Monetary Policy & Cash Rate in Australia: An Economics Case Study

VerifiedAdded on 2023/06/04

|20

|4114

|163

Case Study

AI Summary

This case study provides an in-depth analysis of Australia's monetary policy, focusing on the factors influencing the official cash rate and the objectives of the Reserve Bank of Australia (RBA). It examines macroeconomic indicators such as GDP growth, inflation, unemployment, and exchange rates, and their relationship to the cash rate. The study also explores the functions of money and the RBA's role in maintaining financial stability and implementing monetary policies. It delves into the reasons behind the RBA's decision to keep the cash rate unchanged at 1.50% for the past two years, linking this decision to economic stimulation, investment, consumption, and employment dynamics within Australia. The analysis incorporates figures and data to illustrate these trends, providing a comprehensive overview of the monetary policy landscape in Australia.

Running head: PRINCIPLES OF ECONOMICS

Principles of Economics

Name of the Student

Name of the University

Author Note

Principles of Economics

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRINCIPLES OF ECONOMICS

Introduction

The economic conditions and health of economy of any country considerably depend

on the policies and economic strategies which are taken by the governments of the respective

countries, which are designed and implemented with the objective of manipulating and

influencing the dynamics of the vital economic variables, like GDP, inflation, unemployment,

exchange rates and other aspects of the economy of the country (Frank & Cartwright, 2013).

In the contemporary period, especially post Globalisation and trade liberalisation,

most of the major economies of the country being interconnected in terms of economic and

commercial transactions, the economic policies designed and implemented by the

government of a country have considerable and bilateral relationships with the economic

dynamics and conditions as well as economic policies in other countries, having economic,

trade and political relations with the concerned country (Rader, 2014).

Keeping this into consideration, the concerned essay tries to emphasis on one of the

dominant economies in the global scenario, the economy of Australia and focusses on the

monetary policies of the country, the objectives of the same and also tries to analyse the

reasons behind the recent decision of the monetary authority of the concerned country, to

keep the cash rate at an unchanged level of 1.50% in the last two years. For the purpose of the

same the essay refers to the media release statement by Philip Lowe, dated 7th August, 2018

(Rba.gov.au, 2018).

Factors influencing official cash rate of Australia

The macroeconomic indicators are those economic statistics which, being periodically

released by the governments of the countries and which provide insights about the

performance of the economy from different perspectives. The primary macroeconomic

indicators of an economy, usually consists of the following:

Introduction

The economic conditions and health of economy of any country considerably depend

on the policies and economic strategies which are taken by the governments of the respective

countries, which are designed and implemented with the objective of manipulating and

influencing the dynamics of the vital economic variables, like GDP, inflation, unemployment,

exchange rates and other aspects of the economy of the country (Frank & Cartwright, 2013).

In the contemporary period, especially post Globalisation and trade liberalisation,

most of the major economies of the country being interconnected in terms of economic and

commercial transactions, the economic policies designed and implemented by the

government of a country have considerable and bilateral relationships with the economic

dynamics and conditions as well as economic policies in other countries, having economic,

trade and political relations with the concerned country (Rader, 2014).

Keeping this into consideration, the concerned essay tries to emphasis on one of the

dominant economies in the global scenario, the economy of Australia and focusses on the

monetary policies of the country, the objectives of the same and also tries to analyse the

reasons behind the recent decision of the monetary authority of the concerned country, to

keep the cash rate at an unchanged level of 1.50% in the last two years. For the purpose of the

same the essay refers to the media release statement by Philip Lowe, dated 7th August, 2018

(Rba.gov.au, 2018).

Factors influencing official cash rate of Australia

The macroeconomic indicators are those economic statistics which, being periodically

released by the governments of the countries and which provide insights about the

performance of the economy from different perspectives. The primary macroeconomic

indicators of an economy, usually consists of the following:

2PRINCIPLES OF ECONOMICS

Growth rate of Gross Domestic Product- The GDP of a country showing the total valuation of

the final commodities and services, produced within the boundaries of a country, within a

particular period of time, the growth rate of the same indicates towards the economic

productivity trends of the country over time (Mankiw, 2014).

Inflation- This measures the dynamics of price levels of goods and services in a country.

Unemployment- The unemployment level in a country, showing the dynamics in the number

of people eligible to be employed, but not finding employment, also highlights the conditions

of job creations and overall economic welfare of people in the country.

Exchange rate- This measures the value of the currency of a nation with respect to the

currency of another nation.

On the other hand, the cash rate of Australia refers to the rate of interest which the

Reserve Bank of the country charges from the commercial banks for their overnight loans,

which in turn, directly influences the rate of interest prevailing in the economy.

In general, the cash rate and dynamics of the same, having direct influence on the

interest rate prevailing in the country, has direct negative linkage with the levels of

investment, which implies that with a fall in the rate of interest the investment increases and

vice-versa. Again, with the fall in interest rate, people tend to borrow more money for

consumption and vice versa, which in turn has direct impacts on the price levels or inflation

in a country (Berkelmans & Duong, 2014). The fall in rate of interest can stimulate

consumption, demand and employment generation in the home country but can also lead to

increase in inflation. On the other hand, the cash rate present in a country, also influences the

flow of investment from other countries and also the trade dynamics between the two

countries. High level of interest rate also leads to higher value of the country’s currency

which attracts high investment from other countries (McLaughlin, 2012).

Growth rate of Gross Domestic Product- The GDP of a country showing the total valuation of

the final commodities and services, produced within the boundaries of a country, within a

particular period of time, the growth rate of the same indicates towards the economic

productivity trends of the country over time (Mankiw, 2014).

Inflation- This measures the dynamics of price levels of goods and services in a country.

Unemployment- The unemployment level in a country, showing the dynamics in the number

of people eligible to be employed, but not finding employment, also highlights the conditions

of job creations and overall economic welfare of people in the country.

Exchange rate- This measures the value of the currency of a nation with respect to the

currency of another nation.

On the other hand, the cash rate of Australia refers to the rate of interest which the

Reserve Bank of the country charges from the commercial banks for their overnight loans,

which in turn, directly influences the rate of interest prevailing in the economy.

