Managerial Finance Report: Financial Ratio Analysis and Appraisal

VerifiedAdded on 2022/12/30

|17

|3768

|67

Report

AI Summary

This report delves into managerial finance, evaluating the financial performance of companies using ratio analysis and investment appraisal techniques. The first part of the report focuses on comparing Tesco and Sainsbury's, calculating and interpreting various financial ratios such as current ratio, quick ratio, net profit margin, gross profit margin, gearing ratio, price/earning ratio, earning per share, return on capital employed, average inventories turnover, and dividend payout ratio to assess their financial health and investment potential. The report also offers recommendations for improving the performance of a poorly performing business and discusses the limitations of financial ratios. The second part of the report applies capital investment appraisal techniques, specifically the payback period method, to evaluate two mutually exclusive projects (A and B), aiding in capital budgeting decisions. The report also discusses the limitations of investment appraisal techniques for long-term decision-making.

Managerial Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...............................................................................................................................3

MAIN BODY......................................................................................................................................3

PORTFOLIO 1....................................................................................................................................3

Calculation of ratios........................................................................................................................3

Analysis of performance and financial position.............................................................................7

Recommendation on how poorly performing business can be improved.....................................8

Limitations of financial ratios in interpreting a company's performance.......................................8

PORTFOLIO 2....................................................................................................................................9

Capital Investment Appraisal.........................................................................................................9

Limitation of investment appraisal technique for long run decision making...............................13

CONCLUSION.................................................................................................................................14

REFERENCES..................................................................................................................................15

INTRODUCTION...............................................................................................................................3

MAIN BODY......................................................................................................................................3

PORTFOLIO 1....................................................................................................................................3

Calculation of ratios........................................................................................................................3

Analysis of performance and financial position.............................................................................7

Recommendation on how poorly performing business can be improved.....................................8

Limitations of financial ratios in interpreting a company's performance.......................................8

PORTFOLIO 2....................................................................................................................................9

Capital Investment Appraisal.........................................................................................................9

Limitation of investment appraisal technique for long run decision making...............................13

CONCLUSION.................................................................................................................................14

REFERENCES..................................................................................................................................15

INTRODUCTION

Managerial finance refers to the conduction of financial activities in the course of managing

a company. The managers always strives hard for maximising profits and minimising costs. They

are required to take many financial decision like investment in assets and acquiring finance for

running a business. This report is about how managers and even investors try to evaluate financial

performance of the company. So that the managers can take future decision on where to invest, or

which opportunity is better in terms of profitability (Arkan, 2016 ). Investors can also evaluate the

company's performance to decide upon where to invest and how much to be invested. The report is

based on how financial supervisor will decide, on the basis of various ratios calculated. This will

help them in selecting between Tesco and Sainsbury's for investment purpose. The second part of

the report is about how finance manager evaluate two projects, that is A and B, with the help of

their future cash flows. For this different capital budgeting technique has been used.

MAIN BODY

PORTFOLIO 1

Calculation of ratios

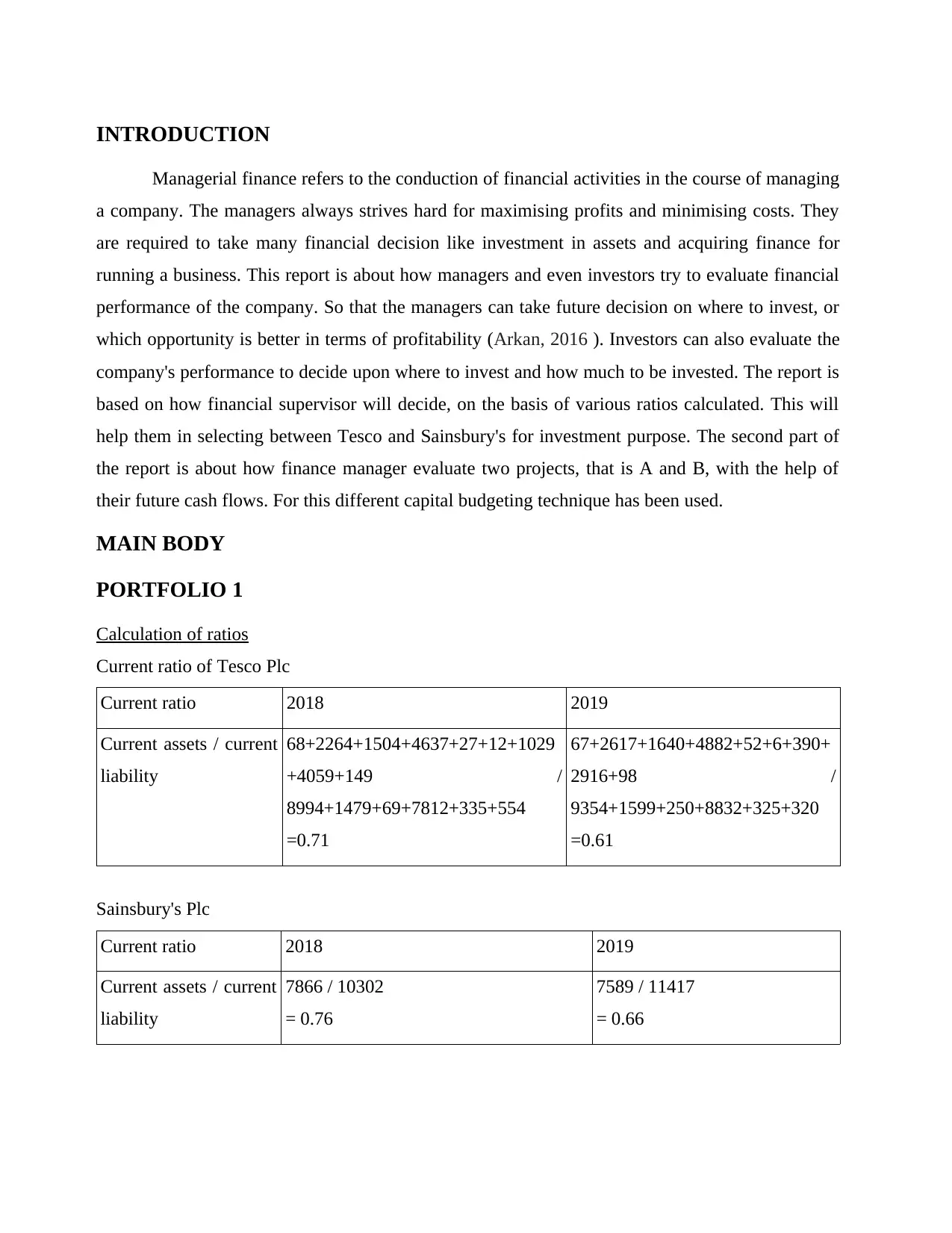

Current ratio of Tesco Plc

Current ratio 2018 2019

Current assets / current

liability

68+2264+1504+4637+27+12+1029

+4059+149 /

8994+1479+69+7812+335+554

=0.71

67+2617+1640+4882+52+6+390+

2916+98 /

9354+1599+250+8832+325+320

=0.61

Sainsbury's Plc

Current ratio 2018 2019

Current assets / current

liability

7866 / 10302

= 0.76

7589 / 11417

= 0.66

Managerial finance refers to the conduction of financial activities in the course of managing

a company. The managers always strives hard for maximising profits and minimising costs. They

are required to take many financial decision like investment in assets and acquiring finance for

running a business. This report is about how managers and even investors try to evaluate financial

performance of the company. So that the managers can take future decision on where to invest, or

which opportunity is better in terms of profitability (Arkan, 2016 ). Investors can also evaluate the

company's performance to decide upon where to invest and how much to be invested. The report is

based on how financial supervisor will decide, on the basis of various ratios calculated. This will

help them in selecting between Tesco and Sainsbury's for investment purpose. The second part of

the report is about how finance manager evaluate two projects, that is A and B, with the help of

their future cash flows. For this different capital budgeting technique has been used.

