TAXA3004 FBT Assignment: Montgomery’s Pty Ltd Taxable Benefits

VerifiedAdded on 2023/06/04

|10

|2233

|133

Homework Assignment

AI Summary

This assignment analyzes the fringe benefits tax (FBT) liability of Montgomery’s Pty Ltd, detailing various benefits provided to employees and their tax implications. The solution calculates taxable values for benefits such as cash salary, superannuation contributions, a new Audi sedan, entertainment allowances, home internet and mobile telephone expenses, low-interest loans, a new desktop computer, professional membership fees, a prepaid Visa card, taxi services, and a BMW X5. It also covers benefits provided to general staff, including fresh fruit, Christmas parties, and educational assistance. The assignment categorizes benefits as type 1 or exempt, providing workings and citations to relevant legislation and case law, ultimately arriving at a total fringe benefits tax liability for the company. The analysis is based on the Australian Taxation Office (ATO) guidelines and relevant sections of the FBTAA 1986. The document also excludes benefits like parking and daily newspapers from FBT calculations, providing a comprehensive overview of FBT principles and their application.

Surname 1

Name:

Instructor’s Name:

Course Details:

Date of Submission:

Montgomery’s Pty Ltd’s Taxable Values of the Benefits the Firm Provided and its Fringe

Benefits Tax Liability

a) Fringe Benefit on Providing Brad Cruise with a Cash salary of $125,000

Cash salary is not part of the fringe benefits. According to Caplow, fringe benefits are the

things that the employer gives to his or her employees or the employee's associates, or the family

members as a benefit as an alternative to remunerating that individual with salary.

b) Fringe Benefit on Superannuation Payable of 12% Based on the Cash Salary

Employers should pay 9.5% of every eligible worker's salary as superannuation

contributions to a conforming superannuation fund (Hodgson and Prafula). Therefore, the benefit

that Brad gets from his employer is as follows.

Cash salary = $125,000

The actual rate that employer provided = 12%

Government’s set rate = 9.5%

The benefit that Brad gets = 12%- 9.5% = 2.5%

Taxable value = 2.5% X $125,000 = $3,125

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

9.5% requirement of salary superannuation contributions falls under section 19(4) of the

Superannuation Guarantee Administration Act 1992 (SGAA).

Name:

Instructor’s Name:

Course Details:

Date of Submission:

Montgomery’s Pty Ltd’s Taxable Values of the Benefits the Firm Provided and its Fringe

Benefits Tax Liability

a) Fringe Benefit on Providing Brad Cruise with a Cash salary of $125,000

Cash salary is not part of the fringe benefits. According to Caplow, fringe benefits are the

things that the employer gives to his or her employees or the employee's associates, or the family

members as a benefit as an alternative to remunerating that individual with salary.

b) Fringe Benefit on Superannuation Payable of 12% Based on the Cash Salary

Employers should pay 9.5% of every eligible worker's salary as superannuation

contributions to a conforming superannuation fund (Hodgson and Prafula). Therefore, the benefit

that Brad gets from his employer is as follows.

Cash salary = $125,000

The actual rate that employer provided = 12%

Government’s set rate = 9.5%

The benefit that Brad gets = 12%- 9.5% = 2.5%

Taxable value = 2.5% X $125,000 = $3,125

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

9.5% requirement of salary superannuation contributions falls under section 19(4) of the

Superannuation Guarantee Administration Act 1992 (SGAA).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname 2

c) Fringe Benefit on Providing Brad Cruise with a New Audi sedan (Including GST)

According to Braverman, Stephen, and Kerrie, the vehicle’s taxable value is calculated in

the following way.

Taxable value = A x B x C

Where A = the vehicle’s cost to the employer

B = the legal percentage

C = the percentage of distance that the worker used the car for private reasons

Hence, from the question,

A = $1,250 per month X 12 months = $15,000

B = 47% starting from 1 April 2017 to 31 March 2018 (Australian Taxation Office).

C = 100% - 70% (business-related kilometers) = 30%

Taxable value = $15,000 X 47% X 30% = $2,115

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The car

fringe benefit rates on the cars an employer leases are found in section 7.7 of the FBTAA 1986

(Prince).

d) Fringe Benefit on Providing Brad Cruise with an Entertainment Allowance of

$3,000

The employer pays FBT on the share that relates to his or her worker’s entertainment

only or the worker’s associates (Raftery). In this case, the taxable value = $3,000 and not the

$3,100 that Brad Cruise spent entertaining clients. This is a type 1 benefit, since, Montgomery’s

Pty Ltd is eligible for a GST credit. The expense entertainment allowance fringe benefits on the

special legislative provisions are found in section 19.5 of the FBTAA 1986 (Raftery).

c) Fringe Benefit on Providing Brad Cruise with a New Audi sedan (Including GST)

According to Braverman, Stephen, and Kerrie, the vehicle’s taxable value is calculated in

the following way.

