Managerial Accounting

VerifiedAdded on 2023/04/22

|13

|3101

|254

AI Summary

The study has shown that the typical issues associated with KF’s costing system may also mislead the investors and management of the company. The breakdown of the product cost has shown direct cost per unit may be inferred with $ 50 for Expert fitters and $ 30 for Junior fitters. The adoption of the alternative job costing approach in this case needs to be proceeding with variable costing. It is recommended for Fred to proceed with direct costing method and adopt variable costing for allocating the manufacturing costs and reporting net income.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGERIAL ACCOUNTING

Managerial Accounting

Name of the Student

Name of the University

Author’s Note

Managerial Accounting

Name of the Student

Name of the University

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1MANAGERIAL ACCOUNTING

Executive Summary

The discussions of the study have aimed to address the specific requirement from the

owner Fred Ferrous of Kilbirnie Fabrications (KF). The study will also address areas which

shows that the current costing system at KF is outdated. It has further included the breakdown of

the various costs such as “direct labour costs per unit, direct materials per unit, overhead costs

per unit, full cost per unit, and quoted price per unit”. As per the depictions of the present

costing system the study has shown the rationale for the adoption of alternative job costing

approach which will be able to provide an accurate job costs and provide appropriate quote for

the customer of KF. The findings of the study have shown that as the company follows

absorption costing it may lead to company’s profit level appear better than the actual accounting

period.Moreover, increasing profit and loss statement may also mislead the investors and

management of the company. The findings on the breakdown of the individual cost overhead

have been stated with $ 50 for Expert fitters and $ 30 for Junior fitters. The per unit direct cost

for total direct labour costs may be inferred with $ 38. The breakdown of the quoted price per

unit is stated with 3 complex hours for Expert fitters (including time spent using welding

equipment). The basic hours are seen with 2 hours for Junior fitters and complex Junior hour of 1

hour. The main difference between the previous and alternative job costing approach has allowed

the company in segregating the cost as per fixed cost for the operating expenses and cost of

production.

Executive Summary

The discussions of the study have aimed to address the specific requirement from the

owner Fred Ferrous of Kilbirnie Fabrications (KF). The study will also address areas which

shows that the current costing system at KF is outdated. It has further included the breakdown of

the various costs such as “direct labour costs per unit, direct materials per unit, overhead costs

per unit, full cost per unit, and quoted price per unit”. As per the depictions of the present

costing system the study has shown the rationale for the adoption of alternative job costing

approach which will be able to provide an accurate job costs and provide appropriate quote for

the customer of KF. The findings of the study have shown that as the company follows

absorption costing it may lead to company’s profit level appear better than the actual accounting

period.Moreover, increasing profit and loss statement may also mislead the investors and

management of the company. The findings on the breakdown of the individual cost overhead

have been stated with $ 50 for Expert fitters and $ 30 for Junior fitters. The per unit direct cost

for total direct labour costs may be inferred with $ 38. The breakdown of the quoted price per

unit is stated with 3 complex hours for Expert fitters (including time spent using welding

equipment). The basic hours are seen with 2 hours for Junior fitters and complex Junior hour of 1

hour. The main difference between the previous and alternative job costing approach has allowed

the company in segregating the cost as per fixed cost for the operating expenses and cost of

production.

2MANAGERIAL ACCOUNTING

Table of Contents

Introduction......................................................................................................................................3

General problems associated with KF’s costing system..................................................................3

Breakdown of product costs............................................................................................................4

Alternative job costing approach that will provide more accurate job costs...................................6

Difference of the previous and alternative job costing approach....................................................7

Advising Fred for using appropriate job costing system.................................................................8

Conclusion.......................................................................................................................................9

References......................................................................................................................................11

Table of Contents

Introduction......................................................................................................................................3

General problems associated with KF’s costing system..................................................................3

Breakdown of product costs............................................................................................................4

Alternative job costing approach that will provide more accurate job costs...................................6

Difference of the previous and alternative job costing approach....................................................7

Advising Fred for using appropriate job costing system.................................................................8

Conclusion.......................................................................................................................................9

References......................................................................................................................................11

3MANAGERIAL ACCOUNTING

Introduction

The study aims to address the specific requirement from the owner Fred Ferrous of

Kilbirnie Fabrications (KF). The main aspects of the study will be conducive in discussing the

various types of key reasons which the costing system produces pertaining to information for

management. The main aspects of the report will consider explaining the general issues

associated with the costing system at KF. The study will also address areas which shows that the

current costing system at KF is outdated. The second section will show the complete job cost per

unit along with the quoted price for basic and complex fabrication jobs. This statement will

further include the breakdown of the various costs such as “direct labour costs per unit, direct

materials per unit, overhead costs per unit, full cost per unit, and quoted price per unit”. The

third section of the report has been further able to suggest about the rationale for the adoption of

alternative job costing approach which will be able to provide an accurate job costs and provide

appropriate quote for the customer of KF. The discourse of the study has also differentiated on

the previous and alternative job costing approach. The final section of the report has been able to

suggest on the appropriate method which KF will use along with reason for the same (Weygandt,

Kimmel & Kieso, 2015).

