Accounting Research and Publication Analysis

VerifiedAdded on 2020/10/23

|16

|3901

|436

AI Summary

This assignment involves analyzing various studies related to accounting research. The provided list includes articles that discuss different aspects of accounting, such as the importance of social responsibility in corporations, the implications of research on accounting conservatism, and the use of big data in accounting. The studies also touch upon managerial overconfidence and its effects on audit fees, as well as the signaling effects of scholarly profiles on editorial teams. Additionally, there are papers that explore the construct shift in accounting research, the integration of corporate sustainability assessment with management accounting, control, and reporting, and the use of balance scorecards in performance management. The assignment likely requires students to read and analyze these studies, possibly extracting key points or discussing their relevance to accounting practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managerial

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION..............................................................................................................1

PART 1.............................................................................................................................1

1. Types of cost which is discussed in given case...................................................1

2. Best alternative to purchase appliance ..............................................................3

3. The cost that couple launder clothes ..................................................................4

4. Should frank hire additional employee................................................................5

5. The number of employee which need to hire .....................................................6

PART B ........................................................................................................................... 7

1. Management accounting system in Apple computer and Canon ........................7

2. Management accounting contribute to the innovation process..........................10

3. Specific lessons from article research ..............................................................11

CONCLUSION............................................................................................................... 12

REFERENCE................................................................................................................. 13

INTRODUCTION..............................................................................................................1

PART 1.............................................................................................................................1

1. Types of cost which is discussed in given case...................................................1

2. Best alternative to purchase appliance ..............................................................3

3. The cost that couple launder clothes ..................................................................4

4. Should frank hire additional employee................................................................5

5. The number of employee which need to hire .....................................................6

PART B ........................................................................................................................... 7

1. Management accounting system in Apple computer and Canon ........................7

2. Management accounting contribute to the innovation process..........................10

3. Specific lessons from article research ..............................................................11

CONCLUSION............................................................................................................... 12

REFERENCE................................................................................................................. 13

INTRODUCTION

Managerial accounting refers to a study of accounts which is prepared by the

manager of the organisation in order to make better economic business decisions. It is a

profession which contains partnership in management decision. Moreover,

management accounting is essential tool for firm's manager as it helps to prepare

accounts, collect financial information and built financial statement that is used to make

effective business. Every enterprise whether small, medium or large size uses

management accounting to keep proper records of financial transaction which gives true

and fair views in company (Alkordi, Al-Nimer and Dabaghia, 2017). The present report

will discuss about Nanna's house that is a child care business run by Douglas and

Pamela. They provide child care facility business at their home and charging some fixed

amounts for take caring. The main aim of this report is to understand cost and

accounting concept that help to make decision in order to achieve organisation's goals.

This report will discuss about cost of organisation, relevancy of information and launder

cost which affects organisation business.

PART 1

1. Types of cost which is discussed in given case

Accounting is the study of financial information which is recoded, collected and

presented by manager of the business enterprises. The main object is to understand the

financial data and use it optimally which helps to increase the profitability. Cost means

amount of money which is spent on manufacturing and creating a good or services.

Cost is the monetary value containing expenditure for rendering services, products, raw

1

Managerial accounting refers to a study of accounts which is prepared by the

manager of the organisation in order to make better economic business decisions. It is a

profession which contains partnership in management decision. Moreover,

management accounting is essential tool for firm's manager as it helps to prepare

accounts, collect financial information and built financial statement that is used to make

effective business. Every enterprise whether small, medium or large size uses

management accounting to keep proper records of financial transaction which gives true

and fair views in company (Alkordi, Al-Nimer and Dabaghia, 2017). The present report

will discuss about Nanna's house that is a child care business run by Douglas and

Pamela. They provide child care facility business at their home and charging some fixed

amounts for take caring. The main aim of this report is to understand cost and

accounting concept that help to make decision in order to achieve organisation's goals.

This report will discuss about cost of organisation, relevancy of information and launder

cost which affects organisation business.

PART 1

1. Types of cost which is discussed in given case

Accounting is the study of financial information which is recoded, collected and

presented by manager of the business enterprises. The main object is to understand the

financial data and use it optimally which helps to increase the profitability. Cost means

amount of money which is spent on manufacturing and creating a good or services.

Cost is the monetary value containing expenditure for rendering services, products, raw

1

material and employees who are working in business industry (Christensen, Nikolaev

and Wittenberg‐Moerman, 2016).

In this case, Douglas and Pamela are the managers of organisation who has

determined different types of cost such as-

Fixed cost: The cost which occurs on regular basis and remain constant is

known as fixed cost. It contains rent, salary and administrative cost within business

organisation. As given in case scenario, annual insurance is fixed cost $3840, the

overall cost of washer and dryer is $420 and $380 which will not change. Moreover, the

total cost of delivery the appliance is $35 that is fixed and the cost of installation is also

fixed $43.72 which will not vary regardless the activity of couple. The cost of mileage at

a rate of $0.56 per mile cannot vary with the total mile driven because it is given in case

which is fixed for 6 miles (two way).

Variable cost: The variable expenses covers cost of raw material, labour,

packaging, finished goods that cab be change proportionately. In the discussed case

the variable cost of meal and snacks expenses that can be change after increasing and

decreasing the number of children. The meal charges in Nanna's house are $ 800 per

month for each child. It provides full day caring services if any person wants extra time

to take care of child than they have to pay more fees as decided $ 15 per hour.

Additionally, Douglas and Pamela provide meals and snacks services two time that help

to increase customer loyalty. The meal and snacks cost is $ 3.20 per child that can vary

with the change in number of children. The utility cost $50 that can be vary according to

the member in daycare. The cost of laundry which they can launder themselves at a

2

and Wittenberg‐Moerman, 2016).

In this case, Douglas and Pamela are the managers of organisation who has

determined different types of cost such as-

Fixed cost: The cost which occurs on regular basis and remain constant is

known as fixed cost. It contains rent, salary and administrative cost within business

organisation. As given in case scenario, annual insurance is fixed cost $3840, the

overall cost of washer and dryer is $420 and $380 which will not change. Moreover, the

total cost of delivery the appliance is $35 that is fixed and the cost of installation is also

fixed $43.72 which will not vary regardless the activity of couple. The cost of mileage at

a rate of $0.56 per mile cannot vary with the total mile driven because it is given in case

which is fixed for 6 miles (two way).

Variable cost: The variable expenses covers cost of raw material, labour,

packaging, finished goods that cab be change proportionately. In the discussed case

the variable cost of meal and snacks expenses that can be change after increasing and

decreasing the number of children. The meal charges in Nanna's house are $ 800 per

month for each child. It provides full day caring services if any person wants extra time

to take care of child than they have to pay more fees as decided $ 15 per hour.

