A Detailed Analysis of the Amazon-Whole Foods Merger & Acquisition

VerifiedAdded on 2023/06/10

|9

|1946

|388

Report

AI Summary

This report provides a detailed analysis of the merger and acquisition between Amazon and Whole Foods, examining the specifics of the deal, its impacts on both companies, and its effects on their financial statements. The acquisition, finalized in August 2017 for $13.7 billion, aimed to expand Amazon's presence in the grocery sector and integrate two customer-centric brands. The report explores the perspectives of both Amazon (the buyer) and Whole Foods (the seller), highlighting the benefits such as increased market share for Amazon and enhanced market power for Whole Foods. It also discusses the allocation of the purchase price, with a significant portion attributed to goodwill, reflecting Amazon's long-term growth expectations. The study concludes that the merger was financially sound, facilitating Amazon's operations both online and in physical stores, while also posing a competitive threat to the broader grocery market. Desklib provides access to similar solved assignments and study tools.

Merger and Acquisition

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction......................................................................................................................................3

Details of merger and acquisition....................................................................................................3

Impact on companies.......................................................................................................................4

From the perspective of the buyer (Amazon)..............................................................................4

From the perspective of the seller (Whole Foods).......................................................................4

Impacts on financial statements.......................................................................................................5

Conclusion.......................................................................................................................................6

Bibliogrpahy....................................................................................................................................7

Appendices......................................................................................................................................8

