Analyzing Risks: Mobile Payment Regulation in Sub-Saharan Africa

VerifiedAdded on 2023/06/04

|10

|1736

|66

Report

AI Summary

This report identifies and analyzes the various risks associated with mobile payment systems in Sub-Saharan Africa, including systematic, operational, reputational, legal, liquidity, fraudulent, and regulatory risks. It emphasizes the importance of risk management strategies to mitigate these risks and safeguard transactional processes. The report reviews existing literature on mobile banking adoption and risk management, highlighting factors such as ease of use, perceived expenditures, and credibility. It also discusses the adoption of mobile banking services among students and the role of risk management plans in addressing privacy concerns. The research methodology involves qualitative primary data collected through interviews with individuals who have experienced different types of risks in mobile payment systems. The report concludes by recommending effective strategies and techniques for minimizing and mitigating these risks through a comprehensive risk management plan, ensuring the security and stability of mobile financial services in the region. Desklib offers a wide array of study tools and resources for students.

Running head: ASSOCIATED RISKS IN MOBILE PAYMENTS

Risk management and mobile money regulation

Name of the Student

Name of the University

Author Note

Risk management and mobile money regulation

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2ASSOCIATED RISKS IN MOBILE PAYMENTS

Abstract

With the advent of the financial transactions through mobile financial services, lives have

been made a lot easier and easier and business processes have been facilitated accordingly.

New sectors and chances have ascended to the doorways of sub Saharan Africa. However,

these mobile transactions have also led to the adjuration of several risks within the system

that remain unattended for most of the time. The purpose of the dissertation proposal is to

project out those risks so that the business process related to the financial transactions gets an

added assistance. As a whole, this proposal portrays the major risks that are associated with

the African economy online.

Abstract

With the advent of the financial transactions through mobile financial services, lives have

been made a lot easier and easier and business processes have been facilitated accordingly.

New sectors and chances have ascended to the doorways of sub Saharan Africa. However,

these mobile transactions have also led to the adjuration of several risks within the system

that remain unattended for most of the time. The purpose of the dissertation proposal is to

project out those risks so that the business process related to the financial transactions gets an

added assistance. As a whole, this proposal portrays the major risks that are associated with

the African economy online.

3ASSOCIATED RISKS IN MOBILE PAYMENTS

Table of Contents

Topic..........................................................................................................................................4

Introduction................................................................................................................................4

Background................................................................................................................................4

Aims and objectives...................................................................................................................5

Literature Review.......................................................................................................................5

Research Methodology...............................................................................................................6

Research Schedule.....................................................................................................................7

Gantt chart..................................................................................................................................9

References................................................................................................................................10

Table of Contents

Topic..........................................................................................................................................4

Introduction................................................................................................................................4

Background................................................................................................................................4

Aims and objectives...................................................................................................................5

Literature Review.......................................................................................................................5

Research Methodology...............................................................................................................6

Research Schedule.....................................................................................................................7

Gantt chart..................................................................................................................................9

References................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4ASSOCIATED RISKS IN MOBILE PAYMENTS

Topic

Risk management and mobile money regulation in the sub Saharan African region.

Introduction

With the advent of the new technologies in the field of science and development, new

opportunities have opened in the field of commercial services and the banking mechanisms.

Transactions between two parties or the involvement of the multiple parties in the

transactional mechanism has been facilitated with the help of the onset of payments through

mobile money (Di Castri, 2013). Payments through mobile has not only provided a boost to

the fiscal exchange system but also has opened a new doorway for the business processes to

experience a fluency in the transfer of the funds (Iddris, 2013). These transactional exchanges

are also associated with several risks that are required to be mitigated at any cost.

Background

Payments made using the mobile services are fast and easy. Due to the fluency in the

services, it is also time efficient. Although there are a lot of benefits of the using the mobile

payments for monetary exchanges, there are several risks such as the systematic risks or the

operational risks or the reputational risks or the legal risks or the liquidity risks or the

fraudulent risks or the regulatory risks that are associated with the online transactional

processes (Jack & Suri, 2014). These risks are required to be seriously considered while

implementing the services as these risks may prove to be fatal in due course of the processes.

To mitigate these risks effectively the authority should take enough initiatives to formulate a

risk management plan by which a fair idea about the concerned risks can be developed along

with their probability of impact in the system (Njenga & Ndlovu, 2013).

