Managerial Finance: Comparative Financial Ratio Analysis Report

VerifiedAdded on 2023/01/16

|20

|3987

|64

Report

AI Summary

This report provides a comprehensive analysis of managerial finance, focusing on the comparative financial performance of GlaxoSmithKline plc and Reckitt Benckiser Group plc. The analysis involves calculating and evaluating ten key financial ratios for the years 2017 and 2018, including current ratio, quick ratio, net profit margin, gross profit margin, gearing ratio, price-earning ratio, earnings per share, return on capital employed, average inventory turnover period, and dividend payout ratio. The report assesses the financial position, performance, and investment potential of both companies based on these ratios. Additionally, it discusses the limitations of financial ratios and investment appraisal techniques, and offers recommendations to improve the financial performance of the comparatively weaker company. The report concludes with an overview of the findings and includes a list of references.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managerial Finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK ..............................................................................................................................................1

PORTFOLIO 1.................................................................................................................................1

(a) Calculation of different financial ratios for two years (2017 – 2018):..................................1

c. Recommendation in order to improve the poorly performing business..................................4

d. Limitation of financial ratios...................................................................................................5

PORTFOLIO 2.................................................................................................................................6

(a). Calculation of financial ratios for two years (2017 – 2018):................................................6

Payback Period:...........................................................................................................................6

b. Limitation of using investment appraisal technique.............................................................10

CONCLUSION..............................................................................................................................11

REFERENCES .............................................................................................................................12

INTRODUCTION...........................................................................................................................1

TASK ..............................................................................................................................................1

PORTFOLIO 1.................................................................................................................................1

(a) Calculation of different financial ratios for two years (2017 – 2018):..................................1

c. Recommendation in order to improve the poorly performing business..................................4

d. Limitation of financial ratios...................................................................................................5

PORTFOLIO 2.................................................................................................................................6

(a). Calculation of financial ratios for two years (2017 – 2018):................................................6

Payback Period:...........................................................................................................................6

b. Limitation of using investment appraisal technique.............................................................10

CONCLUSION..............................................................................................................................11

REFERENCES .............................................................................................................................12

INTRODUCTION

Managerial finance related to finance division that is dealing with fiscal tactics '

managerial importance. Instead of methodology, it depends on interpretation (Carbo‐Valverde,

Rodriguez‐Fernandez and Udell, 2016). Management finance deals with the responsibilities of

the fiscal manager who functions in a company. This study involves comparative analysis of

corporations named Glaxo Smith Kline plc and Reckitt Benckiser Group plc by computation

and critical evaluation of 10 significant financial ratios. It further discuss about several major

investment appraisal methods which assist managers and investors in taking financial and

investment decisions.

TASK

PORTFOLIO 1

(a) Calculation of different financial ratios for two years (2017 – 2018):

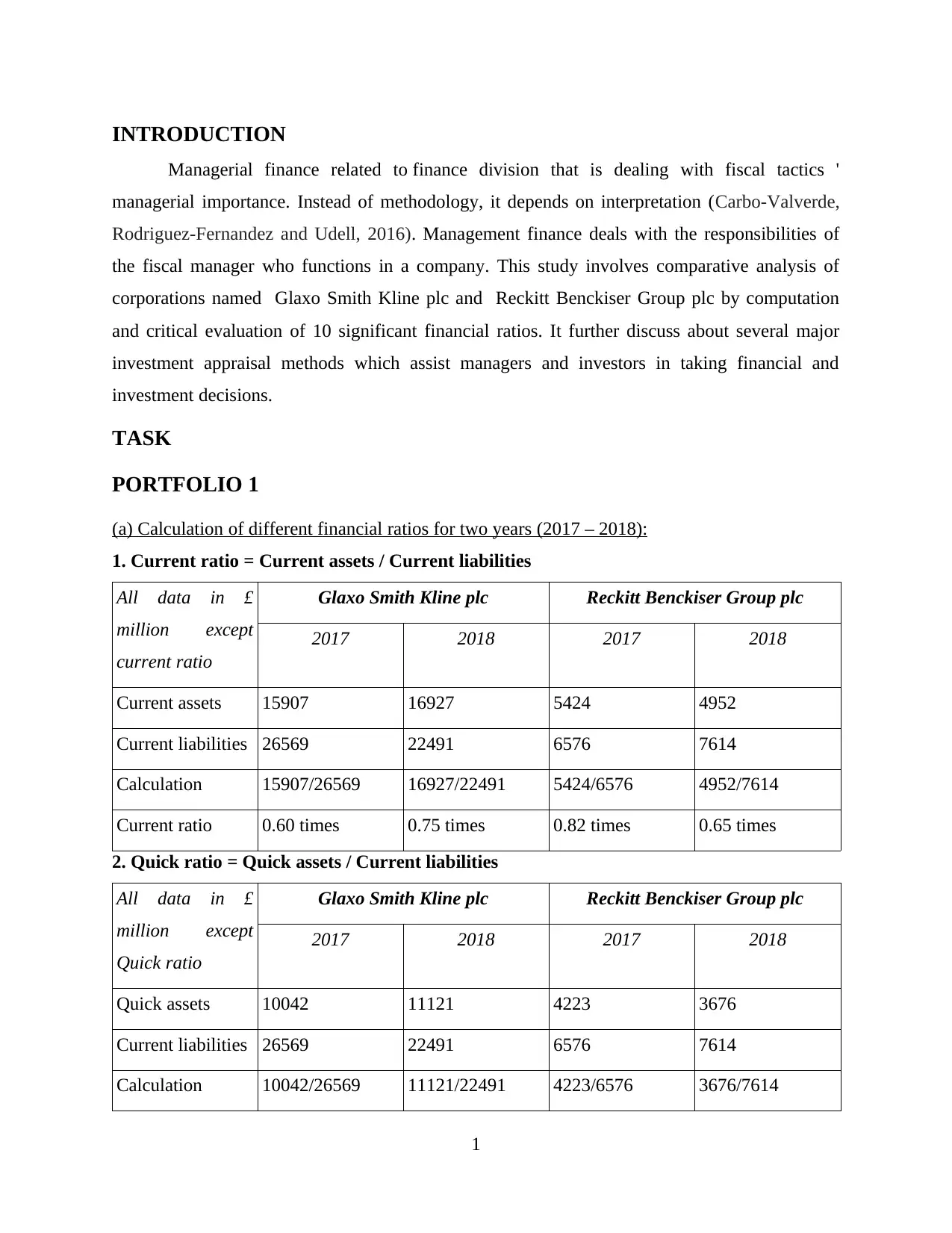

1. Current ratio = Current assets / Current liabilities

All data in £

million except

current ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Current assets 15907 16927 5424 4952

Current liabilities 26569 22491 6576 7614

Calculation 15907/26569 16927/22491 5424/6576 4952/7614

Current ratio 0.60 times 0.75 times 0.82 times 0.65 times

2. Quick ratio = Quick assets / Current liabilities

All data in £

million except

Quick ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Quick assets 10042 11121 4223 3676

Current liabilities 26569 22491 6576 7614

Calculation 10042/26569 11121/22491 4223/6576 3676/7614

1

Managerial finance related to finance division that is dealing with fiscal tactics '

managerial importance. Instead of methodology, it depends on interpretation (Carbo‐Valverde,

Rodriguez‐Fernandez and Udell, 2016). Management finance deals with the responsibilities of

the fiscal manager who functions in a company. This study involves comparative analysis of

corporations named Glaxo Smith Kline plc and Reckitt Benckiser Group plc by computation

and critical evaluation of 10 significant financial ratios. It further discuss about several major

investment appraisal methods which assist managers and investors in taking financial and

investment decisions.

TASK

PORTFOLIO 1

(a) Calculation of different financial ratios for two years (2017 – 2018):

1. Current ratio = Current assets / Current liabilities

All data in £

million except

current ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Current assets 15907 16927 5424 4952

Current liabilities 26569 22491 6576 7614

Calculation 15907/26569 16927/22491 5424/6576 4952/7614

Current ratio 0.60 times 0.75 times 0.82 times 0.65 times

2. Quick ratio = Quick assets / Current liabilities

All data in £

million except

Quick ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Quick assets 10042 11121 4223 3676

Current liabilities 26569 22491 6576 7614

Calculation 10042/26569 11121/22491 4223/6576 3676/7614

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

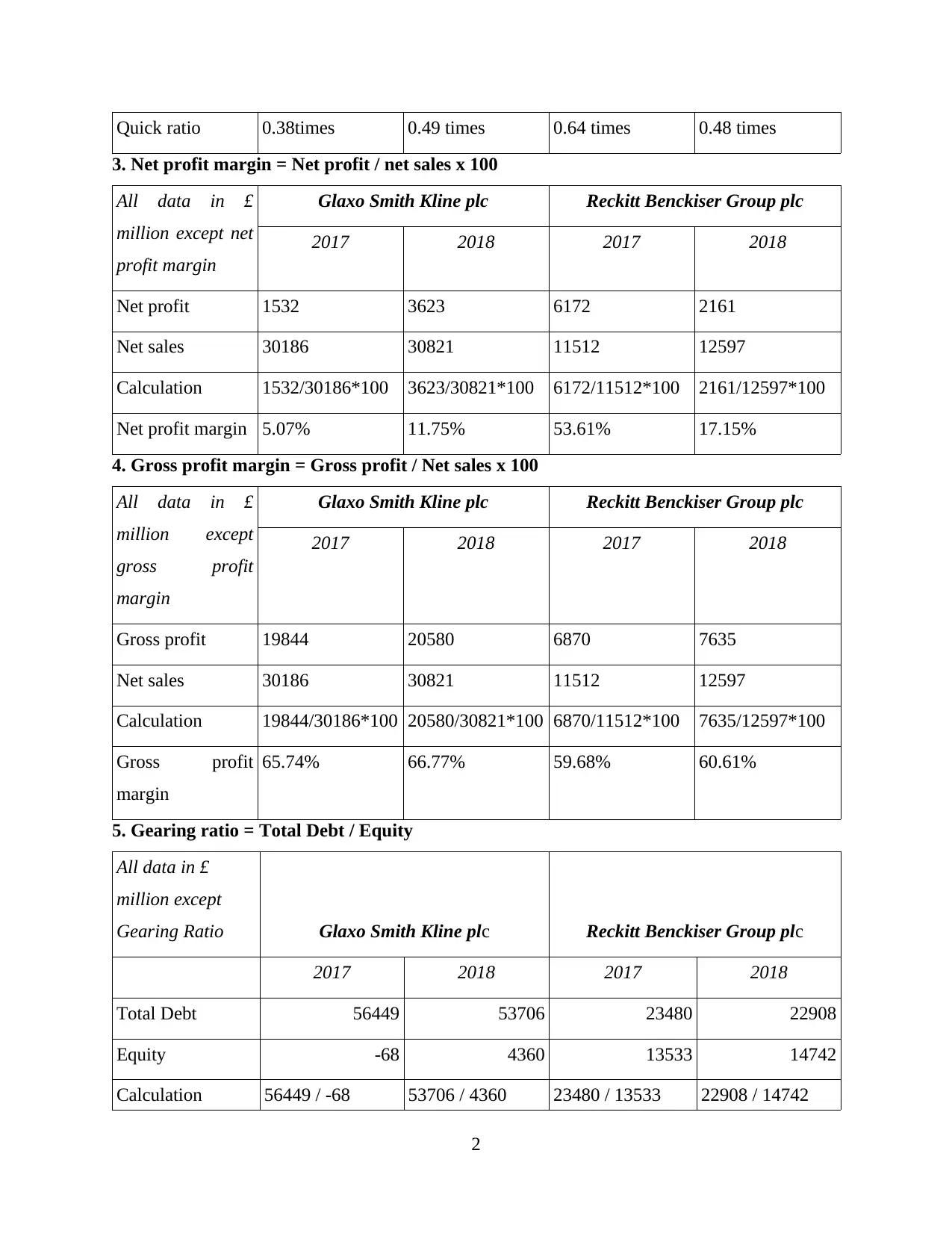

Quick ratio 0.38times 0.49 times 0.64 times 0.48 times

3. Net profit margin = Net profit / net sales x 100

All data in £

million except net

profit margin

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Net profit 1532 3623 6172 2161