Additionally, Douglas and Pamela provide meals and snacks services two time that help

to increase customer loyalty. The meal and snacks cost is $ 3.20 per child that can vary

with the change in number of children. The utility cost $50 that can be vary according to

the member in daycare. The cost of laundry which they can launder themselves at a

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

cost of $8 per week that has chances to be change with the number of weeks

laundering (Duellman, Hurwitz and Sun, 2015).

Semi variable cost: This is the mix cost which are arises by for certain level of

production and can be variable after the production increases as expected. If business

organisation does not manufacture any product, then cost of products will be same. As

per Nanna's house case scenario, the semi variable costs are defined as the hiring the

number of employee which is fixed up to three number of student. Such as if 4 child

increase then the frank need to hire 2 employees. In case of increasing the children up

to 14 then need to hire 3 employees to take care of children, so it will be consider in

semi variable cost (Huber, 2015) .

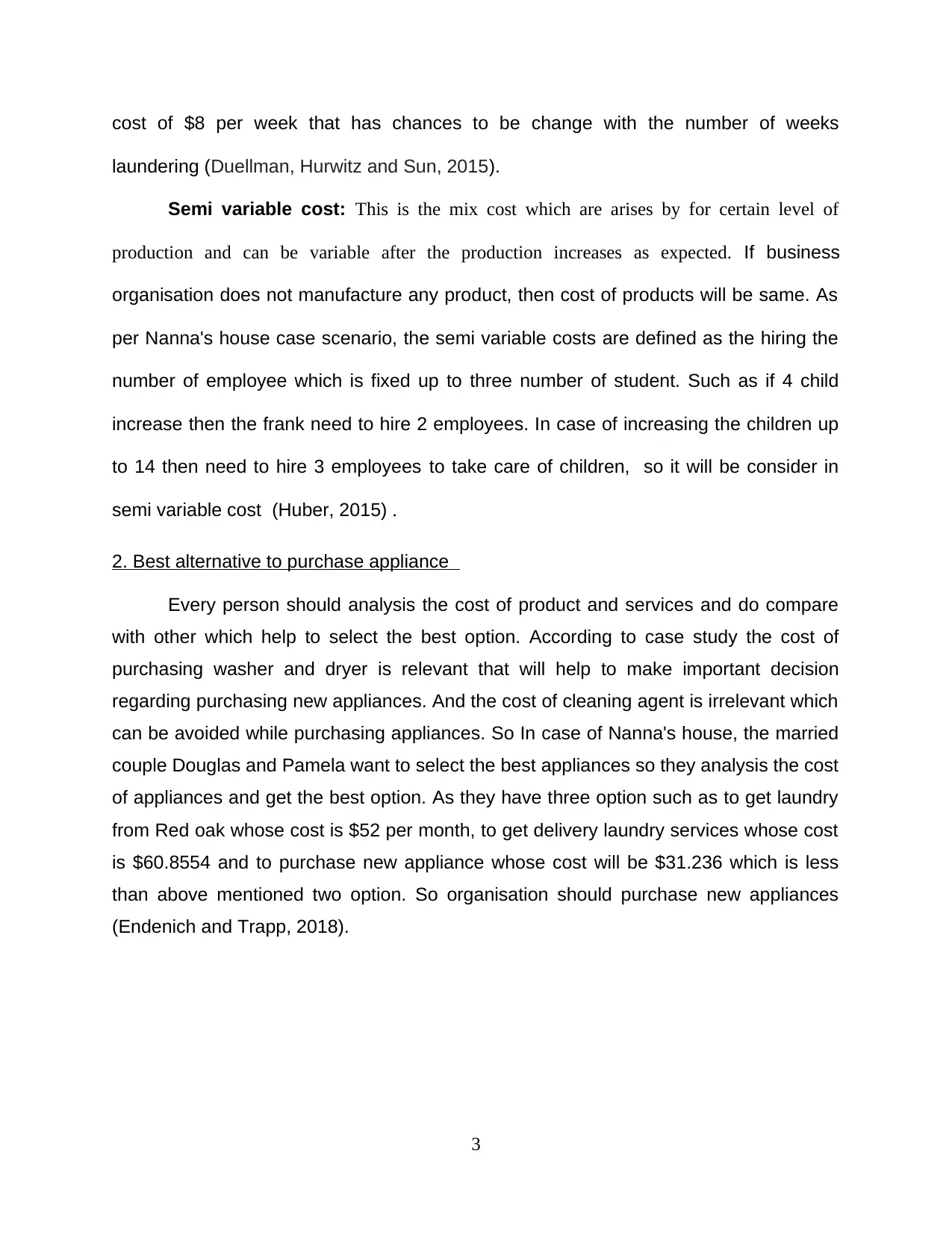

2. Best alternative to purchase appliance

Every person should analysis the cost of product and services and do compare

with other which help to select the best option. According to case study the cost of

purchasing washer and dryer is relevant that will help to make important decision

regarding purchasing new appliances. And the cost of cleaning agent is irrelevant which

can be avoided while purchasing appliances. So In case of Nanna's house, the married

couple Douglas and Pamela want to select the best appliances so they analysis the cost

of appliances and get the best option. As they have three option such as to get laundry

from Red oak whose cost is $52 per month, to get delivery laundry services whose cost

is $60.8554 and to purchase new appliance whose cost will be $31.236 which is less

than above mentioned two option. So organisation should purchase new appliances

(Endenich and Trapp, 2018).

3

laundering (Duellman, Hurwitz and Sun, 2015).

Semi variable cost: This is the mix cost which are arises by for certain level of

production and can be variable after the production increases as expected. If business

organisation does not manufacture any product, then cost of products will be same. As

per Nanna's house case scenario, the semi variable costs are defined as the hiring the

number of employee which is fixed up to three number of student. Such as if 4 child

increase then the frank need to hire 2 employees. In case of increasing the children up

to 14 then need to hire 3 employees to take care of children, so it will be consider in

semi variable cost (Huber, 2015) .

2. Best alternative to purchase appliance

Every person should analysis the cost of product and services and do compare

with other which help to select the best option. According to case study the cost of

purchasing washer and dryer is relevant that will help to make important decision

regarding purchasing new appliances. And the cost of cleaning agent is irrelevant which

can be avoided while purchasing appliances. So In case of Nanna's house, the married

couple Douglas and Pamela want to select the best appliances so they analysis the cost

of appliances and get the best option. As they have three option such as to get laundry

from Red oak whose cost is $52 per month, to get delivery laundry services whose cost

is $60.8554 and to purchase new appliance whose cost will be $31.236 which is less

than above mentioned two option. So organisation should purchase new appliances

(Endenich and Trapp, 2018).

