LSBM203 Managerial Finance: Portfolio Analysis and Recommendations

VerifiedAdded on 2022/12/30

|16

|3558

|85

Report

AI Summary

This report provides a comprehensive managerial finance portfolio analysis of Tesco and Sainsburry, focusing on ratio analysis and investment appraisal techniques. The ratio analysis covers key metrics such as current ratio, quick ratio, gross profit ratio, P/E ratio, net profit ratio, capital gearing ratio, return on capital employed, inventory turnover ratio, dividend payout ratio, and earnings per share, comparing the financial performance of both companies in 2018 and 2019. The report interprets these ratios to assess liquidity, solvency, and profitability, and offers recommendations for improvement. Additionally, the report briefly touches upon capital investment appraisal and its limitations for long-term decision-making. Desklib offers a range of study tools and resources, including past papers and solved assignments to support students.

Managerial Financial

Portfolios

Portfolios

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1.................................................................................................................................3

Ratio analysis:..............................................................................................................................3

Interpretation:...............................................................................................................................5

Recommendations:.....................................................................................................................12

Limitations for using ratio analysis for knowing firms financial position:...............................13

PORTFOLIO 2...............................................................................................................................13

Investment appraisal techniques for project A and project B:...................................................13

Interpretation:.............................................................................................................................14

Limitations of using investment appraisal techniques for long term decision-making:............14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1.................................................................................................................................3

Ratio analysis:..............................................................................................................................3

Interpretation:...............................................................................................................................5

Recommendations:.....................................................................................................................12

Limitations for using ratio analysis for knowing firms financial position:...............................13

PORTFOLIO 2...............................................................................................................................13

Investment appraisal techniques for project A and project B:...................................................13

Interpretation:.............................................................................................................................14

Limitations of using investment appraisal techniques for long term decision-making:............14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Finance is describes as activities which are linked with banking, leverage, debt, credit,

money, investments, capital market etc. finance is all about management of money and

arrangement of acquiring funds. Finance is backbone of any organisation as it provides

information and money management for organising activities in the organisation. Managerial

finance is about assessing how financial techniques are being used at various levels for the

company (Addoum, Korniotis and Kumar, 2017). It is management of finance within an

company how well company is using its available resources with its activities. Every firm needed

for money, finance which is used in firms transactions buying and selling assets. The companies

which are selected for this report is Tesco and sainsburry. Tesco is the British multinational

company deals in retail sector, it was founded in 1919, headquarter situated in UK. Sainsburry is

the retailer based company, it was founded in 1869. headquarter situated in UK. This report

covers topics such as ratio analysis of both company, limitations of ratios, graphs for comparing

both companies. Apart from this it also covers topics such as capital investment appraisal,

limitations of this for long term decision-making (Ameer and Othman, 2017).

PORTFOLIO 1

Ratio analysis:

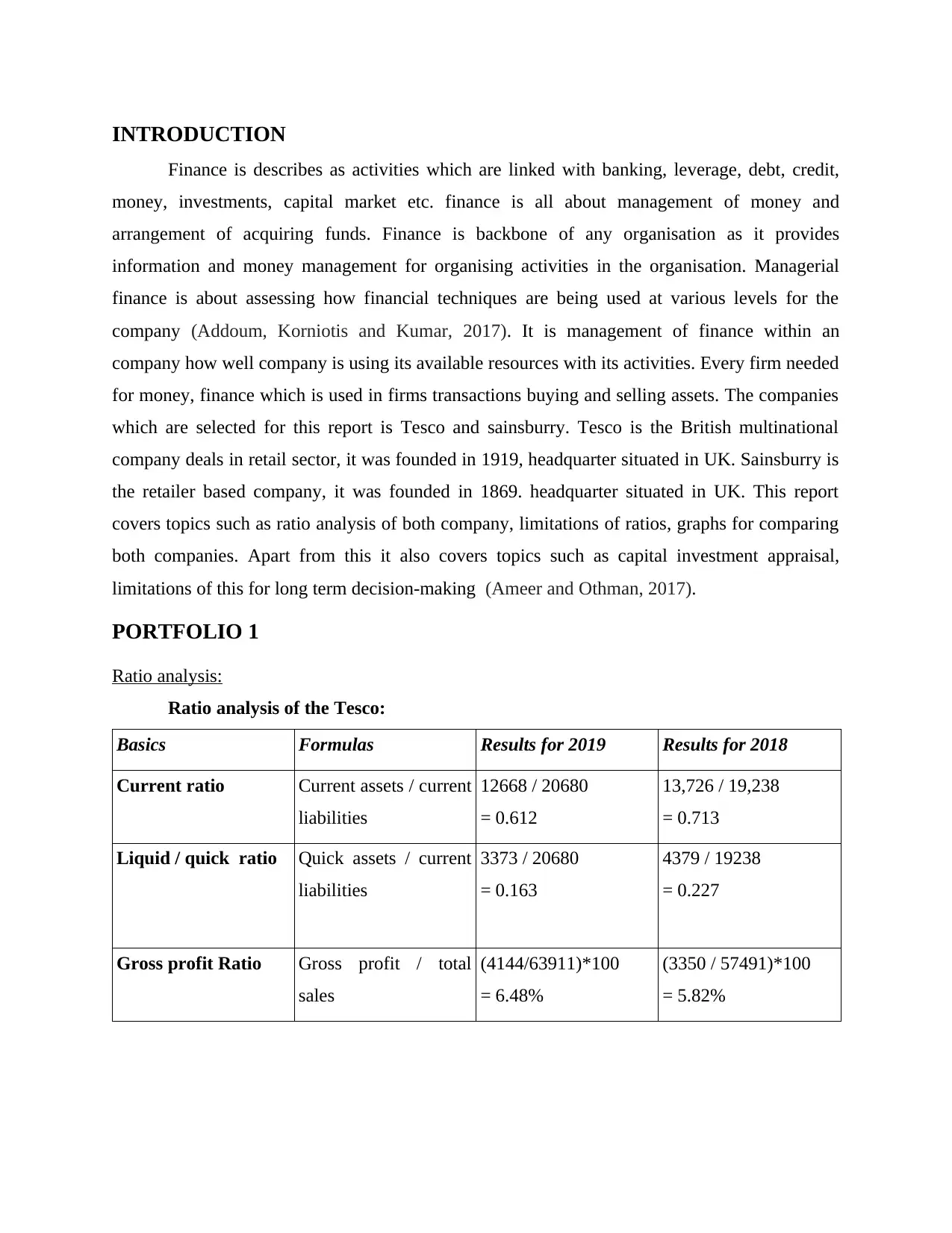

Ratio analysis of the Tesco:

Basics Formulas Results for 2019 Results for 2018

Current ratio Current assets / current

liabilities

12668 / 20680

= 0.612

13,726 / 19,238

= 0.713

Liquid / quick ratio Quick assets / current

liabilities

3373 / 20680

= 0.163

4379 / 19238

= 0.227

Gross profit Ratio Gross profit / total

sales

(4144/63911)*100

= 6.48%

(3350 / 57491)*100

= 5.82%

Finance is describes as activities which are linked with banking, leverage, debt, credit,

money, investments, capital market etc. finance is all about management of money and

arrangement of acquiring funds. Finance is backbone of any organisation as it provides

information and money management for organising activities in the organisation. Managerial

finance is about assessing how financial techniques are being used at various levels for the

company (Addoum, Korniotis and Kumar, 2017). It is management of finance within an

company how well company is using its available resources with its activities. Every firm needed

for money, finance which is used in firms transactions buying and selling assets. The companies

which are selected for this report is Tesco and sainsburry. Tesco is the British multinational

company deals in retail sector, it was founded in 1919, headquarter situated in UK. Sainsburry is

the retailer based company, it was founded in 1869. headquarter situated in UK. This report

covers topics such as ratio analysis of both company, limitations of ratios, graphs for comparing

both companies. Apart from this it also covers topics such as capital investment appraisal,

limitations of this for long term decision-making (Ameer and Othman, 2017).

