Managerial Finance Report: Financial Analysis of Sports Retail Sector

VerifiedAdded on 2020/07/23

|25

|4524

|39

Report

AI Summary

This report delves into managerial finance, focusing on the financial analysis of two prominent sports retail companies: JD Sports Fashion Plc and Sports-Direct International Plc. It begins with a detailed computation of various financial ratios, including current ratio, acid test ratio, gross profit margin, operating profit margin, net profit margin, gearing ratios, earnings per share (EPS), return on capital employed (ROCE), and stock turnover period, for both companies over two years (2015 and 2016). The analysis then interprets these ratios to assess the companies' financial performance, highlighting strengths and weaknesses. Furthermore, the report explores investment appraisal techniques such as Net Present Value (NPV), Average Rate of Return (ARR), and payback period, providing recommendations to management regarding investment decisions. Finally, it discusses the limitations of using financial ratios and investment appraisal methods for long-term decision-making, offering a comprehensive overview of financial analysis within the retail sector.

Managerial Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

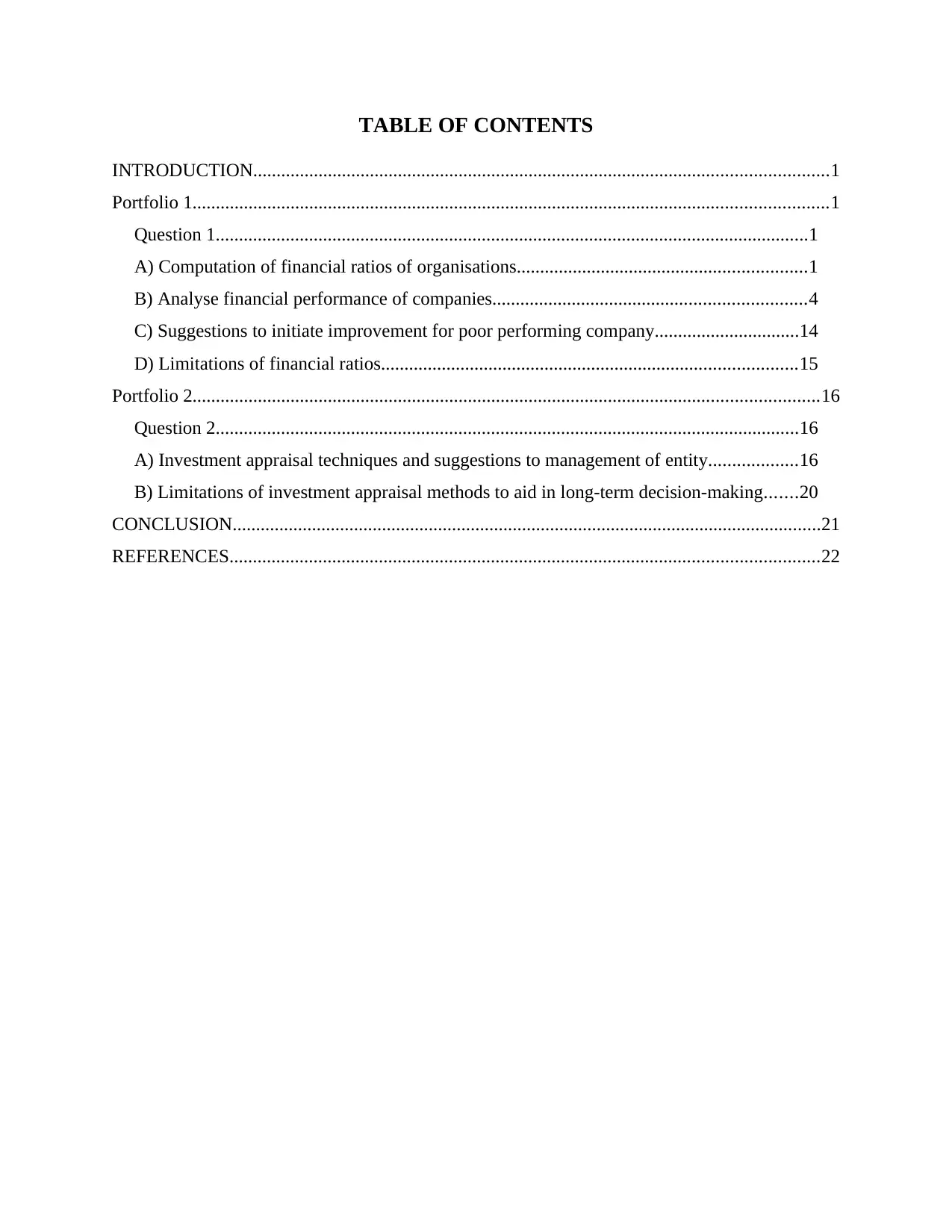

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Portfolio 1........................................................................................................................................1

Question 1...............................................................................................................................1

A) Computation of financial ratios of organisations..............................................................1

B) Analyse financial performance of companies...................................................................4

C) Suggestions to initiate improvement for poor performing company...............................14

D) Limitations of financial ratios.........................................................................................15

Portfolio 2......................................................................................................................................16

Question 2.............................................................................................................................16

A) Investment appraisal techniques and suggestions to management of entity...................16

B) Limitations of investment appraisal methods to aid in long-term decision-making.......20

CONCLUSION..............................................................................................................................21

REFERENCES..............................................................................................................................22

INTRODUCTION...........................................................................................................................1

Portfolio 1........................................................................................................................................1

Question 1...............................................................................................................................1

A) Computation of financial ratios of organisations..............................................................1

B) Analyse financial performance of companies...................................................................4

C) Suggestions to initiate improvement for poor performing company...............................14

D) Limitations of financial ratios.........................................................................................15

Portfolio 2......................................................................................................................................16

Question 2.............................................................................................................................16

A) Investment appraisal techniques and suggestions to management of entity...................16

B) Limitations of investment appraisal methods to aid in long-term decision-making.......20

CONCLUSION..............................................................................................................................21

REFERENCES..............................................................................................................................22

INTRODUCTION

Managerial finance plays crucial role in the company so that finance can be utilised in

proper way and meeting operational requirements. Present report deals with two companies such

as JD Sports Fashion Plc and Sports-Direct International Plc engaged in retail sector of sports

products. Financial ratios are being computed for company to assess performance of both rivals.

On the other hand, investment appraisal methods such as NPV, ARR and payback period are

calculated which clarifies whether investment should be made or not. Thus, overall financial

performance can be analysed with the help of such techniques in effective manner.

