Analyzing Risk in Audit of Financial Reports: JB HI FI Limited

VerifiedAdded on 2023/03/23

|10

|3232

|65

AI Summary

This assignment aims to understand a company and analytically analyse the risk involved in the audit of such financial reports, it contain a detailed explanation on the analysis of the analytical procedures performed on the company

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Master of Professional AccountingUnit code: ma611

Auditing

Auditing

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

Introduction...........................................................................................................................................3

Analytical procedures............................................................................................................................3

Inherent Risk at financial report level....................................................................................................4

Risk of material misstatement at the assertion level.............................................................................5

Conclusion.............................................................................................................................................7

References.............................................................................................................................................8

Introduction...........................................................................................................................................3

Analytical procedures............................................................................................................................3

Inherent Risk at financial report level....................................................................................................4

Risk of material misstatement at the assertion level.............................................................................5

Conclusion.............................................................................................................................................7

References.............................................................................................................................................8

Executive Summary

This assignment aims to understand a company and analytically analyse the risk involved in the audit

of such financial reports, it contain a detailed explanation on the analysis of the analytical

procedures performed on the company,

The inherent risk is estimated / assessed at both the financial reporting level where the control risk

and detection risk of material misstatements are identified and understood,

The risk involved at the level of assertions is made in a given format according to the nature of such

risk at such levels including a brief review of such assertions that can be taken while performing the

audit of such company.

Audit risk based on the risk of material misstatements due to the limitations of conducting an audit

is made in accordance with the available information of the company.

Three key account balances that could affect the risk of assertions are taken into consideration by

analysing the information present in the annual report of the company and steps to reduce such risk

through internal controls is provided to enhance the quality of audit.

The points considered in the assignment are based on the articles and annual report that are

published by the company in the website of the company JB HIFI LIMITED.

This assignment aims to understand a company and analytically analyse the risk involved in the audit

of such financial reports, it contain a detailed explanation on the analysis of the analytical

procedures performed on the company,

The inherent risk is estimated / assessed at both the financial reporting level where the control risk

and detection risk of material misstatements are identified and understood,

The risk involved at the level of assertions is made in a given format according to the nature of such

risk at such levels including a brief review of such assertions that can be taken while performing the

audit of such company.

Audit risk based on the risk of material misstatements due to the limitations of conducting an audit

is made in accordance with the available information of the company.

Three key account balances that could affect the risk of assertions are taken into consideration by

analysing the information present in the annual report of the company and steps to reduce such risk

through internal controls is provided to enhance the quality of audit.

The points considered in the assignment are based on the articles and annual report that are

published by the company in the website of the company JB HIFI LIMITED.

Introduction

The company on which the analysis has to be conducted is JB HI FI Limited. It has been listed on ASX

since October 2003. The company is one of the fastest growing consumer based retailer in Australia

as well as New Zealand. The company has more than 300 stores and is in the growing spree. The

company has been ranked 7th in terms of consumer electronics and home appliances retailer in the

world. Over the last couple of years, the company has been focusing on expansion and growth of

revenue as well as profitability and in a bid to do so, the company has made a number of

acquisitions namely Clive Anthony, Hill and Stewart chain and The Good Guys. The most successful

and the biggest acquisition was of The Good Guys in October 2016 which has led to tremendous

growth in its revenue in the last 2 years (Alieid, 2016).