In general, the cash rate and dynamics of the same, having direct influence on the

interest rate prevailing in the country, has direct negative linkage with the levels of

investment, which implies that with a fall in the rate of interest the investment increases and

vice-versa. Again, with the fall in interest rate, people tend to borrow more money for

consumption and vice versa, which in turn has direct impacts on the price levels or inflation

in a country (Berkelmans & Duong, 2014). The fall in rate of interest can stimulate

consumption, demand and employment generation in the home country but can also lead to

increase in inflation. On the other hand, the cash rate present in a country, also influences the

flow of investment from other countries and also the trade dynamics between the two

countries. High level of interest rate also leads to higher value of the country’s currency

which attracts high investment from other countries (McLaughlin, 2012).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRINCIPLES OF ECONOMICS

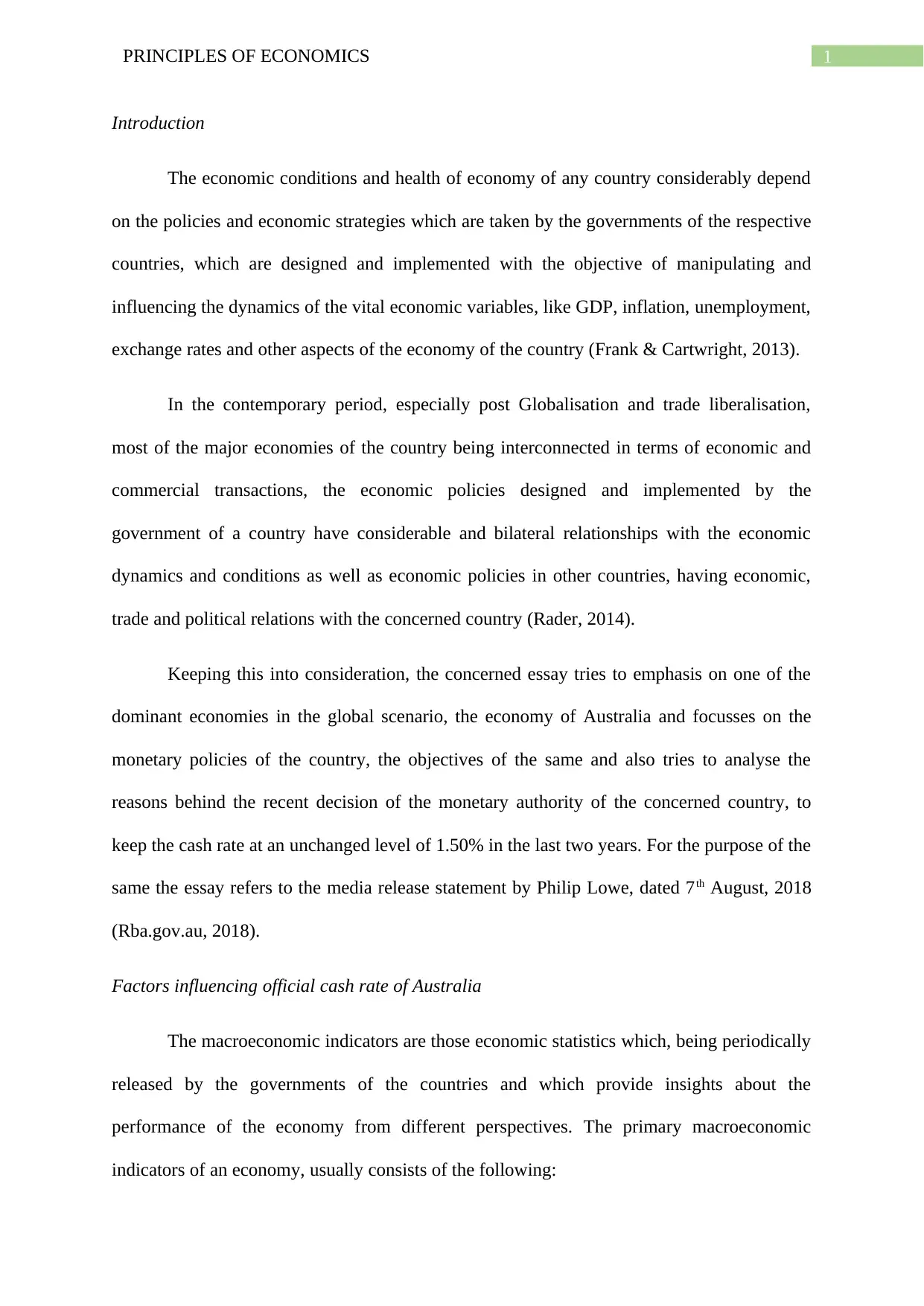

The relationship between the rate of interest and the investment dynamics in the

domestic currency can be shown as follows:

Figure 1: Investment and Rate of Interest

(Source: As created by the author)

Thus, for taking any decision regarding the level of official cash rate of the country,

the monetary authority of the Australia, needs to consider not only the performance of the

macroeconomic indicators of the country itself (which highlights the level of investment,

consumption and inflation of the country), but also the macroeconomic indicators of other

countries like China, Japan and the USA (Cusbert & Rohling, 2013). While a low cash rate

stimulates the economy, by increasing domestic consumption, money borrowed for

investment, as well as economic production and employment, the same also leads to rise in

inflation in the country. In international front, high interest rate is expected to increase FDI

inflow from the other countries and the value of the cash rate also influence the trade

relationships of the country with its trading partners, mainly China, Japan and the USA. The

The relationship between the rate of interest and the investment dynamics in the

domestic currency can be shown as follows:

Figure 1: Investment and Rate of Interest

(Source: As created by the author)

Thus, for taking any decision regarding the level of official cash rate of the country,

the monetary authority of the Australia, needs to consider not only the performance of the

macroeconomic indicators of the country itself (which highlights the level of investment,

consumption and inflation of the country), but also the macroeconomic indicators of other

countries like China, Japan and the USA (Cusbert & Rohling, 2013). While a low cash rate

stimulates the economy, by increasing domestic consumption, money borrowed for

investment, as well as economic production and employment, the same also leads to rise in

inflation in the country. In international front, high interest rate is expected to increase FDI

inflow from the other countries and the value of the cash rate also influence the trade

relationships of the country with its trading partners, mainly China, Japan and the USA. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRINCIPLES OF ECONOMICS

macroeconomic conditions of the related countries also need to be considered for setting the

cash rate as much of the inter-country trade and investment scenarios depend upon the same.

