Financial Report: Sky Cafe Budgeting and Variance Analysis

VerifiedAdded on 2023/01/17

|9

|1946

|42

Report

AI Summary

This report examines the financial performance of Sky Cafe, an independent cafe near London Gatwick Airport, focusing on budgeting and variance analysis for the month of July 2018. The report begins by outlining the objectives of budget preparation, such as providing structure, predicting cash flows, allocating resources, and measuring performance. It then conducts a detailed variance analysis of revenue and expenses, comparing budgeted figures with actual results. The analysis reveals adverse variances in revenue due to lower-than-expected sales and identifies contributing factors such as inaccurate forecasting of fixed expenses, particularly facility rent, and reduced sales volume. The report also highlights the impact of variable costs like raw materials and wages. The report concludes with several recommendations for improving financial performance, including negotiating costs, securing long-term agreements, enhancing employee training and motivation, and utilizing marketing tools to increase sales. The report emphasizes the importance of variance analysis as a crucial tool for business performance evaluation and decision-making.

Managing Finance & HR for

Sustainable Business Success

Sustainable Business Success

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Sky Café has lately been garnering attention for its unique taste, concept and idea. In the report,

the importance of budgets will be highlighted along with the discussion on the variance analysis

and its importance and assistance in the financial decision making. Figures from the financial

statements of Sky Café will be taken and variance analysis will be done.

Sky Café has lately been garnering attention for its unique taste, concept and idea. In the report,

the importance of budgets will be highlighted along with the discussion on the variance analysis

and its importance and assistance in the financial decision making. Figures from the financial

statements of Sky Café will be taken and variance analysis will be done.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

a. Objectives of framing budget...................................................................................................4

b. Variance analysis of revenue and the spending.......................................................................5

c....................................................................................................................................................6

d...................................................................................................................................................7

REFERENCES................................................................................................................................1

EXECUTIVE SUMMARY.............................................................................................................2

a. Objectives of framing budget...................................................................................................4

b. Variance analysis of revenue and the spending.......................................................................5

c....................................................................................................................................................6

d...................................................................................................................................................7

REFERENCES................................................................................................................................1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sky Café is located near London Gatwick Airport and this independent café shop opened in the

year 2016. The unique characteristic of serving the homemade food and local delicacies sets the

café a bar apart from its competitors who are mainly the food and beverage chains (Chiu & Choi,

2016). In this report, the objectives behind budget preparation has been highlighted and the

variance analysis if the company for the month of July will be conducted and appropriate

analysis and recommendation will be made.

