ACC511 - Managerial Finance: Project Evaluation Report, Semester 1

VerifiedAdded on 2023/01/19

|19

|2356

|60

Report

AI Summary

This report provides a comprehensive capital budgeting analysis for a hypothetical new laptop manufacturing plant project for Dell Inc. The analysis includes detailed calculations of depreciation, profits, taxes, and annual cash flows over a ten-year period. Key capital budgeting techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period are employed to evaluate the project's financial viability. The report calculates the NPV to be $97,775,906, the IRR at 18.5%, and a payback period of 5.15 years, along with discussions on the discount rate and loan repayment installments. The report also discusses the advantages and disadvantages of debt financing. Based on the analysis, the report recommends that the management accept the project as it is expected to create value for the company.

MANAGERIAL FINANCE

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The below assignment discussion on various capital budgeting tools such as net present value, internal rate of return and pay-back

period. These tools help the management critically examine the financial viability of a project.

2

The below assignment discussion on various capital budgeting tools such as net present value, internal rate of return and pay-back

period. These tools help the management critically examine the financial viability of a project.

2

Contents

Introduction................................................................................................................................................................................................................. 4

Answer 1:.................................................................................................................................................................................................................... 5

Answer 1(a):............................................................................................................................................................................................................ 5

Answer 1 (b):........................................................................................................................................................................................................... 5

Answer 1(c ):........................................................................................................................................................................................................... 7

Answer 1(d):............................................................................................................................................................................................................ 7

Answer 1(e):............................................................................................................................................................................................................ 7

Answer 1(f):............................................................................................................................................................................................................. 8

Answer 1(g):............................................................................................................................................................................................................ 8

Answer 2:.................................................................................................................................................................................................................... 9

Answer 2(a):............................................................................................................................................................................................................ 9

Answer 2(b):.......................................................................................................................................................................................................... 10

Conclusion................................................................................................................................................................................................................. 11

3

Introduction................................................................................................................................................................................................................. 4

Answer 1:.................................................................................................................................................................................................................... 5

Answer 1(a):............................................................................................................................................................................................................ 5

Answer 1 (b):........................................................................................................................................................................................................... 5

Answer 1(c ):........................................................................................................................................................................................................... 7

Answer 1(d):............................................................................................................................................................................................................ 7

Answer 1(e):............................................................................................................................................................................................................ 7

Answer 1(f):............................................................................................................................................................................................................. 8

Answer 1(g):............................................................................................................................................................................................................ 8

Answer 2:.................................................................................................................................................................................................................... 9

Answer 2(a):............................................................................................................................................................................................................ 9

Answer 2(b):.......................................................................................................................................................................................................... 10

Conclusion................................................................................................................................................................................................................. 11

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The major part of running a business comprise of decision making. The executive board is responsible to take a relevant decision

which ensures Company’s growth and stability. To help in expansion of a business it is important that new projects are taken up. It is

the responsibility of the management now to evaluate the viability of such projects taken. In order to help the management take such

decisions capital budgeting procedures are applied. In the discussion below we have implemented such procedures to help the

management take relevant decisions.

4

The major part of running a business comprise of decision making. The executive board is responsible to take a relevant decision

which ensures Company’s growth and stability. To help in expansion of a business it is important that new projects are taken up. It is

the responsibility of the management now to evaluate the viability of such projects taken. In order to help the management take such

decisions capital budgeting procedures are applied. In the discussion below we have implemented such procedures to help the

management take relevant decisions.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 1:

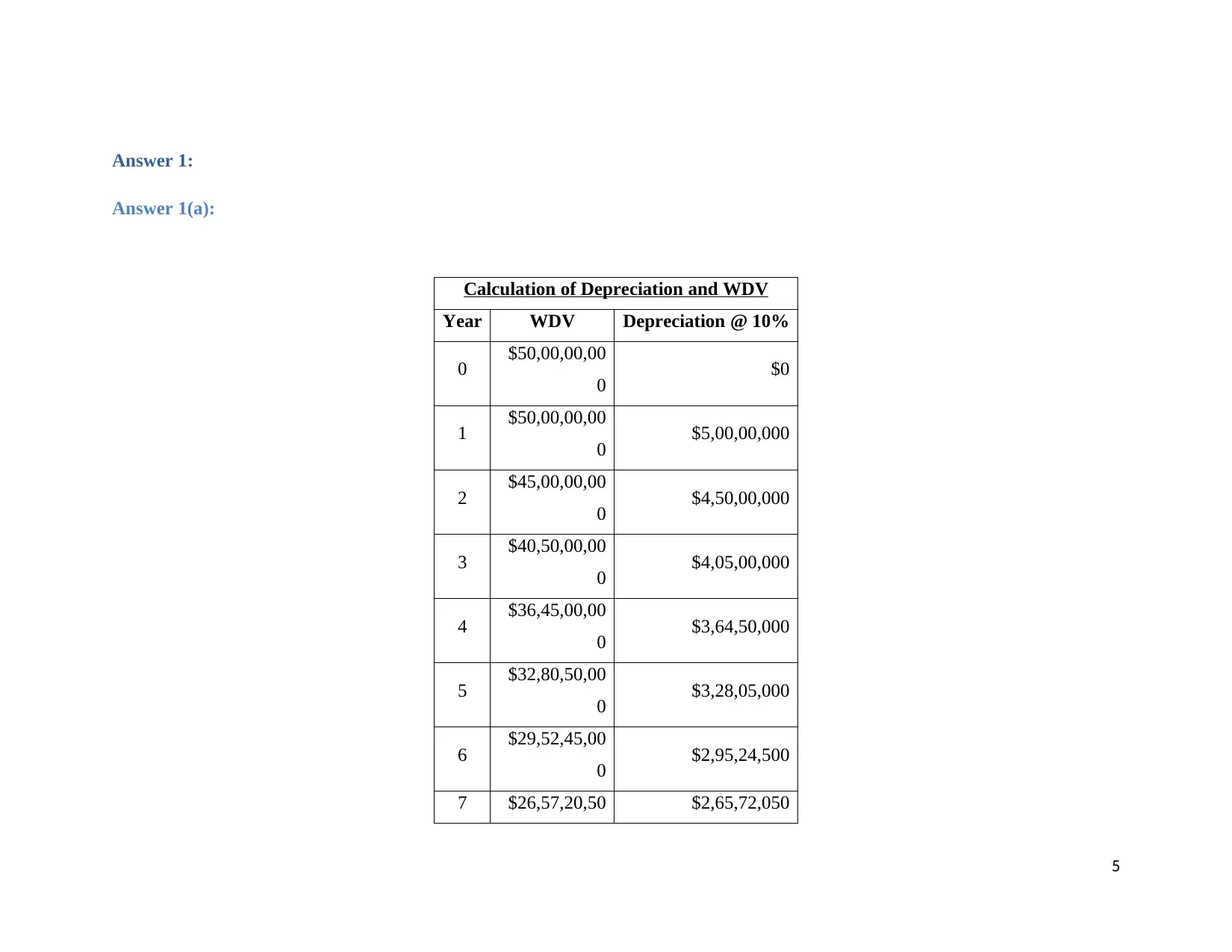

Answer 1(a):

Calculation of Depreciation and WDV

Year WDV Depreciation @ 10%

0 $50,00,00,00

0 $0

1 $50,00,00,00

0 $5,00,00,000

2 $45,00,00,00

0 $4,50,00,000

3 $40,50,00,00

0 $4,05,00,000

4 $36,45,00,00

0 $3,64,50,000

5 $32,80,50,00

0 $3,28,05,000

6 $29,52,45,00

0 $2,95,24,500

7 $26,57,20,50 $2,65,72,050

5

Answer 1(a):