3

3. The cost that couple launder clothes

The couple has two option to get laundry clothes like laundry from Red oak and

dry cleaning and they can launder the clothes by itself. Both costs are defined as-

Option:1 To launder the clothes by them self (Laundromat)

Delivery laundry service

6 miles for 4.33 weeks (6*4.33) 25.98 0.56 per mile 14.5488

$8 Per week cost of laundry 34.64

Cost of detergent or fabric sheer per

month (35/3)

11.6666666

667

Total cost of appliance per month

60.8554666

667

Option:2 To launder the cloth from Red Oak

Option:3

In case of Purchase new appliance

Particulars $

Washer and dryer cost(420+380) 800

Additional accessories for both appliances 43.72

Delivering cost 35

Total cost of appliances 878.72

Annual Depreciation 109.84

4

The couple has two option to get laundry clothes like laundry from Red oak and

dry cleaning and they can launder the clothes by itself. Both costs are defined as-

Option:1 To launder the clothes by them self (Laundromat)

Delivery laundry service

6 miles for 4.33 weeks (6*4.33) 25.98 0.56 per mile 14.5488

$8 Per week cost of laundry 34.64

Cost of detergent or fabric sheer per

month (35/3)

11.6666666

667

Total cost of appliance per month

60.8554666

667

Option:2 To launder the cloth from Red Oak

Option:3

In case of Purchase new appliance

Particulars $

Washer and dryer cost(420+380) 800

Additional accessories for both appliances 43.72

Delivering cost 35

Total cost of appliances 878.72

Annual Depreciation 109.84

4

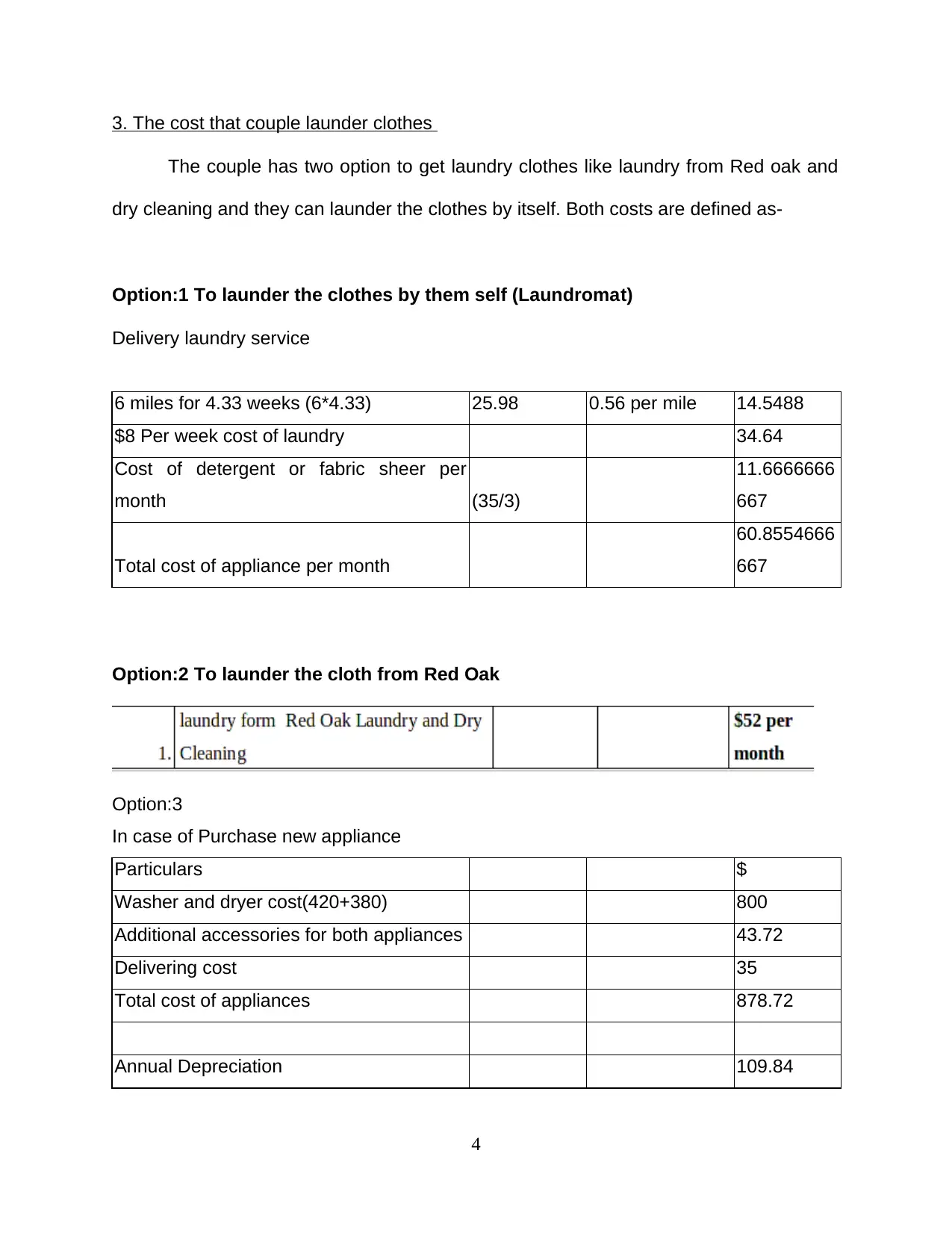

Per month Depreciation

9.15333333

33

Incremental cost (120+145)

22.0833333

333

31.2366666

667

4. Should frank hire additional employee

The cost of organisation in case of 6 children

Income statement for month $

Revenue

Fees from each child 800*6 4800

Expenses

State and annual fees 225/12 18.75

Insurance charges 3840/12 320

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Total cost 1229.75

Net profit 3570.25

If an additional employee is hired

Revenue

Fees from each child 800*9 7200

5

9.15333333

33

Incremental cost (120+145)

