Activity Based Costing in Managerial Accounting: A Detailed Report

VerifiedAdded on 2020/12/18

|12

|3738

|328

Report

AI Summary

This report delves into the application of Activity Based Costing (ABC) within managerial accounting, focusing on its use in a plastic product manufacturing company, Innovation Fibreglass Pty Ltd, based in Australia. It begins with an explanation of ABC, highlighting its role in cost allocation to activities and its benefits for improving accuracy and strategic decision-making. The report then examines the purposes of two selected journal articles: "Accounting, Auditing and Accountability Journal" and "Journal of Management Accounting Research," exploring their research questions, similarities, and differences in their findings. The analysis covers how ABC facilitates accounting processes, improves performance, and aids in cost control. The report also examines the implementation steps of ABC and its impact on accountability and decision-making. Finally, it presents specific lessons and outcomes from the studies, offering insights for management accountants at Innovation Fibreglass Pty Ltd, addressing how ABC can be used in auditing and its value in managerial reporting and policy formation.

Managerial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION..............................................................................................................................1

MAIN BODY.................................................................................................................................... 1

a. Explanation of Activity based costing....................................................................................1

b. Explanation of purpose of both the selected journal articles................................................3

c. Similarities and differences in both the journals...................................................................6

d. Specific lesson and outcomes from these studies.................................................................7

CONCLUSION................................................................................................................................. 8

REFERENCES...................................................................................................................................9

INTRODUCTION..............................................................................................................................1

MAIN BODY.................................................................................................................................... 1

a. Explanation of Activity based costing....................................................................................1

b. Explanation of purpose of both the selected journal articles................................................3

c. Similarities and differences in both the journals...................................................................6

d. Specific lesson and outcomes from these studies.................................................................7

CONCLUSION................................................................................................................................. 8

REFERENCES...................................................................................................................................9

INTRODUCTION

Managerial accounting refers to the process of analysing, observing, recording and

controlling accounting information to attain organisational goals. Managers examine data of

previous years to form strategies for upcoming years and managerial accounting help them, by

providing accurate data. It facilitates the activities related to administration, operations and

execution of a company. It direct the managers to form different documents and reports that

help in decision making to reach predetermined objectives (Benson and et. al., 2015).

Management of an organisation can measure success or failure of the business by analysing

different reports that are generated within the business enterprise.

For this project report selected topic is Activity based costing and two selected journal

articles for this topic are accounting auditing and accountability journal and journal of

management accounting research. The organisation chosen for this project is Innovation

Fibreglass Pty Ltd, which is a plastic products and component manufacturing company and

based in Australia. This report covers explanation of selected topic which is activity based

costing and the purpose of selected two journals under this topic, research questions set out to

explore, similarities and differences in both the selected articles and outcomes from the two

studies that will be useful for the Australian company's management accountants.

MAIN BODY

a. Explanation of Activity based costing

Activity based costing: It is mainly used in manufacturing companies to observe

different activities within an organisation and allot costs to the activities with available

resources. In this system an activity can also be reasoned as any group action or outcome that

is a cost driving force, which is used to mention to an allotment base (Braun, 2013). There are

two different categories of Activity based costing that are transaction drivers and duration

drivers. First one involves the computation of how many times an activity occurs, and another is

used to measure the time that an activity takes to complete. In Innovation Fibreglass Pty Ltd

Activity based costing is used to identified assigned costs to activities that are related to

overheads and after identification same costs are allotted to the related products. It helps the

1

Managerial accounting refers to the process of analysing, observing, recording and

controlling accounting information to attain organisational goals. Managers examine data of

previous years to form strategies for upcoming years and managerial accounting help them, by

providing accurate data. It facilitates the activities related to administration, operations and

execution of a company. It direct the managers to form different documents and reports that

help in decision making to reach predetermined objectives (Benson and et. al., 2015).

Management of an organisation can measure success or failure of the business by analysing

different reports that are generated within the business enterprise.

For this project report selected topic is Activity based costing and two selected journal

articles for this topic are accounting auditing and accountability journal and journal of

management accounting research. The organisation chosen for this project is Innovation

Fibreglass Pty Ltd, which is a plastic products and component manufacturing company and

based in Australia. This report covers explanation of selected topic which is activity based

costing and the purpose of selected two journals under this topic, research questions set out to

explore, similarities and differences in both the selected articles and outcomes from the two

studies that will be useful for the Australian company's management accountants.

MAIN BODY

a. Explanation of Activity based costing

Activity based costing: It is mainly used in manufacturing companies to observe

different activities within an organisation and allot costs to the activities with available

resources. In this system an activity can also be reasoned as any group action or outcome that

is a cost driving force, which is used to mention to an allotment base (Braun, 2013). There are

two different categories of Activity based costing that are transaction drivers and duration

drivers. First one involves the computation of how many times an activity occurs, and another is

used to measure the time that an activity takes to complete. In Innovation Fibreglass Pty Ltd

Activity based costing is used to identified assigned costs to activities that are related to

overheads and after identification same costs are allotted to the related products. It helps the

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managers and accountants of the organisation to improve the costing process in different ways

by expanding the number of cost excavations that can be used to bring together different

overhead costs, creating new bases for distribution of costs to related activities, altering nature

of various indirect costs.

