Managing Financial Resources: Cost Analysis, Budgeting, Costa Case

VerifiedAdded on 2023/06/15

|11

|2633

|442

Report

AI Summary

This report provides a detailed analysis of managing financial resources, focusing on cost analysis, budgeting, and variance analysis. It begins with the calculation of various costs for Costa, including prime cost, production cost, and administrative expenses. The report classifies different costs for a cloth manufacturing company and discusses key cost accounting concepts such as budgeting, forecasting, variance analysis (adverse and favorable), and flexible budgets with relevant examples. It covers the grouping of costs into categories like indirect product overhead, administration cost, finance cost, direct materials cost, direct expenses, research and development cost, and selling and distribution cost. The report also illustrates the application of budgeting and forecasting, variance analysis, adverse and favorable variances, and flexible budgets with practical examples, offering a comprehensive understanding of financial resource management.

MANAGING FINANCIAL

RESOURCES

RESOURCES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

SECTION A.....................................................................................................................................3

Question 1....................................................................................................................................3

SECTION B.....................................................................................................................................6

Question 3....................................................................................................................................6

Question 4....................................................................................................................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................3

SECTION A.....................................................................................................................................3

Question 1....................................................................................................................................3

SECTION B.....................................................................................................................................6

Question 3....................................................................................................................................6

Question 4....................................................................................................................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

The present report based on “Managing financial resource” involves calculation of costs related

to different heads of cost sheet for Costa where each element has been defined and calculated

costs are interpreted accordingly. Also, different costs have been classified to their respective

categories for a cloth manufacturing company. Further, various concept of cost accounting such

as budgeting and forecasting, variance analysis, adverse and favorable variance and flexible

budget has been discussed through example.

SECTION A

Question 1

Calculation of costs for Costa

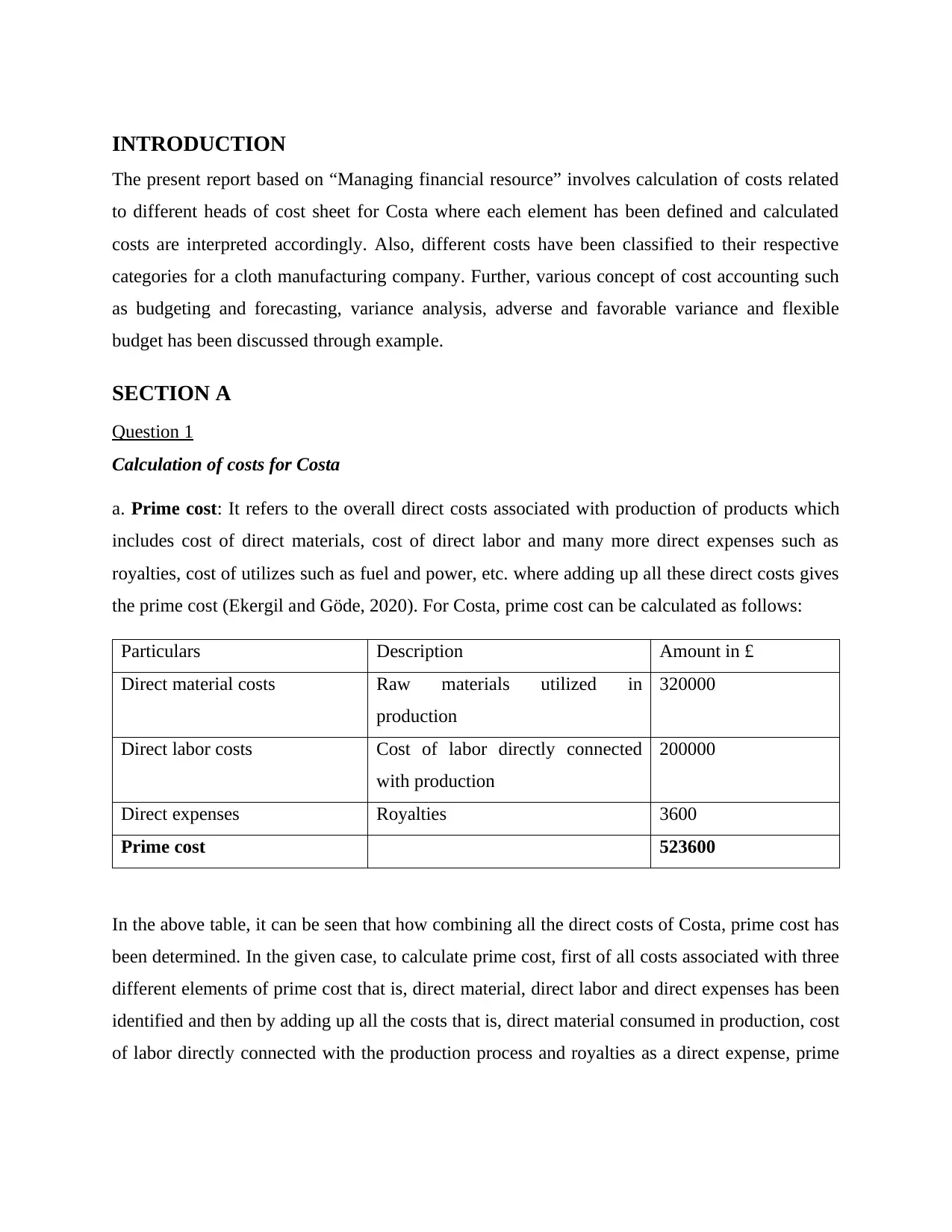

a. Prime cost: It refers to the overall direct costs associated with production of products which

includes cost of direct materials, cost of direct labor and many more direct expenses such as

royalties, cost of utilizes such as fuel and power, etc. where adding up all these direct costs gives

the prime cost (Ekergil and Göde, 2020). For Costa, prime cost can be calculated as follows:

Particulars Description Amount in £

Direct material costs Raw materials utilized in

production

320000

Direct labor costs Cost of labor directly connected

with production

200000

Direct expenses Royalties 3600

Prime cost 523600

In the above table, it can be seen that how combining all the direct costs of Costa, prime cost has

been determined. In the given case, to calculate prime cost, first of all costs associated with three

different elements of prime cost that is, direct material, direct labor and direct expenses has been

identified and then by adding up all the costs that is, direct material consumed in production, cost

of labor directly connected with the production process and royalties as a direct expense, prime

The present report based on “Managing financial resource” involves calculation of costs related

to different heads of cost sheet for Costa where each element has been defined and calculated

costs are interpreted accordingly. Also, different costs have been classified to their respective

categories for a cloth manufacturing company. Further, various concept of cost accounting such

as budgeting and forecasting, variance analysis, adverse and favorable variance and flexible

budget has been discussed through example.

SECTION A

Question 1

Calculation of costs for Costa

a. Prime cost: It refers to the overall direct costs associated with production of products which

includes cost of direct materials, cost of direct labor and many more direct expenses such as

royalties, cost of utilizes such as fuel and power, etc. where adding up all these direct costs gives

the prime cost (Ekergil and Göde, 2020). For Costa, prime cost can be calculated as follows:

Particulars Description Amount in £

Direct material costs Raw materials utilized in

production

320000

Direct labor costs Cost of labor directly connected

with production

200000

Direct expenses Royalties 3600

Prime cost 523600

In the above table, it can be seen that how combining all the direct costs of Costa, prime cost has

been determined. In the given case, to calculate prime cost, first of all costs associated with three

different elements of prime cost that is, direct material, direct labor and direct expenses has been

identified and then by adding up all the costs that is, direct material consumed in production, cost

of labor directly connected with the production process and royalties as a direct expense, prime

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cost has been calculated. Therefore, it can be said that prime cost is that direct cost which

incurred during the manufacturing process while producing a product.

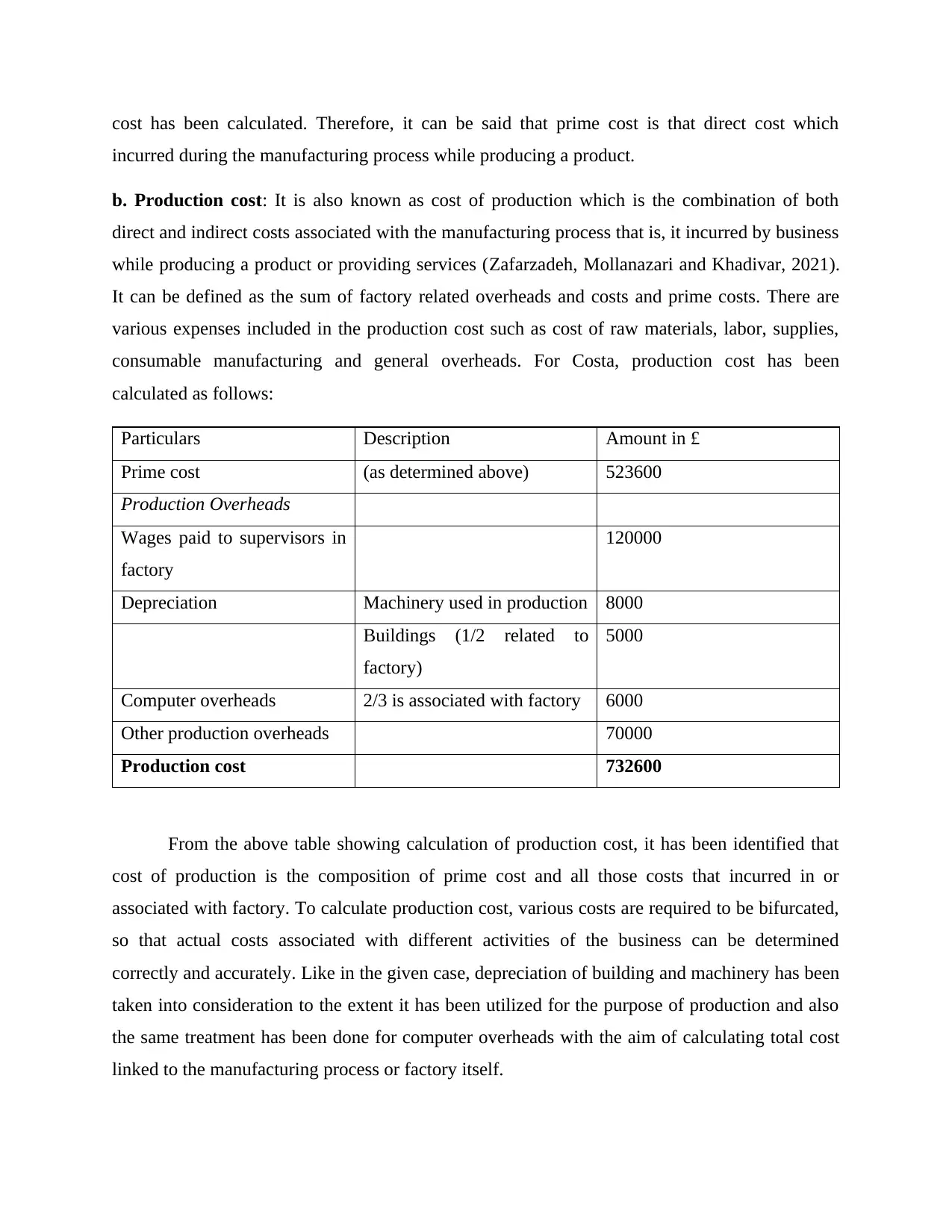

b. Production cost: It is also known as cost of production which is the combination of both