22.0833333

333

31.2366666

667

4. Should frank hire additional employee

The cost of organisation in case of 6 children

Income statement for month $

Revenue

Fees from each child 800*6 4800

Expenses

State and annual fees 225/12 18.75

Insurance charges 3840/12 320

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Total cost 1229.75

Net profit 3570.25

If an additional employee is hired

Revenue

Fees from each child 800*9 7200

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

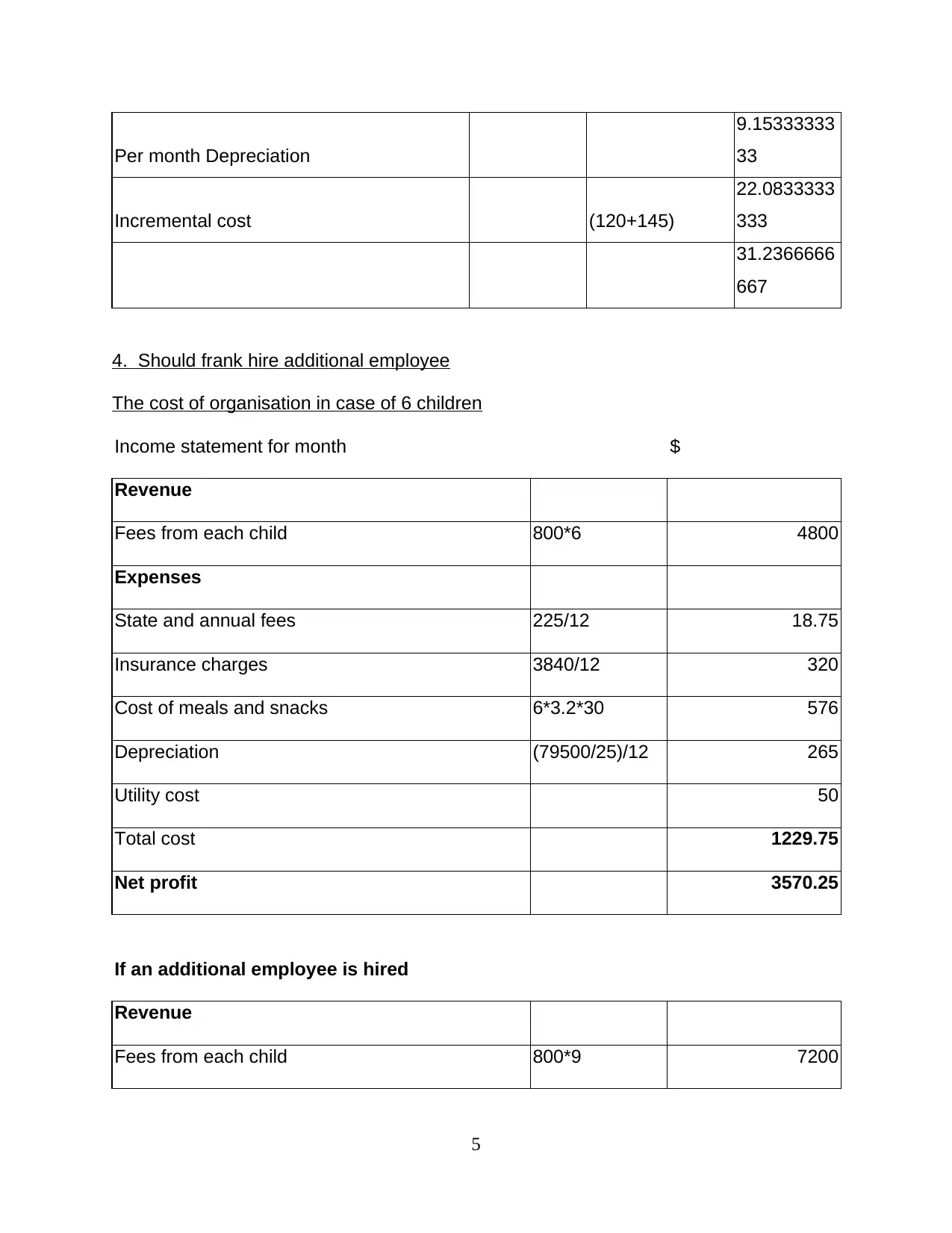

Expenses

State and annual fees 3.125*9 28.125

Insurance charges 3840/12 320

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Salary to additional employee 40*9*4.33 1558.8

