University Microeconomics Assignment: Demand, Elasticity, and Output

VerifiedAdded on 2022/11/30

|8

|1151

|380

Homework Assignment

AI Summary

This microeconomics assignment solution addresses key concepts in managerial economics, including demand functions, price elasticity of demand, and profit maximization. The student analyzes a given demand function, calculates and interprets price elasticity, and determines the optimal output ...

Running head: Microeconomics

Microeconomics

Name of the Student

Name of the University

Student ID

Microeconomics

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1Microeconomics

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................2

Answer 3..........................................................................................................................................6

References........................................................................................................................................7

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................2

Answer 3..........................................................................................................................................6

References........................................................................................................................................7

2Microeconomics

Answer 1

A firm operating in inelastic portion of demand is not maximizing profit because in order

to maximize profit the firm need to increase its output quantity. However, inelastic demand curve

a slight increase in output quantity will reduce the price by much larger amount and as a result

the total revenue of the firm decreases (Schwartz et al. 2019). Therefore, the firm would not be

able maximize its profit by operating at inelastic portion of demand curve. Inelastic demand

curve is not an ideal situation for a profit maximizing firm.

Answer 2

(a)

Demand function given:

Q=400−3 P+ 4 T + 0.6 A

Therefore, at P=0 and other things as given Q is given as

Q=400−(3 ×0)+(4 × 8000)+(0.6 ×10000)

¿ , Q=400−0+ 32000+6000

¿ , Q=384 00

Again, if Q=0 and other things as given then P is given as

Q=400−3 P+(4 × 8000)+(0.6 × 10000)

¿ , 0=38 400−3 P

¿ , 3 P=38 400

Answer 1

A firm operating in inelastic portion of demand is not maximizing profit because in order

to maximize profit the firm need to increase its output quantity. However, inelastic demand curve

a slight increase in output quantity will reduce the price by much larger amount and as a result

the total revenue of the firm decreases (Schwartz et al. 2019). Therefore, the firm would not be

able maximize its profit by operating at inelastic portion of demand curve. Inelastic demand

curve is not an ideal situation for a profit maximizing firm.

Answer 2

(a)

Demand function given:

Q=400−3 P+ 4 T + 0.6 A

Therefore, at P=0 and other things as given Q is given as

Q=400−(3 ×0)+(4 × 8000)+(0.6 ×10000)

¿ , Q=400−0+ 32000+6000

¿ , Q=384 00

Again, if Q=0 and other things as given then P is given as

Q=400−3 P+(4 × 8000)+(0.6 × 10000)

