Managing Financial Resource Decisions: An Analysis of Thomas Cook

VerifiedAdded on 2019/12/03

|15

|3849

|150

Report

AI Summary

This report provides a comprehensive analysis of financial resource decisions, focusing on a case study of Thomas Cook. It begins by exploring various sources of finance, both internal and external, and their implications, including the costs associated with each source. The report then delves into the importance of financial planning and the information needs of different decision-makers within an organization. Furthermore, it examines the impact of finance on financial statements. The second part of the report focuses on budget analysis, calculation of unit costs, and pricing decisions. It also discusses the implications of different investment appraisal techniques, such as Net Present Value (NPV), Internal Rate of Return (IRR), Average Rate of Return (ARR), and payback period. Finally, the report analyzes the financial statements produced by companies, highlighting the differences between various organizational types and conducting a financial statement analysis of Thomas Cook. The conclusion summarizes the key findings and recommendations regarding effective financial resource management.

Managing Financial

Resource Decisions

Resource Decisions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction................................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Sources of finance.....................................................................................................1

AC 1.2 Implication of different finance sources...................................................................2

AC 1.3 Appropriate finance source for Thomas Cook.........................................................2

AC 2.1 Cost of different finance sources..............................................................................2

AC 2.2 Importance of financial planning..............................................................................3

AC 2.3 Information needs of different decision makers.......................................................3

AC 2.4 The impact of finance on the financial statements....................................................4

TASK 2......................................................................................................................................4

AC 3.1 Analysis of the budget...............................................................................................4

AC 3.2 Calculation of unit cost and pricing decisions..........................................................5

AC 3.3 Implication of different investment appraisal techniques.........................................6

TASK 3......................................................................................................................................7

AC 4.1 The financial statements produced by the company.................................................7

AC 4.2 Financial statements of different type of organizations............................................8

AC 4.3 financial statement analysis of Thomas cook...........................................................9

CONCLUSION........................................................................................................................10

REFERENCES.........................................................................................................................10

Introduction................................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Sources of finance.....................................................................................................1

AC 1.2 Implication of different finance sources...................................................................2

AC 1.3 Appropriate finance source for Thomas Cook.........................................................2

AC 2.1 Cost of different finance sources..............................................................................2

AC 2.2 Importance of financial planning..............................................................................3

AC 2.3 Information needs of different decision makers.......................................................3

AC 2.4 The impact of finance on the financial statements....................................................4

TASK 2......................................................................................................................................4

AC 3.1 Analysis of the budget...............................................................................................4

AC 3.2 Calculation of unit cost and pricing decisions..........................................................5

AC 3.3 Implication of different investment appraisal techniques.........................................6

TASK 3......................................................................................................................................7

AC 4.1 The financial statements produced by the company.................................................7

AC 4.2 Financial statements of different type of organizations............................................8

AC 4.3 financial statement analysis of Thomas cook...........................................................9

CONCLUSION........................................................................................................................10

REFERENCES.........................................................................................................................10

Index of Tables

Table 1: Budget for the six month .............................................................................................5

Table 2: calculation of Cost per unit .........................................................................................6

Table 3: Calculation of NPV, IRR and ARR (In £)...................................................................7

Table 4: Calculation of payback period (In £)...........................................................................7

Table 5: Ratio analysis of Thomas Cook .................................................................................9

Table 1: Budget for the six month .............................................................................................5

Table 2: calculation of Cost per unit .........................................................................................6

Table 3: Calculation of NPV, IRR and ARR (In £)...................................................................7

Table 4: Calculation of payback period (In £)...........................................................................7

Table 5: Ratio analysis of Thomas Cook .................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Every enterprises whether private or public organization require funds for different

purposes. An organization that having inadequate availability of funds may not perform

better in the market. Thus, it is important that organization have to collects adequate funds in

order to mitigate the future uncertainty. Funds can be generated through different internal and

external sources to fulfil the organization short term and long term requirements. The

presenting report will helps us in identifying variety of sources for the Thomas Cook. It is a

UK travel Company established in the year 2007. Moreover, the report discussed the different

financial statements that are prepared by different organization. Further, the report also helps

us in taking effective financial decisions through different financial tools.

TASK 1

AC 1.1 Sources of finance

Two type of finance sources are available to Thomas cook that are internal and

external sources. Internal sources are available inside the business organization while external

sources are available outside the business.

Internal sources:

Retained earnings: It is the most common sources of funds that are related to the

business profit. The undistributed profit balance can be reinvested by the company to earn

further return on it.

Disposable of assets: Unusable or scraped assets may be sold out in the market to

collect the require funds (Paramasivan and Subramanian, 2010).

Negotiate the payable: Funds can be stretched through delay its payables and receive

earlier from the debtors (Anderson and Coleman, 2000). It helps to increase the working

capital of the business to operate successfully.

External sources

Share capital: Company can issue both the preference and equity shares to the existing

shareholders or the public. Long term finance requirement can be fulfil through this sources

(Hayre, 2013).

Bank loans: It is largely used by all the organization to fulfil funds requirement for

different periods. Financial institutions such as Banks provide loans on the basis of any

security.

Overdraft: It refers to the negative balance of bank account. Immediate or urgent

finance requirement can be fulfil through this facility.

1 | P a g e

Every enterprises whether private or public organization require funds for different

purposes. An organization that having inadequate availability of funds may not perform

better in the market. Thus, it is important that organization have to collects adequate funds in

order to mitigate the future uncertainty. Funds can be generated through different internal and

external sources to fulfil the organization short term and long term requirements. The

presenting report will helps us in identifying variety of sources for the Thomas Cook. It is a

UK travel Company established in the year 2007. Moreover, the report discussed the different

financial statements that are prepared by different organization. Further, the report also helps

us in taking effective financial decisions through different financial tools.

TASK 1

AC 1.1 Sources of finance

Two type of finance sources are available to Thomas cook that are internal and

external sources. Internal sources are available inside the business organization while external

sources are available outside the business.

Internal sources:

Retained earnings: It is the most common sources of funds that are related to the

business profit. The undistributed profit balance can be reinvested by the company to earn

further return on it.

Disposable of assets: Unusable or scraped assets may be sold out in the market to

collect the require funds (Paramasivan and Subramanian, 2010).

Negotiate the payable: Funds can be stretched through delay its payables and receive

earlier from the debtors (Anderson and Coleman, 2000). It helps to increase the working

capital of the business to operate successfully.

External sources

Share capital: Company can issue both the preference and equity shares to the existing

shareholders or the public. Long term finance requirement can be fulfil through this sources

(Hayre, 2013).

Bank loans: It is largely used by all the organization to fulfil funds requirement for

different periods. Financial institutions such as Banks provide loans on the basis of any

security.

Overdraft: It refers to the negative balance of bank account. Immediate or urgent

finance requirement can be fulfil through this facility.

1 | P a g e

AC 1.2 Implication of different finance sources

The implication of finance sources tends to vary from each other. For instance, if the

business gather funds through issuing shares than legal implication of that is that shareholders

have voting rights. Thus, they can manage the business operations and take part in the

business decisions. However, it do not impose any legal obligations to the company.