Activity based costing help the accountants of Innovation Fibreglass Pty Ltd by

providing them information of each activity separately. It facilitates their work to identify

different costs for various activities. It improves the accuracy of products and help the

managers to understand and evaluate the way in which resources are used within the

organisation (De Waal, 2013). It assists them while forming strategic decisions for the

organisation. Before implementing this system the organisations have to be aware of its

benefits and also the current running technology in the market, because it may lead the

accountants and managers toward best strategy that should be adopted for cost reduction. The

rates of implementing Activity based costing was continuously increasing in Australia in year

1990 but it has fallen during 1994. The charted accountants suggested the organisations to

adopt activity based costing. According to the market research of year 2009, it was adopted by

13% of the manufacturing companies that are based in Australia.

Activity based costing help the organisation to increase the level of success by improving

performance and organisational processes. It increase the level of employee satisfaction

because it helps to assign costs to different overheads as well as direct or indirect activities of

the organisation. In Innovation Fibreglass Pty Ltd it help the managers to record the

appropriate informations in the books of accounting and assist the accountants while analysing

reports to determine actual position of the company (Downen and Hyde, 2016).

The managers have to follow six steps while implementing activity based costing within

the organisations. These steps are initiation, adoption, adaption, acceptance, routinisation and

integration. In initiation the the managers conduct a feasibility analysis of activity based costing.

Adoption includes decision that are made to invest available resources of the company.

Adaption is related to analysis of different activities of the organisation and cost driving force.

Acceptance means top management make decision about the model. In routinisation the upper

managers of the company provide judgement about the information system. The last step

2

by expanding the number of cost excavations that can be used to bring together different

overhead costs, creating new bases for distribution of costs to related activities, altering nature

of various indirect costs.

Activity based costing help the accountants of Innovation Fibreglass Pty Ltd by

providing them information of each activity separately. It facilitates their work to identify

different costs for various activities. It improves the accuracy of products and help the

managers to understand and evaluate the way in which resources are used within the

organisation (De Waal, 2013). It assists them while forming strategic decisions for the

organisation. Before implementing this system the organisations have to be aware of its

benefits and also the current running technology in the market, because it may lead the

accountants and managers toward best strategy that should be adopted for cost reduction. The

rates of implementing Activity based costing was continuously increasing in Australia in year

1990 but it has fallen during 1994. The charted accountants suggested the organisations to

adopt activity based costing. According to the market research of year 2009, it was adopted by

13% of the manufacturing companies that are based in Australia.

Activity based costing help the organisation to increase the level of success by improving

performance and organisational processes. It increase the level of employee satisfaction

because it helps to assign costs to different overheads as well as direct or indirect activities of

the organisation. In Innovation Fibreglass Pty Ltd it help the managers to record the

appropriate informations in the books of accounting and assist the accountants while analysing

reports to determine actual position of the company (Downen and Hyde, 2016).

The managers have to follow six steps while implementing activity based costing within

the organisations. These steps are initiation, adoption, adaption, acceptance, routinisation and

integration. In initiation the the managers conduct a feasibility analysis of activity based costing.

Adoption includes decision that are made to invest available resources of the company.

Adaption is related to analysis of different activities of the organisation and cost driving force.

Acceptance means top management make decision about the model. In routinisation the upper

managers of the company provide judgement about the information system. The last step

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

integration include the consolidation of activity based costing in the management accounting

system.

It provides such information of such activities that exceeds the assigned costs by

highlighting the inefficiencies in the accounting system, it may lead the managers to reduce

waste with the help of such information. It separates the value adding and non value adding

activities in order to reach the predetermined goals. It is very beneficial for the accountants

while analysing the accounting books to get separate idea of each cost which is concerned with

different activities. The growth in activity based costing supplied an approach for accountants

to lay claim to their strategic relevance. The adoption of ABC in Australia was not able to fulfil

the expectations (Gitman, Juchau and Flanagan, 2015). It is a tool which is used by accountants

to control the extra costs of labour and other overheads. It is very advantageous for managers

and accountants while preparing managerial reports for the organisation it help in

accountability, analysis of different reports and accounting process as it may help to keep the

information of cost separately according to their nature.

b. Explanation of purpose of both the selected journal articles

Purpose of accounting, auditing and accountability journal: The main purpose of this

journal is to determine the use of activity based costing in accounting and accountability and

how facilitates the work of an accountant while analysing the annual reports of an organisation.

Activity based costing is mainly concerned with the allotment of costs to different segments of a

production process, so that the cost of each activity can be recorded accurately and separately.

Accounting is the process of recording informations in the books and activity based costing

facilitate this work of accountants by providing them abstracted information of different costs

that are involved in activities performed by the organisation.

The process of accounting is and accountability are two tasks that are performed by an

accountant and these both tasks are very tough to perform. Activity based costing help the

accountants to perform these tasks easily by separating different cost and improving the

process of an organisation. In Innovation Fibreglass Pty Ltd accountants using activity based

costing to perform their duties in more effective way because it help them to identify the areas

where modification is required, when these area are identified then accountants may take

3

system.

It provides such information of such activities that exceeds the assigned costs by

highlighting the inefficiencies in the accounting system, it may lead the managers to reduce

waste with the help of such information. It separates the value adding and non value adding

activities in order to reach the predetermined goals. It is very beneficial for the accountants

while analysing the accounting books to get separate idea of each cost which is concerned with

different activities. The growth in activity based costing supplied an approach for accountants

to lay claim to their strategic relevance. The adoption of ABC in Australia was not able to fulfil

the expectations (Gitman, Juchau and Flanagan, 2015). It is a tool which is used by accountants

to control the extra costs of labour and other overheads. It is very advantageous for managers

and accountants while preparing managerial reports for the organisation it help in

accountability, analysis of different reports and accounting process as it may help to keep the

information of cost separately according to their nature.

b. Explanation of purpose of both the selected journal articles

Purpose of accounting, auditing and accountability journal: The main purpose of this

journal is to determine the use of activity based costing in accounting and accountability and

how facilitates the work of an accountant while analysing the annual reports of an organisation.

