Analysis of Capital Budgeting Techniques for Financial Projects

VerifiedAdded on 2021/06/14

|16

|1675

|53

Homework Assignment

AI Summary

This assignment analyzes two financial projects using capital budgeting techniques. Solution 1 calculates the Net Present Value (NPV), Internal Rate of Return (IRR), Profitability Index, and Payback Period for a new plant investment, concluding the project is viable. Solution 2 compares two projects (A and B), calculating their payback periods, NPVs, and IRRs. The analysis reveals that Project B has a higher NPV and IRR, and a shorter payback period, making it the preferred choice. The assignment highlights the importance of these capital budgeting tools in evaluating investment opportunities and making informed financial decisions. The document also includes a bibliography citing relevant finance resources.

MANAGING FINANCE

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Solution 1:..................................................................................................................................................................................................................................... 3

Solution 2:................................................................................................................................................................................................................................... 10

Bibliography................................................................................................................................................................................................................................ 15

2

Solution 1:..................................................................................................................................................................................................................................... 3

Solution 2:................................................................................................................................................................................................................................... 10

Bibliography................................................................................................................................................................................................................................ 15

2

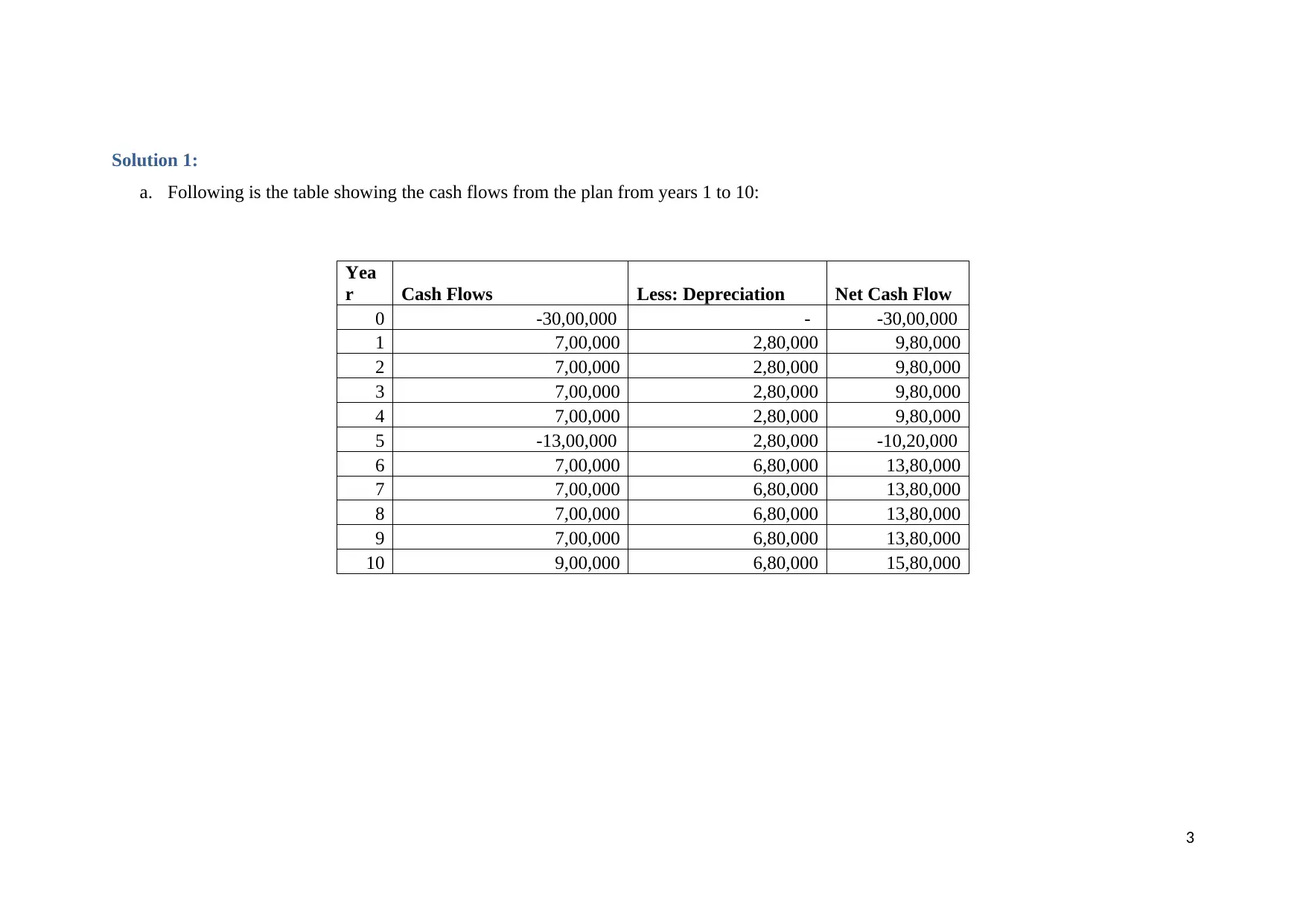

Solution 1:

a. Following is the table showing the cash flows from the plan from years 1 to 10:

Yea

r Cash Flows Less: Depreciation Net Cash Flow

0 -30,00,000 - -30,00,000

1 7,00,000 2,80,000 9,80,000

2 7,00,000 2,80,000 9,80,000

3 7,00,000 2,80,000 9,80,000

4 7,00,000 2,80,000 9,80,000

5 -13,00,000 2,80,000 -10,20,000

6 7,00,000 6,80,000 13,80,000

7 7,00,000 6,80,000 13,80,000

8 7,00,000 6,80,000 13,80,000

9 7,00,000 6,80,000 13,80,000

10 9,00,000 6,80,000 15,80,000

3

a. Following is the table showing the cash flows from the plan from years 1 to 10:

Yea

r Cash Flows Less: Depreciation Net Cash Flow

0 -30,00,000 - -30,00,000

1 7,00,000 2,80,000 9,80,000

2 7,00,000 2,80,000 9,80,000

3 7,00,000 2,80,000 9,80,000

4 7,00,000 2,80,000 9,80,000

5 -13,00,000 2,80,000 -10,20,000

6 7,00,000 6,80,000 13,80,000

7 7,00,000 6,80,000 13,80,000

8 7,00,000 6,80,000 13,80,000

9 7,00,000 6,80,000 13,80,000

10 9,00,000 6,80,000 15,80,000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

