Comprehensive Financial Analysis Report for Melmotte Ltd

VerifiedAdded on 2023/01/17

|9

|2098

|69

Report

AI Summary

This report presents a financial analysis of Melmotte Ltd, examining its financial health and performance. The analysis includes a review of the company's financial statements, focusing on revenue, gross profit, and operating profit across different sectors like retail operations, online stores, and hotel contracts. The report investigates the treatment of non-current assets, depreciation, and research costs. It also assesses the impact of a proposed investment by Grosvenor, analyzing gearing ratios and cash flow statements. Key financial ratios are used to evaluate the company's efficiency and profitability, with the goal of providing insights into investment viability and overall financial performance. The report also discusses the reasons behind the negative cash balance and provides a detailed analysis of the company's financial position.

MELMOTTE LTD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

EXECUTIVE SUMMARY.............................................................................................................1

Question 1........................................................................................................................................1

a) Descriptions.............................................................................................................................1

b) Purpose of financial statements...............................................................................................1

c) Treatment for product going out of fashion.............................................................................1

Question 2........................................................................................................................................1

a) Revenue ..................................................................................................................................2

b) Gross Profit .............................................................................................................................2

c) Other SPL Costs ......................................................................................................................3

d) Operating Profit ......................................................................................................................4

Question 3........................................................................................................................................5

a) Non Current Assets .................................................................................................................5

b) Grosvenor proposed investment. ............................................................................................6

Question 4........................................................................................................................................6

a) Reasons for negative cash balance...........................................................................................6

b) Outflows from cash statements................................................................................................6

REFERENCES................................................................................................................................7

EXECUTIVE SUMMARY.............................................................................................................1

Question 1........................................................................................................................................1

a) Descriptions.............................................................................................................................1

b) Purpose of financial statements...............................................................................................1

c) Treatment for product going out of fashion.............................................................................1

Question 2........................................................................................................................................1

a) Revenue ..................................................................................................................................2

b) Gross Profit .............................................................................................................................2

c) Other SPL Costs ......................................................................................................................3

d) Operating Profit ......................................................................................................................4

Question 3........................................................................................................................................5

a) Non Current Assets .................................................................................................................5

b) Grosvenor proposed investment. ............................................................................................6

Question 4........................................................................................................................................6

a) Reasons for negative cash balance...........................................................................................6

b) Outflows from cash statements................................................................................................6

REFERENCES................................................................................................................................7

EXECUTIVE SUMMARY

The present report is about the financial analysis of company. The report will reflect the

health and position of company. Various ratios will be used in assessing the financial statements.

Performance of company from previous year has been analysed for Grosvenor to check the

investments viability. Report has given understanding about various accounting concepts and

treatments.

2.2 QUESTIONS

Question 1

a) Descriptions

I) The above description relates to statement of Profit or Loss. Second statement of

description relates to statement of financial position.

II) Transaction for securing the long term debt would be allocated in balance sheet where the

expense related to the hiring of administrator will be charged to the profit or loss.

b) Purpose of financial statements.

SOFP – The above statements represents the financial health of the organisation. Example

customer ; for knowing whether company would be able to continue its supplies.

SPL – This is prepared for knowing the profitability from running a business. User Investors ;

they seek whether company is able to provide adequate returns overt their investments.

SCF – The statements is prepared for knowing the cash inflow and outflow during the year.

Suppliers seek to know whether company has the liquidity to repay the purchases (Williams and

Dobelman, 2017).

c) Treatment for product going out of fashion.

I) As per IAS 2 inventories should be recognised at cost or net realizable value whichever is

lower.

II) This complies with the recognition criteria as company recognises carrying cost of

inventories when they are sold.

III) The effect of writing off could be charged directly to cost of goods sold in the profit or

loss statement or the inventory may be offset from inventory account in balance sheet

(Platonova and et.al., 2018.).

1

The present report is about the financial analysis of company. The report will reflect the

health and position of company. Various ratios will be used in assessing the financial statements.