Topic

Risk management and mobile money regulation in the sub Saharan African region.

Introduction

With the advent of the new technologies in the field of science and development, new

opportunities have opened in the field of commercial services and the banking mechanisms.

Transactions between two parties or the involvement of the multiple parties in the

transactional mechanism has been facilitated with the help of the onset of payments through

mobile money (Di Castri, 2013). Payments through mobile has not only provided a boost to

the fiscal exchange system but also has opened a new doorway for the business processes to

experience a fluency in the transfer of the funds (Iddris, 2013). These transactional exchanges

are also associated with several risks that are required to be mitigated at any cost.

Background

Payments made using the mobile services are fast and easy. Due to the fluency in the

services, it is also time efficient. Although there are a lot of benefits of the using the mobile

payments for monetary exchanges, there are several risks such as the systematic risks or the

operational risks or the reputational risks or the legal risks or the liquidity risks or the

fraudulent risks or the regulatory risks that are associated with the online transactional

processes (Jack & Suri, 2014). These risks are required to be seriously considered while

implementing the services as these risks may prove to be fatal in due course of the processes.

To mitigate these risks effectively the authority should take enough initiatives to formulate a

risk management plan by which a fair idea about the concerned risks can be developed along

with their probability of impact in the system (Njenga & Ndlovu, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5ASSOCIATED RISKS IN MOBILE PAYMENTS

Aims and objectives

The main aim of this dissertation proposal is to highlight the risks that are often

associated with that of the mobile payments and the online transactional mechanisms through

the mobile financial services or the MFS. These highlighted risks shall be subjected with

effective management strategies that are dedicated towards marking the impact and the

probability of the associated risks in the mobile money transactions. A risk management plan

is highly required to mitigate the risks so that the safeguarding of the transactional process

can be easily attained keeping the future prospect in mind.

The main objectives of the dissertation proposal has been stated as the following:

To understand the various types of risks that may be associated with the transactional

processes of the mobile financial services.

To understand the impact of the associated risks in mobile money regulation and also

the probability of those risks in the upcoming stages.

To recommend effective strategies and techniques through which the associated risks

can be minimised and can be easily mitigated through a risk management plan.

Literature Review

According to Hanafizadeh et al., 2014, encouraging the users to use vehemently the

cell phones for the transactional processes and the risks associated with the transactional

process makes it obvious to understand the associated risks and develop a risk management

plan to counter the impacts of those risks in future. The study builds on the idea of the mobile

banking and the adoption of those practices. This study has been towards a specific region in

the country of Iran. The study found that the mobile banking services are widely adopted in

this area due to the ease of use, personalised life style, perceived expenditures and the

credibility (Oscar Akotey & Abor, 2013). The study is based upon the mixture of the primary

Aims and objectives

The main aim of this dissertation proposal is to highlight the risks that are often

associated with that of the mobile payments and the online transactional mechanisms through

the mobile financial services or the MFS. These highlighted risks shall be subjected with

effective management strategies that are dedicated towards marking the impact and the

probability of the associated risks in the mobile money transactions. A risk management plan

is highly required to mitigate the risks so that the safeguarding of the transactional process

can be easily attained keeping the future prospect in mind.

The main objectives of the dissertation proposal has been stated as the following:

To understand the various types of risks that may be associated with the transactional

processes of the mobile financial services.

To understand the impact of the associated risks in mobile money regulation and also

the probability of those risks in the upcoming stages.

To recommend effective strategies and techniques through which the associated risks

can be minimised and can be easily mitigated through a risk management plan.

Literature Review

According to Hanafizadeh et al., 2014, encouraging the users to use vehemently the

cell phones for the transactional processes and the risks associated with the transactional

process makes it obvious to understand the associated risks and develop a risk management

plan to counter the impacts of those risks in future. The study builds on the idea of the mobile

banking and the adoption of those practices. This study has been towards a specific region in

the country of Iran. The study found that the mobile banking services are widely adopted in

this area due to the ease of use, personalised life style, perceived expenditures and the

credibility (Oscar Akotey & Abor, 2013). The study is based upon the mixture of the primary

6ASSOCIATED RISKS IN MOBILE PAYMENTS

and the secondary sources. Although the study has done in depth analysis, it is concentrated

towards a particular region for which it cannot be highly relied upon for all cases of the

mobile banking industry.