General problems associated with KF’s costing system

The general problems related to the costing system at KF needs to be identified in terms

of using absorption costing. The main problem with the use of such an approach may lead to

company’s profit level appear better than the actual accounting period. This is also seen due to

the reason of fixed cost not deducted from the revenues unless the company has sold all the

products which are manufactured(Ibarrondo-Dávila et al., 2015). Moreover, increasing profit and

loss statement may also mislead the investors and management of the company.In this case the

Introduction

The study aims to address the specific requirement from the owner Fred Ferrous of

Kilbirnie Fabrications (KF). The main aspects of the study will be conducive in discussing the

various types of key reasons which the costing system produces pertaining to information for

management. The main aspects of the report will consider explaining the general issues

associated with the costing system at KF. The study will also address areas which shows that the

current costing system at KF is outdated. The second section will show the complete job cost per

unit along with the quoted price for basic and complex fabrication jobs. This statement will

further include the breakdown of the various costs such as “direct labour costs per unit, direct

materials per unit, overhead costs per unit, full cost per unit, and quoted price per unit”. The

third section of the report has been further able to suggest about the rationale for the adoption of

alternative job costing approach which will be able to provide an accurate job costs and provide

appropriate quote for the customer of KF. The discourse of the study has also differentiated on

the previous and alternative job costing approach. The final section of the report has been able to

suggest on the appropriate method which KF will use along with reason for the same (Weygandt,

Kimmel & Kieso, 2015).

General problems associated with KF’s costing system

The general problems related to the costing system at KF needs to be identified in terms

of using absorption costing. The main problem with the use of such an approach may lead to

company’s profit level appear better than the actual accounting period. This is also seen due to

the reason of fixed cost not deducted from the revenues unless the company has sold all the

products which are manufactured(Ibarrondo-Dávila et al., 2015). Moreover, increasing profit and

loss statement may also mislead the investors and management of the company.In this case the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4MANAGERIAL ACCOUNTING

fixed costs are seen to be particularly large pertaining to the total production costs then it is

difficult to ascertain the variations in the costs occurring at a different level of production. This

makes it difficult for the management in making efficient decision to increase the operational

efficiency. Therefore, it can be inferred that as per the present costing system followed by

Kilbirnie Fabrications (KF), there can be no logical relationship found among the direct materials

cost of a product and factory overhead(Appelbaum et al., 2017).

At present, in each economy, there is a fluctuating trend in the material prices. This is

related to pose an additional threat pertaining to the high or low overhead costs in case there is

no change in the overhead costs. In most situations, the overhead expenses are seen to vary with

time and they are accrued as per time basis instead of the materials consumed. However, the use

of direct materials cost approach ignores the time factor which is an essential characteristic to be

considered during allocation of the overhead (Butler & Ghosh, 2015).

Breakdown of product costs

fixed costs are seen to be particularly large pertaining to the total production costs then it is

difficult to ascertain the variations in the costs occurring at a different level of production. This

makes it difficult for the management in making efficient decision to increase the operational

efficiency. Therefore, it can be inferred that as per the present costing system followed by

Kilbirnie Fabrications (KF), there can be no logical relationship found among the direct materials

cost of a product and factory overhead(Appelbaum et al., 2017).

At present, in each economy, there is a fluctuating trend in the material prices. This is

related to pose an additional threat pertaining to the high or low overhead costs in case there is

no change in the overhead costs. In most situations, the overhead expenses are seen to vary with

time and they are accrued as per time basis instead of the materials consumed. However, the use

of direct materials cost approach ignores the time factor which is an essential characteristic to be

considered during allocation of the overhead (Butler & Ghosh, 2015).

