University Assignment: Moral Dilemma Analysis of AI in Insurance

VerifiedAdded on 2023/03/23

|11

|2944

|65

Report

AI Summary

This report delves into the moral dilemmas presented by the application of Artificial Intelligence (AI) in the insurance sector. It utilizes the Blanchard-Peale Framework to analyze the ethical considerations, focusing on legal aspects, fairness, and personal reflection. The report examines the benefits of AI, such as automated decision-making and fraud reduction, while also addressing potential harms like data security breaches and job displacement. It explores the responsibilities of IS professionals in ensuring data privacy and ethical practices. The analysis considers the impact of AI on organizations, individuals, business clients, and the industry as a whole, providing a comprehensive overview of the ethical challenges and opportunities associated with AI in insurance. The report emphasizes the importance of data encryption, secure cloud storage, and employee training to mitigate risks and promote ethical AI implementation. The conclusion highlights the need for companies to prioritize ethical considerations when integrating AI to ensure fair and transparent insurance practices.

Running head: MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Name of the Student

Name of the University

Author Note

Introduction

MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Name of the Student

Name of the University

Author Note

Introduction

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Application of Artificial intelligence or AI technology has various benefits. It automates

decision regarding providing insurance to individuals according to their requirements. It also

provides automatic quotation for insurance package, which is also customisable according to the

needs of the consumer.

Discussion:

Ethical decision-making framework:

The framework chosen for the ethical analysis is The Blanchard-Peale Framework. It is a

simple and effective framework for deciding if an action is ethical or not. It consists of three

component for ethical analysis. These components are:

Legal aspect of activity: When an activity is conducted, it should be analysed from legal

framework. An activity needs to be consistent with relevant rules and regulations before it is

considered as ethical. This is one of the first and most important aspect of any ethical analysis

according to this framework.

Fairness of activity: While doing any activity it is important to identify if individual has been

honest or not while conducted any activity. Action has to be honest and fair with respect to

interest of larger entity. If this is not achieved, the action is not ethical.

Personal realization for activity: Personal reflection on any activity is important to identify

and analyse ethical issue associated with an activity.

This framework is applied to analyse important ethical consideration required for IS professional

to consider while designing health insurance policy.

Legal aspect of activity:

Application of Artificial intelligence or AI technology has various benefits. It automates

decision regarding providing insurance to individuals according to their requirements. It also

provides automatic quotation for insurance package, which is also customisable according to the

needs of the consumer.

Discussion:

Ethical decision-making framework:

The framework chosen for the ethical analysis is The Blanchard-Peale Framework. It is a

simple and effective framework for deciding if an action is ethical or not. It consists of three

component for ethical analysis. These components are:

Legal aspect of activity: When an activity is conducted, it should be analysed from legal

framework. An activity needs to be consistent with relevant rules and regulations before it is

considered as ethical. This is one of the first and most important aspect of any ethical analysis

according to this framework.

Fairness of activity: While doing any activity it is important to identify if individual has been

honest or not while conducted any activity. Action has to be honest and fair with respect to

interest of larger entity. If this is not achieved, the action is not ethical.

Personal realization for activity: Personal reflection on any activity is important to identify

and analyse ethical issue associated with an activity.

This framework is applied to analyse important ethical consideration required for IS professional

to consider while designing health insurance policy.

Legal aspect of activity:

2MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Application of AI in providing insurance policy has various benefits, it Automates decision

regarding health insurance claim and helps in payment adjustment. It create a strong portfolio in

the market for the company. Along with that, company will have competitive and strategic

advantage over traditional insurance provider, which is a long-term benefit for the company. For

individual staff the benefits include customers efficiently through integration of chatbots,

automate decision regarding insurance claim, and manage payments and other technical aspect of

the service. As company grow with their service through effective business process, it will

benefit staff of the company in long term. The business clients will be benefitted from this

technology as well. Artificial intelligence helps them avoiding fraud in insurance settlement and

get price quote for insurance faster. In addition, concerning industry, it provides context for

innovation and enrich industry with application of technology. Along with benefits, it has some

drawbacks as well, not only for the organization who is providing insurance policy, but also for

all the entities considered in the ethical framework.