Analytical procedures

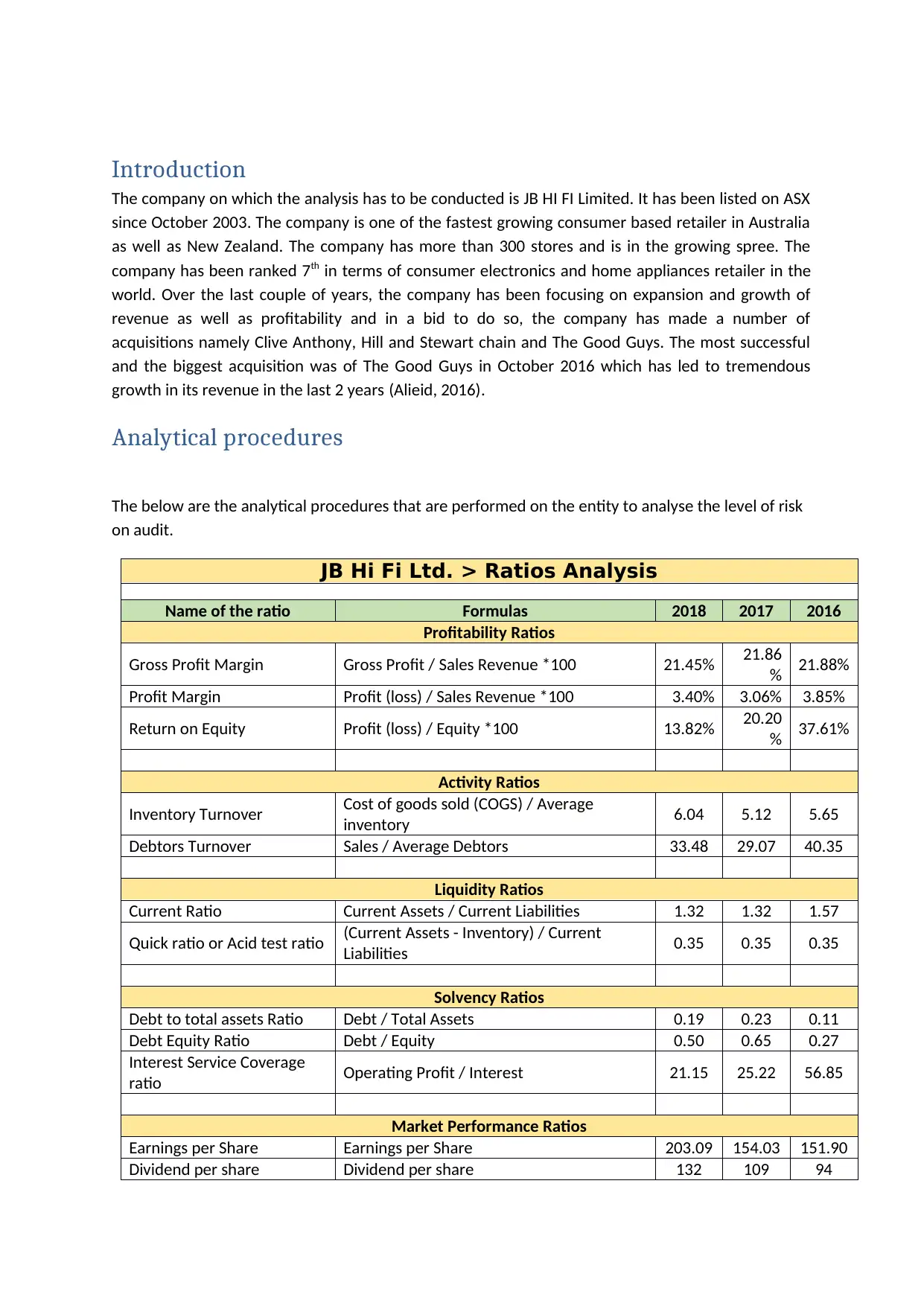

The below are the analytical procedures that are performed on the entity to analyse the level of risk

on audit.

