Managerial Finance Report: Financial Performance of Two Companies

VerifiedAdded on 2022/12/30

|17

|3984

|58

Report

AI Summary

This report provides a detailed analysis of managerial finance, focusing on the financial performance of Tesco and Sainsbury's. The report begins with an introduction to managerial finance and its application in evaluating organizational performance. It then proceeds to compare the two companies through ratio analysis, including current ratio, quick ratio, net profit margin, gross profit margin, gearing ratio, price-earnings ratio, earnings per share, return on capital employed, average inventory turnover rate, and dividend payout ratio. The analysis covers the years 2018 and 2019, with charts and interpretations of the ratios. The report also examines investment appraisal techniques and their limitations in decision-making. Finally, it concludes by summarizing the key findings and discussing the limitations of both ratio analysis and investment appraisal techniques. The report offers valuable insights into the financial health and operational efficiency of the two companies.

Managerial

Finance

Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1.................................................................................................................................3

Comparison of performance of Tesco and Sainsbury’s through ratio analysis:..........................3

Interpretation of ratio analysis and chart for the purpose of evaluating financial performance of

business:.......................................................................................................................................5

Recommendations for improvement of financial performance:................................................12

Limitations of reliance on financial ratios for interpretation of performance of company:......13

PORTFOLIO 2...............................................................................................................................14

Usage of appropriate investment appraisal techniques for opting appropriate project:.............14

Limitations of utilizing investment appraisal techniques for decision making of long term:. . .16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1.................................................................................................................................3

Comparison of performance of Tesco and Sainsbury’s through ratio analysis:..........................3

Interpretation of ratio analysis and chart for the purpose of evaluating financial performance of

business:.......................................................................................................................................5

Recommendations for improvement of financial performance:................................................12

Limitations of reliance on financial ratios for interpretation of performance of company:......13

PORTFOLIO 2...............................................................................................................................14

Usage of appropriate investment appraisal techniques for opting appropriate project:.............14

Limitations of utilizing investment appraisal techniques for decision making of long term:. . .16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

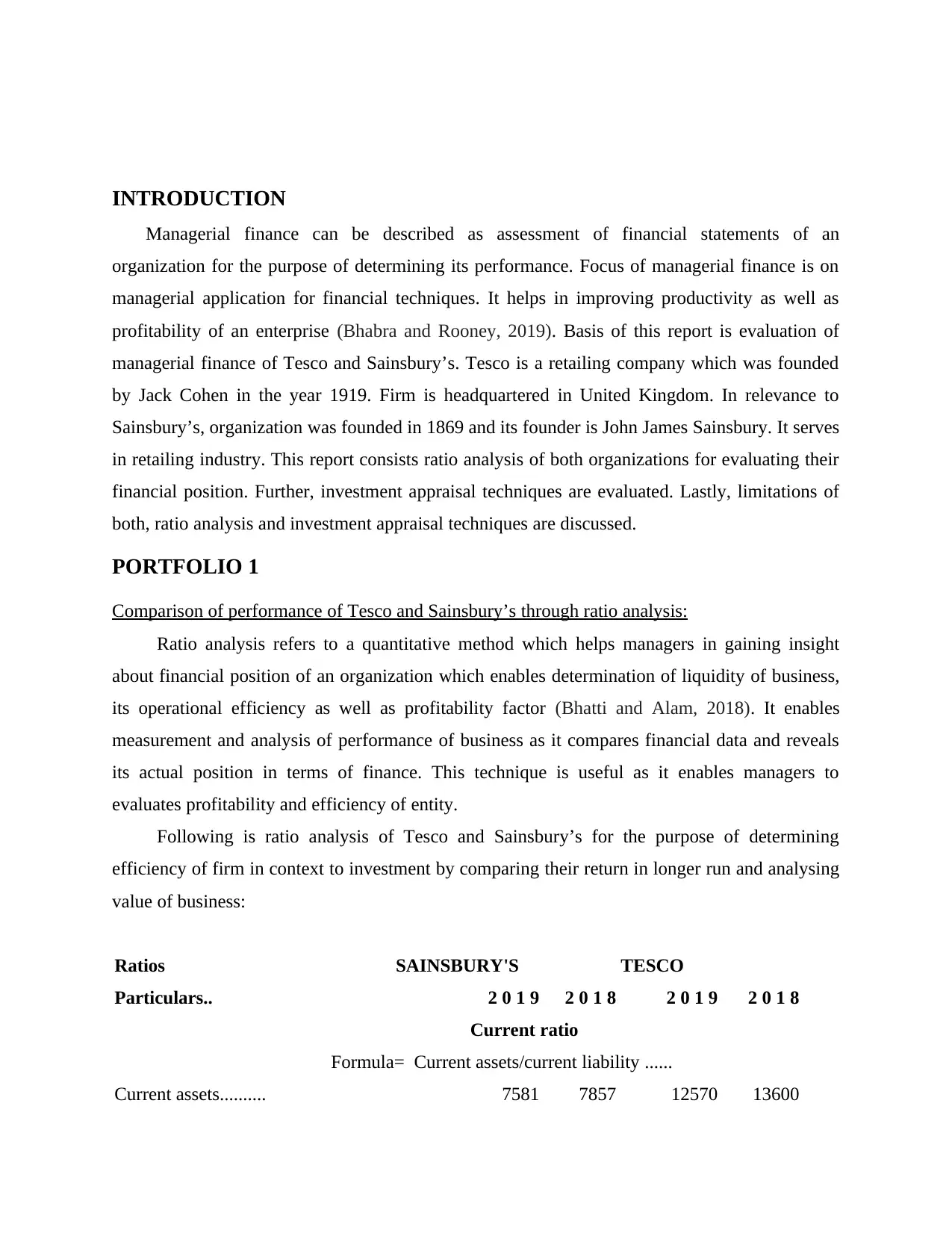

INTRODUCTION

Managerial finance can be described as assessment of financial statements of an

organization for the purpose of determining its performance. Focus of managerial finance is on

managerial application for financial techniques. It helps in improving productivity as well as

profitability of an enterprise (Bhabra and Rooney, 2019). Basis of this report is evaluation of

managerial finance of Tesco and Sainsbury’s. Tesco is a retailing company which was founded

by Jack Cohen in the year 1919. Firm is headquartered in United Kingdom. In relevance to

Sainsbury’s, organization was founded in 1869 and its founder is John James Sainsbury. It serves

in retailing industry. This report consists ratio analysis of both organizations for evaluating their

financial position. Further, investment appraisal techniques are evaluated. Lastly, limitations of

both, ratio analysis and investment appraisal techniques are discussed.

PORTFOLIO 1

Comparison of performance of Tesco and Sainsbury’s through ratio analysis:

Ratio analysis refers to a quantitative method which helps managers in gaining insight

about financial position of an organization which enables determination of liquidity of business,

its operational efficiency as well as profitability factor (Bhatti and Alam, 2018). It enables

measurement and analysis of performance of business as it compares financial data and reveals

its actual position in terms of finance. This technique is useful as it enables managers to

evaluates profitability and efficiency of entity.

Following is ratio analysis of Tesco and Sainsbury’s for the purpose of determining

efficiency of firm in context to investment by comparing their return in longer run and analysing

value of business:

Ratios SAINSBURY'S TESCO

Particulars.. 2 0 1 9 2 0 1 8 2 0 1 9 2 0 1 8

Current ratio

Formula= Current assets/current liability ......

Current assets.......... 7581 7857 12570 13600

Managerial finance can be described as assessment of financial statements of an

organization for the purpose of determining its performance. Focus of managerial finance is on

managerial application for financial techniques. It helps in improving productivity as well as

profitability of an enterprise (Bhabra and Rooney, 2019). Basis of this report is evaluation of

managerial finance of Tesco and Sainsbury’s. Tesco is a retailing company which was founded

by Jack Cohen in the year 1919. Firm is headquartered in United Kingdom. In relevance to

Sainsbury’s, organization was founded in 1869 and its founder is John James Sainsbury. It serves

in retailing industry. This report consists ratio analysis of both organizations for evaluating their

financial position. Further, investment appraisal techniques are evaluated. Lastly, limitations of

both, ratio analysis and investment appraisal techniques are discussed.

PORTFOLIO 1

Comparison of performance of Tesco and Sainsbury’s through ratio analysis:

Ratio analysis refers to a quantitative method which helps managers in gaining insight

about financial position of an organization which enables determination of liquidity of business,

its operational efficiency as well as profitability factor (Bhatti and Alam, 2018). It enables

measurement and analysis of performance of business as it compares financial data and reveals

its actual position in terms of finance. This technique is useful as it enables managers to

evaluates profitability and efficiency of entity.

Following is ratio analysis of Tesco and Sainsbury’s for the purpose of determining

efficiency of firm in context to investment by comparing their return in longer run and analysing

value of business:

Ratios SAINSBURY'S TESCO

Particulars.. 2 0 1 9 2 0 1 8 2 0 1 9 2 0 1 8

Current ratio

Formula= Current assets/current liability ......

Current assets.......... 7581 7857 12570 13600

You're viewing a preview

Unlock full access by subscribing today!

current liabilities........ 11417 10302 20680 19233

Results......... 0.66 0.76 0.61 0.71

Quick ratio

Formula= Quick assets/ current liability......

Quick assets........ 5652 6047 9953 11336

Current liabilities......... 11417 10302 20680 19233

Results......... 0.5 0.59 0.48 0.59

Net profit margin

Formula= Net profit/ revenue*100.....

Net profit...... 219 309 1320 1210

Revenues...... 29007 28456 63911 57493

Results......... 0.75 1.09 2.07 2.1

Gross profit margin

Formula= Gross profit/ revenue *100......

Gross profit.. ......... 2007 1882 4144 3352

Revenues....... 29007 28456 63911 57493

Results......... 6.92 6.61 6.48 5.83

Gearing ratio

formula= Debts/ equity ......

Debts........ 15085 14590 34213 34404

Equity....... 8456 7411 14834 10480

Results......... 1.78 1.97 2.31 3.28

Price earnings ratio

Formula= Share price/ EPS.......

Share price........ 229.9 264.9 255.2 189.55

Earnings per share......... 1.86 2.49 6.14 4.96

Results......... 123.6 106.39 41.56 38.22

Earnings per share

Formula= Total earnings/ Outstanding shares ......

Total earnings........ 219 309 1320 1210

Outstanding shares........ 54 65 215 244

Results......... 0.66 0.76 0.61 0.71

Quick ratio

Formula= Quick assets/ current liability......

Quick assets........ 5652 6047 9953 11336

Current liabilities......... 11417 10302 20680 19233

Results......... 0.5 0.59 0.48 0.59

Net profit margin

Formula= Net profit/ revenue*100.....

Net profit...... 219 309 1320 1210

Revenues...... 29007 28456 63911 57493

Results......... 0.75 1.09 2.07 2.1

Gross profit margin

Formula= Gross profit/ revenue *100......

Gross profit.. ......... 2007 1882 4144 3352

Revenues....... 29007 28456 63911 57493

Results......... 6.92 6.61 6.48 5.83

Gearing ratio

formula= Debts/ equity ......

Debts........ 15085 14590 34213 34404

Equity....... 8456 7411 14834 10480

Results......... 1.78 1.97 2.31 3.28

Price earnings ratio

Formula= Share price/ EPS.......

Share price........ 229.9 264.9 255.2 189.55

Earnings per share......... 1.86 2.49 6.14 4.96

Results......... 123.6 106.39 41.56 38.22

Earnings per share

Formula= Total earnings/ Outstanding shares ......