Performance of company from previous year has been analysed for Grosvenor to check the

investments viability. Report has given understanding about various accounting concepts and

treatments.

2.2 QUESTIONS

Question 1

a) Descriptions

I) The above description relates to statement of Profit or Loss. Second statement of

description relates to statement of financial position.

II) Transaction for securing the long term debt would be allocated in balance sheet where the

expense related to the hiring of administrator will be charged to the profit or loss.

b) Purpose of financial statements.

SOFP – The above statements represents the financial health of the organisation. Example

customer ; for knowing whether company would be able to continue its supplies.

SPL – This is prepared for knowing the profitability from running a business. User Investors ;

they seek whether company is able to provide adequate returns overt their investments.

SCF – The statements is prepared for knowing the cash inflow and outflow during the year.

Suppliers seek to know whether company has the liquidity to repay the purchases (Williams and

Dobelman, 2017).

c) Treatment for product going out of fashion.

I) As per IAS 2 inventories should be recognised at cost or net realizable value whichever is

lower.

II) This complies with the recognition criteria as company recognises carrying cost of

inventories when they are sold.

III) The effect of writing off could be charged directly to cost of goods sold in the profit or

loss statement or the inventory may be offset from inventory account in balance sheet

(Platonova and et.al., 2018.).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

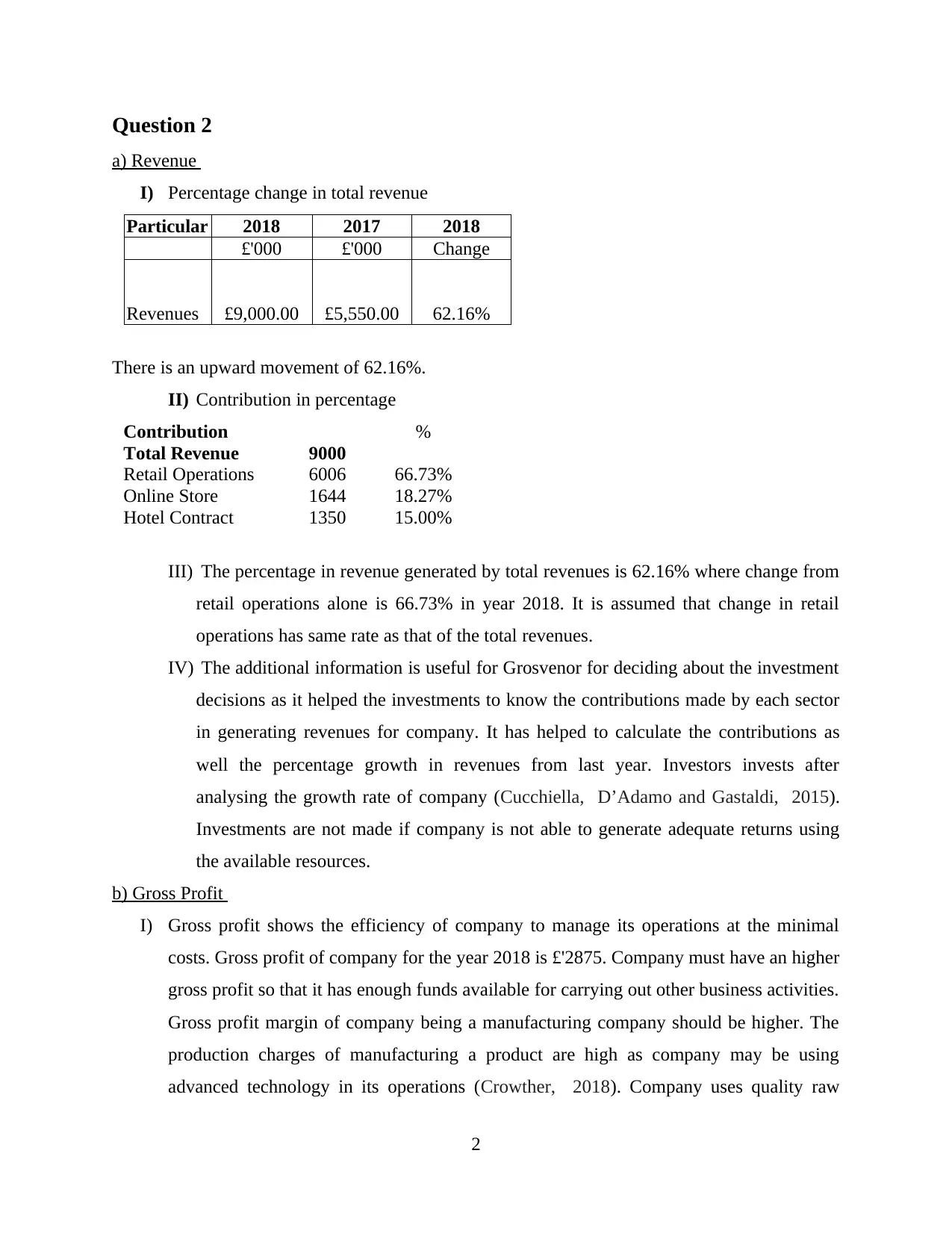

Question 2

a) Revenue

I) Percentage change in total revenue

Particular 2018 2017 2018

£'000 £'000 Change

Revenues £9,000.00 £5,550.00 62.16%

There is an upward movement of 62.16%.

II) Contribution in percentage

Contribution %

Total Revenue 9000

Retail Operations 6006 66.73%

Online Store 1644 18.27%

Hotel Contract 1350 15.00%

III) The percentage in revenue generated by total revenues is 62.16% where change from

retail operations alone is 66.73% in year 2018. It is assumed that change in retail

operations has same rate as that of the total revenues.

IV) The additional information is useful for Grosvenor for deciding about the investment

decisions as it helped the investments to know the contributions made by each sector

in generating revenues for company. It has helped to calculate the contributions as