Objectives of monetary policy, functions of money and RBA

The monetary policies formed by the government of a country are crucial

macroeconomic policies which are generally formed and implemented by the central banks of

the economy, for the purpose of managing the money supply, rate of interest and other

monetary aspects of the economy, which in turn help the government to control inflation,

liquidity of money and consumption in the country (Smales, 2012).

Objectives of Monetary Policies

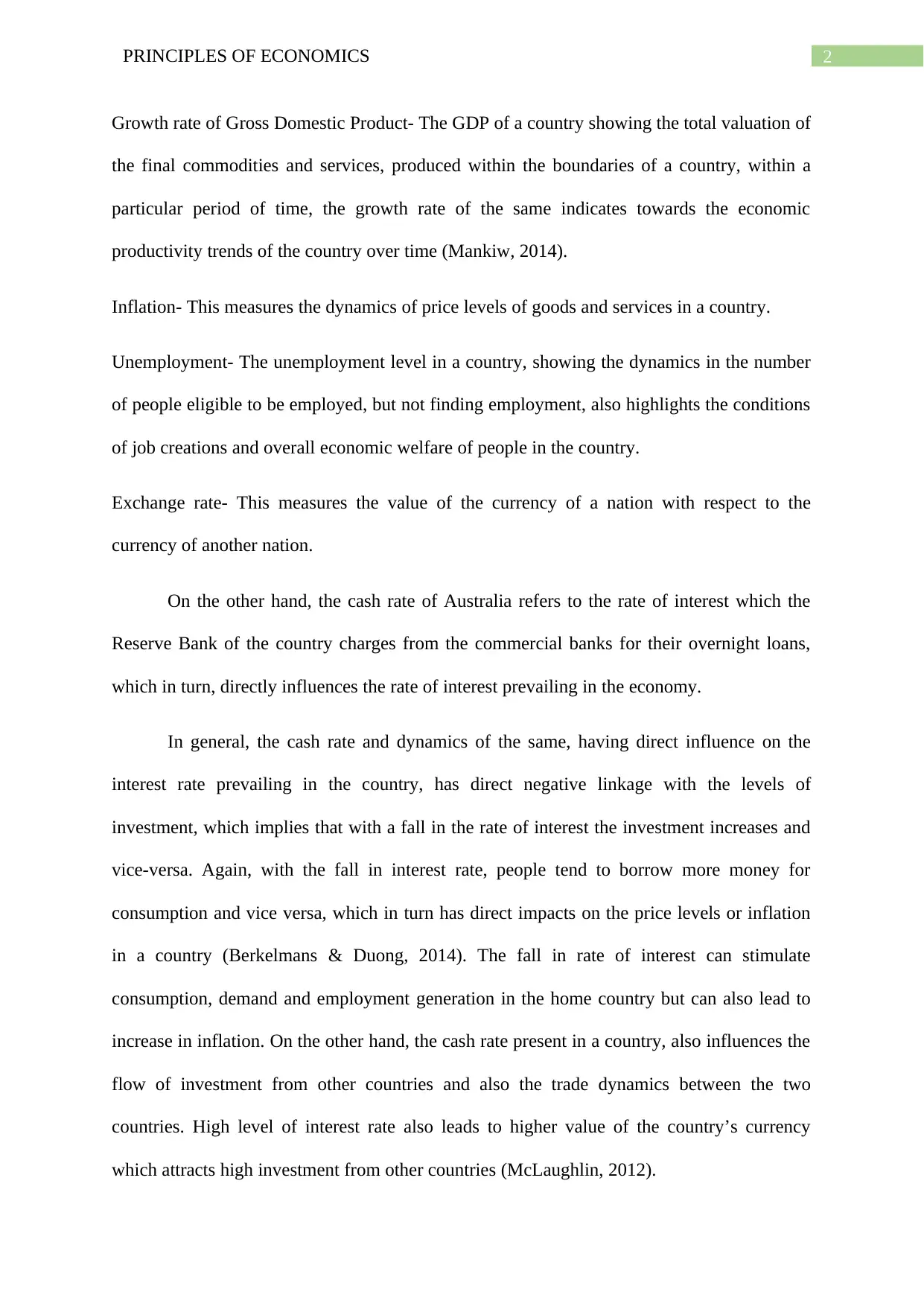

In general, the monetary policies are of expansionary and contractionary types. While

the expansionary monetary policies involve those policies which stimulate the economy,

including those of interest lowering and aggregate demand increasing, the contractionary

monetary policies help in fighting inflation by lowering money supply and aggregate

demand. This can be shown as follows:

Figure 2: Expansionary Monetary Policy

(Source: As created by the author)

macroeconomic conditions of the related countries also need to be considered for setting the

cash rate as much of the inter-country trade and investment scenarios depend upon the same.

Objectives of monetary policy, functions of money and RBA

The monetary policies formed by the government of a country are crucial

macroeconomic policies which are generally formed and implemented by the central banks of

the economy, for the purpose of managing the money supply, rate of interest and other

monetary aspects of the economy, which in turn help the government to control inflation,

liquidity of money and consumption in the country (Smales, 2012).

Objectives of Monetary Policies

In general, the monetary policies are of expansionary and contractionary types. While

the expansionary monetary policies involve those policies which stimulate the economy,

including those of interest lowering and aggregate demand increasing, the contractionary

monetary policies help in fighting inflation by lowering money supply and aggregate

demand. This can be shown as follows:

Figure 2: Expansionary Monetary Policy

(Source: As created by the author)