Net sales 30186 30821 11512 12597

Calculation 1532/30186*100 3623/30821*100 6172/11512*100 2161/12597*100

Net profit margin 5.07% 11.75% 53.61% 17.15%

4. Gross profit margin = Gross profit / Net sales x 100

All data in £

million except

gross profit

margin

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Gross profit 19844 20580 6870 7635

Net sales 30186 30821 11512 12597

Calculation 19844/30186*100 20580/30821*100 6870/11512*100 7635/12597*100

Gross profit

margin

65.74% 66.77% 59.68% 60.61%

5. Gearing ratio = Total Debt / Equity

All data in £

million except

Gearing Ratio Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Total Debt 56449 53706 23480 22908

Equity -68 4360 13533 14742

Calculation 56449 / -68 53706 / 4360 23480 / 13533 22908 / 14742

2

3. Net profit margin = Net profit / net sales x 100

All data in £

million except net

profit margin

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Net profit 1532 3623 6172 2161

Net sales 30186 30821 11512 12597

Calculation 1532/30186*100 3623/30821*100 6172/11512*100 2161/12597*100

Net profit margin 5.07% 11.75% 53.61% 17.15%

4. Gross profit margin = Gross profit / Net sales x 100

All data in £

million except

gross profit

margin

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Gross profit 19844 20580 6870 7635

Net sales 30186 30821 11512 12597

Calculation 19844/30186*100 20580/30821*100 6870/11512*100 7635/12597*100

Gross profit

margin

65.74% 66.77% 59.68% 60.61%

5. Gearing ratio = Total Debt / Equity

All data in £

million except

Gearing Ratio Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Total Debt 56449 53706 23480 22908

Equity -68 4360 13533 14742

Calculation 56449 / -68 53706 / 4360 23480 / 13533 22908 / 14742

2

Gearing Ratio -830.13 12.32 1.74 1.55

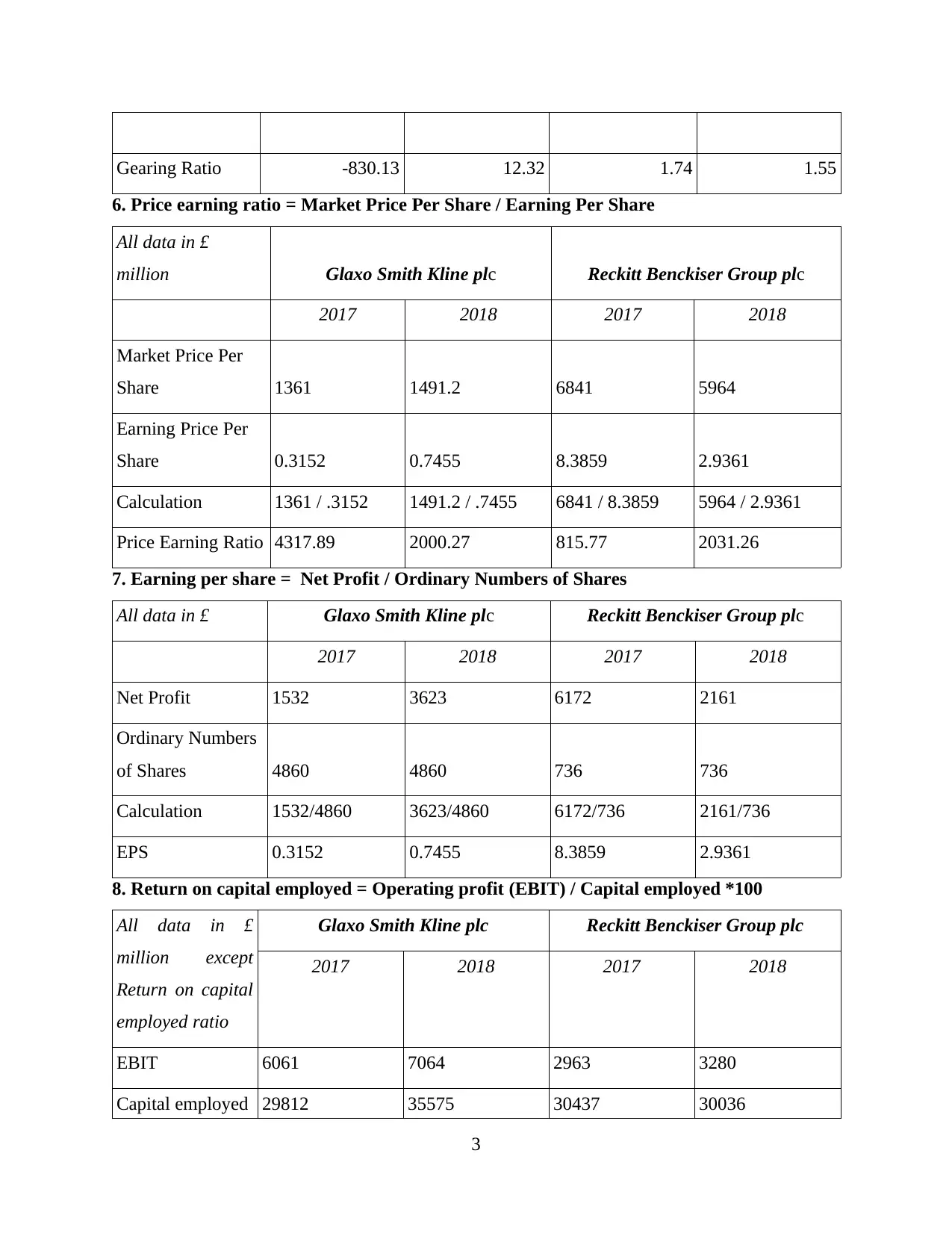

6. Price earning ratio = Market Price Per Share / Earning Per Share

All data in £

million Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Market Price Per

Share 1361 1491.2 6841 5964

Earning Price Per

Share 0.3152 0.7455 8.3859 2.9361

Calculation 1361 / .3152 1491.2 / .7455 6841 / 8.3859 5964 / 2.9361

Price Earning Ratio 4317.89 2000.27 815.77 2031.26

7. Earning per share = Net Profit / Ordinary Numbers of Shares

All data in £ Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Net Profit 1532 3623 6172 2161

Ordinary Numbers

of Shares 4860 4860 736 736

Calculation 1532/4860 3623/4860 6172/736 2161/736

EPS 0.3152 0.7455 8.3859 2.9361

8. Return on capital employed = Operating profit (EBIT) / Capital employed *100

All data in £

million except

Return on capital

employed ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

EBIT 6061 7064 2963 3280

Capital employed 29812 35575 30437 30036

3

6. Price earning ratio = Market Price Per Share / Earning Per Share

All data in £

million Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Market Price Per

Share 1361 1491.2 6841 5964

Earning Price Per

Share 0.3152 0.7455 8.3859 2.9361

Calculation 1361 / .3152 1491.2 / .7455 6841 / 8.3859 5964 / 2.9361

Price Earning Ratio 4317.89 2000.27 815.77 2031.26

7. Earning per share = Net Profit / Ordinary Numbers of Shares

All data in £ Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Net Profit 1532 3623 6172 2161

Ordinary Numbers

of Shares 4860 4860 736 736

Calculation 1532/4860 3623/4860 6172/736 2161/736

EPS 0.3152 0.7455 8.3859 2.9361

8. Return on capital employed = Operating profit (EBIT) / Capital employed *100

All data in £

million except

Return on capital

employed ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

EBIT 6061 7064 2963 3280

Capital employed 29812 35575 30437 30036

3

Calculation 6061/29812*100 7064/35575*100 2963/30437*100 3280/30036*100

ROCE 20.33% 19.86% 9.73% 10.92%

Working Note:

Capital employed = Total assets – Current liabilities

9. Average inventory turn over period = Average stock / Cost of goods sold * 365 days

All data in £

million except

Average

inventory turn

over period

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Average stock 5557 5476 1201 1276

Cost of goods

sold

10342 10241 4642 4962

Calculation 5557/10342*365 5476/10241*365 1201/4642*365 1276/4962*365

Average

inventory turn

over days

196 days 195 days 94 days 93.86 or 94 days

10. Dividend payout ratio = Total debts / total equities

All data in £

million except

Dividend payout

ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Total debts 56449 53706 23480 22908

Total equities -68 4360 13533 14742

Calculation 56449/-68 53706/4360 23480/13533 22908/14742

4

ROCE 20.33% 19.86% 9.73% 10.92%

Working Note:

Capital employed = Total assets – Current liabilities

9. Average inventory turn over period = Average stock / Cost of goods sold * 365 days

All data in £

million except

Average

inventory turn

over period

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Average stock 5557 5476 1201 1276

Cost of goods

sold

10342 10241 4642 4962

Calculation 5557/10342*365 5476/10241*365 1201/4642*365 1276/4962*365

Average

inventory turn

over days

196 days 195 days 94 days 93.86 or 94 days

10. Dividend payout ratio = Total debts / total equities

All data in £

million except

Dividend payout

ratio

Glaxo Smith Kline plc Reckitt Benckiser Group plc

2017 2018 2017 2018

Total debts 56449 53706 23480 22908

Total equities -68 4360 13533 14742

Calculation 56449/-68 53706/4360 23480/13533 22908/14742

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dividend payout

ratio

-830.13 12.31 1.73 1.55

(b) Evaluation of performance, financial position and investment potential.

