Managerial Economics Assignment Solution: Comprehensive Analysis

VerifiedAdded on 2023/04/25

|39

|9292

|77

Homework Assignment

AI Summary

This document presents a complete solution to a managerial economics assignment. Part A addresses topics such as the calculation of financial and economic costs, profit maximization using marginal revenue and marginal cost, the concept of price elasticity of demand and its determinants, price discrimination strategies with examples from the airline industry, and the law of diminishing returns in relation to short-run cost curves. Part B delves into the application of economic principles to real-world scenarios, providing detailed answers to practical questions. The solution includes calculations, explanations, and relevant economic theories to offer a thorough understanding of the subject matter. This comprehensive resource is designed to aid students in their coursework and enhance their grasp of managerial economics principles.

Running head: MANAGERIAL ECONOMICS

Managerial Economics

Name of the Student

Name of the University

Course ID

Managerial Economics

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGERIAL ECONOMICS

Table of Contents

Part A.........................................................................................................................................2

Answer 1................................................................................................................................2

Answer 2................................................................................................................................3

Answer 3................................................................................................................................4

Answer 4................................................................................................................................6

Answer 5................................................................................................................................9

Answer 6..............................................................................................................................14

Answer 7..............................................................................................................................17

Part B........................................................................................................................................21

Answer 1..............................................................................................................................21

Answer 2..............................................................................................................................24

Answer 3..............................................................................................................................27

References................................................................................................................................32

Table of Contents

Part A.........................................................................................................................................2

Answer 1................................................................................................................................2

Answer 2................................................................................................................................3

Answer 3................................................................................................................................4

Answer 4................................................................................................................................6

Answer 5................................................................................................................................9

Answer 6..............................................................................................................................14

Answer 7..............................................................................................................................17

Part B........................................................................................................................................21

Answer 1..............................................................................................................................21

Answer 2..............................................................................................................................24

Answer 3..............................................................................................................................27

References................................................................................................................................32

2MANAGERIAL ECONOMICS

Part A

Answer 1

In making any economic decision, an individual should consider both the explicit and

implicit cost associated with the decision. An explicit cost refers to the direct payment or

monetary cost associated with a business (Varian, 2014). It includes only the financial costs

during the course of an action. Implicit cost in contrast refers to the imputed cost or

opportunity cost related to the economic decision. Opportunity cost is the cost incurred from

forgoing the next best alternative (Cowen & Tabarrok, 2015). It is the indirect cost associated

with a decision. It is also termed as economic cost.

Mr. Rahim’s decision to pursue MBA involves both financial and economic costs.

The financial cost of pursuing MBA involve the direct costs of pursuing the course. These

include tuition fee, buy books and transport cost. In order to pursue the MBA program Mr.

Rahim has to forgone his current job yielding a salary of RM 2,500 per month.

Therefore, the financial and economic cost of doing MBA can be computed

Financial cost=Tuition fee+Cost of buying books+Transport cost

¿ RM 20,000+RM 2,000+ RM 500

¿ RM 22500

Economic Cost =Forgone salary of the current job

¿ ( RM 2500 ×18 )

¿ RM 45000

Part A

Answer 1

In making any economic decision, an individual should consider both the explicit and

implicit cost associated with the decision. An explicit cost refers to the direct payment or

monetary cost associated with a business (Varian, 2014). It includes only the financial costs

during the course of an action. Implicit cost in contrast refers to the imputed cost or

opportunity cost related to the economic decision. Opportunity cost is the cost incurred from

forgoing the next best alternative (Cowen & Tabarrok, 2015). It is the indirect cost associated

with a decision. It is also termed as economic cost.

Mr. Rahim’s decision to pursue MBA involves both financial and economic costs.

The financial cost of pursuing MBA involve the direct costs of pursuing the course. These

include tuition fee, buy books and transport cost. In order to pursue the MBA program Mr.

Rahim has to forgone his current job yielding a salary of RM 2,500 per month.

