Annotated Bibliography of Financial Planning

VerifiedAdded on 2019/12/28

|19

|7286

|149

Essay

AI Summary

The provided content comprises of several research articles and books related to finance and accounting. The topics covered include M&As in the retail sector, understanding financial statements, corporate finance and investments, bank loan announcements and borrower stock returns, financial ratio analysis of commercial banks, access to finance for innovative SMEs, key performance indicators, and financial planning. These resources provide insights on various aspects of finance such as mergers and acquisitions, financial reporting standards, financial ratios, and investment appraisal. They can be useful for individuals interested in pursuing a career in finance or accounting.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managing financial

resource and

decisions

1

resource and

decisions

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION................................................................................................................................3

1.1 Identify the sources of finance available to Morrison...............................................................3

1.2 Assess the implication of the different sources..........................................................................4

1.3 Evaluate appropriate source of finance for Morrison................................................................5

TASK 2 ................................................................................................................................................6

2.1 Analyse the cost of different types of sources..........................................................................6

2.2 Explain the importance of financial planning............................................................................7

2.3 Assess the information needs of different decision makers.......................................................8

2.4 Explain the impact of finance on the financial statements........................................................9

TASK 3 ................................................................................................................................................9

3.1 Analyse budgets and make appropriate decisions......................................................................9

3.2 Explain calculation of unit cost and make pricing decisions using relevant information........11

3.3 Assess the viability of project using investment appraisal techniques....................................12

TASK 4...............................................................................................................................................13

4.1 Discuss the main financial statements.....................................................................................13

4.2 Compare appropriate formats of financial statements for different types of business............14

4.3 Interpret financial statements using appropriate ratios and comparison, both internal and

external...........................................................................................................................................14

REFERENCES...................................................................................................................................17

Index of Tables

Table 1: Sales budget of Morrison for the period of 6 months ending on 30th September..................9

Table 2: Cash budget of Morrison for the period of 6 months ending on 30th September................10

Table 3: Calculation of Pay back period and Accounting rate of return.............................................12

Table 4: Calculation of NPV and IRR................................................................................................12

Table 5: Ratio analysis of Sainsbury and Morrison............................................................................14

2

INTRODUCTION................................................................................................................................3

1.1 Identify the sources of finance available to Morrison...............................................................3

1.2 Assess the implication of the different sources..........................................................................4

1.3 Evaluate appropriate source of finance for Morrison................................................................5

TASK 2 ................................................................................................................................................6

2.1 Analyse the cost of different types of sources..........................................................................6

2.2 Explain the importance of financial planning............................................................................7

2.3 Assess the information needs of different decision makers.......................................................8

2.4 Explain the impact of finance on the financial statements........................................................9

TASK 3 ................................................................................................................................................9

3.1 Analyse budgets and make appropriate decisions......................................................................9

3.2 Explain calculation of unit cost and make pricing decisions using relevant information........11

3.3 Assess the viability of project using investment appraisal techniques....................................12

TASK 4...............................................................................................................................................13

4.1 Discuss the main financial statements.....................................................................................13

4.2 Compare appropriate formats of financial statements for different types of business............14

4.3 Interpret financial statements using appropriate ratios and comparison, both internal and

external...........................................................................................................................................14

REFERENCES...................................................................................................................................17

Index of Tables

Table 1: Sales budget of Morrison for the period of 6 months ending on 30th September..................9

Table 2: Cash budget of Morrison for the period of 6 months ending on 30th September................10

Table 3: Calculation of Pay back period and Accounting rate of return.............................................12

Table 4: Calculation of NPV and IRR................................................................................................12

Table 5: Ratio analysis of Sainsbury and Morrison............................................................................14

2

INTRODUCTION

In the present dynamic and competitive business world, every organization needs

appropriate quantum of funds to support operations and run successfully. Morrison is the fourth

largest supermarket chain of United kingdom who operates in retail industry. It is a public limited

company established in the year 1899 and headquartered in Bradford, West Yorkshire, UK. Present

project will discuss a range of financial sources through which Morrison can mitigate its financial

need. Moreover, the role of financial planning and the information need of company's stakeholders

will be analysed. Besides this, product cost will be determined to take effective pricing decisions.

Apart from that, various kinds of financial statement and its objectives will be demonstrated. In

addition to it, Morrison's financial performance will be evaluated with its competitor organization

Sainsbury. It will be conducted through using ratio analysis techniques.

TASK 1

1.1 Identify the sources of finance available to Morrison

Morrison can mitigate its short-term, medium-term and long-term financial need from both

internal and external sources. Internal sources are available inside in the organizations whilst

externally, funds can be collected from outside market, described below:

Short-term sources: Bank overdraft: It is an facility in which bank allow firm to withdraw higher amount than

available balance at an interest rate (Addison, Mavrotas and McGillivray, 2005). It helps to

fulfil very urgent financial requirement of the company.

Working capital stock control: Working capital requirement can be solve by cash squeezing

operations. In this. Morrison can pay creditors delayed and get prompt payments from the

debtors invoices by factoring. Through this, company can maintain effective surplus of cash

to run successfully.

Medium-term sources: Hire purchase: It is a facility through which Morrison can purchase equipments from vendor

by making payment of only an initial amount. Remainder can be paid in equal periodic

instalments (Plank, 2015).

Leasing: Morrison can take assets on lease by making payment of rental charges for a fixed

duration to the lessor. So that, company will not need to buy the assets and gain rights to use

property of the lessor.

Long-term sources:

3

In the present dynamic and competitive business world, every organization needs

appropriate quantum of funds to support operations and run successfully. Morrison is the fourth

largest supermarket chain of United kingdom who operates in retail industry. It is a public limited

company established in the year 1899 and headquartered in Bradford, West Yorkshire, UK. Present

project will discuss a range of financial sources through which Morrison can mitigate its financial

need. Moreover, the role of financial planning and the information need of company's stakeholders

will be analysed. Besides this, product cost will be determined to take effective pricing decisions.

Apart from that, various kinds of financial statement and its objectives will be demonstrated. In

addition to it, Morrison's financial performance will be evaluated with its competitor organization

Sainsbury. It will be conducted through using ratio analysis techniques.

TASK 1

1.1 Identify the sources of finance available to Morrison

Morrison can mitigate its short-term, medium-term and long-term financial need from both

internal and external sources. Internal sources are available inside in the organizations whilst

externally, funds can be collected from outside market, described below:

Short-term sources: Bank overdraft: It is an facility in which bank allow firm to withdraw higher amount than

available balance at an interest rate (Addison, Mavrotas and McGillivray, 2005). It helps to

fulfil very urgent financial requirement of the company.

Working capital stock control: Working capital requirement can be solve by cash squeezing

operations. In this. Morrison can pay creditors delayed and get prompt payments from the

debtors invoices by factoring. Through this, company can maintain effective surplus of cash

to run successfully.

Medium-term sources: Hire purchase: It is a facility through which Morrison can purchase equipments from vendor

by making payment of only an initial amount. Remainder can be paid in equal periodic

instalments (Plank, 2015).

Leasing: Morrison can take assets on lease by making payment of rental charges for a fixed

duration to the lessor. So that, company will not need to buy the assets and gain rights to use

property of the lessor.

Long-term sources:

3

Share capital: Morrison can sale their ownership in the form of equity to the investors and

gather required funds. By issuing equity shares in the market, company will be able to collect long

term funds by complying with the stock market rules and regulations (Buchner and Wilkinson,

2015).

Bank Loan: Morrison can acquire funds from bank loan by complying with all the legal

formalities. Bank provide funds at fixed interest rate which business will need to pay at a fixed

interval of time. Thus, it creates fixed financial burden to the business.

Retained earnings: The amount of profit which is retained after making payment of

shareholder's dividend is known as retained earnings. Morrison can ploughing back its retained

profits in the business for long period.