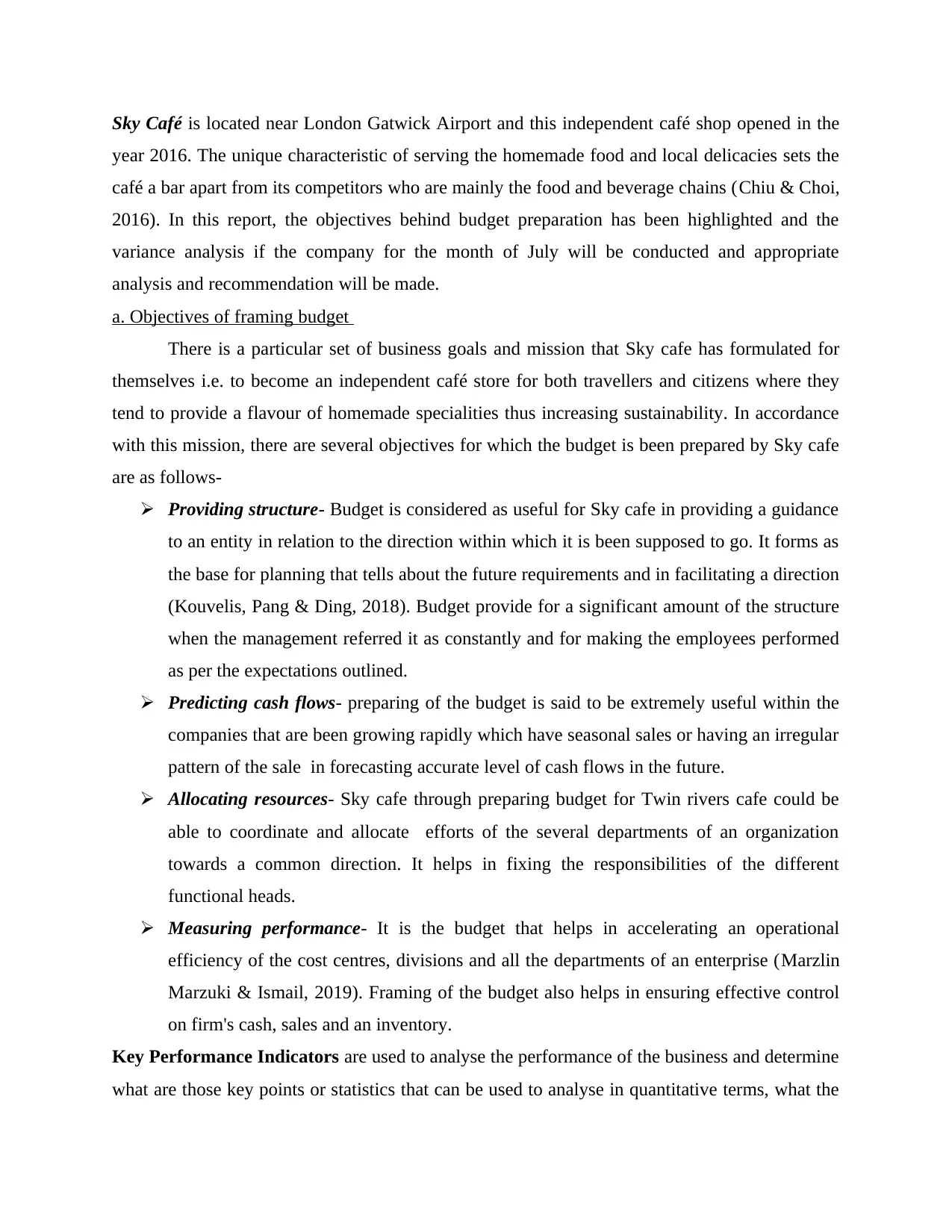

a. Objectives of framing budget

There is a particular set of business goals and mission that Sky cafe has formulated for

themselves i.e. to become an independent café store for both travellers and citizens where they

tend to provide a flavour of homemade specialities thus increasing sustainability. In accordance

with this mission, there are several objectives for which the budget is been prepared by Sky cafe

are as follows-

Providing structure- Budget is considered as useful for Sky cafe in providing a guidance

to an entity in relation to the direction within which it is been supposed to go. It forms as

the base for planning that tells about the future requirements and in facilitating a direction

(Kouvelis, Pang & Ding, 2018). Budget provide for a significant amount of the structure

when the management referred it as constantly and for making the employees performed

as per the expectations outlined.

Predicting cash flows- preparing of the budget is said to be extremely useful within the

companies that are been growing rapidly which have seasonal sales or having an irregular

pattern of the sale in forecasting accurate level of cash flows in the future.

Allocating resources- Sky cafe through preparing budget for Twin rivers cafe could be

able to coordinate and allocate efforts of the several departments of an organization

towards a common direction. It helps in fixing the responsibilities of the different

functional heads.

Measuring performance- It is the budget that helps in accelerating an operational

efficiency of the cost centres, divisions and all the departments of an enterprise (Marzlin

Marzuki & Ismail, 2019). Framing of the budget also helps in ensuring effective control

on firm's cash, sales and an inventory.

Key Performance Indicators are used to analyse the performance of the business and determine

what are those key points or statistics that can be used to analyse in quantitative terms, what the

year 2016. The unique characteristic of serving the homemade food and local delicacies sets the

café a bar apart from its competitors who are mainly the food and beverage chains (Chiu & Choi,

2016). In this report, the objectives behind budget preparation has been highlighted and the

variance analysis if the company for the month of July will be conducted and appropriate

analysis and recommendation will be made.

a. Objectives of framing budget

There is a particular set of business goals and mission that Sky cafe has formulated for

themselves i.e. to become an independent café store for both travellers and citizens where they

tend to provide a flavour of homemade specialities thus increasing sustainability. In accordance

with this mission, there are several objectives for which the budget is been prepared by Sky cafe

are as follows-

Providing structure- Budget is considered as useful for Sky cafe in providing a guidance

to an entity in relation to the direction within which it is been supposed to go. It forms as

the base for planning that tells about the future requirements and in facilitating a direction

(Kouvelis, Pang & Ding, 2018). Budget provide for a significant amount of the structure

when the management referred it as constantly and for making the employees performed

as per the expectations outlined.