Therefore, the financial and economic cost of doing MBA can be computed

Financial cost=Tuition fee+Cost of buying books+Transport cost

¿ RM 20,000+RM 2,000+ RM 500

¿ RM 22500

Economic Cost =Forgone salary of the current job

¿ ( RM 2500 ×18 )

¿ RM 45000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGERIAL ECONOMICS

Answer 2

The Total Revenue (TR) function of the firm is given as

TR=60Q−Q2

The Total Cost (TC) function of the firm is given as

TC=1

2 Q2+ 30Q+30

Profit maximization of firm occurs at the point where marginal revenue equals marginal cost

(Baumol & Blinder, 2015). From the given, total revenue function, marginal revenue of the

firm is obtained as

Marginal Revenue ( MR ) = d ( TR )

dQ

¿ d ( 60Q−Q2 )

dQ

¿ 60−2Q

Given the total cost function, marginal cost of the firm is obtained as

Marginal Cost ( MC ) = d ( TC )

dQ

¿

d ( 1

2 Q2+ 30Q+30 )

dQ

¿ Q+30

Profit maximization occurs

MR=MC

¿ , 60−2Q=Q+30

Answer 2

The Total Revenue (TR) function of the firm is given as

TR=60Q−Q2

The Total Cost (TC) function of the firm is given as

TC=1

2 Q2+ 30Q+30

Profit maximization of firm occurs at the point where marginal revenue equals marginal cost

(Baumol & Blinder, 2015). From the given, total revenue function, marginal revenue of the

firm is obtained as

Marginal Revenue ( MR ) = d ( TR )

dQ

¿ d ( 60Q−Q2 )

dQ

¿ 60−2Q

Given the total cost function, marginal cost of the firm is obtained as

Marginal Cost ( MC ) = d ( TC )

dQ

¿

d ( 1

2 Q2+ 30Q+30 )

dQ

¿ Q+30

Profit maximization occurs

MR=MC

¿ , 60−2Q=Q+30

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGERIAL ECONOMICS

¿ , 2Q+Q=60−30

¿ , 3 Q=30

¿ , Q= 30

3

¿ , Q=10

The quantity level that maximizes total profit of the firm is obtained as 10.

Answer 3

Price elasticity of demand

The term price elastic of demand in economic measures the percentage change in

quantity demanded of a commodity in response to a percentage change in price (Whitehead,

2014). Price elasticity of demand actually measures the responsiveness of demand for a

change in price.

It is measured by computing the percentage change in quantity demanded with respect to

certain percentage change in price.

Price elasticity of demand= Percentage change∈quantity demanded

Percentage chamge∈ price

Determinants of demand

The first primary determinant of demand is price of the product. Given all the factors,

an increase in price lowers demand and vice-versa. Except price, several factors influence

demand of the product. Some of the factors determining demand of a product are discussed

below.

¿ , 2Q+Q=60−30

¿ , 3 Q=30

¿ , Q= 30

3

¿ , Q=10

The quantity level that maximizes total profit of the firm is obtained as 10.

Answer 3

Price elasticity of demand

The term price elastic of demand in economic measures the percentage change in

quantity demanded of a commodity in response to a percentage change in price (Whitehead,

2014). Price elasticity of demand actually measures the responsiveness of demand for a

change in price.

It is measured by computing the percentage change in quantity demanded with respect to

certain percentage change in price.

Price elasticity of demand= Percentage change∈quantity demanded

Percentage chamge∈ price

Determinants of demand

The first primary determinant of demand is price of the product. Given all the factors,

an increase in price lowers demand and vice-versa. Except price, several factors influence

demand of the product. Some of the factors determining demand of a product are discussed

below.

5MANAGERIAL ECONOMICS

Income

In case of a normal good, income has a positive relation with demand. That is as

income increases, ceteris paribus demand for a good or service increases and vice-versa

(Kreps, 2019). Goods for which this does not hold, that is demand reduces with increase in

income are termed as inferior good.

Taste and preferences

Tastes and preferences capture personal like or dislike of buyers of various goods and

services. Tastes and preferences are again influenced by religious belief, advertising, culture,

government reports, promotions, campaign and such other factors. Increasing preference for a

good increases demand and vice-versa.

Price of related good

Related goods of particular goods referred as either substitutes or complements of the

good. When price of a substitute good increases, demand for the concerned good increases as

consumers look for relatively cheaper substitutes (Bade & Parkin, 2015). For example, tea

and coffee. When price of a complementary good increases, demand for the particular good

decreases as consumers to reduce demand for the good along with its complementary good.

For example car and petrol.

Number of consumers/population

The effect of number of buyers on demand for a product varies depending on interest

of changing demographics and associated tastes and preferences.

Future expectation

Buyers’ expectation that price of a good or service will increase in future; encourage

buyers to increase their current demand (McKenzie & Lee, 2016).

Income

In case of a normal good, income has a positive relation with demand. That is as

income increases, ceteris paribus demand for a good or service increases and vice-versa

(Kreps, 2019). Goods for which this does not hold, that is demand reduces with increase in

income are termed as inferior good.