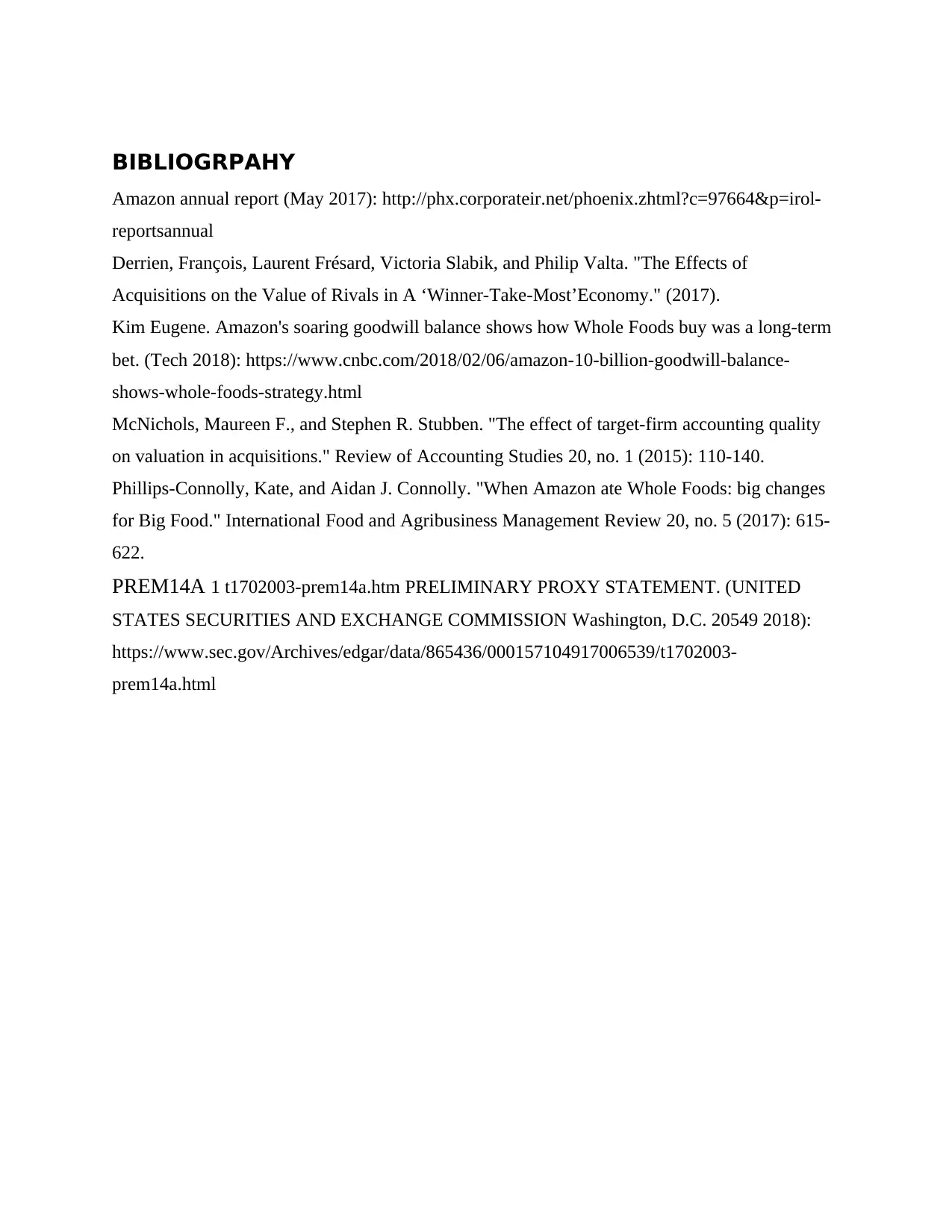

Purchase price allocation.............................................................................................................8

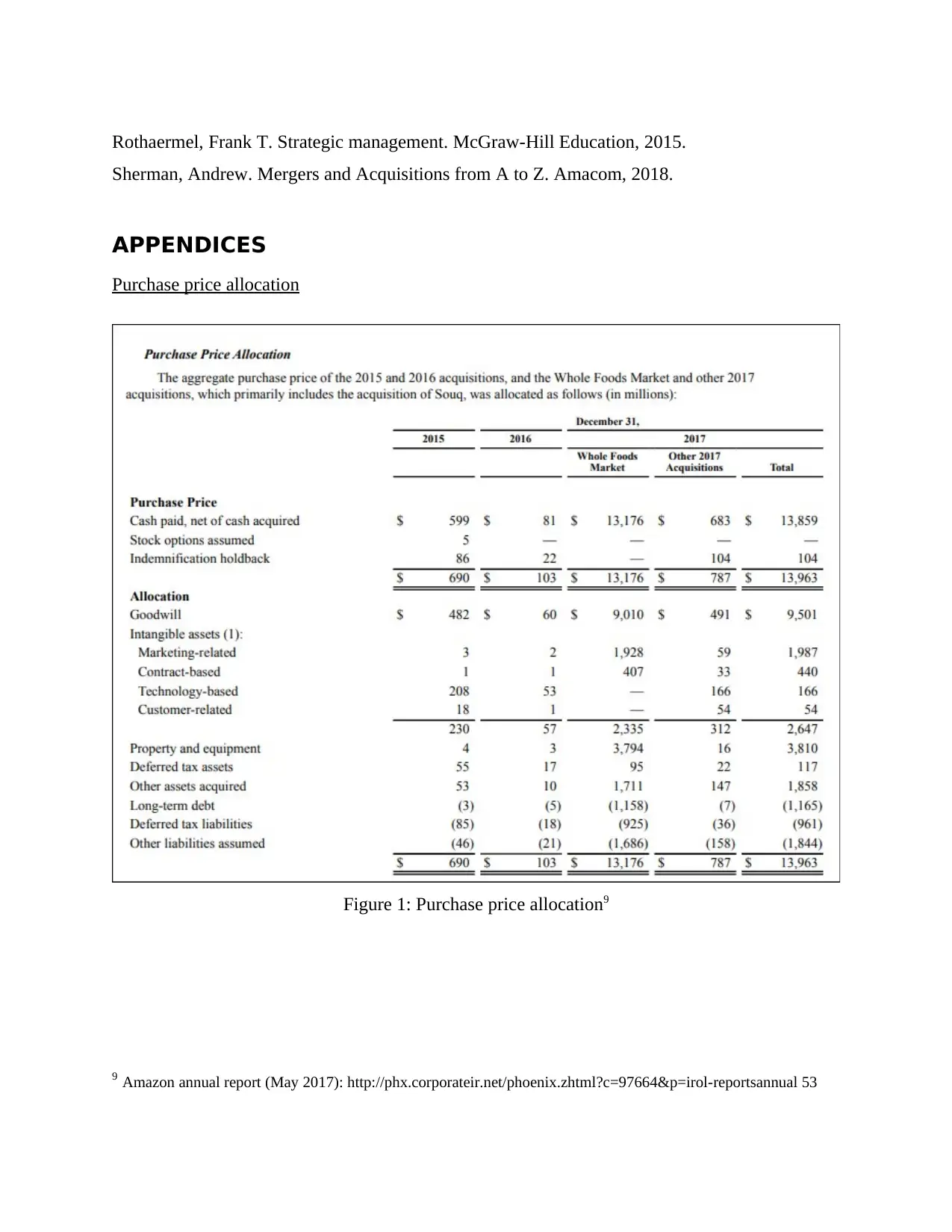

Pro forma financial information..................................................................................................9