PORTFOLIO 1

Ratio analysis:

Ratio analysis of the Tesco:

Basics Formulas Results for 2019 Results for 2018

Current ratio Current assets / current

liabilities

12668 / 20680

= 0.612

13,726 / 19,238

= 0.713

Liquid / quick ratio Quick assets / current

liabilities

3373 / 20680

= 0.163

4379 / 19238

= 0.227

Gross profit Ratio Gross profit / total

sales

(4144/63911)*100

= 6.48%

(3350 / 57491)*100

= 5.82%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

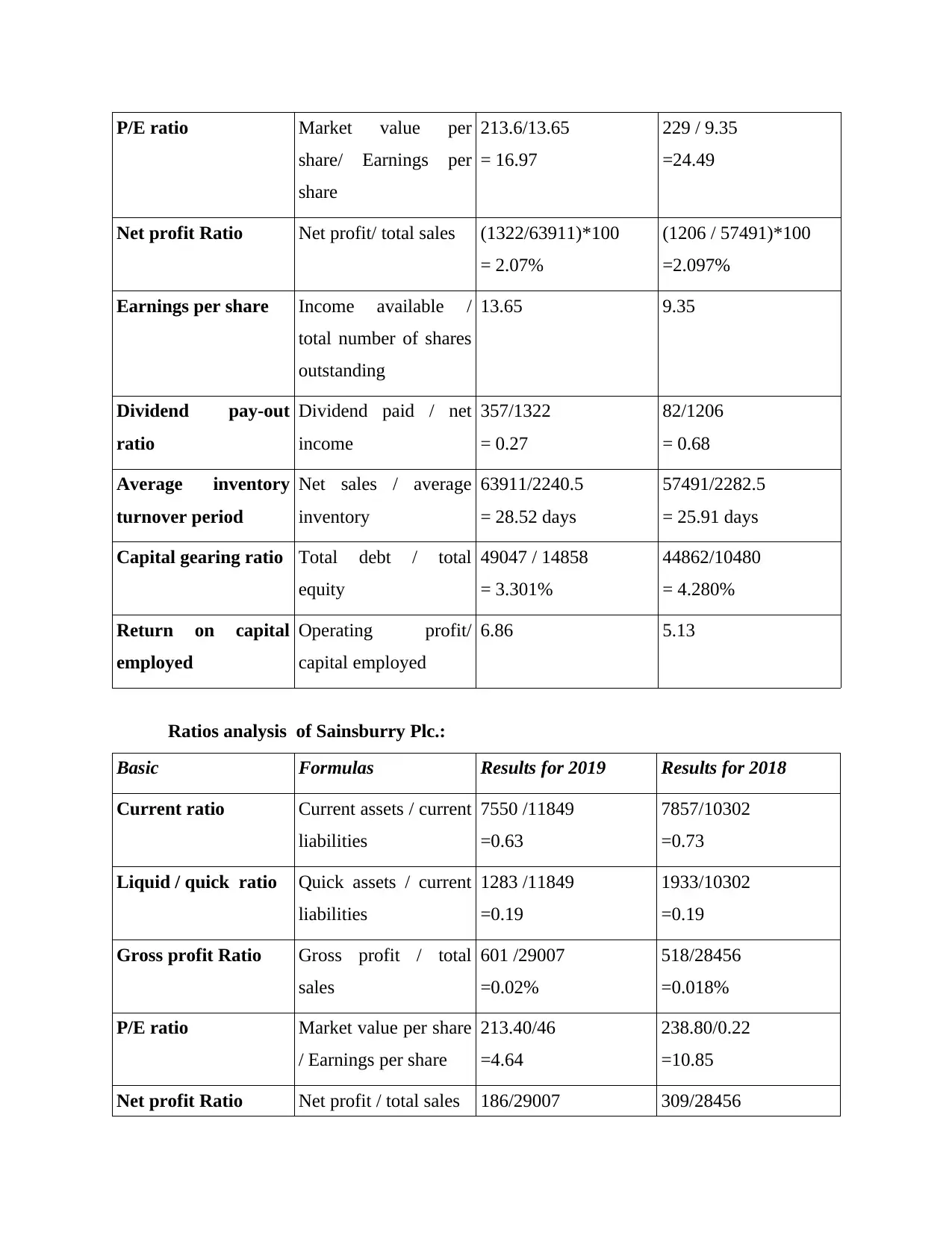

P/E ratio Market value per

share/ Earnings per

share

213.6/13.65

= 16.97

229 / 9.35

=24.49

Net profit Ratio Net profit/ total sales (1322/63911)*100

= 2.07%

(1206 / 57491)*100

=2.097%

Earnings per share Income available /

total number of shares

outstanding

13.65 9.35

Dividend pay-out

ratio

Dividend paid / net

income

357/1322

= 0.27

82/1206

= 0.68

Average inventory

turnover period

Net sales / average

inventory

63911/2240.5

= 28.52 days

57491/2282.5

= 25.91 days

Capital gearing ratio Total debt / total

equity

49047 / 14858

= 3.301%

44862/10480

= 4.280%

Return on capital

employed

Operating profit/

capital employed

6.86 5.13

Ratios analysis of Sainsburry Plc.:

Basic Formulas Results for 2019 Results for 2018

Current ratio Current assets / current

liabilities

7550 /11849

=0.63

7857/10302

=0.73

Liquid / quick ratio Quick assets / current

liabilities

1283 /11849

=0.19

1933/10302

=0.19

Gross profit Ratio Gross profit / total

sales

601 /29007

=0.02%

518/28456

=0.018%

P/E ratio Market value per share

/ Earnings per share

213.40/46

=4.64

238.80/0.22

=10.85

Net profit Ratio Net profit / total sales 186/29007 309/28456

share/ Earnings per

share

213.6/13.65

= 16.97

229 / 9.35

=24.49

Net profit Ratio Net profit/ total sales (1322/63911)*100

= 2.07%

(1206 / 57491)*100

=2.097%

Earnings per share Income available /

total number of shares

outstanding

13.65 9.35

Dividend pay-out

ratio

Dividend paid / net

income

357/1322

= 0.27

82/1206

= 0.68

Average inventory

turnover period

Net sales / average

inventory

63911/2240.5

= 28.52 days

57491/2282.5

= 25.91 days

Capital gearing ratio Total debt / total

equity

49047 / 14858

= 3.301%

44862/10480

= 4.280%

Return on capital

employed

Operating profit/

capital employed

6.86 5.13

Ratios analysis of Sainsburry Plc.:

Basic Formulas Results for 2019 Results for 2018

Current ratio Current assets / current

liabilities

7550 /11849

=0.63

7857/10302

=0.73

Liquid / quick ratio Quick assets / current

liabilities

1283 /11849

=0.19

1933/10302

=0.19

Gross profit Ratio Gross profit / total

sales

601 /29007

=0.02%

518/28456

=0.018%

P/E ratio Market value per share

/ Earnings per share

213.40/46

=4.64

238.80/0.22

=10.85

Net profit Ratio Net profit / total sales 186/29007 309/28456

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=0.006%

=0.11%

Earnings per share Income available /

total number of shares

outstanding

46 22

Dividend pay-out

ratio

Dividend paid / net

income

247/186

=1.33

235/309

=0.76

Capital gearing ratio Total debt / total

equity

97.75 34.44

Average inventory

turnover period

Net sales / average

inventory

29007/1869.5

=15.51 days

28456/1792.5

=15.87 days

Return on capital

employed

Operating profit/

capital employed

3.84 4.65

Interpretation:

Ratio analysis shows liquidity, solvency, profitability of the Tesco and Sainsburry for

knowing its financial positions. As per the above information it shows ratios for Tesco for the

year 2018 and 2019 which shows its financial position in both years (Baker, Kumar and Pandey,

2020). There are various ratios which are calculated for knowing firms financial position.