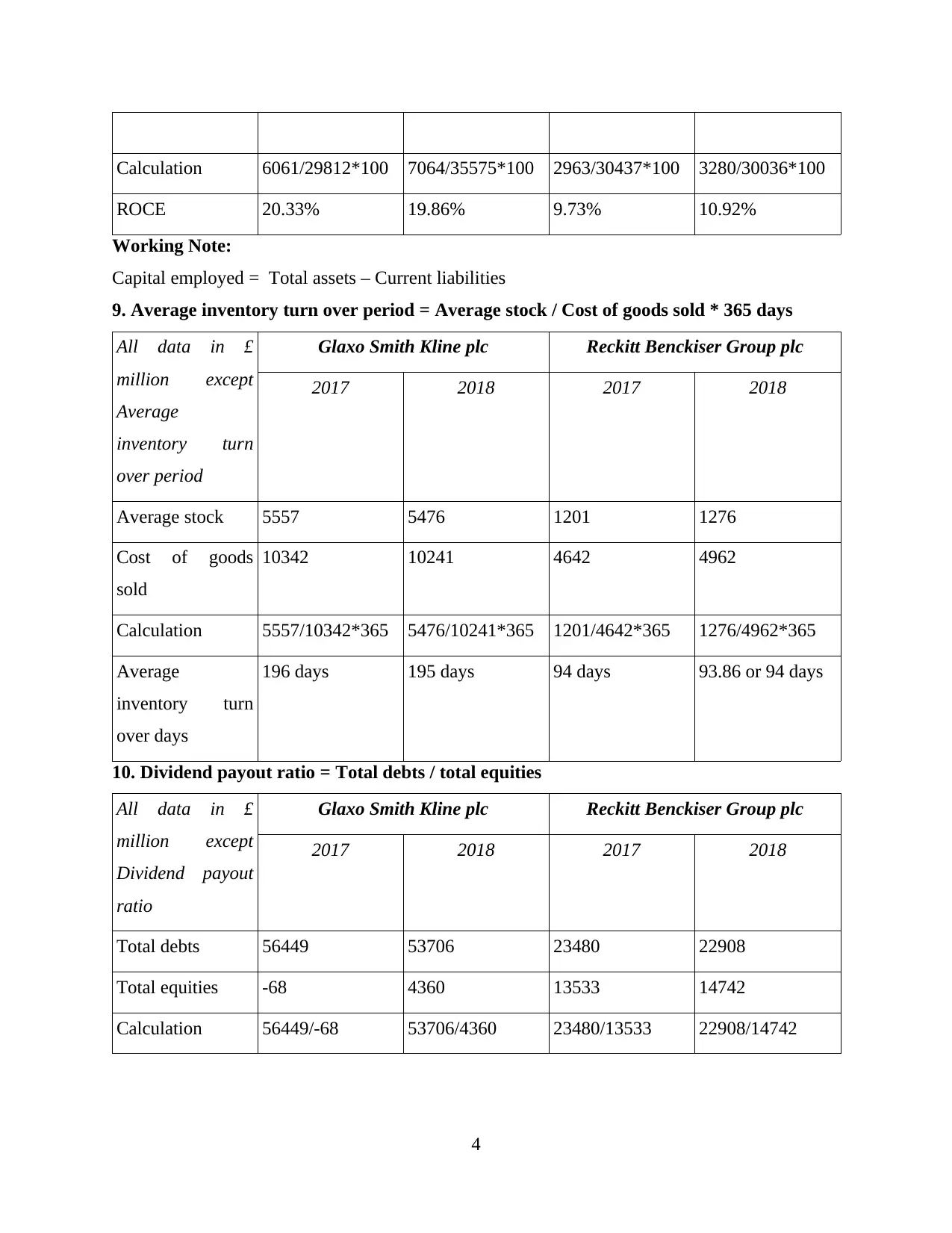

1. Current ratio

2017 (in times) 2018 (in times)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

0.6

0.75

0.82 0.85

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: Current ratio clearly reflects a corporation's short-term liquidation status.

Generally current ratio 2 or exceeding 2 is considered as most appropriate. This is most

significant proportion between current assets and short-term liabilities or current liabilities over a

specified time-period. RBG Plc and GSK Plc stated current ratio of 0.6 and 0.82 in year 2017,

and 0.75 and 0.85 in year 2018 (About Glaxo Smith Kline plc, 2019). RBG has reported an

increase in current ratio and also much better than other company GSK. This shows RBG is

effectively more capable to repay all its current liabilities as compare to GSK.

2. Quick Ratio

2017 (in times) 2018 (in times)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.38

0.49

0.64

0.48

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation:

3. Net Profit Margin Ratio

5

ratio

-830.13 12.31 1.73 1.55

(b) Evaluation of performance, financial position and investment potential.

1. Current ratio

2017 (in times) 2018 (in times)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

0.6

0.75

0.82 0.85

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: Current ratio clearly reflects a corporation's short-term liquidation status.

Generally current ratio 2 or exceeding 2 is considered as most appropriate. This is most

significant proportion between current assets and short-term liabilities or current liabilities over a

specified time-period. RBG Plc and GSK Plc stated current ratio of 0.6 and 0.82 in year 2017,

and 0.75 and 0.85 in year 2018 (About Glaxo Smith Kline plc, 2019). RBG has reported an

increase in current ratio and also much better than other company GSK. This shows RBG is

effectively more capable to repay all its current liabilities as compare to GSK.

2. Quick Ratio

2017 (in times) 2018 (in times)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.38

0.49

0.64

0.48

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation:

3. Net Profit Margin Ratio

5

2017 (in %) 2018 (in %)

0

10

20

30

40

50

60

5.07

11.75

53.61

17.15

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

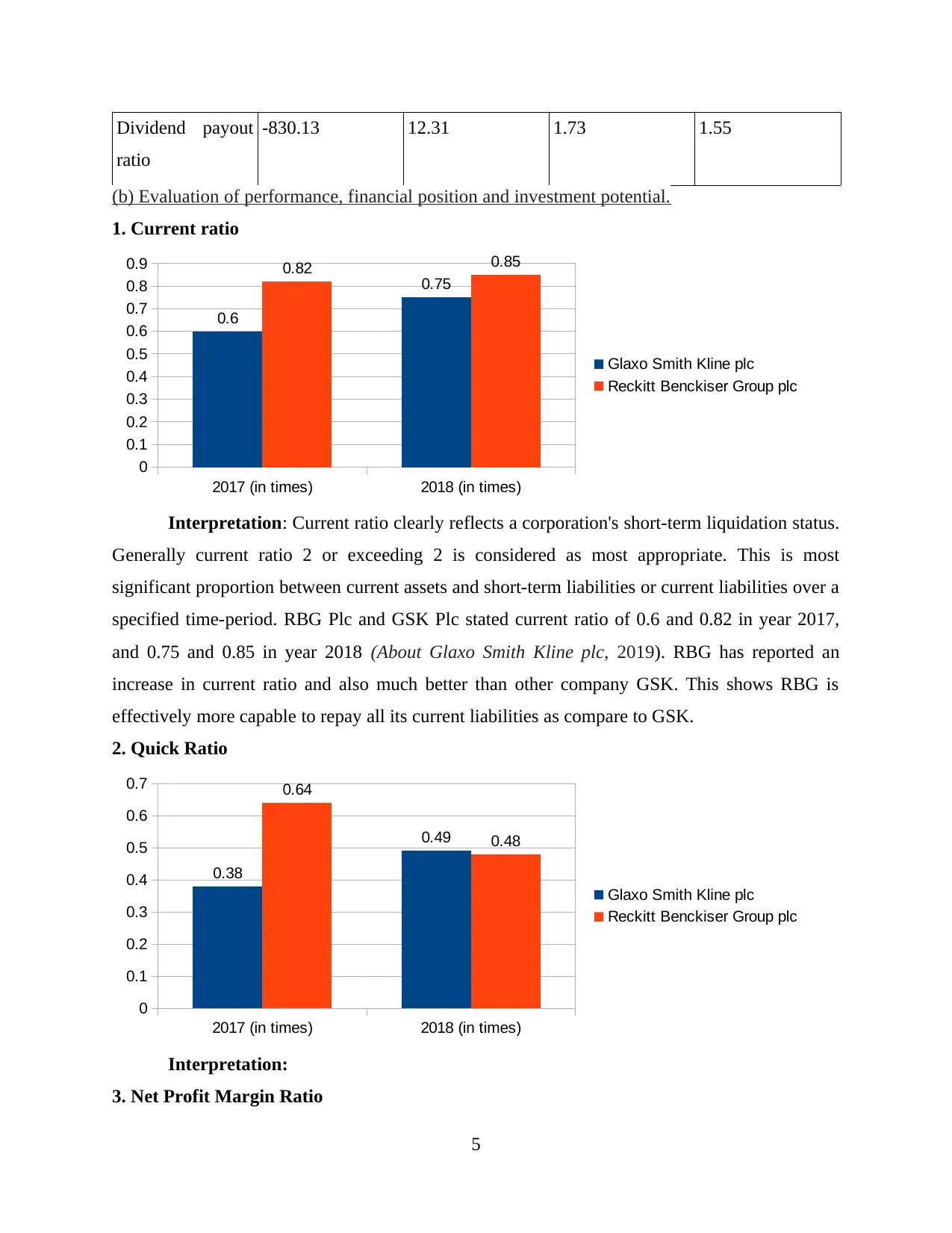

Interpretation: This ratio indicates how efficiently company is satisfy net profitability

criteria. It clearly states a corporation's net profitability status during particular financial period.

In 2017 net profit margin of companies RBG Plc and GSK Plc were respectively 53.61 percent

and 5.07 percent while in year 2018 this level have been changed to 17.15 percent and 11.75

percent respectively (About Reckitt Benckiser Group plc, 2019). Here higher net profit ratio in

comparison is of RBG Plc but there is also a decrease in net profit. While GSK Plc's ratio has

been shown a upward trend.

4. Gross Profit margin ratio

2017 (in %) 2018 (in %)

56

58

60

62

64

66

68

65.74 66.67

59.68 60.61 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This is more specifically shows company's profit generation capacity

through their core trade operations. Here in gross profitability ratio GSK's ratio are more better

as in comparison to RBG. In year 2018, GP ratio of RBG and GSK are 60.61 percent and 66.67

percent whereas in 2017, GP ratio of respective corporation are 59.68 percent and 66.74 percent.

In both corporations, GP ratio has been increased but GSK's GP ratio is higher then another

company which shows that company has more capability to generate gross profit.