MAIN BODY

PORTFOLIO 1

Calculation of ratios

Current ratio of Tesco Plc

Current ratio 2018 2019

Current assets / current

liability

68+2264+1504+4637+27+12+1029

+4059+149 /

8994+1479+69+7812+335+554

=0.71

67+2617+1640+4882+52+6+390+

2916+98 /

9354+1599+250+8832+325+320

=0.61

Sainsbury's Plc

Current ratio 2018 2019

Current assets / current

liability

7866 / 10302

= 0.76

7589 / 11417

= 0.66

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

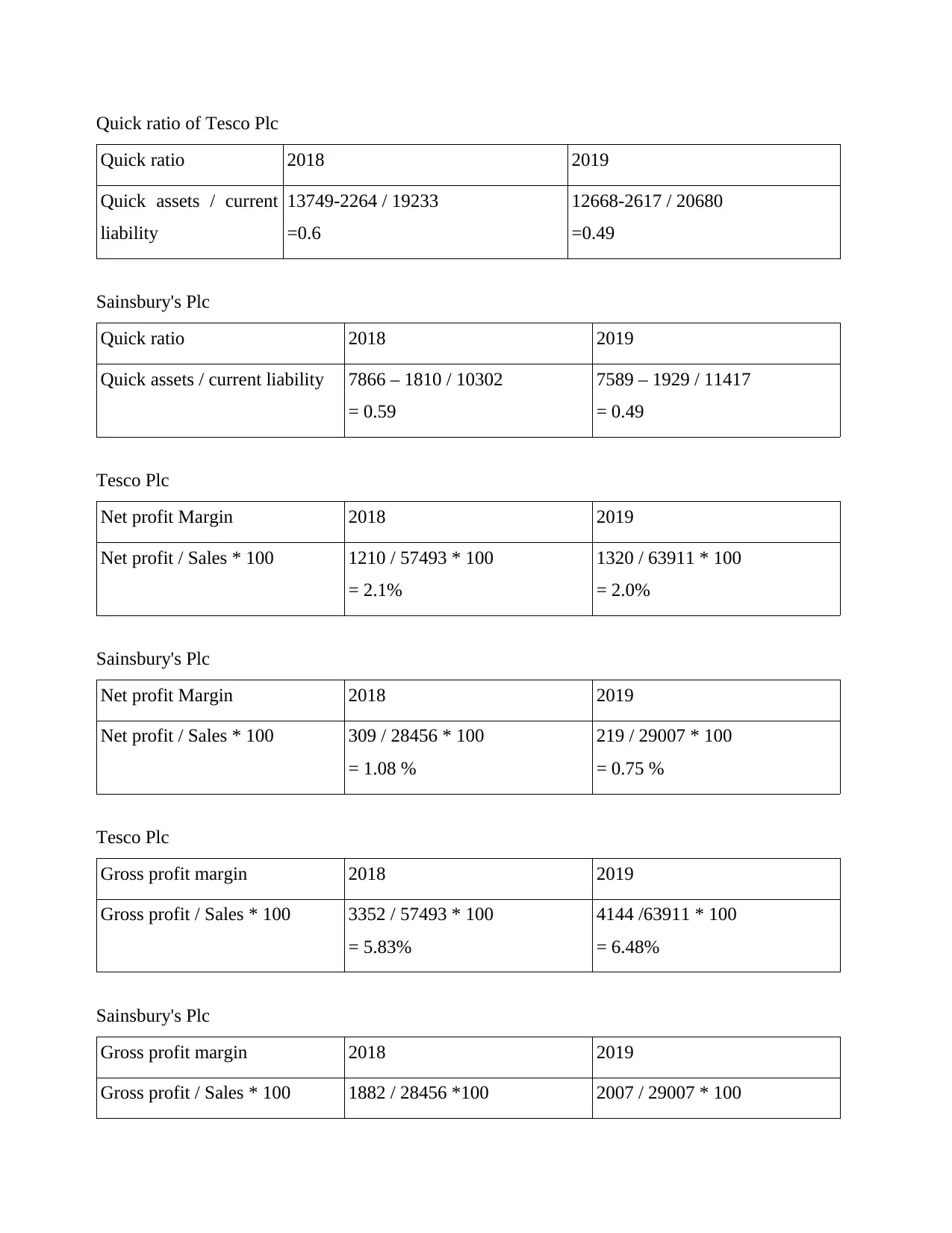

Quick ratio of Tesco Plc

Quick ratio 2018 2019

Quick assets / current

liability

13749-2264 / 19233

=0.6

12668-2617 / 20680

=0.49

Sainsbury's Plc

Quick ratio 2018 2019

Quick assets / current liability 7866 – 1810 / 10302

= 0.59

7589 – 1929 / 11417

= 0.49

Tesco Plc

Net profit Margin 2018 2019

Net profit / Sales * 100 1210 / 57493 * 100

= 2.1%

1320 / 63911 * 100

= 2.0%

Sainsbury's Plc

Net profit Margin 2018 2019

Net profit / Sales * 100 309 / 28456 * 100

= 1.08 %

219 / 29007 * 100

= 0.75 %

Tesco Plc

Gross profit margin 2018 2019

Gross profit / Sales * 100 3352 / 57493 * 100

= 5.83%

4144 /63911 * 100

= 6.48%

Sainsbury's Plc

Gross profit margin 2018 2019

Gross profit / Sales * 100 1882 / 28456 *100 2007 / 29007 * 100

Quick ratio 2018 2019

Quick assets / current

liability

13749-2264 / 19233

=0.6

12668-2617 / 20680

=0.49

Sainsbury's Plc

Quick ratio 2018 2019

Quick assets / current liability 7866 – 1810 / 10302

= 0.59

7589 – 1929 / 11417

= 0.49

Tesco Plc

Net profit Margin 2018 2019

Net profit / Sales * 100 1210 / 57493 * 100

= 2.1%

1320 / 63911 * 100

= 2.0%

Sainsbury's Plc

Net profit Margin 2018 2019

Net profit / Sales * 100 309 / 28456 * 100

= 1.08 %

219 / 29007 * 100

= 0.75 %

Tesco Plc

Gross profit margin 2018 2019

Gross profit / Sales * 100 3352 / 57493 * 100

= 5.83%

4144 /63911 * 100

= 6.48%

Sainsbury's Plc

Gross profit margin 2018 2019

Gross profit / Sales * 100 1882 / 28456 *100 2007 / 29007 * 100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= 6.61 % = 6.92 %