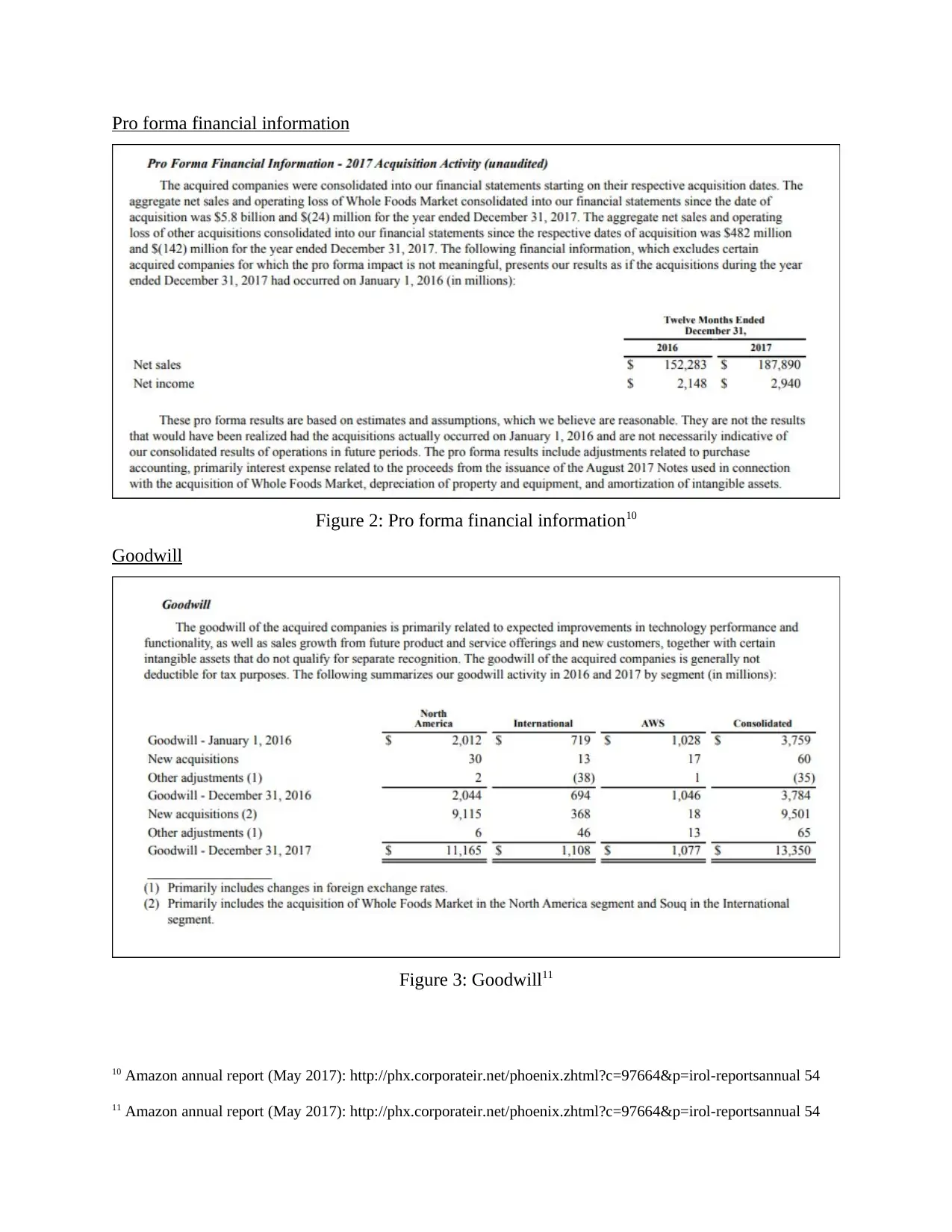

Goodwill......................................................................................................................................9

Introduction......................................................................................................................................3

Details of merger and acquisition....................................................................................................3

Impact on companies.......................................................................................................................4

From the perspective of the buyer (Amazon)..............................................................................4

From the perspective of the seller (Whole Foods).......................................................................4

Impacts on financial statements.......................................................................................................5

Conclusion.......................................................................................................................................6

Bibliogrpahy....................................................................................................................................7

Appendices......................................................................................................................................8

Purchase price allocation.............................................................................................................8

Pro forma financial information..................................................................................................9

Goodwill......................................................................................................................................9

INTRODUCTION

The present study is based on the analysis and evaluation of the Merger and Acquisition of

Amazon and Whole Foods. The study will include the proper details of overall merger and

acquisition; along with this, the study will also cover the impact of the same on companies and

financial statements.