Portfolio 1

Question 1

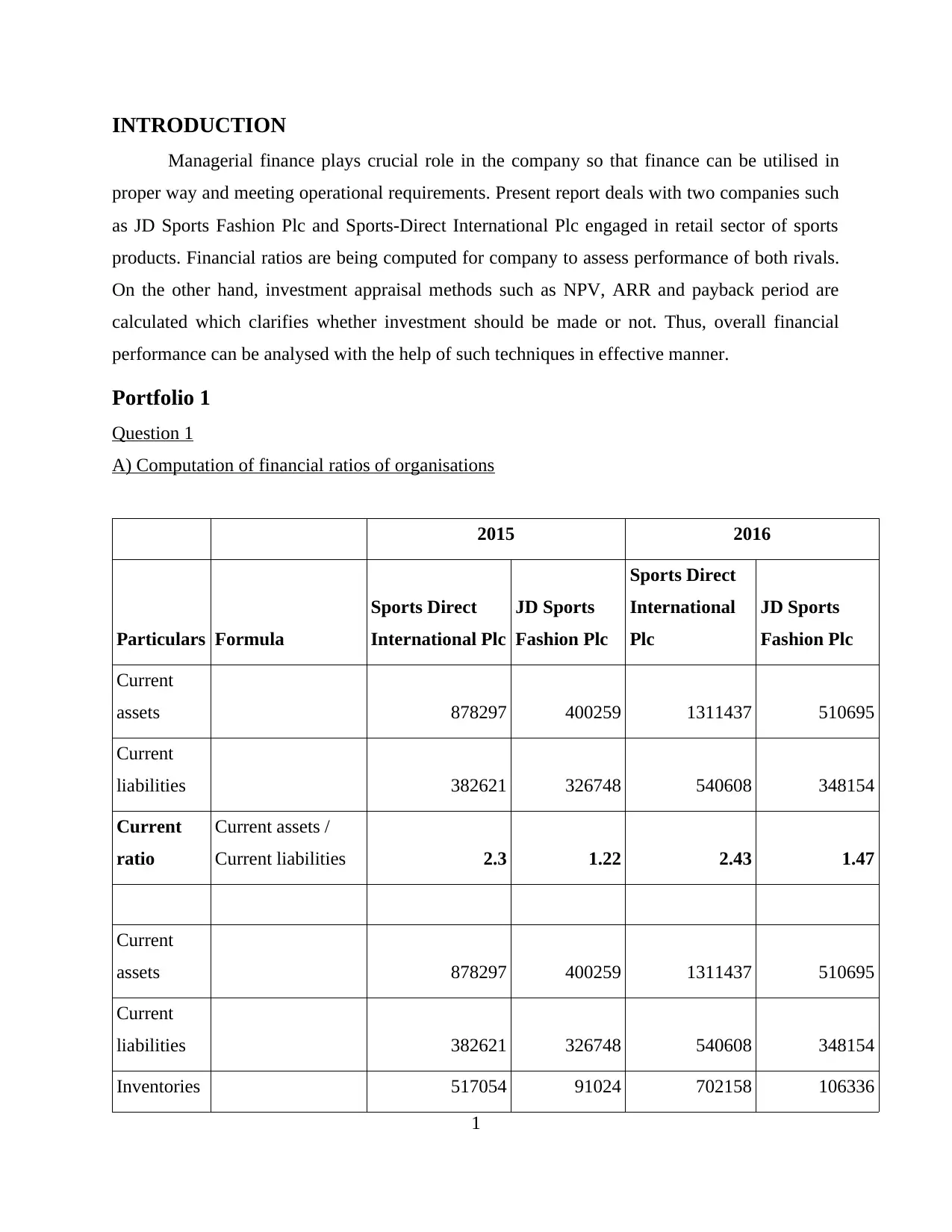

A) Computation of financial ratios of organisations

2015 2016

Particulars Formula

Sports Direct

International Plc

JD Sports

Fashion Plc

Sports Direct

International

Plc

JD Sports

Fashion Plc

Current

assets 878297 400259 1311437 510695

Current

liabilities 382621 326748 540608 348154

Current

ratio

Current assets /

Current liabilities 2.3 1.22 2.43 1.47

Current

assets 878297 400259 1311437 510695

Current

liabilities 382621 326748 540608 348154

Inventories 517054 91024 702158 106336

1

Managerial finance plays crucial role in the company so that finance can be utilised in

proper way and meeting operational requirements. Present report deals with two companies such

as JD Sports Fashion Plc and Sports-Direct International Plc engaged in retail sector of sports

products. Financial ratios are being computed for company to assess performance of both rivals.

On the other hand, investment appraisal methods such as NPV, ARR and payback period are

calculated which clarifies whether investment should be made or not. Thus, overall financial

performance can be analysed with the help of such techniques in effective manner.

