Bachelor's Thesis: Market Research of Window Units and Doors in Russia

VerifiedAdded on 2022/10/19

|68

|26758

|283

Report

AI Summary

This Bachelor's thesis presents a comprehensive market research analysis of the window units and doors industry in Russia. The research investigates the macro-environmental and competitive forces influencing a company's performance in the Russian market. It employs a framework based on market research approaches, Michael Porter's five forces, and international entry strategies. The study includes qualitative and quantitative data, incorporating macroeconomic factors and expert interviews. Key findings highlight the influence of economic and political forces, direct rivalry, and the distribution chain. While a clear strategic plan formulation was limited due to data constraints, the research offers valuable insights and methodologies for deeper market analysis, particularly regarding the risks Finnish companies face, such as political, currency, and cultural risks. Furthermore, the paper provides information on relevant legal issues including visas, taxation and custom procedures.

Market research of window units and doors industry in Russia

Elena Grishankova

Bachelor‟s Thesis

DP of Management Assistants

2010

Elena Grishankova

Bachelor‟s Thesis

DP of Management Assistants

2010

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Abstract

13 May 2010

Degree programme in Multilingual Management Assistants

Authors

Elena Grishankova

Group

The title of your thesis

Market Research of Window Units and Doors Industry in Russia

Number of pages

and appendices

61+3

Supervisors

Olli Laintila, Eija Kärnä

The purpose of this research is to analyze macro-environmental and competitive fo

Russian market and to determine possible entry modes for a new company. Some

information on legal issues and regulatory organizations is also included in the pa

create a comprehensive overview of any potentially influential factors.

The conceptual framework is based on the macro-environmental market research

Michael Porter‟s five forces framework and international entry strategies. This the

framework was used as a basis for formulating interview questions in order to per

qualitative, as well as quantitative, research. Quantitative data were collected from

and were primarily concerned with macro-economic factors. Interview questions w

structured and formulated differently for each of the three respondents, taking the

expertise into account in order to get the best results possible.

By the end of this research it was possible to conclude that economic and political

influential ones that a company in the Russian market will face. The most importa

five forces appeared to be direct rivalry and the distribution chain, the latter of wh

the supplier, manufacturer and buyer. The overall situation in the Russian market

window units does not appear to be that clear at the moment; the same can also b

prognoses for the future. For this reason, and also because of the lack of data rega

commissioning party‟s strategic objectives and assets, it was unfortunately impos

a clear plan regarding the development of strategy. However, this work offers way

information for a necessary deeper market research, which is needed in this area.

Key words

market research, five forces, doors and window units, entry mode, Russia

13 May 2010

Degree programme in Multilingual Management Assistants

Authors

Elena Grishankova

Group

The title of your thesis

Market Research of Window Units and Doors Industry in Russia

Number of pages

and appendices

61+3

Supervisors

Olli Laintila, Eija Kärnä

The purpose of this research is to analyze macro-environmental and competitive fo

Russian market and to determine possible entry modes for a new company. Some

information on legal issues and regulatory organizations is also included in the pa

create a comprehensive overview of any potentially influential factors.

The conceptual framework is based on the macro-environmental market research

Michael Porter‟s five forces framework and international entry strategies. This the

framework was used as a basis for formulating interview questions in order to per

qualitative, as well as quantitative, research. Quantitative data were collected from

and were primarily concerned with macro-economic factors. Interview questions w

structured and formulated differently for each of the three respondents, taking the

expertise into account in order to get the best results possible.

By the end of this research it was possible to conclude that economic and political

influential ones that a company in the Russian market will face. The most importa

five forces appeared to be direct rivalry and the distribution chain, the latter of wh

the supplier, manufacturer and buyer. The overall situation in the Russian market

window units does not appear to be that clear at the moment; the same can also b

prognoses for the future. For this reason, and also because of the lack of data rega

commissioning party‟s strategic objectives and assets, it was unfortunately impos

a clear plan regarding the development of strategy. However, this work offers way

information for a necessary deeper market research, which is needed in this area.