well the percentage growth in revenues from last year. Investors invests after

analysing the growth rate of company (Cucchiella, D’Adamo and Gastaldi, 2015).

Investments are not made if company is not able to generate adequate returns using

the available resources.

b) Gross Profit

I) Gross profit shows the efficiency of company to manage its operations at the minimal

costs. Gross profit of company for the year 2018 is £'2875. Company must have an higher

gross profit so that it has enough funds available for carrying out other business activities.

Gross profit margin of company being a manufacturing company should be higher. The

production charges of manufacturing a product are high as company may be using

advanced technology in its operations (Crowther, 2018). Company uses quality raw

2

a) Revenue

I) Percentage change in total revenue

Particular 2018 2017 2018

£'000 £'000 Change

Revenues £9,000.00 £5,550.00 62.16%

There is an upward movement of 62.16%.

II) Contribution in percentage

Contribution %

Total Revenue 9000

Retail Operations 6006 66.73%

Online Store 1644 18.27%

Hotel Contract 1350 15.00%

III) The percentage in revenue generated by total revenues is 62.16% where change from

retail operations alone is 66.73% in year 2018. It is assumed that change in retail

operations has same rate as that of the total revenues.

IV) The additional information is useful for Grosvenor for deciding about the investment

decisions as it helped the investments to know the contributions made by each sector

in generating revenues for company. It has helped to calculate the contributions as

well the percentage growth in revenues from last year. Investors invests after

analysing the growth rate of company (Cucchiella, D’Adamo and Gastaldi, 2015).

Investments are not made if company is not able to generate adequate returns using

the available resources.

b) Gross Profit

I) Gross profit shows the efficiency of company to manage its operations at the minimal

costs. Gross profit of company for the year 2018 is £'2875. Company must have an higher

gross profit so that it has enough funds available for carrying out other business activities.

Gross profit margin of company being a manufacturing company should be higher. The

production charges of manufacturing a product are high as company may be using

advanced technology in its operations (Crowther, 2018). Company uses quality raw

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

materials for its products that costs high. Company has to adopt for strategies that are

essential for reducing the production costs.