Total earnings........ 219 309 1320 1210

Outstanding shares........ 54 65 215 244

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

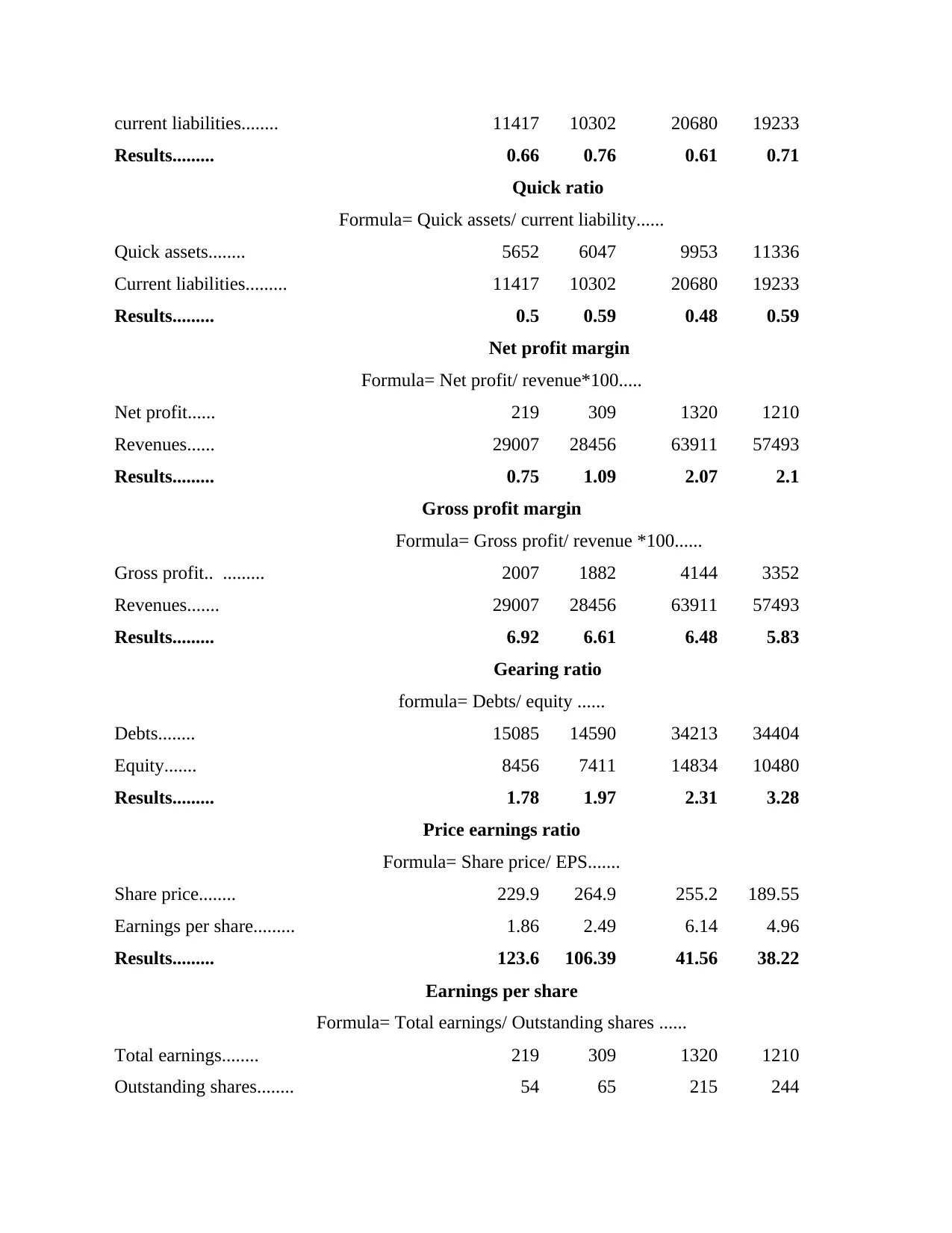

Results......... 4.06 4.75 6.14 4.96

Return on capital employed

Formula= Operating profit/ Capital employed*100......

Operating profit........ 601 518 2639 1566

Capital employed......... 12097 11699 28269 25502

Results......... 4.97 4.43 9.34 6.14

Average inventories turnover rate

Formula= Cost of goods sold/ Average inventory......

Cost of goods sold........ 27000 26574 59769 54141

Cost of goods sold........ 1869.5 1792.5 2440 2282

Results....... 14.44 14.83 24.5 23.73

Dividend pay- out ratio

Formula= Dividend/ Net profit* 100......

Dividend …. .... 247 247 357 82

Net profit........ 219 219 1320 1210

Results....... 112.79 112.79 27.05 6.78

Working Notes:

Calculation of capital employed......

Particulars.. Tesco.. Sainsbury..

2018.. 2019.. 2018.. 2019..

Total assets...... 44,735.. 48,949.. 22,001.. 23,514..

Less: Current liabilities....... 19,233.. 20,680.. 10,302.. 11,417..

Capital employed......... 25,502.. 28,269 11,699.. 12,097..

Interpretation of ratio analysis and chart for the purpose of evaluating financial performance of

business:

Current ratio: It is calculated for determining efficiency of an organization in meeting

short term requirements of business. In other words, it is liquidity ratio which helps in

Return on capital employed

Formula= Operating profit/ Capital employed*100......

Operating profit........ 601 518 2639 1566

Capital employed......... 12097 11699 28269 25502

Results......... 4.97 4.43 9.34 6.14

Average inventories turnover rate

Formula= Cost of goods sold/ Average inventory......

Cost of goods sold........ 27000 26574 59769 54141

Cost of goods sold........ 1869.5 1792.5 2440 2282

Results....... 14.44 14.83 24.5 23.73

Dividend pay- out ratio

Formula= Dividend/ Net profit* 100......

Dividend …. .... 247 247 357 82

Net profit........ 219 219 1320 1210

Results....... 112.79 112.79 27.05 6.78

Working Notes:

Calculation of capital employed......

Particulars.. Tesco.. Sainsbury..

2018.. 2019.. 2018.. 2019..

Total assets...... 44,735.. 48,949.. 22,001.. 23,514..

Less: Current liabilities....... 19,233.. 20,680.. 10,302.. 11,417..

Capital employed......... 25,502.. 28,269 11,699.. 12,097..

Interpretation of ratio analysis and chart for the purpose of evaluating financial performance of

business:

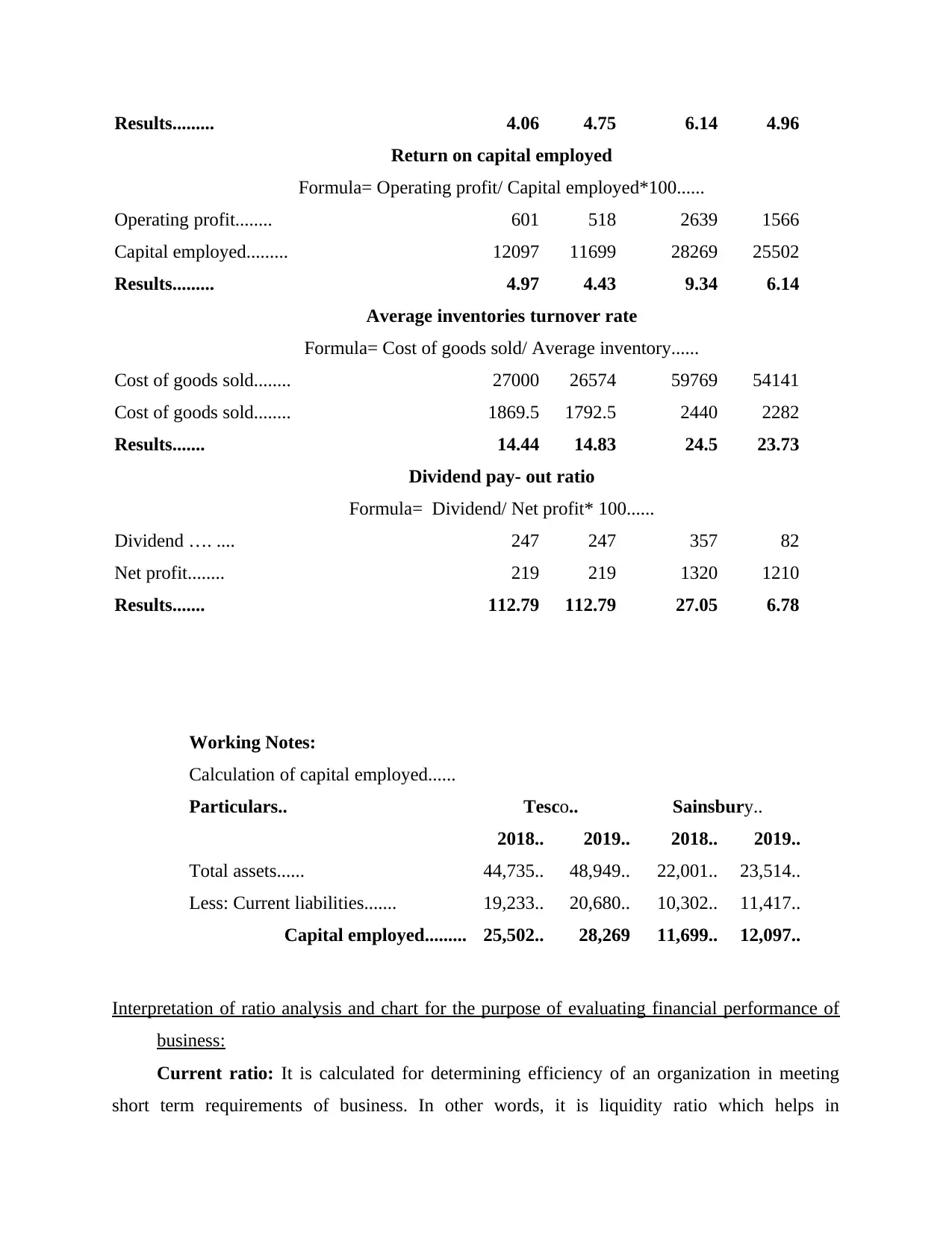

Current ratio: It is calculated for determining efficiency of an organization in meeting

short term requirements of business. In other words, it is liquidity ratio which helps in

measurement of ability of entity in paying off its short term obligations, that is, obligations

which are due within a year. It is helpful is informing managers regarding maximization of

current assets for satisfying current liabilities (Cleary and Wang, 2017).

Tes c o

S ain s b u ry

0

0 .2

0 .4

0 .6

0 .8 0 .7 1 0 .7 6

0 .6 1 0 .6 6

C u rre n t ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that Sainsbury’s has high current ratio as

compared to Tesco in both years, 2018 and 2019. It indicates that ability of Sainsbury’s

regarding paying off short term loans or obligations is higher as compared to Tesco.

