Managing Financial Resources Solved Assignment

VerifiedAdded on 2021/02/18

|11

|2910

|16

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managing Financial

Resources

Resources

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A) Calculation of financial ratios for DeBrun Ltd and McGill Ltd............................................1

B) Recommendation to Dipapa over investment choice.............................................................5

TASK 2............................................................................................................................................6

A) Preparation of Job cost Statement for Job No 21...................................................................6

B) Advice to financial mangers over acceptance or rejection of the quotation.........................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A) Calculation of financial ratios for DeBrun Ltd and McGill Ltd............................................1

B) Recommendation to Dipapa over investment choice.............................................................5

TASK 2............................................................................................................................................6

A) Preparation of Job cost Statement for Job No 21...................................................................6

B) Advice to financial mangers over acceptance or rejection of the quotation.........................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

The financial performance of an organization is evaluated with financial ratio analysis.

This is considers as the best tool that interpreter the exact fiscal position of a business. With this

the current, past and competitor's performance of the firm is also compared that states at what

level the entity is performing. In the present report this analysis is carried out for two firms

DeBrun Ltd and McGill Ltd. For both organisation various types of ration is calculated and on

basis of them recommendation in made to Dipapa Ltd for investing in any one of the firm. Along

with this job cost statement for a given job is done and over this Dipapa is suggested on

whether to accept the quotation or not.

TASK 1

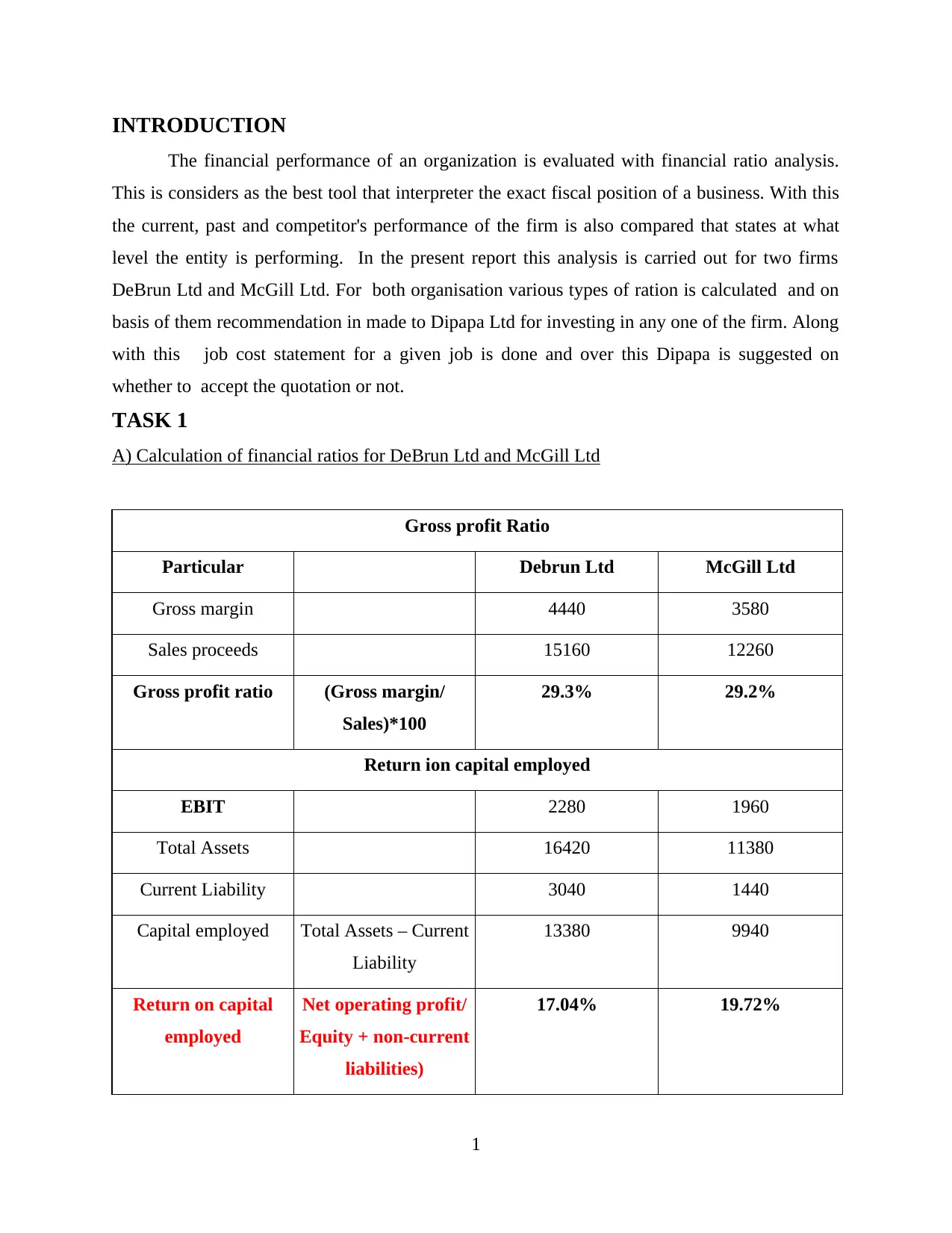

A) Calculation of financial ratios for DeBrun Ltd and McGill Ltd

Gross profit Ratio

Particular Debrun Ltd McGill Ltd

Gross margin 4440 3580

Sales proceeds 15160 12260

Gross profit ratio (Gross margin/

Sales)*100

29.3% 29.2%

Return ion capital employed

EBIT 2280 1960

Total Assets 16420 11380

Current Liability 3040 1440

Capital employed Total Assets – Current

Liability

13380 9940

Return on capital

employed

Net operating profit/

Equity + non-current

liabilities)

17.04% 19.72%

1

The financial performance of an organization is evaluated with financial ratio analysis.

This is considers as the best tool that interpreter the exact fiscal position of a business. With this

the current, past and competitor's performance of the firm is also compared that states at what

level the entity is performing. In the present report this analysis is carried out for two firms

DeBrun Ltd and McGill Ltd. For both organisation various types of ration is calculated and on

basis of them recommendation in made to Dipapa Ltd for investing in any one of the firm. Along

with this job cost statement for a given job is done and over this Dipapa is suggested on

whether to accept the quotation or not.