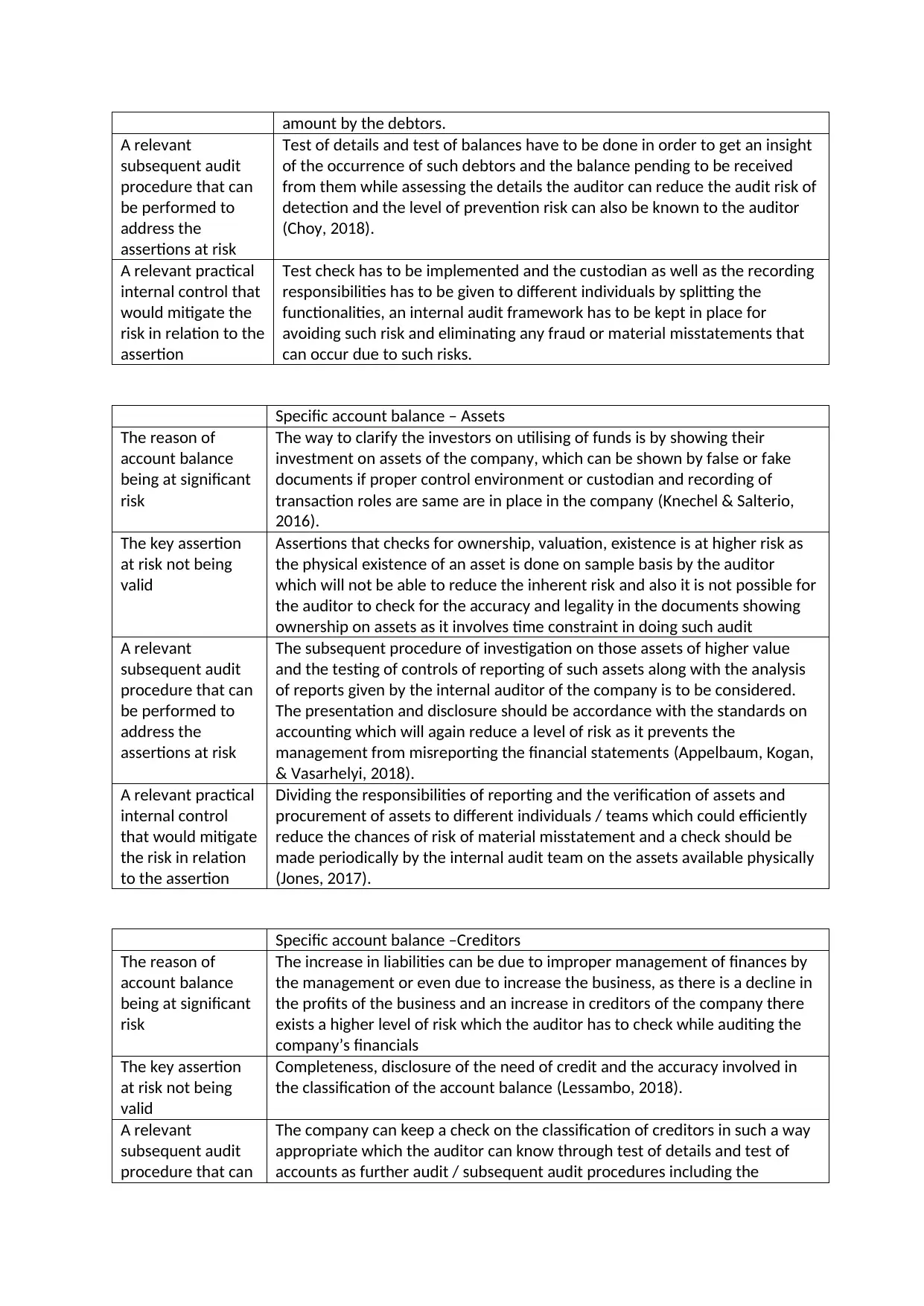

JB Hi Fi Ltd. > Ratios Analysis

Name of the ratio Formulas 2018 2017 2016

Profitability Ratios

Gross Profit Margin Gross Profit / Sales Revenue *100 21.45% 21.86

% 21.88%

Profit Margin Profit (loss) / Sales Revenue *100 3.40% 3.06% 3.85%

Return on Equity Profit (loss) / Equity *100 13.82% 20.20

% 37.61%

Activity Ratios

Inventory Turnover Cost of goods sold (COGS) / Average

inventory 6.04 5.12 5.65

Debtors Turnover Sales / Average Debtors 33.48 29.07 40.35

Liquidity Ratios

Current Ratio Current Assets / Current Liabilities 1.32 1.32 1.57

Quick ratio or Acid test ratio (Current Assets - Inventory) / Current

Liabilities 0.35 0.35 0.35

Solvency Ratios

Debt to total assets Ratio Debt / Total Assets 0.19 0.23 0.11

Debt Equity Ratio Debt / Equity 0.50 0.65 0.27

Interest Service Coverage

ratio Operating Profit / Interest 21.15 25.22 56.85

Market Performance Ratios

Earnings per Share Earnings per Share 203.09 154.03 151.90

Dividend per share Dividend per share 132 109 94

The company on which the analysis has to be conducted is JB HI FI Limited. It has been listed on ASX

since October 2003. The company is one of the fastest growing consumer based retailer in Australia

as well as New Zealand. The company has more than 300 stores and is in the growing spree. The

company has been ranked 7th in terms of consumer electronics and home appliances retailer in the

world. Over the last couple of years, the company has been focusing on expansion and growth of

revenue as well as profitability and in a bid to do so, the company has made a number of

acquisitions namely Clive Anthony, Hill and Stewart chain and The Good Guys. The most successful

and the biggest acquisition was of The Good Guys in October 2016 which has led to tremendous

growth in its revenue in the last 2 years (Alieid, 2016).

Analytical procedures

The below are the analytical procedures that are performed on the entity to analyse the level of risk

on audit.

JB Hi Fi Ltd. > Ratios Analysis

Name of the ratio Formulas 2018 2017 2016

Profitability Ratios

Gross Profit Margin Gross Profit / Sales Revenue *100 21.45% 21.86

% 21.88%

Profit Margin Profit (loss) / Sales Revenue *100 3.40% 3.06% 3.85%

Return on Equity Profit (loss) / Equity *100 13.82% 20.20

% 37.61%

Activity Ratios

Inventory Turnover Cost of goods sold (COGS) / Average

inventory 6.04 5.12 5.65

Debtors Turnover Sales / Average Debtors 33.48 29.07 40.35

Liquidity Ratios

Current Ratio Current Assets / Current Liabilities 1.32 1.32 1.57

Quick ratio or Acid test ratio (Current Assets - Inventory) / Current

Liabilities 0.35 0.35 0.35

Solvency Ratios

Debt to total assets Ratio Debt / Total Assets 0.19 0.23 0.11

Debt Equity Ratio Debt / Equity 0.50 0.65 0.27

Interest Service Coverage

ratio Operating Profit / Interest 21.15 25.22 56.85

Market Performance Ratios

Earnings per Share Earnings per Share 203.09 154.03 151.90

Dividend per share Dividend per share 132 109 94

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

In this table consisting of analytical data, we can see that there is an increase in the value of

shareholders and an increasing trend in the dividend payment to each shareholder is in positive

trend that can state that the company is in growing trend, which reduces the risk of sustainability in

future.

Based on profitability ratios, there is a subsequent reduction in the return generated for the equity

capital, this may be due to a reduction in gross profits and profit margin, the auditor has to check on

the risk of understanding the revenue and the leakage of funds if any by the management as there is

no much difference with the percentage of decrease In both the gross profit margin and the profit

margin when we compare it with that of the return the company is giving to the equity shareholders

(Boccia & Leonardi, 2016).

