Mining Profitability in Australia: Production Costs Impact

VerifiedAdded on 2023/06/06

|28

|4741

|356

Report

AI Summary

This report examines the impact of production costs on the profitability of the Australian mining sector. The study investigates the relationship between operational costs and profit margins using data from 1996-2015. It analyzes key cost factors, including mining equipment, wages, and energy, and employs correlation analysis to determine the strength and direction of their influence on profitability. The report addresses research questions on how production costs relate to profitability across different mining sectors and if there are any differences in production costs over the specified period. The findings reveal a positive correlation between production costs and industry profitability. The methodology includes data collection from the Australian Bureau of Statistics, data preparation, and the use of Pearson correlation to test hypotheses. The report also includes a literature review that covers mining's role in the Australian GDP, revenue, profit, and cost relationships, and capital-to-output ratios. The study concludes by highlighting the implications of the findings and discussing potential areas for future research.

Title: Impact of Production costs on the mining profitability in Australia

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive summary

Mining has been a booming endeavor for the past decade, with it being a major contributor to the

Australian GDP it has made great contribution to the growth of the Economy. In this paper,

factors that influence the profitability of the Australian mining industry are explored and their

relationship determined through use of correlation and forecasting. The results show that the cost

of production has a positive relationship with the industry’s profitability i.e. positive correlation.

Mining has been a booming endeavor for the past decade, with it being a major contributor to the

Australian GDP it has made great contribution to the growth of the Economy. In this paper,

factors that influence the profitability of the Australian mining industry are explored and their

relationship determined through use of correlation and forecasting. The results show that the cost

of production has a positive relationship with the industry’s profitability i.e. positive correlation.

Introduction

Overview and problem statement

Accounting for up to 7% national GDP, mining is one of the country’s primary sectors

contributing 50-60% of the total exports made by the country in 2007-2008 (Export Gov, 2018).

Therefore, despite recent economic hurdles in the field, Australian mining still is in shape to

satisfy its market needs given its large mineral resources and hence remains a crucial sector in

the country’s revenue generation (Michael, 2018). Australia’s largest exports include coal i.e. it

is the largest global coal exporter (up to 35% in international market). Other major minerals

include;

i. Lead

ii. Iron ore

iii. Diamond

iv. Zinc

v. Rutile

vi. Zirconium

The country is the second largest exporter of gold and Uranium as well as the third largest

exporter of aluminum.

Mineral exploration

Mineral exploration is largely private. Nevertheless, the government plays a critical role in

identification of minerals through research and other supportive roles. It is such a structure that

may be attributed the importance of profit-cost monitoring since the mining industry players

Overview and problem statement

Accounting for up to 7% national GDP, mining is one of the country’s primary sectors

contributing 50-60% of the total exports made by the country in 2007-2008 (Export Gov, 2018).

Therefore, despite recent economic hurdles in the field, Australian mining still is in shape to

satisfy its market needs given its large mineral resources and hence remains a crucial sector in

the country’s revenue generation (Michael, 2018). Australia’s largest exports include coal i.e. it

is the largest global coal exporter (up to 35% in international market). Other major minerals

include;

i. Lead

ii. Iron ore

iii. Diamond

iv. Zinc

v. Rutile

vi. Zirconium

The country is the second largest exporter of gold and Uranium as well as the third largest

exporter of aluminum.

Mineral exploration

Mineral exploration is largely private. Nevertheless, the government plays a critical role in

identification of minerals through research and other supportive roles. It is such a structure that

may be attributed the importance of profit-cost monitoring since the mining industry players

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

should always look for ways to sustain themselves in the business and maintain their

profitability.

Costs

The basic mining costs models include: mining equipment costs, smelting costs (hauling and

crashing), mining wages and benefit, taxes, electric power, and supplies.

Problem statement

Just like any other business endeavor, mining is set up for profits, where profits can generally be

viewed as the amount remaining after the total input costs have been subtracted from the total

sales. In this case the input costs will be the operational costs. Predicting the relationship

between operational costs and profitability of mining is therefore crucial to mining companies.