Portfolio 1

Question 1

A) Computation of financial ratios of organisations

2015 2016

Particulars Formula

Sports Direct

International Plc

JD Sports

Fashion Plc

Sports Direct

International

Plc

JD Sports

Fashion Plc

Current

assets 878297 400259 1311437 510695

Current

liabilities 382621 326748 540608 348154

Current

ratio

Current assets /

Current liabilities 2.3 1.22 2.43 1.47

Current

assets 878297 400259 1311437 510695

Current

liabilities 382621 326748 540608 348154

Inventories 517054 91024 702158 106336

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

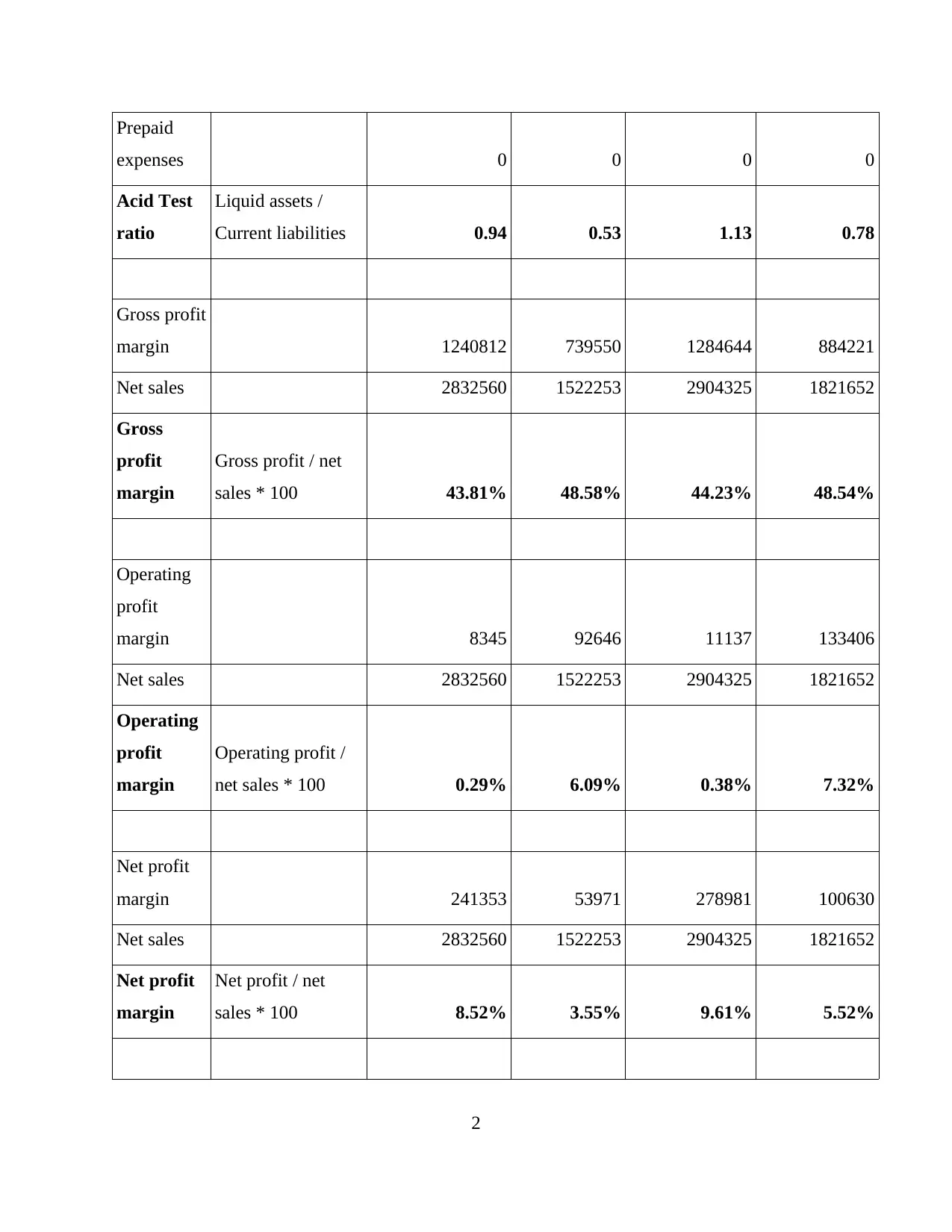

Prepaid

expenses 0 0 0 0

Acid Test

ratio

Liquid assets /

Current liabilities 0.94 0.53 1.13 0.78

Gross profit

margin 1240812 739550 1284644 884221

Net sales 2832560 1522253 2904325 1821652

Gross

profit

margin

Gross profit / net

sales * 100 43.81% 48.58% 44.23% 48.54%

Operating

profit

margin 8345 92646 11137 133406

Net sales 2832560 1522253 2904325 1821652

Operating

profit

margin

Operating profit /

net sales * 100 0.29% 6.09% 0.38% 7.32%

Net profit

margin 241353 53971 278981 100630

Net sales 2832560 1522253 2904325 1821652

Net profit

margin

Net profit / net

sales * 100 8.52% 3.55% 9.61% 5.52%

2

expenses 0 0 0 0

Acid Test

ratio

Liquid assets /

Current liabilities 0.94 0.53 1.13 0.78

Gross profit

margin 1240812 739550 1284644 884221

Net sales 2832560 1522253 2904325 1821652

Gross

profit

margin

Gross profit / net

sales * 100 43.81% 48.58% 44.23% 48.54%

Operating

profit

margin 8345 92646 11137 133406

Net sales 2832560 1522253 2904325 1821652

Operating

profit

margin

Operating profit /

net sales * 100 0.29% 6.09% 0.38% 7.32%

Net profit

margin 241353 53971 278981 100630

Net sales 2832560 1522253 2904325 1821652

Net profit

margin

Net profit / net

sales * 100 8.52% 3.55% 9.61% 5.52%

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

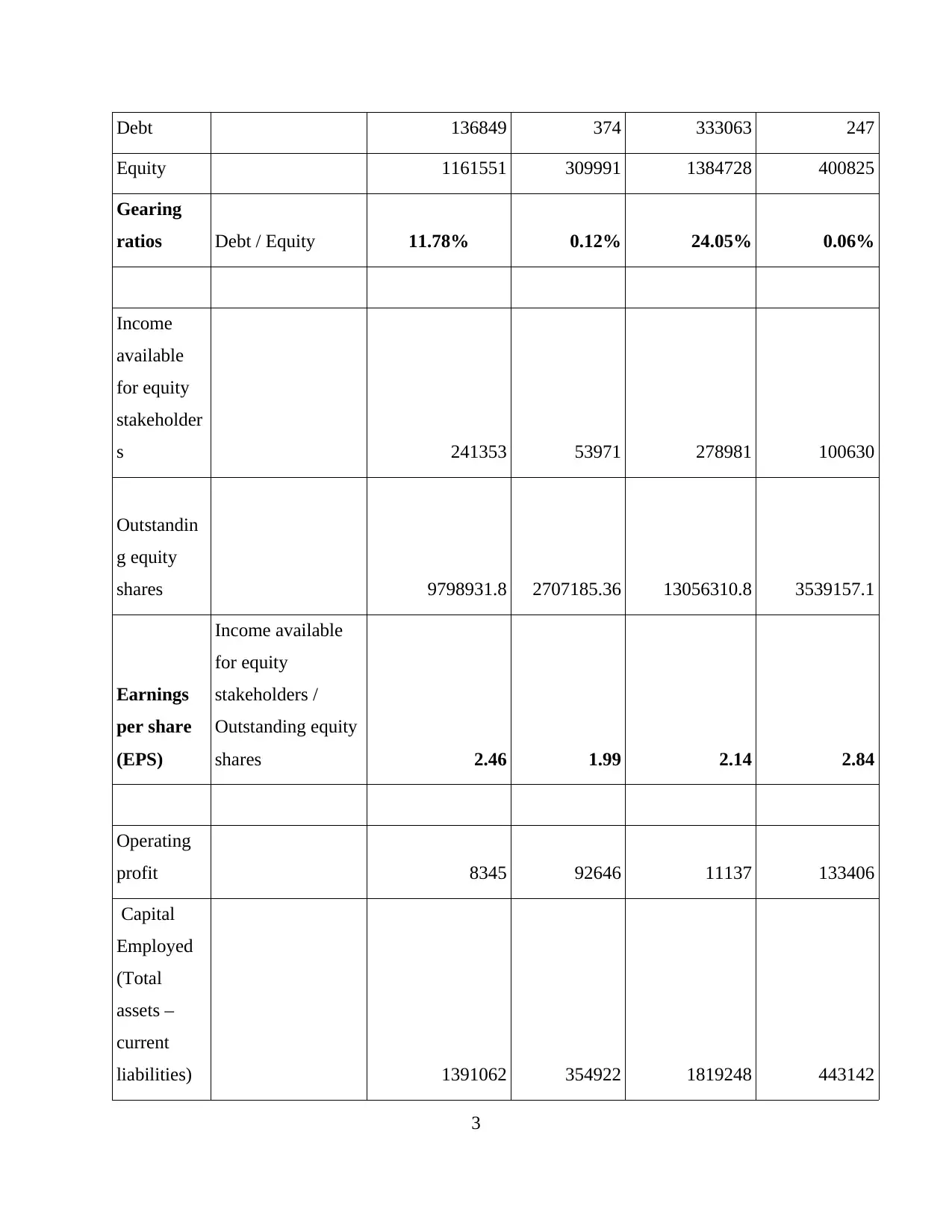

Debt 136849 374 333063 247

Equity 1161551 309991 1384728 400825

Gearing

ratios Debt / Equity 11.78% 0.12% 24.05% 0.06%

Income

available

for equity

stakeholder

s 241353 53971 278981 100630

Outstandin

g equity

shares 9798931.8 2707185.36 13056310.8 3539157.1

Earnings

per share

(EPS)

Income available

for equity

stakeholders /

Outstanding equity

shares 2.46 1.99 2.14 2.84

Operating

profit 8345 92646 11137 133406

Capital

Employed

(Total

assets –

current

liabilities) 1391062 354922 1819248 443142

3

Equity 1161551 309991 1384728 400825

Gearing

ratios Debt / Equity 11.78% 0.12% 24.05% 0.06%

Income

available

for equity

stakeholder

s 241353 53971 278981 100630

Outstandin

g equity

shares 9798931.8 2707185.36 13056310.8 3539157.1

Earnings

per share

(EPS)

Income available

for equity

stakeholders /

Outstanding equity

shares 2.46 1.99 2.14 2.84

Operating

profit 8345 92646 11137 133406

Capital

Employed

(Total

assets –

current

liabilities) 1391062 354922 1819248 443142

3

Return on

capital

employed

(ROCE)