Taste and preferences

Tastes and preferences capture personal like or dislike of buyers of various goods and

services. Tastes and preferences are again influenced by religious belief, advertising, culture,

government reports, promotions, campaign and such other factors. Increasing preference for a

good increases demand and vice-versa.

Price of related good

Related goods of particular goods referred as either substitutes or complements of the

good. When price of a substitute good increases, demand for the concerned good increases as

consumers look for relatively cheaper substitutes (Bade & Parkin, 2015). For example, tea

and coffee. When price of a complementary good increases, demand for the particular good

decreases as consumers to reduce demand for the good along with its complementary good.

For example car and petrol.

Number of consumers/population

The effect of number of buyers on demand for a product varies depending on interest

of changing demographics and associated tastes and preferences.

Future expectation

Buyers’ expectation that price of a good or service will increase in future; encourage

buyers to increase their current demand (McKenzie & Lee, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGERIAL ECONOMICS

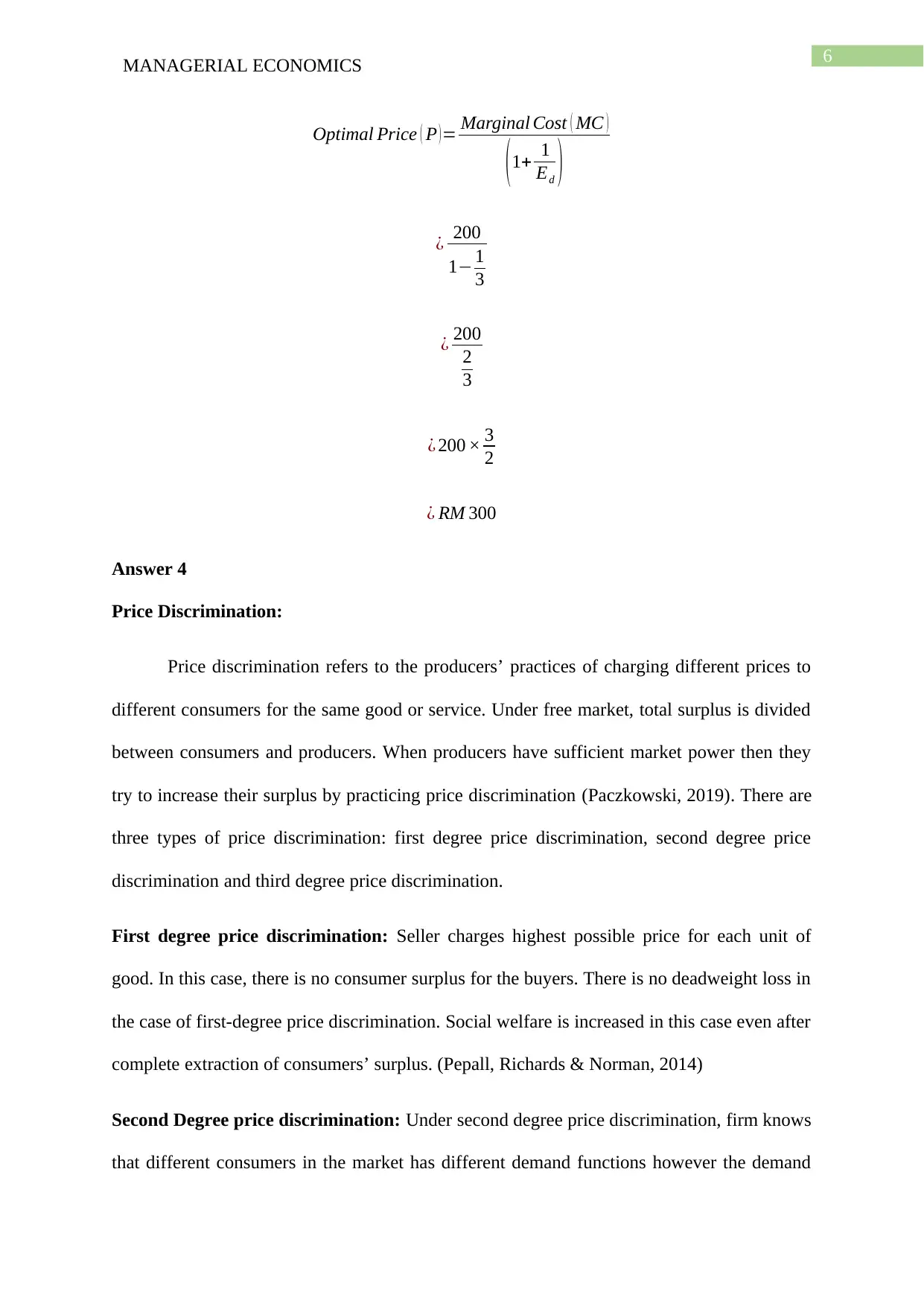

Optimal Price ( P )= Marginal Cost ( MC )