TASK 1

A) Calculation of financial ratios for DeBrun Ltd and McGill Ltd

Gross profit Ratio

Particular Debrun Ltd McGill Ltd

Gross margin 4440 3580

Sales proceeds 15160 12260

Gross profit ratio (Gross margin/

Sales)*100

29.3% 29.2%

Return ion capital employed

EBIT 2280 1960

Total Assets 16420 11380

Current Liability 3040 1440

Capital employed Total Assets – Current

Liability

13380 9940

Return on capital

employed

Net operating profit/

Equity + non-current

liabilities)

17.04% 19.72%

1

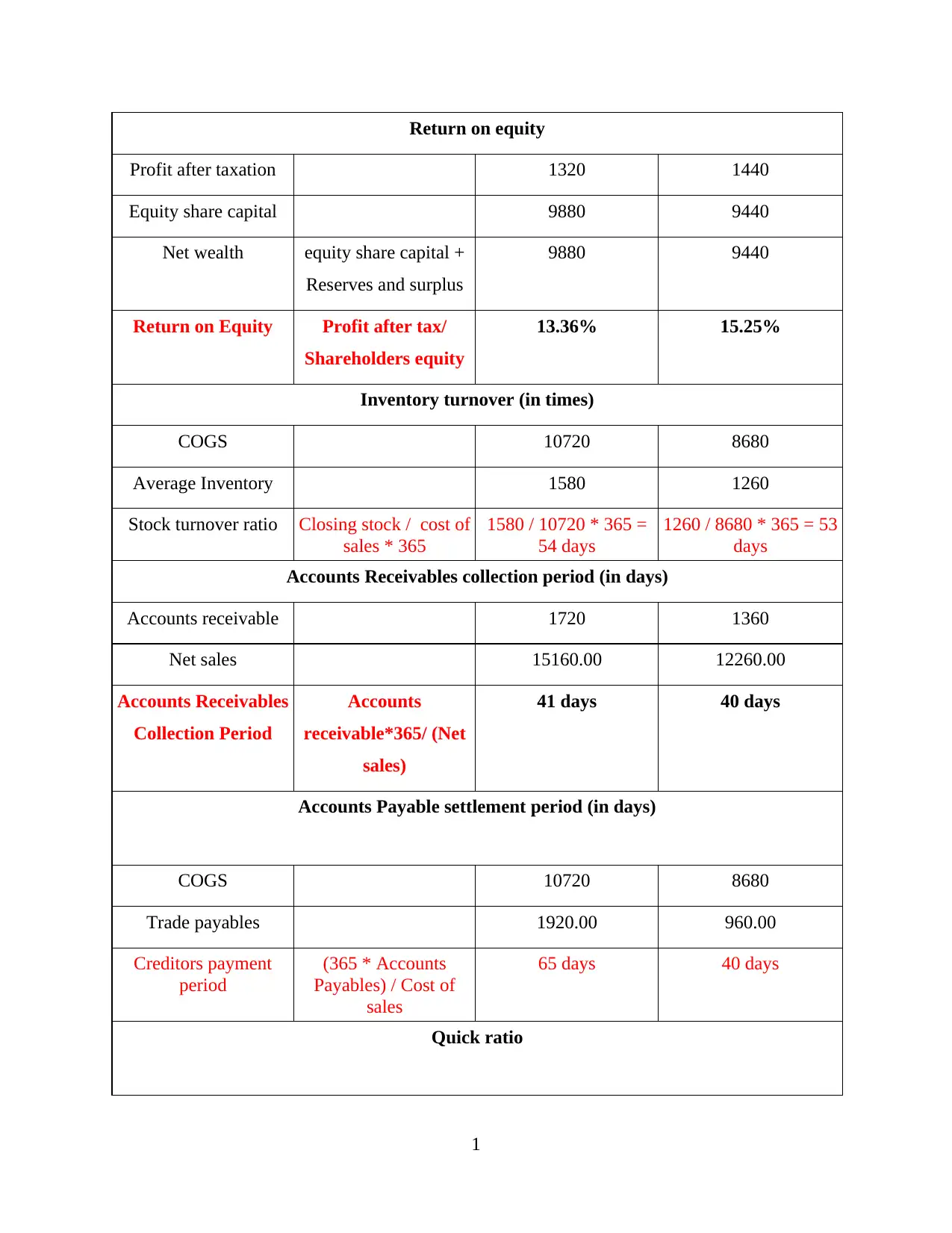

Return on equity

Profit after taxation 1320 1440

Equity share capital 9880 9440

Net wealth equity share capital +

Reserves and surplus

9880 9440

Return on Equity Profit after tax/

Shareholders equity

13.36% 15.25%

Inventory turnover (in times)

COGS 10720 8680

Average Inventory 1580 1260

Stock turnover ratio Closing stock / cost of

sales * 365

1580 / 10720 * 365 =

54 days

1260 / 8680 * 365 = 53

days

Accounts Receivables collection period (in days)

Accounts receivable 1720 1360

Net sales 15160.00 12260.00

Accounts Receivables

Collection Period

Accounts

receivable*365/ (Net

sales)

41 days 40 days

Accounts Payable settlement period (in days)

COGS 10720 8680

Trade payables 1920.00 960.00

Creditors payment

period

(365 * Accounts

Payables) / Cost of

sales

65 days 40 days

Quick ratio

1

Profit after taxation 1320 1440

Equity share capital 9880 9440

Net wealth equity share capital +

Reserves and surplus

9880 9440

Return on Equity Profit after tax/

Shareholders equity

13.36% 15.25%

Inventory turnover (in times)

COGS 10720 8680

Average Inventory 1580 1260

Stock turnover ratio Closing stock / cost of

sales * 365

1580 / 10720 * 365 =

54 days

1260 / 8680 * 365 = 53

days

Accounts Receivables collection period (in days)

Accounts receivable 1720 1360

Net sales 15160.00 12260.00

Accounts Receivables

Collection Period

Accounts

receivable*365/ (Net

sales)

41 days 40 days

Accounts Payable settlement period (in days)