II) Gross margin Ratio

The above table shows that gross margin ratio is lowest in the retail operation of 29.97% and

highest in hotel contract of 43.04%. Online store is having gross margin ratio of 30.05. It could

be analysed from the above table that sector generating highest revenues is having lowest gross

profits. Gross profit margins of the above sectors can be improved further taking the cost

reduction steps. It is the amount left with company for carrying out other operational cost of the

business.

III) Gross Profit margin of hotel contract is higher in comparison to other sectors as company

has made a lucrative agreement with hotel chain. Company is selling its product with

branding of hotel. This is helping company to charge premium prices for its products bot

over hotels and on online store. The premium prices has increased the gross profit from

hotel contract.

c) Other SPL Costs

I) Differences between cost of sales and overheads in profit or loss.

Cost of goods sold or cost of sales refer to cost involved in manufacturing and delivering

the products and services to customers. Salaries of service providers in service company

are cost of sales (Khan and Jain, 2018). It includes raw material, direct material, factory

costs etc. Overheads on other hand are cost incurred for running company. These are the

ongoing costs. These costs include sales, marketing, accounting, human resources and

information technology.

3

essential for reducing the production costs.

II) Gross margin Ratio

The above table shows that gross margin ratio is lowest in the retail operation of 29.97% and

highest in hotel contract of 43.04%. Online store is having gross margin ratio of 30.05. It could

be analysed from the above table that sector generating highest revenues is having lowest gross

profits. Gross profit margins of the above sectors can be improved further taking the cost

reduction steps. It is the amount left with company for carrying out other operational cost of the

business.

III) Gross Profit margin of hotel contract is higher in comparison to other sectors as company

has made a lucrative agreement with hotel chain. Company is selling its product with

branding of hotel. This is helping company to charge premium prices for its products bot

over hotels and on online store. The premium prices has increased the gross profit from

hotel contract.

c) Other SPL Costs

I) Differences between cost of sales and overheads in profit or loss.

Cost of goods sold or cost of sales refer to cost involved in manufacturing and delivering

the products and services to customers. Salaries of service providers in service company

are cost of sales (Khan and Jain, 2018). It includes raw material, direct material, factory

costs etc. Overheads on other hand are cost incurred for running company. These are the

ongoing costs. These costs include sales, marketing, accounting, human resources and

information technology.