5PRINCIPLES OF ECONOMICS

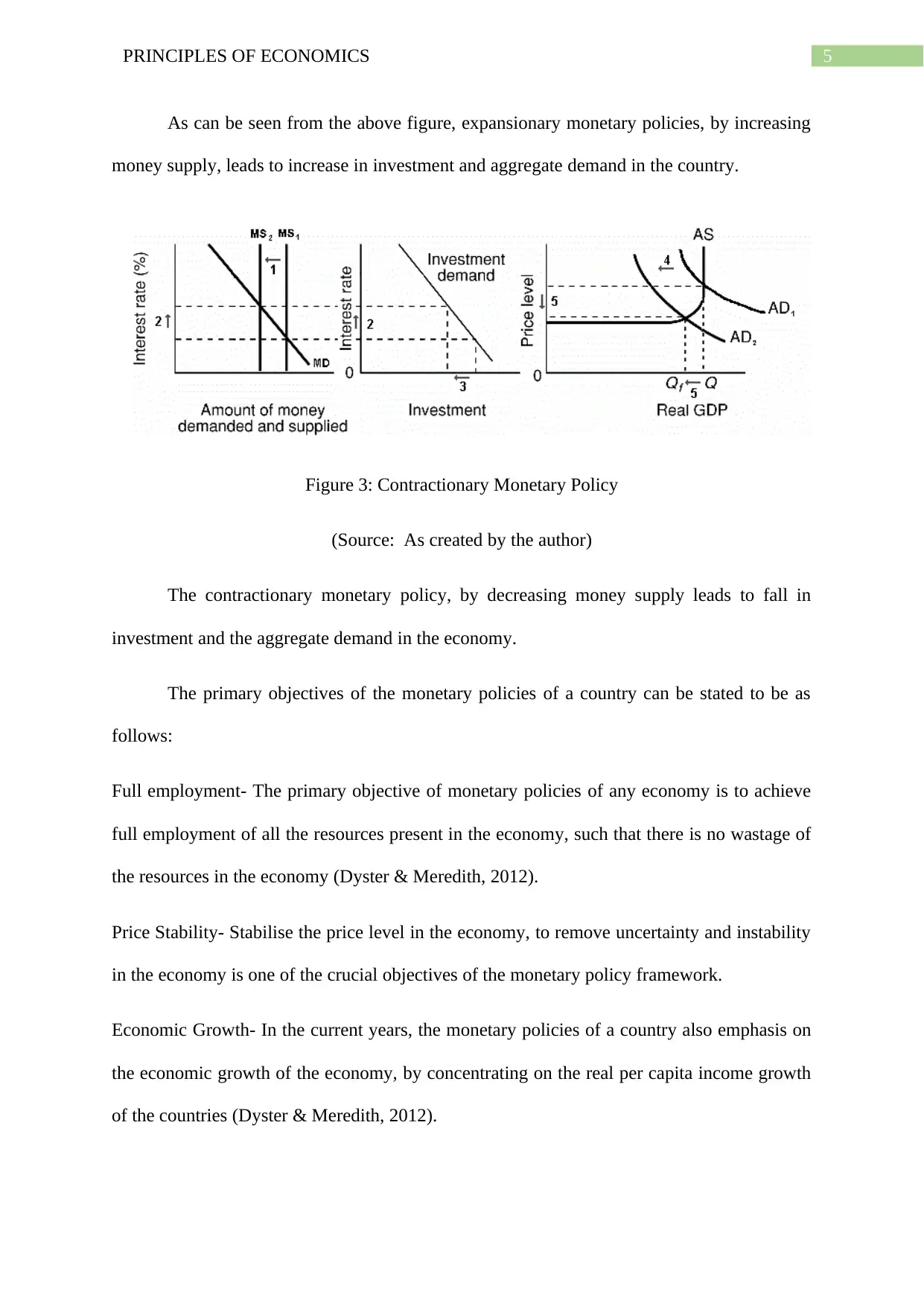

As can be seen from the above figure, expansionary monetary policies, by increasing

money supply, leads to increase in investment and aggregate demand in the country.

Figure 3: Contractionary Monetary Policy

(Source: As created by the author)

The contractionary monetary policy, by decreasing money supply leads to fall in

investment and the aggregate demand in the economy.

The primary objectives of the monetary policies of a country can be stated to be as

follows:

Full employment- The primary objective of monetary policies of any economy is to achieve

full employment of all the resources present in the economy, such that there is no wastage of

the resources in the economy (Dyster & Meredith, 2012).

Price Stability- Stabilise the price level in the economy, to remove uncertainty and instability

in the economy is one of the crucial objectives of the monetary policy framework.

Economic Growth- In the current years, the monetary policies of a country also emphasis on

the economic growth of the economy, by concentrating on the real per capita income growth

of the countries (Dyster & Meredith, 2012).

As can be seen from the above figure, expansionary monetary policies, by increasing

money supply, leads to increase in investment and aggregate demand in the country.

Figure 3: Contractionary Monetary Policy

(Source: As created by the author)

The contractionary monetary policy, by decreasing money supply leads to fall in

investment and the aggregate demand in the economy.

The primary objectives of the monetary policies of a country can be stated to be as

follows:

Full employment- The primary objective of monetary policies of any economy is to achieve

full employment of all the resources present in the economy, such that there is no wastage of

the resources in the economy (Dyster & Meredith, 2012).

Price Stability- Stabilise the price level in the economy, to remove uncertainty and instability

in the economy is one of the crucial objectives of the monetary policy framework.

Economic Growth- In the current years, the monetary policies of a country also emphasis on

the economic growth of the economy, by concentrating on the real per capita income growth

of the countries (Dyster & Meredith, 2012).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PRINCIPLES OF ECONOMICS

Balance of Payments- The monetary policies of the countries also try to maintain equilibrium

in the balance of payments and also regulate the exchange rate of the currency to keep the

economy buoyant.

Functions of Money

Money, on the other hand, refers to the common medium which is used for the

purpose of exchange of goods and services within an economy.

Money can be of two broad types- one with intrinsic values of the same (like coins

made of precious metals) and those with no intrinsic values (known as fiat money).

The main functions of money can be seen to be as follows:

Medium of exchange- The most important function of money is that of acting as a medium of

exchange, which is used to facilitate all types of transactions of goods and services. Absence

of money leads to creation of barter system in which the transactions only take place in the

presence of double coincidence of wants (Scitovsky, 2016).

Store of value- Money acts as a store of value and is one of the most liquid form of such

stores of values as the same is also the most common medium of exchange.

Unit of account- Being a common yardstick for the measurement of the values of the goods

and services in an economy, money is also a unit of account for the measurement of the

values of the goods and services bought and sold by using money as the medium.

Standard of deferred payment- Money also plays the function of a standard of deferred or

postponed payment, that is it is used to measure the value of the debt which a customer needs

to pay for purchasing goods and services, especially those bought in instalments (McLeay,

Radia & Thomas, 2014).

Balance of Payments- The monetary policies of the countries also try to maintain equilibrium

in the balance of payments and also regulate the exchange rate of the currency to keep the

economy buoyant.

Functions of Money

Money, on the other hand, refers to the common medium which is used for the

purpose of exchange of goods and services within an economy.