However, in case of loan borrowings, firms have to pay interest on an specific duration.

Moreover, if company do not repay the loan on time than security can be sold out by the bank

(Brigham and Houston, 2009). On contrary, the benefit of such sources is that it provides tax

benefit to the company. Further, creditors have no control on the organization. In addition to

it, using the profits may create shareholders dissatisfaction. They can demand more dividend

in this situation. However, benefit is that it do not imposed any cost to the company.

AC 1.3 Appropriate finance source for Thomas Cook

Thomas cook require funds for getting optimum funds for performing various

operations. It require funds for its expansion and meet its working capital requirement. Under

the business expansion it need funds for investing in new assets or establish new business

units. The company can generate funds through issuing share capital and debentures for

fulfilling the long term finance need. Another bank loans can be acquired to meet funds

requirement for different periods. In addition, the company can use its other operation profits

and disposed off its loss bearing units. Further, venture capital can be provided to the

investors. However, immediate finance need can be eliminated through using overdraft,

retained earnings, selling is waste assets and cash squeezing operations. The Bank loan is the

best finance source for acquiring the medium and long term funds. However, retained

earnings is the best sources for fulfilling the short term funds requirement.

AC 2.1 Cost of different finance sources

Every finance source involves some cost that is addition to the amount taken by the business,

explained here as under:

Internal sources: No amount of interest and dividend payment is required on the

retained earnings. Therefore, it can be said that it does not involve any cost for the

businesses. However, in case of disposable assets the cost is that the organization has to make

necessary efforts to dispose off the underused assets (Ismail and Mohsin, 2013). It includes

attorney fees, permits, and the payments associated with removing the assets from service.

External sources: The amount of share capital that is issued by the company include

cost in terms of dividend payments. Moreover, it also include flotation cost which is required

2 | P a g e

The implication of finance sources tends to vary from each other. For instance, if the

business gather funds through issuing shares than legal implication of that is that shareholders

have voting rights. Thus, they can manage the business operations and take part in the

business decisions. However, it do not impose any legal obligations to the company.

However, in case of loan borrowings, firms have to pay interest on an specific duration.

Moreover, if company do not repay the loan on time than security can be sold out by the bank

(Brigham and Houston, 2009). On contrary, the benefit of such sources is that it provides tax

benefit to the company. Further, creditors have no control on the organization. In addition to

it, using the profits may create shareholders dissatisfaction. They can demand more dividend

in this situation. However, benefit is that it do not imposed any cost to the company.

AC 1.3 Appropriate finance source for Thomas Cook

Thomas cook require funds for getting optimum funds for performing various

operations. It require funds for its expansion and meet its working capital requirement. Under

the business expansion it need funds for investing in new assets or establish new business

units. The company can generate funds through issuing share capital and debentures for

fulfilling the long term finance need. Another bank loans can be acquired to meet funds

requirement for different periods. In addition, the company can use its other operation profits

and disposed off its loss bearing units. Further, venture capital can be provided to the

investors. However, immediate finance need can be eliminated through using overdraft,

retained earnings, selling is waste assets and cash squeezing operations. The Bank loan is the

best finance source for acquiring the medium and long term funds. However, retained

earnings is the best sources for fulfilling the short term funds requirement.

AC 2.1 Cost of different finance sources

Every finance source involves some cost that is addition to the amount taken by the business,

explained here as under:

Internal sources: No amount of interest and dividend payment is required on the

retained earnings. Therefore, it can be said that it does not involve any cost for the

businesses. However, in case of disposable assets the cost is that the organization has to make

necessary efforts to dispose off the underused assets (Ismail and Mohsin, 2013). It includes

attorney fees, permits, and the payments associated with removing the assets from service.

External sources: The amount of share capital that is issued by the company include

cost in terms of dividend payments. Moreover, it also include flotation cost which is required

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to write off from the upcoming year profits. However, the cost of loan amount that the

interest imposed by the banks on respective loans. The interest rate is based on the loan

amount and loan duration. Further, on the bank overdraft the business has to pay high rate on

interest as cost of this facility.

AC 2.2 Importance of financial planning

Financial planning is the significant financial tool for taking effective and strategic

business decisions.

Importance of financial planning: It helps to determine the funds requirements for

the business. It includes both working capital requirements and funds for capital expenditures

(Llias, 2010). Working capital requirements helps to improve business performance whether

capital expenditures decisions helps to increase the financial performance. Moreover,

financial planning undertakes to decide an appropriate ratio between debt and equity for

gathering the required funds. It also ensures proper availability of working capital through

managing the cash inflows and outflows on a regular basis. It administrates the funds through

analysing its sources and its application. Further, it ensures optimum utilization of funds of

all the resources that helps in increasing the business profitability (Pike and Neale, 2006).

AC 2.3 Information needs of different decision makers

Decision making is the process of taking effective decisions by determining the valid

conclusions from different information. Mangers are the internal decision makers of the

organization. They require the information in order to identifying the financial status of the

business. It helps to make strategic future plans for the business unit. They can make

important decisions to improve the business operational as well as financial performance.

Department stores require information regarding resource allocation to make plans for

optimum utilization of it. However, investors, suppliers and government are the external

decision makers. Investor requires information for making risk return analysis regarding their

investment (Kaplan and Atkinson, 2015). Supplier identifies the business credit worthiness to

determine the business ability to pay payables on time. Government require information of

business profits to determine that they are paying taxes on time or not.

AC 2.4 the impact of finance on the financial statements

The cost of each finance sources are shown in the income statement. However, the

amount of the gathered funds shows in the balance sheet. The amount of dividend payments

and floating cost shows in the profit and loss account of the business. Moreover, the issued

share capital shows in the liability side and also lead to increase the cash or bank balance

3 | P a g e

interest imposed by the banks on respective loans. The interest rate is based on the loan

amount and loan duration. Further, on the bank overdraft the business has to pay high rate on

interest as cost of this facility.

AC 2.2 Importance of financial planning

Financial planning is the significant financial tool for taking effective and strategic

business decisions.

Importance of financial planning: It helps to determine the funds requirements for

the business. It includes both working capital requirements and funds for capital expenditures

(Llias, 2010). Working capital requirements helps to improve business performance whether

capital expenditures decisions helps to increase the financial performance. Moreover,

financial planning undertakes to decide an appropriate ratio between debt and equity for

gathering the required funds. It also ensures proper availability of working capital through

managing the cash inflows and outflows on a regular basis. It administrates the funds through

analysing its sources and its application. Further, it ensures optimum utilization of funds of

all the resources that helps in increasing the business profitability (Pike and Neale, 2006).

AC 2.3 Information needs of different decision makers

Decision making is the process of taking effective decisions by determining the valid

conclusions from different information. Mangers are the internal decision makers of the

organization. They require the information in order to identifying the financial status of the

business. It helps to make strategic future plans for the business unit. They can make

important decisions to improve the business operational as well as financial performance.

Department stores require information regarding resource allocation to make plans for

optimum utilization of it. However, investors, suppliers and government are the external

decision makers. Investor requires information for making risk return analysis regarding their

investment (Kaplan and Atkinson, 2015). Supplier identifies the business credit worthiness to

determine the business ability to pay payables on time. Government require information of

business profits to determine that they are paying taxes on time or not.