Analysis of ratios are mentioned below:

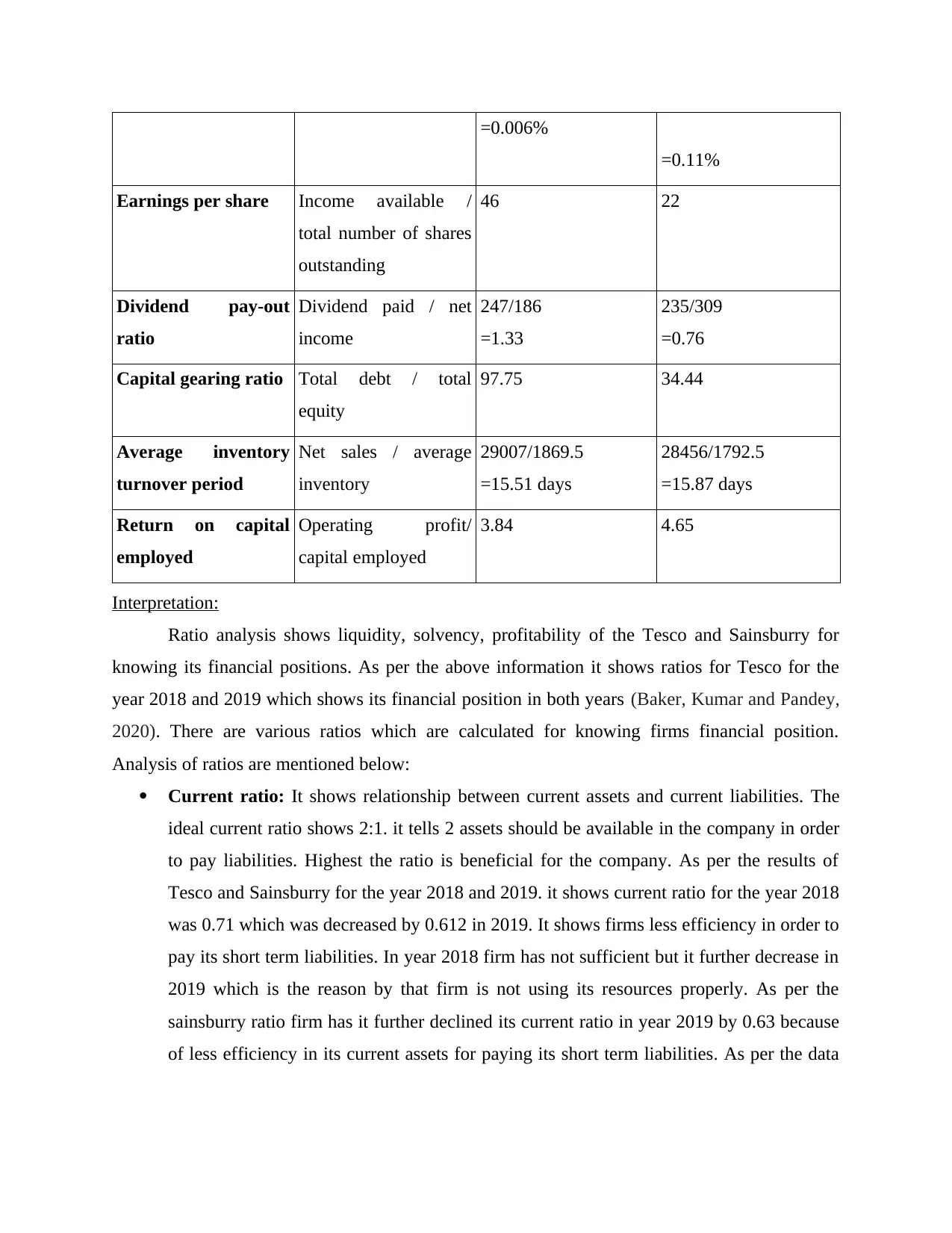

Current ratio: It shows relationship between current assets and current liabilities. The

ideal current ratio shows 2:1. it tells 2 assets should be available in the company in order

to pay liabilities. Highest the ratio is beneficial for the company. As per the results of

Tesco and Sainsburry for the year 2018 and 2019. it shows current ratio for the year 2018

was 0.71 which was decreased by 0.612 in 2019. It shows firms less efficiency in order to

pay its short term liabilities. In year 2018 firm has not sufficient but it further decrease in

2019 which is the reason by that firm is not using its resources properly. As per the

sainsburry ratio firm has it further declined its current ratio in year 2019 by 0.63 because

of less efficiency in its current assets for paying its short term liabilities. As per the data

=0.11%

Earnings per share Income available /

total number of shares

outstanding

46 22

Dividend pay-out

ratio

Dividend paid / net

income

247/186

=1.33

235/309

=0.76

Capital gearing ratio Total debt / total

equity

97.75 34.44

Average inventory

turnover period

Net sales / average

inventory

29007/1869.5

=15.51 days

28456/1792.5

=15.87 days

Return on capital

employed

Operating profit/

capital employed

3.84 4.65

Interpretation:

Ratio analysis shows liquidity, solvency, profitability of the Tesco and Sainsburry for

knowing its financial positions. As per the above information it shows ratios for Tesco for the

year 2018 and 2019 which shows its financial position in both years (Baker, Kumar and Pandey,

2020). There are various ratios which are calculated for knowing firms financial position.

Analysis of ratios are mentioned below:

Current ratio: It shows relationship between current assets and current liabilities. The

ideal current ratio shows 2:1. it tells 2 assets should be available in the company in order

to pay liabilities. Highest the ratio is beneficial for the company. As per the results of

Tesco and Sainsburry for the year 2018 and 2019. it shows current ratio for the year 2018

was 0.71 which was decreased by 0.612 in 2019. It shows firms less efficiency in order to

pay its short term liabilities. In year 2018 firm has not sufficient but it further decrease in

2019 which is the reason by that firm is not using its resources properly. As per the

sainsburry ratio firm has it further declined its current ratio in year 2019 by 0.63 because

of less efficiency in its current assets for paying its short term liabilities. As per the data

of both companies Sainsburry has higher position than Tesco as its ratios liquidity are

more than Tesco for the both years (Blanco-Oliver and Irimia-Diéguez, 2019).