Taxable value = A x B x C

Where A = the vehicle’s cost to the employer

B = the legal percentage

C = the percentage of distance that the worker used the car for private reasons

Hence, from the question,

A = $1,250 per month X 12 months = $15,000

B = 47% starting from 1 April 2017 to 31 March 2018 (Australian Taxation Office).

C = 100% - 70% (business-related kilometers) = 30%

Taxable value = $15,000 X 47% X 30% = $2,115

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The car

fringe benefit rates on the cars an employer leases are found in section 7.7 of the FBTAA 1986

(Prince).

d) Fringe Benefit on Providing Brad Cruise with an Entertainment Allowance of

$3,000

The employer pays FBT on the share that relates to his or her worker’s entertainment

only or the worker’s associates (Raftery). In this case, the taxable value = $3,000 and not the

$3,100 that Brad Cruise spent entertaining clients. This is a type 1 benefit, since, Montgomery’s

Pty Ltd is eligible for a GST credit. The expense entertainment allowance fringe benefits on the

special legislative provisions are found in section 19.5 of the FBTAA 1986 (Raftery).

Surname 3

e) Fringe Benefit on the Reimbursement of Brad Cruise’s Home Internet and Mobile

Telephone Expenses of $960 ($350 for Private Calls)

The employer pays FBT on the share that relates to his or her worker’s private use of the

home internet and mobile telephone expenses (Raftery). In this case, the fringe benefit value is

$350. This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

telephone expenses fringe benefits found in section 19.4 of the FBTAA 1986.

f) Fringe Benefit on Providing Brad’s Wife with a Low-Interest Loan (including GST)

According to Caplow, the employer gives loan fringe benefits to his or her employees or

the employee's associates. Starting from 1 April 2017 to 31 March 2018, the loan’s interest rate

is 5.25% as per the Australian government (Australian Taxation Office). The low rate of interest

fringe benefits is calculated in the following way.

The loan that Montgomery’s Pty Ltd gave Brad’s wife = $75,000

Interest rate on the loan = 4%

The government’s set rate = 5.25%

The benefit that Brad’s wife gets = 5.25% - 4%= 1.25%

Taxable value = 1.25% X $75,000 = $937.50

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

low-interest loan fringe benefits are found in section 16 of the FBTAA 1986 division 4 division

A (Hodgson and Prafula).

e) Fringe Benefit on the Reimbursement of Brad Cruise’s Home Internet and Mobile

Telephone Expenses of $960 ($350 for Private Calls)

The employer pays FBT on the share that relates to his or her worker’s private use of the

home internet and mobile telephone expenses (Raftery). In this case, the fringe benefit value is

$350. This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

telephone expenses fringe benefits found in section 19.4 of the FBTAA 1986.

f) Fringe Benefit on Providing Brad’s Wife with a Low-Interest Loan (including GST)

According to Caplow, the employer gives loan fringe benefits to his or her employees or

the employee's associates. Starting from 1 April 2017 to 31 March 2018, the loan’s interest rate

is 5.25% as per the Australian government (Australian Taxation Office). The low rate of interest

fringe benefits is calculated in the following way.

The loan that Montgomery’s Pty Ltd gave Brad’s wife = $75,000

Interest rate on the loan = 4%

The government’s set rate = 5.25%

The benefit that Brad’s wife gets = 5.25% - 4%= 1.25%

Taxable value = 1.25% X $75,000 = $937.50

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The

low-interest loan fringe benefits are found in section 16 of the FBTAA 1986 division 4 division

A (Hodgson and Prafula).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname 4

g) Fringe Benefit on Brad’s Purchase of a New Desktop Non-Portable Computer

Montgomery’s Pty Ltd selling price to the public = $3,000. Brad purchase price = $2,500.

According to Cortis and Christine, the computer falls under the retail goods (identical) because

the firm sells computers, hence, the computer’s fringe benefit = (75% X $3,000) - $2,500 =

$2,250 - $2,500 = $-250. The retail goods (identical) fringe benefits are found in section 17.3

of the FBTAA 1986 (Raftery).

h) Fringe Benefit on the Payment for Tom’s Membership to the Sales Managers’

Organisation

Montgomery’s Pty Ltd will not pay any FBT on the $650 membership fees. Professional

membership subscriptions’ fringe benefits are exempted from tax (Clement, et al.). This is a type

1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The professional

membership subscriptions’ fringe benefits are found in section 20.2 of the FBTAA 1986.