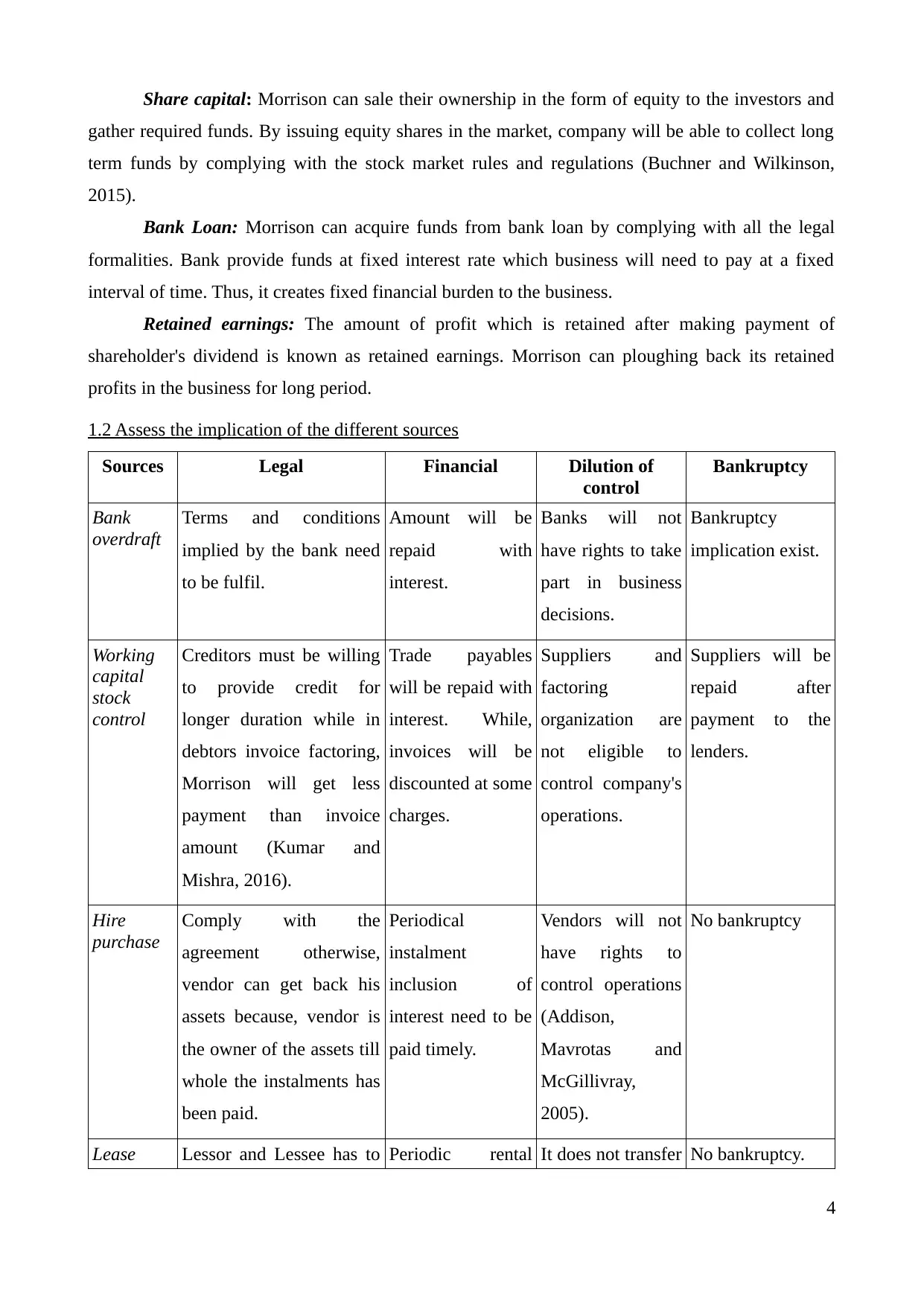

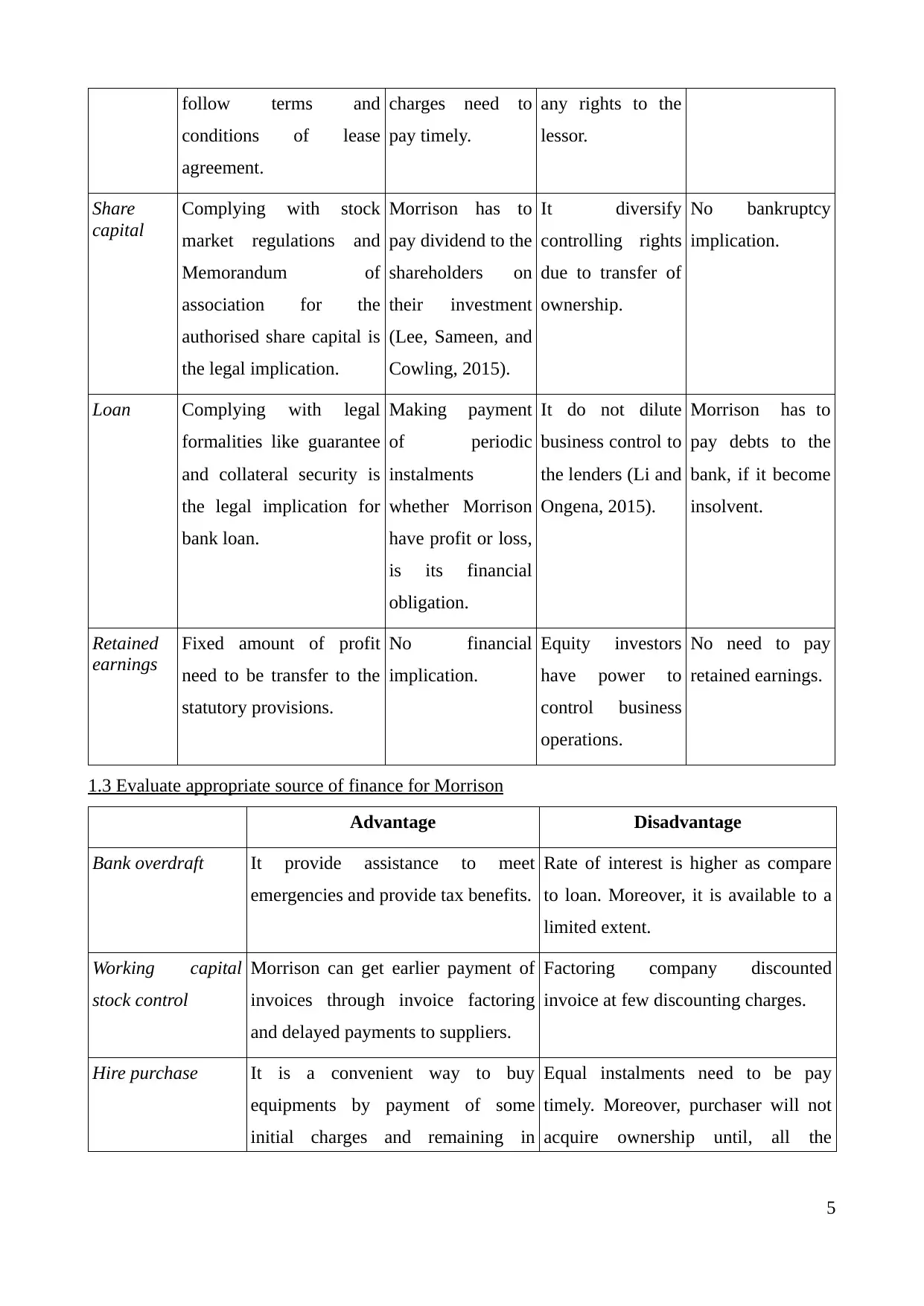

1.2 Assess the implication of the different sources

Sources Legal Financial Dilution of

control

Bankruptcy

Bank

overdraft

Terms and conditions

implied by the bank need

to be fulfil.

Amount will be

repaid with

interest.

Banks will not

have rights to take

part in business

decisions.

Bankruptcy

implication exist.

Working

capital

stock

control

Creditors must be willing

to provide credit for

longer duration while in

debtors invoice factoring,

Morrison will get less

payment than invoice

amount (Kumar and

Mishra, 2016).

Trade payables

will be repaid with

interest. While,

invoices will be

discounted at some

charges.

Suppliers and

factoring

organization are

not eligible to

control company's

operations.

Suppliers will be

repaid after

payment to the

lenders.

Hire

purchase

Comply with the

agreement otherwise,

vendor can get back his

assets because, vendor is

the owner of the assets till

whole the instalments has

been paid.

Periodical

instalment

inclusion of

interest need to be

paid timely.

Vendors will not

have rights to

control operations

(Addison,

Mavrotas and

McGillivray,

2005).

No bankruptcy

Lease Lessor and Lessee has to Periodic rental It does not transfer No bankruptcy.

4

gather required funds. By issuing equity shares in the market, company will be able to collect long

term funds by complying with the stock market rules and regulations (Buchner and Wilkinson,

2015).

Bank Loan: Morrison can acquire funds from bank loan by complying with all the legal

formalities. Bank provide funds at fixed interest rate which business will need to pay at a fixed

interval of time. Thus, it creates fixed financial burden to the business.

Retained earnings: The amount of profit which is retained after making payment of

shareholder's dividend is known as retained earnings. Morrison can ploughing back its retained

profits in the business for long period.

1.2 Assess the implication of the different sources

Sources Legal Financial Dilution of

control

Bankruptcy

Bank

overdraft

Terms and conditions

implied by the bank need

to be fulfil.

Amount will be

repaid with

interest.

Banks will not

have rights to take

part in business

decisions.

Bankruptcy

implication exist.

Working

capital

stock

control

Creditors must be willing

to provide credit for

longer duration while in

debtors invoice factoring,

Morrison will get less

payment than invoice

amount (Kumar and

Mishra, 2016).

Trade payables

will be repaid with

interest. While,

invoices will be

discounted at some

charges.

Suppliers and

factoring

organization are

not eligible to

control company's

operations.

Suppliers will be

repaid after

payment to the

lenders.

Hire

purchase

Comply with the

agreement otherwise,

vendor can get back his

assets because, vendor is

the owner of the assets till

whole the instalments has

been paid.

Periodical

instalment

inclusion of

interest need to be

paid timely.

Vendors will not

have rights to

control operations

(Addison,

Mavrotas and

McGillivray,

2005).

No bankruptcy

Lease Lessor and Lessee has to Periodic rental It does not transfer No bankruptcy.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

follow terms and

conditions of lease

agreement.

charges need to

pay timely.

any rights to the

lessor.

Share

capital

Complying with stock

market regulations and

Memorandum of

association for the

authorised share capital is

the legal implication.

Morrison has to

pay dividend to the

shareholders on

their investment

(Lee, Sameen, and

Cowling, 2015).

It diversify

controlling rights

due to transfer of

ownership.

No bankruptcy

implication.

Loan Complying with legal

formalities like guarantee

and collateral security is

the legal implication for

bank loan.

Making payment

of periodic

instalments

whether Morrison

have profit or loss,

is its financial

obligation.

It do not dilute

business control to

the lenders (Li and

Ongena, 2015).

Morrison has to

pay debts to the

bank, if it become

insolvent.

Retained

earnings

Fixed amount of profit

need to be transfer to the

statutory provisions.

No financial

implication.

Equity investors

have power to

control business

operations.

No need to pay

retained earnings.

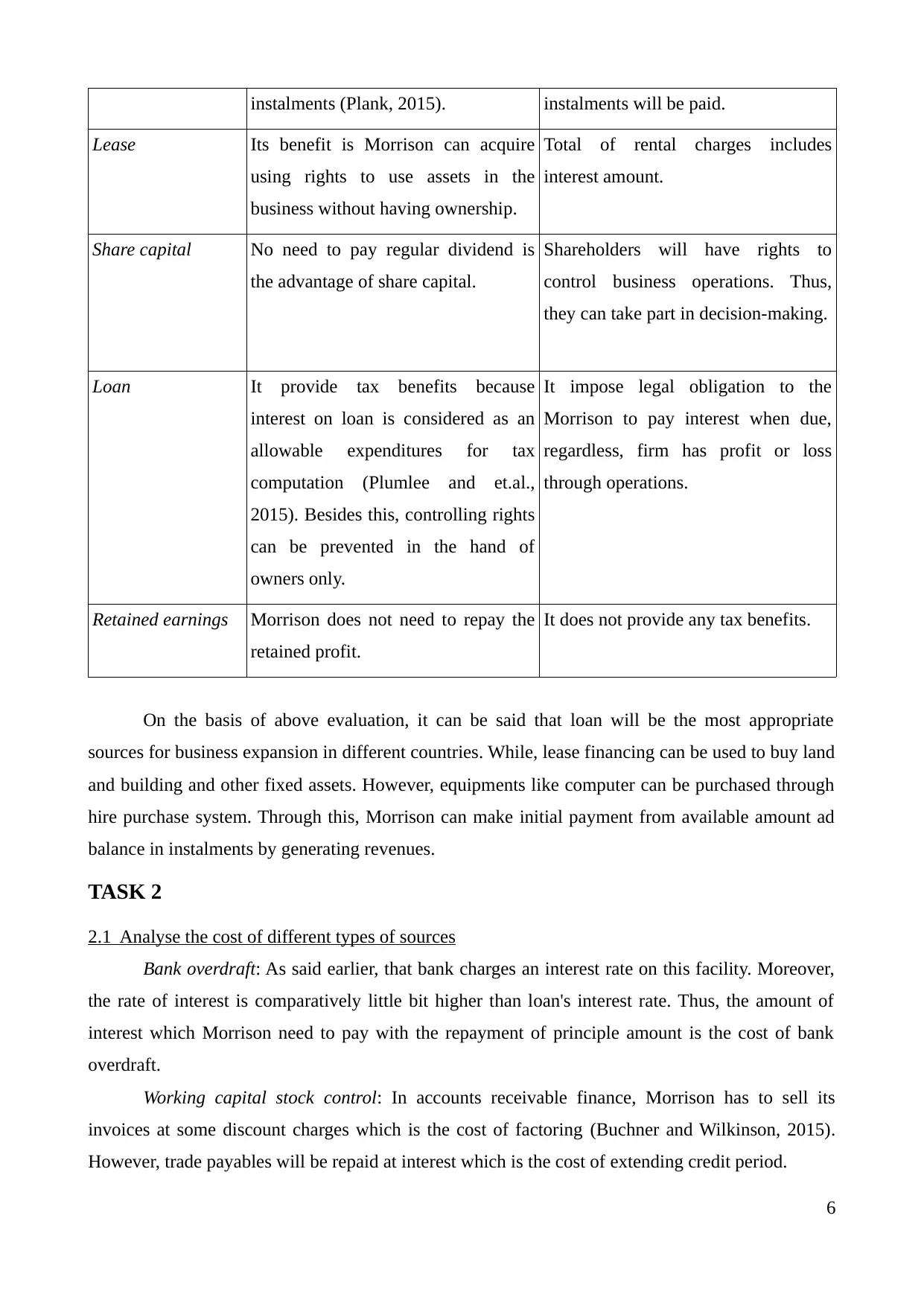

1.3 Evaluate appropriate source of finance for Morrison

Advantage Disadvantage

Bank overdraft It provide assistance to meet

emergencies and provide tax benefits.

Rate of interest is higher as compare

to loan. Moreover, it is available to a

limited extent.

Working capital

stock control

Morrison can get earlier payment of

invoices through invoice factoring

and delayed payments to suppliers.

Factoring company discounted

invoice at few discounting charges.

Hire purchase It is a convenient way to buy

equipments by payment of some

initial charges and remaining in

Equal instalments need to be pay

timely. Moreover, purchaser will not

acquire ownership until, all the

5

conditions of lease

agreement.

charges need to

pay timely.

any rights to the

lessor.

Share

capital

Complying with stock

market regulations and

Memorandum of

association for the

authorised share capital is

the legal implication.

Morrison has to

pay dividend to the

shareholders on

their investment

(Lee, Sameen, and

Cowling, 2015).

It diversify

controlling rights

due to transfer of

ownership.

No bankruptcy

implication.

Loan Complying with legal

formalities like guarantee

and collateral security is

the legal implication for

bank loan.

Making payment

of periodic

instalments

whether Morrison

have profit or loss,

is its financial

obligation.

It do not dilute

business control to

the lenders (Li and

Ongena, 2015).

Morrison has to

pay debts to the

bank, if it become

insolvent.

Retained

earnings

Fixed amount of profit

need to be transfer to the

statutory provisions.

No financial

implication.

Equity investors

have power to

control business

operations.

No need to pay

retained earnings.

1.3 Evaluate appropriate source of finance for Morrison

Advantage Disadvantage

Bank overdraft It provide assistance to meet

emergencies and provide tax benefits.

Rate of interest is higher as compare

to loan. Moreover, it is available to a

limited extent.

Working capital

stock control

Morrison can get earlier payment of

invoices through invoice factoring

and delayed payments to suppliers.

Factoring company discounted

invoice at few discounting charges.

Hire purchase It is a convenient way to buy

equipments by payment of some

initial charges and remaining in

Equal instalments need to be pay

timely. Moreover, purchaser will not

acquire ownership until, all the

5

instalments (Plank, 2015). instalments will be paid.

Lease Its benefit is Morrison can acquire

using rights to use assets in the

business without having ownership.

Total of rental charges includes

interest amount.

Share capital No need to pay regular dividend is

the advantage of share capital.

Shareholders will have rights to

control business operations. Thus,

they can take part in decision-making.

