Microeconomics 12: Analysis of Production, Taxes, and Disasters

VerifiedAdded on 2021/05/31

|12

|1939

|118

Homework Assignment

AI Summary

This microeconomics assignment analyzes several key economic concepts. The first question explores the Production Possibility Frontier (PPF), discussing its properties, attainable and unattainable combinations, and opportunity costs. The second question delves into tax incidence, calculating equilibrium, elasticity, and the burden of a per-unit tax on consumers and producers, including a graphical representation. The third question examines price regulation, specifically minimum price controls, analyzing oversupply, deadweight loss, and fairness of outcomes. The final question investigates the impact of a natural disaster on coffee supply, illustrating shifts in supply and demand, price changes, and market shortages, including graphical representations.

Running Head: Microeconomics

Microeconomic Analysis

By (Name)

Student ID

(Tutor)

(University)

(Date)

Microeconomic Analysis

By (Name)

Student ID

(Tutor)

(University)

(Date)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Microeconomics 2

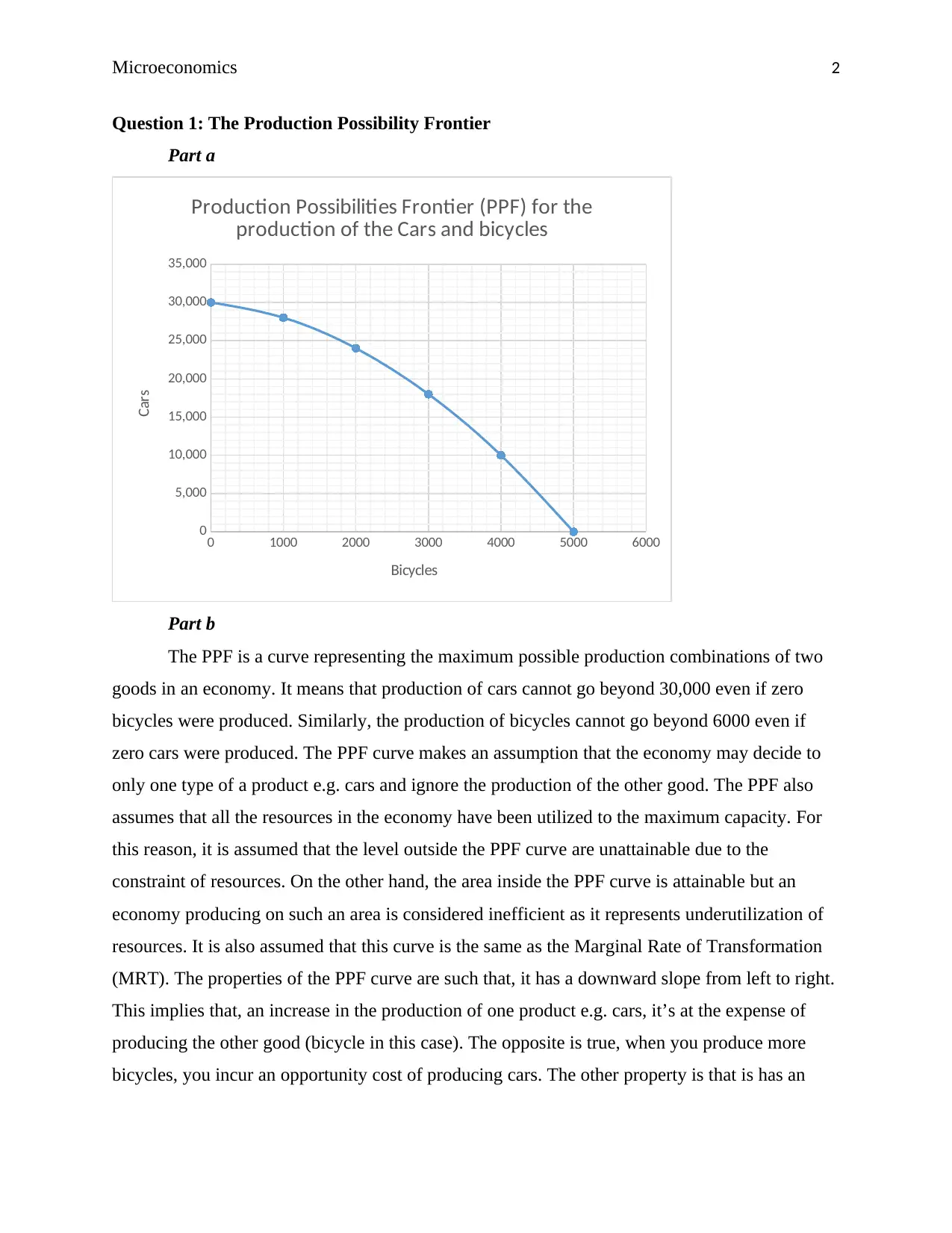

Question 1: The Production Possibility Frontier

Part a

0 1000 2000 3000 4000 5000 6000

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Production Possibilities Frontier (PPF) for the

production of the Cars and bicycles

Bicycles

Cars

Part b

The PPF is a curve representing the maximum possible production combinations of two

goods in an economy. It means that production of cars cannot go beyond 30,000 even if zero

bicycles were produced. Similarly, the production of bicycles cannot go beyond 6000 even if

zero cars were produced. The PPF curve makes an assumption that the economy may decide to

only one type of a product e.g. cars and ignore the production of the other good. The PPF also

assumes that all the resources in the economy have been utilized to the maximum capacity. For

this reason, it is assumed that the level outside the PPF curve are unattainable due to the

constraint of resources. On the other hand, the area inside the PPF curve is attainable but an

economy producing on such an area is considered inefficient as it represents underutilization of

resources. It is also assumed that this curve is the same as the Marginal Rate of Transformation

(MRT). The properties of the PPF curve are such that, it has a downward slope from left to right.

This implies that, an increase in the production of one product e.g. cars, it’s at the expense of

producing the other good (bicycle in this case). The opposite is true, when you produce more

bicycles, you incur an opportunity cost of producing cars. The other property is that is has an

Question 1: The Production Possibility Frontier

Part a

0 1000 2000 3000 4000 5000 6000

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Production Possibilities Frontier (PPF) for the

production of the Cars and bicycles

Bicycles

Cars

Part b

The PPF is a curve representing the maximum possible production combinations of two

goods in an economy. It means that production of cars cannot go beyond 30,000 even if zero

bicycles were produced. Similarly, the production of bicycles cannot go beyond 6000 even if

zero cars were produced. The PPF curve makes an assumption that the economy may decide to

only one type of a product e.g. cars and ignore the production of the other good. The PPF also

assumes that all the resources in the economy have been utilized to the maximum capacity. For

this reason, it is assumed that the level outside the PPF curve are unattainable due to the

constraint of resources. On the other hand, the area inside the PPF curve is attainable but an

economy producing on such an area is considered inefficient as it represents underutilization of

resources. It is also assumed that this curve is the same as the Marginal Rate of Transformation

(MRT). The properties of the PPF curve are such that, it has a downward slope from left to right.