i) Fringe Benefit on Providing the Access to Daily Newspapers in the Office

The daily newspapers in the office are not part of the fringe benefits because it is a cost to

the firm that enables it to check its competitors’ prices, which is a benefit to the organization.

j) Fringe Benefit on Brad’s Reception of a Prepaid Visa Card for $280

The employer will pay FBT on the Christmas gift that is $280. This is a type 1 benefit,

since, Montgomery’s Pty Ltd is eligible for a GST credit. The Christmas gift falls under the

expense entertainment allowance fringe benefits on the special legislative provisions found in

section 19.5 of the FBTAA 1986.

g) Fringe Benefit on Brad’s Purchase of a New Desktop Non-Portable Computer

Montgomery’s Pty Ltd selling price to the public = $3,000. Brad purchase price = $2,500.

According to Cortis and Christine, the computer falls under the retail goods (identical) because

the firm sells computers, hence, the computer’s fringe benefit = (75% X $3,000) - $2,500 =

$2,250 - $2,500 = $-250. The retail goods (identical) fringe benefits are found in section 17.3

of the FBTAA 1986 (Raftery).

h) Fringe Benefit on the Payment for Tom’s Membership to the Sales Managers’

Organisation

Montgomery’s Pty Ltd will not pay any FBT on the $650 membership fees. Professional

membership subscriptions’ fringe benefits are exempted from tax (Clement, et al.). This is a type

1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The professional

membership subscriptions’ fringe benefits are found in section 20.2 of the FBTAA 1986.

i) Fringe Benefit on Providing the Access to Daily Newspapers in the Office

The daily newspapers in the office are not part of the fringe benefits because it is a cost to

the firm that enables it to check its competitors’ prices, which is a benefit to the organization.

j) Fringe Benefit on Brad’s Reception of a Prepaid Visa Card for $280

The employer will pay FBT on the Christmas gift that is $280. This is a type 1 benefit,

since, Montgomery’s Pty Ltd is eligible for a GST credit. The Christmas gift falls under the

expense entertainment allowance fringe benefits on the special legislative provisions found in

section 19.5 of the FBTAA 1986.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname 5