3

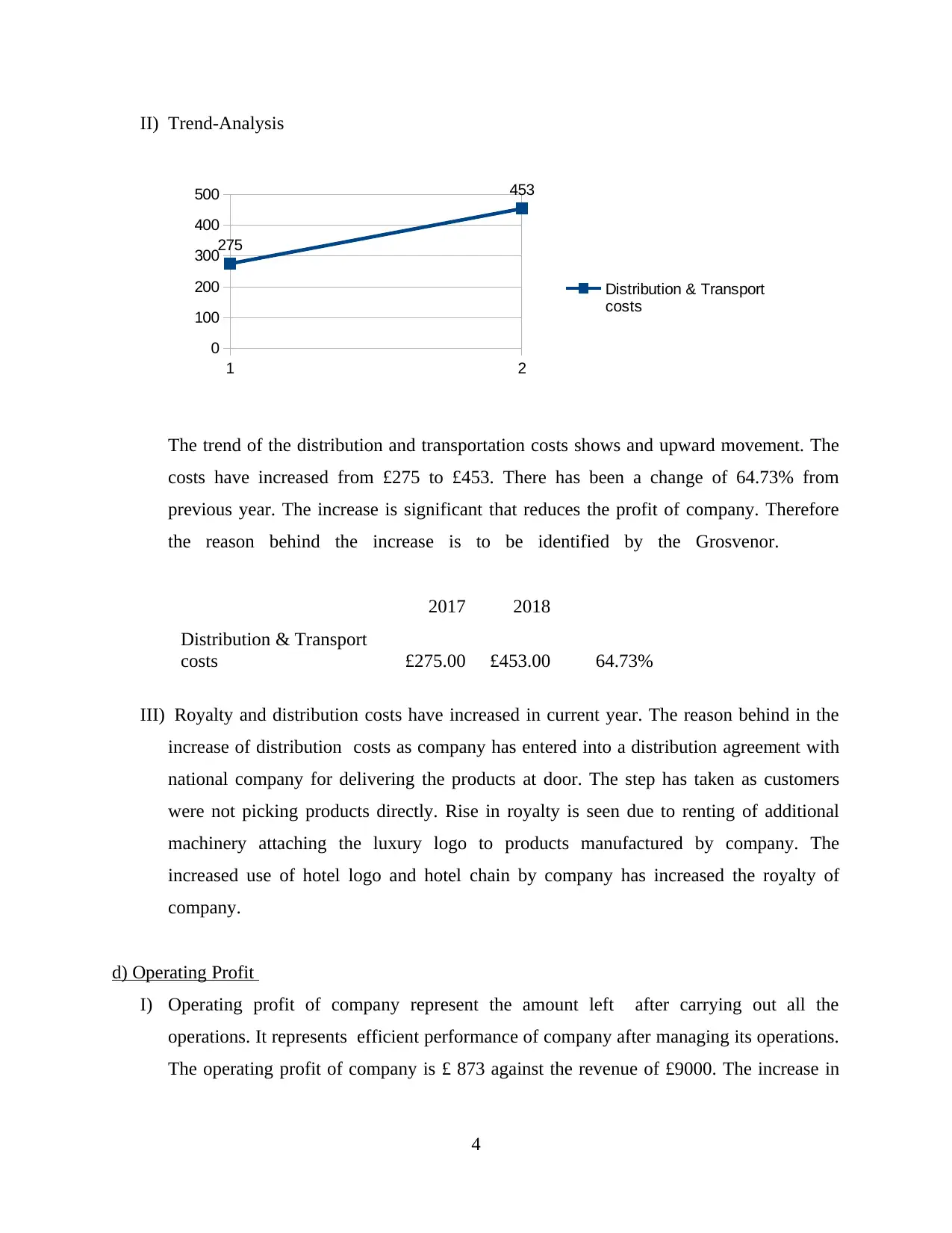

II) Trend-Analysis

The trend of the distribution and transportation costs shows and upward movement. The

costs have increased from £275 to £453. There has been a change of 64.73% from

previous year. The increase is significant that reduces the profit of company. Therefore

the reason behind the increase is to be identified by the Grosvenor.

2017 2018

Distribution & Transport

costs £275.00 £453.00 64.73%

III) Royalty and distribution costs have increased in current year. The reason behind in the

increase of distribution costs as company has entered into a distribution agreement with

national company for delivering the products at door. The step has taken as customers

were not picking products directly. Rise in royalty is seen due to renting of additional

machinery attaching the luxury logo to products manufactured by company. The

increased use of hotel logo and hotel chain by company has increased the royalty of

company.

d) Operating Profit

I) Operating profit of company represent the amount left after carrying out all the

operations. It represents efficient performance of company after managing its operations.

The operating profit of company is £ 873 against the revenue of £9000. The increase in

4

1 2

0

100

200

300

400

500

275

453

Distribution & Transport

costs

The trend of the distribution and transportation costs shows and upward movement. The

costs have increased from £275 to £453. There has been a change of 64.73% from

previous year. The increase is significant that reduces the profit of company. Therefore

the reason behind the increase is to be identified by the Grosvenor.

2017 2018

Distribution & Transport

costs £275.00 £453.00 64.73%

III) Royalty and distribution costs have increased in current year. The reason behind in the

increase of distribution costs as company has entered into a distribution agreement with

national company for delivering the products at door. The step has taken as customers

were not picking products directly. Rise in royalty is seen due to renting of additional

machinery attaching the luxury logo to products manufactured by company. The

increased use of hotel logo and hotel chain by company has increased the royalty of

company.

d) Operating Profit

I) Operating profit of company represent the amount left after carrying out all the

operations. It represents efficient performance of company after managing its operations.