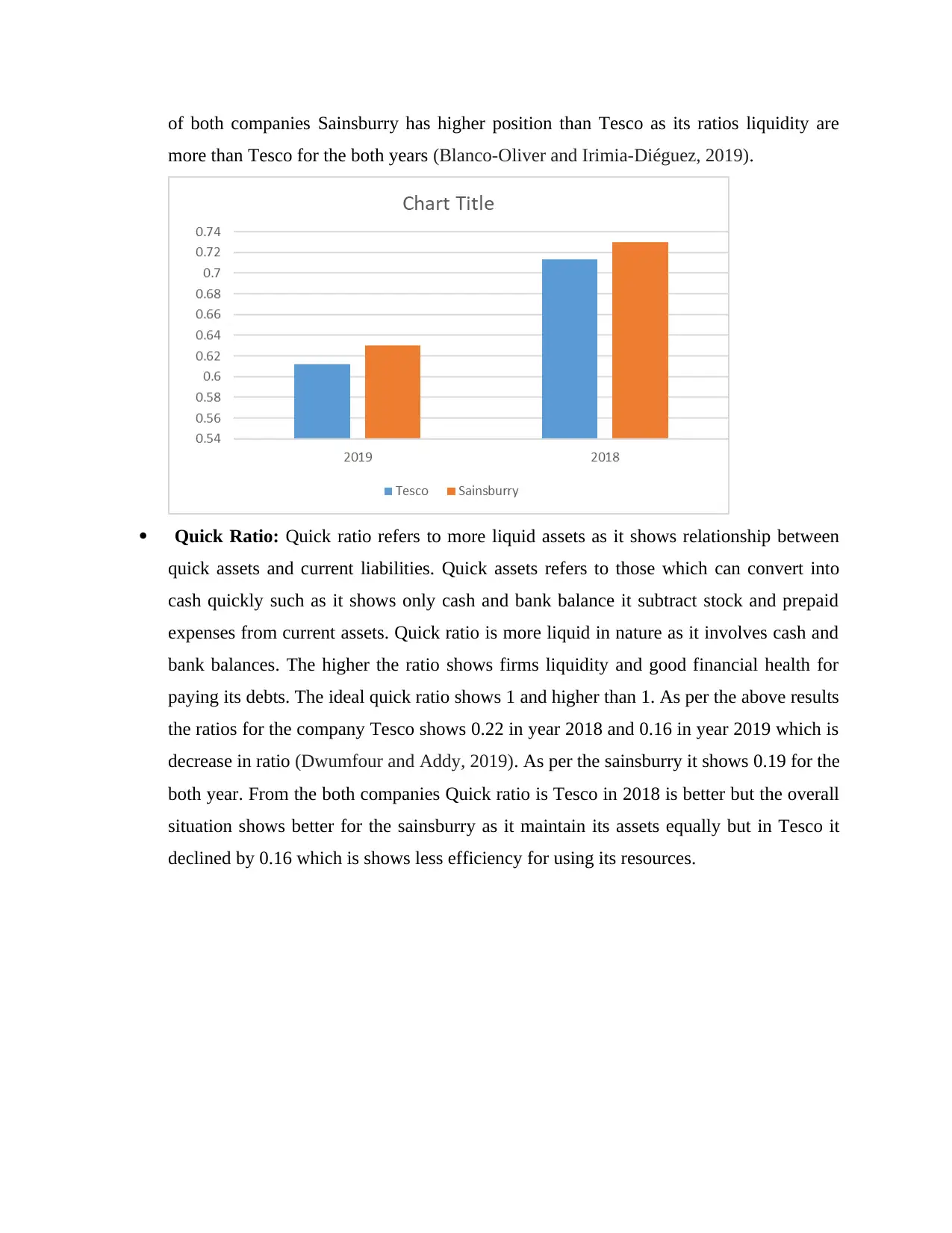

Quick Ratio: Quick ratio refers to more liquid assets as it shows relationship between

quick assets and current liabilities. Quick assets refers to those which can convert into

cash quickly such as it shows only cash and bank balance it subtract stock and prepaid

expenses from current assets. Quick ratio is more liquid in nature as it involves cash and

bank balances. The higher the ratio shows firms liquidity and good financial health for

paying its debts. The ideal quick ratio shows 1 and higher than 1. As per the above results

the ratios for the company Tesco shows 0.22 in year 2018 and 0.16 in year 2019 which is

decrease in ratio (Dwumfour and Addy, 2019). As per the sainsburry it shows 0.19 for the

both year. From the both companies Quick ratio is Tesco in 2018 is better but the overall

situation shows better for the sainsburry as it maintain its assets equally but in Tesco it

declined by 0.16 which is shows less efficiency for using its resources.

more than Tesco for the both years (Blanco-Oliver and Irimia-Diéguez, 2019).

Quick Ratio: Quick ratio refers to more liquid assets as it shows relationship between

quick assets and current liabilities. Quick assets refers to those which can convert into

cash quickly such as it shows only cash and bank balance it subtract stock and prepaid

expenses from current assets. Quick ratio is more liquid in nature as it involves cash and

bank balances. The higher the ratio shows firms liquidity and good financial health for

paying its debts. The ideal quick ratio shows 1 and higher than 1. As per the above results

the ratios for the company Tesco shows 0.22 in year 2018 and 0.16 in year 2019 which is

decrease in ratio (Dwumfour and Addy, 2019). As per the sainsburry it shows 0.19 for the

both year. From the both companies Quick ratio is Tesco in 2018 is better but the overall

situation shows better for the sainsburry as it maintain its assets equally but in Tesco it

declined by 0.16 which is shows less efficiency for using its resources.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