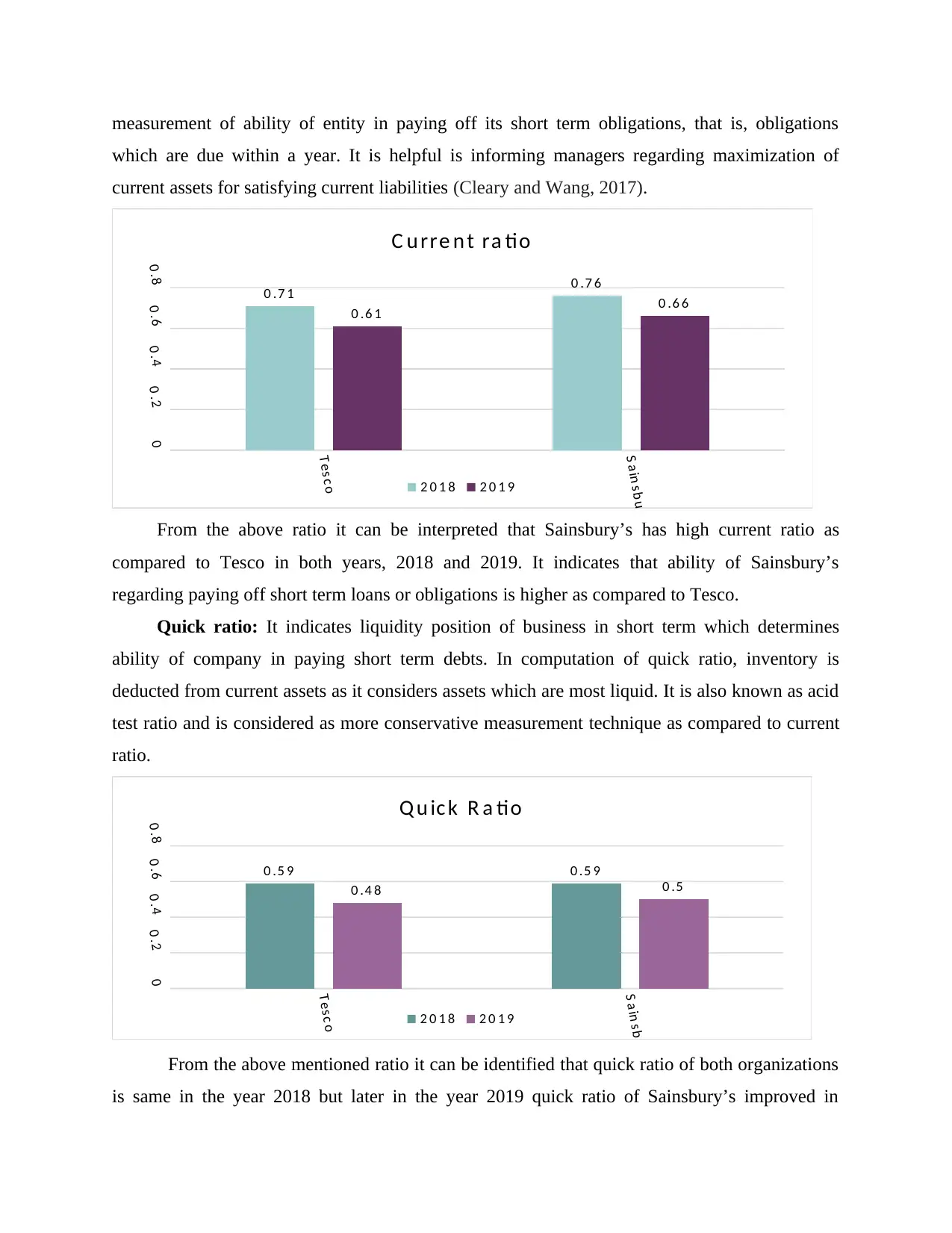

Quick ratio: It indicates liquidity position of business in short term which determines

ability of company in paying short term debts. In computation of quick ratio, inventory is

deducted from current assets as it considers assets which are most liquid. It is also known as acid

test ratio and is considered as more conservative measurement technique as compared to current

ratio.

Tes c o

S a in s b u ry

00 .20 .40 .60 .8

0 .5 9 0 .5 9

0 .4 8 0 .5

Q u ic k R a tio

2 0 1 8 2 0 1 9

From the above mentioned ratio it can be identified that quick ratio of both organizations

is same in the year 2018 but later in the year 2019 quick ratio of Sainsbury’s improved in

which are due within a year. It is helpful is informing managers regarding maximization of

current assets for satisfying current liabilities (Cleary and Wang, 2017).

Tes c o

S ain s b u ry

0

0 .2

0 .4

0 .6

0 .8 0 .7 1 0 .7 6

0 .6 1 0 .6 6

C u rre n t ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that Sainsbury’s has high current ratio as

compared to Tesco in both years, 2018 and 2019. It indicates that ability of Sainsbury’s

regarding paying off short term loans or obligations is higher as compared to Tesco.

Quick ratio: It indicates liquidity position of business in short term which determines

ability of company in paying short term debts. In computation of quick ratio, inventory is

deducted from current assets as it considers assets which are most liquid. It is also known as acid

test ratio and is considered as more conservative measurement technique as compared to current

ratio.

Tes c o

S a in s b u ry

00 .20 .40 .60 .8

0 .5 9 0 .5 9

0 .4 8 0 .5

Q u ic k R a tio

2 0 1 8 2 0 1 9

From the above mentioned ratio it can be identified that quick ratio of both organizations

is same in the year 2018 but later in the year 2019 quick ratio of Sainsbury’s improved in

You're viewing a preview

Unlock full access by subscribing today!

comparison to Tesco. It showcases that liquidity position of former is better than later and

Sainsbury’s is highly efficient regarding debt payment in short run and maintains high liquidity

or cash flow for smooth functioning of business activities.

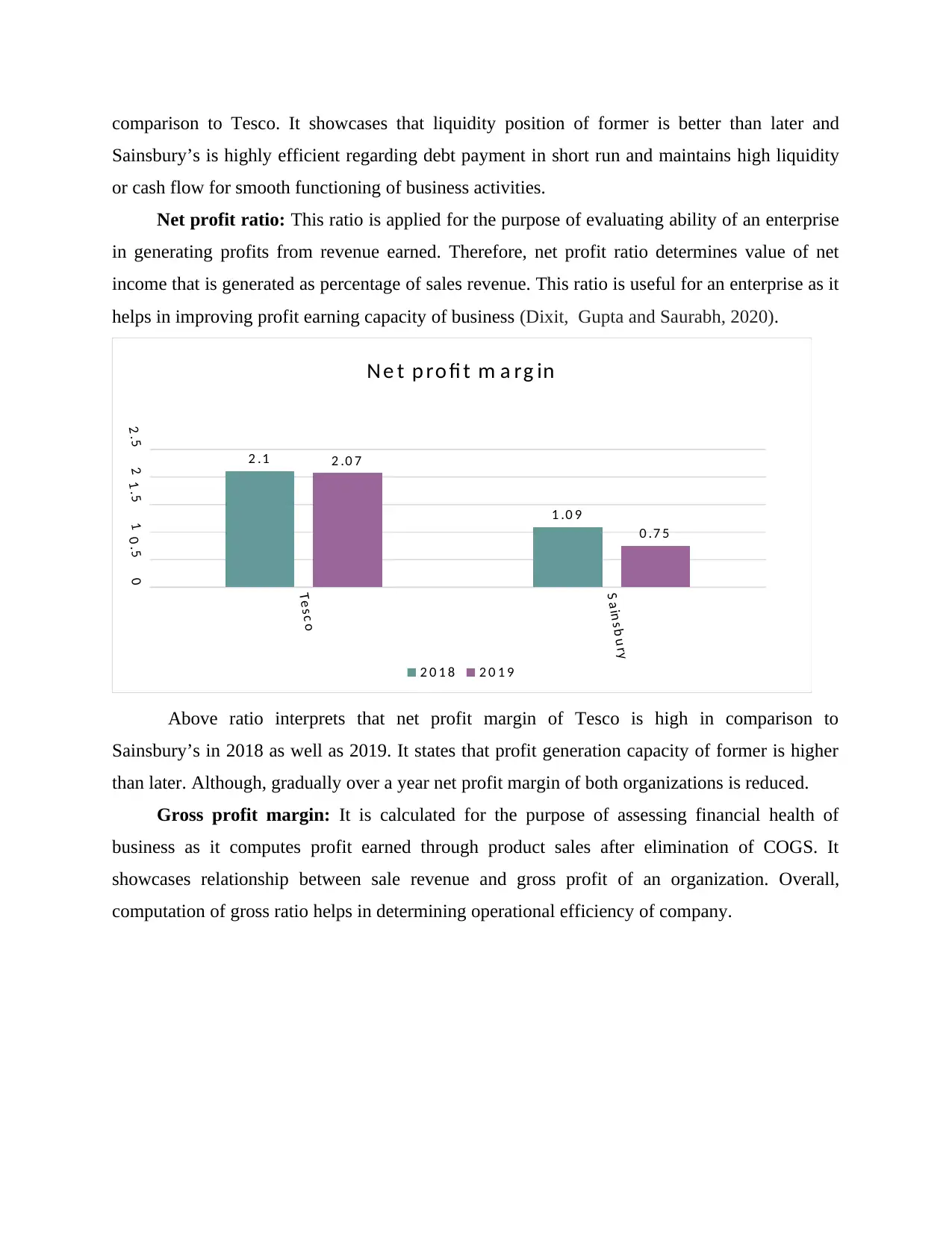

Net profit ratio: This ratio is applied for the purpose of evaluating ability of an enterprise

in generating profits from revenue earned. Therefore, net profit ratio determines value of net

income that is generated as percentage of sales revenue. This ratio is useful for an enterprise as it

helps in improving profit earning capacity of business (Dixit, Gupta and Saurabh, 2020).

Tes c o

S a in s b u ry

00 .511 .522 .5

2 .1

1 .0 9

2 .0 7

0 .7 5

N e t p ro fi t m a rg in

2 0 1 8 2 0 1 9

Above ratio interprets that net profit margin of Tesco is high in comparison to

Sainsbury’s in 2018 as well as 2019. It states that profit generation capacity of former is higher

than later. Although, gradually over a year net profit margin of both organizations is reduced.

Gross profit margin: It is calculated for the purpose of assessing financial health of

business as it computes profit earned through product sales after elimination of COGS. It

showcases relationship between sale revenue and gross profit of an organization. Overall,

computation of gross ratio helps in determining operational efficiency of company.

Sainsbury’s is highly efficient regarding debt payment in short run and maintains high liquidity

or cash flow for smooth functioning of business activities.

Net profit ratio: This ratio is applied for the purpose of evaluating ability of an enterprise

in generating profits from revenue earned. Therefore, net profit ratio determines value of net

income that is generated as percentage of sales revenue. This ratio is useful for an enterprise as it

helps in improving profit earning capacity of business (Dixit, Gupta and Saurabh, 2020).

Tes c o

S a in s b u ry

00 .511 .522 .5

2 .1

1 .0 9

2 .0 7

0 .7 5

N e t p ro fi t m a rg in

2 0 1 8 2 0 1 9

Above ratio interprets that net profit margin of Tesco is high in comparison to

Sainsbury’s in 2018 as well as 2019. It states that profit generation capacity of former is higher

than later. Although, gradually over a year net profit margin of both organizations is reduced.