The operating profit of company is £ 873 against the revenue of £9000. The increase in

4

1 2

0

100

200

300

400

500

275

453

Distribution & Transport

costs

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

operating margin is not significant. The margin is 9.70% for the year and return of

company is adequate as per the industry trend.

II) Operating profit margin ratio

Operating profit

Margin Operating Profit

Operating

Margin

Revenue

Retail Operations £544.00 9.06%

£6,006.00

Online Store £206.00 12.53%

£1,644.00

Hotel Contract £123.00 9.11%

£1,350.00

The operating profits are derived after carrying out all the activities for running a business. There

are two costs incurred by company after the gross profits are administration expenses and the

distribution cost. Margin is 9.06% in retail operations, 12.53% in online stores and 9.11% in

hotel chain. Distribution cost as against its revenues are high in hotel sector this brings the

operating margin even after having highest gross profit margin.

III) Operating margin of online store is highest as compared with other segments. Margin is

high as the over head costs do not increases with additional sales in online stores that are

seen in the retail stores.

Question 3

a) Non Current Assets

I) PPE and development costs are shown separately as PPE represents the tangible fixed

asset of company and the development cost is the cost incurred for preparing the platform

for online store and therefore capitalised in balance sheet. It is not tangible but is

recognised in the balance sheet as an asset (Edwards, Schwab and Shevlin, 2015). It is

an capitalised expense not a physical asset.

II) Depreciation is charged for the wear and tear due to use of assets with time. Value of

asset do not remain the same. The decrease in value is loss and therefore charged as

expense in profit or loss. Depreciation decreases the value of PPE represented in balance

sheet.

III) Research costs are treated as expense and charged to p&l as these are incurred for

innovating new products or techniques. Research do not flow any economic benefit to

5

company is adequate as per the industry trend.

II) Operating profit margin ratio

Operating profit

Margin Operating Profit

Operating

Margin

Revenue

Retail Operations £544.00 9.06%

£6,006.00

Online Store £206.00 12.53%

£1,644.00

Hotel Contract £123.00 9.11%

£1,350.00

The operating profits are derived after carrying out all the activities for running a business. There

are two costs incurred by company after the gross profits are administration expenses and the

distribution cost. Margin is 9.06% in retail operations, 12.53% in online stores and 9.11% in

hotel chain. Distribution cost as against its revenues are high in hotel sector this brings the

operating margin even after having highest gross profit margin.

III) Operating margin of online store is highest as compared with other segments. Margin is

high as the over head costs do not increases with additional sales in online stores that are

seen in the retail stores.

Question 3

a) Non Current Assets

I) PPE and development costs are shown separately as PPE represents the tangible fixed

asset of company and the development cost is the cost incurred for preparing the platform

for online store and therefore capitalised in balance sheet. It is not tangible but is

recognised in the balance sheet as an asset (Edwards, Schwab and Shevlin, 2015). It is

an capitalised expense not a physical asset.

II) Depreciation is charged for the wear and tear due to use of assets with time. Value of

asset do not remain the same. The decrease in value is loss and therefore charged as

expense in profit or loss. Depreciation decreases the value of PPE represented in balance

sheet.

III) Research costs are treated as expense and charged to p&l as these are incurred for

innovating new products or techniques. Research do not flow any economic benefit to

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company. Development is the application of research findings to design or plan (West

and Bhattacharya, 2016). This flows economic benefits to company therefore treated as

asset in balance sheet.

b) Grosvenor proposed investment.

I) In cash investment used for paying off overdraft figures that will change in SOFP are

cash balance, overdraft liability and share capital of company. The bank overdraft will

become 0, cash and equivalents to £648000 and share capital will increase to £1575,000.

II) Gearing ratio shows the fund raised by company through borrowings and interest cover

shows interest expenses. High debts means high risks and interest expense will lower the

profits of company. Company having high debts with negative cash may go insolvent.