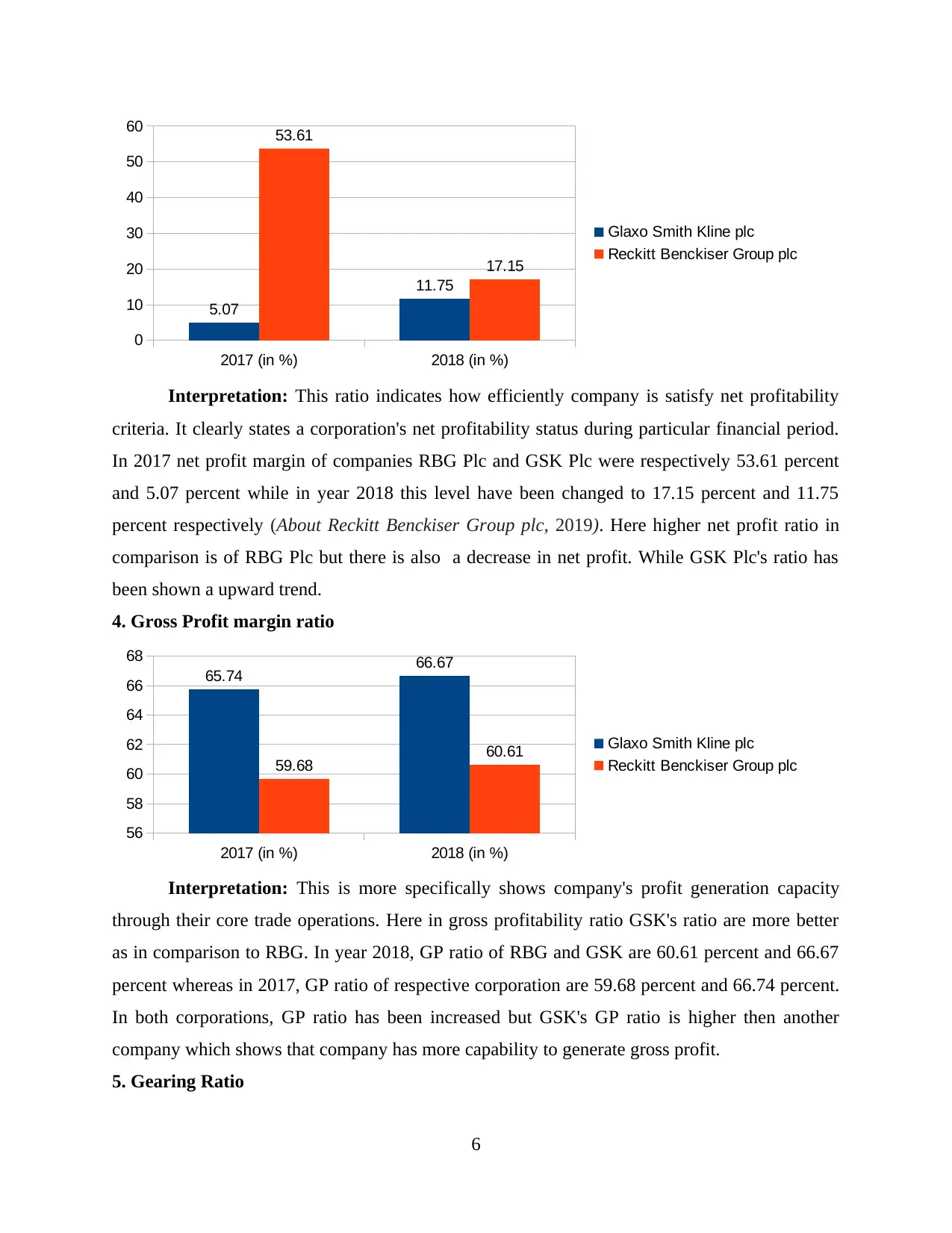

5. Gearing Ratio

6

0

10

20

30

40

50

60

5.07

11.75

53.61

17.15

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This ratio indicates how efficiently company is satisfy net profitability

criteria. It clearly states a corporation's net profitability status during particular financial period.

In 2017 net profit margin of companies RBG Plc and GSK Plc were respectively 53.61 percent

and 5.07 percent while in year 2018 this level have been changed to 17.15 percent and 11.75

percent respectively (About Reckitt Benckiser Group plc, 2019). Here higher net profit ratio in

comparison is of RBG Plc but there is also a decrease in net profit. While GSK Plc's ratio has

been shown a upward trend.

4. Gross Profit margin ratio

2017 (in %) 2018 (in %)

56

58

60

62

64

66

68

65.74 66.67

59.68 60.61 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This is more specifically shows company's profit generation capacity

through their core trade operations. Here in gross profitability ratio GSK's ratio are more better

as in comparison to RBG. In year 2018, GP ratio of RBG and GSK are 60.61 percent and 66.67

percent whereas in 2017, GP ratio of respective corporation are 59.68 percent and 66.74 percent.

In both corporations, GP ratio has been increased but GSK's GP ratio is higher then another

company which shows that company has more capability to generate gross profit.

5. Gearing Ratio

6

2017 2018

0

2

4

6

8

10

12

14

0

12.32

1.74 1.55

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This ratio shows how effectively company is leveraged and effectiveness of

company's capital structure. It relates debts level of company with equity employed (Gitman,

Juchau and Flanagan, 2015). In RBG and GSK plc gearing ratios are 1.74 and nil (– 803.13) in

year 2017, here negative gearing ratio represents excessive debts in organisation. While in 2018,

Gearing ratios in year 2018, are 1.55 and 12.32 respectively in both corporations. GSK has

improved their gearing ratio in 2018 so company comparatively has more improved leveraged

position.

6. P/E Ratio

2017 2018

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

4317.89

2000.27

815.77

2031.36 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: In 2017 companies RBG and GSK have PE ratio of 815.77 and 4317.89

respectively, whereas in year 2018, respective companies PE ratio are 2031.36 and 2000.27

respectively. RBG has improved their PE ratio in 2018 which is also higher than PE ratio of

GSK. A lower figure of PE Ratio is indicator that share of corporation are undervalued and

having lower earning growth. Thus RBG's share are overvalued and indicating earning growth in

shares.

7

0

2

4

6

8

10

12

14

0

12.32

1.74 1.55

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This ratio shows how effectively company is leveraged and effectiveness of

company's capital structure. It relates debts level of company with equity employed (Gitman,

Juchau and Flanagan, 2015). In RBG and GSK plc gearing ratios are 1.74 and nil (– 803.13) in

year 2017, here negative gearing ratio represents excessive debts in organisation. While in 2018,

Gearing ratios in year 2018, are 1.55 and 12.32 respectively in both corporations. GSK has

improved their gearing ratio in 2018 so company comparatively has more improved leveraged

position.

6. P/E Ratio

2017 2018

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

4317.89

2000.27

815.77

2031.36 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: In 2017 companies RBG and GSK have PE ratio of 815.77 and 4317.89

respectively, whereas in year 2018, respective companies PE ratio are 2031.36 and 2000.27

respectively. RBG has improved their PE ratio in 2018 which is also higher than PE ratio of

GSK. A lower figure of PE Ratio is indicator that share of corporation are undervalued and

having lower earning growth. Thus RBG's share are overvalued and indicating earning growth in

shares.

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

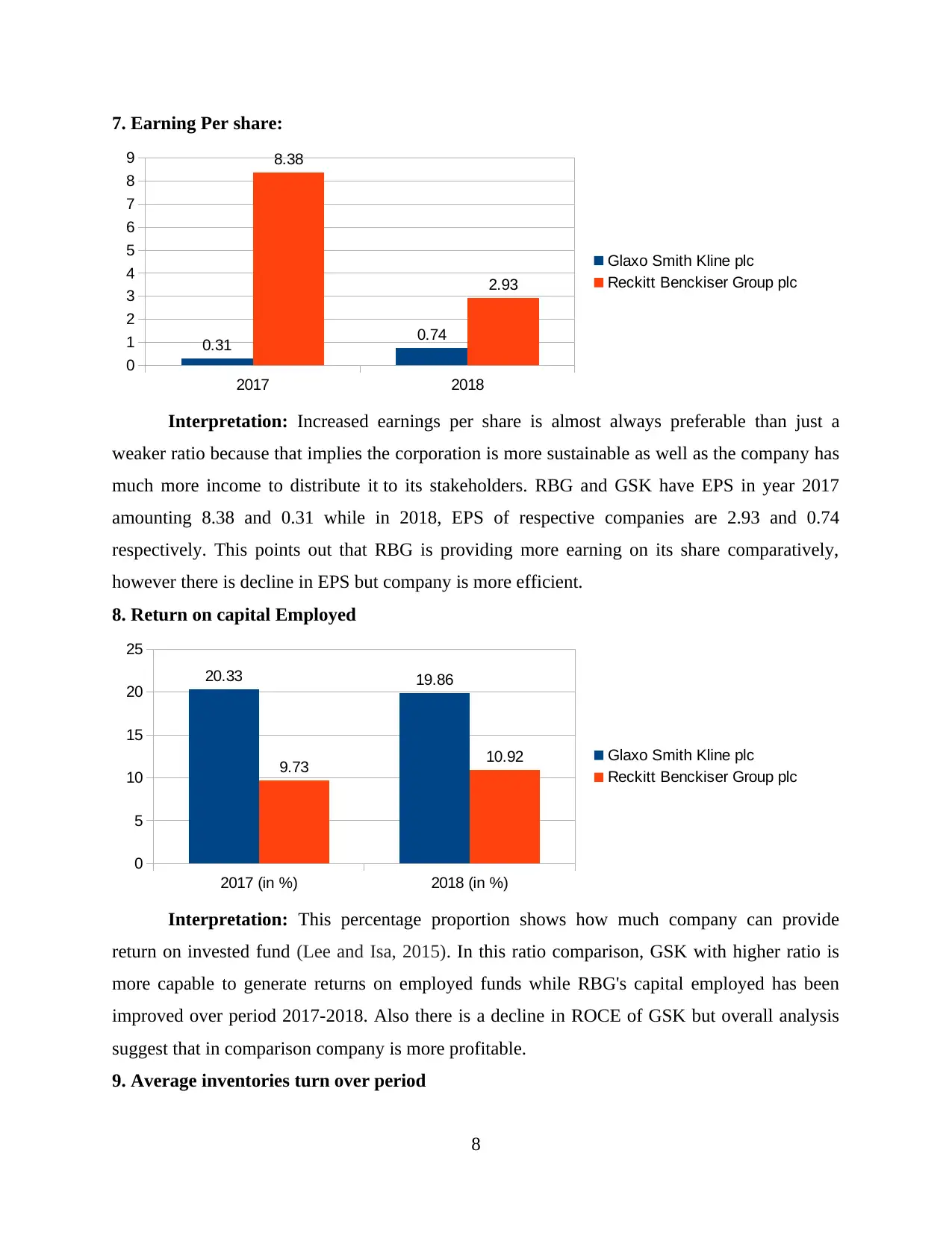

7. Earning Per share:

2017 2018

0

1

2

3

4

5

6

7

8

9

0.31 0.74

8.38

2.93

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: Increased earnings per share is almost always preferable than just a

weaker ratio because that implies the corporation is more sustainable as well as the company has

much more income to distribute it to its stakeholders. RBG and GSK have EPS in year 2017

amounting 8.38 and 0.31 while in 2018, EPS of respective companies are 2.93 and 0.74

respectively. This points out that RBG is providing more earning on its share comparatively,

however there is decline in EPS but company is more efficient.