¿ , 0=38 400−3 P

¿ , 3 P=38 400

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3Microeconomics

¿ , P=12800

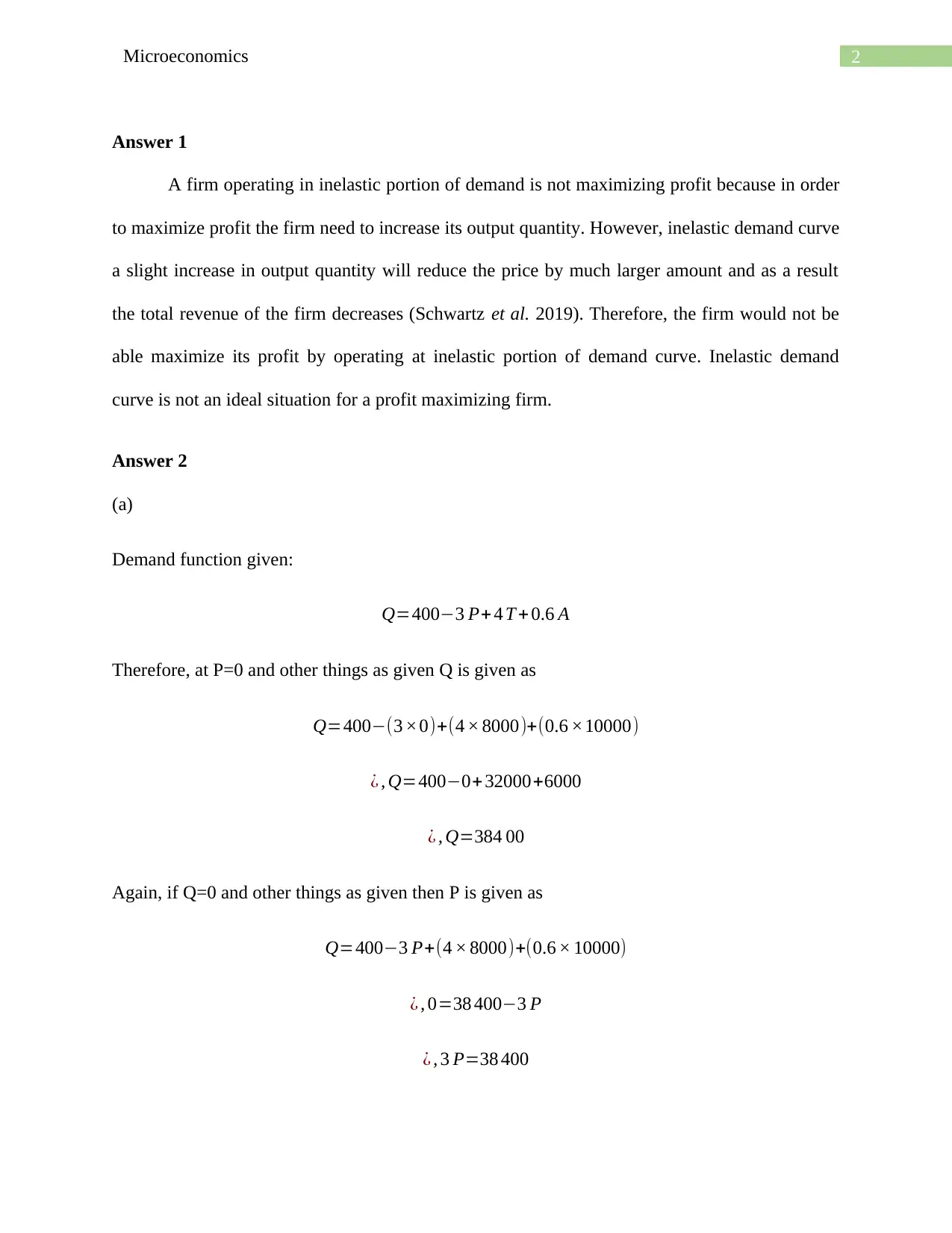

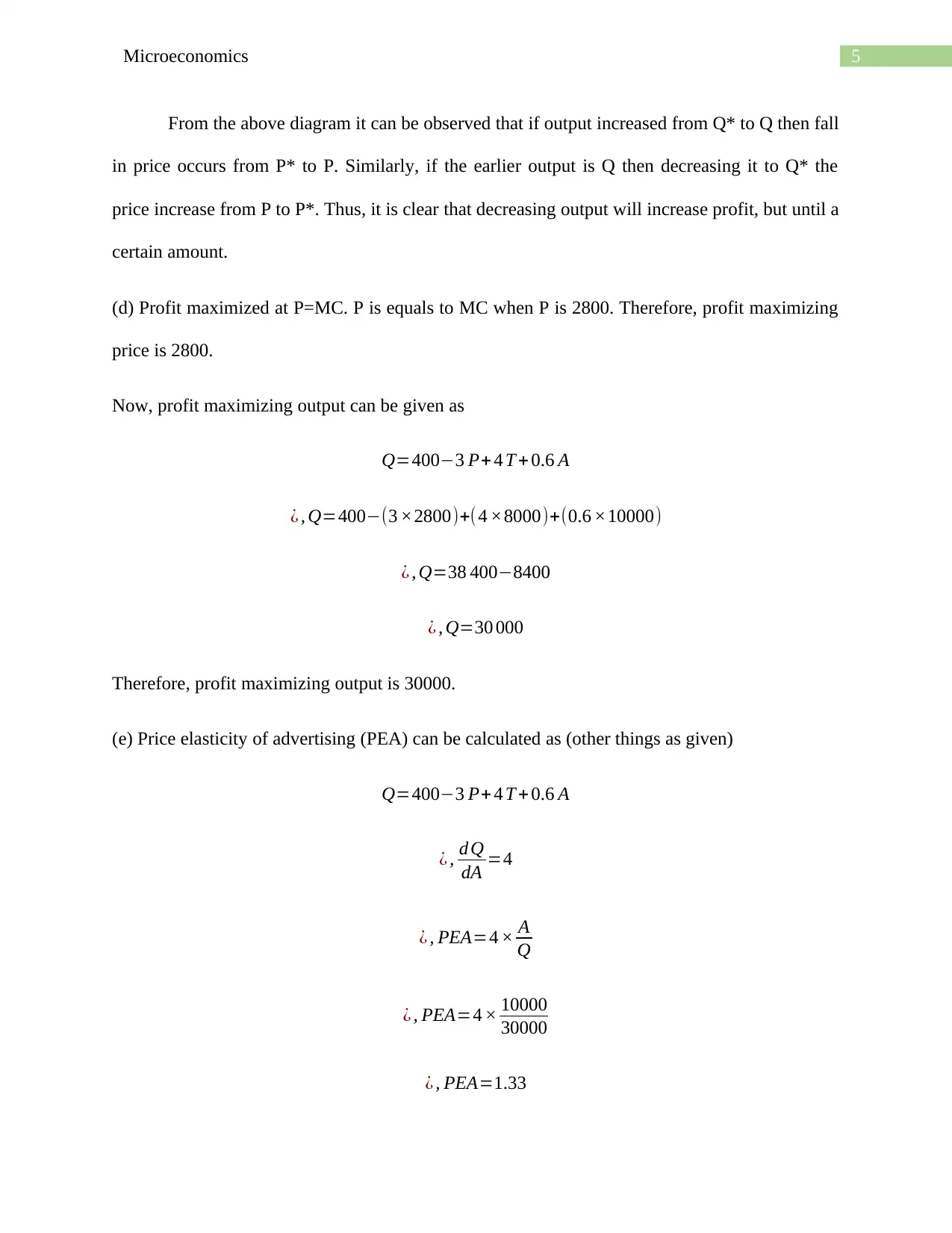

Hence, from the above calculation demand curve can be derived and is given in the diagram

below:

Figure 1: Demand curve

Source: (Created by the Author)

(b)

Current price elasticity of demand considering other factors is given as

Q=400−3 P+ 4 T + 0.6 A

¿ , Q=38 400−3 P

¿ , d Q

dP =−3

¿ , PED=−3 × P

Q

0 5000 10000 15000 20000 25000 30000 35000 40000 45000

0

2000

4000

6000

8000

10000

12000

14000

Demand Curve

Quantity

Price

¿ , P=12800

Hence, from the above calculation demand curve can be derived and is given in the diagram

below:

Figure 1: Demand curve

Source: (Created by the Author)

(b)

Current price elasticity of demand considering other factors is given as

Q=400−3 P+ 4 T + 0.6 A

¿ , Q=38 400−3 P

¿ , d Q

dP =−3

¿ , PED=−3 × P

Q

0 5000 10000 15000 20000 25000 30000 35000 40000 45000

0

2000

4000

6000

8000

10000

12000

14000

Demand Curve

Quantity

Price

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4Microeconomics

D

Q*

Q

P

P*

Quantity

Price

¿ , PED=−3 × 2800

30000

¿ , PED=−0.28

The price elasticity of demand is highly inelastic, that means with 1 unit change in price demand

will change decline by 0.28 units. It indicates that demand is much less responsive to change in

price.

