Dell Laptop Plant Project: Financial Analysis and Recommendations

VerifiedAdded on 2023/03/17

|8

|1222

|92

Report

AI Summary

This report presents a financial analysis of a proposed laptop manufacturing plant for Dell, evaluating its feasibility using capital budgeting techniques. The analysis includes calculations for depreciation, incremental cash flows, and initial investments, leading to the computation of Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. The report finds the project financially viable based on a positive NPV and an IRR exceeding the discount rate. The report also assesses the impact of debt financing and the company's current approach to the cost of capital. It concludes with recommendations to adjust the cost of capital based on risk and relax the CEO's stringent debt servicing requirement to maximize shareholder wealth. References to academic sources are also provided.

MANAGERIAL FINANCE

STUDENT ID:

[Pick the date]

1

STUDENT ID:

[Pick the date]

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The given report aims to capture the financial analysis with regards to the laptop production

plant that Dell intends to setup. Considering the input estimates for the project and the requisite

capital budgeting techniques, the feasibility of the project in financial terms is established. Also,

after the introduction of the new requirement regarding project cash inflows funding debt

repayments, it is expected that the project still remains feasible. But it is imperative that the

company should bring a change in the stringent requirement of debt servicing in each year and

also ensure that the cost of capital for each project is based on the relative risk profile.

Introduction

The given report aims to present the financial analysis of the laptop manufacturing facility to be

setup by Dell. Considering the relevant details about the facility and the expected future

cashflows, suitable capital budgeting techniques have been used for ascertaining the project

feasibility. Besides, an additional scenario for project feasibility has also been considered where

it is expected that repayment of debt on an annual basis would be funded by the project cash

inflows. Also, the company’s policy of using one particular cost of capital without regards to the

risk of the project has also been analysed.

Analysis

Question 1

The various aspects of project analysis are as discussed below.