Predicting cash flows- preparing of the budget is said to be extremely useful within the

companies that are been growing rapidly which have seasonal sales or having an irregular

pattern of the sale in forecasting accurate level of cash flows in the future.

Allocating resources- Sky cafe through preparing budget for Twin rivers cafe could be

able to coordinate and allocate efforts of the several departments of an organization

towards a common direction. It helps in fixing the responsibilities of the different

functional heads.

Measuring performance- It is the budget that helps in accelerating an operational

efficiency of the cost centres, divisions and all the departments of an enterprise (Marzlin

Marzuki & Ismail, 2019). Framing of the budget also helps in ensuring effective control

on firm's cash, sales and an inventory.

Key Performance Indicators are used to analyse the performance of the business and determine

what are those key points or statistics that can be used to analyse in quantitative terms, what the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

performance of business has been. It also helps in meeting the objectives of the company and

anything that is of relevance to the company can be categorised as a KPI for the company.

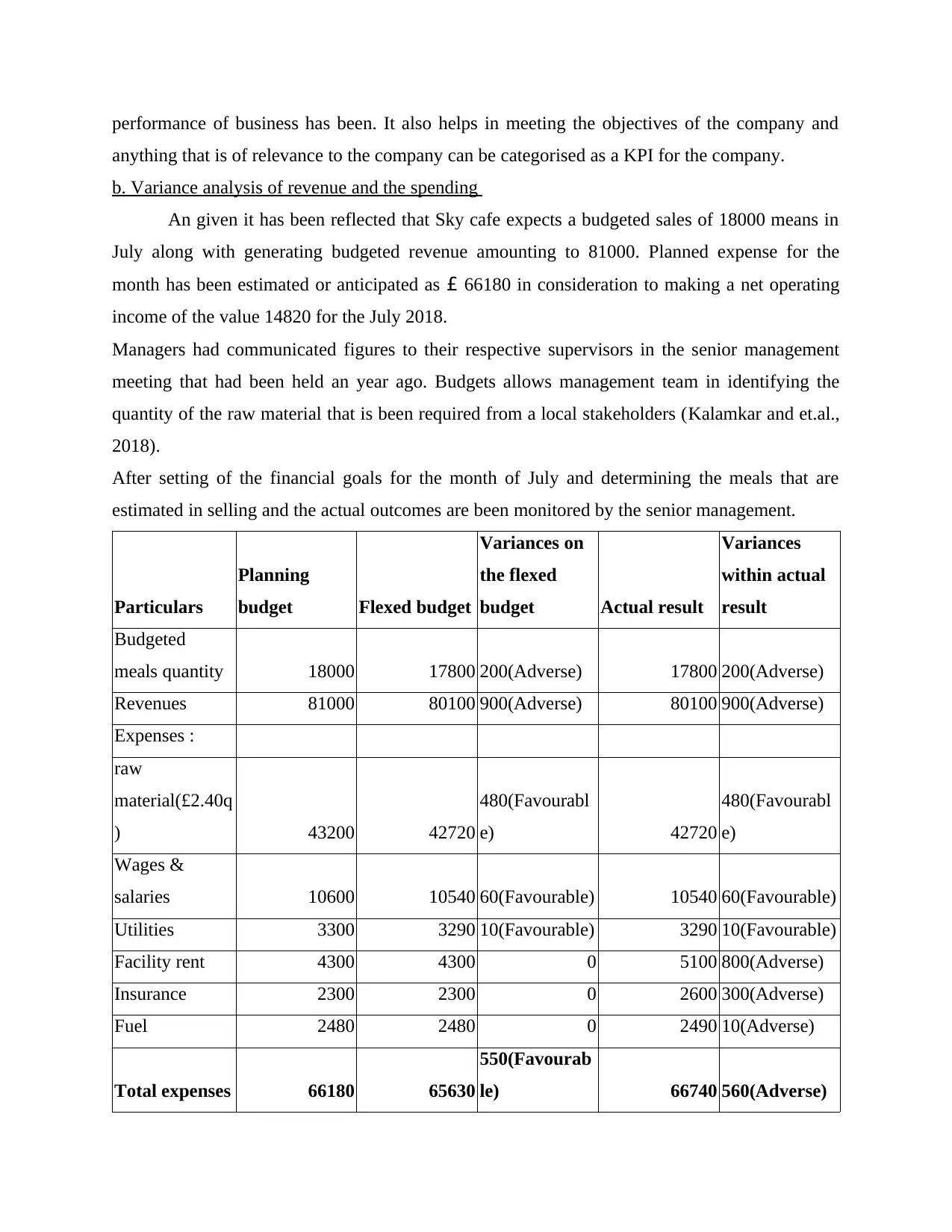

b. Variance analysis of revenue and the spending

An given it has been reflected that Sky cafe expects a budgeted sales of 18000 means in

July along with generating budgeted revenue amounting to 81000. Planned expense for the

month has been estimated or anticipated as £ 66180 in consideration to making a net operating

income of the value 14820 for the July 2018.

Managers had communicated figures to their respective supervisors in the senior management

meeting that had been held an year ago. Budgets allows management team in identifying the

quantity of the raw material that is been required from a local stakeholders (Kalamkar and et.al.,

2018).

After setting of the financial goals for the month of July and determining the meals that are

estimated in selling and the actual outcomes are been monitored by the senior management.

Particulars

Planning

budget Flexed budget

Variances on

the flexed

budget Actual result

Variances

within actual

result

Budgeted

meals quantity 18000 17800 200(Adverse) 17800 200(Adverse)

Revenues 81000 80100 900(Adverse) 80100 900(Adverse)

Expenses :

raw

material(£2.40q

) 43200 42720

480(Favourabl

e) 42720

480(Favourabl

e)

Wages &

salaries 10600 10540 60(Favourable) 10540 60(Favourable)

Utilities 3300 3290 10(Favourable) 3290 10(Favourable)

Facility rent 4300 4300 0 5100 800(Adverse)

Insurance 2300 2300 0 2600 300(Adverse)

Fuel 2480 2480 0 2490 10(Adverse)

Total expenses 66180 65630