COGS 10720 8680

Trade payables 1920.00 960.00

Creditors payment

period

(365 * Accounts

Payables) / Cost of

sales

65 days 40 days

Quick ratio

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

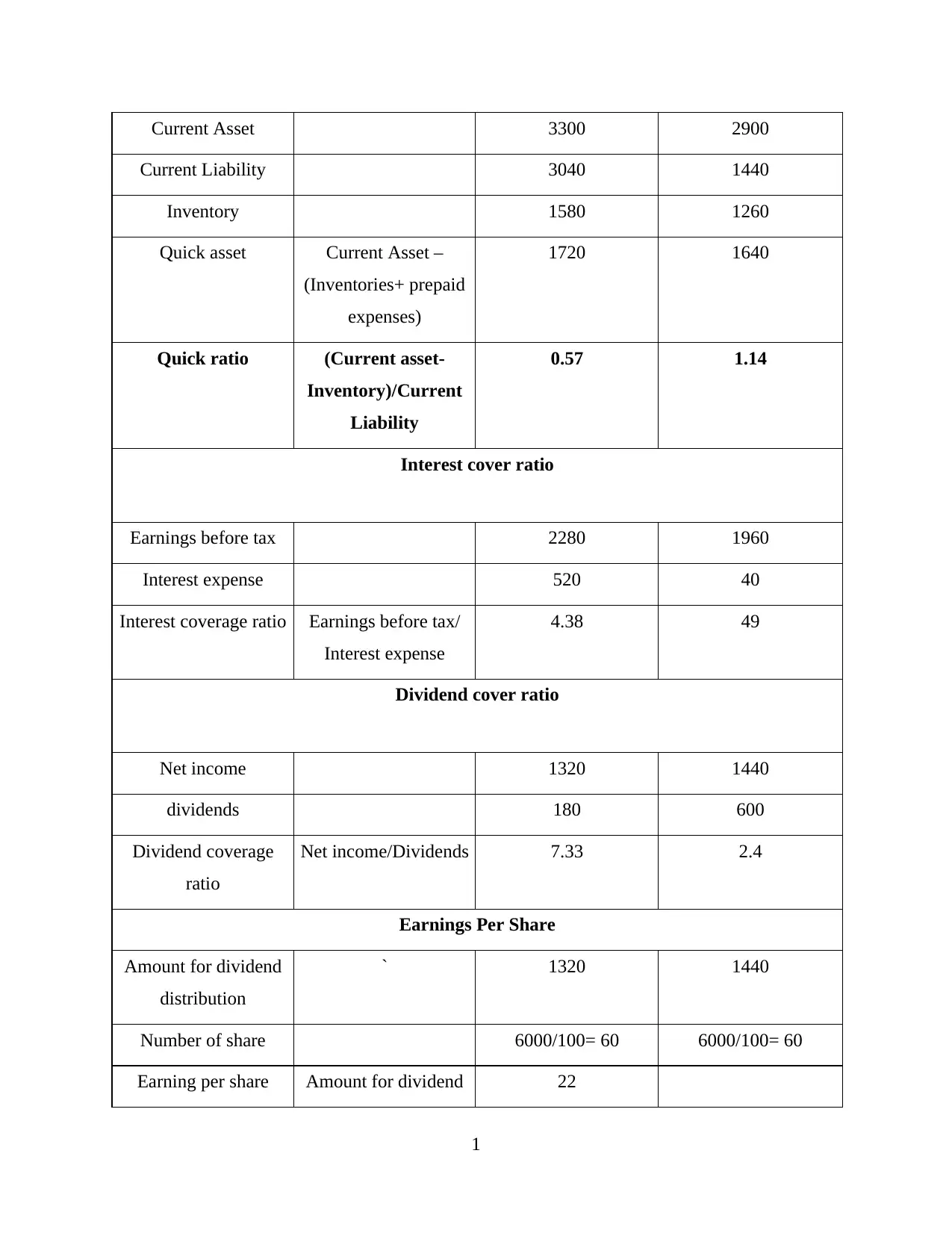

Current Asset 3300 2900

Current Liability 3040 1440

Inventory 1580 1260

Quick asset Current Asset –

(Inventories+ prepaid

expenses)

1720 1640

Quick ratio (Current asset-

Inventory)/Current

Liability

0.57 1.14

Interest cover ratio

Earnings before tax 2280 1960

Interest expense 520 40

Interest coverage ratio Earnings before tax/

Interest expense

4.38 49

Dividend cover ratio

Net income 1320 1440

dividends 180 600

Dividend coverage

ratio

Net income/Dividends 7.33 2.4

Earnings Per Share

Amount for dividend

distribution

` 1320 1440

Number of share 6000/100= 60 6000/100= 60

Earning per share Amount for dividend 22

1

Current Liability 3040 1440

Inventory 1580 1260

Quick asset Current Asset –

(Inventories+ prepaid

expenses)

1720 1640

Quick ratio (Current asset-

Inventory)/Current

Liability

0.57 1.14

Interest cover ratio

Earnings before tax 2280 1960

Interest expense 520 40

Interest coverage ratio Earnings before tax/

Interest expense

4.38 49

Dividend cover ratio

Net income 1320 1440

dividends 180 600

Dividend coverage

ratio

Net income/Dividends 7.33 2.4

Earnings Per Share

Amount for dividend

distribution

` 1320 1440

Number of share 6000/100= 60 6000/100= 60

Earning per share Amount for dividend 22

1

distribution/ number

of shares

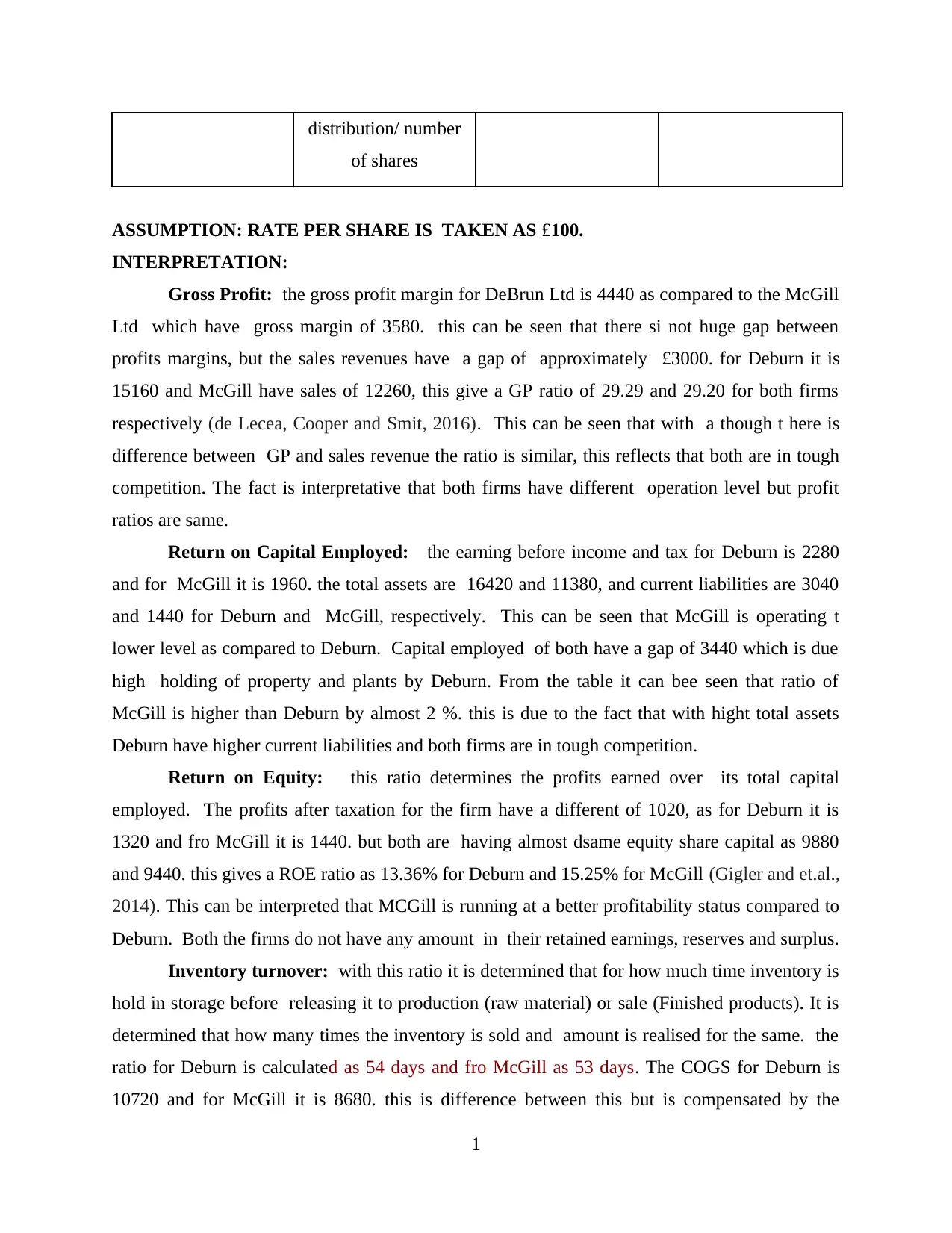

ASSUMPTION: RATE PER SHARE IS TAKEN AS £100.