PART A

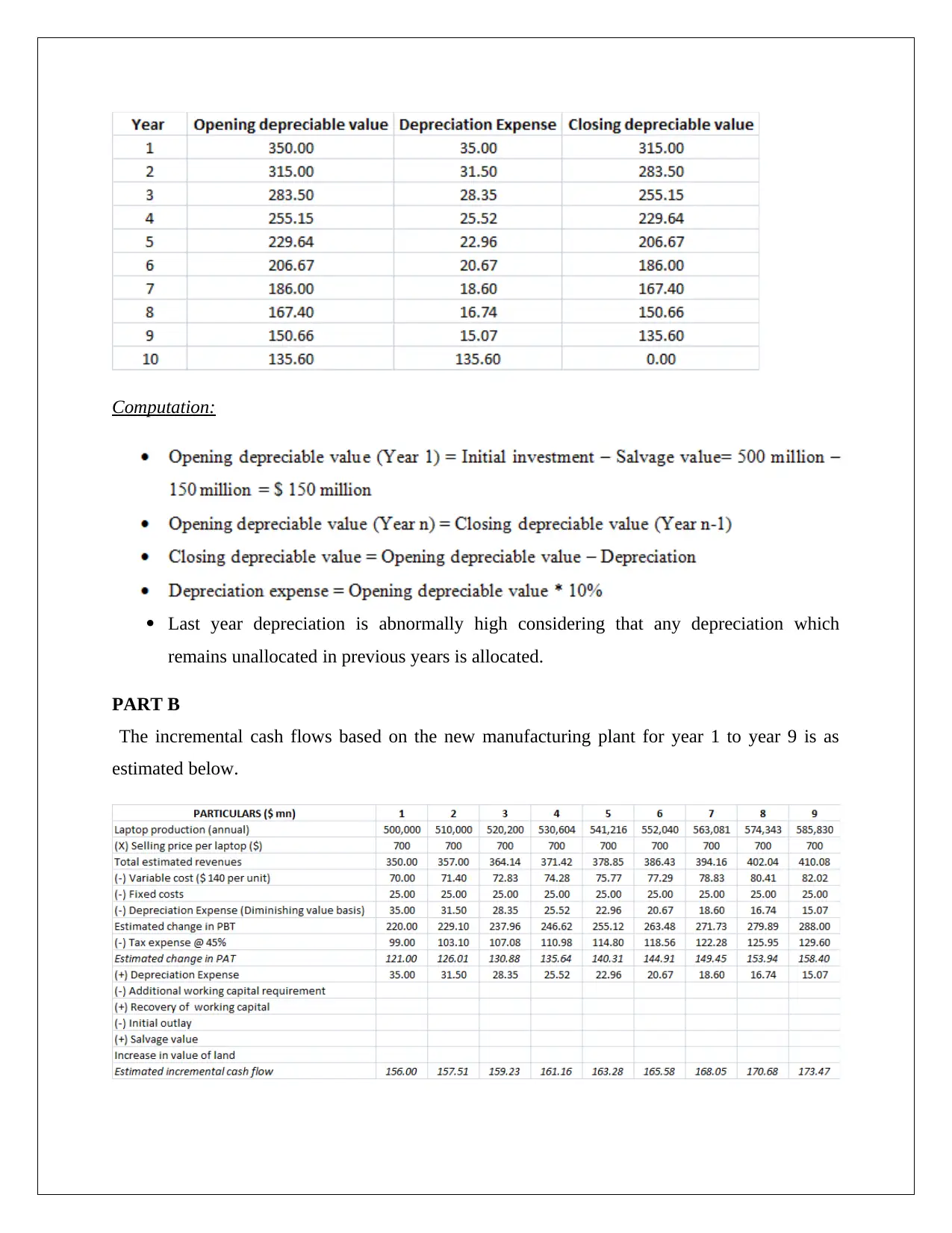

The project related annual depreciation schedule for the 10 year useful life is indicated as

follows.

The given report aims to capture the financial analysis with regards to the laptop production

plant that Dell intends to setup. Considering the input estimates for the project and the requisite

capital budgeting techniques, the feasibility of the project in financial terms is established. Also,

after the introduction of the new requirement regarding project cash inflows funding debt

repayments, it is expected that the project still remains feasible. But it is imperative that the

company should bring a change in the stringent requirement of debt servicing in each year and

also ensure that the cost of capital for each project is based on the relative risk profile.

Introduction

The given report aims to present the financial analysis of the laptop manufacturing facility to be

setup by Dell. Considering the relevant details about the facility and the expected future

cashflows, suitable capital budgeting techniques have been used for ascertaining the project

feasibility. Besides, an additional scenario for project feasibility has also been considered where

it is expected that repayment of debt on an annual basis would be funded by the project cash

inflows. Also, the company’s policy of using one particular cost of capital without regards to the

risk of the project has also been analysed.

Analysis

Question 1

The various aspects of project analysis are as discussed below.

PART A

The project related annual depreciation schedule for the 10 year useful life is indicated as

follows.

Computation:

Last year depreciation is abnormally high considering that any depreciation which

remains unallocated in previous years is allocated.

