Rosetta Stone IPO: Market-Multiple and DCF Valuation Analysis

VerifiedAdded on 2020/01/07

|14

|4029

|425

Report

AI Summary

This report provides a comprehensive financial analysis of Rosetta Stone's Initial Public Offering (IPO). It begins by describing the key features of Rosetta Stone's cloud-based business model, its strategy of acquiring firms to expand its reach, and its focus on innovation and customer experience. The report then delves into the advantages and disadvantages of undertaking an IPO, including raising capital, enhancing brand image, and balancing capital structure. It then utilizes the market-multiple approach, using metrics like PE ratio and EV/EBITDA, to identify a range of potential IPO prices. The report also includes a Discounted Cash Flow (DCF) model to determine the fair value of shares, along with calculations for the reasonable rate of return, cash flow projections, enterprise value, WACC, terminal value, and equity value. Finally, the report concludes with a discussion of intrinsic value and the overall valuation of Rosetta Stone's shares, supported by illustrations and references.

Financial entrepreneurial

initiatives

initiatives

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Rosetta Stone..........................................................................................................................3

1. Describe the key features of Rosetta Stone's business model and its strategy...................3

2. Advantage and disadvantage of Rosetta stone undertaking an IPO...................................4

3. Market-Multiples approach to identify range of prices for an IPO....................................6

4. Market-Multiple approach and its use for identifying fair value of shares........................7

5 Reasonable rate of return for Rosetta Stone shares ...........................................................9

6 Cash flow model and explanation on calculations...........................................................10

REFERENCES..............................................................................................................................13

ILLUSTRATION INDEX

Illustration 1: Average of EV/EBITDA for 2008............................................................................7

Illustration 2: Average of EV/EBITDA for 2009...........................................................................8

Illustration 3: PE ratio for 2008.......................................................................................................8

Illustration 4: PE ratio for 2009.......................................................................................................9

Illustration 5: Valuation of shares....................................................................................................9

Illustration 6: Required rate of return..............................................................................................9

Illustration 7: CAPM Model..........................................................................................................10

Illustration 8: Projected income.....................................................................................................11

Illustration 9: Calculation of enterprise value................................................................................11

Illustration 10: Calculation of WACC...........................................................................................12

Illustration 11: Calculation of terminal value................................................................................12

Illustration 12: Calculation of equity value...................................................................................12

Illustration 13: Calculation of intrinsic value................................................................................12

Rosetta Stone..........................................................................................................................3

1. Describe the key features of Rosetta Stone's business model and its strategy...................3

2. Advantage and disadvantage of Rosetta stone undertaking an IPO...................................4

3. Market-Multiples approach to identify range of prices for an IPO....................................6

4. Market-Multiple approach and its use for identifying fair value of shares........................7

5 Reasonable rate of return for Rosetta Stone shares ...........................................................9

6 Cash flow model and explanation on calculations...........................................................10

REFERENCES..............................................................................................................................13

ILLUSTRATION INDEX

Illustration 1: Average of EV/EBITDA for 2008............................................................................7

Illustration 2: Average of EV/EBITDA for 2009...........................................................................8

Illustration 3: PE ratio for 2008.......................................................................................................8

Illustration 4: PE ratio for 2009.......................................................................................................9

Illustration 5: Valuation of shares....................................................................................................9

Illustration 6: Required rate of return..............................................................................................9

Illustration 7: CAPM Model..........................................................................................................10

Illustration 8: Projected income.....................................................................................................11

Illustration 9: Calculation of enterprise value................................................................................11

Illustration 10: Calculation of WACC...........................................................................................12

Illustration 11: Calculation of terminal value................................................................................12

Illustration 12: Calculation of equity value...................................................................................12

Illustration 13: Calculation of intrinsic value................................................................................12

Rosetta Stone

Rosetta Stone is the company that prepare language learning software and it is going to

launch its IPO in the market. In the report different methods of valuation like market multiple an

DCF model are prepared and on the basis of same offer price of firm shares is determined. In

end part of the report, all calculations are attached and explanation on same is given.

1. Describe the key features of Rosetta Stone's business model and its strategy

Rosseta stone's is following the has cloud-based business model and under this model

company is providing software's on which one can learn languages. It can be said that firm is

providing language learning solutions. On its software it is using innovative technology and time

to time upgrade its software so the one can learn language in better way. Mentioned firm in order

to expand its business purchase many firms like are Tell Me More and Livemocha etc. students

and professionals visit firm website to learn languages and it is major source of income for the

firm. These acquisitions helps firm in improving its competitive capability. There are many

corporate clients of the Rosseta stone and it have its own sales personnel who perform CRM

function for the firm. In order to expand business at rapid pace firm is focusing on developing

its core competency (Learn a new language now, 2016). In this regards it is selecting highly

skilled and talented person as employees It drive value by recruiting skilled and highly

experienced sales force. This is helping firm in making available content on languages in best

way. The one of the best thing that Rosseta stone have in its business is that it is not dependent

on single type of customer for earning revenue. Currently, its customer's segment comprises

students and professionals, governmental administered offices etc. In terms of product it can be

said that sale of new language and updated learning software's is the the main source of income

of the firm.

Its main strategy is to increase its competitiveness by preparing software in such a way

that give good learning experience to the stakeholders in terms of learning on its software's.

In order to implement this strategy firm is making heavy investment in its research and

development projects (Boulton and Campbell, 2016). In this regarding it is upgrading its

technology base. With passage of time it is making heavy investment in its research and

development projects. On same time it is also focusing on keeping stiff control on its

expenditures. In this regard, it is maintaining stiff control on material purchase, usage of money

Rosetta Stone is the company that prepare language learning software and it is going to

launch its IPO in the market. In the report different methods of valuation like market multiple an

DCF model are prepared and on the basis of same offer price of firm shares is determined. In

end part of the report, all calculations are attached and explanation on same is given.

1. Describe the key features of Rosetta Stone's business model and its strategy

Rosseta stone's is following the has cloud-based business model and under this model

company is providing software's on which one can learn languages. It can be said that firm is

providing language learning solutions. On its software it is using innovative technology and time

to time upgrade its software so the one can learn language in better way. Mentioned firm in order

to expand its business purchase many firms like are Tell Me More and Livemocha etc. students

and professionals visit firm website to learn languages and it is major source of income for the

firm. These acquisitions helps firm in improving its competitive capability. There are many

corporate clients of the Rosseta stone and it have its own sales personnel who perform CRM

function for the firm. In order to expand business at rapid pace firm is focusing on developing

its core competency (Learn a new language now, 2016). In this regards it is selecting highly

skilled and talented person as employees It drive value by recruiting skilled and highly

experienced sales force. This is helping firm in making available content on languages in best

way. The one of the best thing that Rosseta stone have in its business is that it is not dependent

on single type of customer for earning revenue. Currently, its customer's segment comprises

students and professionals, governmental administered offices etc. In terms of product it can be

said that sale of new language and updated learning software's is the the main source of income

of the firm.