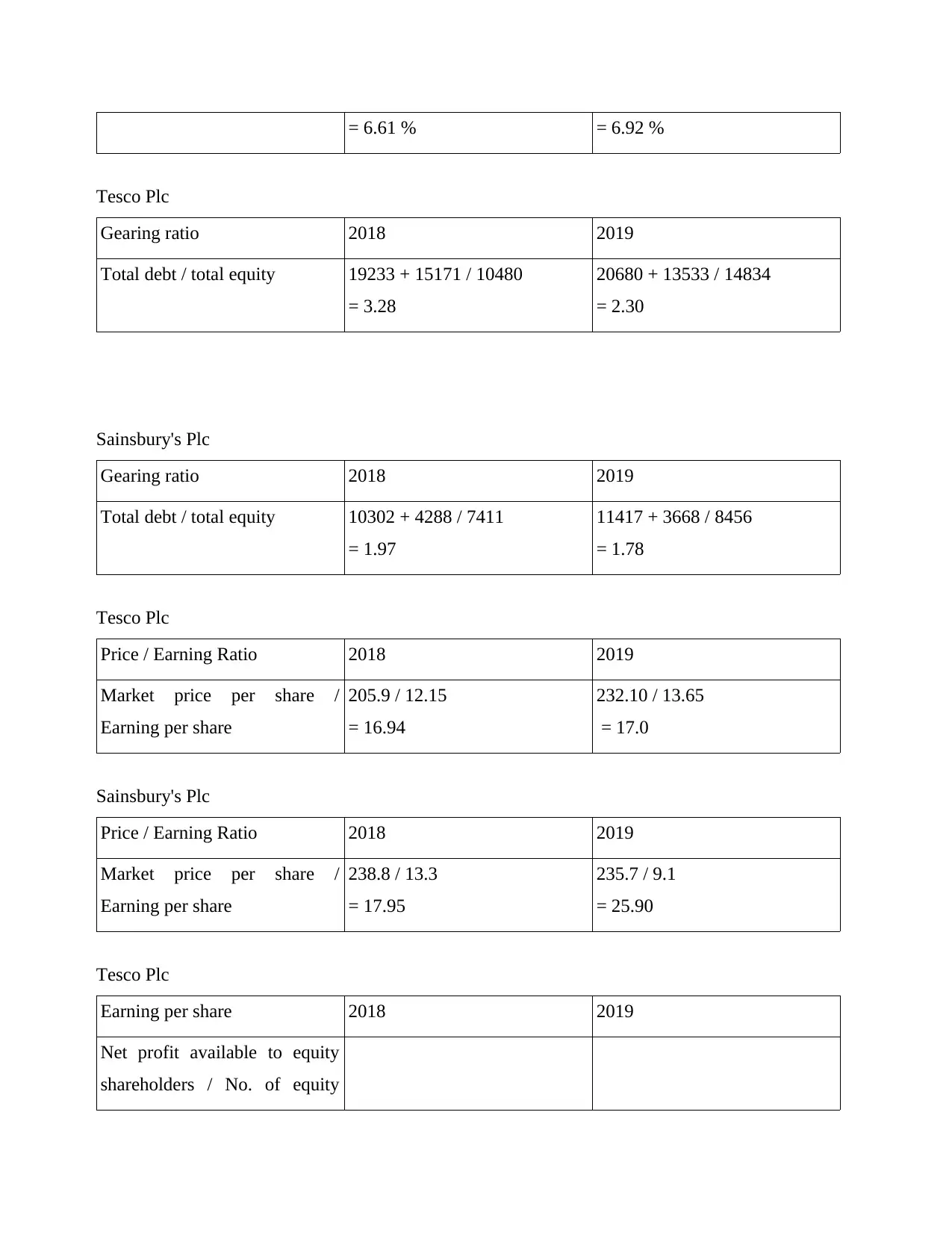

Tesco Plc

Gearing ratio 2018 2019

Total debt / total equity 19233 + 15171 / 10480

= 3.28

20680 + 13533 / 14834

= 2.30

Sainsbury's Plc

Gearing ratio 2018 2019

Total debt / total equity 10302 + 4288 / 7411

= 1.97

11417 + 3668 / 8456

= 1.78

Tesco Plc

Price / Earning Ratio 2018 2019

Market price per share /

Earning per share

205.9 / 12.15

= 16.94

232.10 / 13.65

= 17.0

Sainsbury's Plc

Price / Earning Ratio 2018 2019

Market price per share /

Earning per share

238.8 / 13.3

= 17.95

235.7 / 9.1

= 25.90

Tesco Plc

Earning per share 2018 2019

Net profit available to equity

shareholders / No. of equity

Tesco Plc

Gearing ratio 2018 2019

Total debt / total equity 19233 + 15171 / 10480

= 3.28

20680 + 13533 / 14834

= 2.30

Sainsbury's Plc

Gearing ratio 2018 2019

Total debt / total equity 10302 + 4288 / 7411

= 1.97

11417 + 3668 / 8456

= 1.78

Tesco Plc

Price / Earning Ratio 2018 2019

Market price per share /

Earning per share

205.9 / 12.15

= 16.94

232.10 / 13.65

= 17.0

Sainsbury's Plc

Price / Earning Ratio 2018 2019

Market price per share /

Earning per share

238.8 / 13.3

= 17.95

235.7 / 9.1

= 25.90

Tesco Plc

Earning per share 2018 2019

Net profit available to equity

shareholders / No. of equity

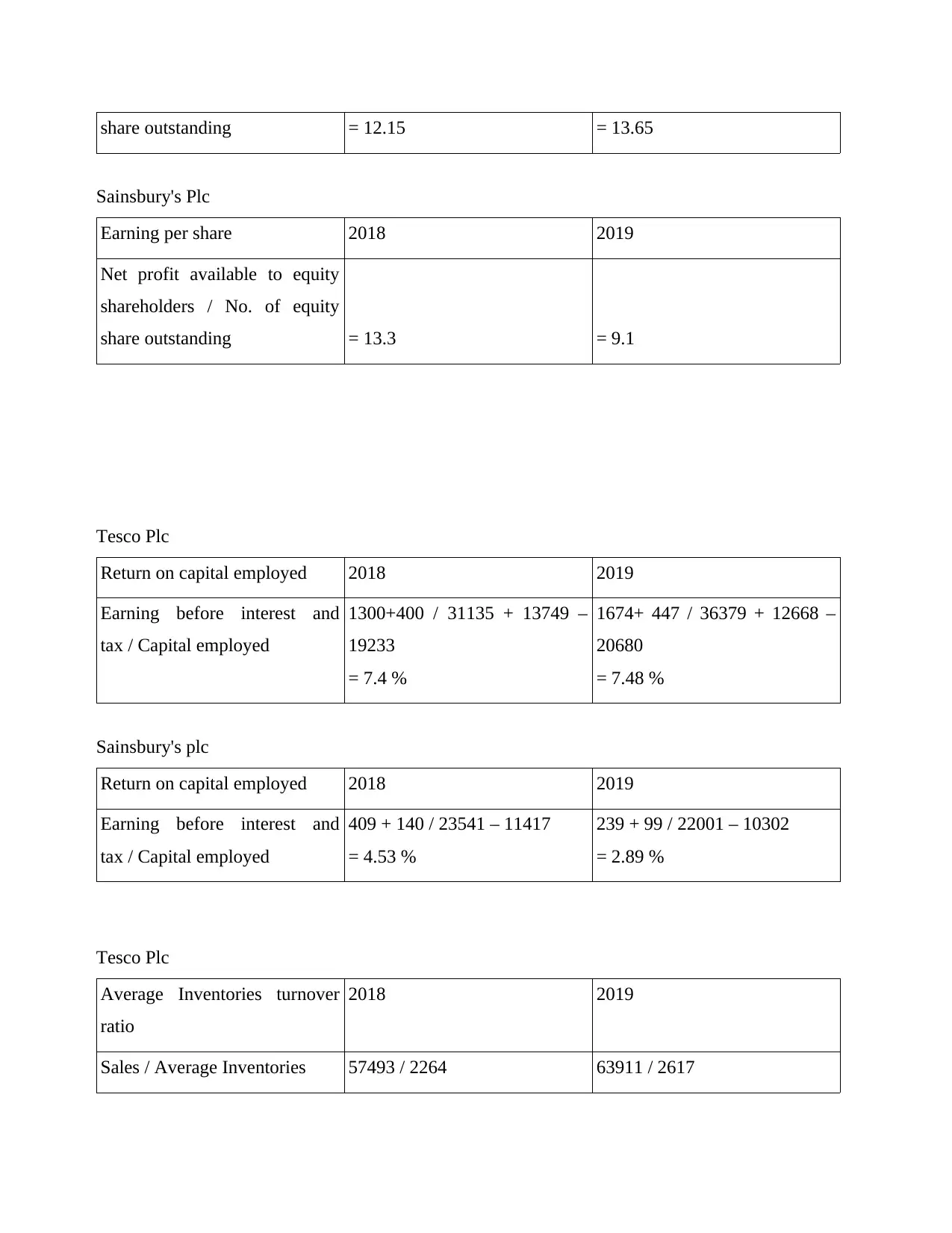

share outstanding = 12.15 = 13.65

Sainsbury's Plc

Earning per share 2018 2019

Net profit available to equity

shareholders / No. of equity

share outstanding = 13.3 = 9.1

Tesco Plc

Return on capital employed 2018 2019

Earning before interest and

tax / Capital employed

1300+400 / 31135 + 13749 –

19233

= 7.4 %

1674+ 447 / 36379 + 12668 –

20680

= 7.48 %

Sainsbury's plc

Return on capital employed 2018 2019

Earning before interest and

tax / Capital employed

409 + 140 / 23541 – 11417

= 4.53 %

239 + 99 / 22001 – 10302

= 2.89 %

Tesco Plc

Average Inventories turnover