Operating profit /

Capital Employed 0.60% 26.10% 0.61% 30.10%

Cost of

Sales 1591748 782703 1619681 937431

Average

stock 517054 91024 702158 106336

Stock

turnover

period

Cost of Sales /

Average stock 119 days 43 days 158 days 41 days

Dividend

paid 0 13260 0 13820

Net income

available to

equity

shareholder

s 241353 53971 278981 100630

Dividend

payout

ratios

Dividends / Net

income available to

equity shareholders 0.00% 24.57% 0.00% 13.73%

B) Analyse financial performance of companies

Financial ratios are quite helpful in determining performance of the company in that way

by which improvement if any required can be made by interpreting results in the best possible

manner (Arena and Ferris, 2017). It can be said that computation of ratios are beneficial for

4

capital

employed

(ROCE)

Operating profit /

Capital Employed 0.60% 26.10% 0.61% 30.10%

Cost of

Sales 1591748 782703 1619681 937431

Average

stock 517054 91024 702158 106336

Stock

turnover

period

Cost of Sales /

Average stock 119 days 43 days 158 days 41 days

Dividend

paid 0 13260 0 13820

Net income

available to

equity

shareholder

s 241353 53971 278981 100630

Dividend

payout

ratios

Dividends / Net

income available to

equity shareholders 0.00% 24.57% 0.00% 13.73%

B) Analyse financial performance of companies

Financial ratios are quite helpful in determining performance of the company in that way

by which improvement if any required can be made by interpreting results in the best possible

manner (Arena and Ferris, 2017). It can be said that computation of ratios are beneficial for

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organisation so that necessary improvements may be easily done and as such, financial condition

can be enhanced with much ease. In relation to this, financial ratios for JD Sports Plc and Sports-

Direct International Plc have been calculated for the period of two years ie 2015 and 2016.

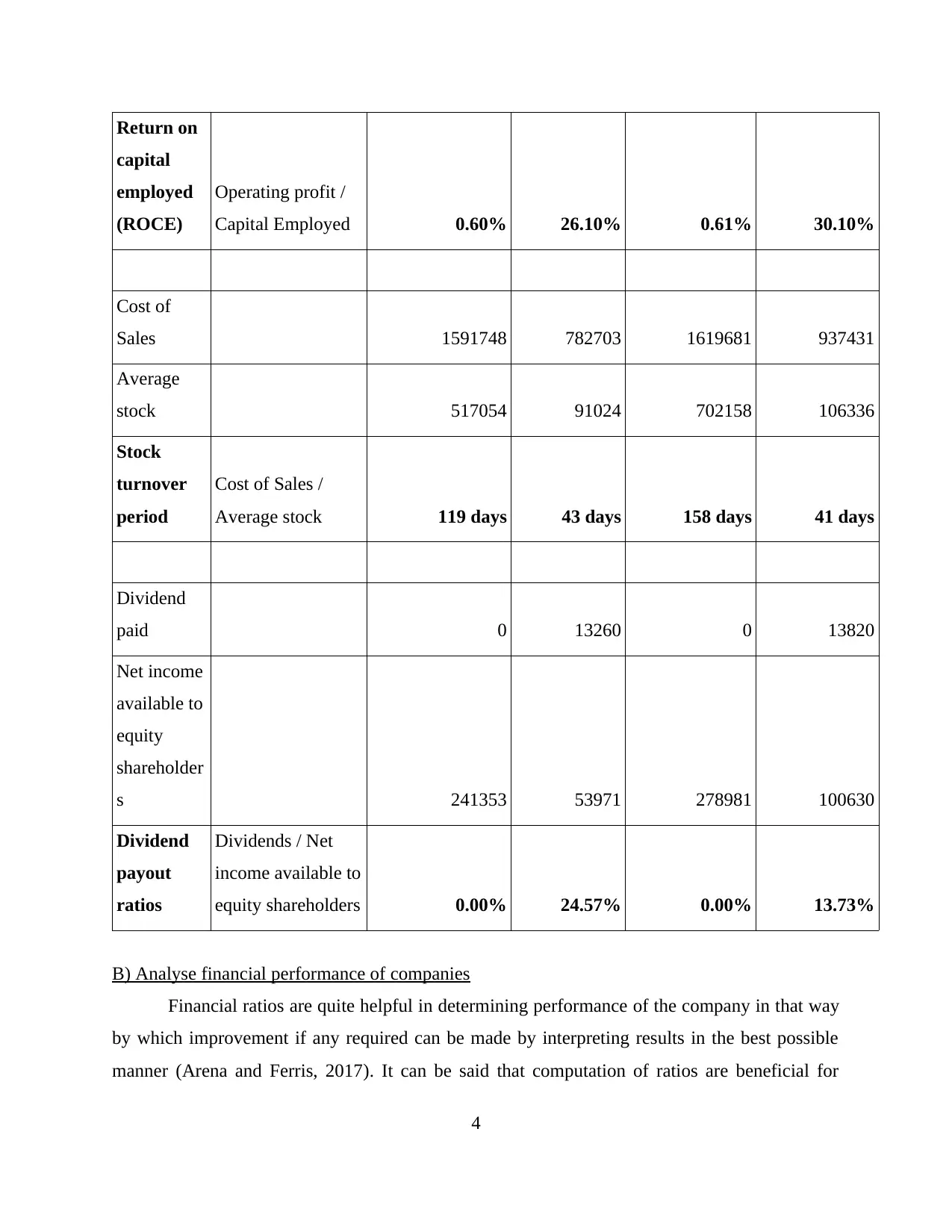

Current ratio

Current ratio of both companies have been computed for two periods. It shows how much

assets company has to effectively fulfil liabilities which becomes liquid within one year. Thus,

short-term liabilities are to be paid from the current assets. The ideal current ratio is 2 : 1 as

recommended by the market experts. It can be analysed that JD Sports Fashion Plc had 1.22 and

1.47 respectively in financial years 2015 and 2016. On the other hand, current ratio of Sports-

Direct International Plc had 2.3 and 2.43 in past two years. It clearly shows that Sports-Direct

International Plc has effective ratio which is more than ideal one as well. JD Sports Fashion Plc

has to improve upon its current ratio so that liabilities can be met within time frame.

Acid Test ratio

5

Sports Direct International Plc JD Sports Fashion Plc

0

0.5

1

1.5

2

2.5

3

2.3 2.43

1.22

1.47 2015

2016

Illustration 1: Current ratio

can be enhanced with much ease. In relation to this, financial ratios for JD Sports Plc and Sports-

Direct International Plc have been calculated for the period of two years ie 2015 and 2016.

Current ratio

Current ratio of both companies have been computed for two periods. It shows how much

assets company has to effectively fulfil liabilities which becomes liquid within one year. Thus,

short-term liabilities are to be paid from the current assets. The ideal current ratio is 2 : 1 as

recommended by the market experts. It can be analysed that JD Sports Fashion Plc had 1.22 and

1.47 respectively in financial years 2015 and 2016. On the other hand, current ratio of Sports-

Direct International Plc had 2.3 and 2.43 in past two years. It clearly shows that Sports-Direct

International Plc has effective ratio which is more than ideal one as well. JD Sports Fashion Plc

has to improve upon its current ratio so that liabilities can be met within time frame.