DETAILS OF MERGER AND ACQUISITION

During March 20 in the year 2018, Amazon turned out to be the 2nd most valuable company all

over the world, having a market capitalization surpassing $768B. Key investments were made by

the retailing giant of US in the year 2017, inclusive of an offer to purchase the WHM organic

grocery chain on the rate of $42 each share or the total amount of 13B. After the declaration, the

Amazon received approx $19 billion held from market capitalization, and further, the final

decision was made on the acquisition in August 2017.

At the time of the announcement was made and the deal was done at 13B, this surprised the

entire grocery industry, a shock of a deal that projects the e-commerce giant into several physical

stores and satisfies the long-term objective of putting a higher amount of groceries into same1.

In June 2017, Amazon bombshell customers and industry with the acquisition prices at $13.7

billion of the grocery chain2. It evidenced the seriousness of Amazon regarding the operation of

traditional brick-and-mortar stores at a wide scale.

Whole Foods increased by 28% on acquisition deal of the Amazon. It also indicated that

Amazon was directly aiming at the old grocery industry. Further, the deal was finalized in

August, and the stamp was put by Amazon throughout the stores of Whole Foods.

The reason for the acquisition was that the Amazon’s e-commerce group was attempting to

expand its online to compete effectively with the Walmart in the retailing sector3.

1 Andrew Sherman. Mergers and Acquisitions from A to Z. (Amacom, 2018).

2 Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term bet. (Tech 2018):

https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-shows-whole-foods-strategy.html

3 Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term bet. (Tech 2018):

https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-shows-whole-foods-strategy.html

The present study is based on the analysis and evaluation of the Merger and Acquisition of

Amazon and Whole Foods. The study will include the proper details of overall merger and

acquisition; along with this, the study will also cover the impact of the same on companies and

financial statements.

DETAILS OF MERGER AND ACQUISITION

During March 20 in the year 2018, Amazon turned out to be the 2nd most valuable company all

over the world, having a market capitalization surpassing $768B. Key investments were made by

the retailing giant of US in the year 2017, inclusive of an offer to purchase the WHM organic

grocery chain on the rate of $42 each share or the total amount of 13B. After the declaration, the

Amazon received approx $19 billion held from market capitalization, and further, the final

decision was made on the acquisition in August 2017.

At the time of the announcement was made and the deal was done at 13B, this surprised the

entire grocery industry, a shock of a deal that projects the e-commerce giant into several physical

stores and satisfies the long-term objective of putting a higher amount of groceries into same1.

In June 2017, Amazon bombshell customers and industry with the acquisition prices at $13.7

billion of the grocery chain2. It evidenced the seriousness of Amazon regarding the operation of

traditional brick-and-mortar stores at a wide scale.

Whole Foods increased by 28% on acquisition deal of the Amazon. It also indicated that

Amazon was directly aiming at the old grocery industry. Further, the deal was finalized in

August, and the stamp was put by Amazon throughout the stores of Whole Foods.

The reason for the acquisition was that the Amazon’s e-commerce group was attempting to

expand its online to compete effectively with the Walmart in the retailing sector3.

1 Andrew Sherman. Mergers and Acquisitions from A to Z. (Amacom, 2018).

2 Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term bet. (Tech 2018):

https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-shows-whole-foods-strategy.html

3 Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term bet. (Tech 2018):

https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-shows-whole-foods-strategy.html

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Taking the Whole Foods over, which is the largest grocer in the US, would foster the goals of the

Amazon in the $800bn US grocery sector, in which the Seattle group has been struggling to

conduct the delivery of grocery.

Amazon buys Whole Foods, has made it possible to integrate two dominating brands into one,

both based on the approach of customer-centred. With the partnership, Amazon will be able to

do expansion of its products, services and offerings while improvising customer experience. The

possibility for development is vast due to the presence of Whole Market in the US.

