Managerial Accounting Report: Master Budget Analysis and Comparison

VerifiedAdded on 2023/04/24

|19

|4861

|336

Report

AI Summary

This report delves into the core elements of a master budget, including cash, direct labor, direct materials, and ending finished goods budgets. It contrasts the top-down and bottom-up approaches to budgeting, highlighting their differences and suitability for various organizational structures. The report analyzes the budget for Abundant Produce, considering scenarios with sales, cost of goods sold, and expense growth. It also includes a detailed discussion about the comparison of the budgeted income statement with the actual statement. The study identifies key components of a master budget, such as the cash budget, direct labor budget, direct materials budget and the ending finished goods budget. The report provides a comparison between top-down and bottom-up approaches to the budget process. The report concludes with an opinion on the comparison of budgeted income statements and actual statements, offering insights into the financial performance of Abundant Produce.

Running head: MANAGERIAL ACCOUNTING

Managerial Accounting

Name of the Student

Name of the University

Author’s Note

Managerial Accounting

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGERIAL ACCOUNTING

Executive Summary

The discourse of the report has covered the elements in present in a master budget. It has also

included discussion about the comparison of top-down and bottom-up approach to the budget

process. In addition to this, the study covered analysis of the budget for Abundant Produce

which will be based on several types of changes in budget projections. This will begin with sales

projection with a growth of 10%. In addition to this, the cost of goods sold will be considered

with a growth of 8% and the expenses forecasted with a growth of 2%. The latter part of the

study has included a relevant projection of opinion on the comparison of Budgeted Income

Statement and actual statement. The main elements of master budget are identified with “Cash

budget”, “Direct labour budget”, “Direct materials budget” and “Ending finished goods

budget”. The top-down approach of budgeting involves setting the spending limits at high level

of aggregation like total spending for the company as a whole and each line item of the

expenses included in the accounting hierarchy. On the other hand, bottom-up method requires

individual departments and reporting units to prepare their personal is spending wish list which

is segregated as per line item of expenses. As per the computation of Budgeted income

statement of 2018 for Abundant Resource the increase in revenue, cost of goods sold and

expenses has led to increase in the net comprehensive loss for the year.

Executive Summary

The discourse of the report has covered the elements in present in a master budget. It has also

included discussion about the comparison of top-down and bottom-up approach to the budget

process. In addition to this, the study covered analysis of the budget for Abundant Produce

which will be based on several types of changes in budget projections. This will begin with sales

projection with a growth of 10%. In addition to this, the cost of goods sold will be considered

with a growth of 8% and the expenses forecasted with a growth of 2%. The latter part of the

study has included a relevant projection of opinion on the comparison of Budgeted Income

Statement and actual statement. The main elements of master budget are identified with “Cash

budget”, “Direct labour budget”, “Direct materials budget” and “Ending finished goods

budget”. The top-down approach of budgeting involves setting the spending limits at high level

of aggregation like total spending for the company as a whole and each line item of the

expenses included in the accounting hierarchy. On the other hand, bottom-up method requires

individual departments and reporting units to prepare their personal is spending wish list which

is segregated as per line item of expenses. As per the computation of Budgeted income

statement of 2018 for Abundant Resource the increase in revenue, cost of goods sold and

expenses has led to increase in the net comprehensive loss for the year.

2MANAGERIAL ACCOUNTING

Table of Contents

Introduction.........................................................................................................................3

a. Explanation of the elements in Master Budget...............................................................3

b. A discussion about the comparison of top-down and bottom-up approach to the

budget process and rational for the chosen company....................................................................7

c. Budgeted income statement 2019..................................................................................9

d. Opinion on the comparison of Budgeted Income Statement and actual statement....11

Conclusion..........................................................................................................................14

References.........................................................................................................................16

Table of Contents

Introduction.........................................................................................................................3

a. Explanation of the elements in Master Budget...............................................................3

b. A discussion about the comparison of top-down and bottom-up approach to the

budget process and rational for the chosen company....................................................................7

c. Budgeted income statement 2019..................................................................................9

d. Opinion on the comparison of Budgeted Income Statement and actual statement....11

Conclusion..........................................................................................................................14

References.........................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGERIAL ACCOUNTING

Introduction

The main aspects of the study have covered the elements in present in a master budget.

