Comprehensive Financial Performance Analysis of Enero Group Limited

VerifiedAdded on 2023/01/11

|13

|2661

|63

Report

AI Summary

This report presents a financial analysis of Enero Group Limited, a telecommunications and marketing company, focusing on its financial performance and position. The analysis employs financial ratio analysis, vertical analysis, and trend analysis using data from 2017 to 2019. Key findings indicate a declining financial performance despite a strong financial position, with decreasing profitability ratios such as return on capital employed, return on equity, and net profit margin. The report assesses liquidity and efficiency ratios, revealing an adequate current ratio and asset turnover, but also highlights concerns about declining earnings per share (EPS). Vertical analysis examines the income statement and balance sheet, showing fluctuating cost of sales and administrative expenses. Horizontal analysis reveals a downward trend in revenue and significant changes in profit after tax. The report concludes by emphasizing the need for corporate restructuring and strategic management to stabilize performance and prevent further decline.

MANAGING FINANCIAL

RESOURCES

RESOURCES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Financial management refers to the process of planning, directing, organising and

controlling the financial activities like the procurement and the utilisation of the funds of

company applying the general management principles. Report has analysed the financial

performance and position of Enero group limited which is a telecommunication and marketing

company. Financial position of the company is strong however from the past years it could be

seen that the performance of the company is declining at a steady. Financial performance of the

company is required to be managed with corporate restructuring for preventing the downfall of

profits. It is to be controlled using strong strategies to stabilise the performance and position of

the company.

1

Financial management refers to the process of planning, directing, organising and

controlling the financial activities like the procurement and the utilisation of the funds of

company applying the general management principles. Report has analysed the financial

performance and position of Enero group limited which is a telecommunication and marketing

company. Financial position of the company is strong however from the past years it could be

seen that the performance of the company is declining at a steady. Financial performance of the

company is required to be managed with corporate restructuring for preventing the downfall of

profits. It is to be controlled using strong strategies to stabilise the performance and position of

the company.

1

Table of Contents

INTRODUCTION...........................................................................................................................3

Financial Ratio analysis...................................................................................................................3

Vertical and trend analysis...............................................................................................................8

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

2

INTRODUCTION...........................................................................................................................3

Financial Ratio analysis...................................................................................................................3

Vertical and trend analysis...............................................................................................................8

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial resources are those resources which are scarce in nature and required to be

managed effectively. It is completely based on the information gathered by analysing the

performance of the company. There are various tools which can eb used by the company in

analysing the financial performance of the company. This report, states about the financial

performance of Enero Group. It provides detailed analysis of the financial statements of the

company, that is, income statement and balance sheet with the help of financial ratio analysis,

vertical analysis and trend analysis of the company.

Financial Ratio analysis

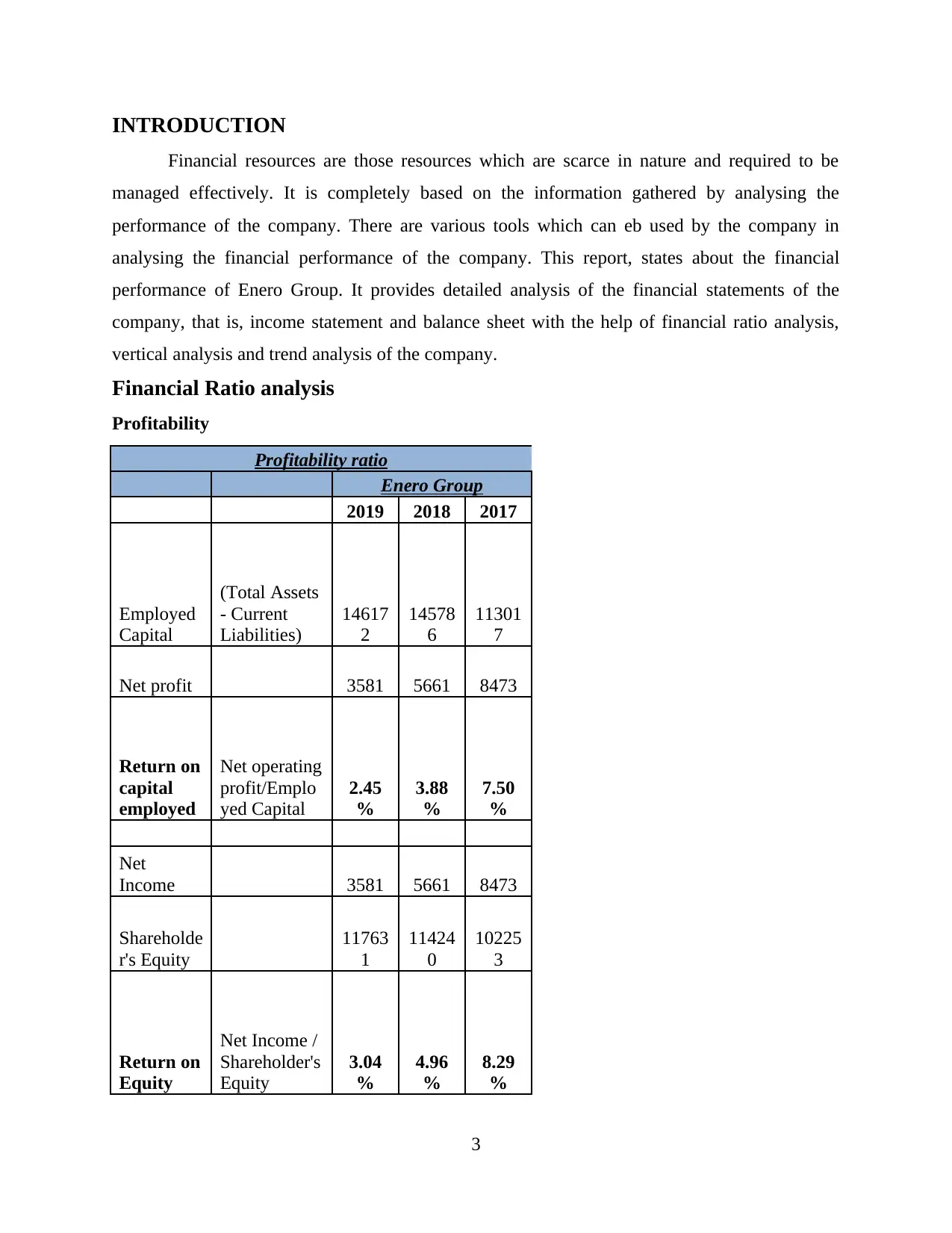

Profitability

Profitability ratio

Enero Group

2019 2018 2017

Employed

Capital

(Total Assets

- Current

Liabilities)

14617

2

14578

6

11301

7

Net profit 3581 5661 8473

Return on

capital

employed

Net operating

profit/Emplo

yed Capital

2.45

%

3.88

%

7.50

%

Net

Income 3581 5661 8473

Shareholde

r's Equity

11763

1

11424

0

10225

3

Return on

Equity

Net Income /

Shareholder's

Equity

3.04

%

4.96

%

8.29

%

3

Financial resources are those resources which are scarce in nature and required to be

managed effectively. It is completely based on the information gathered by analysing the

performance of the company. There are various tools which can eb used by the company in

analysing the financial performance of the company. This report, states about the financial

performance of Enero Group. It provides detailed analysis of the financial statements of the

company, that is, income statement and balance sheet with the help of financial ratio analysis,

vertical analysis and trend analysis of the company.