Key words

market research, five forces, doors and window units, entry mode, Russia

Table of contents

1 Introduction .............................................................................................................. 1

1.1 Aim of the study ................................................................................................ 2

1.2 Contents of the report ...................................................................................... 2

1.3 Commissioning party ........................................................................................ 3

2 Methodology ............................................................................................................. 5

3 Current situation in Russia ........................................................................................ 7

3.1 Main macroeconomic facts ............................................................................... 8

3.2 Trends and difficulties of the industry ............................................................ 10

3.3 SROs ................................................................................................................ 13

3.4 Finnish business on the Russian market ......................................................... 14

4 Concepts of market research .................................................................................. 15

4.1 Macro environment ........................................................................................ 15

4.2 Porter’s five forces .......................................................................................... 19

4.2.1 Direct rivalry ............................................................................................ 20

4.2.2 Bargaining power of buyers .................................................................... 21

4.2.3 Suppliers .................................................................................................. 22

4.2.4 Substitutes .............................................................................................. 23

4.2.5 New entries ............................................................................................. 23

4.3 Risks of the new market entry ........................................................................ 24

4.3.1 Political risk ............................................................................................. 25

4.3.2 Currency risk ........................................................................................... 26

4.3.3 Cultural diversity risk .............................................................................. 27

5 Strategy development ............................................................................................. 29

5.1 Determining mission and objectives ............................................................... 29

5.2 Choice of entry mode ...................................................................................... 30

1 Introduction .............................................................................................................. 1

1.1 Aim of the study ................................................................................................ 2

1.2 Contents of the report ...................................................................................... 2

1.3 Commissioning party ........................................................................................ 3

2 Methodology ............................................................................................................. 5

3 Current situation in Russia ........................................................................................ 7

3.1 Main macroeconomic facts ............................................................................... 8

3.2 Trends and difficulties of the industry ............................................................ 10

3.3 SROs ................................................................................................................ 13

3.4 Finnish business on the Russian market ......................................................... 14

4 Concepts of market research .................................................................................. 15

4.1 Macro environment ........................................................................................ 15

4.2 Porter’s five forces .......................................................................................... 19

4.2.1 Direct rivalry ............................................................................................ 20

4.2.2 Bargaining power of buyers .................................................................... 21

4.2.3 Suppliers .................................................................................................. 22

4.2.4 Substitutes .............................................................................................. 23

4.2.5 New entries ............................................................................................. 23

4.3 Risks of the new market entry ........................................................................ 24

4.3.1 Political risk ............................................................................................. 25

4.3.2 Currency risk ........................................................................................... 26

4.3.3 Cultural diversity risk .............................................................................. 27

5 Strategy development ............................................................................................. 29

5.1 Determining mission and objectives ............................................................... 29

5.2 Choice of entry mode ...................................................................................... 30

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5.3 Monitoring the strategy .................................................................................. 33

6 Competitive environment in Russia ........................................................................ 34

6.1 Direct competitors .......................................................................................... 34

6.2 Extended competition ..................................................................................... 36

6.3 General risks .................................................................................................... 38

6.3.1 Political risks ............................................................................................ 38

6.3.2 Currency risk ........................................................................................... 40

7 Legislation issues ..................................................................................................... 42

7.1 Visas and work permits for foreign employees .............................................. 43

7.2 Taxation ........................................................................................................... 44

7.3 Customs procedures legislation ...................................................................... 45

7.4 Information sources ........................................................................................ 47

8 Results ..................................................................................................................... 49

8.1 Validity and reliability ..................................................................................... 49

8.2 Macro and competitive environment ............................................................. 50

8.3 Entry modes .................................................................................................... 54

8.4 Secondary findings .......................................................................................... 55

9 Conclusion ............................................................................................................... 57

Bibliography .................................................................................................................... 59

Appendices ...................................................................................................................... 62

Appendix 1. Interview questions YIT........................................................................... 62

Appendix 2. Interview questions Finpro ..................................................................... 63

Appendix 3. Interview questions FRCC ....................................................................... 64

6 Competitive environment in Russia ........................................................................ 34

6.1 Direct competitors .......................................................................................... 34

6.2 Extended competition ..................................................................................... 36

6.3 General risks .................................................................................................... 38

6.3.1 Political risks ............................................................................................ 38

6.3.2 Currency risk ........................................................................................... 40

7 Legislation issues ..................................................................................................... 42

7.1 Visas and work permits for foreign employees .............................................. 43

7.2 Taxation ........................................................................................................... 44

7.3 Customs procedures legislation ...................................................................... 45

7.4 Information sources ........................................................................................ 47

8 Results ..................................................................................................................... 49

8.1 Validity and reliability ..................................................................................... 49

8.2 Macro and competitive environment ............................................................. 50

8.3 Entry modes .................................................................................................... 54

8.4 Secondary findings .......................................................................................... 55

9 Conclusion ............................................................................................................... 57

Bibliography .................................................................................................................... 59

Appendices ...................................................................................................................... 62

Appendix 1. Interview questions YIT........................................................................... 62