This implies that, an increase in the production of one product e.g. cars, it’s at the expense of

producing the other good (bicycle in this case). The opposite is true, when you produce more

bicycles, you incur an opportunity cost of producing cars. The other property is that is has an

Microeconomics 3

increasing slope given its concavity to the origin. Lastly, all the points of combination along the

PPF curve are considered to be efficient.

Part c

The first thing is to accept the fact that this combination is not attainable as it lies outside

the PPF. This is the assumption that resources are scarce and that they have been utilized fully at

the point of PPF curve. There are two possible combinations that can take place in this case. One,

increase the production of cars from 18,000 to 20,000 but this would result in the production of

bicycles falling from 3,000 to 2,700. The second combination would be to raise the number of

bicycles production from 3,000 to 4,000 but this would cause the demand for cars to fall from

18,000 to 10,000. The solution would be to consider the opportunity cost of increasing the

production of the other good and produce that with the lowest opportunity cost. If 4000 bicycles

are produced, the production for cars declines by 8,000. However if 20,000 cars are produced,

the production for bicycles declines by 300. The opportunity cost of producing bicycles is very

high than that of cars production and thus it’s more efficient to produce 20,000 cars and 2700

bicycles. By producing Cars to avoid the high opportunity cost, Newland can import 1300 units

of bicycles to meet the demand for bicycles also.

The second possible way is to increment in productive resources. This will raise the

productivity capacity and the PPF will shift outward accommodating the increase in demand for

both goods1. The third possibility is to improve technology; for Newland to meet both demands,

it should find cheaper ways of production such that the current resources can be able to produce

more of these products; the PPF will shift outwards.

1 Adam Hayes, Economics Basics: Production Possibility Frontier, Growth, Opportunity Cost and Trade.

(Investopedia, 2018).

increasing slope given its concavity to the origin. Lastly, all the points of combination along the

PPF curve are considered to be efficient.

Part c

The first thing is to accept the fact that this combination is not attainable as it lies outside

the PPF. This is the assumption that resources are scarce and that they have been utilized fully at

the point of PPF curve. There are two possible combinations that can take place in this case. One,

increase the production of cars from 18,000 to 20,000 but this would result in the production of

bicycles falling from 3,000 to 2,700. The second combination would be to raise the number of

bicycles production from 3,000 to 4,000 but this would cause the demand for cars to fall from

18,000 to 10,000. The solution would be to consider the opportunity cost of increasing the

production of the other good and produce that with the lowest opportunity cost. If 4000 bicycles

are produced, the production for cars declines by 8,000. However if 20,000 cars are produced,

the production for bicycles declines by 300. The opportunity cost of producing bicycles is very

high than that of cars production and thus it’s more efficient to produce 20,000 cars and 2700

bicycles. By producing Cars to avoid the high opportunity cost, Newland can import 1300 units

of bicycles to meet the demand for bicycles also.

The second possible way is to increment in productive resources. This will raise the

productivity capacity and the PPF will shift outward accommodating the increase in demand for

both goods1. The third possibility is to improve technology; for Newland to meet both demands,

it should find cheaper ways of production such that the current resources can be able to produce

more of these products; the PPF will shift outwards.

1 Adam Hayes, Economics Basics: Production Possibility Frontier, Growth, Opportunity Cost and Trade.

(Investopedia, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Microeconomics 4

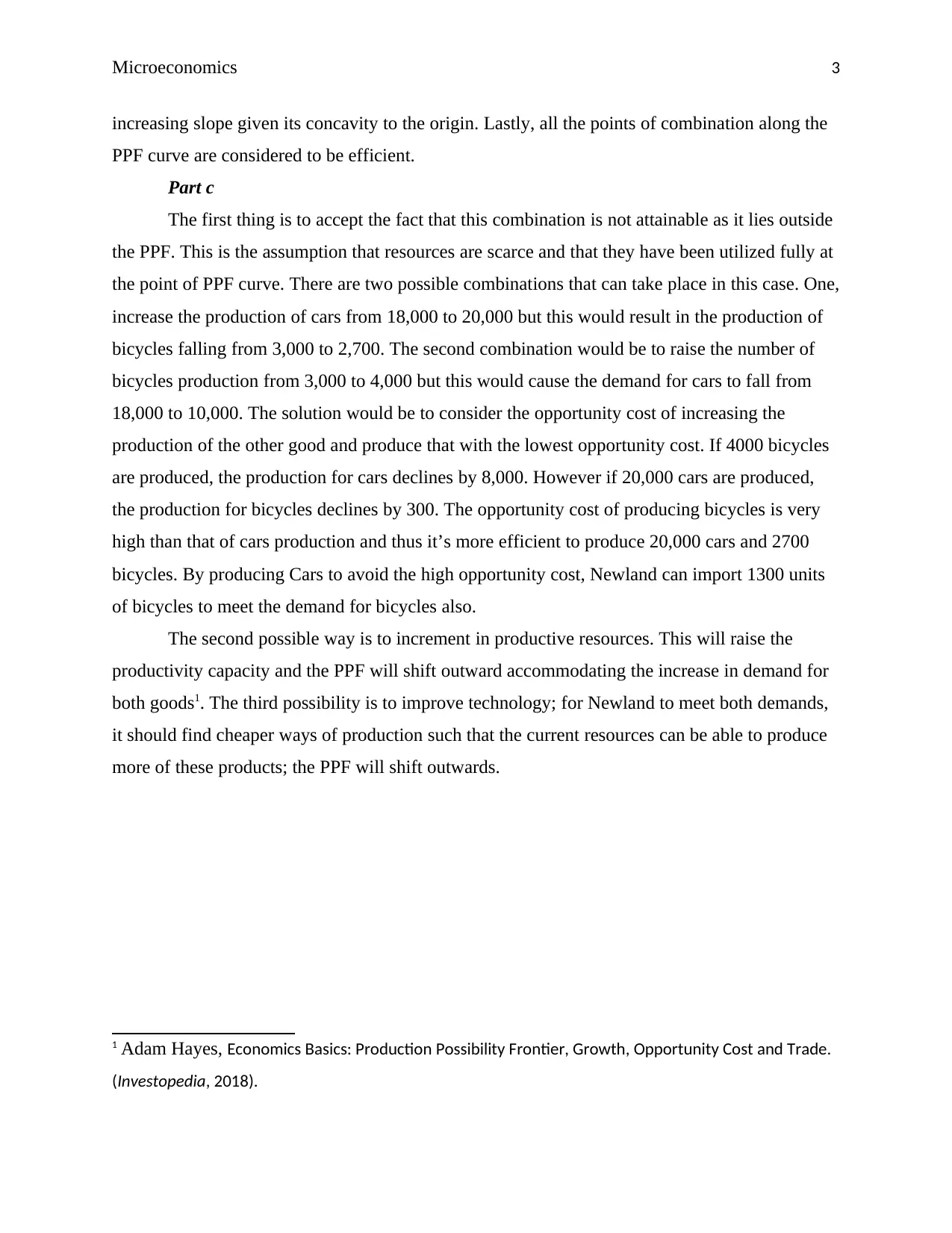

Question 2: Part I: Tax Incidence

QD = 20 - 2p

Qs = P – 1

At equilibrium, QD= Qs

The imposition of $3 per Pizza is per unit tax

The price change will rise by the amount of tax, however, the rise will not be $3 above