550(Favourab

le) 66740 560(Adverse)

anything that is of relevance to the company can be categorised as a KPI for the company.

b. Variance analysis of revenue and the spending

An given it has been reflected that Sky cafe expects a budgeted sales of 18000 means in

July along with generating budgeted revenue amounting to 81000. Planned expense for the

month has been estimated or anticipated as £ 66180 in consideration to making a net operating

income of the value 14820 for the July 2018.

Managers had communicated figures to their respective supervisors in the senior management

meeting that had been held an year ago. Budgets allows management team in identifying the

quantity of the raw material that is been required from a local stakeholders (Kalamkar and et.al.,

2018).

After setting of the financial goals for the month of July and determining the meals that are

estimated in selling and the actual outcomes are been monitored by the senior management.

Particulars

Planning

budget Flexed budget

Variances on

the flexed

budget Actual result

Variances

within actual

result

Budgeted

meals quantity 18000 17800 200(Adverse) 17800 200(Adverse)

Revenues 81000 80100 900(Adverse) 80100 900(Adverse)

Expenses :

raw

material(£2.40q

) 43200 42720

480(Favourabl

e) 42720

480(Favourabl

e)

Wages &

salaries 10600 10540 60(Favourable) 10540 60(Favourable)

Utilities 3300 3290 10(Favourable) 3290 10(Favourable)

Facility rent 4300 4300 0 5100 800(Adverse)

Insurance 2300 2300 0 2600 300(Adverse)

Fuel 2480 2480 0 2490 10(Adverse)

Total expenses 66180 65630

550(Favourab

le) 66740 560(Adverse)

Net Operating

income 14820 14470 350(Adverse) 13360 1460(Adverse)

In accordance to above analysis it has been interpreted that the reduction in the value of

the sales had a direct impact on expenses that includes a variable aspect that are raw material,

salaries, wages and the utilities. Such variances are counted as favourable but it results as the

circumstances when lower quantity of the product is been sold. An assessment of the flexed

budget indicates that adverse value of variance in the revenue is resulted of the value £ 900 as it

is based on the £ 4.5 value of the per meal sold. Furthermore, raw materials are seen as the

expenses that are incurred in connection to selling of the meals. This shows that as lower meals

were been sold so less quantity of the raw material is been required in order to attain a favourable

variance. Wages and the salaries having a variable aspects in connection with quantity of the

meals that are sold. As there exist the shortage of the sales valuing to 200 meals, there is £60

underspend in the salaries. Utilities shows a favourable difference of the value resulting as £10.