According to Govender & Sihlali, 2014, the increased usage of the mobile

technologies makes the mobile services more appealing among the students who have

intensions to remain technically updated all the time. The study revolves around the adoption

of the mobile banking services among the students. This study is highly reliable since it is

based upon the application of the quantitative approach in the collection of data through the

distribution questionnaires among the students. The study particularly depends upon the

implementation of the Trans Acceptance Model or the TAM. It has been stated in the study

that the risks and the privacy issues are found to considerably low among the students since

they are well updated about the risks through an effective risk management plan (Osei-

Assibey, 2015). Further the study also addresses the risks that are associated in the mobile

banking and recommends way to mitigate the associated risks in the transactional processes.

Research Methodology

The research is intended to be conducted by the application of the certain principles

and guidelines of the risk management in mobile banking and the mobile money regulations.

The data for the effective framing of the dissertation shall be completely based on the

primary data regarding the associated risks and their effective management strategies in

mobile money regulation. As this proposal is concentrated towards the association of the

several risks and their management procedures, a qualitative primary data will be used in the

dissertation. The qualitative data will be collected through the help of several interviews of

the people who has been subjected to either the systematic risks or the operational risks or the

and the secondary sources. Although the study has done in depth analysis, it is concentrated

towards a particular region for which it cannot be highly relied upon for all cases of the

mobile banking industry.

According to Govender & Sihlali, 2014, the increased usage of the mobile

technologies makes the mobile services more appealing among the students who have

intensions to remain technically updated all the time. The study revolves around the adoption

of the mobile banking services among the students. This study is highly reliable since it is

based upon the application of the quantitative approach in the collection of data through the

distribution questionnaires among the students. The study particularly depends upon the

implementation of the Trans Acceptance Model or the TAM. It has been stated in the study

that the risks and the privacy issues are found to considerably low among the students since

they are well updated about the risks through an effective risk management plan (Osei-

Assibey, 2015). Further the study also addresses the risks that are associated in the mobile

banking and recommends way to mitigate the associated risks in the transactional processes.

Research Methodology

The research is intended to be conducted by the application of the certain principles

and guidelines of the risk management in mobile banking and the mobile money regulations.

The data for the effective framing of the dissertation shall be completely based on the

primary data regarding the associated risks and their effective management strategies in

mobile money regulation. As this proposal is concentrated towards the association of the

several risks and their management procedures, a qualitative primary data will be used in the

dissertation. The qualitative data will be collected through the help of several interviews of

the people who has been subjected to either the systematic risks or the operational risks or the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7ASSOCIATED RISKS IN MOBILE PAYMENTS

reputational risks or the legal risks or the liquidity risks or the fraudulent risks or the

regulatory risks.