Breakdown of product costs

5MANAGERIAL ACCOUNTING

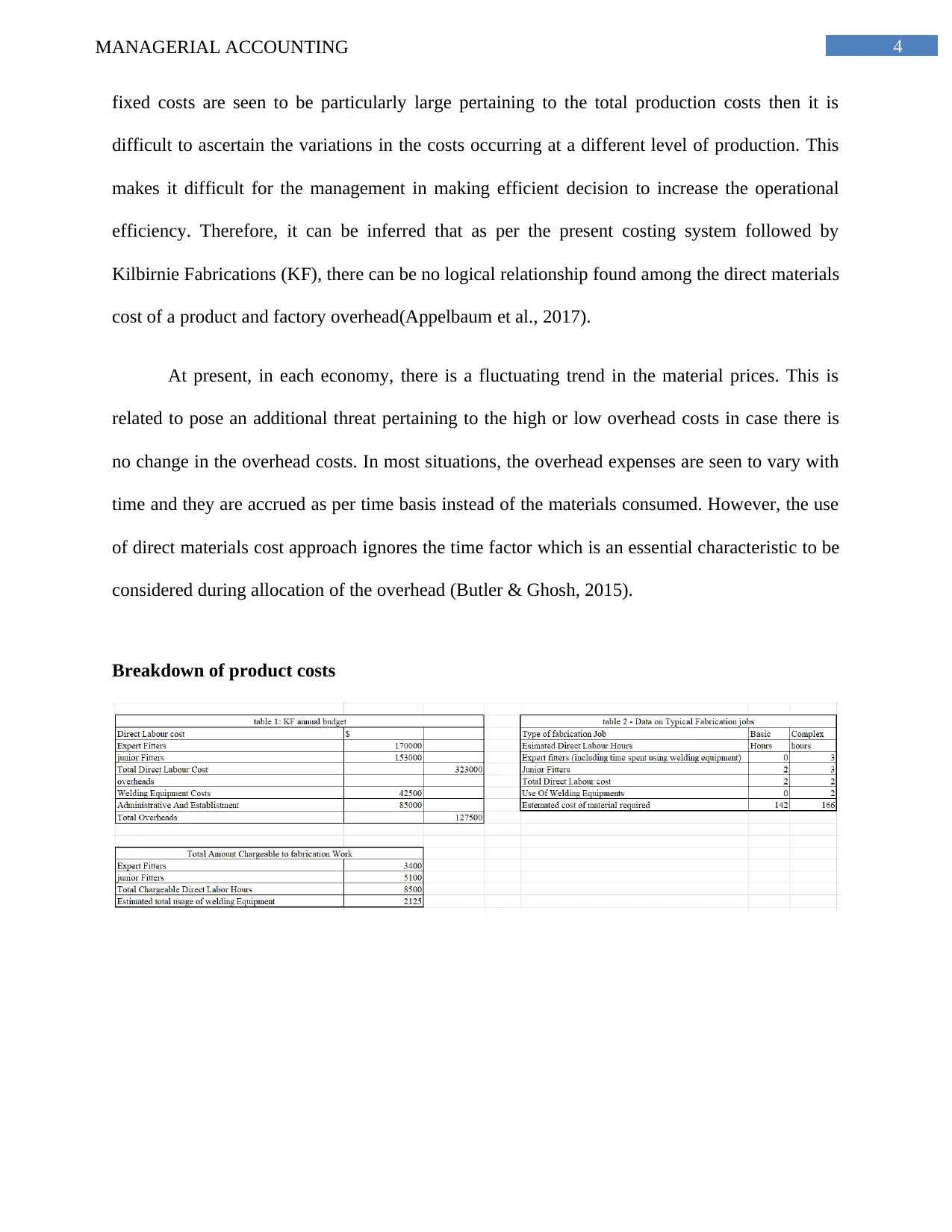

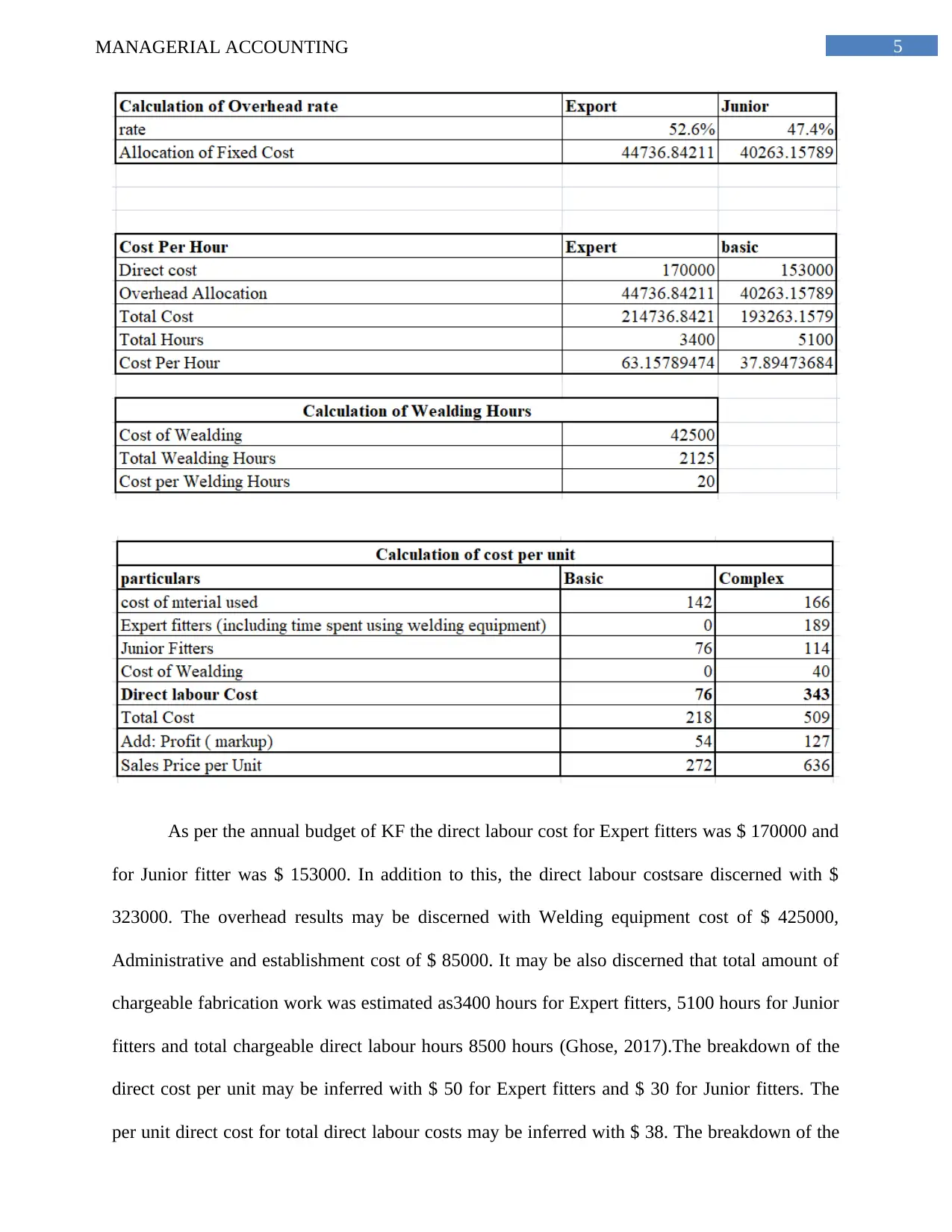

As per the annual budget of KF the direct labour cost for Expert fitters was $ 170000 and

for Junior fitter was $ 153000. In addition to this, the direct labour costsare discerned with $