The merger and acquisition of Amazon and Whole foods were taxable, the receipt of the cash

held in return for the shares of general stock in pursuit with the merger will usually consider as a

transaction entitled to tax for the tax purposes of U.S. federal income4. The company should take

advice from their personal tax advisor about the specific tax impacts on the on the exchange of

the share5. The merger of Whole Foods Market, the existing company and the paying agent

meant for the merger concern will be obliged to deduct with withholdings of the due amount as

per the applicable laws that would be otherwise paid as per the terms of M&A.

IMPACT ON COMPANIES

The Merger and Acquisition will have direct as well as indirect impacts over both the companies

and the same are discussed as below:

From the perspective of the buyer (Amazon): Amazon’s Whole Foods acquisition is one of the

largest deals in the US. It will spot the online entry of juggernaut in a retail space of brick-and-

mortar. By this, Amazon can make covert the retail stores of Whole Foods into distribution and

pickup centres for their orders placed on an online basis. With the broad scale of this deal,

Amazon would be able to earn great market shares and authority by larger economies of scale.

From the perspective of the seller (Whole Foods): Whole Foods Market has been struggling to

maintain their profit margins and market position for certain time. The deal of retailer with

Amazon can provide the WFM with a great market power with the strength to exist strongly in

the fiercely competitive grocery market. The advanced technology and large customer base of

Amazon can assist the Whole Foods in driving their success. With the help of deal, the stock

4 Frank T Rothaermel. Strategic management. (McGraw-Hill Education, 2015).

5 PREM14A 1 t1702003-prem14a.htm PRELIMINARY PROXY STATEMENT. (UNITED

STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 2018):

https://www.sec.gov/Archives/edgar/data/865436/000157104917006539/t1702003-prem14a.html

Amazon in the $800bn US grocery sector, in which the Seattle group has been struggling to

conduct the delivery of grocery.

Amazon buys Whole Foods, has made it possible to integrate two dominating brands into one,

both based on the approach of customer-centred. With the partnership, Amazon will be able to

do expansion of its products, services and offerings while improvising customer experience. The

possibility for development is vast due to the presence of Whole Market in the US.

The merger and acquisition of Amazon and Whole foods were taxable, the receipt of the cash

held in return for the shares of general stock in pursuit with the merger will usually consider as a

transaction entitled to tax for the tax purposes of U.S. federal income4. The company should take

advice from their personal tax advisor about the specific tax impacts on the on the exchange of

the share5. The merger of Whole Foods Market, the existing company and the paying agent

meant for the merger concern will be obliged to deduct with withholdings of the due amount as

per the applicable laws that would be otherwise paid as per the terms of M&A.

IMPACT ON COMPANIES

The Merger and Acquisition will have direct as well as indirect impacts over both the companies

and the same are discussed as below:

From the perspective of the buyer (Amazon): Amazon’s Whole Foods acquisition is one of the

largest deals in the US. It will spot the online entry of juggernaut in a retail space of brick-and-

mortar. By this, Amazon can make covert the retail stores of Whole Foods into distribution and

pickup centres for their orders placed on an online basis. With the broad scale of this deal,

Amazon would be able to earn great market shares and authority by larger economies of scale.

From the perspective of the seller (Whole Foods): Whole Foods Market has been struggling to

maintain their profit margins and market position for certain time. The deal of retailer with

Amazon can provide the WFM with a great market power with the strength to exist strongly in

the fiercely competitive grocery market. The advanced technology and large customer base of

Amazon can assist the Whole Foods in driving their success. With the help of deal, the stock

4 Frank T Rothaermel. Strategic management. (McGraw-Hill Education, 2015).

5 PREM14A 1 t1702003-prem14a.htm PRELIMINARY PROXY STATEMENT. (UNITED

STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 2018):

https://www.sec.gov/Archives/edgar/data/865436/000157104917006539/t1702003-prem14a.html

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

price of Whole foods achieved greater heights and enjoyed a great competitive edge over the

competitions. The WFM has driven most of the free owner food retail stores out of the food

business while also improvising consolidation as well as company takeover of the food sector as

a whole.

The deal created a positive impact, by increasing affordability with the reduced prices

particularly on organic food, one of the most actual changes is that the Whole Foods did price

drops on most of their top-notch and popular staples6. Further, the deal also enhanced the

availability of healthy yet organic food throughout the country, not merely on online basis but

also on store-basis.