(1+ 1

Ed )

¿ 200

1− 1

3

¿ 200

2

3

¿ 200 × 3

2

¿ RM 300

Answer 4

Price Discrimination:

Price discrimination refers to the producers’ practices of charging different prices to

different consumers for the same good or service. Under free market, total surplus is divided

between consumers and producers. When producers have sufficient market power then they

try to increase their surplus by practicing price discrimination (Paczkowski, 2019). There are

three types of price discrimination: first degree price discrimination, second degree price

discrimination and third degree price discrimination.

First degree price discrimination: Seller charges highest possible price for each unit of

good. In this case, there is no consumer surplus for the buyers. There is no deadweight loss in

the case of first-degree price discrimination. Social welfare is increased in this case even after

complete extraction of consumers’ surplus. (Pepall, Richards & Norman, 2014)

Second Degree price discrimination: Under second degree price discrimination, firm knows

that different consumers in the market has different demand functions however the demand

Optimal Price ( P )= Marginal Cost ( MC )

(1+ 1

Ed )

¿ 200

1− 1

3

¿ 200

2

3

¿ 200 × 3

2

¿ RM 300

Answer 4

Price Discrimination:

Price discrimination refers to the producers’ practices of charging different prices to

different consumers for the same good or service. Under free market, total surplus is divided

between consumers and producers. When producers have sufficient market power then they

try to increase their surplus by practicing price discrimination (Paczkowski, 2019). There are

three types of price discrimination: first degree price discrimination, second degree price

discrimination and third degree price discrimination.

First degree price discrimination: Seller charges highest possible price for each unit of

good. In this case, there is no consumer surplus for the buyers. There is no deadweight loss in

the case of first-degree price discrimination. Social welfare is increased in this case even after

complete extraction of consumers’ surplus. (Pepall, Richards & Norman, 2014)

Second Degree price discrimination: Under second degree price discrimination, firm knows

that different consumers in the market has different demand functions however the demand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGERIAL ECONOMICS

function of a particular consumer is not known. Firm here offers a menu price for different

packages. Options are designed in such a way consumers can self-select by choosing suitable

package for themselves. Unlike first-degree price discrimination, firms by practicing second-

degree price discrimination cannot capture all consumer surplus.

Third Degree price discrimination: In this case, seller charges according to the elasticity of

demand among different group of buyers. Price discriminator will separate buyers in different

groups having different elasticity of demand (Waldman & Jensen, 2016). Now, the seller will

charge lower price for highly demand elastic market and higher price for lower demand

elastic market. Third degree price discrimination cannot increase the social welfare.

Conditions for Effective price discrimination:

To discriminate price effectively, seller need to identify the demands of the buyers or the

group of the buyers. Conditions for effective price discrimination are the following:

Immovability of buyers: In order the make price discrimination effective, sellers should

ensure that the buyers are not able to switch from one market to another market. That means

buyers cannot move from high price market to low price market (Gillespie, 2016). Markets

could be separated depending on the following factors:

Time: Different prices are charged in different times of a day or week or month.

Age: Prices are different for different age group. Example, due to reservation for old- age

people, they pay less than other people do.

Region: Transportation cost changes the price of same good. Where the transportation cost is

high, prices are higher in that place and vice versa.

Status: Prices can vary for the status or designation of the buyer. For an example, entry fee or

the charges in a club is different for the club members and non-members.

function of a particular consumer is not known. Firm here offers a menu price for different

packages. Options are designed in such a way consumers can self-select by choosing suitable

package for themselves. Unlike first-degree price discrimination, firms by practicing second-

degree price discrimination cannot capture all consumer surplus.

Third Degree price discrimination: In this case, seller charges according to the elasticity of

demand among different group of buyers. Price discriminator will separate buyers in different

groups having different elasticity of demand (Waldman & Jensen, 2016). Now, the seller will

charge lower price for highly demand elastic market and higher price for lower demand

elastic market. Third degree price discrimination cannot increase the social welfare.

Conditions for Effective price discrimination:

To discriminate price effectively, seller need to identify the demands of the buyers or the

group of the buyers. Conditions for effective price discrimination are the following:

Immovability of buyers: In order the make price discrimination effective, sellers should

ensure that the buyers are not able to switch from one market to another market. That means

buyers cannot move from high price market to low price market (Gillespie, 2016). Markets

could be separated depending on the following factors:

Time: Different prices are charged in different times of a day or week or month.