III) New Gearing Ratio

Gearing Debt 618

Debt + equity 2961

20.87%

IV) As the result of investment company would be considered less riskier as the gross

margin ratio has lowered. Equity is high as against debts.

Question 4

a) Reasons for negative cash balance

Company has negative cash flows because

Inventories have increased significantly & Trade payables have increased significantly.

Company has invested in product development and purchase of PPE.

Dividend has paid very high rate of dividend in comparison to previous year.

b) Outflows from cash statements.

The outflows were necessary for improving the inventory days of company and payables

period. This will help in shortening the cash operating cycle as short cycle requires less cash. The

efficiency ratio were improved because of the outflows in trade receivables. The dividend payout

ratio has increased.

6

and Bhattacharya, 2016). This flows economic benefits to company therefore treated as

asset in balance sheet.

b) Grosvenor proposed investment.

I) In cash investment used for paying off overdraft figures that will change in SOFP are

cash balance, overdraft liability and share capital of company. The bank overdraft will

become 0, cash and equivalents to £648000 and share capital will increase to £1575,000.

II) Gearing ratio shows the fund raised by company through borrowings and interest cover

shows interest expenses. High debts means high risks and interest expense will lower the

profits of company. Company having high debts with negative cash may go insolvent.

III) New Gearing Ratio

Gearing Debt 618

Debt + equity 2961

20.87%

IV) As the result of investment company would be considered less riskier as the gross

margin ratio has lowered. Equity is high as against debts.

Question 4

a) Reasons for negative cash balance

Company has negative cash flows because

Inventories have increased significantly & Trade payables have increased significantly.

Company has invested in product development and purchase of PPE.

Dividend has paid very high rate of dividend in comparison to previous year.

b) Outflows from cash statements.

The outflows were necessary for improving the inventory days of company and payables

period. This will help in shortening the cash operating cycle as short cycle requires less cash. The

efficiency ratio were improved because of the outflows in trade receivables. The dividend payout

ratio has increased.

6

REFERENCES

Books and Journals

Crowther, D., 2018. A Social Critique of Corporate Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting: A Semiotic Analysis of Corporate Financial and

Environmental Reporting. Routledge.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental

Policy. 17(4). pp.887-904.

Edwards, A., Schwab, C. and Shevlin, T., 2015. Financial constraints and cash tax savings. The

Accounting Review. 91(3). pp.859-881.

Khan, M.Y. and Jain, P.K., 2018. Financial Management: Text, Problems and Cases, 8e.

McGraw-Hill Education.

Platonova, and et.al., 2018. The impact of corporate social responsibility disclosure on financial

performance: Evidence from the GCC Islamic banking sector. Journal of Business

Ethics. 151(2). pp.451-471.

West, J. and Bhattacharya, M., 2016. Intelligent financial fraud detection: a comprehensive

review. Computers & security. 57. pp.47-66.

Williams, E.E. and Dobelman, J.A., 2017. Financial statement analysis. World Scientific Book

Chapters. pp.109-169.

7

Books and Journals

Crowther, D., 2018. A Social Critique of Corporate Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting: A Semiotic Analysis of Corporate Financial and

Environmental Reporting. Routledge.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental

Policy. 17(4). pp.887-904.

Edwards, A., Schwab, C. and Shevlin, T., 2015. Financial constraints and cash tax savings. The

Accounting Review. 91(3). pp.859-881.

Khan, M.Y. and Jain, P.K., 2018. Financial Management: Text, Problems and Cases, 8e.

McGraw-Hill Education.

Platonova, and et.al., 2018. The impact of corporate social responsibility disclosure on financial

performance: Evidence from the GCC Islamic banking sector. Journal of Business

Ethics. 151(2). pp.451-471.

West, J. and Bhattacharya, M., 2016. Intelligent financial fraud detection: a comprehensive

review. Computers & security. 57. pp.47-66.

Williams, E.E. and Dobelman, J.A., 2017. Financial statement analysis. World Scientific Book

Chapters. pp.109-169.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.