This acquisition will also enable most of the customer to take benefit of fresh, healthy organic

foods, thereby increasing the sales and profitability of business while resulting in a beneficial

aspect for the food industry as large and converting a win-win situation7. Adding to this, the best

quality products will also be accessible on the online website of Amazon, the private label

products of Whole foods will be available on the Amazon-com, which will enhance the sales of

both the corporate

On the other hand, the negative impact would be that it will lower the standards and quality of

organic foods, as the force will be put on the industry to reduce the prices, by this organic

standards might suffer.

IMPACTS ON FINANCIAL STATEMENTS

The resilient goodwill balance sheet of Amazon reflects the way by which the purchase of Whole

Foods is a permanent and successful bet. Approximately 70% of the price of the deal that is $13

billion was allocated to the goodwill, reflecting that the Amazon paid the amount for the long-

term growth other than the surviving assets. Consequently, the goodwill balance of Amazon

exceeded 10B in the year 2017 for the first time. Investors were not likely to pay more concern

6 François Derrien, Frésard Laurent Slabik Victoria, and Valta Philip. "The Effects of Acquisitions on the Value of

Rivals in A ‘Winner-Take-Most’Economy." (2017).

7 Kate Phillips-Connolly and Connolly Aidan J.. "When Amazon ate Whole Foods: big changes for Big

Food." (International Food and Agribusiness Management Review, 2017) 20, no. 5 615.

competitions. The WFM has driven most of the free owner food retail stores out of the food

business while also improvising consolidation as well as company takeover of the food sector as

a whole.

The deal created a positive impact, by increasing affordability with the reduced prices

particularly on organic food, one of the most actual changes is that the Whole Foods did price

drops on most of their top-notch and popular staples6. Further, the deal also enhanced the

availability of healthy yet organic food throughout the country, not merely on online basis but

also on store-basis.

This acquisition will also enable most of the customer to take benefit of fresh, healthy organic

foods, thereby increasing the sales and profitability of business while resulting in a beneficial

aspect for the food industry as large and converting a win-win situation7. Adding to this, the best

quality products will also be accessible on the online website of Amazon, the private label

products of Whole foods will be available on the Amazon-com, which will enhance the sales of

both the corporate

On the other hand, the negative impact would be that it will lower the standards and quality of

organic foods, as the force will be put on the industry to reduce the prices, by this organic

standards might suffer.

IMPACTS ON FINANCIAL STATEMENTS

The resilient goodwill balance sheet of Amazon reflects the way by which the purchase of Whole

Foods is a permanent and successful bet. Approximately 70% of the price of the deal that is $13

billion was allocated to the goodwill, reflecting that the Amazon paid the amount for the long-

term growth other than the surviving assets. Consequently, the goodwill balance of Amazon

exceeded 10B in the year 2017 for the first time. Investors were not likely to pay more concern

6 François Derrien, Frésard Laurent Slabik Victoria, and Valta Philip. "The Effects of Acquisitions on the Value of

Rivals in A ‘Winner-Take-Most’Economy." (2017).

7 Kate Phillips-Connolly and Connolly Aidan J.. "When Amazon ate Whole Foods: big changes for Big

Food." (International Food and Agribusiness Management Review, 2017) 20, no. 5 615.

towards the goodwill due to its presence as a non-cash item. The balance sheet of Amazon

provides evidence to the thinking of company for the expenditure of $13 billion.

The amount of well paid by the Amazon for beyond on its worth on the balance sheet of Whole

Foods markers as $9 billion, approximately 70% of the acquisition price of $13 billion as per the

annual report of Amazon.

The price of Acquisition is allocated to goodwill, intensely, stating that the Amazon is spotting

and driving the opportunity to get long-term success in the business. The tough goodwill balance

states the high confidence of the Amazon in converting the Whole Foods into a larger driver of

revenue; however, it will also come up with risks8. Impairment testing is done on goodwill on a

yearly basis, and in case the acquisitions do not make sense, then the corporation must do write it

off affecting the bottom line on a direct basis.

CONCLUSION

Present study depicts that the takeover of Whole Foods by Amazon resulted fair in terms of

financial aspects and other related terms. The deal was successful, as it allowed ease operation of

Amazon services across the country on the store and online basis. The overall M&A shocked the

organic and food industry as a whole, is a threat to the competitors in the grocery market.