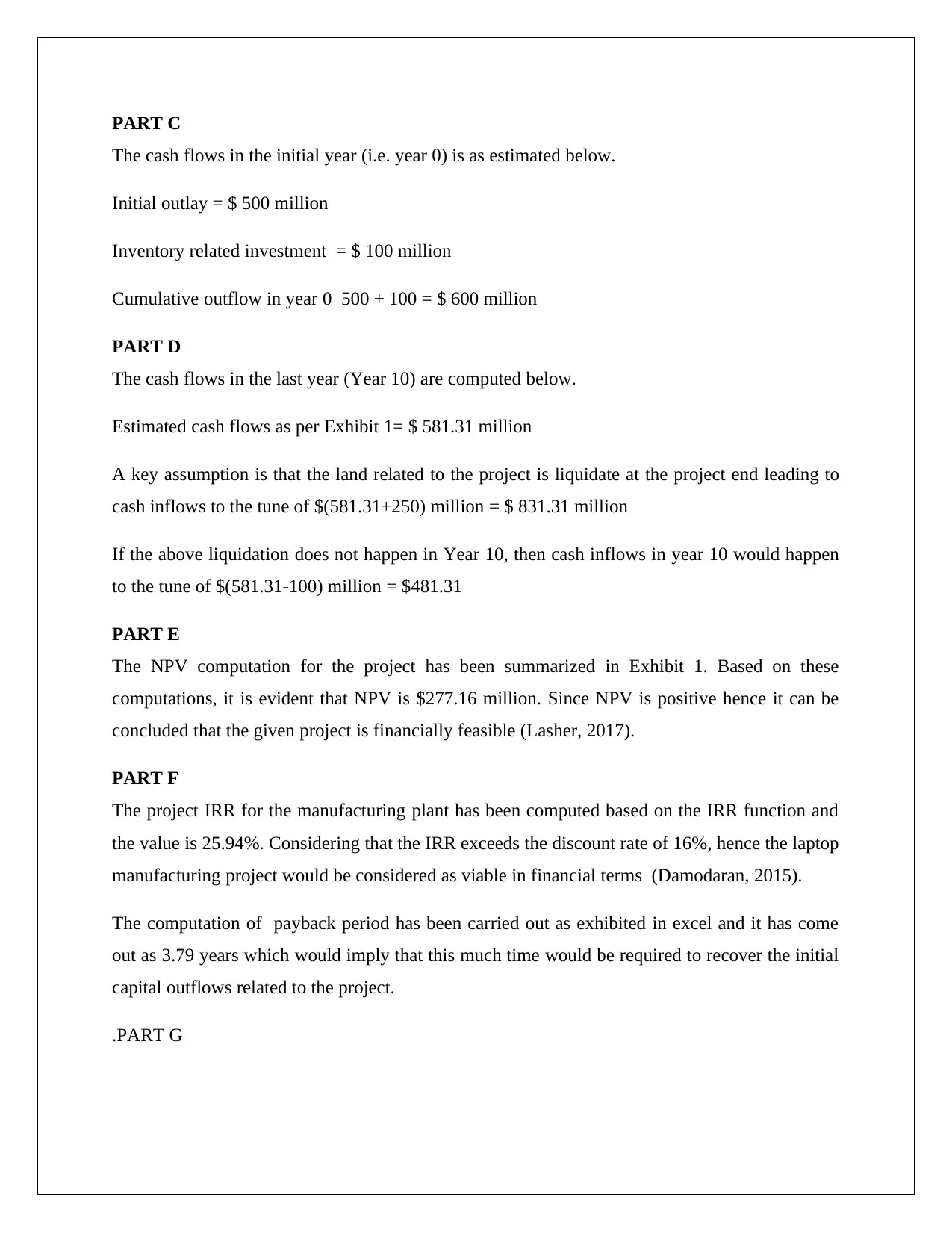

PART B

The incremental cash flows based on the new manufacturing plant for year 1 to year 9 is as

estimated below.

Last year depreciation is abnormally high considering that any depreciation which

remains unallocated in previous years is allocated.

PART B

The incremental cash flows based on the new manufacturing plant for year 1 to year 9 is as