Appendix 2. Interview questions Finpro ..................................................................... 63

Appendix 3. Interview questions FRCC ....................................................................... 64

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

1 Introduction

The research paper you are about to read is meant as a practical and guide for a F

on what factors to consider when entering the Russian market. As the author of th

Russian origin it was natural to choose a topic that concerns Finnish-Russian conn

inspiration for the research question were comments of Finnish businessmen on p

arise when Finnish companies wish to start operating in the Russian market. Russ

traditionally been a business partner for Finland so it is without a doubt necessary

intercultural relations between companies. Although there have been many succes

embrace this subject they did not overview all aspects of business activities. Besid

changes in world economy and their influence on all countries and almost all indu

assumption that conditions influencing companies‟ performance needed to be revi

the fact that many Finnish companies operate in the Russian market for a long tim

construction related firms, there is no comprehensive literature available on macr

factors, competition or entry modes for these firms. This research is an attempt to

necessary pieces of information in order to put together a picture of what is to exp

consider when entering the Russian market.

With formulation of the research question “What are the factors influencing perfor

company entering the Russian market?” it was easy to choose conceptual framewo

market research approach, Porter‟s five forces and international entry modes theo

collection was based on this framework and mainly consisted of qualitative method

observation and interviews, and also supported by quantitative data. Interviews w

in a manner that allowed acquisition of most amount of valuable information from

Theoretical background was based on proven theories; meanwhile quantitative da

character was mainly extracted from articles of reliable organizations and periodi

necessary for keeping the research information as much up to date and reliable as

it could be used practically by the commissioning party. Reviews of such topics as

political, social and technological situations in Russia were included in this paper

data on direct rivalry, suppliers, substitutes, buyers and possible new entries. The

that a Finnish company can face in the Russian market, such as political, cultural

were also described in this paper. For even more practical use information on som

1 Introduction

The research paper you are about to read is meant as a practical and guide for a F

on what factors to consider when entering the Russian market. As the author of th

Russian origin it was natural to choose a topic that concerns Finnish-Russian conn

inspiration for the research question were comments of Finnish businessmen on p

arise when Finnish companies wish to start operating in the Russian market. Russ

traditionally been a business partner for Finland so it is without a doubt necessary

intercultural relations between companies. Although there have been many succes

embrace this subject they did not overview all aspects of business activities. Besid

changes in world economy and their influence on all countries and almost all indu

assumption that conditions influencing companies‟ performance needed to be revi

the fact that many Finnish companies operate in the Russian market for a long tim

construction related firms, there is no comprehensive literature available on macr

factors, competition or entry modes for these firms. This research is an attempt to

necessary pieces of information in order to put together a picture of what is to exp

consider when entering the Russian market.

With formulation of the research question “What are the factors influencing perfor

company entering the Russian market?” it was easy to choose conceptual framewo

market research approach, Porter‟s five forces and international entry modes theo

collection was based on this framework and mainly consisted of qualitative method

observation and interviews, and also supported by quantitative data. Interviews w

in a manner that allowed acquisition of most amount of valuable information from

Theoretical background was based on proven theories; meanwhile quantitative da

character was mainly extracted from articles of reliable organizations and periodi

necessary for keeping the research information as much up to date and reliable as

it could be used practically by the commissioning party. Reviews of such topics as

political, social and technological situations in Russia were included in this paper

data on direct rivalry, suppliers, substitutes, buyers and possible new entries. The

that a Finnish company can face in the Russian market, such as political, cultural

were also described in this paper. For even more practical use information on som

2

concerning registration of companies, taxation and customs follows the environme

However, law regulations are not the main topic of this paper so they are not scru

Information analysis has lead to pretty much expected conclusions and some recom

However, these results cannot be generalized due to the specifics of the industry,

changing global economic conditions and rather small sample of interviewees. Ma

the research was successfully fulfilled as the research question was answered and

information gathering, structuring and analyzing was build logically and in a corre

1.1 Aim of the study

The aim of this study is to perform a research of macro-environment and competit

influence the entrant-company‟s performance in the Russian market. This goal is a

using conceptual frameworks of market research, Porter‟s five forces and interna

strategies, and analyzing empirical data on their basis. The main research questio

the factors influencing performance of a company entering the Russian market?” S

are the following:

1. What macro-environmental and competition forces have the greatest influen

2. What entry strategy is appropriate considering these forces?

1.2 Contents of the report

First chapter of this report, introduction, is devoted to overall description of work

during this research process. It tells about the background of the research questio

study. After that, a short piece of information is given on a commissioning party, F