Financial Ratio analysis

Profitability

Profitability ratio

Enero Group

2019 2018 2017

Employed

Capital

(Total Assets

- Current

Liabilities)

14617

2

14578

6

11301

7

Net profit 3581 5661 8473

Return on

capital

employed

Net operating

profit/Emplo

yed Capital

2.45

%

3.88

%

7.50

%

Net

Income 3581 5661 8473

Shareholde

r's Equity

11763

1

11424

0

10225

3

Return on

Equity

Net Income /

Shareholder's

Equity

3.04

%

4.96

%

8.29

%

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

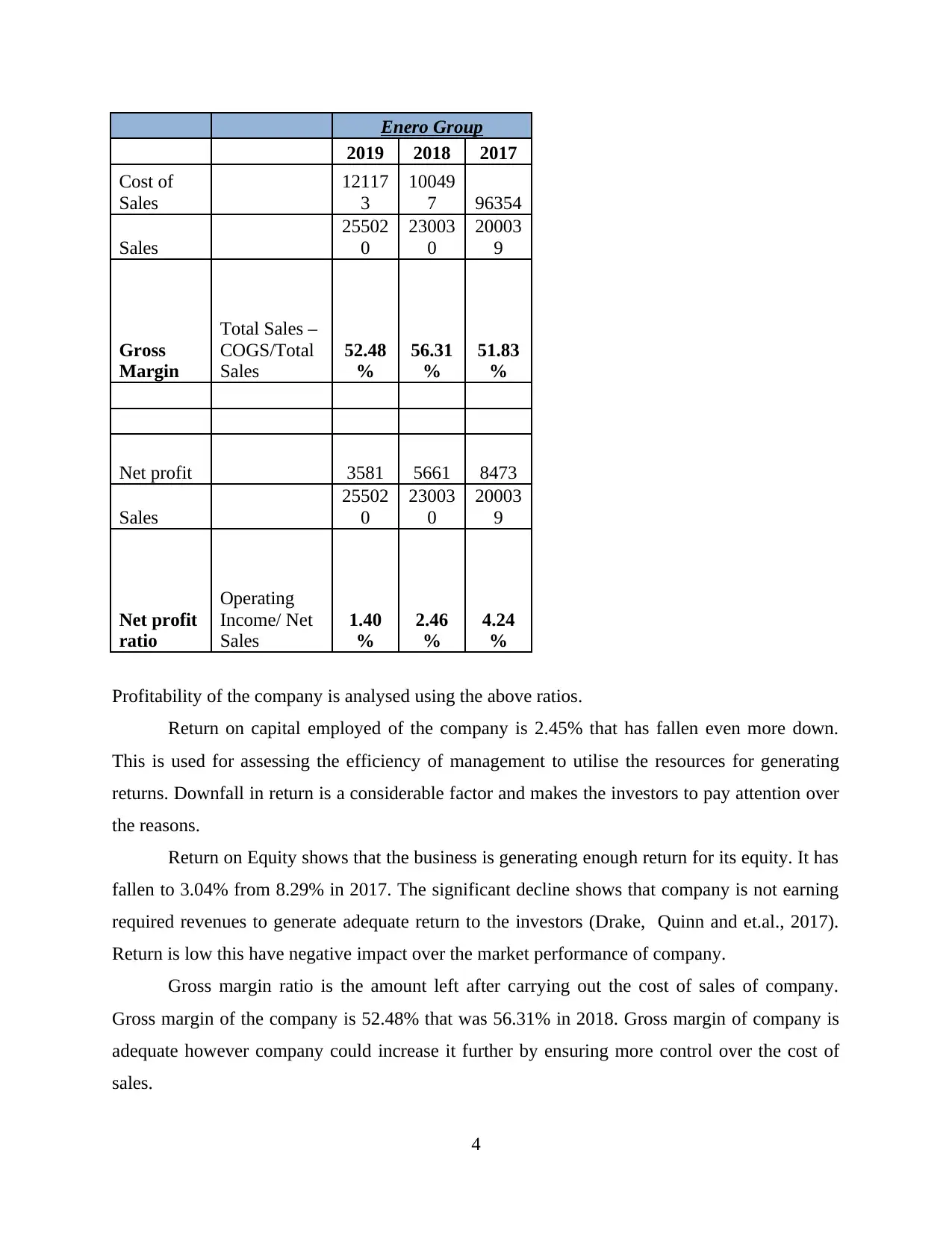

Enero Group

2019 2018 2017

Cost of

Sales

12117

3

10049

7 96354

Sales

25502

0

23003

0

20003

9

Gross

Margin

Total Sales –

COGS/Total

Sales

52.48

%

56.31

%

51.83

%

Net profit 3581 5661 8473

Sales

25502

0

23003

0

20003

9

Net profit

ratio

Operating

Income/ Net

Sales

1.40

%

2.46

%

4.24

%

Profitability of the company is analysed using the above ratios.

Return on capital employed of the company is 2.45% that has fallen even more down.

This is used for assessing the efficiency of management to utilise the resources for generating

returns. Downfall in return is a considerable factor and makes the investors to pay attention over

the reasons.

Return on Equity shows that the business is generating enough return for its equity. It has

fallen to 3.04% from 8.29% in 2017. The significant decline shows that company is not earning

required revenues to generate adequate return to the investors (Drake, Quinn and et.al., 2017).

Return is low this have negative impact over the market performance of company.

Gross margin ratio is the amount left after carrying out the cost of sales of company.

Gross margin of the company is 52.48% that was 56.31% in 2018. Gross margin of company is

adequate however company could increase it further by ensuring more control over the cost of

sales.

4

2019 2018 2017

Cost of

Sales

12117

3

10049

7 96354

Sales

25502

0

23003

0

20003

9

Gross

Margin

Total Sales –

COGS/Total

Sales

52.48

%

56.31

%

51.83

%

Net profit 3581 5661 8473

Sales

25502

0

23003

0

20003

9

Net profit

ratio

Operating

Income/ Net

Sales

1.40

%

2.46

%

4.24

%

Profitability of the company is analysed using the above ratios.

Return on capital employed of the company is 2.45% that has fallen even more down.

This is used for assessing the efficiency of management to utilise the resources for generating

returns. Downfall in return is a considerable factor and makes the investors to pay attention over

the reasons.

Return on Equity shows that the business is generating enough return for its equity. It has

fallen to 3.04% from 8.29% in 2017. The significant decline shows that company is not earning

required revenues to generate adequate return to the investors (Drake, Quinn and et.al., 2017).

Return is low this have negative impact over the market performance of company.

Gross margin ratio is the amount left after carrying out the cost of sales of company.

Gross margin of the company is 52.48% that was 56.31% in 2018. Gross margin of company is

adequate however company could increase it further by ensuring more control over the cost of

sales.

4

Net profit margin of company is 1.40%which was 4.24% in 2017. The profit of company

is declining constantly and this is serious concern for the management and the interested parties.

If strong actions to control the profitability are not taken it may cause the company to suffer

losses in the coming years.