Based on the liquidity ratios, there is clearly a reduced level of risk in control of working capital

management and budgetary allocation by the management of the company as there is no declining

trend nor an increasing trend, the auditor has an increased risk of material misstatement of current

assets and current liabilities assertions in valuations as there are chances of window dressing by the

management for better ratio as the returns are in a declining trend (Fukukawa & Mock, 2011).

On analysing the solvency ratios, the debt over equity is growing and there are chances of a risk of

financial pressure on the company due to debt and the increase in dividend paid to the equity shares

when analysed to the debt to equity ratio, there are chances of mismanagement of financial

resources that has to be audited (Visinescu, Jones, & Sidorova, 2017).

Checking the activity ratio there is an increase in the debtor turnover ratio more than that of the

increase in the utilisation of the inventories which can also be a case of reduction in potential of

earning revenue which is tried to be boosted by credit sales, the auditor has to check for the

reporting of such activities while ensuring the adequacy of internal controls involved in the

production process including the sale of such resources.

While comparing the financial information for previous three periods the trend of increase or

decrease is changing and not constant where the change in debt to equity ratio from increasing

trend between 2016 to 2017 and then a declining trend between 2017 and 2018, similarly the

inventory turnover ratio was in a declining trend between 2016 and 2017 which is not same in case

of 2017 to 2018 (Goldmann, 2016).

An overall analysis shows that there exists significant problems in the financial figures of the

company that has to be taken into consideration by the auditor while auditing the statements of

accounts as this could be a form of window dressing or a deviation in standards on accounting.

Inherent Risk at financial report level

a. The risk involved in the audit, which is inherent while preparing the financial reports are

those that involve the judgements and assumptions formed by the management including

such disclosures which are made while preparing the financial reports, the risk of detection

of any fraud or misstatement is higher in a company where corporate governance is not

shareholders and an increasing trend in the dividend payment to each shareholder is in positive

trend that can state that the company is in growing trend, which reduces the risk of sustainability in

future.

Based on profitability ratios, there is a subsequent reduction in the return generated for the equity

capital, this may be due to a reduction in gross profits and profit margin, the auditor has to check on

the risk of understanding the revenue and the leakage of funds if any by the management as there is

no much difference with the percentage of decrease In both the gross profit margin and the profit

margin when we compare it with that of the return the company is giving to the equity shareholders

(Boccia & Leonardi, 2016).

Based on the liquidity ratios, there is clearly a reduced level of risk in control of working capital

management and budgetary allocation by the management of the company as there is no declining

trend nor an increasing trend, the auditor has an increased risk of material misstatement of current

assets and current liabilities assertions in valuations as there are chances of window dressing by the

management for better ratio as the returns are in a declining trend (Fukukawa & Mock, 2011).

On analysing the solvency ratios, the debt over equity is growing and there are chances of a risk of

financial pressure on the company due to debt and the increase in dividend paid to the equity shares

when analysed to the debt to equity ratio, there are chances of mismanagement of financial

resources that has to be audited (Visinescu, Jones, & Sidorova, 2017).

Checking the activity ratio there is an increase in the debtor turnover ratio more than that of the

increase in the utilisation of the inventories which can also be a case of reduction in potential of

earning revenue which is tried to be boosted by credit sales, the auditor has to check for the

reporting of such activities while ensuring the adequacy of internal controls involved in the

production process including the sale of such resources.

While comparing the financial information for previous three periods the trend of increase or

decrease is changing and not constant where the change in debt to equity ratio from increasing

trend between 2016 to 2017 and then a declining trend between 2017 and 2018, similarly the

inventory turnover ratio was in a declining trend between 2016 and 2017 which is not same in case

of 2017 to 2018 (Goldmann, 2016).

An overall analysis shows that there exists significant problems in the financial figures of the

company that has to be taken into consideration by the auditor while auditing the statements of

accounts as this could be a form of window dressing or a deviation in standards on accounting.

Inherent Risk at financial report level

a. The risk involved in the audit, which is inherent while preparing the financial reports are

those that involve the judgements and assumptions formed by the management including

such disclosures which are made while preparing the financial reports, the risk of detection

of any fraud or misstatement is higher in a company where corporate governance is not

effective or in a company where the management is not effective in keeping a controlled

reporting environment (Gay & Simnett, 2015).

b. In this company, based on the annual reports there are key committees taking care of the

reporting requirement and there is a corporate governance intact with the regulations that

suggest the chance / risk of material misstatements are lower and the detection as well as

control risk that is inherent while conducting audit is comparatively reduced for conducting

of audit on the financial statements of the company.

c. The company is involved in the business of sale of consumer goods which in itself has an

inherent risk of leakage of funds and misreporting in the financials, the revenue recorded

should be automated and a clear audit trail should be present which can be checked through

test check basis (Jones, 2017).

d. By analysing the business environment of the company it can be seen that the company

deals with the industry of entertainment where investors are curious about the profits

gained from the company being in an industry of growing nature, there are chances of

company misstating facts due to non-availability of direct relationship with the revenue and

the work performed (Glaum & Klocker, 2011).