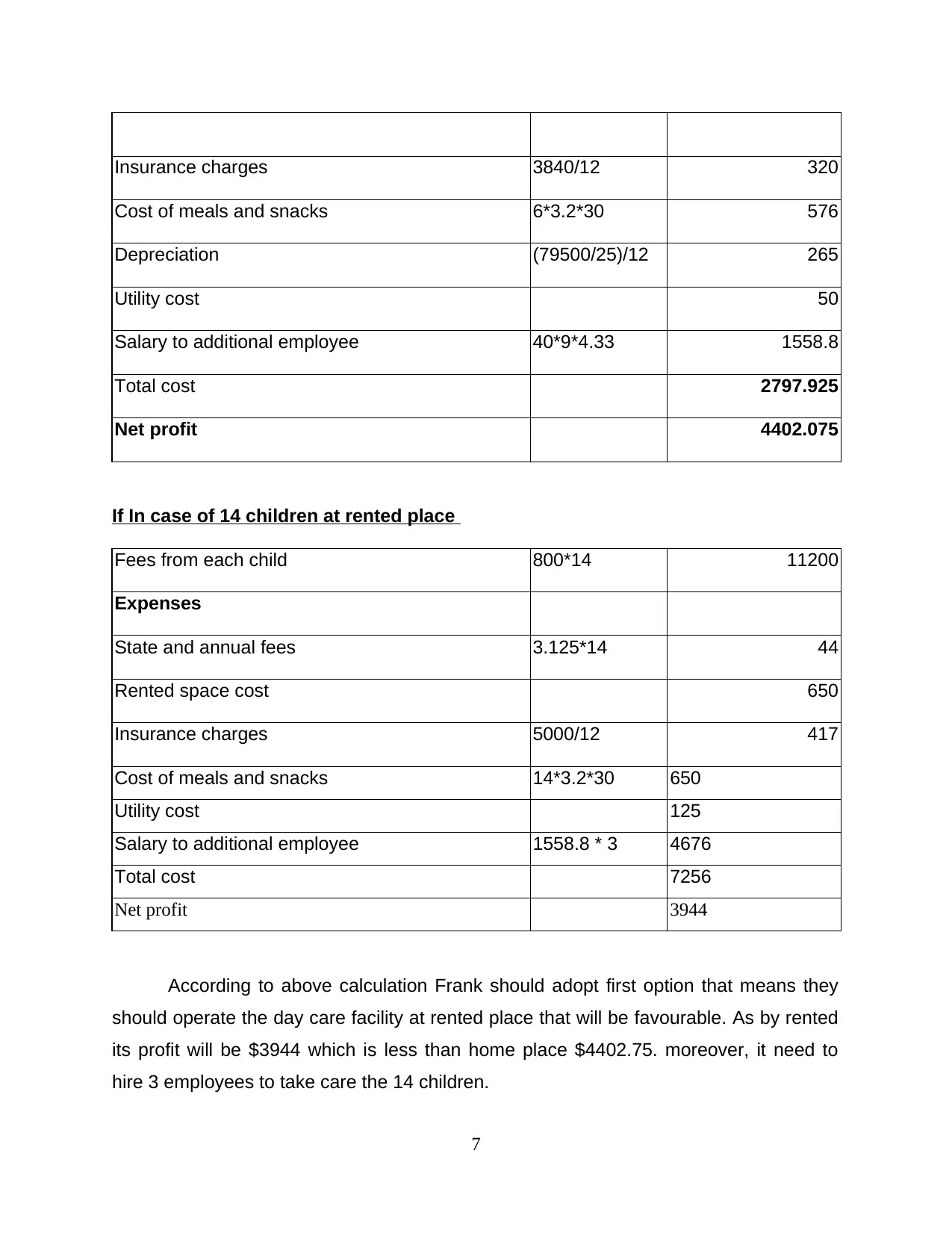

Total cost 2797.925

Net profit 4402.075

If the organisation hires an additional employee then it will get high profit than

previous as shown in above calculation. Because by hiring an additional employee the

fees from children will be increases and the utility cost will be decreased (Kholis and

Maksum, 2017).

5. The number of employee which need to hire

In case of 9 children

If an additional employee is hired

Revenue

Fees from each child 800*9 7200

Expenses

State and annual fees 3.125*9 28.125

6

State and annual fees 3.125*9 28.125

Insurance charges 3840/12 320

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Salary to additional employee 40*9*4.33 1558.8

Total cost 2797.925

Net profit 4402.075

If the organisation hires an additional employee then it will get high profit than

previous as shown in above calculation. Because by hiring an additional employee the

fees from children will be increases and the utility cost will be decreased (Kholis and

Maksum, 2017).

5. The number of employee which need to hire

In case of 9 children

If an additional employee is hired

Revenue

Fees from each child 800*9 7200

Expenses

State and annual fees 3.125*9 28.125

6

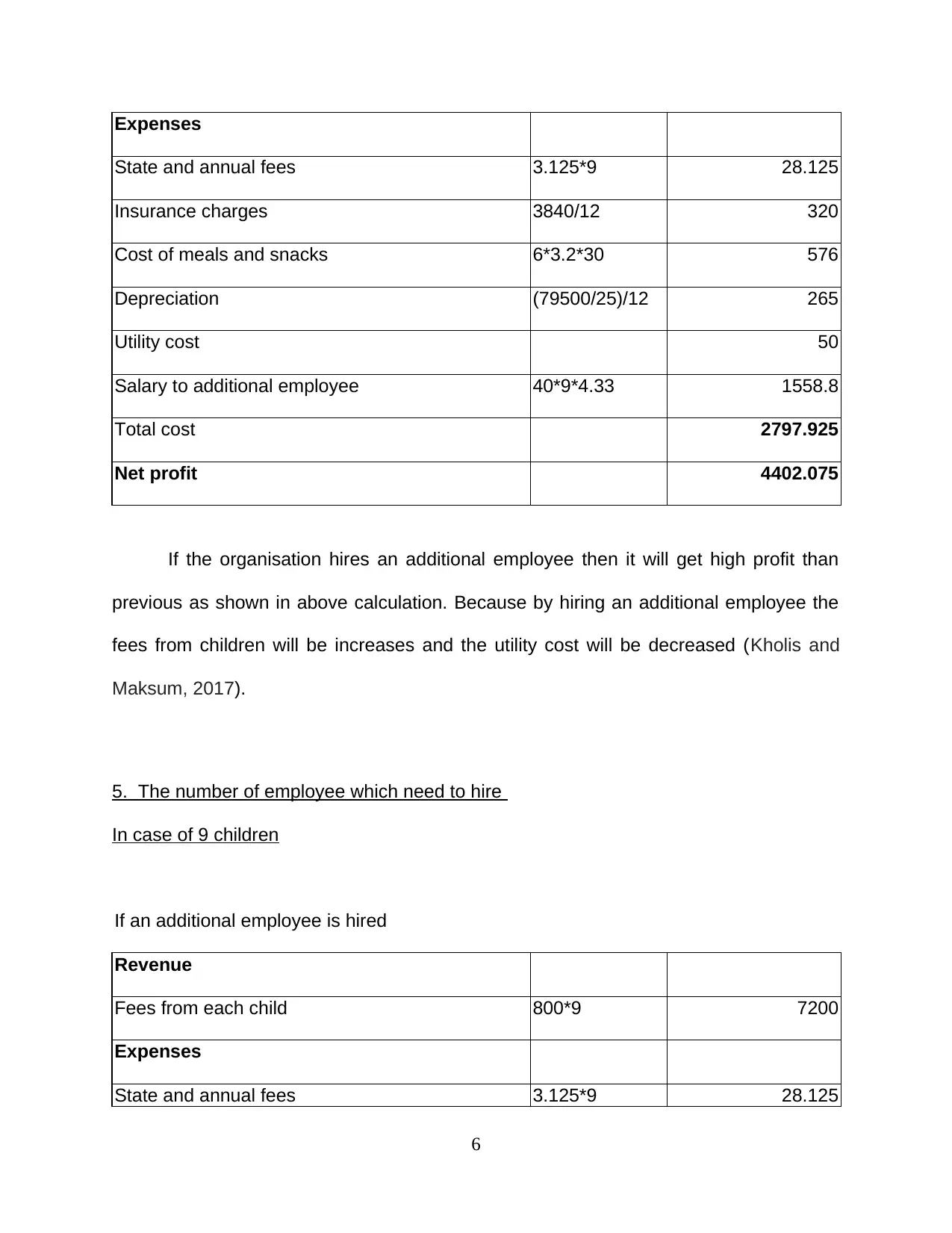

Insurance charges 3840/12 320

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Salary to additional employee 40*9*4.33 1558.8

Total cost 2797.925

Net profit 4402.075

If In case of 14 children at rented place

Fees from each child 800*14 11200

Expenses

State and annual fees 3.125*14 44

Rented space cost 650

Insurance charges 5000/12 417

Cost of meals and snacks 14*3.2*30 650

Utility cost 125

Salary to additional employee 1558.8 * 3 4676

Total cost 7256

Net profit 3944

According to above calculation Frank should adopt first option that means they

should operate the day care facility at rented place that will be favourable. As by rented

its profit will be $3944 which is less than home place $4402.75. moreover, it need to

hire 3 employees to take care the 14 children.