Money can be of two broad types- one with intrinsic values of the same (like coins

made of precious metals) and those with no intrinsic values (known as fiat money).

The main functions of money can be seen to be as follows:

Medium of exchange- The most important function of money is that of acting as a medium of

exchange, which is used to facilitate all types of transactions of goods and services. Absence

of money leads to creation of barter system in which the transactions only take place in the

presence of double coincidence of wants (Scitovsky, 2016).

Store of value- Money acts as a store of value and is one of the most liquid form of such

stores of values as the same is also the most common medium of exchange.

Unit of account- Being a common yardstick for the measurement of the values of the goods

and services in an economy, money is also a unit of account for the measurement of the

values of the goods and services bought and sold by using money as the medium.

Standard of deferred payment- Money also plays the function of a standard of deferred or

postponed payment, that is it is used to measure the value of the debt which a customer needs

to pay for purchasing goods and services, especially those bought in instalments (McLeay,

Radia & Thomas, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PRINCIPLES OF ECONOMICS

Functions of Reserve Bank of Australia

The money and monetary policies in Australia are manipulated and implemented

respectively, by the Reserve Bank of Australia, which is also the monetary authority of the

concerned country. Bestowed with the responsibility of banknote issuing and monetary

policies design and implementation, the main functions of the same are as follows:

Monetary Policy- The RBA designs and implements monetary policies for achieving the

monetary goals of economic prosperities of the population of the country (Rba.gov.au, 2018).

Financial Market Operations- The monetary authority also operates in the international and

domestic financial markets, for ensuring smooth dynamics in balance of payments and for

managing foreign exchange reserves in the country.

Financial Stability- By managing the liquidity of money and monitoring risks in the money

market, the RBA also plays the role of maintaining stability in the financial system of the

economy.

Banknotes Issuing- The money and banknotes are issued by the RBA, which in turn gives the

organization the responsibility to maintain proper valuation and liquidity in the economy

(Rba.gov.au, 2018).

Thus, it can be seen that the RBA plays crucial roles as monetary authority, taking

crucial monetary decisions in the economy of Australia.

Reasons behind constant cash rate in Australia

The cash rate in Australia, is the rate of interest which the Reserve Bank of Australia,

charges from the commercial banks for the loans the latter takes from the former and the cash

rate also have direct implications on the market interest rates in the economy.

Functions of Reserve Bank of Australia

The money and monetary policies in Australia are manipulated and implemented

respectively, by the Reserve Bank of Australia, which is also the monetary authority of the

concerned country. Bestowed with the responsibility of banknote issuing and monetary

policies design and implementation, the main functions of the same are as follows:

Monetary Policy- The RBA designs and implements monetary policies for achieving the

monetary goals of economic prosperities of the population of the country (Rba.gov.au, 2018).

Financial Market Operations- The monetary authority also operates in the international and

domestic financial markets, for ensuring smooth dynamics in balance of payments and for

managing foreign exchange reserves in the country.

Financial Stability- By managing the liquidity of money and monitoring risks in the money

market, the RBA also plays the role of maintaining stability in the financial system of the

economy.

Banknotes Issuing- The money and banknotes are issued by the RBA, which in turn gives the

organization the responsibility to maintain proper valuation and liquidity in the economy

(Rba.gov.au, 2018).

Thus, it can be seen that the RBA plays crucial roles as monetary authority, taking

crucial monetary decisions in the economy of Australia.

Reasons behind constant cash rate in Australia

The cash rate in Australia, is the rate of interest which the Reserve Bank of Australia,

charges from the commercial banks for the loans the latter takes from the former and the cash

rate also have direct implications on the market interest rates in the economy.