AC 2.4 the impact of finance on the financial statements

The cost of each finance sources are shown in the income statement. However, the

amount of the gathered funds shows in the balance sheet. The amount of dividend payments

and floating cost shows in the profit and loss account of the business. Moreover, the issued

share capital shows in the liability side and also lead to increase the cash or bank balance

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Davies and Crawford, 2011). However, in case of loan obtaining the interest and instalment

shows in the expenditures side of profit and loss account. Further, the loan amount shows in

the liability side as bank loan and includes in cash or bank balance. On contrary, the bank

overdraft shows under the short term liability head and in cash balance. However, the amount

of interest on overdraft shows as indirect expenditure under the profit and loss account. The

expenditure incurred for disposing the asset shows under the profit and loss account. In

addition, the sales value includes in cash and the value of assets declines from respective

assets group.

TASK 2

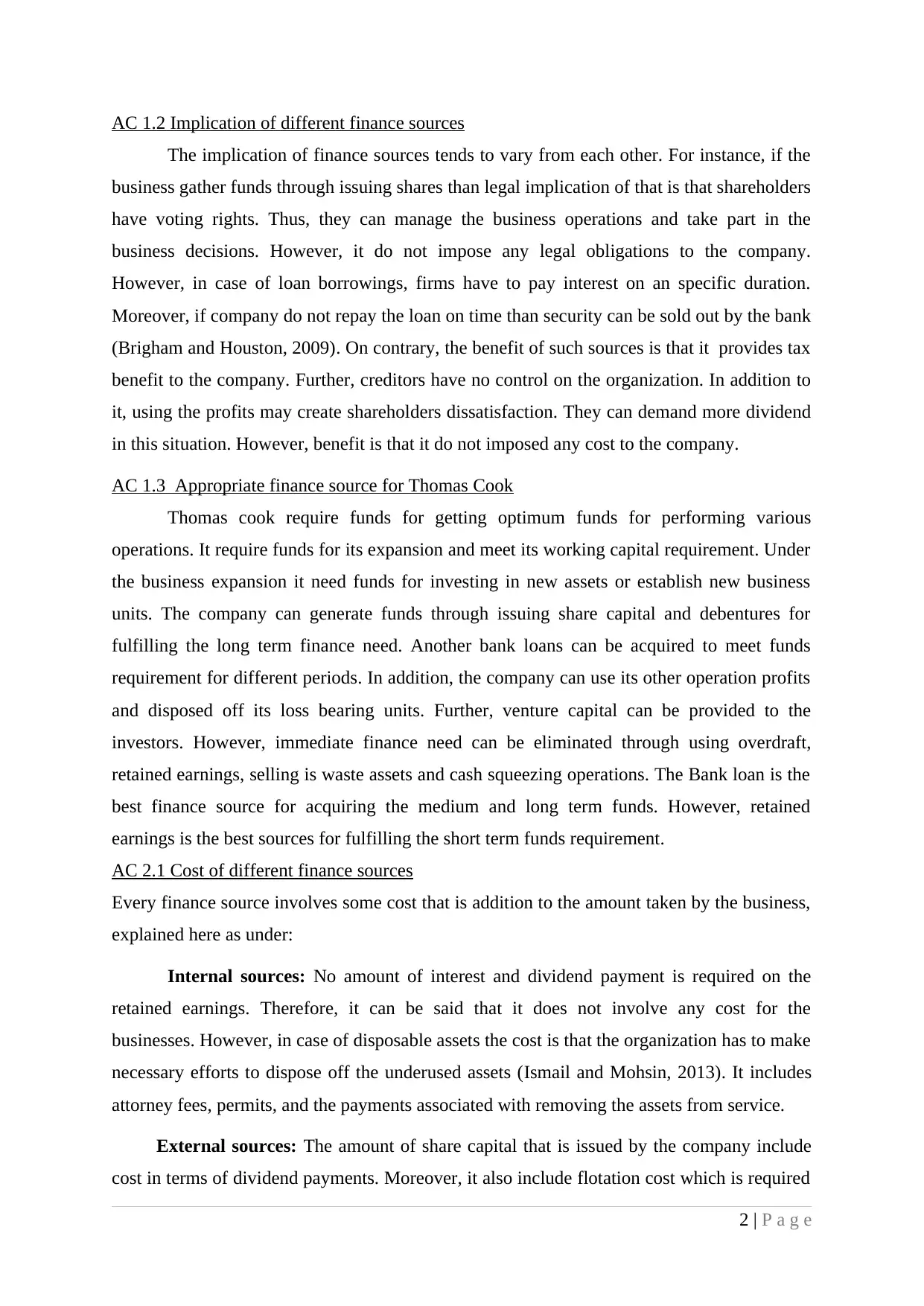

AC 3.1 Analysis of the budget

Budget contains all the estimated incomes and expenditures for the specific period. The

analysis of the statements helps to mitigate negative cash balance by reducing the

expenditures and increase revenues.

Table 1: Budget for the six month

Particulars June July August Sept. October Nov.

Cash inflow

Revenue 48000 50000 56005 56515.05 57030.2 57550.5

Finance income 25000 25000 25000 25000 25000 25000

Miscellaneous

income 13000 15000 15201 15303.01 15406.04 15510.1

Total inflow 86000 90000 96206 96818.06 97436.24 98060.6

Cash outflow

Purchase of

materials 23000 25200 28402 28606.02 27812.08 30020.2

Labor cost 8000 8000 8000 8000 8000 8000

Overhead cost 9000 10000 10500 10600 10800 11000

Miscellaneous

expenditure 15000 15000 15000 15000 15000 15000

Total outflow 55000 58200 61902 62206.02 61612.08 64020.2

Net cash flow 31000 31800 34304 34612.04 35824.16 34040.4

Opening balance 0 31000 62800 97104 131716.04 167540.2

Closing balance 31000 62800 97104 131716.04 167540.2 201580.6

4 | P a g e

shows in the expenditures side of profit and loss account. Further, the loan amount shows in

the liability side as bank loan and includes in cash or bank balance. On contrary, the bank

overdraft shows under the short term liability head and in cash balance. However, the amount

of interest on overdraft shows as indirect expenditure under the profit and loss account. The

expenditure incurred for disposing the asset shows under the profit and loss account. In

addition, the sales value includes in cash and the value of assets declines from respective

assets group.

TASK 2

AC 3.1 Analysis of the budget

Budget contains all the estimated incomes and expenditures for the specific period. The

analysis of the statements helps to mitigate negative cash balance by reducing the

expenditures and increase revenues.

Table 1: Budget for the six month

Particulars June July August Sept. October Nov.