Age: Prices are different for different age group. Example, due to reservation for old- age

people, they pay less than other people do.

Region: Transportation cost changes the price of same good. Where the transportation cost is

high, prices are higher in that place and vice versa.

Status: Prices can vary for the status or designation of the buyer. For an example, entry fee or

the charges in a club is different for the club members and non-members.

8MANAGERIAL ECONOMICS

Different elasticity of demand: Price elasticity of demand should be different for different

markets. Price inelastic demand one market enables the market to charge more price in the

market and less in other market (Currie, Peel & Peters, 2016). Different demand enables the

market to charge different price. In the inelastic demand market price is higher than the

elastic market.

Except the above two conditions there are some conditions which are also important

in the process of price discrimination. To discriminate price, firms need market power to

charge above marginal cost. Consumers need to be heterogeneous and resealing of products

needs to be banned or costly.

Price discrimination in the airline industry

In the airline industry, price discrimination is a common phenomenon. Passengers

pays different prices for the same flight and same services in the airline industry. Ticket fare

varies depending on time of booking the tickets, facilities associated with seat, seasons and

other attributes (Cattaneo et al., 2016). The conditions that make the price dissemination

possible in the airline industry are explained below.

1. In the airline industry, the source of market power is the barriers that have been

raised by the scale of economies and sunk cost to discriminate price.

2. They occupy the different schedules of flight. To do so, they offer different routes.

This helps them to differentiate among customers. For example, carriers, which

have too many connections to offer for west coast, make itself different from other

carrier, which flies to the east coast only (Bergantino & Capozza, 2015). Both of

them offer their ticket for sale for Boston-Miami route.

3. Different consumers have different elasticity of demand.

Different elasticity of demand: Price elasticity of demand should be different for different

markets. Price inelastic demand one market enables the market to charge more price in the

market and less in other market (Currie, Peel & Peters, 2016). Different demand enables the

market to charge different price. In the inelastic demand market price is higher than the

elastic market.

Except the above two conditions there are some conditions which are also important

in the process of price discrimination. To discriminate price, firms need market power to

charge above marginal cost. Consumers need to be heterogeneous and resealing of products

needs to be banned or costly.

Price discrimination in the airline industry

In the airline industry, price discrimination is a common phenomenon. Passengers

pays different prices for the same flight and same services in the airline industry. Ticket fare

varies depending on time of booking the tickets, facilities associated with seat, seasons and

other attributes (Cattaneo et al., 2016). The conditions that make the price dissemination

possible in the airline industry are explained below.

1. In the airline industry, the source of market power is the barriers that have been

raised by the scale of economies and sunk cost to discriminate price.

2. They occupy the different schedules of flight. To do so, they offer different routes.

This helps them to differentiate among customers. For example, carriers, which

have too many connections to offer for west coast, make itself different from other

carrier, which flies to the east coast only (Bergantino & Capozza, 2015). Both of

them offer their ticket for sale for Boston-Miami route.

3. Different consumers have different elasticity of demand.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGERIAL ECONOMICS

The airline industry does some common price discrimination, which are described as

below:

Versions of Ticket: Different versions of tickets are available in the airline industry. Such as,

expensive and flexible tickets enable the customer to reschedule the flight and cheap tickets,

which have restrictions.

Discounts to Large Customers: in the national and international level, some large customers

are likely to sign a contract with the airline companies to get discount (Chakrabarty & Kutlu,

2014). Such as, a firm’s employees get discounts on tickets. In this case, different groups of

customers pay different prices.

Frequent Flyers: in this programme, the flyers, which take the flights frequently, get

member points for every confirmed flights. Further, these points are used to get a free flight

as a discount.

Answer 5

Law of Diminishing Returns and Short-Run Cost Curve:

The law of diminishing returns states that increase in the quantity of an input other

things remaining same, the total productivity will increase at decreasing rate. In other words,

increase in the quantity of input other things remaining same; the marginal physical

productivity of the input will fall (Allen et al., 2013). There are certain assumptions, which

are described as follows:

The state of technology remains constant.

Only one input can be changed and other inputs will remain same.

The law is not applicable in case of the production where the inputs are proportionally

required (Shepherd, 2015).

Only physical inputs and outputs are considered.