Calculation of Depreciation and WDV

Year WDV Depreciation @ 10%

0 $50,00,00,00

0 $0

1 $50,00,00,00

0 $5,00,00,000

2 $45,00,00,00

0 $4,50,00,000

3 $40,50,00,00

0 $4,05,00,000

4 $36,45,00,00

0 $3,64,50,000

5 $32,80,50,00

0 $3,28,05,000

6 $29,52,45,00

0 $2,95,24,500

7 $26,57,20,50 $2,65,72,050

5

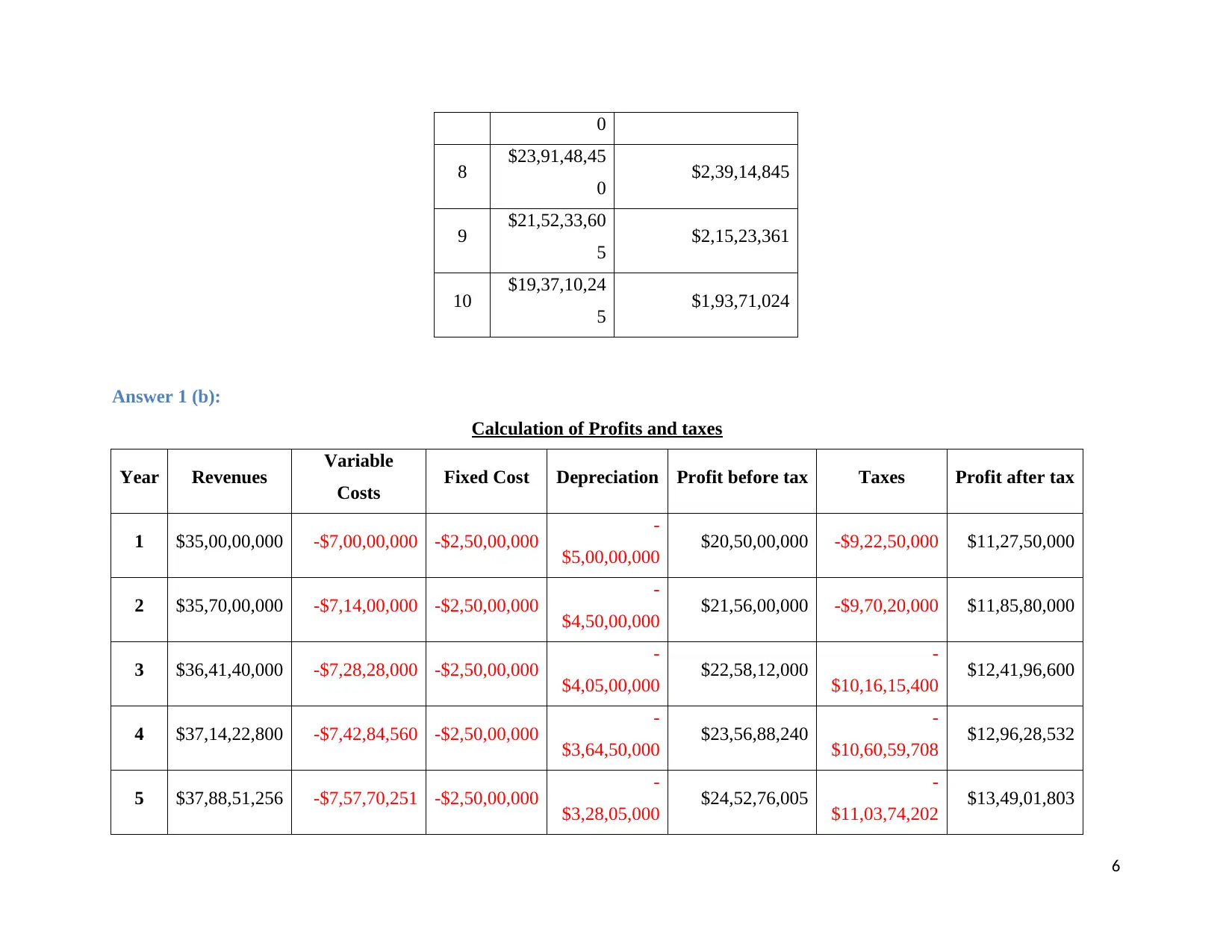

0

8 $23,91,48,45

0 $2,39,14,845

9 $21,52,33,60

5 $2,15,23,361

10 $19,37,10,24

5 $1,93,71,024

Answer 1 (b):

Calculation of Profits and taxes

Year Revenues Variable

Costs Fixed Cost Depreciation Profit before tax Taxes Profit after tax

1 $35,00,00,000 -$7,00,00,000 -$2,50,00,000 -

$5,00,00,000 $20,50,00,000 -$9,22,50,000 $11,27,50,000

2 $35,70,00,000 -$7,14,00,000 -$2,50,00,000 -

$4,50,00,000 $21,56,00,000 -$9,70,20,000 $11,85,80,000

3 $36,41,40,000 -$7,28,28,000 -$2,50,00,000 -

$4,05,00,000 $22,58,12,000 -

$10,16,15,400 $12,41,96,600

4 $37,14,22,800 -$7,42,84,560 -$2,50,00,000 -

$3,64,50,000 $23,56,88,240 -

$10,60,59,708 $12,96,28,532

5 $37,88,51,256 -$7,57,70,251 -$2,50,00,000 -

$3,28,05,000 $24,52,76,005 -

$11,03,74,202 $13,49,01,803

6

8 $23,91,48,45

0 $2,39,14,845

9 $21,52,33,60

5 $2,15,23,361

10 $19,37,10,24

5 $1,93,71,024

Answer 1 (b):