Gross profit margin: It is calculated for the purpose of assessing financial health of

business as it computes profit earned through product sales after elimination of COGS. It

showcases relationship between sale revenue and gross profit of an organization. Overall,

computation of gross ratio helps in determining operational efficiency of company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Tes c o

S a in s b u ry

5

6

7

8

5 .8 3

6 .6 16 .4 8

6 .9 2

G ro s s p ro fi t m a rg in

2 0 1 8 2 0 1 9

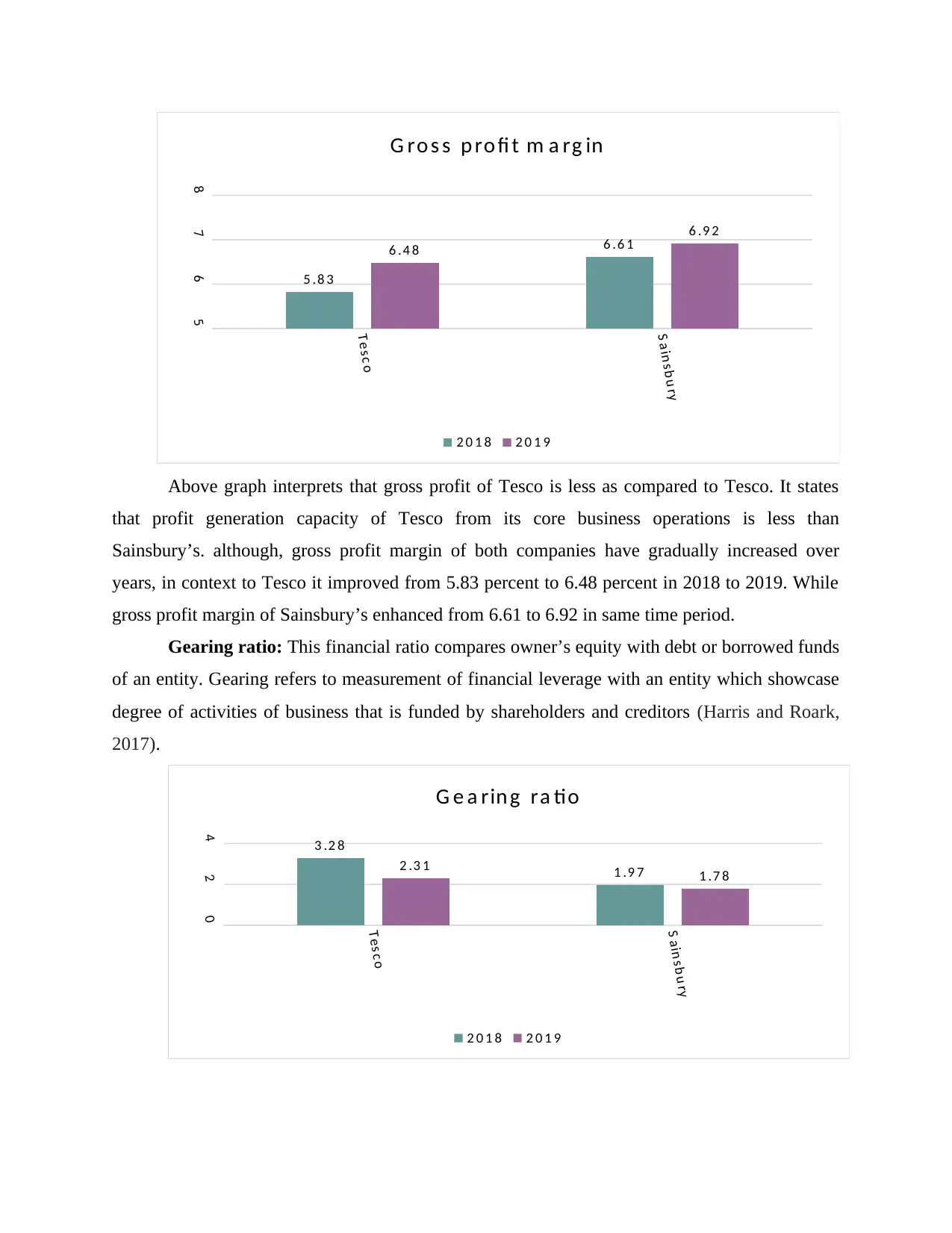

Above graph interprets that gross profit of Tesco is less as compared to Tesco. It states

that profit generation capacity of Tesco from its core business operations is less than

Sainsbury’s. although, gross profit margin of both companies have gradually increased over

years, in context to Tesco it improved from 5.83 percent to 6.48 percent in 2018 to 2019. While

gross profit margin of Sainsbury’s enhanced from 6.61 to 6.92 in same time period.

Gearing ratio: This financial ratio compares owner’s equity with debt or borrowed funds

of an entity. Gearing refers to measurement of financial leverage with an entity which showcase

degree of activities of business that is funded by shareholders and creditors (Harris and Roark,

2017).

Tes c o

S ain s b u ry

0

2

4 3 .2 8

1 .9 72 .3 1 1 .7 8

G e a rin g ra tio

2 0 1 8 2 0 1 9

S a in s b u ry

5

6

7

8

5 .8 3

6 .6 16 .4 8

6 .9 2

G ro s s p ro fi t m a rg in

2 0 1 8 2 0 1 9

Above graph interprets that gross profit of Tesco is less as compared to Tesco. It states

that profit generation capacity of Tesco from its core business operations is less than

Sainsbury’s. although, gross profit margin of both companies have gradually increased over

years, in context to Tesco it improved from 5.83 percent to 6.48 percent in 2018 to 2019. While

gross profit margin of Sainsbury’s enhanced from 6.61 to 6.92 in same time period.

Gearing ratio: This financial ratio compares owner’s equity with debt or borrowed funds

of an entity. Gearing refers to measurement of financial leverage with an entity which showcase

degree of activities of business that is funded by shareholders and creditors (Harris and Roark,

2017).

Tes c o

S ain s b u ry

0

2

4 3 .2 8

1 .9 72 .3 1 1 .7 8

G e a rin g ra tio

2 0 1 8 2 0 1 9

From the above report it can be concluded that gearing ratio of Tesco is higher in

comparison to Sainsbury’s in 2018 as well as 2019. It shows that proportion of debt in Tesco is

high as compared to Sainsbury’s. Hence, financial risk associated in Tesco is higher.

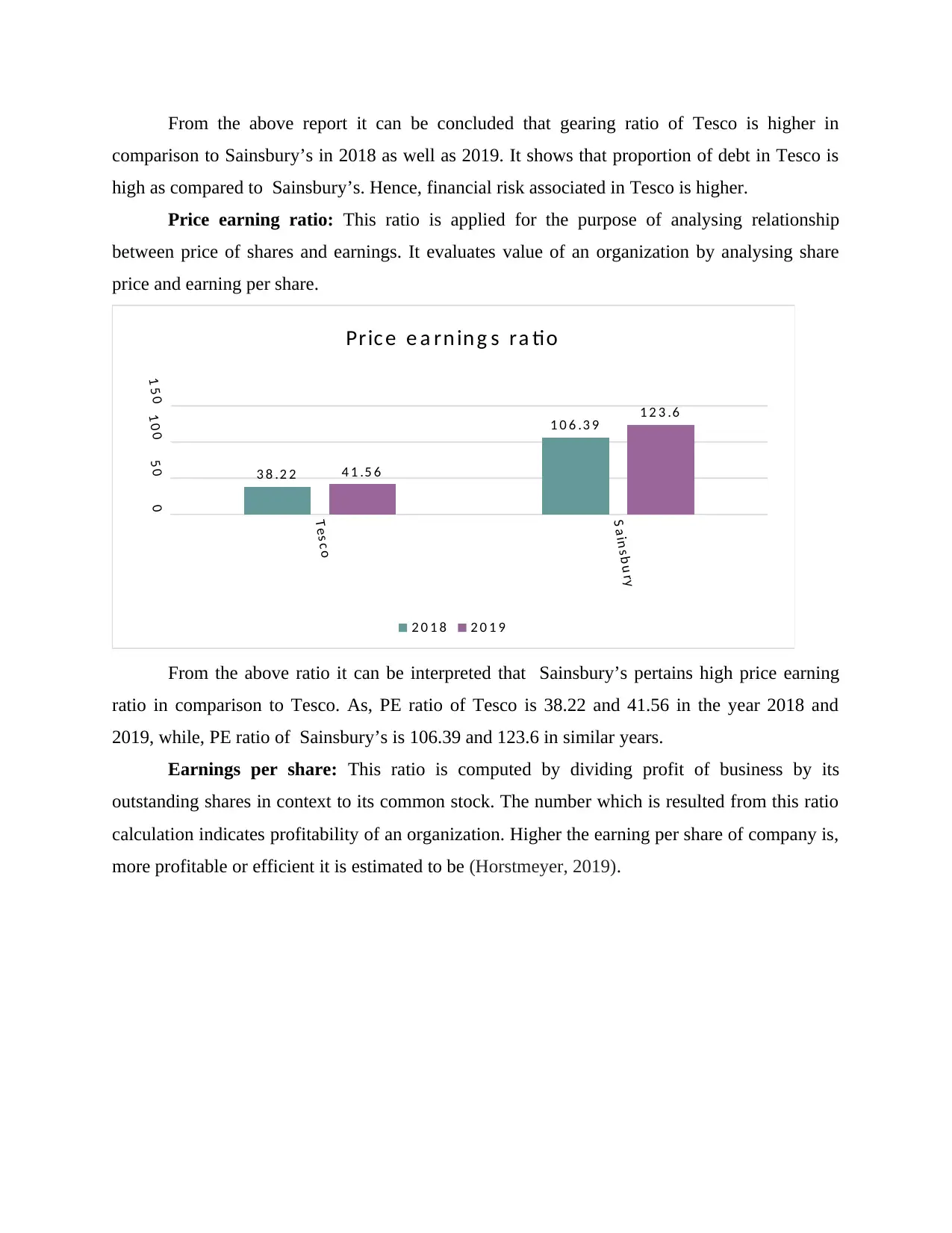

Price earning ratio: This ratio is applied for the purpose of analysing relationship

between price of shares and earnings. It evaluates value of an organization by analysing share

price and earning per share.

Tes c o

S a in s b u ry

05 01 0 01 5 0

3 8 .2 2

1 0 6 .3 9

4 1 .5 6

1 2 3 .6

Pric e e a rn in g s ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that Sainsbury’s pertains high price earning

ratio in comparison to Tesco. As, PE ratio of Tesco is 38.22 and 41.56 in the year 2018 and

2019, while, PE ratio of Sainsbury’s is 106.39 and 123.6 in similar years.

Earnings per share: This ratio is computed by dividing profit of business by its

outstanding shares in context to its common stock. The number which is resulted from this ratio

calculation indicates profitability of an organization. Higher the earning per share of company is,

more profitable or efficient it is estimated to be (Horstmeyer, 2019).

comparison to Sainsbury’s in 2018 as well as 2019. It shows that proportion of debt in Tesco is

high as compared to Sainsbury’s. Hence, financial risk associated in Tesco is higher.

Price earning ratio: This ratio is applied for the purpose of analysing relationship

between price of shares and earnings. It evaluates value of an organization by analysing share

price and earning per share.

Tes c o

S a in s b u ry

05 01 0 01 5 0

3 8 .2 2

1 0 6 .3 9

4 1 .5 6

1 2 3 .6

Pric e e a rn in g s ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that Sainsbury’s pertains high price earning

ratio in comparison to Tesco. As, PE ratio of Tesco is 38.22 and 41.56 in the year 2018 and

2019, while, PE ratio of Sainsbury’s is 106.39 and 123.6 in similar years.

Earnings per share: This ratio is computed by dividing profit of business by its

outstanding shares in context to its common stock. The number which is resulted from this ratio

calculation indicates profitability of an organization. Higher the earning per share of company is,

more profitable or efficient it is estimated to be (Horstmeyer, 2019).

You're viewing a preview

Unlock full access by subscribing today!