Cash inflow

Revenue 48000 50000 56005 56515.05 57030.2 57550.5

Finance income 25000 25000 25000 25000 25000 25000

Miscellaneous

income 13000 15000 15201 15303.01 15406.04 15510.1

Total inflow 86000 90000 96206 96818.06 97436.24 98060.6

Cash outflow

Purchase of

materials 23000 25200 28402 28606.02 27812.08 30020.2

Labor cost 8000 8000 8000 8000 8000 8000

Overhead cost 9000 10000 10500 10600 10800 11000

Miscellaneous

expenditure 15000 15000 15000 15000 15000 15000

Total outflow 55000 58200 61902 62206.02 61612.08 64020.2

Net cash flow 31000 31800 34304 34612.04 35824.16 34040.4

Opening balance 0 31000 62800 97104 131716.04 167540.2

Closing balance 31000 62800 97104 131716.04 167540.2 201580.6

4 | P a g e

In this budget, the total cash inflow is increased continuously from 86000£ to

98060.6£ in the month of November. It is because of increasing the sales and other income.

Moreover, the business expenditures also tend to rise from 55000£ to 64020.2£. It is because

of increasing the purchase expenditures and overheads. However, the other expenditures and

labour cost remain constant in all the month to 15000£ and 8000£. However, the net cash

flow available at the end of the month tend to fluctuate from 31000£ to 34040.4£. Till the

month of October, it tend to increase. However, it tend to decrease in the month of

November to 34040.4£. On contrary, the total cash flow at the end tend to increase

continuously from 31000£ to 201580.6£. Therefore, the management should take decisions to

increase the revenues through increasing the sales and curtailment of unnecessary

expenditure that lead to increase the total cash outflow. Moreover, business unit also can use

previous year cash balances to earn further return on it.

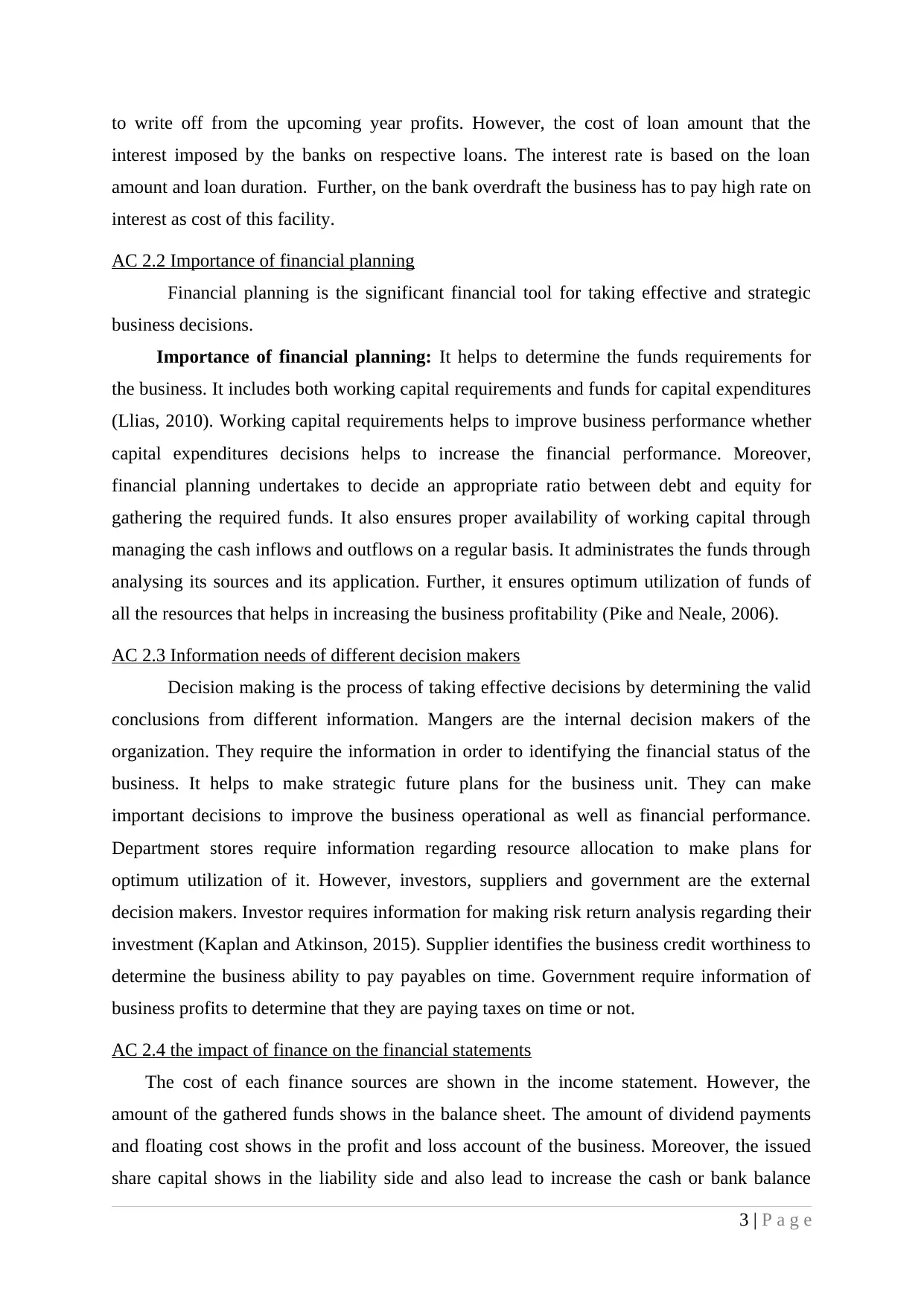

AC 3.2 Calculation of unit cost and pricing decisions

Two types of cost are beared by every manufacturing concern that are fixed cost and variable

cost.

Fixed cost: These types of cost are still same for whole the accounting period. Hence,

it cannot be charged separately to the number of units produced. Depreciation, managers

salary, office staff salary and watchmen salary are the type of this costs.

Variable cost: These costs are directly related to the organization production higher

the production tends to higher the variable cost and vice versa (Scott, 2014). Raw material

cost, labour cost and overhead cost are the type of these costs.

Unit cost: it can be calculated by dividing the total cost to the number of units

produced by the company. It is helpful for deciding the selling price per unit to earn a

required profit margin (Blocher and et. al., 2008). For instance, if the number of units

produced by the company is 10000 and per unit variable cost is 10£ while company bears a

fixed cost of 8000£. per unit cost and selling price at a profit margin of 10% can be calculated

as follows:

Table 2: calculation of Cost per unit

particular Per unit cost Amount

Variable cost 10 100000

Fixed cost 8000

5 | P a g e

98060.6£ in the month of November. It is because of increasing the sales and other income.

Moreover, the business expenditures also tend to rise from 55000£ to 64020.2£. It is because

of increasing the purchase expenditures and overheads. However, the other expenditures and

labour cost remain constant in all the month to 15000£ and 8000£. However, the net cash

flow available at the end of the month tend to fluctuate from 31000£ to 34040.4£. Till the

month of October, it tend to increase. However, it tend to decrease in the month of

November to 34040.4£. On contrary, the total cash flow at the end tend to increase

continuously from 31000£ to 201580.6£. Therefore, the management should take decisions to

increase the revenues through increasing the sales and curtailment of unnecessary

expenditure that lead to increase the total cash outflow. Moreover, business unit also can use

previous year cash balances to earn further return on it.