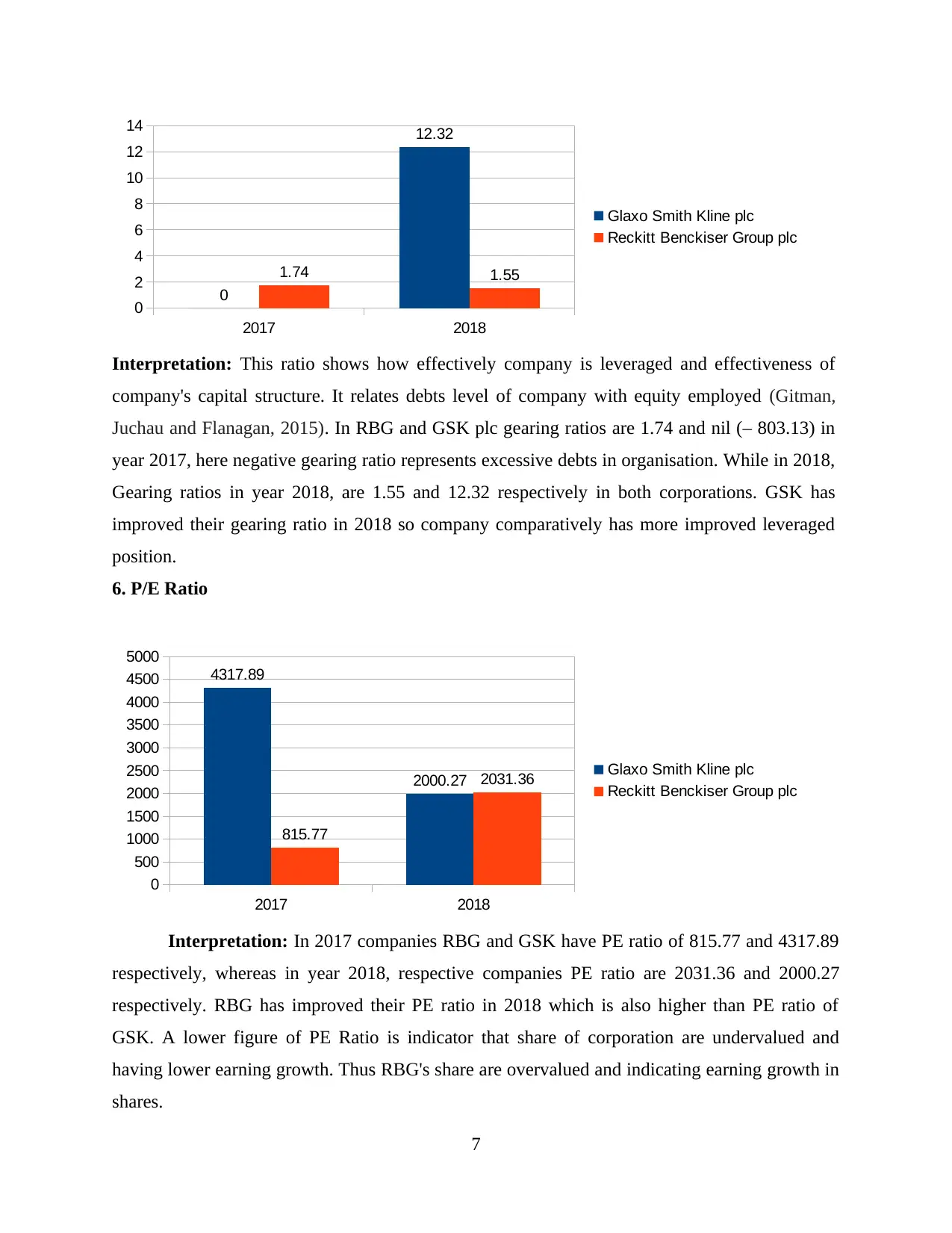

8. Return on capital Employed

2017 (in %) 2018 (in %)

0

5

10

15

20

25

20.33 19.86

9.73 10.92 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This percentage proportion shows how much company can provide

return on invested fund (Lee and Isa, 2015). In this ratio comparison, GSK with higher ratio is

more capable to generate returns on employed funds while RBG's capital employed has been

improved over period 2017-2018. Also there is a decline in ROCE of GSK but overall analysis

suggest that in comparison company is more profitable.

9. Average inventories turn over period

8

2017 2018

0

1

2

3

4

5

6

7

8

9

0.31 0.74

8.38

2.93

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: Increased earnings per share is almost always preferable than just a

weaker ratio because that implies the corporation is more sustainable as well as the company has

much more income to distribute it to its stakeholders. RBG and GSK have EPS in year 2017

amounting 8.38 and 0.31 while in 2018, EPS of respective companies are 2.93 and 0.74

respectively. This points out that RBG is providing more earning on its share comparatively,

however there is decline in EPS but company is more efficient.

8. Return on capital Employed

2017 (in %) 2018 (in %)

0

5

10

15

20

25

20.33 19.86

9.73 10.92 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This percentage proportion shows how much company can provide

return on invested fund (Lee and Isa, 2015). In this ratio comparison, GSK with higher ratio is

more capable to generate returns on employed funds while RBG's capital employed has been

improved over period 2017-2018. Also there is a decline in ROCE of GSK but overall analysis

suggest that in comparison company is more profitable.

9. Average inventories turn over period

8

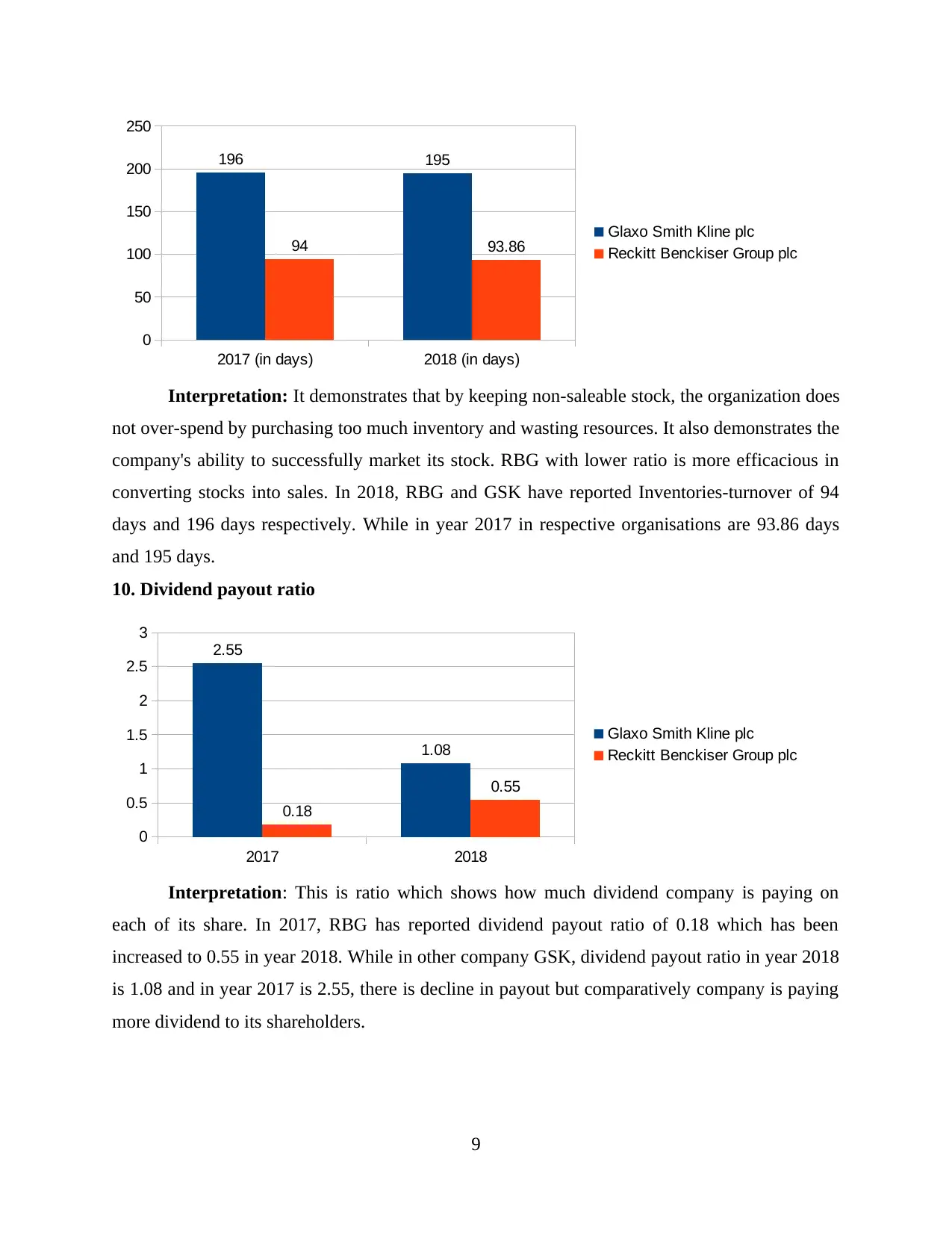

2017 (in days) 2018 (in days)

0

50

100

150

200

250

196 195

94 93.86 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: It demonstrates that by keeping non-saleable stock, the organization does

not over-spend by purchasing too much inventory and wasting resources. It also demonstrates the

company's ability to successfully market its stock. RBG with lower ratio is more efficacious in

converting stocks into sales. In 2018, RBG and GSK have reported Inventories-turnover of 94

days and 196 days respectively. While in year 2017 in respective organisations are 93.86 days

and 195 days.

10. Dividend payout ratio

2017 2018

0

0.5

1

1.5

2

2.5

3

2.55

1.08

0.18

0.55

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This is ratio which shows how much dividend company is paying on

each of its share. In 2017, RBG has reported dividend payout ratio of 0.18 which has been

increased to 0.55 in year 2018. While in other company GSK, dividend payout ratio in year 2018

is 1.08 and in year 2017 is 2.55, there is decline in payout but comparatively company is paying

more dividend to its shareholders.

9

0

50

100

150

200

250

196 195

94 93.86 Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: It demonstrates that by keeping non-saleable stock, the organization does

not over-spend by purchasing too much inventory and wasting resources. It also demonstrates the

company's ability to successfully market its stock. RBG with lower ratio is more efficacious in

converting stocks into sales. In 2018, RBG and GSK have reported Inventories-turnover of 94

days and 196 days respectively. While in year 2017 in respective organisations are 93.86 days

and 195 days.

