Managerial Accounting - Seek Limited

VerifiedAdded on 2021/06/15

|19

|3745

|32

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGERIAL ACCOUNTING

Managerial Accounting

University Name

Student Name

Authors’ Note

Managerial Accounting

University Name

Student Name

Authors’ Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2MANAGERIAL ACCOUNTING

Introduction

The current study elucidates illustratively remuneration scheme with special reference to the

operations of the firm SEEK. Seek Limited s well as its subsidiary companies, referred to as

the Seek Group, concentrate on helping the match between particularly jobseekers along with

employment chances and assisting hirers get candidates for different roles. This study

presents structure of remuneration committee along with its memberships and delivers

critically analysis of remuneration. This can help in understanding the way approach of the

company helped in inspiring higher performance by particularly the executive team and take

into account if this can be translated to superior performance of the company. Again, analysis

of allocation executive remuneration is also presented for the SEEK that takes in fixed pay,

short term incentive plan as well as the long term incentive plan. The research also explicates

with reference to the operations of the firm SEEK the mix of performance dimensions used.

Particularly, this can again be utilized to take into account the use of financial performance

dimensions as well as non –financial performance dimensions. Moreover, this study also

reports about any kind of alterations in the executive remuneration report of the firm SEEK.

Moving further, the study effectively presents the recommendations supported by the

academic literature on the subject matter under consideration. Also, the study also explains

the way the company might perhaps enhance the process of reporting or else broaden their

performance dimensions.

Summary of findings

Remuneration Committee and its memberships of the firm SEEK

Analysis of the annual report of the firm “SEEK” reveals the fact that objective of the

remuneration framework of the firm is to attract and to same time retain different talented

executives and keep them in line to build long term value of shareholders (Hooghiemstra et

Introduction

The current study elucidates illustratively remuneration scheme with special reference to the

operations of the firm SEEK. Seek Limited s well as its subsidiary companies, referred to as

the Seek Group, concentrate on helping the match between particularly jobseekers along with

employment chances and assisting hirers get candidates for different roles. This study

presents structure of remuneration committee along with its memberships and delivers

critically analysis of remuneration. This can help in understanding the way approach of the

company helped in inspiring higher performance by particularly the executive team and take

into account if this can be translated to superior performance of the company. Again, analysis

of allocation executive remuneration is also presented for the SEEK that takes in fixed pay,

short term incentive plan as well as the long term incentive plan. The research also explicates

with reference to the operations of the firm SEEK the mix of performance dimensions used.

Particularly, this can again be utilized to take into account the use of financial performance

dimensions as well as non –financial performance dimensions. Moreover, this study also

reports about any kind of alterations in the executive remuneration report of the firm SEEK.

Moving further, the study effectively presents the recommendations supported by the

academic literature on the subject matter under consideration. Also, the study also explains

the way the company might perhaps enhance the process of reporting or else broaden their

performance dimensions.

Summary of findings

Remuneration Committee and its memberships of the firm SEEK

Analysis of the annual report of the firm “SEEK” reveals the fact that objective of the

remuneration framework of the firm is to attract and to same time retain different talented

executives and keep them in line to build long term value of shareholders (Hooghiemstra et

3MANAGERIAL ACCOUNTING

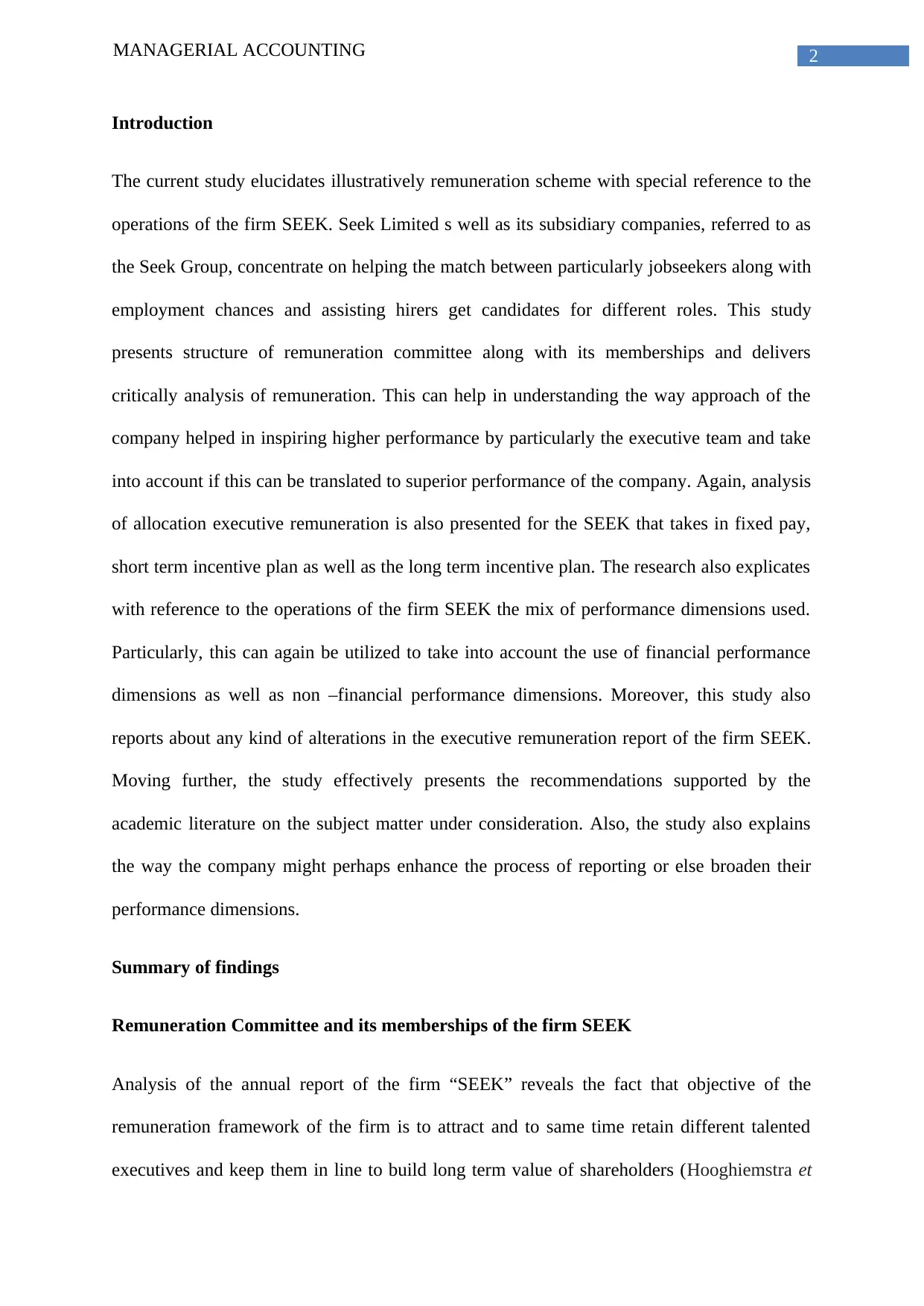

al. 2017). Evaluation of annual report of the firm reflects the list of key management

personnel that include a list of non-executive directors, executive directors as well as key

management personnel. The list of key members is hereby presented below:

The changes in the remuneration committee can be observed by way of thorough analysis as

presented in the annual pronouncements of the corporation (Scholtz and Engelbrecht 2015). It

can be hereby witnessed that John Armstrong essentially resigned as the chief executive

officer (CEO) of the group during the year 2016 particularly in the role of consultant to the

entire group CFO helping with the transition to the new group. The company SEEK declared

the appointment of Geoff Roberts as the CEO of the group. The remuneration of Geoff is

divulged for the period 2015. Jason Lenga also ceased to operate as managing director and

stayed employed until the period July 2016 as Special Advisor, delivering strategic services

on worldwide business as well as corporate issues. Meahen Callaghan also resigned as

Director of Human Resource Group.

Remuneration Committee and its memberships of the competitor firm Fairfax Media

Ltd

al. 2017). Evaluation of annual report of the firm reflects the list of key management

personnel that include a list of non-executive directors, executive directors as well as key

management personnel. The list of key members is hereby presented below:

The changes in the remuneration committee can be observed by way of thorough analysis as

presented in the annual pronouncements of the corporation (Scholtz and Engelbrecht 2015). It

can be hereby witnessed that John Armstrong essentially resigned as the chief executive

officer (CEO) of the group during the year 2016 particularly in the role of consultant to the

entire group CFO helping with the transition to the new group. The company SEEK declared

the appointment of Geoff Roberts as the CEO of the group. The remuneration of Geoff is

divulged for the period 2015. Jason Lenga also ceased to operate as managing director and

stayed employed until the period July 2016 as Special Advisor, delivering strategic services

on worldwide business as well as corporate issues. Meahen Callaghan also resigned as

Director of Human Resource Group.