Loan It provide tax benefits because

interest on loan is considered as an

allowable expenditures for tax

computation (Plumlee and et.al.,

2015). Besides this, controlling rights

can be prevented in the hand of

owners only.

It impose legal obligation to the

Morrison to pay interest when due,

regardless, firm has profit or loss

through operations.

Retained earnings Morrison does not need to repay the

retained profit.

It does not provide any tax benefits.

On the basis of above evaluation, it can be said that loan will be the most appropriate

sources for business expansion in different countries. While, lease financing can be used to buy land

and building and other fixed assets. However, equipments like computer can be purchased through

hire purchase system. Through this, Morrison can make initial payment from available amount ad

balance in instalments by generating revenues.

TASK 2

2.1 Analyse the cost of different types of sources

Bank overdraft: As said earlier, that bank charges an interest rate on this facility. Moreover,

the rate of interest is comparatively little bit higher than loan's interest rate. Thus, the amount of

interest which Morrison need to pay with the repayment of principle amount is the cost of bank

overdraft.

Working capital stock control: In accounts receivable finance, Morrison has to sell its

invoices at some discount charges which is the cost of factoring (Buchner and Wilkinson, 2015).

However, trade payables will be repaid at interest which is the cost of extending credit period.

6

Lease Its benefit is Morrison can acquire

using rights to use assets in the

business without having ownership.

Total of rental charges includes

interest amount.

Share capital No need to pay regular dividend is

the advantage of share capital.

Shareholders will have rights to

control business operations. Thus,

they can take part in decision-making.

Loan It provide tax benefits because

interest on loan is considered as an

allowable expenditures for tax

computation (Plumlee and et.al.,

2015). Besides this, controlling rights

can be prevented in the hand of

owners only.

It impose legal obligation to the

Morrison to pay interest when due,

regardless, firm has profit or loss

through operations.

Retained earnings Morrison does not need to repay the

retained profit.

It does not provide any tax benefits.

On the basis of above evaluation, it can be said that loan will be the most appropriate

sources for business expansion in different countries. While, lease financing can be used to buy land

and building and other fixed assets. However, equipments like computer can be purchased through

hire purchase system. Through this, Morrison can make initial payment from available amount ad

balance in instalments by generating revenues.

TASK 2

2.1 Analyse the cost of different types of sources

Bank overdraft: As said earlier, that bank charges an interest rate on this facility. Moreover,

the rate of interest is comparatively little bit higher than loan's interest rate. Thus, the amount of

interest which Morrison need to pay with the repayment of principle amount is the cost of bank

overdraft.

Working capital stock control: In accounts receivable finance, Morrison has to sell its

invoices at some discount charges which is the cost of factoring (Buchner and Wilkinson, 2015).

However, trade payables will be repaid at interest which is the cost of extending credit period.

6

Hire purchase: The remaining balance after making down payments will be paid in equal

instalments. This instalments includes some interest charges due to which, total payment exceeds

the buying price is known as cost of hire purchase.

Leasing: Regular rental charges need to be paid to use the assets of the owner. Lessor

include some amount of interest when deciding rental charges is the cost of getting assets on lease.

Share capital: Investors invest in the company so as to get maximum return on their equity.

Otherwise, they will sell their equity and invest in other organization (Lee, Sameen, and Cowling,

2015). Therefore, the return in the way of dividend and capital appreciation is the cost of share

capital. Moreover, shareholders also have right to control business operations. Besides this, cost of

printing shares, photocopy etc. are also the included in the cost.

Bank loan: Morrison will be liable to pay timely instalments with the interest charges as the

cost of debt funds. It also must be kept in mind that whether company will have profit or not, but it

will be obliged to pay instalments (Plumlee and et.al., 2015). Besides this, complying legal

formalities, stamp paper, collateral security to secure funds and guarantee also are the cost of loan.

Retained earnings: There is no financial cost of using retained profits because Morrison will

not need to pay back this amount but still, opportunity cost included in this. It refers to the profit

which Morrison can generate by investing retained income in any profitable investment.

2.2 Explain the importance of financial planning

Financial planning is an integral part of corporate planning through which Morrison can

make sensible financial decisions about their funds. With the assistance of this, Morrison's Certified

Financial Officer (CFO) can estimate required amount of capital which it will need to meet its

revenue and capital expenditures. Through this. CFO can frame strategic financial policies in order

to procurement, investment and effective administration of acquired funds (Altfest, 2016). It mainly

aims at deciding an optimum capital structure by the combination of both debt and equity capital.

Moreover, It focuses on effective utilization of the scare financial resources in the best possible

manner. So that, cost can be controlled and return can be maximized.

Importance of financial planning:

It assist Morrison to have adequate quantity of funds in the business to meet its financial

need timely.

Financial planning helps to maintain an effective balance between cash inflow and outflow

by ensuring maximum utilization of resources and enlarging revenue (Agarwal and et.al.,

2015).

It also helps Morrison to expand business operations in different market segments around

7

instalments. This instalments includes some interest charges due to which, total payment exceeds

the buying price is known as cost of hire purchase.

Leasing: Regular rental charges need to be paid to use the assets of the owner. Lessor

include some amount of interest when deciding rental charges is the cost of getting assets on lease.

Share capital: Investors invest in the company so as to get maximum return on their equity.

Otherwise, they will sell their equity and invest in other organization (Lee, Sameen, and Cowling,

2015). Therefore, the return in the way of dividend and capital appreciation is the cost of share

capital. Moreover, shareholders also have right to control business operations. Besides this, cost of

printing shares, photocopy etc. are also the included in the cost.

Bank loan: Morrison will be liable to pay timely instalments with the interest charges as the

cost of debt funds. It also must be kept in mind that whether company will have profit or not, but it

will be obliged to pay instalments (Plumlee and et.al., 2015). Besides this, complying legal

formalities, stamp paper, collateral security to secure funds and guarantee also are the cost of loan.

Retained earnings: There is no financial cost of using retained profits because Morrison will

not need to pay back this amount but still, opportunity cost included in this. It refers to the profit

which Morrison can generate by investing retained income in any profitable investment.

2.2 Explain the importance of financial planning

Financial planning is an integral part of corporate planning through which Morrison can

make sensible financial decisions about their funds. With the assistance of this, Morrison's Certified

Financial Officer (CFO) can estimate required amount of capital which it will need to meet its

revenue and capital expenditures. Through this. CFO can frame strategic financial policies in order

to procurement, investment and effective administration of acquired funds (Altfest, 2016). It mainly

aims at deciding an optimum capital structure by the combination of both debt and equity capital.

Moreover, It focuses on effective utilization of the scare financial resources in the best possible

manner. So that, cost can be controlled and return can be maximized.

Importance of financial planning:

It assist Morrison to have adequate quantity of funds in the business to meet its financial

need timely.

Financial planning helps to maintain an effective balance between cash inflow and outflow

by ensuring maximum utilization of resources and enlarging revenue (Agarwal and et.al.,

2015).

It also helps Morrison to expand business operations in different market segments around

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the world in order to assure long-run survival.

Making plan in advance helps Morrison to protect from potential uncertainties in relation to

market volatility. This in turn, company will be able to face threats an overcome it by having

enough quantity of funds (Financial planning definition, objectives and importance, 2016).

Financial policies and procedures helps to assure sound administration of funds and ensure

surplus available in the enterprise.

(Chand, 2015)It also provide assistance to maintain liquidity position of the firm by making

an adequate surplus between funds available and its disbursement in various business

functions.

Morrison's CFO can construct budget in the financial plan and thereby determine situation

whether business will have excess or shortage of cash (Chand, 2015). So that, company can

take decisions to improve their cash inflows and control expenditures to ensure excess

availability of funds.

2.3 Assess the information needs of different decision makers

There are different types of decision makers who are directly or indirectly affected by

Morrison's operations, enumerated below;

Shareholders: They deliver capital to the corporation and take risk so as to get higher return.

Therefore, they willing to know profit, cash generating ability, capital structure and investors return

such as earning per share, dividend per share, share price etc (Hammond, Keeney and Raiffa,

2015). With this, they make assessment of enterprisers ability and determine their potential return so

as to take good investment decisions.

Lenders: They make evaluation of profitability, cash flow position, goodwill, solvency

position and debt burden capacity of the Morrison. Lenders will only provide funds if they think

that Morrison is able to bear fixed financial burden and will adequate cash funds to pay instalments

timely.

Suppliers:They provide short term credit by analysing liquidity concern of the firm.

Therefore, they determine current assets to examine that Morrison will have enough resources or

not to meet its short-term obligations timely (Gadde and Håkansson, 2015).

Government: Taxation authority aims at generating correct amount of taxes on their

profitability. Therefore, they make assessment of income statement and determine taxation

obligations on net earnings. Besides this, they have right to impose penalties and fines for the

incorrect filling of tax return. It also identify that all the operations are conducting ethically and in

public interest.

8

Making plan in advance helps Morrison to protect from potential uncertainties in relation to

market volatility. This in turn, company will be able to face threats an overcome it by having

enough quantity of funds (Financial planning definition, objectives and importance, 2016).

Financial policies and procedures helps to assure sound administration of funds and ensure

surplus available in the enterprise.

(Chand, 2015)It also provide assistance to maintain liquidity position of the firm by making

an adequate surplus between funds available and its disbursement in various business

functions.

Morrison's CFO can construct budget in the financial plan and thereby determine situation

whether business will have excess or shortage of cash (Chand, 2015). So that, company can

take decisions to improve their cash inflows and control expenditures to ensure excess

availability of funds.

2.3 Assess the information needs of different decision makers

There are different types of decision makers who are directly or indirectly affected by

Morrison's operations, enumerated below;

Shareholders: They deliver capital to the corporation and take risk so as to get higher return.

Therefore, they willing to know profit, cash generating ability, capital structure and investors return

such as earning per share, dividend per share, share price etc (Hammond, Keeney and Raiffa,

2015). With this, they make assessment of enterprisers ability and determine their potential return so

as to take good investment decisions.

Lenders: They make evaluation of profitability, cash flow position, goodwill, solvency

position and debt burden capacity of the Morrison. Lenders will only provide funds if they think

that Morrison is able to bear fixed financial burden and will adequate cash funds to pay instalments

timely.

Suppliers:They provide short term credit by analysing liquidity concern of the firm.

Therefore, they determine current assets to examine that Morrison will have enough resources or

not to meet its short-term obligations timely (Gadde and Håkansson, 2015).

Government: Taxation authority aims at generating correct amount of taxes on their

profitability. Therefore, they make assessment of income statement and determine taxation

obligations on net earnings. Besides this, they have right to impose penalties and fines for the

incorrect filling of tax return. It also identify that all the operations are conducting ethically and in

public interest.

8

Managers: They are accountable to manage core business functioning by framing policies

and take effective decisions. Therefore, they analyse income, expenditures, profits, liquidity,

solvency, cash gathering ability and assets using efficiency (Hogan, Olson and Capella, 2015).

Employees: Workers are interested to get high salary, position, appraisal and non-monetary

rewards. Therefore, they make evaluation of business profitability and serve organization who have

good position and greater yield.

Public: Morrison operates in society therefore, company has certain responsibility towards

community. Public desire that corporations fulfil its environmental responsibility and respect all the

culture and religion of different community.

2.4 Explain the impact of finance on the financial statements

Bank Overdraft: In profitability statement, interest on overdraft will be shows on the debit

side as expenditure. While, in balance sheet, bank overdraft will be recorded as current liabilities

and include in cash balance in the head current assets. In addition, paid interest will be deducted

from the cash position.

Working capital: Discounted debtors through factoring will be subtracted from total debtors

in the current assets of Balance sheet and increase cash balance. While, creditors payments will

subtracted accounts payable and cash as well (Chand, 2015).

Hire purchase: In balance sheet, equipment will be shows as assets and instalments will be

recorded as expenditures in profitability statement and subtracted from cash balance as well.

Lease: Assets acquired will be shows as fixed assets in the balance sheet whereas periodic

rental charges will be reported as spendings in income statement and reduced available cash funds.

Share capital: Issued share capital will be reported as equity in the balance sheet and

improve cash position. While, dividend payment will be recorded in income statement as payment

and deducted from the cash balance in B/S (Buchner and Wilkinson, 2015)..

Loan: It will be recorded as non-current liability and improve cash balance in the current

assets head of B/S. However, in profitability statement, loan instalments will be shown as revenue

expenditures which decline business profit. Besides this, it will also subtracted from the cash

balance reported in B/S.

Retained earnings: It only changes the capital structure of the company therefore, it will be

reported in the statement of changes in equity and retained earnings (Plumlee and et.al., 2015).