Calculation of Profits and taxes

Year Revenues Variable

Costs Fixed Cost Depreciation Profit before tax Taxes Profit after tax

1 $35,00,00,000 -$7,00,00,000 -$2,50,00,000 -

$5,00,00,000 $20,50,00,000 -$9,22,50,000 $11,27,50,000

2 $35,70,00,000 -$7,14,00,000 -$2,50,00,000 -

$4,50,00,000 $21,56,00,000 -$9,70,20,000 $11,85,80,000

3 $36,41,40,000 -$7,28,28,000 -$2,50,00,000 -

$4,05,00,000 $22,58,12,000 -

$10,16,15,400 $12,41,96,600

4 $37,14,22,800 -$7,42,84,560 -$2,50,00,000 -

$3,64,50,000 $23,56,88,240 -

$10,60,59,708 $12,96,28,532

5 $37,88,51,256 -$7,57,70,251 -$2,50,00,000 -

$3,28,05,000 $24,52,76,005 -

$11,03,74,202 $13,49,01,803

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

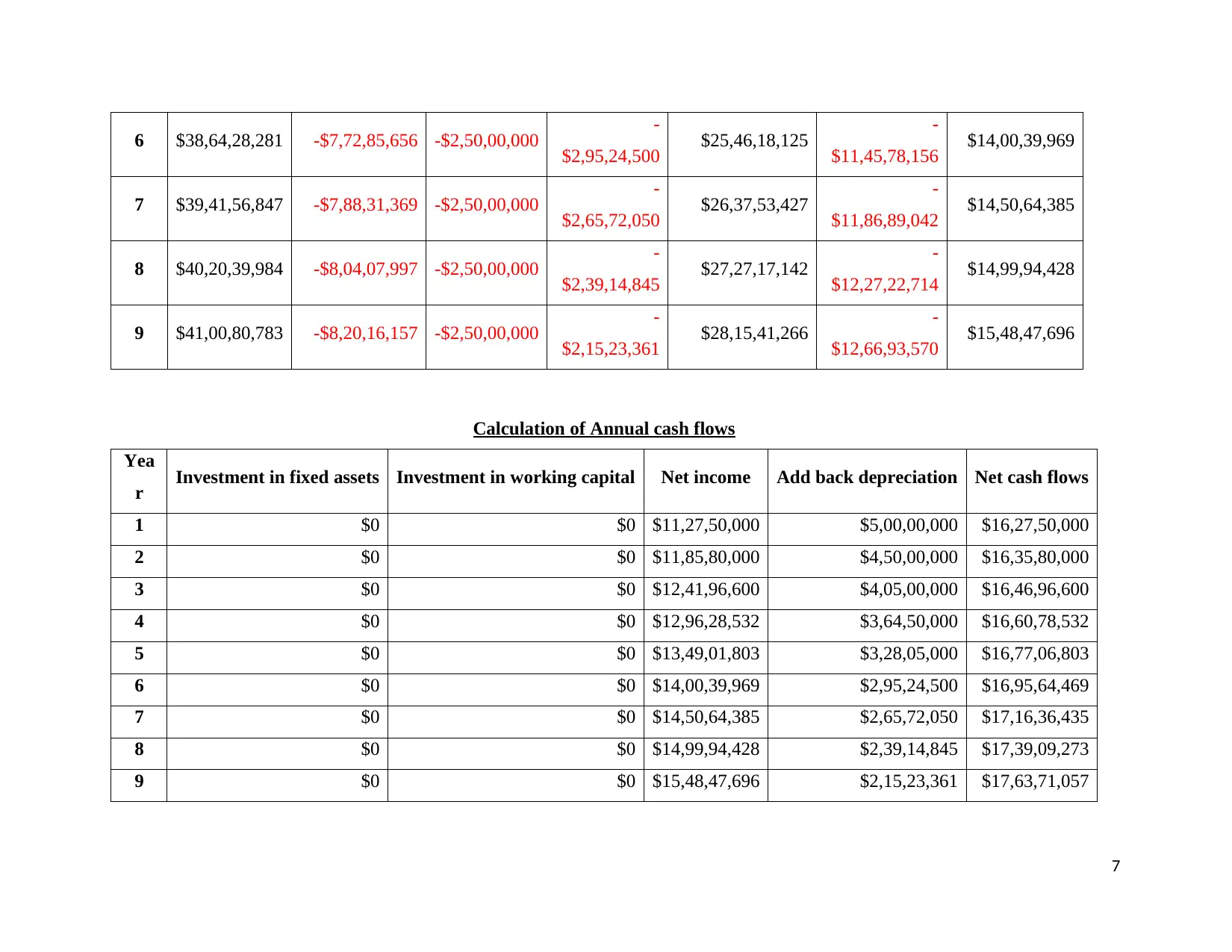

6 $38,64,28,281 -$7,72,85,656 -$2,50,00,000 -

$2,95,24,500 $25,46,18,125 -

$11,45,78,156 $14,00,39,969

7 $39,41,56,847 -$7,88,31,369 -$2,50,00,000 -

$2,65,72,050 $26,37,53,427 -

$11,86,89,042 $14,50,64,385

8 $40,20,39,984 -$8,04,07,997 -$2,50,00,000 -

$2,39,14,845 $27,27,17,142 -

$12,27,22,714 $14,99,94,428

9 $41,00,80,783 -$8,20,16,157 -$2,50,00,000 -

$2,15,23,361 $28,15,41,266 -

$12,66,93,570 $15,48,47,696

Calculation of Annual cash flows

Yea

r Investment in fixed assets Investment in working capital Net income Add back depreciation Net cash flows

1 $0 $0 $11,27,50,000 $5,00,00,000 $16,27,50,000

2 $0 $0 $11,85,80,000 $4,50,00,000 $16,35,80,000

3 $0 $0 $12,41,96,600 $4,05,00,000 $16,46,96,600

4 $0 $0 $12,96,28,532 $3,64,50,000 $16,60,78,532

5 $0 $0 $13,49,01,803 $3,28,05,000 $16,77,06,803

6 $0 $0 $14,00,39,969 $2,95,24,500 $16,95,64,469

7 $0 $0 $14,50,64,385 $2,65,72,050 $17,16,36,435

8 $0 $0 $14,99,94,428 $2,39,14,845 $17,39,09,273

9 $0 $0 $15,48,47,696 $2,15,23,361 $17,63,71,057

7

$2,95,24,500 $25,46,18,125 -

$11,45,78,156 $14,00,39,969

7 $39,41,56,847 -$7,88,31,369 -$2,50,00,000 -