ratio

2018 2019

Sales / Average Inventories 57493 / 2264 63911 / 2617

Sainsbury's Plc

Earning per share 2018 2019

Net profit available to equity

shareholders / No. of equity

share outstanding = 13.3 = 9.1

Tesco Plc

Return on capital employed 2018 2019

Earning before interest and

tax / Capital employed

1300+400 / 31135 + 13749 –

19233

= 7.4 %

1674+ 447 / 36379 + 12668 –

20680

= 7.48 %

Sainsbury's plc

Return on capital employed 2018 2019

Earning before interest and

tax / Capital employed

409 + 140 / 23541 – 11417

= 4.53 %

239 + 99 / 22001 – 10302

= 2.89 %

Tesco Plc

Average Inventories turnover

ratio

2018 2019

Sales / Average Inventories 57493 / 2264 63911 / 2617

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

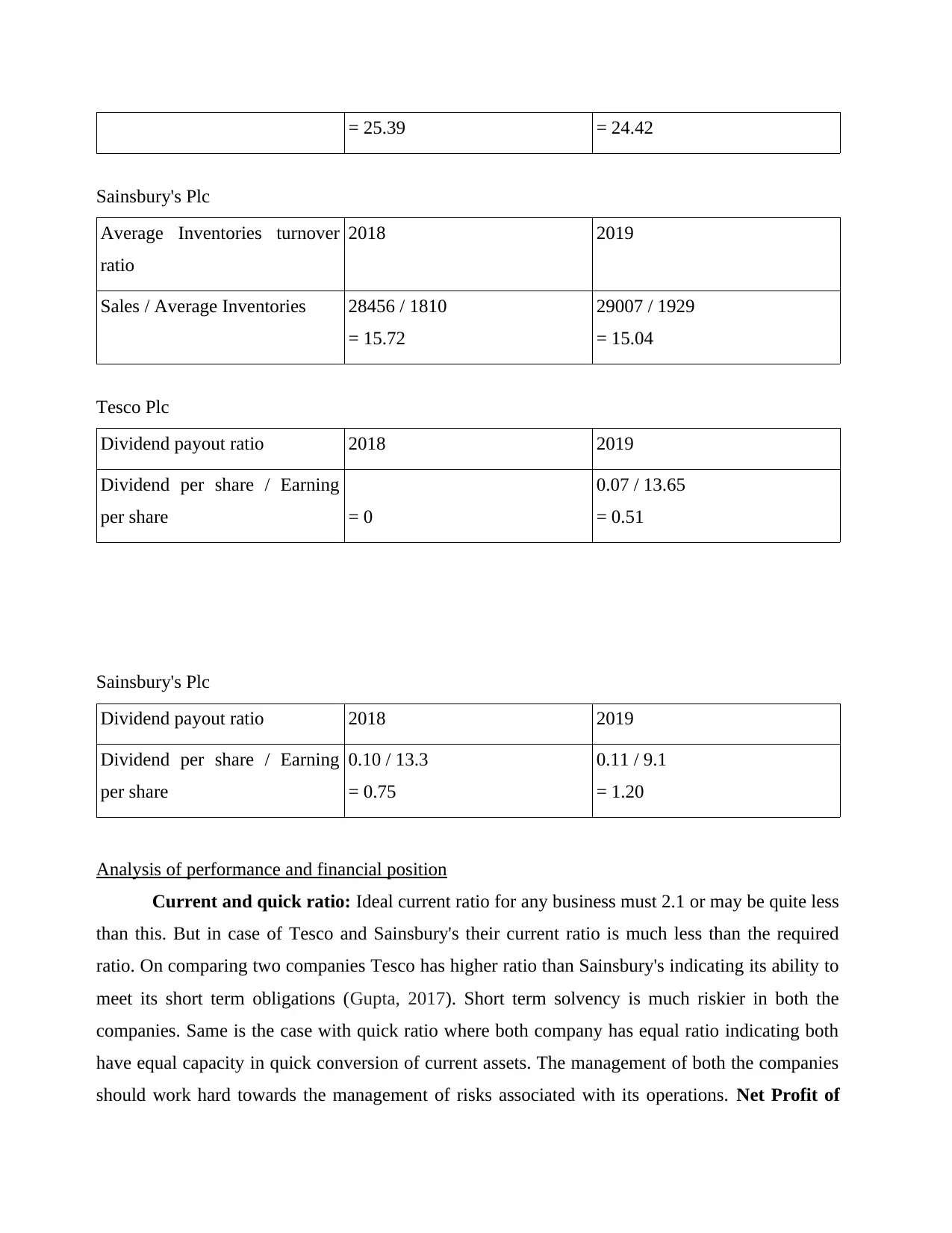

= 25.39 = 24.42

Sainsbury's Plc

Average Inventories turnover

ratio

2018 2019

Sales / Average Inventories 28456 / 1810

= 15.72

29007 / 1929

= 15.04

Tesco Plc

Dividend payout ratio 2018 2019

Dividend per share / Earning

per share = 0

0.07 / 13.65

= 0.51

Sainsbury's Plc

Dividend payout ratio 2018 2019

Dividend per share / Earning

per share

0.10 / 13.3

= 0.75

0.11 / 9.1

= 1.20

Analysis of performance and financial position

Current and quick ratio: Ideal current ratio for any business must 2.1 or may be quite less

than this. But in case of Tesco and Sainsbury's their current ratio is much less than the required

ratio. On comparing two companies Tesco has higher ratio than Sainsbury's indicating its ability to

meet its short term obligations (Gupta, 2017). Short term solvency is much riskier in both the

companies. Same is the case with quick ratio where both company has equal ratio indicating both

have equal capacity in quick conversion of current assets. The management of both the companies

should work hard towards the management of risks associated with its operations. Net Profit of