Activity based costing is mainly concerned with the allotment of costs to different segments of a

production process, so that the cost of each activity can be recorded accurately and separately.

Accounting is the process of recording informations in the books and activity based costing

facilitate this work of accountants by providing them abstracted information of different costs

that are involved in activities performed by the organisation.

The process of accounting is and accountability are two tasks that are performed by an

accountant and these both tasks are very tough to perform. Activity based costing help the

accountants to perform these tasks easily by separating different cost and improving the

process of an organisation. In Innovation Fibreglass Pty Ltd accountants using activity based

costing to perform their duties in more effective way because it help them to identify the areas

where modification is required, when these area are identified then accountants may take

3

action in form of improvements and increase the level of organisational performance. It also

help the companies to easily attain predetermined goals, reducing complexness in the process

of accounting (Accounting, auditing and accountability Journals. 2018).

The purpose of this journal is to clearly identify the role of activity based costing in

accounting, auditing and accountability. This journal is basically related to the use of these

three elements in different organisations. In accounting, ABC is used to identify the function of

different costs that are assigned to different activities or products from available resources

within the organisation. This journal is mainly concerned with the identification of performance

of a business and its market condition. The journal reflects that how an accountant can observe

and analyse the actual condition of the company with the help of provided information. Activity

based costing may help the accountant while analysing the reports because it is used by the

organisation to control the costs and improve the present performance of different activities

(Songini, Gnan and Malmi, 2013).

Accounting, auditing and accountability journal's purpose is to provide the valuable

content to accountants and their organisations, how they can manage their accounting

information in effective manner. In accountability activity based coating may help the

accountants and other executives of the organisation to analyse the performance and

behaviour of individuals by identifying the costs that are allotted for the activities that are going

to be performed by them. The intention of this journal is to easily determine the impact of

activity based costing on accounting and accountability of an organisation. ABC help the

accountants in decision making because it provides the accurate data which is more reliable. It

helps to set appropriate selling prices for the products as the accurate and reliable data is

available and it help to increase profits for the company.

Accountants of Innovation Fibreglass Pty Ltd are also benefited by ABC as it may

facilitate their work. The purpose of this journal is to observe that how accounting, auditing and

accountability can help a company to grow faster by identifying growth opportunities. In

Innovation Fibreglass Pty Ltd activity based costing has helped the accountants while examining

the financial statements to form a report by providing valuable data abut every activity that

was performed by employees of the organisation (Socea, 2012).

4

help the companies to easily attain predetermined goals, reducing complexness in the process

of accounting (Accounting, auditing and accountability Journals. 2018).

The purpose of this journal is to clearly identify the role of activity based costing in

accounting, auditing and accountability. This journal is basically related to the use of these

three elements in different organisations. In accounting, ABC is used to identify the function of

different costs that are assigned to different activities or products from available resources

within the organisation. This journal is mainly concerned with the identification of performance

of a business and its market condition. The journal reflects that how an accountant can observe

and analyse the actual condition of the company with the help of provided information. Activity

based costing may help the accountant while analysing the reports because it is used by the

organisation to control the costs and improve the present performance of different activities

(Songini, Gnan and Malmi, 2013).

Accounting, auditing and accountability journal's purpose is to provide the valuable

content to accountants and their organisations, how they can manage their accounting

information in effective manner. In accountability activity based coating may help the

accountants and other executives of the organisation to analyse the performance and

behaviour of individuals by identifying the costs that are allotted for the activities that are going

to be performed by them. The intention of this journal is to easily determine the impact of

activity based costing on accounting and accountability of an organisation. ABC help the

accountants in decision making because it provides the accurate data which is more reliable. It

helps to set appropriate selling prices for the products as the accurate and reliable data is

available and it help to increase profits for the company.

Accountants of Innovation Fibreglass Pty Ltd are also benefited by ABC as it may

facilitate their work. The purpose of this journal is to observe that how accounting, auditing and

accountability can help a company to grow faster by identifying growth opportunities. In

Innovation Fibreglass Pty Ltd activity based costing has helped the accountants while examining

the financial statements to form a report by providing valuable data abut every activity that

was performed by employees of the organisation (Socea, 2012).

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

There are two different questions that are set out for the accountants and auditors of

Innovation Fibreglass Pty Ltd. First one is that, do the organisation have used activity based

costing, if yes than how it helped to achieve predetermine organisational goals? Second

question that should be asked is that do activity based costing can be used in auditing process

or not?

Purpose of Journal of management accounting research: The main purpose of this

journal is to identify that activity based costing may or may not facilitate the process of

recording, analysing and controlling the accounting information. In management accounting

reports various information is recorded that directs the managers to make decisions. In

Innovation Fibreglass Pty Ltd activity based costing is used and help the managers to record the

accurate information of cost of each department which is recorded in management accounting

reports such as inventory management report, job cost reports etc.

This journal may help to enhance the knowledge of management accounting and its

different components like its systems, reports etc. Activity based costing help the managers to

make strategic decisions by analysing the actual performance of the company and fields of of

organisation where improvement is required. Managers of the organisation can record the

accurate information with the help of ABC because it may help to record the separate cost of

different activities. It is a system which is mainly used to allot costs to the products according to

their requirements and if the cost exceeds the managers may control it on time, by

implementing ABC. It provides the accurate and transparent data to the managers that will lead

while making different policies for the company to achieve higher level of success and improve

the level of existing performance (Journals of Management Accounting. 2018).