the equilibrium price. Tax incidence tells how much tax burden is borne by consumers and that

borne by the producers. The elasticity of demand determines the tax incidence. When a product

has an elastic demand, the highest tax burden lies on the producers and a small proportion is

shifted to the consumers. Similarly, when a product has an inelastic demand, the highest tax

burden lies on the consumers, and producers only carry a small proportion of the burden2. The

price will rise by $3 above equilibrium price only if the producer is able to shift the tax burden

100% to the consumers. Deadweight will result since there will be a loss in both surplus for the

producer and for the consumer.

We start by calculating equilibrium P and Q

QD= Qs

20 - 2p = P – 1

21 = 3P

P = 7

Since QD= Qs, Q = either QDor Qs

Take Qs = P -1 = Q

But P = 7, therefore Q = 7 – 1 = 6

Q = 6

Now we calculate the elasticity of demand (Ped) and supply (Pes) to price changes given by the

formula

ΔQ

ΔP ∗P

Q

When P = 7 and Q = 6

Ped given QD = 20 - 2p but ΔQ

ΔP = -2

2 Adam Gifford, Tax Incidence: Definition, Formula & Example. (Studycom, 2018).

Question 2: Part I: Tax Incidence

QD = 20 - 2p

Qs = P – 1

At equilibrium, QD= Qs

The imposition of $3 per Pizza is per unit tax

The price change will rise by the amount of tax, however, the rise will not be $3 above

the equilibrium price. Tax incidence tells how much tax burden is borne by consumers and that

borne by the producers. The elasticity of demand determines the tax incidence. When a product

has an elastic demand, the highest tax burden lies on the producers and a small proportion is

shifted to the consumers. Similarly, when a product has an inelastic demand, the highest tax

burden lies on the consumers, and producers only carry a small proportion of the burden2. The

price will rise by $3 above equilibrium price only if the producer is able to shift the tax burden

100% to the consumers. Deadweight will result since there will be a loss in both surplus for the

producer and for the consumer.

We start by calculating equilibrium P and Q

QD= Qs

20 - 2p = P – 1

21 = 3P

P = 7

Since QD= Qs, Q = either QDor Qs

Take Qs = P -1 = Q

But P = 7, therefore Q = 7 – 1 = 6

Q = 6

Now we calculate the elasticity of demand (Ped) and supply (Pes) to price changes given by the

formula

ΔQ

ΔP ∗P

Q

When P = 7 and Q = 6

Ped given QD = 20 - 2p but ΔQ

ΔP = -2

2 Adam Gifford, Tax Incidence: Definition, Formula & Example. (Studycom, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Microeconomics 5

Ped = -2 * 7

6 = -2.33

Pes given Qs = P - 1 but ΔQ

ΔP = 1

Pes = 1 * 7

6 = 1.17

Now we find fraction of consumers and producers tax burden

Consumers’ tax burden

= Es

Ed+ Es

= 1.17

−2.33+1.17

= 1.17

−1.17 = -1.00

Producers’ tax burden

= Ed

Ed+ Es

= −2.33

−2.33+1.17

= −2.33

−1.17 = 2.00

Fig: Tax incidence

P

Supply

8

7

5 Demand

0 4 6 Q

Ped = -2 * 7

6 = -2.33

Pes given Qs = P - 1 but ΔQ

ΔP = 1

Pes = 1 * 7

6 = 1.17

Now we find fraction of consumers and producers tax burden

Consumers’ tax burden

= Es

Ed+ Es

= 1.17

−2.33+1.17

= 1.17

−1.17 = -1.00

Producers’ tax burden

= Ed

Ed+ Es

= −2.33

−2.33+1.17

= −2.33

−1.17 = 2.00

Fig: Tax incidence

P

Supply

8

7

5 Demand

0 4 6 Q

Microeconomics 6

When price is $ 8, given Qd = 20 – 2P = Q, Q = 20 – 2(8), Q = 4.

Incidence of tax on consumers

= ΔP * new Q

= (8 – 7)4 = $4

Incidence of tax on producers

= ΔP * new Q

= (7 – 5)4 = $8

Deadweight

= 1

2 b∗h where b = 8 – 5 = 3, and h = 6 – 4 = 2

= 1

2 (3)∗2 = $3

When price is $ 8, given Qd = 20 – 2P = Q, Q = 20 – 2(8), Q = 4.

Incidence of tax on consumers

= ΔP * new Q

= (8 – 7)4 = $4

Incidence of tax on producers

= ΔP * new Q

= (7 – 5)4 = $8

Deadweight

= 1

2 b∗h where b = 8 – 5 = 3, and h = 6 – 4 = 2

= 1

2 (3)∗2 = $3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Microeconomics 7