Tes c o

S a in s b u ry

01234567

4 .9 6 4 .7 5

6 .1 4

4 .0 6

E a rn in g s p e r s h a re

2 0 1 8 2 0 1 9

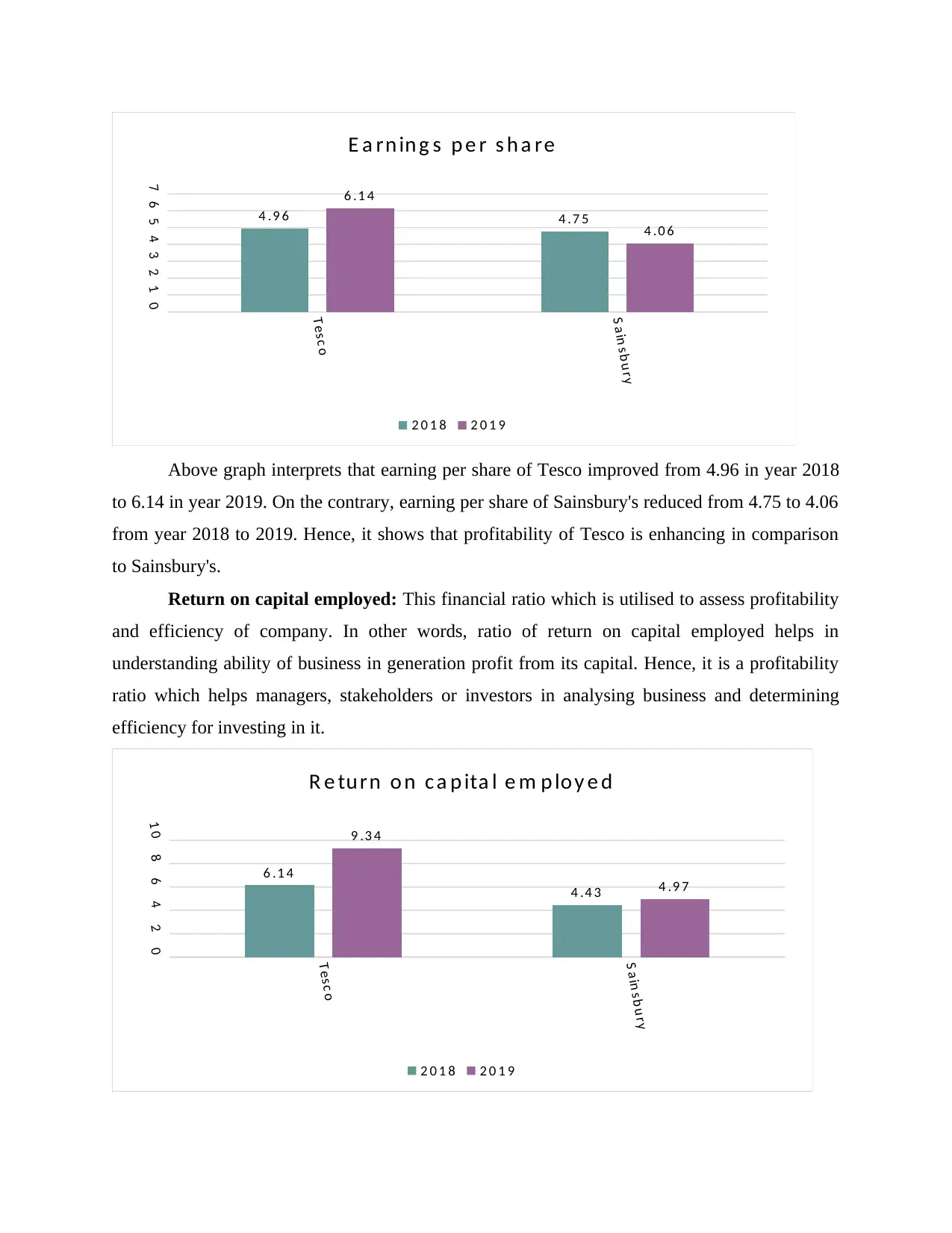

Above graph interprets that earning per share of Tesco improved from 4.96 in year 2018

to 6.14 in year 2019. On the contrary, earning per share of Sainsbury's reduced from 4.75 to 4.06

from year 2018 to 2019. Hence, it shows that profitability of Tesco is enhancing in comparison

to Sainsbury's.

Return on capital employed: This financial ratio which is utilised to assess profitability

and efficiency of company. In other words, ratio of return on capital employed helps in

understanding ability of business in generation profit from its capital. Hence, it is a profitability

ratio which helps managers, stakeholders or investors in analysing business and determining

efficiency for investing in it.

Tes c o

S ain s b u ry

024681 0

6 .1 4

4 .4 3

9 .3 4

4 .9 7

R e tu rn o n c a p ita l e m p lo y e d

2 0 1 8 2 0 1 9

S a in s b u ry

01234567

4 .9 6 4 .7 5

6 .1 4

4 .0 6

E a rn in g s p e r s h a re

2 0 1 8 2 0 1 9

Above graph interprets that earning per share of Tesco improved from 4.96 in year 2018

to 6.14 in year 2019. On the contrary, earning per share of Sainsbury's reduced from 4.75 to 4.06

from year 2018 to 2019. Hence, it shows that profitability of Tesco is enhancing in comparison

to Sainsbury's.

Return on capital employed: This financial ratio which is utilised to assess profitability

and efficiency of company. In other words, ratio of return on capital employed helps in

understanding ability of business in generation profit from its capital. Hence, it is a profitability

ratio which helps managers, stakeholders or investors in analysing business and determining

efficiency for investing in it.

Tes c o

S ain s b u ry

024681 0

6 .1 4

4 .4 3

9 .3 4

4 .9 7

R e tu rn o n c a p ita l e m p lo y e d

2 0 1 8 2 0 1 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Above ratio states that Tesco gains more return on capital employed as compared to

Sainsbury's. Hence, it can be interpreted that Tesco uses its capital in better way as compared to

Sainsbury's in context to generation of income or profit.

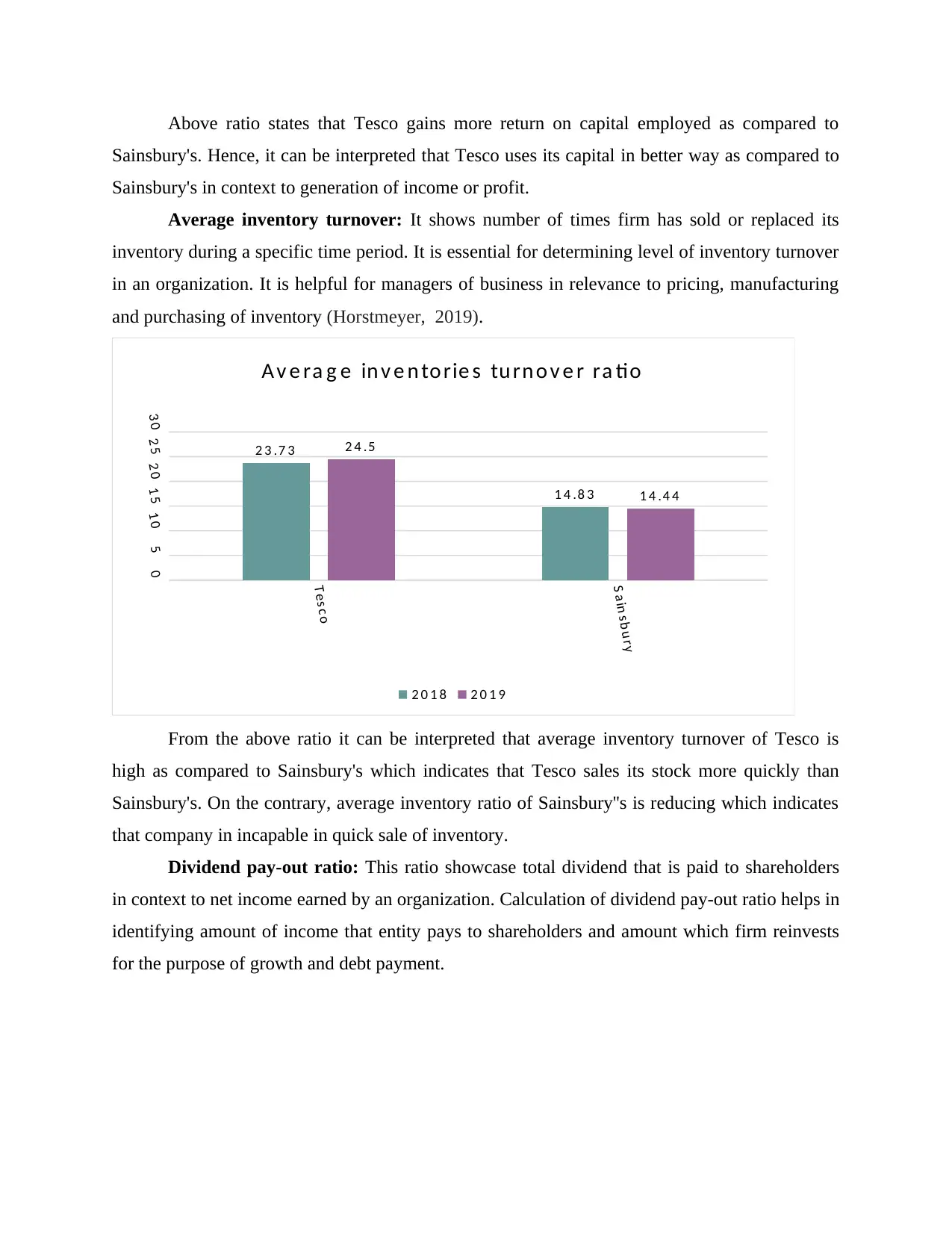

Average inventory turnover: It shows number of times firm has sold or replaced its

inventory during a specific time period. It is essential for determining level of inventory turnover

in an organization. It is helpful for managers of business in relevance to pricing, manufacturing

and purchasing of inventory (Horstmeyer, 2019).

Tes c o

S a in s b u ry

051 01 52 02 53 0

2 3 .7 3

1 4 .8 3

2 4 .5

1 4 .4 4

A v e ra g e in v e n to rie s tu rn o v e r ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that average inventory turnover of Tesco is

high as compared to Sainsbury's which indicates that Tesco sales its stock more quickly than

Sainsbury's. On the contrary, average inventory ratio of Sainsbury''s is reducing which indicates

that company in incapable in quick sale of inventory.

Dividend pay-out ratio: This ratio showcase total dividend that is paid to shareholders

in context to net income earned by an organization. Calculation of dividend pay-out ratio helps in

identifying amount of income that entity pays to shareholders and amount which firm reinvests

for the purpose of growth and debt payment.

Sainsbury's. Hence, it can be interpreted that Tesco uses its capital in better way as compared to

Sainsbury's in context to generation of income or profit.

Average inventory turnover: It shows number of times firm has sold or replaced its

inventory during a specific time period. It is essential for determining level of inventory turnover

in an organization. It is helpful for managers of business in relevance to pricing, manufacturing

and purchasing of inventory (Horstmeyer, 2019).

Tes c o

S a in s b u ry

051 01 52 02 53 0

2 3 .7 3

1 4 .8 3

2 4 .5

1 4 .4 4

A v e ra g e in v e n to rie s tu rn o v e r ra tio

2 0 1 8 2 0 1 9

From the above ratio it can be interpreted that average inventory turnover of Tesco is

high as compared to Sainsbury's which indicates that Tesco sales its stock more quickly than

Sainsbury's. On the contrary, average inventory ratio of Sainsbury''s is reducing which indicates

that company in incapable in quick sale of inventory.

Dividend pay-out ratio: This ratio showcase total dividend that is paid to shareholders

in context to net income earned by an organization. Calculation of dividend pay-out ratio helps in

identifying amount of income that entity pays to shareholders and amount which firm reinvests

for the purpose of growth and debt payment.