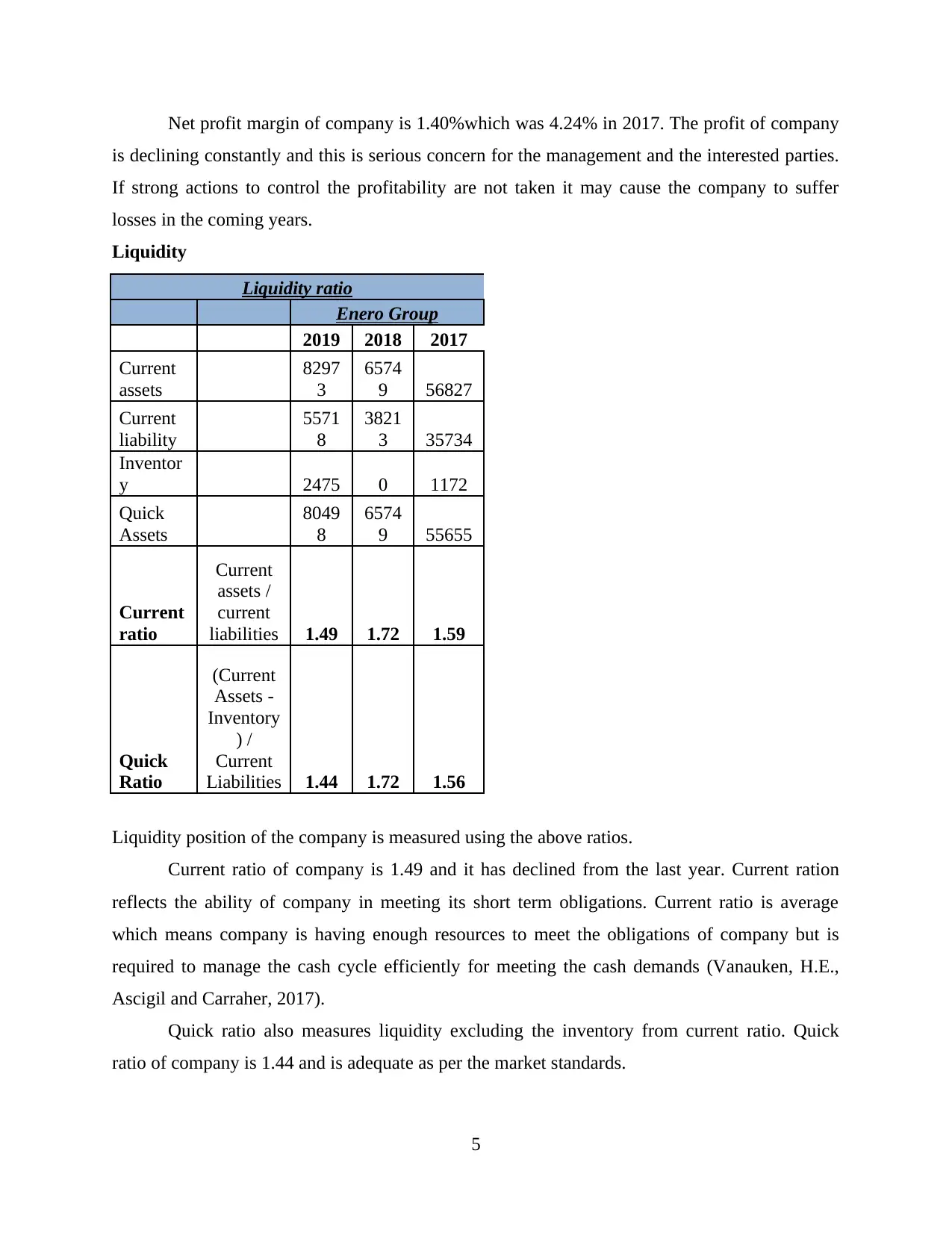

Liquidity

Liquidity ratio

Enero Group

2019 2018 2017

Current

assets

8297

3

6574

9 56827

Current

liability

5571

8

3821

3 35734

Inventor

y 2475 0 1172

Quick

Assets

8049

8

6574

9 55655

Current

ratio

Current

assets /

current

liabilities 1.49 1.72 1.59

Quick

Ratio

(Current

Assets -

Inventory

) /

Current

Liabilities 1.44 1.72 1.56

Liquidity position of the company is measured using the above ratios.

Current ratio of company is 1.49 and it has declined from the last year. Current ration

reflects the ability of company in meeting its short term obligations. Current ratio is average

which means company is having enough resources to meet the obligations of company but is

required to manage the cash cycle efficiently for meeting the cash demands (Vanauken, H.E.,

Ascigil and Carraher, 2017).

Quick ratio also measures liquidity excluding the inventory from current ratio. Quick

ratio of company is 1.44 and is adequate as per the market standards.

5

is declining constantly and this is serious concern for the management and the interested parties.

If strong actions to control the profitability are not taken it may cause the company to suffer

losses in the coming years.

Liquidity

Liquidity ratio

Enero Group

2019 2018 2017

Current

assets

8297

3

6574

9 56827

Current

liability

5571

8

3821

3 35734

Inventor

y 2475 0 1172

Quick

Assets

8049

8

6574

9 55655

Current

ratio

Current

assets /

current

liabilities 1.49 1.72 1.59

Quick

Ratio

(Current

Assets -

Inventory

) /

Current

Liabilities 1.44 1.72 1.56

Liquidity position of the company is measured using the above ratios.

Current ratio of company is 1.49 and it has declined from the last year. Current ration

reflects the ability of company in meeting its short term obligations. Current ratio is average

which means company is having enough resources to meet the obligations of company but is

required to manage the cash cycle efficiently for meeting the cash demands (Vanauken, H.E.,

Ascigil and Carraher, 2017).

Quick ratio also measures liquidity excluding the inventory from current ratio. Quick

ratio of company is 1.44 and is adequate as per the market standards.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

