Finance Report: MFRD Analysis of Sources, Planning, and Statements

VerifiedAdded on 2020/07/22

|21

|4810

|55

Report

AI Summary

This report delves into the financial aspects of a business, exploring various sources of finance such as equity, debentures, bank loans, venture capital, and retained earnings, along with their implications on a firm's financial and legal aspects. It evaluates the cost of different financing options and emphasizes the importance of financial planning for prudent cash management. The report analyzes the information needs of internal and external decision-makers, including stakeholders and suppliers, and examines the impact of different sources of finance on financial statements. It further analyzes budgets, unit cost calculations, and project viability, including the calculation of payback period, ARR, NPV, and IRR. Finally, it compares financial statements and performs ratio analysis to assess the performance of Marks and Spencer, offering insights into its financial health and decision-making processes.

MFRD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Sources of finance available to business firms.................................................................1

1.2 Implications of sources of finance....................................................................................2

1.3 Evaluating appropriate source of finance for the firm......................................................4

TASK 2............................................................................................................................................4

2.1 Cost of varied sources of finance...........................................................................................4

2.2 Importance of financial planning...........................................................................................5

2.3 Analysis of the information needs of internal and external decision maker..........................5

2.4 Impact of various sources of finance upon the financial statement.......................................5

TASK 3............................................................................................................................................6

3.1 Analysis of budget and important decisions..........................................................................6

3.2 Explain the calculation of unit cost and pricing decisions....................................................7

3.3 Viability of project.................................................................................................................8

TASK 4..........................................................................................................................................10

4.1 Important financial statements prepared by Marks and Spencer.........................................10

4.2 Comparison of format of financial statemetnts...................................................................11

financial statements...................................................................................................................11

4.3 Ratio analysis.......................................................................................................................15

CONCLUSION..............................................................................................................................17

Table 1Calculation of Payback period.............................................................................................8

Table 2Calculation of ARR.............................................................................................................9

Table 3Calculation of NPV.............................................................................................................9

Table 4Calculation of IRR...............................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Sources of finance available to business firms.................................................................1

1.2 Implications of sources of finance....................................................................................2

1.3 Evaluating appropriate source of finance for the firm......................................................4

TASK 2............................................................................................................................................4

2.1 Cost of varied sources of finance...........................................................................................4

2.2 Importance of financial planning...........................................................................................5

2.3 Analysis of the information needs of internal and external decision maker..........................5

2.4 Impact of various sources of finance upon the financial statement.......................................5

TASK 3............................................................................................................................................6

3.1 Analysis of budget and important decisions..........................................................................6

3.2 Explain the calculation of unit cost and pricing decisions....................................................7

3.3 Viability of project.................................................................................................................8

TASK 4..........................................................................................................................................10

4.1 Important financial statements prepared by Marks and Spencer.........................................10

4.2 Comparison of format of financial statemetnts...................................................................11

financial statements...................................................................................................................11

4.3 Ratio analysis.......................................................................................................................15

CONCLUSION..............................................................................................................................17

Table 1Calculation of Payback period.............................................................................................8

Table 2Calculation of ARR.............................................................................................................9

Table 3Calculation of NPV.............................................................................................................9

Table 4Calculation of IRR...............................................................................................................9

Table 5Ratio analysis of M&S and Tesco.....................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is the one of branch of business management that matter a lot for the business

firm. In the present research study sources of finance are explained and their implications for the

firm are discussed in detail. In middle part of the reprot, cash budget and project evaluation is

done. On the basis of obtained results most profitable project is selected for the business firm. At

end of thre report, ratio analysis is done and on that basis performance of the firm is acessed and

funancial statements are also compared and differentiate in respect to sole trader, partnership and

company.

TASK 1

1.1 Sources of finance available to business firms

There are number of sources of finance that are available to the business firms. All these

sources of finannce have some merits and demerits. It become inevitable for the firm to ensure

that it is raising funds from appropriate source of finance. Some of the common sources of

finance that are available to Marks and Spencer are given below.

External source of finance

Equity: Equity is commonly used as a source to fund project that required heavy capital

investment (Caglayan and Demir, 2014). This source of finance is usually used by the

business firms when they want to make huge capital investment in the business to

expand it at rapid pace. Marks and Spencer can issue shares in stock market and can

invest proceed amount to develop its own infrastructure and opening new branches across

globe.

Debenture: It is a variant of debt and similar to bank loan. Only difference between

debenture and bank loan is that in case of former one debt is taken from general public at

specific interest rate but in case of latter one financial institute give loan to the business

firm. large corporates that have good reputation usually issue debentures on which

investment is made by the mutual fund and other firms.

Bank loan: Bank loan is the commonly available source of finance that is available to

Marks and Spencer. Under this simply by mortgaging some property target amount of

loan is raised from financial institute and then same is invested in business. From earned

revenue principal and interest amount is paid by firm to bank.

1 | P a g e

Finance is the one of branch of business management that matter a lot for the business

firm. In the present research study sources of finance are explained and their implications for the

firm are discussed in detail. In middle part of the reprot, cash budget and project evaluation is

done. On the basis of obtained results most profitable project is selected for the business firm. At

end of thre report, ratio analysis is done and on that basis performance of the firm is acessed and

funancial statements are also compared and differentiate in respect to sole trader, partnership and

company.

TASK 1

1.1 Sources of finance available to business firms

There are number of sources of finance that are available to the business firms. All these

sources of finannce have some merits and demerits. It become inevitable for the firm to ensure

that it is raising funds from appropriate source of finance. Some of the common sources of

finance that are available to Marks and Spencer are given below.

External source of finance

Equity: Equity is commonly used as a source to fund project that required heavy capital

investment (Caglayan and Demir, 2014). This source of finance is usually used by the

business firms when they want to make huge capital investment in the business to

expand it at rapid pace. Marks and Spencer can issue shares in stock market and can

invest proceed amount to develop its own infrastructure and opening new branches across

globe.

Debenture: It is a variant of debt and similar to bank loan. Only difference between

debenture and bank loan is that in case of former one debt is taken from general public at

specific interest rate but in case of latter one financial institute give loan to the business

firm. large corporates that have good reputation usually issue debentures on which

investment is made by the mutual fund and other firms.

Bank loan: Bank loan is the commonly available source of finance that is available to

Marks and Spencer. Under this simply by mortgaging some property target amount of

loan is raised from financial institute and then same is invested in business. From earned

revenue principal and interest amount is paid by firm to bank.