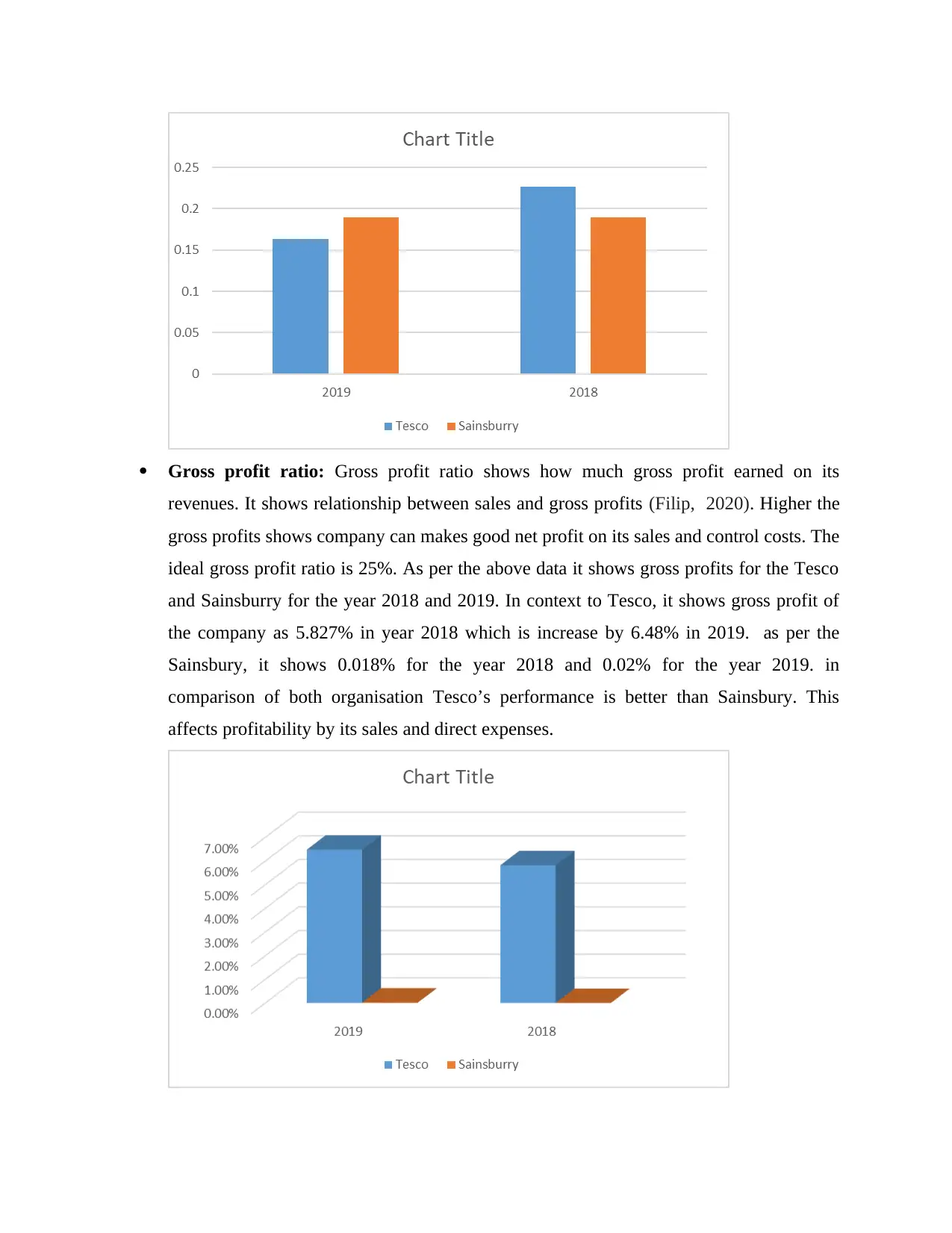

Gross profit ratio: Gross profit ratio shows how much gross profit earned on its

revenues. It shows relationship between sales and gross profits (Filip, 2020). Higher the

gross profits shows company can makes good net profit on its sales and control costs. The

ideal gross profit ratio is 25%. As per the above data it shows gross profits for the Tesco

and Sainsburry for the year 2018 and 2019. In context to Tesco, it shows gross profit of

the company as 5.827% in year 2018 which is increase by 6.48% in 2019. as per the

Sainsbury, it shows 0.018% for the year 2018 and 0.02% for the year 2019. in

comparison of both organisation Tesco’s performance is better than Sainsbury. This

affects profitability by its sales and direct expenses.

revenues. It shows relationship between sales and gross profits (Filip, 2020). Higher the

gross profits shows company can makes good net profit on its sales and control costs. The

ideal gross profit ratio is 25%. As per the above data it shows gross profits for the Tesco

and Sainsburry for the year 2018 and 2019. In context to Tesco, it shows gross profit of

the company as 5.827% in year 2018 which is increase by 6.48% in 2019. as per the

Sainsbury, it shows 0.018% for the year 2018 and 0.02% for the year 2019. in

comparison of both organisation Tesco’s performance is better than Sainsbury. This

affects profitability by its sales and direct expenses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

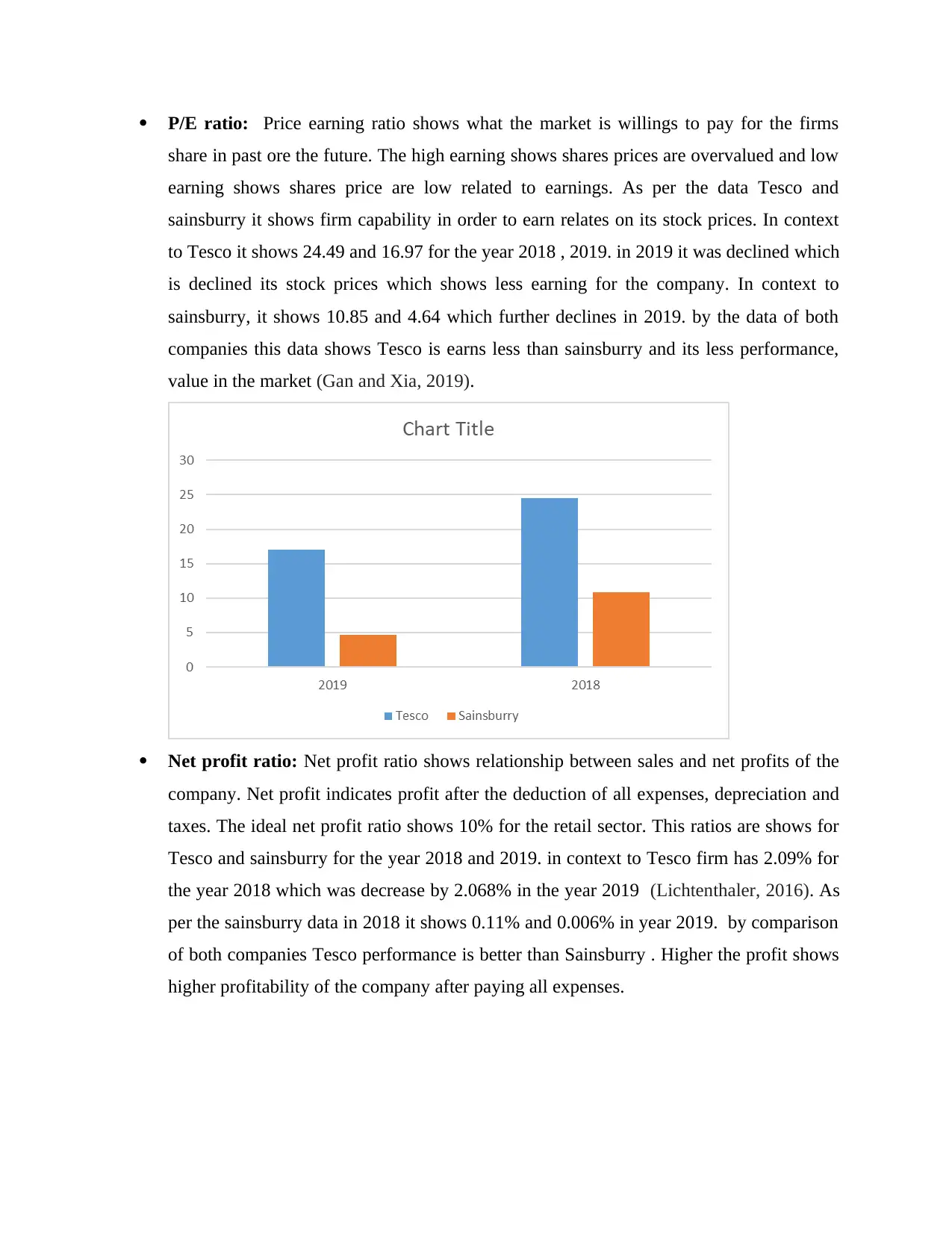

P/E ratio: Price earning ratio shows what the market is willings to pay for the firms

share in past ore the future. The high earning shows shares prices are overvalued and low

earning shows shares price are low related to earnings. As per the data Tesco and

sainsburry it shows firm capability in order to earn relates on its stock prices. In context

to Tesco it shows 24.49 and 16.97 for the year 2018 , 2019. in 2019 it was declined which

is declined its stock prices which shows less earning for the company. In context to

sainsburry, it shows 10.85 and 4.64 which further declines in 2019. by the data of both

companies this data shows Tesco is earns less than sainsburry and its less performance,

value in the market (Gan and Xia, 2019).