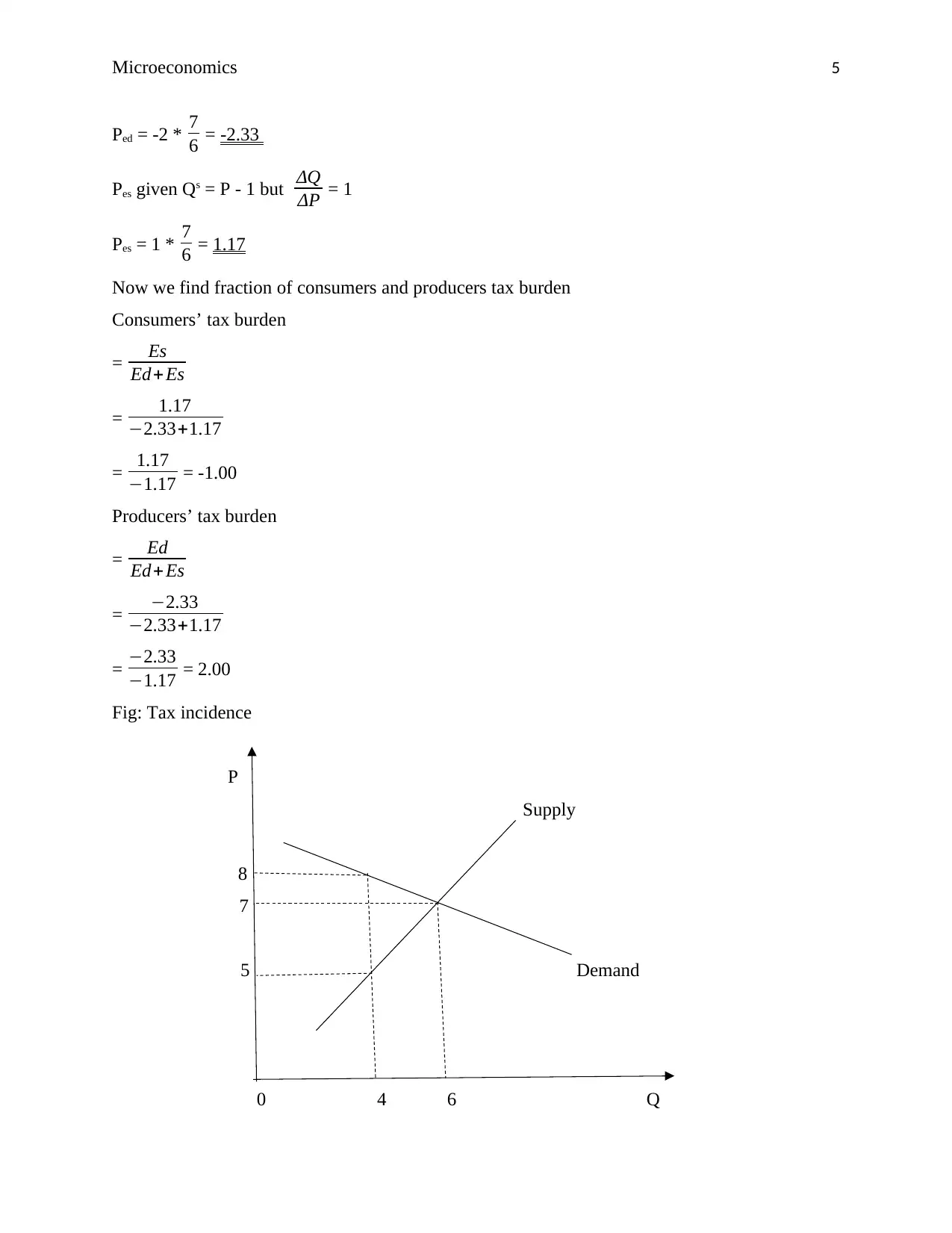

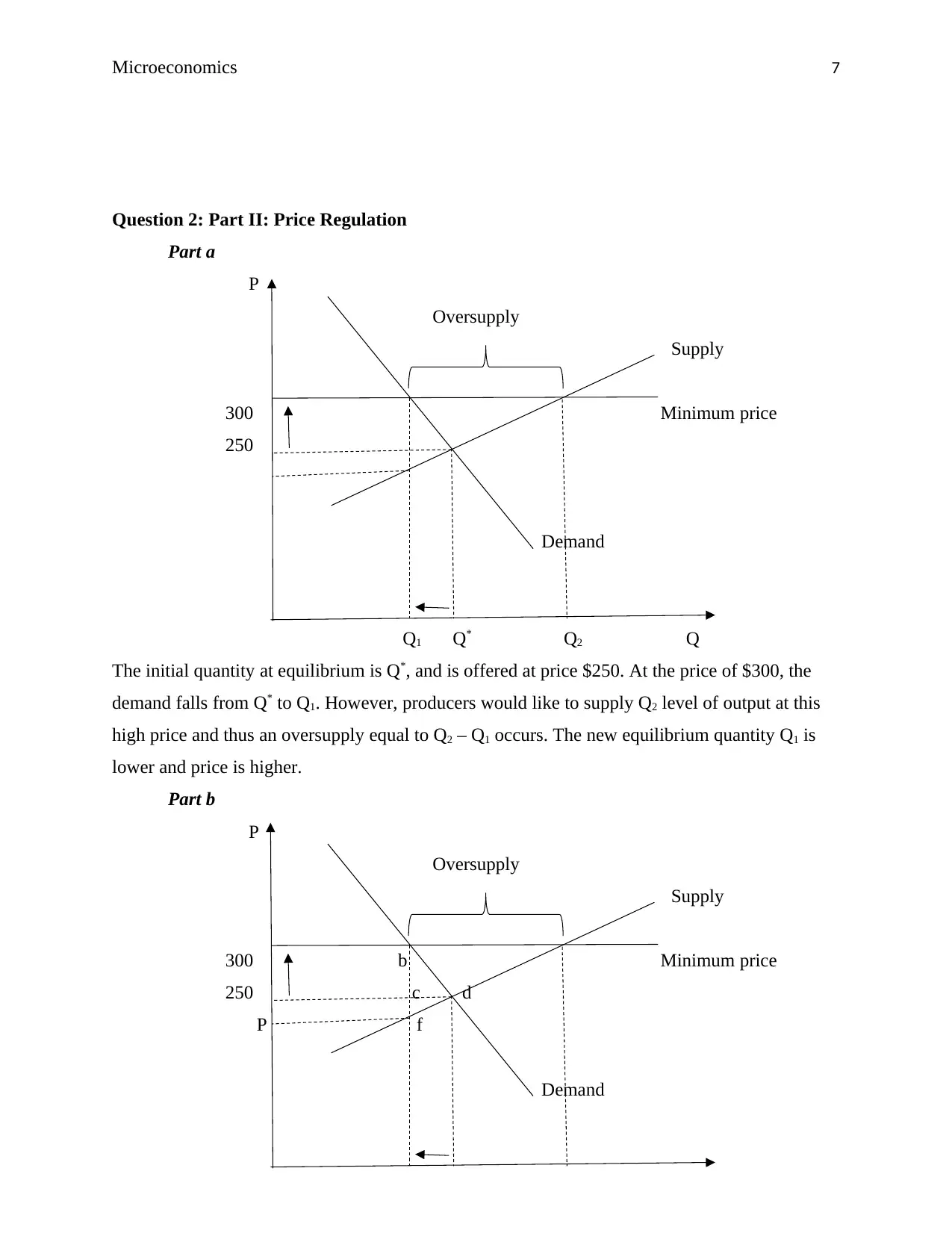

Question 2: Part II: Price Regulation

Part a

P

Oversupply

Supply

300 Minimum price

250

Demand

Q1 Q* Q2 Q

The initial quantity at equilibrium is Q*, and is offered at price $250. At the price of $300, the

demand falls from Q* to Q1. However, producers would like to supply Q2 level of output at this

high price and thus an oversupply equal to Q2 – Q1 occurs. The new equilibrium quantity Q1 is

lower and price is higher.