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Venture capital: Venture capital is the source of finance under which there is a VC firm

which provide equity to the company and obtain shareholding in same. Due to purchase

of equity these shareholders have right to take part in decision making process. Usuallly,

VC firmm charge heavy fee from firm for proving services.

Internal source of finance

Retained earning: It is another source of finance where portion of revenue is kept aside

for future time period in order to meet business needs. Usually, it is assumed that there is

no cost of capital of mentioned source of finance (Irwin and Scott,2010).

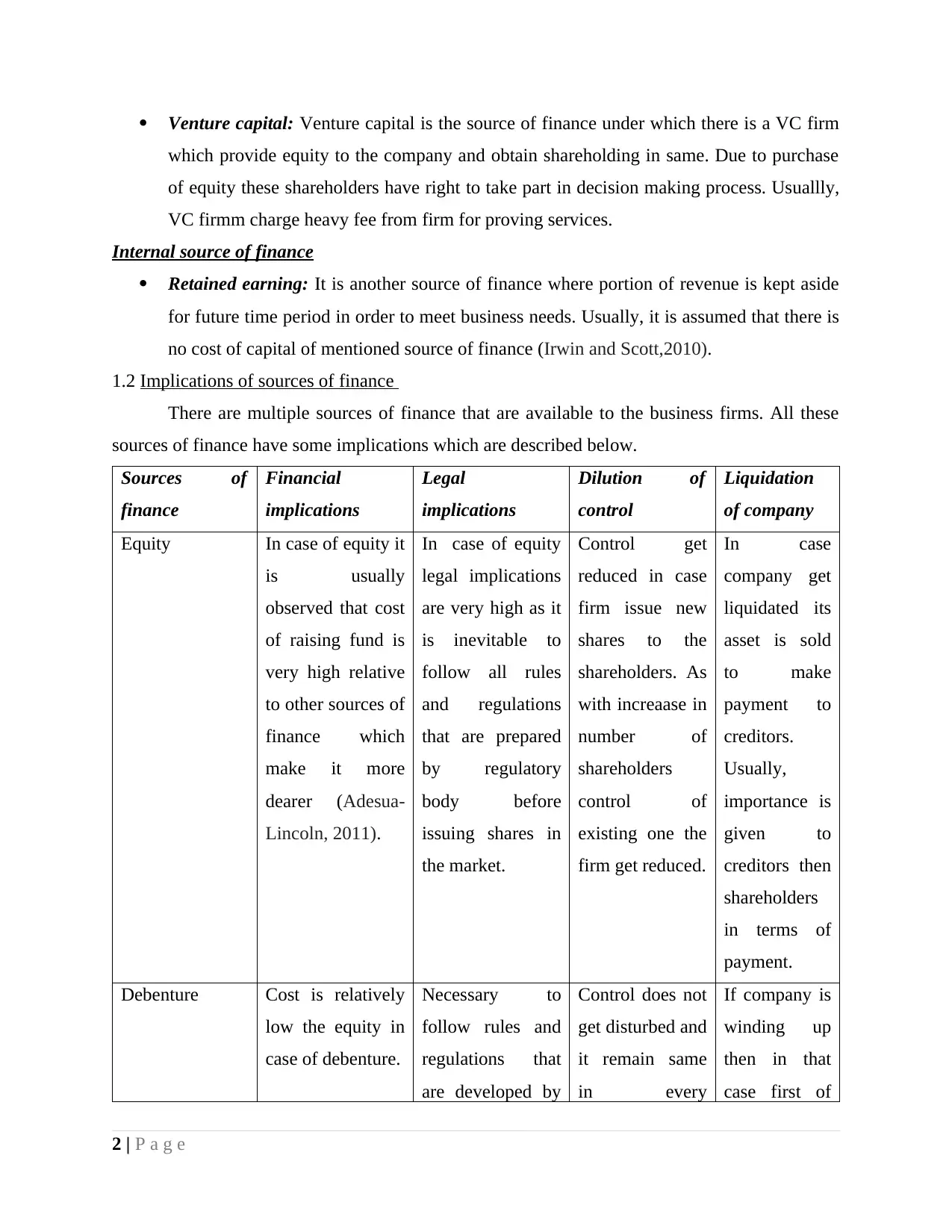

1.2 Implications of sources of finance

There are multiple sources of finance that are available to the business firms. All these

sources of finance have some implications which are described below.

Sources of

finance

Financial

implications

Legal

implications

Dilution of

control

Liquidation

of company

Equity In case of equity it

is usually

observed that cost

of raising fund is

very high relative

to other sources of

finance which

make it more

dearer (Adesua-

Lincoln, 2011).

In case of equity

legal implications

are very high as it

is inevitable to

follow all rules

and regulations

that are prepared

by regulatory

body before

issuing shares in

the market.

Control get

reduced in case

firm issue new

shares to the

shareholders. As

with increaase in

number of

shareholders

control of

existing one the

firm get reduced.

In case

company get

liquidated its

asset is sold

to make

payment to

creditors.

Usually,

importance is

given to

creditors then

shareholders

in terms of

payment.

Debenture Cost is relatively

low the equity in

case of debenture.

Necessary to

follow rules and

regulations that

are developed by

Control does not

get disturbed and

it remain same

in every

If company is

winding up

then in that

case first of

2 | P a g e

which provide equity to the company and obtain shareholding in same. Due to purchase

of equity these shareholders have right to take part in decision making process. Usuallly,

VC firmm charge heavy fee from firm for proving services.

Internal source of finance

Retained earning: It is another source of finance where portion of revenue is kept aside

for future time period in order to meet business needs. Usually, it is assumed that there is

no cost of capital of mentioned source of finance (Irwin and Scott,2010).

1.2 Implications of sources of finance

There are multiple sources of finance that are available to the business firms. All these

sources of finance have some implications which are described below.

Sources of

finance

Financial

implications

Legal

implications

Dilution of

control

Liquidation

of company

Equity In case of equity it

is usually

observed that cost

of raising fund is

very high relative

to other sources of

finance which

make it more

dearer (Adesua-

Lincoln, 2011).

In case of equity

legal implications

are very high as it

is inevitable to

follow all rules

and regulations

that are prepared

by regulatory

body before

issuing shares in

the market.

Control get

reduced in case

firm issue new

shares to the

shareholders. As

with increaase in

number of

shareholders

control of

existing one the

firm get reduced.

In case

company get

liquidated its

asset is sold

to make

payment to

creditors.

Usually,

importance is

given to

creditors then

shareholders

in terms of

payment.

Debenture Cost is relatively

low the equity in

case of debenture.