Assumptions of study

Assumptions made in this study are that, the total cost of production in the mining industry is

distributed across all the sub-sectors of the industry. The business environment is perfect, i.e. no

existence of external influence on profitability. Hence, cost of production is the only factor that

affects profitability.

Aim of research

The aim of this research is to explore the impact of operational costs on the mining profitability.

Research questions

In order to achieve our research aim, two questions are formulated:

i. How does production costs relate to profitability in different mining sectors?

ii. Is there a difference in the production costs annually since 1996-2015?

profitability.

Costs

The basic mining costs models include: mining equipment costs, smelting costs (hauling and

crashing), mining wages and benefit, taxes, electric power, and supplies.

Problem statement

Just like any other business endeavor, mining is set up for profits, where profits can generally be

viewed as the amount remaining after the total input costs have been subtracted from the total

sales. In this case the input costs will be the operational costs. Predicting the relationship

between operational costs and profitability of mining is therefore crucial to mining companies.

Assumptions of study

Assumptions made in this study are that, the total cost of production in the mining industry is

distributed across all the sub-sectors of the industry. The business environment is perfect, i.e. no

existence of external influence on profitability. Hence, cost of production is the only factor that

affects profitability.

Aim of research

The aim of this research is to explore the impact of operational costs on the mining profitability.

Research questions

In order to achieve our research aim, two questions are formulated:

i. How does production costs relate to profitability in different mining sectors?

ii. Is there a difference in the production costs annually since 1996-2015?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Literature review

Mining and sustainability

There has been a relative positive growth experienced by the mining sector in the past decade

both locally and globally, such a growth has been largely linked to the emergence of China and

India as fast growing economies (Hojem, 2014) given the new demand for minerals in the

international market. In response to the boom there were raised concerns over the industry’s

effect in the short and long term. Australia is strategically located to be able to supply Asia with

the much required minerals and energy products (Satchwell, 2014). In Western Australia, mining

is set to be beneficial a view owed to the large mining deposits in the region. For instance in

2011 WA made mineral exports of USD 13.6 billion which had grown by approximately USD

2.1 billion (Brant, Plevin, and Farrell, 2010) . In 2015 the area exported minerals and mineral

products worth $69.5 billion with those of iron ore being $48 billion (Mayes and Pini, 2014) .

Mining sector since the boom of the 2000s has been able to sustain itself due to the vast and

relatively non-volatile mineral resources boasted by Australia, (Koitsiwe and Adachi, 2015). The

county’s mining sector is a global competitor due to a number of strengths including: its

“resource endowment, view on sovereign risk, access to capital, minimal government

interventions, access to labor, skills and technology …” (Australian Council of learned

Academies, 2014).

Mining and Australia’s GDP

With its rich deposits of minerals such as oil, iron ore and several others, apart from profits, the

Australian mining industry is a great GDP contributor. For instance, considering oil which is

termed as the “liquid” gold, the only relatively stable price of oil was seen in the 50s and 60s

Mining and sustainability

There has been a relative positive growth experienced by the mining sector in the past decade

both locally and globally, such a growth has been largely linked to the emergence of China and

India as fast growing economies (Hojem, 2014) given the new demand for minerals in the

international market. In response to the boom there were raised concerns over the industry’s

effect in the short and long term. Australia is strategically located to be able to supply Asia with

the much required minerals and energy products (Satchwell, 2014). In Western Australia, mining

is set to be beneficial a view owed to the large mining deposits in the region. For instance in

2011 WA made mineral exports of USD 13.6 billion which had grown by approximately USD

2.1 billion (Brant, Plevin, and Farrell, 2010) . In 2015 the area exported minerals and mineral

products worth $69.5 billion with those of iron ore being $48 billion (Mayes and Pini, 2014) .

Mining sector since the boom of the 2000s has been able to sustain itself due to the vast and

relatively non-volatile mineral resources boasted by Australia, (Koitsiwe and Adachi, 2015). The

county’s mining sector is a global competitor due to a number of strengths including: its

“resource endowment, view on sovereign risk, access to capital, minimal government

interventions, access to labor, skills and technology …” (Australian Council of learned

Academies, 2014).