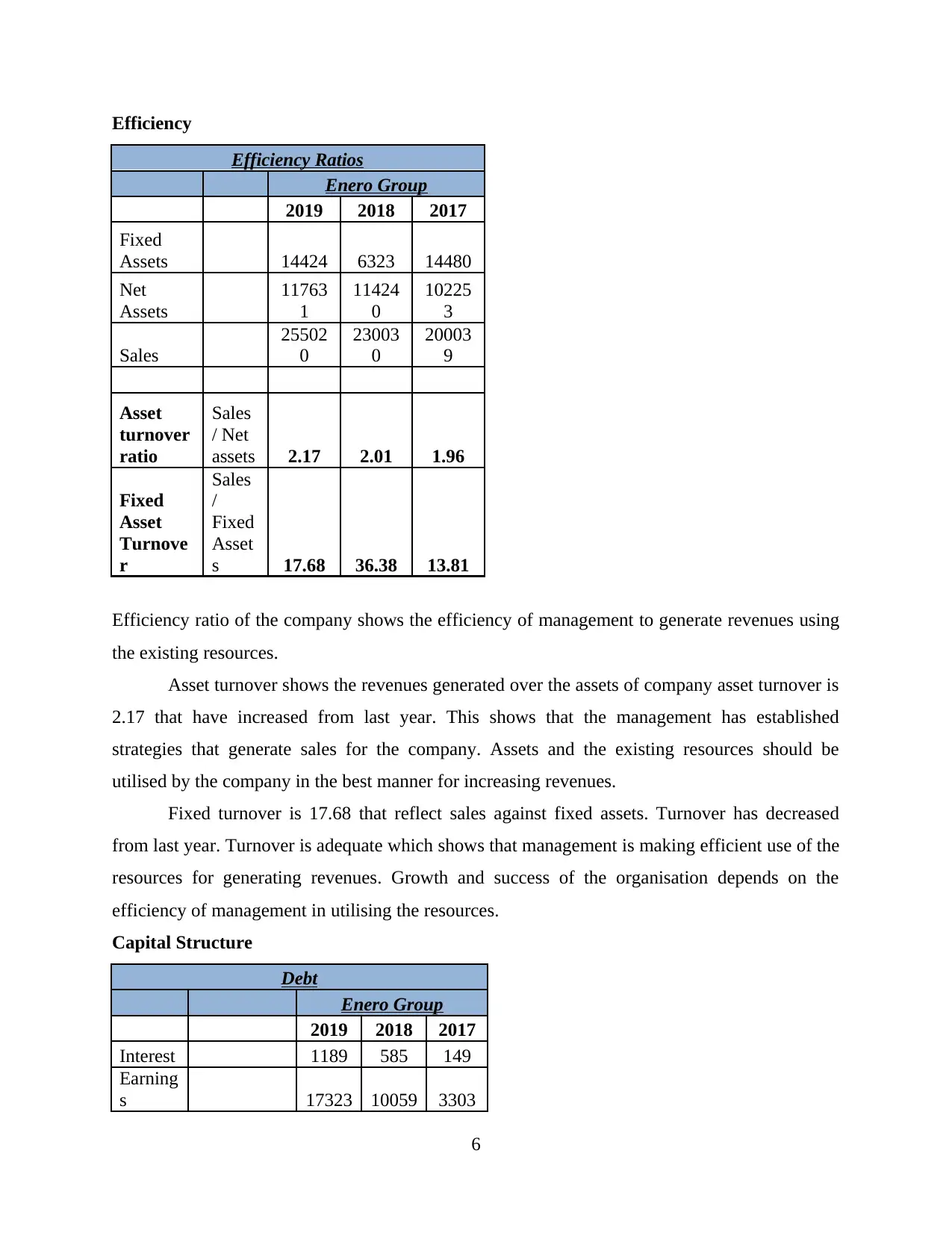

Efficiency

Efficiency Ratios

Enero Group

2019 2018 2017

Fixed

Assets 14424 6323 14480

Net

Assets

11763

1

11424

0

10225

3

Sales

25502

0

23003

0

20003

9

Asset

turnover

ratio

Sales

/ Net

assets 2.17 2.01 1.96

Fixed

Asset

Turnove

r

Sales

/

Fixed

Asset

s 17.68 36.38 13.81

Efficiency ratio of the company shows the efficiency of management to generate revenues using

the existing resources.

Asset turnover shows the revenues generated over the assets of company asset turnover is

2.17 that have increased from last year. This shows that the management has established

strategies that generate sales for the company. Assets and the existing resources should be

utilised by the company in the best manner for increasing revenues.

Fixed turnover is 17.68 that reflect sales against fixed assets. Turnover has decreased

from last year. Turnover is adequate which shows that management is making efficient use of the

resources for generating revenues. Growth and success of the organisation depends on the

efficiency of management in utilising the resources.

Capital Structure

Debt

Enero Group

2019 2018 2017

Interest 1189 585 149

Earning

s 17323 10059 3303

6

Efficiency Ratios

Enero Group

2019 2018 2017

Fixed

Assets 14424 6323 14480

Net

Assets

11763

1

11424

0

10225

3

Sales

25502

0

23003

0

20003

9

Asset

turnover

ratio

Sales

/ Net

assets 2.17 2.01 1.96

Fixed

Asset

Turnove

r

Sales

/

Fixed

Asset

s 17.68 36.38 13.81

Efficiency ratio of the company shows the efficiency of management to generate revenues using

the existing resources.

Asset turnover shows the revenues generated over the assets of company asset turnover is

2.17 that have increased from last year. This shows that the management has established

strategies that generate sales for the company. Assets and the existing resources should be

utilised by the company in the best manner for increasing revenues.

Fixed turnover is 17.68 that reflect sales against fixed assets. Turnover has decreased

from last year. Turnover is adequate which shows that management is making efficient use of the

resources for generating revenues. Growth and success of the organisation depends on the

efficiency of management in utilising the resources.

Capital Structure

Debt

Enero Group

2019 2018 2017

Interest 1189 585 149

Earning

s 17323 10059 3303

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interes

t

Covera

ge

Ratio

EBIT/

Interest 14.57 17.19 22.17

Debt 26810 30714

1006

0

Equity

11763

1

11424

0

1022

53

Debt

equity

ratio

Debt/

Equity

22.79

%

26.89

%

9.84

%

Interest coverage ratio represents the ratio of interest as against its profits. Interest on

loan cover 14% of the profit of company. at the same time it could be seen that it is decreased

from last years. Company is reducing its debt to reduce the interest costs.

Debt equity ratio is used for analysing the financial risk and capital structure of company.

Ratio of debt and equity is 22.79% with a decline from last year (Li, 2019). Company is

restructuring the capital structure by reducing debt and issuing equity funds for raising the capital

from markets. Cost of raising funds through equity is higher and also it will raise the cost of

capital of company.