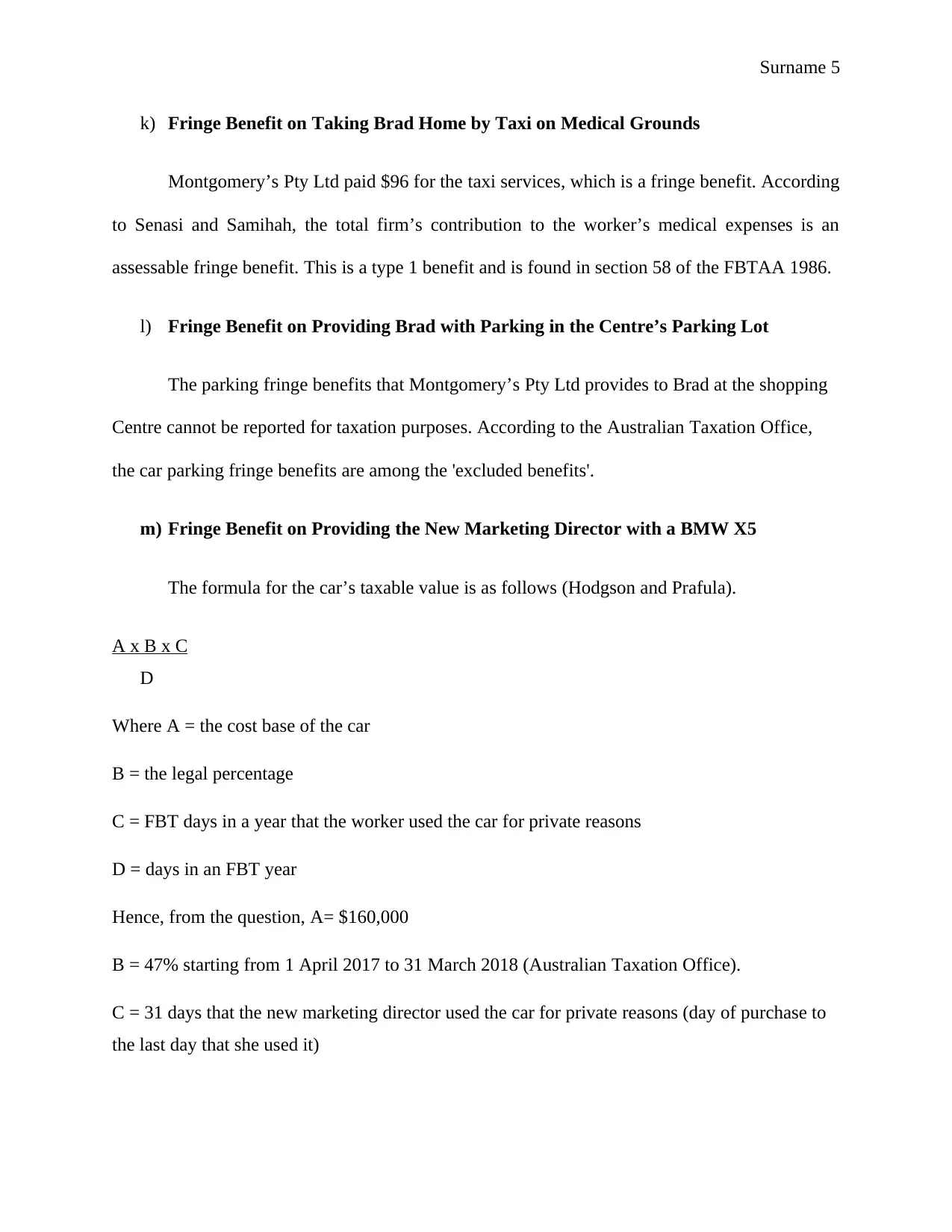

k) Fringe Benefit on Taking Brad Home by Taxi on Medical Grounds

Montgomery’s Pty Ltd paid $96 for the taxi services, which is a fringe benefit. According

to Senasi and Samihah, the total firm’s contribution to the worker’s medical expenses is an

assessable fringe benefit. This is a type 1 benefit and is found in section 58 of the FBTAA 1986.

l) Fringe Benefit on Providing Brad with Parking in the Centre’s Parking Lot

The parking fringe benefits that Montgomery’s Pty Ltd provides to Brad at the shopping

Centre cannot be reported for taxation purposes. According to the Australian Taxation Office,

the car parking fringe benefits are among the 'excluded benefits'.

m) Fringe Benefit on Providing the New Marketing Director with a BMW X5

The formula for the car’s taxable value is as follows (Hodgson and Prafula).

A x B x C

D

Where A = the cost base of the car

B = the legal percentage

C = FBT days in a year that the worker used the car for private reasons

D = days in an FBT year

Hence, from the question, A= $160,000

B = 47% starting from 1 April 2017 to 31 March 2018 (Australian Taxation Office).

C = 31 days that the new marketing director used the car for private reasons (day of purchase to

the last day that she used it)

k) Fringe Benefit on Taking Brad Home by Taxi on Medical Grounds

Montgomery’s Pty Ltd paid $96 for the taxi services, which is a fringe benefit. According

to Senasi and Samihah, the total firm’s contribution to the worker’s medical expenses is an

assessable fringe benefit. This is a type 1 benefit and is found in section 58 of the FBTAA 1986.

l) Fringe Benefit on Providing Brad with Parking in the Centre’s Parking Lot

The parking fringe benefits that Montgomery’s Pty Ltd provides to Brad at the shopping

Centre cannot be reported for taxation purposes. According to the Australian Taxation Office,

the car parking fringe benefits are among the 'excluded benefits'.

m) Fringe Benefit on Providing the New Marketing Director with a BMW X5

The formula for the car’s taxable value is as follows (Hodgson and Prafula).

A x B x C

D

Where A = the cost base of the car

B = the legal percentage

C = FBT days in a year that the worker used the car for private reasons

D = days in an FBT year

Hence, from the question, A= $160,000

B = 47% starting from 1 April 2017 to 31 March 2018 (Australian Taxation Office).

C = 31 days that the new marketing director used the car for private reasons (day of purchase to

the last day that she used it)