In the annual report, we can see that the retained earnings are in growing trend, which the

auditor has to consider while giving his audit opinion as this could be based on the strategic

decision of the management or to show a higher profit (Linden & Freeman, 2017).

e. The risk of prevention could be higher in the field of consumer goods as the external

confirmations could be hard to take being the customer base is wide and the auditor cannot

check for his work reconciliation with that of an intermediary, which can happen in case of

companies providing goods and services to the intermediaries (Cundill, Smart, & Wilson,

2017).

Based on the analysis of financials of the company in its annual report the above

identifications were made, these were based on the retained earnings that are increased,

board report telling about the corporate governance in the company and the independent

auditor’s report that mentioned the compliance of reporting by the company is in

accordance with the applicable accounting standards and there are no such significant audit

findings, also the cash flow statement is considered to check for any leakage of funds which

could increase the inherent risk during audit of the company.

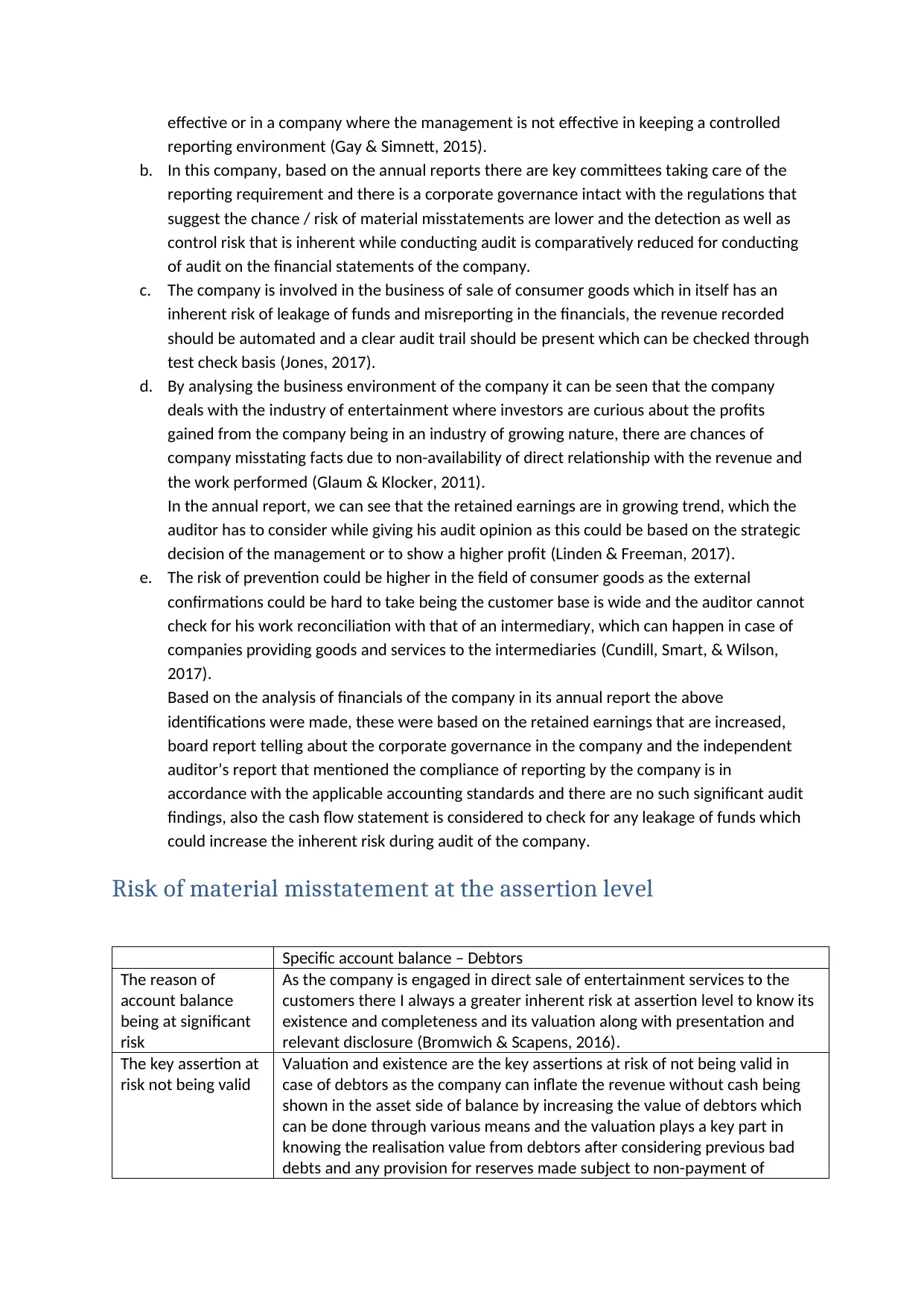

Risk of material misstatement at the assertion level

Specific account balance – Debtors

The reason of

account balance

being at significant

risk

As the company is engaged in direct sale of entertainment services to the

customers there I always a greater inherent risk at assertion level to know its

existence and completeness and its valuation along with presentation and

relevant disclosure (Bromwich & Scapens, 2016).