Remuneration Committee and its memberships of the competitor firm Fairfax Media

Ltd

4MANAGERIAL ACCOUNTING

The remuneration arrangement of the entire Fairfax Media is as per the regulations of Key

Management Personnel that is presented according to the Corporations Act of the year 2001

(Bian 2016). The composition of the competitor firm is as presented below:

Remuneration strategy of the main firm SEEK

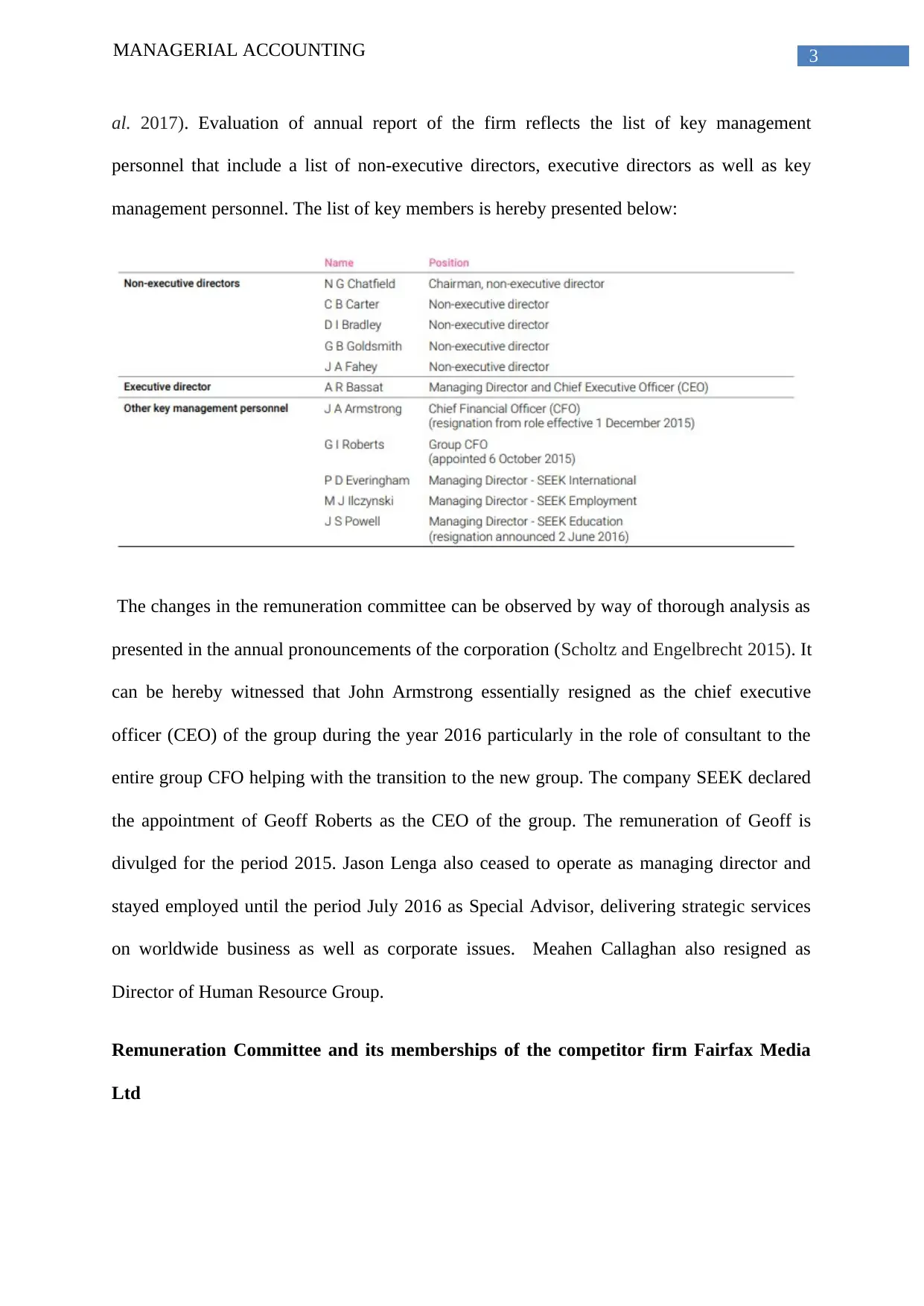

Remuneration strategy of the firm is aligned to the purpose as well as vision of the company.

Essentially, 50% of executive remuneration is necessarily in cash as base salary as well as

superannuation (Cassim and Madlela 2017). In essence, this is established at specific levels

that attract the people to operate in different market conditions as well as economic cycles

(Riaz et al. 2015). Primarily, 50% of executive remuneration is particularly in equity, having

25% in rights for equity and 25% in LTI options. The components of LTI has essentially

three year vesting period and is particularly locked up for particularly 12 months. Executives

are in essence subject to minimum necessity of shareholding. Given the emphasis on mainly

The remuneration arrangement of the entire Fairfax Media is as per the regulations of Key

Management Personnel that is presented according to the Corporations Act of the year 2001

(Bian 2016). The composition of the competitor firm is as presented below:

Remuneration strategy of the main firm SEEK

Remuneration strategy of the firm is aligned to the purpose as well as vision of the company.

Essentially, 50% of executive remuneration is necessarily in cash as base salary as well as

superannuation (Cassim and Madlela 2017). In essence, this is established at specific levels

that attract the people to operate in different market conditions as well as economic cycles

(Riaz et al. 2015). Primarily, 50% of executive remuneration is particularly in equity, having

25% in rights for equity and 25% in LTI options. The components of LTI has essentially

three year vesting period and is particularly locked up for particularly 12 months. Executives

are in essence subject to minimum necessity of shareholding. Given the emphasis on mainly

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5MANAGERIAL ACCOUNTING

equity in the remuneration of equity and limitations on disposal on mainly equity, executives

mainly concentrate on enhancing value of shareholders.

Remuneration strategy of the competitor firm Fairfax Media Ltd

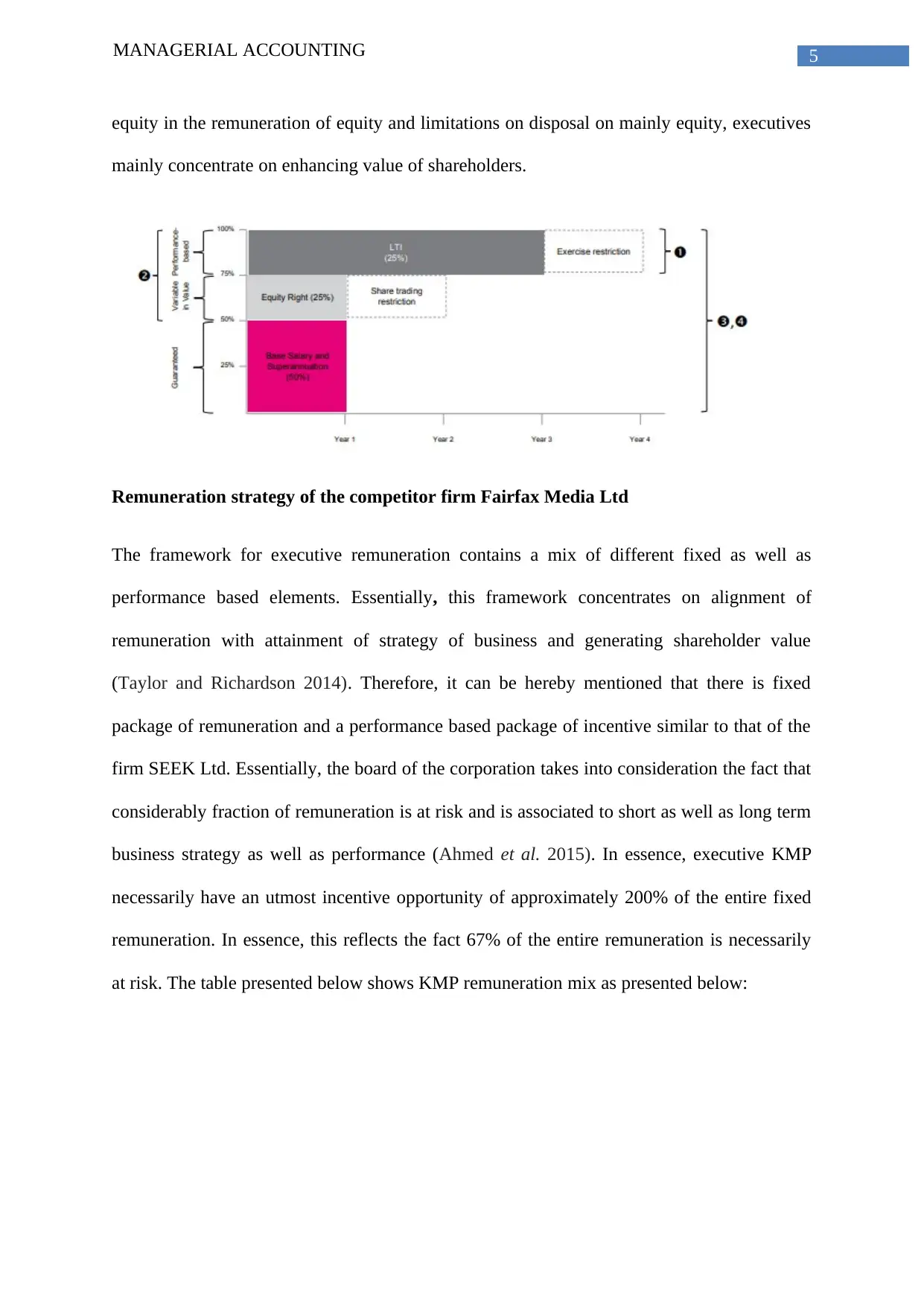

The framework for executive remuneration contains a mix of different fixed as well as

performance based elements. Essentially, this framework concentrates on alignment of

remuneration with attainment of strategy of business and generating shareholder value

(Taylor and Richardson 2014). Therefore, it can be hereby mentioned that there is fixed

package of remuneration and a performance based package of incentive similar to that of the

firm SEEK Ltd. Essentially, the board of the corporation takes into consideration the fact that

considerably fraction of remuneration is at risk and is associated to short as well as long term

business strategy as well as performance (Ahmed et al. 2015). In essence, executive KMP

necessarily have an utmost incentive opportunity of approximately 200% of the entire fixed

remuneration. In essence, this reflects the fact 67% of the entire remuneration is necessarily

at risk. The table presented below shows KMP remuneration mix as presented below:

equity in the remuneration of equity and limitations on disposal on mainly equity, executives

mainly concentrate on enhancing value of shareholders.