Mining and Australia’s GDP

With its rich deposits of minerals such as oil, iron ore and several others, apart from profits, the

Australian mining industry is a great GDP contributor. For instance, considering oil which is

termed as the “liquid” gold, the only relatively stable price of oil was seen in the 50s and 60s

(Blanchard, and Jordi, 2007) since then, oil prices have been fairly volatile driven by laws of

demand and supply, so has been their effect on the growth domestic product (GDP). Historically,

Carmine (2014) argues that, “Each spike in oil prices is followed by a sharp drop in world GDP

growth.” However, prices are not the only responsible factor in the drop in or rise in profitability

in the mining business. Crowson (2001) notes that, “After keeping roughly in pace with the

world share index for a decade, the index of non-ferrous mining companies' shares fell relatively

in 1997–1998, and has never regained its lost ground.” He attributes such a change to the shift of

interest in investors from the non-ferrous mining sector in favor of sectors such as coal and iron

mining which within that period of time had begun to pick up. In 2010 for instance iron became

the most valuable export in Australia (Gavin and Mohan, 2011).

Revenue, Profit and Cost

RPC is the relationship between the revenue, profit and cost components amongst each other and

the company’s net profit performance (Amy, 2017). In their article on the relationship between

revenue, profitability and cost, Amy (2016) argue that revenue * net profit = profit.

Additionally, the relationship between cost and profit is a direct one such that eliminating a $1

cost increases the profit by $1, hence a 1:1 ratio (Wheaton, 2018). Such costs comprise marginal

costs, variable costs, fixed costs and total costs which can be broadly categorized into implicit

and explicit costs while profits are categorized into accounting, economic, and normal profit,

(Hallock and Hall, 2014), where:

Accounting profits= Total revenue- explicit costs

Economic profits= total revenues- (explicit costs + Implicit costs)

demand and supply, so has been their effect on the growth domestic product (GDP). Historically,

Carmine (2014) argues that, “Each spike in oil prices is followed by a sharp drop in world GDP

growth.” However, prices are not the only responsible factor in the drop in or rise in profitability

in the mining business. Crowson (2001) notes that, “After keeping roughly in pace with the

world share index for a decade, the index of non-ferrous mining companies' shares fell relatively

in 1997–1998, and has never regained its lost ground.” He attributes such a change to the shift of

interest in investors from the non-ferrous mining sector in favor of sectors such as coal and iron

mining which within that period of time had begun to pick up. In 2010 for instance iron became

the most valuable export in Australia (Gavin and Mohan, 2011).

Revenue, Profit and Cost

RPC is the relationship between the revenue, profit and cost components amongst each other and

the company’s net profit performance (Amy, 2017). In their article on the relationship between

revenue, profitability and cost, Amy (2016) argue that revenue * net profit = profit.

Additionally, the relationship between cost and profit is a direct one such that eliminating a $1

cost increases the profit by $1, hence a 1:1 ratio (Wheaton, 2018). Such costs comprise marginal

costs, variable costs, fixed costs and total costs which can be broadly categorized into implicit

and explicit costs while profits are categorized into accounting, economic, and normal profit,

(Hallock and Hall, 2014), where:

Accounting profits= Total revenue- explicit costs

Economic profits= total revenues- (explicit costs + Implicit costs)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In addition, a company is inferred to have made normal profit if and only if its economic profits

are zero (Cliff, 2018). Operational costs are, according to Spacey (2015), “…expenditures related

to the core business process of an organization…” Mining companies adopted large-scale capital

expenditure i.e. a capex (Keaton et al, 2018) strategy in an effort to increase the sectors

productivity for the past decade.

In the mining sector, the operating costs (Drebenstedt, Bongaerts and Inthavongsa, 2015) are

calculated as:

Operating costs (OP) = (Mining costs) + (Processing costs) + (Mine reclamation costs)

+ (Power and Energy costs)

The cost of production includes the cost of material incurred, direct labor and manufacturing

overhead/ indirect costs.

Capital to Output ratio

This is the measure of capital amount invested in production of a single product unit. As

discussed earlier, in mining industry, capital consists of machinery, equipment and infrastructure.