AC 3.2 Calculation of unit cost and pricing decisions

Two types of cost are beared by every manufacturing concern that are fixed cost and variable

cost.

Fixed cost: These types of cost are still same for whole the accounting period. Hence,

it cannot be charged separately to the number of units produced. Depreciation, managers

salary, office staff salary and watchmen salary are the type of this costs.

Variable cost: These costs are directly related to the organization production higher

the production tends to higher the variable cost and vice versa (Scott, 2014). Raw material

cost, labour cost and overhead cost are the type of these costs.

Unit cost: it can be calculated by dividing the total cost to the number of units

produced by the company. It is helpful for deciding the selling price per unit to earn a

required profit margin (Blocher and et. al., 2008). For instance, if the number of units

produced by the company is 10000 and per unit variable cost is 10£ while company bears a

fixed cost of 8000£. per unit cost and selling price at a profit margin of 10% can be calculated

as follows:

Table 2: calculation of Cost per unit

particular Per unit cost Amount

Variable cost 10 100000

Fixed cost 8000

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total cost 10.8 108000

Profit percentage on cost 10.00% 10800

Sales 11.88 118800

Break-even point: It is the sales value that required to be sale by the business unit

where the business having neither profits nor loss. At this point business is using its assets at

maximum level. After this point the organization can earn profit for the business. Thus, every

organization required to determine this point in order to increase its sales in the excess of

BEP sales and increase profitability.

BEP = Total Fixed cost/profit volume ratio

= 8000£/(10800£/118800£*100)