According to data protection regulation, if data is collected about individuals specially critical

information like health data, it has to be protected. If data collected for this purpose is hacked, it

will bring legal action against the company. Too much dependence on technology might affects

skills of the employee in long terms, application of AI might bring threat to traditional insurance

provider, and this might affect the industry itself in long term.

Various sophisticated tools are available for exploiting data security and this has to be considered

for data security as well. It is not enough to only consider that data collection is legal, it is also s

to secure these data as well for ensuring that data is secured. Hence, after collecting data for

automation with AI technology, these data has to be encrypted. Once data is encrypted, it is

difficult to access this data. Hence, data after collecting from individuals needs to be stored in

secure place.

For applying data in automation through AI, it is important to ensure that data is accessible from

anywhere. Hence data needs to be stored in the cloud. for this private cloud technology has to be

considered which ensures that data is not shared between others. These aspects are important too

for enhancing data security and data processing.

IS professionals will have to take this consideration into account while collecting data for

providing health insurance and designing health insurance policy.

Fairness of activity:

While applying AI, it is important to analyse benefits for analysing fairness of this action and

this is an important consideration for IS professionals.

Benefits of this action:

Application of AI in providing insurance policy has various benefits, it Automates decision

regarding health insurance claim and helps in payment adjustment. It create a strong portfolio in

the market for the company. Along with that, company will have competitive and strategic

advantage over traditional insurance provider, which is a long-term benefit for the company. For

individual staff the benefits include customers efficiently through integration of chatbots,

automate decision regarding insurance claim, and manage payments and other technical aspect of

the service. As company grow with their service through effective business process, it will

benefit staff of the company in long term. The business clients will be benefitted from this

technology as well. Artificial intelligence helps them avoiding fraud in insurance settlement and

get price quote for insurance faster. In addition, concerning industry, it provides context for

innovation and enrich industry with application of technology. Along with benefits, it has some

drawbacks as well, not only for the organization who is providing insurance policy, but also for

all the entities considered in the ethical framework.

According to data protection regulation, if data is collected about individuals specially critical

information like health data, it has to be protected. If data collected for this purpose is hacked, it

will bring legal action against the company. Too much dependence on technology might affects

skills of the employee in long terms, application of AI might bring threat to traditional insurance

provider, and this might affect the industry itself in long term.

Various sophisticated tools are available for exploiting data security and this has to be considered

for data security as well. It is not enough to only consider that data collection is legal, it is also s

to secure these data as well for ensuring that data is secured. Hence, after collecting data for

automation with AI technology, these data has to be encrypted. Once data is encrypted, it is

difficult to access this data. Hence, data after collecting from individuals needs to be stored in

secure place.

For applying data in automation through AI, it is important to ensure that data is accessible from

anywhere. Hence data needs to be stored in the cloud. for this private cloud technology has to be

considered which ensures that data is not shared between others. These aspects are important too

for enhancing data security and data processing.

IS professionals will have to take this consideration into account while collecting data for

providing health insurance and designing health insurance policy.

Fairness of activity:

While applying AI, it is important to analyse benefits for analysing fairness of this action and

this is an important consideration for IS professionals.