323000. The overhead results may be discerned with Welding equipment cost of $ 425000,

Administrative and establishment cost of $ 85000. It may be also discerned that total amount of

chargeable fabrication work was estimated as3400 hours for Expert fitters, 5100 hours for Junior

fitters and total chargeable direct labour hours 8500 hours (Ghose, 2017).The breakdown of the

direct cost per unit may be inferred with $ 50 for Expert fitters and $ 30 for Junior fitters. The

per unit direct cost for total direct labour costs may be inferred with $ 38. The breakdown of the

As per the annual budget of KF the direct labour cost for Expert fitters was $ 170000 and

for Junior fitter was $ 153000. In addition to this, the direct labour costsare discerned with $

323000. The overhead results may be discerned with Welding equipment cost of $ 425000,

Administrative and establishment cost of $ 85000. It may be also discerned that total amount of

chargeable fabrication work was estimated as3400 hours for Expert fitters, 5100 hours for Junior

fitters and total chargeable direct labour hours 8500 hours (Ghose, 2017).The breakdown of the

direct cost per unit may be inferred with $ 50 for Expert fitters and $ 30 for Junior fitters. The

per unit direct cost for total direct labour costs may be inferred with $ 38. The breakdown of the

6MANAGERIAL ACCOUNTING

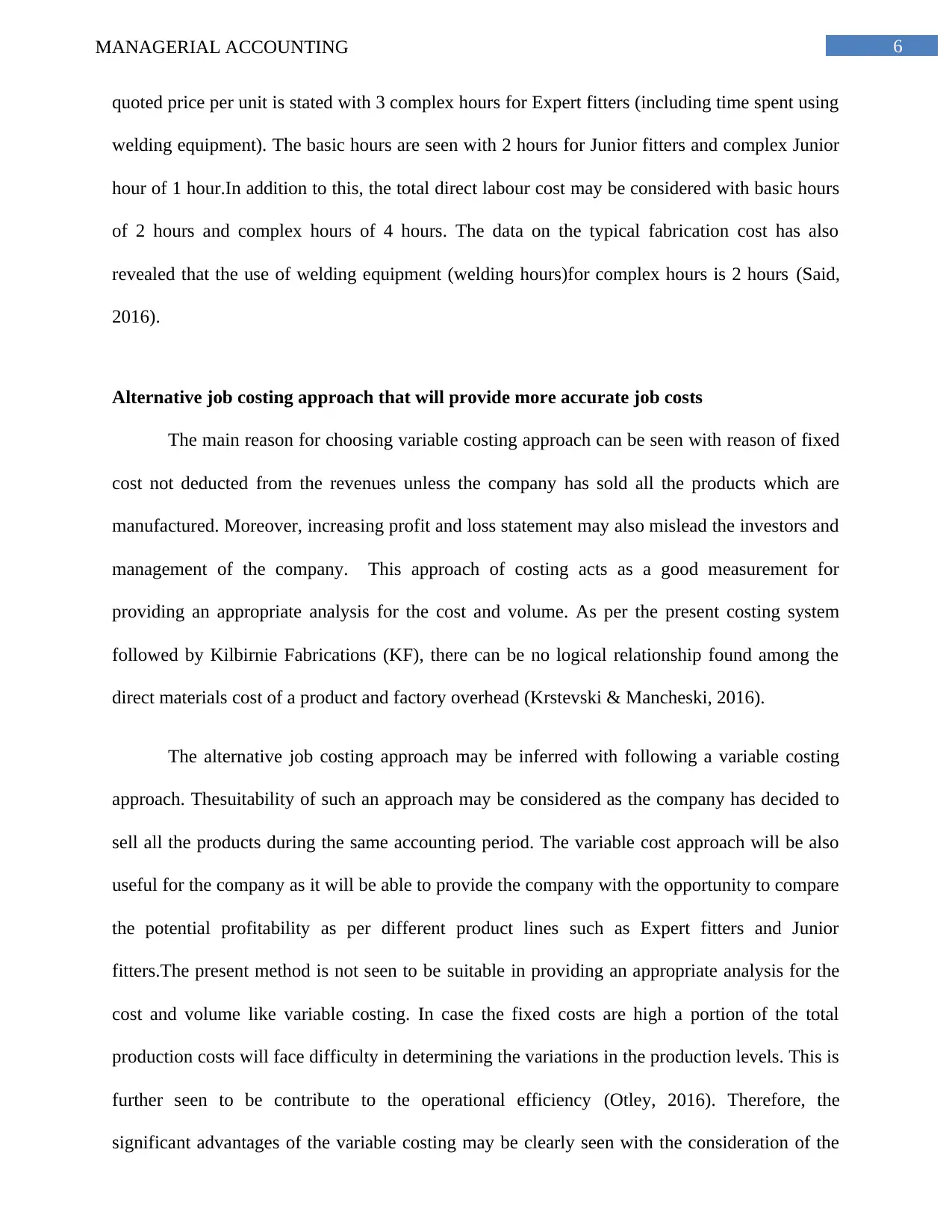

quoted price per unit is stated with 3 complex hours for Expert fitters (including time spent using

welding equipment). The basic hours are seen with 2 hours for Junior fitters and complex Junior

hour of 1 hour.In addition to this, the total direct labour cost may be considered with basic hours

of 2 hours and complex hours of 4 hours. The data on the typical fabrication cost has also

revealed that the use of welding equipment (welding hours)for complex hours is 2 hours (Said,

2016).

