Understanding Financial Terms and their Impact on Cash Flow

VerifiedAdded on 2023/01/10

|13

|3124

|50

AI Summary

This report explains important financial terms like profit, cash flow, and working capital, and examines the impact of changes in working capital on cash flow. It provides recommendations for improving cash flow.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MOD003319 BUSINESS

FINANCE

FINANCE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................3

1. a. Profit and Cash flow............................................................................................................4

b. Working capital and receivable, inventory and payable..........................................................4

c. Impact of working capital on cash flow...................................................................................5

2. Application and analysis..........................................................................................................5

3. Recommendation of the steps to be taken...............................................................................6

EXECUTIVE SUMMARY.............................................................................................................7

i. Purpose of budget preparation..................................................................................................8

ii. Demonstrating the applicability of budgeting methods to plan future cost management.......9

iii. Analysing which method is appropriate for Phonus Plc......................................................10

REFERENCES................................................................................................................................1

EXECUTIVE SUMMARY.............................................................................................................3

1. a. Profit and Cash flow............................................................................................................4

b. Working capital and receivable, inventory and payable..........................................................4

c. Impact of working capital on cash flow...................................................................................5

2. Application and analysis..........................................................................................................5

3. Recommendation of the steps to be taken...............................................................................6

EXECUTIVE SUMMARY.............................................................................................................7

i. Purpose of budget preparation..................................................................................................8

ii. Demonstrating the applicability of budgeting methods to plan future cost management.......9

iii. Analysing which method is appropriate for Phonus Plc......................................................10

REFERENCES................................................................................................................................1

EXECUTIVE SUMMARY

In this report, some of the important financial terms have been explained and their

relevance in the business like cashflow, profit, working capital and so forth. It also examines the

impact of changes in the working capital over the cash flow of the Fitt Ltd. Based on the

findings, some of the steps that can eb undertaken by Fitt Ltd are recommended for improving its

cash flow.

In this report, some of the important financial terms have been explained and their

relevance in the business like cashflow, profit, working capital and so forth. It also examines the

impact of changes in the working capital over the cash flow of the Fitt Ltd. Based on the

findings, some of the steps that can eb undertaken by Fitt Ltd are recommended for improving its

cash flow.

PART 1

1. a. Profit and Cash flow

The term profit indicates the net warning that a company or an organisation is able to earn

after deducting all the expenses from the revenue that is earned (Aktas, Croci and Petmezas,

2015). The gross profit and net profit are the two distinctions in the profits where the gross profit

indicates the profit after only direct expenses are deducted from the sale revenue that is earned

while net profit on the other hand is indicated by the profit that is earned after deducting all the

other expenses as well where the taxes and the operating expenses are also deducted from the

revenue.

Cash flow is a statement that indicates the overall cash inflow and outflow that is earned

in a company over a period of time. The cash income that is earned is indicated by the cash

inflow and the overall expenses that are earned are indicated by the term of cash outflow

(Weetman, 2010). It mainly acts as a decision making matrix where the managers can use the

data available to take decisions regarding investments to be made and the decisions that are to be

taken.

The difference between the two of them is that while the cash flow simply shows the inflow and

outflow of cash, profit on the other hand is the earnings that are earned after deduction of all the

expenses (Atrill and McLaney, 2008). Further the cash flow helps in presenting a long term

outlook regarding the financial status, the same is not the case for the profit as it indicates the

present success or failure of a business.

b. Working capital and receivable, inventory and payable

The term working capital refers to the calculation of the net short terms that are available

in the business after all the short term obligations have been met. Working capital indicates the

net difference between the current assets of the company and current liabilities. If the difference

is positive then it is said that the working capital is favourable and in case of negative difference,

it is negative (Watson and Head, 2010). This working capital can be used to complete the daily

activities in a business and is also used in the cash operating cycle.

Receivables: Receivables indicate those short assets of a company from which payment is yet to

be recovered. This is against the goods or services sold on credit for a short period i.e. it is

usually lesser than 1 year. The receivables are recorded as an asset in the company’s balance

sheet usually.

1. a. Profit and Cash flow

The term profit indicates the net warning that a company or an organisation is able to earn

after deducting all the expenses from the revenue that is earned (Aktas, Croci and Petmezas,

2015). The gross profit and net profit are the two distinctions in the profits where the gross profit

indicates the profit after only direct expenses are deducted from the sale revenue that is earned

while net profit on the other hand is indicated by the profit that is earned after deducting all the

other expenses as well where the taxes and the operating expenses are also deducted from the

revenue.

Cash flow is a statement that indicates the overall cash inflow and outflow that is earned

in a company over a period of time. The cash income that is earned is indicated by the cash

inflow and the overall expenses that are earned are indicated by the term of cash outflow

(Weetman, 2010). It mainly acts as a decision making matrix where the managers can use the

data available to take decisions regarding investments to be made and the decisions that are to be

taken.