7

Cost of meals and snacks 6*3.2*30 576

Depreciation (79500/25)/12 265

Utility cost 50

Salary to additional employee 40*9*4.33 1558.8

Total cost 2797.925

Net profit 4402.075

If In case of 14 children at rented place

Fees from each child 800*14 11200

Expenses

State and annual fees 3.125*14 44

Rented space cost 650

Insurance charges 5000/12 417

Cost of meals and snacks 14*3.2*30 650

Utility cost 125

Salary to additional employee 1558.8 * 3 4676

Total cost 7256

Net profit 3944

According to above calculation Frank should adopt first option that means they

should operate the day care facility at rented place that will be favourable. As by rented

its profit will be $3944 which is less than home place $4402.75. moreover, it need to

hire 3 employees to take care the 14 children.

7

PART B

1. Management accounting system in Apple computer and Canon

Management accounting system are helpful to make planning for future in order

to achieve the organisation goals. Business concern uses financial information to take

the correct action. Accounting system help to maintain all records of transaction and use

it properly. It contains the internal and external information which help to make budget,

financial statement and management report in order to check the ability of business

organisation (Maas, Schaltegger and Crutzen, 2016). Additionally, this is the procedure

of defining, collecting, studying and improving the performance of business firm. For

instance, Canon and Apple computer uses different management accounting system

that help to make effective business decision and also help to set the prices of products

and services. Different types of management accounting system are described as-

Cost reliability improvement system: This system is used by Cannon and

Apple computer in order to improve the cost of manufactured product. For instance,

Canon has introduced PPC in 1969 by using original technology. By 1982, its demand

was levelling off and appear for fice market saturation. Then Canon has introduced new

product that was small copier or mini copier which can be use in offices as well as at

home easily. This mini copier was very effective such as light weight and compact which

gives a clear copy at less than 50 ponds which was less costly. The manager of Canon

has state that it might be required for service and can be maintain simply. This product

was feasible because it is not expensive, no extra maintenance required and will be

useful for customer to acquire mini copier (Mora and Walker, 2015).

8

1. Management accounting system in Apple computer and Canon

Management accounting system are helpful to make planning for future in order

to achieve the organisation goals. Business concern uses financial information to take

the correct action. Accounting system help to maintain all records of transaction and use

it properly. It contains the internal and external information which help to make budget,

financial statement and management report in order to check the ability of business

organisation (Maas, Schaltegger and Crutzen, 2016). Additionally, this is the procedure

of defining, collecting, studying and improving the performance of business firm. For

instance, Canon and Apple computer uses different management accounting system

that help to make effective business decision and also help to set the prices of products

and services. Different types of management accounting system are described as-

Cost reliability improvement system: This system is used by Cannon and

Apple computer in order to improve the cost of manufactured product. For instance,

Canon has introduced PPC in 1969 by using original technology. By 1982, its demand

was levelling off and appear for fice market saturation. Then Canon has introduced new

product that was small copier or mini copier which can be use in offices as well as at

home easily. This mini copier was very effective such as light weight and compact which

gives a clear copy at less than 50 ponds which was less costly. The manager of Canon

has state that it might be required for service and can be maintain simply. This product

was feasible because it is not expensive, no extra maintenance required and will be

useful for customer to acquire mini copier (Mora and Walker, 2015).

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The Apple computer company also focused cost of product and features of

computer. Such as Apple thought to entire the Mac project with new features by 1988.

This project will help to attract the customer by providing the best quality and features.

Moreover, the cost of product is high because it maintain the quality of products.

Quality control system: This system helped Canon and Apple computer to

manufacture the best quality of products as customer wants. It mainly considers quality

which need to maintain by manufactures. As Canon and Apple computer bring new

innovation to produce new product like mini copier and Mac project. For instance,

Canon provide a best quality of mini copier which does not need to spend extra

expenses.

The Apple computer is well known company who thought about entire Mac

project which is of best quality and will attract the customer by providing the new

innovative products. Moreover, both company uses quality control system which help to

maintain the best quality.

This is useful system such as by maintaining the quality the number of customer

will increase and profitability of the company will also be increased (Nica, 2017).

Job order costing system: This system is used to delegate and gather the

producing cost of particular unit of output. For Example, Canon organisation used this

system to match the flow of cost to physical flow of products as assign the assign the

task accurately among employees.

The Apple's manager prepares the budget after thinking about new innovation

process. The research and development department of Apple company visits the

market and get information what features customer wants and then make assign the

9

computer. Such as Apple thought to entire the Mac project with new features by 1988.

This project will help to attract the customer by providing the best quality and features.

Moreover, the cost of product is high because it maintain the quality of products.

Quality control system: This system helped Canon and Apple computer to

manufacture the best quality of products as customer wants. It mainly considers quality

which need to maintain by manufactures. As Canon and Apple computer bring new

innovation to produce new product like mini copier and Mac project. For instance,

Canon provide a best quality of mini copier which does not need to spend extra

expenses.

The Apple computer is well known company who thought about entire Mac

project which is of best quality and will attract the customer by providing the new

innovative products. Moreover, both company uses quality control system which help to

maintain the best quality.

This is useful system such as by maintaining the quality the number of customer

will increase and profitability of the company will also be increased (Nica, 2017).

Job order costing system: This system is used to delegate and gather the

producing cost of particular unit of output. For Example, Canon organisation used this

system to match the flow of cost to physical flow of products as assign the assign the

task accurately among employees.

The Apple's manager prepares the budget after thinking about new innovation

process. The research and development department of Apple company visits the

market and get information what features customer wants and then make assign the

9

work between employee. They assign the work according to their specialisation

accomplish the target.

This is beneficial system which help to allocate the work and provide them

training and development which help to increase the productivity. Such as companies

are delegate the work in different depart which help to perform better and speedily

(Pavlatos and Kostakis, 2015).

Price optimisation system: Canon as well as Apple computer company are

using this system to set the prices of innovated products. For instance, the manager of

Canon has decided to set the prices of mini copier which should not be more expensive.

That means the prices of product should be affordable for customers which can be

easily acquired. So Canon set the reasonable price and uses this prices optimally (Pratt,

2016).

The Apple computer keeps high prices of product along with better quality that

help to attract the customer. The manager of Apple set the price policy and uses it

properly which in order to maximize the production.

This is beneficial system which is used by both company to use the prices of

product. This system also helps to understand the buying power of customer and make

policies further.

The components which is described in given case

Balance scorecard: This is most important component of Management

accounting system which is used by to make strategy and innovate product. For

instance, Apple company innovate and upgrade own business activities by innovating

new products. In other words, it help Apple company in their work such as customer

10

accomplish the target.