INTERPRETATION:

Gross Profit: the gross profit margin for DeBrun Ltd is 4440 as compared to the McGill

Ltd which have gross margin of 3580. this can be seen that there si not huge gap between

profits margins, but the sales revenues have a gap of approximately £3000. for Deburn it is

15160 and McGill have sales of 12260, this give a GP ratio of 29.29 and 29.20 for both firms

respectively (de Lecea, Cooper and Smit, 2016). This can be seen that with a though t here is

difference between GP and sales revenue the ratio is similar, this reflects that both are in tough

competition. The fact is interpretative that both firms have different operation level but profit

ratios are same.

Return on Capital Employed: the earning before income and tax for Deburn is 2280

and for McGill it is 1960. the total assets are 16420 and 11380, and current liabilities are 3040

and 1440 for Deburn and McGill, respectively. This can be seen that McGill is operating t

lower level as compared to Deburn. Capital employed of both have a gap of 3440 which is due

high holding of property and plants by Deburn. From the table it can bee seen that ratio of

McGill is higher than Deburn by almost 2 %. this is due to the fact that with hight total assets

Deburn have higher current liabilities and both firms are in tough competition.

Return on Equity: this ratio determines the profits earned over its total capital

employed. The profits after taxation for the firm have a different of 1020, as for Deburn it is

1320 and fro McGill it is 1440. but both are having almost dsame equity share capital as 9880

and 9440. this gives a ROE ratio as 13.36% for Deburn and 15.25% for McGill (Gigler and et.al.,

2014). This can be interpreted that MCGill is running at a better profitability status compared to

Deburn. Both the firms do not have any amount in their retained earnings, reserves and surplus.

Inventory turnover: with this ratio it is determined that for how much time inventory is

hold in storage before releasing it to production (raw material) or sale (Finished products). It is

determined that how many times the inventory is sold and amount is realised for the same. the

ratio for Deburn is calculated as 54 days and fro McGill as 53 days. The COGS for Deburn is

10720 and for McGill it is 8680. this is difference between this but is compensated by the

1

of shares

ASSUMPTION: RATE PER SHARE IS TAKEN AS £100.

INTERPRETATION:

Gross Profit: the gross profit margin for DeBrun Ltd is 4440 as compared to the McGill

Ltd which have gross margin of 3580. this can be seen that there si not huge gap between

profits margins, but the sales revenues have a gap of approximately £3000. for Deburn it is

15160 and McGill have sales of 12260, this give a GP ratio of 29.29 and 29.20 for both firms

respectively (de Lecea, Cooper and Smit, 2016). This can be seen that with a though t here is

difference between GP and sales revenue the ratio is similar, this reflects that both are in tough

competition. The fact is interpretative that both firms have different operation level but profit

ratios are same.

Return on Capital Employed: the earning before income and tax for Deburn is 2280

and for McGill it is 1960. the total assets are 16420 and 11380, and current liabilities are 3040

and 1440 for Deburn and McGill, respectively. This can be seen that McGill is operating t

lower level as compared to Deburn. Capital employed of both have a gap of 3440 which is due

high holding of property and plants by Deburn. From the table it can bee seen that ratio of

McGill is higher than Deburn by almost 2 %. this is due to the fact that with hight total assets

Deburn have higher current liabilities and both firms are in tough competition.

Return on Equity: this ratio determines the profits earned over its total capital

employed. The profits after taxation for the firm have a different of 1020, as for Deburn it is

1320 and fro McGill it is 1440. but both are having almost dsame equity share capital as 9880

and 9440. this gives a ROE ratio as 13.36% for Deburn and 15.25% for McGill (Gigler and et.al.,

2014). This can be interpreted that MCGill is running at a better profitability status compared to

Deburn. Both the firms do not have any amount in their retained earnings, reserves and surplus.

Inventory turnover: with this ratio it is determined that for how much time inventory is

hold in storage before releasing it to production (raw material) or sale (Finished products). It is

determined that how many times the inventory is sold and amount is realised for the same. the

ratio for Deburn is calculated as 54 days and fro McGill as 53 days. The COGS for Deburn is

10720 and for McGill it is 8680. this is difference between this but is compensated by the