Chapter2 describesmethodologicalapproach,i.e. groundsfor choiceof qualitativeand

quantitative methods, data collection methods and issues that arose during this pr

Chapter 3 contains empirical information on current situation in Russia, such as G

rates, unemployment etc. The scope is then being narrowed to recent changes and

window units and door production industry, as well as Self Regulating Orga

regulatory organ created by most recent initiative. Ending this chapter are

Finnish companies in the Russian market.

concerning registration of companies, taxation and customs follows the environme

However, law regulations are not the main topic of this paper so they are not scru

Information analysis has lead to pretty much expected conclusions and some recom

However, these results cannot be generalized due to the specifics of the industry,

changing global economic conditions and rather small sample of interviewees. Ma

the research was successfully fulfilled as the research question was answered and

information gathering, structuring and analyzing was build logically and in a corre

1.1 Aim of the study

The aim of this study is to perform a research of macro-environment and competit

influence the entrant-company‟s performance in the Russian market. This goal is a

using conceptual frameworks of market research, Porter‟s five forces and interna

strategies, and analyzing empirical data on their basis. The main research questio

the factors influencing performance of a company entering the Russian market?” S

are the following:

1. What macro-environmental and competition forces have the greatest influen

2. What entry strategy is appropriate considering these forces?

1.2 Contents of the report

First chapter of this report, introduction, is devoted to overall description of work

during this research process. It tells about the background of the research questio

study. After that, a short piece of information is given on a commissioning party, F

Chapter2 describesmethodologicalapproach,i.e. groundsfor choiceof qualitativeand

quantitative methods, data collection methods and issues that arose during this pr

Chapter 3 contains empirical information on current situation in Russia, such as G

rates, unemployment etc. The scope is then being narrowed to recent changes and

window units and door production industry, as well as Self Regulating Orga

regulatory organ created by most recent initiative. Ending this chapter are

Finnish companies in the Russian market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Chapter 4 opens the theoretical part of this paper by introducing concepts of mark

such as macro-environment and competitive forces approach by Michael Porter. T

tells general facts about such macro economic factors as economic, political, techn

social ones. Porter‟s five forces approach is being described later in the chapter d

chapters according to number of forces; direct rivalry, buyers, suppliers, su

entries. Closing part of this chapter is devoted to most common risks during the e

such as political, cultural and currency risk. Milestones of strategic development f

are outlined in Chapter 5, which contains the following parts: the mission and obje

of entrymodeand monitoring.Next Chapter6 revealssomeempiricaldataon current

competitive situation in Russia as well as tips on information sources that a comm

could use. Its structure is based on earlier described Porter‟s model and general r

Chapter number 7 on legislation issues, overviews regulations on visas and

foreign employees in the RF, including lists of some necessary papers. Besides tha

tells about taxation and customs procedures legislation and some latest news abou

contains the results of the research process; the analysis method, primary findings

research question and secondary findings. Finally, Chapter 8 draws the conclusion

research as well author‟s personal comments.

1.3 Commissioning party

Fenestra Oy is one of the leading high-quality window and door solutions service p

Finland and a major player in the Nordic countries. It was first registered at the N

Patens and Registration in 1917. Fenestra Oy produces annually more than 300,00

and approximately 400,000 doors. The turnover of Fenestra Oy is approximately M

the number of personnel is around 800 people.

Fenestra‟s business operation is divided into six different sectors: construction co

rise renovation, house building factories, retailers, agents and export. Fenestra‟s

situates in Vantaa, Finland, but the company's production plants are located in Fo

assembly), window component production in Kuopio, production of exterior doors

production of interior and special purpose doors in Alavus and production of door

Chapter 4 opens the theoretical part of this paper by introducing concepts of mark

such as macro-environment and competitive forces approach by Michael Porter. T

tells general facts about such macro economic factors as economic, political, techn

social ones. Porter‟s five forces approach is being described later in the chapter d

chapters according to number of forces; direct rivalry, buyers, suppliers, su

entries. Closing part of this chapter is devoted to most common risks during the e

such as political, cultural and currency risk. Milestones of strategic development f

are outlined in Chapter 5, which contains the following parts: the mission and obje

of entrymodeand monitoring.Next Chapter6 revealssomeempiricaldataon current

competitive situation in Russia as well as tips on information sources that a comm

could use. Its structure is based on earlier described Porter‟s model and general r

Chapter number 7 on legislation issues, overviews regulations on visas and

foreign employees in the RF, including lists of some necessary papers. Besides tha

tells about taxation and customs procedures legislation and some latest news abou

contains the results of the research process; the analysis method, primary findings

research question and secondary findings. Finally, Chapter 8 draws the conclusion

research as well author‟s personal comments.