TASK 3

3.1 Analyse budgets and make appropriate decisions

Cash budget is a budget that accumulates estimated cash inflow and outflow from different

9

and take effective decisions. Therefore, they analyse income, expenditures, profits, liquidity,

solvency, cash gathering ability and assets using efficiency (Hogan, Olson and Capella, 2015).

Employees: Workers are interested to get high salary, position, appraisal and non-monetary

rewards. Therefore, they make evaluation of business profitability and serve organization who have

good position and greater yield.

Public: Morrison operates in society therefore, company has certain responsibility towards

community. Public desire that corporations fulfil its environmental responsibility and respect all the

culture and religion of different community.

2.4 Explain the impact of finance on the financial statements

Bank Overdraft: In profitability statement, interest on overdraft will be shows on the debit

side as expenditure. While, in balance sheet, bank overdraft will be recorded as current liabilities

and include in cash balance in the head current assets. In addition, paid interest will be deducted

from the cash position.

Working capital: Discounted debtors through factoring will be subtracted from total debtors

in the current assets of Balance sheet and increase cash balance. While, creditors payments will

subtracted accounts payable and cash as well (Chand, 2015).

Hire purchase: In balance sheet, equipment will be shows as assets and instalments will be

recorded as expenditures in profitability statement and subtracted from cash balance as well.

Lease: Assets acquired will be shows as fixed assets in the balance sheet whereas periodic

rental charges will be reported as spendings in income statement and reduced available cash funds.

Share capital: Issued share capital will be reported as equity in the balance sheet and

improve cash position. While, dividend payment will be recorded in income statement as payment

and deducted from the cash balance in B/S (Buchner and Wilkinson, 2015)..

Loan: It will be recorded as non-current liability and improve cash balance in the current

assets head of B/S. However, in profitability statement, loan instalments will be shown as revenue

expenditures which decline business profit. Besides this, it will also subtracted from the cash

balance reported in B/S.

Retained earnings: It only changes the capital structure of the company therefore, it will be

reported in the statement of changes in equity and retained earnings (Plumlee and et.al., 2015).

TASK 3

3.1 Analyse budgets and make appropriate decisions

Cash budget is a budget that accumulates estimated cash inflow and outflow from different

9

business functions. However, sales budget helps to determine potential sales volume and sales value

which firm will generate in future period (Sintomer, Röcke and Herzberg, 2015). With regards to

Morrison, cash and sales budget for the six month period is prepared as under:

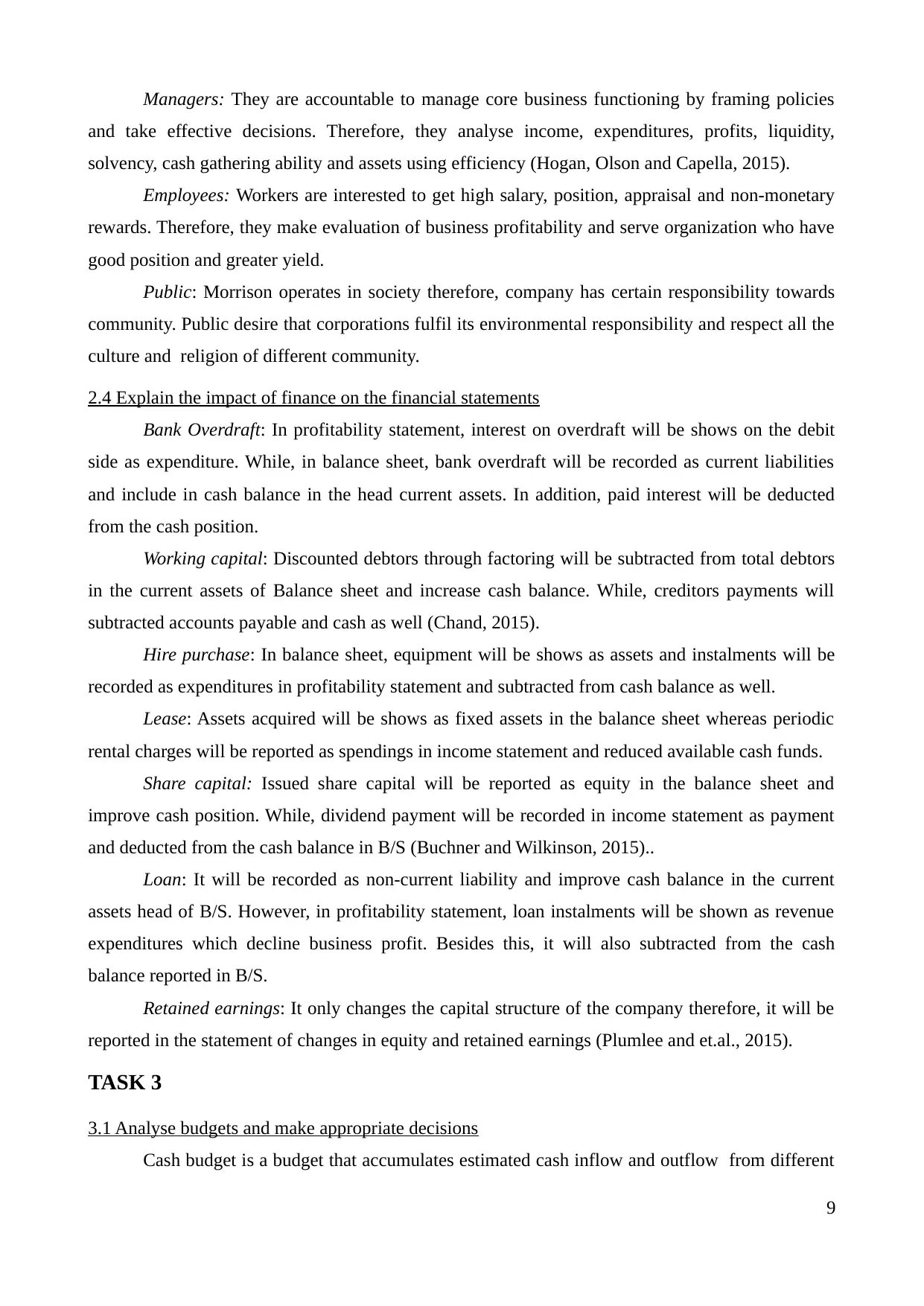

Table 1: Sales budget of Morrison for the period of 6 months ending on 30th September.

Particulars April May June July August September

Forecasted sales unit 3000 3150 3465 3880 4462 5265

*Selling price 75 78 81 84 87 90

Total sales 225000 245700 280665 325920 388194 473850

Less: Discount @ 7.5% 16875 18427.5 21049.875 24444 29114.55 35538.75

Net sales 208125 227272.5 259615.125 301476 359079.45 438311.25

Interpretation:

As per the budget, it can be seen that Morrisons sales volume is increasing at higher rate as

total sales unit in April from 3000 has been increased to 5265 units in the September. The rate of

increasing is 5%, 10%, 12%, 15% and 18% respectively. While, selling price is increasing at 4%

inflation rate and the rate of discounts over the budgeted period is constant to 7.5%. As a result, net

sales has been increased from £208125 to £438311.25 in the end.

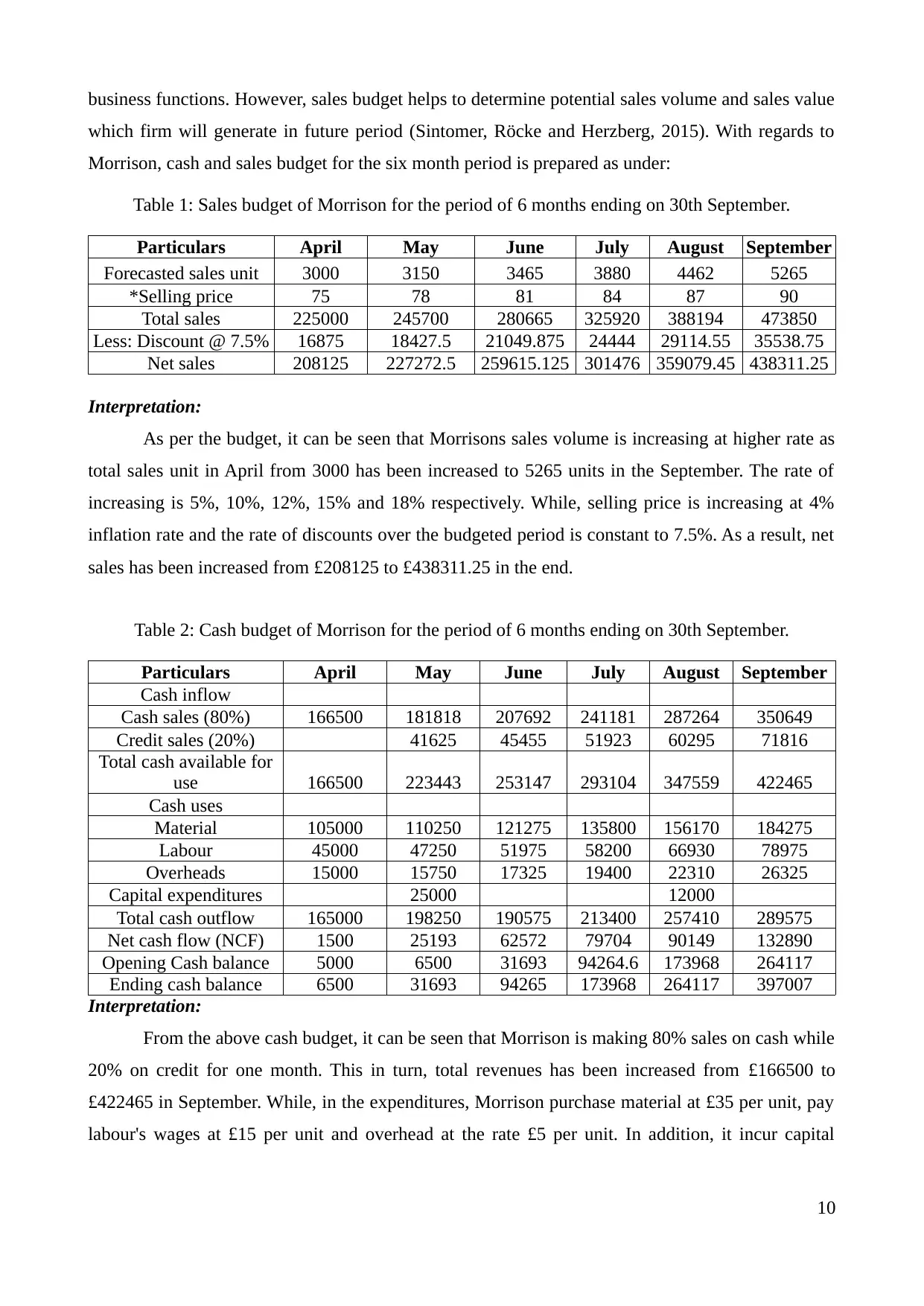

Table 2: Cash budget of Morrison for the period of 6 months ending on 30th September.

Particulars April May June July August September

Cash inflow

Cash sales (80%) 166500 181818 207692 241181 287264 350649

Credit sales (20%) 41625 45455 51923 60295 71816

Total cash available for

use 166500 223443 253147 293104 347559 422465

Cash uses

Material 105000 110250 121275 135800 156170 184275

Labour 45000 47250 51975 58200 66930 78975

Overheads 15000 15750 17325 19400 22310 26325

Capital expenditures 25000 12000

Total cash outflow 165000 198250 190575 213400 257410 289575

Net cash flow (NCF) 1500 25193 62572 79704 90149 132890

Opening Cash balance 5000 6500 31693 94264.6 173968 264117

Ending cash balance 6500 31693 94265 173968 264117 397007

Interpretation:

From the above cash budget, it can be seen that Morrison is making 80% sales on cash while

20% on credit for one month. This in turn, total revenues has been increased from £166500 to

£422465 in September. While, in the expenditures, Morrison purchase material at £35 per unit, pay

labour's wages at £15 per unit and overhead at the rate £5 per unit. In addition, it incur capital

10

which firm will generate in future period (Sintomer, Röcke and Herzberg, 2015). With regards to

Morrison, cash and sales budget for the six month period is prepared as under:

Table 1: Sales budget of Morrison for the period of 6 months ending on 30th September.

Particulars April May June July August September

Forecasted sales unit 3000 3150 3465 3880 4462 5265

*Selling price 75 78 81 84 87 90

Total sales 225000 245700 280665 325920 388194 473850

Less: Discount @ 7.5% 16875 18427.5 21049.875 24444 29114.55 35538.75

Net sales 208125 227272.5 259615.125 301476 359079.45 438311.25

Interpretation:

As per the budget, it can be seen that Morrisons sales volume is increasing at higher rate as

total sales unit in April from 3000 has been increased to 5265 units in the September. The rate of

increasing is 5%, 10%, 12%, 15% and 18% respectively. While, selling price is increasing at 4%

inflation rate and the rate of discounts over the budgeted period is constant to 7.5%. As a result, net

sales has been increased from £208125 to £438311.25 in the end.