The purpose of this journal is to identify those elements that may help in management

accounting and its elements. Budgetary control is also a part of management accounting in

which managers control the extra costs of different department's activities to save monetary

resources of the company. In budgetary control there is an important role of activity based

costing because it may provide reliable data which can be used to determine future expenses

and consequences that may occur. Managers can make different activities in advance to face

such type of consequences.

5

Innovation Fibreglass Pty Ltd. First one is that, do the organisation have used activity based

costing, if yes than how it helped to achieve predetermine organisational goals? Second

question that should be asked is that do activity based costing can be used in auditing process

or not?

Purpose of Journal of management accounting research: The main purpose of this

journal is to identify that activity based costing may or may not facilitate the process of

recording, analysing and controlling the accounting information. In management accounting

reports various information is recorded that directs the managers to make decisions. In

Innovation Fibreglass Pty Ltd activity based costing is used and help the managers to record the

accurate information of cost of each department which is recorded in management accounting

reports such as inventory management report, job cost reports etc.

This journal may help to enhance the knowledge of management accounting and its

different components like its systems, reports etc. Activity based costing help the managers to

make strategic decisions by analysing the actual performance of the company and fields of of

organisation where improvement is required. Managers of the organisation can record the

accurate information with the help of ABC because it may help to record the separate cost of

different activities. It is a system which is mainly used to allot costs to the products according to

their requirements and if the cost exceeds the managers may control it on time, by

implementing ABC. It provides the accurate and transparent data to the managers that will lead

while making different policies for the company to achieve higher level of success and improve

the level of existing performance (Journals of Management Accounting. 2018).

The purpose of this journal is to identify those elements that may help in management

accounting and its elements. Budgetary control is also a part of management accounting in

which managers control the extra costs of different department's activities to save monetary

resources of the company. In budgetary control there is an important role of activity based

costing because it may provide reliable data which can be used to determine future expenses

and consequences that may occur. Managers can make different activities in advance to face

such type of consequences.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In Innovation Fibreglass Pty Ltd activity based costing is used by the management to get

the accurate data that will help them in decision making and policy formation. It help the

managers to examine exact cost information of different products that are manufactured by the

company. Activity based costing compile the overhead cost for each activity which is performed

by the organisation. It is more beneficial than tradition cost accounting system because that

methods was not able to provide the reliable and valuable data but ABC have succeeded in this

prospect and can provide the actual and more relevant data to the managers (Sajady, Dastgir

and Nejad, 2012).

Management accounting is a tool which help the internal stakeholders to get the

information of organisation's performance, its position and financial status in the market. In

ABC some costs are difficult to allot like chief executives salary, and this journal may help the

managers to dissolve this difficulty by providing solution. The purpose of this journal is to help

the managers to focus on those activities that can generate more profits. This may help to

increase the profitability which may help to enhance the level of performance. It also help to

eliminate possibility of waste and inefficiencies by observing those fields of the organisations

where transformation is required (Saadi Halbouni and Kamal Hassan, 2012).

Journal of Management accounting research aids the managers toward the solutions to

the managerial problems as it can provide the detailed information of management accounting

and solutions to the problems that are faced by a manager while recording the informations in

different reports. A company also have to face different financial problems like late payments

by clients, sudden expenses and this journal may help the managers to identify tools and

techniques that may help to overcome the same in a short period. Activity based costing may

also help to resolve these problems, because it provides the transparent data to the managers

that will help them to identify the problem in advance and plan to resolve the same in less time

(Kanellou and Spathis, 2013).

There are two questions that may be asked to the managers of the organisation. First

one is that do activity based costing facilitate the work of managers? Second is that is it

important for the companies to generate management accounting reports?

6

the accurate data that will help them in decision making and policy formation. It help the

managers to examine exact cost information of different products that are manufactured by the

company. Activity based costing compile the overhead cost for each activity which is performed

by the organisation. It is more beneficial than tradition cost accounting system because that

methods was not able to provide the reliable and valuable data but ABC have succeeded in this

prospect and can provide the actual and more relevant data to the managers (Sajady, Dastgir

and Nejad, 2012).

Management accounting is a tool which help the internal stakeholders to get the

information of organisation's performance, its position and financial status in the market. In

ABC some costs are difficult to allot like chief executives salary, and this journal may help the

managers to dissolve this difficulty by providing solution. The purpose of this journal is to help

the managers to focus on those activities that can generate more profits. This may help to

increase the profitability which may help to enhance the level of performance. It also help to

eliminate possibility of waste and inefficiencies by observing those fields of the organisations

where transformation is required (Saadi Halbouni and Kamal Hassan, 2012).

Journal of Management accounting research aids the managers toward the solutions to

the managerial problems as it can provide the detailed information of management accounting

and solutions to the problems that are faced by a manager while recording the informations in

different reports. A company also have to face different financial problems like late payments

by clients, sudden expenses and this journal may help the managers to identify tools and

techniques that may help to overcome the same in a short period. Activity based costing may

also help to resolve these problems, because it provides the transparent data to the managers

that will help them to identify the problem in advance and plan to resolve the same in less time

(Kanellou and Spathis, 2013).

There are two questions that may be asked to the managers of the organisation. First

one is that do activity based costing facilitate the work of managers? Second is that is it

important for the companies to generate management accounting reports?