Its main strategy is to increase its competitiveness by preparing software in such a way

that give good learning experience to the stakeholders in terms of learning on its software's.

In order to implement this strategy firm is making heavy investment in its research and

development projects (Boulton and Campbell, 2016). In this regarding it is upgrading its

technology base. With passage of time it is making heavy investment in its research and

development projects. On same time it is also focusing on keeping stiff control on its

expenditures. In this regard, it is maintaining stiff control on material purchase, usage of money

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and R&D projects cost. Firm is following specific strategy under which it is working on projects

that are different from its current product line. Like it is developing apps that are related to brain.

This will enhance customer's base of the firm and will generate new source of income. Hence, it

can be said that firm is focusing on multiple things to increase its business.

Porter five forces model of the business firm are as follows.

Threat from new entrants- There is less threat from new entrants because in this industry

as per past trends very small number of firms enter in some previous years.

Bargaining power of buyers- Buyers does not have any bargaining power as they lots of

alternatives are not available to them.

Bargaining power of suppliers- Firm have bargaining power because it is giving

different and good experience to the people in terms of service quality.

Threat from substitutes- Less threat from substitute products because firm is consistently

updating its technology base.

Threat from rivals- There are few competitors in the industry. However, firm is receiving

tough competition from them. But it is capable to compete them. Hence, there is less

threat from rival firms.

Some of the elements like key markets, company growth and innovation underpin the

forecast of business growth and development. It can be seen that firm in a sector in which there

are lots of growth opportunities. This means that in future firm business will also grow. Hence, it

can be said that sector in which firm operate is growing then growth rate of same will also

accelerate. Innovation is another thing that differentiate firm from its competitors. Rosseta stone

is focusing on innovating its technology base which will lead to easy performance of operations

and reduction in cost. Hence, automatically this form a base of forecast that in future firm growth

rate will increase at rapid pace. In this factors like key markets, company growth and innovation

support the forecast of business growth and development.

2. Advantage and disadvantage of Rosseta stone undertaking an IPO

In order to issue IPO there is a regulatory authority from which it is necessary to take

permission. These authorities lay down some rules or parameters and those firms that wants to

launch there IPO needs to pass these parameters in order to launch IPO. These criteria are

that are different from its current product line. Like it is developing apps that are related to brain.

This will enhance customer's base of the firm and will generate new source of income. Hence, it

can be said that firm is focusing on multiple things to increase its business.

Porter five forces model of the business firm are as follows.

Threat from new entrants- There is less threat from new entrants because in this industry

as per past trends very small number of firms enter in some previous years.

Bargaining power of buyers- Buyers does not have any bargaining power as they lots of

alternatives are not available to them.

Bargaining power of suppliers- Firm have bargaining power because it is giving

different and good experience to the people in terms of service quality.

Threat from substitutes- Less threat from substitute products because firm is consistently

updating its technology base.

Threat from rivals- There are few competitors in the industry. However, firm is receiving

tough competition from them. But it is capable to compete them. Hence, there is less

threat from rival firms.

Some of the elements like key markets, company growth and innovation underpin the

forecast of business growth and development. It can be seen that firm in a sector in which there

are lots of growth opportunities. This means that in future firm business will also grow. Hence, it

can be said that sector in which firm operate is growing then growth rate of same will also

accelerate. Innovation is another thing that differentiate firm from its competitors. Rosseta stone

is focusing on innovating its technology base which will lead to easy performance of operations

and reduction in cost. Hence, automatically this form a base of forecast that in future firm growth

rate will increase at rapid pace. In this factors like key markets, company growth and innovation

support the forecast of business growth and development.

2. Advantage and disadvantage of Rosseta stone undertaking an IPO

In order to issue IPO there is a regulatory authority from which it is necessary to take

permission. These authorities lay down some rules or parameters and those firms that wants to

launch there IPO needs to pass these parameters in order to launch IPO. These criteria are

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

determined in terms of number of years of profitability in range of some specific years and firm

financial position etc. Process that Rosseta stone needs to follow for listing of IPO is give below

1. Creating pitch: In the initial stage of the meeting managers of the firm prepare a detail

plan that they needs to follow in respect to completion of formalities regarding launch of

IPO. In this regard top managers of Board of Directors of the firm will collect

information about the requirements that need to fulfil like submission of financial

statements and other documents to regulatory authority (Judge and et.al., 2015). Board of

Directors will also establish relationship with the underwriters who will make purchase of

firm shares if they will remain unsold in IPO. In respect to this top managers of the

Rosseta stone will evaluate different underwriters and will select best of them.

2. Kick-off meeting: Rosseta stone after making all preliminary preparations will carry out

meeting with its stakeholders like Directors, accountants and investment bank. By

carrying out meeting with all these detail discussion will be carried out about

preparations that needs to be done in further stages. Investment bank will give

recommendation regarding the price at which firm must listed its shares by considering

its forecast earnings and financial position. Investment bank will also frame a prospectus

and present in front of the firm Board of Directors and other stakeholders in the meeting .

In the meeting detail information will be provided about the firm financials and its

business, conditions it currently is facing and strategies that it adopted to cope with

challenges (Pinto and et.al., 2015). Such prospectus will be made available to investors

whether they are retail or institutional investors. On the basis of information provided by

the prospectus investors will be make there investment related decisions.

3. Filling registration statement and due diligence: It is the one of the most important

stage and under this firm needs to file registration statement with SEC of which, Part – I

is preparation of prospectus. Apart from this second part encompass agreements copy that

are signed with underwriter , Rosetta Stone's charter, laws and a specimen of security as

well. Rosseta stone also needs to follow process of due diligence under which will

confirm that it follow all rules and regulations tightly. In this regard all necessary

documents will be made available to the SEC. Apart from this, underwriter of the firm

will form syndicate which will comprise varied investment bankers who will purchase

shares at value less underwriter discount.

financial position etc. Process that Rosseta stone needs to follow for listing of IPO is give below

1. Creating pitch: In the initial stage of the meeting managers of the firm prepare a detail

plan that they needs to follow in respect to completion of formalities regarding launch of

IPO. In this regard top managers of Board of Directors of the firm will collect

information about the requirements that need to fulfil like submission of financial

statements and other documents to regulatory authority (Judge and et.al., 2015). Board of

Directors will also establish relationship with the underwriters who will make purchase of

firm shares if they will remain unsold in IPO. In respect to this top managers of the

Rosseta stone will evaluate different underwriters and will select best of them.

2. Kick-off meeting: Rosseta stone after making all preliminary preparations will carry out

meeting with its stakeholders like Directors, accountants and investment bank. By

carrying out meeting with all these detail discussion will be carried out about

preparations that needs to be done in further stages. Investment bank will give

recommendation regarding the price at which firm must listed its shares by considering

its forecast earnings and financial position. Investment bank will also frame a prospectus

and present in front of the firm Board of Directors and other stakeholders in the meeting .