Tes c o

S a in s b u ry

0

5 0

1 0 0

1 5 0

6 .7 8

7 6 .0 5

2 7 .0 5

1 1 2 .7 9

D iv id e n d p a y o u t ra tio

2 0 1 8 2 0 1 9

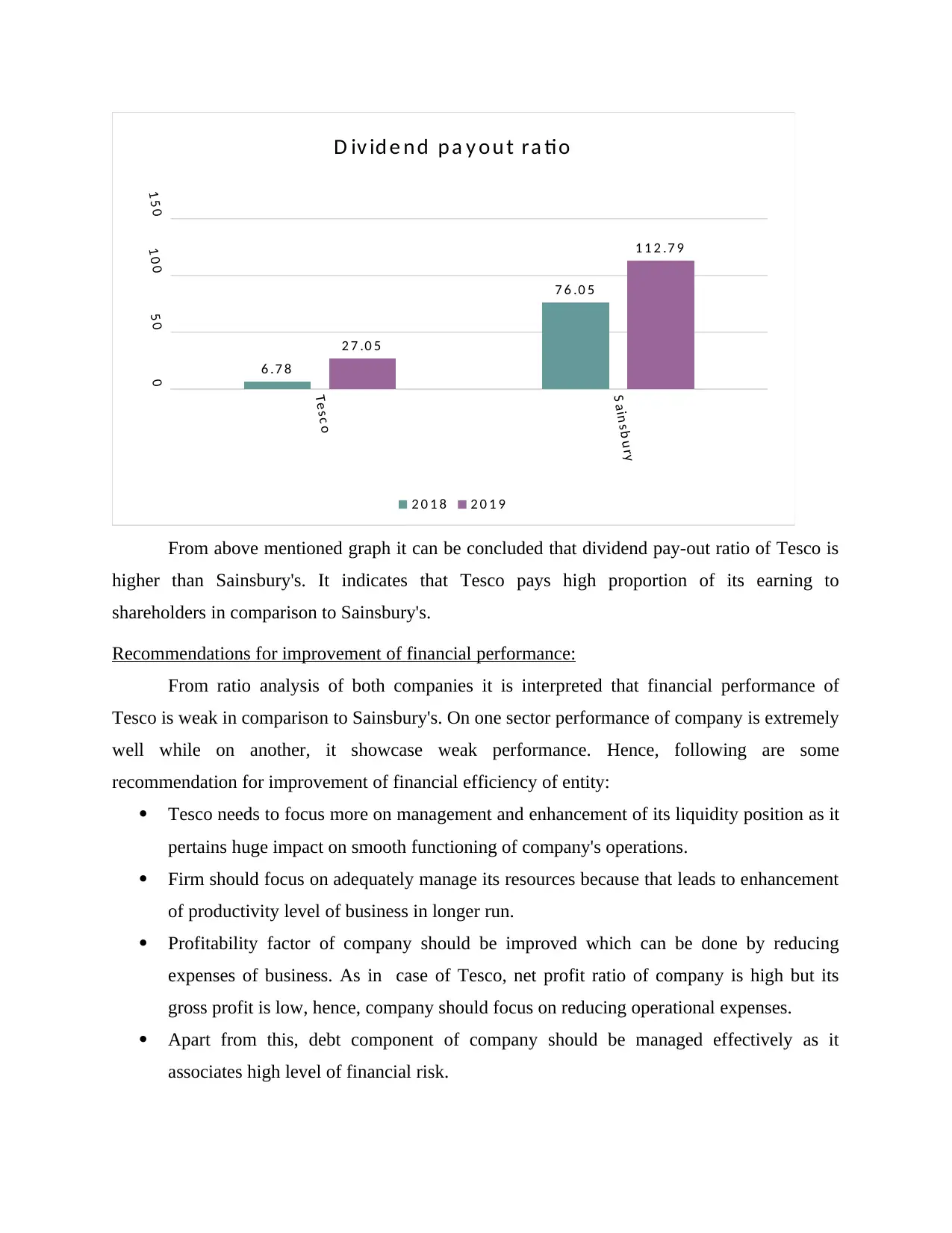

From above mentioned graph it can be concluded that dividend pay-out ratio of Tesco is

higher than Sainsbury's. It indicates that Tesco pays high proportion of its earning to

shareholders in comparison to Sainsbury's.

Recommendations for improvement of financial performance:

From ratio analysis of both companies it is interpreted that financial performance of

Tesco is weak in comparison to Sainsbury's. On one sector performance of company is extremely

well while on another, it showcase weak performance. Hence, following are some

recommendation for improvement of financial efficiency of entity:

Tesco needs to focus more on management and enhancement of its liquidity position as it

pertains huge impact on smooth functioning of company's operations.

Firm should focus on adequately manage its resources because that leads to enhancement

of productivity level of business in longer run.

Profitability factor of company should be improved which can be done by reducing

expenses of business. As in case of Tesco, net profit ratio of company is high but its

gross profit is low, hence, company should focus on reducing operational expenses.

Apart from this, debt component of company should be managed effectively as it

associates high level of financial risk.

S a in s b u ry

0

5 0

1 0 0

1 5 0

6 .7 8

7 6 .0 5

2 7 .0 5

1 1 2 .7 9

D iv id e n d p a y o u t ra tio

2 0 1 8 2 0 1 9

From above mentioned graph it can be concluded that dividend pay-out ratio of Tesco is

higher than Sainsbury's. It indicates that Tesco pays high proportion of its earning to

shareholders in comparison to Sainsbury's.

Recommendations for improvement of financial performance:

From ratio analysis of both companies it is interpreted that financial performance of

Tesco is weak in comparison to Sainsbury's. On one sector performance of company is extremely

well while on another, it showcase weak performance. Hence, following are some

recommendation for improvement of financial efficiency of entity:

Tesco needs to focus more on management and enhancement of its liquidity position as it

pertains huge impact on smooth functioning of company's operations.

Firm should focus on adequately manage its resources because that leads to enhancement

of productivity level of business in longer run.

Profitability factor of company should be improved which can be done by reducing

expenses of business. As in case of Tesco, net profit ratio of company is high but its

gross profit is low, hence, company should focus on reducing operational expenses.

Apart from this, debt component of company should be managed effectively as it

associates high level of financial risk.

You're viewing a preview

Unlock full access by subscribing today!

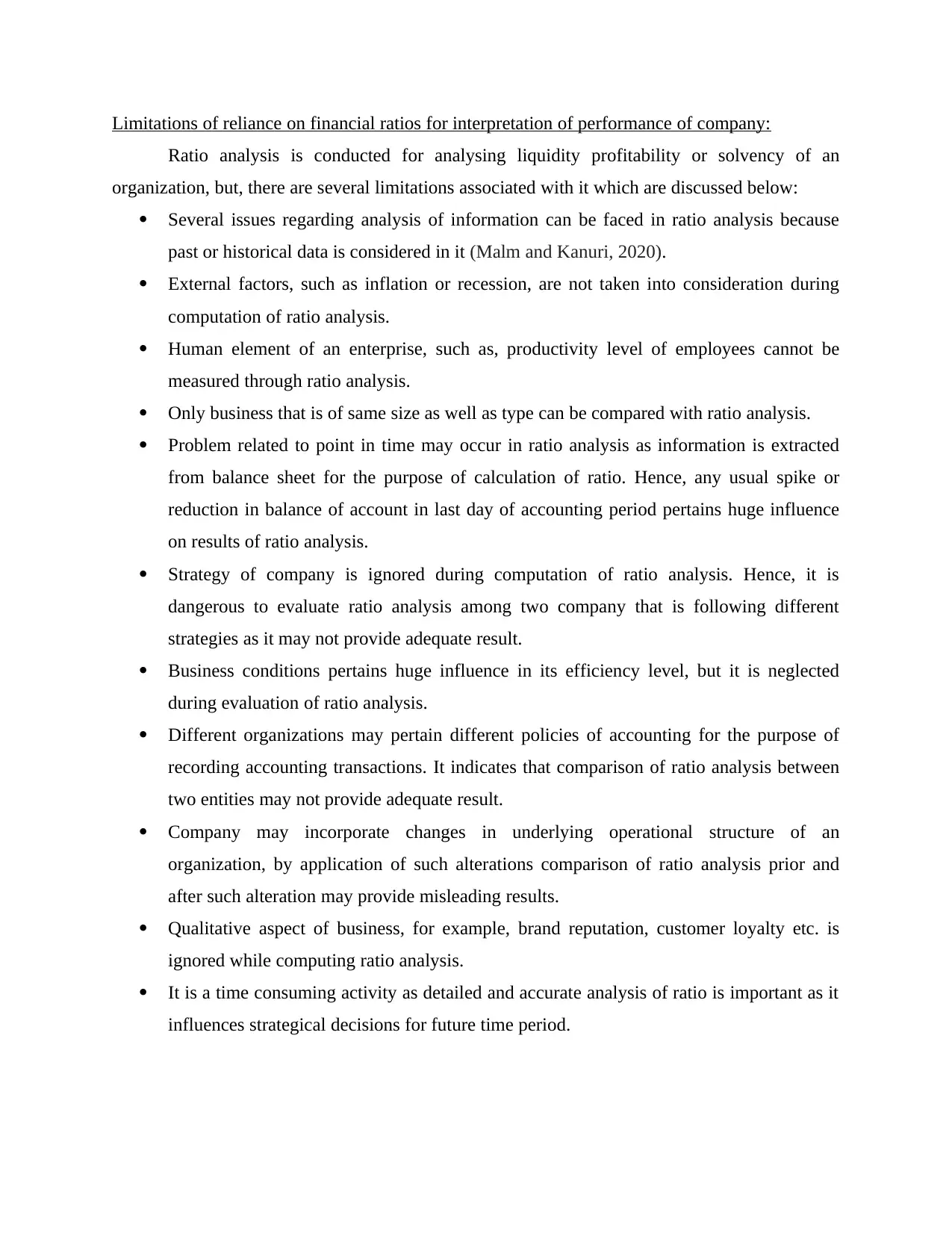

Limitations of reliance on financial ratios for interpretation of performance of company:

Ratio analysis is conducted for analysing liquidity profitability or solvency of an

organization, but, there are several limitations associated with it which are discussed below:

Several issues regarding analysis of information can be faced in ratio analysis because

past or historical data is considered in it (Malm and Kanuri, 2020).

External factors, such as inflation or recession, are not taken into consideration during

computation of ratio analysis.

Human element of an enterprise, such as, productivity level of employees cannot be

measured through ratio analysis.

Only business that is of same size as well as type can be compared with ratio analysis.

Problem related to point in time may occur in ratio analysis as information is extracted

from balance sheet for the purpose of calculation of ratio. Hence, any usual spike or

reduction in balance of account in last day of accounting period pertains huge influence

on results of ratio analysis.

Strategy of company is ignored during computation of ratio analysis. Hence, it is

dangerous to evaluate ratio analysis among two company that is following different

strategies as it may not provide adequate result.

Business conditions pertains huge influence in its efficiency level, but it is neglected

during evaluation of ratio analysis.

Different organizations may pertain different policies of accounting for the purpose of

recording accounting transactions. It indicates that comparison of ratio analysis between

two entities may not provide adequate result.

Company may incorporate changes in underlying operational structure of an

organization, by application of such alterations comparison of ratio analysis prior and

after such alteration may provide misleading results.

Qualitative aspect of business, for example, brand reputation, customer loyalty etc. is

ignored while computing ratio analysis.

It is a time consuming activity as detailed and accurate analysis of ratio is important as it

influences strategical decisions for future time period.

Ratio analysis is conducted for analysing liquidity profitability or solvency of an

organization, but, there are several limitations associated with it which are discussed below:

Several issues regarding analysis of information can be faced in ratio analysis because

past or historical data is considered in it (Malm and Kanuri, 2020).

External factors, such as inflation or recession, are not taken into consideration during

computation of ratio analysis.

Human element of an enterprise, such as, productivity level of employees cannot be

measured through ratio analysis.

Only business that is of same size as well as type can be compared with ratio analysis.

Problem related to point in time may occur in ratio analysis as information is extracted

from balance sheet for the purpose of calculation of ratio. Hence, any usual spike or

reduction in balance of account in last day of accounting period pertains huge influence

on results of ratio analysis.