6

Purpose of both the journals is to provide valuable information to the managers and

accountants that may help them to find solutions for their problems.

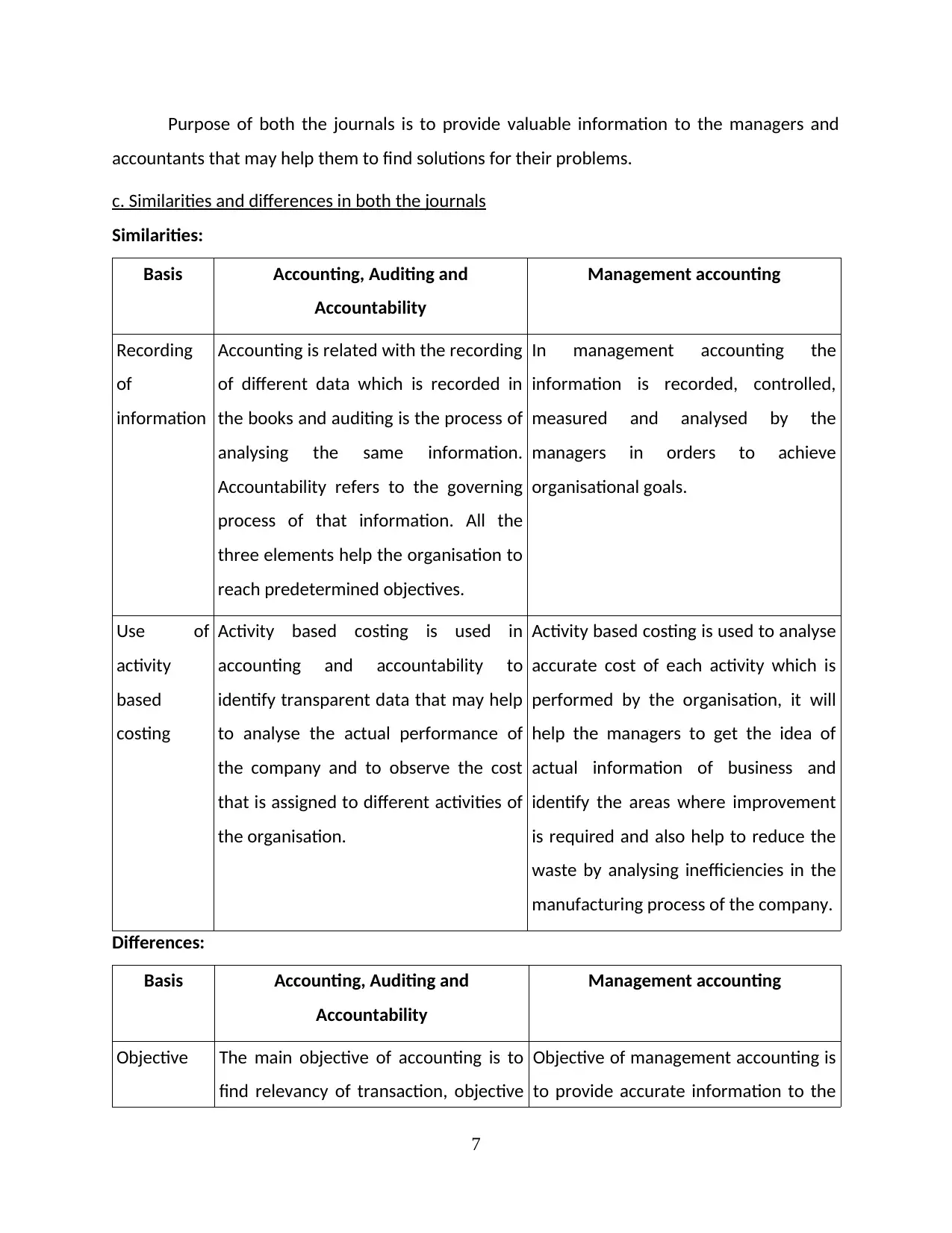

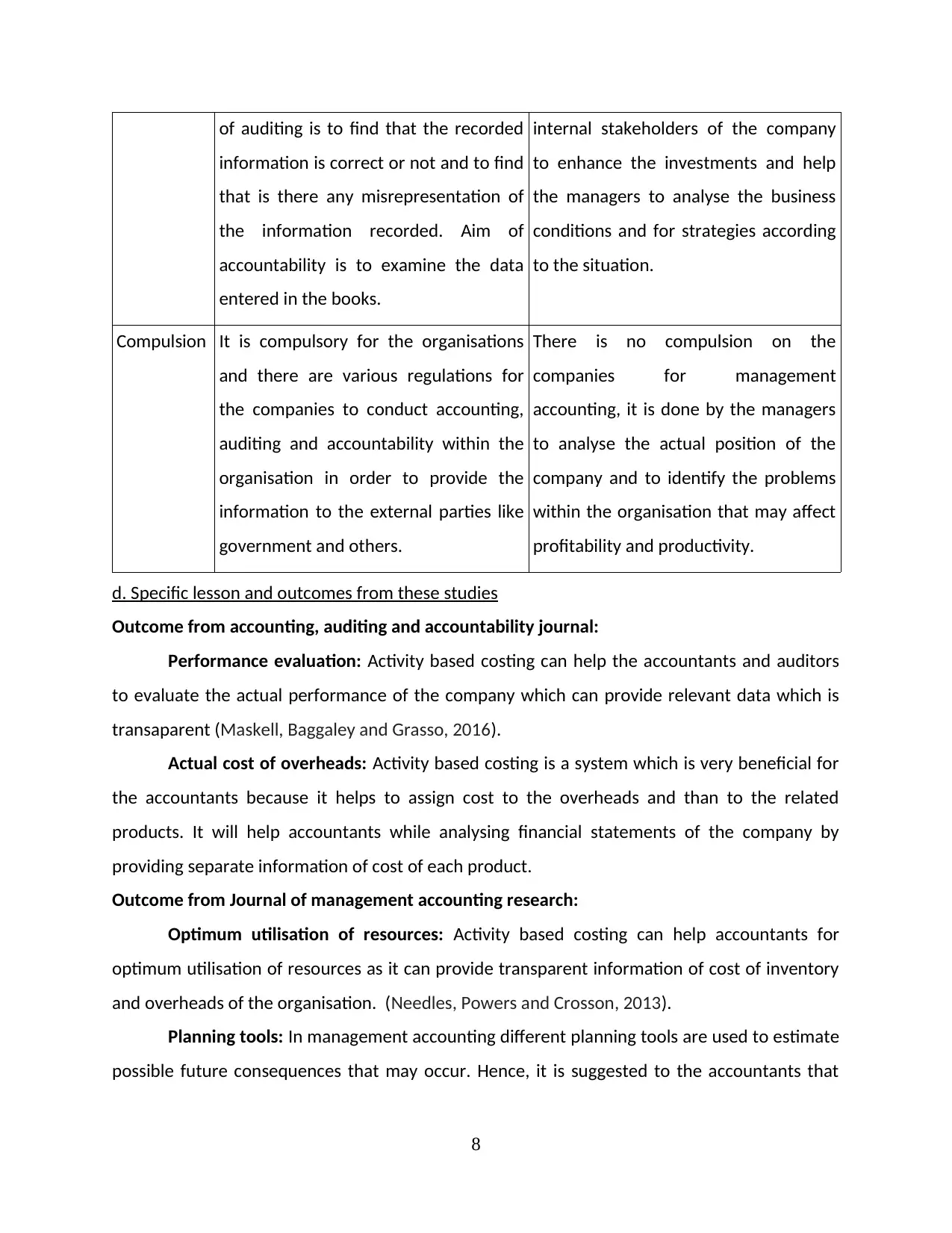

c. Similarities and differences in both the journals

Similarities:

Basis Accounting, Auditing and

Accountability

Management accounting

Recording

of

information

Accounting is related with the recording

of different data which is recorded in

the books and auditing is the process of

analysing the same information.

Accountability refers to the governing

process of that information. All the

three elements help the organisation to

reach predetermined objectives.

In management accounting the

information is recorded, controlled,

measured and analysed by the

managers in orders to achieve

organisational goals.

Use of

activity

based

costing

Activity based costing is used in

accounting and accountability to

identify transparent data that may help

to analyse the actual performance of

the company and to observe the cost

that is assigned to different activities of

the organisation.

Activity based costing is used to analyse

accurate cost of each activity which is

performed by the organisation, it will

help the managers to get the idea of

actual information of business and

identify the areas where improvement

is required and also help to reduce the

waste by analysing inefficiencies in the

manufacturing process of the company.

