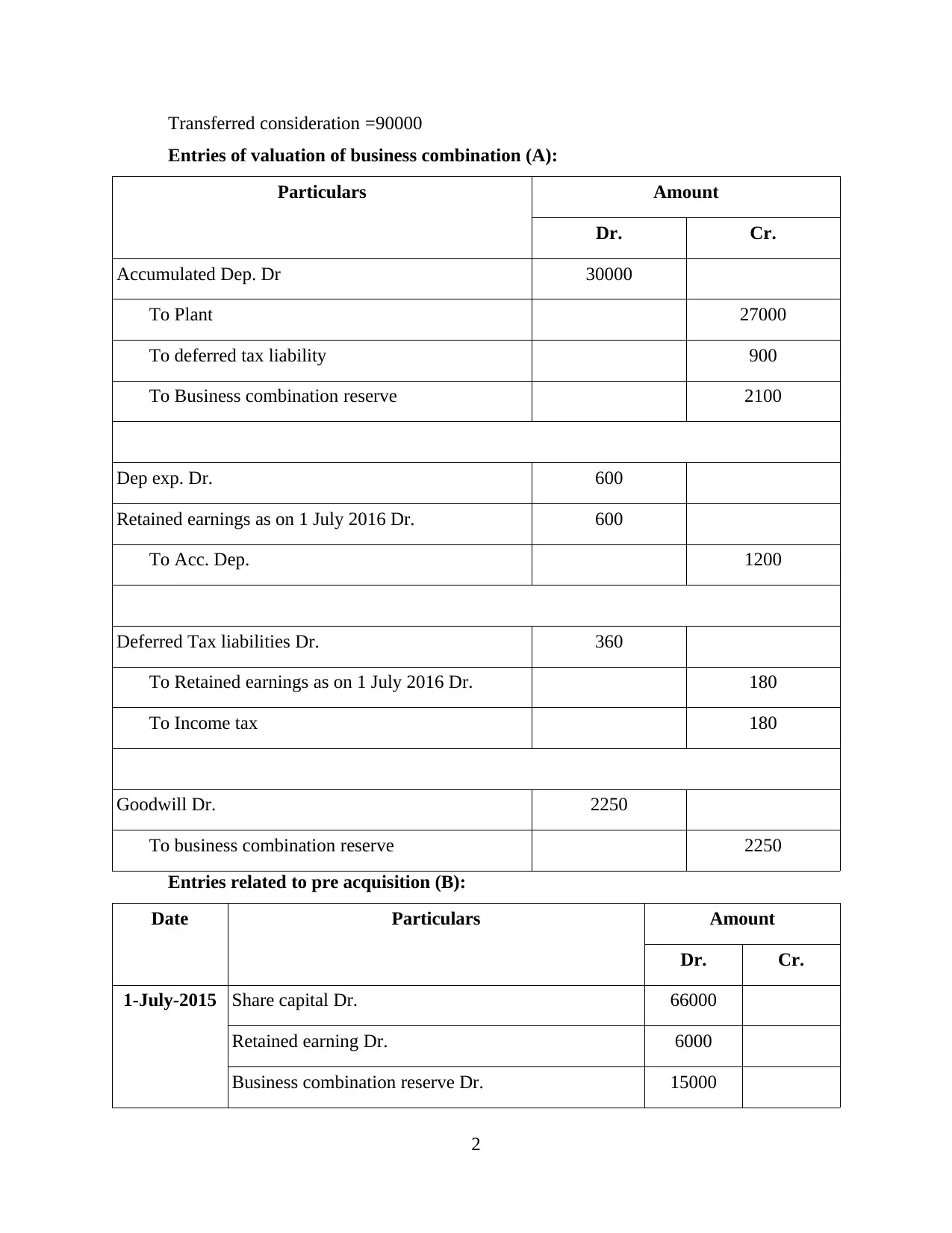

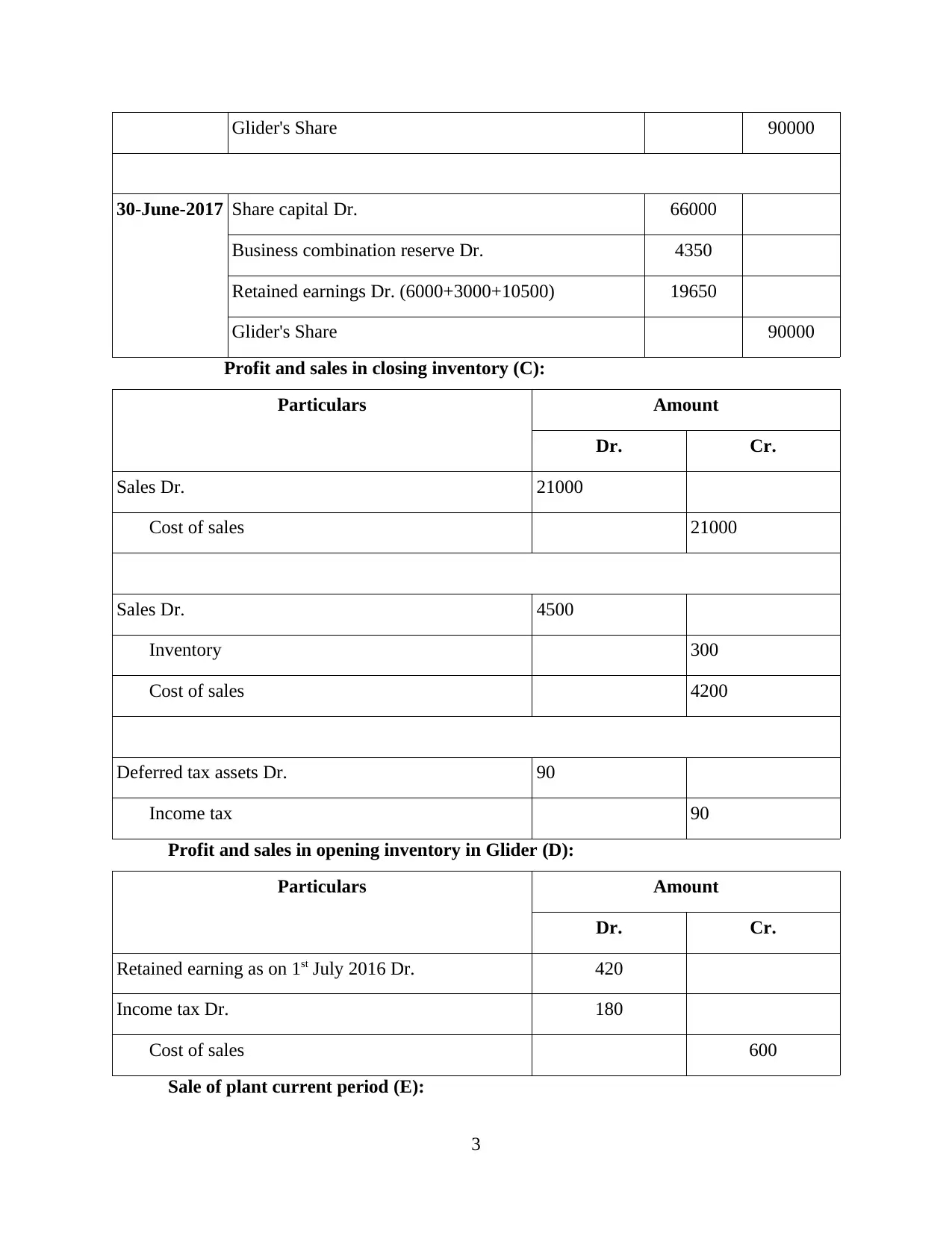

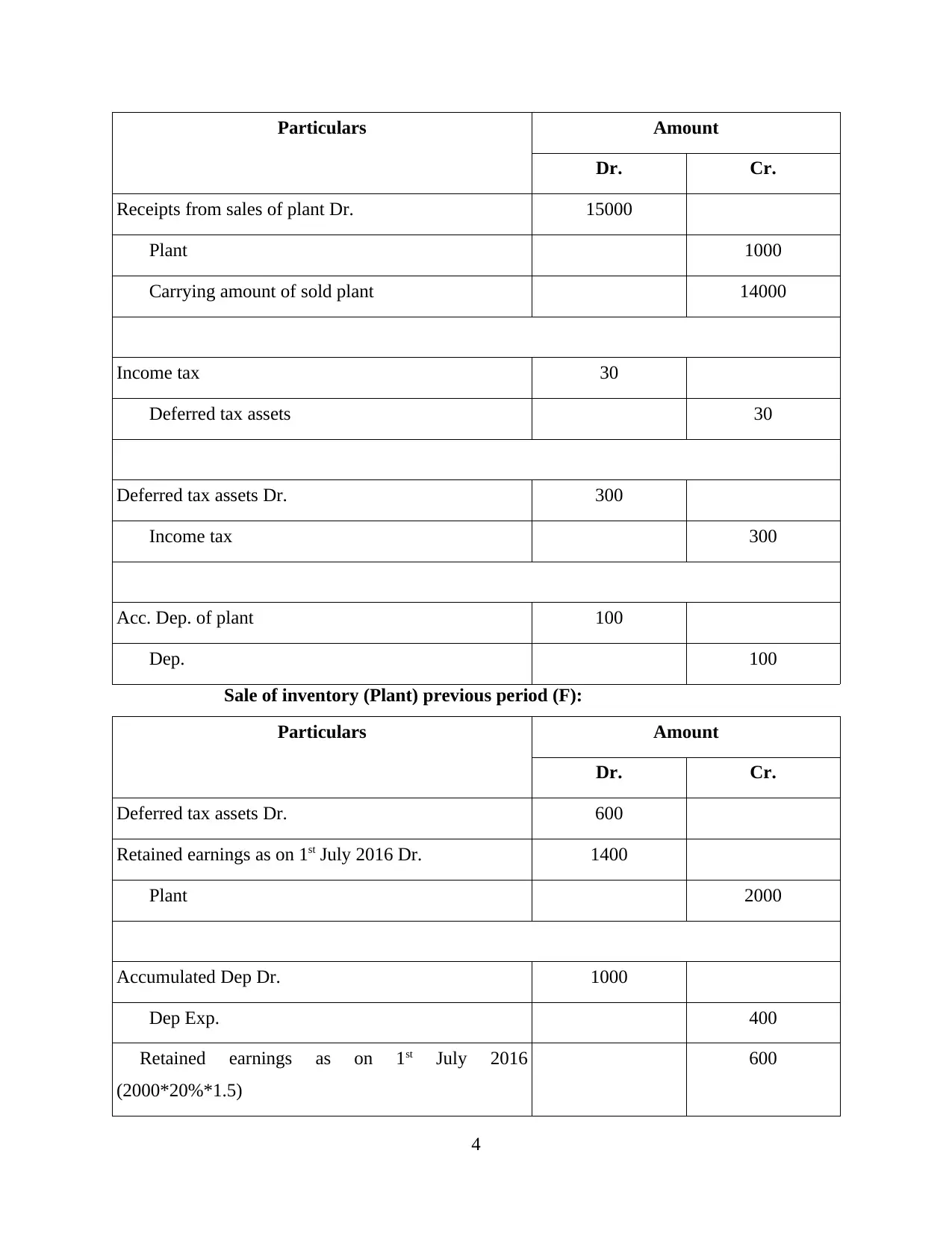