direct and indirect costs associated with the manufacturing process that is, it incurred by business

while producing a product or providing services (Zafarzadeh, Mollanazari and Khadivar, 2021).

It can be defined as the sum of factory related overheads and costs and prime costs. There are

various expenses included in the production cost such as cost of raw materials, labor, supplies,

consumable manufacturing and general overheads. For Costa, production cost has been

calculated as follows:

Particulars Description Amount in £

Prime cost (as determined above) 523600

Production Overheads

Wages paid to supervisors in

factory

120000

Depreciation Machinery used in production 8000

Buildings (1/2 related to

factory)

5000

Computer overheads 2/3 is associated with factory 6000

Other production overheads 70000

Production cost 732600

From the above table showing calculation of production cost, it has been identified that

cost of production is the composition of prime cost and all those costs that incurred in or

associated with factory. To calculate production cost, various costs are required to be bifurcated,

so that actual costs associated with different activities of the business can be determined

correctly and accurately. Like in the given case, depreciation of building and machinery has been

taken into consideration to the extent it has been utilized for the purpose of production and also

the same treatment has been done for computer overheads with the aim of calculating total cost

linked to the manufacturing process or factory itself.

incurred during the manufacturing process while producing a product.

b. Production cost: It is also known as cost of production which is the combination of both

direct and indirect costs associated with the manufacturing process that is, it incurred by business

while producing a product or providing services (Zafarzadeh, Mollanazari and Khadivar, 2021).

It can be defined as the sum of factory related overheads and costs and prime costs. There are

various expenses included in the production cost such as cost of raw materials, labor, supplies,

consumable manufacturing and general overheads. For Costa, production cost has been

calculated as follows:

Particulars Description Amount in £

Prime cost (as determined above) 523600

Production Overheads

Wages paid to supervisors in

factory

120000

Depreciation Machinery used in production 8000

Buildings (1/2 related to

factory)

5000

Computer overheads 2/3 is associated with factory 6000

Other production overheads 70000

Production cost 732600

From the above table showing calculation of production cost, it has been identified that

cost of production is the composition of prime cost and all those costs that incurred in or

associated with factory. To calculate production cost, various costs are required to be bifurcated,

so that actual costs associated with different activities of the business can be determined

correctly and accurately. Like in the given case, depreciation of building and machinery has been

taken into consideration to the extent it has been utilized for the purpose of production and also

the same treatment has been done for computer overheads with the aim of calculating total cost

linked to the manufacturing process or factory itself.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