Alternative job costing approach that will provide more accurate job costs

The main reason for choosing variable costing approach can be seen with reason of fixed

cost not deducted from the revenues unless the company has sold all the products which are

manufactured. Moreover, increasing profit and loss statement may also mislead the investors and

management of the company. This approach of costing acts as a good measurement for

providing an appropriate analysis for the cost and volume. As per the present costing system

followed by Kilbirnie Fabrications (KF), there can be no logical relationship found among the

direct materials cost of a product and factory overhead (Krstevski & Mancheski, 2016).

The alternative job costing approach may be inferred with following a variable costing

approach. Thesuitability of such an approach may be considered as the company has decided to

sell all the products during the same accounting period. The variable cost approach will be also

useful for the company as it will be able to provide the company with the opportunity to compare

the potential profitability as per different product lines such as Expert fitters and Junior

fitters.The present method is not seen to be suitable in providing an appropriate analysis for the

cost and volume like variable costing. In case the fixed costs are high a portion of the total

production costs will face difficulty in determining the variations in the production levels. This is

further seen to be contribute to the operational efficiency (Otley, 2016). Therefore, the

significant advantages of the variable costing may be clearly seen with the consideration of the

quoted price per unit is stated with 3 complex hours for Expert fitters (including time spent using

welding equipment). The basic hours are seen with 2 hours for Junior fitters and complex Junior

hour of 1 hour.In addition to this, the total direct labour cost may be considered with basic hours

of 2 hours and complex hours of 4 hours. The data on the typical fabrication cost has also

revealed that the use of welding equipment (welding hours)for complex hours is 2 hours (Said,

2016).

Alternative job costing approach that will provide more accurate job costs

The main reason for choosing variable costing approach can be seen with reason of fixed

cost not deducted from the revenues unless the company has sold all the products which are

manufactured. Moreover, increasing profit and loss statement may also mislead the investors and

management of the company. This approach of costing acts as a good measurement for

providing an appropriate analysis for the cost and volume. As per the present costing system

followed by Kilbirnie Fabrications (KF), there can be no logical relationship found among the

direct materials cost of a product and factory overhead (Krstevski & Mancheski, 2016).

The alternative job costing approach may be inferred with following a variable costing

approach. Thesuitability of such an approach may be considered as the company has decided to

sell all the products during the same accounting period. The variable cost approach will be also

useful for the company as it will be able to provide the company with the opportunity to compare

the potential profitability as per different product lines such as Expert fitters and Junior

fitters.The present method is not seen to be suitable in providing an appropriate analysis for the

cost and volume like variable costing. In case the fixed costs are high a portion of the total

production costs will face difficulty in determining the variations in the production levels. This is

further seen to be contribute to the operational efficiency (Otley, 2016). Therefore, the

significant advantages of the variable costing may be clearly seen with the consideration of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGERIAL ACCOUNTING

actual incremental costs related to a certain product. This is also seen to be essential in providing

the rationale for accurate representation of the financial statement as per the consideration of cost

of production. In addition to this, the various proponents of the variable costing method will be

able to identify the accurate cost constraints which are seento berelated with accurately

representing the fixed manufacturing overhead irrespective of the volume of production. This

will be further helpful in making suitable product related decisions. Henceforth, the variable

costing will allow the users of the financial statement to represent the actual inputs of a product.

The manufacturing overhead is also important as it will be able to consider the cost which will

not be able to contribute directly to the creation of a product (Keller, 2015).