Remuneration strategy of the competitor firm Fairfax Media Ltd

The framework for executive remuneration contains a mix of different fixed as well as

performance based elements. Essentially, this framework concentrates on alignment of

remuneration with attainment of strategy of business and generating shareholder value

(Taylor and Richardson 2014). Therefore, it can be hereby mentioned that there is fixed

package of remuneration and a performance based package of incentive similar to that of the

firm SEEK Ltd. Essentially, the board of the corporation takes into consideration the fact that

considerably fraction of remuneration is at risk and is associated to short as well as long term

business strategy as well as performance (Ahmed et al. 2015). In essence, executive KMP

necessarily have an utmost incentive opportunity of approximately 200% of the entire fixed

remuneration. In essence, this reflects the fact 67% of the entire remuneration is necessarily

at risk. The table presented below shows KMP remuneration mix as presented below:

6MANAGERIAL ACCOUNTING

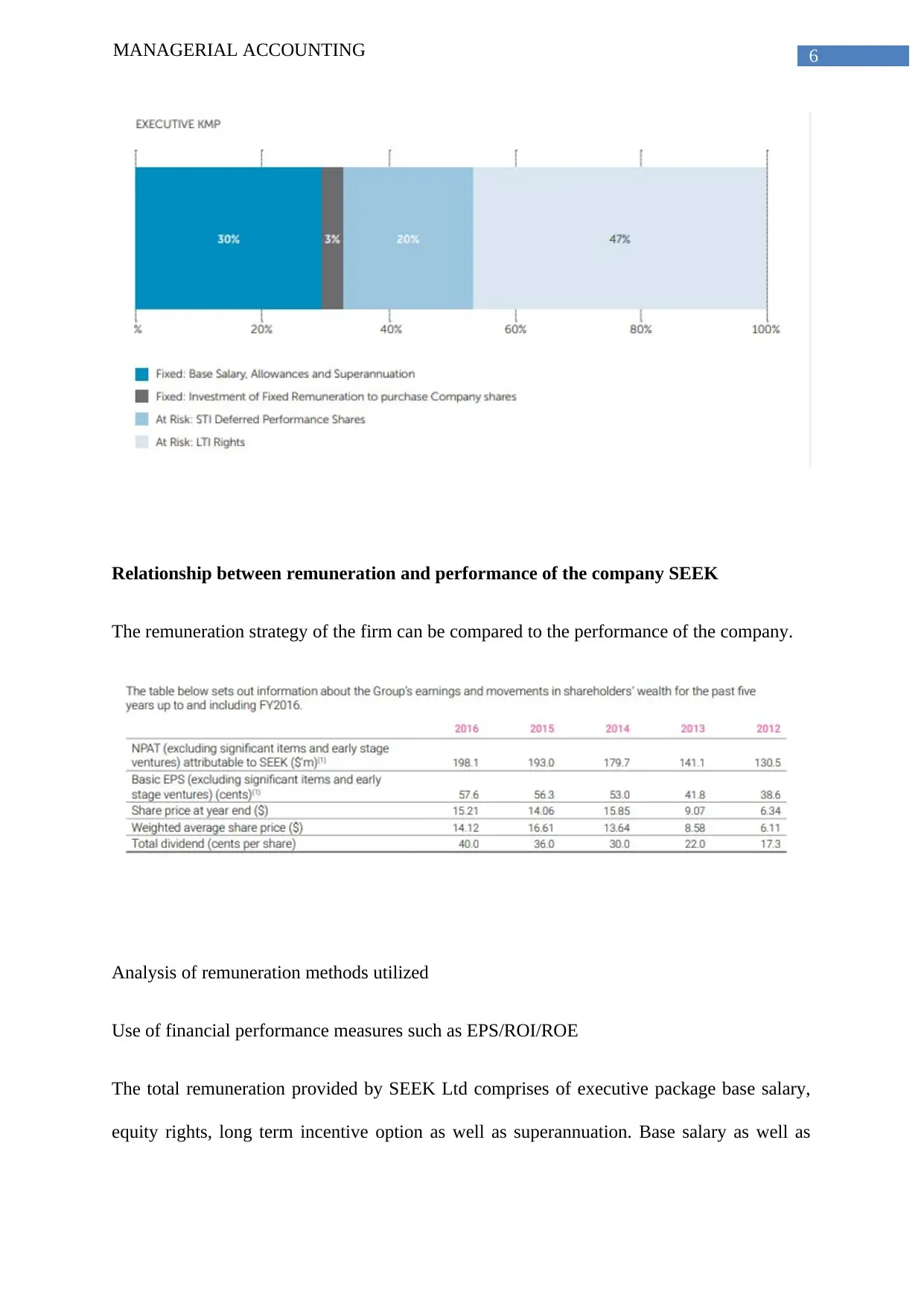

Relationship between remuneration and performance of the company SEEK

The remuneration strategy of the firm can be compared to the performance of the company.

Analysis of remuneration methods utilized

Use of financial performance measures such as EPS/ROI/ROE

The total remuneration provided by SEEK Ltd comprises of executive package base salary,

equity rights, long term incentive option as well as superannuation. Base salary as well as

Relationship between remuneration and performance of the company SEEK

The remuneration strategy of the firm can be compared to the performance of the company.

Analysis of remuneration methods utilized

Use of financial performance measures such as EPS/ROI/ROE

The total remuneration provided by SEEK Ltd comprises of executive package base salary,

equity rights, long term incentive option as well as superannuation. Base salary as well as

7MANAGERIAL ACCOUNTING

superannuation for executives of the company SEEK is established at 50% of total

remuneration (Riaz 2016).

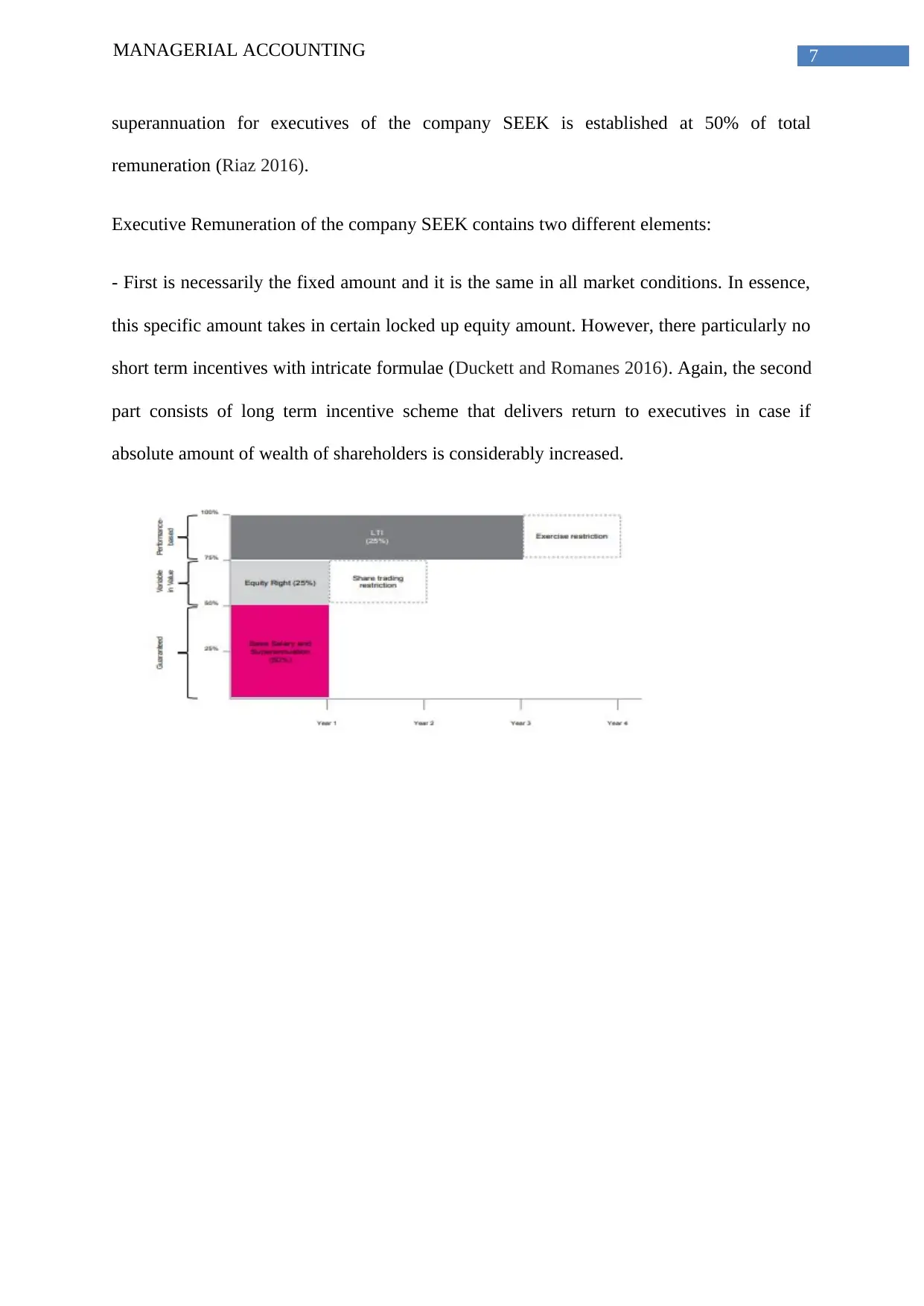

Executive Remuneration of the company SEEK contains two different elements:

- First is necessarily the fixed amount and it is the same in all market conditions. In essence,

this specific amount takes in certain locked up equity amount. However, there particularly no

short term incentives with intricate formulae (Duckett and Romanes 2016). Again, the second

part consists of long term incentive scheme that delivers return to executives in case if

absolute amount of wealth of shareholders is considerably increased.

superannuation for executives of the company SEEK is established at 50% of total

remuneration (Riaz 2016).

Executive Remuneration of the company SEEK contains two different elements:

- First is necessarily the fixed amount and it is the same in all market conditions. In essence,

this specific amount takes in certain locked up equity amount. However, there particularly no

short term incentives with intricate formulae (Duckett and Romanes 2016). Again, the second

part consists of long term incentive scheme that delivers return to executives in case if

absolute amount of wealth of shareholders is considerably increased.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8MANAGERIAL ACCOUNTING

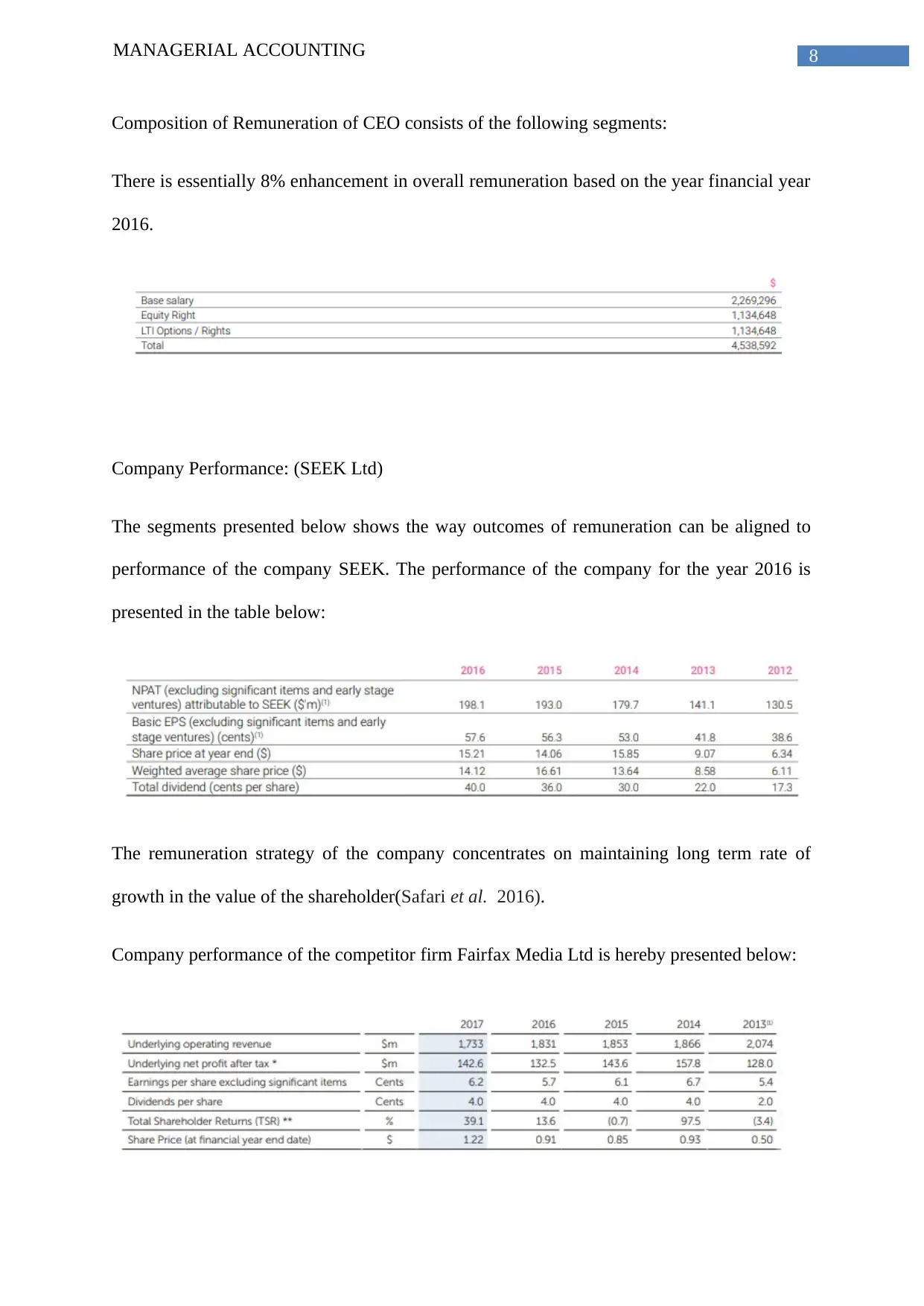

Composition of Remuneration of CEO consists of the following segments:

There is essentially 8% enhancement in overall remuneration based on the year financial year

2016.

Company Performance: (SEEK Ltd)

The segments presented below shows the way outcomes of remuneration can be aligned to

performance of the company SEEK. The performance of the company for the year 2016 is

presented in the table below:

The remuneration strategy of the company concentrates on maintaining long term rate of

growth in the value of the shareholder(Safari et al. 2016).

Company performance of the competitor firm Fairfax Media Ltd is hereby presented below:

Composition of Remuneration of CEO consists of the following segments:

There is essentially 8% enhancement in overall remuneration based on the year financial year

2016.

Company Performance: (SEEK Ltd)

The segments presented below shows the way outcomes of remuneration can be aligned to

performance of the company SEEK. The performance of the company for the year 2016 is

presented in the table below:

The remuneration strategy of the company concentrates on maintaining long term rate of

growth in the value of the shareholder(Safari et al. 2016).

Company performance of the competitor firm Fairfax Media Ltd is hereby presented below:

9MANAGERIAL ACCOUNTING

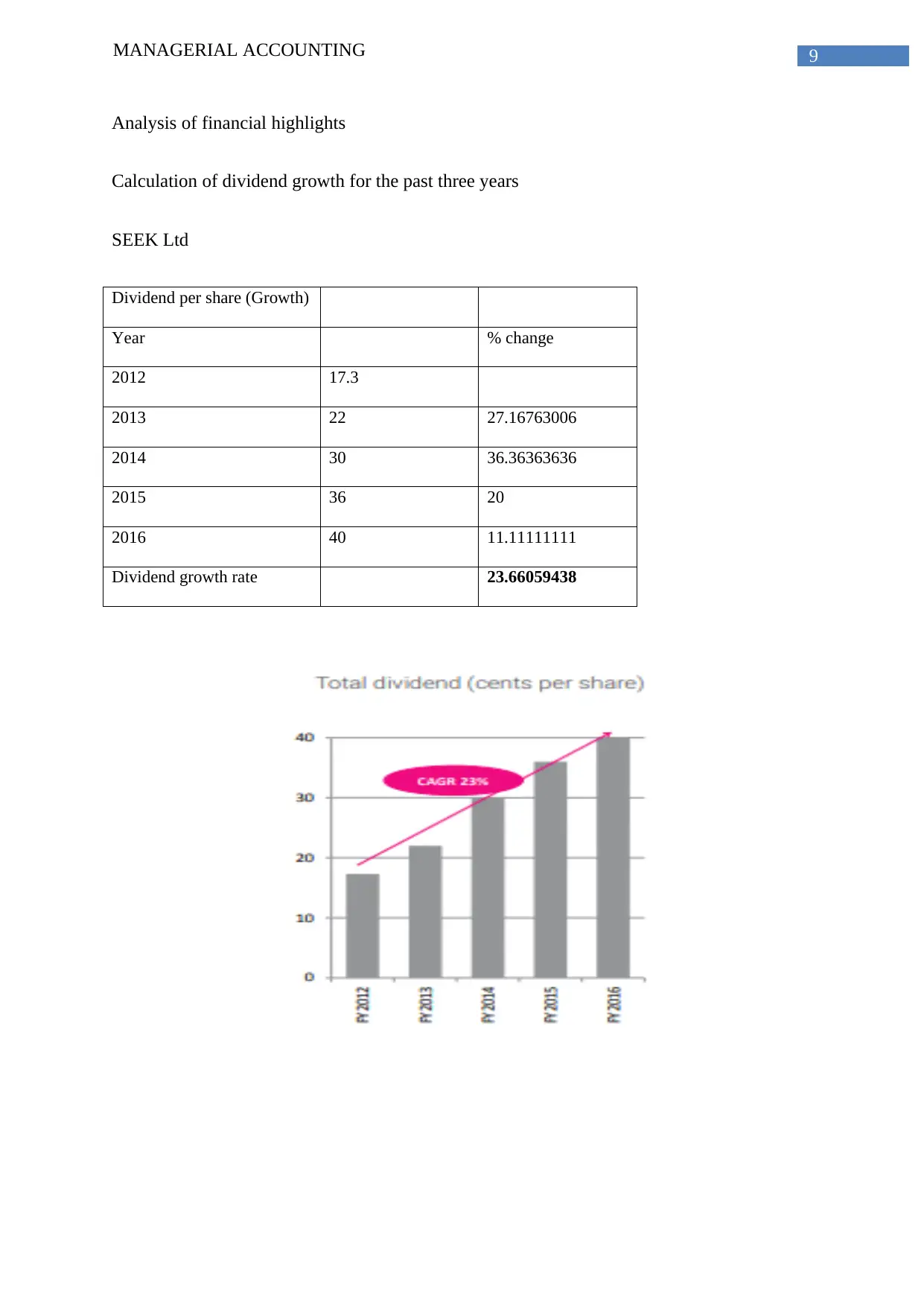

Analysis of financial highlights

Calculation of dividend growth for the past three years

SEEK Ltd

Dividend per share (Growth)

Year % change

2012 17.3

2013 22 27.16763006

2014 30 36.36363636

2015 36 20

2016 40 11.11111111

Dividend growth rate 23.66059438

Analysis of financial highlights

Calculation of dividend growth for the past three years

SEEK Ltd

Dividend per share (Growth)

Year % change

2012 17.3

2013 22 27.16763006

2014 30 36.36363636

2015 36 20

2016 40 11.11111111

Dividend growth rate 23.66059438

10MANAGERIAL ACCOUNTING

The above table and graph shows that dividend growth rate for the past 5 years are recorded

to be approximately 23%.

The table below shows the calculation of the dividend growth rate of the competitor firm Fair

fax Media Ltd:

Dividend per share

(Growth)

Fairfax Media Ltd % change

2015 0.06

2016 0.05 -16.66666667

2017 0.05 0

-8.333333333

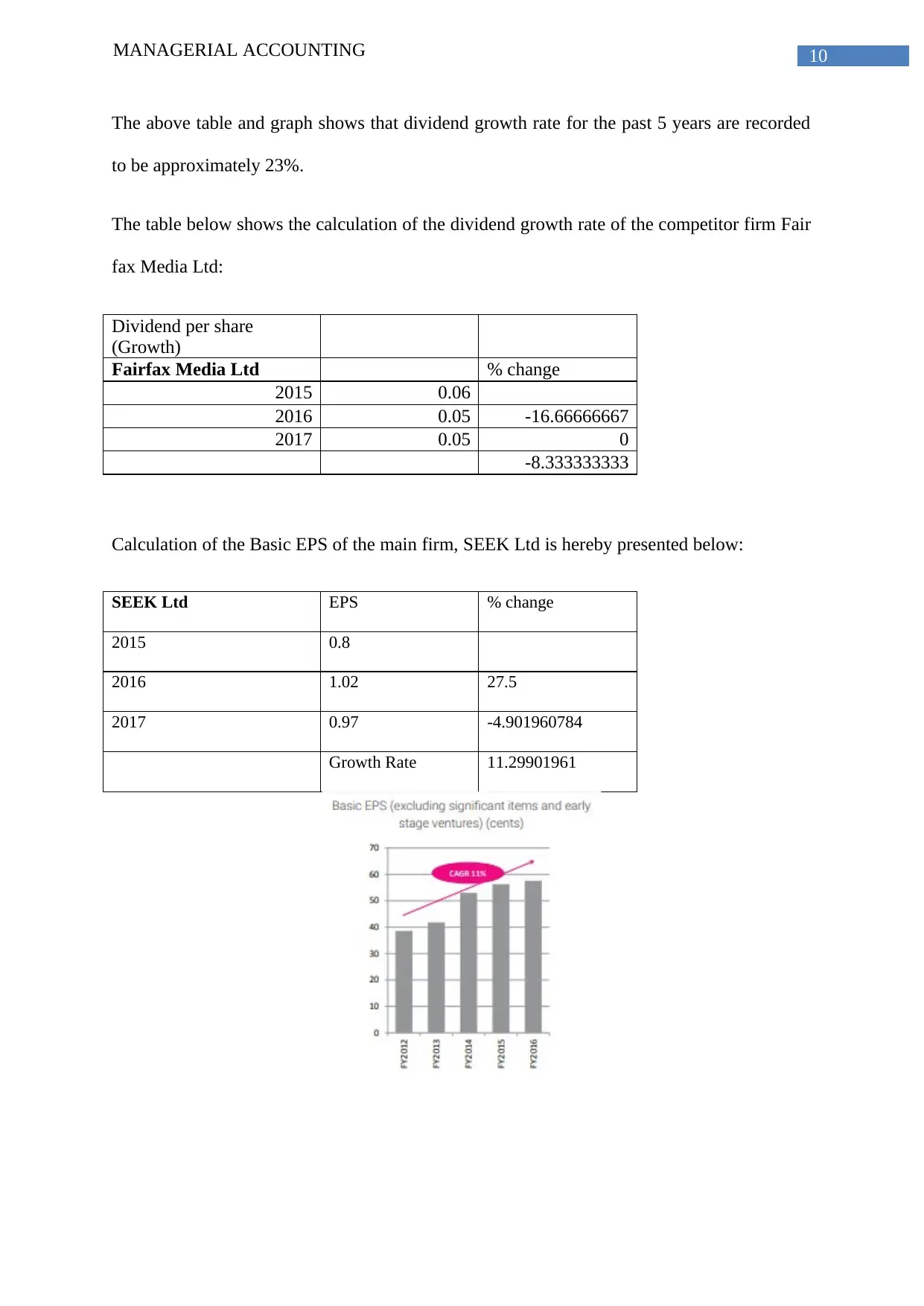

Calculation of the Basic EPS of the main firm, SEEK Ltd is hereby presented below:

SEEK Ltd EPS % change

2015 0.8

2016 1.02 27.5

2017 0.97 -4.901960784

Growth Rate 11.29901961

The above table and graph shows that dividend growth rate for the past 5 years are recorded

to be approximately 23%.

The table below shows the calculation of the dividend growth rate of the competitor firm Fair

fax Media Ltd:

Dividend per share

(Growth)

Fairfax Media Ltd % change

2015 0.06

2016 0.05 -16.66666667

2017 0.05 0

-8.333333333

Calculation of the Basic EPS of the main firm, SEEK Ltd is hereby presented below:

SEEK Ltd EPS % change

2015 0.8

2016 1.02 27.5

2017 0.97 -4.901960784

Growth Rate 11.29901961

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11MANAGERIAL ACCOUNTING

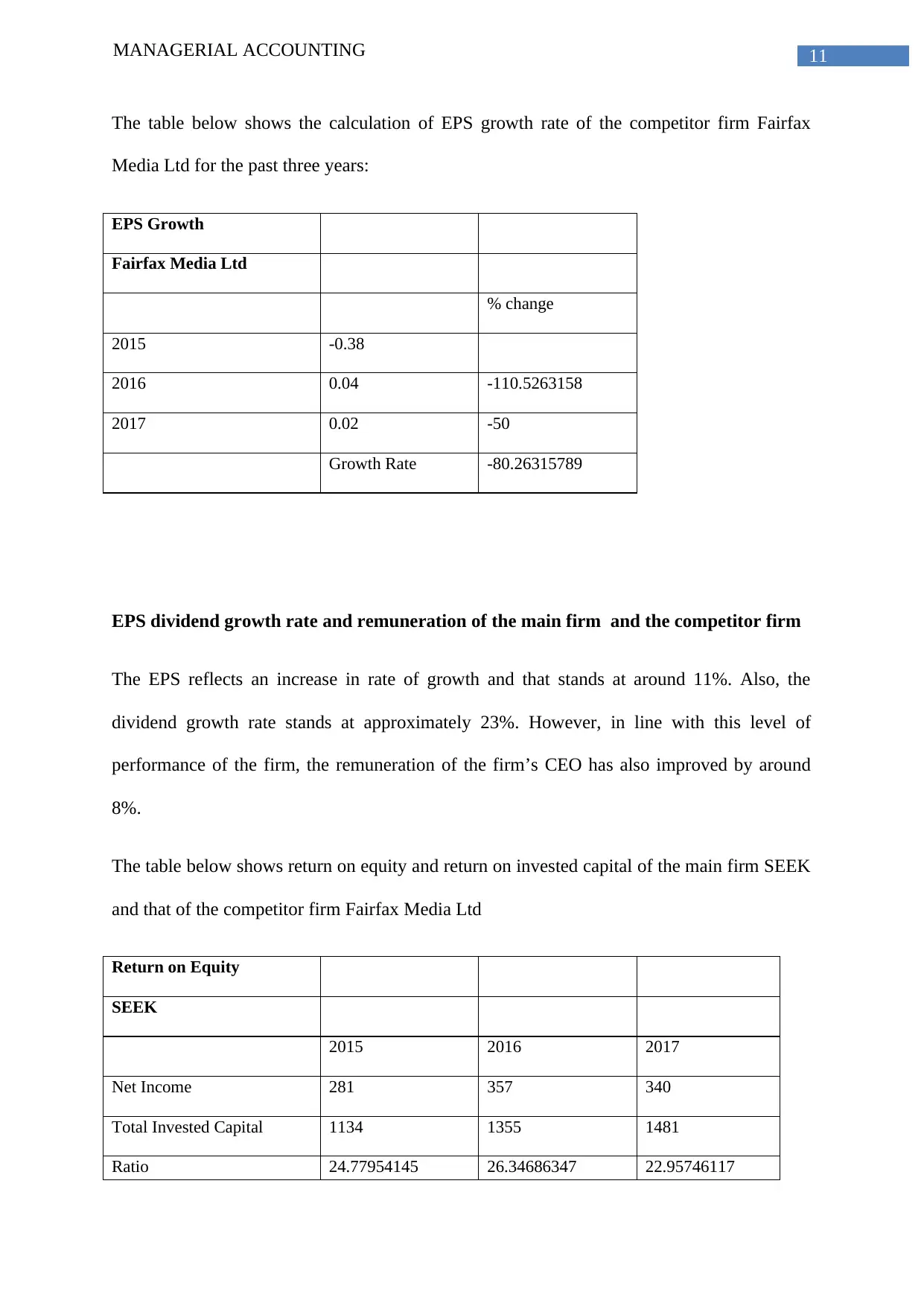

The table below shows the calculation of EPS growth rate of the competitor firm Fairfax

Media Ltd for the past three years:

EPS Growth

Fairfax Media Ltd

% change

2015 -0.38

2016 0.04 -110.5263158

2017 0.02 -50

Growth Rate -80.26315789

EPS dividend growth rate and remuneration of the main firm and the competitor firm

The EPS reflects an increase in rate of growth and that stands at around 11%. Also, the

dividend growth rate stands at approximately 23%. However, in line with this level of

performance of the firm, the remuneration of the firm’s CEO has also improved by around

8%.

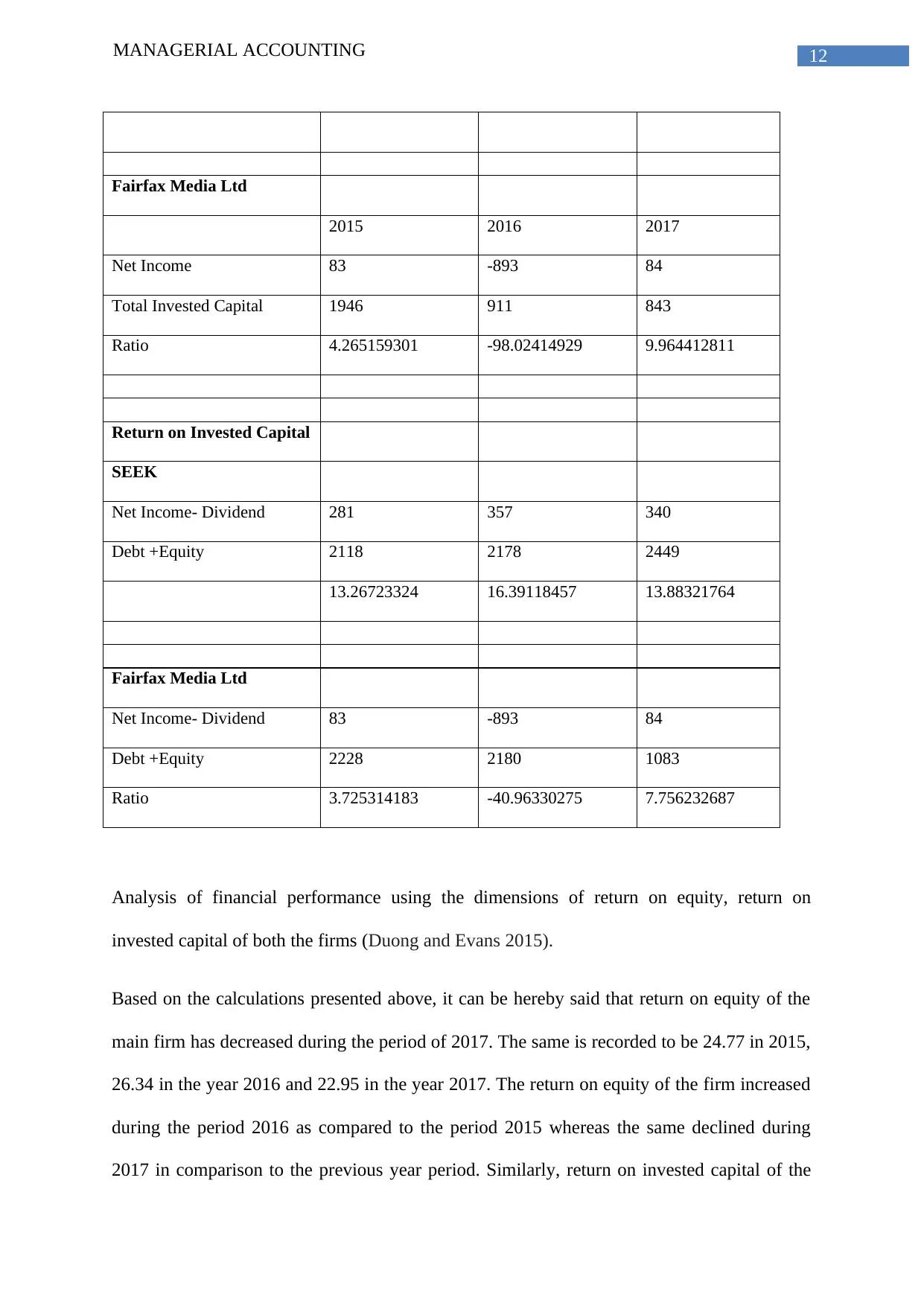

The table below shows return on equity and return on invested capital of the main firm SEEK

and that of the competitor firm Fairfax Media Ltd

Return on Equity

SEEK

2015 2016 2017

Net Income 281 357 340

Total Invested Capital 1134 1355 1481

Ratio 24.77954145 26.34686347 22.95746117

The table below shows the calculation of EPS growth rate of the competitor firm Fairfax

Media Ltd for the past three years:

EPS Growth

Fairfax Media Ltd

% change

2015 -0.38

2016 0.04 -110.5263158

2017 0.02 -50

Growth Rate -80.26315789

EPS dividend growth rate and remuneration of the main firm and the competitor firm

The EPS reflects an increase in rate of growth and that stands at around 11%. Also, the

dividend growth rate stands at approximately 23%. However, in line with this level of

performance of the firm, the remuneration of the firm’s CEO has also improved by around

8%.

The table below shows return on equity and return on invested capital of the main firm SEEK

and that of the competitor firm Fairfax Media Ltd

Return on Equity

SEEK

2015 2016 2017

Net Income 281 357 340

Total Invested Capital 1134 1355 1481

Ratio 24.77954145 26.34686347 22.95746117

12MANAGERIAL ACCOUNTING

Fairfax Media Ltd

2015 2016 2017

Net Income 83 -893 84

Total Invested Capital 1946 911 843

Ratio 4.265159301 -98.02414929 9.964412811

Return on Invested Capital

SEEK

Net Income- Dividend 281 357 340

Debt +Equity 2118 2178 2449

13.26723324 16.39118457 13.88321764

Fairfax Media Ltd

Net Income- Dividend 83 -893 84

Debt +Equity 2228 2180 1083

Ratio 3.725314183 -40.96330275 7.756232687

Analysis of financial performance using the dimensions of return on equity, return on

invested capital of both the firms (Duong and Evans 2015).

Based on the calculations presented above, it can be hereby said that return on equity of the

main firm has decreased during the period of 2017. The same is recorded to be 24.77 in 2015,

26.34 in the year 2016 and 22.95 in the year 2017. The return on equity of the firm increased

during the period 2016 as compared to the period 2015 whereas the same declined during

2017 in comparison to the previous year period. Similarly, return on invested capital of the

Fairfax Media Ltd

2015 2016 2017

Net Income 83 -893 84

Total Invested Capital 1946 911 843

Ratio 4.265159301 -98.02414929 9.964412811

Return on Invested Capital

SEEK

Net Income- Dividend 281 357 340

Debt +Equity 2118 2178 2449

13.26723324 16.39118457 13.88321764

Fairfax Media Ltd

Net Income- Dividend 83 -893 84

Debt +Equity 2228 2180 1083

Ratio 3.725314183 -40.96330275 7.756232687

Analysis of financial performance using the dimensions of return on equity, return on

invested capital of both the firms (Duong and Evans 2015).

Based on the calculations presented above, it can be hereby said that return on equity of the

main firm has decreased during the period of 2017. The same is recorded to be 24.77 in 2015,

26.34 in the year 2016 and 22.95 in the year 2017. The return on equity of the firm increased

during the period 2016 as compared to the period 2015 whereas the same declined during

2017 in comparison to the previous year period. Similarly, return on invested capital of the

13MANAGERIAL ACCOUNTING

firm SEEK is observe to have increased to 16.39 during the period 2016 in comparison to

13.26 during the year 2015. However, the same is said to have declined in the year 2017 to

13.88 as comparison to 16.39 in the year 2016. Thus, this decline can be considered to be an

unfavourable financial condition for the firm (Grosse et al. 2017).