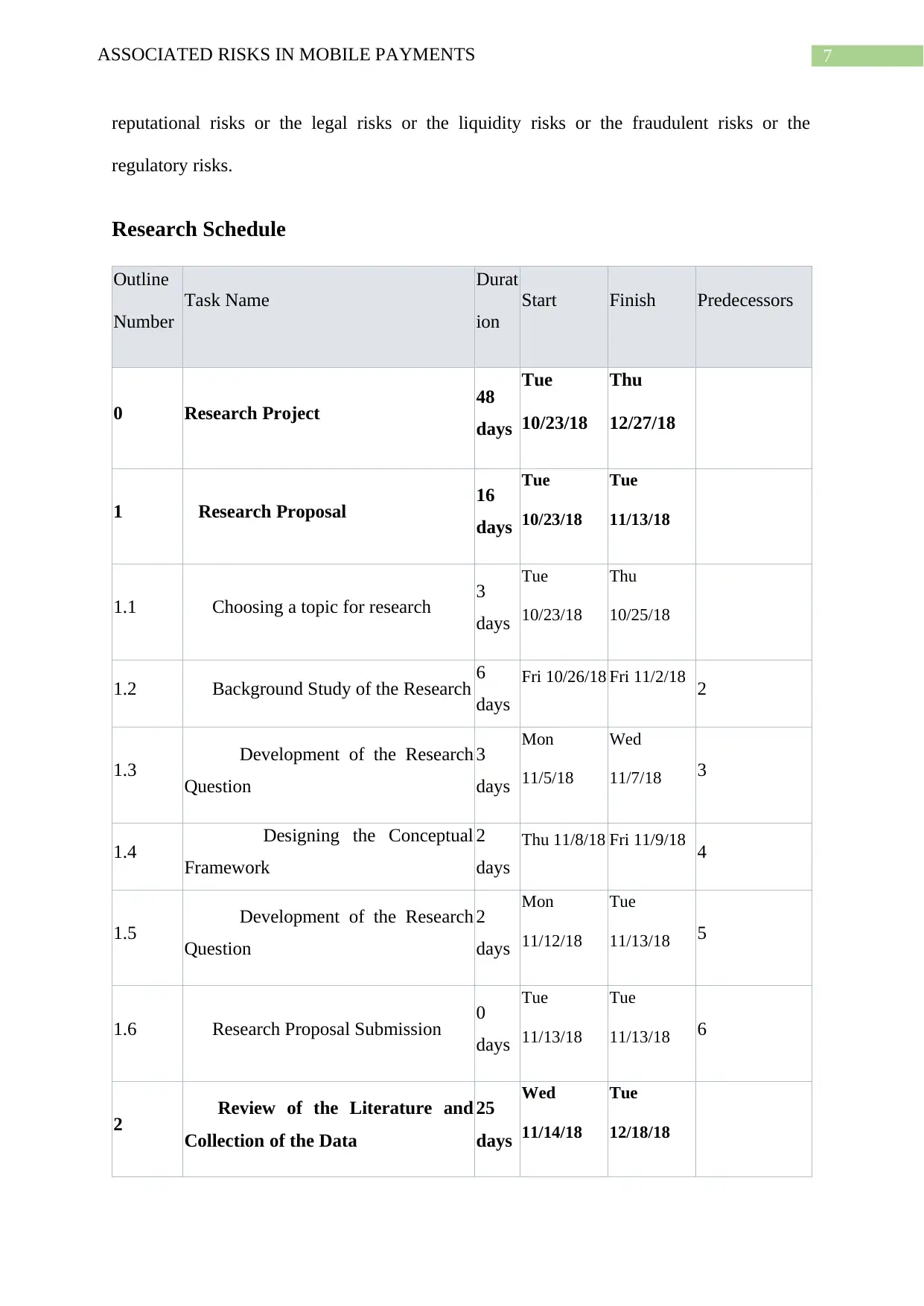

Research Schedule

Outline

Number

Task Name

Durat

ion

Start Finish Predecessors

0 Research Project 48

days

Tue

10/23/18

Thu

12/27/18

1 Research Proposal 16

days

Tue

10/23/18

Tue

11/13/18

1.1 Choosing a topic for research 3

days

Tue

10/23/18

Thu

10/25/18

1.2 Background Study of the Research 6

days

Fri 10/26/18 Fri 11/2/18 2

1.3 Development of the Research

Question

3

days

Mon

11/5/18

Wed

11/7/18 3

1.4 Designing the Conceptual

Framework

2

days

Thu 11/8/18 Fri 11/9/18 4

1.5 Development of the Research

Question

2

days

Mon

11/12/18

Tue

11/13/18 5

1.6 Research Proposal Submission 0

days

Tue

11/13/18

Tue

11/13/18 6

2 Review of the Literature and

Collection of the Data

25

days

Wed

11/14/18

Tue

12/18/18

reputational risks or the legal risks or the liquidity risks or the fraudulent risks or the

regulatory risks.

Research Schedule

Outline

Number

Task Name

Durat

ion

Start Finish Predecessors

0 Research Project 48

days

Tue

10/23/18

Thu

12/27/18

1 Research Proposal 16

days

Tue

10/23/18

Tue

11/13/18

1.1 Choosing a topic for research 3

days

Tue

10/23/18

Thu

10/25/18

1.2 Background Study of the Research 6

days

Fri 10/26/18 Fri 11/2/18 2

1.3 Development of the Research

Question

3

days

Mon

11/5/18

Wed

11/7/18 3

1.4 Designing the Conceptual

Framework

2

days

Thu 11/8/18 Fri 11/9/18 4

1.5 Development of the Research

Question

2

days

Mon

11/12/18

Tue

11/13/18 5

1.6 Research Proposal Submission 0

days

Tue

11/13/18

Tue

11/13/18 6

2 Review of the Literature and

Collection of the Data

25

days

Wed

11/14/18

Tue

12/18/18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8ASSOCIATED RISKS IN MOBILE PAYMENTS