1.3 Commissioning party

Fenestra Oy is one of the leading high-quality window and door solutions service p

Finland and a major player in the Nordic countries. It was first registered at the N

Patens and Registration in 1917. Fenestra Oy produces annually more than 300,00

and approximately 400,000 doors. The turnover of Fenestra Oy is approximately M

the number of personnel is around 800 people.

Fenestra‟s business operation is divided into six different sectors: construction co

rise renovation, house building factories, retailers, agents and export. Fenestra‟s

situates in Vantaa, Finland, but the company's production plants are located in Fo

assembly), window component production in Kuopio, production of exterior doors

production of interior and special purpose doors in Alavus and production of door

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Posio. Fenestra also has sales offices in Tampere, Turku, Kouvola, Jyväskylä and O

also includes Fenestra Oy‟s so far only foreign subsidiary, Fenestra AS in Estonia

window factory in Tallinn.

Vision of the company for the year 2012 is to be the most desirable partner as a w

producer. Fenestra‟s values are customers‟ satisfaction, productivity, continuous

integrity and cooperation. Fenestra is a customer oriented company that promotes

delivery and zero error tolerance (Fenestra Ltd Company presentation 2010).

Posio. Fenestra also has sales offices in Tampere, Turku, Kouvola, Jyväskylä and O

also includes Fenestra Oy‟s so far only foreign subsidiary, Fenestra AS in Estonia

window factory in Tallinn.

Vision of the company for the year 2012 is to be the most desirable partner as a w

producer. Fenestra‟s values are customers‟ satisfaction, productivity, continuous

integrity and cooperation. Fenestra is a customer oriented company that promotes

delivery and zero error tolerance (Fenestra Ltd Company presentation 2010).

5

2 Methodology

Theory should proceed data observation in order to know what to pay attention to

framework helps seeing the gaps in the information, the missing answers and thus

the research problem (Ghauri & Grønhang 2005, 16). It is argued that this approa

adequate with quantitative research, but at the same time it is believed that it is a

to rely purely on qualitative or quantitative method in polytechnic research as bot

methods must be used at different levels of a research. At the very beginning of th

qualitative research was chosen as the most appropriate method because the purp

research is to find the case corresponding with conceptual framework; not to expl

of some event. Here it means that conceptual basis built up by macro environment

forces and international entry strategy theories is being used throughout the resea

framework. Data collection and data analysis rely on this framework as well.

Qualitative approach allows a better understanding of the conditions in which mar

must be implemented, gives insights on phenomenon, which allows the constructio

explanations. It also gives opportunity to embrace many sources of information on

and changing market factors by collecting data from actual sources and real-life c

same time analyze these data. Besides, qualitative method has a more dramatic ap

reader because it concerns real phenomena and experience without binding borde

quantitative method. But in the course of data collection, application of quantitativ

proved to be necessary as well as great deal of information concerning economic m

environment can be represented only in numbers and percentages, e.g. in Chapter

Quantitative and qualitative methods are thus both used in order to perform this r

Research approach is descriptive because both exploratory and causal have no gro

there is no search for the general explanation of the problem as well as no depend

assess. First, general moments of the market are being described according

framework of macro analysis. After that the research proceeds with thoroug

theories and successive presentation of empirical data. Preference in this pa

qualitative approach, and data collection method traditionally associated with

and interviews (Ghauri & Grønhang 2005, 109). Collection of empirical data is don

reading and analyzing articles, official reports and documents as well as following

2 Methodology

Theory should proceed data observation in order to know what to pay attention to

framework helps seeing the gaps in the information, the missing answers and thus

the research problem (Ghauri & Grønhang 2005, 16). It is argued that this approa

adequate with quantitative research, but at the same time it is believed that it is a

to rely purely on qualitative or quantitative method in polytechnic research as bot

methods must be used at different levels of a research. At the very beginning of th

qualitative research was chosen as the most appropriate method because the purp

research is to find the case corresponding with conceptual framework; not to expl

of some event. Here it means that conceptual basis built up by macro environment

forces and international entry strategy theories is being used throughout the resea

framework. Data collection and data analysis rely on this framework as well.