estimated below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

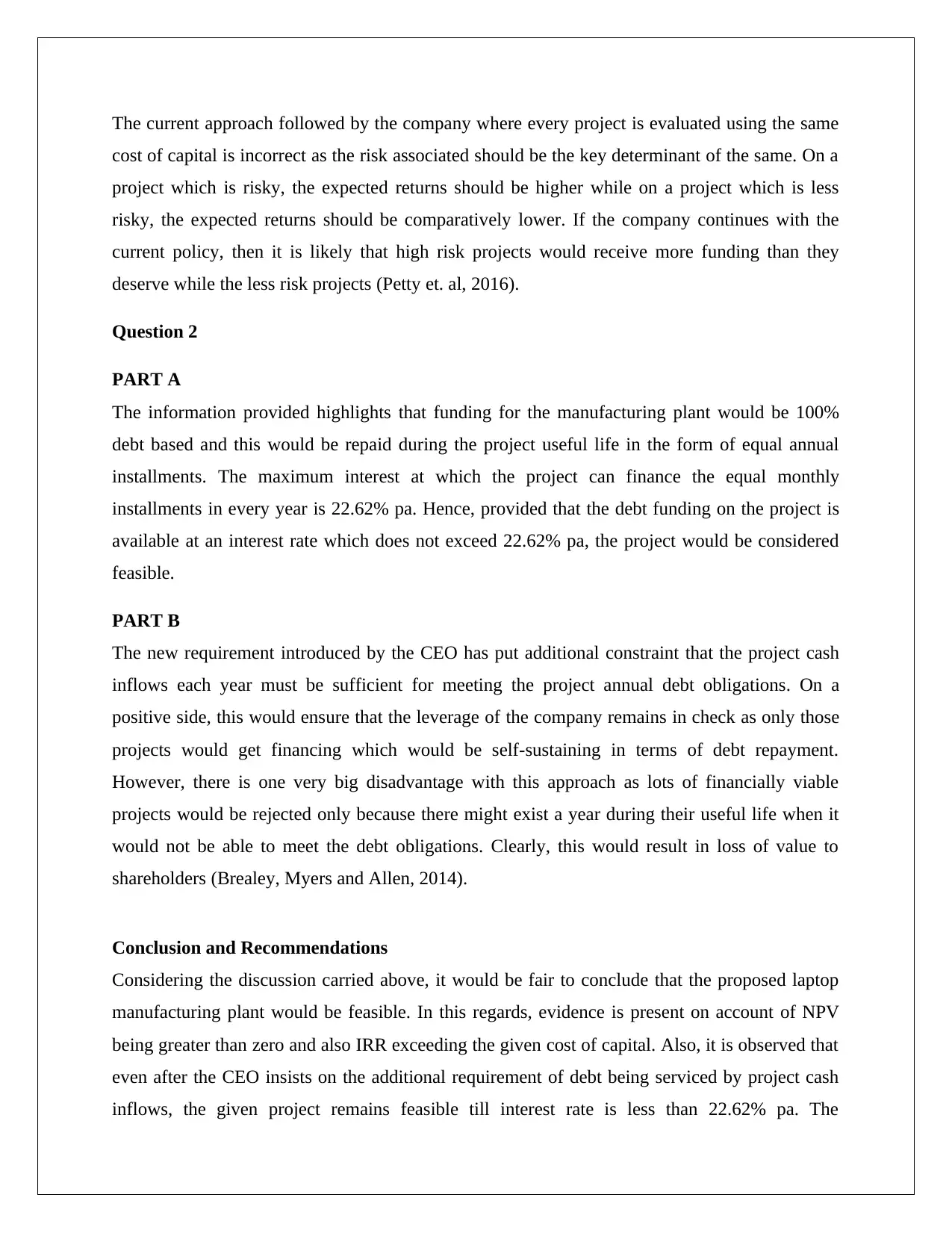

PART C

The cash flows in the initial year (i.e. year 0) is as estimated below.

Initial outlay = $ 500 million

Inventory related investment = $ 100 million

Cumulative outflow in year 0 500 + 100 = $ 600 million

PART D

The cash flows in the last year (Year 10) are computed below.

Estimated cash flows as per Exhibit 1= $ 581.31 million

A key assumption is that the land related to the project is liquidate at the project end leading to

cash inflows to the tune of $(581.31+250) million = $ 831.31 million

If the above liquidation does not happen in Year 10, then cash inflows in year 10 would happen