Table 2: Cash budget of Morrison for the period of 6 months ending on 30th September.

Particulars April May June July August September

Cash inflow

Cash sales (80%) 166500 181818 207692 241181 287264 350649

Credit sales (20%) 41625 45455 51923 60295 71816

Total cash available for

use 166500 223443 253147 293104 347559 422465

Cash uses

Material 105000 110250 121275 135800 156170 184275

Labour 45000 47250 51975 58200 66930 78975

Overheads 15000 15750 17325 19400 22310 26325

Capital expenditures 25000 12000

Total cash outflow 165000 198250 190575 213400 257410 289575

Net cash flow (NCF) 1500 25193 62572 79704 90149 132890

Opening Cash balance 5000 6500 31693 94264.6 173968 264117

Ending cash balance 6500 31693 94265 173968 264117 397007

Interpretation:

From the above cash budget, it can be seen that Morrison is making 80% sales on cash while

20% on credit for one month. This in turn, total revenues has been increased from £166500 to

£422465 in September. While, in the expenditures, Morrison purchase material at £35 per unit, pay

labour's wages at £15 per unit and overhead at the rate £5 per unit. In addition, it incur capital

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

expenditures of £25000 and £12000 in the month of May and August. As a result, NCF has been

significantly enhanced from £1500 to £132890 whereas closing cash position has been improved

from £6500 to £397007 respectively.

Decisions:

Morrison can control material cost by finding overseas suppliers who are ready to supply

raw material at less rate (Hawkins and Turner, 2015).

Labour cost can be controlled by recruiting skilled and talented workforce at less piece rate .

Overheads can be controlled by regular monitoring of the operational activities (Muflih,

2016).

3.2 Explain calculation of unit cost and make pricing decisions using relevant information

Unit cost: It indicates expenditures incurred by Morrison on each production unit. In other

words, it can be said that total cost which firm needs to incur for production of one unit is known as

unit cost (Chandar and Tchamkerten, 2015). It has been computed here as under:

Material cost = £400000

Labour cost = £200000

Variable overhead = £150000

Fixed overhead = £50000

Total number of units = 20000 units

Unit cost formula: Total cost of the production/Number of units produced

= (£400000+£200000+£150000+£50000)/20000 units

= £800000/20000 units

= £40

Cost per unit of Morrison's product is £40.

Pricing decisions: Cost is the basis of pricing decisions because all the organization decides

their product price at the minimum level through which both total cost incurred can be recovered.

Cost-plus-pricing is the most simplest and often use techniques that are used by the corporations to

decide their product prices (Haynes, 2015). In this method, Morrison can add an desired or target

profit percentage and added into the total cost to determine selling price.

Selling price = Unit cost + target profit percentage (Mark-up percentage)

= £40 + (£40*25%)

= £40 + £10

= £50

Profit percentage on sales at 20000 units = (£200000/£1000000)*100

11

significantly enhanced from £1500 to £132890 whereas closing cash position has been improved

from £6500 to £397007 respectively.

Decisions:

Morrison can control material cost by finding overseas suppliers who are ready to supply

raw material at less rate (Hawkins and Turner, 2015).

Labour cost can be controlled by recruiting skilled and talented workforce at less piece rate .

Overheads can be controlled by regular monitoring of the operational activities (Muflih,

2016).

3.2 Explain calculation of unit cost and make pricing decisions using relevant information

Unit cost: It indicates expenditures incurred by Morrison on each production unit. In other

words, it can be said that total cost which firm needs to incur for production of one unit is known as

unit cost (Chandar and Tchamkerten, 2015). It has been computed here as under:

Material cost = £400000

Labour cost = £200000

Variable overhead = £150000

Fixed overhead = £50000

Total number of units = 20000 units

Unit cost formula: Total cost of the production/Number of units produced

= (£400000+£200000+£150000+£50000)/20000 units

= £800000/20000 units

= £40

Cost per unit of Morrison's product is £40.

Pricing decisions: Cost is the basis of pricing decisions because all the organization decides

their product price at the minimum level through which both total cost incurred can be recovered.

Cost-plus-pricing is the most simplest and often use techniques that are used by the corporations to

decide their product prices (Haynes, 2015). In this method, Morrison can add an desired or target

profit percentage and added into the total cost to determine selling price.

Selling price = Unit cost + target profit percentage (Mark-up percentage)

= £40 + (£40*25%)

= £40 + £10

= £50

Profit percentage on sales at 20000 units = (£200000/£1000000)*100

11

= 20%

At £50 selling price, Morrison can earn £10 profit on each unit henceforth at total sales

volume of 20000 units, it can earn profit amounted to £200000. At this level, profit percentage on

sales will be 20%. This method assure recovery of total cost plus return in the business. In case, if

Morrison enhance its selling price than it will be able to generate larger profit or vice-versa.

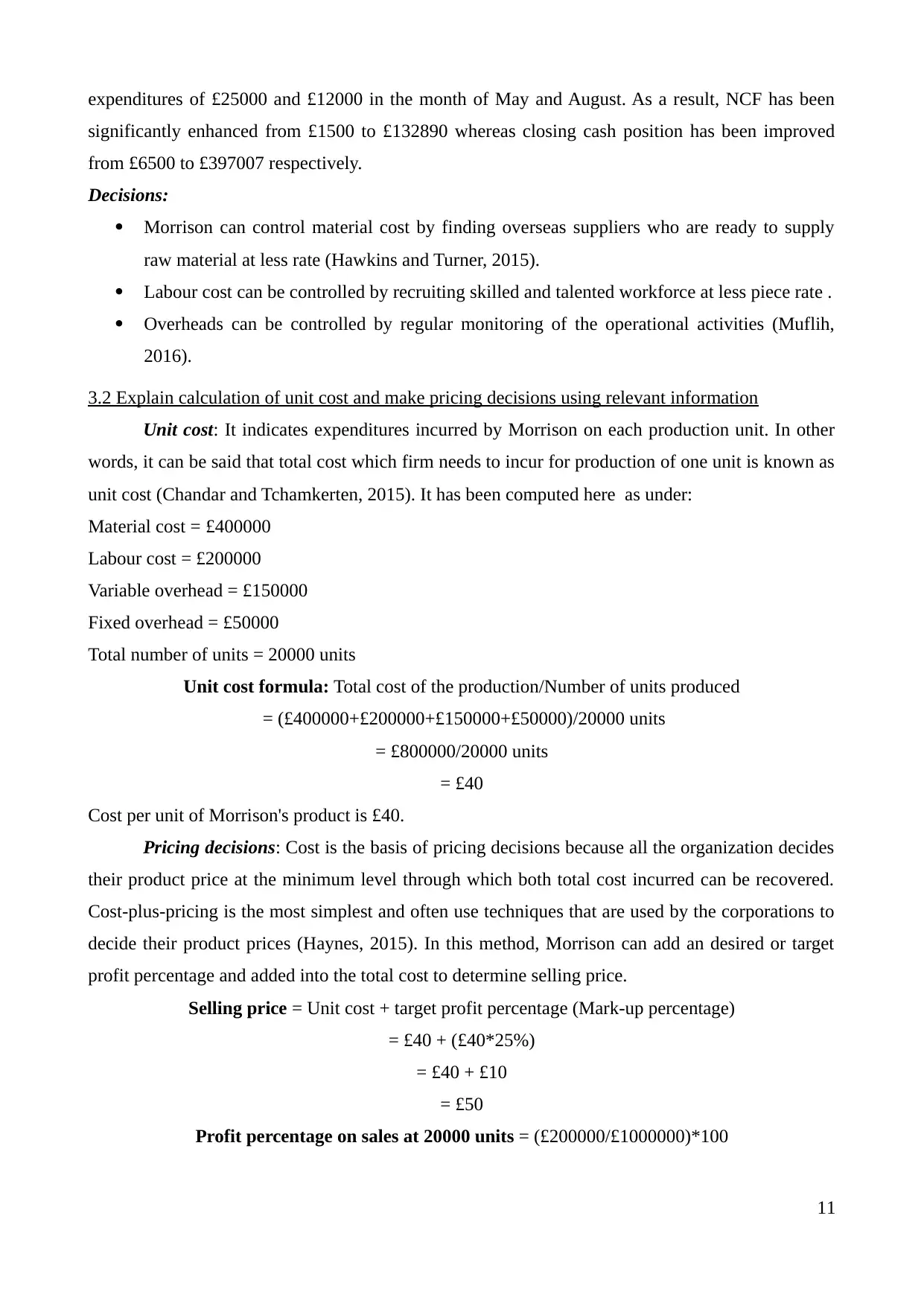

3.3 Assess the viability of project using investment appraisal techniques

Every capital decisions have certain type of risk therefore, it is essential for the Morrison to

take better decisions by using investment appraisal techniques. It enable company to evaluate

strength and weakness of each capital project and identify most viable project.

Pay back period: Time period to get back its initial cash outlay is called PP, Morrison must

select project which PP is shorter (Upton and et.al., 2015). Easiness and simplicity are the benefits

whereas ignoring true value of money and post pay back profitability are the disadvantage.

Accounting rate of return (ARR): It express profit percentage which Morrison can generates

on its initial investment, is known as ARR. Morrison must select project whose ARR is

comparatively higher. Determining profit percentage is the advantage and evaluating profit instead

of cash flow and do not taken into account tie value of money are the disadvantage (Sims, Powell

and Vidgen, 2015).

Table 3: Calculation of Pay back period and Accounting rate of return

Year Project A Project B

Cumulative

cash flow

Cumulative

cash flow

Initial investment -160000 -160000

1 58000 53000 -102000 -107000

2 76000 79000 -26000 -28000

3 88500 83000 62500 55000

4 93000 96000 155500 151000

Total cash inflows 315500 311000

Payback period

Project A = 2 year + (£26000/£88500) = 2.29 year

Project B = 2 year + (£28000/£83000) = 2.34 year

ARR = Average profit/Initial investment*100

Project A = (£315500/5)/£160000*100 = 49.29%

Project B = (£311000/5)/£160000*100 = 48.59%

Net present value (NPV): Excess of total of potential cash inflows over project cost is known

as NPV. Considering true value of money is the benefit whereas determining an appropriate rate of

discount is very difficult task (Higham, Fortune and Boothman, 2016).

12

At £50 selling price, Morrison can earn £10 profit on each unit henceforth at total sales

volume of 20000 units, it can earn profit amounted to £200000. At this level, profit percentage on

sales will be 20%. This method assure recovery of total cost plus return in the business. In case, if

Morrison enhance its selling price than it will be able to generate larger profit or vice-versa.

3.3 Assess the viability of project using investment appraisal techniques

Every capital decisions have certain type of risk therefore, it is essential for the Morrison to

take better decisions by using investment appraisal techniques. It enable company to evaluate

strength and weakness of each capital project and identify most viable project.

Pay back period: Time period to get back its initial cash outlay is called PP, Morrison must

select project which PP is shorter (Upton and et.al., 2015). Easiness and simplicity are the benefits

whereas ignoring true value of money and post pay back profitability are the disadvantage.

Accounting rate of return (ARR): It express profit percentage which Morrison can generates

on its initial investment, is known as ARR. Morrison must select project whose ARR is

comparatively higher. Determining profit percentage is the advantage and evaluating profit instead

of cash flow and do not taken into account tie value of money are the disadvantage (Sims, Powell

and Vidgen, 2015).

Table 3: Calculation of Pay back period and Accounting rate of return

Year Project A Project B

Cumulative

cash flow

Cumulative

cash flow

Initial investment -160000 -160000

1 58000 53000 -102000 -107000

2 76000 79000 -26000 -28000

3 88500 83000 62500 55000

4 93000 96000 155500 151000

Total cash inflows 315500 311000

Payback period

Project A = 2 year + (£26000/£88500) = 2.29 year

Project B = 2 year + (£28000/£83000) = 2.34 year

ARR = Average profit/Initial investment*100

Project A = (£315500/5)/£160000*100 = 49.29%

Project B = (£311000/5)/£160000*100 = 48.59%

Net present value (NPV): Excess of total of potential cash inflows over project cost is known

as NPV. Considering true value of money is the benefit whereas determining an appropriate rate of

discount is very difficult task (Higham, Fortune and Boothman, 2016).