8PRINCIPLES OF ECONOMICS

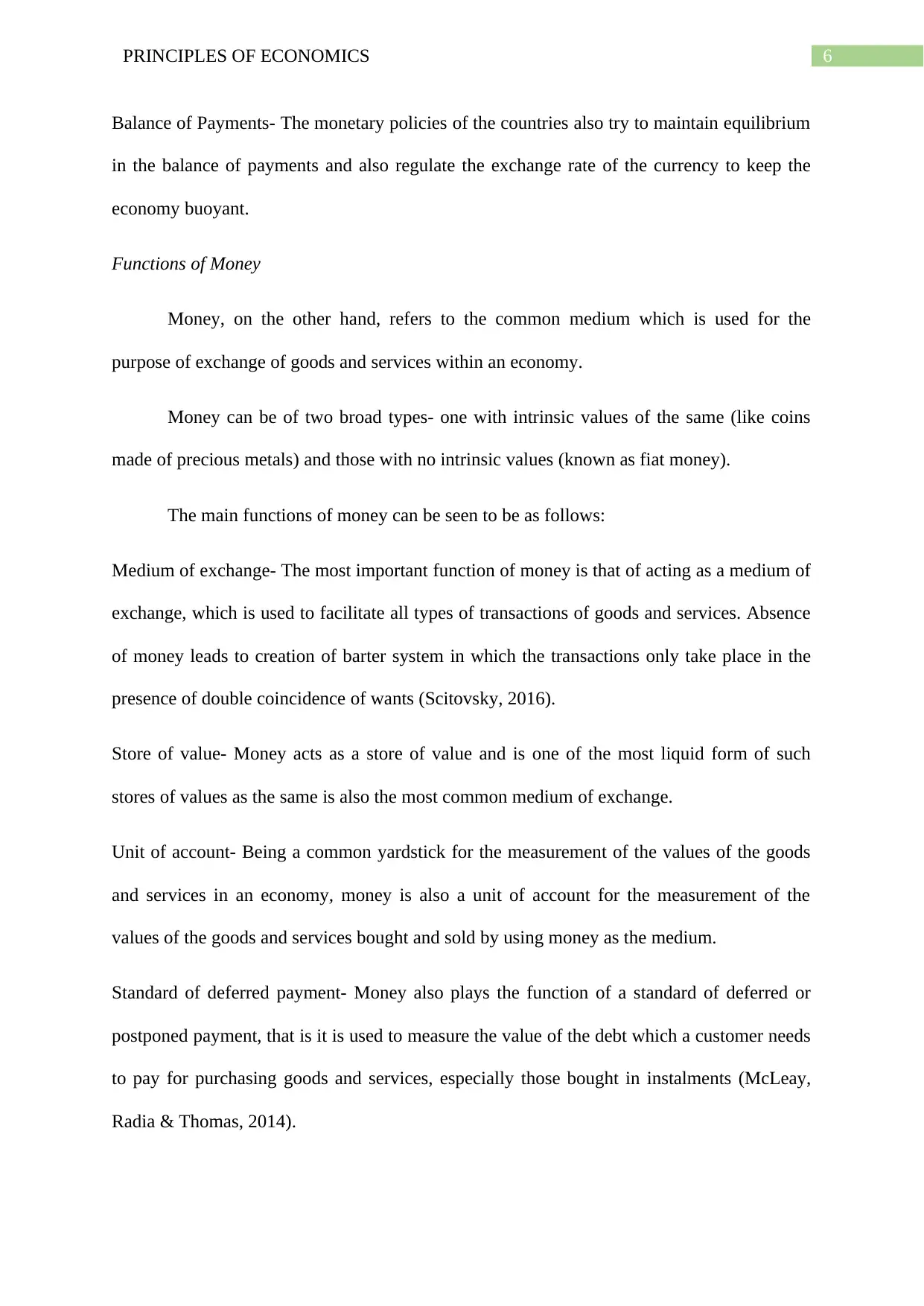

In general, the cash rate is decreased, when the government tries to stimulate the

economy, by increasing borrowing for investment and consumption. The property market

also experiences high demand in such situations as more people tend to take loans to invest in

the same. On the other hand, cash rate is increased when there is excess money supply and

high inflation in the economy, so as to decrease the aggregate demand in the economy

(Agénor & Montiel, 2015). The RBA, in Australia, can be seen to be keeping the cash rate

unchanged for the last two years, as can be seen from the following figure:

Figure 4: Cash Rate of Australia over the years

(Source: Rba.gov.au, 2018)

As is evident from the above figure, the RBA, has been keeping the cash rate at

1.50% for the last couple of years. The primary reason behind the same, can be of that of

stimulating the economy, as low interest rate leads to higher borrowing for investment and

consumption purposes (Liu, 2018). The higher investments, in turn, leads to creation of

industrial development and creation of new businesses as well as expansion of existing

businesses, which in turn, leads to higher growth of the economy of the country. The

industrial expansion can also be seen to create employment in the country, as is evident from

the following figure:

In general, the cash rate is decreased, when the government tries to stimulate the

economy, by increasing borrowing for investment and consumption. The property market

also experiences high demand in such situations as more people tend to take loans to invest in

the same. On the other hand, cash rate is increased when there is excess money supply and

high inflation in the economy, so as to decrease the aggregate demand in the economy

(Agénor & Montiel, 2015). The RBA, in Australia, can be seen to be keeping the cash rate

unchanged for the last two years, as can be seen from the following figure:

Figure 4: Cash Rate of Australia over the years

(Source: Rba.gov.au, 2018)

As is evident from the above figure, the RBA, has been keeping the cash rate at

1.50% for the last couple of years. The primary reason behind the same, can be of that of

stimulating the economy, as low interest rate leads to higher borrowing for investment and

consumption purposes (Liu, 2018). The higher investments, in turn, leads to creation of

industrial development and creation of new businesses as well as expansion of existing

businesses, which in turn, leads to higher growth of the economy of the country. The

industrial expansion can also be seen to create employment in the country, as is evident from

the following figure:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PRINCIPLES OF ECONOMICS