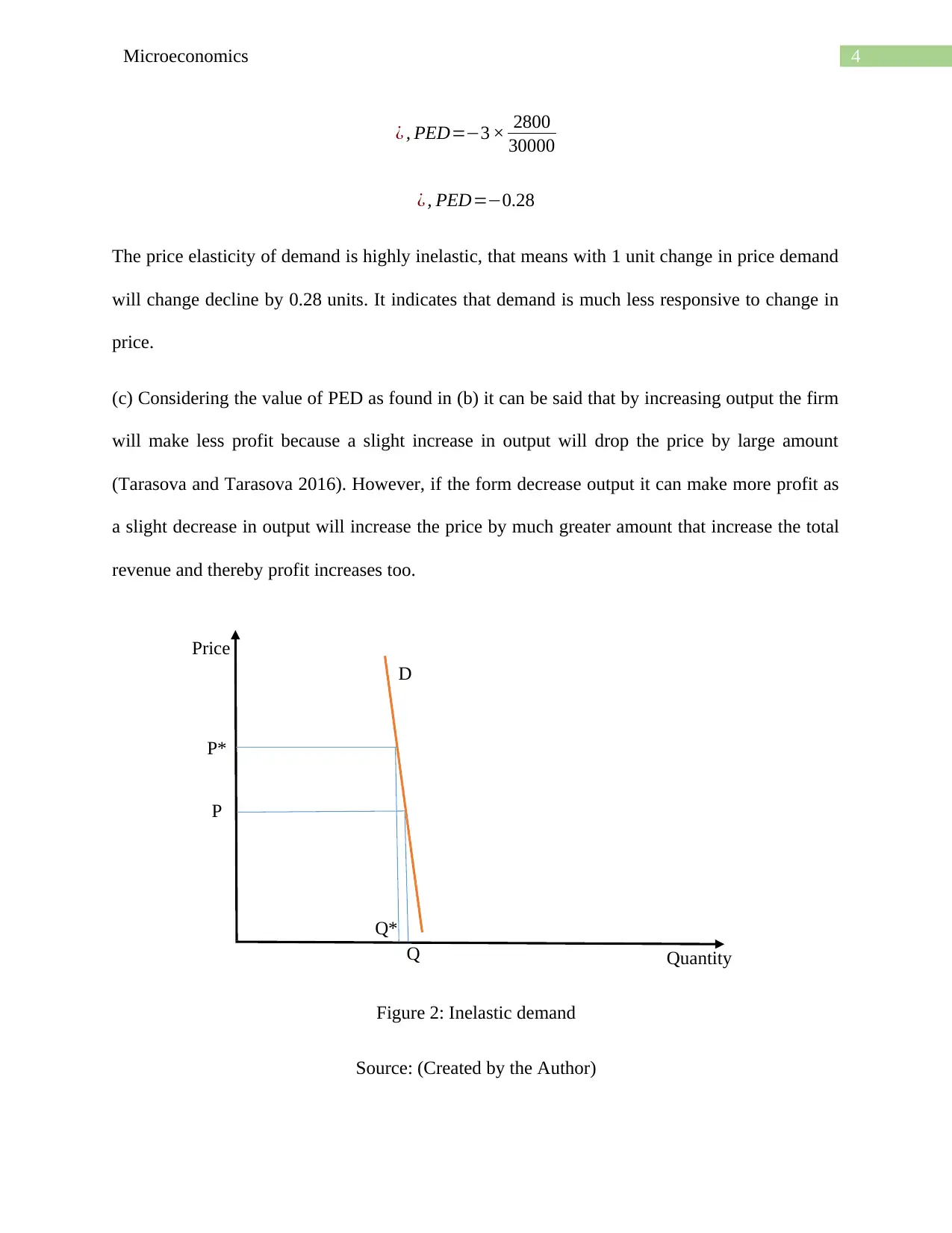

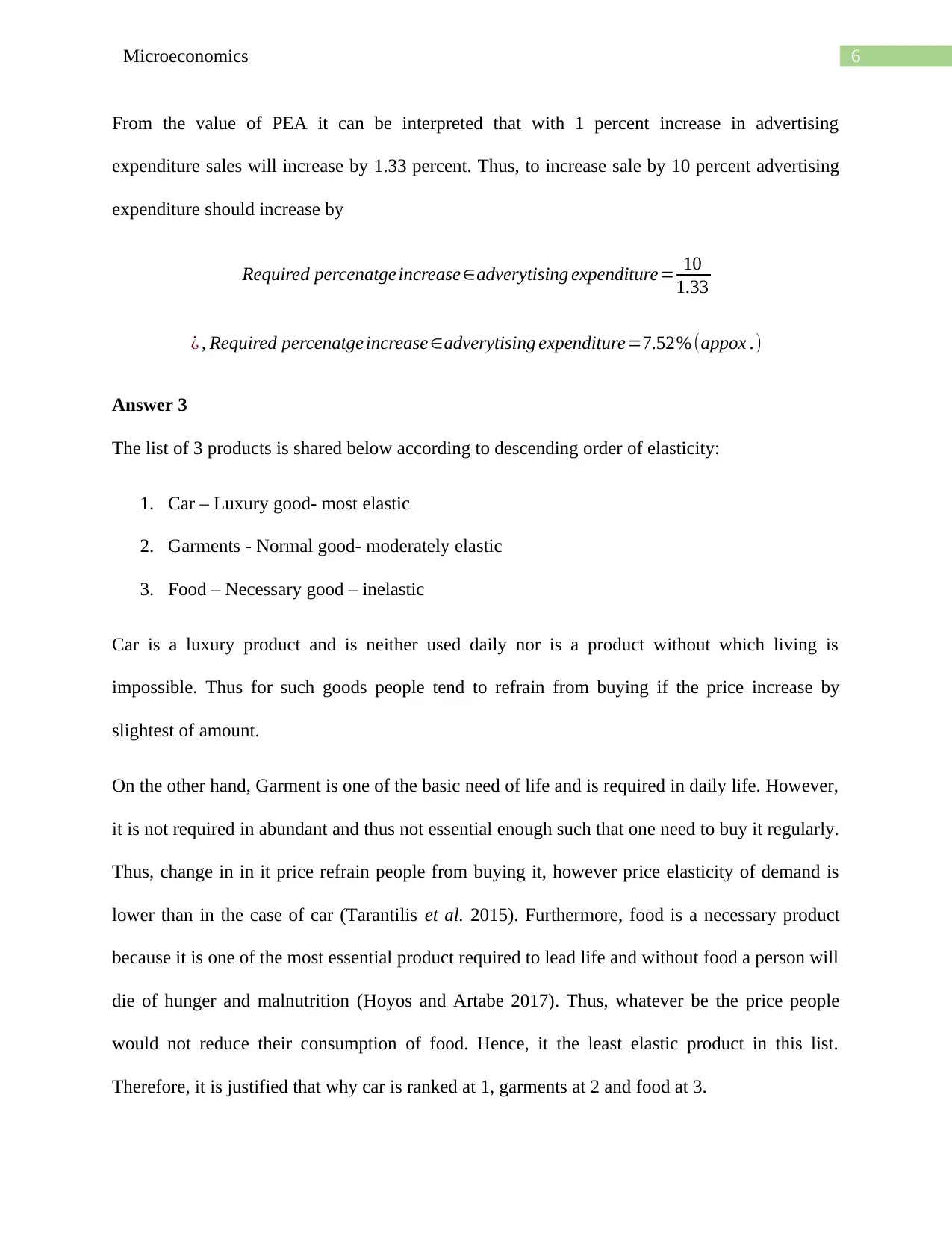

(c) Considering the value of PED as found in (b) it can be said that by increasing output the firm

will make less profit because a slight increase in output will drop the price by large amount

(Tarasova and Tarasova 2016). However, if the form decrease output it can make more profit as

a slight decrease in output will increase the price by much greater amount that increase the total

revenue and thereby profit increases too.