In the meeting detail information will be provided about the firm financials and its

business, conditions it currently is facing and strategies that it adopted to cope with

challenges (Pinto and et.al., 2015). Such prospectus will be made available to investors

whether they are retail or institutional investors. On the basis of information provided by

the prospectus investors will be make there investment related decisions.

3. Filling registration statement and due diligence: It is the one of the most important

stage and under this firm needs to file registration statement with SEC of which, Part – I

is preparation of prospectus. Apart from this second part encompass agreements copy that

are signed with underwriter , Rosetta Stone's charter, laws and a specimen of security as

well. Rosseta stone also needs to follow process of due diligence under which will

confirm that it follow all rules and regulations tightly. In this regard all necessary

documents will be made available to the SEC. Apart from this, underwriter of the firm

will form syndicate which will comprise varied investment bankers who will purchase

shares at value less underwriter discount.

4. SEC review: This is another stage and under this SEC will check or review all documents

that are made available by the firm to former entity. As per rules and regulations it

registration statement that is filed by the firm are effective only for 20 days of the filling

date. In any case it is find out that firm make available wrong facts and figures then SEC

will sent letter of comment to the firm and will give twenty days to re-file the registration

statement.

5. Road show: It is a stage in which firm will meet with potential investors that can make

investment in the firm. In respect to this 1-2 week road shows will be done by the

underwriter on behalf of the firm.

6. Pricing meeting: It is a stage in which share price negotiation will be carried out with the

underwriter. Discussion will be carried out on the underwriter discount and amount of

same will be determined on the basis of surrounding condition's and estimation of money

that can be raised from the market.

7. Allocation: In this stage syndicate member will sold there shareholding to those who

wants to make investment under IPO (Laeven, Laeven and Michalopoulos, 2015). Copy

of sales confirmation will be made available to underwriters. In this, underwriter will

cancel the deal if payment is not receive in 5 days after delivering confirmation of sale.

8. Trading: After completion of allocation process trading is commenced on firms shares

and public can buy and sale shares. Offering settlement get completed after 10 days from

commencing date, which is mentioned in the underwriter agreement. Security certificate

is given to the underwriter and updated comfort letter will be delivered to the individual

accountants.

Advantage of IPO

It helps firm in raising money from the public as debt is commonly available source of

finance but in case of same it is very important to pay interest every year irrespective of

firm profitability. It can be seen that in case of equity it is not necessary to pay dividend.

Hence, it can be said that firm does not have any pressure to pay finance cost.

By issuing shares in the market firm create its good image and everyone become familiar

with its name (Sikora, Nybakk and Panwar, 2016). It can be said that it become easy for

the firm to create business relationship with other parties.

that are made available by the firm to former entity. As per rules and regulations it

registration statement that is filed by the firm are effective only for 20 days of the filling

date. In any case it is find out that firm make available wrong facts and figures then SEC

will sent letter of comment to the firm and will give twenty days to re-file the registration

statement.

5. Road show: It is a stage in which firm will meet with potential investors that can make

investment in the firm. In respect to this 1-2 week road shows will be done by the

underwriter on behalf of the firm.

6. Pricing meeting: It is a stage in which share price negotiation will be carried out with the

underwriter. Discussion will be carried out on the underwriter discount and amount of

same will be determined on the basis of surrounding condition's and estimation of money

that can be raised from the market.

7. Allocation: In this stage syndicate member will sold there shareholding to those who

wants to make investment under IPO (Laeven, Laeven and Michalopoulos, 2015). Copy

of sales confirmation will be made available to underwriters. In this, underwriter will

cancel the deal if payment is not receive in 5 days after delivering confirmation of sale.

8. Trading: After completion of allocation process trading is commenced on firms shares

and public can buy and sale shares. Offering settlement get completed after 10 days from

commencing date, which is mentioned in the underwriter agreement. Security certificate

is given to the underwriter and updated comfort letter will be delivered to the individual

accountants.

Advantage of IPO

It helps firm in raising money from the public as debt is commonly available source of

finance but in case of same it is very important to pay interest every year irrespective of

firm profitability. It can be seen that in case of equity it is not necessary to pay dividend.

Hence, it can be said that firm does not have any pressure to pay finance cost.

By issuing shares in the market firm create its good image and everyone become familiar

with its name (Sikora, Nybakk and Panwar, 2016). It can be said that it become easy for

the firm to create business relationship with other parties.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By issuing shares capital structure can be balanced by the firm and concentration of debt

can be reduced.

Disadvantage of IPO

Investors by making investment in the firm reduce powers of the owners of the firm to

make there business decisions. It is major disadvantage of issue of shares.

Cost of equity is always higher then equity which means that amount of dividend paid by

the firm is always high then interest amount.

3. Market-Multiples approach to identify range of prices for an IPO

Market multiple approach is totally a different method of valuation and under this share

price is valued by using similar type of assets in same price range. Under this approach number

of things are used to value a share like PE ratio, market price and EPS. PE ratio is computed by

dividing share price by the earning per share. On other hand, earning per share is computed

dividing net profit by the shares that are issued by the firm. PE ratio and profit are some of the

specific parameters that can be used to determine share price when IPO is launched by the firm

in the market. PE ratio helps in measuring that share price of the shares price is overvalued or

undervalued in comparison to peer firms or industry (Xavier-Oliveira Laplume and Pathak,

2015). If firm shares PE ratio is below industry PE ratio then it can be said that firm shares are

undervalued and there valuations are appropriate. Contrary to this if it is identified that PE ratio

of the firm is greater then industry then it means that its shares are overvalued and are available

for purchase more then the fair value. In order to compute PE ratio and to check valuation of

Rosetta stone shares some competitor firms are selected like Apollo Group Inc, American Public

Education Inc, Corinthian Education Corp, and Capella Education etc.

Another multiple that is used in this approach are Enterprise value which include total

shares value plus aggregate value of debt. Following formula is used to compute enterprise

value.

Enterprise value (EV) = Market capitalization + Debt fund + Minority interest – Cash and

equivalents – investment

There are other multiples that can be used like EV/EBITDA. In this enterprise value is

divided by the earning before interest and tax. Discounted cash model is another method that is

often used by the research analysts but some of them prefer to use EV/EBITDA method in

comparison to DCF analysis. There are some merits and demerits of these three multiple

can be reduced.

Disadvantage of IPO

Investors by making investment in the firm reduce powers of the owners of the firm to

make there business decisions. It is major disadvantage of issue of shares.

Cost of equity is always higher then equity which means that amount of dividend paid by

the firm is always high then interest amount.

3. Market-Multiples approach to identify range of prices for an IPO

Market multiple approach is totally a different method of valuation and under this share

price is valued by using similar type of assets in same price range. Under this approach number

of things are used to value a share like PE ratio, market price and EPS. PE ratio is computed by

dividing share price by the earning per share. On other hand, earning per share is computed

dividing net profit by the shares that are issued by the firm. PE ratio and profit are some of the

specific parameters that can be used to determine share price when IPO is launched by the firm

in the market. PE ratio helps in measuring that share price of the shares price is overvalued or

undervalued in comparison to peer firms or industry (Xavier-Oliveira Laplume and Pathak,

2015). If firm shares PE ratio is below industry PE ratio then it can be said that firm shares are

undervalued and there valuations are appropriate. Contrary to this if it is identified that PE ratio

of the firm is greater then industry then it means that its shares are overvalued and are available

for purchase more then the fair value. In order to compute PE ratio and to check valuation of

Rosetta stone shares some competitor firms are selected like Apollo Group Inc, American Public

Education Inc, Corinthian Education Corp, and Capella Education etc.