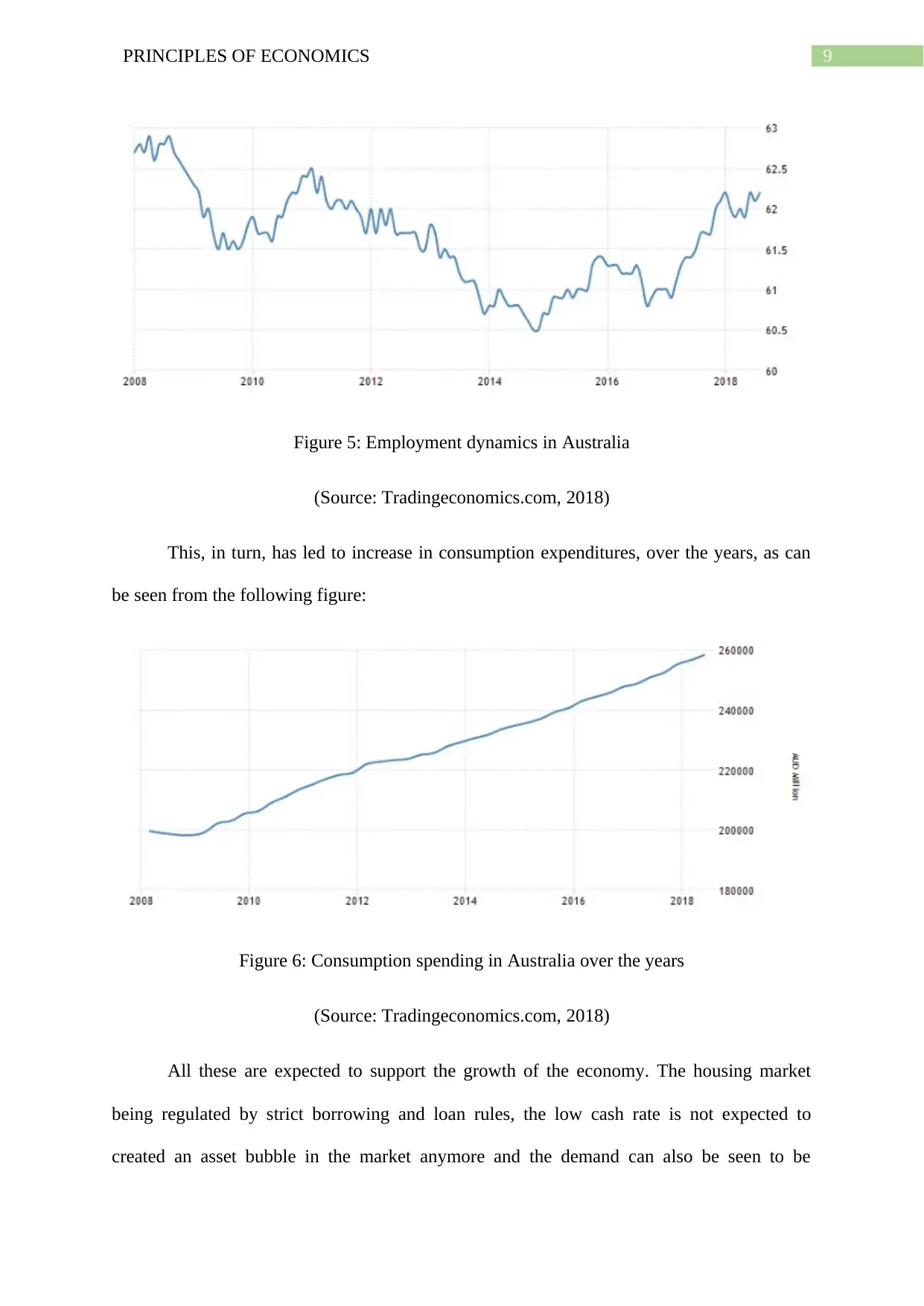

Figure 5: Employment dynamics in Australia

(Source: Tradingeconomics.com, 2018)

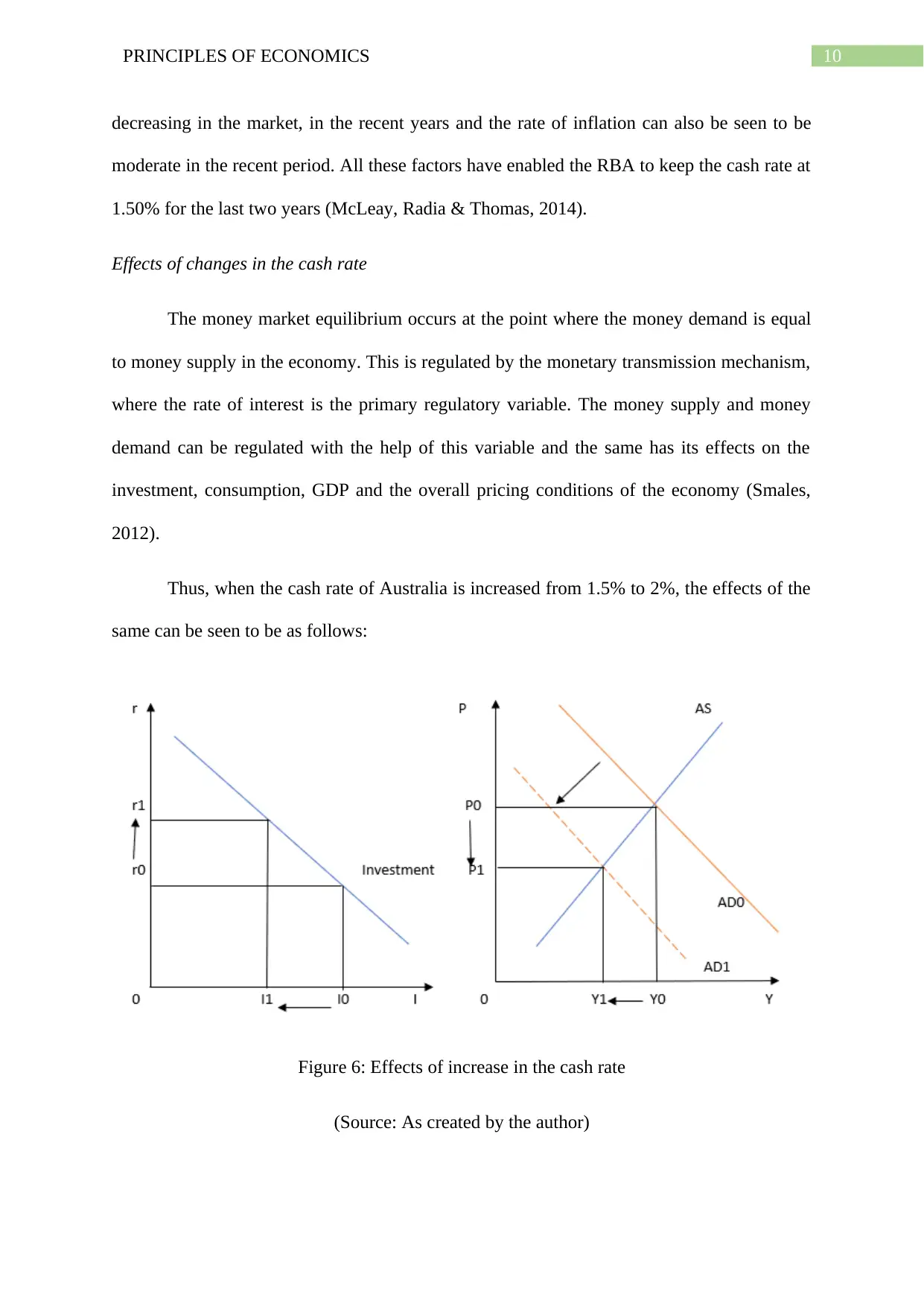

This, in turn, has led to increase in consumption expenditures, over the years, as can

be seen from the following figure:

Figure 6: Consumption spending in Australia over the years

(Source: Tradingeconomics.com, 2018)

All these are expected to support the growth of the economy. The housing market

being regulated by strict borrowing and loan rules, the low cash rate is not expected to

created an asset bubble in the market anymore and the demand can also be seen to be

Figure 5: Employment dynamics in Australia

(Source: Tradingeconomics.com, 2018)

This, in turn, has led to increase in consumption expenditures, over the years, as can

be seen from the following figure:

Figure 6: Consumption spending in Australia over the years

(Source: Tradingeconomics.com, 2018)

All these are expected to support the growth of the economy. The housing market

being regulated by strict borrowing and loan rules, the low cash rate is not expected to

created an asset bubble in the market anymore and the demand can also be seen to be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PRINCIPLES OF ECONOMICS

decreasing in the market, in the recent years and the rate of inflation can also be seen to be

moderate in the recent period. All these factors have enabled the RBA to keep the cash rate at

1.50% for the last two years (McLeay, Radia & Thomas, 2014).