On the other hand, the financial performance of the competitor firm (Fairfax Media Ltd) can

be compared with that of the main firm for the specified period. The return on equity of the

competitor firm initially declined to approximately 98% in 2016 in comparison to 4.2% in the

year 2015. However, the same increased to 9.96% during the period 2017. This implies that

return on equity of the firm improved implying favourable financial condition of the

corporation (Windsor et al. 2017). Analysis of return on equity replicates that the firm SEEK

has significantly higher return equity (in percentage) in comparison to the competitor firm

Fairfax Media Ltd. However, the return on equity is considered to be the highest for the firm

SEEK during the period 2016.

Based on the enumerations of return on invested capital of the main firm SEEK it can be

hereby said that return on invested capital increased to 16.39 in the year 2016 in comparison

to 13.26 in the year 2015. This reflects improved financial condition for the firm replicating

higher efficiency of the firm to acquire higher amount of capital (Pottenger and Leigh2016).

Nonetheless, the same declined during the period 2017 reflecting extremely undesirable

financial condition. On the other hand, the Return on investment capital for the competitor

firm Fairfax Media Ltd increased during the period 2017 in comparison to the year 2016.

Analysis of financial condition of the firm replicates the fact that SEEK has a considerably

better financial condition in comparison to Fairfax Media particularly during the current

period of 2017 in terms of both return on both equity as well as return on invested capital (Fu

et al. 2015).

firm SEEK is observe to have increased to 16.39 during the period 2016 in comparison to

13.26 during the year 2015. However, the same is said to have declined in the year 2017 to

13.88 as comparison to 16.39 in the year 2016. Thus, this decline can be considered to be an

unfavourable financial condition for the firm (Grosse et al. 2017).

On the other hand, the financial performance of the competitor firm (Fairfax Media Ltd) can

be compared with that of the main firm for the specified period. The return on equity of the

competitor firm initially declined to approximately 98% in 2016 in comparison to 4.2% in the

year 2015. However, the same increased to 9.96% during the period 2017. This implies that

return on equity of the firm improved implying favourable financial condition of the

corporation (Windsor et al. 2017). Analysis of return on equity replicates that the firm SEEK

has significantly higher return equity (in percentage) in comparison to the competitor firm

Fairfax Media Ltd. However, the return on equity is considered to be the highest for the firm

SEEK during the period 2016.

Based on the enumerations of return on invested capital of the main firm SEEK it can be

hereby said that return on invested capital increased to 16.39 in the year 2016 in comparison

to 13.26 in the year 2015. This reflects improved financial condition for the firm replicating

higher efficiency of the firm to acquire higher amount of capital (Pottenger and Leigh2016).

Nonetheless, the same declined during the period 2017 reflecting extremely undesirable

financial condition. On the other hand, the Return on investment capital for the competitor

firm Fairfax Media Ltd increased during the period 2017 in comparison to the year 2016.

Analysis of financial condition of the firm replicates the fact that SEEK has a considerably

better financial condition in comparison to Fairfax Media particularly during the current

period of 2017 in terms of both return on both equity as well as return on invested capital (Fu

et al. 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14MANAGERIAL ACCOUNTING

Keeping in mind the performance of the firm, it can be hereby said that the firm SEEK

enhanced the remuneration by nearly 8% in line with improvement in performance of the

firm.

Again, in case of the competitor firm, it can be hereby said that it is only during the financial

year 2017, the only executive key management personnel who necessarily received an

enhancement in mainly the base pay was the chief executive officer (Peetz 2015). Essentially,

the executive KMP persistently carried out the investment of 10% of yearly base pay into

shares of the competitor firm Fairfax Media Ltd. Nevertheless, the base pay of the firm’s

director of remained constant that is unaltered during the financial year 2017. Nevertheless,

for the current period, the executive management personnel essentially were concentrated on

attainment of targets regards group as well as departmental earnings before interest tax

depreciation as well as amortisation (Steele et al. 2016). Short term payments for incentive

for the executive key management personnel can be considered to be modest that was

necessarily the outcome of providing low EBITDA. Again, long term incentive analysis of

the firm shows that the prior Transformation Incentive Plan is owing to vest subsequent to the

closing of the year 2017.

Keeping in mind the performance of the firm, it can be hereby said that the firm SEEK

enhanced the remuneration by nearly 8% in line with improvement in performance of the

firm.

Again, in case of the competitor firm, it can be hereby said that it is only during the financial

year 2017, the only executive key management personnel who necessarily received an

enhancement in mainly the base pay was the chief executive officer (Peetz 2015). Essentially,

the executive KMP persistently carried out the investment of 10% of yearly base pay into

shares of the competitor firm Fairfax Media Ltd. Nevertheless, the base pay of the firm’s

director of remained constant that is unaltered during the financial year 2017. Nevertheless,

for the current period, the executive management personnel essentially were concentrated on

attainment of targets regards group as well as departmental earnings before interest tax

depreciation as well as amortisation (Steele et al. 2016). Short term payments for incentive

for the executive key management personnel can be considered to be modest that was

necessarily the outcome of providing low EBITDA. Again, long term incentive analysis of

the firm shows that the prior Transformation Incentive Plan is owing to vest subsequent to the

closing of the year 2017.

15MANAGERIAL ACCOUNTING

Allocation of Executive Remuneration

Mix of performance measures utilized

Use of non-financial performance measures such as scorecards are used for analysing

performance of the firm from different perspective such as people, financial aspects,

Report on alterations in Executive Remuneration Reporting (analysis of 2016 and 2017)

Analysis of the remuneration report presented in the annual report of the firm reveals the fact

that there are a number of changes that took place during the period 2017 in comparison to

the prior years in particularly executive key management personnel section of the

remuneration report. The changes can be presented hereby below:

- The managing director of the firm SEEK that is Joseph Powel of particularly SEEK

Education during the financial year 2016 left the entire group with effect from period

September 5 of the year 2016. The remuneration of this managing director of the firm for the

period 2016 at the time when he stopped to be a key management perswonnel is divulged in

the current report. In essence, the main accountabilities of the current role were mainly

allocated to diverse other members of particularly the executive as well as the entire team of

senior management (Kanapathippillai et al. 2016). Again, Michael IIczynki was essentially

appointed as the managing director of the firm SEEK Australia as well as New Zealand that

is necessarily effective from the period September 1 of the year 2016 in the process of

identification of particularly absorbing the supplementary accountability of the nation

Australia as well as New Zealand SEEK Learning Business. In addition to this, Peter

Everingham who is the managing director of the firm SEEK International essentially left the

Allocation of Executive Remuneration

Mix of performance measures utilized

Use of non-financial performance measures such as scorecards are used for analysing

performance of the firm from different perspective such as people, financial aspects,

Report on alterations in Executive Remuneration Reporting (analysis of 2016 and 2017)

Analysis of the remuneration report presented in the annual report of the firm reveals the fact

that there are a number of changes that took place during the period 2017 in comparison to

the prior years in particularly executive key management personnel section of the

remuneration report. The changes can be presented hereby below:

- The managing director of the firm SEEK that is Joseph Powel of particularly SEEK

Education during the financial year 2016 left the entire group with effect from period

September 5 of the year 2016. The remuneration of this managing director of the firm for the

period 2016 at the time when he stopped to be a key management perswonnel is divulged in

the current report. In essence, the main accountabilities of the current role were mainly

allocated to diverse other members of particularly the executive as well as the entire team of

senior management (Kanapathippillai et al. 2016). Again, Michael IIczynki was essentially

appointed as the managing director of the firm SEEK Australia as well as New Zealand that

is necessarily effective from the period September 1 of the year 2016 in the process of

identification of particularly absorbing the supplementary accountability of the nation

Australia as well as New Zealand SEEK Learning Business. In addition to this, Peter

Everingham who is the managing director of the firm SEEK International essentially left the

16MANAGERIAL ACCOUNTING

specific group effectively from the period December 31 of the year 2016. The remuneration

of the Peter for the specified period till the period 31st December of the year 2016 when he

stopped to be a key management personnel is divulged in the current report. In particular, the

accountabilities of this specific role were to large extent allocated to the person Isar Mazar.

However, the personnel Peter continue in the current role as chiefly chairman of particularly

Zhaopin Ltd. In addition to this, yet another change that can be hereby observed includes that

of Isar Mazar. Isar Mazar was essentially appointed as the managing director of the firm

SEEK International in 2016. These personnel became key management personnel on

December 1 of the year 2016 and the remuneration for financial year 2017 is divulged from

this specific period onwards (Adams and Borsellino 2015).