One of the most used production function is the Cobb-Douglas function (Keaton et al, 2018)

which states that “the long-run capital-to-output ratio (K/Y) depends on the capital share of

income (α) and the return on capital (r)” i.e.:

K

Y = α

r

are zero (Cliff, 2018). Operational costs are, according to Spacey (2015), “…expenditures related

to the core business process of an organization…” Mining companies adopted large-scale capital

expenditure i.e. a capex (Keaton et al, 2018) strategy in an effort to increase the sectors

productivity for the past decade.

In the mining sector, the operating costs (Drebenstedt, Bongaerts and Inthavongsa, 2015) are

calculated as:

Operating costs (OP) = (Mining costs) + (Processing costs) + (Mine reclamation costs)

+ (Power and Energy costs)

The cost of production includes the cost of material incurred, direct labor and manufacturing

overhead/ indirect costs.

Capital to Output ratio

This is the measure of capital amount invested in production of a single product unit. As

discussed earlier, in mining industry, capital consists of machinery, equipment and infrastructure.

One of the most used production function is the Cobb-Douglas function (Keaton et al, 2018)

which states that “the long-run capital-to-output ratio (K/Y) depends on the capital share of

income (α) and the return on capital (r)” i.e.:

K

Y = α

r

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Where α denotes ratio of accrued generated income from mining against the percentage of wages

given to employees. In the recent years, the capital share in mining industry has shown a

fluctuation of 70-80% (Sontamino and Drebenstedt, 2013).

The Capital cost is given by:

Capital Cost (CC) = (Total equipment costs) + (Mills associated capital costs) +

(Mines associated capital costs) + (*G&A costs) + (Fixed costs*).

G & A costs and fixed costs are costs incurred when setting up

the mine for the first time.

Gaps in literature and ethical concerns

Despite mining being around for years, its profitability has rarely if ever been measured against

operational costs especially in Australia even though there have previous studies in several fields

that show relationship between input cost and a firm’s profitability. This literature seeks to fill

the gap on how input costs in the Australian mining sector impact mining profits. The study will

use correlation method to determine whether there exists any relationship in the variables of

interest. Despite the profitability of the mining sector, one of the biggest challenges that remain

is the climate and environmental concerns (Gavin and Mohan, 2011).

given to employees. In the recent years, the capital share in mining industry has shown a

fluctuation of 70-80% (Sontamino and Drebenstedt, 2013).

The Capital cost is given by:

Capital Cost (CC) = (Total equipment costs) + (Mills associated capital costs) +

(Mines associated capital costs) + (*G&A costs) + (Fixed costs*).

G & A costs and fixed costs are costs incurred when setting up

the mine for the first time.

Gaps in literature and ethical concerns

Despite mining being around for years, its profitability has rarely if ever been measured against

operational costs especially in Australia even though there have previous studies in several fields

that show relationship between input cost and a firm’s profitability. This literature seeks to fill

the gap on how input costs in the Australian mining sector impact mining profits. The study will

use correlation method to determine whether there exists any relationship in the variables of

interest. Despite the profitability of the mining sector, one of the biggest challenges that remain

is the climate and environmental concerns (Gavin and Mohan, 2011).

Methodology

Purpose

The purpose of this study is to determine the relationship between production costs and

profitability of the mining sector in Australia using historical data from the year 1996-2015.

Data

To fulfill the purpose, the data for this project is obtained from the Australian Bureau of

Statistics website for the years 1996-2015 under mining section in the previous and future release

subsections. It includes information on different mining areas such as gold, copper, iron ore, etc.

In addition, it contains financial information on mining operations for the stated years. This

source of data is reliable due to its occasional updates, ensuring the data is accurate.

Data preparation

The data was extracted using scale of importance, i.e. only relevant information was recorded,

such that the final dataset has nine variables:

i. Year

ii. Production costs calculated as total selected expenses such as labor cost added to the

total expenses such as cost of input materials

iii. Trading profit, obtained from the data it includes

iv. Operating profit before taxation

v. The gross profit is obtained through subtraction of total production costs from total

income

vi. Income generated from sales

Purpose

The purpose of this study is to determine the relationship between production costs and

profitability of the mining sector in Australia using historical data from the year 1996-2015.