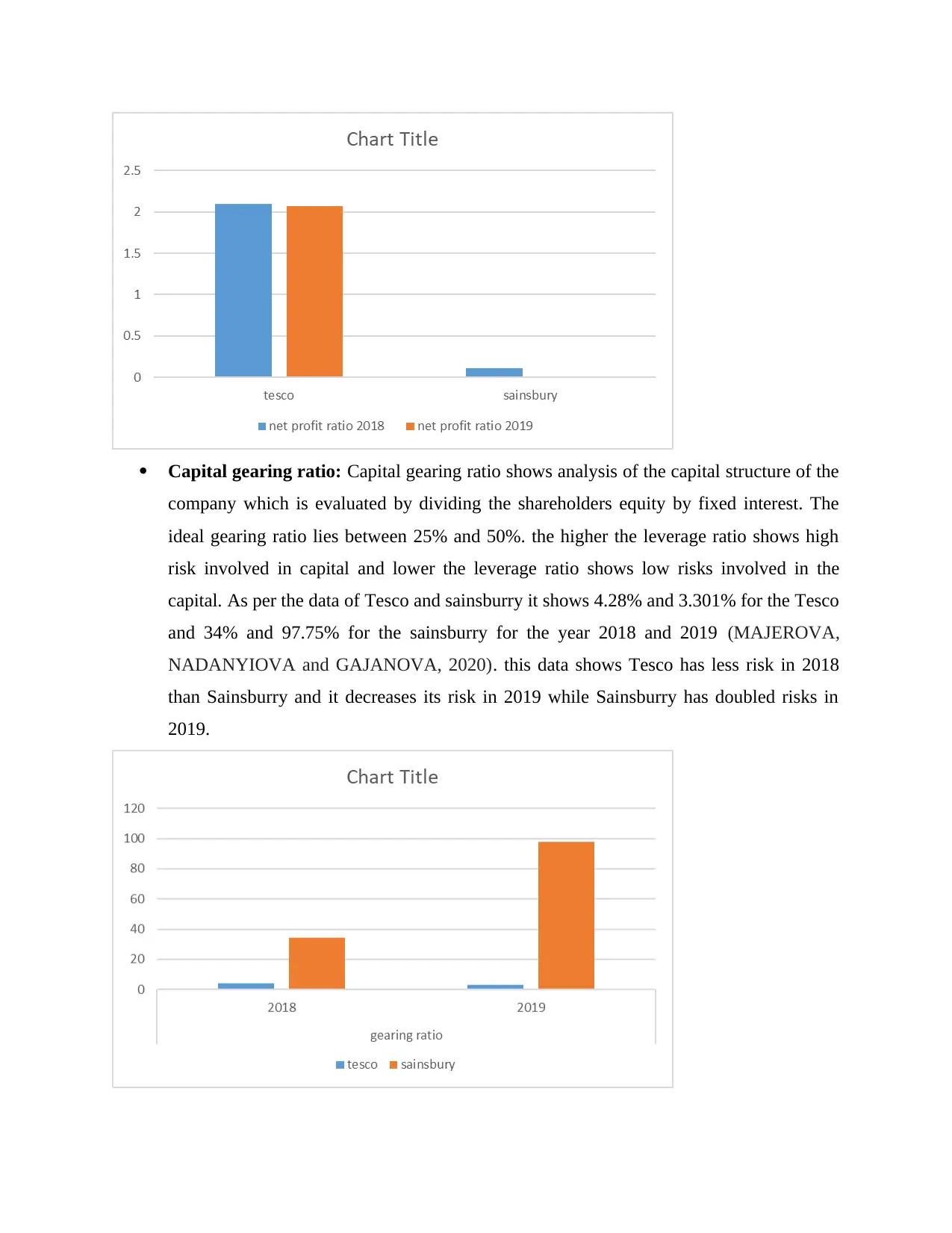

Net profit ratio: Net profit ratio shows relationship between sales and net profits of the

company. Net profit indicates profit after the deduction of all expenses, depreciation and

taxes. The ideal net profit ratio shows 10% for the retail sector. This ratios are shows for

Tesco and sainsburry for the year 2018 and 2019. in context to Tesco firm has 2.09% for

the year 2018 which was decrease by 2.068% in the year 2019 (Lichtenthaler, 2016). As

per the sainsburry data in 2018 it shows 0.11% and 0.006% in year 2019. by comparison

of both companies Tesco performance is better than Sainsburry . Higher the profit shows

higher profitability of the company after paying all expenses.

share in past ore the future. The high earning shows shares prices are overvalued and low

earning shows shares price are low related to earnings. As per the data Tesco and

sainsburry it shows firm capability in order to earn relates on its stock prices. In context

to Tesco it shows 24.49 and 16.97 for the year 2018 , 2019. in 2019 it was declined which

is declined its stock prices which shows less earning for the company. In context to

sainsburry, it shows 10.85 and 4.64 which further declines in 2019. by the data of both

companies this data shows Tesco is earns less than sainsburry and its less performance,

value in the market (Gan and Xia, 2019).

Net profit ratio: Net profit ratio shows relationship between sales and net profits of the

company. Net profit indicates profit after the deduction of all expenses, depreciation and

taxes. The ideal net profit ratio shows 10% for the retail sector. This ratios are shows for

Tesco and sainsburry for the year 2018 and 2019. in context to Tesco firm has 2.09% for

the year 2018 which was decrease by 2.068% in the year 2019 (Lichtenthaler, 2016). As

per the sainsburry data in 2018 it shows 0.11% and 0.006% in year 2019. by comparison

of both companies Tesco performance is better than Sainsburry . Higher the profit shows

higher profitability of the company after paying all expenses.

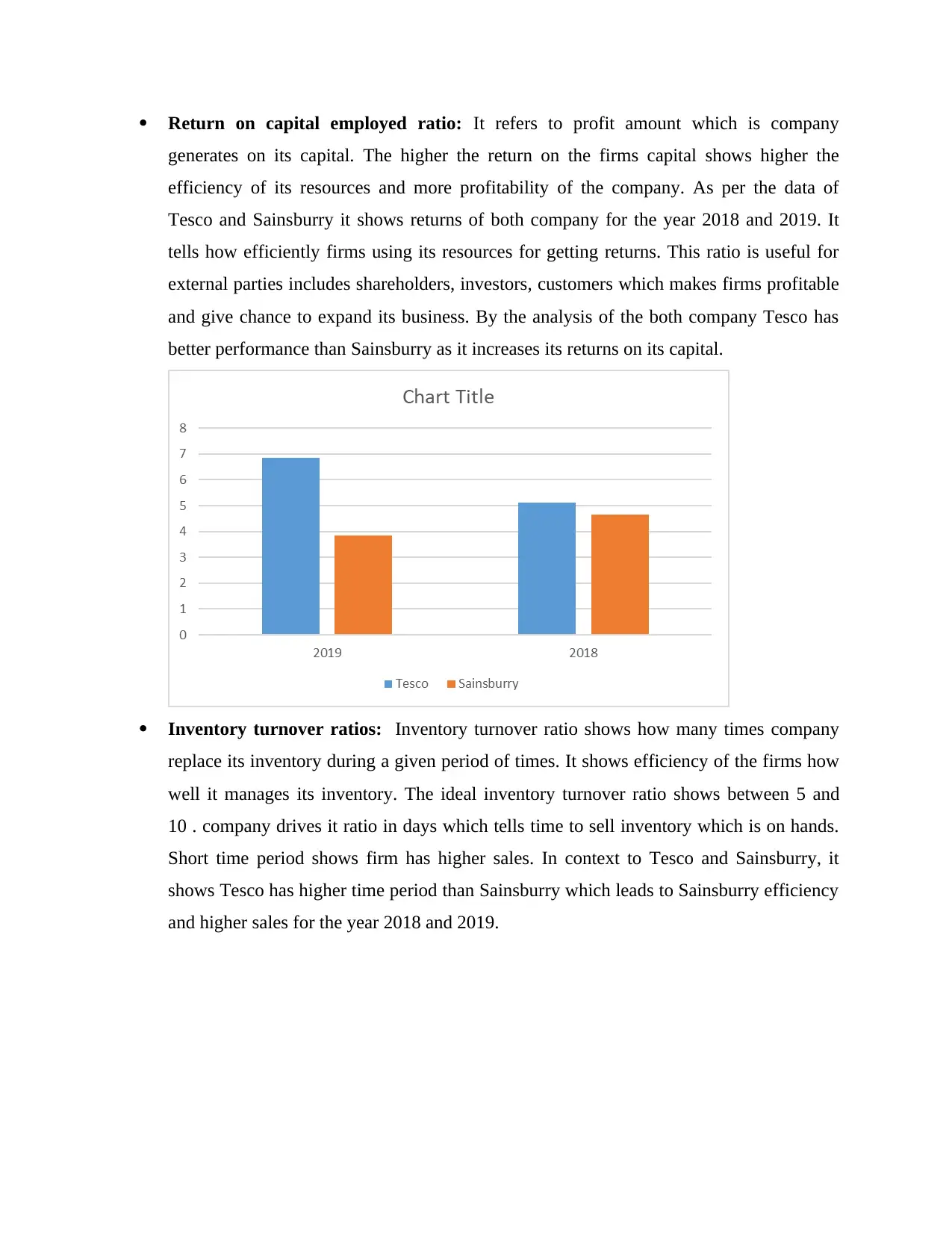

Capital gearing ratio: Capital gearing ratio shows analysis of the capital structure of the