Necessary to

follow rules and

regulations that

are developed by

Control does not

get disturbed and

it remain same

in every

If company is

winding up

then in that

case first of

2 | P a g e

relevant govrning

body. In case of

failure to do so

may results in

negatue

consequence in

business.

situation. all its assets

are sold in the

market and by

using same

payment is

made to the

debenture

holders. If

any amount

remain then

same is used

to make

payment to

shareholders.

Bank loan In case of bank

loan like

debenture there is

loss cost of source

of finance. Due to

this reason it is

preffered by most

of the business

firms (Duchin,

Ozbas. and

Sensoy, 2010).

In case of bank

loan financial

institutes have

their own standard

that they followed

for giving loan to

the business firms.

As per rules in

case if Marks and

Spencer failed to

given loan amount

on time strict

action can be

taken by bank

against it.

Like debenture

in case of bank

loan also control

remain

unchanged.

In case of

bank loan

first of all

relevant

amount is

paid to bank

and then

remaining

proceeds are

used to pay

shareholders.

Venture capital VC firms have

huge control on

Terms and

conditions are

Control of

existing

In case of

liquidation

3 | P a g e

body. In case of

failure to do so

may results in

negatue

consequence in

business.

situation. all its assets

are sold in the

market and by

using same

payment is

made to the

debenture

holders. If

any amount

remain then

same is used

to make

payment to

shareholders.

Bank loan In case of bank

loan like

debenture there is

loss cost of source

of finance. Due to

this reason it is

preffered by most

of the business

firms (Duchin,

Ozbas. and

Sensoy, 2010).

In case of bank

loan financial

institutes have

their own standard

that they followed

for giving loan to

the business firms.

As per rules in

case if Marks and

Spencer failed to

given loan amount

on time strict

action can be

taken by bank

against it.

Like debenture

in case of bank

loan also control

remain

unchanged.

In case of

bank loan

first of all

relevant

amount is

paid to bank

and then

remaining

proceeds are

used to pay

shareholders.

Venture capital VC firms have

huge control on

Terms and

conditions are

Control of

existing

In case of

liquidation

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

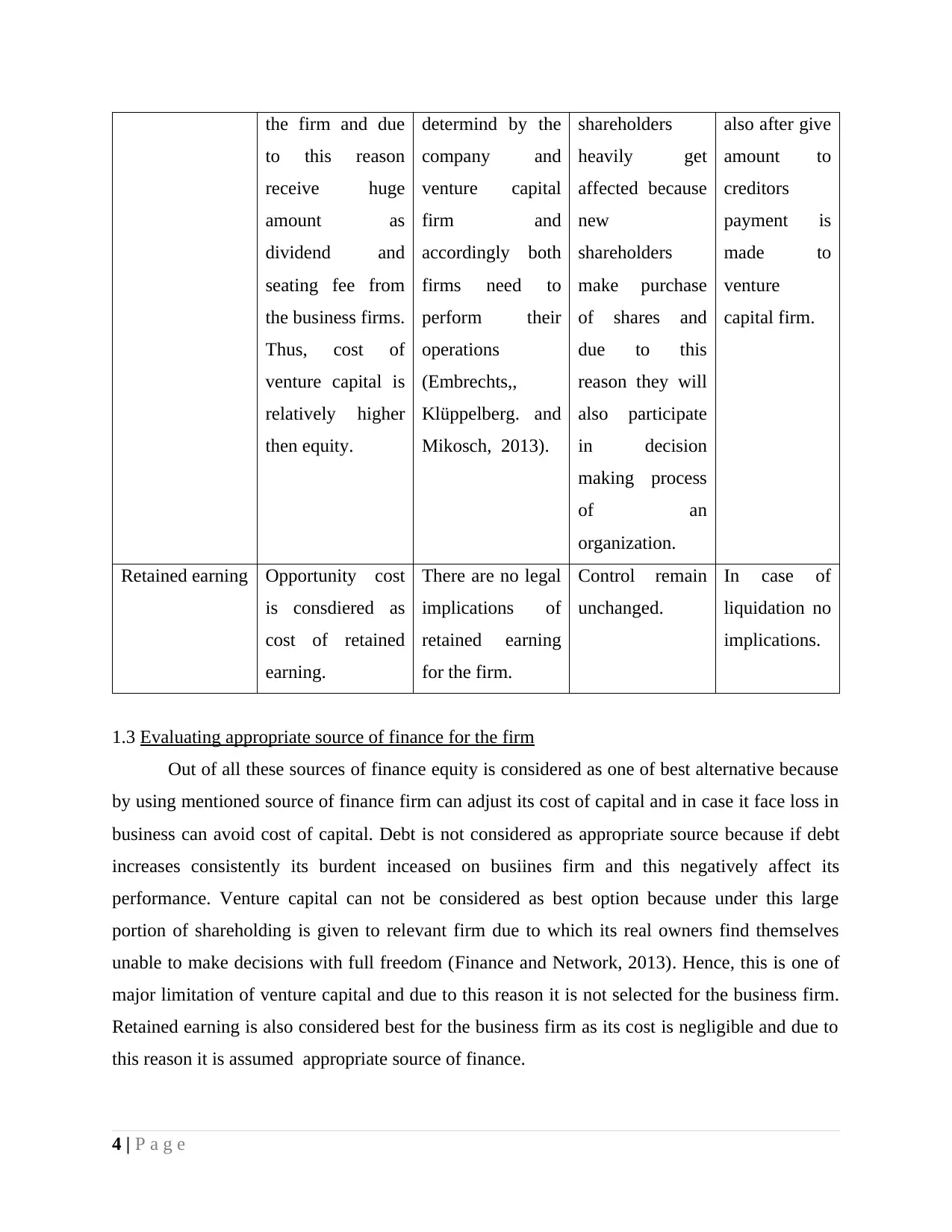

the firm and due

to this reason

receive huge

amount as

dividend and

seating fee from

the business firms.

Thus, cost of

venture capital is

relatively higher

then equity.

determind by the

company and

venture capital

firm and

accordingly both

firms need to

perform their

operations

(Embrechts,,

Klüppelberg. and

Mikosch, 2013).

shareholders

heavily get

affected because

new

shareholders

make purchase

of shares and

due to this

reason they will

also participate

in decision

making process

of an

organization.

also after give

amount to

creditors

payment is

made to

venture

capital firm.

Retained earning Opportunity cost

is consdiered as

cost of retained

earning.

There are no legal

implications of

retained earning

for the firm.

Control remain

unchanged.

In case of

liquidation no

implications.