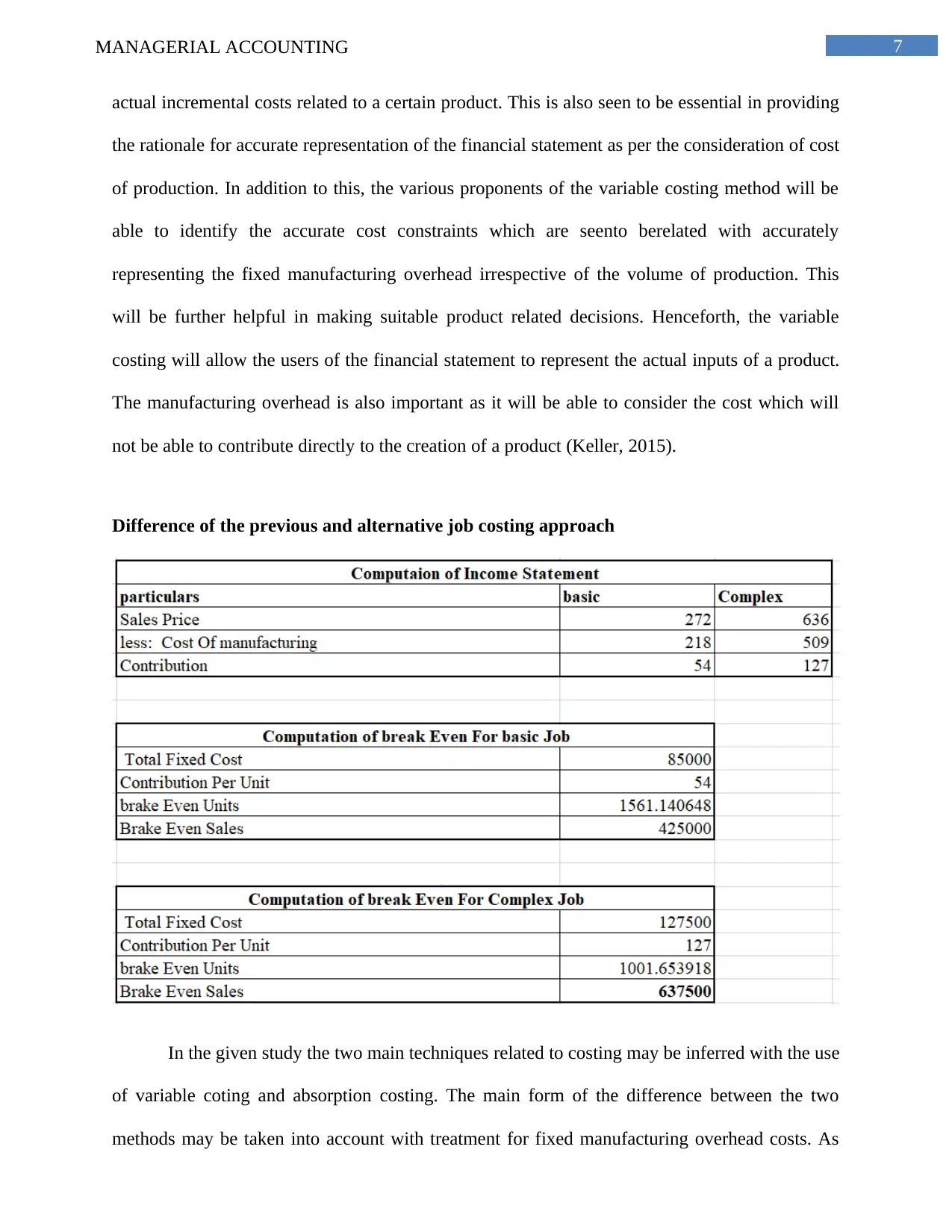

Difference of the previous and alternative job costing approach

In the given study the two main techniques related to costing may be inferred with the use

of variable coting and absorption costing. The main form of the difference between the two

methods may be taken into account with treatment for fixed manufacturing overhead costs. As

actual incremental costs related to a certain product. This is also seen to be essential in providing

the rationale for accurate representation of the financial statement as per the consideration of cost

of production. In addition to this, the various proponents of the variable costing method will be

able to identify the accurate cost constraints which are seento berelated with accurately

representing the fixed manufacturing overhead irrespective of the volume of production. This

will be further helpful in making suitable product related decisions. Henceforth, the variable

costing will allow the users of the financial statement to represent the actual inputs of a product.

The manufacturing overhead is also important as it will be able to consider the cost which will

not be able to contribute directly to the creation of a product (Keller, 2015).

Difference of the previous and alternative job costing approach

In the given study the two main techniques related to costing may be inferred with the use

of variable coting and absorption costing. The main form of the difference between the two

methods may be taken into account with treatment for fixed manufacturing overhead costs. As

8MANAGERIAL ACCOUNTING

per the application of absorption costing for KF the various types of cost including the fixed cost

are associated to the production (Horngren & Harrison, 2015). On the other hand, the various

types of the cost considerations as per the variable costing taken into account the costs which are

directly related to the production. The adoption of the alternative costing method such as variable

costing has allowed KF to segregate cost considerations as per fixed cost for the operating

expenses and cost of production (Calderon, 2019).

The different nature of the direct costs related to the manufacturing activity of a

production can be further inferred in terms of including wages from the workers and physical

manufacturing of the product. The manufacturing activities are included with raw materials used

in producing a product and inputs required for running a machinery. The differences of the

variable and absorption costing system are inferred with components in budget which has not

shown any changes in the level of production (Malmi, 2016). As per the implementation of

Absorption costing (full costing), the company has the opportunity to allocate the fixed overhead

cost resulting to all units which are produced during a particular period.The variable costing will

be able to combine the fixed overhead cost into one expense group and reporting the same under

single line item in a balance sheet taken as per net income. On the other hand, absorption costing

will result in two categories of fixed overhead costs which will applicable with the cost of goods

sold and values attributable to the inventory.The full costing method will be also beneficial in

allocating both variable and fixed manufacturing overhead applied with each product (Eker

&Aytaç, 2017).

Advising Fred for using appropriate job costing system

In the present situation it is recommended for Fred to proceed with direct costing method.

This is seen to be applicable for all the direct costs and variable manufacturing overhead costs.

This particular method will be appropriate for the company in movingthe product through the

per the application of absorption costing for KF the various types of cost including the fixed cost

are associated to the production (Horngren & Harrison, 2015). On the other hand, the various

types of the cost considerations as per the variable costing taken into account the costs which are

directly related to the production. The adoption of the alternative costing method such as variable

costing has allowed KF to segregate cost considerations as per fixed cost for the operating

expenses and cost of production (Calderon, 2019).