to the tune of $(581.31-100) million = $481.31

PART E

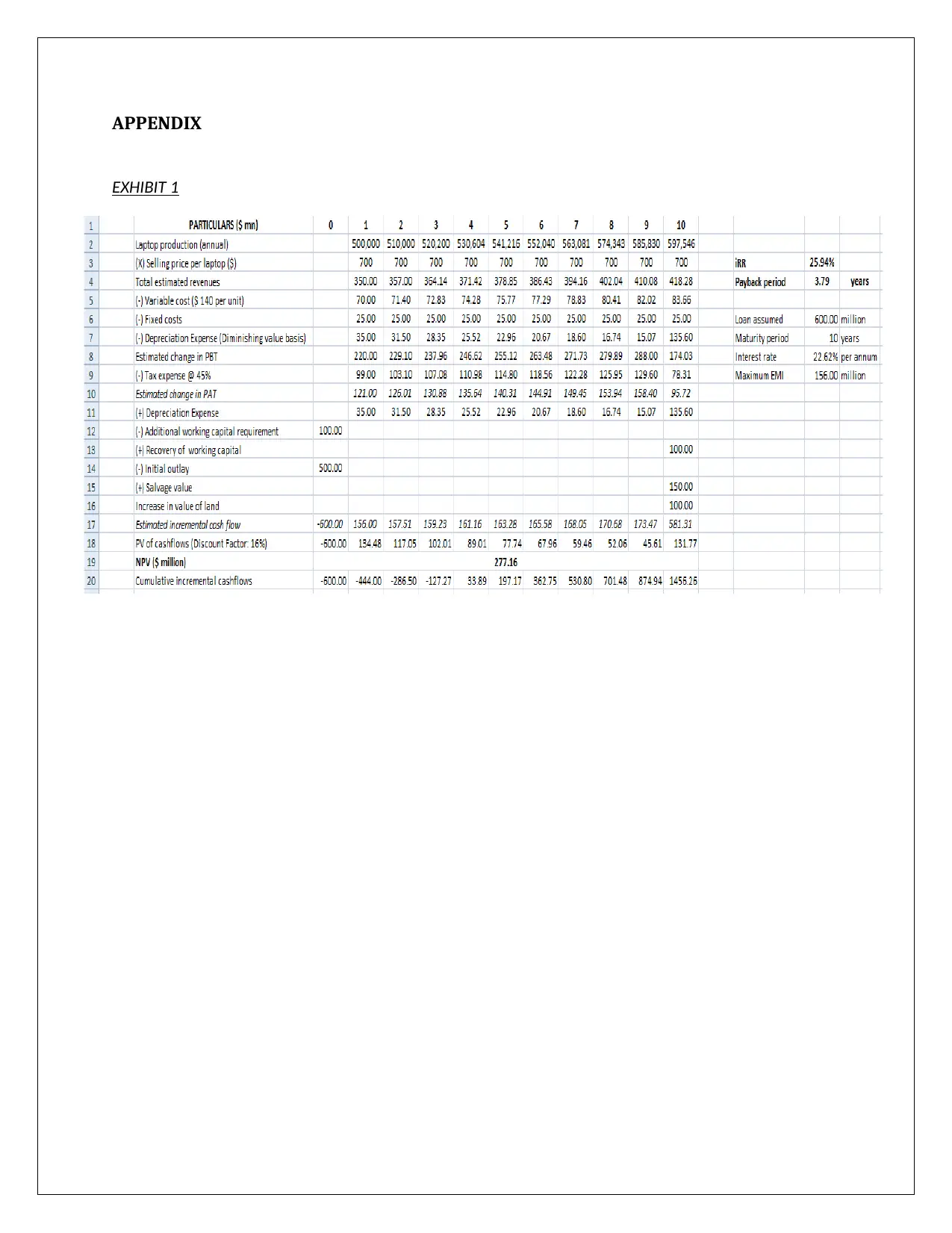

The NPV computation for the project has been summarized in Exhibit 1. Based on these

computations, it is evident that NPV is $277.16 million. Since NPV is positive hence it can be

concluded that the given project is financially feasible (Lasher, 2017).

PART F

The project IRR for the manufacturing plant has been computed based on the IRR function and

the value is 25.94%. Considering that the IRR exceeds the discount rate of 16%, hence the laptop

manufacturing project would be considered as viable in financial terms (Damodaran, 2015).

The computation of payback period has been carried out as exhibited in excel and it has come

out as 3.79 years which would imply that this much time would be required to recover the initial

capital outflows related to the project.

.PART G

The cash flows in the initial year (i.e. year 0) is as estimated below.

Initial outlay = $ 500 million

Inventory related investment = $ 100 million

Cumulative outflow in year 0 500 + 100 = $ 600 million

PART D

The cash flows in the last year (Year 10) are computed below.

Estimated cash flows as per Exhibit 1= $ 581.31 million

A key assumption is that the land related to the project is liquidate at the project end leading to

cash inflows to the tune of $(581.31+250) million = $ 831.31 million

If the above liquidation does not happen in Year 10, then cash inflows in year 10 would happen

to the tune of $(581.31-100) million = $481.31

PART E

The NPV computation for the project has been summarized in Exhibit 1. Based on these

computations, it is evident that NPV is $277.16 million. Since NPV is positive hence it can be

concluded that the given project is financially feasible (Lasher, 2017).

PART F

The project IRR for the manufacturing plant has been computed based on the IRR function and

the value is 25.94%. Considering that the IRR exceeds the discount rate of 16%, hence the laptop

manufacturing project would be considered as viable in financial terms (Damodaran, 2015).

The computation of payback period has been carried out as exhibited in excel and it has come

out as 3.79 years which would imply that this much time would be required to recover the initial

capital outflows related to the project.

.PART G

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The current approach followed by the company where every project is evaluated using the same

cost of capital is incorrect as the risk associated should be the key determinant of the same. On a

project which is risky, the expected returns should be higher while on a project which is less

risky, the expected returns should be comparatively lower. If the company continues with the

current policy, then it is likely that high risk projects would receive more funding than they

deserve while the less risk projects (Petty et. al, 2016).