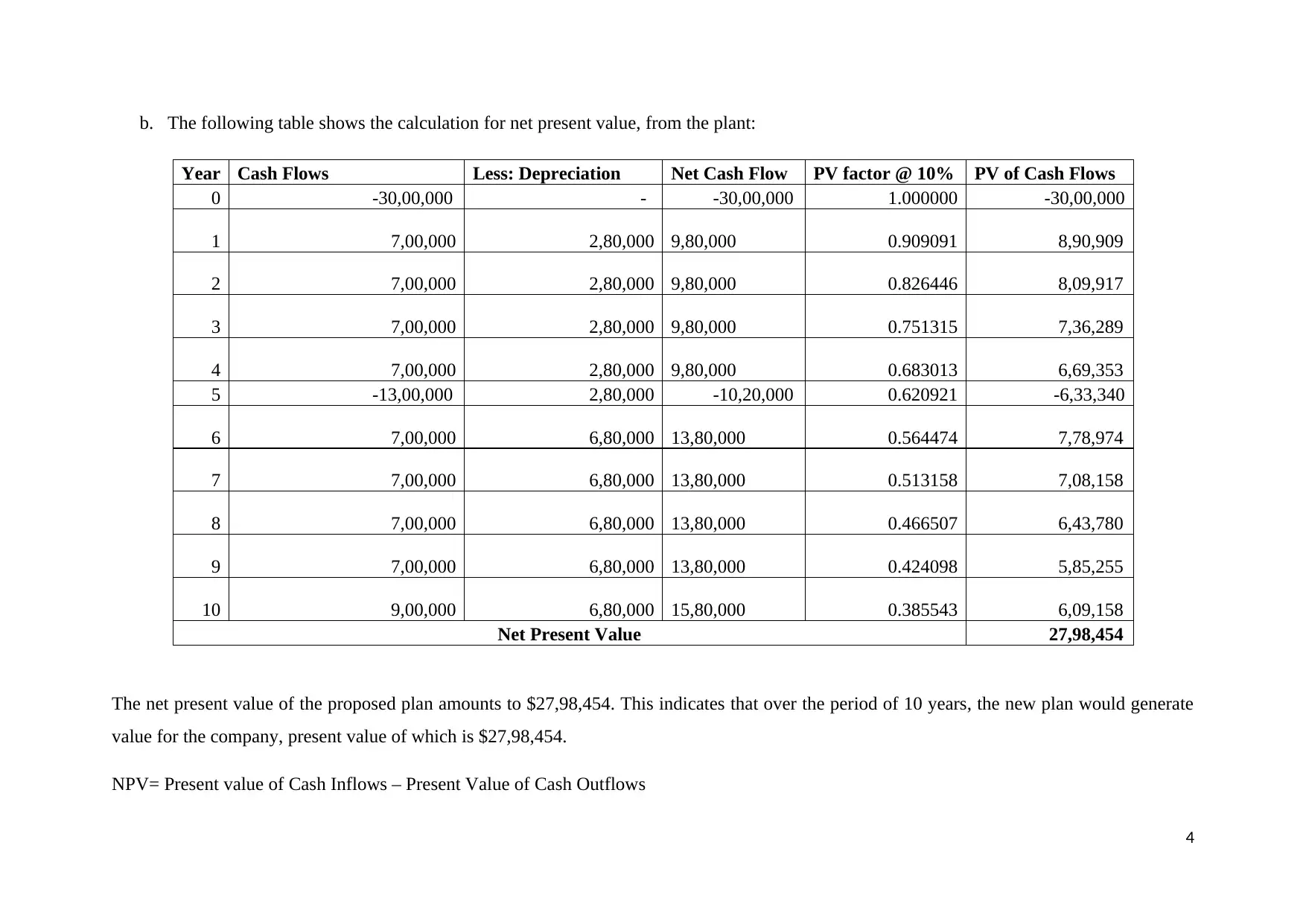

b. The following table shows the calculation for net present value, from the plant:

Year Cash Flows Less: Depreciation Net Cash Flow PV factor @ 10% PV of Cash Flows

0 -30,00,000 - -30,00,000 1.000000 -30,00,000

1 7,00,000 2,80,000 9,80,000 0.909091 8,90,909

2 7,00,000 2,80,000 9,80,000 0.826446 8,09,917

3 7,00,000 2,80,000 9,80,000 0.751315 7,36,289

4 7,00,000 2,80,000 9,80,000 0.683013 6,69,353

5 -13,00,000 2,80,000 -10,20,000 0.620921 -6,33,340

6 7,00,000 6,80,000 13,80,000 0.564474 7,78,974

7 7,00,000 6,80,000 13,80,000 0.513158 7,08,158

8 7,00,000 6,80,000 13,80,000 0.466507 6,43,780

9 7,00,000 6,80,000 13,80,000 0.424098 5,85,255

10 9,00,000 6,80,000 15,80,000 0.385543 6,09,158

Net Present Value 27,98,454

The net present value of the proposed plan amounts to $27,98,454. This indicates that over the period of 10 years, the new plan would generate

value for the company, present value of which is $27,98,454.

NPV= Present value of Cash Inflows – Present Value of Cash Outflows

4

Year Cash Flows Less: Depreciation Net Cash Flow PV factor @ 10% PV of Cash Flows

0 -30,00,000 - -30,00,000 1.000000 -30,00,000

1 7,00,000 2,80,000 9,80,000 0.909091 8,90,909

2 7,00,000 2,80,000 9,80,000 0.826446 8,09,917

3 7,00,000 2,80,000 9,80,000 0.751315 7,36,289

4 7,00,000 2,80,000 9,80,000 0.683013 6,69,353

5 -13,00,000 2,80,000 -10,20,000 0.620921 -6,33,340

6 7,00,000 6,80,000 13,80,000 0.564474 7,78,974

7 7,00,000 6,80,000 13,80,000 0.513158 7,08,158

8 7,00,000 6,80,000 13,80,000 0.466507 6,43,780

9 7,00,000 6,80,000 13,80,000 0.424098 5,85,255

10 9,00,000 6,80,000 15,80,000 0.385543 6,09,158

Net Present Value 27,98,454

The net present value of the proposed plan amounts to $27,98,454. This indicates that over the period of 10 years, the new plan would generate

value for the company, present value of which is $27,98,454.

NPV= Present value of Cash Inflows – Present Value of Cash Outflows

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The net present value is the capital budgeting tool which helps calculate the value of the proposed plan (Adelaja, 2015). That is it helps the

investor analyse if there are expected to be positive cash flows or negative cash flows from a said proposal. In the given case, we see that the

proposal is expected to create a value of $2798454 for the company; hence the proposal should be accepted.

5

investor analyse if there are expected to be positive cash flows or negative cash flows from a said proposal. In the given case, we see that the

proposal is expected to create a value of $2798454 for the company; hence the proposal should be accepted.