Strategy of company is ignored during computation of ratio analysis. Hence, it is

dangerous to evaluate ratio analysis among two company that is following different

strategies as it may not provide adequate result.

Business conditions pertains huge influence in its efficiency level, but it is neglected

during evaluation of ratio analysis.

Different organizations may pertain different policies of accounting for the purpose of

recording accounting transactions. It indicates that comparison of ratio analysis between

two entities may not provide adequate result.

Company may incorporate changes in underlying operational structure of an

organization, by application of such alterations comparison of ratio analysis prior and

after such alteration may provide misleading results.

Qualitative aspect of business, for example, brand reputation, customer loyalty etc. is

ignored while computing ratio analysis.

It is a time consuming activity as detailed and accurate analysis of ratio is important as it

influences strategical decisions for future time period.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Seasonal factors are neglected in ratio analysis of business which provides misleading

results as seasonal factors imposes high impact of profitability of business (Park, Park

and Ratti, 2018).

PORTFOLIO 2

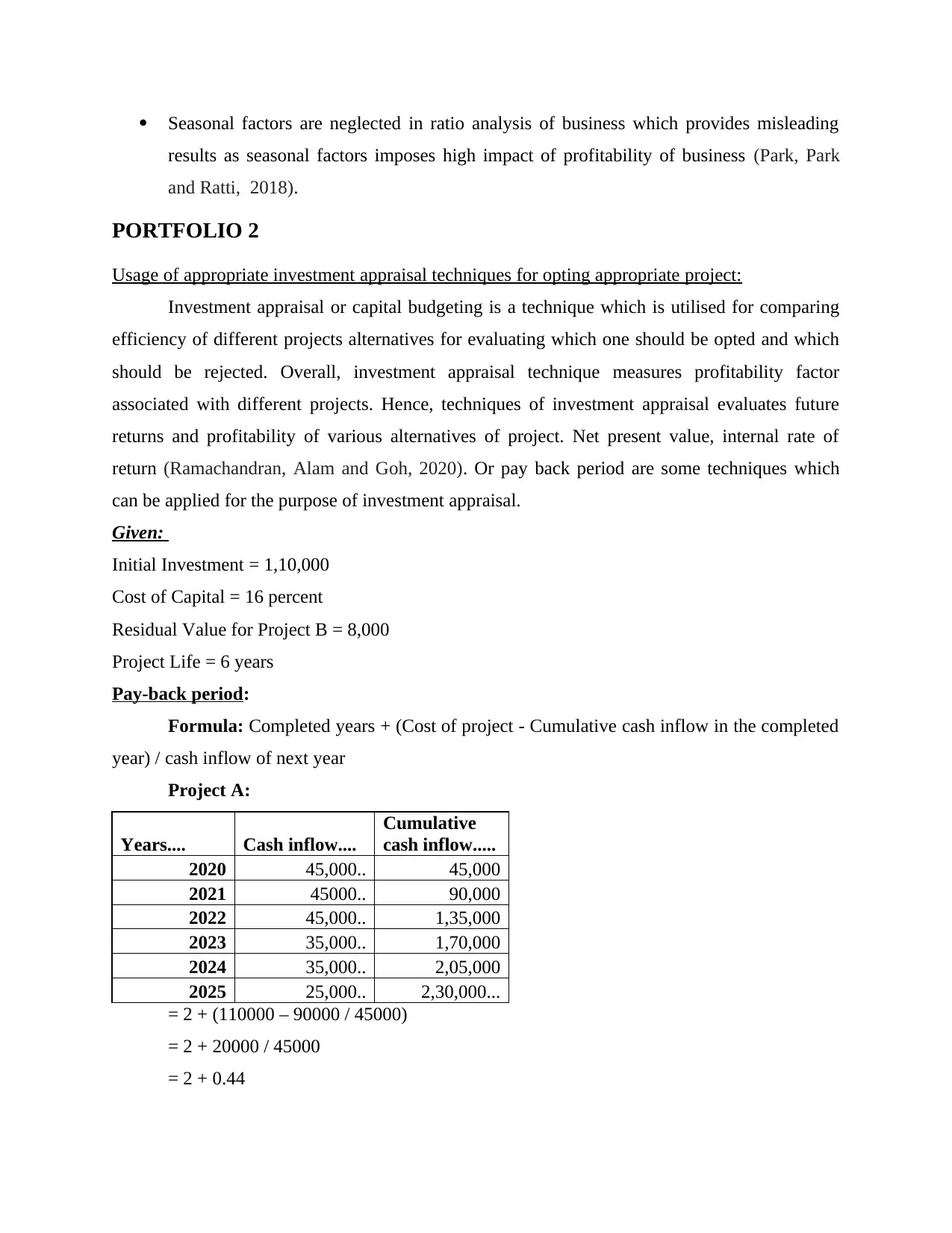

Usage of appropriate investment appraisal techniques for opting appropriate project:

Investment appraisal or capital budgeting is a technique which is utilised for comparing

efficiency of different projects alternatives for evaluating which one should be opted and which

should be rejected. Overall, investment appraisal technique measures profitability factor

associated with different projects. Hence, techniques of investment appraisal evaluates future

returns and profitability of various alternatives of project. Net present value, internal rate of

return (Ramachandran, Alam and Goh, 2020). Or pay back period are some techniques which

can be applied for the purpose of investment appraisal.

Given:

Initial Investment = 1,10,000

Cost of Capital = 16 percent

Residual Value for Project B = 8,000

Project Life = 6 years

Pay-back period:

Formula: Completed years + (Cost of project - Cumulative cash inflow in the completed

year) / cash inflow of next year

Project A:

Years.... Cash inflow....

Cumulative

cash inflow.....

2020 45,000.. 45,000

2021 45000.. 90,000

2022 45,000.. 1,35,000

2023 35,000.. 1,70,000

2024 35,000.. 2,05,000

2025 25,000.. 2,30,000...

= 2 + (110000 – 90000 / 45000)

= 2 + 20000 / 45000

= 2 + 0.44

results as seasonal factors imposes high impact of profitability of business (Park, Park

and Ratti, 2018).

PORTFOLIO 2

Usage of appropriate investment appraisal techniques for opting appropriate project:

Investment appraisal or capital budgeting is a technique which is utilised for comparing

efficiency of different projects alternatives for evaluating which one should be opted and which

should be rejected. Overall, investment appraisal technique measures profitability factor

associated with different projects. Hence, techniques of investment appraisal evaluates future

returns and profitability of various alternatives of project. Net present value, internal rate of

return (Ramachandran, Alam and Goh, 2020). Or pay back period are some techniques which

can be applied for the purpose of investment appraisal.

Given:

Initial Investment = 1,10,000

Cost of Capital = 16 percent

Residual Value for Project B = 8,000

Project Life = 6 years

Pay-back period:

Formula: Completed years + (Cost of project - Cumulative cash inflow in the completed

year) / cash inflow of next year

Project A:

Years.... Cash inflow....

Cumulative

cash inflow.....

2020 45,000.. 45,000

2021 45000.. 90,000

2022 45,000.. 1,35,000

2023 35,000.. 1,70,000

2024 35,000.. 2,05,000

2025 25,000.. 2,30,000...

= 2 + (110000 – 90000 / 45000)

= 2 + 20000 / 45000

= 2 + 0.44

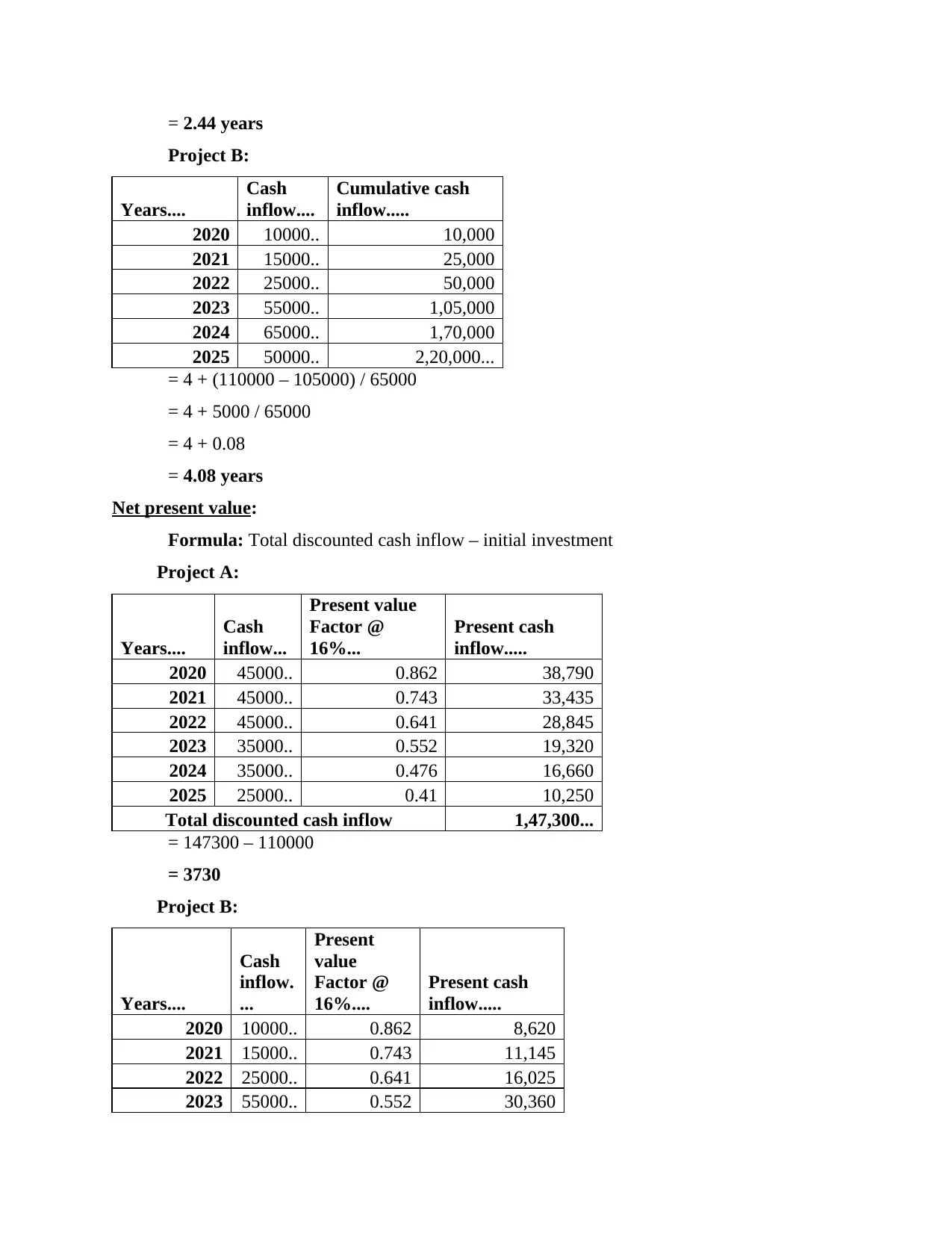

= 2.44 years

Project B:

Years....

Cash

inflow....

Cumulative cash

inflow.....

2020 10000.. 10,000

2021 15000.. 25,000

2022 25000.. 50,000

2023 55000.. 1,05,000

2024 65000.. 1,70,000

2025 50000.. 2,20,000...

= 4 + (110000 – 105000) / 65000

= 4 + 5000 / 65000

= 4 + 0.08

= 4.08 years

Net present value:

Formula: Total discounted cash inflow – initial investment

Project A:

Years....

Cash

inflow...