Part b

P

Oversupply

Supply

300 b Minimum price

250 c d

P f

Demand

Question 2: Part II: Price Regulation

Part a

P

Oversupply

Supply

300 Minimum price

250

Demand

Q1 Q* Q2 Q

The initial quantity at equilibrium is Q*, and is offered at price $250. At the price of $300, the

demand falls from Q* to Q1. However, producers would like to supply Q2 level of output at this

high price and thus an oversupply equal to Q2 – Q1 occurs. The new equilibrium quantity Q1 is

lower and price is higher.

Part b

P

Oversupply

Supply

300 b Minimum price

250 c d

P f

Demand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

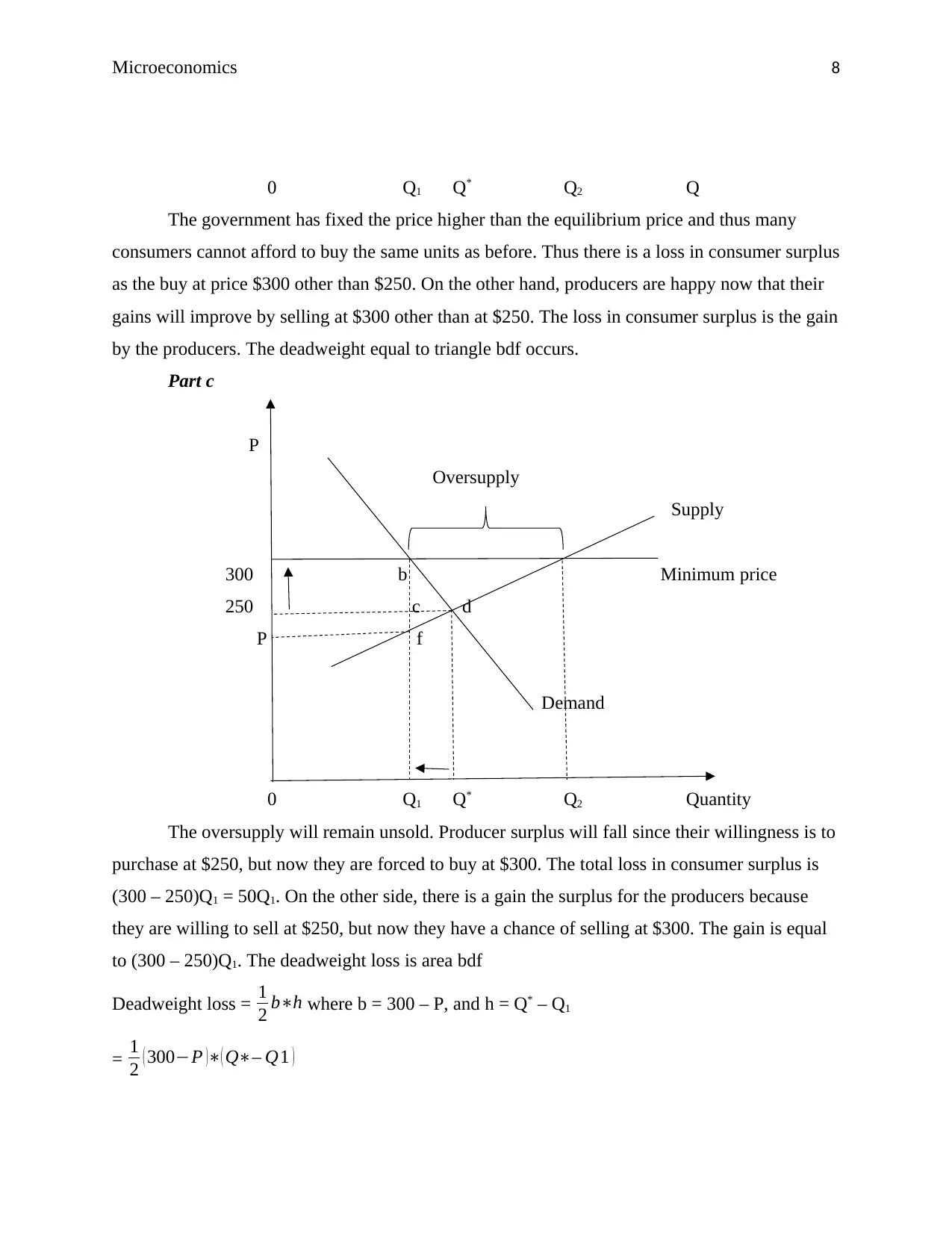

Microeconomics 8

0 Q1 Q* Q2 Q

The government has fixed the price higher than the equilibrium price and thus many

consumers cannot afford to buy the same units as before. Thus there is a loss in consumer surplus

as the buy at price $300 other than $250. On the other hand, producers are happy now that their

gains will improve by selling at $300 other than at $250. The loss in consumer surplus is the gain

by the producers. The deadweight equal to triangle bdf occurs.

Part c

P

Oversupply

Supply

300 b Minimum price

250 c d

P f

Demand

0 Q1 Q* Q2 Quantity

The oversupply will remain unsold. Producer surplus will fall since their willingness is to

purchase at $250, but now they are forced to buy at $300. The total loss in consumer surplus is

(300 – 250)Q1 = 50Q1. On the other side, there is a gain the surplus for the producers because

they are willing to sell at $250, but now they have a chance of selling at $300. The gain is equal

to (300 – 250)Q1. The deadweight loss is area bdf

Deadweight loss = 1

2 b∗h where b = 300 – P, and h = Q* – Q1

= 1

2 ( 300−P )∗( Q∗– Q1 )

0 Q1 Q* Q2 Q

The government has fixed the price higher than the equilibrium price and thus many

consumers cannot afford to buy the same units as before. Thus there is a loss in consumer surplus

as the buy at price $300 other than $250. On the other hand, producers are happy now that their

gains will improve by selling at $300 other than at $250. The loss in consumer surplus is the gain

by the producers. The deadweight equal to triangle bdf occurs.