Another multiple that is used in this approach are Enterprise value which include total

shares value plus aggregate value of debt. Following formula is used to compute enterprise

value.

Enterprise value (EV) = Market capitalization + Debt fund + Minority interest – Cash and

equivalents – investment

There are other multiples that can be used like EV/EBITDA. In this enterprise value is

divided by the earning before interest and tax. Discounted cash model is another method that is

often used by the research analysts but some of them prefer to use EV/EBITDA method in

comparison to DCF analysis. There are some merits and demerits of these three multiple

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

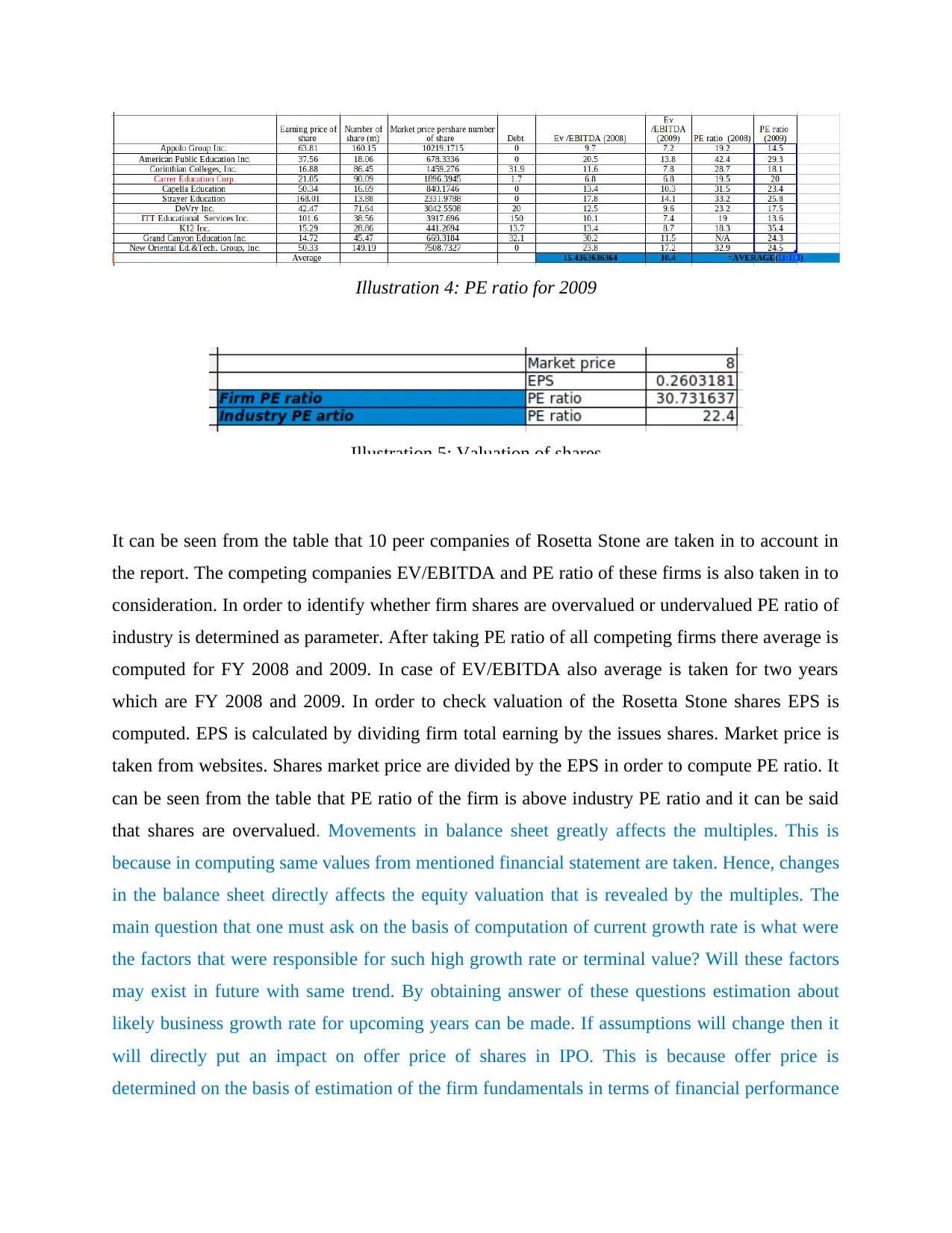

approached (Caution, Platt and Platt, 2011). The main merit of these methods is that in these

multiple ratios like PE ratios are used which are computed by using marker facts and figures. to

decide share price. Hence, from market point of view valuation of shares is done in correct way.

Inverse to this, the main weak point of this approach is that it does not consider firm profitability

or its business performance to great extent for valuation like discounted cash flow model.