The airline industry does some common price discrimination, which are described as

below:

Versions of Ticket: Different versions of tickets are available in the airline industry. Such as,

expensive and flexible tickets enable the customer to reschedule the flight and cheap tickets,

which have restrictions.

Discounts to Large Customers: in the national and international level, some large customers

are likely to sign a contract with the airline companies to get discount (Chakrabarty & Kutlu,

2014). Such as, a firm’s employees get discounts on tickets. In this case, different groups of

customers pay different prices.

Frequent Flyers: in this programme, the flyers, which take the flights frequently, get

member points for every confirmed flights. Further, these points are used to get a free flight

as a discount.

Answer 5

Law of Diminishing Returns and Short-Run Cost Curve:

The law of diminishing returns states that increase in the quantity of an input other

things remaining same, the total productivity will increase at decreasing rate. In other words,

increase in the quantity of input other things remaining same; the marginal physical

productivity of the input will fall (Allen et al., 2013). There are certain assumptions, which

are described as follows:

The state of technology remains constant.

Only one input can be changed and other inputs will remain same.

The law is not applicable in case of the production where the inputs are proportionally

required (Shepherd, 2015).

Only physical inputs and outputs are considered.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGERIAL ECONOMICS

Cost

Quantity

Fixed Cost

Variable Cost

Total Cost

Cost

Quantity

Marginal Cost

Average Total Cost

Average Variable Cost

Average Fixed

Cost

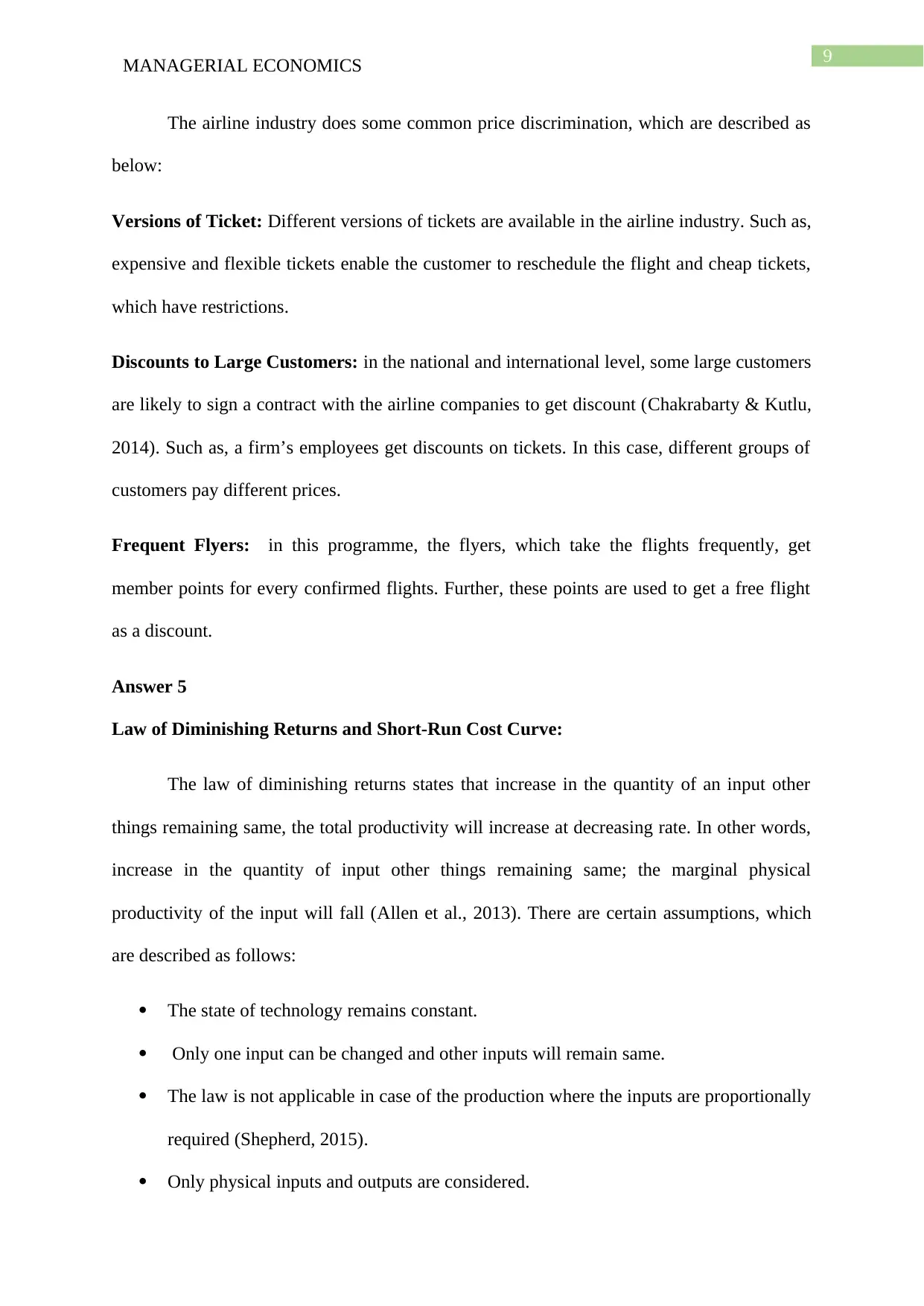

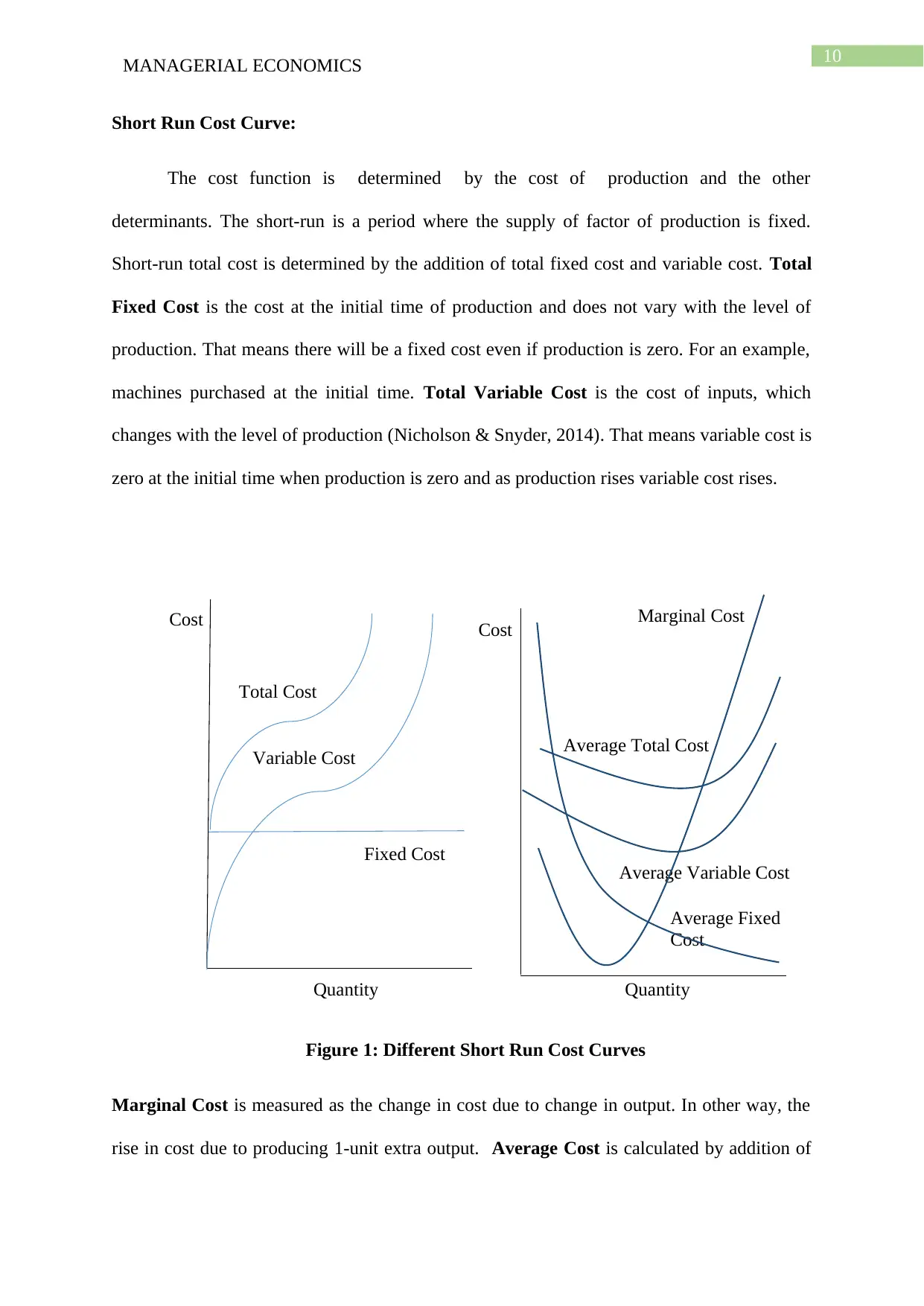

Short Run Cost Curve:

The cost function is determined by the cost of production and the other

determinants. The short-run is a period where the supply of factor of production is fixed.