10. Dividend payout ratio

2017 2018

0

0.5

1

1.5

2

2.5

3

2.55

1.08

0.18

0.55

Glaxo Smith Kline plc

Reckitt Benckiser Group plc

Interpretation: This is ratio which shows how much dividend company is paying on

each of its share. In 2017, RBG has reported dividend payout ratio of 0.18 which has been

increased to 0.55 in year 2018. While in other company GSK, dividend payout ratio in year 2018

is 1.08 and in year 2017 is 2.55, there is decline in payout but comparatively company is paying

more dividend to its shareholders.

9

c. Recommendation in order to improve the poorly performing business.

In the end of above calculation of different significant ratios it has been identified that the

overall financial stability and efficiency of GSK is weak as compared to RGB. The analysis

shows that Reckitt Benckiser Group plc have better performance of net profit ratio, current and

quick ratio are better as well as the earning per share and ROCE are also higher (Osterhoff and

Kaserer, 2016). It is also observed that after Brexit deal in 2018 there have been decrease on the

financial strength of RGB but the overall financial status, solvency and liquidity are far better

than other company. This is because of higher sales and significant control on additional

expenses. There are several measures that can be followed by the management to improve the

overall capital base of the GSK. Such as:

In terms of raising cash flow rates, GSK directors can pay careful attention on increasing

financial assets, which will facilitate short-term business activity to be carried out

productively and reach the desired outcome in much less time.

Through useful, efficient strategies and tactics like increasing sales and reducing the costs

that enhance overall income per unit.

The average inventory period of the organization is quite high so it is necessary for

managers to find ways to cut the time length. Directors should create new strategies such

as setting suitable re order level, regular stock audit etc. to improve their financial results

in a year (Van Essen, Otten and Carberry, 2015).

It is advised that RBG company monitor the practices which are increasing at the current

amount of profit and raise it in order to maintain market penetration in specific business. In terms

of improving their profits, the company must compete throughout the growing market. In

general, the liquidity condition needs to be controlled and long-term measures should be taken

for meeting the short-term debts requirements. It is primarily improvement in the context of the

ROCE so that better step must be taken for equal distribution.

d. Limitation of financial ratios.

Ratio analysis is an useful technique, particularly for an external credit analyst lender or

stock analyst in order to make favourable decision (Xiang and Worthington, 2015). It mainly

show the scale of a company's financial consequences and condition from the annual financial

reports. Nonetheless, a variety of ratio analysis drawbacks are recognized which are discussed

below:

10

In the end of above calculation of different significant ratios it has been identified that the

overall financial stability and efficiency of GSK is weak as compared to RGB. The analysis

shows that Reckitt Benckiser Group plc have better performance of net profit ratio, current and

quick ratio are better as well as the earning per share and ROCE are also higher (Osterhoff and

Kaserer, 2016). It is also observed that after Brexit deal in 2018 there have been decrease on the

financial strength of RGB but the overall financial status, solvency and liquidity are far better

than other company. This is because of higher sales and significant control on additional

expenses. There are several measures that can be followed by the management to improve the

overall capital base of the GSK. Such as:

In terms of raising cash flow rates, GSK directors can pay careful attention on increasing

financial assets, which will facilitate short-term business activity to be carried out

productively and reach the desired outcome in much less time.

Through useful, efficient strategies and tactics like increasing sales and reducing the costs

that enhance overall income per unit.

The average inventory period of the organization is quite high so it is necessary for

managers to find ways to cut the time length. Directors should create new strategies such

as setting suitable re order level, regular stock audit etc. to improve their financial results

in a year (Van Essen, Otten and Carberry, 2015).

It is advised that RBG company monitor the practices which are increasing at the current

amount of profit and raise it in order to maintain market penetration in specific business. In terms

of improving their profits, the company must compete throughout the growing market. In

general, the liquidity condition needs to be controlled and long-term measures should be taken

for meeting the short-term debts requirements. It is primarily improvement in the context of the

ROCE so that better step must be taken for equal distribution.

d. Limitation of financial ratios.

Ratio analysis is an useful technique, particularly for an external credit analyst lender or

stock analyst in order to make favourable decision (Xiang and Worthington, 2015). It mainly

show the scale of a company's financial consequences and condition from the annual financial

reports. Nonetheless, a variety of ratio analysis drawbacks are recognized which are discussed

below:

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Historical Information: The evidence used in the study were based on the findings from

the history that the organization reports. Ratio analyses do not accurately reflect potential

business performance.

Changes in accounting policies: The financial statements can have a major impact if the

organization has modified its financial policies and practices. All the changes are

basically recorded in the notes section of financial statement. In this situation, the major

financial parameters used in the ratios study will be changed as well as the financial

results obtained after the adjustment will not be equivalent to those reported before the

adjustment. Until the end of the fiscal current period, adjustments in the actual

accounting reports are made in all companies and no clear accurate informations are

needed for investors on these figures.

Manipulation of financial statements: The information in balance sheet can be

manipulated by the person preparing reports in order to make better outcome. Therefore,

the ratio calculation can not properly portray a company's real nature, since a basic

analysis does not detect a false representation of facts (Throsby, 2016).

Aggregations: It is observed that the information in financial statements are being

aggregated in the past to make calculation easy for Audit. Thus, the ratio analysis do not

include the specific information within whole trend period which can impact the results.

Point in time: It is observed that ratio take information form balance sheet which is

prepared at the last of the reporting year. In case if there are an unseen decline or increase

in the balance of the last time then the results are going to be different which impact the

overall analysis (Uchide and Imanishi, 2016).

PORTFOLIO 2

(a). Calculation of financial ratios for two years (2017 – 2018):

It is observed that to make a better and worthy investment manager uses various kind of

investment appraisal techniques so that higher return are received (Alkaraan, 2015). These

methods are NPV, Payback period which consider accounting rate of return in order to determine

the most suitable funding option. In the present report, Harris Pvt Ltd. Is planning to buy a new

machine in order make best possible outcome that support to grow overall profitability.

11

the history that the organization reports. Ratio analyses do not accurately reflect potential

business performance.

Changes in accounting policies: The financial statements can have a major impact if the

organization has modified its financial policies and practices. All the changes are

basically recorded in the notes section of financial statement. In this situation, the major

financial parameters used in the ratios study will be changed as well as the financial

results obtained after the adjustment will not be equivalent to those reported before the

adjustment. Until the end of the fiscal current period, adjustments in the actual

accounting reports are made in all companies and no clear accurate informations are

needed for investors on these figures.

Manipulation of financial statements: The information in balance sheet can be

manipulated by the person preparing reports in order to make better outcome. Therefore,

the ratio calculation can not properly portray a company's real nature, since a basic

analysis does not detect a false representation of facts (Throsby, 2016).

Aggregations: It is observed that the information in financial statements are being

aggregated in the past to make calculation easy for Audit. Thus, the ratio analysis do not

include the specific information within whole trend period which can impact the results.

Point in time: It is observed that ratio take information form balance sheet which is

prepared at the last of the reporting year. In case if there are an unseen decline or increase

in the balance of the last time then the results are going to be different which impact the

overall analysis (Uchide and Imanishi, 2016).

PORTFOLIO 2

(a). Calculation of financial ratios for two years (2017 – 2018):

It is observed that to make a better and worthy investment manager uses various kind of

investment appraisal techniques so that higher return are received (Alkaraan, 2015). These

methods are NPV, Payback period which consider accounting rate of return in order to determine

the most suitable funding option. In the present report, Harris Pvt Ltd. Is planning to buy a new

machine in order make best possible outcome that support to grow overall profitability.