5

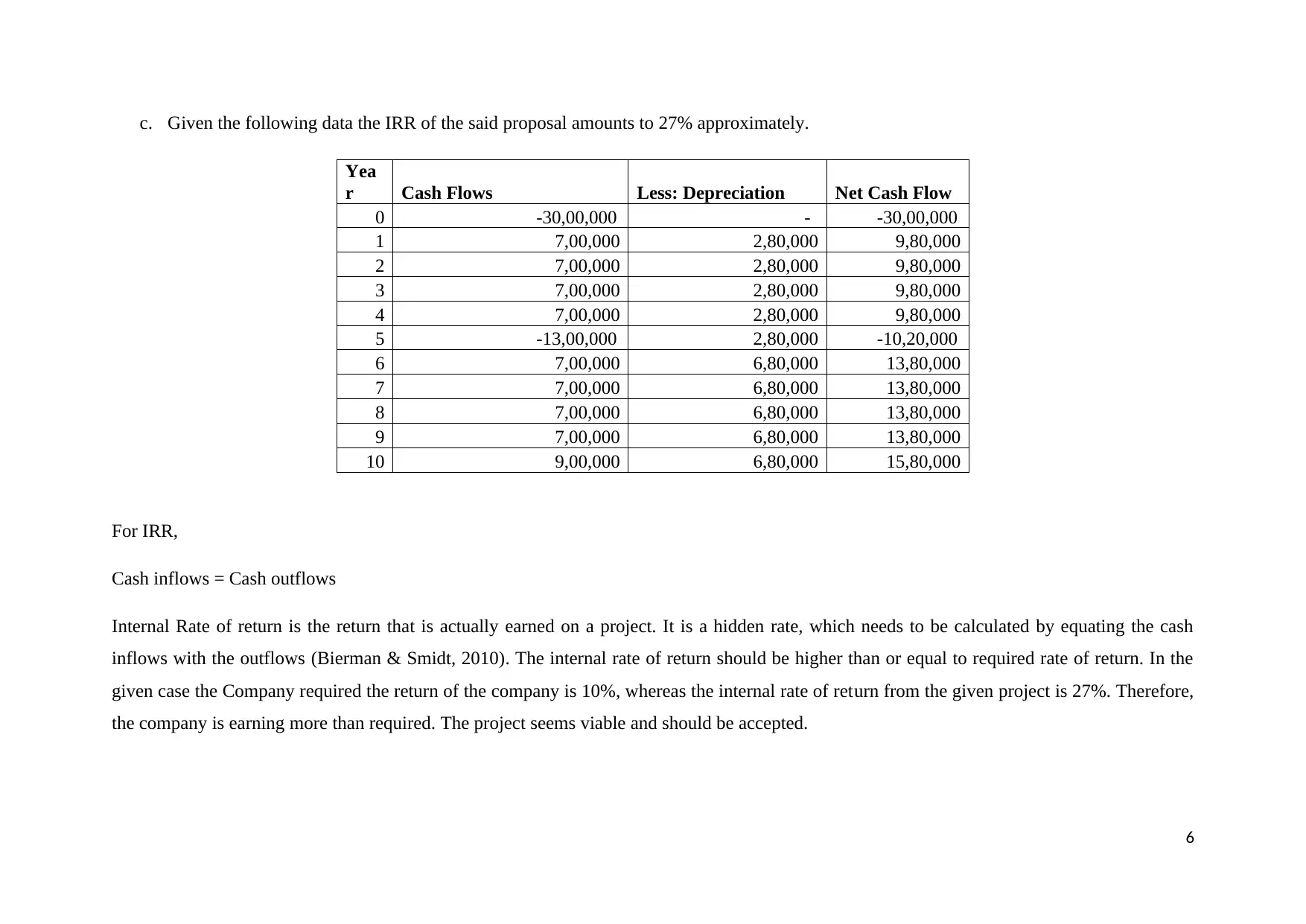

c. Given the following data the IRR of the said proposal amounts to 27% approximately.

Yea

r Cash Flows Less: Depreciation Net Cash Flow

0 -30,00,000 - -30,00,000

1 7,00,000 2,80,000 9,80,000

2 7,00,000 2,80,000 9,80,000

3 7,00,000 2,80,000 9,80,000

4 7,00,000 2,80,000 9,80,000

5 -13,00,000 2,80,000 -10,20,000

6 7,00,000 6,80,000 13,80,000

7 7,00,000 6,80,000 13,80,000

8 7,00,000 6,80,000 13,80,000

9 7,00,000 6,80,000 13,80,000

10 9,00,000 6,80,000 15,80,000

For IRR,

Cash inflows = Cash outflows

Internal Rate of return is the return that is actually earned on a project. It is a hidden rate, which needs to be calculated by equating the cash

inflows with the outflows (Bierman & Smidt, 2010). The internal rate of return should be higher than or equal to required rate of return. In the

given case the Company required the return of the company is 10%, whereas the internal rate of return from the given project is 27%. Therefore,

the company is earning more than required. The project seems viable and should be accepted.

6

Yea

r Cash Flows Less: Depreciation Net Cash Flow

0 -30,00,000 - -30,00,000

1 7,00,000 2,80,000 9,80,000

2 7,00,000 2,80,000 9,80,000

3 7,00,000 2,80,000 9,80,000

4 7,00,000 2,80,000 9,80,000

5 -13,00,000 2,80,000 -10,20,000

6 7,00,000 6,80,000 13,80,000

7 7,00,000 6,80,000 13,80,000

8 7,00,000 6,80,000 13,80,000

9 7,00,000 6,80,000 13,80,000

10 9,00,000 6,80,000 15,80,000

For IRR,

Cash inflows = Cash outflows

Internal Rate of return is the return that is actually earned on a project. It is a hidden rate, which needs to be calculated by equating the cash

inflows with the outflows (Bierman & Smidt, 2010). The internal rate of return should be higher than or equal to required rate of return. In the

given case the Company required the return of the company is 10%, whereas the internal rate of return from the given project is 27%. Therefore,

the company is earning more than required. The project seems viable and should be accepted.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

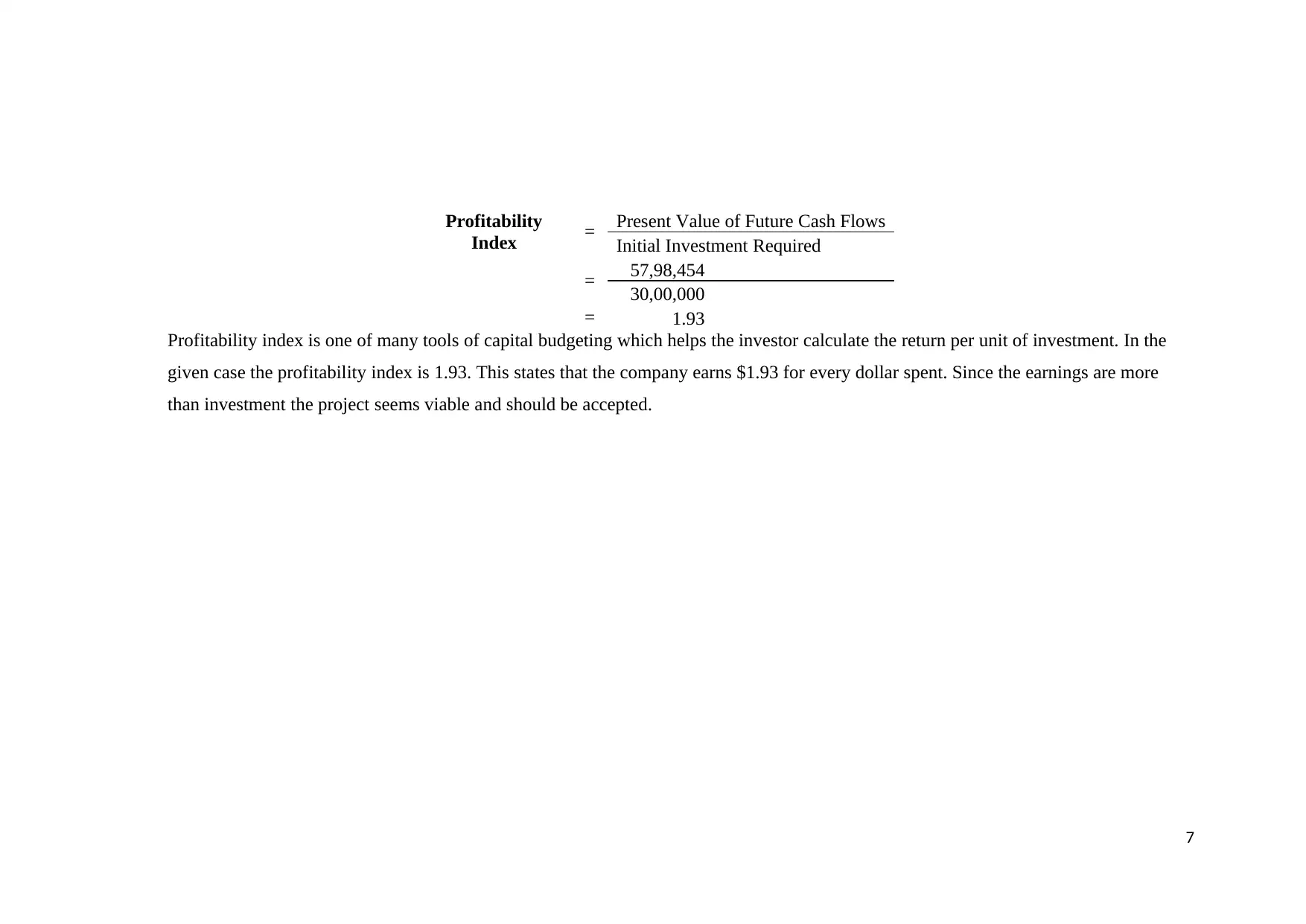

Profitability

Index = Present Value of Future Cash Flows

Initial Investment Required

= 57,98,454

30,00,000

= 1.93

Profitability index is one of many tools of capital budgeting which helps the investor calculate the return per unit of investment. In the

given case the profitability index is 1.93. This states that the company earns $1.93 for every dollar spent. Since the earnings are more

than investment the project seems viable and should be accepted.