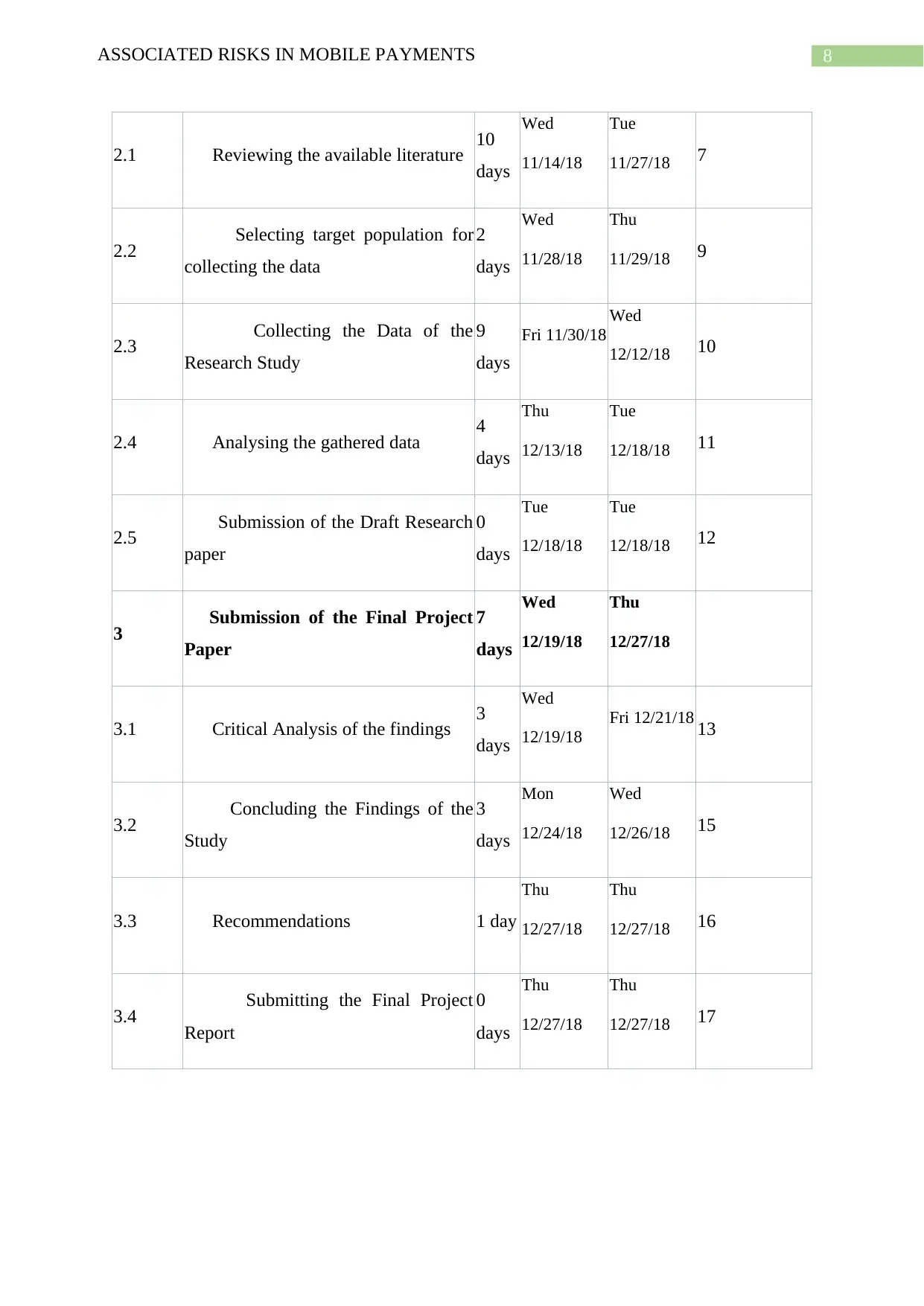

2.1 Reviewing the available literature 10

days

Wed

11/14/18

Tue

11/27/18 7

2.2 Selecting target population for

collecting the data

2

days

Wed

11/28/18

Thu

11/29/18 9

2.3 Collecting the Data of the

Research Study

9

days

Fri 11/30/18

Wed

12/12/18 10

2.4 Analysing the gathered data 4

days

Thu

12/13/18

Tue

12/18/18 11

2.5 Submission of the Draft Research

paper

0

days

Tue

12/18/18

Tue

12/18/18 12

3 Submission of the Final Project

Paper

7

days

Wed

12/19/18

Thu

12/27/18

3.1 Critical Analysis of the findings 3

days

Wed

12/19/18

Fri 12/21/18 13

3.2 Concluding the Findings of the

Study

3

days

Mon

12/24/18

Wed

12/26/18 15

3.3 Recommendations 1 day

Thu

12/27/18

Thu

12/27/18 16

3.4 Submitting the Final Project

Report

0

days

Thu

12/27/18

Thu

12/27/18 17

2.1 Reviewing the available literature 10

days

Wed

11/14/18

Tue

11/27/18 7

2.2 Selecting target population for

collecting the data

2

days

Wed

11/28/18

Thu

11/29/18 9

2.3 Collecting the Data of the

Research Study

9

days

Fri 11/30/18

Wed

12/12/18 10

2.4 Analysing the gathered data 4

days

Thu

12/13/18

Tue

12/18/18 11

2.5 Submission of the Draft Research

paper

0

days

Tue

12/18/18

Tue

12/18/18 12

3 Submission of the Final Project

Paper

7

days

Wed

12/19/18

Thu

12/27/18

3.1 Critical Analysis of the findings 3

days

Wed

12/19/18

Fri 12/21/18 13

3.2 Concluding the Findings of the