Surname 6

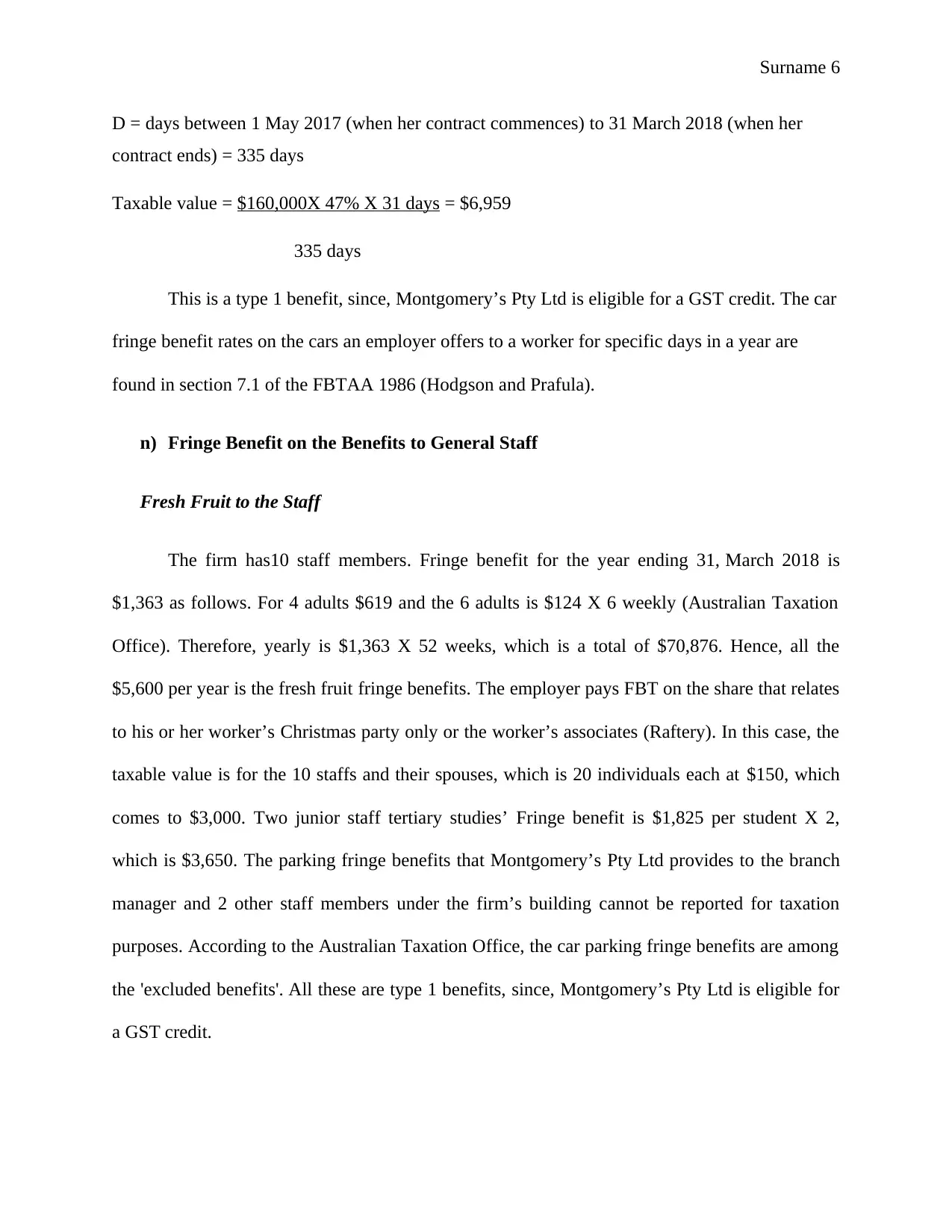

D = days between 1 May 2017 (when her contract commences) to 31 March 2018 (when her

contract ends) = 335 days

Taxable value = $160,000X 47% X 31 days = $6,959

335 days

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The car

fringe benefit rates on the cars an employer offers to a worker for specific days in a year are

found in section 7.1 of the FBTAA 1986 (Hodgson and Prafula).

n) Fringe Benefit on the Benefits to General Staff

Fresh Fruit to the Staff

The firm has10 staff members. Fringe benefit for the year ending 31, March 2018 is

$1,363 as follows. For 4 adults $619 and the 6 adults is $124 X 6 weekly (Australian Taxation

Office). Therefore, yearly is $1,363 X 52 weeks, which is a total of $70,876. Hence, all the

$5,600 per year is the fresh fruit fringe benefits. The employer pays FBT on the share that relates

to his or her worker’s Christmas party only or the worker’s associates (Raftery). In this case, the

taxable value is for the 10 staffs and their spouses, which is 20 individuals each at $150, which

comes to $3,000. Two junior staff tertiary studies’ Fringe benefit is $1,825 per student X 2,

which is $3,650. The parking fringe benefits that Montgomery’s Pty Ltd provides to the branch

manager and 2 other staff members under the firm’s building cannot be reported for taxation

purposes. According to the Australian Taxation Office, the car parking fringe benefits are among

the 'excluded benefits'. All these are type 1 benefits, since, Montgomery’s Pty Ltd is eligible for

a GST credit.