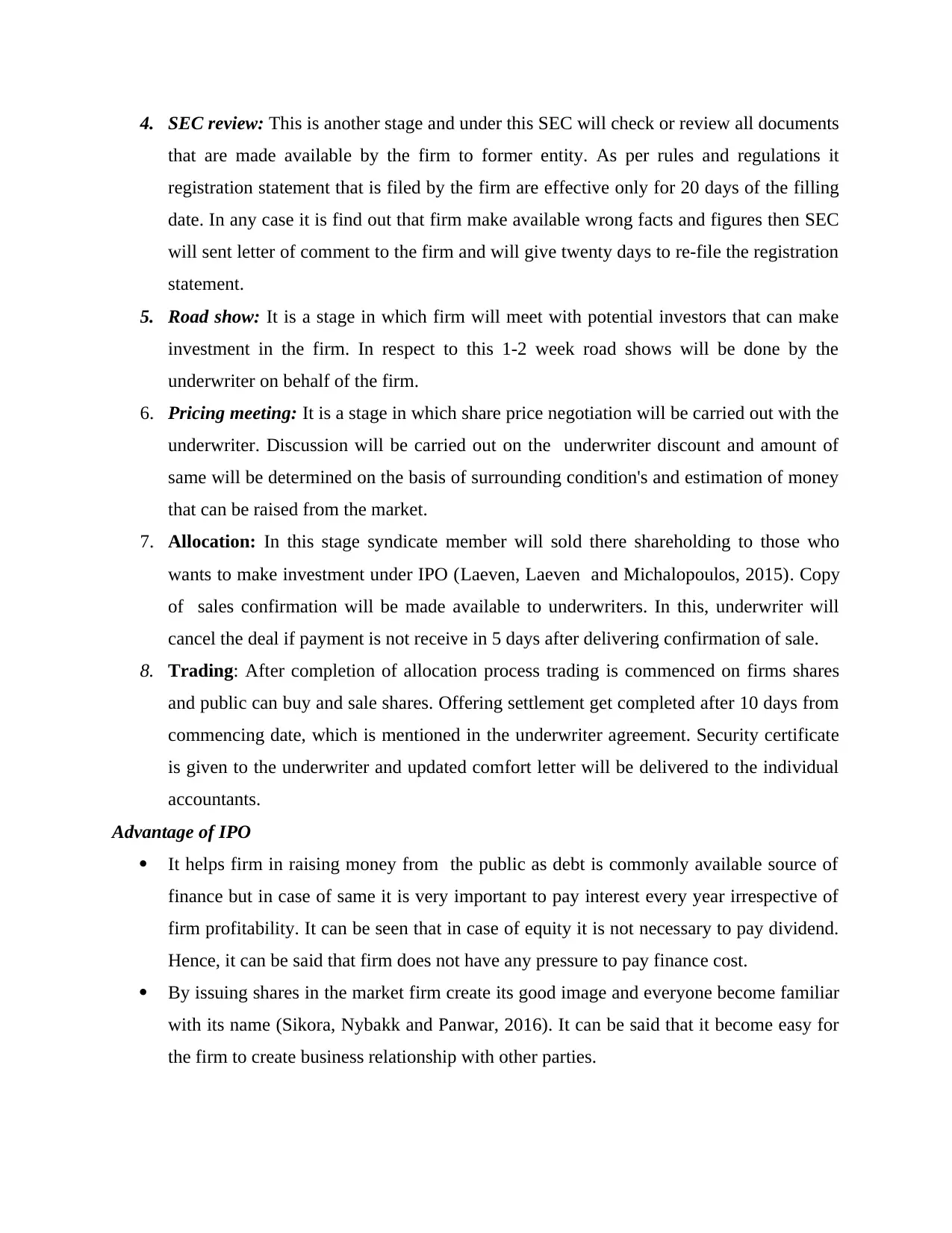

4. Market-Multiple approach and its use for identifying fair value of shares

Market multiple approach is different method of shares valuation then other methods of

equity valuation. Under this method competitors of the firm are taken in to consideration and

there price earning ratio is computed. By using this method in following way calculations will be

done.

Illustration 1: Average of EV/EBITDA for 2008

Illustration 2: Average of EV/EBITDA for 2009

Illustration 3: PE ratio for 2008

multiple ratios like PE ratios are used which are computed by using marker facts and figures. to

decide share price. Hence, from market point of view valuation of shares is done in correct way.

Inverse to this, the main weak point of this approach is that it does not consider firm profitability

or its business performance to great extent for valuation like discounted cash flow model.

4. Market-Multiple approach and its use for identifying fair value of shares

Market multiple approach is different method of shares valuation then other methods of

equity valuation. Under this method competitors of the firm are taken in to consideration and

there price earning ratio is computed. By using this method in following way calculations will be

done.