The difference between the two of them is that while the cash flow simply shows the inflow and

outflow of cash, profit on the other hand is the earnings that are earned after deduction of all the

expenses (Atrill and McLaney, 2008). Further the cash flow helps in presenting a long term

outlook regarding the financial status, the same is not the case for the profit as it indicates the

present success or failure of a business.

b. Working capital and receivable, inventory and payable

The term working capital refers to the calculation of the net short terms that are available

in the business after all the short term obligations have been met. Working capital indicates the

net difference between the current assets of the company and current liabilities. If the difference

is positive then it is said that the working capital is favourable and in case of negative difference,

it is negative (Watson and Head, 2010). This working capital can be used to complete the daily

activities in a business and is also used in the cash operating cycle.

Receivables: Receivables indicate those short assets of a company from which payment is yet to

be recovered. This is against the goods or services sold on credit for a short period i.e. it is

usually lesser than 1 year. The receivables are recorded as an asset in the company’s balance

sheet usually.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Inventory: Inventory can be termed as the stock or raw materials that are available in a company

and which are to be used for further production of final products (Drury, 2005). This is a short

term asset and acts as a main source of revenue generation.

Payables: Payables, as opposed to receivables, indicate the short term obligations that a company

has towards its creditors to whom money is to be paid. These are usually categorised as bill

payables in the liability side of the balance sheet.

c. Impact of working capital on cash flow

The fluctuation in working capital affects the cash flow of an organisation directly. When

the working capital increases then this indicates that the funds invested in short terms assets and

liabilities are higher. Contrarily, a negative movement in the working capital indicates that the

overall dependence on the short terms funds to meet the business requirements has increased.

Hence the cash flow funds will automatically increase. For instance, if a company is spending

cash on purchase of inventory, then the working capital will remain unchanged as cash and

inventory both are part of working capital but the cash inflow will reduce (Atrill and McLaney,

2009). Another example can be taken in the form of settling of the creditors of the company

where working capital remains constant but the overall cash flow statement declines as the cash

goes out. Therefore, working capital has a consistent impact on the overall cash flow preparation

and overall amount.

2. Application and analysis

The operation profit that was earned by Fitt Ltd. in previous year amounted to an excellent

figure of £55 million indicating that company is in a good position and business. However,

consequently the debt of company has also increased from £65 million earlier to £90 million in

the last year. Further, it was illustrated that Fitt Ltd. has acquired a 30% stake in the sandal

manufacturing company amounting to £10 million and additional £8 million have been promised

to be paid. Additionally, it was also ascertained that there are various sources from which the

amount is due for the company. Company is due to receive £12.5 million from Mike Ltd and an

approximate amount of £12 million from Sadidas which is caught in a dispute between both the

companies. The overall investments etc. made by the company indicates that the management of

the company is very poor and the overall decision making is not proper. The company has

invested too much whose returns are yet to be borne and the majority of the customers are being

served on a credit basis. The overall bills receivables of the company have increased causing a

and which are to be used for further production of final products (Drury, 2005). This is a short

term asset and acts as a main source of revenue generation.

Payables: Payables, as opposed to receivables, indicate the short term obligations that a company

has towards its creditors to whom money is to be paid. These are usually categorised as bill

payables in the liability side of the balance sheet.

c. Impact of working capital on cash flow

The fluctuation in working capital affects the cash flow of an organisation directly. When

the working capital increases then this indicates that the funds invested in short terms assets and

liabilities are higher. Contrarily, a negative movement in the working capital indicates that the

overall dependence on the short terms funds to meet the business requirements has increased.

Hence the cash flow funds will automatically increase. For instance, if a company is spending

cash on purchase of inventory, then the working capital will remain unchanged as cash and

inventory both are part of working capital but the cash inflow will reduce (Atrill and McLaney,

2009). Another example can be taken in the form of settling of the creditors of the company

where working capital remains constant but the overall cash flow statement declines as the cash

goes out. Therefore, working capital has a consistent impact on the overall cash flow preparation

and overall amount.

2. Application and analysis

The operation profit that was earned by Fitt Ltd. in previous year amounted to an excellent

figure of £55 million indicating that company is in a good position and business. However,

consequently the debt of company has also increased from £65 million earlier to £90 million in

the last year. Further, it was illustrated that Fitt Ltd. has acquired a 30% stake in the sandal

manufacturing company amounting to £10 million and additional £8 million have been promised

to be paid. Additionally, it was also ascertained that there are various sources from which the

amount is due for the company. Company is due to receive £12.5 million from Mike Ltd and an

approximate amount of £12 million from Sadidas which is caught in a dispute between both the

companies. The overall investments etc. made by the company indicates that the management of

the company is very poor and the overall decision making is not proper. The company has

invested too much whose returns are yet to be borne and the majority of the customers are being

served on a credit basis. The overall bills receivables of the company have increased causing a

reduced cash flow and the increased short term liabilities in the company. Therefore, the time

utilised in the collection of the overall amount in the company is very long. Additionally the

investment decisions that are being made by the management of the company are not adequately

time where they tend to make multiple investments or huge amounts at the same time and this

has led to increase in operating profit but increase in the overall debts as well (Aktas, Croci and

Petmezas, 2015). The collection strategy of the company is also very weak and they tend to

depict the overall delay that is shown in the collection of debt amounts. The cash flow is

depicting lower amount due to these misplaced investments and longer payable time period. The

working capital on the other hand depicts a declining amount where the current liabilities of the

company are much higher and hence the overall amount is decreasing.