7

Index = Present Value of Future Cash Flows

Initial Investment Required

= 57,98,454

30,00,000

= 1.93

Profitability index is one of many tools of capital budgeting which helps the investor calculate the return per unit of investment. In the

given case the profitability index is 1.93. This states that the company earns $1.93 for every dollar spent. Since the earnings are more

than investment the project seems viable and should be accepted.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

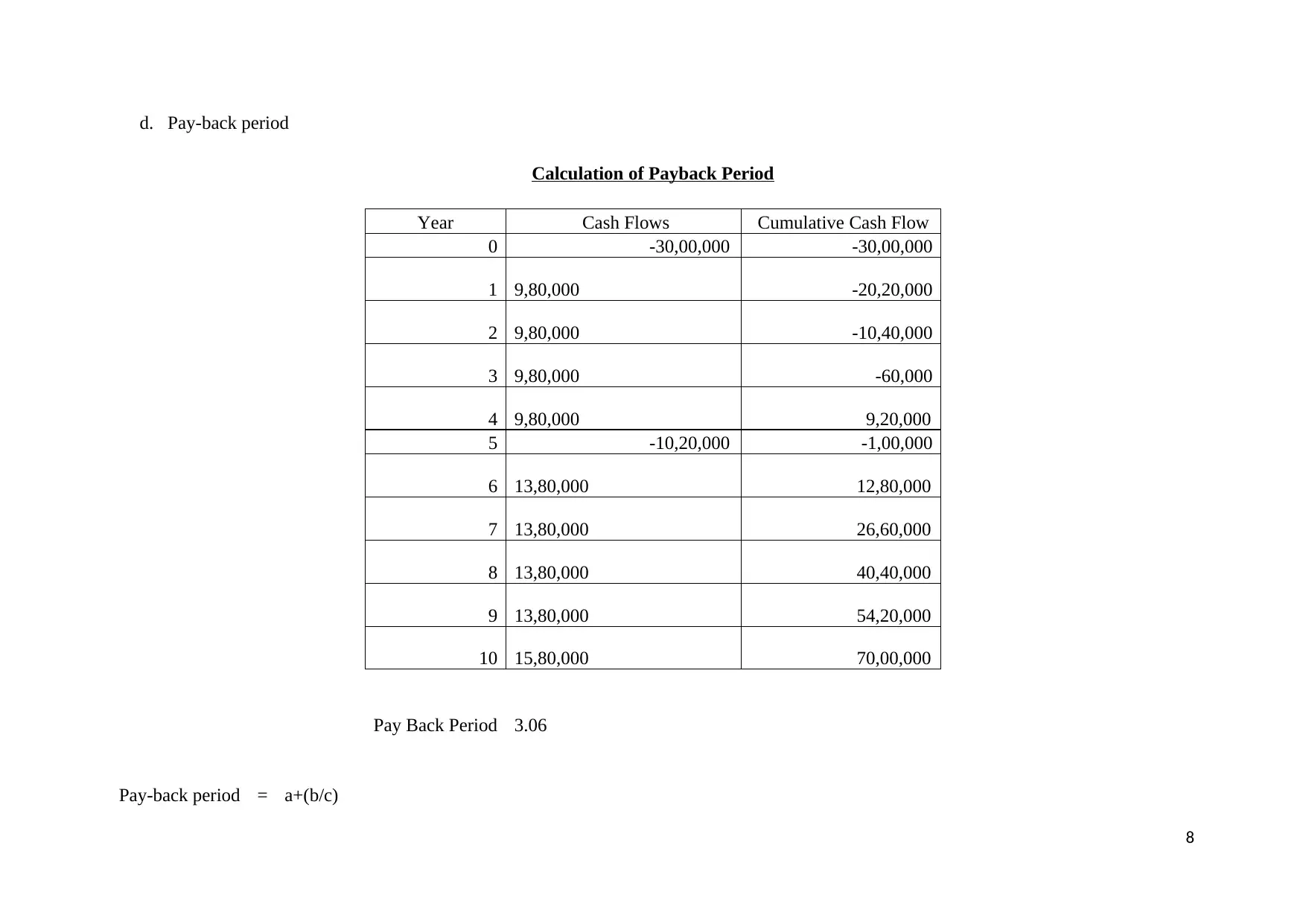

d. Pay-back period

Calculation of Payback Period

Year Cash Flows Cumulative Cash Flow

0 -30,00,000 -30,00,000

1 9,80,000 -20,20,000

2 9,80,000 -10,40,000

3 9,80,000 -60,000

4 9,80,000 9,20,000

5 -10,20,000 -1,00,000

6 13,80,000 12,80,000

7 13,80,000 26,60,000

8 13,80,000 40,40,000

9 13,80,000 54,20,000

10 15,80,000 70,00,000

Pay Back Period 3.06

Pay-back period = a+(b/c)

8

Calculation of Payback Period

Year Cash Flows Cumulative Cash Flow

0 -30,00,000 -30,00,000

1 9,80,000 -20,20,000

2 9,80,000 -10,40,000

3 9,80,000 -60,000

4 9,80,000 9,20,000

5 -10,20,000 -1,00,000

6 13,80,000 12,80,000

7 13,80,000 26,60,000

8 13,80,000 40,40,000

9 13,80,000 54,20,000

10 15,80,000 70,00,000

Pay Back Period 3.06

Pay-back period = a+(b/c)