Part c

P

Oversupply

Supply

300 b Minimum price

250 c d

P f

Demand

0 Q1 Q* Q2 Quantity

The oversupply will remain unsold. Producer surplus will fall since their willingness is to

purchase at $250, but now they are forced to buy at $300. The total loss in consumer surplus is

(300 – 250)Q1 = 50Q1. On the other side, there is a gain the surplus for the producers because

they are willing to sell at $250, but now they have a chance of selling at $300. The gain is equal

to (300 – 250)Q1. The deadweight loss is area bdf

Deadweight loss = 1

2 b∗h where b = 300 – P, and h = Q* – Q1

= 1

2 ( 300−P )∗( Q∗– Q1 )

Microeconomics 9

Part d

The outcome of the U.S. Bill is not fair as it is not producing fair results. The demand has

fallen and consumers have a loss in surplus. This results in a gain in producer surplus, but this

are not fair results given that there is an oversupply that remain unsold. The deadweight loss

represents a welfare loss by the consumers. Even though the producers gain, they are not able to

generate greater revenue due to the deficiency in demand. It is even possible that the profit made

while selling Q1 at $300 could be lower than selling Q* at $250. This Bill could have been fair if

the U.S. trade wheat internationally. The Bill is therefore hurting both the consumers and the

producers. Or rather, if the producers are able to make the same level of revenue as before, the

bill can be argued to make the consumers worse off without making the producers better off.

Other policies need to accompany the Bill to generate some fair results, this could include the

government buying the excess supply.

Part d

The outcome of the U.S. Bill is not fair as it is not producing fair results. The demand has

fallen and consumers have a loss in surplus. This results in a gain in producer surplus, but this

are not fair results given that there is an oversupply that remain unsold. The deadweight loss

represents a welfare loss by the consumers. Even though the producers gain, they are not able to

generate greater revenue due to the deficiency in demand. It is even possible that the profit made

while selling Q1 at $300 could be lower than selling Q* at $250. This Bill could have been fair if

the U.S. trade wheat internationally. The Bill is therefore hurting both the consumers and the

producers. Or rather, if the producers are able to make the same level of revenue as before, the

bill can be argued to make the consumers worse off without making the producers better off.

Other policies need to accompany the Bill to generate some fair results, this could include the

government buying the excess supply.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