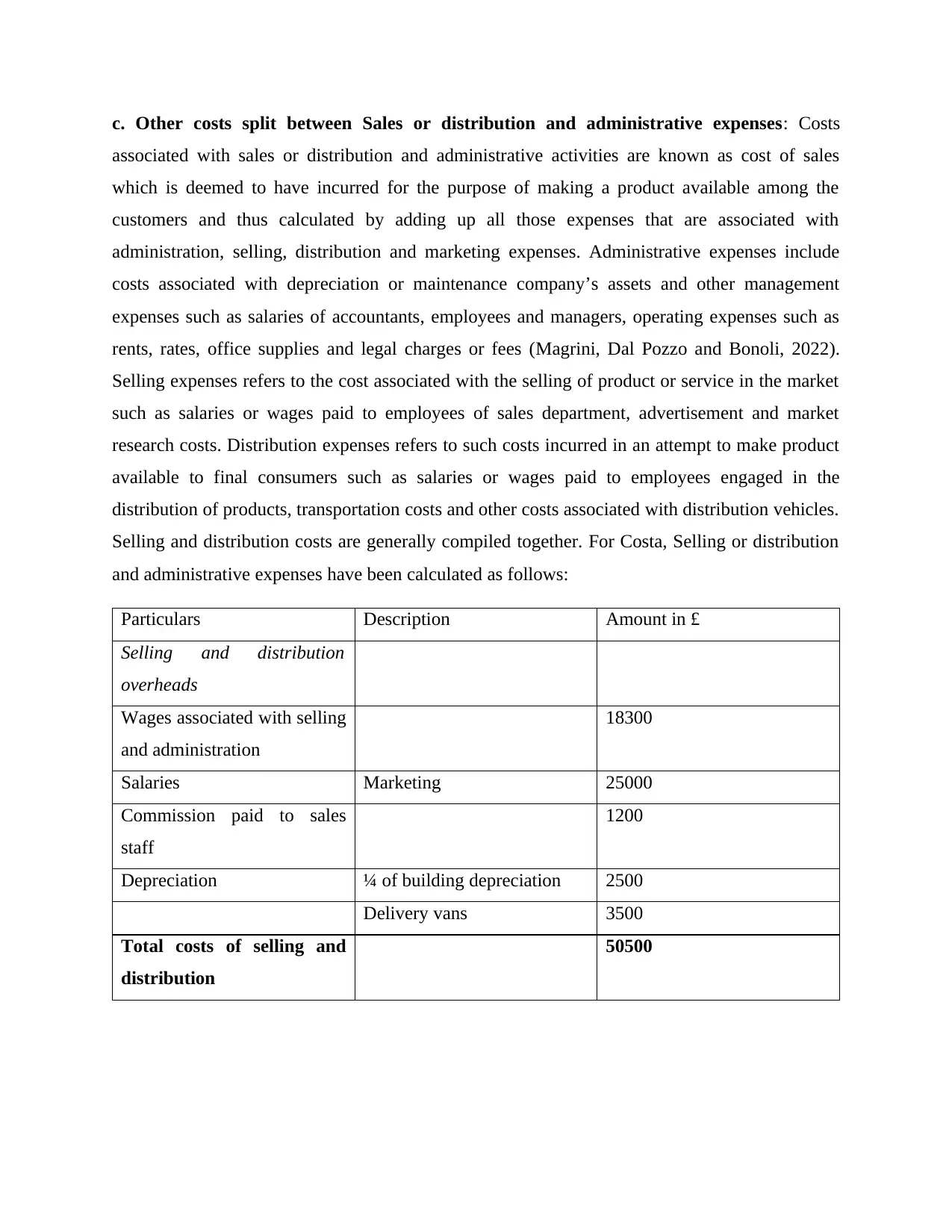

c. Other costs split between Sales or distribution and administrative expenses: Costs

associated with sales or distribution and administrative activities are known as cost of sales

which is deemed to have incurred for the purpose of making a product available among the

customers and thus calculated by adding up all those expenses that are associated with

administration, selling, distribution and marketing expenses. Administrative expenses include

costs associated with depreciation or maintenance company’s assets and other management

expenses such as salaries of accountants, employees and managers, operating expenses such as

rents, rates, office supplies and legal charges or fees (Magrini, Dal Pozzo and Bonoli, 2022).

Selling expenses refers to the cost associated with the selling of product or service in the market

such as salaries or wages paid to employees of sales department, advertisement and market

research costs. Distribution expenses refers to such costs incurred in an attempt to make product

available to final consumers such as salaries or wages paid to employees engaged in the

distribution of products, transportation costs and other costs associated with distribution vehicles.

Selling and distribution costs are generally compiled together. For Costa, Selling or distribution

and administrative expenses have been calculated as follows:

Particulars Description Amount in £

Selling and distribution

overheads

Wages associated with selling

and administration

18300

Salaries Marketing 25000

Commission paid to sales

staff

1200

Depreciation ¼ of building depreciation 2500

Delivery vans 3500

Total costs of selling and

distribution

50500

associated with sales or distribution and administrative activities are known as cost of sales

which is deemed to have incurred for the purpose of making a product available among the

customers and thus calculated by adding up all those expenses that are associated with

administration, selling, distribution and marketing expenses. Administrative expenses include

costs associated with depreciation or maintenance company’s assets and other management

expenses such as salaries of accountants, employees and managers, operating expenses such as

rents, rates, office supplies and legal charges or fees (Magrini, Dal Pozzo and Bonoli, 2022).

Selling expenses refers to the cost associated with the selling of product or service in the market

such as salaries or wages paid to employees of sales department, advertisement and market

research costs. Distribution expenses refers to such costs incurred in an attempt to make product

available to final consumers such as salaries or wages paid to employees engaged in the

distribution of products, transportation costs and other costs associated with distribution vehicles.

Selling and distribution costs are generally compiled together. For Costa, Selling or distribution

and administrative expenses have been calculated as follows:

Particulars Description Amount in £

Selling and distribution

overheads

Wages associated with selling

and administration

18300

Salaries Marketing 25000

Commission paid to sales

staff

1200

Depreciation ¼ of building depreciation 2500

Delivery vans 3500

Total costs of selling and

distribution

50500

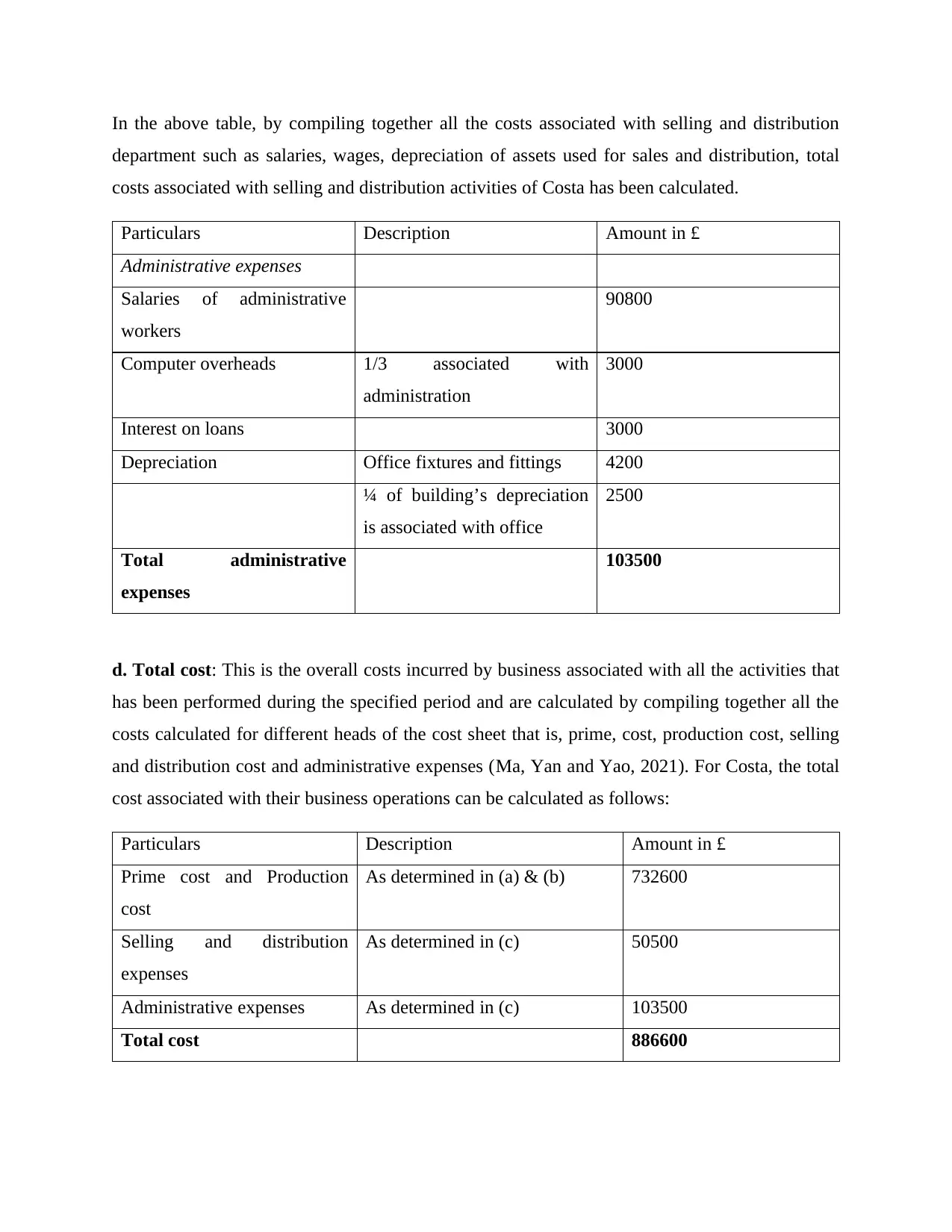

In the above table, by compiling together all the costs associated with selling and distribution

department such as salaries, wages, depreciation of assets used for sales and distribution, total

costs associated with selling and distribution activities of Costa has been calculated.

Particulars Description Amount in £

Administrative expenses

Salaries of administrative

workers

90800

Computer overheads 1/3 associated with

administration

3000

Interest on loans 3000

Depreciation Office fixtures and fittings 4200

¼ of building’s depreciation

is associated with office

2500

Total administrative

expenses

103500

d. Total cost: This is the overall costs incurred by business associated with all the activities that

has been performed during the specified period and are calculated by compiling together all the

costs calculated for different heads of the cost sheet that is, prime, cost, production cost, selling

and distribution cost and administrative expenses (Ma, Yan and Yao, 2021). For Costa, the total

cost associated with their business operations can be calculated as follows:

Particulars Description Amount in £

Prime cost and Production

cost

As determined in (a) & (b) 732600

Selling and distribution

expenses

As determined in (c) 50500

Administrative expenses As determined in (c) 103500

Total cost 886600

department such as salaries, wages, depreciation of assets used for sales and distribution, total

costs associated with selling and distribution activities of Costa has been calculated.

Particulars Description Amount in £

Administrative expenses

Salaries of administrative

workers

90800

Computer overheads 1/3 associated with

administration

3000

Interest on loans 3000

Depreciation Office fixtures and fittings 4200

¼ of building’s depreciation

is associated with office

2500

Total administrative

expenses

103500

d. Total cost: This is the overall costs incurred by business associated with all the activities that

has been performed during the specified period and are calculated by compiling together all the

costs calculated for different heads of the cost sheet that is, prime, cost, production cost, selling

and distribution cost and administrative expenses (Ma, Yan and Yao, 2021). For Costa, the total

cost associated with their business operations can be calculated as follows:

Particulars Description Amount in £

Prime cost and Production

cost

As determined in (a) & (b) 732600

Selling and distribution

expenses

As determined in (c) 50500

Administrative expenses As determined in (c) 103500

Total cost 886600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

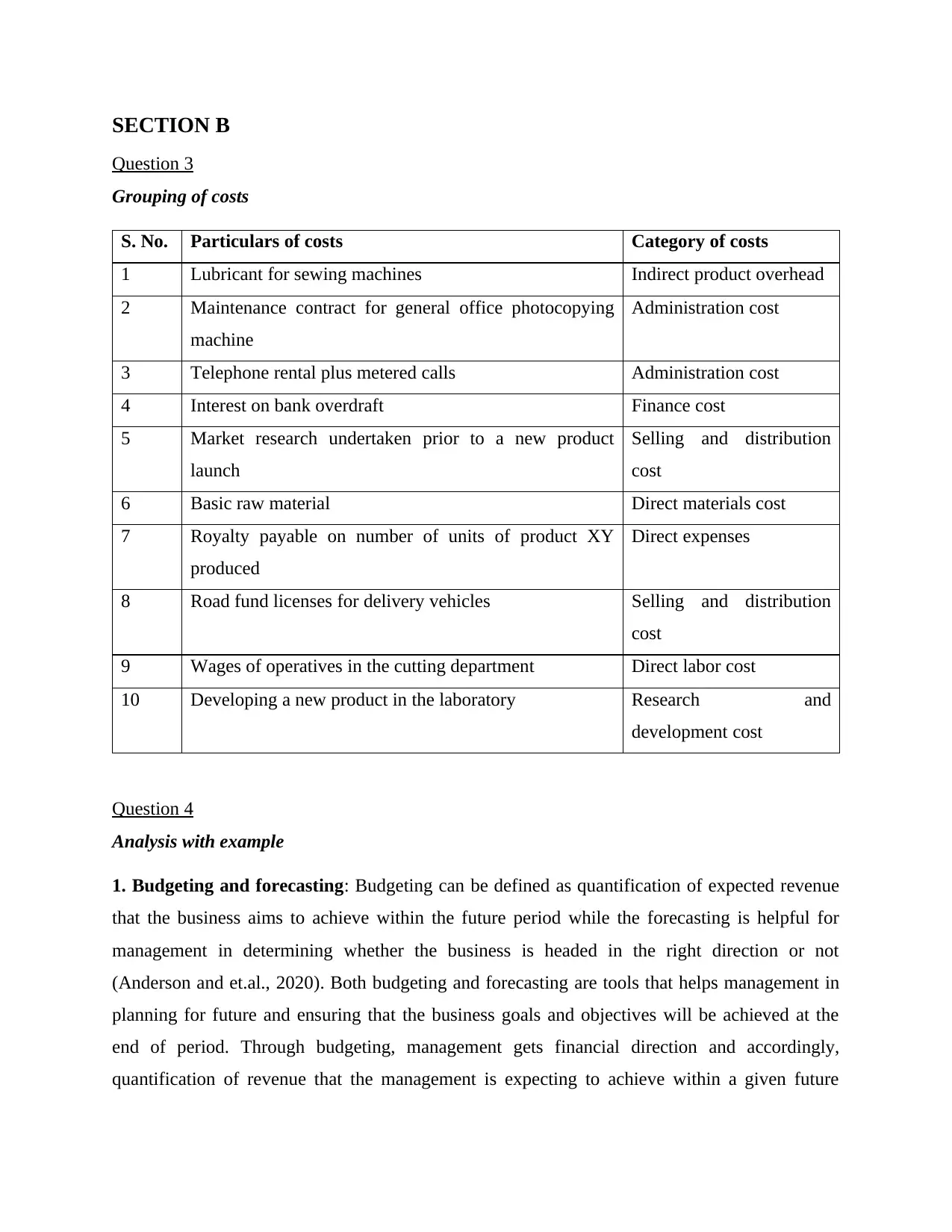

SECTION B

Question 3

Grouping of costs

S. No. Particulars of costs Category of costs

1 Lubricant for sewing machines Indirect product overhead

2 Maintenance contract for general office photocopying

machine

Administration cost

3 Telephone rental plus metered calls Administration cost

4 Interest on bank overdraft Finance cost

5 Market research undertaken prior to a new product

launch

Selling and distribution

cost

6 Basic raw material Direct materials cost

7 Royalty payable on number of units of product XY

produced

Direct expenses

8 Road fund licenses for delivery vehicles Selling and distribution

cost

9 Wages of operatives in the cutting department Direct labor cost

10 Developing a new product in the laboratory Research and

development cost

Question 4

Analysis with example

1. Budgeting and forecasting: Budgeting can be defined as quantification of expected revenue

that the business aims to achieve within the future period while the forecasting is helpful for

management in determining whether the business is headed in the right direction or not

(Anderson and et.al., 2020). Both budgeting and forecasting are tools that helps management in

planning for future and ensuring that the business goals and objectives will be achieved at the

end of period. Through budgeting, management gets financial direction and accordingly,

quantification of revenue that the management is expecting to achieve within a given future

Question 3

Grouping of costs

S. No. Particulars of costs Category of costs

1 Lubricant for sewing machines Indirect product overhead

2 Maintenance contract for general office photocopying

machine

Administration cost

3 Telephone rental plus metered calls Administration cost

4 Interest on bank overdraft Finance cost

5 Market research undertaken prior to a new product

launch

Selling and distribution

cost

6 Basic raw material Direct materials cost

7 Royalty payable on number of units of product XY

produced

Direct expenses

8 Road fund licenses for delivery vehicles Selling and distribution

cost

9 Wages of operatives in the cutting department Direct labor cost

10 Developing a new product in the laboratory Research and

development cost

Question 4

Analysis with example

1. Budgeting and forecasting: Budgeting can be defined as quantification of expected revenue

that the business aims to achieve within the future period while the forecasting is helpful for

management in determining whether the business is headed in the right direction or not

(Anderson and et.al., 2020). Both budgeting and forecasting are tools that helps management in

planning for future and ensuring that the business goals and objectives will be achieved at the

end of period. Through budgeting, management gets financial direction and accordingly,

quantification of revenue that the management is expecting to achieve within a given future

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

period are done. On the other hand, through forecasting, estimation of amount of revenue and

income accordingly is done that is needed to be achieved in the upcoming duration (Farr, 2019).

In budgeting, variances at the end of period has analyzed against the actual performance whereas

no such analysis of variances takes place in case of forecasting. As against this, forecasting

allows management in how they should allocate the budgets for the upcoming future period.