Conclusion and Recommendations

The above mentioned study helps in understanding remuneration of the main firm SEEK ltd

and the competitor firm Fairfax Media Ltd. This study elucidates in detail about remuneration

Committee and its memberships of both the main as well as the competitor firm,

remuneration strategy of both the firms and analysis of alignment of remuneration of the firm

with the performance of the firm. In addition to this, the other non-financial measures that are

used for analysis of performance are also detailed in the current study. Analysis of financial

performance of the firm SEEK and Fairfax Media Ltd shows that SEEK has a better

performance in terms of ROI, ROE, earnings rate of growth as the dividend growth during

the year 20117. Accordingly, the remuneration of the firm SEEK is also seen to have

increased. However, financial performance of the firm Fairfax Media Ltd s superior in 2017

in comparison to the year 2016. Therefore, the remuneration of the firm was enhanced during

the year 2017. Bearing in mind results of the yearly report, it can be hereby said that the firm

SEEK can focus on improvement by means of thorough analysis and recommendation to the

particular board on mainly structure of remuneration. Again, the board of the firm have the

specific group effectively from the period December 31 of the year 2016. The remuneration

of the Peter for the specified period till the period 31st December of the year 2016 when he

stopped to be a key management personnel is divulged in the current report. In particular, the

accountabilities of this specific role were to large extent allocated to the person Isar Mazar.

However, the personnel Peter continue in the current role as chiefly chairman of particularly

Zhaopin Ltd. In addition to this, yet another change that can be hereby observed includes that

of Isar Mazar. Isar Mazar was essentially appointed as the managing director of the firm

SEEK International in 2016. These personnel became key management personnel on

December 1 of the year 2016 and the remuneration for financial year 2017 is divulged from

this specific period onwards (Adams and Borsellino 2015).

Conclusion and Recommendations

The above mentioned study helps in understanding remuneration of the main firm SEEK ltd

and the competitor firm Fairfax Media Ltd. This study elucidates in detail about remuneration

Committee and its memberships of both the main as well as the competitor firm,

remuneration strategy of both the firms and analysis of alignment of remuneration of the firm

with the performance of the firm. In addition to this, the other non-financial measures that are

used for analysis of performance are also detailed in the current study. Analysis of financial

performance of the firm SEEK and Fairfax Media Ltd shows that SEEK has a better

performance in terms of ROI, ROE, earnings rate of growth as the dividend growth during

the year 20117. Accordingly, the remuneration of the firm SEEK is also seen to have

increased. However, financial performance of the firm Fairfax Media Ltd s superior in 2017

in comparison to the year 2016. Therefore, the remuneration of the firm was enhanced during

the year 2017. Bearing in mind results of the yearly report, it can be hereby said that the firm

SEEK can focus on improvement by means of thorough analysis and recommendation to the

particular board on mainly structure of remuneration. Again, the board of the firm have the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17MANAGERIAL ACCOUNTING

need to make certain that framework of remuneration replicates concentration of the board

along with alignment of the firm SEEK. Also, there is need to make certain that level of

remuneration are essentially competitive and can attract qualified as well as experiences

executives as well as directors.

need to make certain that framework of remuneration replicates concentration of the board

along with alignment of the firm SEEK. Also, there is need to make certain that level of

remuneration are essentially competitive and can attract qualified as well as experiences

executives as well as directors.

18MANAGERIAL ACCOUNTING

References

Adams, M.A. and Borsellino, G., 2015. The unspoken reality of diversity on

boards. Governance Directions, 67(2), p.78.

Ahmed, A., Ng, C. and Delaney, D., 2015. Women on corporate boards and the incidence of

receiving a ‘strike’on the remuneration report. Corporate Ownership & Control, 12(4),

pp.261-272.

Bian, C., 2016. CEO option incentives, firm risk-taking and shareholder value: evidence from

Australia (Doctoral dissertation, Lincoln University).

Cassim, R. and Madlela, V., 2017. Disclosure of Directors’ Remuneration under South

African Company Law: is it adequate?.

Duckett, S. and Romanes, D., 2016. Submission to Review of Pharmacy Remuneration and

Regulation. Grattan Institute.

Duong, L. and Evans, J., 2015. CFO compensation: Evidence from Australia. Pacific-Basin

Finance Journal, 35, pp.425-443.

Fu, Y., Carson, E. and Simnett, R., 2015. Transparency report disclosure by Australian audit

firms and opportunities for research. Managerial Auditing Journal, 30(8/9), pp.870-910.

Grosse, M., Kean, S. and Scott, T., 2017. Shareholder say on pay and CEO compensation:

three strikes and the board is out. Accounting & Finance, 57(3), pp.701-725.

Hooghiemstra, R., Kuang, Y.F. and Qin, B., 2017. Does obfuscating excessive CEO pay

work? The influence of remuneration report readability on say-on-pay votes. Accounting and

Business Research, 47(6), pp.695-729.

References

Adams, M.A. and Borsellino, G., 2015. The unspoken reality of diversity on

boards. Governance Directions, 67(2), p.78.

Ahmed, A., Ng, C. and Delaney, D., 2015. Women on corporate boards and the incidence of

receiving a ‘strike’on the remuneration report. Corporate Ownership & Control, 12(4),

pp.261-272.

Bian, C., 2016. CEO option incentives, firm risk-taking and shareholder value: evidence from

Australia (Doctoral dissertation, Lincoln University).

Cassim, R. and Madlela, V., 2017. Disclosure of Directors’ Remuneration under South

African Company Law: is it adequate?.

Duckett, S. and Romanes, D., 2016. Submission to Review of Pharmacy Remuneration and

Regulation. Grattan Institute.

Duong, L. and Evans, J., 2015. CFO compensation: Evidence from Australia. Pacific-Basin

Finance Journal, 35, pp.425-443.

Fu, Y., Carson, E. and Simnett, R., 2015. Transparency report disclosure by Australian audit

firms and opportunities for research. Managerial Auditing Journal, 30(8/9), pp.870-910.

Grosse, M., Kean, S. and Scott, T., 2017. Shareholder say on pay and CEO compensation:

three strikes and the board is out. Accounting & Finance, 57(3), pp.701-725.

Hooghiemstra, R., Kuang, Y.F. and Qin, B., 2017. Does obfuscating excessive CEO pay

work? The influence of remuneration report readability on say-on-pay votes. Accounting and

Business Research, 47(6), pp.695-729.

19MANAGERIAL ACCOUNTING

Kanapathippillai, S., Johl, S.K. and Wines, G., 2016. Remuneration committee effectiveness

and narrative remuneration disclosure. Pacific-Basin finance journal, 40, pp.384-402.

Maas, K. and Rosendaal, S., 2016. Sustainability targets in executive remuneration: Targets,

time frame, country and sector specification. Business Strategy and the Environment, 25(6),

pp.390-401.

Peetz, D., 2015. An institutional analysis of the growth of executive remuneration. Journal of

Industrial Relations, 57(5), pp.707-725.

Pottenger, M. and Leigh, A., 2016. Long‐Run Trends in Australian Executive Remuneration:

BHP, 1887–2012. Australian Economic History Review, 56(1), pp.2-20.

Riaz, Z., 2016. A hybrid of state regulation and self-regulation for remuneration governance

in Australia. Corporate Governance, 16(3), pp.539-563.

Riaz, Z., Ray, S., Ray, P.K. and Kumar, V., 2015. Disclosure practices of foreign and

domestic firms in Australia. Journal of World Business, 50(4), pp.781-792.

Safari, M., Cooper, B.J. and Dellaportas, S., 2016. The influence of remuneration structures

on financial reporting quality: evidence from Australia. Australian Accounting Review, 26(1),

pp.66-75.

Scholtz, H.E. and Engelbrecht, W.A., 2015. The effect of remuneration committees, directors'

shareholding and institutional ownership on the remuneration of directors in the top 100

companies in South Africa. Southern African Business Review, 19(Special edition 2), pp.22-

51.

Steele, S., Chen, V. and Ramsay, I., 2016. An empirical study of Australian judicial decisions

relating to insolvency practitioner remuneration.

Kanapathippillai, S., Johl, S.K. and Wines, G., 2016. Remuneration committee effectiveness

and narrative remuneration disclosure. Pacific-Basin finance journal, 40, pp.384-402.

Maas, K. and Rosendaal, S., 2016. Sustainability targets in executive remuneration: Targets,

time frame, country and sector specification. Business Strategy and the Environment, 25(6),

pp.390-401.

Peetz, D., 2015. An institutional analysis of the growth of executive remuneration. Journal of

Industrial Relations, 57(5), pp.707-725.

Pottenger, M. and Leigh, A., 2016. Long‐Run Trends in Australian Executive Remuneration:

BHP, 1887–2012. Australian Economic History Review, 56(1), pp.2-20.

Riaz, Z., 2016. A hybrid of state regulation and self-regulation for remuneration governance

in Australia. Corporate Governance, 16(3), pp.539-563.

Riaz, Z., Ray, S., Ray, P.K. and Kumar, V., 2015. Disclosure practices of foreign and

domestic firms in Australia. Journal of World Business, 50(4), pp.781-792.

Safari, M., Cooper, B.J. and Dellaportas, S., 2016. The influence of remuneration structures

on financial reporting quality: evidence from Australia. Australian Accounting Review, 26(1),

pp.66-75.

Scholtz, H.E. and Engelbrecht, W.A., 2015. The effect of remuneration committees, directors'

shareholding and institutional ownership on the remuneration of directors in the top 100

companies in South Africa. Southern African Business Review, 19(Special edition 2), pp.22-

51.

Steele, S., Chen, V. and Ramsay, I., 2016. An empirical study of Australian judicial decisions

relating to insolvency practitioner remuneration.

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.