1

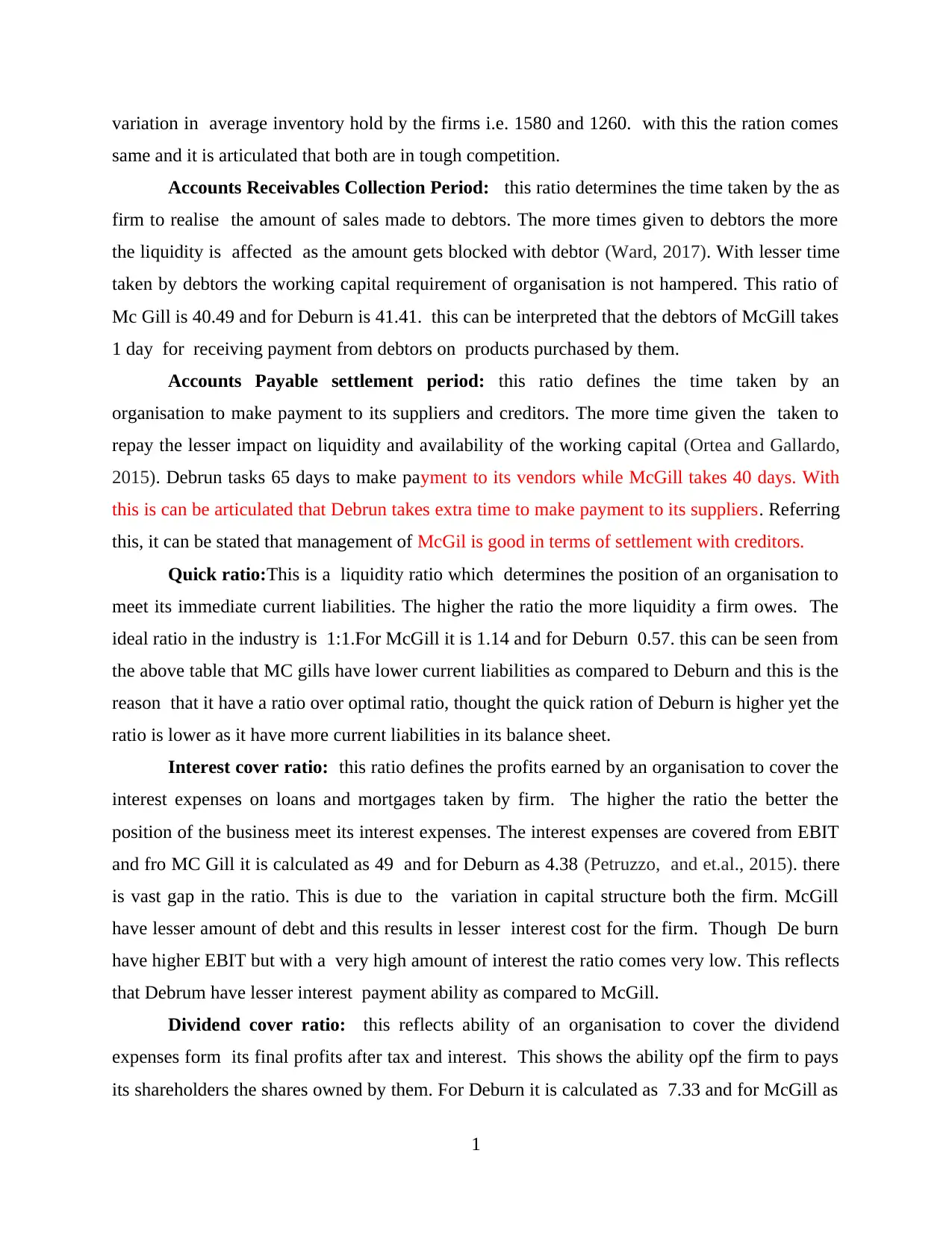

variation in average inventory hold by the firms i.e. 1580 and 1260. with this the ration comes

same and it is articulated that both are in tough competition.

Accounts Receivables Collection Period: this ratio determines the time taken by the as

firm to realise the amount of sales made to debtors. The more times given to debtors the more

the liquidity is affected as the amount gets blocked with debtor (Ward, 2017). With lesser time

taken by debtors the working capital requirement of organisation is not hampered. This ratio of

Mc Gill is 40.49 and for Deburn is 41.41. this can be interpreted that the debtors of McGill takes

1 day for receiving payment from debtors on products purchased by them.

Accounts Payable settlement period: this ratio defines the time taken by an

organisation to make payment to its suppliers and creditors. The more time given the taken to

repay the lesser impact on liquidity and availability of the working capital (Ortea and Gallardo,

2015). Debrun tasks 65 days to make payment to its vendors while McGill takes 40 days. With

this is can be articulated that Debrun takes extra time to make payment to its suppliers. Referring

this, it can be stated that management of McGil is good in terms of settlement with creditors.

Quick ratio:This is a liquidity ratio which determines the position of an organisation to

meet its immediate current liabilities. The higher the ratio the more liquidity a firm owes. The

ideal ratio in the industry is 1:1.For McGill it is 1.14 and for Deburn 0.57. this can be seen from

the above table that MC gills have lower current liabilities as compared to Deburn and this is the

reason that it have a ratio over optimal ratio, thought the quick ration of Deburn is higher yet the

ratio is lower as it have more current liabilities in its balance sheet.

Interest cover ratio: this ratio defines the profits earned by an organisation to cover the

interest expenses on loans and mortgages taken by firm. The higher the ratio the better the

position of the business meet its interest expenses. The interest expenses are covered from EBIT

and fro MC Gill it is calculated as 49 and for Deburn as 4.38 (Petruzzo, and et.al., 2015). there

is vast gap in the ratio. This is due to the variation in capital structure both the firm. McGill

have lesser amount of debt and this results in lesser interest cost for the firm. Though De burn

have higher EBIT but with a very high amount of interest the ratio comes very low. This reflects

that Debrum have lesser interest payment ability as compared to McGill.

Dividend cover ratio: this reflects ability of an organisation to cover the dividend

expenses form its final profits after tax and interest. This shows the ability opf the firm to pays

its shareholders the shares owned by them. For Deburn it is calculated as 7.33 and for McGill as

1

same and it is articulated that both are in tough competition.

Accounts Receivables Collection Period: this ratio determines the time taken by the as

firm to realise the amount of sales made to debtors. The more times given to debtors the more

the liquidity is affected as the amount gets blocked with debtor (Ward, 2017). With lesser time

taken by debtors the working capital requirement of organisation is not hampered. This ratio of

Mc Gill is 40.49 and for Deburn is 41.41. this can be interpreted that the debtors of McGill takes

1 day for receiving payment from debtors on products purchased by them.

Accounts Payable settlement period: this ratio defines the time taken by an

organisation to make payment to its suppliers and creditors. The more time given the taken to

repay the lesser impact on liquidity and availability of the working capital (Ortea and Gallardo,

2015). Debrun tasks 65 days to make payment to its vendors while McGill takes 40 days. With

this is can be articulated that Debrun takes extra time to make payment to its suppliers. Referring

this, it can be stated that management of McGil is good in terms of settlement with creditors.

Quick ratio:This is a liquidity ratio which determines the position of an organisation to

meet its immediate current liabilities. The higher the ratio the more liquidity a firm owes. The

ideal ratio in the industry is 1:1.For McGill it is 1.14 and for Deburn 0.57. this can be seen from

the above table that MC gills have lower current liabilities as compared to Deburn and this is the

reason that it have a ratio over optimal ratio, thought the quick ration of Deburn is higher yet the

ratio is lower as it have more current liabilities in its balance sheet.

Interest cover ratio: this ratio defines the profits earned by an organisation to cover the

interest expenses on loans and mortgages taken by firm. The higher the ratio the better the

position of the business meet its interest expenses. The interest expenses are covered from EBIT

and fro MC Gill it is calculated as 49 and for Deburn as 4.38 (Petruzzo, and et.al., 2015). there

is vast gap in the ratio. This is due to the variation in capital structure both the firm. McGill

have lesser amount of debt and this results in lesser interest cost for the firm. Though De burn

have higher EBIT but with a very high amount of interest the ratio comes very low. This reflects

that Debrum have lesser interest payment ability as compared to McGill.

Dividend cover ratio: this reflects ability of an organisation to cover the dividend

expenses form its final profits after tax and interest. This shows the ability opf the firm to pays

its shareholders the shares owned by them. For Deburn it is calculated as 7.33 and for McGill as

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.4. Here it can be seen that the ratio of Deburn is higher though the net income for McHill is

and the reason behind this is McGill have higher amount for dividends in it is balance sheet.

This is articulated for this ratio is that Deburn is in a better position to pay its shareholders.

Earnings Per Share: this can be defined as amount earned on each share of the

organisation, it can be calculated as the incomes after interest, taxes and payment of divined to

preference share dived by the number of equity shares (Shoko, Limbu and Mgaya, 2016). From

the above table it can be seen that EPS for Debrun is 22 and for McGill it is 24. this is due the

later organisation have hight profits after taxation and same number of hares as of Deburn.