Acid Test ratio

5

Sports Direct International Plc JD Sports Fashion Plc

0

0.5

1

1.5

2

2.5

3

2.3 2.43

1.22

1.47 2015

2016

Illustration 1: Current ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

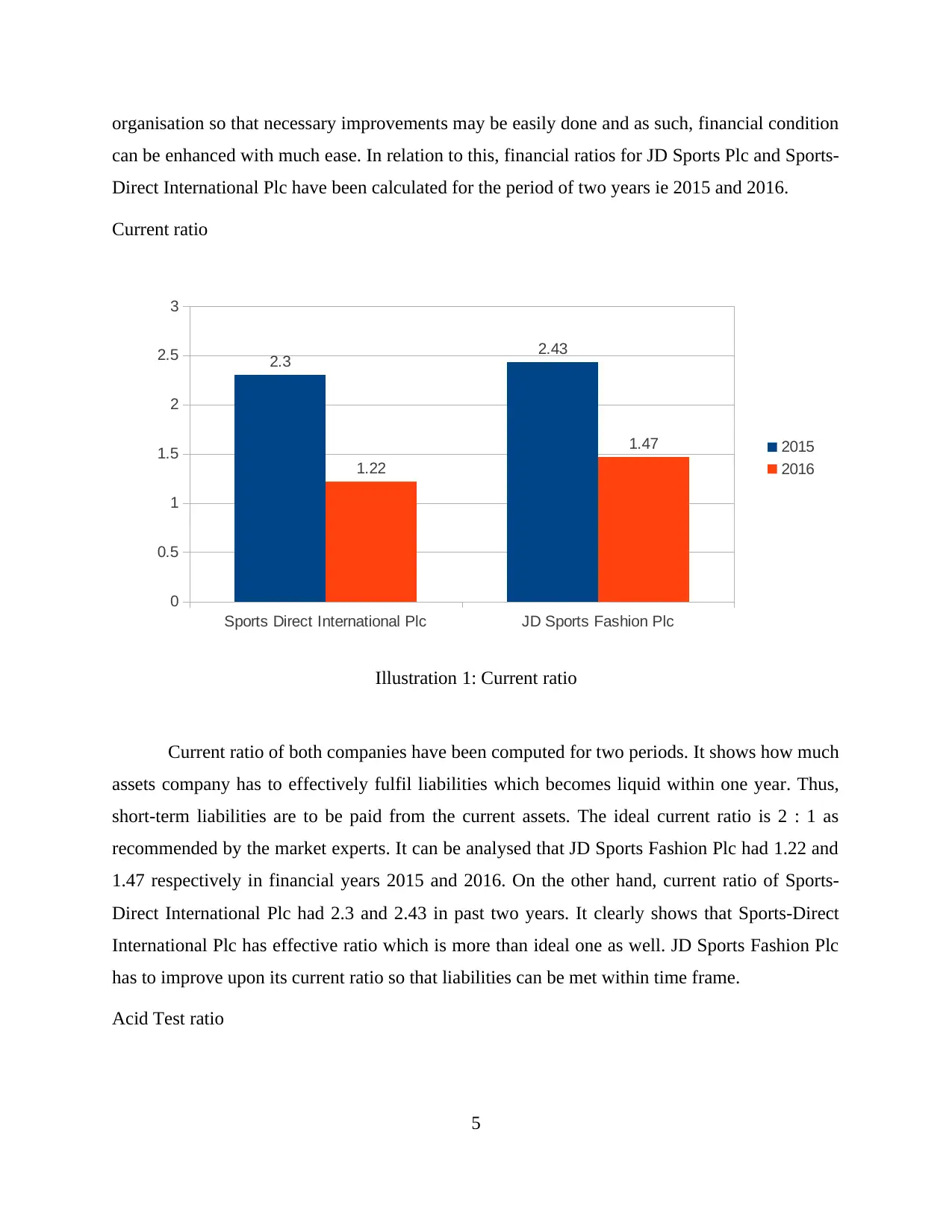

Acid Test ratio is further extension of above discussed ratio as it implies whether

liabilities can be paid within extreme liquid assets falling in one year. Here, extreme liquid assets

means that by subtracting prepaid expenses and inventories from current assets. Thus, residual

left after such subtraction is known as liquid assets. It can be interpreted that JD Sports Fashion

Plc has 0.53 and 0.78 ratio in both years. While, other organisation has 0.94 and 1.13 in 2015 and

2016. It shows that JD Sports Fashion Plc has to improve upon acid test ratio (Jackowicz,

Mielcarz and Wnuczak, 2017).

Gross Profit margin

6

Sports Direct International Plc JD Sports Fashion Plc

0

0.2

0.4

0.6

0.8

1

1.2

0.94

0.53

1.13

0.78

2015

2016

Illustration 2: Acid test ratio

liabilities can be paid within extreme liquid assets falling in one year. Here, extreme liquid assets

means that by subtracting prepaid expenses and inventories from current assets. Thus, residual

left after such subtraction is known as liquid assets. It can be interpreted that JD Sports Fashion

Plc has 0.53 and 0.78 ratio in both years. While, other organisation has 0.94 and 1.13 in 2015 and

2016. It shows that JD Sports Fashion Plc has to improve upon acid test ratio (Jackowicz,

Mielcarz and Wnuczak, 2017).