Benefits of this action:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

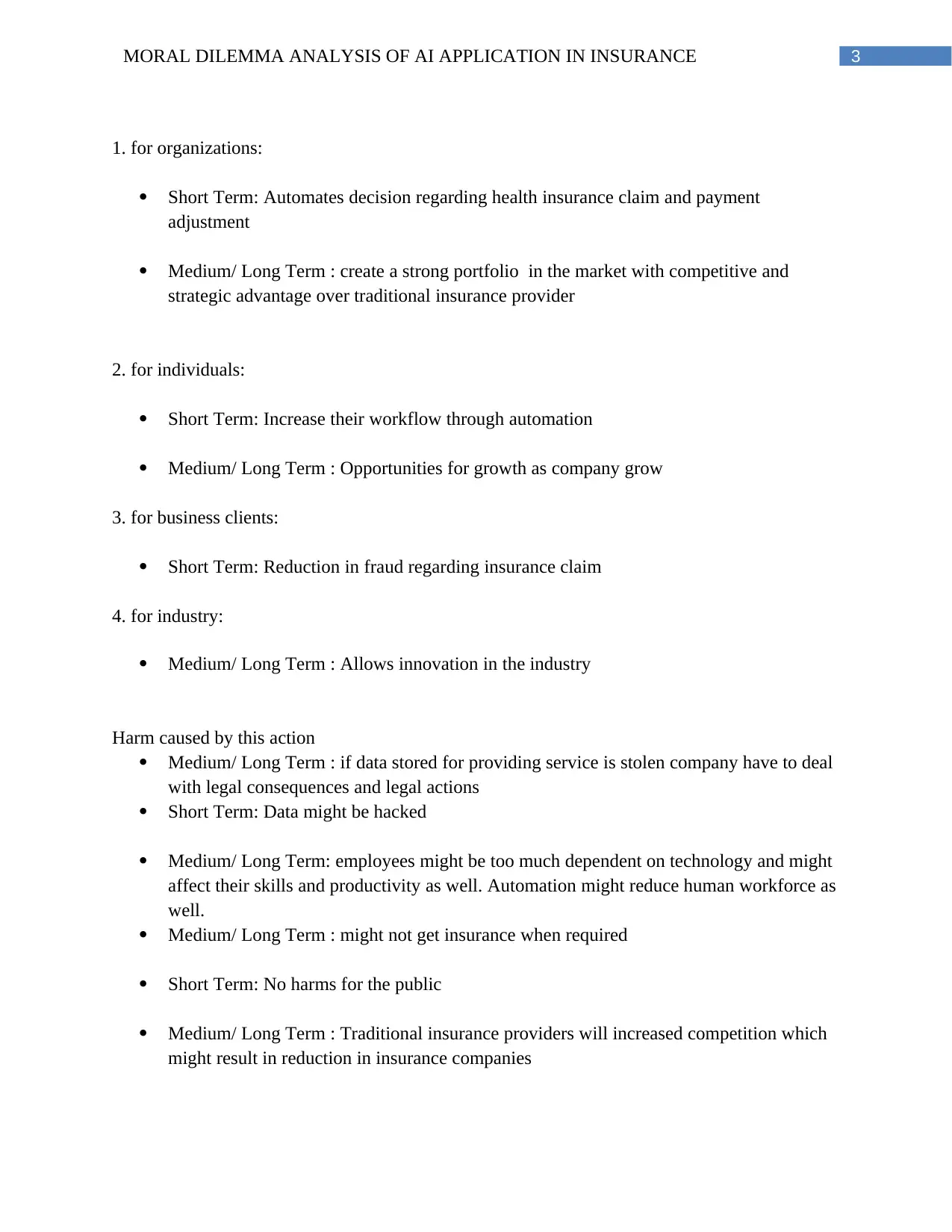

1. for organizations:

Short Term: Automates decision regarding health insurance claim and payment

adjustment

Medium/ Long Term : create a strong portfolio in the market with competitive and

strategic advantage over traditional insurance provider

2. for individuals:

Short Term: Increase their workflow through automation

Medium/ Long Term : Opportunities for growth as company grow

3. for business clients:

Short Term: Reduction in fraud regarding insurance claim

4. for industry:

Medium/ Long Term : Allows innovation in the industry

Harm caused by this action

Medium/ Long Term : if data stored for providing service is stolen company have to deal

with legal consequences and legal actions

Short Term: Data might be hacked

Medium/ Long Term: employees might be too much dependent on technology and might

affect their skills and productivity as well. Automation might reduce human workforce as

well.