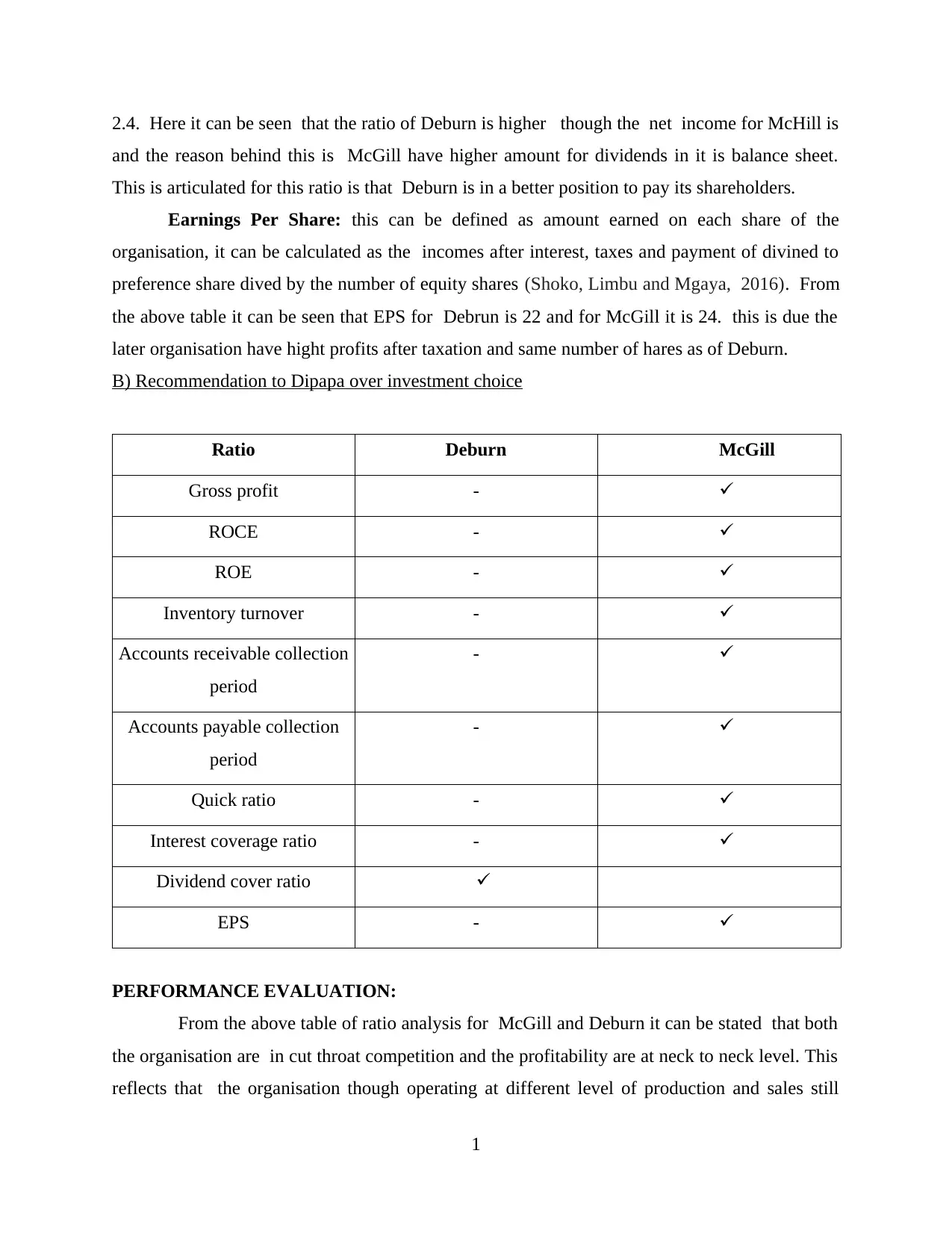

B) Recommendation to Dipapa over investment choice

Ratio Deburn McGill

Gross profit -

ROCE -

ROE -

Inventory turnover -

Accounts receivable collection

period

-

Accounts payable collection

period

-

Quick ratio -

Interest coverage ratio -

Dividend cover ratio

EPS -

PERFORMANCE EVALUATION:

From the above table of ratio analysis for McGill and Deburn it can be stated that both

the organisation are in cut throat competition and the profitability are at neck to neck level. This

reflects that the organisation though operating at different level of production and sales still

1

and the reason behind this is McGill have higher amount for dividends in it is balance sheet.

This is articulated for this ratio is that Deburn is in a better position to pay its shareholders.

Earnings Per Share: this can be defined as amount earned on each share of the

organisation, it can be calculated as the incomes after interest, taxes and payment of divined to

preference share dived by the number of equity shares (Shoko, Limbu and Mgaya, 2016). From

the above table it can be seen that EPS for Debrun is 22 and for McGill it is 24. this is due the

later organisation have hight profits after taxation and same number of hares as of Deburn.

B) Recommendation to Dipapa over investment choice

Ratio Deburn McGill

Gross profit -

ROCE -

ROE -

Inventory turnover -

Accounts receivable collection

period

-

Accounts payable collection

period

-

Quick ratio -

Interest coverage ratio -

Dividend cover ratio

EPS -

PERFORMANCE EVALUATION:

From the above table of ratio analysis for McGill and Deburn it can be stated that both

the organisation are in cut throat competition and the profitability are at neck to neck level. This

reflects that the organisation though operating at different level of production and sales still

1

profitability ratios are same. Both do not have same liquidity position as McGill have optimal

current and quick ratio but Deburn liquidity is not good as it has more current liabilities in its

balance sheet. This can be stated that McGill is operating at an optimal level with all ratio are

near the standards instead Deburn is not.

Recommendation:

From the above calculation of ratio and recommendation table it can be clearly stared that

Dipapa must invest in McGill as this have better profitability, leverage and liquidity position as

compared to Deburn. In certain ratios both are at same place but in late ratios the liquidity

condition, collection and payment period and coverage ratios of McGill are better. It is suggested

to management of Dipapa to invest in McGill Ltd.