Sainsbury's Plc

Average Inventories turnover

ratio

2018 2019

Sales / Average Inventories 28456 / 1810

= 15.72

29007 / 1929

= 15.04

Tesco Plc

Dividend payout ratio 2018 2019

Dividend per share / Earning

per share = 0

0.07 / 13.65

= 0.51

Sainsbury's Plc

Dividend payout ratio 2018 2019

Dividend per share / Earning

per share

0.10 / 13.3

= 0.75

0.11 / 9.1

= 1.20

Analysis of performance and financial position

Current and quick ratio: Ideal current ratio for any business must 2.1 or may be quite less

than this. But in case of Tesco and Sainsbury's their current ratio is much less than the required

ratio. On comparing two companies Tesco has higher ratio than Sainsbury's indicating its ability to

meet its short term obligations (Gupta, 2017). Short term solvency is much riskier in both the

companies. Same is the case with quick ratio where both company has equal ratio indicating both

have equal capacity in quick conversion of current assets. The management of both the companies

should work hard towards the management of risks associated with its operations. Net Profit of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

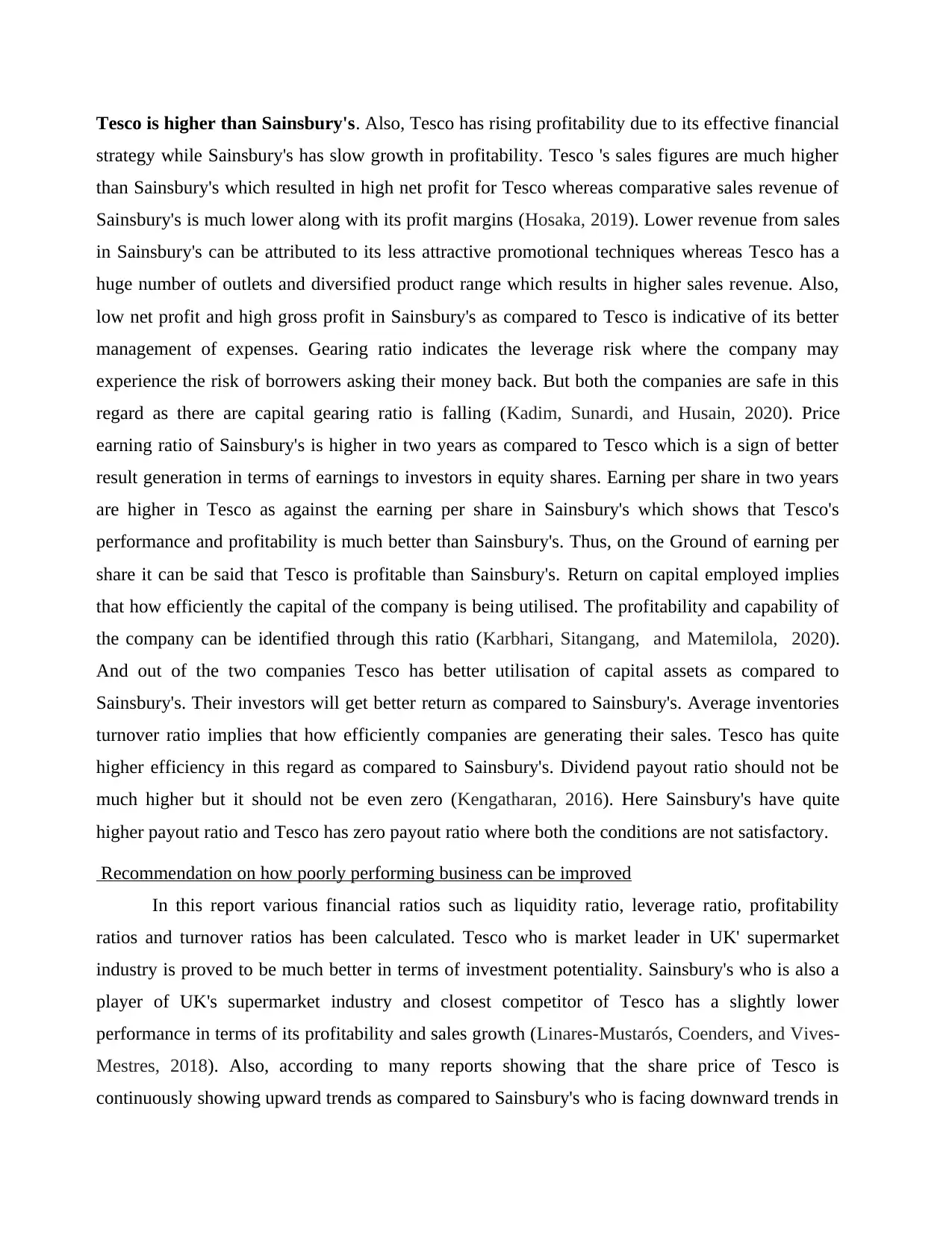

Tesco is higher than Sainsbury's. Also, Tesco has rising profitability due to its effective financial

strategy while Sainsbury's has slow growth in profitability. Tesco 's sales figures are much higher

than Sainsbury's which resulted in high net profit for Tesco whereas comparative sales revenue of

Sainsbury's is much lower along with its profit margins (Hosaka, 2019). Lower revenue from sales

in Sainsbury's can be attributed to its less attractive promotional techniques whereas Tesco has a

huge number of outlets and diversified product range which results in higher sales revenue. Also,

low net profit and high gross profit in Sainsbury's as compared to Tesco is indicative of its better

management of expenses. Gearing ratio indicates the leverage risk where the company may

experience the risk of borrowers asking their money back. But both the companies are safe in this

regard as there are capital gearing ratio is falling (Kadim, Sunardi, and Husain, 2020). Price

earning ratio of Sainsbury's is higher in two years as compared to Tesco which is a sign of better

result generation in terms of earnings to investors in equity shares. Earning per share in two years

are higher in Tesco as against the earning per share in Sainsbury's which shows that Tesco's

performance and profitability is much better than Sainsbury's. Thus, on the Ground of earning per

share it can be said that Tesco is profitable than Sainsbury's. Return on capital employed implies

that how efficiently the capital of the company is being utilised. The profitability and capability of

the company can be identified through this ratio (Karbhari, Sitangang, and Matemilola, 2020).

And out of the two companies Tesco has better utilisation of capital assets as compared to

Sainsbury's. Their investors will get better return as compared to Sainsbury's. Average inventories

turnover ratio implies that how efficiently companies are generating their sales. Tesco has quite

higher efficiency in this regard as compared to Sainsbury's. Dividend payout ratio should not be

much higher but it should not be even zero (Kengatharan, 2016). Here Sainsbury's have quite

higher payout ratio and Tesco has zero payout ratio where both the conditions are not satisfactory.

Recommendation on how poorly performing business can be improved

In this report various financial ratios such as liquidity ratio, leverage ratio, profitability

ratios and turnover ratios has been calculated. Tesco who is market leader in UK' supermarket

industry is proved to be much better in terms of investment potentiality. Sainsbury's who is also a

player of UK's supermarket industry and closest competitor of Tesco has a slightly lower

performance in terms of its profitability and sales growth (Linares-Mustarós, Coenders, and Vives-

Mestres, 2018). Also, according to many reports showing that the share price of Tesco is

continuously showing upward trends as compared to Sainsbury's who is facing downward trends in

strategy while Sainsbury's has slow growth in profitability. Tesco 's sales figures are much higher

than Sainsbury's which resulted in high net profit for Tesco whereas comparative sales revenue of

Sainsbury's is much lower along with its profit margins (Hosaka, 2019). Lower revenue from sales

in Sainsbury's can be attributed to its less attractive promotional techniques whereas Tesco has a

huge number of outlets and diversified product range which results in higher sales revenue. Also,

low net profit and high gross profit in Sainsbury's as compared to Tesco is indicative of its better

management of expenses. Gearing ratio indicates the leverage risk where the company may

experience the risk of borrowers asking their money back. But both the companies are safe in this

regard as there are capital gearing ratio is falling (Kadim, Sunardi, and Husain, 2020). Price

earning ratio of Sainsbury's is higher in two years as compared to Tesco which is a sign of better

result generation in terms of earnings to investors in equity shares. Earning per share in two years

are higher in Tesco as against the earning per share in Sainsbury's which shows that Tesco's

performance and profitability is much better than Sainsbury's. Thus, on the Ground of earning per

share it can be said that Tesco is profitable than Sainsbury's. Return on capital employed implies

that how efficiently the capital of the company is being utilised. The profitability and capability of

the company can be identified through this ratio (Karbhari, Sitangang, and Matemilola, 2020).