$2,65,72,050 $26,37,53,427 -

$11,86,89,042 $14,50,64,385

8 $40,20,39,984 -$8,04,07,997 -$2,50,00,000 -

$2,39,14,845 $27,27,17,142 -

$12,27,22,714 $14,99,94,428

9 $41,00,80,783 -$8,20,16,157 -$2,50,00,000 -

$2,15,23,361 $28,15,41,266 -

$12,66,93,570 $15,48,47,696

Calculation of Annual cash flows

Yea

r Investment in fixed assets Investment in working capital Net income Add back depreciation Net cash flows

1 $0 $0 $11,27,50,000 $5,00,00,000 $16,27,50,000

2 $0 $0 $11,85,80,000 $4,50,00,000 $16,35,80,000

3 $0 $0 $12,41,96,600 $4,05,00,000 $16,46,96,600

4 $0 $0 $12,96,28,532 $3,64,50,000 $16,60,78,532

5 $0 $0 $13,49,01,803 $3,28,05,000 $16,77,06,803

6 $0 $0 $14,00,39,969 $2,95,24,500 $16,95,64,469

7 $0 $0 $14,50,64,385 $2,65,72,050 $17,16,36,435

8 $0 $0 $14,99,94,428 $2,39,14,845 $17,39,09,273

9 $0 $0 $15,48,47,696 $2,15,23,361 $17,63,71,057

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 1(c ):

Year Investment in fixed

assets Investment in working capital

0 -$75,00,00,000 -$10,00,00,000

Answer 1(d):

Calculation of Annual cash flows

Yea

r Investment in fixed assets Investment in working capital Net income Add back depreciation Net cash flows

10 $51,09,52,649 $10,00,00,000 $15,96,40,192 $1,93,71,024 $78,99,63,866

Answer 1(e):

Net present value of the project is the net total of the discounted cash flows of a project. The cash outflows and inflows are discounted

using a relevant rate of return (Berry, 2009). These are then summed up in order to calculate the present value of expected net cash

flows. If the value of inflows are higher than outflows are project is accepted taking other factors into account as well (Bierman &

Smidt, 2010).

The NPV of the given project is $97775906. Since the present value of cash inflows are higher than the present value of cash outflows

the project should be accepted.