11

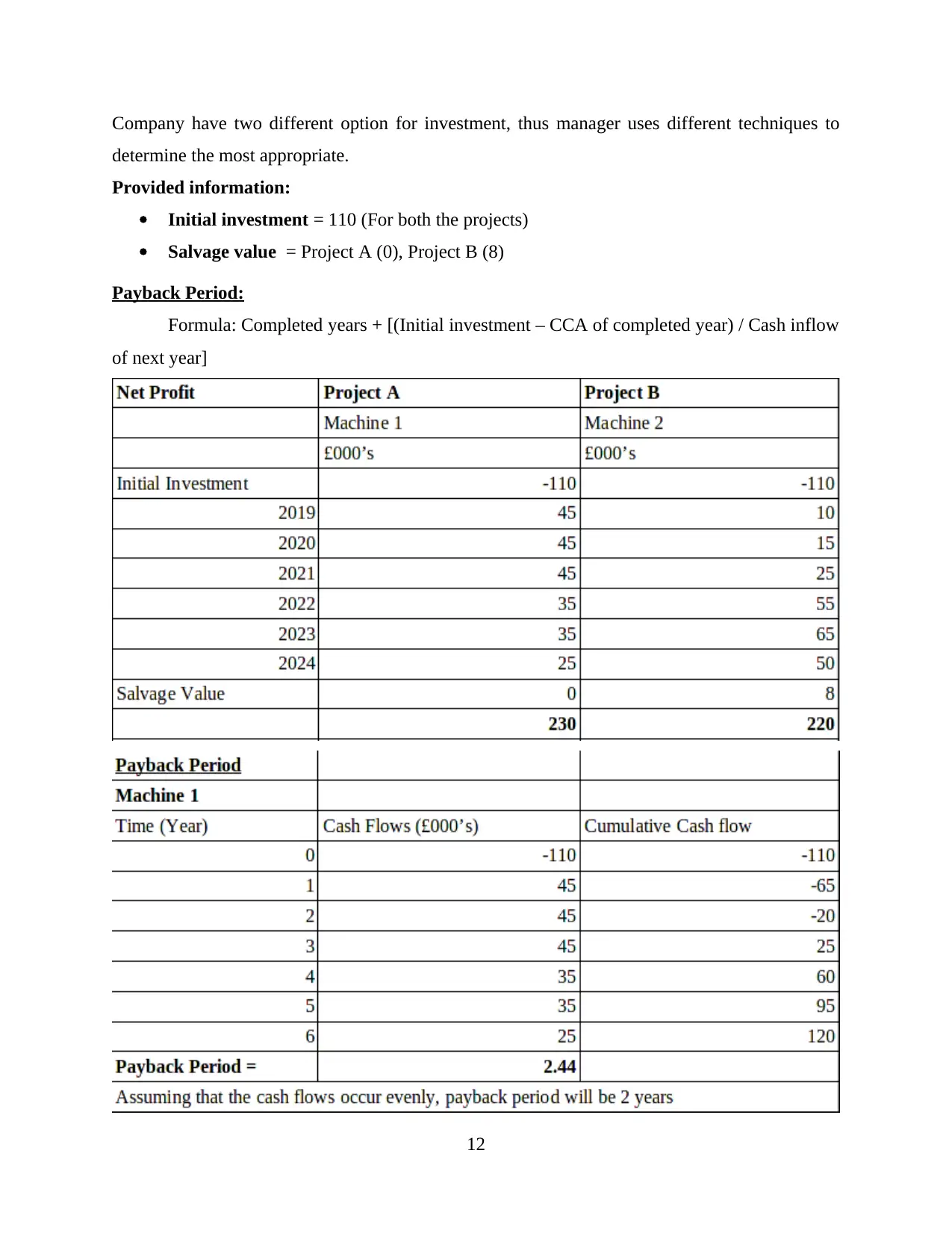

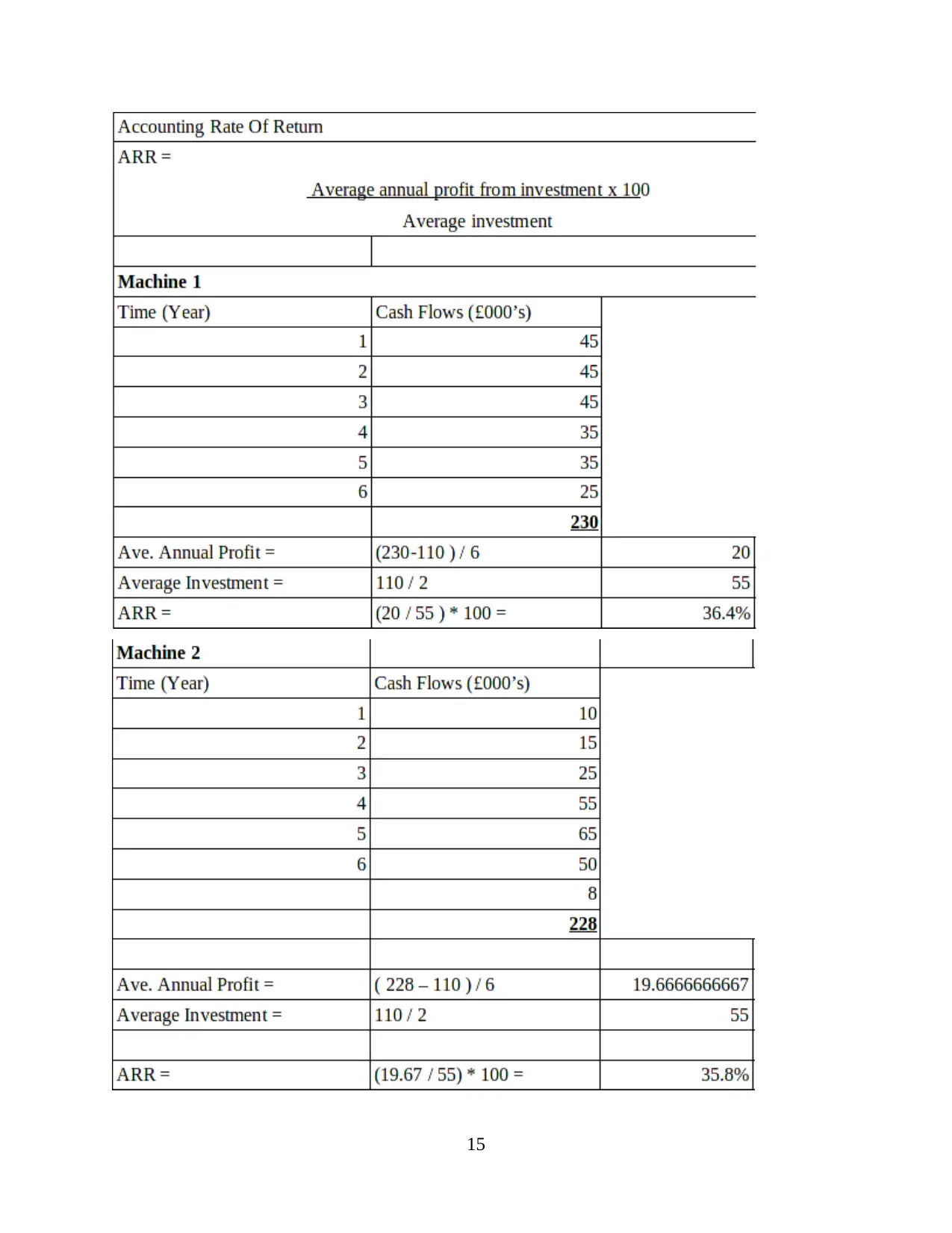

Company have two different option for investment, thus manager uses different techniques to

determine the most appropriate.

Provided information:

Initial investment = 110 (For both the projects)

Salvage value = Project A (0), Project B (8)

Payback Period:

Formula: Completed years + [(Initial investment – CCA of completed year) / Cash inflow

of next year]

12

determine the most appropriate.

Provided information:

Initial investment = 110 (For both the projects)

Salvage value = Project A (0), Project B (8)

Payback Period:

Formula: Completed years + [(Initial investment – CCA of completed year) / Cash inflow

of next year]

12

Working note:

Pay back period for Project A = 2 + (110 – 90) /45

= 2 + (20 / 45)

= 2 + 0.44

= 2.44

Pay back period for Project B = 4 + (110 – 105) / 65

= 4 + (5 / 65)

= 4 + 0.07

= 4.07

In the above calculation, it has been determined that the payback time of machine A is

less than machine B, so Harris Pvt Ltd must choose option A for future use and stability.

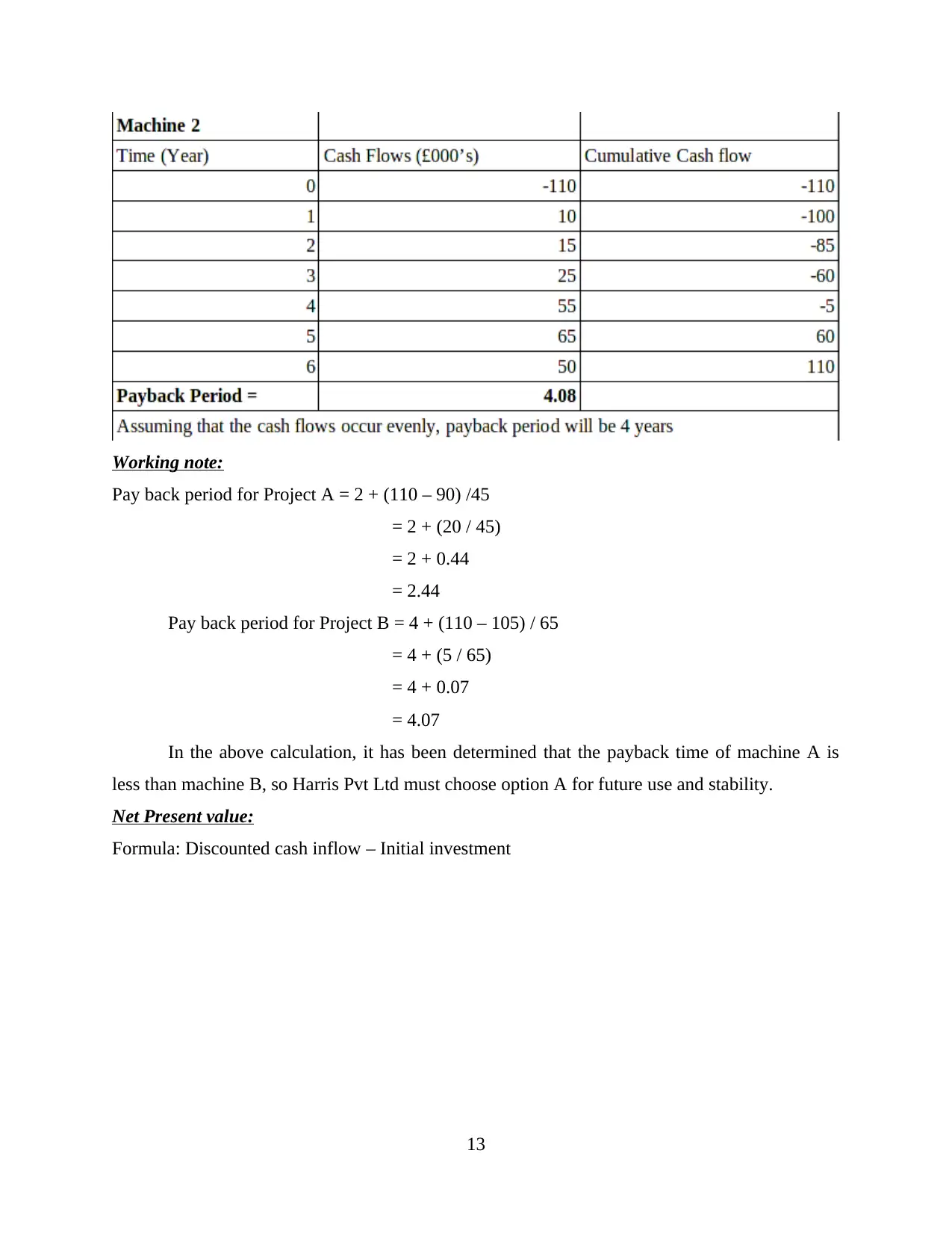

Net Present value:

Formula: Discounted cash inflow – Initial investment

13

Pay back period for Project A = 2 + (110 – 90) /45

= 2 + (20 / 45)

= 2 + 0.44

= 2.44

Pay back period for Project B = 4 + (110 – 105) / 65

= 4 + (5 / 65)

= 4 + 0.07

= 4.07

In the above calculation, it has been determined that the payback time of machine A is

less than machine B, so Harris Pvt Ltd must choose option A for future use and stability.

Net Present value:

Formula: Discounted cash inflow – Initial investment

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Working note:

NPV for Project A = 147.31 – 110

= 37.31

NPV for project B = 120.92 – 110

= 10.92

From the above computation it is determined that Machine B have lower NPV in

comparison to option A which means that company must select the higher NPV machine to make

profitable results.

14

NPV for Project A = 147.31 – 110

= 37.31

NPV for project B = 120.92 – 110

= 10.92

From the above computation it is determined that Machine B have lower NPV in

comparison to option A which means that company must select the higher NPV machine to make

profitable results.