Study

3

days

Mon

12/24/18

Wed

12/26/18 15

3.3 Recommendations 1 day

Thu

12/27/18

Thu

12/27/18 16

3.4 Submitting the Final Project

Report

0

days

Thu

12/27/18

Thu

12/27/18 17

9ASSOCIATED RISKS IN MOBILE PAYMENTS

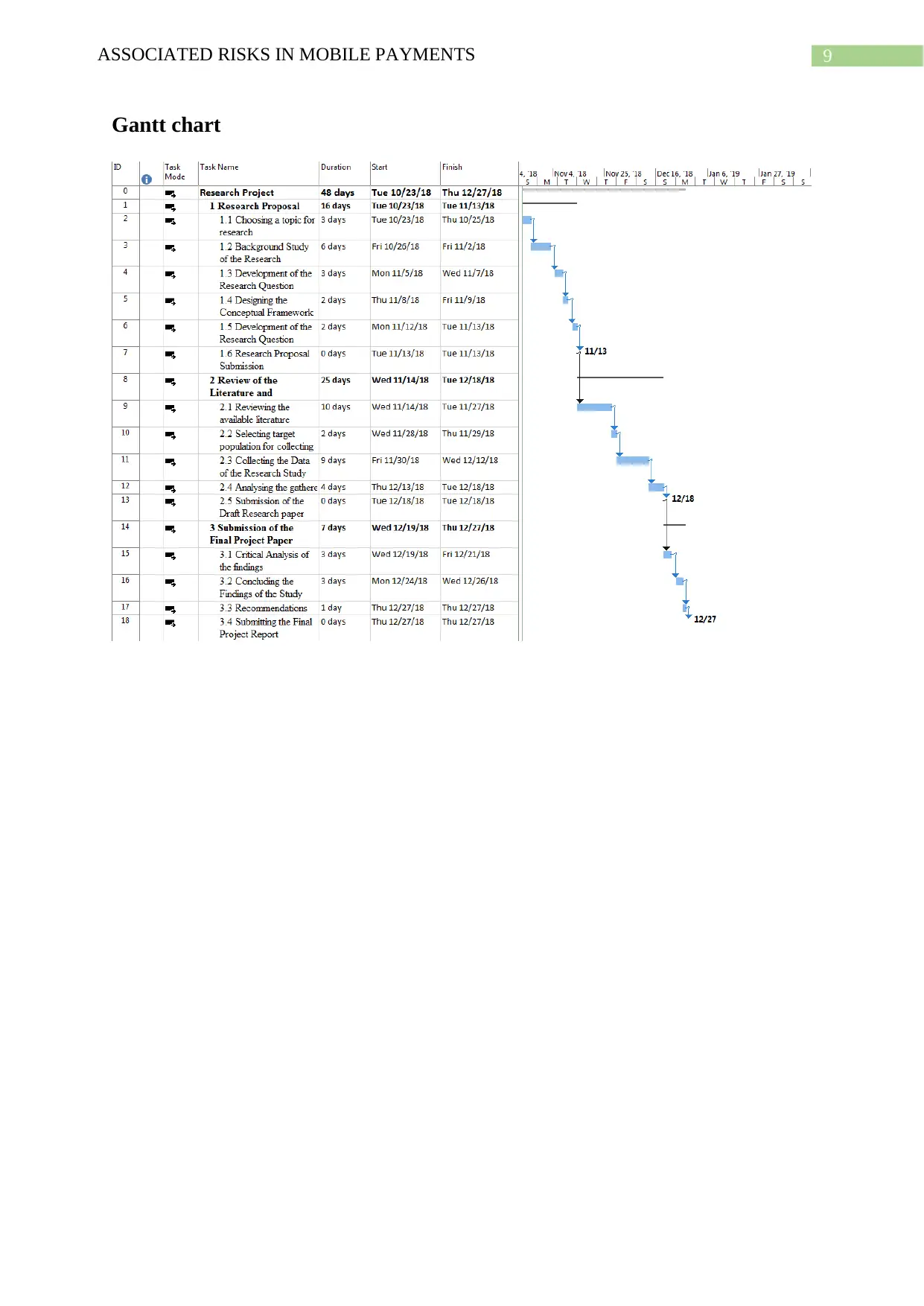

Gantt chart

Gantt chart

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10ASSOCIATED RISKS IN MOBILE PAYMENTS

References

Di Castri, S. (2013). Mobile money: Enabling regulatory solutions.

Govender, I., & Sihlali, W. (2014). A study of mobile banking adoption among university

students using an extended TAM. Mediterranean Journal of Social Sciences, 5(7),

451.

Hanafizadeh, P., Behboudi, M., Koshksaray, A. A., & Tabar, M. J. S. (2014). Mobile-banking

adoption by Iranian bank clients. Telematics and Informatics, 31(1), 62-78.

Iddris, F. (2013). Barriers to adoption of mobile banking: Evidence from

Ghana. International Journal of Academic Research in Business and Social

Sciences, 3(7), 356-370.

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's

mobile money revolution. American Economic Review, 104(1), 183-223.

Njenga, K., & Ndlovu, S. (2013). On rational choice, risk and utility in mobile banking:

building the information society. The African Journal of Information and

Communication, 2013(13), 42-61.

Oscar Akotey, J., & Abor, J. (2013). Risk management in the Ghanaian insurance

industry. Qualitative Research in Financial Markets, 5(1), 26-42.