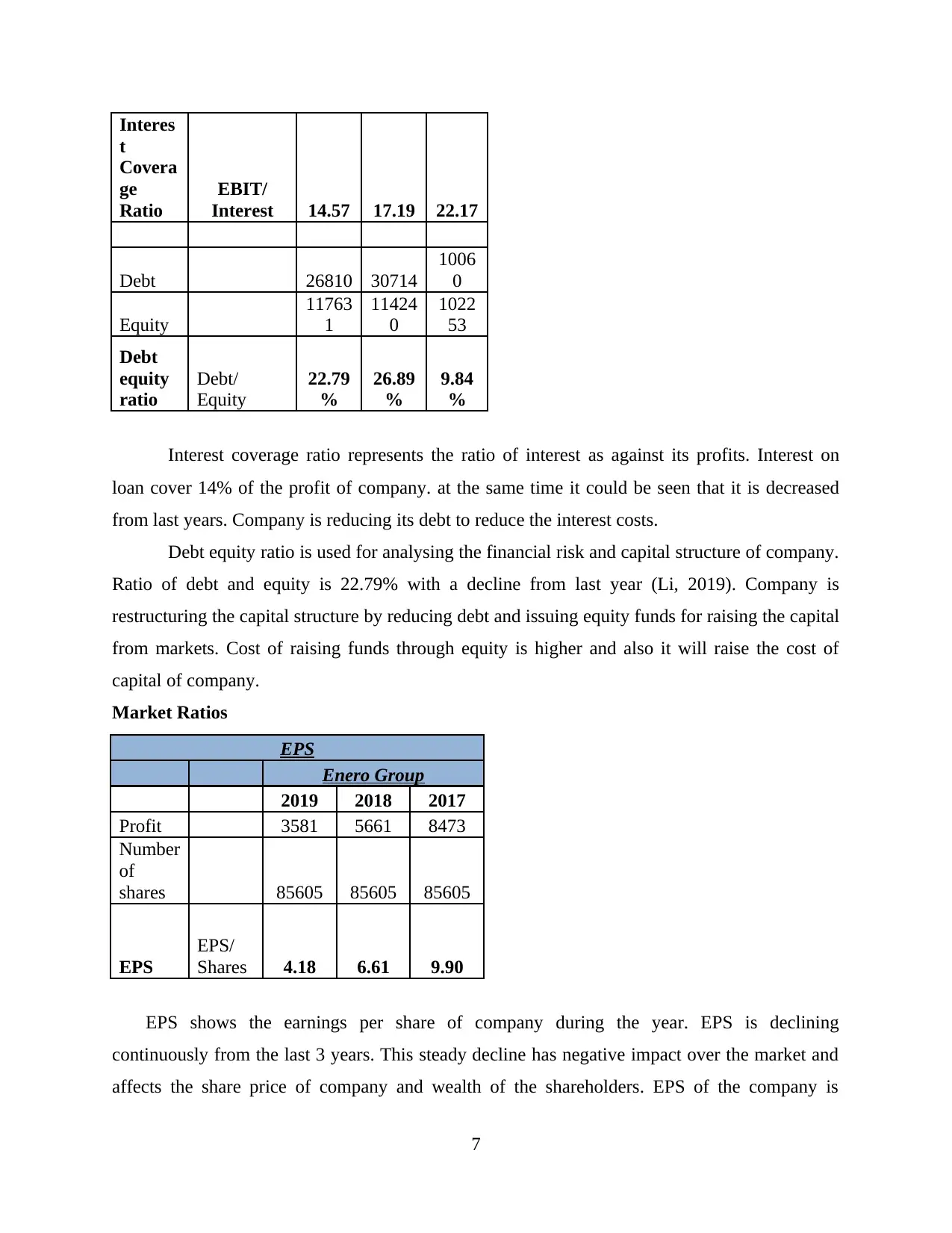

Market Ratios

EPS

Enero Group

2019 2018 2017

Profit 3581 5661 8473

Number

of

shares 85605 85605 85605

EPS

EPS/

Shares 4.18 6.61 9.90

EPS shows the earnings per share of company during the year. EPS is declining

continuously from the last 3 years. This steady decline has negative impact over the market and

affects the share price of company and wealth of the shareholders. EPS of the company is

7

t

Covera

ge

Ratio

EBIT/

Interest 14.57 17.19 22.17

Debt 26810 30714

1006

0

Equity

11763

1

11424

0

1022

53

Debt

equity

ratio

Debt/

Equity

22.79

%

26.89

%

9.84

%

Interest coverage ratio represents the ratio of interest as against its profits. Interest on

loan cover 14% of the profit of company. at the same time it could be seen that it is decreased

from last years. Company is reducing its debt to reduce the interest costs.

Debt equity ratio is used for analysing the financial risk and capital structure of company.

Ratio of debt and equity is 22.79% with a decline from last year (Li, 2019). Company is

restructuring the capital structure by reducing debt and issuing equity funds for raising the capital

from markets. Cost of raising funds through equity is higher and also it will raise the cost of

capital of company.

Market Ratios

EPS

Enero Group

2019 2018 2017

Profit 3581 5661 8473

Number

of

shares 85605 85605 85605

EPS

EPS/

Shares 4.18 6.61 9.90

EPS shows the earnings per share of company during the year. EPS is declining

continuously from the last 3 years. This steady decline has negative impact over the market and

affects the share price of company and wealth of the shareholders. EPS of the company is

7

required to be increased raising the revenues and profits of company. Decrease in the EPS will

affect the interest of investors in the company.

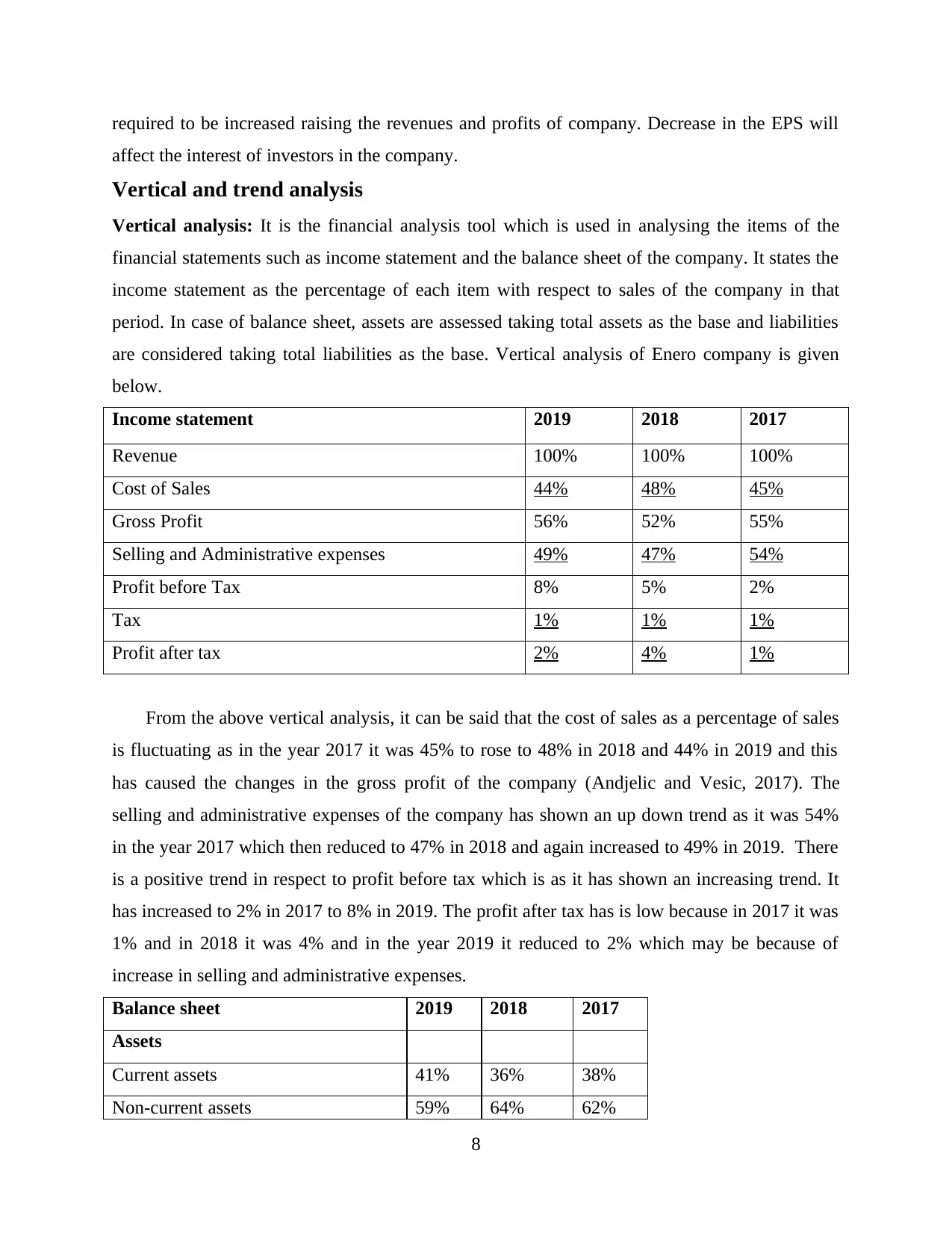

Vertical and trend analysis

Vertical analysis: It is the financial analysis tool which is used in analysing the items of the

financial statements such as income statement and the balance sheet of the company. It states the

income statement as the percentage of each item with respect to sales of the company in that

period. In case of balance sheet, assets are assessed taking total assets as the base and liabilities

are considered taking total liabilities as the base. Vertical analysis of Enero company is given

below.