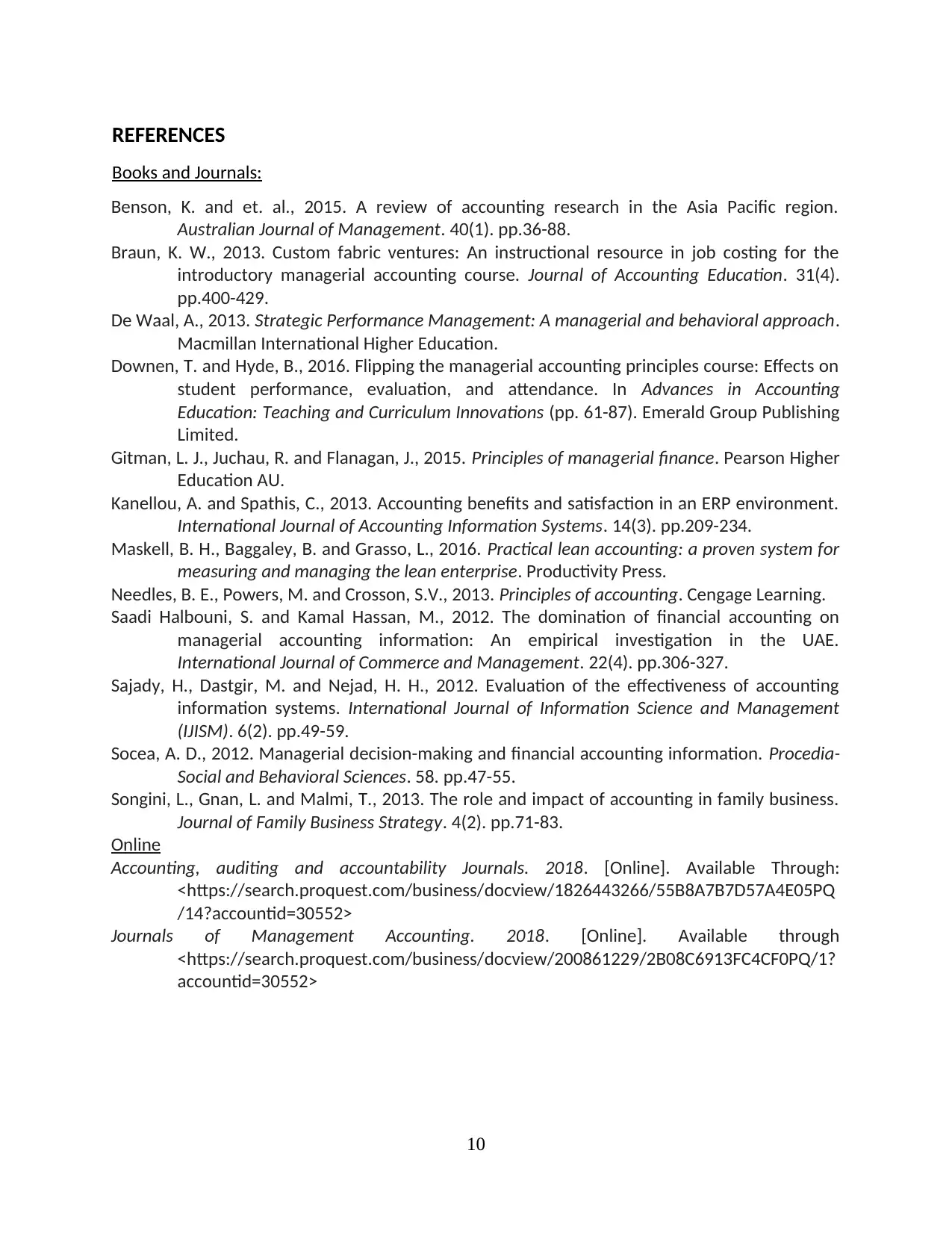

Differences:

Basis Accounting, Auditing and

Accountability

Management accounting

Objective The main objective of accounting is to

find relevancy of transaction, objective

Objective of management accounting is

to provide accurate information to the

7

accountants that may help them to find solutions for their problems.

c. Similarities and differences in both the journals

Similarities:

Basis Accounting, Auditing and

Accountability

Management accounting

Recording

of

information

Accounting is related with the recording

of different data which is recorded in

the books and auditing is the process of

analysing the same information.

Accountability refers to the governing

process of that information. All the

three elements help the organisation to

reach predetermined objectives.

In management accounting the

information is recorded, controlled,

measured and analysed by the

managers in orders to achieve

organisational goals.

Use of

activity

based

costing

Activity based costing is used in

accounting and accountability to

identify transparent data that may help

to analyse the actual performance of

the company and to observe the cost

that is assigned to different activities of

the organisation.

Activity based costing is used to analyse

accurate cost of each activity which is

performed by the organisation, it will

help the managers to get the idea of

actual information of business and

identify the areas where improvement

is required and also help to reduce the

waste by analysing inefficiencies in the

manufacturing process of the company.

Differences:

Basis Accounting, Auditing and

Accountability

Management accounting

Objective The main objective of accounting is to

find relevancy of transaction, objective

Objective of management accounting is

to provide accurate information to the

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of auditing is to find that the recorded

information is correct or not and to find

that is there any misrepresentation of

the information recorded. Aim of

accountability is to examine the data

entered in the books.

internal stakeholders of the company

to enhance the investments and help

the managers to analyse the business

conditions and for strategies according

to the situation.

Compulsion It is compulsory for the organisations

and there are various regulations for

the companies to conduct accounting,

auditing and accountability within the

organisation in order to provide the

information to the external parties like

government and others.

There is no compulsion on the

companies for management

accounting, it is done by the managers

to analyse the actual position of the

company and to identify the problems

within the organisation that may affect

profitability and productivity.

d. Specific lesson and outcomes from these studies

Outcome from accounting, auditing and accountability journal:

Performance evaluation: Activity based costing can help the accountants and auditors

to evaluate the actual performance of the company which can provide relevant data which is

transaparent (Maskell, Baggaley and Grasso, 2016).

Actual cost of overheads: Activity based costing is a system which is very beneficial for

the accountants because it helps to assign cost to the overheads and than to the related

products. It will help accountants while analysing financial statements of the company by

providing separate information of cost of each product.

Outcome from Journal of management accounting research:

Optimum utilisation of resources: Activity based costing can help accountants for

optimum utilisation of resources as it can provide transparent information of cost of inventory

and overheads of the organisation. (Needles, Powers and Crosson, 2013).

Planning tools: In management accounting different planning tools are used to estimate

possible future consequences that may occur. Hence, it is suggested to the accountants that

8

information is correct or not and to find

that is there any misrepresentation of

the information recorded. Aim of

accountability is to examine the data

entered in the books.

internal stakeholders of the company

to enhance the investments and help

the managers to analyse the business

conditions and for strategies according

to the situation.

Compulsion It is compulsory for the organisations

and there are various regulations for

the companies to conduct accounting,

auditing and accountability within the

organisation in order to provide the

information to the external parties like

government and others.

There is no compulsion on the

companies for management

accounting, it is done by the managers

to analyse the actual position of the

company and to identify the problems

within the organisation that may affect

profitability and productivity.

d. Specific lesson and outcomes from these studies

Outcome from accounting, auditing and accountability journal:

Performance evaluation: Activity based costing can help the accountants and auditors

to evaluate the actual performance of the company which can provide relevant data which is

transaparent (Maskell, Baggaley and Grasso, 2016).

Actual cost of overheads: Activity based costing is a system which is very beneficial for

the accountants because it helps to assign cost to the overheads and than to the related

products. It will help accountants while analysing financial statements of the company by

providing separate information of cost of each product.

Outcome from Journal of management accounting research:

Optimum utilisation of resources: Activity based costing can help accountants for

optimum utilisation of resources as it can provide transparent information of cost of inventory

and overheads of the organisation. (Needles, Powers and Crosson, 2013).