The second section has covered discussion about the comparison of top-down and bottom-up

approach to the budget process. In addition to this, the study has been also seen to include the

analysis of the budget for Abundant Produce which will be based on several types of changes in

budget projections. This will begin with sales projection with a growth of 10%. In addition to

this, the cost of goods sold will be considered with a growth of 8% and the expenses forecasted

with a growth of 2%. The latter part of the study has included a relevant projection of opinion

on the comparison of Budgeted Income Statement and actual statement (Shcherbina &

Tamulevičienė, 2016).

a. Explanation of the elements in Master Budget

Master budget is identified as the aggregation of budget produced in lower level with

consideration of different types of functional areas such as budgeted financial statement, cash

forecast and financing plan. It is a plan to manage the company’s sales and manufacturing

activities for meeting cash flow and profit goals. In order to create a master budget, there

needs to be a careful coordination of smaller budgets covering all parts of the organisation so

that the master budget is able to provide a realistic but not complacent result (Kalra et al.,

2015).

The typical elements of a master budget may be segregated into either quarterly or

monthly format which encompasses the entire fiscal year. The overall explanation of master

budget can be seen with assisting specific goals to achieve management actions and explaining

the strategic direction of the company. In addition to this, it may also include a discussion

Introduction

The main aspects of the study have covered the elements in present in a master budget.

The second section has covered discussion about the comparison of top-down and bottom-up

approach to the budget process. In addition to this, the study has been also seen to include the

analysis of the budget for Abundant Produce which will be based on several types of changes in

budget projections. This will begin with sales projection with a growth of 10%. In addition to

this, the cost of goods sold will be considered with a growth of 8% and the expenses forecasted

with a growth of 2%. The latter part of the study has included a relevant projection of opinion

on the comparison of Budgeted Income Statement and actual statement (Shcherbina &

Tamulevičienė, 2016).

a. Explanation of the elements in Master Budget

Master budget is identified as the aggregation of budget produced in lower level with

consideration of different types of functional areas such as budgeted financial statement, cash

forecast and financing plan. It is a plan to manage the company’s sales and manufacturing

activities for meeting cash flow and profit goals. In order to create a master budget, there

needs to be a careful coordination of smaller budgets covering all parts of the organisation so

that the master budget is able to provide a realistic but not complacent result (Kalra et al.,

2015).

The typical elements of a master budget may be segregated into either quarterly or

monthly format which encompasses the entire fiscal year. The overall explanation of master

budget can be seen with assisting specific goals to achieve management actions and explaining

the strategic direction of the company. In addition to this, it may also include a discussion

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGERIAL ACCOUNTING

pertaining to headcount changes which are essential to achieve a budget (Sutardja, Zhu & Cao,

2016).

It can be said that a master budget is a central tool for planning which is based on direct

the activities, judging the performance about various responsibility of a corporation. Master

budget is therefore customary for senior management in reviewing several numbers of

iterations and incorporating modifications until it is able to allocate funds for achieving the

anticipated results. The company using participatory budget to arrive at a decision may impose

significant strategies by consultation with the senior management with some input from other

employees as well (Weygandt, Kimmel & Kieso, 2015). The fundamental elements which go into

creation of a master budget are listed below as follows:

“Cash budget” “Direct labour budget” “Direct materials budget” “Ending finished goods budget” “Manufacturing overhead budget” “Production budget” “Sales budget” “Selling and administrative expense budget”

Cash budget acts as a plan for showing the expected disbursements and cash receipt

during a certain period. This includes cash inflows and cash outflows elements such as revenue

collected, loan receipts, payments and expenses paid. Cash Budget acts as an estimate of

company’s cash position in future. In general, management develops such a budget after capital

pertaining to headcount changes which are essential to achieve a budget (Sutardja, Zhu & Cao,

2016).