This is beneficial system which help to allocate the work and provide them

training and development which help to increase the productivity. Such as companies

are delegate the work in different depart which help to perform better and speedily

(Pavlatos and Kostakis, 2015).

Price optimisation system: Canon as well as Apple computer company are

using this system to set the prices of innovated products. For instance, the manager of

Canon has decided to set the prices of mini copier which should not be more expensive.

That means the prices of product should be affordable for customers which can be

easily acquired. So Canon set the reasonable price and uses this prices optimally (Pratt,

2016).

The Apple computer keeps high prices of product along with better quality that

help to attract the customer. The manager of Apple set the price policy and uses it

properly which in order to maximize the production.

This is beneficial system which is used by both company to use the prices of

product. This system also helps to understand the buying power of customer and make

policies further.

The components which is described in given case

Balance scorecard: This is most important component of Management

accounting system which is used by to make strategy and innovate product. For

instance, Apple company innovate and upgrade own business activities by innovating

new products. In other words, it help Apple company in their work such as customer

10

satisfaction, employee commitment, increasing marketing share and share value

(Component of management accounting system 2018).

Canon used Balance scorecard to know about innovation and how it should be

introduced in front of others which help to achieve high level of objectives. Additionally,

by using this manager can make solid planning which help to increase the productivity.

Activity based costing: Apple computer company is a multinational company

who uses activity based costing to identify the cost that need to be allocate. Apple

design and manufacture customer electronic and PC software. Additional, Apple assign

cost only for goods that need the activity for production (Schreck, 2015).

Canon uses this to define the costly activity which is required to complete

products. Canon innovate products and assign the overhead cost in different

department which help to get accurate cost of the manufacturing product.

2. Management accounting contribute to the innovation process

Innovation help the organisation to beat the competition by creating new idea and

producing new product and services. For example, As given in article, Canon has

introduced PPC in 1969 with new technology which help to attract the customer. After

some time, it realized that it should bring a new copier machine which should be

lightweight and less costly through management accounting (Sun, 2016).

Another example is, it has introduced a mini copier by using new technology.

This product was more effective such as it has described features it manufactured mini

copier according to expectation. The mini copier was lightweight, clear copier, and

easily installation which does not recover any extra cost to maintain. This innovation

affected Canon business and the profitability increased.

11

(Component of management accounting system 2018).

Canon used Balance scorecard to know about innovation and how it should be

introduced in front of others which help to achieve high level of objectives. Additionally,

by using this manager can make solid planning which help to increase the productivity.

Activity based costing: Apple computer company is a multinational company

who uses activity based costing to identify the cost that need to be allocate. Apple

design and manufacture customer electronic and PC software. Additional, Apple assign

cost only for goods that need the activity for production (Schreck, 2015).

Canon uses this to define the costly activity which is required to complete

products. Canon innovate products and assign the overhead cost in different

department which help to get accurate cost of the manufacturing product.

2. Management accounting contribute to the innovation process

Innovation help the organisation to beat the competition by creating new idea and

producing new product and services. For example, As given in article, Canon has

introduced PPC in 1969 with new technology which help to attract the customer. After

some time, it realized that it should bring a new copier machine which should be

lightweight and less costly through management accounting (Sun, 2016).

Another example is, it has introduced a mini copier by using new technology.

This product was more effective such as it has described features it manufactured mini

copier according to expectation. The mini copier was lightweight, clear copier, and

easily installation which does not recover any extra cost to maintain. This innovation

affected Canon business and the profitability increased.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The Apple computer also uses management accounting which helped innovation

such as it has decided to work on Mac project and prepared budget with the help of

management accounting. The manager of Apple take correct action to maintain the

production of product and also control the cost of computers (Vasarhelyi, Kogan and

Tuttle, 2015).

Other example is, management accounting system contributes in founding team

within environment there was little financial and bureaucratic discipline are helped to

innovate new products. In 1979 it has examined the feasibility of developing a low cost

computer for public with new innovation. That's why it has started to work on Mac

project.

3. Specific lessons from article research

The management accountant gets the information from managers and built

report which hep to make corrective business decision. An accountant can evaluate the

profit from business operation that help to make further decision (Ward and Calabrese,

2018). There are some lessons which can help management accountant why

management accounting system is important-

Apple computer

From the given article it has been recommended that management accounting

system is useful such as it helped Apple to define the problems, and getting the solution

which help to increase the production.

By maintaining accounting system, the manager can get accurate and actual

budget information and can plan according for maximize the profitability. For instance,

Apple's manager has analysis that some customer are not able to afford high rate of

12

such as it has decided to work on Mac project and prepared budget with the help of

management accounting. The manager of Apple take correct action to maintain the

production of product and also control the cost of computers (Vasarhelyi, Kogan and

Tuttle, 2015).

Other example is, management accounting system contributes in founding team

within environment there was little financial and bureaucratic discipline are helped to

innovate new products. In 1979 it has examined the feasibility of developing a low cost

computer for public with new innovation. That's why it has started to work on Mac

project.

3. Specific lessons from article research

The management accountant gets the information from managers and built

report which hep to make corrective business decision. An accountant can evaluate the

profit from business operation that help to make further decision (Ward and Calabrese,

2018). There are some lessons which can help management accountant why

management accounting system is important-

Apple computer

From the given article it has been recommended that management accounting

system is useful such as it helped Apple to define the problems, and getting the solution

which help to increase the production.

By maintaining accounting system, the manager can get accurate and actual

budget information and can plan according for maximize the profitability. For instance,

Apple's manager has analysis that some customer are not able to afford high rate of

12

computers so it has planned to manufacture low cost computer with the help of cost

management accounting system (Warren and Jones, 2018).

Canon

Management accounting is useful for Canon such as it assigned the work among

different which helped to achieve goals faster and by using cost accounting system the

manager has produced a mini copier at less price which increases the interest of

customer.

Another example is, it help to make effective business decision by concerning

financial information. Moreover, it help to make further planning for expanding business.

CONCLUSION

All organisation has same dream to increase the profit by expanding the

business. Therefore, organisation make efforts which help to increase the productivity

and profitability. The business concern analysis the market and get the needs and

wants of customer that help to make better business decision. The fixed cost does not

change with an increase or decrease in production of units. Variable cost changes in

proportion in order to manufacture more units. This type of cost not remain same as it

gets changes as production changes. The report has discussed about Apple and Canon

who uses management accounting system in order to beat the competition by

innovating new product. Additionally, this report has defined the cost of Frank's

business who run a child care business and maintain different types of cost which help

to make decision.