company which is evaluated by dividing the shareholders equity by fixed interest. The

ideal gearing ratio lies between 25% and 50%. the higher the leverage ratio shows high

risk involved in capital and lower the leverage ratio shows low risks involved in the

capital. As per the data of Tesco and sainsburry it shows 4.28% and 3.301% for the Tesco

and 34% and 97.75% for the sainsburry for the year 2018 and 2019 (MAJEROVA,

NADANYIOVA and GAJANOVA, 2020). this data shows Tesco has less risk in 2018

than Sainsburry and it decreases its risk in 2019 while Sainsburry has doubled risks in

2019.

company which is evaluated by dividing the shareholders equity by fixed interest. The

ideal gearing ratio lies between 25% and 50%. the higher the leverage ratio shows high

risk involved in capital and lower the leverage ratio shows low risks involved in the

capital. As per the data of Tesco and sainsburry it shows 4.28% and 3.301% for the Tesco

and 34% and 97.75% for the sainsburry for the year 2018 and 2019 (MAJEROVA,

NADANYIOVA and GAJANOVA, 2020). this data shows Tesco has less risk in 2018

than Sainsburry and it decreases its risk in 2019 while Sainsburry has doubled risks in

2019.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

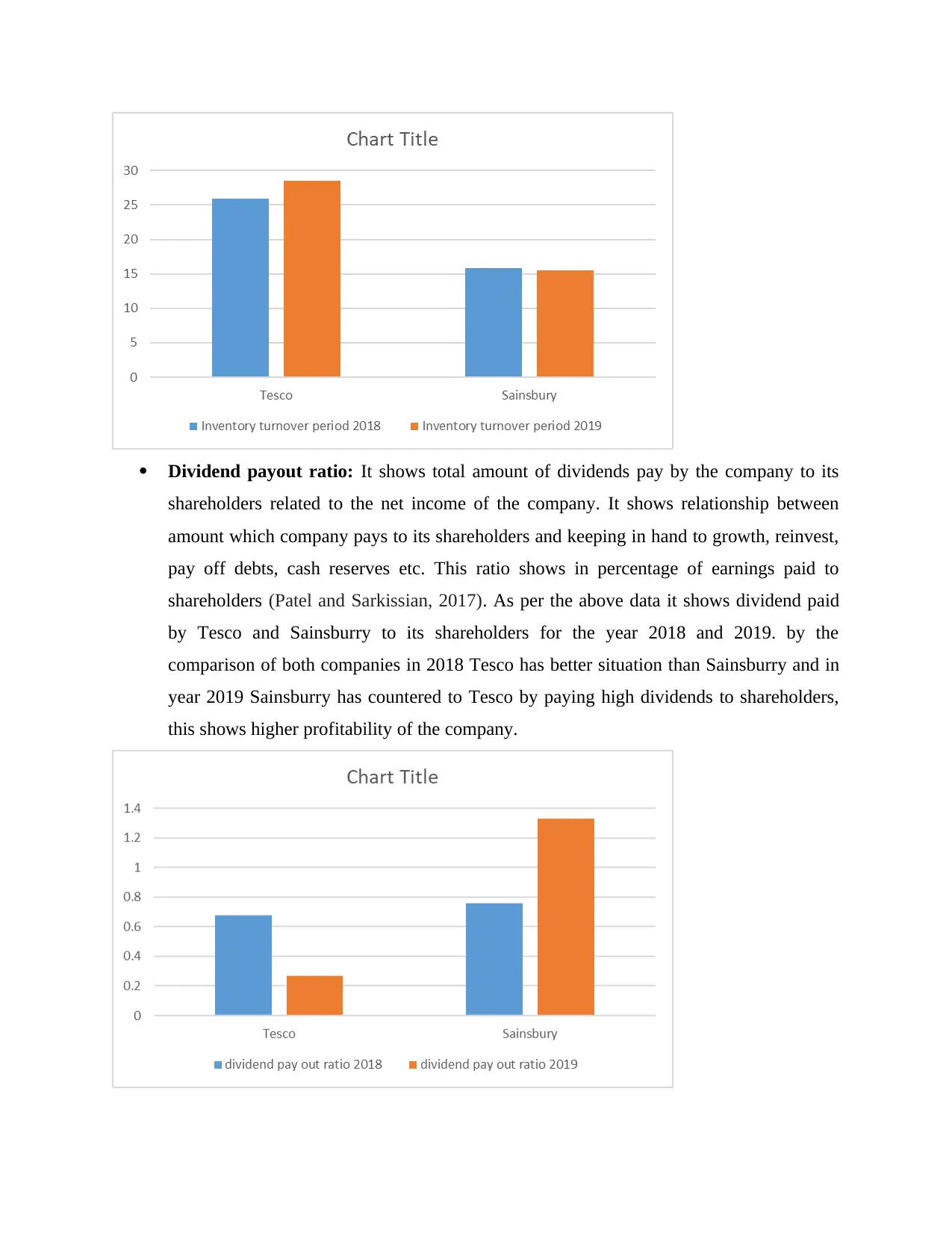

Return on capital employed ratio: It refers to profit amount which is company

generates on its capital. The higher the return on the firms capital shows higher the

efficiency of its resources and more profitability of the company. As per the data of

Tesco and Sainsburry it shows returns of both company for the year 2018 and 2019. It

tells how efficiently firms using its resources for getting returns. This ratio is useful for

external parties includes shareholders, investors, customers which makes firms profitable

and give chance to expand its business. By the analysis of the both company Tesco has

better performance than Sainsburry as it increases its returns on its capital.

Inventory turnover ratios: Inventory turnover ratio shows how many times company

replace its inventory during a given period of times. It shows efficiency of the firms how

well it manages its inventory. The ideal inventory turnover ratio shows between 5 and

10 . company drives it ratio in days which tells time to sell inventory which is on hands.

Short time period shows firm has higher sales. In context to Tesco and Sainsburry, it

shows Tesco has higher time period than Sainsburry which leads to Sainsburry efficiency

and higher sales for the year 2018 and 2019.

generates on its capital. The higher the return on the firms capital shows higher the

efficiency of its resources and more profitability of the company. As per the data of

Tesco and Sainsburry it shows returns of both company for the year 2018 and 2019. It

tells how efficiently firms using its resources for getting returns. This ratio is useful for

external parties includes shareholders, investors, customers which makes firms profitable

and give chance to expand its business. By the analysis of the both company Tesco has

better performance than Sainsburry as it increases its returns on its capital.