It can be said that a master budget is a central tool for planning which is based on direct

the activities, judging the performance about various responsibility of a corporation. Master

budget is therefore customary for senior management in reviewing several numbers of

iterations and incorporating modifications until it is able to allocate funds for achieving the

anticipated results. The company using participatory budget to arrive at a decision may impose

significant strategies by consultation with the senior management with some input from other

employees as well (Weygandt, Kimmel & Kieso, 2015). The fundamental elements which go into

creation of a master budget are listed below as follows:

“Cash budget” “Direct labour budget” “Direct materials budget” “Ending finished goods budget” “Manufacturing overhead budget” “Production budget” “Sales budget” “Selling and administrative expense budget”

Cash budget acts as a plan for showing the expected disbursements and cash receipt

during a certain period. This includes cash inflows and cash outflows elements such as revenue

collected, loan receipts, payments and expenses paid. Cash Budget acts as an estimate of

company’s cash position in future. In general, management develops such a budget after capital

5MANAGERIAL ACCOUNTING

expenditure, sales and purchases are already done. This budget helps in providing accurate

information how the cash may be affected during a particular period. For instance, such a

budget is used by the management for estimating the overall sales which can be collected

during a certain financial year (Abdullah & Djalil, 2018). Direct labour budget is essential for

computation of labour hours required to produce itemised unit in the production budget. In

various cases, this type of budget will also provide additional information on breakdown of

labour category. The direct labour budget is conducive for anticipating the number of

employees required for manufacturing a particular product. This also enables the management

in anticipation of hiring needs and other information such as scheduling over time and layoffs.

The overall information considered with the budget shows aggregate level which is typically not

used for the purpose of hiring or layoff requirements. The presentation of such an information

is done on both monthly or quarterly format (Abebe, 2018).

The ending finished goods inventory is associated with computing the cost involved in

producing the finished goods during the end of each budgeting period. However, such a budget

will also include the total unit quantity of finished goods at the end of each budgeting period.

The real source of the information can be considered with production budget. The main

purpose of such a budget can be seen with providing the estimate of inventory asset which

appears under budgeted balance sheet. This is necessary for determining the amount of cash

which is to be invested in the assets. The cost television for such budget will include direct

material, direct labour and overhead allocation. The subdivision of selling and administrative

expenses will further include budget from individual departments such as marketing, facilities,

engineering and accounting. The ending inventory also considers the carrying value which

refers to the ending value of finished goods pertaining to use of previous year’s beginning

expenditure, sales and purchases are already done. This budget helps in providing accurate

information how the cash may be affected during a particular period. For instance, such a

budget is used by the management for estimating the overall sales which can be collected

during a certain financial year (Abdullah & Djalil, 2018). Direct labour budget is essential for

computation of labour hours required to produce itemised unit in the production budget. In

various cases, this type of budget will also provide additional information on breakdown of

labour category. The direct labour budget is conducive for anticipating the number of

employees required for manufacturing a particular product. This also enables the management

in anticipation of hiring needs and other information such as scheduling over time and layoffs.

The overall information considered with the budget shows aggregate level which is typically not

used for the purpose of hiring or layoff requirements. The presentation of such an information

is done on both monthly or quarterly format (Abebe, 2018).

The ending finished goods inventory is associated with computing the cost involved in

producing the finished goods during the end of each budgeting period. However, such a budget

will also include the total unit quantity of finished goods at the end of each budgeting period.

The real source of the information can be considered with production budget. The main

purpose of such a budget can be seen with providing the estimate of inventory asset which

appears under budgeted balance sheet. This is necessary for determining the amount of cash

which is to be invested in the assets. The cost television for such budget will include direct

material, direct labour and overhead allocation. The subdivision of selling and administrative

expenses will further include budget from individual departments such as marketing, facilities,

engineering and accounting. The ending inventory also considers the carrying value which

refers to the ending value of finished goods pertaining to use of previous year’s beginning

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGERIAL ACCOUNTING

inventory for the current year. In order to arrive at the final value this budget subtracts the cost

of goods sold from the total goods which are available for sale (Bernau, Hahn & Boehler, 2018).