Present value

Factor @

16%...

Present cash

inflow.....

2020 45000.. 0.862 38,790

2021 45000.. 0.743 33,435

2022 45000.. 0.641 28,845

2023 35000.. 0.552 19,320

2024 35000.. 0.476 16,660

2025 25000.. 0.41 10,250

Total discounted cash inflow 1,47,300...

= 147300 – 110000

= 3730

Project B:

Years....

Cash

inflow.

...

Present

value

Factor @

16%....

Present cash

inflow.....

2020 10000.. 0.862 8,620

2021 15000.. 0.743 11,145

2022 25000.. 0.641 16,025

2023 55000.. 0.552 30,360

Project B:

Years....

Cash

inflow....

Cumulative cash

inflow.....

2020 10000.. 10,000

2021 15000.. 25,000

2022 25000.. 50,000

2023 55000.. 1,05,000

2024 65000.. 1,70,000

2025 50000.. 2,20,000...

= 4 + (110000 – 105000) / 65000

= 4 + 5000 / 65000

= 4 + 0.08

= 4.08 years

Net present value:

Formula: Total discounted cash inflow – initial investment

Project A:

Years....

Cash

inflow...

Present value

Factor @

16%...

Present cash

inflow.....

2020 45000.. 0.862 38,790

2021 45000.. 0.743 33,435

2022 45000.. 0.641 28,845

2023 35000.. 0.552 19,320

2024 35000.. 0.476 16,660

2025 25000.. 0.41 10,250

Total discounted cash inflow 1,47,300...

= 147300 – 110000

= 3730

Project B:

Years....

Cash

inflow.

...

Present

value

Factor @

16%....

Present cash

inflow.....

2020 10000.. 0.862 8,620

2021 15000.. 0.743 11,145

2022 25000.. 0.641 16,025

2023 55000.. 0.552 30,360

You're viewing a preview

Unlock full access by subscribing today!

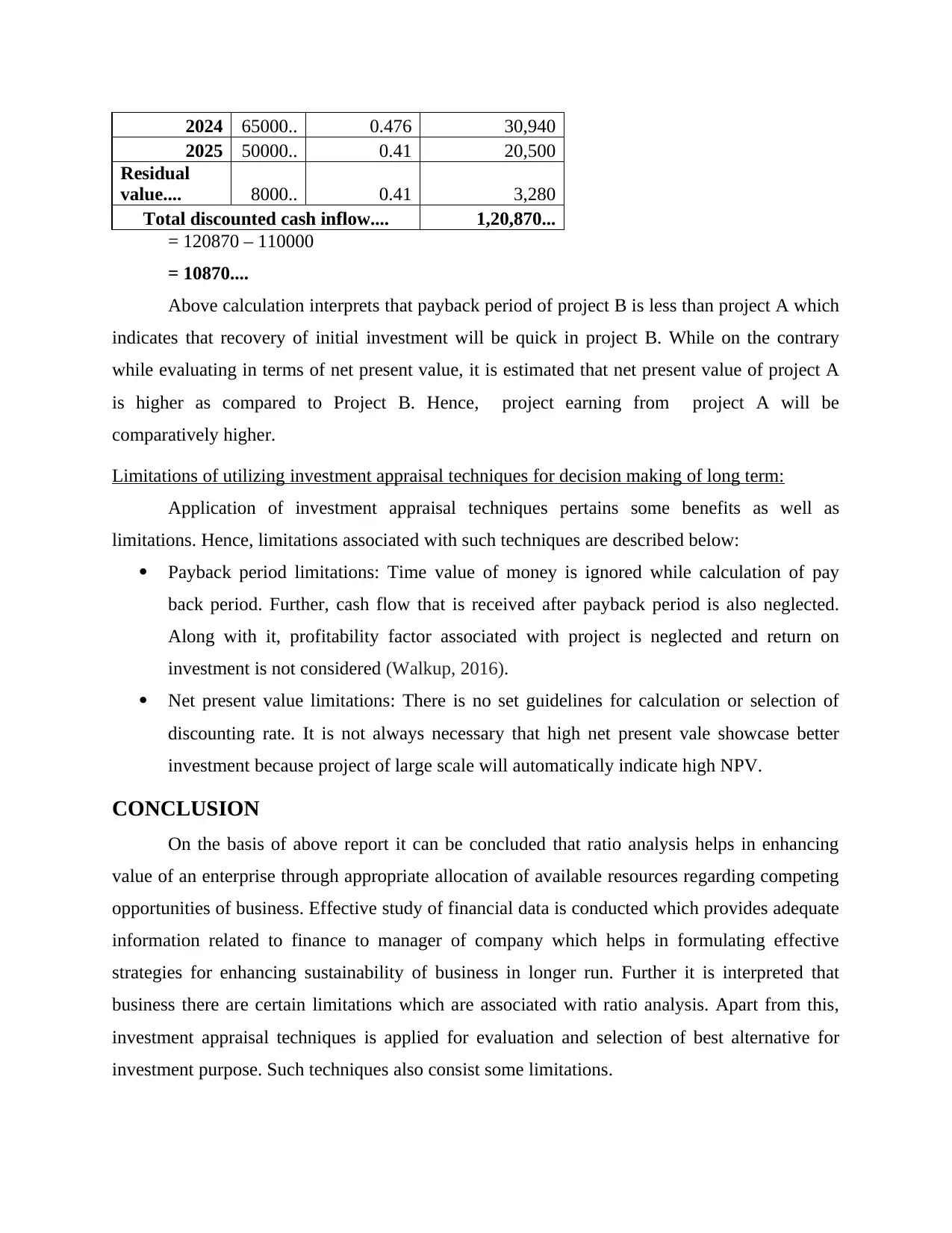

2024 65000.. 0.476 30,940

2025 50000.. 0.41 20,500

Residual

value.... 8000.. 0.41 3,280

Total discounted cash inflow.... 1,20,870...

= 120870 – 110000

= 10870....

Above calculation interprets that payback period of project B is less than project A which

indicates that recovery of initial investment will be quick in project B. While on the contrary

while evaluating in terms of net present value, it is estimated that net present value of project A

is higher as compared to Project B. Hence, project earning from project A will be

comparatively higher.

Limitations of utilizing investment appraisal techniques for decision making of long term:

Application of investment appraisal techniques pertains some benefits as well as

limitations. Hence, limitations associated with such techniques are described below:

Payback period limitations: Time value of money is ignored while calculation of pay

back period. Further, cash flow that is received after payback period is also neglected.

Along with it, profitability factor associated with project is neglected and return on

investment is not considered (Walkup, 2016).

Net present value limitations: There is no set guidelines for calculation or selection of

discounting rate. It is not always necessary that high net present vale showcase better

investment because project of large scale will automatically indicate high NPV.

CONCLUSION

On the basis of above report it can be concluded that ratio analysis helps in enhancing

value of an enterprise through appropriate allocation of available resources regarding competing

opportunities of business. Effective study of financial data is conducted which provides adequate

information related to finance to manager of company which helps in formulating effective

strategies for enhancing sustainability of business in longer run. Further it is interpreted that

business there are certain limitations which are associated with ratio analysis. Apart from this,

investment appraisal techniques is applied for evaluation and selection of best alternative for

investment purpose. Such techniques also consist some limitations.

2025 50000.. 0.41 20,500

Residual

value.... 8000.. 0.41 3,280

Total discounted cash inflow.... 1,20,870...

= 120870 – 110000

= 10870....

Above calculation interprets that payback period of project B is less than project A which

indicates that recovery of initial investment will be quick in project B. While on the contrary

while evaluating in terms of net present value, it is estimated that net present value of project A

is higher as compared to Project B. Hence, project earning from project A will be

comparatively higher.

Limitations of utilizing investment appraisal techniques for decision making of long term:

Application of investment appraisal techniques pertains some benefits as well as

limitations. Hence, limitations associated with such techniques are described below:

Payback period limitations: Time value of money is ignored while calculation of pay

back period. Further, cash flow that is received after payback period is also neglected.

Along with it, profitability factor associated with project is neglected and return on

investment is not considered (Walkup, 2016).

Net present value limitations: There is no set guidelines for calculation or selection of

discounting rate. It is not always necessary that high net present vale showcase better

investment because project of large scale will automatically indicate high NPV.

CONCLUSION

On the basis of above report it can be concluded that ratio analysis helps in enhancing

value of an enterprise through appropriate allocation of available resources regarding competing

opportunities of business. Effective study of financial data is conducted which provides adequate

information related to finance to manager of company which helps in formulating effective

strategies for enhancing sustainability of business in longer run. Further it is interpreted that

business there are certain limitations which are associated with ratio analysis. Apart from this,

investment appraisal techniques is applied for evaluation and selection of best alternative for

investment purpose. Such techniques also consist some limitations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals:

Bhabra, G. S. and Rooney, J., 2019. Sarbanes-Oxley, agency conflicts and the marginal value of

capital expenditure. Managerial Finance.

Bhatti, M. and Alam, N., 2018. Editorial note on the role of Islamic finance in mainstream

finance. Managerial Finance.

Cleary, W. S. and Wang, J., 2017. Institutional investors, monitoring and corporate finance

policies. International Journal of Managerial Finance.

Dixit, B. K., Gupta, N. and Saurabh, S., 2020. Dividend policy in India: reconciling theory and

evidence. Managerial Finance.

Harris, C. and Roark, S., 2017. Exploring the decline in trade credit investment. Managerial

Finance.

Horstmeyer, D., 2019. Formation of a student managed investment fund: risk management and

oversight. Managerial Finance.

Horstmeyer, D., 2019. Formation of a student managed investment fund: risk management and

oversight. Managerial Finance.

Magnusson, G., 2020. Trick or treat? The Halloween effect in stock markets revisited.

Managerial Finance.

Malm, J. and Kanuri, S., 2020. Litigation risk and payout policy. Managerial Finance.

Park, J. H., Park, K. and Ratti, R. A., 2018. Controlling shareholders and financial constraints

around the world. Managerial Finance.

Ramachandran, J., Alam, N. and Goh, C. E., 2020. A win-win situation for both managers and

shareholders. Managerial Finance.

Walkup, B., 2016. The impact of uncertainty on payout policy. Managerial Finance.

Books and Journals:

Bhabra, G. S. and Rooney, J., 2019. Sarbanes-Oxley, agency conflicts and the marginal value of

capital expenditure. Managerial Finance.

Bhatti, M. and Alam, N., 2018. Editorial note on the role of Islamic finance in mainstream

finance. Managerial Finance.

Cleary, W. S. and Wang, J., 2017. Institutional investors, monitoring and corporate finance

policies. International Journal of Managerial Finance.

Dixit, B. K., Gupta, N. and Saurabh, S., 2020. Dividend policy in India: reconciling theory and

evidence. Managerial Finance.

Harris, C. and Roark, S., 2017. Exploring the decline in trade credit investment. Managerial

Finance.

Horstmeyer, D., 2019. Formation of a student managed investment fund: risk management and

oversight. Managerial Finance.

Horstmeyer, D., 2019. Formation of a student managed investment fund: risk management and

oversight. Managerial Finance.

Magnusson, G., 2020. Trick or treat? The Halloween effect in stock markets revisited.

Managerial Finance.

Malm, J. and Kanuri, S., 2020. Litigation risk and payout policy. Managerial Finance.

Park, J. H., Park, K. and Ratti, R. A., 2018. Controlling shareholders and financial constraints

around the world. Managerial Finance.

Ramachandran, J., Alam, N. and Goh, C. E., 2020. A win-win situation for both managers and

shareholders. Managerial Finance.

Walkup, B., 2016. The impact of uncertainty on payout policy. Managerial Finance.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.