And out of the two companies Tesco has better utilisation of capital assets as compared to

Sainsbury's. Their investors will get better return as compared to Sainsbury's. Average inventories

turnover ratio implies that how efficiently companies are generating their sales. Tesco has quite

higher efficiency in this regard as compared to Sainsbury's. Dividend payout ratio should not be

much higher but it should not be even zero (Kengatharan, 2016). Here Sainsbury's have quite

higher payout ratio and Tesco has zero payout ratio where both the conditions are not satisfactory.

Recommendation on how poorly performing business can be improved

In this report various financial ratios such as liquidity ratio, leverage ratio, profitability

ratios and turnover ratios has been calculated. Tesco who is market leader in UK' supermarket

industry is proved to be much better in terms of investment potentiality. Sainsbury's who is also a

player of UK's supermarket industry and closest competitor of Tesco has a slightly lower

performance in terms of its profitability and sales growth (Linares-Mustarós, Coenders, and Vives-

Mestres, 2018). Also, according to many reports showing that the share price of Tesco is

continuously showing upward trends as compared to Sainsbury's who is facing downward trends in

its share price continuously. Both Tesco and Sainsbury's can work on their current ratio where

management of both the companies should increase its current assets or decrease its current

liability. Both have closely related margins in both gross and net profits. This can be improved

through managing expenses and improving sales through promotional techniques. For this they can

also reframe their pricing strategy through which they can also improve both sales and profitability.

Also, tracking and improving cash flows are helpful in improving the financial performance of the

business.

Limitations of financial ratios in interpreting a company's performance

Ratio analysis is a tool for analysing and interpreting any company's performance based on

the information disclosed by them. But as every coin has two aspects, there are many limitations

suffered by these ratios which make them quite ineffective. Certain limitations pertaining to

financial ratios are as follows:

The ratios so calculated are based on past or historic information. This make them quite

unsuitable for future representative of company's performance (Nemlioglu, and Mallick,

2017).

Financial statements related to different time period has been taken for calculating ratios.

But it has ignored the factor such as inflation and remain unadjusted because no adjustment

has been done at the time of calculating these ratios regarding inflation occur.

Interpretation of company's performance through financial ratios is a complete ignorance of

qualitative aspects (Rombolotti Axelrod, 2017). This is because the management, its

expertise, unique products and technology of the company, quality of human resource are

not at all considered in financial ratios.

Many times there are changes occurred in policies and procedures of accounting practices.

This change may affect or result in changes in the financial results as against the results

from prior practices (Sarwary, 2020). Due to this limitation, ratios may become useless

sometimes.

Manipulations on the part of management with regards to financial information in reporting

the same to the public to indicate better than what has actually occurred. Such

manipulations can't be identified through simple examination. The financial analyst must be

management of both the companies should increase its current assets or decrease its current

liability. Both have closely related margins in both gross and net profits. This can be improved

through managing expenses and improving sales through promotional techniques. For this they can

also reframe their pricing strategy through which they can also improve both sales and profitability.

Also, tracking and improving cash flows are helpful in improving the financial performance of the

business.

Limitations of financial ratios in interpreting a company's performance

Ratio analysis is a tool for analysing and interpreting any company's performance based on

the information disclosed by them. But as every coin has two aspects, there are many limitations

suffered by these ratios which make them quite ineffective. Certain limitations pertaining to

financial ratios are as follows:

The ratios so calculated are based on past or historic information. This make them quite

unsuitable for future representative of company's performance (Nemlioglu, and Mallick,

2017).

Financial statements related to different time period has been taken for calculating ratios.

But it has ignored the factor such as inflation and remain unadjusted because no adjustment

has been done at the time of calculating these ratios regarding inflation occur.

Interpretation of company's performance through financial ratios is a complete ignorance of

qualitative aspects (Rombolotti Axelrod, 2017). This is because the management, its

expertise, unique products and technology of the company, quality of human resource are

not at all considered in financial ratios.

Many times there are changes occurred in policies and procedures of accounting practices.

This change may affect or result in changes in the financial results as against the results

from prior practices (Sarwary, 2020). Due to this limitation, ratios may become useless

sometimes.

Manipulations on the part of management with regards to financial information in reporting

the same to the public to indicate better than what has actually occurred. Such

manipulations can't be identified through simple examination. The financial analyst must be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

enough vigilant about such manipulations in the financial reports. And if the same is not

possible then the ratios calculated on the basis of these ratios can't be able show the actual

company's performance.

The ratios are not at all adjusted for seasonal factors which may affect the company's

overall performance. Hence, making them unreliable for interpretation.