Example of budgeting is, a company preparing sales budget in order to project sales of the

company while production budget to project how much production does a company need to do

for the upcoming future period.

Example of forecasting in business are determination of feasibility that there would be

competition faced from existing competitors, measurement of possibility related to creation of a

product’s demand.

2. Variance analysis: It refers to the determination of difference that has occurred between the

actual performance as against what has been planned for the given period. It can be both

favorable and unfavorable where in the former case the actual performance is higher than the

planned one and in the latter case the actual performance are less than the planned performance

(Olszewska, 2019). By summing up all the variances associated with a given reporting period, a

picture of whether there is over or under performance can be created.

Example of variance analysis, if the standard cost exceeds the actual cost despite of consuming

the same quantity of materials, then such condition indicates that there are favorable price

variances because the actual costs are less the planned cost. Like 100 kg of raw material was

budgeted to cost £10000, however at the end of budget period the actual cost of raw materials

comes out to be £9000 only. Therefore, there is favorable price variance of £1000.

3. Adverse variances: It refers to such unfavorable variances where actual expenditure exceeds

budgeted expenditure and the actual income is less than that of budgeted one (Sotiriadis, 2018).

It is quite similar to that of deficit where there is less income available to cover total expenditure

associated with the given period. There could be many reasons for adverse variance such as

changes in economic conditions or market situation (entrance of new competitor).

For example, adverse variance could be understood well through quoting example from dual

point of view that is, from income and expenditure both. If the budgeted sales revenue for the

income accordingly is done that is needed to be achieved in the upcoming duration (Farr, 2019).

In budgeting, variances at the end of period has analyzed against the actual performance whereas

no such analysis of variances takes place in case of forecasting. As against this, forecasting

allows management in how they should allocate the budgets for the upcoming future period.

Example of budgeting is, a company preparing sales budget in order to project sales of the

company while production budget to project how much production does a company need to do

for the upcoming future period.

Example of forecasting in business are determination of feasibility that there would be

competition faced from existing competitors, measurement of possibility related to creation of a

product’s demand.

2. Variance analysis: It refers to the determination of difference that has occurred between the

actual performance as against what has been planned for the given period. It can be both

favorable and unfavorable where in the former case the actual performance is higher than the

planned one and in the latter case the actual performance are less than the planned performance

(Olszewska, 2019). By summing up all the variances associated with a given reporting period, a

picture of whether there is over or under performance can be created.

Example of variance analysis, if the standard cost exceeds the actual cost despite of consuming

the same quantity of materials, then such condition indicates that there are favorable price

variances because the actual costs are less the planned cost. Like 100 kg of raw material was

budgeted to cost £10000, however at the end of budget period the actual cost of raw materials

comes out to be £9000 only. Therefore, there is favorable price variance of £1000.

3. Adverse variances: It refers to such unfavorable variances where actual expenditure exceeds

budgeted expenditure and the actual income is less than that of budgeted one (Sotiriadis, 2018).

It is quite similar to that of deficit where there is less income available to cover total expenditure

associated with the given period. There could be many reasons for adverse variance such as

changes in economic conditions or market situation (entrance of new competitor).

For example, adverse variance could be understood well through quoting example from dual

point of view that is, from income and expenditure both. If the budgeted sales revenue for the

period was £3 million while the actual sales realized at the end of this period is £2.75 million.

Therefore, the difference of £250000 sales is known as adverse variance because revenue

realized is less than the budgeted one. Also, from the expenditure point of view, if the budgeted

cost of direct materials was £5 million whereas the actual cost of direct materials incurred during

the budgeted period is £5.5 million, then the difference amount of £500000 is the adverse

variance.

4. favorable variance: Unlike adverse variance, favorable variance occurs where actual income

or sales realized at the end of budget period exceeds the planned income or sales whereas the

actual expenditure incurred during the budget period is less than what has been planned while

setting budget (KHAMATKHANOVA, 2018). Therefore, there would be favorable conditions

for business in the event of favorable variance because this signifies that actual performance is

higher than that of planned performance.

For example, favorable variance can also be understood well with the help of example based on

both income and expenditure. If the budgeted sales are £5 million and actual sales realized are £6

million, then there is favorable variance amounting to £1 million. Similarly, if budgeted cost of

direct labor was £500000 and the actual cost incurred for hiring direct labor is £480000, then

there is £20000 favorable variance.

5. Flexible budget: It refers to such method of setting budget where the figures within the

budget gets adjusted with the level of activity or volume of a company (Osadchy and et.al.,

2018). Such format of budgeting allows for evaluating manager’s performance along with acting

as good tool for planning done by management as manager can establish financial modelling

through which financial results can be analyzed at different levels of activities.

For instance, if a company is using flexible budget where there are 10 million budgeted as sales

and 5 million as costs of goods sold which comprises of 2 million fixed and 3 million variables

that is, variable cost of goods sold is 30% of sales. If at end of budget period, there are actual

sales amounting to 9 million only, then by keeping fixed as 1 million, the actual variable cost of

goods sold would be 2.7 million only which is equivalent to 30% of actual sales revenue.

Therefore, the difference of £250000 sales is known as adverse variance because revenue

realized is less than the budgeted one. Also, from the expenditure point of view, if the budgeted

cost of direct materials was £5 million whereas the actual cost of direct materials incurred during

the budgeted period is £5.5 million, then the difference amount of £500000 is the adverse

variance.