Gross Profit margin

6

Sports Direct International Plc JD Sports Fashion Plc

0

0.2

0.4

0.6

0.8

1

1.2

0.94

0.53

1.13

0.78

2015

2016

Illustration 2: Acid test ratio

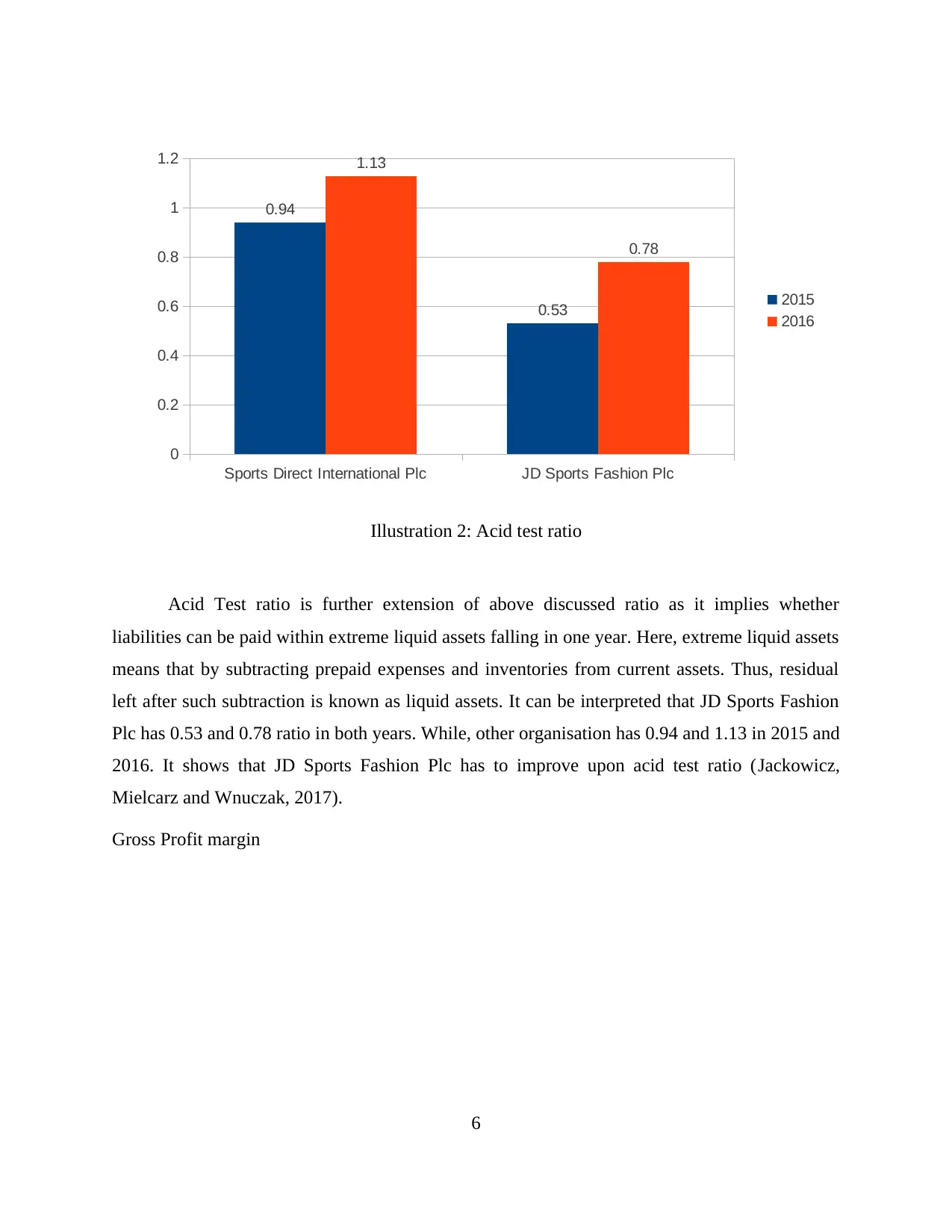

This is a ratio that pertains to profitability aspect of the population in effective way.

Gross profit margin shows whether company has enough gross margin after reducing cost of

sales from revenue. If expenses are more than it is required to initiate control over the same so

that desired profit can be attained. It can be interpreted that Sports-Direct International Plc had

43.81 % in 2015 and 44.23 % in next year. On the other hand, JD Sports Fashion Plc had 48.58%

and 48.54 % in two years respectively (Diltz and Rakowski, 2018). This shows that latter

company has effective gross profit margin. While, former organisation has to reduce

expenditures for attaining more income.

Operating profit margin

7

Sports Direct International Plc JD Sports Fashion Plc

41

42

43

44

45

46

47

48

49

43.81

48.58

44.23

48.54

2015

2016

Illustration 3: Gross profit margin

Gross profit margin shows whether company has enough gross margin after reducing cost of

sales from revenue. If expenses are more than it is required to initiate control over the same so

that desired profit can be attained. It can be interpreted that Sports-Direct International Plc had

43.81 % in 2015 and 44.23 % in next year. On the other hand, JD Sports Fashion Plc had 48.58%

and 48.54 % in two years respectively (Diltz and Rakowski, 2018). This shows that latter

company has effective gross profit margin. While, former organisation has to reduce

expenditures for attaining more income.