Planning tools: In management accounting different planning tools are used to estimate

possible future consequences that may occur. Hence, it is suggested to the accountants that

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

they should use planning tools like forecasting, contingency and scenario tool in management

accounting. These tools may help to be prepare for possible risk or uncertainty.

CONCLUSION

From the above project report it has been analysed that accounting, auditing,

accountability and management accounting all of them are very important because it may help

the managers and accountants to determine the actual information of the business and also

provide the valuable data of a business. Activity based costing is a tool which is used by various

companies to observe accurate information of cost involved in different activities of the

company.

9

accounting. These tools may help to be prepare for possible risk or uncertainty.

CONCLUSION

From the above project report it has been analysed that accounting, auditing,

accountability and management accounting all of them are very important because it may help

the managers and accountants to determine the actual information of the business and also

provide the valuable data of a business. Activity based costing is a tool which is used by various

companies to observe accurate information of cost involved in different activities of the

company.

9

REFERENCES

Books and Journals:

Benson, K. and et. al., 2015. A review of accounting research in the Asia Pacific region.

Australian Journal of Management. 40(1). pp.36-88.

Braun, K. W., 2013. Custom fabric ventures: An instructional resource in job costing for the

introductory managerial accounting course. Journal of Accounting Education. 31(4).

pp.400-429.

De Waal, A., 2013. Strategic Performance Management: A managerial and behavioral approach.

Macmillan International Higher Education.

Downen, T. and Hyde, B., 2016. Flipping the managerial accounting principles course: Effects on

student performance, evaluation, and attendance. In Advances in Accounting

Education: Teaching and Curriculum Innovations (pp. 61-87). Emerald Group Publishing

Limited.

Gitman, L. J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson Higher

Education AU.

Kanellou, A. and Spathis, C., 2013. Accounting benefits and satisfaction in an ERP environment.

International Journal of Accounting Information Systems. 14(3). pp.209-234.

Maskell, B. H., Baggaley, B. and Grasso, L., 2016. Practical lean accounting: a proven system for

measuring and managing the lean enterprise. Productivity Press.

Needles, B. E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage Learning.

Saadi Halbouni, S. and Kamal Hassan, M., 2012. The domination of financial accounting on

managerial accounting information: An empirical investigation in the UAE.

International Journal of Commerce and Management. 22(4). pp.306-327.

Sajady, H., Dastgir, M. and Nejad, H. H., 2012. Evaluation of the effectiveness of accounting

information systems. International Journal of Information Science and Management

(IJISM). 6(2). pp.49-59.

Socea, A. D., 2012. Managerial decision-making and financial accounting information. Procedia-

Social and Behavioral Sciences. 58. pp.47-55.

Songini, L., Gnan, L. and Malmi, T., 2013. The role and impact of accounting in family business.

Journal of Family Business Strategy. 4(2). pp.71-83.

Online

Accounting, auditing and accountability Journals. 2018. [Online]. Available Through:

<https://search.proquest.com/business/docview/1826443266/55B8A7B7D57A4E05PQ

/14?accountid=30552>

Journals of Management Accounting. 2018. [Online]. Available through

<https://search.proquest.com/business/docview/200861229/2B08C6913FC4CF0PQ/1?

accountid=30552>

10

Books and Journals:

Benson, K. and et. al., 2015. A review of accounting research in the Asia Pacific region.

Australian Journal of Management. 40(1). pp.36-88.

Braun, K. W., 2013. Custom fabric ventures: An instructional resource in job costing for the

introductory managerial accounting course. Journal of Accounting Education. 31(4).

pp.400-429.

De Waal, A., 2013. Strategic Performance Management: A managerial and behavioral approach.

Macmillan International Higher Education.

Downen, T. and Hyde, B., 2016. Flipping the managerial accounting principles course: Effects on

student performance, evaluation, and attendance. In Advances in Accounting

Education: Teaching and Curriculum Innovations (pp. 61-87). Emerald Group Publishing

Limited.

Gitman, L. J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson Higher

Education AU.

Kanellou, A. and Spathis, C., 2013. Accounting benefits and satisfaction in an ERP environment.

International Journal of Accounting Information Systems. 14(3). pp.209-234.

Maskell, B. H., Baggaley, B. and Grasso, L., 2016. Practical lean accounting: a proven system for

measuring and managing the lean enterprise. Productivity Press.

Needles, B. E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage Learning.

Saadi Halbouni, S. and Kamal Hassan, M., 2012. The domination of financial accounting on

managerial accounting information: An empirical investigation in the UAE.

International Journal of Commerce and Management. 22(4). pp.306-327.

Sajady, H., Dastgir, M. and Nejad, H. H., 2012. Evaluation of the effectiveness of accounting

information systems. International Journal of Information Science and Management

(IJISM). 6(2). pp.49-59.

Socea, A. D., 2012. Managerial decision-making and financial accounting information. Procedia-

Social and Behavioral Sciences. 58. pp.47-55.

Songini, L., Gnan, L. and Malmi, T., 2013. The role and impact of accounting in family business.

Journal of Family Business Strategy. 4(2). pp.71-83.

Online

Accounting, auditing and accountability Journals. 2018. [Online]. Available Through:

<https://search.proquest.com/business/docview/1826443266/55B8A7B7D57A4E05PQ

/14?accountid=30552>

Journals of Management Accounting. 2018. [Online]. Available through

<https://search.proquest.com/business/docview/200861229/2B08C6913FC4CF0PQ/1?

accountid=30552>

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.