Inventory turnover ratios: Inventory turnover ratio shows how many times company

replace its inventory during a given period of times. It shows efficiency of the firms how

well it manages its inventory. The ideal inventory turnover ratio shows between 5 and

10 . company drives it ratio in days which tells time to sell inventory which is on hands.

Short time period shows firm has higher sales. In context to Tesco and Sainsburry, it

shows Tesco has higher time period than Sainsburry which leads to Sainsburry efficiency

and higher sales for the year 2018 and 2019.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

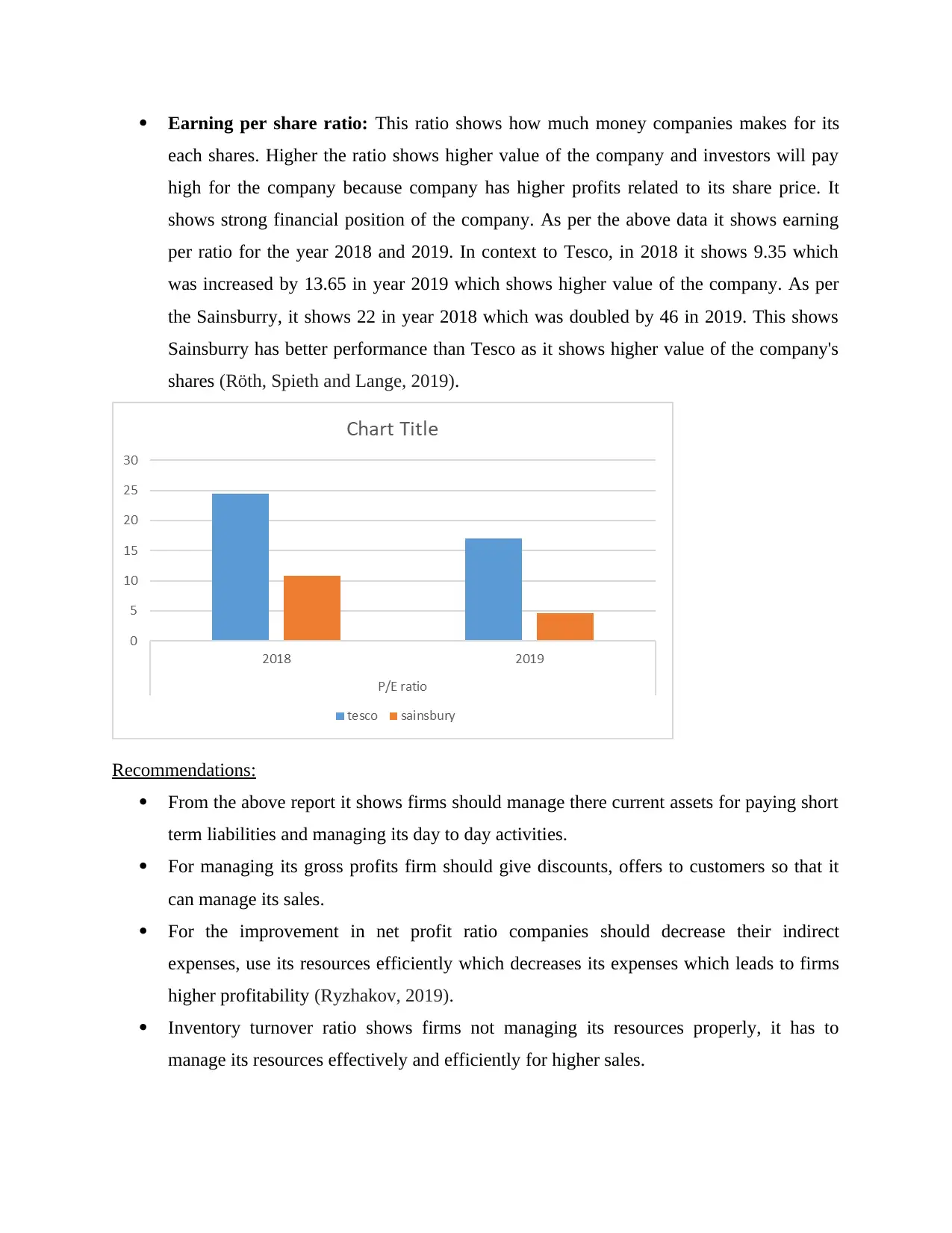

Dividend payout ratio: It shows total amount of dividends pay by the company to its

shareholders related to the net income of the company. It shows relationship between

amount which company pays to its shareholders and keeping in hand to growth, reinvest,

pay off debts, cash reserves etc. This ratio shows in percentage of earnings paid to

shareholders (Patel and Sarkissian, 2017). As per the above data it shows dividend paid

by Tesco and Sainsburry to its shareholders for the year 2018 and 2019. by the

comparison of both companies in 2018 Tesco has better situation than Sainsburry and in

year 2019 Sainsburry has countered to Tesco by paying high dividends to shareholders,

this shows higher profitability of the company.

shareholders related to the net income of the company. It shows relationship between

amount which company pays to its shareholders and keeping in hand to growth, reinvest,

pay off debts, cash reserves etc. This ratio shows in percentage of earnings paid to

shareholders (Patel and Sarkissian, 2017). As per the above data it shows dividend paid

by Tesco and Sainsburry to its shareholders for the year 2018 and 2019. by the

comparison of both companies in 2018 Tesco has better situation than Sainsburry and in

year 2019 Sainsburry has countered to Tesco by paying high dividends to shareholders,

this shows higher profitability of the company.

Earning per share ratio: This ratio shows how much money companies makes for its

each shares. Higher the ratio shows higher value of the company and investors will pay

high for the company because company has higher profits related to its share price. It

shows strong financial position of the company. As per the above data it shows earning

per ratio for the year 2018 and 2019. In context to Tesco, in 2018 it shows 9.35 which

was increased by 13.65 in year 2019 which shows higher value of the company. As per

the Sainsburry, it shows 22 in year 2018 which was doubled by 46 in 2019. This shows

Sainsburry has better performance than Tesco as it shows higher value of the company's

shares (Röth, Spieth and Lange, 2019).

Recommendations:

From the above report it shows firms should manage there current assets for paying short

term liabilities and managing its day to day activities.

For managing its gross profits firm should give discounts, offers to customers so that it

can manage its sales.

For the improvement in net profit ratio companies should decrease their indirect

expenses, use its resources efficiently which decreases its expenses which leads to firms

higher profitability (Ryzhakov, 2019).

Inventory turnover ratio shows firms not managing its resources properly, it has to

manage its resources effectively and efficiently for higher sales.

each shares. Higher the ratio shows higher value of the company and investors will pay

high for the company because company has higher profits related to its share price. It

shows strong financial position of the company. As per the above data it shows earning

per ratio for the year 2018 and 2019. In context to Tesco, in 2018 it shows 9.35 which

was increased by 13.65 in year 2019 which shows higher value of the company. As per

the Sainsburry, it shows 22 in year 2018 which was doubled by 46 in 2019. This shows

Sainsburry has better performance than Tesco as it shows higher value of the company's

shares (Röth, Spieth and Lange, 2019).

Recommendations:

From the above report it shows firms should manage there current assets for paying short

term liabilities and managing its day to day activities.

For managing its gross profits firm should give discounts, offers to customers so that it

can manage its sales.

For the improvement in net profit ratio companies should decrease their indirect

expenses, use its resources efficiently which decreases its expenses which leads to firms

higher profitability (Ryzhakov, 2019).

Inventory turnover ratio shows firms not managing its resources properly, it has to

manage its resources effectively and efficiently for higher sales.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.