Illustration 1: Average of EV/EBITDA for 2008

Illustration 2: Average of EV/EBITDA for 2009

Illustration 3: PE ratio for 2008

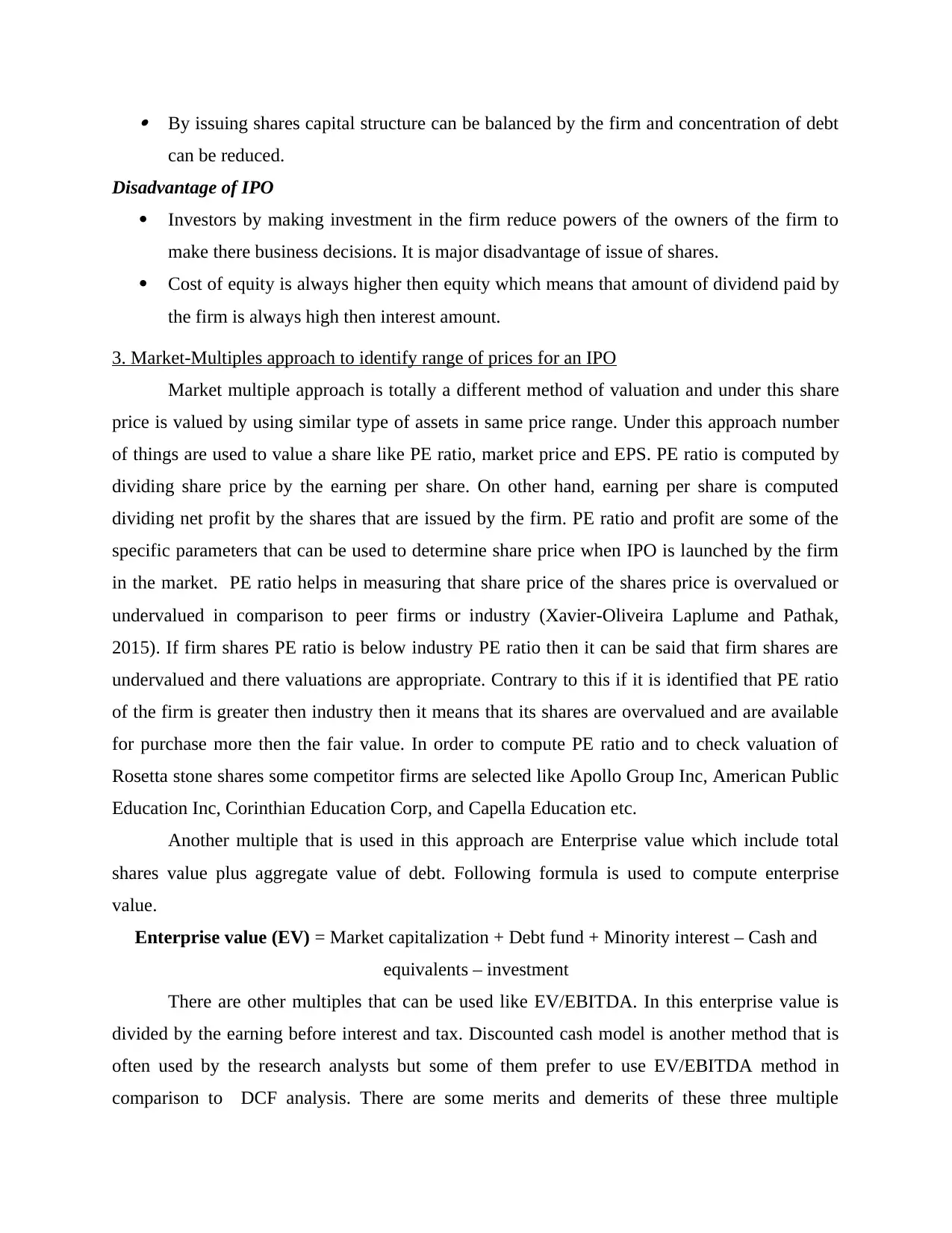

Illustration 4: PE ratio for 2009

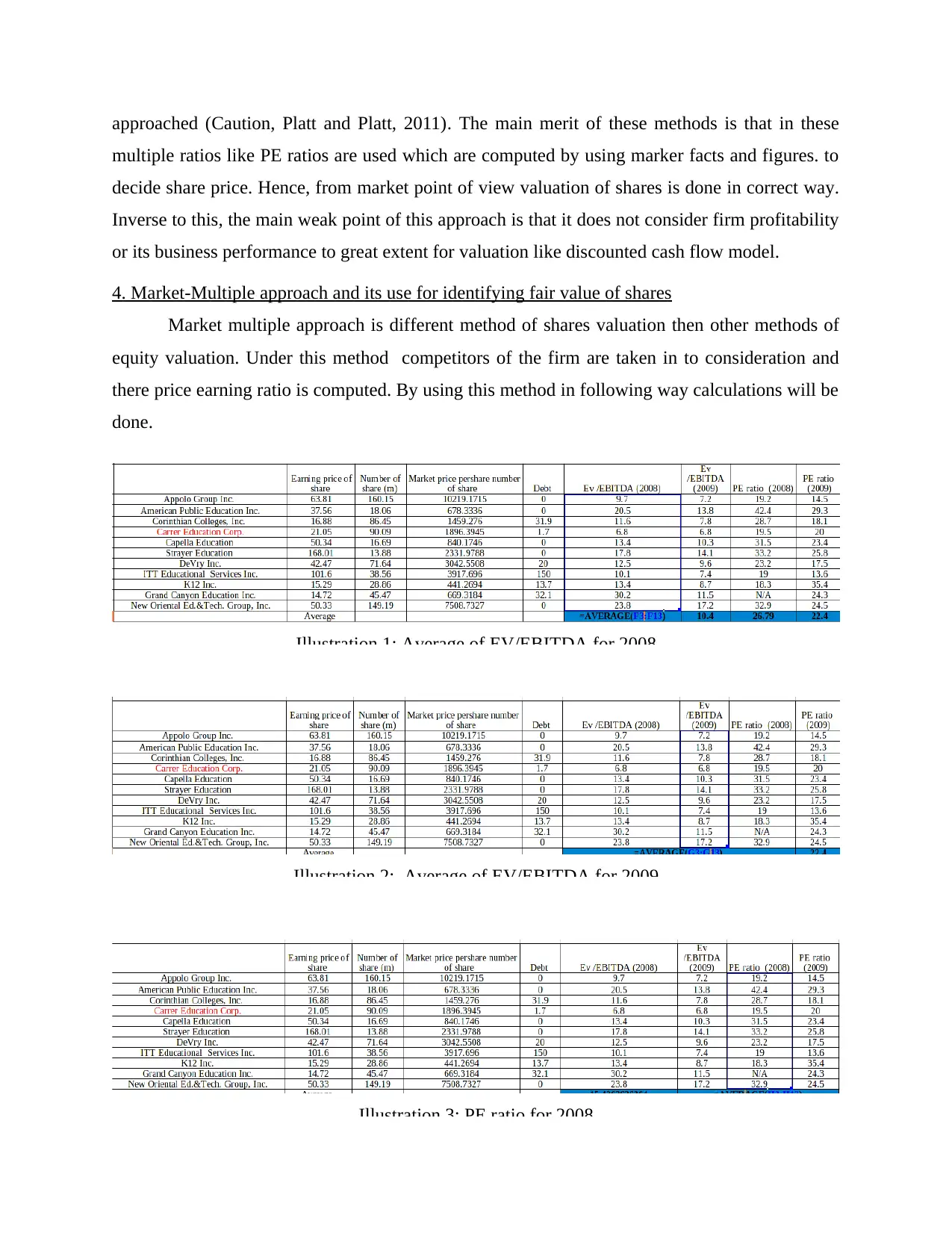

It can be seen from the table that 10 peer companies of Rosetta Stone are taken in to account in

the report. The competing companies EV/EBITDA and PE ratio of these firms is also taken in to

consideration. In order to identify whether firm shares are overvalued or undervalued PE ratio of

industry is determined as parameter. After taking PE ratio of all competing firms there average is

computed for FY 2008 and 2009. In case of EV/EBITDA also average is taken for two years

which are FY 2008 and 2009. In order to check valuation of the Rosetta Stone shares EPS is

computed. EPS is calculated by dividing firm total earning by the issues shares. Market price is

taken from websites. Shares market price are divided by the EPS in order to compute PE ratio. It

can be seen from the table that PE ratio of the firm is above industry PE ratio and it can be said

that shares are overvalued. Movements in balance sheet greatly affects the multiples. This is

because in computing same values from mentioned financial statement are taken. Hence, changes

in the balance sheet directly affects the equity valuation that is revealed by the multiples. The

main question that one must ask on the basis of computation of current growth rate is what were

the factors that were responsible for such high growth rate or terminal value? Will these factors

may exist in future with same trend. By obtaining answer of these questions estimation about

likely business growth rate for upcoming years can be made. If assumptions will change then it

will directly put an impact on offer price of shares in IPO. This is because offer price is

determined on the basis of estimation of the firm fundamentals in terms of financial performance

Illustration 5: Valuation of shares

It can be seen from the table that 10 peer companies of Rosetta Stone are taken in to account in

the report. The competing companies EV/EBITDA and PE ratio of these firms is also taken in to

consideration. In order to identify whether firm shares are overvalued or undervalued PE ratio of

industry is determined as parameter. After taking PE ratio of all competing firms there average is

computed for FY 2008 and 2009. In case of EV/EBITDA also average is taken for two years

which are FY 2008 and 2009. In order to check valuation of the Rosetta Stone shares EPS is

computed. EPS is calculated by dividing firm total earning by the issues shares. Market price is

taken from websites. Shares market price are divided by the EPS in order to compute PE ratio. It

can be seen from the table that PE ratio of the firm is above industry PE ratio and it can be said

that shares are overvalued. Movements in balance sheet greatly affects the multiples. This is

because in computing same values from mentioned financial statement are taken. Hence, changes

in the balance sheet directly affects the equity valuation that is revealed by the multiples. The

main question that one must ask on the basis of computation of current growth rate is what were

the factors that were responsible for such high growth rate or terminal value? Will these factors

may exist in future with same trend. By obtaining answer of these questions estimation about

likely business growth rate for upcoming years can be made. If assumptions will change then it

will directly put an impact on offer price of shares in IPO. This is because offer price is

determined on the basis of estimation of the firm fundamentals in terms of financial performance

Illustration 5: Valuation of shares

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

that may be seen in future time period. Hence, if assumptions will change then offer price will

also change. Such a variation may be positive or negative depends on changes that are made in

the assumption. Offer price is computed by using varied methods and each of them revealed the

different share issue price. Decision in respect to price which must be picked must be taken on

the basis of existing economic condition of the nation and investors sentiments regarding making

an investment in the stock market.