Short-run total cost is determined by the addition of total fixed cost and variable cost. Total

Fixed Cost is the cost at the initial time of production and does not vary with the level of

production. That means there will be a fixed cost even if production is zero. For an example,

machines purchased at the initial time. Total Variable Cost is the cost of inputs, which

changes with the level of production (Nicholson & Snyder, 2014). That means variable cost is

zero at the initial time when production is zero and as production rises variable cost rises.

Figure 1: Different Short Run Cost Curves

Marginal Cost is measured as the change in cost due to change in output. In other way, the

rise in cost due to producing 1-unit extra output. Average Cost is calculated by addition of

Cost

Quantity

Fixed Cost

Variable Cost

Total Cost

Cost

Quantity

Marginal Cost

Average Total Cost

Average Variable Cost

Average Fixed

Cost

Short Run Cost Curve:

The cost function is determined by the cost of production and the other

determinants. The short-run is a period where the supply of factor of production is fixed.

Short-run total cost is determined by the addition of total fixed cost and variable cost. Total

Fixed Cost is the cost at the initial time of production and does not vary with the level of

production. That means there will be a fixed cost even if production is zero. For an example,

machines purchased at the initial time. Total Variable Cost is the cost of inputs, which

changes with the level of production (Nicholson & Snyder, 2014). That means variable cost is

zero at the initial time when production is zero and as production rises variable cost rises.

Figure 1: Different Short Run Cost Curves

Marginal Cost is measured as the change in cost due to change in output. In other way, the

rise in cost due to producing 1-unit extra output. Average Cost is calculated by addition of

11MANAGERIAL ECONOMICS

average fixed cost and average variable cost. Average Fixed Cost is calculated by dividing

the fixed cost with the quantity of output. As output increases, average fixed cost decreases.

Average Variable Cost is measured in the same way by dividing the variable cost with the

quantity of output.

In the short-run, according to law of diminishing returns, an increase in variable input

increases the output at initial time and then decreases. That means the marginal productivity

is negative for the variable input (Mankiw, 2014). The marginal cost of extra units of output

supply is connected with the productivity of input. The law of diminishing returns means the

cost will increase the average total cost.

Economies of Scale and the Long Run Cost Curve

Economies of scale means the cost advantage that arises because of the negative

impact of quantity produced on average fixed cost. A rise in the quantity of output reduces

the average fixed cost. Operational efficiency relates the economies of scale and average

variable cost. Firms can introduce it at any stage of production.

Effects of Economies of Scale

It reduces the average fixed cost, average variable cost and average cost of

production. This happens because of increase in production, which absorb the fixed cost and

expanded scale of production raises the efficiency of production, which helps the economic

scale to reduce the variable cost (Carlton & Perloff, 2015).

Types of Economies of Scale

Internal Economies of Scale: This means the unique economies of a firm. For an example, a

patent over a quality production machine which enables the firm to produce more qualitative

products, which also reduces the cost of production to compete the firms in the industry.

average fixed cost and average variable cost. Average Fixed Cost is calculated by dividing

the fixed cost with the quantity of output. As output increases, average fixed cost decreases.

Average Variable Cost is measured in the same way by dividing the variable cost with the

quantity of output.

In the short-run, according to law of diminishing returns, an increase in variable input

increases the output at initial time and then decreases. That means the marginal productivity

is negative for the variable input (Mankiw, 2014). The marginal cost of extra units of output

supply is connected with the productivity of input. The law of diminishing returns means the

cost will increase the average total cost.

Economies of Scale and the Long Run Cost Curve

Economies of scale means the cost advantage that arises because of the negative

impact of quantity produced on average fixed cost. A rise in the quantity of output reduces

the average fixed cost. Operational efficiency relates the economies of scale and average

variable cost. Firms can introduce it at any stage of production.

Effects of Economies of Scale

It reduces the average fixed cost, average variable cost and average cost of

production. This happens because of increase in production, which absorb the fixed cost and

expanded scale of production raises the efficiency of production, which helps the economic

scale to reduce the variable cost (Carlton & Perloff, 2015).

Types of Economies of Scale

Internal Economies of Scale: This means the unique economies of a firm. For an example, a

patent over a quality production machine which enables the firm to produce more qualitative

products, which also reduces the cost of production to compete the firms in the industry.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 39

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.