The key assertion at

risk not being valid

Valuation and existence are the key assertions at risk of not being valid in

case of debtors as the company can inflate the revenue without cash being

shown in the asset side of balance by increasing the value of debtors which

can be done through various means and the valuation plays a key part in

knowing the realisation value from debtors after considering previous bad

debts and any provision for reserves made subject to non-payment of

reporting environment (Gay & Simnett, 2015).

b. In this company, based on the annual reports there are key committees taking care of the

reporting requirement and there is a corporate governance intact with the regulations that

suggest the chance / risk of material misstatements are lower and the detection as well as

control risk that is inherent while conducting audit is comparatively reduced for conducting

of audit on the financial statements of the company.

c. The company is involved in the business of sale of consumer goods which in itself has an

inherent risk of leakage of funds and misreporting in the financials, the revenue recorded

should be automated and a clear audit trail should be present which can be checked through

test check basis (Jones, 2017).

d. By analysing the business environment of the company it can be seen that the company

deals with the industry of entertainment where investors are curious about the profits

gained from the company being in an industry of growing nature, there are chances of

company misstating facts due to non-availability of direct relationship with the revenue and

the work performed (Glaum & Klocker, 2011).

In the annual report, we can see that the retained earnings are in growing trend, which the

auditor has to consider while giving his audit opinion as this could be based on the strategic

decision of the management or to show a higher profit (Linden & Freeman, 2017).

e. The risk of prevention could be higher in the field of consumer goods as the external

confirmations could be hard to take being the customer base is wide and the auditor cannot

check for his work reconciliation with that of an intermediary, which can happen in case of

companies providing goods and services to the intermediaries (Cundill, Smart, & Wilson,

2017).

Based on the analysis of financials of the company in its annual report the above

identifications were made, these were based on the retained earnings that are increased,

board report telling about the corporate governance in the company and the independent

auditor’s report that mentioned the compliance of reporting by the company is in

accordance with the applicable accounting standards and there are no such significant audit

findings, also the cash flow statement is considered to check for any leakage of funds which

could increase the inherent risk during audit of the company.

Risk of material misstatement at the assertion level

Specific account balance – Debtors

The reason of

account balance

being at significant

risk

As the company is engaged in direct sale of entertainment services to the

customers there I always a greater inherent risk at assertion level to know its

existence and completeness and its valuation along with presentation and

relevant disclosure (Bromwich & Scapens, 2016).

The key assertion at

risk not being valid

Valuation and existence are the key assertions at risk of not being valid in

case of debtors as the company can inflate the revenue without cash being

shown in the asset side of balance by increasing the value of debtors which

can be done through various means and the valuation plays a key part in

knowing the realisation value from debtors after considering previous bad

debts and any provision for reserves made subject to non-payment of

amount by the debtors.

A relevant

subsequent audit

procedure that can

be performed to

address the

assertions at risk

Test of details and test of balances have to be done in order to get an insight

of the occurrence of such debtors and the balance pending to be received

from them while assessing the details the auditor can reduce the audit risk of

detection and the level of prevention risk can also be known to the auditor

(Choy, 2018).

A relevant practical

internal control that

would mitigate the

risk in relation to the

assertion

Test check has to be implemented and the custodian as well as the recording

responsibilities has to be given to different individuals by splitting the

functionalities, an internal audit framework has to be kept in place for

avoiding such risk and eliminating any fraud or material misstatements that

can occur due to such risks.

Specific account balance – Assets

The reason of

account balance

being at significant

risk

The way to clarify the investors on utilising of funds is by showing their

investment on assets of the company, which can be shown by false or fake

documents if proper control environment or custodian and recording of

transaction roles are same are in place in the company (Knechel & Salterio,

2016).

The key assertion

at risk not being

valid

Assertions that checks for ownership, valuation, existence is at higher risk as

the physical existence of an asset is done on sample basis by the auditor

which will not be able to reduce the inherent risk and also it is not possible for

the auditor to check for the accuracy and legality in the documents showing

ownership on assets as it involves time constraint in doing such audit

A relevant

subsequent audit

procedure that can

be performed to

address the

assertions at risk

The subsequent procedure of investigation on those assets of higher value

and the testing of controls of reporting of such assets along with the analysis

of reports given by the internal auditor of the company is to be considered.

The presentation and disclosure should be accordance with the standards on

accounting which will again reduce a level of risk as it prevents the

management from misreporting the financial statements (Appelbaum, Kogan,

& Vasarhelyi, 2018).

A relevant practical

internal control

that would mitigate

the risk in relation

to the assertion

Dividing the responsibilities of reporting and the verification of assets and

procurement of assets to different individuals / teams which could efficiently

reduce the chances of risk of material misstatement and a check should be

made periodically by the internal audit team on the assets available physically

(Jones, 2017).

Specific account balance –Creditors

The reason of

account balance

being at significant

risk

The increase in liabilities can be due to improper management of finances by

the management or even due to increase the business, as there is a decline in

the profits of the business and an increase in creditors of the company there

exists a higher level of risk which the auditor has to check while auditing the

company’s financials

The key assertion

at risk not being

valid

Completeness, disclosure of the need of credit and the accuracy involved in

the classification of the account balance (Lessambo, 2018).