After finalisation of the master budget and accounting staff mentor the details into

accounting software so that it is able to issue financial reports for the purpose of comparing

actual results and budgeted data. After the creation of master budget and accounting staff may

decide to enter the results in companies accounting software so that it is able to issue financial

report for the purpose of comparing budgeted and actual anticipated results. Several smaller

organisations construct the master budget with the use of electronic spreadsheet. Despite of

this, such spreadsheet may consist of errors in formula which may be facing difficulty during

construction of a budgeted report. On the contrary, larger organisations tend to implement

budget specific software solutions which does not have any difficulty in producing budgeted

balance sheet (Arora, 2016).

It is to be understood that lower-level budgets have an appropriate format for arriving

at a certain outcome like fully absorbed cost of finished goods inventory and number of units to

be manufactured for a product. However, such ideology is not applicable in case of preparing a

master budget. In case of a master budget, the income statement and balance sheet are

prepared based on relevant accounting standard. The main difference can be identified in the

cash budget which does not necessarily appear in a standard format under statement of cash

flows. Instead of this, it is seen to be more practical for depicting the specific cash outflows and

inflows which will result from the rest of the budgeted model. Manufacturing overhead budget

includes manufacturing costs excluding direct material and direct labour. This budget provides

the necessary information on manufacturing overhead which becomes a part of cost of goods

sold in the master budget (Eisenberg, 2016). Production budget provides an estimate of the

inventory for the current year. In order to arrive at the final value this budget subtracts the cost

of goods sold from the total goods which are available for sale (Bernau, Hahn & Boehler, 2018).

After finalisation of the master budget and accounting staff mentor the details into

accounting software so that it is able to issue financial reports for the purpose of comparing

actual results and budgeted data. After the creation of master budget and accounting staff may

decide to enter the results in companies accounting software so that it is able to issue financial

report for the purpose of comparing budgeted and actual anticipated results. Several smaller

organisations construct the master budget with the use of electronic spreadsheet. Despite of

this, such spreadsheet may consist of errors in formula which may be facing difficulty during

construction of a budgeted report. On the contrary, larger organisations tend to implement

budget specific software solutions which does not have any difficulty in producing budgeted

balance sheet (Arora, 2016).

It is to be understood that lower-level budgets have an appropriate format for arriving

at a certain outcome like fully absorbed cost of finished goods inventory and number of units to

be manufactured for a product. However, such ideology is not applicable in case of preparing a

master budget. In case of a master budget, the income statement and balance sheet are

prepared based on relevant accounting standard. The main difference can be identified in the

cash budget which does not necessarily appear in a standard format under statement of cash

flows. Instead of this, it is seen to be more practical for depicting the specific cash outflows and

inflows which will result from the rest of the budgeted model. Manufacturing overhead budget

includes manufacturing costs excluding direct material and direct labour. This budget provides

the necessary information on manufacturing overhead which becomes a part of cost of goods

sold in the master budget (Eisenberg, 2016). Production budget provides an estimate of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGERIAL ACCOUNTING

number of units which must be manufactured and derived from the combination of sales

forecast including planning of finished goods inventory. The typical element of production

budget and the identified with including a push Manufacturing system as evident in material

requirements planning environment. The production budget is usually considered either

quarterly or monthly. As per the information of the sales budget it provides the management

estimate about sales for future financial period. This is used by the management to set

departmental goals and forecast production requirements (Miller-Nobles, Mattison &

Matsumura, 2016).

b. A discussion about the comparison of top-down and bottom-up approach to the budget

process and rational for the chosen company

The top-down approach of budgeting involves setting the spending limits at high level of

aggregation like total spending for the company as a whole and each line item of the expenses

included in the accounting hierarchy. On the other hand, bottom-up method requires individual

departments and reporting units to prepare their personal is spending wish list which is

segregated as per line item of expenses. In general, as per bottom-up method there will be

higher spending targets envisaged in compared to top-down approach. Therefore, top-down

approach uses reconciliation process for producing companywide information which equals the

whole (Law, 2016).