Medium/ Long Term : might not get insurance when required

Short Term: No harms for the public

Medium/ Long Term : Traditional insurance providers will increased competition which

might result in reduction in insurance companies

1. for organizations:

Short Term: Automates decision regarding health insurance claim and payment

adjustment

Medium/ Long Term : create a strong portfolio in the market with competitive and

strategic advantage over traditional insurance provider

2. for individuals:

Short Term: Increase their workflow through automation

Medium/ Long Term : Opportunities for growth as company grow

3. for business clients:

Short Term: Reduction in fraud regarding insurance claim

4. for industry:

Medium/ Long Term : Allows innovation in the industry

Harm caused by this action

Medium/ Long Term : if data stored for providing service is stolen company have to deal

with legal consequences and legal actions

Short Term: Data might be hacked

Medium/ Long Term: employees might be too much dependent on technology and might

affect their skills and productivity as well. Automation might reduce human workforce as

well.

Medium/ Long Term : might not get insurance when required

Short Term: No harms for the public

Medium/ Long Term : Traditional insurance providers will increased competition which

might result in reduction in insurance companies

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

The AI has been helping enormously in the insurance industry. The use of AI in the healthcare

industry has been helping in gathering health related data. These data are of great importance for

the insurance providers to decide about credibility of an individual to claim for insurance term.

Fraud in insurance claim has been one of the critical problem in insurance industry and it

becomes difficult for policy makers to ensure fraud free insurance claim. However, application

of AI provides context for resolving these issues properly. People like to have insurance in less

time and without any fraud, for which AI is an important consideration. However when new

services are brought to the market it is important to review applicable rules and regulation and

analyse business process about ethical framework. Hence, in this context, application of AI in

providing insurance policies is analysed with ethical framework with detailed analysis of

possible benefits and harms of this application both in short-term and mid to long term context

for providing a comprehensive overview on ethical analysis.

The use of the artificial intelligence in insurance industry might be harmful for the employees as

there might be some data loss of patients in the hospitals. These issues have to be considered by

the IS professionals. If the technology has been universalized, the use of the technology will be

done by every clients in the market. Therefore, thus become an issue for the organzation and

professionals to handle the situation. The hackers might target insurance organization for

breaching into their network server and database if the organization. This has been causing a

huge data loss to the organization in the healthcare industry. The use of AI in the insurance

industry has been maintaining a keen approach in the market. Management might problems in

defending their data in case there have been universalization of technology. This technology

need to be secure properly that might help in providing a proper approach to the development of

industry.

Personal realization for activity:

Before initial implementation of AI in the healthcare system, there is a need to provide proper

training by feeding in data generated through clinical activities like screening. They help the

process of AI to expand in its use in the healthcare sector regarding allowance for insurance.

Company has more power over employees, clients and the public regarding choice of their action

and it is duty of the company to ensure that their action are consistent with ethical framework.

The rights have not been violating because of their actions it cannot be used in end user for

violating rights of staff’s and patients. The organization has been following all the policies that

are maintaining a keen approach in the insurance industry. The policies and legal frameworks of

the organization has been properly followed. Introduction of AI in insurance have brought about

numerous benefits and it has rapidly increased the progress report of the allowance of insurance ,

providing status regarding insurance claim. The insurance system by using the applications of

AI has reduced the turnaround in providing insurance. AI is applied in both structured and

unstructured healthcare data. Machine learning methodologies are used to get network data and

The AI has been helping enormously in the insurance industry. The use of AI in the healthcare

industry has been helping in gathering health related data. These data are of great importance for

the insurance providers to decide about credibility of an individual to claim for insurance term.