8

Year Investment in fixed

assets Investment in working capital

0 -$75,00,00,000 -$10,00,00,000

Answer 1(d):

Calculation of Annual cash flows

Yea

r Investment in fixed assets Investment in working capital Net income Add back depreciation Net cash flows

10 $51,09,52,649 $10,00,00,000 $15,96,40,192 $1,93,71,024 $78,99,63,866

Answer 1(e):

Net present value of the project is the net total of the discounted cash flows of a project. The cash outflows and inflows are discounted

using a relevant rate of return (Berry, 2009). These are then summed up in order to calculate the present value of expected net cash

flows. If the value of inflows are higher than outflows are project is accepted taking other factors into account as well (Bierman &

Smidt, 2010).

The NPV of the given project is $97775906. Since the present value of cash inflows are higher than the present value of cash outflows

the project should be accepted.

8

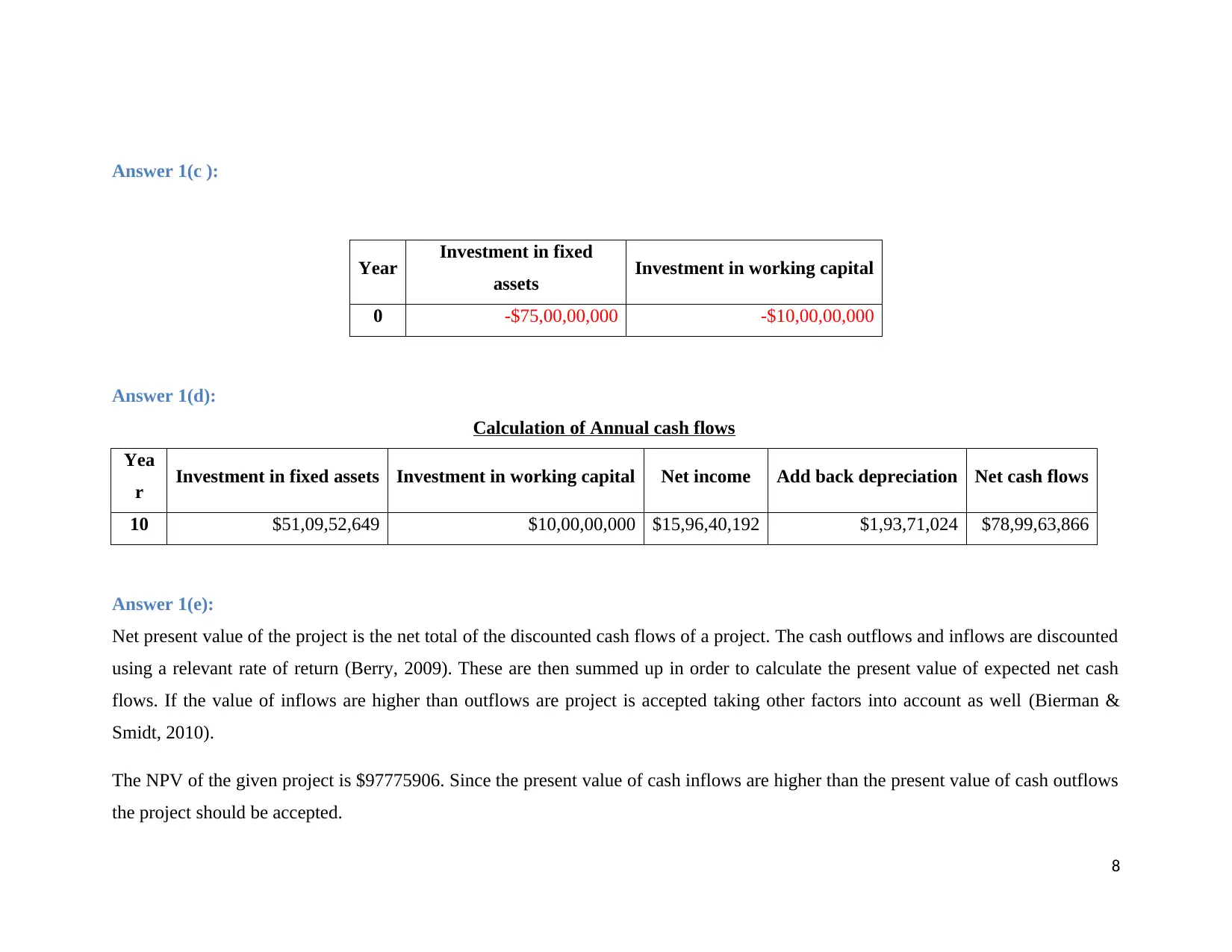

Answer 1(f):

IRR is internal rate of return. The cash inflows are equated with the cash outflows to calculate the hidden rate of return (Datar, 2015).