A relevant

subsequent audit

procedure that can

The company can keep a check on the classification of creditors in such a way

appropriate which the auditor can know through test of details and test of

accounts as further audit / subsequent audit procedures including the

A relevant

subsequent audit

procedure that can

be performed to

address the

assertions at risk

Test of details and test of balances have to be done in order to get an insight

of the occurrence of such debtors and the balance pending to be received

from them while assessing the details the auditor can reduce the audit risk of

detection and the level of prevention risk can also be known to the auditor

(Choy, 2018).

A relevant practical

internal control that

would mitigate the

risk in relation to the

assertion

Test check has to be implemented and the custodian as well as the recording

responsibilities has to be given to different individuals by splitting the

functionalities, an internal audit framework has to be kept in place for

avoiding such risk and eliminating any fraud or material misstatements that

can occur due to such risks.

Specific account balance – Assets

The reason of

account balance

being at significant

risk

The way to clarify the investors on utilising of funds is by showing their

investment on assets of the company, which can be shown by false or fake

documents if proper control environment or custodian and recording of

transaction roles are same are in place in the company (Knechel & Salterio,

2016).

The key assertion

at risk not being

valid

Assertions that checks for ownership, valuation, existence is at higher risk as

the physical existence of an asset is done on sample basis by the auditor

which will not be able to reduce the inherent risk and also it is not possible for

the auditor to check for the accuracy and legality in the documents showing

ownership on assets as it involves time constraint in doing such audit

A relevant

subsequent audit

procedure that can

be performed to

address the

assertions at risk

The subsequent procedure of investigation on those assets of higher value

and the testing of controls of reporting of such assets along with the analysis

of reports given by the internal auditor of the company is to be considered.

The presentation and disclosure should be accordance with the standards on

accounting which will again reduce a level of risk as it prevents the

management from misreporting the financial statements (Appelbaum, Kogan,

& Vasarhelyi, 2018).

A relevant practical

internal control

that would mitigate

the risk in relation

to the assertion

Dividing the responsibilities of reporting and the verification of assets and

procurement of assets to different individuals / teams which could efficiently

reduce the chances of risk of material misstatement and a check should be

made periodically by the internal audit team on the assets available physically

(Jones, 2017).

Specific account balance –Creditors

The reason of

account balance

being at significant

risk

The increase in liabilities can be due to improper management of finances by

the management or even due to increase the business, as there is a decline in

the profits of the business and an increase in creditors of the company there

exists a higher level of risk which the auditor has to check while auditing the

company’s financials

The key assertion

at risk not being

valid

Completeness, disclosure of the need of credit and the accuracy involved in

the classification of the account balance (Lessambo, 2018).

A relevant

subsequent audit

procedure that can

The company can keep a check on the classification of creditors in such a way

appropriate which the auditor can know through test of details and test of

accounts as further audit / subsequent audit procedures including the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

be performed to

address the

assertions at risk

requirement of taking external confirmation from creditors based on sampling

which the accuracy or the completeness in recording such transaction can be

known to the auditor (Alexander, 2016).

A relevant practical

internal control

that would mitigate

the risk in relation

to the assertion

Internal control in recording the credit transaction where the actual usage of

such amount / asset is in accordance to the regulations and the company’s

policies, as usual a test check based system has to be implemented where the

performance of an employee can be known through another employee and

vice versa which can improve the performance of the employee as well as

reduce the risk of material misstatement (Sithole, Chandler, Abeysekera, &

Paas, 2017).

Conclusion

From the above discussion and analytical review, it can be clearly seen that even though the

company is growing at a rapid pace, there are few accounting and management issues. Some of the

risks inherent in the company have been highlighted along with the reason for considering that

account, the key assertion and the audit procedure to be undertaken in that regard. The inherent

risk at the financial report level has also been shown in the report above.

address the

assertions at risk

requirement of taking external confirmation from creditors based on sampling

which the accuracy or the completeness in recording such transaction can be

known to the auditor (Alexander, 2016).

A relevant practical

internal control

that would mitigate

the risk in relation

to the assertion

Internal control in recording the credit transaction where the actual usage of

such amount / asset is in accordance to the regulations and the company’s

policies, as usual a test check based system has to be implemented where the

performance of an employee can be known through another employee and

vice versa which can improve the performance of the employee as well as

reduce the risk of material misstatement (Sithole, Chandler, Abeysekera, &

Paas, 2017).

Conclusion

From the above discussion and analytical review, it can be clearly seen that even though the

company is growing at a rapid pace, there are few accounting and management issues. Some of the

risks inherent in the company have been highlighted along with the reason for considering that

account, the key assertion and the audit procedure to be undertaken in that regard. The inherent

risk at the financial report level has also been shown in the report above.

References

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4),

411-431.

Alieid, E. E. (2016). The Role of Accounting Information Systems in Making Investment Decisions.

Internal Auditing & Risk Management, 11(2), 233-242.