The top-down budgeting involves senior management to develop high-level budget for

the entire organisation. After the completion of such a budget, the individual amounts are

allocated to the departments which should then take those numbers and build the

corresponding budgets confined to the executive level budget creation. On the other hand, I

number of units which must be manufactured and derived from the combination of sales

forecast including planning of finished goods inventory. The typical element of production

budget and the identified with including a push Manufacturing system as evident in material

requirements planning environment. The production budget is usually considered either

quarterly or monthly. As per the information of the sales budget it provides the management

estimate about sales for future financial period. This is used by the management to set

departmental goals and forecast production requirements (Miller-Nobles, Mattison &

Matsumura, 2016).

b. A discussion about the comparison of top-down and bottom-up approach to the budget

process and rational for the chosen company

The top-down approach of budgeting involves setting the spending limits at high level of

aggregation like total spending for the company as a whole and each line item of the expenses

included in the accounting hierarchy. On the other hand, bottom-up method requires individual

departments and reporting units to prepare their personal is spending wish list which is

segregated as per line item of expenses. In general, as per bottom-up method there will be

higher spending targets envisaged in compared to top-down approach. Therefore, top-down

approach uses reconciliation process for producing companywide information which equals the

whole (Law, 2016).

The top-down budgeting involves senior management to develop high-level budget for

the entire organisation. After the completion of such a budget, the individual amounts are

allocated to the departments which should then take those numbers and build the

corresponding budgets confined to the executive level budget creation. On the other hand, I

8MANAGERIAL ACCOUNTING

bottom-up budgeting approach begins in the individual departments when the manager creates

any budget and forwards the same for approval of higher authority. This type of budget is

either revised, approved and created with various departmental creations (Weygandt Kimmel &

Kieso, 2015).

A more detailed comparison of both the budget shows that, top-down budgeting can

have a greater potential for accuracy in large aggregates. On the other hand, bottom-up

approach may consist of errors which are accumulated as roll ups resulting in larger totals. The

overall analysis of both the budgeting shows that as Abundant Produce specialises as a hybrid

plant breeder which is dedicated in translating Australia’s world-class agricultural science in a

commercially viable intellectual property. The main changes set out by the company is aimed

towards commercialisation and development of high-value food crops especially greenhouse

vegetables like cucumbers, tomatoes and selecting breeding lines which are developed by

scientists at the University of Sydney (Järvinen, 2016).

Therefore, a large aggregate of the company depends on producing accurate budget

estimate of a specific segment which is associated with agronomy. It is important that the top

management of Abundant Produce takes relevant reports on budget estimates and forecasting

from the relevant departments. Moreover, this budgeting process will be appropriate for

accounting day-to-day expenses involved in production (Ardiansyah, Pituringsih & Irwan, 2017).

As a result, a bottom-up approach will improve the budget estimates as they will be created by

the individual managers of these department and forwarded for approval of higher

management. This will also lead to increased ownership and result in more information as the

employees are familiar with individual departments creating the budget. Some of the other

benefits for proceeding with bottom-up approach in case of Abundant Produce can be directly

bottom-up budgeting approach begins in the individual departments when the manager creates

any budget and forwards the same for approval of higher authority. This type of budget is

either revised, approved and created with various departmental creations (Weygandt Kimmel &

Kieso, 2015).

A more detailed comparison of both the budget shows that, top-down budgeting can

have a greater potential for accuracy in large aggregates. On the other hand, bottom-up

approach may consist of errors which are accumulated as roll ups resulting in larger totals. The

overall analysis of both the budgeting shows that as Abundant Produce specialises as a hybrid

plant breeder which is dedicated in translating Australia’s world-class agricultural science in a

commercially viable intellectual property. The main changes set out by the company is aimed

towards commercialisation and development of high-value food crops especially greenhouse

vegetables like cucumbers, tomatoes and selecting breeding lines which are developed by

scientists at the University of Sydney (Järvinen, 2016).

Therefore, a large aggregate of the company depends on producing accurate budget

estimate of a specific segment which is associated with agronomy. It is important that the top

management of Abundant Produce takes relevant reports on budget estimates and forecasting

from the relevant departments. Moreover, this budgeting process will be appropriate for

accounting day-to-day expenses involved in production (Ardiansyah, Pituringsih & Irwan, 2017).