= 8000£/9.091%

= 88000£

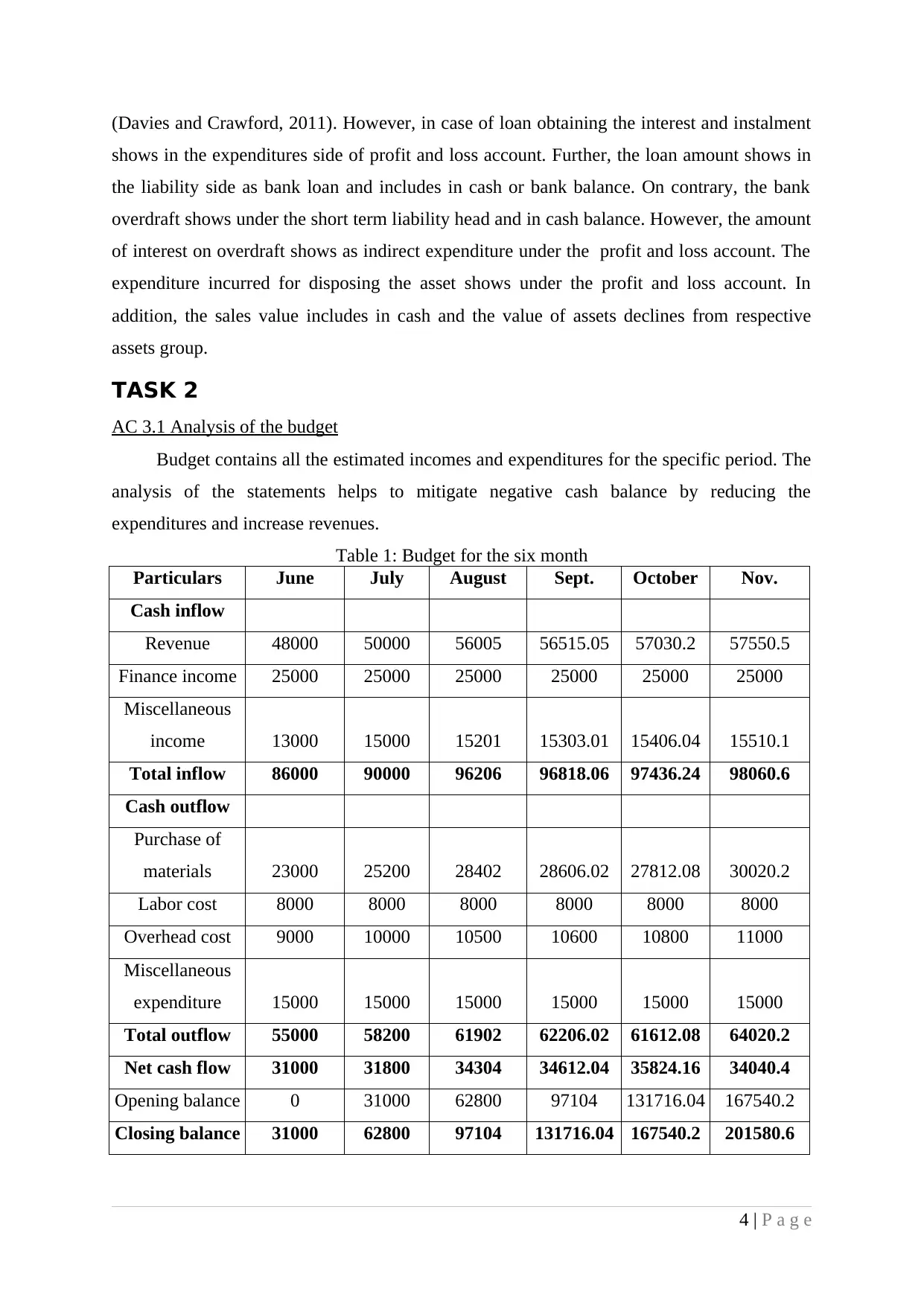

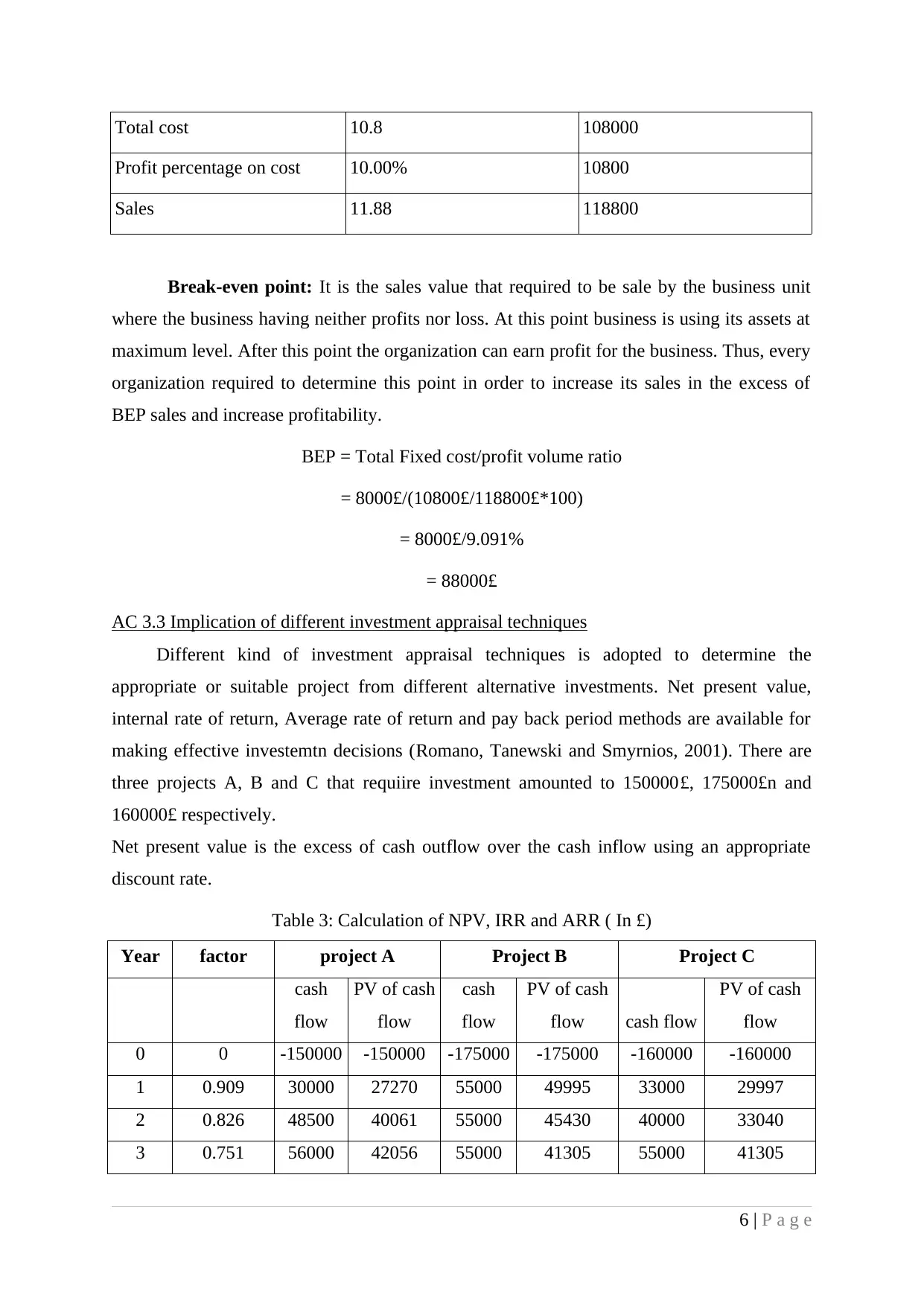

AC 3.3 Implication of different investment appraisal techniques

Different kind of investment appraisal techniques is adopted to determine the

appropriate or suitable project from different alternative investments. Net present value,

internal rate of return, Average rate of return and pay back period methods are available for

making effective investemtn decisions (Romano, Tanewski and Smyrnios, 2001). There are

three projects A, B and C that requiire investment amounted to 150000£, 175000£n and

160000£ respectively.

Net present value is the excess of cash outflow over the cash inflow using an appropriate

discount rate.

Table 3: Calculation of NPV, IRR and ARR ( In £)

Year factor project A Project B Project C

cash

flow

PV of cash

flow

cash

flow

PV of cash

flow cash flow

PV of cash

flow

0 0 -150000 -150000 -175000 -175000 -160000 -160000

1 0.909 30000 27270 55000 49995 33000 29997

2 0.826 48500 40061 55000 45430 40000 33040

3 0.751 56000 42056 55000 41305 55000 41305

6 | P a g e

Profit percentage on cost 10.00% 10800

Sales 11.88 118800

Break-even point: It is the sales value that required to be sale by the business unit

where the business having neither profits nor loss. At this point business is using its assets at

maximum level. After this point the organization can earn profit for the business. Thus, every

organization required to determine this point in order to increase its sales in the excess of

BEP sales and increase profitability.

BEP = Total Fixed cost/profit volume ratio

= 8000£/(10800£/118800£*100)

= 8000£/9.091%

= 88000£

AC 3.3 Implication of different investment appraisal techniques

Different kind of investment appraisal techniques is adopted to determine the

appropriate or suitable project from different alternative investments. Net present value,

internal rate of return, Average rate of return and pay back period methods are available for

making effective investemtn decisions (Romano, Tanewski and Smyrnios, 2001). There are

three projects A, B and C that requiire investment amounted to 150000£, 175000£n and

160000£ respectively.

Net present value is the excess of cash outflow over the cash inflow using an appropriate

discount rate.

Table 3: Calculation of NPV, IRR and ARR ( In £)

Year factor project A Project B Project C

cash

flow

PV of cash

flow

cash

flow

PV of cash

flow cash flow

PV of cash

flow

0 0 -150000 -150000 -175000 -175000 -160000 -160000

1 0.909 30000 27270 55000 49995 33000 29997

2 0.826 48500 40061 55000 45430 40000 33040

3 0.751 56000 42056 55000 41305 55000 41305

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4 0.683 70500 48151.5 55000 37565 58000 39614

Total 55000 45000 26000

IRR/NPV 12.03% 7538.5 9.83% -705 16.25% -16044

ARR is the project return rate calculated by dividing the average profit to the initial cash

outflow of the project.