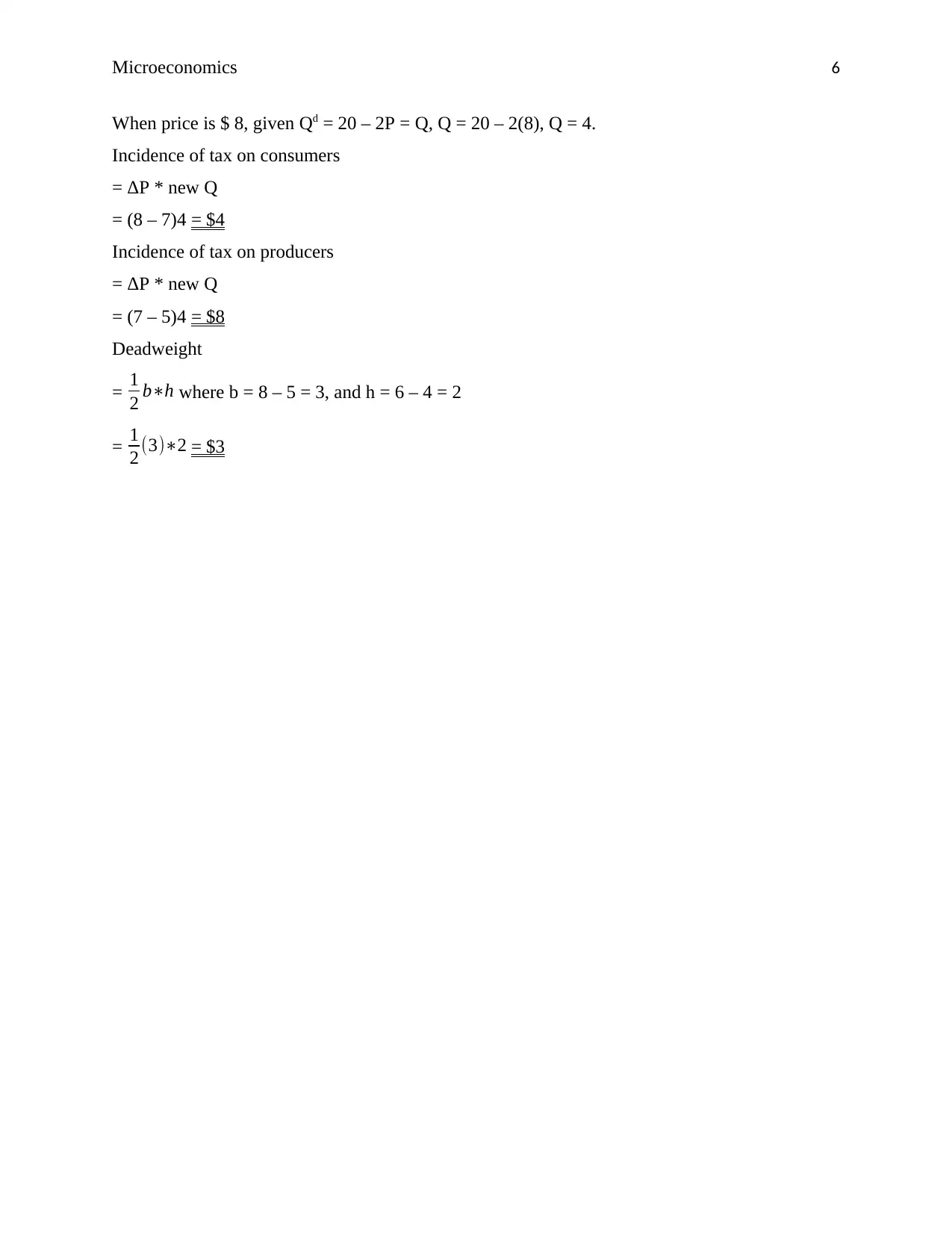

Microeconomics 10

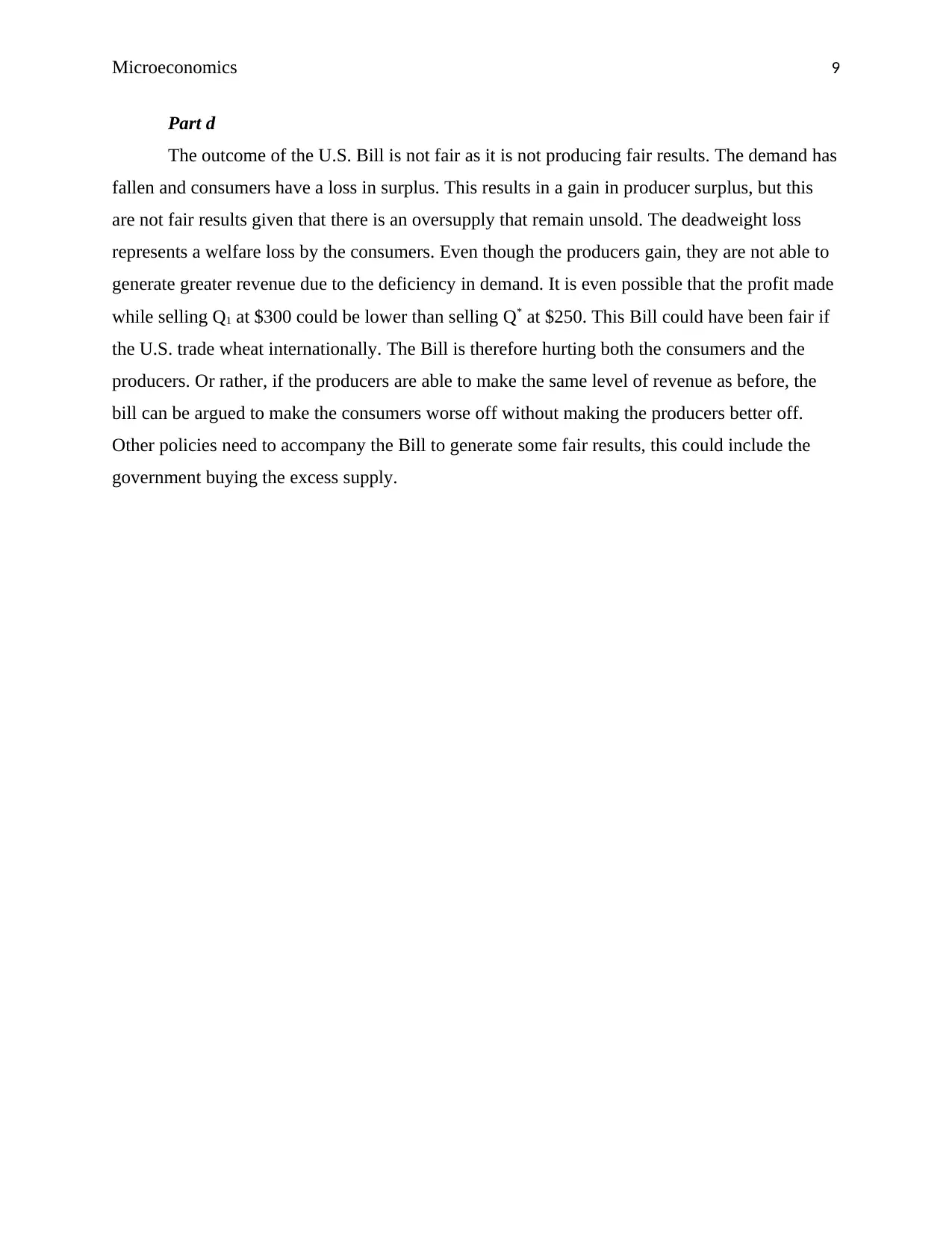

Question 3: The Impact of Natural Disaster

Part a

Price

S1

Shortage S

P1

P

Demand

Q1 Q Q2 Quantity

Supply of coffee will fall and the equilibrium supply curve S will shift to S1 causing price to rise

from P to P1. The supply shift to the right is because it’s induced by a non-price factor. The

shortage is as observed above because suppliers need to supply Q2 at price P1.

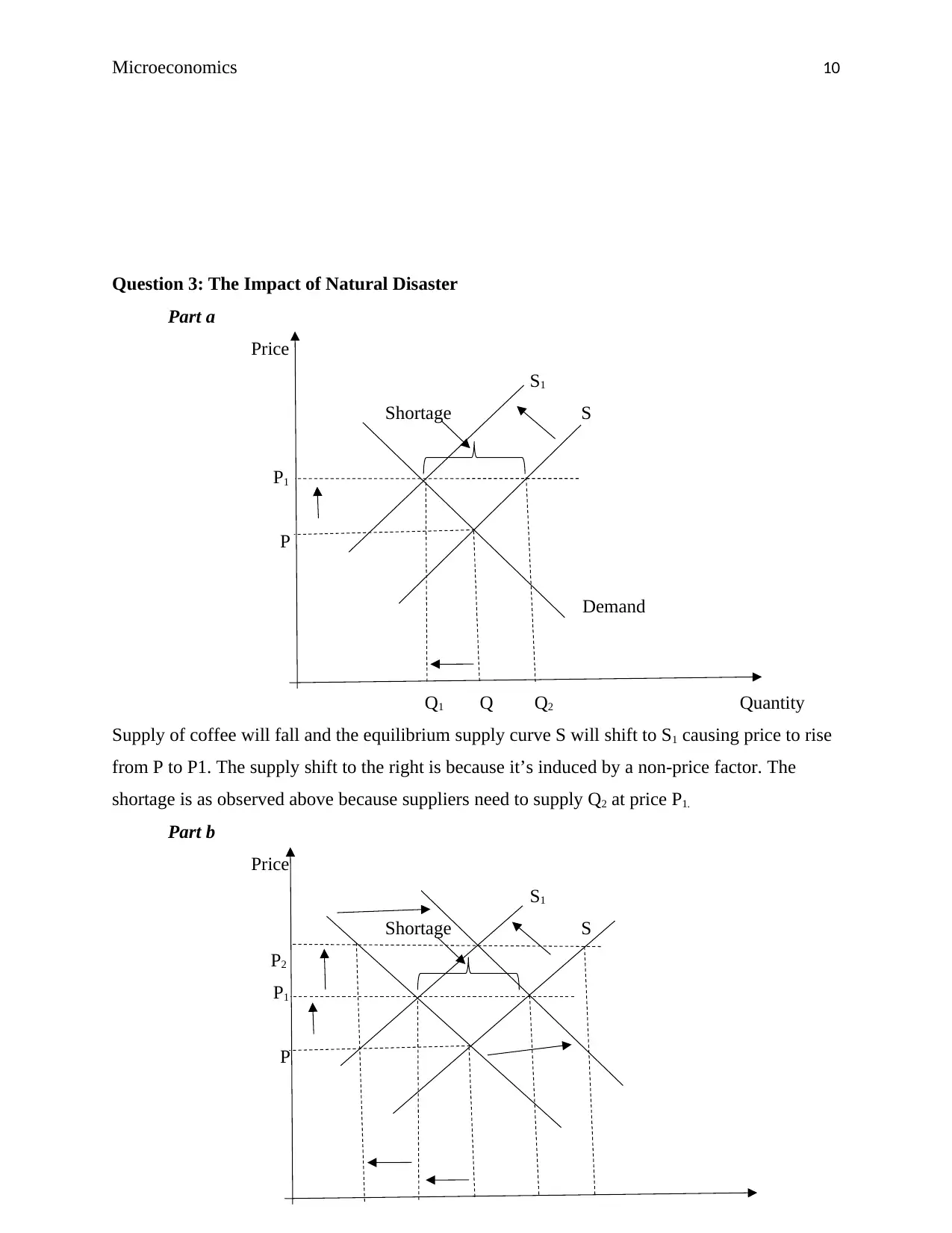

Part b

Price

S1

Shortage S

P2

P1

P

Question 3: The Impact of Natural Disaster

Part a

Price

S1

Shortage S

P1

P

Demand

Q1 Q Q2 Quantity

Supply of coffee will fall and the equilibrium supply curve S will shift to S1 causing price to rise

from P to P1. The supply shift to the right is because it’s induced by a non-price factor. The

shortage is as observed above because suppliers need to supply Q2 at price P1.