Figure 2: Inelastic demand

Source: (Created by the Author)

D

Q*

Q

P

P*

Quantity

Price

¿ , PED=−3 × 2800

30000

¿ , PED=−0.28

The price elasticity of demand is highly inelastic, that means with 1 unit change in price demand

will change decline by 0.28 units. It indicates that demand is much less responsive to change in

price.

(c) Considering the value of PED as found in (b) it can be said that by increasing output the firm

will make less profit because a slight increase in output will drop the price by large amount

(Tarasova and Tarasova 2016). However, if the form decrease output it can make more profit as

a slight decrease in output will increase the price by much greater amount that increase the total

revenue and thereby profit increases too.

Figure 2: Inelastic demand

Source: (Created by the Author)

5Microeconomics

From the above diagram it can be observed that if output increased from Q* to Q then fall

in price occurs from P* to P. Similarly, if the earlier output is Q then decreasing it to Q* the

price increase from P to P*. Thus, it is clear that decreasing output will increase profit, but until a

certain amount.

(d) Profit maximized at P=MC. P is equals to MC when P is 2800. Therefore, profit maximizing

price is 2800.

Now, profit maximizing output can be given as

Q=400−3 P+ 4 T + 0.6 A

¿ , Q=400−(3 ×2800)+(4 ×8000)+(0.6 ×10000)

¿ , Q=38 400−8400

¿ , Q=30 000

Therefore, profit maximizing output is 30000.

(e) Price elasticity of advertising (PEA) can be calculated as (other things as given)

Q=400−3 P+ 4 T + 0.6 A

¿ , d Q

dA =4

¿ , PEA=4 × A

Q

¿ , PEA=4 × 10000

30000

¿ , PEA=1.33

From the above diagram it can be observed that if output increased from Q* to Q then fall

in price occurs from P* to P. Similarly, if the earlier output is Q then decreasing it to Q* the

price increase from P to P*. Thus, it is clear that decreasing output will increase profit, but until a

certain amount.

(d) Profit maximized at P=MC. P is equals to MC when P is 2800. Therefore, profit maximizing

price is 2800.

Now, profit maximizing output can be given as

Q=400−3 P+ 4 T + 0.6 A

¿ , Q=400−(3 ×2800)+(4 ×8000)+(0.6 ×10000)

¿ , Q=38 400−8400

¿ , Q=30 000

Therefore, profit maximizing output is 30000.

(e) Price elasticity of advertising (PEA) can be calculated as (other things as given)

Q=400−3 P+ 4 T + 0.6 A

¿ , d Q

dA =4

¿ , PEA=4 × A

Q

¿ , PEA=4 × 10000

30000

¿ , PEA=1.33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6Microeconomics

From the value of PEA it can be interpreted that with 1 percent increase in advertising

expenditure sales will increase by 1.33 percent. Thus, to increase sale by 10 percent advertising

expenditure should increase by

Required percenatge increase∈adverytising expenditure= 10

1.33

¿ , Required percenatge increase∈adverytising expenditure=7.52% (appox .)

Answer 3

The list of 3 products is shared below according to descending order of elasticity:

1. Car – Luxury good- most elastic

2. Garments - Normal good- moderately elastic

3. Food – Necessary good – inelastic

Car is a luxury product and is neither used daily nor is a product without which living is

impossible. Thus for such goods people tend to refrain from buying if the price increase by

slightest of amount.