As a result, a bottom-up approach will improve the budget estimates as they will be created by

the individual managers of these department and forwarded for approval of higher

management. This will also lead to increased ownership and result in more information as the

employees are familiar with individual departments creating the budget. Some of the other

benefits for proceeding with bottom-up approach in case of Abundant Produce can be directly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGERIAL ACCOUNTING

associated to increased, negation, understanding and commitment levels on behalf of the

manager (Abdullah & Djalil, 2018).

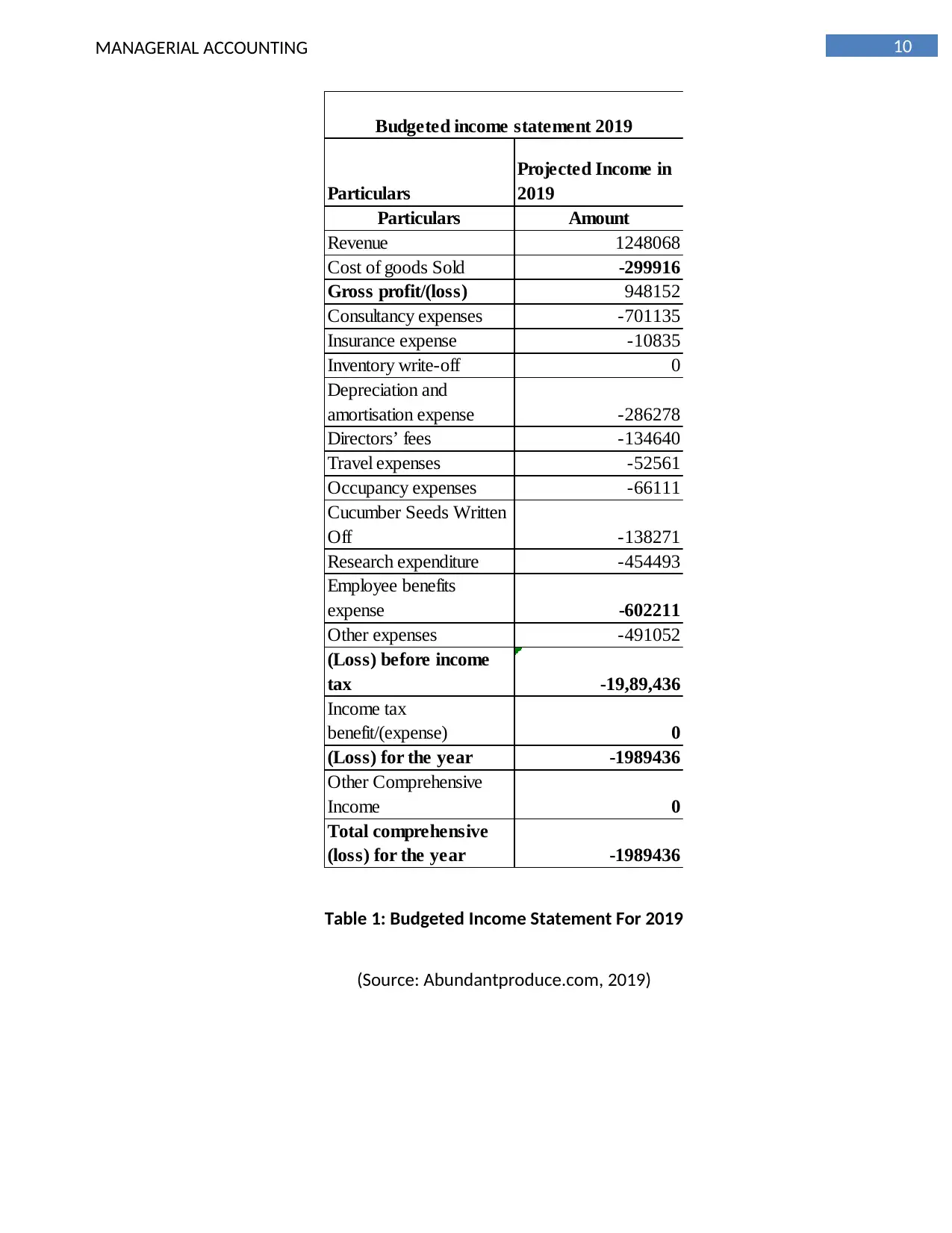

c. Budgeted income statement 2019

The budgeted income statement has considered significant changes pertaining to

revenue and cost of goods sold. In addition to this, it is also prepared with necessary changes