1.3 Evaluating appropriate source of finance for the firm

Out of all these sources of finance equity is considered as one of best alternative because

by using mentioned source of finance firm can adjust its cost of capital and in case it face loss in

business can avoid cost of capital. Debt is not considered as appropriate source because if debt

increases consistently its burdent inceased on busiines firm and this negatively affect its

performance. Venture capital can not be considered as best option because under this large

portion of shareholding is given to relevant firm due to which its real owners find themselves

unable to make decisions with full freedom (Finance and Network, 2013). Hence, this is one of

major limitation of venture capital and due to this reason it is not selected for the business firm.

Retained earning is also considered best for the business firm as its cost is negligible and due to

this reason it is assumed appropriate source of finance.

4 | P a g e

to this reason

receive huge

amount as

dividend and

seating fee from

the business firms.

Thus, cost of

venture capital is

relatively higher

then equity.

determind by the

company and

venture capital

firm and

accordingly both

firms need to

perform their

operations

(Embrechts,,

Klüppelberg. and

Mikosch, 2013).

shareholders

heavily get

affected because

new

shareholders

make purchase

of shares and

due to this

reason they will

also participate

in decision

making process

of an

organization.

also after give

amount to

creditors

payment is

made to

venture

capital firm.

Retained earning Opportunity cost

is consdiered as

cost of retained

earning.

There are no legal

implications of

retained earning

for the firm.

Control remain

unchanged.

In case of

liquidation no

implications.

1.3 Evaluating appropriate source of finance for the firm

Out of all these sources of finance equity is considered as one of best alternative because

by using mentioned source of finance firm can adjust its cost of capital and in case it face loss in

business can avoid cost of capital. Debt is not considered as appropriate source because if debt

increases consistently its burdent inceased on busiines firm and this negatively affect its

performance. Venture capital can not be considered as best option because under this large

portion of shareholding is given to relevant firm due to which its real owners find themselves

unable to make decisions with full freedom (Finance and Network, 2013). Hence, this is one of

major limitation of venture capital and due to this reason it is not selected for the business firm.

Retained earning is also considered best for the business firm as its cost is negligible and due to

this reason it is assumed appropriate source of finance.

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

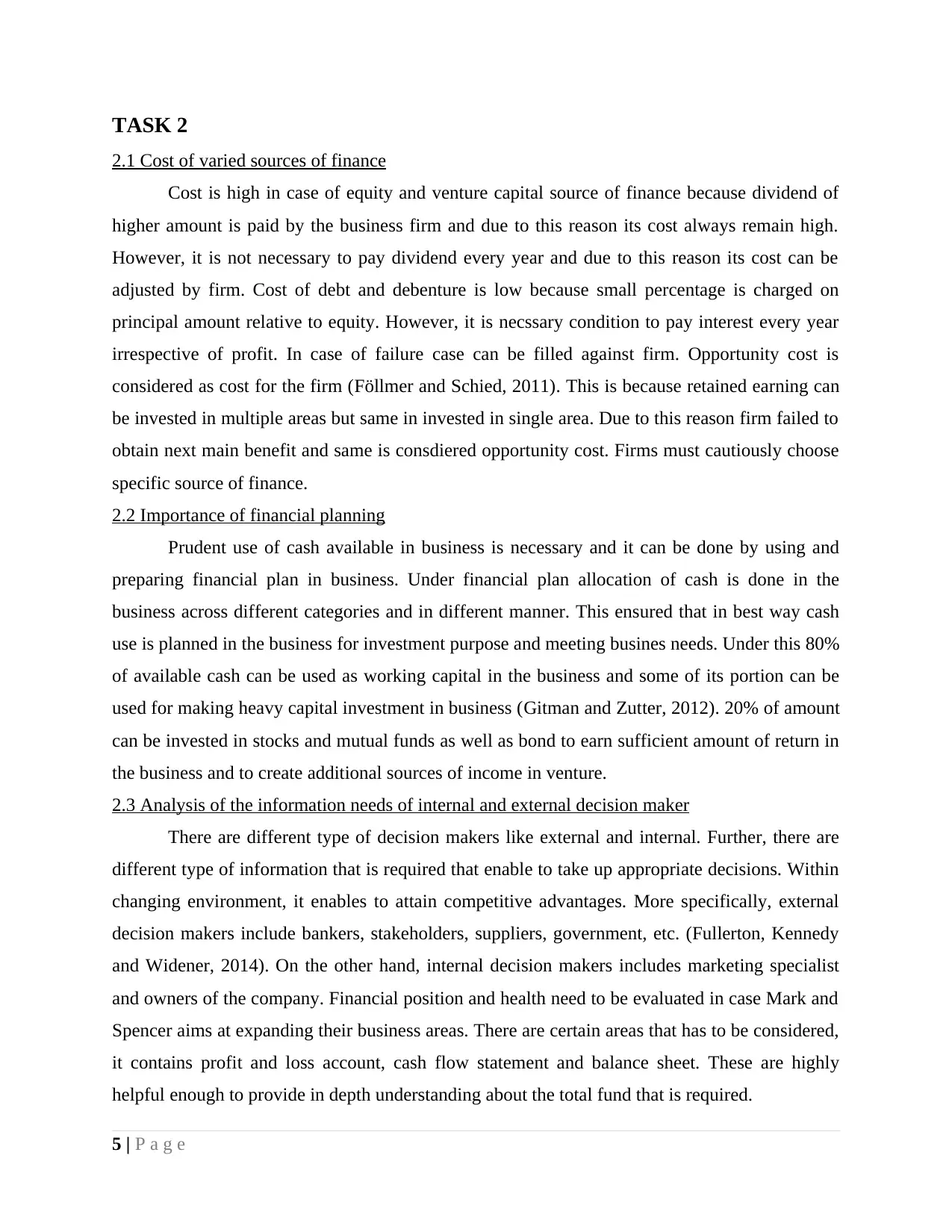

TASK 2

2.1 Cost of varied sources of finance

Cost is high in case of equity and venture capital source of finance because dividend of

higher amount is paid by the business firm and due to this reason its cost always remain high.

However, it is not necessary to pay dividend every year and due to this reason its cost can be

adjusted by firm. Cost of debt and debenture is low because small percentage is charged on

principal amount relative to equity. However, it is necssary condition to pay interest every year

irrespective of profit. In case of failure case can be filled against firm. Opportunity cost is

considered as cost for the firm (Föllmer and Schied, 2011). This is because retained earning can

be invested in multiple areas but same in invested in single area. Due to this reason firm failed to

obtain next main benefit and same is consdiered opportunity cost. Firms must cautiously choose

specific source of finance.