12

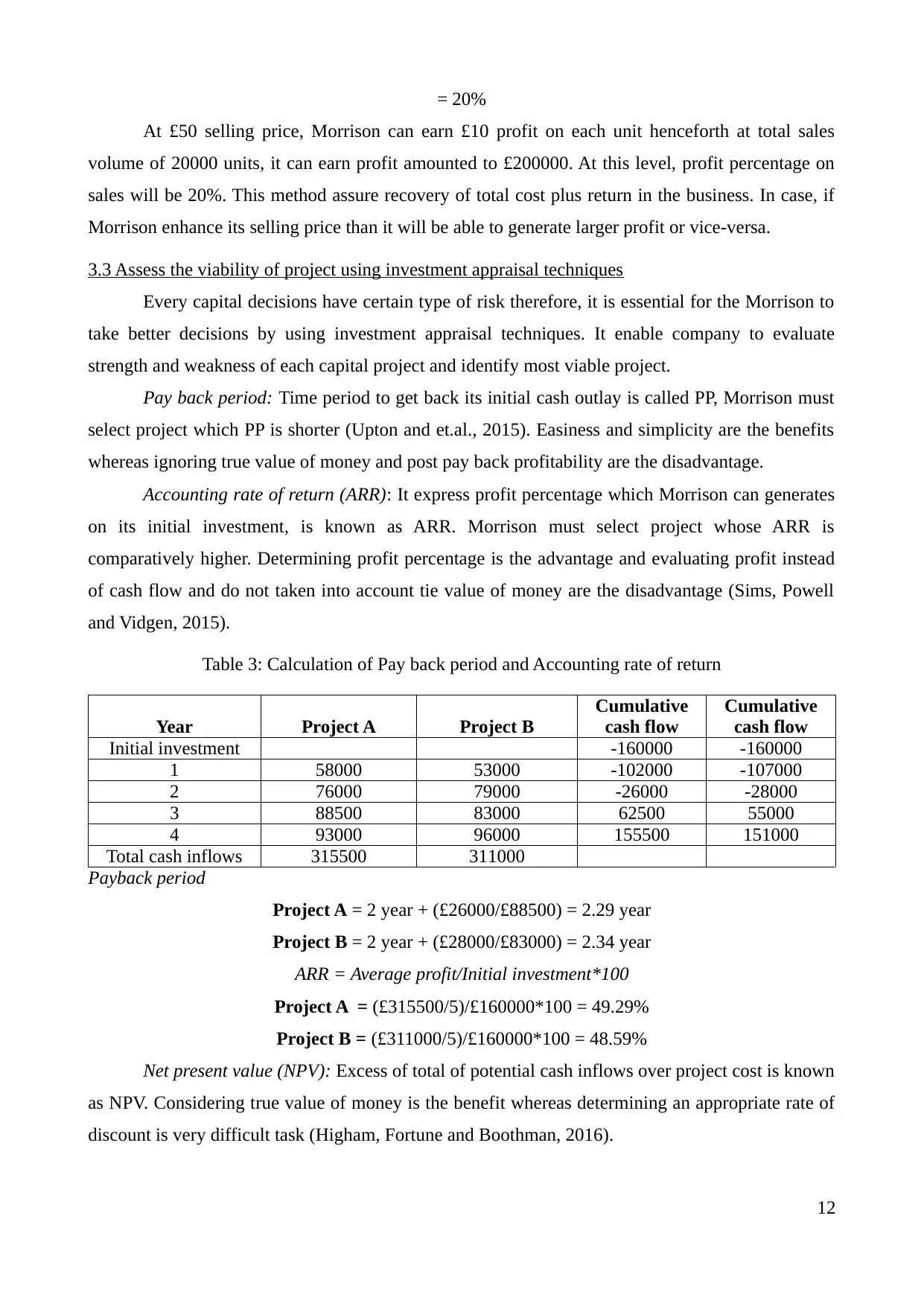

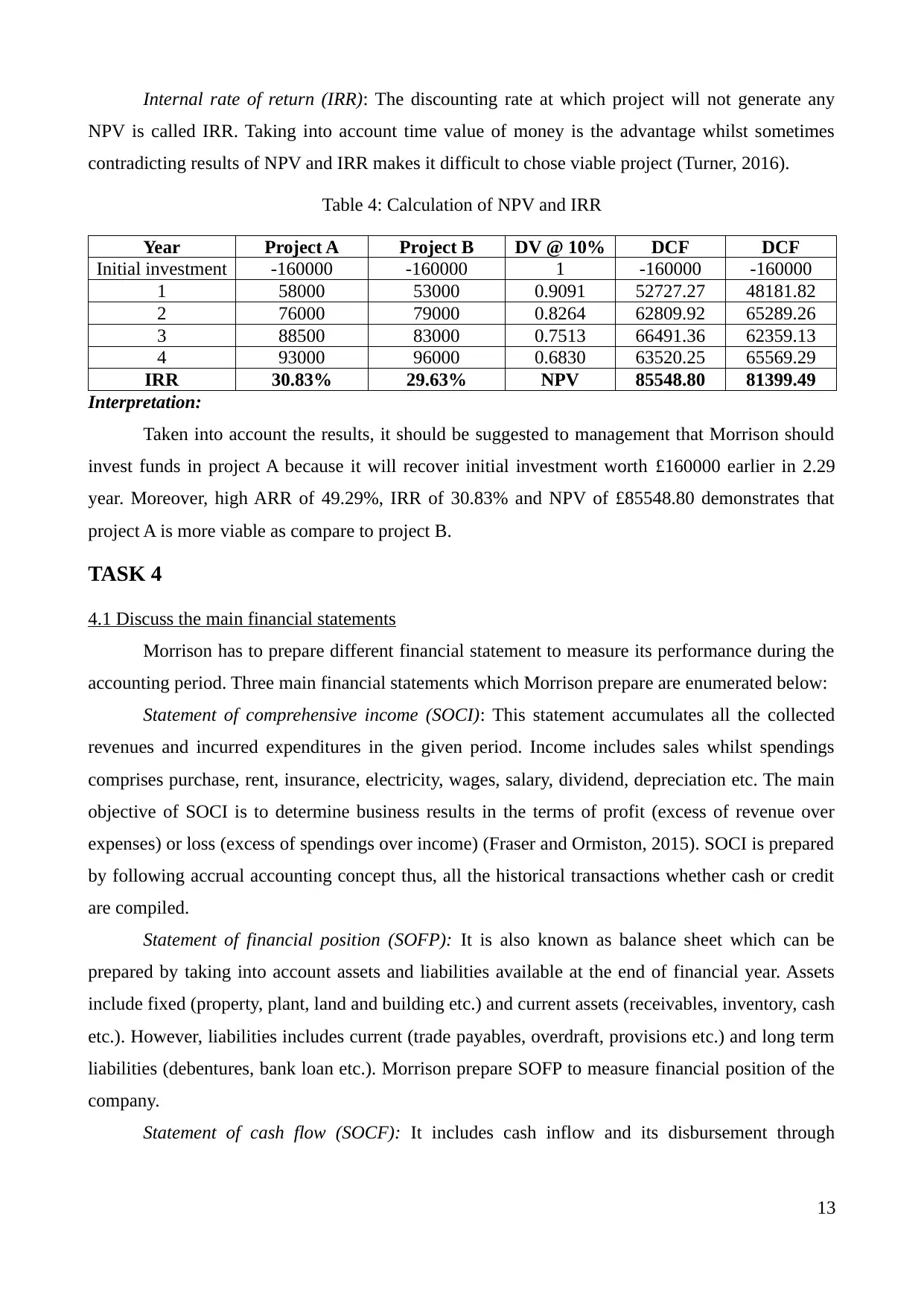

Internal rate of return (IRR): The discounting rate at which project will not generate any

NPV is called IRR. Taking into account time value of money is the advantage whilst sometimes

contradicting results of NPV and IRR makes it difficult to chose viable project (Turner, 2016).

Table 4: Calculation of NPV and IRR

Year Project A Project B DV @ 10% DCF DCF

Initial investment -160000 -160000 1 -160000 -160000

1 58000 53000 0.9091 52727.27 48181.82

2 76000 79000 0.8264 62809.92 65289.26

3 88500 83000 0.7513 66491.36 62359.13

4 93000 96000 0.6830 63520.25 65569.29

IRR 30.83% 29.63% NPV 85548.80 81399.49

Interpretation:

Taken into account the results, it should be suggested to management that Morrison should

invest funds in project A because it will recover initial investment worth £160000 earlier in 2.29

year. Moreover, high ARR of 49.29%, IRR of 30.83% and NPV of £85548.80 demonstrates that

project A is more viable as compare to project B.

TASK 4

4.1 Discuss the main financial statements

Morrison has to prepare different financial statement to measure its performance during the

accounting period. Three main financial statements which Morrison prepare are enumerated below:

Statement of comprehensive income (SOCI): This statement accumulates all the collected

revenues and incurred expenditures in the given period. Income includes sales whilst spendings

comprises purchase, rent, insurance, electricity, wages, salary, dividend, depreciation etc. The main

objective of SOCI is to determine business results in the terms of profit (excess of revenue over

expenses) or loss (excess of spendings over income) (Fraser and Ormiston, 2015). SOCI is prepared

by following accrual accounting concept thus, all the historical transactions whether cash or credit

are compiled.

Statement of financial position (SOFP): It is also known as balance sheet which can be

prepared by taking into account assets and liabilities available at the end of financial year. Assets

include fixed (property, plant, land and building etc.) and current assets (receivables, inventory, cash

etc.). However, liabilities includes current (trade payables, overdraft, provisions etc.) and long term

liabilities (debentures, bank loan etc.). Morrison prepare SOFP to measure financial position of the

company.

Statement of cash flow (SOCF): It includes cash inflow and its disbursement through

13

NPV is called IRR. Taking into account time value of money is the advantage whilst sometimes

contradicting results of NPV and IRR makes it difficult to chose viable project (Turner, 2016).

Table 4: Calculation of NPV and IRR

Year Project A Project B DV @ 10% DCF DCF

Initial investment -160000 -160000 1 -160000 -160000

1 58000 53000 0.9091 52727.27 48181.82

2 76000 79000 0.8264 62809.92 65289.26

3 88500 83000 0.7513 66491.36 62359.13

4 93000 96000 0.6830 63520.25 65569.29

IRR 30.83% 29.63% NPV 85548.80 81399.49

Interpretation:

Taken into account the results, it should be suggested to management that Morrison should

invest funds in project A because it will recover initial investment worth £160000 earlier in 2.29

year. Moreover, high ARR of 49.29%, IRR of 30.83% and NPV of £85548.80 demonstrates that

project A is more viable as compare to project B.

TASK 4

4.1 Discuss the main financial statements

Morrison has to prepare different financial statement to measure its performance during the

accounting period. Three main financial statements which Morrison prepare are enumerated below:

Statement of comprehensive income (SOCI): This statement accumulates all the collected

revenues and incurred expenditures in the given period. Income includes sales whilst spendings

comprises purchase, rent, insurance, electricity, wages, salary, dividend, depreciation etc. The main

objective of SOCI is to determine business results in the terms of profit (excess of revenue over

expenses) or loss (excess of spendings over income) (Fraser and Ormiston, 2015). SOCI is prepared

by following accrual accounting concept thus, all the historical transactions whether cash or credit

are compiled.

Statement of financial position (SOFP): It is also known as balance sheet which can be

prepared by taking into account assets and liabilities available at the end of financial year. Assets

include fixed (property, plant, land and building etc.) and current assets (receivables, inventory, cash

etc.). However, liabilities includes current (trade payables, overdraft, provisions etc.) and long term

liabilities (debentures, bank loan etc.). Morrison prepare SOFP to measure financial position of the

company.

Statement of cash flow (SOCF): It includes cash inflow and its disbursement through

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

operating, financing and investing activities. It aims to determine reasons for different cash position

at the end of two different financial year (Minnis and Sutherland, 2015). Operating activities

includes revenue and income from daily functions, investing activities includes acquisition and

disposal of fixed assets and financing activities comprises inflow and outflow through debt and

equity sources.

4.2 Compare appropriate formats of financial statements for different types of business

Organization which is owned, regulated and governed by only one entrepreneur, is known as

sole proprietorship. It prepare SOCI, SOFP and SOCF by complying with generally accepted

accounting principles (GAAP) like accrual, monetary, separate entity etc. They are not follow any

specific format when preparing final accounts (Kreder, 2015). Moreover, auditing is not compulsory

for this organizations.

While, firms which are owned by two or more entrepreneurs who are decided to put mutual

efforts and share profit or loss in decided ratio, is called partnership. They prepare profit and loss

appropriation account, partners capital and current account by complying with the partnership act

and GAAP.