Operating profit margin

7

Sports Direct International Plc JD Sports Fashion Plc

41

42

43

44

45

46

47

48

49

43.81

48.58

44.23

48.54

2015

2016

Illustration 3: Gross profit margin

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

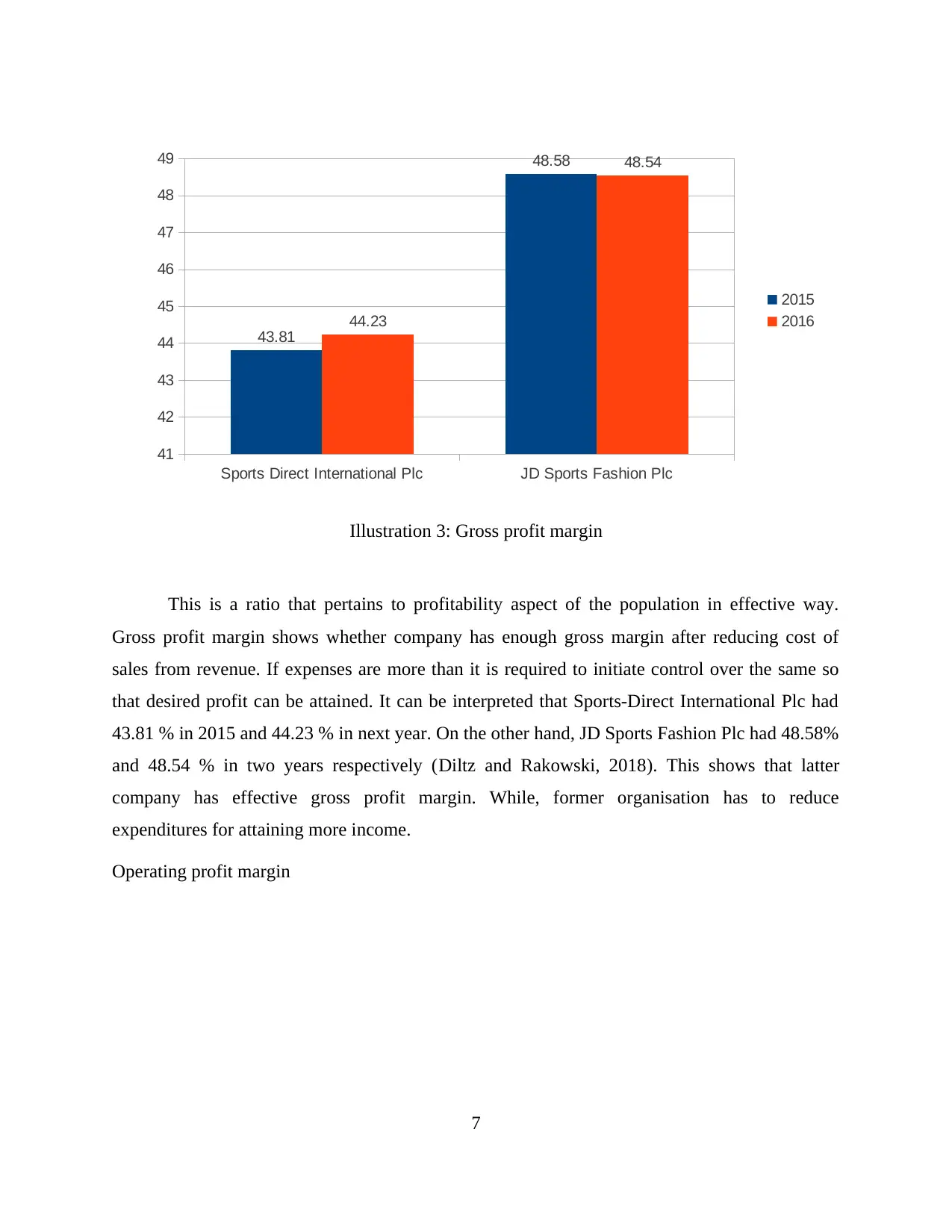

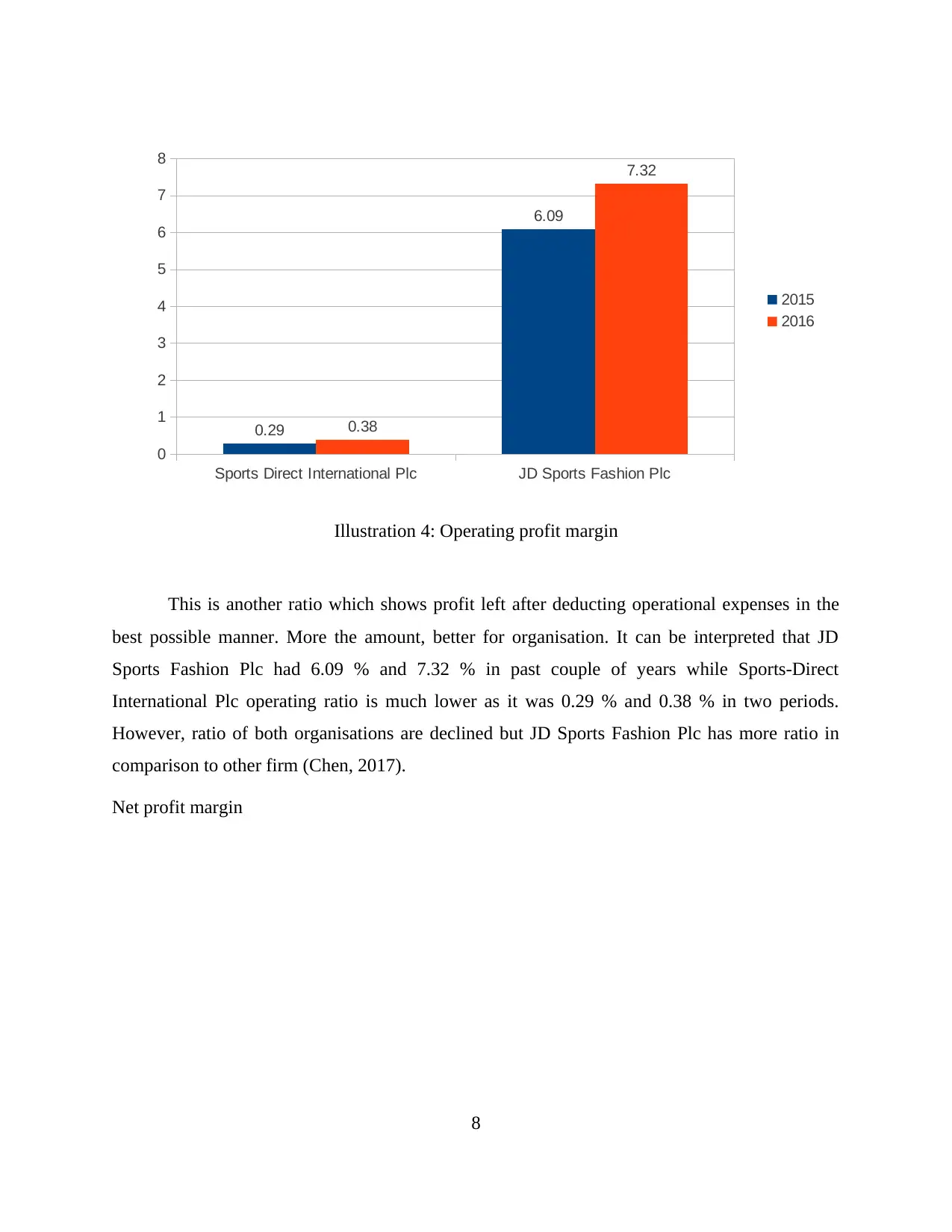

This is another ratio which shows profit left after deducting operational expenses in the

best possible manner. More the amount, better for organisation. It can be interpreted that JD

Sports Fashion Plc had 6.09 % and 7.32 % in past couple of years while Sports-Direct

International Plc operating ratio is much lower as it was 0.29 % and 0.38 % in two periods.

However, ratio of both organisations are declined but JD Sports Fashion Plc has more ratio in

comparison to other firm (Chen, 2017).

Net profit margin

8

Sports Direct International Plc JD Sports Fashion Plc

0

1

2

3

4

5

6

7

8

0.29

6.09

0.38

7.32

2015

2016

Illustration 4: Operating profit margin

best possible manner. More the amount, better for organisation. It can be interpreted that JD

Sports Fashion Plc had 6.09 % and 7.32 % in past couple of years while Sports-Direct

International Plc operating ratio is much lower as it was 0.29 % and 0.38 % in two periods.

However, ratio of both organisations are declined but JD Sports Fashion Plc has more ratio in

comparison to other firm (Chen, 2017).