2.2 Importance of financial planning

Prudent use of cash available in business is necessary and it can be done by using and

preparing financial plan in business. Under financial plan allocation of cash is done in the

business across different categories and in different manner. This ensured that in best way cash

use is planned in the business for investment purpose and meeting busines needs. Under this 80%

of available cash can be used as working capital in the business and some of its portion can be

used for making heavy capital investment in business (Gitman and Zutter, 2012). 20% of amount

can be invested in stocks and mutual funds as well as bond to earn sufficient amount of return in

the business and to create additional sources of income in venture.

2.3 Analysis of the information needs of internal and external decision maker

There are different type of decision makers like external and internal. Further, there are

different type of information that is required that enable to take up appropriate decisions. Within

changing environment, it enables to attain competitive advantages. More specifically, external

decision makers include bankers, stakeholders, suppliers, government, etc. (Fullerton, Kennedy

and Widener, 2014). On the other hand, internal decision makers includes marketing specialist

and owners of the company. Financial position and health need to be evaluated in case Mark and

Spencer aims at expanding their business areas. There are certain areas that has to be considered,

it contains profit and loss account, cash flow statement and balance sheet. These are highly

helpful enough to provide in depth understanding about the total fund that is required.

5 | P a g e

2.1 Cost of varied sources of finance

Cost is high in case of equity and venture capital source of finance because dividend of

higher amount is paid by the business firm and due to this reason its cost always remain high.

However, it is not necessary to pay dividend every year and due to this reason its cost can be

adjusted by firm. Cost of debt and debenture is low because small percentage is charged on

principal amount relative to equity. However, it is necssary condition to pay interest every year

irrespective of profit. In case of failure case can be filled against firm. Opportunity cost is

considered as cost for the firm (Föllmer and Schied, 2011). This is because retained earning can

be invested in multiple areas but same in invested in single area. Due to this reason firm failed to

obtain next main benefit and same is consdiered opportunity cost. Firms must cautiously choose

specific source of finance.

2.2 Importance of financial planning

Prudent use of cash available in business is necessary and it can be done by using and

preparing financial plan in business. Under financial plan allocation of cash is done in the

business across different categories and in different manner. This ensured that in best way cash

use is planned in the business for investment purpose and meeting busines needs. Under this 80%

of available cash can be used as working capital in the business and some of its portion can be

used for making heavy capital investment in business (Gitman and Zutter, 2012). 20% of amount

can be invested in stocks and mutual funds as well as bond to earn sufficient amount of return in

the business and to create additional sources of income in venture.

2.3 Analysis of the information needs of internal and external decision maker

There are different type of decision makers like external and internal. Further, there are

different type of information that is required that enable to take up appropriate decisions. Within

changing environment, it enables to attain competitive advantages. More specifically, external

decision makers include bankers, stakeholders, suppliers, government, etc. (Fullerton, Kennedy

and Widener, 2014). On the other hand, internal decision makers includes marketing specialist

and owners of the company. Financial position and health need to be evaluated in case Mark and

Spencer aims at expanding their business areas. There are certain areas that has to be considered,

it contains profit and loss account, cash flow statement and balance sheet. These are highly

helpful enough to provide in depth understanding about the total fund that is required.

5 | P a g e

Further, various type of information need to be considered by external decision makers.

In this context, when firm needs to take loan, then they have to make proper analysis of the

financial statement of M&S. this enables to provide appropriate data about the financial position.

This way, it can be stated whether firm will be able to relay on the interest or the loan. Further,

assessment is made by potential stakeholders so that financial performance can be properly

evaluated (Otley, 2016). Information gained through this sources helps to make decision related

with investment. Financial position is assessed by suppliers through ratios and this is done before

deals are made with M&S.

2.4 Impact of various sources of finance upon the financial statement

There are different type of finance that impact the financial statement of the company.

With this respect, it includes profit and loss account, balance sheet, etc. This can be understood

with the help of an example, when Mark and Spencer take loan, then they have to pay back

interest and this is determined to be the cost of the organization (Suomala, Lyly-Yrjänäinen and

Lukka, 2014). Further, there will be changes that has to be made in the P&L statement in which

the credit and debit side will increase when loan is taken.

It is important for the firm to pay dividends when they focus on raising the funds. This

will impose cost for the firm and this is to be entered on debit side of profit and loss account. For

balance sheet, it will be shown on the liability side as it is important for the firm to make sure

that they pay dividends whenever they gain profit. This is an effective way to develop trust on

investors.