This is the actual rate which is expected to be earned from the planned project. If the IRR is higher than the required rate of return then

it indicates that that the project will earn higher than expected. In such cases the project seems viable (Peterson & Fabozzi, 2012).

The IRR of the given project is 18.5% and the required rate is 16%. Since the projected is expected to earn more than the expectations

it should be accepted.

Pay-back period is the period in which the investors can expect to earn back the amount of investments made. Lower the pay-back

period better it is for the investors (Rivenbark, Vogt, & Marlowe, 2009).

The pay-back period for the given project is 5.15 years and the project is expected to generate cash flows for 10 years. Since the pay-

back period is lower than the project life, the project should be accepted.

Answer 1(g):

The discount rate used in the capital budgeting process is project specific. They are calculated taking in mind the relevant costs and

expected returns for a specific venture (Seal, 2012). Effects of various risks are also taken into account in calculation of this required

rate of return.

Therefore the contention of the CFO to use the same rate for projects of the same category is not correct. The project specific risks

should be adjusted in the return in order to have a proper conclusion.

9

IRR is internal rate of return. The cash inflows are equated with the cash outflows to calculate the hidden rate of return (Datar, 2015).

This is the actual rate which is expected to be earned from the planned project. If the IRR is higher than the required rate of return then

it indicates that that the project will earn higher than expected. In such cases the project seems viable (Peterson & Fabozzi, 2012).

The IRR of the given project is 18.5% and the required rate is 16%. Since the projected is expected to earn more than the expectations

it should be accepted.

Pay-back period is the period in which the investors can expect to earn back the amount of investments made. Lower the pay-back

period better it is for the investors (Rivenbark, Vogt, & Marlowe, 2009).

The pay-back period for the given project is 5.15 years and the project is expected to generate cash flows for 10 years. Since the pay-

back period is lower than the project life, the project should be accepted.

Answer 1(g):

The discount rate used in the capital budgeting process is project specific. They are calculated taking in mind the relevant costs and

expected returns for a specific venture (Seal, 2012). Effects of various risks are also taken into account in calculation of this required

rate of return.

Therefore the contention of the CFO to use the same rate for projects of the same category is not correct. The project specific risks

should be adjusted in the return in order to have a proper conclusion.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Answer 2:

Answer 2(a):