Net profit margin

8

Sports Direct International Plc JD Sports Fashion Plc

0

1

2

3

4

5

6

7

8

0.29

6.09

0.38

7.32

2015

2016

Illustration 4: Operating profit margin

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

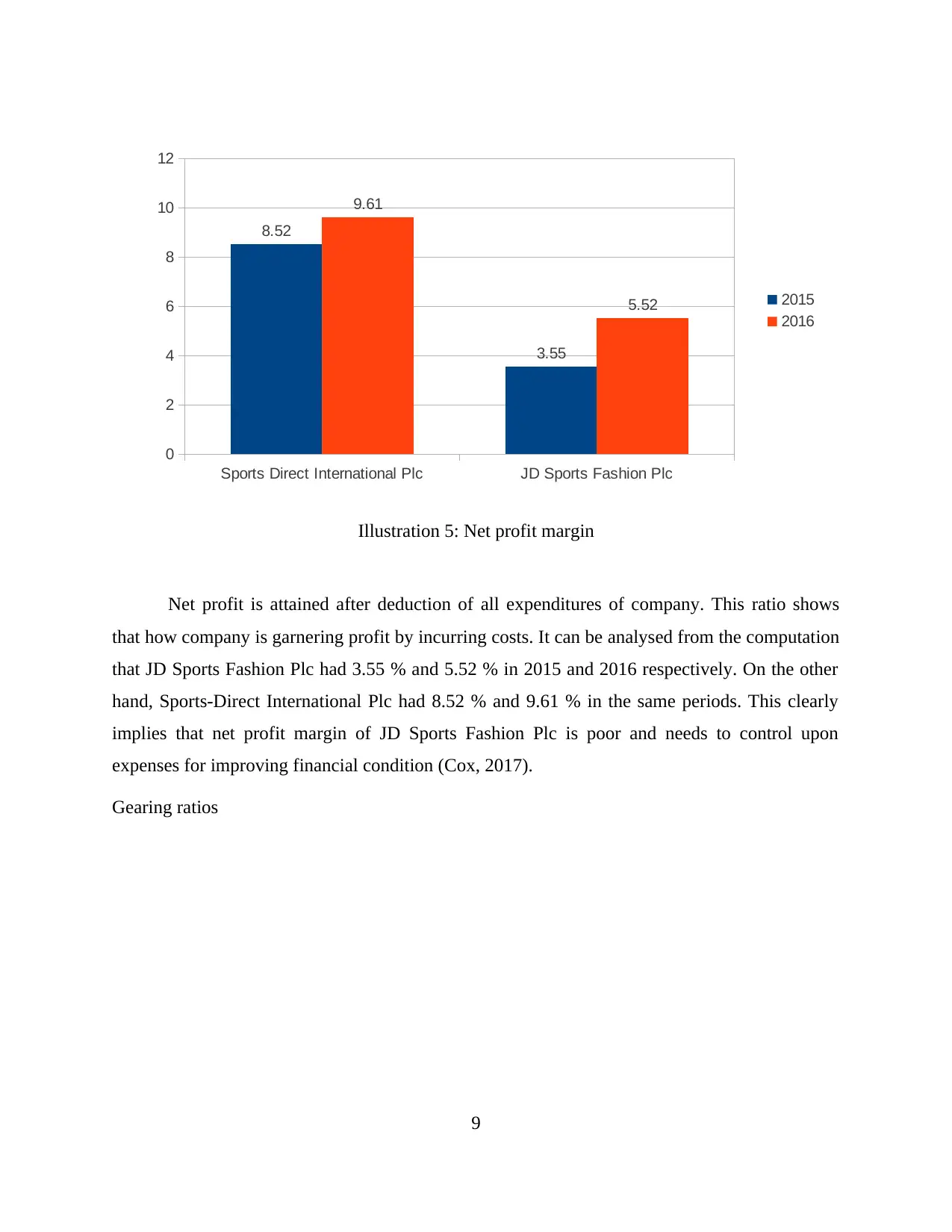

Net profit is attained after deduction of all expenditures of company. This ratio shows

that how company is garnering profit by incurring costs. It can be analysed from the computation

that JD Sports Fashion Plc had 3.55 % and 5.52 % in 2015 and 2016 respectively. On the other

hand, Sports-Direct International Plc had 8.52 % and 9.61 % in the same periods. This clearly

implies that net profit margin of JD Sports Fashion Plc is poor and needs to control upon

expenses for improving financial condition (Cox, 2017).

Gearing ratios

9

Sports Direct International Plc JD Sports Fashion Plc

0

2

4

6

8

10

12

8.52

3.55

9.61

5.52 2015

2016

Illustration 5: Net profit margin

that how company is garnering profit by incurring costs. It can be analysed from the computation

that JD Sports Fashion Plc had 3.55 % and 5.52 % in 2015 and 2016 respectively. On the other

hand, Sports-Direct International Plc had 8.52 % and 9.61 % in the same periods. This clearly

implies that net profit margin of JD Sports Fashion Plc is poor and needs to control upon

expenses for improving financial condition (Cox, 2017).

Gearing ratios

9

Sports Direct International Plc JD Sports Fashion Plc

0

2

4

6

8

10

12

8.52

3.55

9.61

5.52 2015

2016

Illustration 5: Net profit margin

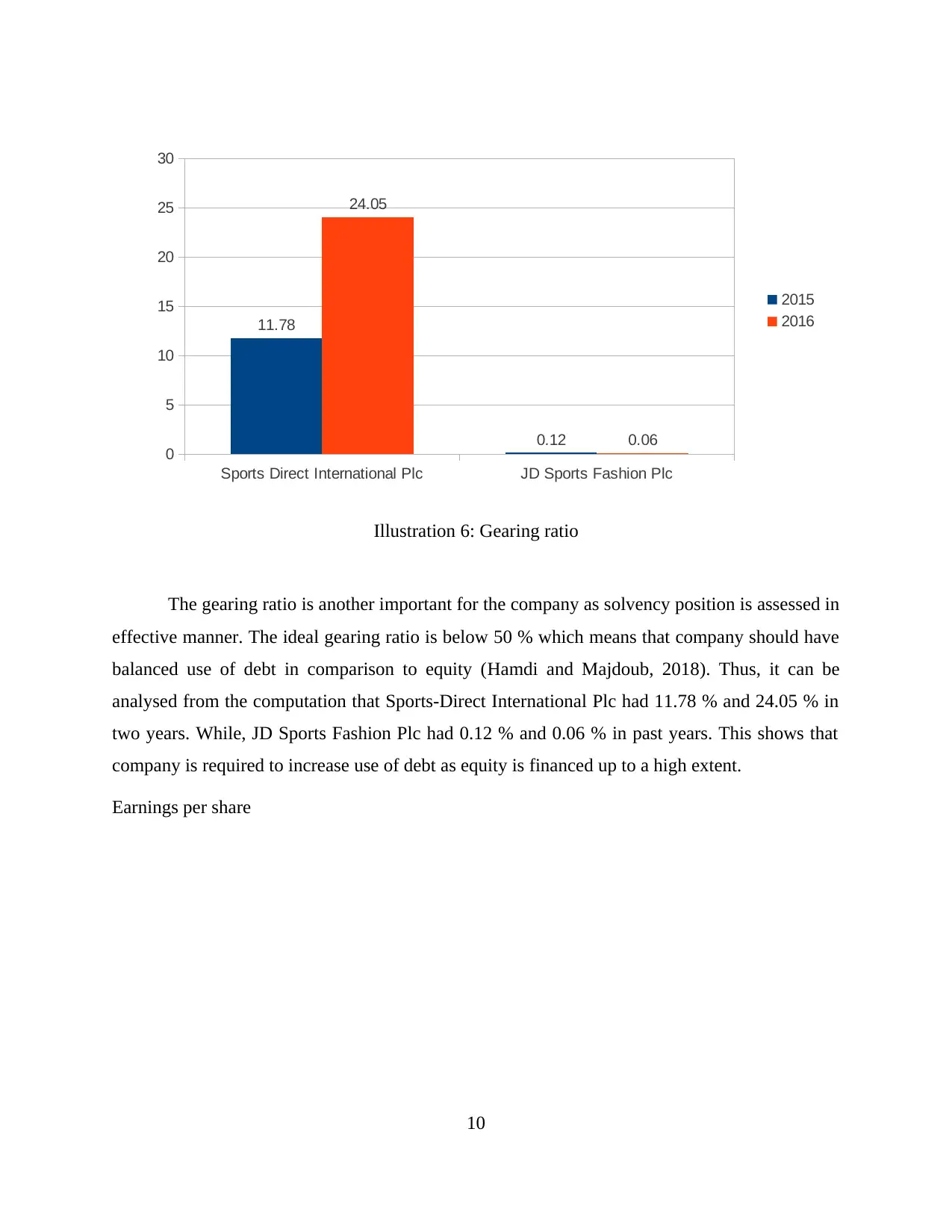

The gearing ratio is another important for the company as solvency position is assessed in

effective manner. The ideal gearing ratio is below 50 % which means that company should have

balanced use of debt in comparison to equity (Hamdi and Majdoub, 2018). Thus, it can be

analysed from the computation that Sports-Direct International Plc had 11.78 % and 24.05 % in

two years. While, JD Sports Fashion Plc had 0.12 % and 0.06 % in past years. This shows that

company is required to increase use of debt as equity is financed up to a high extent.

Earnings per share

10

Sports Direct International Plc JD Sports Fashion Plc

0

5

10

15

20

25

30

11.78

0.12

24.05

0.06

2015

2016

Illustration 6: Gearing ratio

effective manner. The ideal gearing ratio is below 50 % which means that company should have

balanced use of debt in comparison to equity (Hamdi and Majdoub, 2018). Thus, it can be

analysed from the computation that Sports-Direct International Plc had 11.78 % and 24.05 % in

two years. While, JD Sports Fashion Plc had 0.12 % and 0.06 % in past years. This shows that

company is required to increase use of debt as equity is financed up to a high extent.

Earnings per share

10

Sports Direct International Plc JD Sports Fashion Plc

0

5

10

15

20

25

30

11.78

0.12

24.05

0.06

2015

2016

Illustration 6: Gearing ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.