Expenses like fuel, facility rent and the insurance were not been anticipated correctly. Thus, total

of the expenses have been resulted as 65630 rather than 66740.

The flexed budget contains a total amount of operating profit resulted as 14470 that is

counted as an adverse variance of the value 350 as the difference between budgeted and actual.

The actual value of the net operating income accounted as 13360 that seems to be adverse

variance of the 1460 than the planned. Therefore, it is clearly seen that such adverse variance

resulted because of the lower volume of the sales from the budgeted and higher amount of the

fixed expenses.

c.

Inaccurate forecasting of fixed expense- The facility remains due for the managers and

the renewal by assuming that rent would remain of the same amount. Because of the economic

climate, landlords has changes an agreement and resulted a increase in the cost of rent. This data

is not been accounted in planning the budget for the month of July in relation to the effect on the

rent cost. It acts as the major concern for the managers with regards to the future prospects of the

company.

Actual sales resulted lower than budgeted- An external and the internal analysis

involving the non-financial measures are ascertained because of the reduced quality of the

income 14820 14470 350(Adverse) 13360 1460(Adverse)

In accordance to above analysis it has been interpreted that the reduction in the value of

the sales had a direct impact on expenses that includes a variable aspect that are raw material,

salaries, wages and the utilities. Such variances are counted as favourable but it results as the

circumstances when lower quantity of the product is been sold. An assessment of the flexed

budget indicates that adverse value of variance in the revenue is resulted of the value £ 900 as it

is based on the £ 4.5 value of the per meal sold. Furthermore, raw materials are seen as the

expenses that are incurred in connection to selling of the meals. This shows that as lower meals

were been sold so less quantity of the raw material is been required in order to attain a favourable

variance. Wages and the salaries having a variable aspects in connection with quantity of the

meals that are sold. As there exist the shortage of the sales valuing to 200 meals, there is £60

underspend in the salaries. Utilities shows a favourable difference of the value resulting as £10.

Expenses like fuel, facility rent and the insurance were not been anticipated correctly. Thus, total

of the expenses have been resulted as 65630 rather than 66740.

The flexed budget contains a total amount of operating profit resulted as 14470 that is

counted as an adverse variance of the value 350 as the difference between budgeted and actual.

The actual value of the net operating income accounted as 13360 that seems to be adverse

variance of the 1460 than the planned. Therefore, it is clearly seen that such adverse variance

resulted because of the lower volume of the sales from the budgeted and higher amount of the

fixed expenses.

c.

Inaccurate forecasting of fixed expense- The facility remains due for the managers and

the renewal by assuming that rent would remain of the same amount. Because of the economic

climate, landlords has changes an agreement and resulted a increase in the cost of rent. This data

is not been accounted in planning the budget for the month of July in relation to the effect on the

rent cost. It acts as the major concern for the managers with regards to the future prospects of the

company.

Actual sales resulted lower than budgeted- An external and the internal analysis

involving the non-financial measures are ascertained because of the reduced quality of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

products in reviewing the customer feedback (Messer, 2016). Another reason for reduction of the

sales is attained because of the formal training has not been provided new members of the staff.

It likely to correlates with the customers in capturing delivery delays in respect to the feedback

of the customers.

d.

As it has been analysed that the main variance with regards to the actual results was

accounted as increase in the amount of rent which in turn means that fixed cost are increasing.

From this it is advised for negotiating procedures and the cost with the stakeholders and the

landlords as of relevant. An aim of the company must be getting a fixed period agreement for

long run which ensures that cafe minimises any amount of the unstimulated additional cost

which could affect net profit of the company.

For example- it is been recommended to the company in checking for the other insurance

companies for seeing in case they are having the better deals.

Increasing an internal communication with all the employees in an organization results in

increasing the motivation. Employees at Sky cafe must be having an enough knowledge

regarding their targets, in making sure that the budgets seems to be realistic but as challenging.

In case if company is making investment in the training that is important for ensuring that each

and every employees stays in company for the long term period. It has been suggested to

increase bonus for per meal that is been sold at single employee (Kes & Kuźmiński, 2019). Also,

managers should have consider the programme relating to employee excellence where the

employees gets rewards for the great performance with the customer liaison.