D = days between 1 May 2017 (when her contract commences) to 31 March 2018 (when her

contract ends) = 335 days

Taxable value = $160,000X 47% X 31 days = $6,959

335 days

This is a type 1 benefit, since, Montgomery’s Pty Ltd is eligible for a GST credit. The car

fringe benefit rates on the cars an employer offers to a worker for specific days in a year are

found in section 7.1 of the FBTAA 1986 (Hodgson and Prafula).

n) Fringe Benefit on the Benefits to General Staff

Fresh Fruit to the Staff

The firm has10 staff members. Fringe benefit for the year ending 31, March 2018 is

$1,363 as follows. For 4 adults $619 and the 6 adults is $124 X 6 weekly (Australian Taxation

Office). Therefore, yearly is $1,363 X 52 weeks, which is a total of $70,876. Hence, all the

$5,600 per year is the fresh fruit fringe benefits. The employer pays FBT on the share that relates

to his or her worker’s Christmas party only or the worker’s associates (Raftery). In this case, the

taxable value is for the 10 staffs and their spouses, which is 20 individuals each at $150, which

comes to $3,000. Two junior staff tertiary studies’ Fringe benefit is $1,825 per student X 2,

which is $3,650. The parking fringe benefits that Montgomery’s Pty Ltd provides to the branch

manager and 2 other staff members under the firm’s building cannot be reported for taxation

purposes. According to the Australian Taxation Office, the car parking fringe benefits are among

the 'excluded benefits'. All these are type 1 benefits, since, Montgomery’s Pty Ltd is eligible for