The different nature of the direct costs related to the manufacturing activity of a

production can be further inferred in terms of including wages from the workers and physical

manufacturing of the product. The manufacturing activities are included with raw materials used

in producing a product and inputs required for running a machinery. The differences of the

variable and absorption costing system are inferred with components in budget which has not

shown any changes in the level of production (Malmi, 2016). As per the implementation of

Absorption costing (full costing), the company has the opportunity to allocate the fixed overhead

cost resulting to all units which are produced during a particular period.The variable costing will

be able to combine the fixed overhead cost into one expense group and reporting the same under

single line item in a balance sheet taken as per net income. On the other hand, absorption costing

will result in two categories of fixed overhead costs which will applicable with the cost of goods

sold and values attributable to the inventory.The full costing method will be also beneficial in

allocating both variable and fixed manufacturing overhead applied with each product (Eker

&Aytaç, 2017).

Advising Fred for using appropriate job costing system

In the present situation it is recommended for Fred to proceed with direct costing method.

This is seen to be applicable for all the direct costs and variable manufacturing overhead costs.

This particular method will be appropriate for the company in movingthe product through the

9MANAGERIAL ACCOUNTING

inventory account until the product has been sold. In addition to this, this method also states on

the inventory method which will allow manufacturing overhead to be expenses in a certain

period. The adoption of the variable costing method will be ideal for the company in allocating

the manufacturing costs and consider the effect of the same as per reporting of the net income

(Butterfield, 2016). This will provide Fred with the option to include the direct costs along with

variable manufacturing costs. The variable costing will be essential in influencing the inventory

values in a different manner. In addition to this, the variable costing will be only able to include

the variable production costs. By the adoption of such a method Fred will be able to influence the

value od inventory in separate manner. As it was previous stated that the interpretation of the

different types of the values pertaining to the variable costing will be able to include the variable

costs under the inventory valuation. Therefore, it may be also inferred that variable costing will

be more concrete and visible to the managers of the company (Sy, Tinker & Mickhail, 2015).

It needs to be also considered that the selling and administrative expenses include the

various aspects of administrative expenses however the adoption of such a technique will ensure

that variable and fixed are not charged with the individual products. The adoption variable

costing will also ensure that the company will include direct material, direct labour and variable

manufacturing overhead. Similarly, the variable selling and administrative overhead will be

considered appropriately with the use of variable costing system (Apostolou et al., 2016).

Conclusion

The study has shown that the typical issues associated with KF’s costing system may also

mislead the investors and management of the company. This approach of costing acts as a good

measurement for providing an appropriate analysis for the cost and volume as variable costing.

In this case the fixed costs are seen to be particularly large pertaining to the total production

costs then it is difficult to ascertain the variations in the costs occurring at a different level of

inventory account until the product has been sold. In addition to this, this method also states on

the inventory method which will allow manufacturing overhead to be expenses in a certain

period. The adoption of the variable costing method will be ideal for the company in allocating

the manufacturing costs and consider the effect of the same as per reporting of the net income

(Butterfield, 2016). This will provide Fred with the option to include the direct costs along with

variable manufacturing costs. The variable costing will be essential in influencing the inventory

values in a different manner. In addition to this, the variable costing will be only able to include

the variable production costs. By the adoption of such a method Fred will be able to influence the

value od inventory in separate manner. As it was previous stated that the interpretation of the

different types of the values pertaining to the variable costing will be able to include the variable

costs under the inventory valuation. Therefore, it may be also inferred that variable costing will

be more concrete and visible to the managers of the company (Sy, Tinker & Mickhail, 2015).

It needs to be also considered that the selling and administrative expenses include the

various aspects of administrative expenses however the adoption of such a technique will ensure

that variable and fixed are not charged with the individual products. The adoption variable

costing will also ensure that the company will include direct material, direct labour and variable

manufacturing overhead. Similarly, the variable selling and administrative overhead will be

considered appropriately with the use of variable costing system (Apostolou et al., 2016).

Conclusion

The study has shown that the typical issues associated with KF’s costing system may also

mislead the investors and management of the company. This approach of costing acts as a good

measurement for providing an appropriate analysis for the cost and volume as variable costing.

In this case the fixed costs are seen to be particularly large pertaining to the total production

costs then it is difficult to ascertain the variations in the costs occurring at a different level of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10MANAGERIAL ACCOUNTING

production. The breakdown of the product cost has shown direct cost per unit may be inferred

with $ 50 for Expert fitters and $ 30 for Junior fitters. The per unit direct cost for total direct

labour costs may be inferred with $ 38. The adoption of the alternative job costing approach in

this case needs to be proceeding with variable costing. This approach will ensure that fixed cost

not isdeducted from the revenues unless the company has sold all the products which are

manufactured. The suitability of such an approach may be considered as the company has

decided to sell all the products during the same accounting period. It will allow the company to

compare the potential profitability as per different product lines such as Expert fitters and Junior

fitters.

production. The breakdown of the product cost has shown direct cost per unit may be inferred

with $ 50 for Expert fitters and $ 30 for Junior fitters. The per unit direct cost for total direct

labour costs may be inferred with $ 38. The adoption of the alternative job costing approach in

this case needs to be proceeding with variable costing. This approach will ensure that fixed cost

not isdeducted from the revenues unless the company has sold all the products which are

manufactured. The suitability of such an approach may be considered as the company has

decided to sell all the products during the same accounting period. It will allow the company to

compare the potential profitability as per different product lines such as Expert fitters and Junior

fitters.