Fraud in insurance claim has been one of the critical problem in insurance industry and it

becomes difficult for policy makers to ensure fraud free insurance claim. However, application

of AI provides context for resolving these issues properly. People like to have insurance in less

time and without any fraud, for which AI is an important consideration. However when new

services are brought to the market it is important to review applicable rules and regulation and

analyse business process about ethical framework. Hence, in this context, application of AI in

providing insurance policies is analysed with ethical framework with detailed analysis of

possible benefits and harms of this application both in short-term and mid to long term context

for providing a comprehensive overview on ethical analysis.

The use of the artificial intelligence in insurance industry might be harmful for the employees as

there might be some data loss of patients in the hospitals. These issues have to be considered by

the IS professionals. If the technology has been universalized, the use of the technology will be

done by every clients in the market. Therefore, thus become an issue for the organzation and

professionals to handle the situation. The hackers might target insurance organization for

breaching into their network server and database if the organization. This has been causing a

huge data loss to the organization in the healthcare industry. The use of AI in the insurance

industry has been maintaining a keen approach in the market. Management might problems in

defending their data in case there have been universalization of technology. This technology

need to be secure properly that might help in providing a proper approach to the development of

industry.

Personal realization for activity:

Before initial implementation of AI in the healthcare system, there is a need to provide proper

training by feeding in data generated through clinical activities like screening. They help the

process of AI to expand in its use in the healthcare sector regarding allowance for insurance.

Company has more power over employees, clients and the public regarding choice of their action

and it is duty of the company to ensure that their action are consistent with ethical framework.

The rights have not been violating because of their actions it cannot be used in end user for

violating rights of staff’s and patients. The organization has been following all the policies that

are maintaining a keen approach in the insurance industry. The policies and legal frameworks of

the organization has been properly followed. Introduction of AI in insurance have brought about

numerous benefits and it has rapidly increased the progress report of the allowance of insurance ,

providing status regarding insurance claim. The insurance system by using the applications of

AI has reduced the turnaround in providing insurance. AI is applied in both structured and

unstructured healthcare data. Machine learning methodologies are used to get network data and

5MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

neural language is for the unstructured data. In case of other chronic diseases AI helps in easy

identification of the patient’s condition. This information is important to collect for providing

insurance. If action is universalized benefits for the organization is that it need stronger

innovation for service and thus provide context for innovation. if action is universalized harm

for the organization is that Management will not be able to manger employees

If action is universalized contradiction for the organization is that it Might cause the end of

company

with more power comes greater responsibility and in reference to this, it is also duty of the

company to ensure that they protects rights of their consumers, clients and public as they are

powerless compared to the company. The actions might violate the rights of patients in case of

universalization of AI technology in the insurance industry.

employees should realise that it is not only the organization that is responsible for data security

collected for providing health insurance. Employees need to ensure that data is collected properly

and also stored appropriately so that it is not exploited. If an employee wants to ensure that

action is ethical, he or she should reflect personally that even though illegal access or share of

data might benefit company, it might compromise security of personals. They have to think from

this framework, not just from organisational and business context. this will help them to analyse

ethical issues through personal reflection and this will also help them to design policy that is

consistent with ethical framework.

Summary

Framewo

rk

The

Organizat

ion selling

products/

services

Individua

l Staff

The

Organizatio

n’s business

Clients

The Public The

Industry/

Professio

n

Ethical?

Benefits

of this

action?