TASK 2

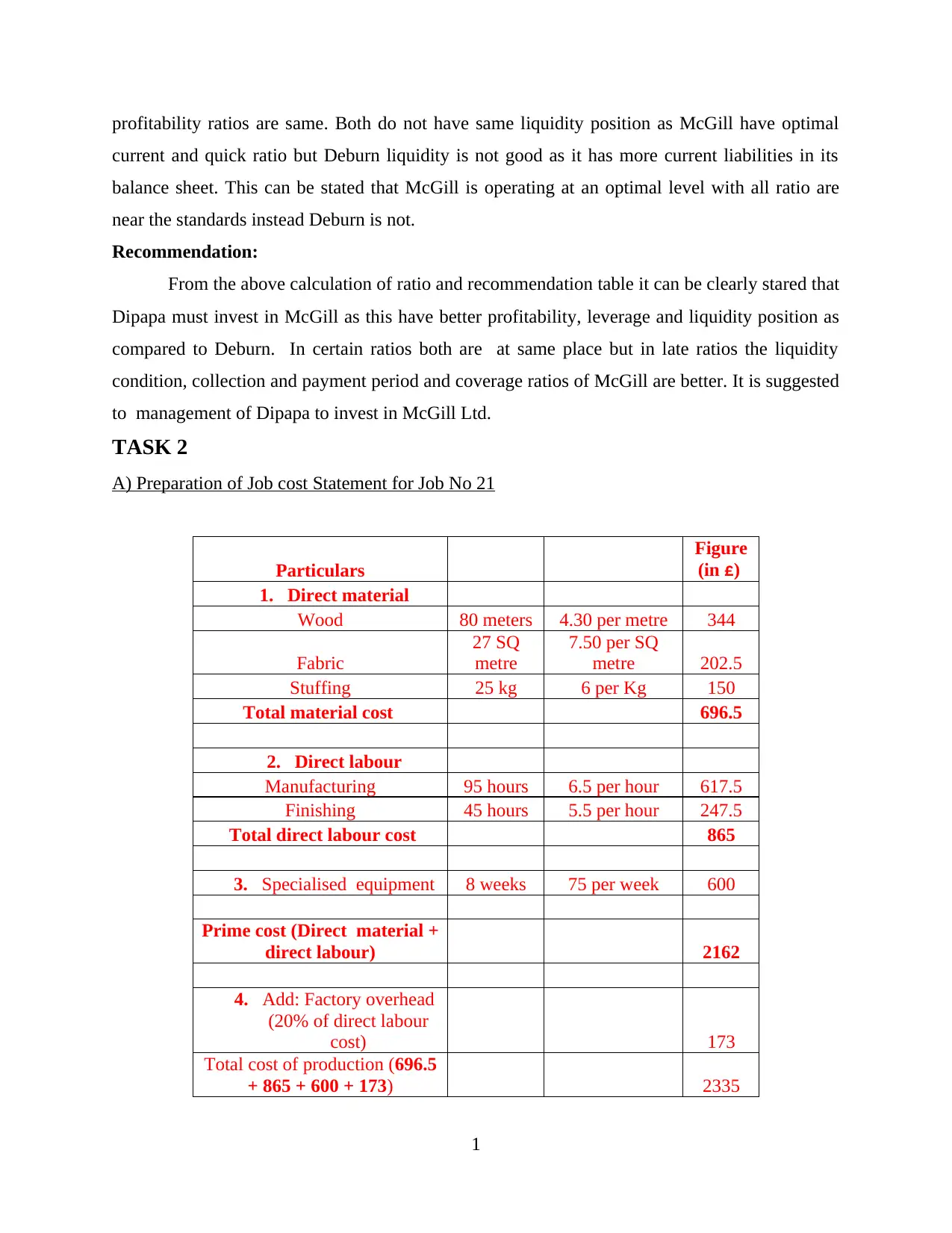

A) Preparation of Job cost Statement for Job No 21

Particulars

Figure

(in £)

1. Direct material

Wood 80 meters 4.30 per metre 344

Fabric

27 SQ

metre

7.50 per SQ

metre 202.5

Stuffing 25 kg 6 per Kg 150

Total material cost 696.5

2. Direct labour

Manufacturing 95 hours 6.5 per hour 617.5

Finishing 45 hours 5.5 per hour 247.5

Total direct labour cost 865

3. Specialised equipment 8 weeks 75 per week 600

Prime cost (Direct material +

direct labour) 2162

4. Add: Factory overhead

(20% of direct labour

cost) 173

Total cost of production (696.5

+ 865 + 600 + 173) 2335

1

current and quick ratio but Deburn liquidity is not good as it has more current liabilities in its

balance sheet. This can be stated that McGill is operating at an optimal level with all ratio are

near the standards instead Deburn is not.

Recommendation:

From the above calculation of ratio and recommendation table it can be clearly stared that

Dipapa must invest in McGill as this have better profitability, leverage and liquidity position as

compared to Deburn. In certain ratios both are at same place but in late ratios the liquidity

condition, collection and payment period and coverage ratios of McGill are better. It is suggested

to management of Dipapa to invest in McGill Ltd.

TASK 2

A) Preparation of Job cost Statement for Job No 21

Particulars

Figure

(in £)