TASK 3

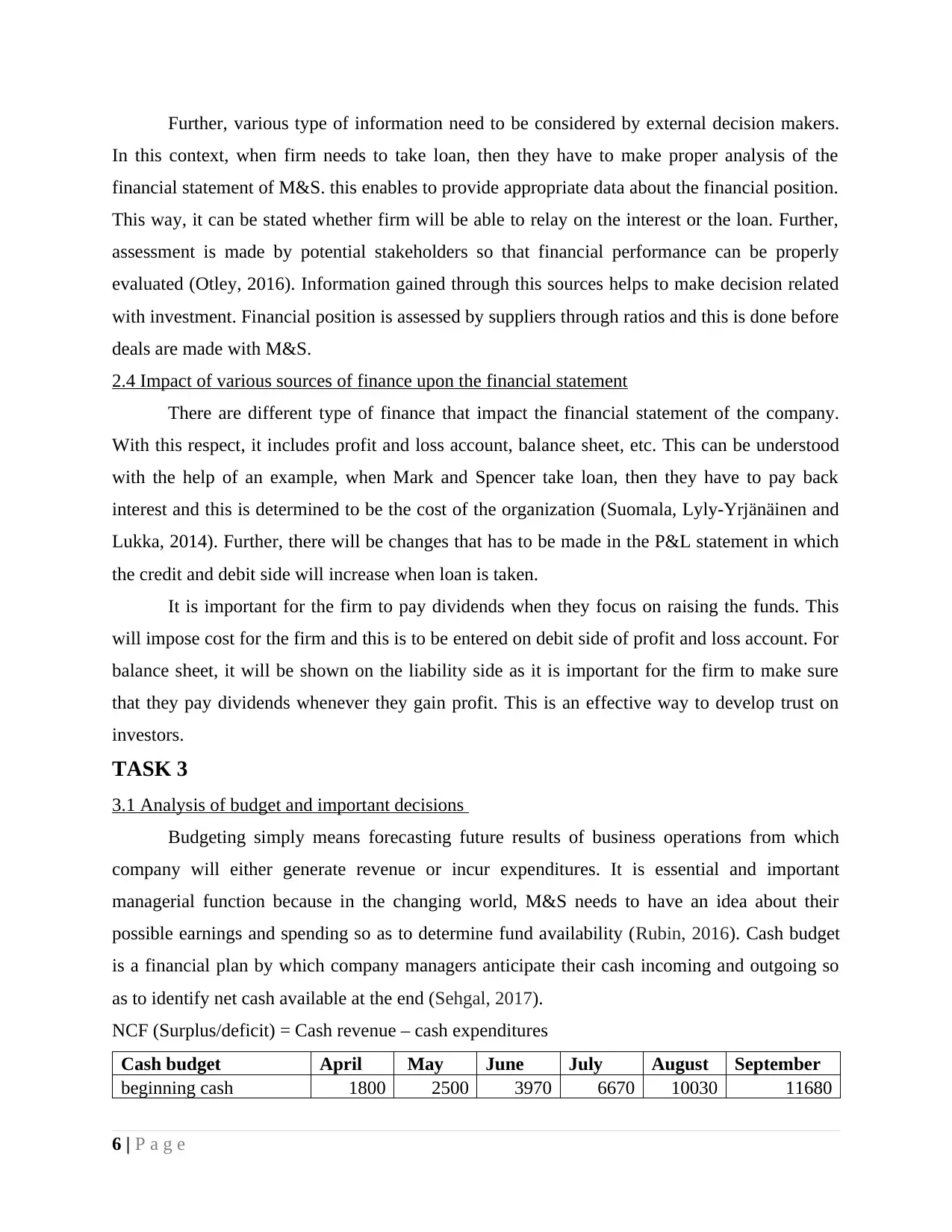

3.1 Analysis of budget and important decisions

Budgeting simply means forecasting future results of business operations from which

company will either generate revenue or incur expenditures. It is essential and important

managerial function because in the changing world, M&S needs to have an idea about their

possible earnings and spending so as to determine fund availability (Rubin, 2016). Cash budget

is a financial plan by which company managers anticipate their cash incoming and outgoing so

as to identify net cash available at the end (Sehgal, 2017).

NCF (Surplus/deficit) = Cash revenue – cash expenditures

Cash budget April May June July August September

beginning cash 1800 2500 3970 6670 10030 11680

6 | P a g e

In this context, when firm needs to take loan, then they have to make proper analysis of the

financial statement of M&S. this enables to provide appropriate data about the financial position.

This way, it can be stated whether firm will be able to relay on the interest or the loan. Further,

assessment is made by potential stakeholders so that financial performance can be properly

evaluated (Otley, 2016). Information gained through this sources helps to make decision related

with investment. Financial position is assessed by suppliers through ratios and this is done before

deals are made with M&S.

2.4 Impact of various sources of finance upon the financial statement

There are different type of finance that impact the financial statement of the company.

With this respect, it includes profit and loss account, balance sheet, etc. This can be understood

with the help of an example, when Mark and Spencer take loan, then they have to pay back

interest and this is determined to be the cost of the organization (Suomala, Lyly-Yrjänäinen and

Lukka, 2014). Further, there will be changes that has to be made in the P&L statement in which

the credit and debit side will increase when loan is taken.

It is important for the firm to pay dividends when they focus on raising the funds. This

will impose cost for the firm and this is to be entered on debit side of profit and loss account. For

balance sheet, it will be shown on the liability side as it is important for the firm to make sure

that they pay dividends whenever they gain profit. This is an effective way to develop trust on

investors.

TASK 3

3.1 Analysis of budget and important decisions

Budgeting simply means forecasting future results of business operations from which

company will either generate revenue or incur expenditures. It is essential and important

managerial function because in the changing world, M&S needs to have an idea about their

possible earnings and spending so as to determine fund availability (Rubin, 2016). Cash budget

is a financial plan by which company managers anticipate their cash incoming and outgoing so

as to identify net cash available at the end (Sehgal, 2017).