Question 2

PART A

The information provided highlights that funding for the manufacturing plant would be 100%

debt based and this would be repaid during the project useful life in the form of equal annual

installments. The maximum interest at which the project can finance the equal monthly

installments in every year is 22.62% pa. Hence, provided that the debt funding on the project is

available at an interest rate which does not exceed 22.62% pa, the project would be considered

feasible.

PART B

The new requirement introduced by the CEO has put additional constraint that the project cash

inflows each year must be sufficient for meeting the project annual debt obligations. On a

positive side, this would ensure that the leverage of the company remains in check as only those

projects would get financing which would be self-sustaining in terms of debt repayment.

However, there is one very big disadvantage with this approach as lots of financially viable

projects would be rejected only because there might exist a year during their useful life when it

would not be able to meet the debt obligations. Clearly, this would result in loss of value to

shareholders (Brealey, Myers and Allen, 2014).

Conclusion and Recommendations

Considering the discussion carried above, it would be fair to conclude that the proposed laptop

manufacturing plant would be feasible. In this regards, evidence is present on account of NPV

being greater than zero and also IRR exceeding the given cost of capital. Also, it is observed that

even after the CEO insists on the additional requirement of debt being serviced by project cash

inflows, the given project remains feasible till interest rate is less than 22.62% pa. The

cost of capital is incorrect as the risk associated should be the key determinant of the same. On a

project which is risky, the expected returns should be higher while on a project which is less

risky, the expected returns should be comparatively lower. If the company continues with the

current policy, then it is likely that high risk projects would receive more funding than they

deserve while the less risk projects (Petty et. al, 2016).

Question 2

PART A

The information provided highlights that funding for the manufacturing plant would be 100%

debt based and this would be repaid during the project useful life in the form of equal annual

installments. The maximum interest at which the project can finance the equal monthly

installments in every year is 22.62% pa. Hence, provided that the debt funding on the project is

available at an interest rate which does not exceed 22.62% pa, the project would be considered

feasible.

PART B

The new requirement introduced by the CEO has put additional constraint that the project cash

inflows each year must be sufficient for meeting the project annual debt obligations. On a

positive side, this would ensure that the leverage of the company remains in check as only those

projects would get financing which would be self-sustaining in terms of debt repayment.

However, there is one very big disadvantage with this approach as lots of financially viable

projects would be rejected only because there might exist a year during their useful life when it

would not be able to meet the debt obligations. Clearly, this would result in loss of value to

shareholders (Brealey, Myers and Allen, 2014).

Conclusion and Recommendations

Considering the discussion carried above, it would be fair to conclude that the proposed laptop

manufacturing plant would be feasible. In this regards, evidence is present on account of NPV

being greater than zero and also IRR exceeding the given cost of capital. Also, it is observed that

even after the CEO insists on the additional requirement of debt being serviced by project cash

inflows, the given project remains feasible till interest rate is less than 22.62% pa. The

company’s practice of using a uniform WACC also is not correct and this should be adjusted fro

risk. Additionally, the nee requirement put in place by the CEO seems quite stringent and must

be relaxed so that projects which are not able to meet the debt obligations for a year or two may

also be considered so as shareholder wealth is maximized.

risk. Additionally, the nee requirement put in place by the CEO seems quite stringent and must

be relaxed so that projects which are not able to meet the debt obligations for a year or two may

also be considered so as shareholder wealth is maximized.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Brealey, R.A., Myers, S.C. and Allen, F. (2014) Principles of corporate finance. 2nd ed. New

York: McGraw-Hill Inc, pp. 198

Damodaran, A. (2015) Applied corporate finance: A user’s manual. 3rd ed. New York: Wiley,

John & Sons, pp. 167

Lasher, W. R., (2017) Practical Financial Management. 5th ed. London: South- Western

College Publisher, pp. 145

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia, pp. 231

Brealey, R.A., Myers, S.C. and Allen, F. (2014) Principles of corporate finance. 2nd ed. New

York: McGraw-Hill Inc, pp. 198

Damodaran, A. (2015) Applied corporate finance: A user’s manual. 3rd ed. New York: Wiley,

John & Sons, pp. 167

Lasher, W. R., (2017) Practical Financial Management. 5th ed. London: South- Western

College Publisher, pp. 145

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia, pp. 231

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDIX

EXHIBIT 1

EXHIBIT 1

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.