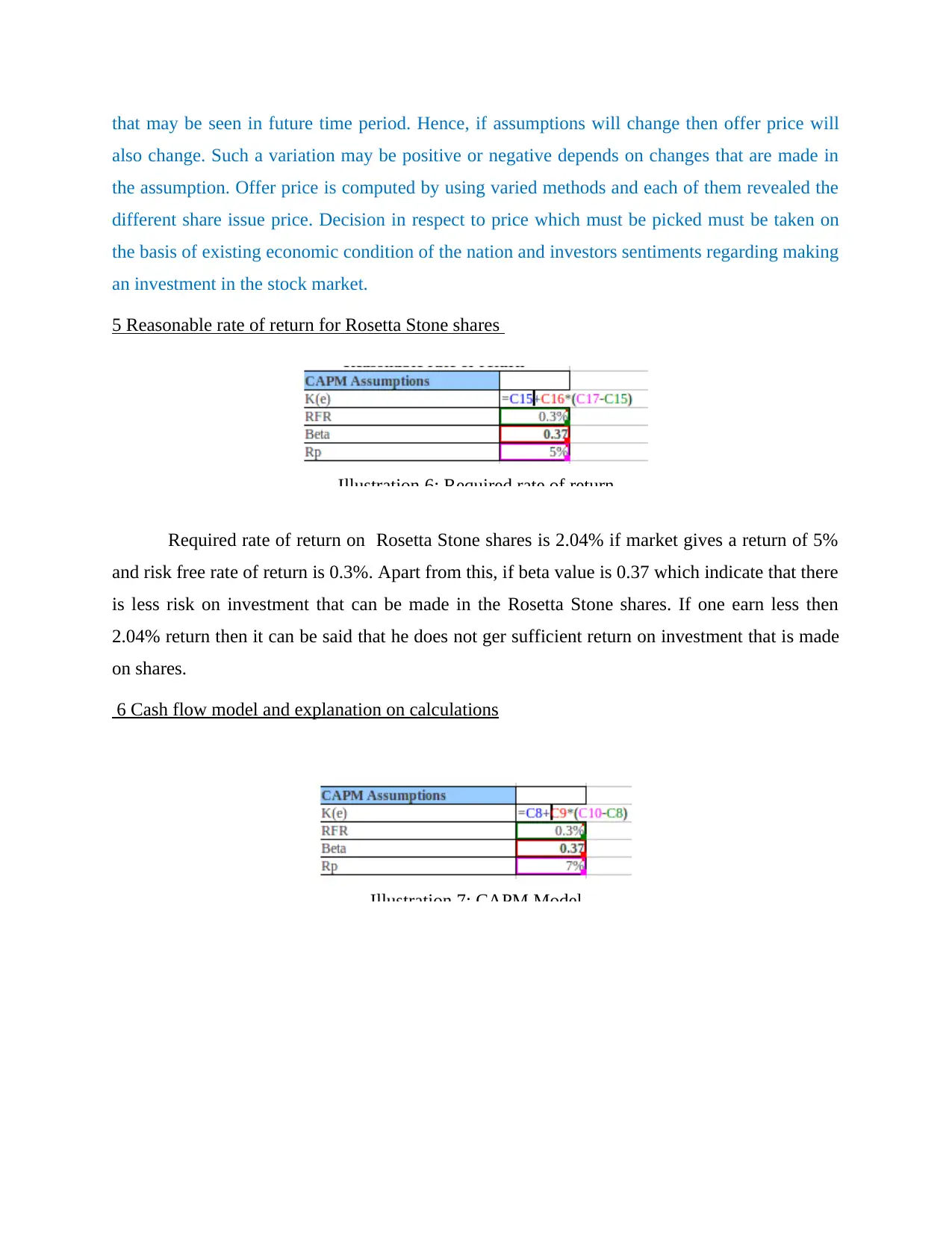

5 Reasonable rate of return for Rosetta Stone shares

Required rate of return on Rosetta Stone shares is 2.04% if market gives a return of 5%

and risk free rate of return is 0.3%. Apart from this, if beta value is 0.37 which indicate that there

is less risk on investment that can be made in the Rosetta Stone shares. If one earn less then

2.04% return then it can be said that he does not ger sufficient return on investment that is made

on shares.

6 Cash flow model and explanation on calculations

Illustration 7: CAPM Model

Illustration 6: Required rate of return

also change. Such a variation may be positive or negative depends on changes that are made in

the assumption. Offer price is computed by using varied methods and each of them revealed the

different share issue price. Decision in respect to price which must be picked must be taken on

the basis of existing economic condition of the nation and investors sentiments regarding making

an investment in the stock market.

5 Reasonable rate of return for Rosetta Stone shares

Required rate of return on Rosetta Stone shares is 2.04% if market gives a return of 5%

and risk free rate of return is 0.3%. Apart from this, if beta value is 0.37 which indicate that there

is less risk on investment that can be made in the Rosetta Stone shares. If one earn less then

2.04% return then it can be said that he does not ger sufficient return on investment that is made

on shares.