13

management accounting system (Warren and Jones, 2018).

Canon

Management accounting is useful for Canon such as it assigned the work among

different which helped to achieve goals faster and by using cost accounting system the

manager has produced a mini copier at less price which increases the interest of

customer.

Another example is, it help to make effective business decision by concerning

financial information. Moreover, it help to make further planning for expanding business.

CONCLUSION

All organisation has same dream to increase the profit by expanding the

business. Therefore, organisation make efforts which help to increase the productivity

and profitability. The business concern analysis the market and get the needs and

wants of customer that help to make better business decision. The fixed cost does not

change with an increase or decrease in production of units. Variable cost changes in

proportion in order to manufacture more units. This type of cost not remain same as it

gets changes as production changes. The report has discussed about Apple and Canon

who uses management accounting system in order to beat the competition by

innovating new product. Additionally, this report has defined the cost of Frank's

business who run a child care business and maintain different types of cost which help

to make decision.

13

REFERENCE

Books and Journal

Alkordi, A., Al-Nimer, M. and Dabaghia, M., 2017. Accounting conservatism and

ownership structure effect: evidence from industrial and financial Jordanian

listed companies. International Journal of Economics and Financial Issues. 7(2).

pp.608-619.

Christensen, H. B., Nikolaev, V. V. and Wittenberg‐Moerman, R., 2016. Accounting

information in financial contracting: The incomplete contract theory

perspective. Journal of accounting research. 54(2). pp.397-435.

Duellman, S., Hurwitz, H. and Sun, Y., 2015. Managerial overconfidence and audit

fees. Journal of Contemporary Accounting & Economics. 11(2). pp.148-165.

Endenich, C. and Trapp, R., 2018. Signaling effects of scholarly profiles–The editorial

teams of North American accounting association journals. Critical Perspectives

on Accounting. 51. pp.4-23.

Huber, W., 2015. The research-publication complex and the construct shift in

accounting research. International Journal of Critical Accounting. 7(1). pp.1-48.

Kholis, A. and Maksum, A., 2017. Analisis Tentang Pentingnya Tanggungjawab Dan

Akuntansi Sosial Perusahaan (Corporate Responsibilities and Social

Accounting) Studi Kasus Empiris Di Kota Medan. Media Riset Akuntansi,

Auditing & Informasi. 3(2). pp.101-132.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability

assessment, management accounting, control, and reporting. Journal of

Cleaner Production.136. pp.237-248.

Mora, A. and Walker, M., 2015. The implications of research on accounting

conservatism for accounting standard setting. Accounting and Business

Research. 45(5). pp.620-650.

Nica, E., 2017. Foucault on Managerial Governmentality and Biopolitical

Neoliberalism. Journal of Self-Governance and Management Economics. 5(1).

pp.80-86.

Pavlatos, O. and Kostakis, H., 2015. Management accounting practices before and

during economic crisis: Evidence from Greece. Advances in accounting. 31(1).

pp.150-164.

Pratt, J., 2016. Financial accounting in an economic context. John Wiley & Sons.

Schreck, P., 2015. Honesty in managerial reporting: How competition affects the

benefits and costs of lying. Critical Perspectives on Accounting. 27. pp.177-188.

Sun, L., 2016. Managerial ability and goodwill impairment. Advances in accounting. 32.

pp.42-51.

Vasarhelyi, M. A., Kogan, A. and Tuttle, B. M., 2015. Big Data in accounting: An

overview. Accounting Horizons. 29(2). pp.381-396.

Ward, D. M. and Calabrese, T., 2018. Accounting fundamentals for health care

management. Jones & Bartlett Learning.

Warren, C. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

Online

Component of management accounting system. 2018. [Online]. Available through:

<https://www.performancemagazine.org/apple-balance-scorecard/>

14

Books and Journal

Alkordi, A., Al-Nimer, M. and Dabaghia, M., 2017. Accounting conservatism and

ownership structure effect: evidence from industrial and financial Jordanian

listed companies. International Journal of Economics and Financial Issues. 7(2).

pp.608-619.

Christensen, H. B., Nikolaev, V. V. and Wittenberg‐Moerman, R., 2016. Accounting

information in financial contracting: The incomplete contract theory

perspective. Journal of accounting research. 54(2). pp.397-435.

Duellman, S., Hurwitz, H. and Sun, Y., 2015. Managerial overconfidence and audit

fees. Journal of Contemporary Accounting & Economics. 11(2). pp.148-165.

Endenich, C. and Trapp, R., 2018. Signaling effects of scholarly profiles–The editorial

teams of North American accounting association journals. Critical Perspectives

on Accounting. 51. pp.4-23.

Huber, W., 2015. The research-publication complex and the construct shift in

accounting research. International Journal of Critical Accounting. 7(1). pp.1-48.

Kholis, A. and Maksum, A., 2017. Analisis Tentang Pentingnya Tanggungjawab Dan

Akuntansi Sosial Perusahaan (Corporate Responsibilities and Social

Accounting) Studi Kasus Empiris Di Kota Medan. Media Riset Akuntansi,

Auditing & Informasi. 3(2). pp.101-132.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability

assessment, management accounting, control, and reporting. Journal of

Cleaner Production.136. pp.237-248.

Mora, A. and Walker, M., 2015. The implications of research on accounting

conservatism for accounting standard setting. Accounting and Business

Research. 45(5). pp.620-650.

Nica, E., 2017. Foucault on Managerial Governmentality and Biopolitical

Neoliberalism. Journal of Self-Governance and Management Economics. 5(1).

pp.80-86.

Pavlatos, O. and Kostakis, H., 2015. Management accounting practices before and

during economic crisis: Evidence from Greece. Advances in accounting. 31(1).

pp.150-164.

Pratt, J., 2016. Financial accounting in an economic context. John Wiley & Sons.

Schreck, P., 2015. Honesty in managerial reporting: How competition affects the

benefits and costs of lying. Critical Perspectives on Accounting. 27. pp.177-188.

Sun, L., 2016. Managerial ability and goodwill impairment. Advances in accounting. 32.

pp.42-51.

Vasarhelyi, M. A., Kogan, A. and Tuttle, B. M., 2015. Big Data in accounting: An

overview. Accounting Horizons. 29(2). pp.381-396.

Ward, D. M. and Calabrese, T., 2018. Accounting fundamentals for health care

management. Jones & Bartlett Learning.

Warren, C. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

Online

Component of management accounting system. 2018. [Online]. Available through:

<https://www.performancemagazine.org/apple-balance-scorecard/>

14

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.