3. Recommendation of the steps to be taken

After analysing the case study of Fitt Ltd., there are various areas on which the recommendations

and suggestions can be made for the company so that the cash flow of the company can be

improved and the overall working capital can be managed in a better manner:

The collection period of the Fitt Ltd. needs to be more prominent where they tend should

develop proper strategies and schemes to reduce the collection team and prevent the

ageing of the accounts unnecessarily. Tools like online payments or payments in different

stages and instalments etc. can be used for larger payments by the company. This will

reduce the delay caused and hence both cash inflow and current assets of the company

will improve.

The relationships that Fitt Ltd. has developed with its suppliers and buyers is not very

healthy and this has led to the disruption in the overall work that is being done.

Establishment of better relations with the vendors will help in developing better deals and

hence a cordial relationship can be developed with the suppliers. This will help in

ensuring that the payment is recovered in a timely manner and the overall cost is reduced.

The investments that are being made by the Fitt Ltd. also needs to be reviewed where the

overall debt and interest payments can be evaluated before making any investment

decisions so that proper and efficient decisions can be taken accordingly.

An automated or online system for receiving payments can be developed so that the

collection period and amount is proper and adequate without causing any unnecessary

delay in the overall functioning.

utilised in the collection of the overall amount in the company is very long. Additionally the

investment decisions that are being made by the management of the company are not adequately

time where they tend to make multiple investments or huge amounts at the same time and this

has led to increase in operating profit but increase in the overall debts as well (Aktas, Croci and

Petmezas, 2015). The collection strategy of the company is also very weak and they tend to

depict the overall delay that is shown in the collection of debt amounts. The cash flow is

depicting lower amount due to these misplaced investments and longer payable time period. The

working capital on the other hand depicts a declining amount where the current liabilities of the

company are much higher and hence the overall amount is decreasing.

3. Recommendation of the steps to be taken

After analysing the case study of Fitt Ltd., there are various areas on which the recommendations

and suggestions can be made for the company so that the cash flow of the company can be

improved and the overall working capital can be managed in a better manner:

The collection period of the Fitt Ltd. needs to be more prominent where they tend should

develop proper strategies and schemes to reduce the collection team and prevent the

ageing of the accounts unnecessarily. Tools like online payments or payments in different

stages and instalments etc. can be used for larger payments by the company. This will

reduce the delay caused and hence both cash inflow and current assets of the company

will improve.

The relationships that Fitt Ltd. has developed with its suppliers and buyers is not very

healthy and this has led to the disruption in the overall work that is being done.

Establishment of better relations with the vendors will help in developing better deals and

hence a cordial relationship can be developed with the suppliers. This will help in

ensuring that the payment is recovered in a timely manner and the overall cost is reduced.

The investments that are being made by the Fitt Ltd. also needs to be reviewed where the

overall debt and interest payments can be evaluated before making any investment

decisions so that proper and efficient decisions can be taken accordingly.

An automated or online system for receiving payments can be developed so that the

collection period and amount is proper and adequate without causing any unnecessary

delay in the overall functioning.

EXECUTIVE SUMMARY

This report provides an understanding about the various methods of budgeting which can

eb used by the Phonus Plc for implementation in its business such as activity and zero-

based budgeting and so forth. On the basis of findings, the activity based budgeting method

is considered as the best method for Phonus Plc for its new business expansion plan.

This report provides an understanding about the various methods of budgeting which can

eb used by the Phonus Plc for implementation in its business such as activity and zero-

based budgeting and so forth. On the basis of findings, the activity based budgeting method

is considered as the best method for Phonus Plc for its new business expansion plan.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART 2

i. Purpose of budget preparation

The technique of budget formulation is a detailed and complex task where the overall

decision making in the business gets affected. Budget acts as a tool that indicates the

performance of the last year and then the evaluation is done regarding the trends that are inflicted

in the current year (Atrill and McLaney, 2008). There are different types of budgets that can be

developed and the critical analysis can be done in following manner:

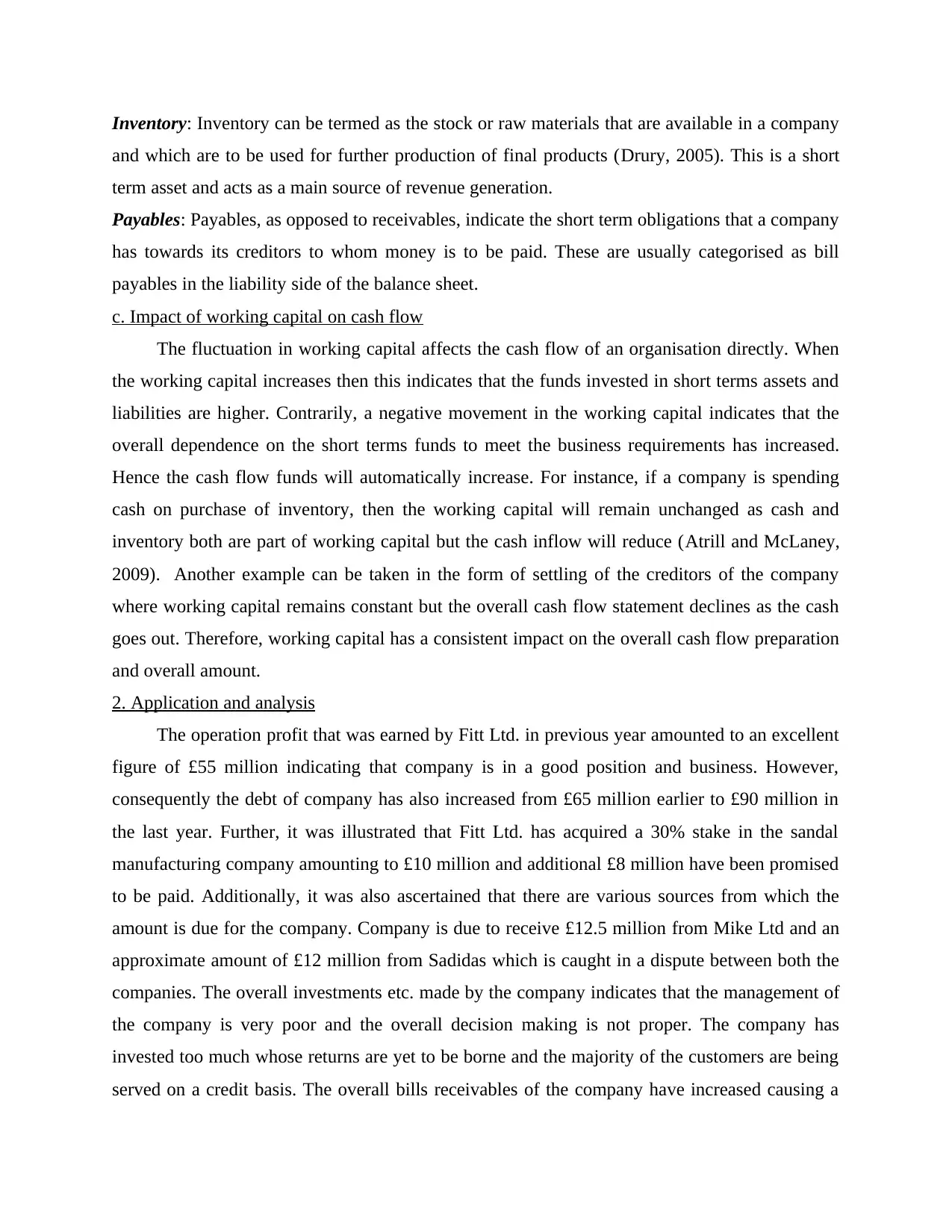

Traditional Budgeting: The traditional budget is prepared by the referring the budget of

the previous year and the different aspects related to inflation etc. are taken into consideration

accordingly. The different aspects or changes that have arisen are taken into consideration where

the key is to develop a comprehensive and adequate budget.

Strengths Weaknesses

The technique is very simple and helps in

quickening the overall decision making

process. The overall stability also increases

in the organisation.

The budget can be inaccurate where the

chances that errors that are caused is

very high. Additionally, the rigidity is

also very high that makes budget

inflexible (Weetman, 2010).

Alternative Budgeting Techniques:

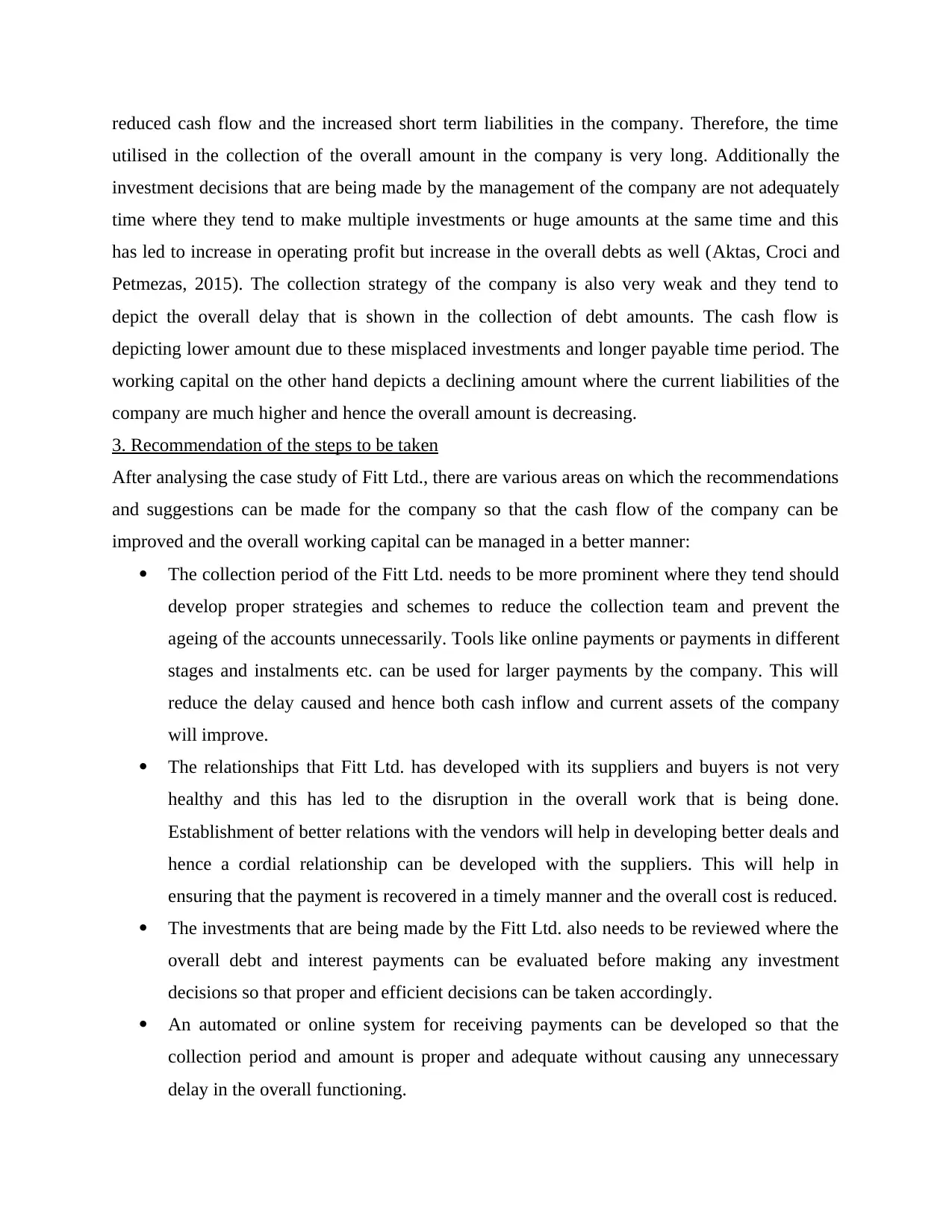

Rolling Budgets: Rolling budgets are the ones that act as continuous budget where they

are revised after regular time intervals when the original budget expires. The management needs

to integrate changes in the budget all through the year and are usually extended beyond the

period of one year.

Strengths Weaknesses

The time require is less and the flexibility

is very high as changes can be easily

incorporated (Watson and Head, 2010).

Budget clearly signifies the areas requiring

improvement.

Only a skilled professional can

formulate these types of budgets and it

is not costly as well. This also might not

be suitable for organisations where the

working conditions are unstable.

i. Purpose of budget preparation

The technique of budget formulation is a detailed and complex task where the overall

decision making in the business gets affected. Budget acts as a tool that indicates the

performance of the last year and then the evaluation is done regarding the trends that are inflicted

in the current year (Atrill and McLaney, 2008). There are different types of budgets that can be

developed and the critical analysis can be done in following manner:

Traditional Budgeting: The traditional budget is prepared by the referring the budget of

the previous year and the different aspects related to inflation etc. are taken into consideration

accordingly. The different aspects or changes that have arisen are taken into consideration where

the key is to develop a comprehensive and adequate budget.

Strengths Weaknesses

The technique is very simple and helps in

quickening the overall decision making

process. The overall stability also increases

in the organisation.

The budget can be inaccurate where the

chances that errors that are caused is

very high. Additionally, the rigidity is

also very high that makes budget

inflexible (Weetman, 2010).

Alternative Budgeting Techniques:

Rolling Budgets: Rolling budgets are the ones that act as continuous budget where they

are revised after regular time intervals when the original budget expires. The management needs

to integrate changes in the budget all through the year and are usually extended beyond the

period of one year.

Strengths Weaknesses

The time require is less and the flexibility

is very high as changes can be easily

incorporated (Watson and Head, 2010).

Budget clearly signifies the areas requiring

improvement.

Only a skilled professional can

formulate these types of budgets and it

is not costly as well. This also might not

be suitable for organisations where the

working conditions are unstable.