8 Maureen F. McNichols, and R. Stubben Stephen. "The effect of target-firm accounting quality on valuation in

acquisitions." (Review of Accounting Studies 2015) 20, no. 1 110

provides evidence to the thinking of company for the expenditure of $13 billion.

The amount of well paid by the Amazon for beyond on its worth on the balance sheet of Whole

Foods markers as $9 billion, approximately 70% of the acquisition price of $13 billion as per the

annual report of Amazon.

The price of Acquisition is allocated to goodwill, intensely, stating that the Amazon is spotting

and driving the opportunity to get long-term success in the business. The tough goodwill balance

states the high confidence of the Amazon in converting the Whole Foods into a larger driver of

revenue; however, it will also come up with risks8. Impairment testing is done on goodwill on a

yearly basis, and in case the acquisitions do not make sense, then the corporation must do write it

off affecting the bottom line on a direct basis.

CONCLUSION

Present study depicts that the takeover of Whole Foods by Amazon resulted fair in terms of

financial aspects and other related terms. The deal was successful, as it allowed ease operation of

Amazon services across the country on the store and online basis. The overall M&A shocked the

organic and food industry as a whole, is a threat to the competitors in the grocery market.

8 Maureen F. McNichols, and R. Stubben Stephen. "The effect of target-firm accounting quality on valuation in

acquisitions." (Review of Accounting Studies 2015) 20, no. 1 110

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BIBLIOGRPAHY

Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-

reportsannual

Derrien, François, Laurent Frésard, Victoria Slabik, and Philip Valta. "The Effects of

Acquisitions on the Value of Rivals in A ‘Winner-Take-Most’Economy." (2017).

Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term

bet. (Tech 2018): https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-

shows-whole-foods-strategy.html

McNichols, Maureen F., and Stephen R. Stubben. "The effect of target-firm accounting quality

on valuation in acquisitions." Review of Accounting Studies 20, no. 1 (2015): 110-140.

Phillips-Connolly, Kate, and Aidan J. Connolly. "When Amazon ate Whole Foods: big changes

for Big Food." International Food and Agribusiness Management Review 20, no. 5 (2017): 615-

622.

PREM14A 1 t1702003-prem14a.htm PRELIMINARY PROXY STATEMENT. (UNITED

STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 2018):

https://www.sec.gov/Archives/edgar/data/865436/000157104917006539/t1702003-

prem14a.html

Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-

reportsannual

Derrien, François, Laurent Frésard, Victoria Slabik, and Philip Valta. "The Effects of

Acquisitions on the Value of Rivals in A ‘Winner-Take-Most’Economy." (2017).

Kim Eugene. Amazon's soaring goodwill balance shows how Whole Foods buy was a long-term

bet. (Tech 2018): https://www.cnbc.com/2018/02/06/amazon-10-billion-goodwill-balance-

shows-whole-foods-strategy.html

McNichols, Maureen F., and Stephen R. Stubben. "The effect of target-firm accounting quality

on valuation in acquisitions." Review of Accounting Studies 20, no. 1 (2015): 110-140.

Phillips-Connolly, Kate, and Aidan J. Connolly. "When Amazon ate Whole Foods: big changes

for Big Food." International Food and Agribusiness Management Review 20, no. 5 (2017): 615-

622.

PREM14A 1 t1702003-prem14a.htm PRELIMINARY PROXY STATEMENT. (UNITED

STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 2018):

https://www.sec.gov/Archives/edgar/data/865436/000157104917006539/t1702003-

prem14a.html

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Rothaermel, Frank T. Strategic management. McGraw-Hill Education, 2015.

Sherman, Andrew. Mergers and Acquisitions from A to Z. Amacom, 2018.

APPENDICES

Purchase price allocation

Figure 1: Purchase price allocation9

9 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 53

Sherman, Andrew. Mergers and Acquisitions from A to Z. Amacom, 2018.

APPENDICES

Purchase price allocation

Figure 1: Purchase price allocation9

9 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 53

Pro forma financial information

Figure 2: Pro forma financial information10

Goodwill

Figure 3: Goodwill11

10 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 54

11 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 54

Figure 2: Pro forma financial information10

Goodwill

Figure 3: Goodwill11

10 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 54

11 Amazon annual report (May 2017): http://phx.corporateir.net/phoenix.zhtml?c=97664&p=irol-reportsannual 54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9