ST : Yes

LT : Yes

ST : No

LT : Yes

ST : Yes

LT : No

ST : N/A

LT : N/A

ST : No

LT : Yes

Unethical

Harm ST : No ST : Yes ST : No ST : N/A ST : No

neural language is for the unstructured data. In case of other chronic diseases AI helps in easy

identification of the patient’s condition. This information is important to collect for providing

insurance. If action is universalized benefits for the organization is that it need stronger

innovation for service and thus provide context for innovation. if action is universalized harm

for the organization is that Management will not be able to manger employees

If action is universalized contradiction for the organization is that it Might cause the end of

company

with more power comes greater responsibility and in reference to this, it is also duty of the

company to ensure that they protects rights of their consumers, clients and public as they are

powerless compared to the company. The actions might violate the rights of patients in case of

universalization of AI technology in the insurance industry.

employees should realise that it is not only the organization that is responsible for data security

collected for providing health insurance. Employees need to ensure that data is collected properly

and also stored appropriately so that it is not exploited. If an employee wants to ensure that

action is ethical, he or she should reflect personally that even though illegal access or share of

data might benefit company, it might compromise security of personals. They have to think from

this framework, not just from organisational and business context. this will help them to analyse

ethical issues through personal reflection and this will also help them to design policy that is

consistent with ethical framework.

Summary

Framewo

rk

The

Organizat

ion selling

products/

services

Individua

l Staff

The

Organizatio

n’s business

Clients

The Public The

Industry/

Professio

n

Ethical?

Benefits

of this

action?

ST : Yes

LT : Yes

ST : No

LT : Yes

ST : Yes

LT : No

ST : N/A

LT : N/A

ST : No

LT : Yes

Unethical

Harm ST : No ST : Yes ST : No ST : N/A ST : No

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

caused by

this

action?

LT : Yes LT : Yes LT : Yes

LT : N/A

LT : Yes

Benefits if

action is

universali

zed?

No No No No No Unethical

Harm if

action is

universali

sed?

Yes Yes Yes Yes Yes

Contradic

tion if

universali

sed?

Yes Yes Yes Yes Yes Unethical

Used as

means to

end,

violating

their

rights?

N/A Yes Yes Yes No Unethical

caused by

this

action?

LT : Yes LT : Yes LT : Yes

LT : N/A

LT : Yes

Benefits if

action is

universali

zed?

No No No No No Unethical

Harm if

action is

universali

sed?

Yes Yes Yes Yes Yes

Contradic

tion if

universali

sed?

Yes Yes Yes Yes Yes Unethical

Used as

means to

end,

violating

their

rights?

N/A Yes Yes Yes No Unethical

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Violating

rights,

seen as

unjust (to

powerless

), action

taker has

more

power?

N/A Yes Yes Yes N/A Unethical

Conclusion

Though AI will automate the process of decision making regarding health insurance, the

choice of decision still depends on the company itself. Things like collecting data of users

without their acknowledgement, breaching consumer trust over insurance policy are some of the

important ethical issue that needs to be considered for developing an ethical and effective

integration of artificial intelligence in insurance industry for providing faster and fraud free

insurance policy.

Violating

rights,

seen as

unjust (to

powerless

), action

taker has

more

power?

N/A Yes Yes Yes N/A Unethical

Conclusion

Though AI will automate the process of decision making regarding health insurance, the

choice of decision still depends on the company itself. Things like collecting data of users

without their acknowledgement, breaching consumer trust over insurance policy are some of the

important ethical issue that needs to be considered for developing an ethical and effective

integration of artificial intelligence in insurance industry for providing faster and fraud free

insurance policy.

8MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

References

Abrahám, A., de Sousa, J.B., Marimon, R. and Mayr, L., 2017. On the design of a European

unemployment insurance mechanism. Draft, European University Institute, Florence.

Adem, A. and Dağdeviren, M., 2016. A life insurance policy selection via hesitant fuzzy

linguistic decision making model. Procedia Computer Science, 102, pp.398-405.

Alabi, A.N., Onuoha, F.M., Madaki, A.J., Nwajei, A.I., Uwakwem, A.C. and Alabi, K.M., 2017.

Enrolees Perception of the Merits and Demerits of National Health Insurance Scheme in a

Nigerian Tertiary Health Facility.