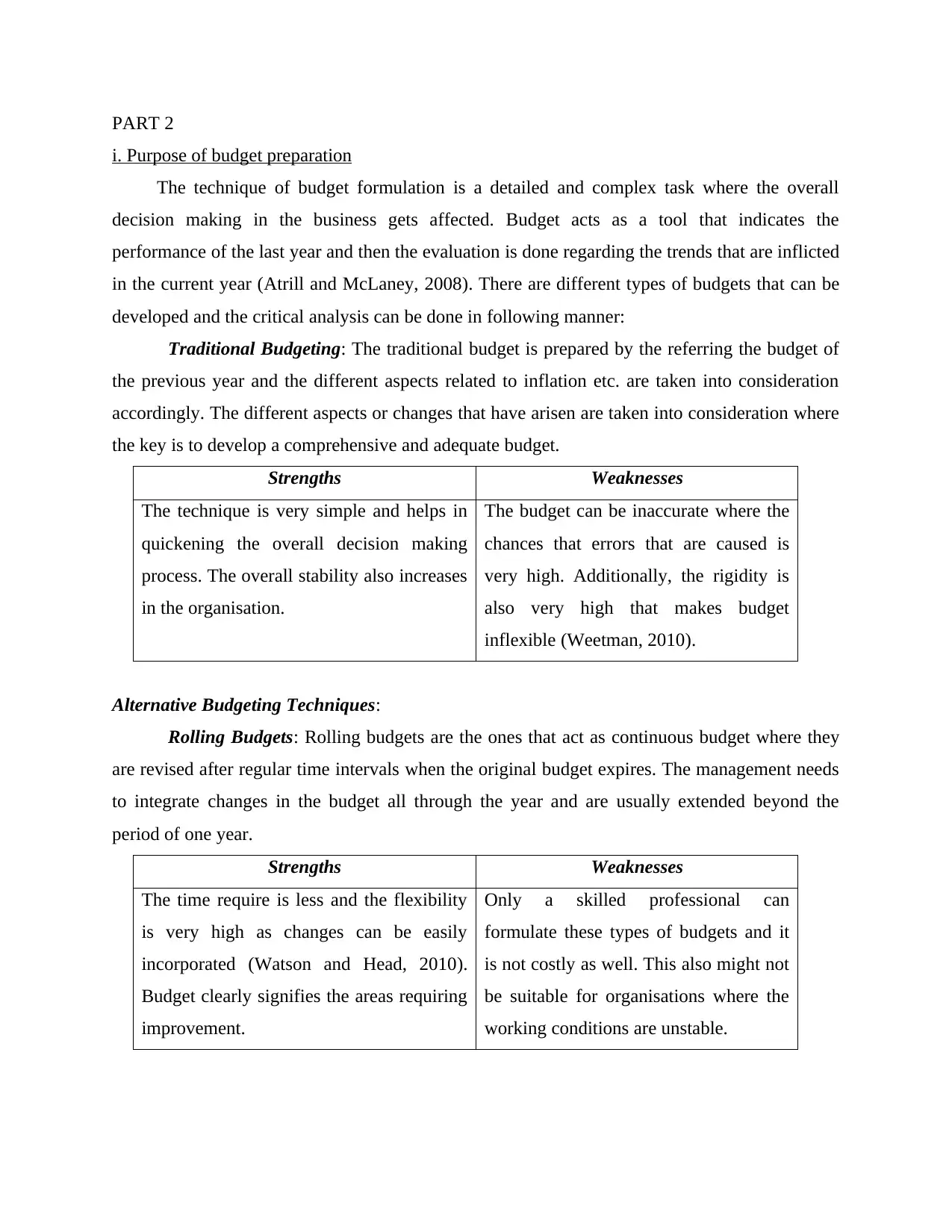

Zero Based Budgets: This kind of budget is the most preferred approach where they are

initiated from zero level. The analysis of every aspect is done and the impact of different

elements are incorporated. The analysis of different aspects helps in indicating the different

objectives that have been developed by the company and the manner in which the goals can be

achieved in a comprehensive manner.

Strengths Weaknesses

This budget is extremely favourable for

NPO’s and the flexibility also rises. The

information available from the resources as

well.

The budget preparation is a timely

process and the decision making

incorporates personal biasness as well

(Atrill and McLaney, 2009).

Activity Based Budgets: These types of budgets are the ones where the overhead expense

is taken into consideration and the past or historical data is not taken into consideration. The

efficiency in the business activities is also increased under the activity based budgeting.

Strengths Weaknesses

Al the unnecessary as well as the non-

value added activities are eliminated and

the overall relationship between the

company and customers also improves

(Drury, 2005).

The integration between the different

functional units should be very strong

otherwise it can lead to creation of the

wrong budget. The overall process is

very complex.