On the other hand, Garment is one of the basic need of life and is required in daily life. However,

it is not required in abundant and thus not essential enough such that one need to buy it regularly.

Thus, change in in it price refrain people from buying it, however price elasticity of demand is

lower than in the case of car (Tarantilis et al. 2015). Furthermore, food is a necessary product

because it is one of the most essential product required to lead life and without food a person will

die of hunger and malnutrition (Hoyos and Artabe 2017). Thus, whatever be the price people

would not reduce their consumption of food. Hence, it the least elastic product in this list.

Therefore, it is justified that why car is ranked at 1, garments at 2 and food at 3.

From the value of PEA it can be interpreted that with 1 percent increase in advertising

expenditure sales will increase by 1.33 percent. Thus, to increase sale by 10 percent advertising

expenditure should increase by

Required percenatge increase∈adverytising expenditure= 10

1.33

¿ , Required percenatge increase∈adverytising expenditure=7.52% (appox .)

Answer 3

The list of 3 products is shared below according to descending order of elasticity:

1. Car – Luxury good- most elastic

2. Garments - Normal good- moderately elastic

3. Food – Necessary good – inelastic

Car is a luxury product and is neither used daily nor is a product without which living is

impossible. Thus for such goods people tend to refrain from buying if the price increase by

slightest of amount.

On the other hand, Garment is one of the basic need of life and is required in daily life. However,

it is not required in abundant and thus not essential enough such that one need to buy it regularly.

Thus, change in in it price refrain people from buying it, however price elasticity of demand is

lower than in the case of car (Tarantilis et al. 2015). Furthermore, food is a necessary product

because it is one of the most essential product required to lead life and without food a person will

die of hunger and malnutrition (Hoyos and Artabe 2017). Thus, whatever be the price people

would not reduce their consumption of food. Hence, it the least elastic product in this list.

Therefore, it is justified that why car is ranked at 1, garments at 2 and food at 3.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7Microeconomics

References

Hoyos, D. and Artabe, A., 2017. Regional differences in the price elasticity of residential water

demand in Spain. Water Resources Management, 31(3), pp.847-865.

Schwartz, L.P., Roma, P.G., Henningfield, J.E., Hursh, S.R., Cone, E.J., Buchhalter, A.R., Fant,

R.V. and Schnoll, S.H., 2019. Behavioral economic demand metrics for abuse deterrent and

abuse potential quantification. Drug and alcohol dependence, 198, pp.13-20.

Tarantilis, F., Athanasakis, K., Zavras, D., Vozikis, A. and Kyriopoulos, I., 2015. Estimates of

price and income elasticity in Greece. Greek debt crisis transforming cigarettes into a luxury

good: an econometric approach. BMJ open, 5(1), p.e004748.

Tarasova, V.V. and Tarasov, V.E., 2016. Elasticity for economic processes with memory:

Fractional differential calculus approach. Fractional Differential Calculus, 6(2), pp.219-232.

References

Hoyos, D. and Artabe, A., 2017. Regional differences in the price elasticity of residential water

demand in Spain. Water Resources Management, 31(3), pp.847-865.

Schwartz, L.P., Roma, P.G., Henningfield, J.E., Hursh, S.R., Cone, E.J., Buchhalter, A.R., Fant,

R.V. and Schnoll, S.H., 2019. Behavioral economic demand metrics for abuse deterrent and

abuse potential quantification. Drug and alcohol dependence, 198, pp.13-20.

Tarantilis, F., Athanasakis, K., Zavras, D., Vozikis, A. and Kyriopoulos, I., 2015. Estimates of

price and income elasticity in Greece. Greek debt crisis transforming cigarettes into a luxury

good: an econometric approach. BMJ open, 5(1), p.e004748.

Tarasova, V.V. and Tarasov, V.E., 2016. Elasticity for economic processes with memory:

Fractional differential calculus approach. Fractional Differential Calculus, 6(2), pp.219-232.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.