4. favorable variance: Unlike adverse variance, favorable variance occurs where actual income

or sales realized at the end of budget period exceeds the planned income or sales whereas the

actual expenditure incurred during the budget period is less than what has been planned while

setting budget (KHAMATKHANOVA, 2018). Therefore, there would be favorable conditions

for business in the event of favorable variance because this signifies that actual performance is

higher than that of planned performance.

For example, favorable variance can also be understood well with the help of example based on

both income and expenditure. If the budgeted sales are £5 million and actual sales realized are £6

million, then there is favorable variance amounting to £1 million. Similarly, if budgeted cost of

direct labor was £500000 and the actual cost incurred for hiring direct labor is £480000, then

there is £20000 favorable variance.

5. Flexible budget: It refers to such method of setting budget where the figures within the

budget gets adjusted with the level of activity or volume of a company (Osadchy and et.al.,

2018). Such format of budgeting allows for evaluating manager’s performance along with acting

as good tool for planning done by management as manager can establish financial modelling

through which financial results can be analyzed at different levels of activities.

For instance, if a company is using flexible budget where there are 10 million budgeted as sales

and 5 million as costs of goods sold which comprises of 2 million fixed and 3 million variables

that is, variable cost of goods sold is 30% of sales. If at end of budget period, there are actual

sales amounting to 9 million only, then by keeping fixed as 1 million, the actual variable cost of

goods sold would be 2.7 million only which is equivalent to 30% of actual sales revenue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONCLUSION

From the above assignment, it has been concluded that management of financial

resources is very necessary within all types of business concern through creating budgets,

calculating and analyzing costs, etc. This is because with the appropriate financial resource

management, performance of the firm can be improved and increased.

From the above assignment, it has been concluded that management of financial

resources is very necessary within all types of business concern through creating budgets,

calculating and analyzing costs, etc. This is because with the appropriate financial resource

management, performance of the firm can be improved and increased.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Osadchy, E. A., and et.al., 2018. Financial statements of a company as an information base for

decision-making in a transforming economy.

KHAMATKHANOVA, M. A., 2018. Systematization of models and methods in managing

financial resources of companies. Revista ESPACIOS, 39(18).

Sotiriadis, M., 2018. Managing Financial Matters. In The Emerald Handbook of

Entrepreneurship in Tourism, Travel and Hospitality. Emerald Publishing Limited.

Olszewska, K., 2019. Cost management with budgeting and Kaizen Costing. World Scientific

News, 133, pp.171-190.

Farr, J. V., 2019. Systems life cycle costing: economic analysis, estimation, and management.

CRC Press.

Anderson, D. M., and et.al., 2020. Budgeting for environmental health services in healthcare

facilities: a ten-step model for planning and costing. International journal of

environmental research and public health, 17(6), p.2075.

Ma, X., Yan, M. and Yao, B., 2021, December. The Labor Cost Management of Marine

Engineering Project Based on Activity-Based Costing Method. In 2021 3rd International

Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 3361-

3367). Atlantis Press.

Magrini, C., Dal Pozzo, A. and Bonoli, A., 2022. Assessing the externalities of a waste

management system via life cycle costing: The case study of the Emilia-Romagna Region

(Italy). Waste Management, 138, pp.285-297.

Zafarzadeh, S., Mollanazari, M. and Khadivar, A., 2021. University cost management by

integrating activity based costing and system dynamics approach. Journal of Accounting

Knowledge.

Ekergil, V. and Göde, M. Ö., 2020. The role of supply chain management and standard costing

techniques in performance evaluations of hotel businesses. In Travel and Tourism:

Sustainability, Economics, and Management Issues (pp. 3-28). Springer, Singapore.

Osadchy, E. A., and et.al., 2018. Financial statements of a company as an information base for

decision-making in a transforming economy.

KHAMATKHANOVA, M. A., 2018. Systematization of models and methods in managing

financial resources of companies. Revista ESPACIOS, 39(18).

Sotiriadis, M., 2018. Managing Financial Matters. In The Emerald Handbook of

Entrepreneurship in Tourism, Travel and Hospitality. Emerald Publishing Limited.

Olszewska, K., 2019. Cost management with budgeting and Kaizen Costing. World Scientific

News, 133, pp.171-190.

Farr, J. V., 2019. Systems life cycle costing: economic analysis, estimation, and management.

CRC Press.

Anderson, D. M., and et.al., 2020. Budgeting for environmental health services in healthcare

facilities: a ten-step model for planning and costing. International journal of

environmental research and public health, 17(6), p.2075.

Ma, X., Yan, M. and Yao, B., 2021, December. The Labor Cost Management of Marine

Engineering Project Based on Activity-Based Costing Method. In 2021 3rd International

Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 3361-

3367). Atlantis Press.

Magrini, C., Dal Pozzo, A. and Bonoli, A., 2022. Assessing the externalities of a waste

management system via life cycle costing: The case study of the Emilia-Romagna Region

(Italy). Waste Management, 138, pp.285-297.

Zafarzadeh, S., Mollanazari, M. and Khadivar, A., 2021. University cost management by

integrating activity based costing and system dynamics approach. Journal of Accounting

Knowledge.

Ekergil, V. and Göde, M. Ö., 2020. The role of supply chain management and standard costing

techniques in performance evaluations of hotel businesses. In Travel and Tourism:

Sustainability, Economics, and Management Issues (pp. 3-28). Springer, Singapore.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.