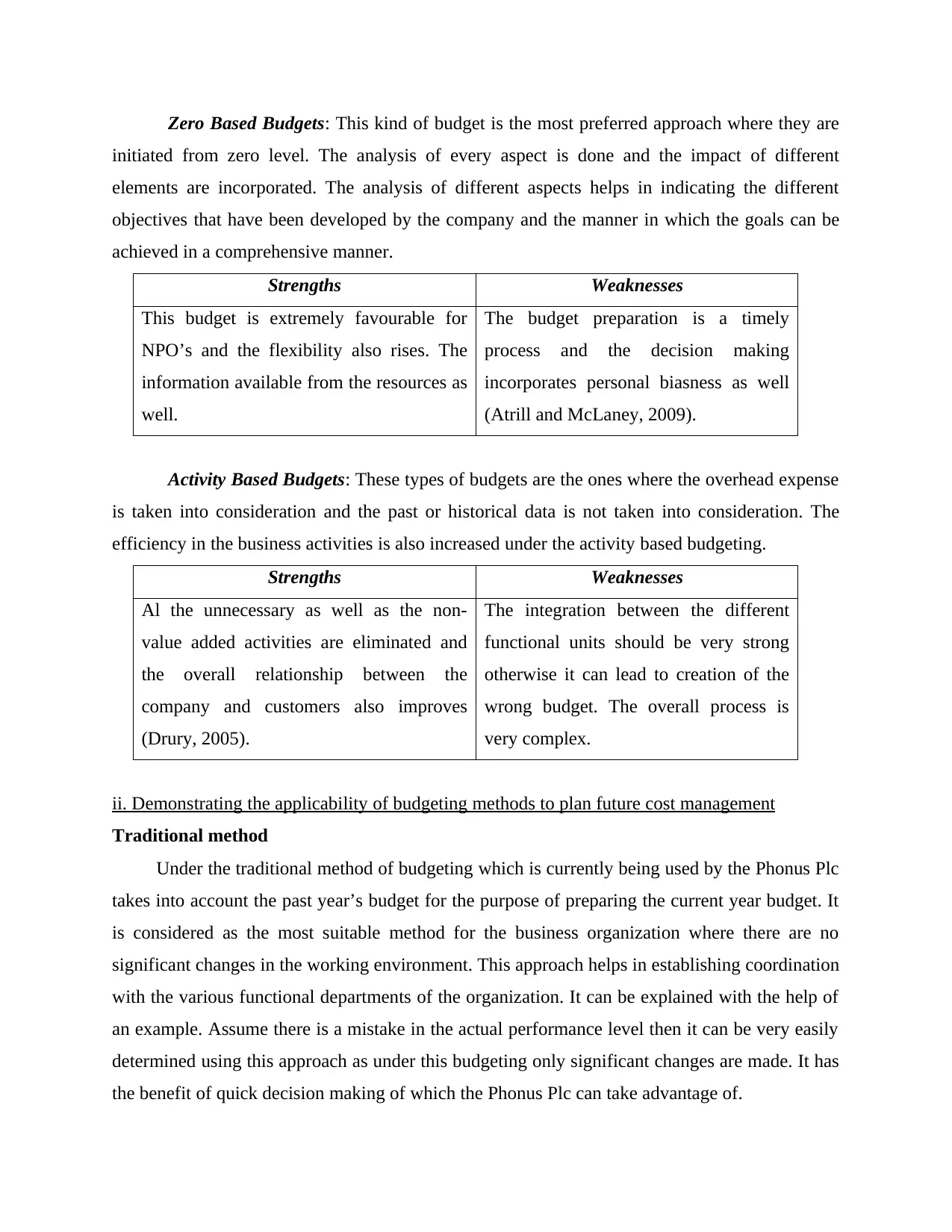

ii. Demonstrating the applicability of budgeting methods to plan future cost management

Traditional method

Under the traditional method of budgeting which is currently being used by the Phonus Plc

takes into account the past year’s budget for the purpose of preparing the current year budget. It

is considered as the most suitable method for the business organization where there are no

significant changes in the working environment. This approach helps in establishing coordination

with the various functional departments of the organization. It can be explained with the help of

an example. Assume there is a mistake in the actual performance level then it can be very easily

determined using this approach as under this budgeting only significant changes are made. It has

the benefit of quick decision making of which the Phonus Plc can take advantage of.

initiated from zero level. The analysis of every aspect is done and the impact of different

elements are incorporated. The analysis of different aspects helps in indicating the different

objectives that have been developed by the company and the manner in which the goals can be

achieved in a comprehensive manner.

Strengths Weaknesses

This budget is extremely favourable for

NPO’s and the flexibility also rises. The

information available from the resources as

well.

The budget preparation is a timely

process and the decision making

incorporates personal biasness as well

(Atrill and McLaney, 2009).

Activity Based Budgets: These types of budgets are the ones where the overhead expense

is taken into consideration and the past or historical data is not taken into consideration. The

efficiency in the business activities is also increased under the activity based budgeting.

Strengths Weaknesses

Al the unnecessary as well as the non-

value added activities are eliminated and

the overall relationship between the

company and customers also improves

(Drury, 2005).

The integration between the different

functional units should be very strong

otherwise it can lead to creation of the

wrong budget. The overall process is

very complex.

ii. Demonstrating the applicability of budgeting methods to plan future cost management

Traditional method

Under the traditional method of budgeting which is currently being used by the Phonus Plc

takes into account the past year’s budget for the purpose of preparing the current year budget. It

is considered as the most suitable method for the business organization where there are no

significant changes in the working environment. This approach helps in establishing coordination

with the various functional departments of the organization. It can be explained with the help of

an example. Assume there is a mistake in the actual performance level then it can be very easily

determined using this approach as under this budgeting only significant changes are made. It has

the benefit of quick decision making of which the Phonus Plc can take advantage of.

Rolling budgets

In case if the Phonus Plc is implementing the rolling budget then has many advantages in

respect to the planning and controlling functions. The rolling budget is very flexible thus, after

preparation of the budget relevant changes can eb easily made (Weetman, 2010). For example, at

the start of the accounting year which is assumed to be from January to December, therefore,

budget will be prepared for these 12 months. After completion of the budget and expiry of the

January month, the budget will be further extended to the next month which is February of the

following year and in this way, it goes on. The primary benefit for the Phonus Plc would be that

the next years budget will be automatically prepared.

Zero based budgets

In this budgeting technique, the Phonus Plc would be able to gain benefit of effectively

distributing the resources since the budget is prepared from the zero level and each department of

the organization identifies and evaluates the resources needed by it for the purpose of carrying

out the business activities. For example, Phonus Plc recruits’ new staff after the budget is being

prepared, so under the traditional approach, it would be difficult to account for this expense and

therefore, zero based budget is very useful in this situation. But the only problem associated with

it is that it is a time consuming process.