NCF (Surplus/deficit) = Cash revenue – cash expenditures

Cash budget April May June July August September

beginning cash 1800 2500 3970 6670 10030 11680

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

sales revenues 12000 14200 18700 20000 22400 26000

Total cash available 13800 16700 22670 26670 32430 37680

Less: cash expenditures

Purchase 8000 9200 10200 12700 15000 18000

wages and salaries 2000 2200 2400 2530 2670 2800

Electricity 1000 1000 1050 1050 1200 1200

Miscellaneous 300 330 350 360 380 400

Furniture 2000 1500

Total spending 11300 12730 16000 16640 20750 22400

Net cash 2500 3970 6670 10030 11680 15280

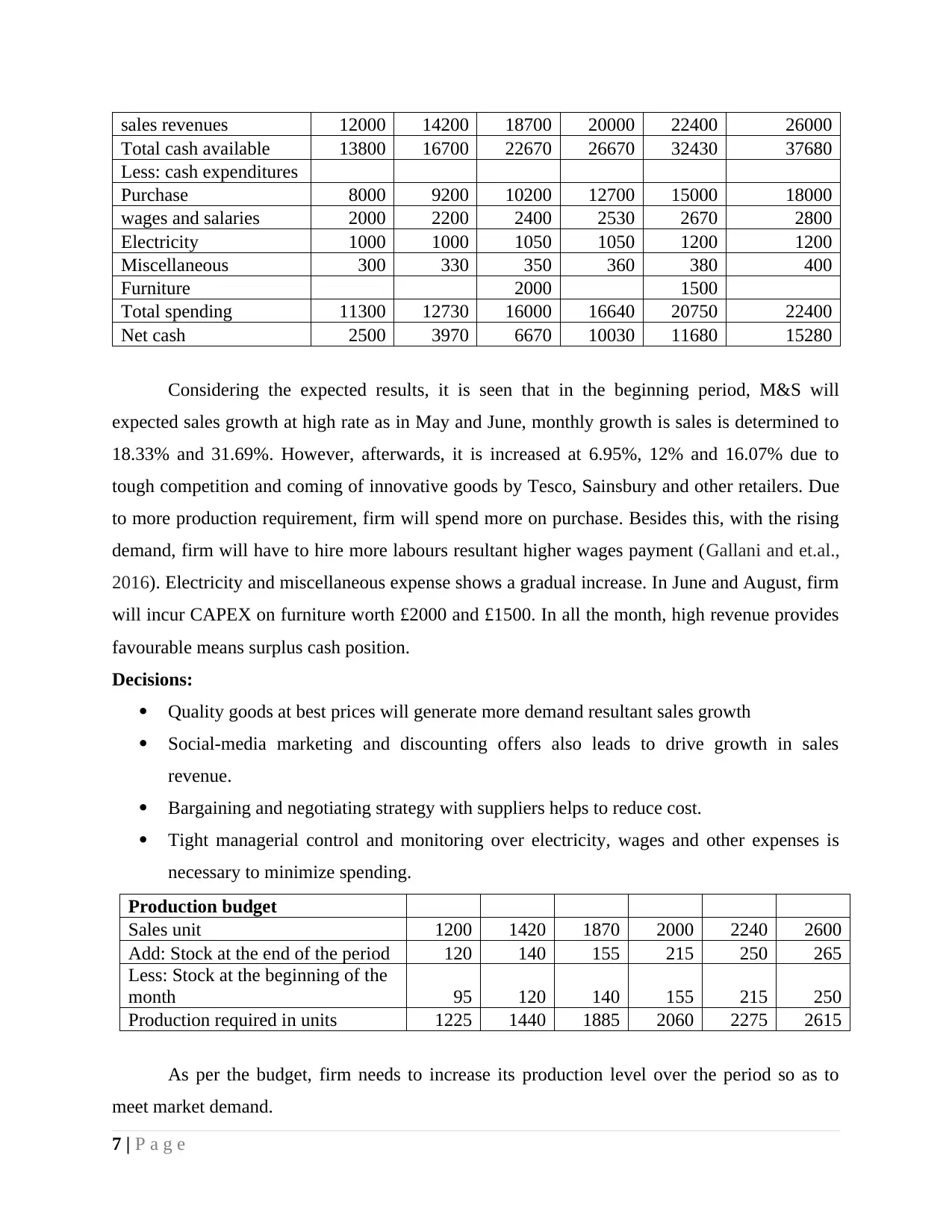

Considering the expected results, it is seen that in the beginning period, M&S will

expected sales growth at high rate as in May and June, monthly growth is sales is determined to

18.33% and 31.69%. However, afterwards, it is increased at 6.95%, 12% and 16.07% due to

tough competition and coming of innovative goods by Tesco, Sainsbury and other retailers. Due

to more production requirement, firm will spend more on purchase. Besides this, with the rising

demand, firm will have to hire more labours resultant higher wages payment (Gallani and et.al.,

2016). Electricity and miscellaneous expense shows a gradual increase. In June and August, firm

will incur CAPEX on furniture worth £2000 and £1500. In all the month, high revenue provides

favourable means surplus cash position.

Decisions:

Quality goods at best prices will generate more demand resultant sales growth

Social-media marketing and discounting offers also leads to drive growth in sales

revenue.

Bargaining and negotiating strategy with suppliers helps to reduce cost.

Tight managerial control and monitoring over electricity, wages and other expenses is

necessary to minimize spending.

Production budget

Sales unit 1200 1420 1870 2000 2240 2600

Add: Stock at the end of the period 120 140 155 215 250 265

Less: Stock at the beginning of the

month 95 120 140 155 215 250

Production required in units 1225 1440 1885 2060 2275 2615

As per the budget, firm needs to increase its production level over the period so as to

meet market demand.

7 | P a g e

Total cash available 13800 16700 22670 26670 32430 37680

Less: cash expenditures

Purchase 8000 9200 10200 12700 15000 18000

wages and salaries 2000 2200 2400 2530 2670 2800

Electricity 1000 1000 1050 1050 1200 1200

Miscellaneous 300 330 350 360 380 400

Furniture 2000 1500

Total spending 11300 12730 16000 16640 20750 22400

Net cash 2500 3970 6670 10030 11680 15280

Considering the expected results, it is seen that in the beginning period, M&S will

expected sales growth at high rate as in May and June, monthly growth is sales is determined to

18.33% and 31.69%. However, afterwards, it is increased at 6.95%, 12% and 16.07% due to

tough competition and coming of innovative goods by Tesco, Sainsbury and other retailers. Due

to more production requirement, firm will spend more on purchase. Besides this, with the rising

demand, firm will have to hire more labours resultant higher wages payment (Gallani and et.al.,

2016). Electricity and miscellaneous expense shows a gradual increase. In June and August, firm

will incur CAPEX on furniture worth £2000 and £1500. In all the month, high revenue provides

favourable means surplus cash position.

Decisions:

Quality goods at best prices will generate more demand resultant sales growth

Social-media marketing and discounting offers also leads to drive growth in sales

revenue.

Bargaining and negotiating strategy with suppliers helps to reduce cost.

Tight managerial control and monitoring over electricity, wages and other expenses is

necessary to minimize spending.

Production budget

Sales unit 1200 1420 1870 2000 2240 2600

Add: Stock at the end of the period 120 140 155 215 250 265

Less: Stock at the beginning of the

month 95 120 140 155 215 250

Production required in units 1225 1440 1885 2060 2275 2615

As per the budget, firm needs to increase its production level over the period so as to

meet market demand.

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Expected unit of

sales 1200 1420 1870 2000 2240 2600

Selling price 10 10 10 10 10 10

Sales revenues 12000 14200 18700 20000 22400 26000

M&S is expected to sale number of units to their consumers due to increase in demand

resultant sales growth.