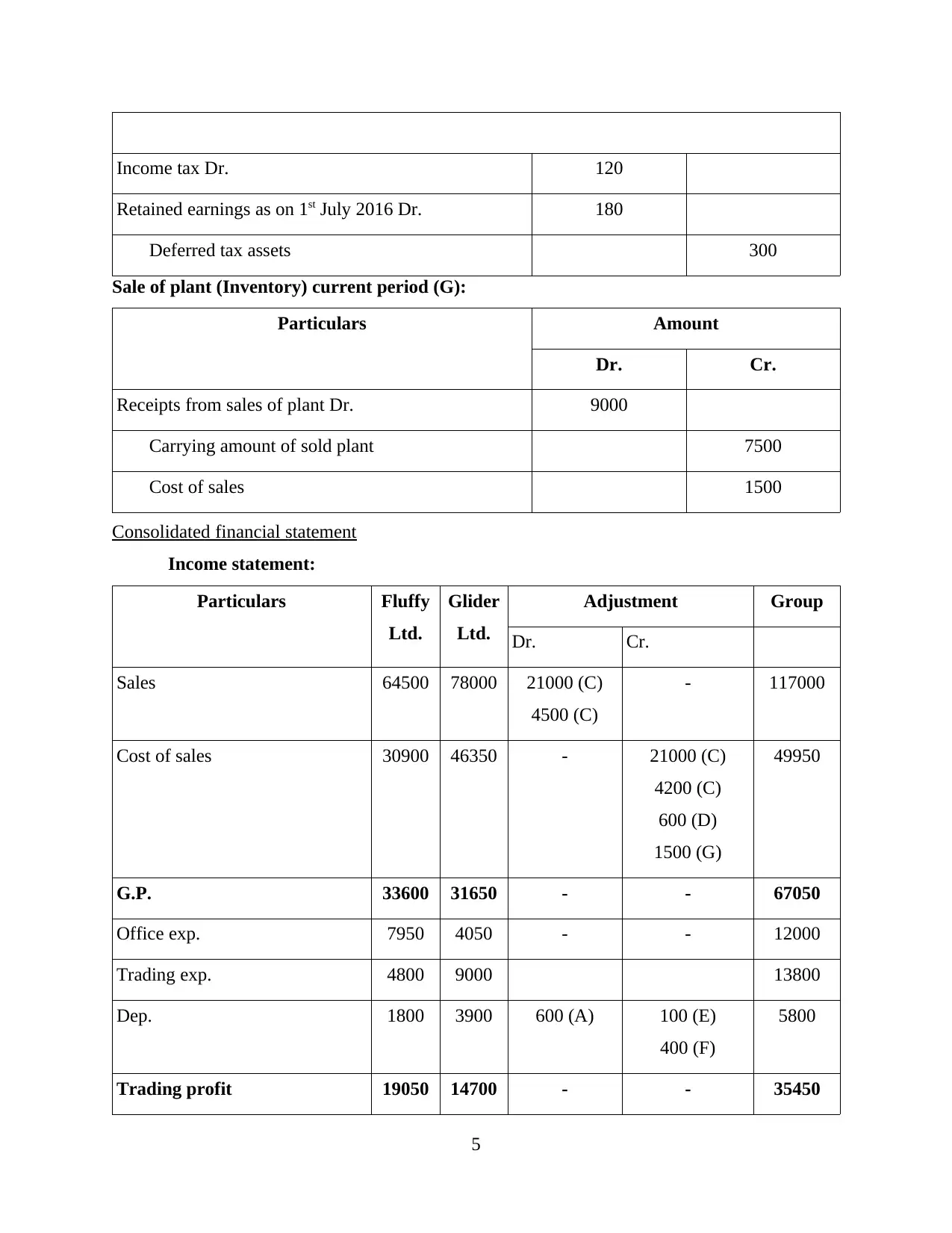

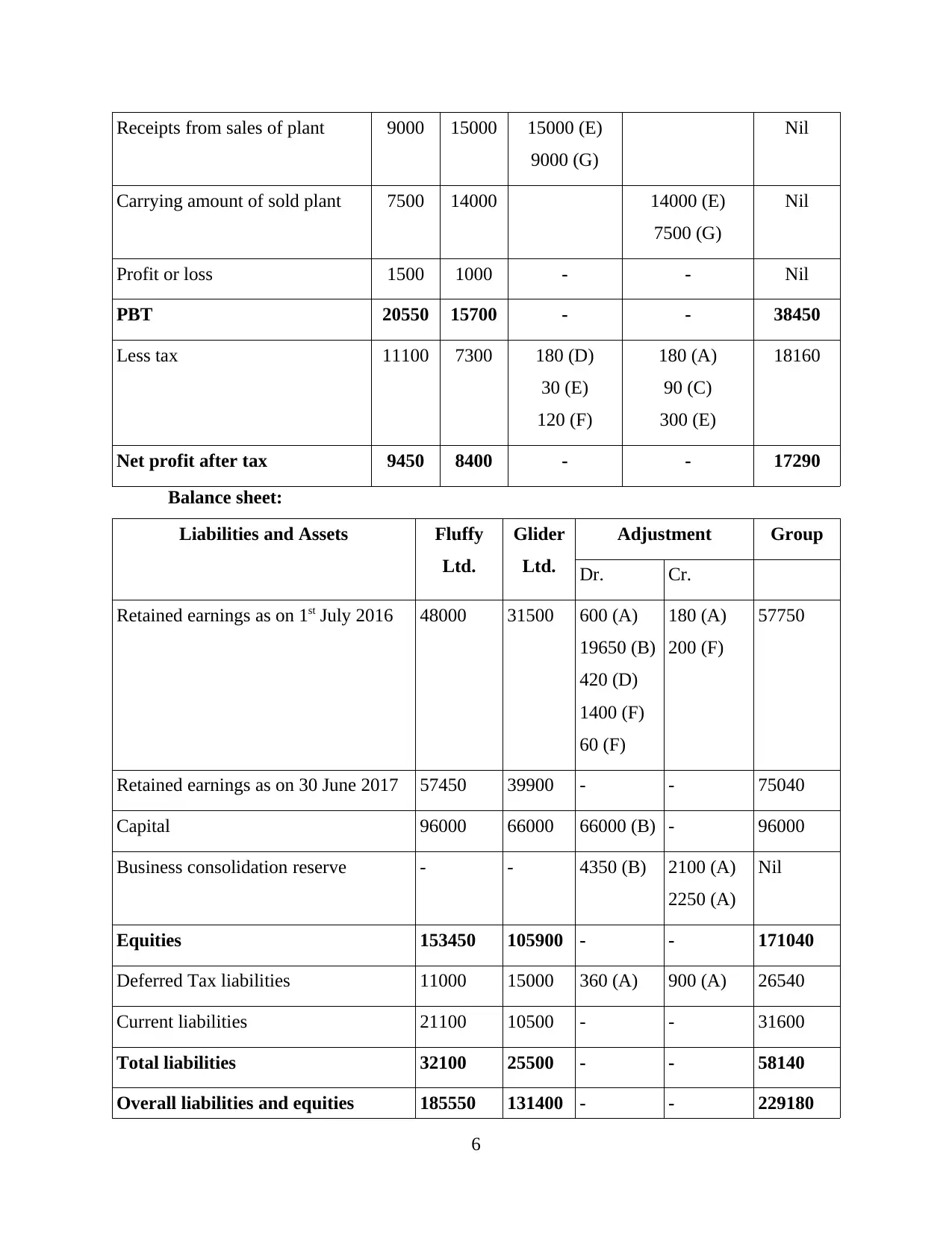

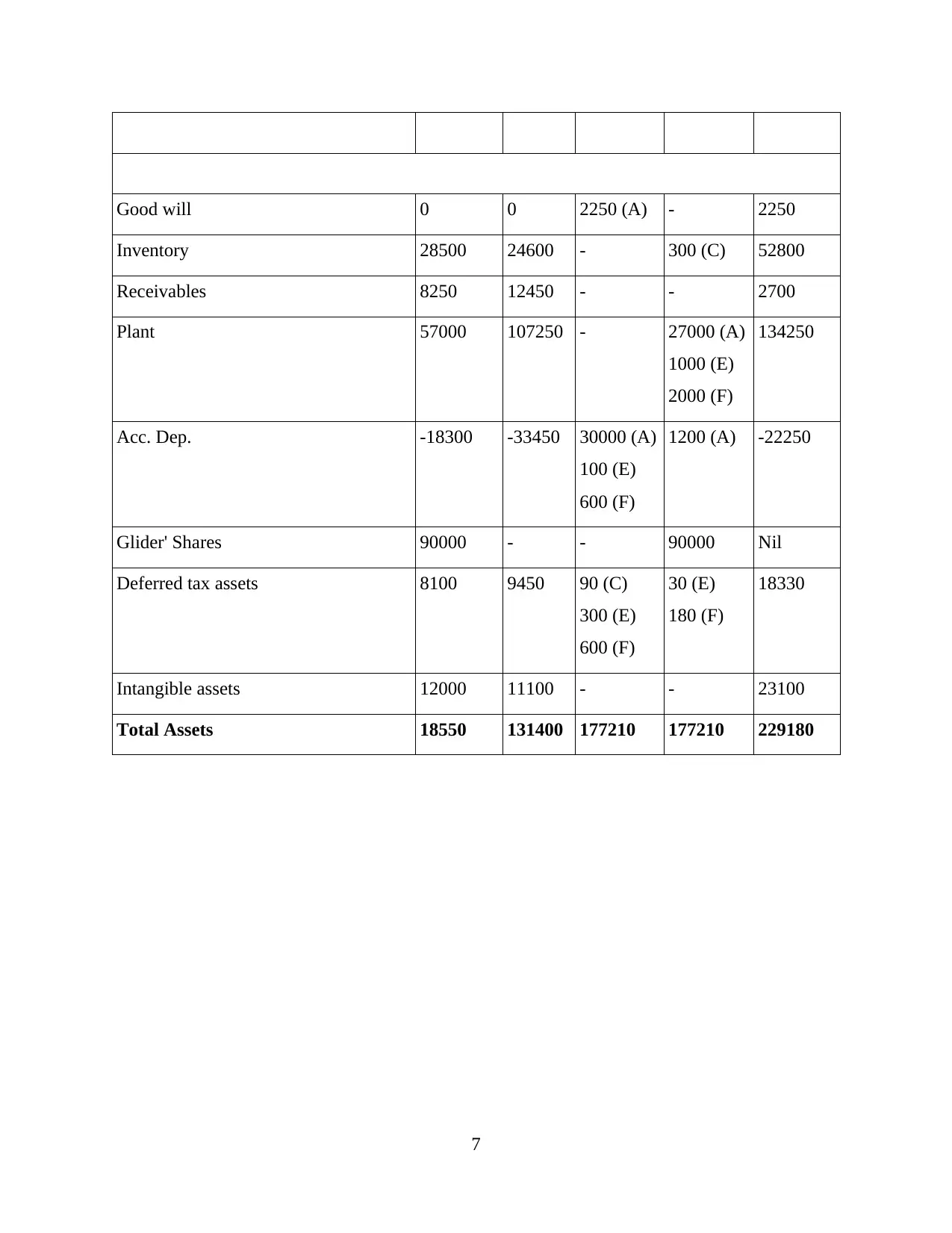

This document is a consolidation worksheet for managerial accounting. It includes calculations for the net fair value of identifiable assets and liabilities of Glider Ltd, as well as the calculation of tax on inventory, patent, and plant. It also includes entries for the valuation of business combination and pre-acquisition, as well as profit and sales in closing inventory. The document concludes with a consolidated financial statement, including an income statement and balance sheet.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 8

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)