Project A = (55000/4)/150000*100 = 36.67%

Project B = (45000/4)/175000*100 = 25.71%

Project C = (26000/4)/160000*100 = 16.25%

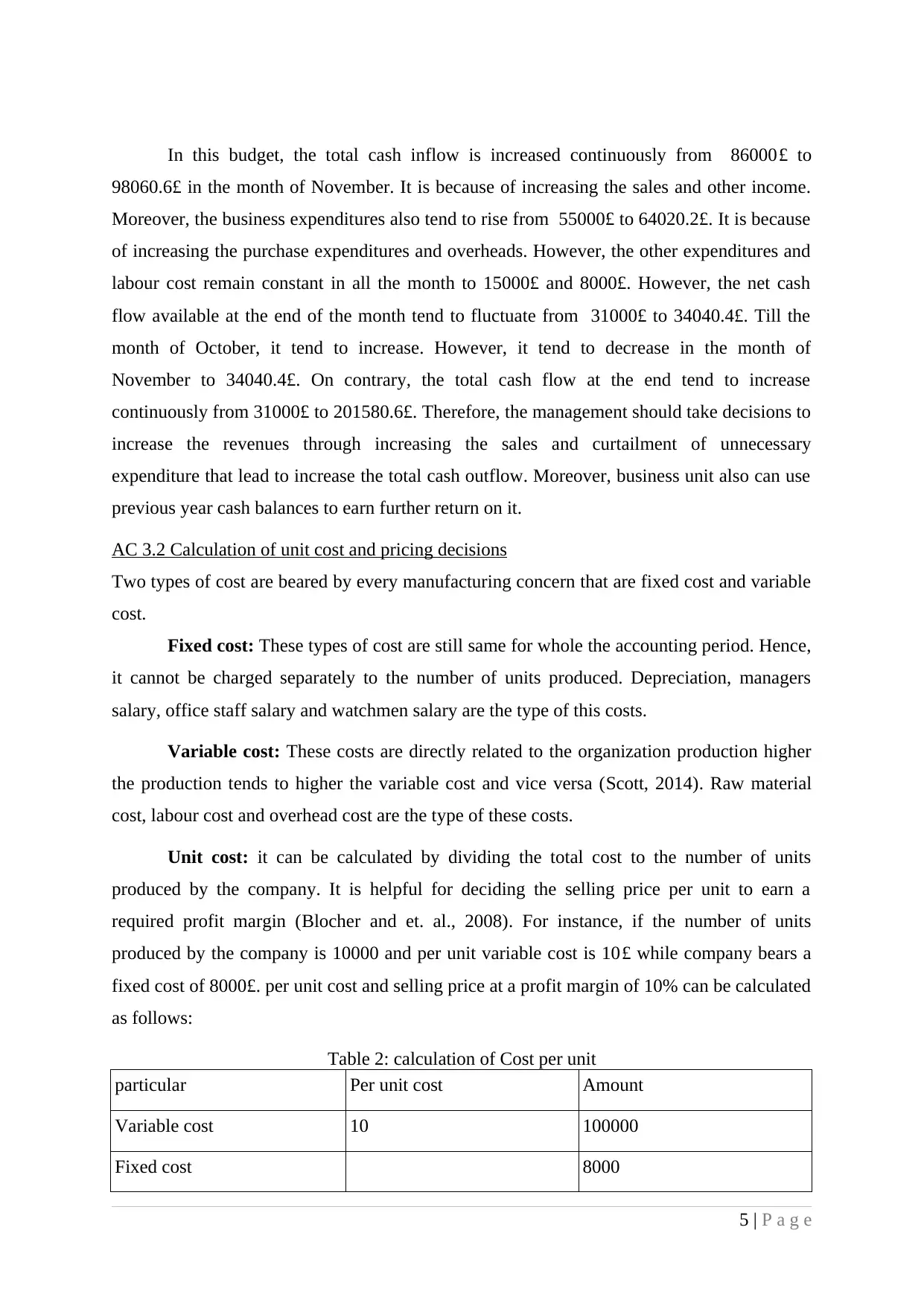

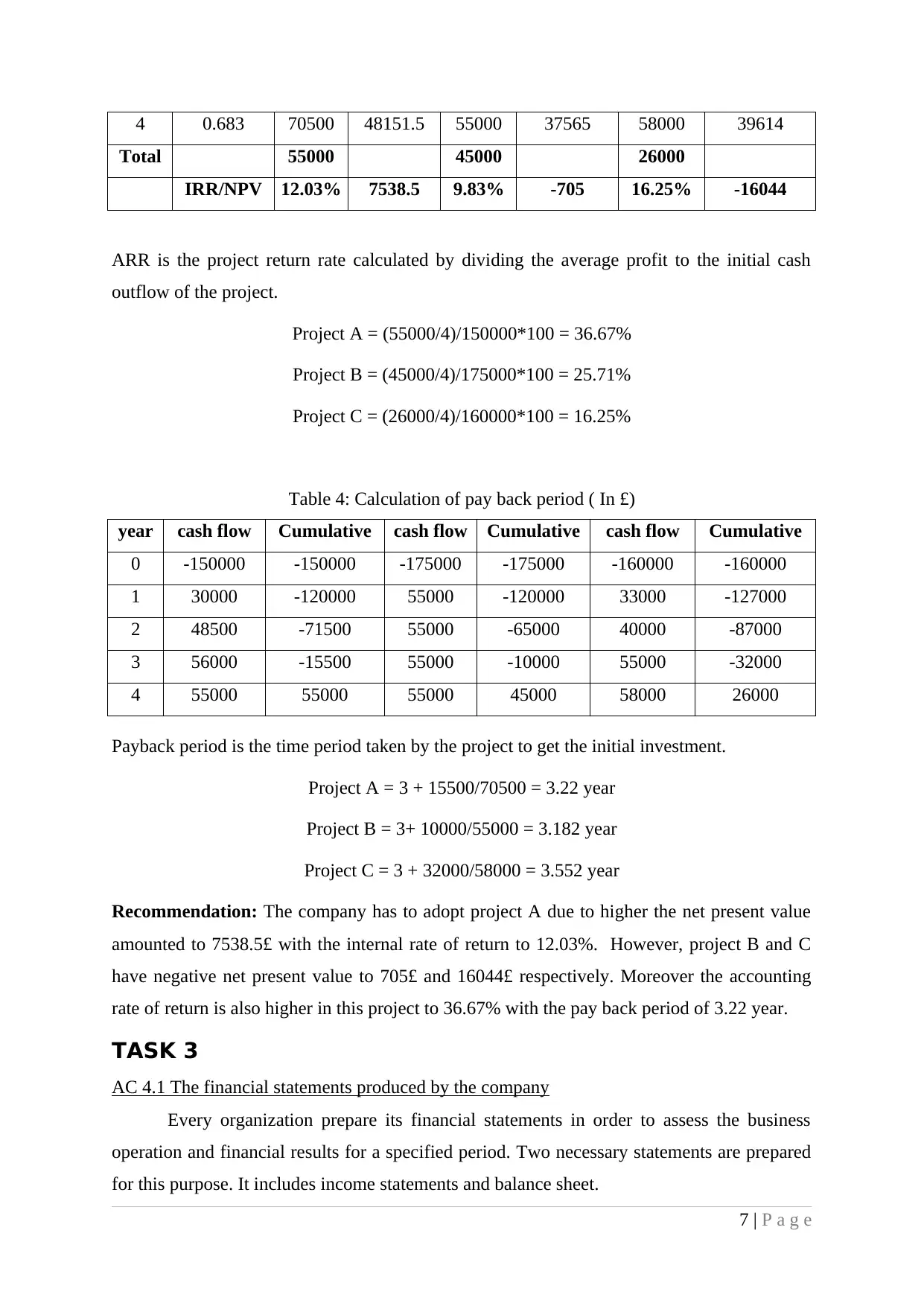

Table 4: Calculation of pay back period ( In £)

year cash flow Cumulative cash flow Cumulative cash flow Cumulative

0 -150000 -150000 -175000 -175000 -160000 -160000

1 30000 -120000 55000 -120000 33000 -127000

2 48500 -71500 55000 -65000 40000 -87000

3 56000 -15500 55000 -10000 55000 -32000

4 55000 55000 55000 45000 58000 26000

Payback period is the time period taken by the project to get the initial investment.

Project A = 3 + 15500/70500 = 3.22 year

Project B = 3+ 10000/55000 = 3.182 year

Project C = 3 + 32000/58000 = 3.552 year

Recommendation: The company has to adopt project A due to higher the net present value

amounted to 7538.5£ with the internal rate of return to 12.03%. However, project B and C

have negative net present value to 705£ and 16044£ respectively. Moreover the accounting

rate of return is also higher in this project to 36.67% with the pay back period of 3.22 year.