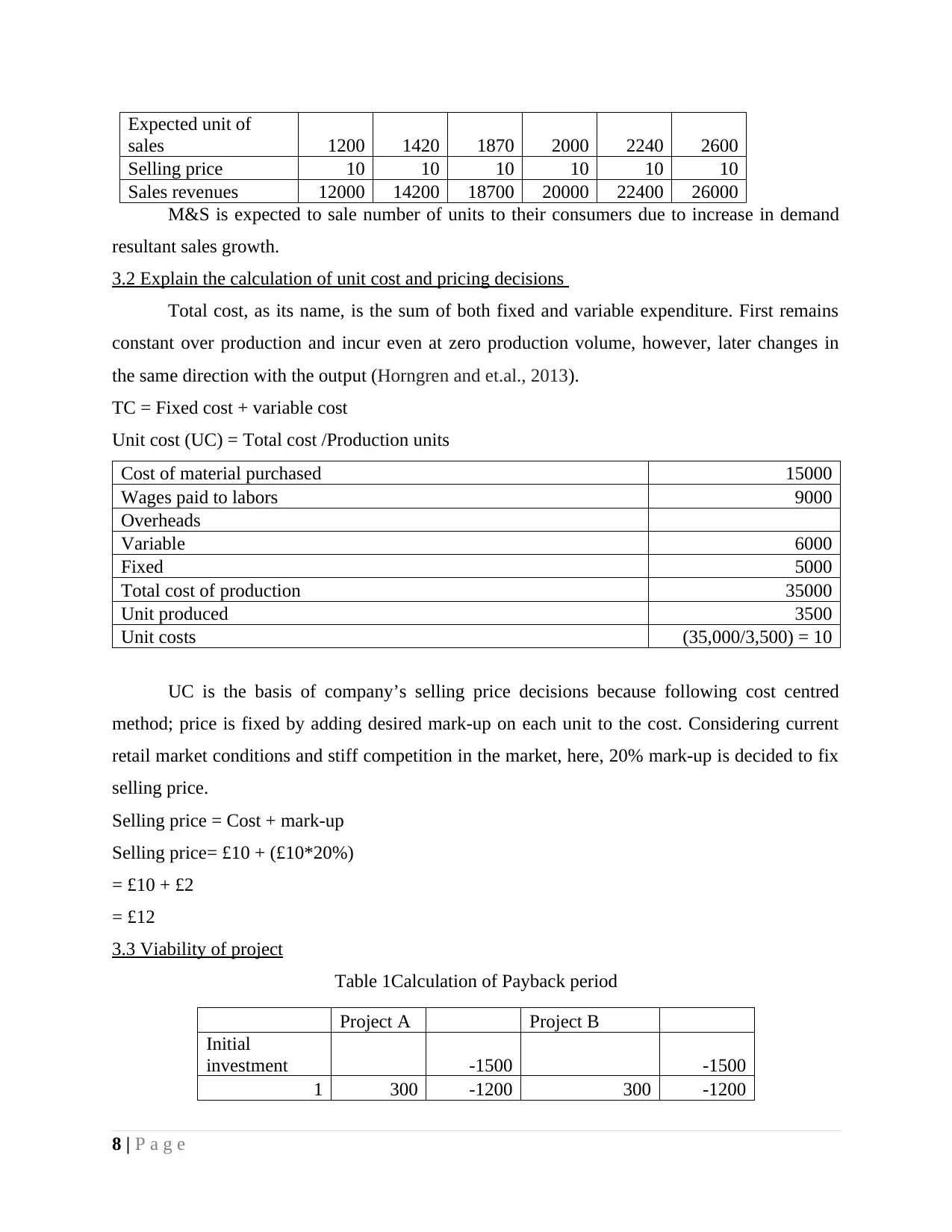

3.2 Explain the calculation of unit cost and pricing decisions

Total cost, as its name, is the sum of both fixed and variable expenditure. First remains

constant over production and incur even at zero production volume, however, later changes in

the same direction with the output (Horngren and et.al., 2013).

TC = Fixed cost + variable cost

Unit cost (UC) = Total cost /Production units

Cost of material purchased 15000

Wages paid to labors 9000

Overheads

Variable 6000

Fixed 5000

Total cost of production 35000

Unit produced 3500

Unit costs (35,000/3,500) = 10

UC is the basis of company’s selling price decisions because following cost centred

method; price is fixed by adding desired mark-up on each unit to the cost. Considering current

retail market conditions and stiff competition in the market, here, 20% mark-up is decided to fix

selling price.

Selling price = Cost + mark-up

Selling price= £10 + (£10*20%)

= £10 + £2

= £12

3.3 Viability of project

Table 1Calculation of Payback period

Project A Project B

Initial

investment -1500 -1500

1 300 -1200 300 -1200

8 | P a g e

sales 1200 1420 1870 2000 2240 2600

Selling price 10 10 10 10 10 10

Sales revenues 12000 14200 18700 20000 22400 26000

M&S is expected to sale number of units to their consumers due to increase in demand

resultant sales growth.

3.2 Explain the calculation of unit cost and pricing decisions

Total cost, as its name, is the sum of both fixed and variable expenditure. First remains

constant over production and incur even at zero production volume, however, later changes in

the same direction with the output (Horngren and et.al., 2013).

TC = Fixed cost + variable cost

Unit cost (UC) = Total cost /Production units

Cost of material purchased 15000

Wages paid to labors 9000

Overheads

Variable 6000

Fixed 5000

Total cost of production 35000

Unit produced 3500

Unit costs (35,000/3,500) = 10

UC is the basis of company’s selling price decisions because following cost centred

method; price is fixed by adding desired mark-up on each unit to the cost. Considering current

retail market conditions and stiff competition in the market, here, 20% mark-up is decided to fix

selling price.

Selling price = Cost + mark-up

Selling price= £10 + (£10*20%)

= £10 + £2

= £12

3.3 Viability of project

Table 1Calculation of Payback period

Project A Project B

Initial

investment -1500 -1500

1 300 -1200 300 -1200

8 | P a g e

2 400 -800 500 -700

3 600 -200 500 -200

4 300 100 400 200

5 500 600 400 600

Table 2Calculation of ARR

Project

A Project B

Initial investment 1500 1500

1 300 300

2 400 500

3 600 500

4 300 400

5 500 400

Total 2100 2100

Average 525 420

ARR 35.00% 28.00%

Table 3Calculation of NPV

Project A

Pv @

10% Present value Project B PV @ 10%

Present

value

Initial

investment 1500 1500

1 300 0.909 273 300 0.909 272.73

2 400 0.826 331 500 0.826 413.22

3 600 0.751 451 500 0.751 375.66

4 300 0.683 205 400 0.683 273.21

5 500 0.621 310 400 0.621 248.37

Total 1569 1583

NPV 69 83.18

Table 4Calculation of IRR

Project A Project B

Initial

investment -1500 -1500

1 300 300

2 400 500

3 600 500

4 300 400

9 | P a g e

3 600 -200 500 -200

4 300 100 400 200

5 500 600 400 600

Table 2Calculation of ARR

Project

A Project B

Initial investment 1500 1500

1 300 300

2 400 500

3 600 500

4 300 400

5 500 400

Total 2100 2100

Average 525 420

ARR 35.00% 28.00%

Table 3Calculation of NPV

Project A

Pv @

10% Present value Project B PV @ 10%

Present

value

Initial

investment 1500 1500

1 300 0.909 273 300 0.909 272.73

2 400 0.826 331 500 0.826 413.22

3 600 0.751 451 500 0.751 375.66

4 300 0.683 205 400 0.683 273.21

5 500 0.621 310 400 0.621 248.37

Total 1569 1583

NPV 69 83.18

Table 4Calculation of IRR

Project A Project B

Initial

investment -1500 -1500

1 300 300

2 400 500

3 600 500

4 300 400

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21