Data

To fulfill the purpose, the data for this project is obtained from the Australian Bureau of

Statistics website for the years 1996-2015 under mining section in the previous and future release

subsections. It includes information on different mining areas such as gold, copper, iron ore, etc.

In addition, it contains financial information on mining operations for the stated years. This

source of data is reliable due to its occasional updates, ensuring the data is accurate.

Data preparation

The data was extracted using scale of importance, i.e. only relevant information was recorded,

such that the final dataset has nine variables:

i. Year

ii. Production costs calculated as total selected expenses such as labor cost added to the

total expenses such as cost of input materials

iii. Trading profit, obtained from the data it includes

iv. Operating profit before taxation

v. The gross profit is obtained through subtraction of total production costs from total

income

vi. Income generated from sales

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

vii. Total selected expenses and purchases

viii. Total expenses

ix. Total income obtained from operating profits and total income

The data was checked for outliers and multicollinearity.

Correlation

Correlation, defined as a mutual relationship between two or more variables in statistical terms,

will be used to examine whether there is a relationship between cost of production in the mining

industry and the profits. It will enable us to determine how strongly the chosen variables

influence profit generated. Normally, correlation is measured in a scale of between -1 and +1

such that, the closer the correlation coefficient (r) is close to either the stronger the relationship.

For instance a correlation that is more negative indicates negative correlation while a more

positive indicates a positive correlation. R-square is thence used for in showing a 2nd result of

every t-test where the significance level will tell us the probability that the correlations are out of

chance in a form of random sampling error. Given a linear relationship between our variables of

interest, we will employ the Pearson correlation coefficient (Survey system, 2018).

The correlation coefficient is calculated as in:

rxy = Cov(x , y)

√ Var (x )

Cov( x , y)

√ Var ( y)

Where cov (x,y) is the covariance between x and y

Hypotheses

To answer our research questions, two sets of statistical hypothesis are formulated.

viii. Total expenses

ix. Total income obtained from operating profits and total income

The data was checked for outliers and multicollinearity.

Correlation

Correlation, defined as a mutual relationship between two or more variables in statistical terms,

will be used to examine whether there is a relationship between cost of production in the mining

industry and the profits. It will enable us to determine how strongly the chosen variables

influence profit generated. Normally, correlation is measured in a scale of between -1 and +1

such that, the closer the correlation coefficient (r) is close to either the stronger the relationship.

For instance a correlation that is more negative indicates negative correlation while a more

positive indicates a positive correlation. R-square is thence used for in showing a 2nd result of

every t-test where the significance level will tell us the probability that the correlations are out of

chance in a form of random sampling error. Given a linear relationship between our variables of

interest, we will employ the Pearson correlation coefficient (Survey system, 2018).

The correlation coefficient is calculated as in:

rxy = Cov(x , y)

√ Var (x )

Cov( x , y)

√ Var ( y)

Where cov (x,y) is the covariance between x and y

Hypotheses

To answer our research questions, two sets of statistical hypothesis are formulated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Null hypothesis 1

H0: Production costs in the mining sector of Australia influences profits made.

Alternative Hypothesis 1

H1: There is no relationship between profits and production costs

Null hypothesis 2

H0: There is significant difference in the production costs over the period 1996-2015

Alternative hypothesis 2

H1: There is no significant difference in the production costs over the time period 1996-2015

H0: Production costs in the mining sector of Australia influences profits made.

Alternative Hypothesis 1

H1: There is no relationship between profits and production costs

Null hypothesis 2

H0: There is significant difference in the production costs over the period 1996-2015

Alternative hypothesis 2

H1: There is no significant difference in the production costs over the time period 1996-2015

Findings

In this section, we present the results of our statistical analyses and hypothesis section for

discussion in the next section.