1. Direct material

Wood 80 meters 4.30 per metre 344

Fabric

27 SQ

metre

7.50 per SQ

metre 202.5

Stuffing 25 kg 6 per Kg 150

Total material cost 696.5

2. Direct labour

Manufacturing 95 hours 6.5 per hour 617.5

Finishing 45 hours 5.5 per hour 247.5

Total direct labour cost 865

3. Specialised equipment 8 weeks 75 per week 600

Prime cost (Direct material +

direct labour) 2162

4. Add: Factory overhead

(20% of direct labour

cost) 173

Total cost of production (696.5

+ 865 + 600 + 173) 2335

1

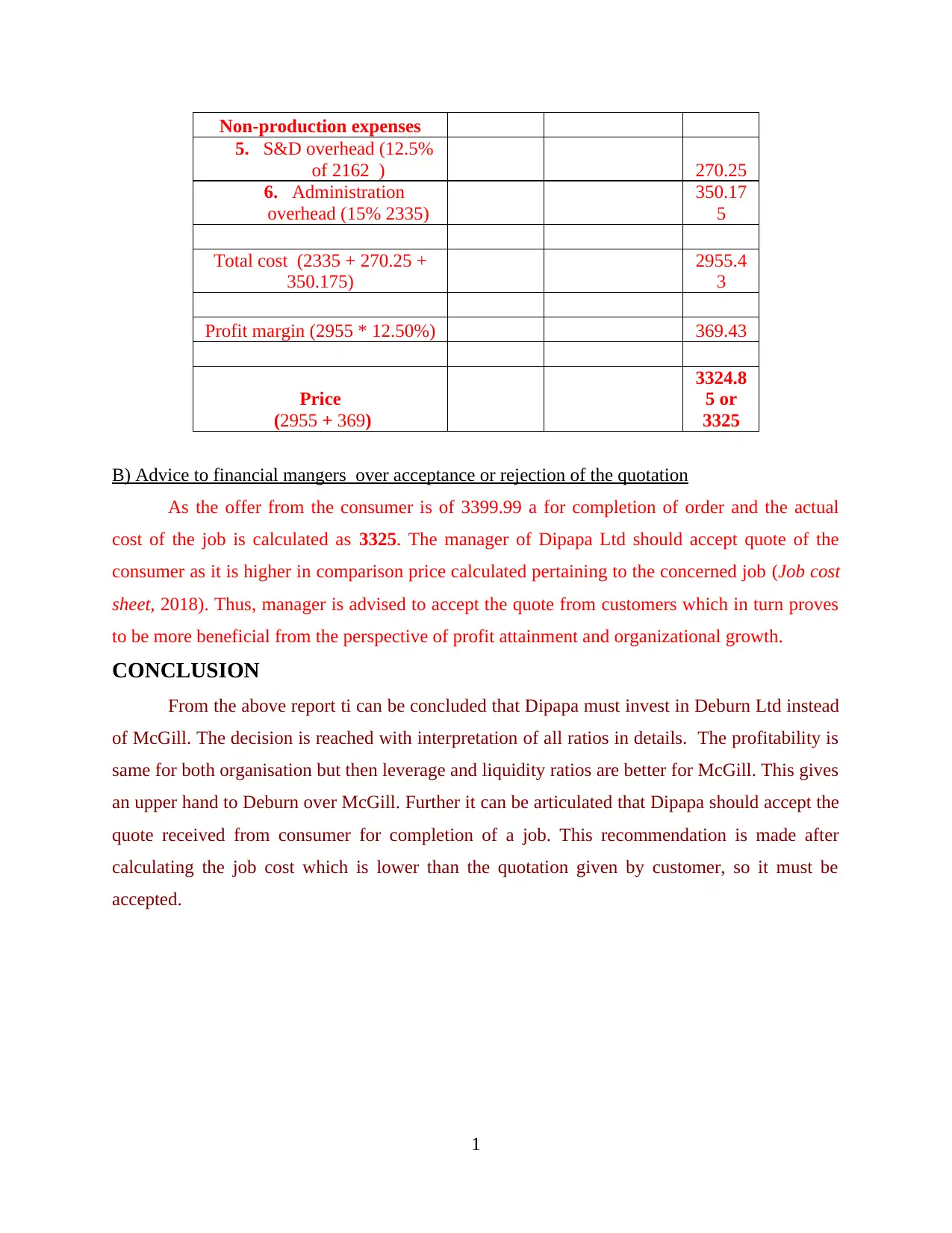

Non-production expenses

5. S&D overhead (12.5%

of 2162 ) 270.25

6. Administration

overhead (15% 2335)

350.17

5

Total cost (2335 + 270.25 +

350.175)

2955.4

3

Profit margin (2955 * 12.50%) 369.43

Price

(2955 + 369)

3324.8

5 or

3325

B) Advice to financial mangers over acceptance or rejection of the quotation

As the offer from the consumer is of 3399.99 a for completion of order and the actual

cost of the job is calculated as 3325. The manager of Dipapa Ltd should accept quote of the

consumer as it is higher in comparison price calculated pertaining to the concerned job (Job cost

sheet, 2018). Thus, manager is advised to accept the quote from customers which in turn proves

to be more beneficial from the perspective of profit attainment and organizational growth.

CONCLUSION

From the above report ti can be concluded that Dipapa must invest in Deburn Ltd instead

of McGill. The decision is reached with interpretation of all ratios in details. The profitability is

same for both organisation but then leverage and liquidity ratios are better for McGill. This gives

an upper hand to Deburn over McGill. Further it can be articulated that Dipapa should accept the

quote received from consumer for completion of a job. This recommendation is made after

calculating the job cost which is lower than the quotation given by customer, so it must be

accepted.

1

5. S&D overhead (12.5%

of 2162 ) 270.25

6. Administration

overhead (15% 2335)

350.17

5

Total cost (2335 + 270.25 +

350.175)

2955.4

3

Profit margin (2955 * 12.50%) 369.43

Price

(2955 + 369)

3324.8

5 or

3325

B) Advice to financial mangers over acceptance or rejection of the quotation

As the offer from the consumer is of 3399.99 a for completion of order and the actual

cost of the job is calculated as 3325. The manager of Dipapa Ltd should accept quote of the

consumer as it is higher in comparison price calculated pertaining to the concerned job (Job cost

sheet, 2018). Thus, manager is advised to accept the quote from customers which in turn proves

to be more beneficial from the perspective of profit attainment and organizational growth.

CONCLUSION

From the above report ti can be concluded that Dipapa must invest in Deburn Ltd instead

of McGill. The decision is reached with interpretation of all ratios in details. The profitability is

same for both organisation but then leverage and liquidity ratios are better for McGill. This gives

an upper hand to Deburn over McGill. Further it can be articulated that Dipapa should accept the

quote received from consumer for completion of a job. This recommendation is made after

calculating the job cost which is lower than the quotation given by customer, so it must be

accepted.

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

de Lecea, A. M., Cooper, R. and Smit, A. J., 2016. Identifying the drivers of the pelagic

ecosystem of an oligotrophic bight (KwaZulu–Natal, South Africa) using stable isotopes

(δ13C, δ15N) and C: N ratio analysis. Marine and Freshwater Research. 67(11). pp.1750-

1761.

Gigler, F. R and et.al ., 2014. How frequent financial reporting can cause managerial short‐

termism: An analysis of the costs and benefits of increasing reporting frequency. Journal of

Accounting Research. 52(2). pp.357-387.

Ortea, I. and Gallardo, J. M., 2015. Investigation of production method, geographical origin and

species authentication in commercially relevant shrimps using stable isotope ratio and/or

multi-element analyses combined with chemometrics: An exploratory analysis. Food

chemistry. 170. pp.145-153.

Petruzzo, P and et.al., 2015. Outcomes after bilateral hand allotransplantation: a risk/benefit ratio

analysis. Annals of surgery. 261(1). pp.213-220.

Shoko, A. P., Limbu, S. M. and Mgaya, Y. D., 2016. Effect of stocking density on growth

performance, survival, production, and financial benefits of African sharptooth catfish

(Clarias gariepinus) monoculture in earthen ponds. Journal of applied aquaculture. 28(3).

pp.220-234.

Ward, G., 2017. Calculating ROI: Measuring the Benefits of Workplace Financial

Wellness. Pension Section. p.24.

Online

Job cost sheet. 2018. [Online]. Available through

:<https://www.accountingformanagement.org/job-cost-sheet/>.

1

Books and Journals

de Lecea, A. M., Cooper, R. and Smit, A. J., 2016. Identifying the drivers of the pelagic

ecosystem of an oligotrophic bight (KwaZulu–Natal, South Africa) using stable isotopes

(δ13C, δ15N) and C: N ratio analysis. Marine and Freshwater Research. 67(11). pp.1750-

1761.

Gigler, F. R and et.al ., 2014. How frequent financial reporting can cause managerial short‐

termism: An analysis of the costs and benefits of increasing reporting frequency. Journal of

Accounting Research. 52(2). pp.357-387.

Ortea, I. and Gallardo, J. M., 2015. Investigation of production method, geographical origin and

species authentication in commercially relevant shrimps using stable isotope ratio and/or

multi-element analyses combined with chemometrics: An exploratory analysis. Food

chemistry. 170. pp.145-153.

Petruzzo, P and et.al., 2015. Outcomes after bilateral hand allotransplantation: a risk/benefit ratio

analysis. Annals of surgery. 261(1). pp.213-220.

Shoko, A. P., Limbu, S. M. and Mgaya, Y. D., 2016. Effect of stocking density on growth

performance, survival, production, and financial benefits of African sharptooth catfish

(Clarias gariepinus) monoculture in earthen ponds. Journal of applied aquaculture. 28(3).

pp.220-234.

Ward, G., 2017. Calculating ROI: Measuring the Benefits of Workplace Financial

Wellness. Pension Section. p.24.

Online

Job cost sheet. 2018. [Online]. Available through

:<https://www.accountingformanagement.org/job-cost-sheet/>.

1

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.