Large organizations which are owned by shareholders is called company. It can be

established by complying with the provisions of company Act. Therefore, it is obliged to prepare

final accounts by taking into account GAAP, International Accounting Standard (IAS), International

financial reporting standard (IFRS), CA, 2006, EU directives etc (Picker, 2016). It is obliged to

prepare SOCI, SOCF, SOFP, statement of changes in equity and necessary disclosure. Moreover,

auditing is also mandatory requirement to test accuracy and reliability of the financial information

reported in the statements and publish it to communicate with the stakeholders. Besides this, it has

to show each and every item of the balance sheet separately as per the schedule. It has to report

audited financial statement to financial institutions, shareholders and taxation authority (Fuchs and

Colyvas, 2013).

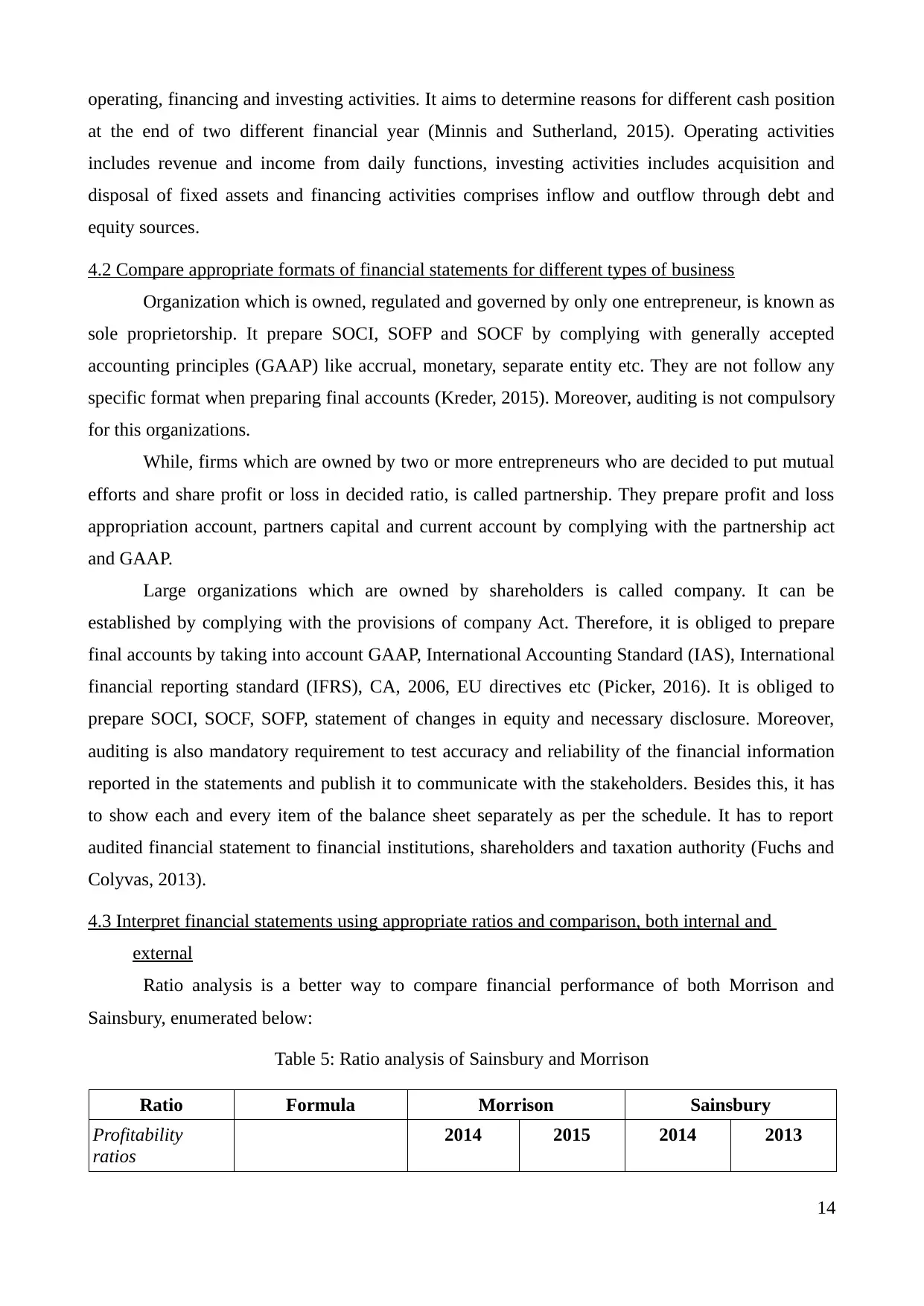

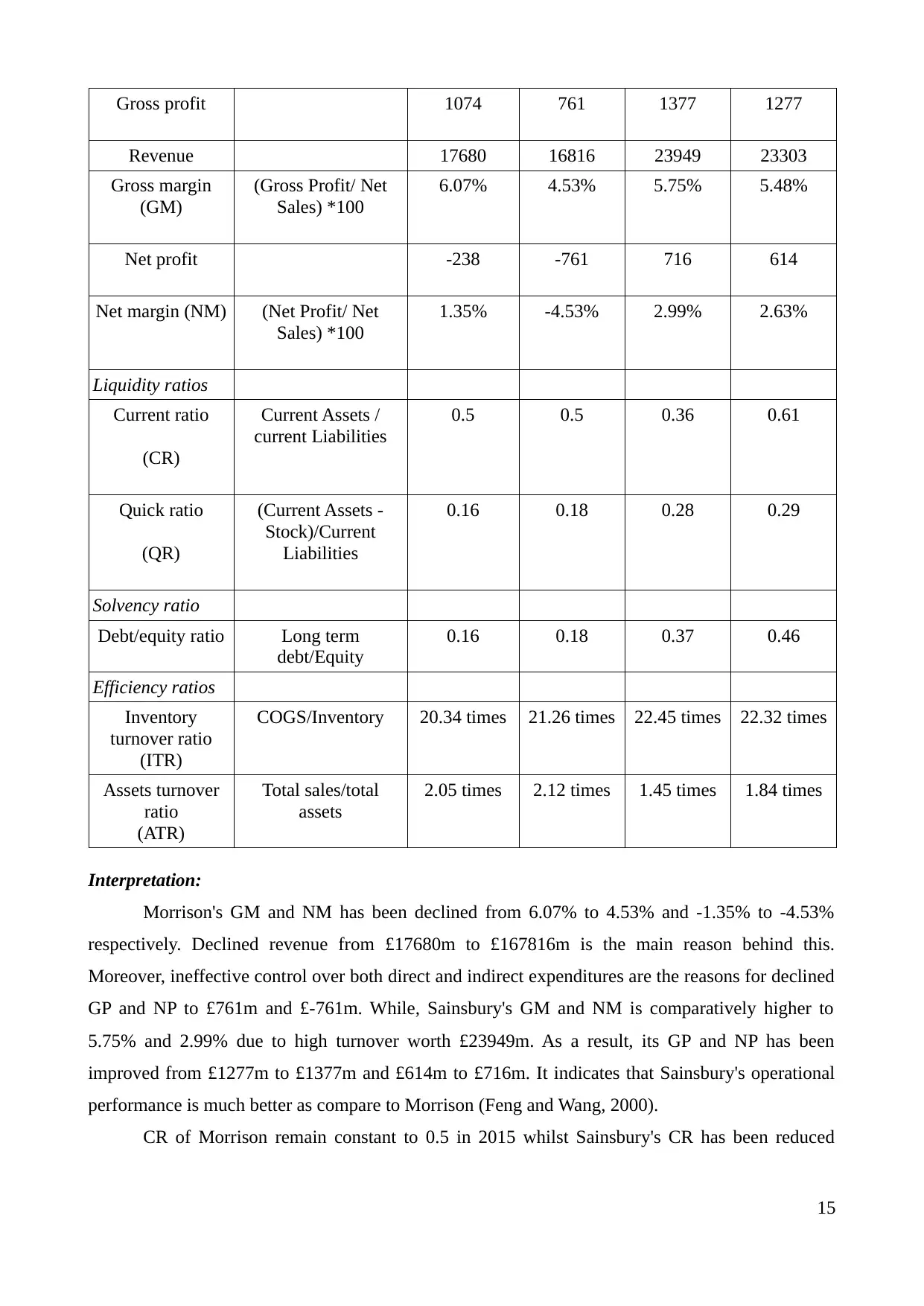

4.3 Interpret financial statements using appropriate ratios and comparison, both internal and

external

Ratio analysis is a better way to compare financial performance of both Morrison and

Sainsbury, enumerated below:

Table 5: Ratio analysis of Sainsbury and Morrison

Ratio Formula Morrison Sainsbury

Profitability

ratios

2014 2015 2014 2013

14

at the end of two different financial year (Minnis and Sutherland, 2015). Operating activities

includes revenue and income from daily functions, investing activities includes acquisition and

disposal of fixed assets and financing activities comprises inflow and outflow through debt and

equity sources.

4.2 Compare appropriate formats of financial statements for different types of business

Organization which is owned, regulated and governed by only one entrepreneur, is known as

sole proprietorship. It prepare SOCI, SOFP and SOCF by complying with generally accepted

accounting principles (GAAP) like accrual, monetary, separate entity etc. They are not follow any

specific format when preparing final accounts (Kreder, 2015). Moreover, auditing is not compulsory

for this organizations.

While, firms which are owned by two or more entrepreneurs who are decided to put mutual

efforts and share profit or loss in decided ratio, is called partnership. They prepare profit and loss

appropriation account, partners capital and current account by complying with the partnership act

and GAAP.

Large organizations which are owned by shareholders is called company. It can be

established by complying with the provisions of company Act. Therefore, it is obliged to prepare

final accounts by taking into account GAAP, International Accounting Standard (IAS), International

financial reporting standard (IFRS), CA, 2006, EU directives etc (Picker, 2016). It is obliged to

prepare SOCI, SOCF, SOFP, statement of changes in equity and necessary disclosure. Moreover,

auditing is also mandatory requirement to test accuracy and reliability of the financial information

reported in the statements and publish it to communicate with the stakeholders. Besides this, it has

to show each and every item of the balance sheet separately as per the schedule. It has to report

audited financial statement to financial institutions, shareholders and taxation authority (Fuchs and

Colyvas, 2013).

4.3 Interpret financial statements using appropriate ratios and comparison, both internal and

external

Ratio analysis is a better way to compare financial performance of both Morrison and

Sainsbury, enumerated below:

Table 5: Ratio analysis of Sainsbury and Morrison

Ratio Formula Morrison Sainsbury

Profitability

ratios

2014 2015 2014 2013

14

Gross profit 1074 761 1377 1277

Revenue 17680 16816 23949 23303

Gross margin

(GM)

(Gross Profit/ Net

Sales) *100

6.07% 4.53% 5.75% 5.48%

Net profit -238 -761 716 614

Net margin (NM) (Net Profit/ Net

Sales) *100

1.35% -4.53% 2.99% 2.63%

Liquidity ratios

Current ratio

(CR)

Current Assets /

current Liabilities

0.5 0.5 0.36 0.61

Quick ratio

(QR)

(Current Assets -

Stock)/Current

Liabilities

0.16 0.18 0.28 0.29

Solvency ratio

Debt/equity ratio Long term

debt/Equity

0.16 0.18 0.37 0.46

Efficiency ratios

Inventory

turnover ratio

(ITR)

COGS/Inventory 20.34 times 21.26 times 22.45 times 22.32 times

Assets turnover

ratio

(ATR)

Total sales/total

assets

2.05 times 2.12 times 1.45 times 1.84 times

Interpretation:

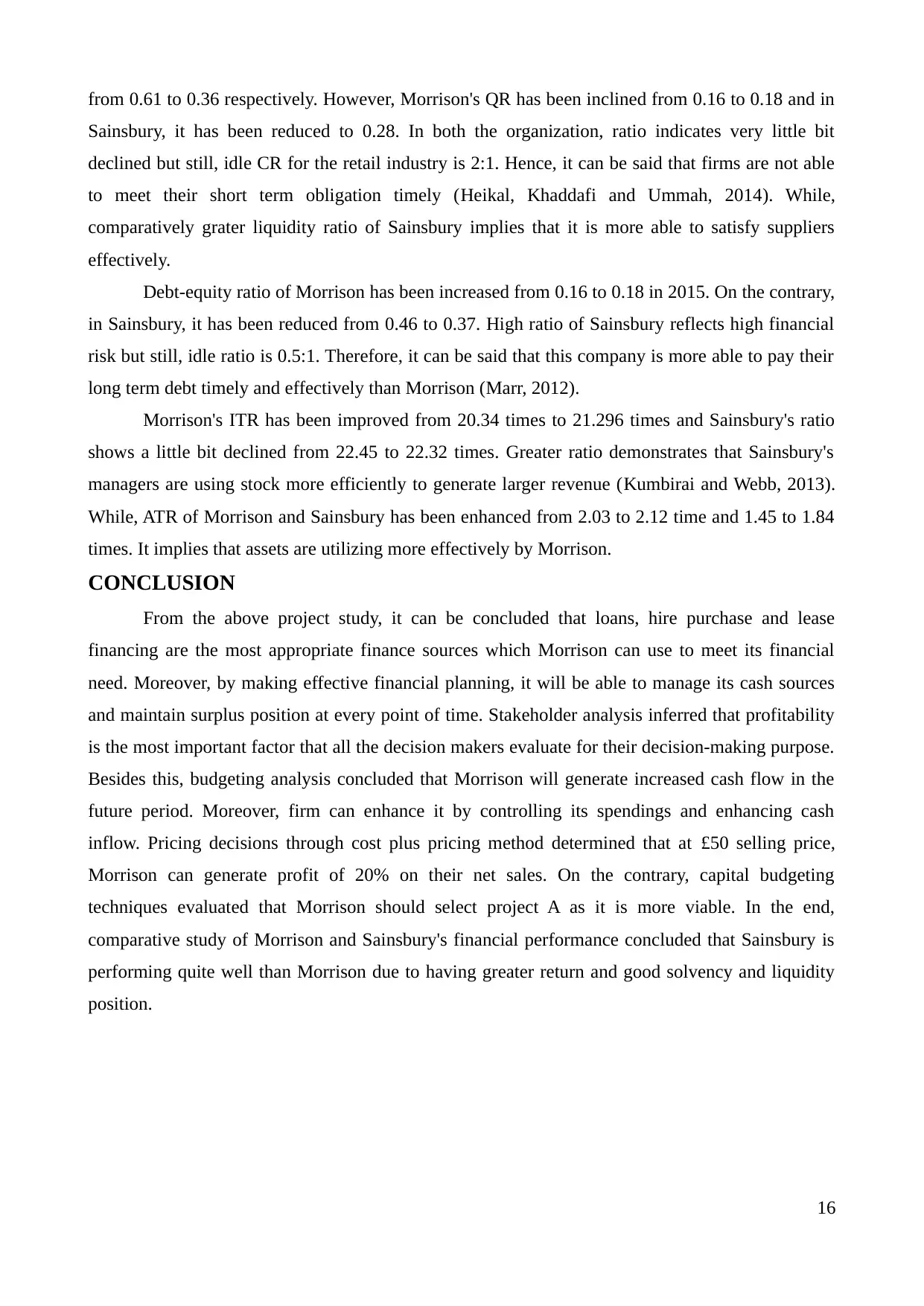

Morrison's GM and NM has been declined from 6.07% to 4.53% and -1.35% to -4.53%

respectively. Declined revenue from £17680m to £167816m is the main reason behind this.

Moreover, ineffective control over both direct and indirect expenditures are the reasons for declined

GP and NP to £761m and £-761m. While, Sainsbury's GM and NM is comparatively higher to

5.75% and 2.99% due to high turnover worth £23949m. As a result, its GP and NP has been

improved from £1277m to £1377m and £614m to £716m. It indicates that Sainsbury's operational

performance is much better as compare to Morrison (Feng and Wang, 2000).

CR of Morrison remain constant to 0.5 in 2015 whilst Sainsbury's CR has been reduced

15

Revenue 17680 16816 23949 23303

Gross margin

(GM)

(Gross Profit/ Net

Sales) *100

6.07% 4.53% 5.75% 5.48%

Net profit -238 -761 716 614

Net margin (NM) (Net Profit/ Net

Sales) *100

1.35% -4.53% 2.99% 2.63%

Liquidity ratios

Current ratio

(CR)

Current Assets /

current Liabilities

0.5 0.5 0.36 0.61

Quick ratio

(QR)

(Current Assets -

Stock)/Current

Liabilities

0.16 0.18 0.28 0.29

Solvency ratio

Debt/equity ratio Long term

debt/Equity

0.16 0.18 0.37 0.46

Efficiency ratios

Inventory

turnover ratio

(ITR)

COGS/Inventory 20.34 times 21.26 times 22.45 times 22.32 times

Assets turnover

ratio

(ATR)

Total sales/total

assets

2.05 times 2.12 times 1.45 times 1.84 times

Interpretation:

Morrison's GM and NM has been declined from 6.07% to 4.53% and -1.35% to -4.53%

respectively. Declined revenue from £17680m to £167816m is the main reason behind this.

Moreover, ineffective control over both direct and indirect expenditures are the reasons for declined

GP and NP to £761m and £-761m. While, Sainsbury's GM and NM is comparatively higher to

5.75% and 2.99% due to high turnover worth £23949m. As a result, its GP and NP has been

improved from £1277m to £1377m and £614m to £716m. It indicates that Sainsbury's operational

performance is much better as compare to Morrison (Feng and Wang, 2000).

CR of Morrison remain constant to 0.5 in 2015 whilst Sainsbury's CR has been reduced

15

from 0.61 to 0.36 respectively. However, Morrison's QR has been inclined from 0.16 to 0.18 and in

Sainsbury, it has been reduced to 0.28. In both the organization, ratio indicates very little bit

declined but still, idle CR for the retail industry is 2:1. Hence, it can be said that firms are not able

to meet their short term obligation timely (Heikal, Khaddafi and Ummah, 2014). While,

comparatively grater liquidity ratio of Sainsbury implies that it is more able to satisfy suppliers

effectively.

Debt-equity ratio of Morrison has been increased from 0.16 to 0.18 in 2015. On the contrary,

in Sainsbury, it has been reduced from 0.46 to 0.37. High ratio of Sainsbury reflects high financial

risk but still, idle ratio is 0.5:1. Therefore, it can be said that this company is more able to pay their

long term debt timely and effectively than Morrison (Marr, 2012).

Morrison's ITR has been improved from 20.34 times to 21.296 times and Sainsbury's ratio

shows a little bit declined from 22.45 to 22.32 times. Greater ratio demonstrates that Sainsbury's

managers are using stock more efficiently to generate larger revenue (Kumbirai and Webb, 2013).

While, ATR of Morrison and Sainsbury has been enhanced from 2.03 to 2.12 time and 1.45 to 1.84

times. It implies that assets are utilizing more effectively by Morrison.

CONCLUSION

From the above project study, it can be concluded that loans, hire purchase and lease

financing are the most appropriate finance sources which Morrison can use to meet its financial

need. Moreover, by making effective financial planning, it will be able to manage its cash sources

and maintain surplus position at every point of time. Stakeholder analysis inferred that profitability

is the most important factor that all the decision makers evaluate for their decision-making purpose.

Besides this, budgeting analysis concluded that Morrison will generate increased cash flow in the

future period. Moreover, firm can enhance it by controlling its spendings and enhancing cash

inflow. Pricing decisions through cost plus pricing method determined that at £50 selling price,

Morrison can generate profit of 20% on their net sales. On the contrary, capital budgeting

techniques evaluated that Morrison should select project A as it is more viable. In the end,

comparative study of Morrison and Sainsbury's financial performance concluded that Sainsbury is

performing quite well than Morrison due to having greater return and good solvency and liquidity

position.

16

Sainsbury, it has been reduced to 0.28. In both the organization, ratio indicates very little bit

declined but still, idle CR for the retail industry is 2:1. Hence, it can be said that firms are not able

to meet their short term obligation timely (Heikal, Khaddafi and Ummah, 2014). While,

comparatively grater liquidity ratio of Sainsbury implies that it is more able to satisfy suppliers

effectively.

Debt-equity ratio of Morrison has been increased from 0.16 to 0.18 in 2015. On the contrary,

in Sainsbury, it has been reduced from 0.46 to 0.37. High ratio of Sainsbury reflects high financial

risk but still, idle ratio is 0.5:1. Therefore, it can be said that this company is more able to pay their

long term debt timely and effectively than Morrison (Marr, 2012).

Morrison's ITR has been improved from 20.34 times to 21.296 times and Sainsbury's ratio

shows a little bit declined from 22.45 to 22.32 times. Greater ratio demonstrates that Sainsbury's

managers are using stock more efficiently to generate larger revenue (Kumbirai and Webb, 2013).

While, ATR of Morrison and Sainsbury has been enhanced from 2.03 to 2.12 time and 1.45 to 1.84

times. It implies that assets are utilizing more effectively by Morrison.

CONCLUSION

From the above project study, it can be concluded that loans, hire purchase and lease

financing are the most appropriate finance sources which Morrison can use to meet its financial

need. Moreover, by making effective financial planning, it will be able to manage its cash sources

and maintain surplus position at every point of time. Stakeholder analysis inferred that profitability

is the most important factor that all the decision makers evaluate for their decision-making purpose.

Besides this, budgeting analysis concluded that Morrison will generate increased cash flow in the

future period. Moreover, firm can enhance it by controlling its spendings and enhancing cash

inflow. Pricing decisions through cost plus pricing method determined that at £50 selling price,

Morrison can generate profit of 20% on their net sales. On the contrary, capital budgeting

techniques evaluated that Morrison should select project A as it is more viable. In the end,

comparative study of Morrison and Sainsbury's financial performance concluded that Sainsbury is

performing quite well than Morrison due to having greater return and good solvency and liquidity

position.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Addison, T., Mavrotas, G. and McGillivray, M., 2005. Aid, debt relief and new sources of finance

for meeting the millennium development goals. Journal of International Affairs. pp.113-

127.

Agarwal, S. and et.al., 2015. Financial literacy and financial planning: Evidence from India. Journal

of Housing Economics. 27(5). pp.4-21.

Altfest, L., 2016. Personal financial planning. McGraw-Hill Higher Education.

Brazel, J. F. and et.al., 2015. Understanding investor perceptions of financial statement fraud and

their use of red flags: evidence from the field. Review of Accounting Studies. 20(4). pp.1373-

1406.

Buchner, B. and Wilkinson, J., 2015. 33 Pros and cons of alternative sources of climate change

financing and prospects for ‘unconventional finance’. Towards a Workable and Effective

Climate Regime. pp.483-493.

Chandar, V. and Tchamkerten, A., 2015, June. Asynchronous capacity per unit cost under a receiver

sampling constraint. In Information Theory (ISIT), 2015 IEEE International Symposium on .

IEEE. 25(3). pp.511-515.

Feng, C.M. and Wang, R.T., 2000. Performance evaluation for airlines including the consideration

of financial ratios. Journal of Air Transport Management. 6(3). pp. 133-142.

Fraser, L.M. and Ormiston, A., 2015. Understanding Financial Statements. Prentice Hall.

Fuchs, C. D. and Colyvas, A., 2013. Improving financial statements quality prior to submission for

audit. IMFO: Official Journal of the Institute of Municipal Finance Officers. 14(2). pp.10-

11.

Gadde, L. E. and Håkansson, H., 2015. Information exchange in buyer-seller relationships. In

Proceedings of the 1993 World Marketing Congress. Springer International Publishing.

26(4). pp. 54-58.

Hammond, J., Keeney, R. and Raiffa, H., 2015. Smart choices: A practical guide to making better

decisions. Harvard Business Review Press.

Hawkins, A. and Turner, C., 2015. Managing budgets pocketbook. Management Pocketbooks.

Haynes, W. W., 2015. Pricing decisions in small business. University Press of Kentucky.

Heikal, M., Khaddafi, M. and Ummah, A., 2014. Influence Analysis of Return on Assets (ROA),

Return on Equity (ROE), Net Profit Margin (NPM), Debt To Equity Ratio (DER), and

current ratio (CR), Against Corporate Profit Growth In Automotive In Indonesia Stock

17

Books and Journals

Addison, T., Mavrotas, G. and McGillivray, M., 2005. Aid, debt relief and new sources of finance

for meeting the millennium development goals. Journal of International Affairs. pp.113-

127.

Agarwal, S. and et.al., 2015. Financial literacy and financial planning: Evidence from India. Journal

of Housing Economics. 27(5). pp.4-21.

Altfest, L., 2016. Personal financial planning. McGraw-Hill Higher Education.

Brazel, J. F. and et.al., 2015. Understanding investor perceptions of financial statement fraud and

their use of red flags: evidence from the field. Review of Accounting Studies. 20(4). pp.1373-

1406.

Buchner, B. and Wilkinson, J., 2015. 33 Pros and cons of alternative sources of climate change

financing and prospects for ‘unconventional finance’. Towards a Workable and Effective

Climate Regime. pp.483-493.

Chandar, V. and Tchamkerten, A., 2015, June. Asynchronous capacity per unit cost under a receiver

sampling constraint. In Information Theory (ISIT), 2015 IEEE International Symposium on .

IEEE. 25(3). pp.511-515.