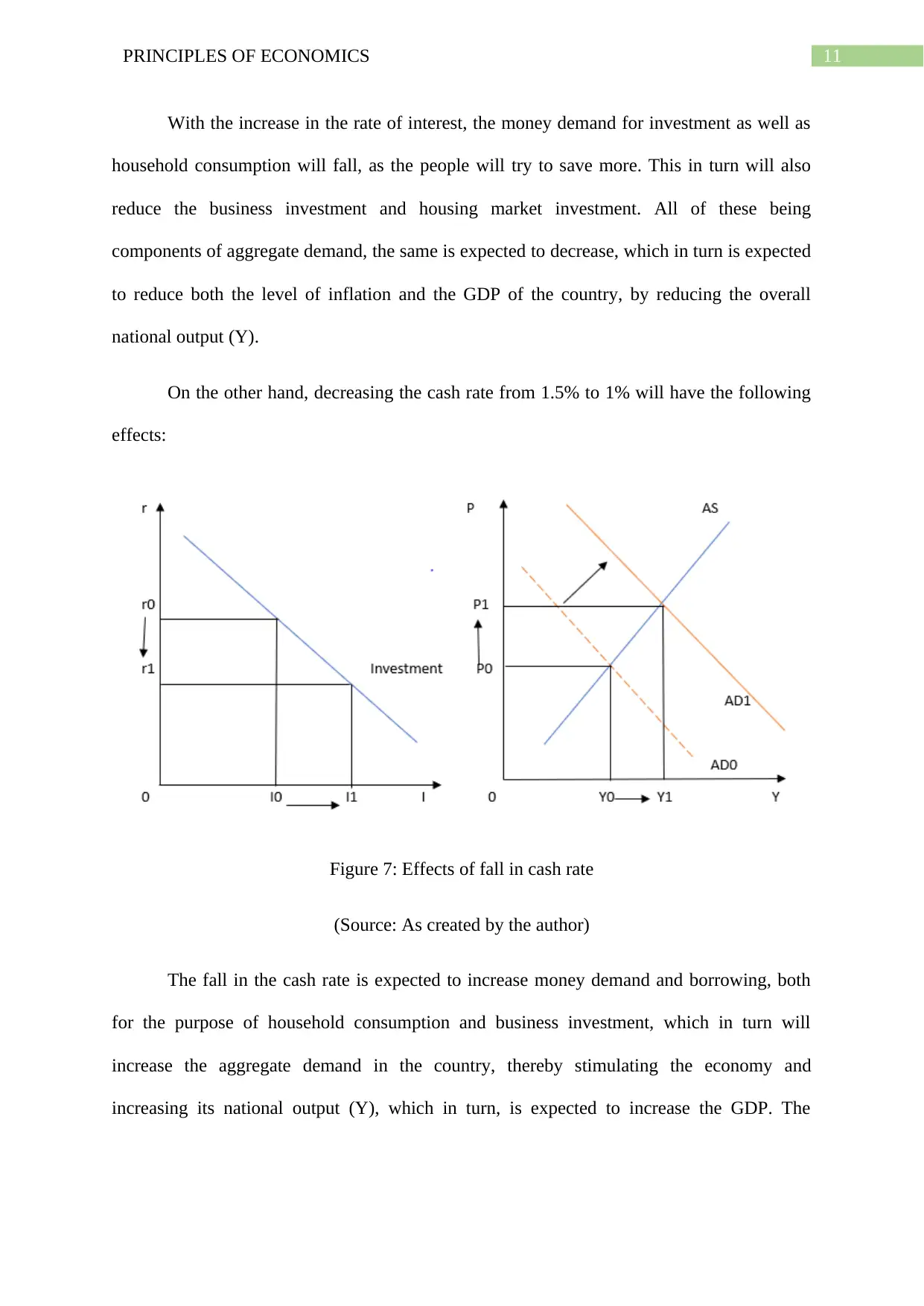

Effects of changes in the cash rate

The money market equilibrium occurs at the point where the money demand is equal

to money supply in the economy. This is regulated by the monetary transmission mechanism,

where the rate of interest is the primary regulatory variable. The money supply and money

demand can be regulated with the help of this variable and the same has its effects on the

investment, consumption, GDP and the overall pricing conditions of the economy (Smales,

2012).

Thus, when the cash rate of Australia is increased from 1.5% to 2%, the effects of the

same can be seen to be as follows:

Figure 6: Effects of increase in the cash rate

(Source: As created by the author)

decreasing in the market, in the recent years and the rate of inflation can also be seen to be

moderate in the recent period. All these factors have enabled the RBA to keep the cash rate at

1.50% for the last two years (McLeay, Radia & Thomas, 2014).

Effects of changes in the cash rate

The money market equilibrium occurs at the point where the money demand is equal

to money supply in the economy. This is regulated by the monetary transmission mechanism,

where the rate of interest is the primary regulatory variable. The money supply and money

demand can be regulated with the help of this variable and the same has its effects on the

investment, consumption, GDP and the overall pricing conditions of the economy (Smales,

2012).

Thus, when the cash rate of Australia is increased from 1.5% to 2%, the effects of the

same can be seen to be as follows:

Figure 6: Effects of increase in the cash rate

(Source: As created by the author)

11PRINCIPLES OF ECONOMICS

With the increase in the rate of interest, the money demand for investment as well as

household consumption will fall, as the people will try to save more. This in turn will also

reduce the business investment and housing market investment. All of these being

components of aggregate demand, the same is expected to decrease, which in turn is expected

to reduce both the level of inflation and the GDP of the country, by reducing the overall

national output (Y).

On the other hand, decreasing the cash rate from 1.5% to 1% will have the following

effects:

Figure 7: Effects of fall in cash rate

(Source: As created by the author)

The fall in the cash rate is expected to increase money demand and borrowing, both

for the purpose of household consumption and business investment, which in turn will

increase the aggregate demand in the country, thereby stimulating the economy and

increasing its national output (Y), which in turn, is expected to increase the GDP. The

With the increase in the rate of interest, the money demand for investment as well as

household consumption will fall, as the people will try to save more. This in turn will also

reduce the business investment and housing market investment. All of these being

components of aggregate demand, the same is expected to decrease, which in turn is expected

to reduce both the level of inflation and the GDP of the country, by reducing the overall

national output (Y).

On the other hand, decreasing the cash rate from 1.5% to 1% will have the following

effects:

Figure 7: Effects of fall in cash rate

(Source: As created by the author)

The fall in the cash rate is expected to increase money demand and borrowing, both

for the purpose of household consumption and business investment, which in turn will

increase the aggregate demand in the country, thereby stimulating the economy and

increasing its national output (Y), which in turn, is expected to increase the GDP. The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.