TASK 3

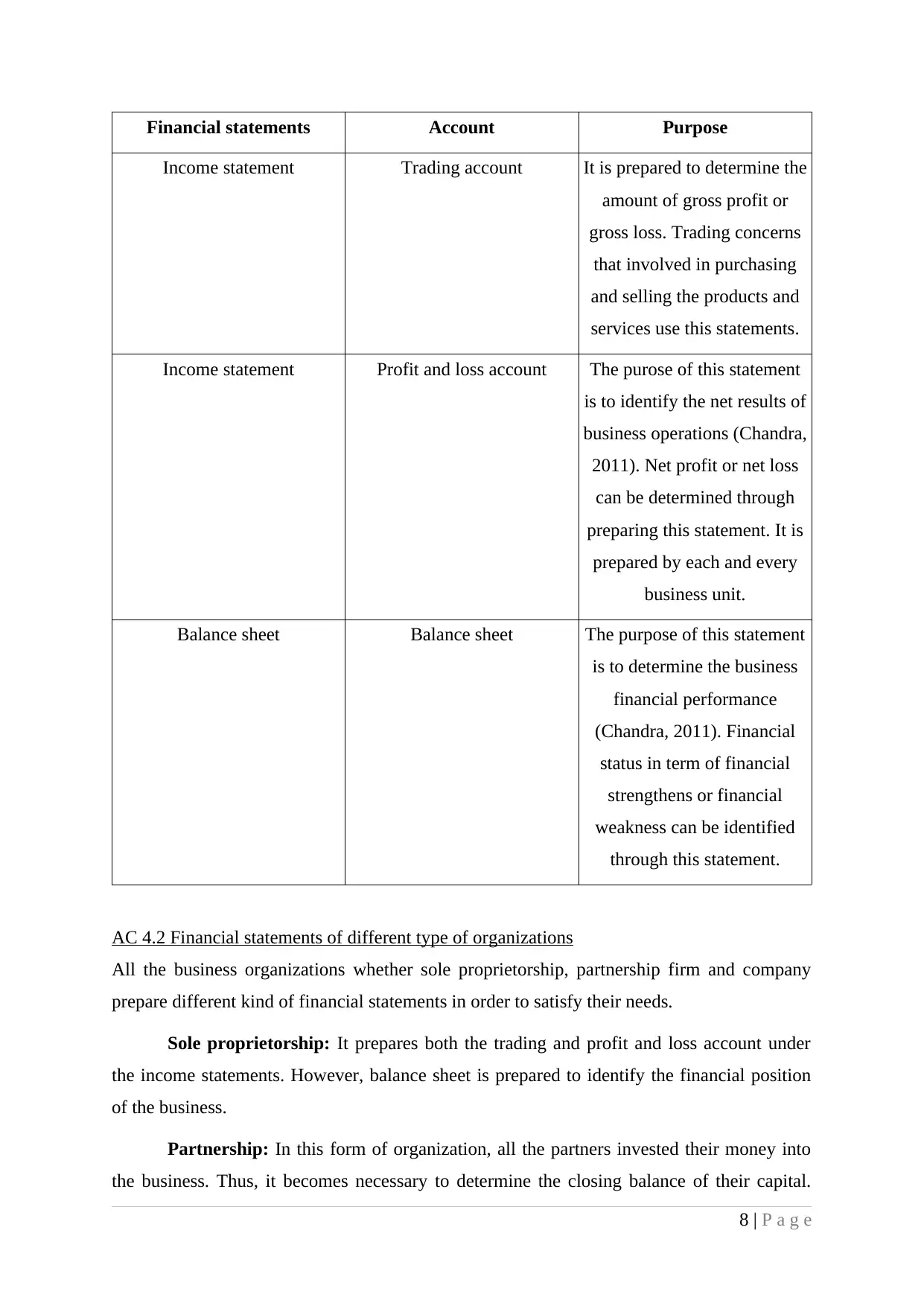

AC 4.1 The financial statements produced by the company

Every organization prepare its financial statements in order to assess the business

operation and financial results for a specified period. Two necessary statements are prepared

for this purpose. It includes income statements and balance sheet.

7 | P a g e

Total 55000 45000 26000

IRR/NPV 12.03% 7538.5 9.83% -705 16.25% -16044

ARR is the project return rate calculated by dividing the average profit to the initial cash

outflow of the project.

Project A = (55000/4)/150000*100 = 36.67%

Project B = (45000/4)/175000*100 = 25.71%

Project C = (26000/4)/160000*100 = 16.25%

Table 4: Calculation of pay back period ( In £)

year cash flow Cumulative cash flow Cumulative cash flow Cumulative

0 -150000 -150000 -175000 -175000 -160000 -160000

1 30000 -120000 55000 -120000 33000 -127000

2 48500 -71500 55000 -65000 40000 -87000

3 56000 -15500 55000 -10000 55000 -32000

4 55000 55000 55000 45000 58000 26000

Payback period is the time period taken by the project to get the initial investment.

Project A = 3 + 15500/70500 = 3.22 year

Project B = 3+ 10000/55000 = 3.182 year

Project C = 3 + 32000/58000 = 3.552 year

Recommendation: The company has to adopt project A due to higher the net present value

amounted to 7538.5£ with the internal rate of return to 12.03%. However, project B and C

have negative net present value to 705£ and 16044£ respectively. Moreover the accounting

rate of return is also higher in this project to 36.67% with the pay back period of 3.22 year.

TASK 3

AC 4.1 The financial statements produced by the company

Every organization prepare its financial statements in order to assess the business

operation and financial results for a specified period. Two necessary statements are prepared

for this purpose. It includes income statements and balance sheet.

7 | P a g e

Financial statements Account Purpose

Income statement Trading account It is prepared to determine the

amount of gross profit or

gross loss. Trading concerns

that involved in purchasing

and selling the products and

services use this statements.

Income statement Profit and loss account The purose of this statement

is to identify the net results of

business operations (Chandra,

2011). Net profit or net loss

can be determined through

preparing this statement. It is

prepared by each and every

business unit.

Balance sheet Balance sheet The purpose of this statement

is to determine the business

financial performance

(Chandra, 2011). Financial

status in term of financial

strengthens or financial

weakness can be identified

through this statement.

AC 4.2 Financial statements of different type of organizations

All the business organizations whether sole proprietorship, partnership firm and company

prepare different kind of financial statements in order to satisfy their needs.

Sole proprietorship: It prepares both the trading and profit and loss account under

the income statements. However, balance sheet is prepared to identify the financial position

of the business.

Partnership: In this form of organization, all the partners invested their money into

the business. Thus, it becomes necessary to determine the closing balance of their capital.

8 | P a g e

Income statement Trading account It is prepared to determine the

amount of gross profit or

gross loss. Trading concerns

that involved in purchasing

and selling the products and

services use this statements.

Income statement Profit and loss account The purose of this statement

is to identify the net results of

business operations (Chandra,

2011). Net profit or net loss

can be determined through

preparing this statement. It is

prepared by each and every

business unit.

Balance sheet Balance sheet The purpose of this statement

is to determine the business

financial performance

(Chandra, 2011). Financial

status in term of financial

strengthens or financial

weakness can be identified

through this statement.

AC 4.2 Financial statements of different type of organizations

All the business organizations whether sole proprietorship, partnership firm and company

prepare different kind of financial statements in order to satisfy their needs.

Sole proprietorship: It prepares both the trading and profit and loss account under

the income statements. However, balance sheet is prepared to identify the financial position

of the business.

Partnership: In this form of organization, all the partners invested their money into

the business. Thus, it becomes necessary to determine the closing balance of their capital.

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.