Qualitative approach allows a better understanding of the conditions in which mar

must be implemented, gives insights on phenomenon, which allows the constructio

explanations. It also gives opportunity to embrace many sources of information on

and changing market factors by collecting data from actual sources and real-life c

same time analyze these data. Besides, qualitative method has a more dramatic ap

reader because it concerns real phenomena and experience without binding borde

quantitative method. But in the course of data collection, application of quantitativ

proved to be necessary as well as great deal of information concerning economic m

environment can be represented only in numbers and percentages, e.g. in Chapter

Quantitative and qualitative methods are thus both used in order to perform this r

Research approach is descriptive because both exploratory and causal have no gro

there is no search for the general explanation of the problem as well as no depend

assess. First, general moments of the market are being described according

framework of macro analysis. After that the research proceeds with thoroug

theories and successive presentation of empirical data. Preference in this pa

qualitative approach, and data collection method traditionally associated with

and interviews (Ghauri & Grønhang 2005, 109). Collection of empirical data is don

reading and analyzing articles, official reports and documents as well as following

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

observation. Interviews with field experts are used to reflect on the theoretical fra

points.Two of the interviewsweree-mailinterviewsas it was moreconvenientfor the

respondents,but constantcontactwas maintainedin orderto avoidmisunderstandingor

misinterpretation of the written questions. It was done for making the interviewin

to a real face-to-face one. Interviews were semi-structured; the questions were str

but no optional answers given because it allowed the respondent give more inform

subject, express own opinion. According to McQuarrie

…judgment samples are generally adequate for purposes of qualitative research, as lon

reason to believe that judgment is available. (McQuarrie 2006, 103)

This manner of interviewing is justified here because: a) personal attitudes of resp

value as far as they work in the researched environment daily in high positions an

of interviews is rather modest, so in-depth approach is justified and there i

informationoverloador data structuring/classifyingissues.Besidesthat,respondentsare

representatives of different fields and they were given different lists of questions

their expertise and not make them answer the questions they are not comp

Interviewees were: Aleksej Leppänen, Senior Consultant at Finpro Oy (respo

Rissanen, Vice President of YIT Moskovia (respondent B) and Petri Kekki, la

Russian Chamber of Commerce (respondent C). There were no difficulties in

interviews. During the face-to-face interview with respondent A some questio

explained in a more detailed manner which is a usual case when interviewer and r

personally and have opportunity for questions‟ and answers‟ alteration. Two

performed by e-mail, were flawless and the written responses were received on ag

observation. Interviews with field experts are used to reflect on the theoretical fra

points.Two of the interviewsweree-mailinterviewsas it was moreconvenientfor the

respondents,but constantcontactwas maintainedin orderto avoidmisunderstandingor

misinterpretation of the written questions. It was done for making the interviewin

to a real face-to-face one. Interviews were semi-structured; the questions were str

but no optional answers given because it allowed the respondent give more inform

subject, express own opinion. According to McQuarrie

…judgment samples are generally adequate for purposes of qualitative research, as lon

reason to believe that judgment is available. (McQuarrie 2006, 103)

This manner of interviewing is justified here because: a) personal attitudes of resp

value as far as they work in the researched environment daily in high positions an

of interviews is rather modest, so in-depth approach is justified and there i

informationoverloador data structuring/classifyingissues.Besidesthat,respondentsare

representatives of different fields and they were given different lists of questions

their expertise and not make them answer the questions they are not comp

Interviewees were: Aleksej Leppänen, Senior Consultant at Finpro Oy (respo

Rissanen, Vice President of YIT Moskovia (respondent B) and Petri Kekki, la

Russian Chamber of Commerce (respondent C). There were no difficulties in

interviews. During the face-to-face interview with respondent A some questio

explained in a more detailed manner which is a usual case when interviewer and r

personally and have opportunity for questions‟ and answers‟ alteration. Two

performed by e-mail, were flawless and the written responses were received on ag

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

3 Current situation in Russia

Market research framework gives clues on how to look at the situation in a given c

what to pay attention to. The aim of this research is to overview the market and in

conditions that dominate business environment in Russia in order for the commiss

develop realistic strategy. To do this it is logical to start with macro economic fact

precisely with numbers crunching. Empirical data in this chapter are meant to dem

situation in nowadays Russia, meanwhile theoretical analysis of macro economic c

be overviewed in the following chapter.