Activity based budget

The activity based budgeting method would provide assistance to Phonus Plc in respect to

evaluating the cost separately for each activity being undertaken by it. It will provide support to

the company in identifying any unwanted cost which has been incurred but can be removed. For

instance, the company estimates that the sales for the coming year will be 15000 units costing £5

per unit, therefore budgeted expense will be of £75000. But if is the compared with the past

year’s budget of £50000 which was expected to increase at 10% then the budget would have

been £55000. Thus, it would have been gone wrong.

iii. Analysing which method is appropriate for Phonus Plc

The Phonus Plc has been using the traditional method of budgeting for the very long time

period which seems to be not right for the company as it is mere an adjustment to the past year’s

budget which is only in respect to the inflation or increase in the revenue. In contrast to it, other

alternative methods of budgeting like activity based budgeting, zero based budgeting and the

rolling budget which helps in taking look at the different business aspects where essential for the

In case if the Phonus Plc is implementing the rolling budget then has many advantages in

respect to the planning and controlling functions. The rolling budget is very flexible thus, after

preparation of the budget relevant changes can eb easily made (Weetman, 2010). For example, at

the start of the accounting year which is assumed to be from January to December, therefore,

budget will be prepared for these 12 months. After completion of the budget and expiry of the

January month, the budget will be further extended to the next month which is February of the

following year and in this way, it goes on. The primary benefit for the Phonus Plc would be that

the next years budget will be automatically prepared.

Zero based budgets

In this budgeting technique, the Phonus Plc would be able to gain benefit of effectively

distributing the resources since the budget is prepared from the zero level and each department of

the organization identifies and evaluates the resources needed by it for the purpose of carrying

out the business activities. For example, Phonus Plc recruits’ new staff after the budget is being

prepared, so under the traditional approach, it would be difficult to account for this expense and

therefore, zero based budget is very useful in this situation. But the only problem associated with

it is that it is a time consuming process.

Activity based budget

The activity based budgeting method would provide assistance to Phonus Plc in respect to

evaluating the cost separately for each activity being undertaken by it. It will provide support to

the company in identifying any unwanted cost which has been incurred but can be removed. For

instance, the company estimates that the sales for the coming year will be 15000 units costing £5

per unit, therefore budgeted expense will be of £75000. But if is the compared with the past

year’s budget of £50000 which was expected to increase at 10% then the budget would have

been £55000. Thus, it would have been gone wrong.

iii. Analysing which method is appropriate for Phonus Plc

The Phonus Plc has been using the traditional method of budgeting for the very long time

period which seems to be not right for the company as it is mere an adjustment to the past year’s

budget which is only in respect to the inflation or increase in the revenue. In contrast to it, other

alternative methods of budgeting like activity based budgeting, zero based budgeting and the

rolling budget which helps in taking look at the different business aspects where essential for the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

business. These methods can be implemented by Phonus Plc in case where there are any material

changes such as location, products and services and so forth. The Phonus Plc should use activity

based budgeting approach in its business. Under this method, there are various advantages that

the Phonus Plc would be able to take advantage of which will be beneficial for its business

growth and performance. The activity based budgeting will assist in making changes in the

budget in a very smooth manner so that relevant changes can be made in the situation when any

uncertain future event arises so that huge amount of losses can be mitigated by timely action.

Since, the company Phonus Plc is looking for expanding its business in other nation this

approach is most appropriate as it will provide more accurate forecasting. A complete cost sheet

can be prepared for the various activities undertaken by the company which will consequently

result into identifying unnecessary cost so that timely actions can be put in place for increasing

the profits.

changes such as location, products and services and so forth. The Phonus Plc should use activity

based budgeting approach in its business. Under this method, there are various advantages that

the Phonus Plc would be able to take advantage of which will be beneficial for its business

growth and performance. The activity based budgeting will assist in making changes in the

budget in a very smooth manner so that relevant changes can be made in the situation when any

uncertain future event arises so that huge amount of losses can be mitigated by timely action.

Since, the company Phonus Plc is looking for expanding its business in other nation this

approach is most appropriate as it will provide more accurate forecasting. A complete cost sheet

can be prepared for the various activities undertaken by the company which will consequently

result into identifying unnecessary cost so that timely actions can be put in place for increasing

the profits.

REFERENCES

Books and journals

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance. 30.

pp.98-113.

Atrill, P. and McLaney, E. J., 2008. Financial accounting for decision makers. Pearson

Education.

Atrill, P. and McLaney, E., 2009. Management accounting for decision makers. Pearson

Education.

Drury, C., 2005. Management accounting for business. Cengage Learning EMEA.

Watson, D. and Head, A., 2010. Corporate finance: principles and practice. Pearson Education.

Weetman, P., 2010. Management accounting. Harlow: FT.

1

Books and journals

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance. 30.

pp.98-113.

Atrill, P. and McLaney, E. J., 2008. Financial accounting for decision makers. Pearson

Education.

Atrill, P. and McLaney, E., 2009. Management accounting for decision makers. Pearson

Education.

Drury, C., 2005. Management accounting for business. Cengage Learning EMEA.

Watson, D. and Head, A., 2010. Corporate finance: principles and practice. Pearson Education.

Weetman, P., 2010. Management accounting. Harlow: FT.

1

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.