under the expenses section. The changes made in the revenue has been identified with the

projected change of 10% on the actual income in 2018. Similarly, the cost of goods sold is

depicted with 8% increase in compared to the income of 2018 (Harvey, 2015). The computation

of gross profit in the budgeted income statement of the 2018 have shown that there is an

increase in total Gross profit from AUD 8,56,907 in 2018 to AUD 9,48,152 in 2019. Some of the

additional changes in the projected budget in terms of expenses can be identified with a 2%

increase in expenses. This includes expenses such as “Consultancy expenses”, “Insurance

expense”, “Inventory write-off”, “Depreciation and amortisation expense”, “Directors’ fees”,

“Travel expenses”, “Occupancy expenses”, “Research expenditure”, “Share based payment

expense” and “Other expenses”. Despite of increase in the overall category of expenses, the

loss before income tax for the company has decreased as a result of increasing sales. This is

evident with a decrease in loss before income tax from AUD -20,23,081 in 2018 to AUD -

19,89,436. Similarly, the income tax benefit expense has also increased by 2%. This has

decreased loss after income tax as well as total comprehensive loss for the year. Therefore, as

per to table can be clearly inferred that after application of the changes pertaining to budgeting

there has been a significant improvement in gross profit. However, in terms of loss before

income tax and total comprehensive loss for the year the company needs to show

improvement (Shcherbina & Tamulevičienė, 2016).

associated to increased, negation, understanding and commitment levels on behalf of the

manager (Abdullah & Djalil, 2018).

c. Budgeted income statement 2019

The budgeted income statement has considered significant changes pertaining to

revenue and cost of goods sold. In addition to this, it is also prepared with necessary changes

under the expenses section. The changes made in the revenue has been identified with the

projected change of 10% on the actual income in 2018. Similarly, the cost of goods sold is

depicted with 8% increase in compared to the income of 2018 (Harvey, 2015). The computation

of gross profit in the budgeted income statement of the 2018 have shown that there is an

increase in total Gross profit from AUD 8,56,907 in 2018 to AUD 9,48,152 in 2019. Some of the

additional changes in the projected budget in terms of expenses can be identified with a 2%

increase in expenses. This includes expenses such as “Consultancy expenses”, “Insurance

expense”, “Inventory write-off”, “Depreciation and amortisation expense”, “Directors’ fees”,

“Travel expenses”, “Occupancy expenses”, “Research expenditure”, “Share based payment

expense” and “Other expenses”. Despite of increase in the overall category of expenses, the

loss before income tax for the company has decreased as a result of increasing sales. This is

evident with a decrease in loss before income tax from AUD -20,23,081 in 2018 to AUD -

19,89,436. Similarly, the income tax benefit expense has also increased by 2%. This has

decreased loss after income tax as well as total comprehensive loss for the year. Therefore, as

per to table can be clearly inferred that after application of the changes pertaining to budgeting

there has been a significant improvement in gross profit. However, in terms of loss before

income tax and total comprehensive loss for the year the company needs to show

improvement (Shcherbina & Tamulevičienė, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGERIAL ACCOUNTING

Particulars

Projected Income in

2019

Particulars Amount

Revenue 1248068

Cost of goods Sold -299916

Gross profit/(loss) 948152

Consultancy expenses -701135

Insurance expense -10835

Inventory write-off 0

Depreciation and

amortisation expense -286278

Directors’ fees -134640

Travel expenses -52561

Occupancy expenses -66111

Cucumber Seeds Written

Off -138271

Research expenditure -454493

Employee benefits

expense -602211

Other expenses -491052

(Loss) before income

tax -19,89,436

Income tax

benefit/(expense) 0

(Loss) for the year -1989436

Other Comprehensive

Income 0

Total comprehensive

(loss) for the year -1989436

Budgeted income statement 2019

Table 1: Budgeted Income Statement For 2019

(Source: Abundantproduce.com, 2019)