6 Cash flow model and explanation on calculations

Illustration 7: CAPM Model

Illustration 6: Required rate of return

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

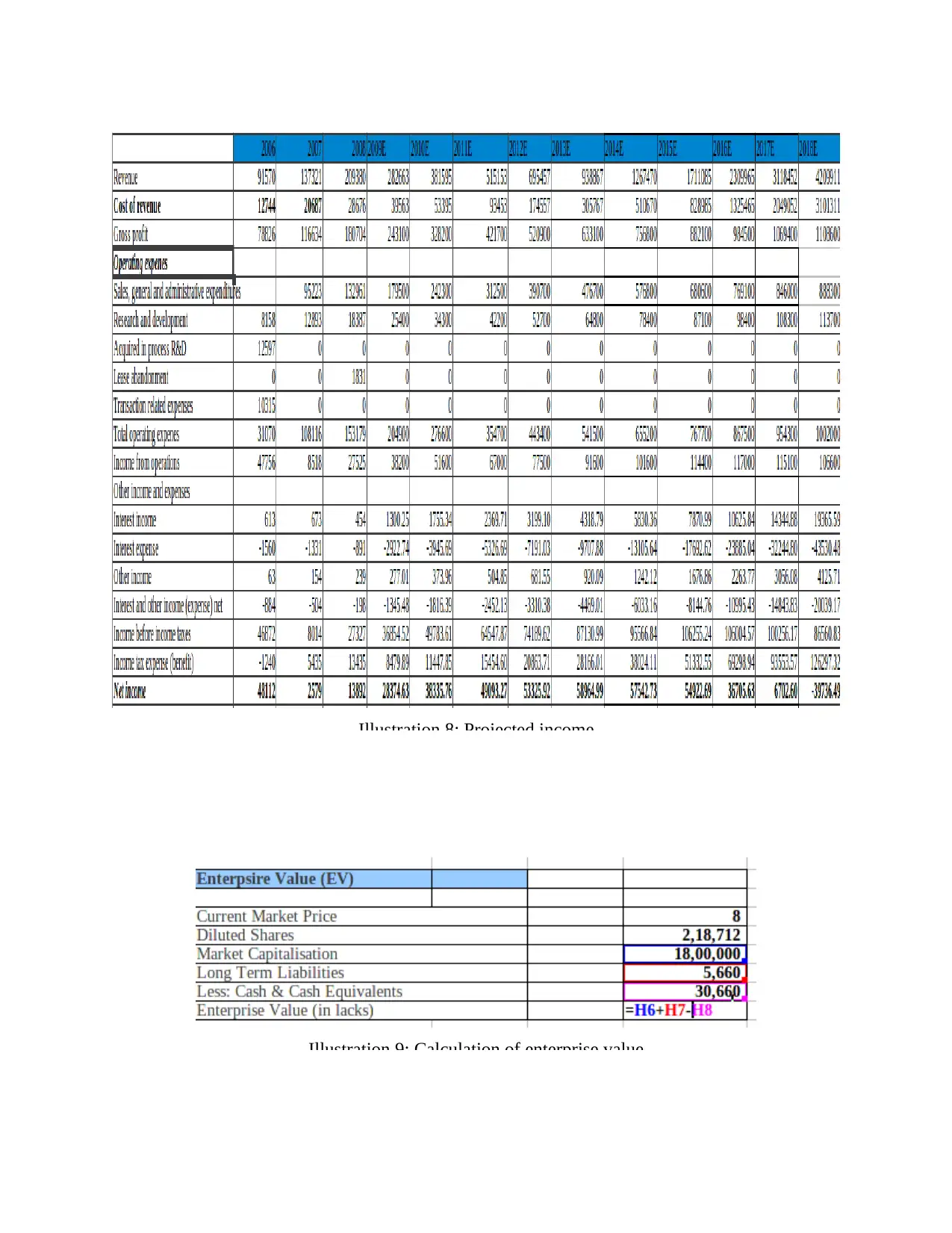

Illustration 8: Projected income

Illustration 9: Calculation of enterprise value

Illustration 9: Calculation of enterprise value

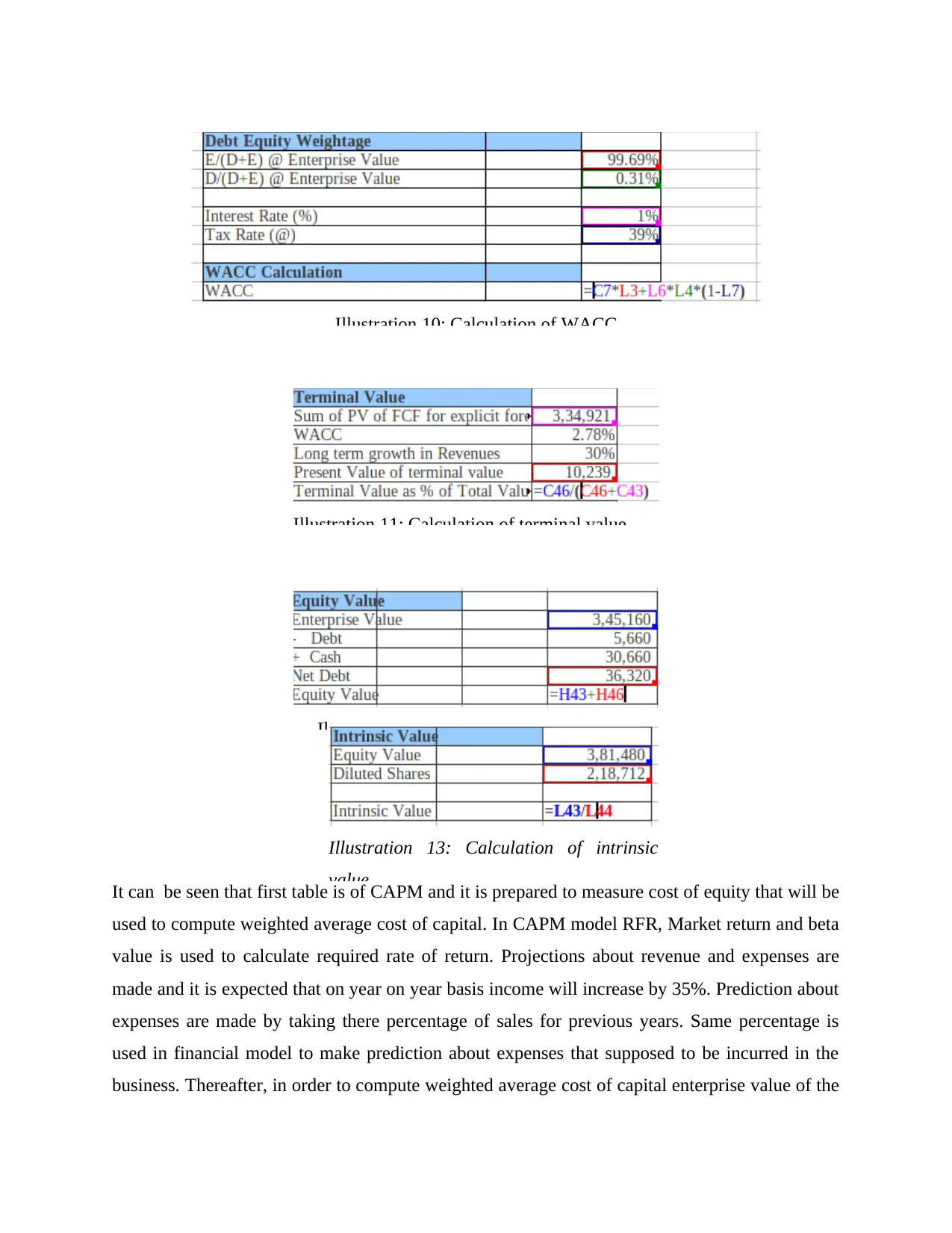

It can be seen that first table is of CAPM and it is prepared to measure cost of equity that will be

used to compute weighted average cost of capital. In CAPM model RFR, Market return and beta

value is used to calculate required rate of return. Projections about revenue and expenses are

made and it is expected that on year on year basis income will increase by 35%. Prediction about

expenses are made by taking there percentage of sales for previous years. Same percentage is

used in financial model to make prediction about expenses that supposed to be incurred in the

business. Thereafter, in order to compute weighted average cost of capital enterprise value of the

Illustration 11: Calculation of terminal value

Illustration 10: Calculation of WACC

Illustration 12: Calculation of equity value

Illustration 13: Calculation of intrinsic

value

used to compute weighted average cost of capital. In CAPM model RFR, Market return and beta

value is used to calculate required rate of return. Projections about revenue and expenses are

made and it is expected that on year on year basis income will increase by 35%. Prediction about

expenses are made by taking there percentage of sales for previous years. Same percentage is

used in financial model to make prediction about expenses that supposed to be incurred in the

business. Thereafter, in order to compute weighted average cost of capital enterprise value of the

Illustration 11: Calculation of terminal value

Illustration 10: Calculation of WACC

Illustration 12: Calculation of equity value

Illustration 13: Calculation of intrinsic

value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.