Income statement 2019 2018 2017

Revenue 100% 100% 100%

Cost of Sales 44% 48% 45%

Gross Profit 56% 52% 55%

Selling and Administrative expenses 49% 47% 54%

Profit before Tax 8% 5% 2%

Tax 1% 1% 1%

Profit after tax 2% 4% 1%

From the above vertical analysis, it can be said that the cost of sales as a percentage of sales

is fluctuating as in the year 2017 it was 45% to rose to 48% in 2018 and 44% in 2019 and this

has caused the changes in the gross profit of the company (Andjelic and Vesic, 2017). The

selling and administrative expenses of the company has shown an up down trend as it was 54%

in the year 2017 which then reduced to 47% in 2018 and again increased to 49% in 2019. There

is a positive trend in respect to profit before tax which is as it has shown an increasing trend. It

has increased to 2% in 2017 to 8% in 2019. The profit after tax has is low because in 2017 it was

1% and in 2018 it was 4% and in the year 2019 it reduced to 2% which may be because of

increase in selling and administrative expenses.

Balance sheet 2019 2018 2017

Assets

Current assets 41% 36% 38%

Non-current assets 59% 64% 62%

8

affect the interest of investors in the company.

Vertical and trend analysis

Vertical analysis: It is the financial analysis tool which is used in analysing the items of the

financial statements such as income statement and the balance sheet of the company. It states the

income statement as the percentage of each item with respect to sales of the company in that

period. In case of balance sheet, assets are assessed taking total assets as the base and liabilities

are considered taking total liabilities as the base. Vertical analysis of Enero company is given

below.

Income statement 2019 2018 2017

Revenue 100% 100% 100%

Cost of Sales 44% 48% 45%

Gross Profit 56% 52% 55%

Selling and Administrative expenses 49% 47% 54%

Profit before Tax 8% 5% 2%

Tax 1% 1% 1%

Profit after tax 2% 4% 1%

From the above vertical analysis, it can be said that the cost of sales as a percentage of sales

is fluctuating as in the year 2017 it was 45% to rose to 48% in 2018 and 44% in 2019 and this

has caused the changes in the gross profit of the company (Andjelic and Vesic, 2017). The

selling and administrative expenses of the company has shown an up down trend as it was 54%

in the year 2017 which then reduced to 47% in 2018 and again increased to 49% in 2019. There

is a positive trend in respect to profit before tax which is as it has shown an increasing trend. It

has increased to 2% in 2017 to 8% in 2019. The profit after tax has is low because in 2017 it was

1% and in 2018 it was 4% and in the year 2019 it reduced to 2% which may be because of

increase in selling and administrative expenses.

Balance sheet 2019 2018 2017

Assets

Current assets 41% 36% 38%

Non-current assets 59% 64% 62%

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total assets 100% 100% 100%

Liabilities and stockholder's equity

Liabilities

Current liabilities 28% 21% 24%

Non-current liabilities 13% 17% 7%

Total liabilities 41% 37% 31%

Stockholder's equity 58% 62% 69%

Total liabilities and stockholder's

equity

100% 100% 100%

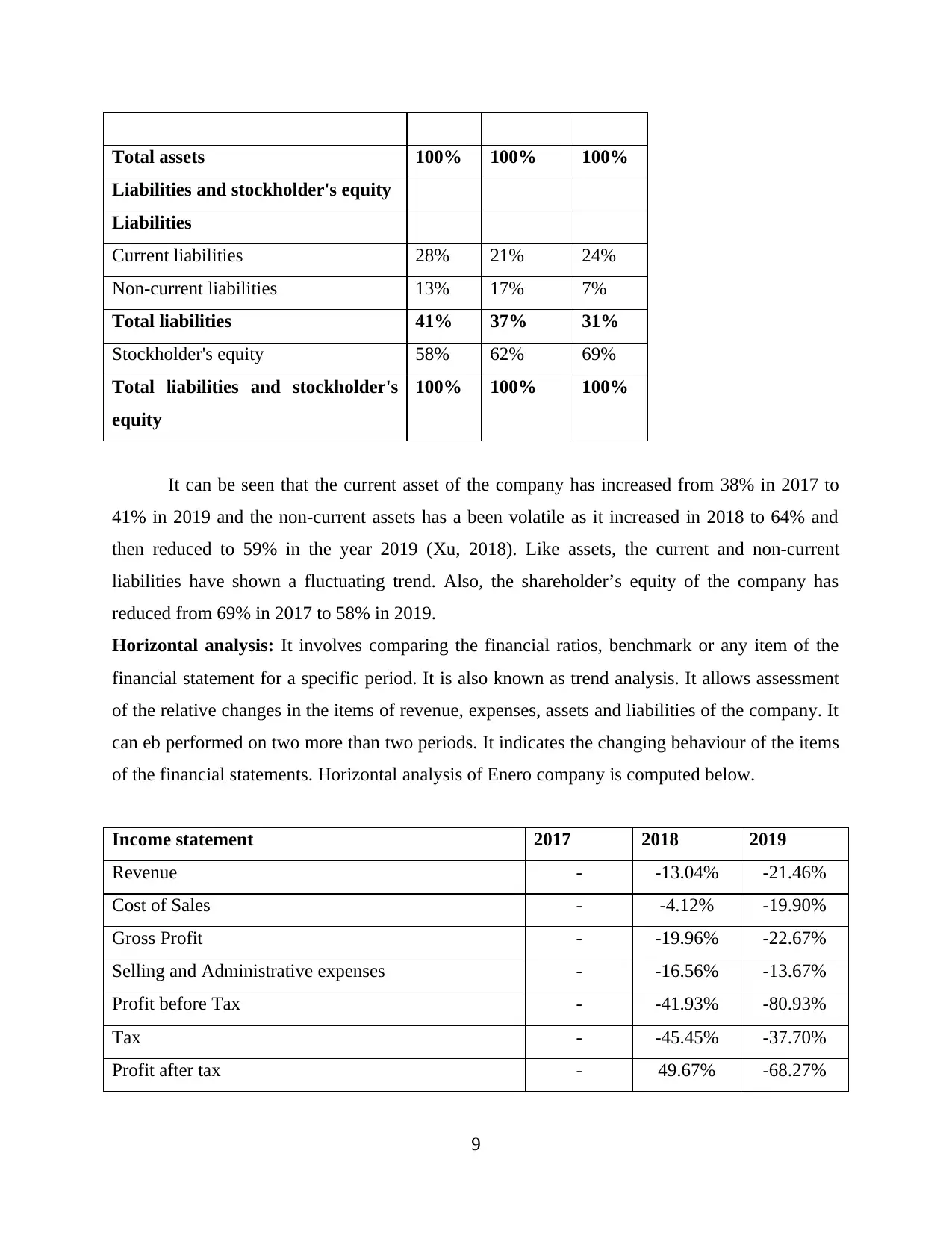

It can be seen that the current asset of the company has increased from 38% in 2017 to

41% in 2019 and the non-current assets has a been volatile as it increased in 2018 to 64% and

then reduced to 59% in the year 2019 (Xu, 2018). Like assets, the current and non-current

liabilities have shown a fluctuating trend. Also, the shareholder’s equity of the company has

reduced from 69% in 2017 to 58% in 2019.