8

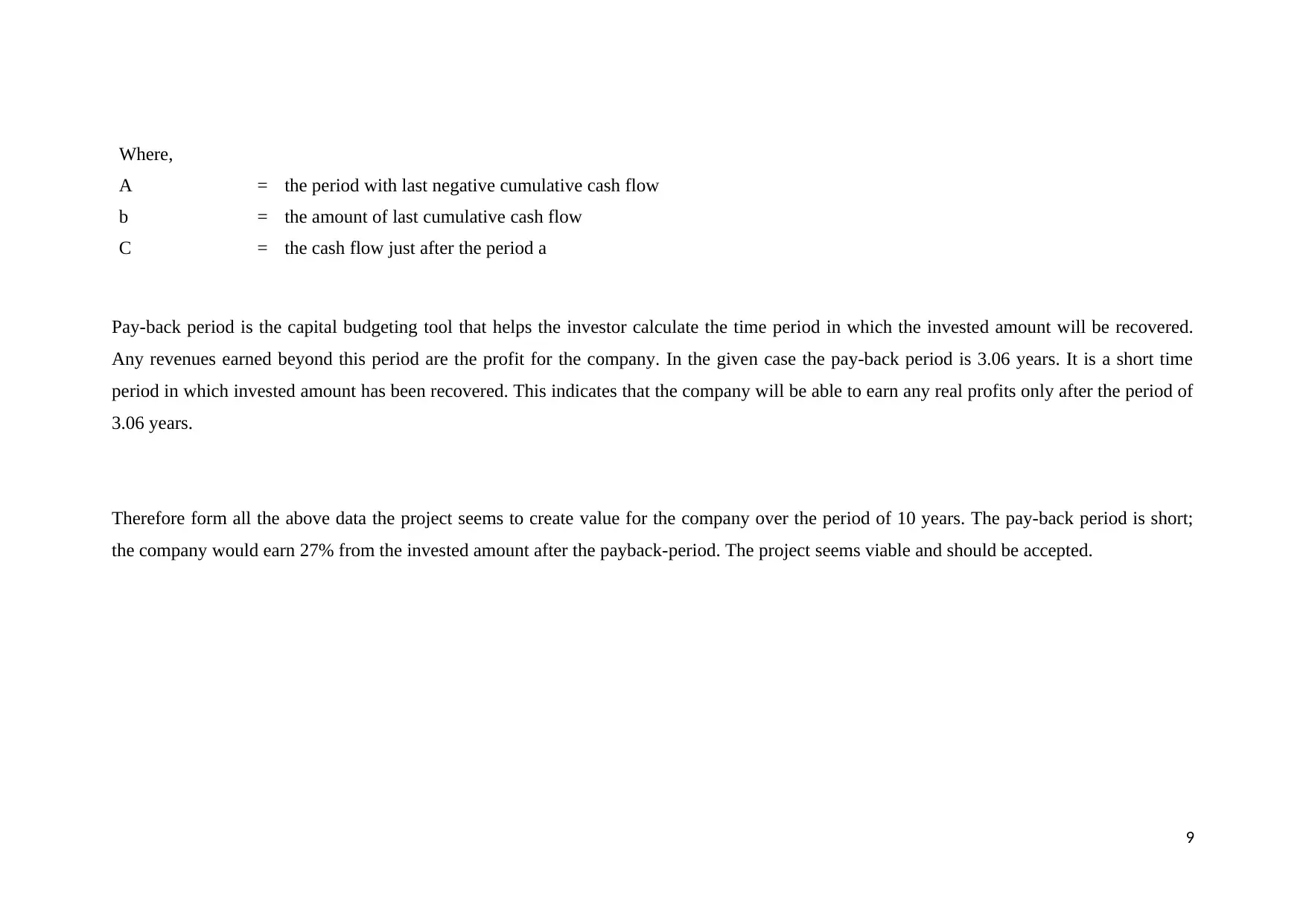

Where,

A = the period with last negative cumulative cash flow

b = the amount of last cumulative cash flow

C = the cash flow just after the period a

Pay-back period is the capital budgeting tool that helps the investor calculate the time period in which the invested amount will be recovered.

Any revenues earned beyond this period are the profit for the company. In the given case the pay-back period is 3.06 years. It is a short time

period in which invested amount has been recovered. This indicates that the company will be able to earn any real profits only after the period of

3.06 years.

Therefore form all the above data the project seems to create value for the company over the period of 10 years. The pay-back period is short;

the company would earn 27% from the invested amount after the payback-period. The project seems viable and should be accepted.

9

A = the period with last negative cumulative cash flow

b = the amount of last cumulative cash flow

C = the cash flow just after the period a

Pay-back period is the capital budgeting tool that helps the investor calculate the time period in which the invested amount will be recovered.

Any revenues earned beyond this period are the profit for the company. In the given case the pay-back period is 3.06 years. It is a short time

period in which invested amount has been recovered. This indicates that the company will be able to earn any real profits only after the period of

3.06 years.

Therefore form all the above data the project seems to create value for the company over the period of 10 years. The pay-back period is short;

the company would earn 27% from the invested amount after the payback-period. The project seems viable and should be accepted.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Solution 2:

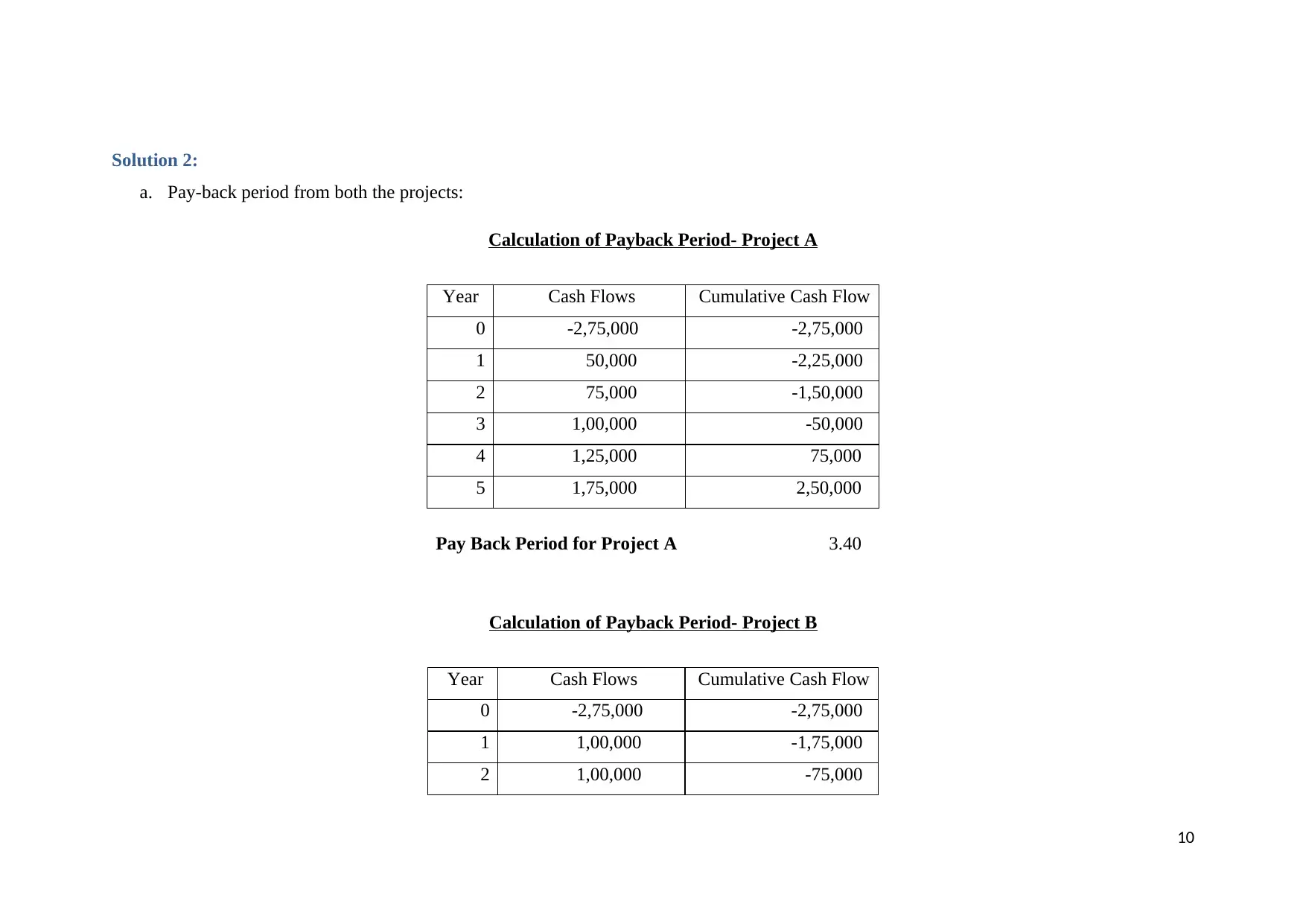

a. Pay-back period from both the projects:

Calculation of Payback Period- Project A

Year Cash Flows Cumulative Cash Flow

0 -2,75,000 -2,75,000

1 50,000 -2,25,000

2 75,000 -1,50,000

3 1,00,000 -50,000

4 1,25,000 75,000

5 1,75,000 2,50,000

Pay Back Period for Project A 3.40

Calculation of Payback Period- Project B

Year Cash Flows Cumulative Cash Flow

0 -2,75,000 -2,75,000

1 1,00,000 -1,75,000

2 1,00,000 -75,000

10

a. Pay-back period from both the projects:

Calculation of Payback Period- Project A

Year Cash Flows Cumulative Cash Flow

0 -2,75,000 -2,75,000

1 50,000 -2,25,000

2 75,000 -1,50,000

3 1,00,000 -50,000

4 1,25,000 75,000

5 1,75,000 2,50,000

Pay Back Period for Project A 3.40

Calculation of Payback Period- Project B

Year Cash Flows Cumulative Cash Flow

0 -2,75,000 -2,75,000

1 1,00,000 -1,75,000

2 1,00,000 -75,000

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3 1,00,000 25,000

4 1,00,000 1,25,000

5 1,00,000 2,25,000

Pay Back Period for Project

B 2.75

Payback period for project A is 3.4 years and that for project B is 2.75 years. Therefore payback of Project B is better than that of project A.