a GST credit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname 7

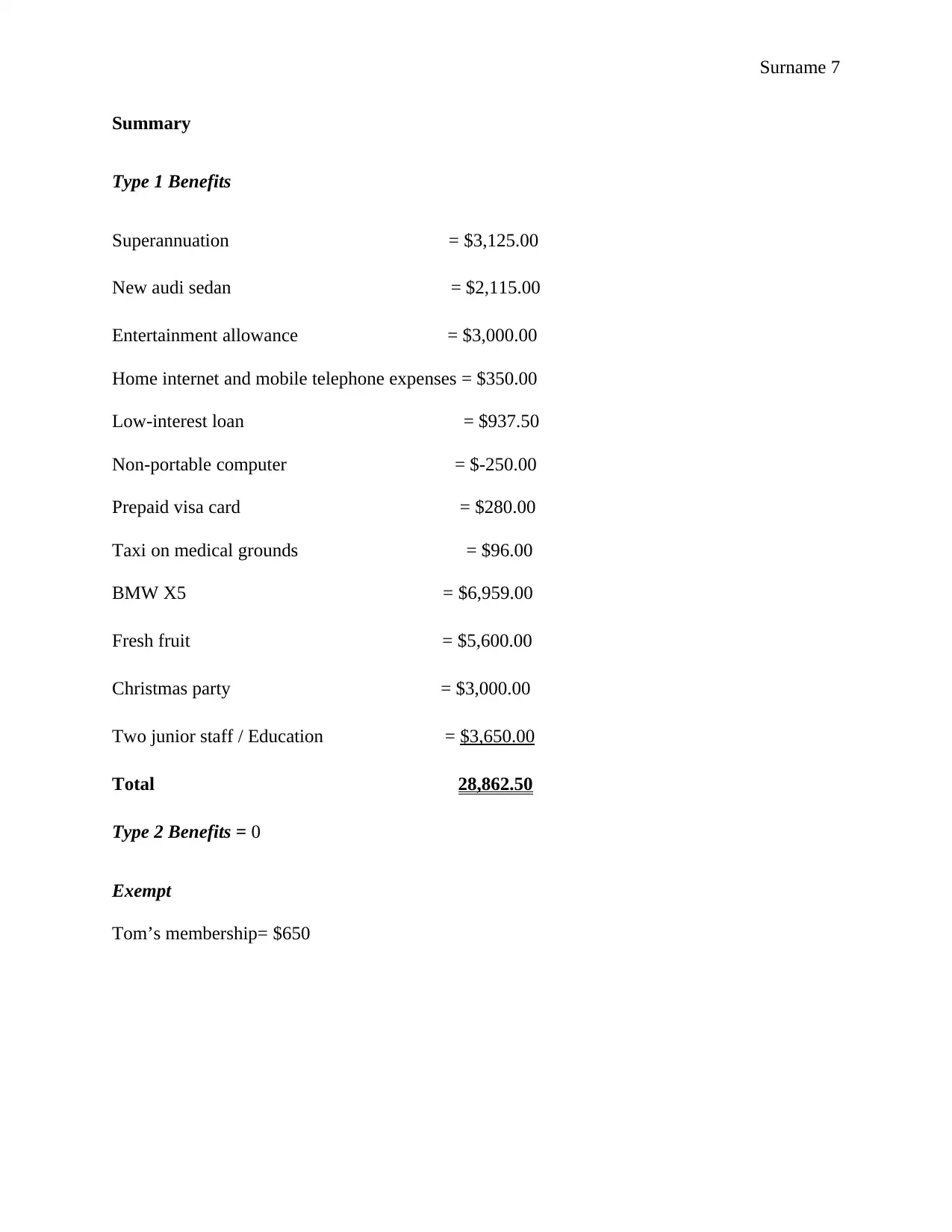

Summary

Type 1 Benefits

Superannuation = $3,125.00

New audi sedan = $2,115.00

Entertainment allowance = $3,000.00

Home internet and mobile telephone expenses = $350.00

Low-interest loan = $937.50

Non-portable computer = $-250.00

Prepaid visa card = $280.00

Taxi on medical grounds = $96.00

BMW X5 = $6,959.00

Fresh fruit = $5,600.00

Christmas party = $3,000.00

Two junior staff / Education = $3,650.00

Total 28,862.50

Type 2 Benefits = 0

Exempt

Tom’s membership= $650

Summary

Type 1 Benefits

Superannuation = $3,125.00

New audi sedan = $2,115.00

Entertainment allowance = $3,000.00

Home internet and mobile telephone expenses = $350.00

Low-interest loan = $937.50

Non-portable computer = $-250.00

Prepaid visa card = $280.00

Taxi on medical grounds = $96.00

BMW X5 = $6,959.00

Fresh fruit = $5,600.00

Christmas party = $3,000.00

Two junior staff / Education = $3,650.00

Total 28,862.50

Type 2 Benefits = 0

Exempt

Tom’s membership= $650

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname 8

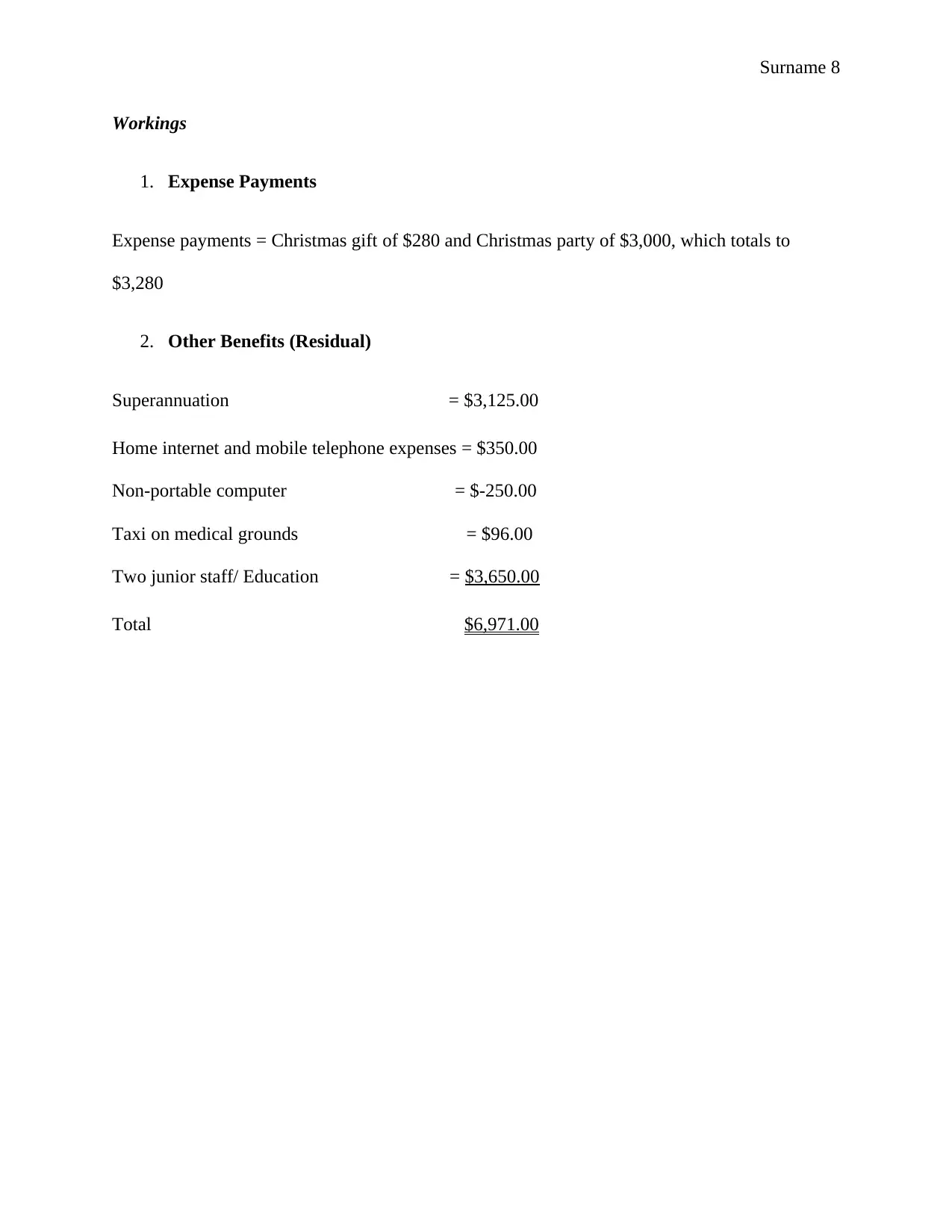

Workings

1. Expense Payments

Expense payments = Christmas gift of $280 and Christmas party of $3,000, which totals to