Horizontal analysis: It involves comparing the financial ratios, benchmark or any item of the

financial statement for a specific period. It is also known as trend analysis. It allows assessment

of the relative changes in the items of revenue, expenses, assets and liabilities of the company. It

can eb performed on two more than two periods. It indicates the changing behaviour of the items

of the financial statements. Horizontal analysis of Enero company is computed below.

Income statement 2017 2018 2019

Revenue - -13.04% -21.46%

Cost of Sales - -4.12% -19.90%

Gross Profit - -19.96% -22.67%

Selling and Administrative expenses - -16.56% -13.67%

Profit before Tax - -41.93% -80.93%

Tax - -45.45% -37.70%

Profit after tax - 49.67% -68.27%

9

Liabilities and stockholder's equity

Liabilities

Current liabilities 28% 21% 24%

Non-current liabilities 13% 17% 7%

Total liabilities 41% 37% 31%

Stockholder's equity 58% 62% 69%

Total liabilities and stockholder's

equity

100% 100% 100%

It can be seen that the current asset of the company has increased from 38% in 2017 to

41% in 2019 and the non-current assets has a been volatile as it increased in 2018 to 64% and

then reduced to 59% in the year 2019 (Xu, 2018). Like assets, the current and non-current

liabilities have shown a fluctuating trend. Also, the shareholder’s equity of the company has

reduced from 69% in 2017 to 58% in 2019.

Horizontal analysis: It involves comparing the financial ratios, benchmark or any item of the

financial statement for a specific period. It is also known as trend analysis. It allows assessment

of the relative changes in the items of revenue, expenses, assets and liabilities of the company. It

can eb performed on two more than two periods. It indicates the changing behaviour of the items

of the financial statements. Horizontal analysis of Enero company is computed below.

Income statement 2017 2018 2019

Revenue - -13.04% -21.46%

Cost of Sales - -4.12% -19.90%

Gross Profit - -19.96% -22.67%

Selling and Administrative expenses - -16.56% -13.67%

Profit before Tax - -41.93% -80.93%

Tax - -45.45% -37.70%

Profit after tax - 49.67% -68.27%

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

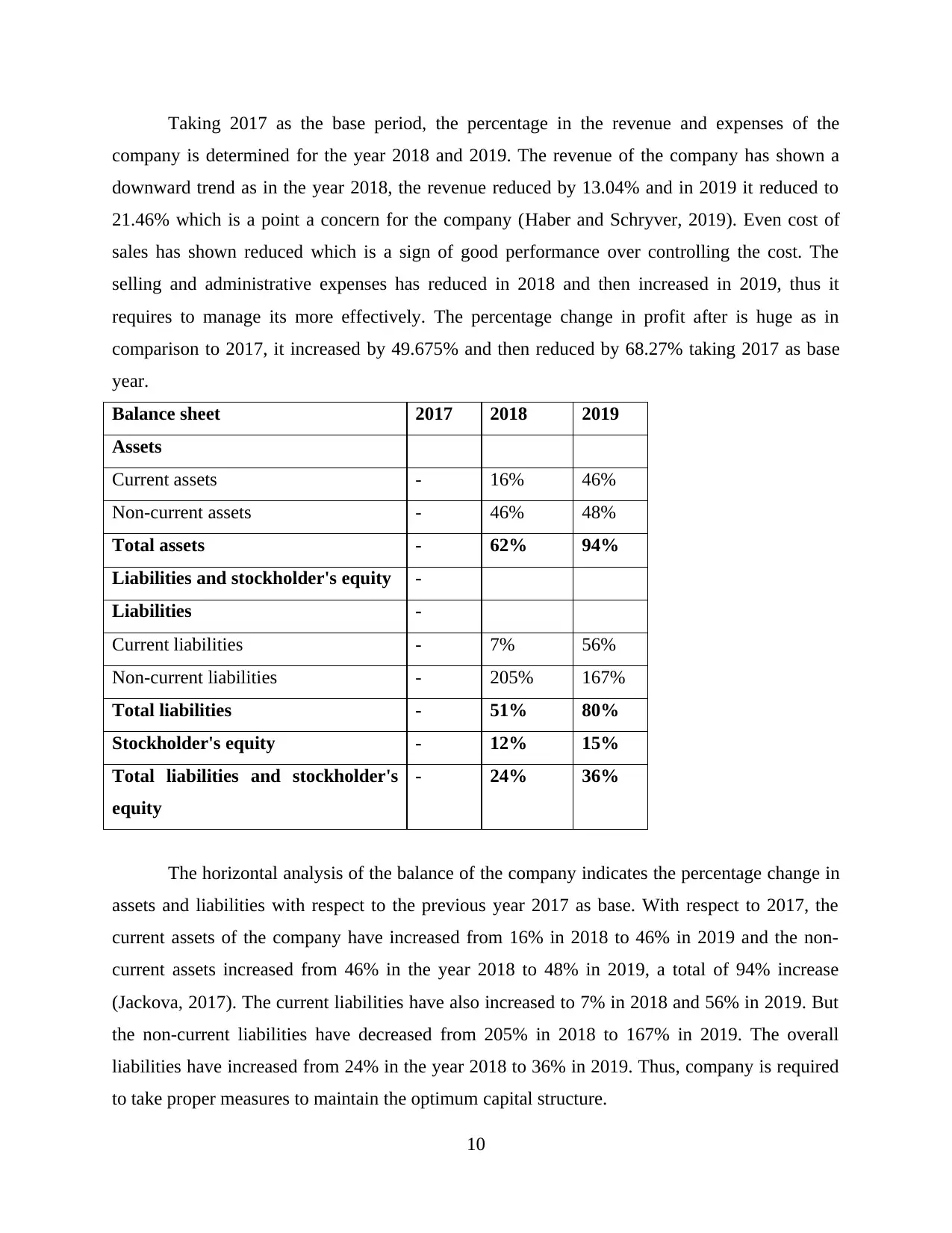

Taking 2017 as the base period, the percentage in the revenue and expenses of the

company is determined for the year 2018 and 2019. The revenue of the company has shown a

downward trend as in the year 2018, the revenue reduced by 13.04% and in 2019 it reduced to

21.46% which is a point a concern for the company (Haber and Schryver, 2019). Even cost of

sales has shown reduced which is a sign of good performance over controlling the cost. The

selling and administrative expenses has reduced in 2018 and then increased in 2019, thus it

requires to manage its more effectively. The percentage change in profit after is huge as in

comparison to 2017, it increased by 49.675% and then reduced by 68.27% taking 2017 as base

year.