PORTFOLIO 2

Capital Investment Appraisal

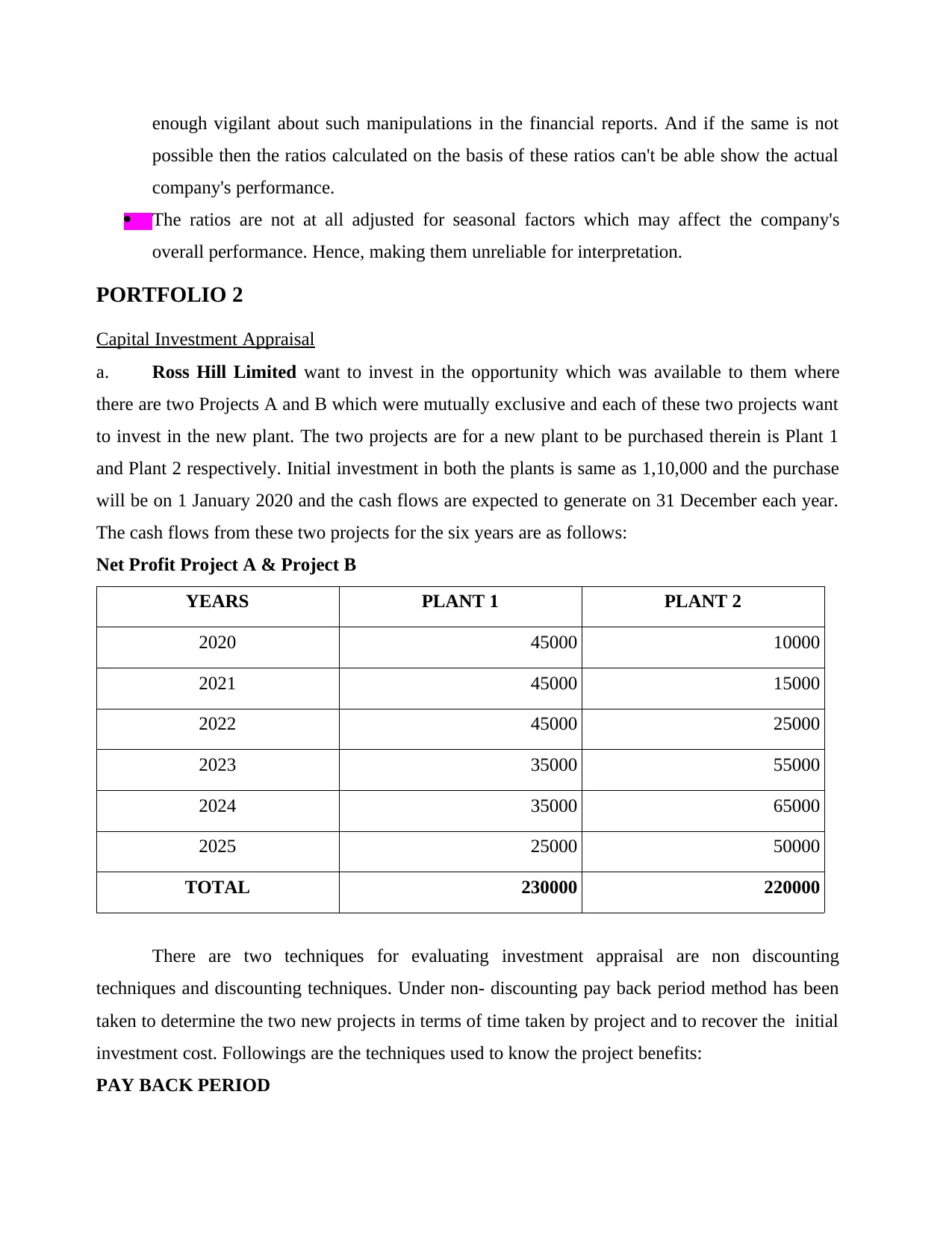

a. Ross Hill Limited want to invest in the opportunity which was available to them where

there are two Projects A and B which were mutually exclusive and each of these two projects want

to invest in the new plant. The two projects are for a new plant to be purchased therein is Plant 1

and Plant 2 respectively. Initial investment in both the plants is same as 1,10,000 and the purchase

will be on 1 January 2020 and the cash flows are expected to generate on 31 December each year.

The cash flows from these two projects for the six years are as follows:

Net Profit Project A & Project B

YEARS PLANT 1 PLANT 2

2020 45000 10000

2021 45000 15000

2022 45000 25000

2023 35000 55000

2024 35000 65000

2025 25000 50000

TOTAL 230000 220000

There are two techniques for evaluating investment appraisal are non discounting

techniques and discounting techniques. Under non- discounting pay back period method has been

taken to determine the two new projects in terms of time taken by project and to recover the initial

investment cost. Followings are the techniques used to know the project benefits:

PAY BACK PERIOD

possible then the ratios calculated on the basis of these ratios can't be able show the actual

company's performance.

The ratios are not at all adjusted for seasonal factors which may affect the company's

overall performance. Hence, making them unreliable for interpretation.

PORTFOLIO 2

Capital Investment Appraisal

a. Ross Hill Limited want to invest in the opportunity which was available to them where

there are two Projects A and B which were mutually exclusive and each of these two projects want

to invest in the new plant. The two projects are for a new plant to be purchased therein is Plant 1

and Plant 2 respectively. Initial investment in both the plants is same as 1,10,000 and the purchase

will be on 1 January 2020 and the cash flows are expected to generate on 31 December each year.

The cash flows from these two projects for the six years are as follows:

Net Profit Project A & Project B

YEARS PLANT 1 PLANT 2

2020 45000 10000

2021 45000 15000

2022 45000 25000

2023 35000 55000

2024 35000 65000

2025 25000 50000

TOTAL 230000 220000

There are two techniques for evaluating investment appraisal are non discounting

techniques and discounting techniques. Under non- discounting pay back period method has been

taken to determine the two new projects in terms of time taken by project and to recover the initial

investment cost. Followings are the techniques used to know the project benefits:

PAY BACK PERIOD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

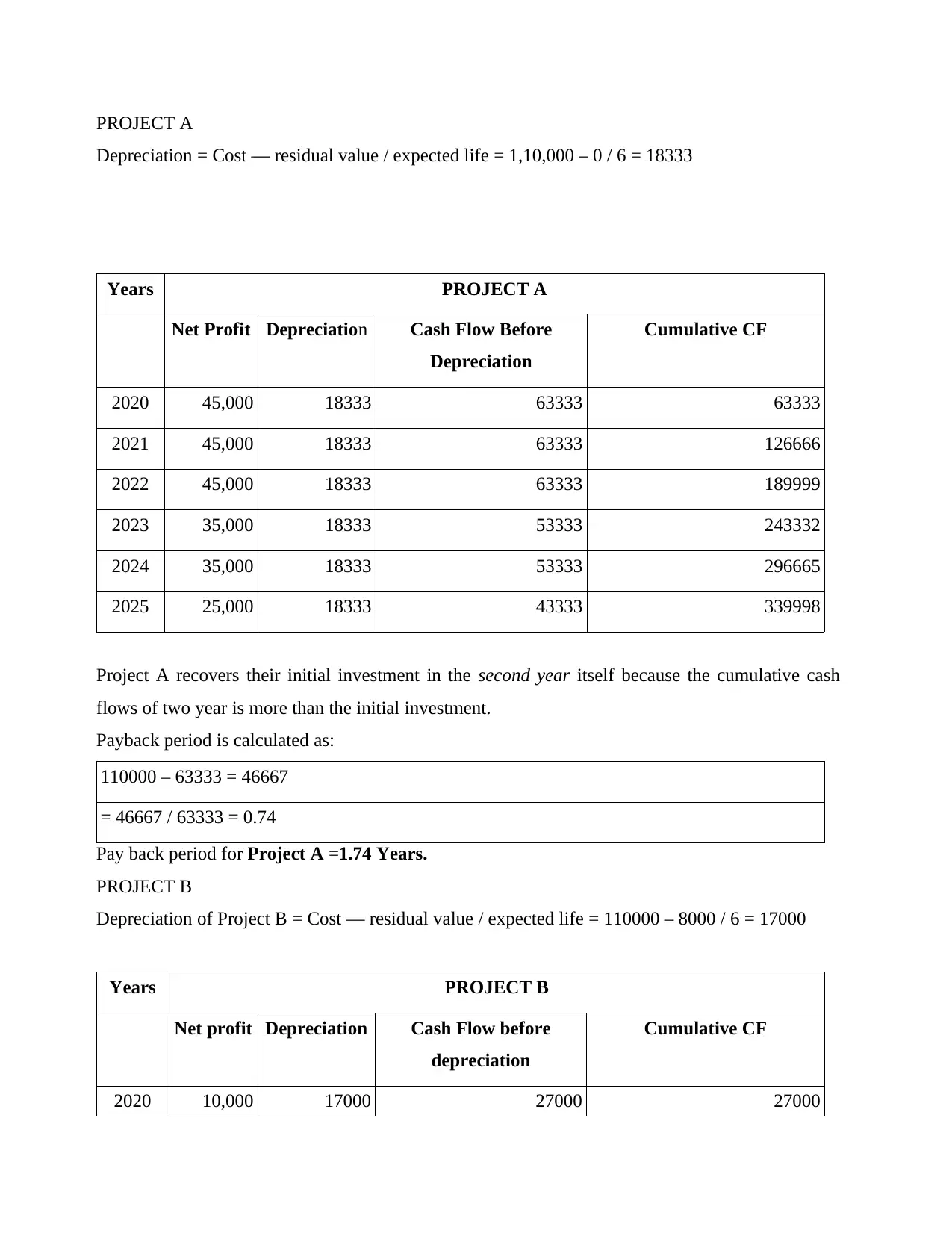

PROJECT A

Depreciation = Cost — residual value / expected life = 1,10,000 – 0 / 6 = 18333

Years PROJECT A

Net Profit Depreciation Cash Flow Before

Depreciation

Cumulative CF

2020 45,000 18333 63333 63333

2021 45,000 18333 63333 126666

2022 45,000 18333 63333 189999

2023 35,000 18333 53333 243332

2024 35,000 18333 53333 296665

2025 25,000 18333 43333 339998

Project A recovers their initial investment in the second year itself because the cumulative cash

flows of two year is more than the initial investment.