It is significant for having more of the proactive budgetary control where the managers

need to have actively focus on the budget control, amendment in the data changes and in

informing teams so that task could be performed by keeping in mind the budgeted estimates.

Lastly, an external communication is also been determined and is highly recommended in using

more and more marketing tools like social media for increasing an opportunity for advertising

company and its major point of selling. Thus, by taking into account such investments, quantity

of the sales may be increased and hence larger profitability could be gained.

It can therefore be concluded that the variance analysis is an extremely important tool in

analysing the performance of the business and helps in taking appropriate decisions.

sales is attained because of the formal training has not been provided new members of the staff.

It likely to correlates with the customers in capturing delivery delays in respect to the feedback

of the customers.

d.

As it has been analysed that the main variance with regards to the actual results was

accounted as increase in the amount of rent which in turn means that fixed cost are increasing.

From this it is advised for negotiating procedures and the cost with the stakeholders and the

landlords as of relevant. An aim of the company must be getting a fixed period agreement for

long run which ensures that cafe minimises any amount of the unstimulated additional cost

which could affect net profit of the company.

For example- it is been recommended to the company in checking for the other insurance

companies for seeing in case they are having the better deals.

Increasing an internal communication with all the employees in an organization results in

increasing the motivation. Employees at Sky cafe must be having an enough knowledge

regarding their targets, in making sure that the budgets seems to be realistic but as challenging.

In case if company is making investment in the training that is important for ensuring that each

and every employees stays in company for the long term period. It has been suggested to

increase bonus for per meal that is been sold at single employee (Kes & Kuźmiński, 2019). Also,

managers should have consider the programme relating to employee excellence where the

employees gets rewards for the great performance with the customer liaison.

It is significant for having more of the proactive budgetary control where the managers

need to have actively focus on the budget control, amendment in the data changes and in

informing teams so that task could be performed by keeping in mind the budgeted estimates.

Lastly, an external communication is also been determined and is highly recommended in using

more and more marketing tools like social media for increasing an opportunity for advertising

company and its major point of selling. Thus, by taking into account such investments, quantity

of the sales may be increased and hence larger profitability could be gained.

It can therefore be concluded that the variance analysis is an extremely important tool in

analysing the performance of the business and helps in taking appropriate decisions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Kes, Z., & Kuźmiński, Ł. (2019). Application of Extreme Value Analysis in the Assessment of

Budget Variance Risk. Econometrics, 23(2). 80-98.

Messer, R. (2016). Teaching Variance Analysis for Cost Accounting: How to Achieve above Par

Performance. In Advances in Accounting Education: Teaching and Curriculum

Innovations (pp. 51-63). Emerald Group Publishing Limited.

Kalamkar, P. and et.al., (2018). Cost variance analysis in treatment of advanced non-small cell

lung cancer.

Marzlin Marzuki, N. A. R., & Ismail, J. (2019). Benefits and limitations of variance analysis in

management accounting. ACCOUNTING BULLETIN, 15.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A

technical review. Annals of Operations Research, 240(2). 489-507.

Kouvelis, P., Pang, Z., & Ding, Q. (2018). Integrated Commodity Inventory Management and

Financial Hedging: A Dynamic Mean‐Variance Analysis. Production and Operations

Management, 27(6). 1052-1073.

1

Books and journals

Kes, Z., & Kuźmiński, Ł. (2019). Application of Extreme Value Analysis in the Assessment of

Budget Variance Risk. Econometrics, 23(2). 80-98.

Messer, R. (2016). Teaching Variance Analysis for Cost Accounting: How to Achieve above Par

Performance. In Advances in Accounting Education: Teaching and Curriculum

Innovations (pp. 51-63). Emerald Group Publishing Limited.

Kalamkar, P. and et.al., (2018). Cost variance analysis in treatment of advanced non-small cell

lung cancer.

Marzlin Marzuki, N. A. R., & Ismail, J. (2019). Benefits and limitations of variance analysis in

management accounting. ACCOUNTING BULLETIN, 15.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A

technical review. Annals of Operations Research, 240(2). 489-507.

Kouvelis, P., Pang, Z., & Ding, Q. (2018). Integrated Commodity Inventory Management and

Financial Hedging: A Dynamic Mean‐Variance Analysis. Production and Operations

Management, 27(6). 1052-1073.

1

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.