Balance sheet 2017 2018 2019

Assets

Current assets - 16% 46%

Non-current assets - 46% 48%

Total assets - 62% 94%

Liabilities and stockholder's equity -

Liabilities -

Current liabilities - 7% 56%

Non-current liabilities - 205% 167%

Total liabilities - 51% 80%

Stockholder's equity - 12% 15%

Total liabilities and stockholder's

equity

- 24% 36%

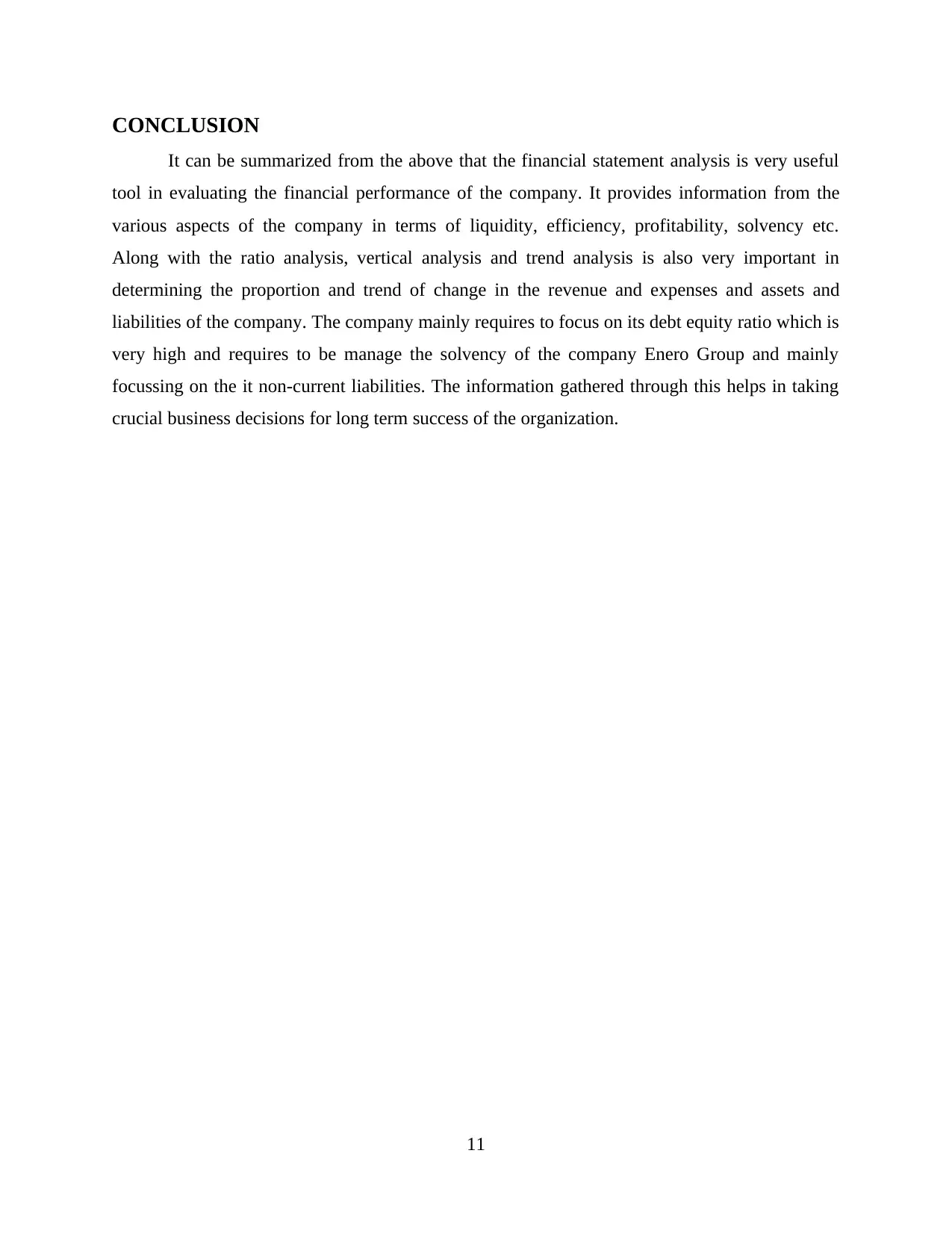

The horizontal analysis of the balance of the company indicates the percentage change in

assets and liabilities with respect to the previous year 2017 as base. With respect to 2017, the

current assets of the company have increased from 16% in 2018 to 46% in 2019 and the non-

current assets increased from 46% in the year 2018 to 48% in 2019, a total of 94% increase

(Jackova, 2017). The current liabilities have also increased to 7% in 2018 and 56% in 2019. But

the non-current liabilities have decreased from 205% in 2018 to 167% in 2019. The overall

liabilities have increased from 24% in the year 2018 to 36% in 2019. Thus, company is required

to take proper measures to maintain the optimum capital structure.

10

company is determined for the year 2018 and 2019. The revenue of the company has shown a

downward trend as in the year 2018, the revenue reduced by 13.04% and in 2019 it reduced to

21.46% which is a point a concern for the company (Haber and Schryver, 2019). Even cost of

sales has shown reduced which is a sign of good performance over controlling the cost. The

selling and administrative expenses has reduced in 2018 and then increased in 2019, thus it

requires to manage its more effectively. The percentage change in profit after is huge as in

comparison to 2017, it increased by 49.675% and then reduced by 68.27% taking 2017 as base

year.

Balance sheet 2017 2018 2019

Assets

Current assets - 16% 46%

Non-current assets - 46% 48%

Total assets - 62% 94%

Liabilities and stockholder's equity -

Liabilities -

Current liabilities - 7% 56%

Non-current liabilities - 205% 167%

Total liabilities - 51% 80%

Stockholder's equity - 12% 15%

Total liabilities and stockholder's

equity

- 24% 36%

The horizontal analysis of the balance of the company indicates the percentage change in

assets and liabilities with respect to the previous year 2017 as base. With respect to 2017, the

current assets of the company have increased from 16% in 2018 to 46% in 2019 and the non-

current assets increased from 46% in the year 2018 to 48% in 2019, a total of 94% increase

(Jackova, 2017). The current liabilities have also increased to 7% in 2018 and 56% in 2019. But

the non-current liabilities have decreased from 205% in 2018 to 167% in 2019. The overall

liabilities have increased from 24% in the year 2018 to 36% in 2019. Thus, company is required

to take proper measures to maintain the optimum capital structure.

10

CONCLUSION

It can be summarized from the above that the financial statement analysis is very useful

tool in evaluating the financial performance of the company. It provides information from the

various aspects of the company in terms of liquidity, efficiency, profitability, solvency etc.

Along with the ratio analysis, vertical analysis and trend analysis is also very important in

determining the proportion and trend of change in the revenue and expenses and assets and

liabilities of the company. The company mainly requires to focus on its debt equity ratio which is

very high and requires to be manage the solvency of the company Enero Group and mainly

focussing on the it non-current liabilities. The information gathered through this helps in taking

crucial business decisions for long term success of the organization.

11

It can be summarized from the above that the financial statement analysis is very useful

tool in evaluating the financial performance of the company. It provides information from the

various aspects of the company in terms of liquidity, efficiency, profitability, solvency etc.

Along with the ratio analysis, vertical analysis and trend analysis is also very important in

determining the proportion and trend of change in the revenue and expenses and assets and

liabilities of the company. The company mainly requires to focus on its debt equity ratio which is

very high and requires to be manage the solvency of the company Enero Group and mainly

focussing on the it non-current liabilities. The information gathered through this helps in taking

crucial business decisions for long term success of the organization.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.