Descriptive statistics

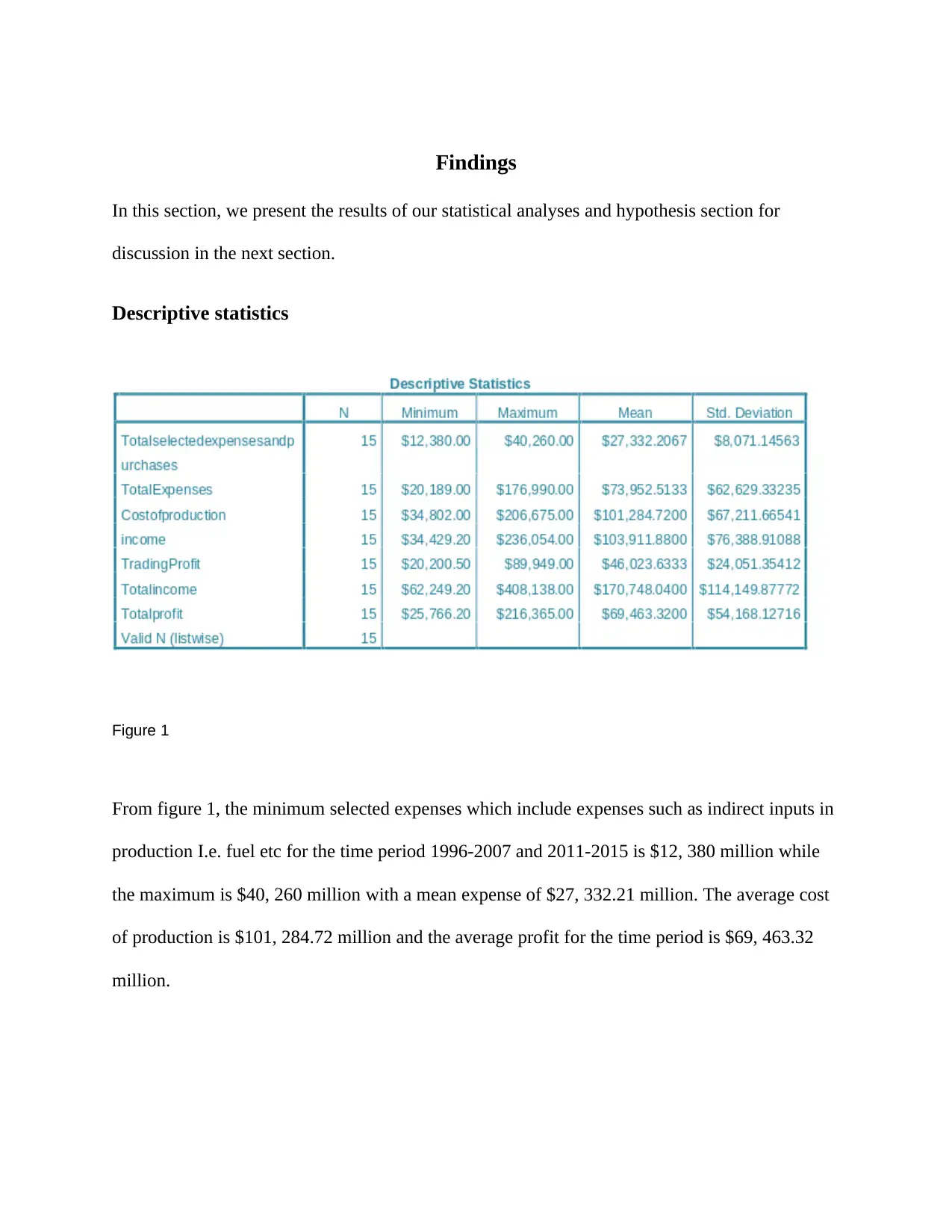

Figure 1

From figure 1, the minimum selected expenses which include expenses such as indirect inputs in

production I.e. fuel etc for the time period 1996-2007 and 2011-2015 is $12, 380 million while

the maximum is $40, 260 million with a mean expense of $27, 332.21 million. The average cost

of production is $101, 284.72 million and the average profit for the time period is $69, 463.32

million.

In this section, we present the results of our statistical analyses and hypothesis section for

discussion in the next section.

Descriptive statistics

Figure 1

From figure 1, the minimum selected expenses which include expenses such as indirect inputs in

production I.e. fuel etc for the time period 1996-2007 and 2011-2015 is $12, 380 million while

the maximum is $40, 260 million with a mean expense of $27, 332.21 million. The average cost

of production is $101, 284.72 million and the average profit for the time period is $69, 463.32

million.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.