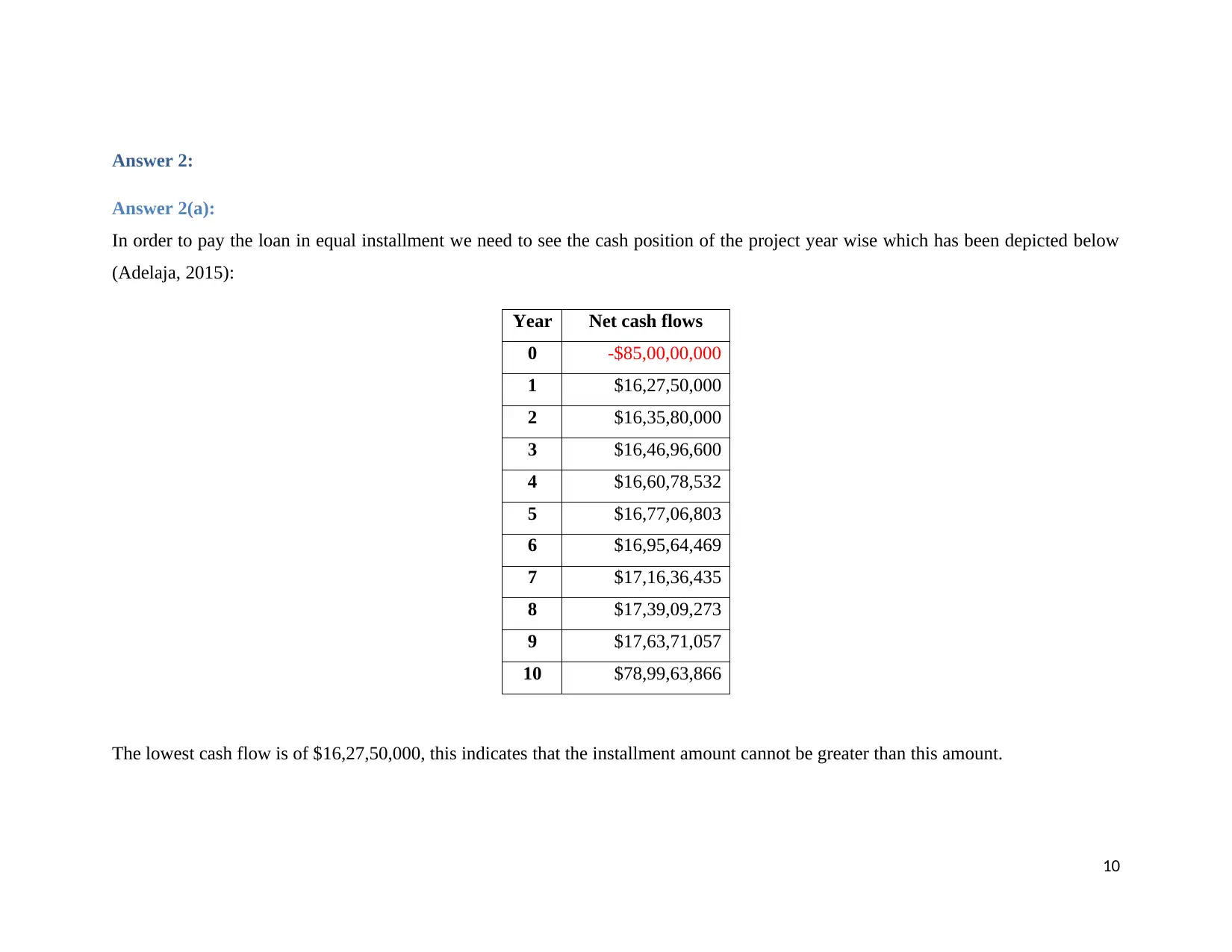

In order to pay the loan in equal installment we need to see the cash position of the project year wise which has been depicted below

(Adelaja, 2015):

Year Net cash flows

0 -$85,00,00,000

1 $16,27,50,000

2 $16,35,80,000

3 $16,46,96,600

4 $16,60,78,532

5 $16,77,06,803

6 $16,95,64,469

7 $17,16,36,435

8 $17,39,09,273

9 $17,63,71,057

10 $78,99,63,866

The lowest cash flow is of $16,27,50,000, this indicates that the installment amount cannot be greater than this amount.

10

Answer 2(a):

In order to pay the loan in equal installment we need to see the cash position of the project year wise which has been depicted below

(Adelaja, 2015):

Year Net cash flows

0 -$85,00,00,000

1 $16,27,50,000

2 $16,35,80,000

3 $16,46,96,600

4 $16,60,78,532

5 $16,77,06,803

6 $16,95,64,469

7 $17,16,36,435

8 $17,39,09,273

9 $17,63,71,057

10 $78,99,63,866

The lowest cash flow is of $16,27,50,000, this indicates that the installment amount cannot be greater than this amount.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Using this figure as the installment amount and total investments made of $85,00,00,000 as the loan amount, we have calculated the

hidden rate. The rate of interest results to approximately 13.92%.

Therefore based on above data the installment amount should be $16,27,50,000 and the interest cannot be greater than 13.92%.

Answer 2(b):

There are various sources of funding a project. The most common is debt funding. Debt funding is one of the simplest ways to obtain

capital. It helps the firm avail benefits of taxation benefits on interest. But since it requires timely repayments it creates a burden on

the cash flows of the company. It also increases the risk of default in cash of irregular cash flows. Therefore funding a project using

debt funding has both its pros and cons.

11

hidden rate. The rate of interest results to approximately 13.92%.

Therefore based on above data the installment amount should be $16,27,50,000 and the interest cannot be greater than 13.92%.

Answer 2(b):

There are various sources of funding a project. The most common is debt funding. Debt funding is one of the simplest ways to obtain

capital. It helps the firm avail benefits of taxation benefits on interest. But since it requires timely repayments it creates a burden on

the cash flows of the company. It also increases the risk of default in cash of irregular cash flows. Therefore funding a project using

debt funding has both its pros and cons.

11

Conclusion

Based on the above analysis of the cash flows using capital budgeting tools, we see that the project has positive NPV, IRR greater than

the required return and a low pay-back period (Atkinson, 2012). The project seems viable. Using the above data as our basis of

decision making we can recommend the management of the company to accept the project as it is expected to create value of the

company.

12

Based on the above analysis of the cash flows using capital budgeting tools, we see that the project has positive NPV, IRR greater than

the required return and a low pay-back period (Atkinson, 2012). The project seems viable. Using the above data as our basis of

decision making we can recommend the management of the company to accept the project as it is expected to create value of the

company.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.