Market Structure of Low-Cost Airlines

VerifiedAdded on 2023/03/22

|1

|792

|34

AI Summary

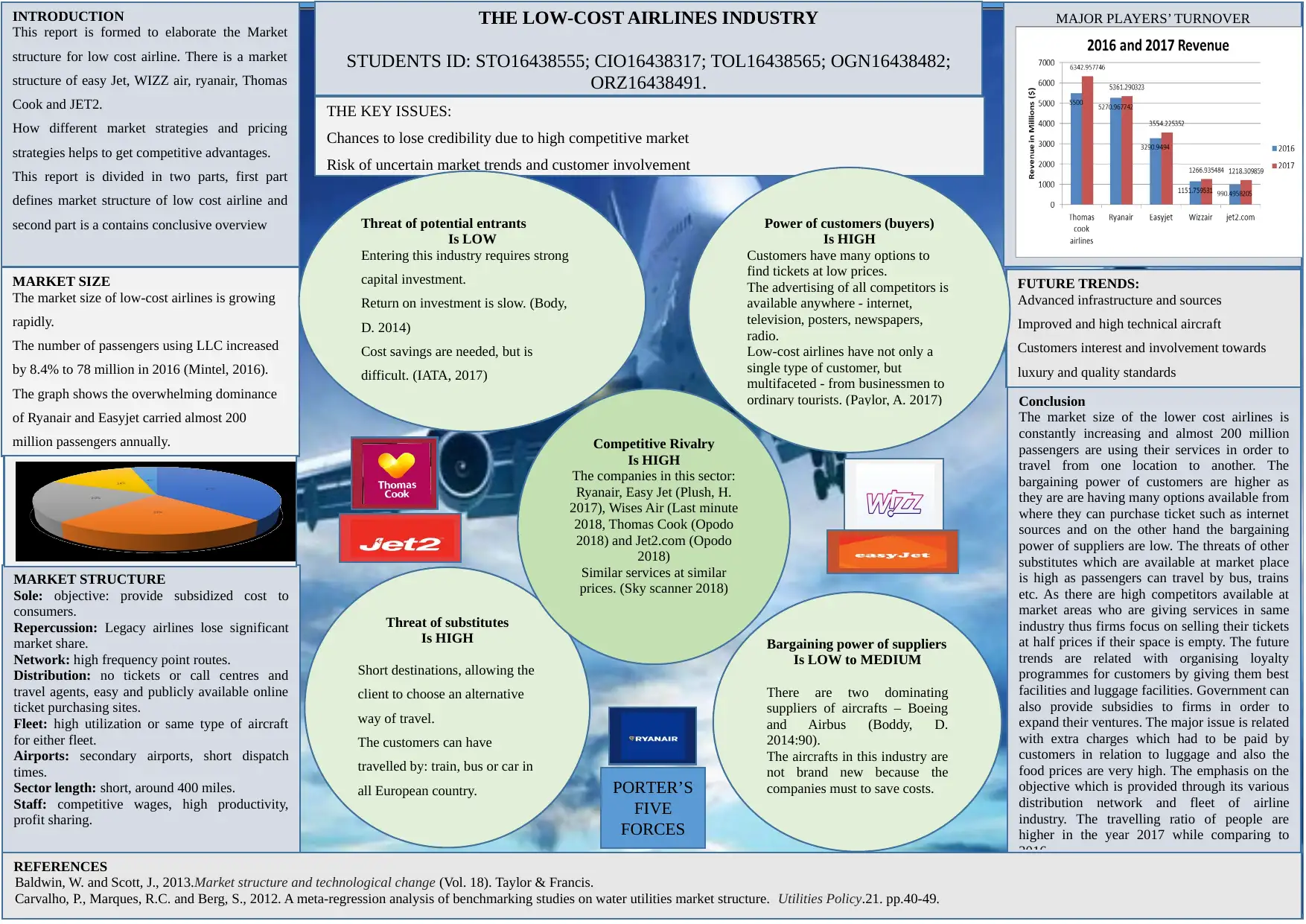

This report provides an overview of the market structure of low-cost airlines, including the major players in the industry, the market size, competitive rivalry, and future trends. It discusses the strategies and pricing strategies that help these airlines gain a competitive advantage. The report also highlights the key issues and challenges faced by low-cost airlines, such as the risk of losing credibility in a highly competitive market and the uncertainty of market trends and customer involvement. The report concludes with future trends in the industry, including advanced infrastructure, improved aircraft technology, and increased customer interest in luxury and quality standards.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 1

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)