Osei-Assibey, E. (2015). What drives behavioral intention of mobile money adoption? The

case of ancient susu saving operations in Ghana. International Journal of Social

Economics, 42(11), 962-979.

References

Di Castri, S. (2013). Mobile money: Enabling regulatory solutions.

Govender, I., & Sihlali, W. (2014). A study of mobile banking adoption among university

students using an extended TAM. Mediterranean Journal of Social Sciences, 5(7),

451.

Hanafizadeh, P., Behboudi, M., Koshksaray, A. A., & Tabar, M. J. S. (2014). Mobile-banking

adoption by Iranian bank clients. Telematics and Informatics, 31(1), 62-78.

Iddris, F. (2013). Barriers to adoption of mobile banking: Evidence from

Ghana. International Journal of Academic Research in Business and Social

Sciences, 3(7), 356-370.

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's

mobile money revolution. American Economic Review, 104(1), 183-223.

Njenga, K., & Ndlovu, S. (2013). On rational choice, risk and utility in mobile banking:

building the information society. The African Journal of Information and

Communication, 2013(13), 42-61.

Oscar Akotey, J., & Abor, J. (2013). Risk management in the Ghanaian insurance

industry. Qualitative Research in Financial Markets, 5(1), 26-42.

Osei-Assibey, E. (2015). What drives behavioral intention of mobile money adoption? The

case of ancient susu saving operations in Ghana. International Journal of Social

Economics, 42(11), 962-979.

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.