Part b

Price

S1

Shortage S

P2

P1

P

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Microeconomics 11

Demand

0 Q3 Q1 Q Q2 Q4 Quantity

Since there is still a shortage and supply remains to be S1, an increase in demand will make the

situation worse, price will rise further from P1 to P2. The shortage will seem severe because at

price P2 producers need to supply Q4. The quantity demanded will fall further from Q1 to Q3.

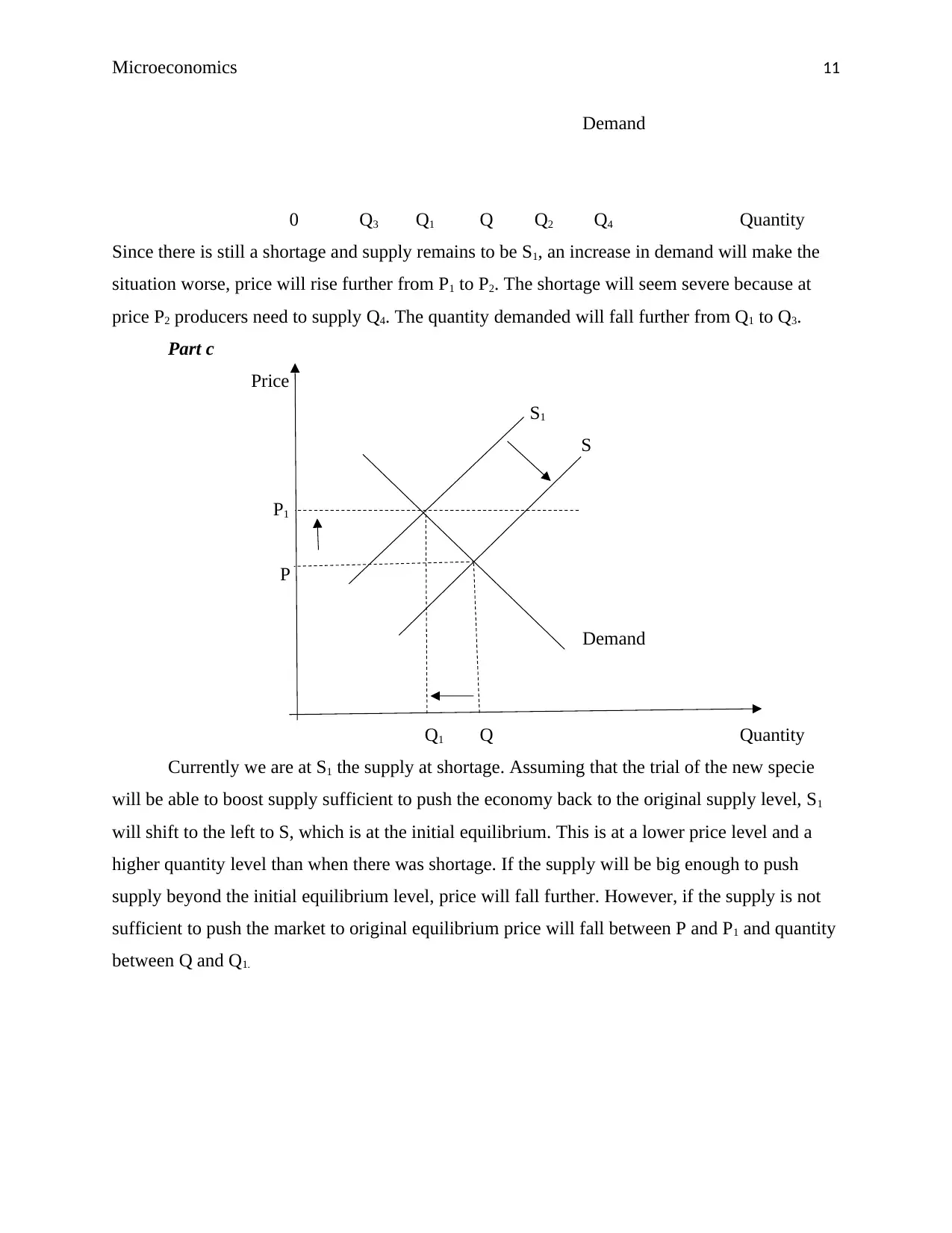

Part c

Price

S1

S

P1

P

Demand

Q1 Q Quantity

Currently we are at S1 the supply at shortage. Assuming that the trial of the new specie

will be able to boost supply sufficient to push the economy back to the original supply level, S1

will shift to the left to S, which is at the initial equilibrium. This is at a lower price level and a

higher quantity level than when there was shortage. If the supply will be big enough to push

supply beyond the initial equilibrium level, price will fall further. However, if the supply is not

sufficient to push the market to original equilibrium price will fall between P and P1 and quantity

between Q and Q1.

Demand

0 Q3 Q1 Q Q2 Q4 Quantity

Since there is still a shortage and supply remains to be S1, an increase in demand will make the

situation worse, price will rise further from P1 to P2. The shortage will seem severe because at

price P2 producers need to supply Q4. The quantity demanded will fall further from Q1 to Q3.

Part c

Price

S1

S

P1

P

Demand

Q1 Q Quantity

Currently we are at S1 the supply at shortage. Assuming that the trial of the new specie

will be able to boost supply sufficient to push the economy back to the original supply level, S1

will shift to the left to S, which is at the initial equilibrium. This is at a lower price level and a

higher quantity level than when there was shortage. If the supply will be big enough to push

supply beyond the initial equilibrium level, price will fall further. However, if the supply is not

sufficient to push the market to original equilibrium price will fall between P and P1 and quantity

between Q and Q1.

Microeconomics 12

Bibliography

Anand, V, Production Possibility Curve under Constant and Increasing Costs. (Economics Discussion,

2018).

Gifford Adam, Tax Incidence: Definition, Formula & Example. (Studycom, 2018).

Hayes Adam, Economics Basics: Production Possibility Frontier, Growth, Opportunity Cost and Trade.

(Investopedia, 2018).

Bibliography

Anand, V, Production Possibility Curve under Constant and Increasing Costs. (Economics Discussion,

2018).

Gifford Adam, Tax Incidence: Definition, Formula & Example. (Studycom, 2018).

Hayes Adam, Economics Basics: Production Possibility Frontier, Growth, Opportunity Cost and Trade.

(Investopedia, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.