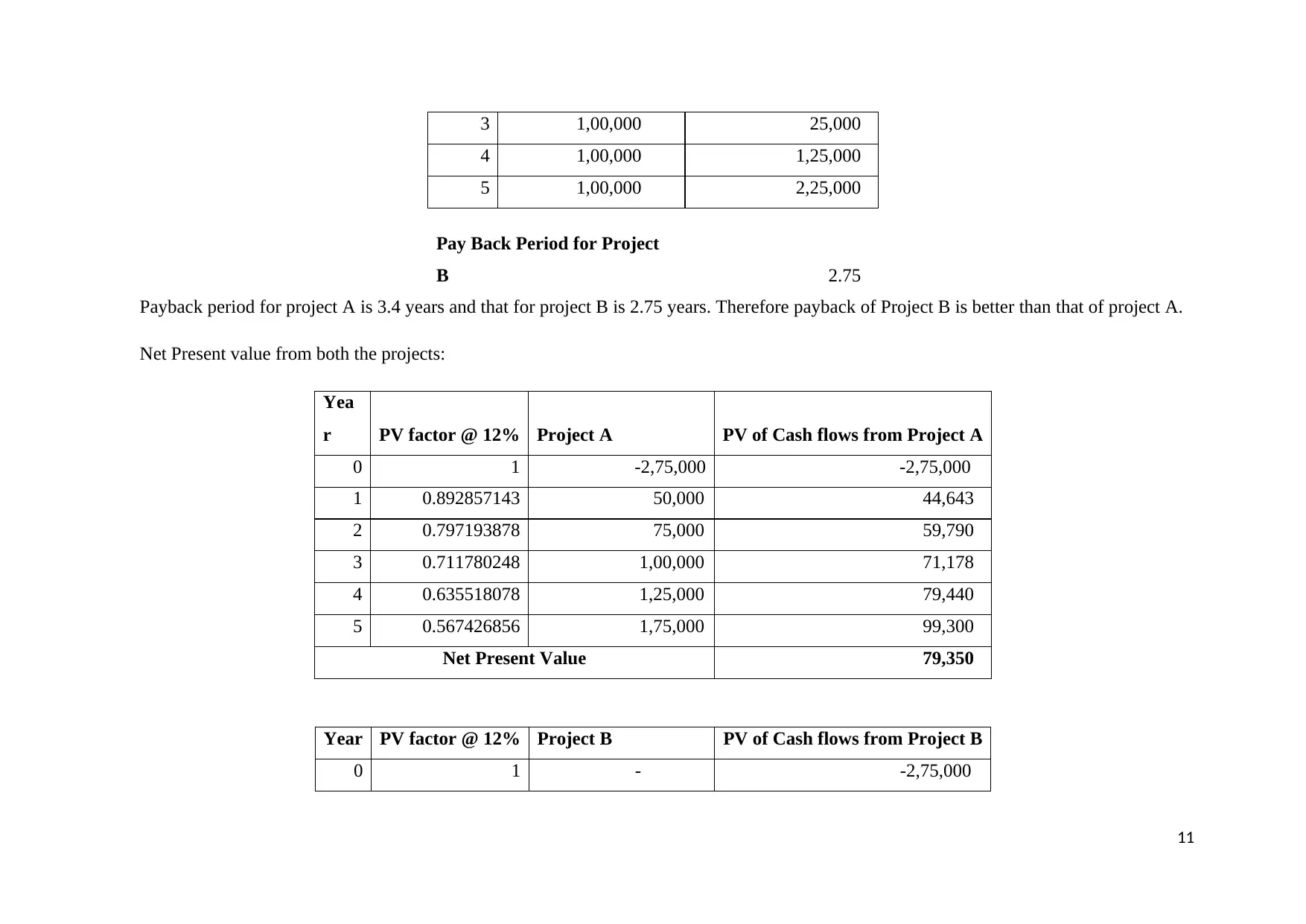

Net Present value from both the projects:

Yea

r PV factor @ 12% Project A PV of Cash flows from Project A

0 1 -2,75,000 -2,75,000

1 0.892857143 50,000 44,643

2 0.797193878 75,000 59,790

3 0.711780248 1,00,000 71,178

4 0.635518078 1,25,000 79,440

5 0.567426856 1,75,000 99,300

Net Present Value 79,350

Year PV factor @ 12% Project B PV of Cash flows from Project B

0 1 - -2,75,000

11

4 1,00,000 1,25,000

5 1,00,000 2,25,000

Pay Back Period for Project

B 2.75

Payback period for project A is 3.4 years and that for project B is 2.75 years. Therefore payback of Project B is better than that of project A.

Net Present value from both the projects:

Yea

r PV factor @ 12% Project A PV of Cash flows from Project A

0 1 -2,75,000 -2,75,000

1 0.892857143 50,000 44,643

2 0.797193878 75,000 59,790

3 0.711780248 1,00,000 71,178

4 0.635518078 1,25,000 79,440

5 0.567426856 1,75,000 99,300

Net Present Value 79,350

Year PV factor @ 12% Project B PV of Cash flows from Project B

0 1 - -2,75,000

11

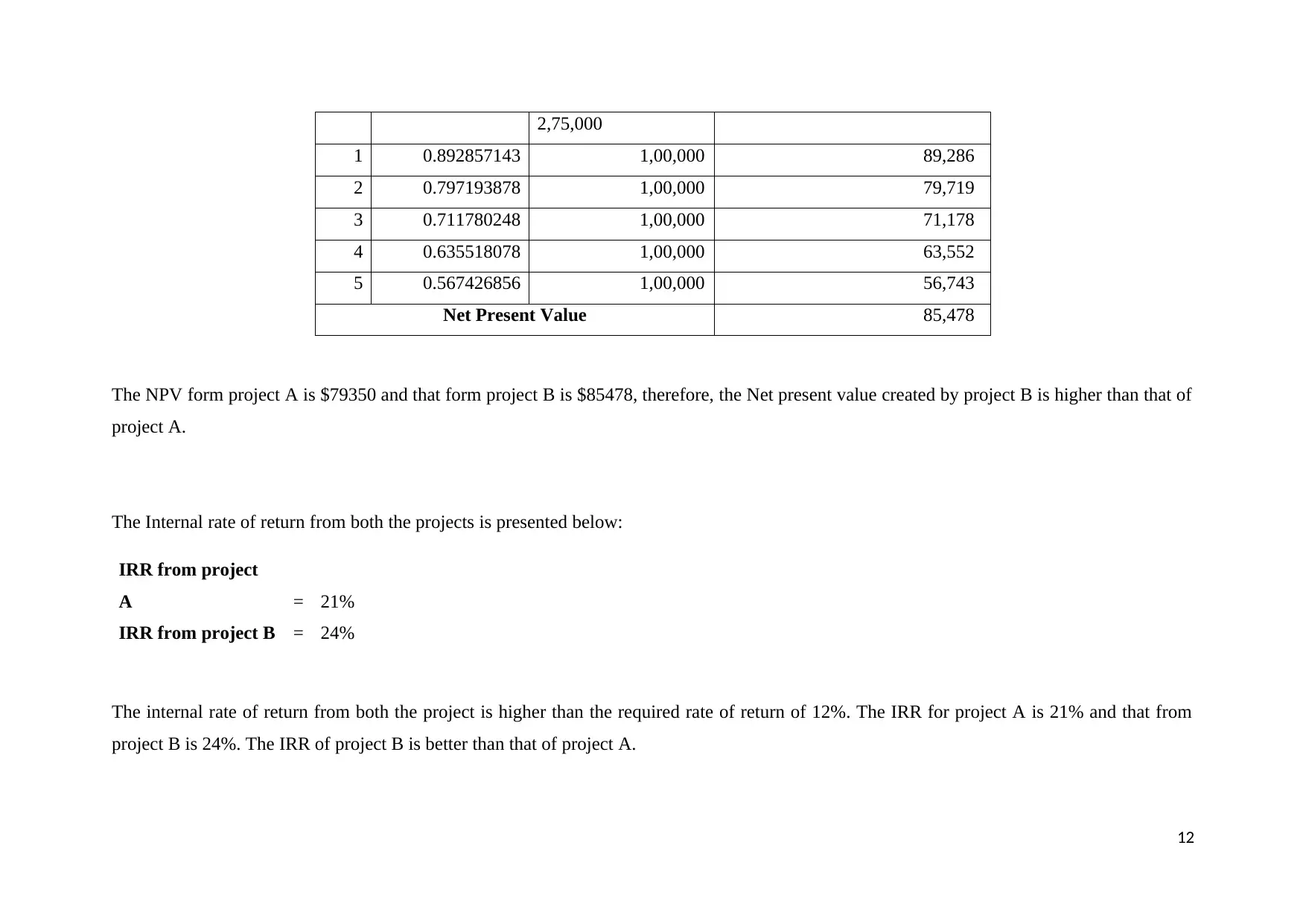

2,75,000

1 0.892857143 1,00,000 89,286

2 0.797193878 1,00,000 79,719

3 0.711780248 1,00,000 71,178

4 0.635518078 1,00,000 63,552

5 0.567426856 1,00,000 56,743

Net Present Value 85,478

The NPV form project A is $79350 and that form project B is $85478, therefore, the Net present value created by project B is higher than that of

project A.

The Internal rate of return from both the projects is presented below:

IRR from project

A = 21%

IRR from project B = 24%

The internal rate of return from both the project is higher than the required rate of return of 12%. The IRR for project A is 21% and that from

project B is 24%. The IRR of project B is better than that of project A.

12

1 0.892857143 1,00,000 89,286

2 0.797193878 1,00,000 79,719

3 0.711780248 1,00,000 71,178

4 0.635518078 1,00,000 63,552

5 0.567426856 1,00,000 56,743

Net Present Value 85,478

The NPV form project A is $79350 and that form project B is $85478, therefore, the Net present value created by project B is higher than that of

project A.

The Internal rate of return from both the projects is presented below:

IRR from project

A = 21%

IRR from project B = 24%

The internal rate of return from both the project is higher than the required rate of return of 12%. The IRR for project A is 21% and that from

project B is 24%. The IRR of project B is better than that of project A.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

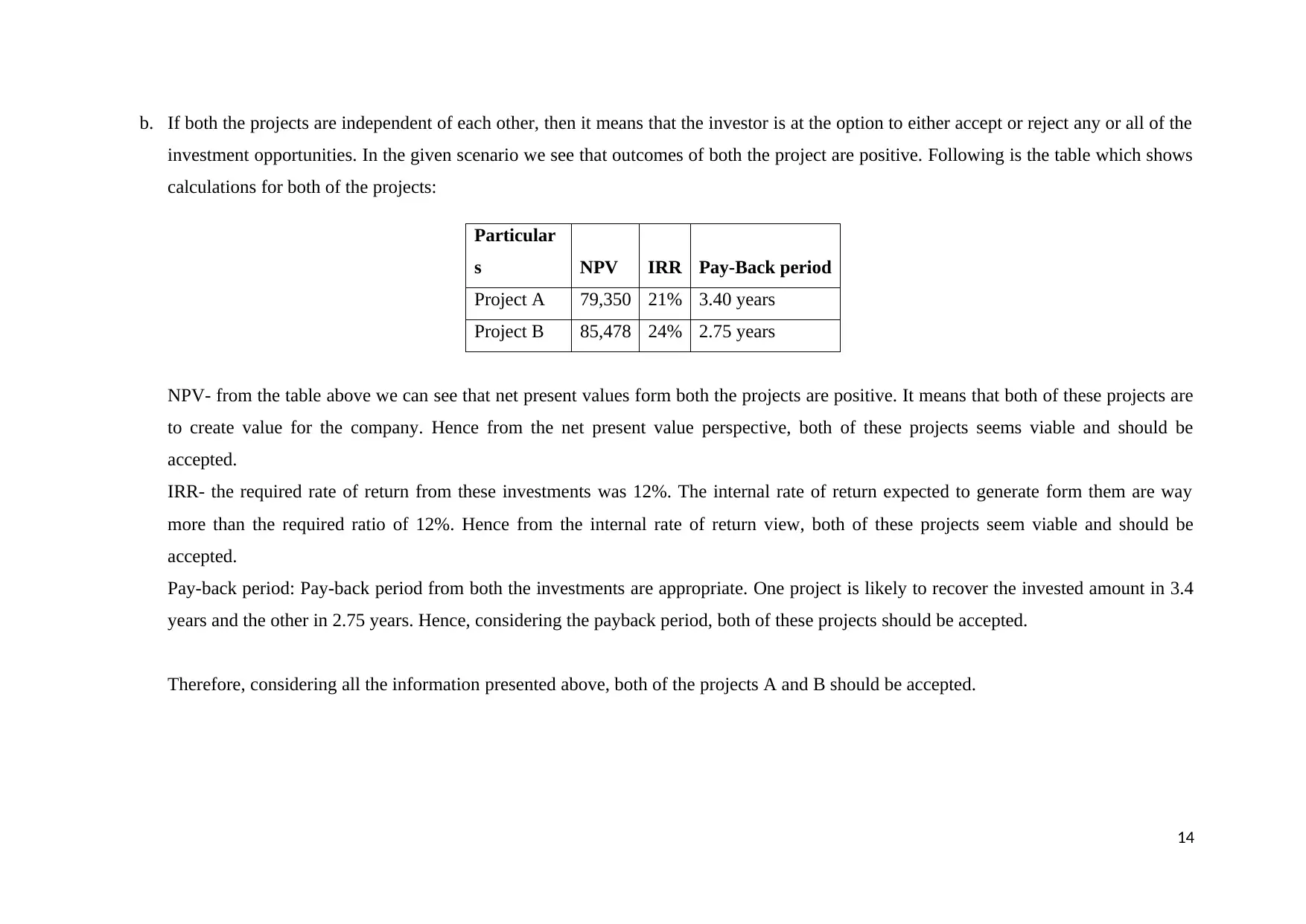

b. If both the projects are independent of each other, then it means that the investor is at the option to either accept or reject any or all of the

investment opportunities. In the given scenario we see that outcomes of both the project are positive. Following is the table which shows

calculations for both of the projects:

Particular

s NPV IRR Pay-Back period

Project A 79,350 21% 3.40 years

Project B 85,478 24% 2.75 years

NPV- from the table above we can see that net present values form both the projects are positive. It means that both of these projects are

to create value for the company. Hence from the net present value perspective, both of these projects seems viable and should be

accepted.