Currently there are 141.9 million people living in the Russian Federation (RF). Ov

live in the cities. Most of them work in public and manufacture sectors. In 2009 ar

million people were registered at the Unemployment Office, i.e. 8.9% of active pop

however, actual numbers of the Russian Federal State Statistics Service (RFSSS15.01.20101) show

that there were more than 6.1 million able men and women who had no job at the

2010. Most of the unemployed are of 15-19 years old, living in urban areas of Cen

Privolzhskij and Siberian regions. The unemployment rate growth has reached its

February 2009; it was the worst for the last 5 years and drew up 9.5% of able-bod

According to seasonal factors, unemployment rate always goes a little bit down in

summer time, so it did that year too. Partial unemployment was also high by the e

around 1.6 million people were in an unpaid leave or working reduced hours all ov

According to the RFSSS (13.08.2009) average monthly wage in Russia by the end

around 18 000 rubles (400€), which is around 3.6% less than ten months ago, but

varies greatly throughout the country regions. For example, in Moscow area it rea

rubles (822€) and somewhere in Kalmykia and Ingushetia it could be as little as 5

(111€)2. Wages also vary greatly from industry to industry; financial sector employe

better conditions than state ones such as teachers, collective farmers or social and

workers. By the end of 2009 federal and company salaries debts together constitu

MRUB which means that nearly 0.3% ml people in the RF did not get their salarie

and/or in full scale.

1 Федеральная Служба Государственной Статистики

2 Note that these are not the lowest salaries, but average ones.

3 Current situation in Russia

Market research framework gives clues on how to look at the situation in a given c

what to pay attention to. The aim of this research is to overview the market and in

conditions that dominate business environment in Russia in order for the commiss

develop realistic strategy. To do this it is logical to start with macro economic fact

precisely with numbers crunching. Empirical data in this chapter are meant to dem

situation in nowadays Russia, meanwhile theoretical analysis of macro economic c

be overviewed in the following chapter.

Currently there are 141.9 million people living in the Russian Federation (RF). Ov

live in the cities. Most of them work in public and manufacture sectors. In 2009 ar

million people were registered at the Unemployment Office, i.e. 8.9% of active pop

however, actual numbers of the Russian Federal State Statistics Service (RFSSS15.01.20101) show

that there were more than 6.1 million able men and women who had no job at the

2010. Most of the unemployed are of 15-19 years old, living in urban areas of Cen

Privolzhskij and Siberian regions. The unemployment rate growth has reached its

February 2009; it was the worst for the last 5 years and drew up 9.5% of able-bod

According to seasonal factors, unemployment rate always goes a little bit down in

summer time, so it did that year too. Partial unemployment was also high by the e

around 1.6 million people were in an unpaid leave or working reduced hours all ov

According to the RFSSS (13.08.2009) average monthly wage in Russia by the end

around 18 000 rubles (400€), which is around 3.6% less than ten months ago, but

varies greatly throughout the country regions. For example, in Moscow area it rea

rubles (822€) and somewhere in Kalmykia and Ingushetia it could be as little as 5

(111€)2. Wages also vary greatly from industry to industry; financial sector employe

better conditions than state ones such as teachers, collective farmers or social and

workers. By the end of 2009 federal and company salaries debts together constitu

MRUB which means that nearly 0.3% ml people in the RF did not get their salarie

and/or in full scale.