Balasubramanian, R., Libarikian, A. and McElhaney, D., 2018. Insurance 2030—The impact of

AI on the future of insurance. McKinsey & Company, New York, NY, USA, Apr.

Bauer, M., Glenn, T., Monteith, S., Bauer, R., Whybrow, P.C. and Geddes, J.,. Ethical

perspectives on recommending digital technology for patients with mental illness. International

journal of bipolar disorders, 5(1), (2017), p.6.

Berendt, B., Büchler, M. and Rockwell, G., 2015. Is it research or is it spying? Thinking-through

ethics in Big Data AI and other knowledge sciences. KI-Künstliche Intelligenz, 29(2), pp.223-

232.

Brundage, M. and Bryson, J., 2016. Smart Policies for Artificial Intelligence. arXiv preprint

arXiv:1608.08196.

Crigger, E. and Khoury, C., 2019. Making policy on augmented intelligence in health care. AMA

journal of ethics, 21(2), pp.188-191.

Goolsbee, A., 2018. Public policy in an AI economy (No. w24653). National Bureau of

Economic Research.

References

Abrahám, A., de Sousa, J.B., Marimon, R. and Mayr, L., 2017. On the design of a European

unemployment insurance mechanism. Draft, European University Institute, Florence.

Adem, A. and Dağdeviren, M., 2016. A life insurance policy selection via hesitant fuzzy

linguistic decision making model. Procedia Computer Science, 102, pp.398-405.

Alabi, A.N., Onuoha, F.M., Madaki, A.J., Nwajei, A.I., Uwakwem, A.C. and Alabi, K.M., 2017.

Enrolees Perception of the Merits and Demerits of National Health Insurance Scheme in a

Nigerian Tertiary Health Facility.

Balasubramanian, R., Libarikian, A. and McElhaney, D., 2018. Insurance 2030—The impact of

AI on the future of insurance. McKinsey & Company, New York, NY, USA, Apr.

Bauer, M., Glenn, T., Monteith, S., Bauer, R., Whybrow, P.C. and Geddes, J.,. Ethical

perspectives on recommending digital technology for patients with mental illness. International

journal of bipolar disorders, 5(1), (2017), p.6.

Berendt, B., Büchler, M. and Rockwell, G., 2015. Is it research or is it spying? Thinking-through

ethics in Big Data AI and other knowledge sciences. KI-Künstliche Intelligenz, 29(2), pp.223-

232.

Brundage, M. and Bryson, J., 2016. Smart Policies for Artificial Intelligence. arXiv preprint

arXiv:1608.08196.

Crigger, E. and Khoury, C., 2019. Making policy on augmented intelligence in health care. AMA

journal of ethics, 21(2), pp.188-191.

Goolsbee, A., 2018. Public policy in an AI economy (No. w24653). National Bureau of

Economic Research.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

Iyengar, A., Kundu, A. and Pallis, G.,. Healthcare Informatics and Privacy. IEEE Internet

Computing, 22(2), (2018), pp.29-31.

Jaremko, J.L., Azar, M., Bromwich, R., Lum, A., Cheong, L.H.A., Gibert, M., Laviolette, F.,

Gray, B., Reinhold, C., Cicero, M. and Chong, J., 2019. Canadian Association of Radiologists

White Paper on Ethical and Legal Issues Related to Artificial Intelligence in

Radiology. Canadian Association of Radiologists Journal.

Jing, L., Zhao, W., Sharma, K. and Feng, R., 2018, January. Research on Probability-based

Learning Application on Car Insurance Data. In 2017 4th International Conference on

Machinery, Materials and Computer (MACMC 2017). Atlantis Press.

Kang, S. and Song, J., 2018. Feature selection for continuous aggregate response and its

application to auto insurance data. Expert Systems with Applications, 93, pp.104-117.

Lamberton, C., Brigo, D. and Hoy, D., 2017. Impact of Robotics, RPA and AI on the insurance

industry: challenges and opportunities. Journal of Financial Perspectives, 4(1).