IRR- the required rate of return from these investments was 12%. The internal rate of return expected to generate form them are way

more than the required ratio of 12%. Hence from the internal rate of return view, both of these projects seem viable and should be

accepted.

Pay-back period: Pay-back period from both the investments are appropriate. One project is likely to recover the invested amount in 3.4

years and the other in 2.75 years. Hence, considering the payback period, both of these projects should be accepted.

Therefore, considering all the information presented above, both of the projects A and B should be accepted.

14

investment opportunities. In the given scenario we see that outcomes of both the project are positive. Following is the table which shows

calculations for both of the projects:

Particular

s NPV IRR Pay-Back period

Project A 79,350 21% 3.40 years

Project B 85,478 24% 2.75 years

NPV- from the table above we can see that net present values form both the projects are positive. It means that both of these projects are

to create value for the company. Hence from the net present value perspective, both of these projects seems viable and should be

accepted.

IRR- the required rate of return from these investments was 12%. The internal rate of return expected to generate form them are way

more than the required ratio of 12%. Hence from the internal rate of return view, both of these projects seem viable and should be

accepted.

Pay-back period: Pay-back period from both the investments are appropriate. One project is likely to recover the invested amount in 3.4

years and the other in 2.75 years. Hence, considering the payback period, both of these projects should be accepted.

Therefore, considering all the information presented above, both of the projects A and B should be accepted.

14

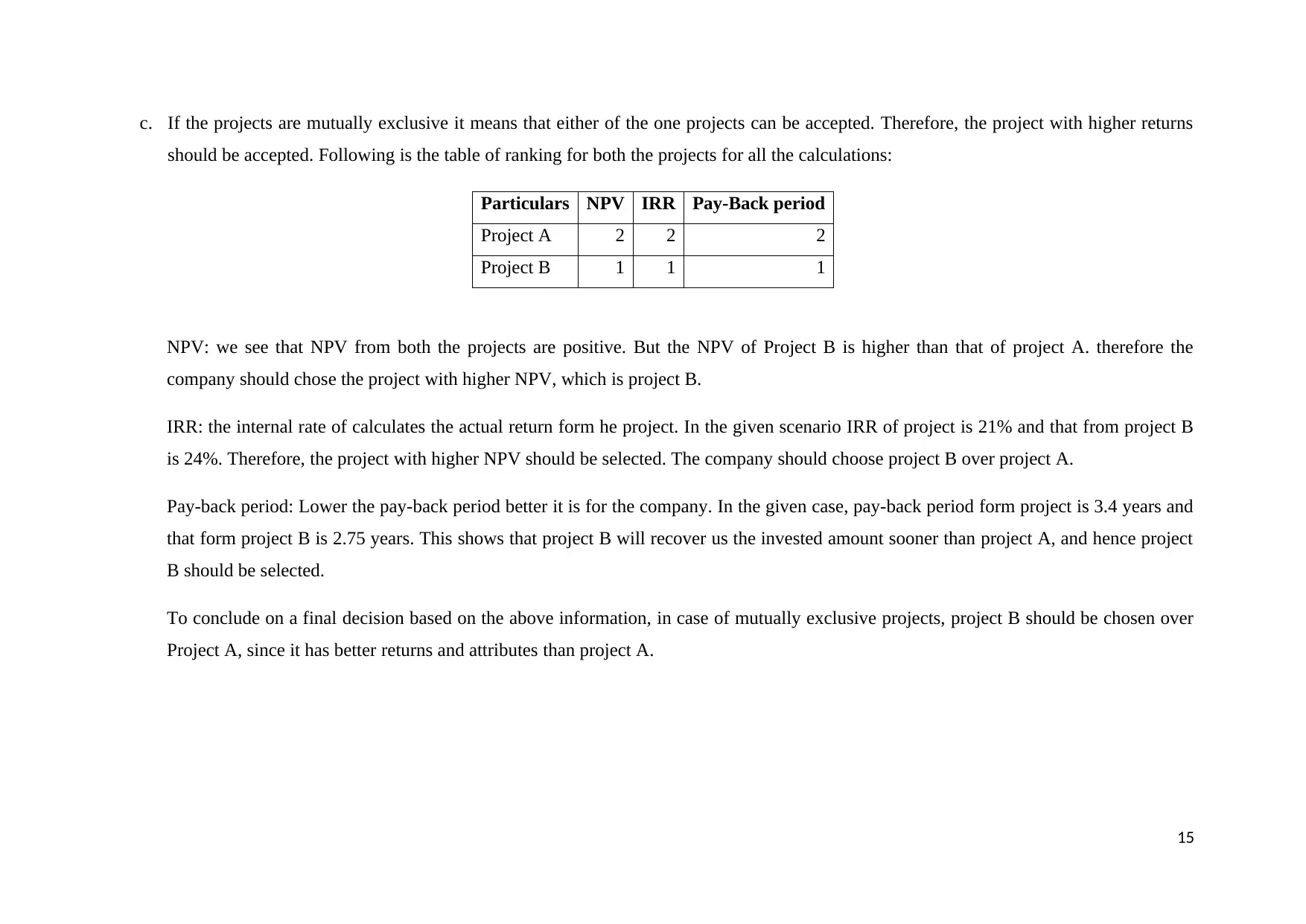

c. If the projects are mutually exclusive it means that either of the one projects can be accepted. Therefore, the project with higher returns

should be accepted. Following is the table of ranking for both the projects for all the calculations:

Particulars NPV IRR Pay-Back period

Project A 2 2 2

Project B 1 1 1

NPV: we see that NPV from both the projects are positive. But the NPV of Project B is higher than that of project A. therefore the

company should chose the project with higher NPV, which is project B.

IRR: the internal rate of calculates the actual return form he project. In the given scenario IRR of project is 21% and that from project B

is 24%. Therefore, the project with higher NPV should be selected. The company should choose project B over project A.

Pay-back period: Lower the pay-back period better it is for the company. In the given case, pay-back period form project is 3.4 years and

that form project B is 2.75 years. This shows that project B will recover us the invested amount sooner than project A, and hence project

B should be selected.

To conclude on a final decision based on the above information, in case of mutually exclusive projects, project B should be chosen over

Project A, since it has better returns and attributes than project A.

15

should be accepted. Following is the table of ranking for both the projects for all the calculations:

Particulars NPV IRR Pay-Back period

Project A 2 2 2

Project B 1 1 1

NPV: we see that NPV from both the projects are positive. But the NPV of Project B is higher than that of project A. therefore the

company should chose the project with higher NPV, which is project B.

IRR: the internal rate of calculates the actual return form he project. In the given scenario IRR of project is 21% and that from project B

is 24%. Therefore, the project with higher NPV should be selected. The company should choose project B over project A.

Pay-back period: Lower the pay-back period better it is for the company. In the given case, pay-back period form project is 3.4 years and

that form project B is 2.75 years. This shows that project B will recover us the invested amount sooner than project A, and hence project

B should be selected.

To conclude on a final decision based on the above information, in case of mutually exclusive projects, project B should be chosen over

Project A, since it has better returns and attributes than project A.

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Bibliography

Adelaja, T. (2015). Capital Budgeting: Investment Appraisal Techniques Under Certainty. Chicago: CreateSpace Independent Publishing

Platform .

Bierman, H., & Smidt, S. (2010). The Capital Budgeting Decision. Boston: Routledge.

16

Adelaja, T. (2015). Capital Budgeting: Investment Appraisal Techniques Under Certainty. Chicago: CreateSpace Independent Publishing

Platform .

Bierman, H., & Smidt, S. (2010). The Capital Budgeting Decision. Boston: Routledge.

16

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.