Particulars

Projected Income in

2019

Particulars Amount

Revenue 1248068

Cost of goods Sold -299916

Gross profit/(loss) 948152

Consultancy expenses -701135

Insurance expense -10835

Inventory write-off 0

Depreciation and

amortisation expense -286278

Directors’ fees -134640

Travel expenses -52561

Occupancy expenses -66111

Cucumber Seeds Written

Off -138271

Research expenditure -454493

Employee benefits

expense -602211

Other expenses -491052

(Loss) before income

tax -19,89,436

Income tax

benefit/(expense) 0

(Loss) for the year -1989436

Other Comprehensive

Income 0

Total comprehensive

(loss) for the year -1989436

Budgeted income statement 2019

Table 1: Budgeted Income Statement For 2019

(Source: Abundantproduce.com, 2019)

11MANAGERIAL ACCOUNTING

d. Opinion on the comparison of Budgeted Income Statement and actual statement

The figure showing comparative budgeted income statement of the projected changes

in 2019 and actual income in 2018 have shown significant differences pertaining to revenue,

expenses and cost of goods sold. As per the information given in table 2 it can be inferred that

the computation of gross profit in the budgeted income statement of the 2019 have shown that

there is an increase in total Gross profit from $ 8,56,907 in 2018 to 9,48,152 in 2019. Moreover,

change pertaining to cost of goods sold shows that there has been a significant increase in cost

of goods sold from actual income statement to the projected income statement of 2018. The

increase in the cost of goods sold is evident with AUD -2,77,700 in 2018 to AUD -299916 in

2019. Moreover, as there has been a decrease in the overall category of expenses the loss

before income tax for the company has also increased. This is evident with a decrease in loss

before income tax from AUD -20,23,081 in 2018 to AUD -19,89,436 in 2019 (Jaafar, Bakar &

Awaluddin, 2015).

The change in budgeting can be resulted from a number of factors which includes price

of the product and changes in income pattern consumer. As per the comparison of actual

income statement and budgeted income statement it can be clearly seen that the company has

struggled to make any profitable progress over the last few years. Due to this, there is a

possibility that in case the overall sales are increased their can be a significant change brought

in increasing the overall comprehensive income for the year (Marcu et al., 2016). However, it is

also important to consider the proportion by which such a change has been brought. In the

given case the increase in revenue by 10% and increasing cost of goods sold by 8% we were not

sufficient to compensate the expenses incurred by the company in 2018. Therefore, despite of

increasing gross profit, the expenses incurred by the company has not been effective to on a

d. Opinion on the comparison of Budgeted Income Statement and actual statement

The figure showing comparative budgeted income statement of the projected changes

in 2019 and actual income in 2018 have shown significant differences pertaining to revenue,

expenses and cost of goods sold. As per the information given in table 2 it can be inferred that

the computation of gross profit in the budgeted income statement of the 2019 have shown that

there is an increase in total Gross profit from $ 8,56,907 in 2018 to 9,48,152 in 2019. Moreover,

change pertaining to cost of goods sold shows that there has been a significant increase in cost

of goods sold from actual income statement to the projected income statement of 2018. The

increase in the cost of goods sold is evident with AUD -2,77,700 in 2018 to AUD -299916 in

2019. Moreover, as there has been a decrease in the overall category of expenses the loss

before income tax for the company has also increased. This is evident with a decrease in loss

before income tax from AUD -20,23,081 in 2018 to AUD -19,89,436 in 2019 (Jaafar, Bakar &

Awaluddin, 2015).

The change in budgeting can be resulted from a number of factors which includes price

of the product and changes in income pattern consumer. As per the comparison of actual

income statement and budgeted income statement it can be clearly seen that the company has

struggled to make any profitable progress over the last few years. Due to this, there is a

possibility that in case the overall sales are increased their can be a significant change brought

in increasing the overall comprehensive income for the year (Marcu et al., 2016). However, it is

also important to consider the proportion by which such a change has been brought. In the

given case the increase in revenue by 10% and increasing cost of goods sold by 8% we were not

sufficient to compensate the expenses incurred by the company in 2018. Therefore, despite of

increasing gross profit, the expenses incurred by the company has not been effective to on a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.