14

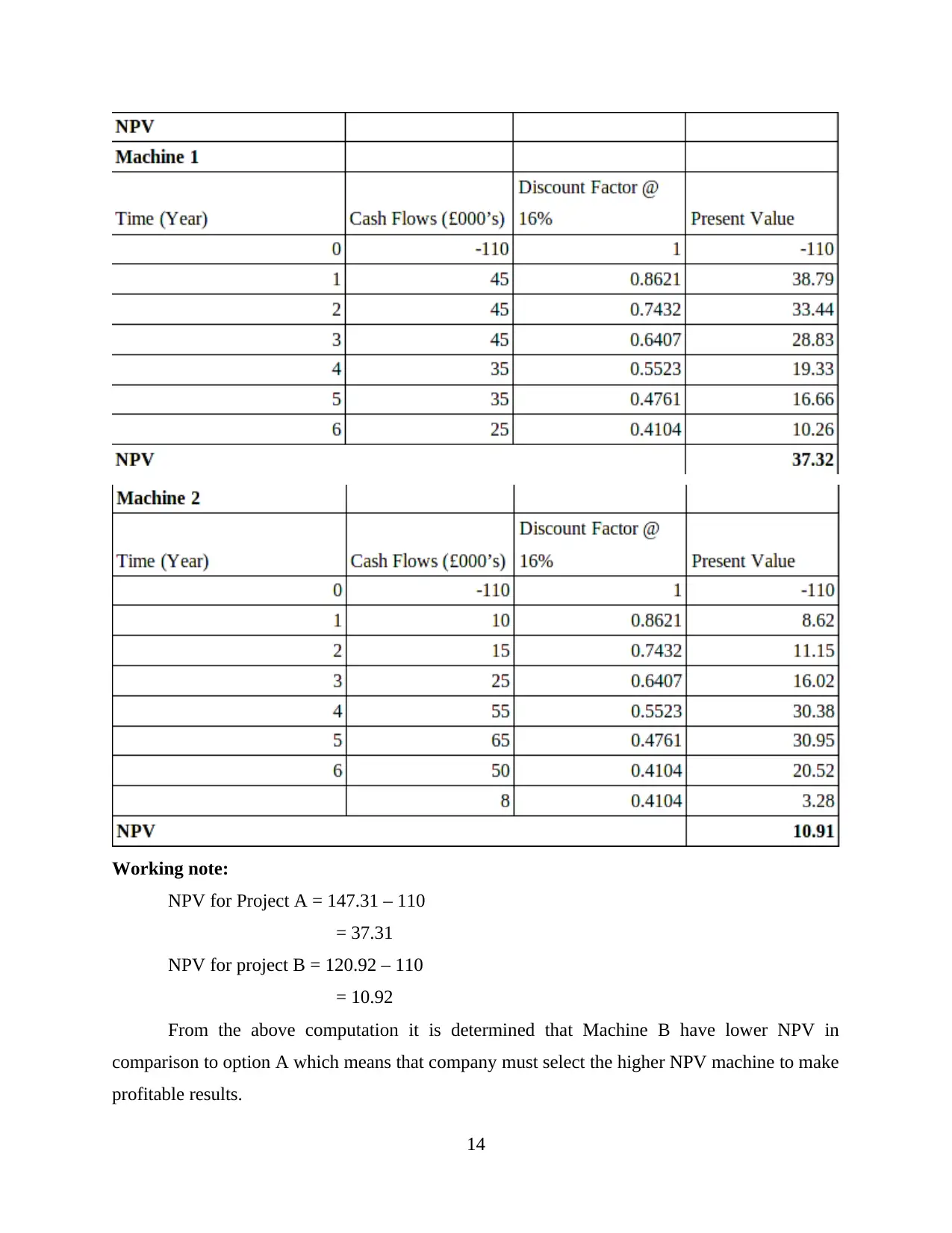

15

From above computation, it is observed that ARR for Machine A is slightly higher than

other machine and it would more advantageous to Harris Pvt Ltd.

Recommendation: It have been recommended that respective company must invest to

purchase machine A as it will be a better option resulting in higher profitable outcome in specific

time period. The total investment would be recovered in 2.44 year with 36.4% ARR and the net

present value of machine A is 37.32 which is higher than other option.

b. Limitation of using investment appraisal technique.

There have been various types of methods applicable to analyse the usefulness of every

proposal or project by an organization (Yarram and Dollery, 2015). There are some major

disadvantage of these techniques which are elaborated underneath:

The time-value of money is among the major drawbacks of this technique. Projects

obtained prematurely in comparison with subsequent cash flow obtained by the end of

years have value. There are two programs of the same time offer off span, but it has been

found that one plan produces additional cash flows in the preceding year.

This comprises of various applications depending on the cost of estimation and analysis,

which decreases cash flow. Depending on theories, the work is performed on premises,

which challenge consequences and use this method to make successful decisions.

This approach is not implemented in conjunction with the circumstance where

expenditure into a specific project is needed and the results of business operations are at

greater risk (Harris, 2017).

CONCLUSION

In the conclusion it is founded that the process of managing and controlling different kind

of management and financing activity within an organisation is known as managerial finance.

There are different type of ratio which are analysed for determining the actual profitability of

company in an accounting year. Investment appraisal techniques are very much effective in

identifying the most beneficial proposal that give higher results. There are certain limitation of

ratio analysis that must be consider by investor while obtaining the actual financial status of

company. Similarly each investment technique have some disadvantage and due to which results

can be negative in many situation.

16

other machine and it would more advantageous to Harris Pvt Ltd.

Recommendation: It have been recommended that respective company must invest to

purchase machine A as it will be a better option resulting in higher profitable outcome in specific

time period. The total investment would be recovered in 2.44 year with 36.4% ARR and the net

present value of machine A is 37.32 which is higher than other option.

b. Limitation of using investment appraisal technique.

There have been various types of methods applicable to analyse the usefulness of every

proposal or project by an organization (Yarram and Dollery, 2015). There are some major

disadvantage of these techniques which are elaborated underneath:

The time-value of money is among the major drawbacks of this technique. Projects

obtained prematurely in comparison with subsequent cash flow obtained by the end of

years have value. There are two programs of the same time offer off span, but it has been

found that one plan produces additional cash flows in the preceding year.

This comprises of various applications depending on the cost of estimation and analysis,

which decreases cash flow. Depending on theories, the work is performed on premises,

which challenge consequences and use this method to make successful decisions.

This approach is not implemented in conjunction with the circumstance where

expenditure into a specific project is needed and the results of business operations are at

greater risk (Harris, 2017).

CONCLUSION

In the conclusion it is founded that the process of managing and controlling different kind

of management and financing activity within an organisation is known as managerial finance.

There are different type of ratio which are analysed for determining the actual profitability of

company in an accounting year. Investment appraisal techniques are very much effective in

identifying the most beneficial proposal that give higher results. There are certain limitation of

ratio analysis that must be consider by investor while obtaining the actual financial status of

company. Similarly each investment technique have some disadvantage and due to which results

can be negative in many situation.

16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals:

Carbo‐Valverde, S., Rodriguez‐Fernandez, F. and Udell, G. F., 2016. Trade credit, the financial

crisis, and SME access to finance. Journal of Money, Credit and Banking. 48(1).

pp.113-143.

Gitman, L. J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Lee, S. P. and Isa, M., 2015. Directors’ remuneration, governance and performance: the case of

Malaysian banks. Managerial Finance. 41(1). pp.26-44.

Osterhoff, F. and Kaserer, C., 2016. Determinants of tracking error in German ETFs–the role of

market liquidity. Managerial Finance. 42(5). pp.417-437.

Van Essen, M., Otten, J. and Carberry, E. J., 2015. Assessing managerial power theory: A meta-

analytic approach to understanding the determinants of CEO compensation. Journal of

Management. 41(1). pp.164-202.

Xiang, D. and Worthington, A., 2015. Finance-seeking behaviour and outcomes for small-and

medium-sized enterprises. International Journal of Managerial Finance. 11(4). pp.513-

530.

Yarram, S. R. and Dollery, B., 2015. Corporate governance and financial policies: influence of

board characteristics on the dividend policy of Australian firms. Managerial Finance.

41(3). pp.267-285.

Uchide, T. and Imanishi, K., 2016. Small earthquakes deviate from the omega‐square model as

revealed by multiple spectral ratio analysis. Bulletin of the Seismological Society of

America. 106(3). pp.1357-1363.

Suzuki, D., Esaka, F., Miyamoto, Y. and Magara, M., 2015. Direct isotope ratio analysis of

individual uranium–plutonium mixed particles with various U/Pu ratios by thermal

ionization mass spectrometry. Applied Radiation and Isotopes. 96. pp.52-56.

Harris, E., 2017. Strategic project risk appraisal and management. Routledge.

Alkaraan, F., 2015. Strategic investment decision-making perspectives. In Advances in mergers

and acquisitions (pp. 53-66). Emerald Group Publishing Limited.

Throsby, D., 2016. Investment in urban heritage conservation in developing countries: Concepts,

methods and data. City, Culture and Society. 7(2). pp.81-86.

Online:

About Glaxo Smith Kline plc, 2019. [Online] available through:

<https://www.gsk.com/>

About Reckitt Benckiser Group plc, 2019. [Online] available through:

<https://www.rb.com/>

17

Books and Journals:

Carbo‐Valverde, S., Rodriguez‐Fernandez, F. and Udell, G. F., 2016. Trade credit, the financial

crisis, and SME access to finance. Journal of Money, Credit and Banking. 48(1).

pp.113-143.

Gitman, L. J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Lee, S. P. and Isa, M., 2015. Directors’ remuneration, governance and performance: the case of

Malaysian banks. Managerial Finance. 41(1). pp.26-44.

Osterhoff, F. and Kaserer, C., 2016. Determinants of tracking error in German ETFs–the role of

market liquidity. Managerial Finance. 42(5). pp.417-437.

Van Essen, M., Otten, J. and Carberry, E. J., 2015. Assessing managerial power theory: A meta-

analytic approach to understanding the determinants of CEO compensation. Journal of

Management. 41(1). pp.164-202.

Xiang, D. and Worthington, A., 2015. Finance-seeking behaviour and outcomes for small-and

medium-sized enterprises. International Journal of Managerial Finance. 11(4). pp.513-

530.

Yarram, S. R. and Dollery, B., 2015. Corporate governance and financial policies: influence of

board characteristics on the dividend policy of Australian firms. Managerial Finance.

41(3). pp.267-285.

Uchide, T. and Imanishi, K., 2016. Small earthquakes deviate from the omega‐square model as

revealed by multiple spectral ratio analysis. Bulletin of the Seismological Society of

America. 106(3). pp.1357-1363.

Suzuki, D., Esaka, F., Miyamoto, Y. and Magara, M., 2015. Direct isotope ratio analysis of

individual uranium–plutonium mixed particles with various U/Pu ratios by thermal

ionization mass spectrometry. Applied Radiation and Isotopes. 96. pp.52-56.

Harris, E., 2017. Strategic project risk appraisal and management. Routledge.

Alkaraan, F., 2015. Strategic investment decision-making perspectives. In Advances in mergers

and acquisitions (pp. 53-66). Emerald Group Publishing Limited.

Throsby, D., 2016. Investment in urban heritage conservation in developing countries: Concepts,

methods and data. City, Culture and Society. 7(2). pp.81-86.

Online:

About Glaxo Smith Kline plc, 2019. [Online] available through:

<https://www.gsk.com/>

About Reckitt Benckiser Group plc, 2019. [Online] available through:

<https://www.rb.com/>

17

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.