Appelbaum, D., Kogan, A., & Vasarhelyi, M. (2018). Analytical procedures in external auditing: A

comprehensive literature survey and framework for external audit analytics. . Journal of

Accounting Literature, 40(1), 83-101.

Boccia, F., & Leonardi, R. (2016). The Challenge of the Digital Economy. Markets, Taxation and

Appropriate Economic Models, 1-16.

Bromwich, M., & Scapens, R. (2016). Management Accounting Research: 25 years on. Management

Accounting Research, 31(1), 1-9.

Choy, Y. K. (2018). Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, 3(1), 145.

doi:https://doi.org/10.1016/j.ecolecon.2017.08.005

Cundill, G., Smart, P., & Wilson, H. (2017). Non financial Shareholder Activism: A Process Model for‐

Influencing Corporate Environmental and Social Performance. International Journal of

Management Reviews, 20(2), 606-626.

Fukukawa, H., & Mock, T. (2011). Audit risk assessments using belief versus probability. Auditing: A

Journal of Practice & Theory, 30(1), 75-99.

Gay, G., & Simnett, R. (2015). Auditing and assurance services in Australia. 253-254: McGraw-Hill

Education Australia.

Glaum, M., & Klocker, A. (2011). Hedge accounting and its influence on financial hedging: when the

tail wags the dog. Accounting and Business Research, 41(5), 459-489.

doi:https://doi.org/10.1080/00014788.2011.573746

Goldmann, K. (2016). Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, 4(3), 103-112.

Jones, P. (2017). Statistical Sampling and Risk Analysis in Auditing. NY: Routledge.

Knechel, W., & Salterio, S. (2016). Auditing:Assurance and Risk (4th ed.). New York: Routledge.

Lessambo, F. (2018). Audit Risks: Identification and Procedures. Auditing, Assurance Services, and

Forensics, 3(1), 183-202.

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4),

411-431.

Alieid, E. E. (2016). The Role of Accounting Information Systems in Making Investment Decisions.

Internal Auditing & Risk Management, 11(2), 233-242.

Appelbaum, D., Kogan, A., & Vasarhelyi, M. (2018). Analytical procedures in external auditing: A

comprehensive literature survey and framework for external audit analytics. . Journal of

Accounting Literature, 40(1), 83-101.

Boccia, F., & Leonardi, R. (2016). The Challenge of the Digital Economy. Markets, Taxation and

Appropriate Economic Models, 1-16.

Bromwich, M., & Scapens, R. (2016). Management Accounting Research: 25 years on. Management

Accounting Research, 31(1), 1-9.

Choy, Y. K. (2018). Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, 3(1), 145.

doi:https://doi.org/10.1016/j.ecolecon.2017.08.005

Cundill, G., Smart, P., & Wilson, H. (2017). Non financial Shareholder Activism: A Process Model for‐

Influencing Corporate Environmental and Social Performance. International Journal of

Management Reviews, 20(2), 606-626.

Fukukawa, H., & Mock, T. (2011). Audit risk assessments using belief versus probability. Auditing: A

Journal of Practice & Theory, 30(1), 75-99.

Gay, G., & Simnett, R. (2015). Auditing and assurance services in Australia. 253-254: McGraw-Hill

Education Australia.

Glaum, M., & Klocker, A. (2011). Hedge accounting and its influence on financial hedging: when the

tail wags the dog. Accounting and Business Research, 41(5), 459-489.

doi:https://doi.org/10.1080/00014788.2011.573746

Goldmann, K. (2016). Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, 4(3), 103-112.

Jones, P. (2017). Statistical Sampling and Risk Analysis in Auditing. NY: Routledge.

Knechel, W., & Salterio, S. (2016). Auditing:Assurance and Risk (4th ed.). New York: Routledge.

Lessambo, F. (2018). Audit Risks: Identification and Procedures. Auditing, Assurance Services, and

Forensics, 3(1), 183-202.

Linden, B., & Freeman, R. (2017). Profit and Other Values: Thick Evaluation in Decision Making.

Business Ethics Quarterly, 27(3), 353-379. Retrieved from

https://doi.org/10.1017/beq.2017.1

Sithole, S., Chandler, P., Abeysekera, I., & Paas, F. (2017). Benefits of guided self-management of

attention on learning accounting. Journal of Educational Psychology, 109(2), 220. Retrieved

from http://psycnet.apa.org/buy/2016-21263-001

Visinescu, L., Jones, M., & Sidorova, A. (2017). Improving Decision Quality: The Role of Business

Intelligence. Journal of Computer Information Systems, 57(1), 58-66.

Business Ethics Quarterly, 27(3), 353-379. Retrieved from

https://doi.org/10.1017/beq.2017.1

Sithole, S., Chandler, P., Abeysekera, I., & Paas, F. (2017). Benefits of guided self-management of

attention on learning accounting. Journal of Educational Psychology, 109(2), 220. Retrieved

from http://psycnet.apa.org/buy/2016-21263-001

Visinescu, L., Jones, M., & Sidorova, A. (2017). Improving Decision Quality: The Role of Business

Intelligence. Journal of Computer Information Systems, 57(1), 58-66.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.