11MANAGERIAL ACCOUNTING

References

Apostolou, B., Dorminey, J. W., Hassell, J. M., &Rebele, J. E. (2016). Accounting education

literature review (2015). Journal of Accounting Education, 35, 20-55.

Appelbaum, D., Kogan, A., Vasarhelyi, M., & Yan, Z. (2017). Impact of business analytics and

enterprise systems on managerial accounting. International Journal of Accounting

Information Systems, 25, 29-44.

Butler, S. A., & Ghosh, D. (2015). Individual differences in managerial accounting judgments

and decision making. The British Accounting Review, 47(1), 33-45.

Butterfield, E. (2016). Managerial Decision-making and Management Accounting Information.

Calderon, T. G. (Ed.). (2019). Advances in accounting education: Teaching and curriculum

innovations. Emerald Publishing Limited.

Eker, M., &Aytaç, A. (2017). The Role of ERP in Advanced Managerial Accounting

Techniques: A Conceptual Framework 1. Business and Economics Research

Journal, 8(1), 83.

Ghose, K. S. (2017). Ethics in Managerial Accounting: Today’s Challenges in USA. GSTF

Journal of Law and Social Sciences (JLSS), 4(2).

Horngren, C., & Harrison, W. (2015). ACCOUNTING: BSB110. Pearson Higher Education AU.

Ibarrondo-Dávila, M. P., López-Alonso, M., & Rubio-Gámez, M. C. (2015). Managerial

accounting for safety management. The case of a Spanish construction company. Safety

science, 79, 116-125.

References

Apostolou, B., Dorminey, J. W., Hassell, J. M., &Rebele, J. E. (2016). Accounting education

literature review (2015). Journal of Accounting Education, 35, 20-55.

Appelbaum, D., Kogan, A., Vasarhelyi, M., & Yan, Z. (2017). Impact of business analytics and

enterprise systems on managerial accounting. International Journal of Accounting

Information Systems, 25, 29-44.

Butler, S. A., & Ghosh, D. (2015). Individual differences in managerial accounting judgments

and decision making. The British Accounting Review, 47(1), 33-45.

Butterfield, E. (2016). Managerial Decision-making and Management Accounting Information.

Calderon, T. G. (Ed.). (2019). Advances in accounting education: Teaching and curriculum

innovations. Emerald Publishing Limited.

Eker, M., &Aytaç, A. (2017). The Role of ERP in Advanced Managerial Accounting

Techniques: A Conceptual Framework 1. Business and Economics Research

Journal, 8(1), 83.

Ghose, K. S. (2017). Ethics in Managerial Accounting: Today’s Challenges in USA. GSTF

Journal of Law and Social Sciences (JLSS), 4(2).

Horngren, C., & Harrison, W. (2015). ACCOUNTING: BSB110. Pearson Higher Education AU.

Ibarrondo-Dávila, M. P., López-Alonso, M., & Rubio-Gámez, M. C. (2015). Managerial

accounting for safety management. The case of a Spanish construction company. Safety

science, 79, 116-125.

12MANAGERIAL ACCOUNTING

Keller, W. D. (2015). Cost and Managerial Accounting II Essentials (Vol. 2). Research &

Education Assoc..

Krstevski, D., &Mancheski, G. (2016). Managerial accounting: Modeling customer lifetime

value-An application in the telecommunication industry. European Journal of Business

and Social Sciences, 5(01), 64-77.

Malmi, T. (2016). Managerialist studies in management accounting: 1990–2014. Management

Accounting Research, 31, 31-44.

Otley, D. (2016). The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, 45-62.

Said, H. A. (2016). Using Different Probability Distributions for Managerial Accounting

Technique: The Cost-Volume-Profit Analysis. Journal of Business and Accounting, 9(1),

3.

Sy, A., Tinker, T., &Mickhail, G. M. E. (2015). US corporate management system and

managerial accounting: a brief history of the aircraft industry company.

Weygandt, J. J., Kimmel, P. D., &Kieso, D. E. (2015). Financial & managerial accounting. John

Wiley & Sons.

Keller, W. D. (2015). Cost and Managerial Accounting II Essentials (Vol. 2). Research &

Education Assoc..

Krstevski, D., &Mancheski, G. (2016). Managerial accounting: Modeling customer lifetime

value-An application in the telecommunication industry. European Journal of Business

and Social Sciences, 5(01), 64-77.

Malmi, T. (2016). Managerialist studies in management accounting: 1990–2014. Management

Accounting Research, 31, 31-44.

Otley, D. (2016). The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, 45-62.

Said, H. A. (2016). Using Different Probability Distributions for Managerial Accounting

Technique: The Cost-Volume-Profit Analysis. Journal of Business and Accounting, 9(1),

3.

Sy, A., Tinker, T., &Mickhail, G. M. E. (2015). US corporate management system and

managerial accounting: a brief history of the aircraft industry company.

Weygandt, J. J., Kimmel, P. D., &Kieso, D. E. (2015). Financial & managerial accounting. John

Wiley & Sons.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.