1 Федеральная Служба Государственной Статистики

2 Note that these are not the lowest salaries, but average ones.

8

3.1 Main macroeconomic facts

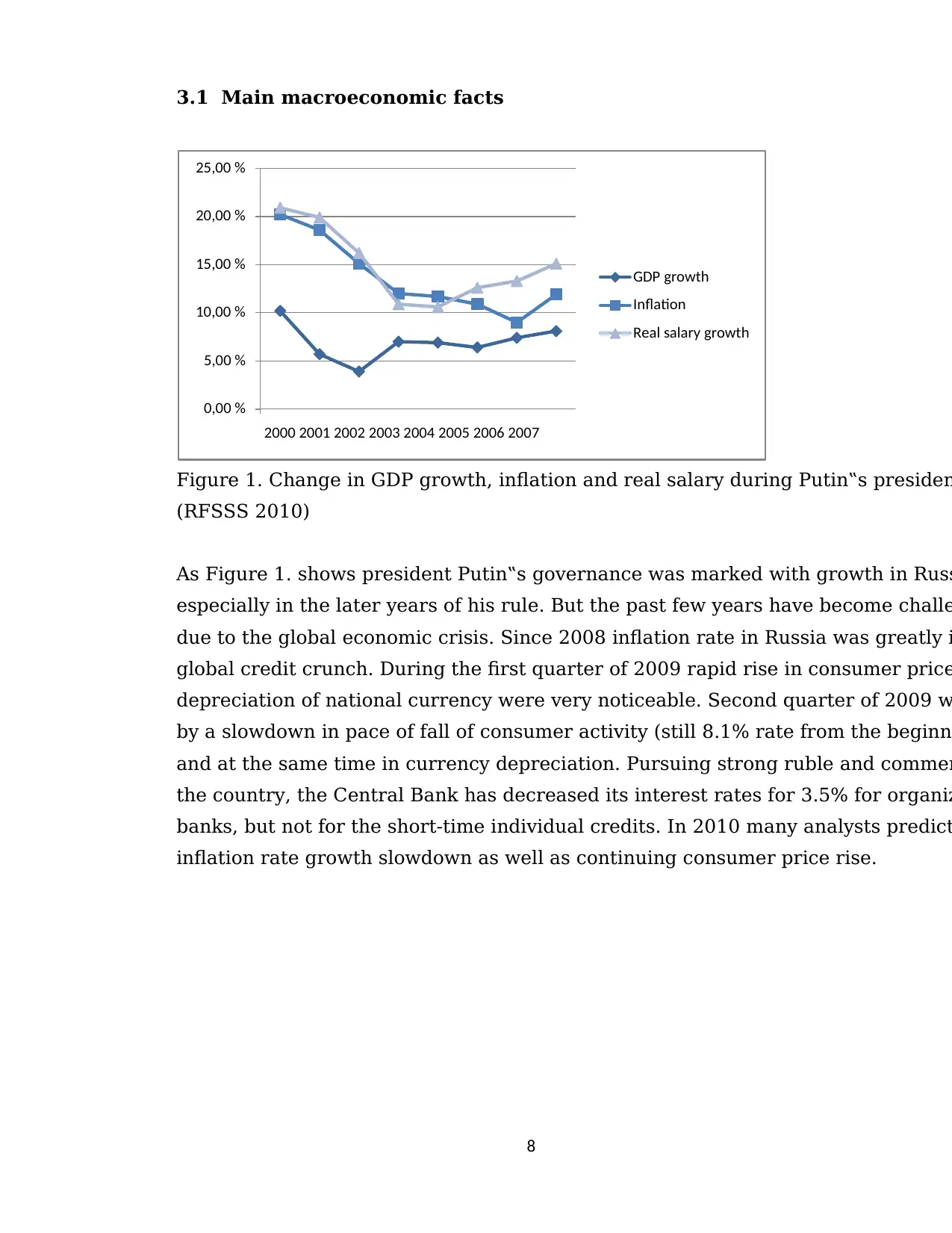

Figure 1. Change in GDP growth, inflation and real salary during Putin‟s presiden

(RFSSS 2010)

As Figure 1. shows president Putin‟s governance was marked with growth in Russ

especially in the later years of his rule. But the past few years have become challe

due to the global economic crisis. Since 2008 inflation rate in Russia was greatly i

global credit crunch. During the first quarter of 2009 rapid rise in consumer price

depreciation of national currency were very noticeable. Second quarter of 2009 w

by a slowdown in pace of fall of consumer activity (still 8.1% rate from the beginni

and at the same time in currency depreciation. Pursuing strong ruble and commer

the country, the Central Bank has decreased its interest rates for 3.5% for organiz

banks, but not for the short-time individual credits. In 2010 many analysts predict

inflation rate growth slowdown as well as continuing consumer price rise.

0,00 %

5,00 %

10,00 %

15,00 %

20,00 %

25,00 %

2000 2001 2002 2003 2004 2005 2006 2007

GDP growth

Inflation

Real salary growth

3.1 Main macroeconomic facts

Figure 1. Change in GDP growth, inflation and real salary during Putin‟s presiden

(RFSSS 2010)

As Figure 1. shows president Putin‟s governance was marked with growth in Russ

especially in the later years of his rule. But the past few years have become challe

due to the global economic crisis. Since 2008 inflation rate in Russia was greatly i

global credit crunch. During the first quarter of 2009 rapid rise in consumer price

depreciation of national currency were very noticeable. Second quarter of 2009 w

by a slowdown in pace of fall of consumer activity (still 8.1% rate from the beginni

and at the same time in currency depreciation. Pursuing strong ruble and commer

the country, the Central Bank has decreased its interest rates for 3.5% for organiz

banks, but not for the short-time individual credits. In 2010 many analysts predict

inflation rate growth slowdown as well as continuing consumer price rise.

0,00 %

5,00 %

10,00 %

15,00 %

20,00 %

25,00 %

2000 2001 2002 2003 2004 2005 2006 2007

GDP growth

Inflation

Real salary growth

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 68

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.