$3,280

2. Other Benefits (Residual)

Superannuation = $3,125.00

Home internet and mobile telephone expenses = $350.00

Non-portable computer = $-250.00

Taxi on medical grounds = $96.00

Two junior staff/ Education = $3,650.00

Total $6,971.00

Workings

1. Expense Payments

Expense payments = Christmas gift of $280 and Christmas party of $3,000, which totals to

$3,280

2. Other Benefits (Residual)

Superannuation = $3,125.00

Home internet and mobile telephone expenses = $350.00

Non-portable computer = $-250.00

Taxi on medical grounds = $96.00

Two junior staff/ Education = $3,650.00

Total $6,971.00

Surname 9

Works Cited

Australian Taxation Office. “Reportable Fringe Benefits – Facts for Employees.” Retrieved on

04.10.2018 from https://www.ato.gov.au/General/Fringe-benefits-tax-(fbt)/In-detail/

Employees/Reportable-fringe-benefits---facts-for-employees/

Australian Taxation Office. “Fringe Benefits Tax – Rates and Thresholds.” Retrieved on

04.10.2018 from https://www.ato.gov.au/Rates/FBT/

Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n17

(2015).

Caplow, Theodore. The Academic Marketplace. Routledge, 2017.

Clement, R. Carter, et al. "Fringe Benefits among U.S. Orthopedic Residency Programs Vary

Considerably: A National Survey." HSS Journal® 12.2 (2016).

Cortis, Natasha, and Christine Eastman. "Salary Sacrificing in Australia: Are Patterns of Uptake

and Benefit Different in the Not‐for‐Profit Sector?" Asia Pacific Journal of Human

Resources 53.3 (2015).

Hodgson, Helen, and Prafula Pearce. "TravelSmart or Travel Tax Breaks: Is the Fringe Benefits

Tax a Barrier to Active Commuting in Australia? 1." eJournal of Tax Research 13.3

(2015).

Prince, Jimmy B. Tax for Australians for Dummies. John Wiley & Sons, 2016.

Raftery, Adrian. 101 Ways to Save Money on Your Tax-Legally! 2017-2018. John Wiley & Sons,

2017.

Works Cited

Australian Taxation Office. “Reportable Fringe Benefits – Facts for Employees.” Retrieved on

04.10.2018 from https://www.ato.gov.au/General/Fringe-benefits-tax-(fbt)/In-detail/

Employees/Reportable-fringe-benefits---facts-for-employees/

Australian Taxation Office. “Fringe Benefits Tax – Rates and Thresholds.” Retrieved on

04.10.2018 from https://www.ato.gov.au/Rates/FBT/

Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n17

(2015).

Caplow, Theodore. The Academic Marketplace. Routledge, 2017.

Clement, R. Carter, et al. "Fringe Benefits among U.S. Orthopedic Residency Programs Vary

Considerably: A National Survey." HSS Journal® 12.2 (2016).

Cortis, Natasha, and Christine Eastman. "Salary Sacrificing in Australia: Are Patterns of Uptake

and Benefit Different in the Not‐for‐Profit Sector?" Asia Pacific Journal of Human

Resources 53.3 (2015).

Hodgson, Helen, and Prafula Pearce. "TravelSmart or Travel Tax Breaks: Is the Fringe Benefits

Tax a Barrier to Active Commuting in Australia? 1." eJournal of Tax Research 13.3

(2015).

Prince, Jimmy B. Tax for Australians for Dummies. John Wiley & Sons, 2016.

Raftery, Adrian. 101 Ways to Save Money on Your Tax-Legally! 2017-2018. John Wiley & Sons,

2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname 10

Senasi, Vally, and Samihah Khalil. "Implementation of Minimum Wage Policy in Malaysia:

Manufacturing Employers’ Perceptions of Training Provision and Fringe

Benefits." International Journal of Humanities and Social Science 5.12 (2015).

Senasi, Vally, and Samihah Khalil. "Implementation of Minimum Wage Policy in Malaysia:

Manufacturing Employers’ Perceptions of Training Provision and Fringe

Benefits." International Journal of Humanities and Social Science 5.12 (2015).

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.