Payback period is calculated as:

110000 – 63333 = 46667

= 46667 / 63333 = 0.74

Pay back period for Project A =1.74 Years.

PROJECT B

Depreciation of Project B = Cost — residual value / expected life = 110000 – 8000 / 6 = 17000

Years PROJECT B

Net profit Depreciation Cash Flow before

depreciation

Cumulative CF

2020 10,000 17000 27000 27000

Depreciation = Cost — residual value / expected life = 1,10,000 – 0 / 6 = 18333

Years PROJECT A

Net Profit Depreciation Cash Flow Before

Depreciation

Cumulative CF

2020 45,000 18333 63333 63333

2021 45,000 18333 63333 126666

2022 45,000 18333 63333 189999

2023 35,000 18333 53333 243332

2024 35,000 18333 53333 296665

2025 25,000 18333 43333 339998

Project A recovers their initial investment in the second year itself because the cumulative cash

flows of two year is more than the initial investment.

Payback period is calculated as:

110000 – 63333 = 46667

= 46667 / 63333 = 0.74

Pay back period for Project A =1.74 Years.

PROJECT B

Depreciation of Project B = Cost — residual value / expected life = 110000 – 8000 / 6 = 17000

Years PROJECT B

Net profit Depreciation Cash Flow before

depreciation

Cumulative CF

2020 10,000 17000 27000 27000

2021 15,000 17000 32000 59000

2022 25,000 17000 42000 101000

2023 55,000 17000 72000 173000

2024 65000 17000 82000 255000

2025 50,000 17000 67000 322000

Project B recover its initial investment cost in almost Three years because cumulative cash

flows are greater than the initial investment in fourth year.

Payback period is calculated as:

110000 – 101000 = 9000

= 9000 / 72000 = 0.125

Payback period for Project B = 3.125 Years.

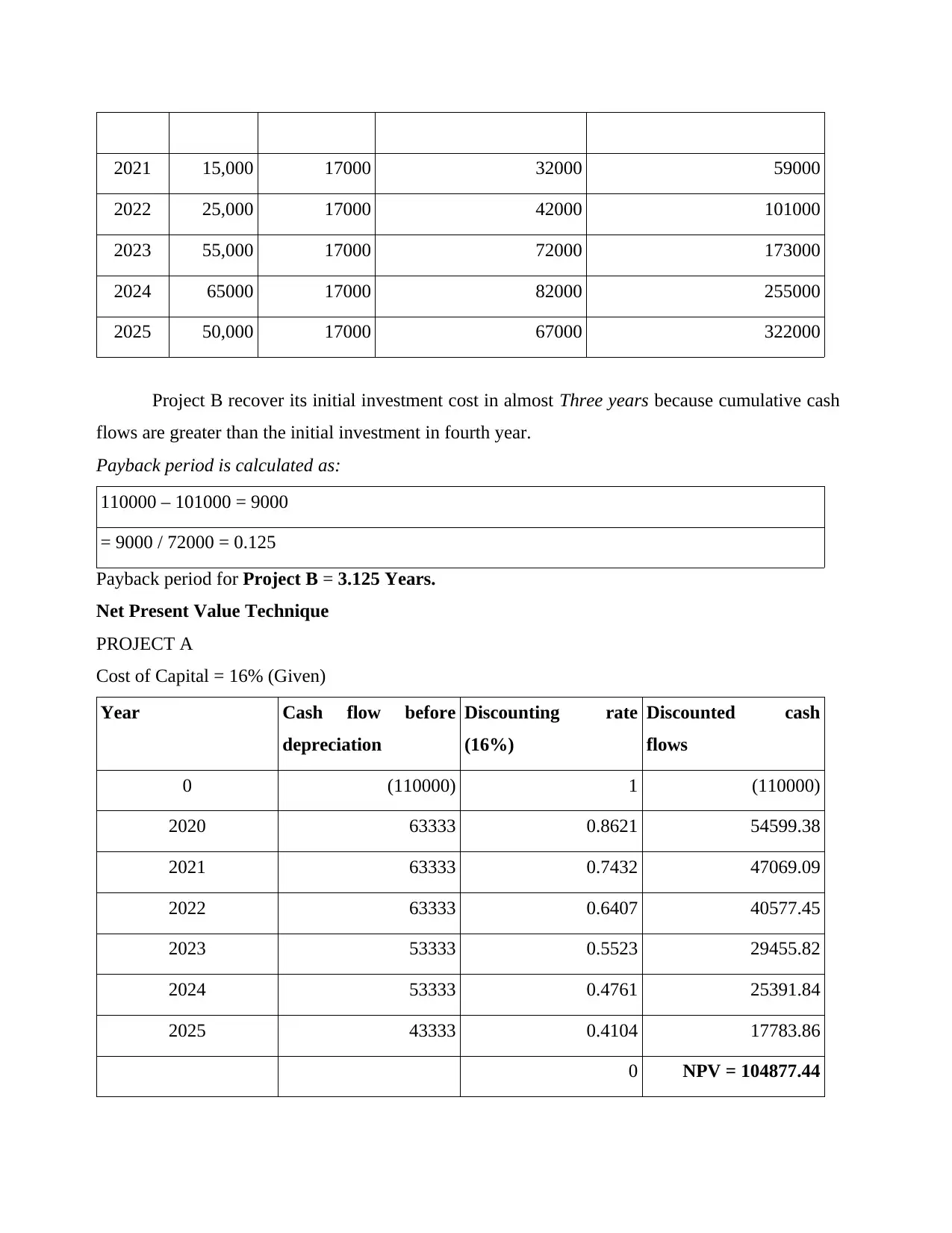

Net Present Value Technique

PROJECT A

Cost of Capital = 16% (Given)

Year Cash flow before

depreciation

Discounting rate

(16%)

Discounted cash

flows

0 (110000) 1 (110000)

2020 63333 0.8621 54599.38

2021 63333 0.7432 47069.09

2022 63333 0.6407 40577.45

2023 53333 0.5523 29455.82

2024 53333 0.4761 25391.84

2025 43333 0.4104 17783.86

0 NPV = 104877.44

2022 25,000 17000 42000 101000

2023 55,000 17000 72000 173000

2024 65000 17000 82000 255000

2025 50,000 17000 67000 322000

Project B recover its initial investment cost in almost Three years because cumulative cash

flows are greater than the initial investment in fourth year.

Payback period is calculated as:

110000 – 101000 = 9000

= 9000 / 72000 = 0.125

Payback period for Project B = 3.125 Years.

Net Present Value Technique

PROJECT A

Cost of Capital = 16% (Given)

Year Cash flow before

depreciation

Discounting rate

(16%)

Discounted cash

flows

0 (110000) 1 (110000)

2020 63333 0.8621 54599.38

2021 63333 0.7432 47069.09

2022 63333 0.6407 40577.45

2023 53333 0.5523 29455.82

2024 53333 0.4761 25391.84

2025 43333 0.4104 17783.86

0 NPV = 104877.44

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.