Montag, C. and Elhai, J.D., 2019. A new agenda for personality psychology in the digital

age?. Personality and Individual Differences, 147, pp.128-134.

Mousa, A.S., Pinheiro, D. and Pinto, A.A., 2016. Optimal life-insurance selection and purchase

within a market of several life-insurance providers. Insurance: Mathematics and Economics, 67,

pp.133-141.

Nakano, Y., 2016. On a law of large numbers for insurance risks. arXiv preprint

arXiv:1601.03171.

O'sullivan, S., Nevejans, N., Allen, C., Blyth, A., Leonard, S., Pagallo, U., Holzinger, K.,

Holzinger, A., Sajid, M.I. and Ashrafian, H., 2019. Legal, regulatory, and ethical frameworks for

Iyengar, A., Kundu, A. and Pallis, G.,. Healthcare Informatics and Privacy. IEEE Internet

Computing, 22(2), (2018), pp.29-31.

Jaremko, J.L., Azar, M., Bromwich, R., Lum, A., Cheong, L.H.A., Gibert, M., Laviolette, F.,

Gray, B., Reinhold, C., Cicero, M. and Chong, J., 2019. Canadian Association of Radiologists

White Paper on Ethical and Legal Issues Related to Artificial Intelligence in

Radiology. Canadian Association of Radiologists Journal.

Jing, L., Zhao, W., Sharma, K. and Feng, R., 2018, January. Research on Probability-based

Learning Application on Car Insurance Data. In 2017 4th International Conference on

Machinery, Materials and Computer (MACMC 2017). Atlantis Press.

Kang, S. and Song, J., 2018. Feature selection for continuous aggregate response and its

application to auto insurance data. Expert Systems with Applications, 93, pp.104-117.

Lamberton, C., Brigo, D. and Hoy, D., 2017. Impact of Robotics, RPA and AI on the insurance

industry: challenges and opportunities. Journal of Financial Perspectives, 4(1).

Montag, C. and Elhai, J.D., 2019. A new agenda for personality psychology in the digital

age?. Personality and Individual Differences, 147, pp.128-134.

Mousa, A.S., Pinheiro, D. and Pinto, A.A., 2016. Optimal life-insurance selection and purchase

within a market of several life-insurance providers. Insurance: Mathematics and Economics, 67,

pp.133-141.

Nakano, Y., 2016. On a law of large numbers for insurance risks. arXiv preprint

arXiv:1601.03171.

O'sullivan, S., Nevejans, N., Allen, C., Blyth, A., Leonard, S., Pagallo, U., Holzinger, K.,

Holzinger, A., Sajid, M.I. and Ashrafian, H., 2019. Legal, regulatory, and ethical frameworks for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MORAL DILEMMA ANALYSIS OF AI APPLICATION IN INSURANCE

development of standards in artificial intelligence (AI) and autonomous robotic surgery. The

International Journal of Medical Robotics and Computer Assisted Surgery, 15(1), p.e1968.

Pesapane, F., Volonté, C., Codari, M. and Sardanelli, F., 2018. Artificial intelligence as a

medical device in radiology: ethical and regulatory issues in Europe and the United

States. Insights into imaging, 9(5), pp.745-753.

Ruß, J., 2018. Asymmetric Information in Secondary Insurance Markets: Evidence from the Life

Settlement Market.

development of standards in artificial intelligence (AI) and autonomous robotic surgery. The

International Journal of Medical Robotics and Computer Assisted Surgery, 15(1), p.e1968.

Pesapane, F., Volonté, C., Codari, M. and Sardanelli, F., 2018. Artificial intelligence as a

medical device in radiology: ethical and regulatory issues in Europe and the United

States. Insights into imaging, 9(5), pp.745-753.

Ruß, J., 2018. Asymmetric Information in Secondary Insurance Markets: Evidence from the Life

Settlement Market.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.