Individual Tax Return 2018

VerifiedAdded on 2023/04/11

|6

|1958

|265

AI Summary

This document is an individual tax return for the year 2018. It includes information about the taxpayer's income, deductions, tax payable, and estimated tax refund. The taxpayer's name is Mr Horacio Paz Senra and their tax file number is 984 732 166. The taxable income is 88,568 and the tax payable on taxable income is 28,855.16. The estimated tax refund is 91.84.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

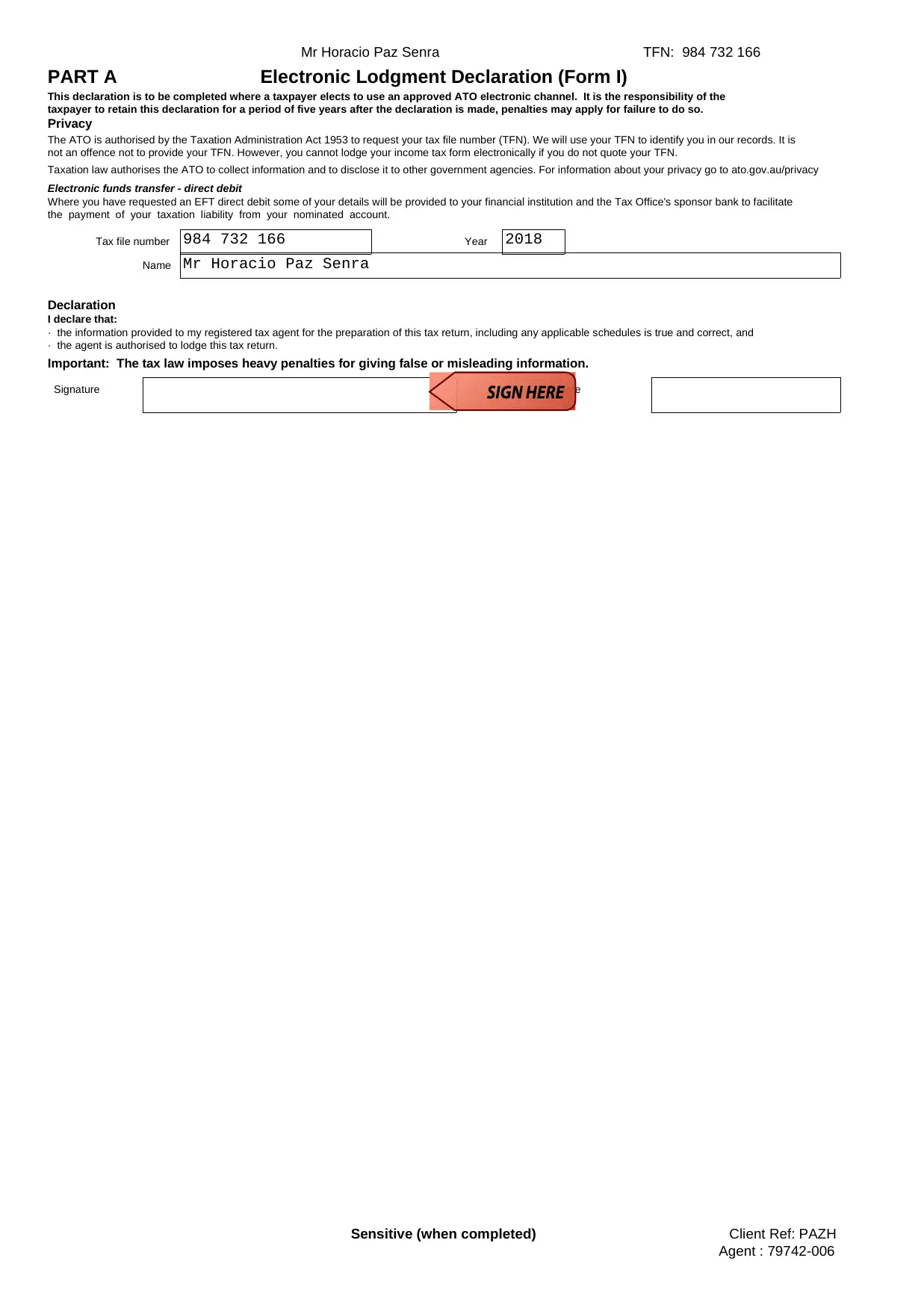

Mr Horacio Paz Senra TFN: 984 732 166

Important: The tax law imposes heavy penalties for giving false or misleading information.

· the agent is authorised to lodge this tax return.

· the information provided to my registered tax agent for the preparation of this tax return, including any applicable schedules is true and correct, and

Declaration

the payment of your taxation liability from your nominated account.

Where you have requested an EFT direct debit some of your details will be provided to your financial institution and the Tax Office's sponsor bank to facilitate

Electronic funds transfer - direct debit

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy go to ato.gov.au/privacy

not an offence not to provide your TFN. However, you cannot lodge your income tax form electronically if you do not quote your TFN.

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you in our records. It is

Privacy

This declaration is to be completed where a taxpayer elects to use an approved ATO electronic channel. It is the responsibility of the

taxpayer to retain this declaration for a period of five years after the declaration is made, penalties may apply for failure to do so.

PART A

Date

I declare that:

YearTax file number

Name

Signature

Electronic Lodgment Declaration (Form I)

984 732 166 2018

Mr Horacio Paz Senra

Sensitive (when completed) Client Ref: PAZH

Agent : 79742-006

Important: The tax law imposes heavy penalties for giving false or misleading information.

· the agent is authorised to lodge this tax return.

· the information provided to my registered tax agent for the preparation of this tax return, including any applicable schedules is true and correct, and

Declaration

the payment of your taxation liability from your nominated account.

Where you have requested an EFT direct debit some of your details will be provided to your financial institution and the Tax Office's sponsor bank to facilitate

Electronic funds transfer - direct debit

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy go to ato.gov.au/privacy

not an offence not to provide your TFN. However, you cannot lodge your income tax form electronically if you do not quote your TFN.

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you in our records. It is

Privacy

This declaration is to be completed where a taxpayer elects to use an approved ATO electronic channel. It is the responsibility of the

taxpayer to retain this declaration for a period of five years after the declaration is made, penalties may apply for failure to do so.

PART A

Date

I declare that:

YearTax file number

Name

Signature

Electronic Lodgment Declaration (Form I)

984 732 166 2018

Mr Horacio Paz Senra

Sensitive (when completed) Client Ref: PAZH

Agent : 79742-006

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

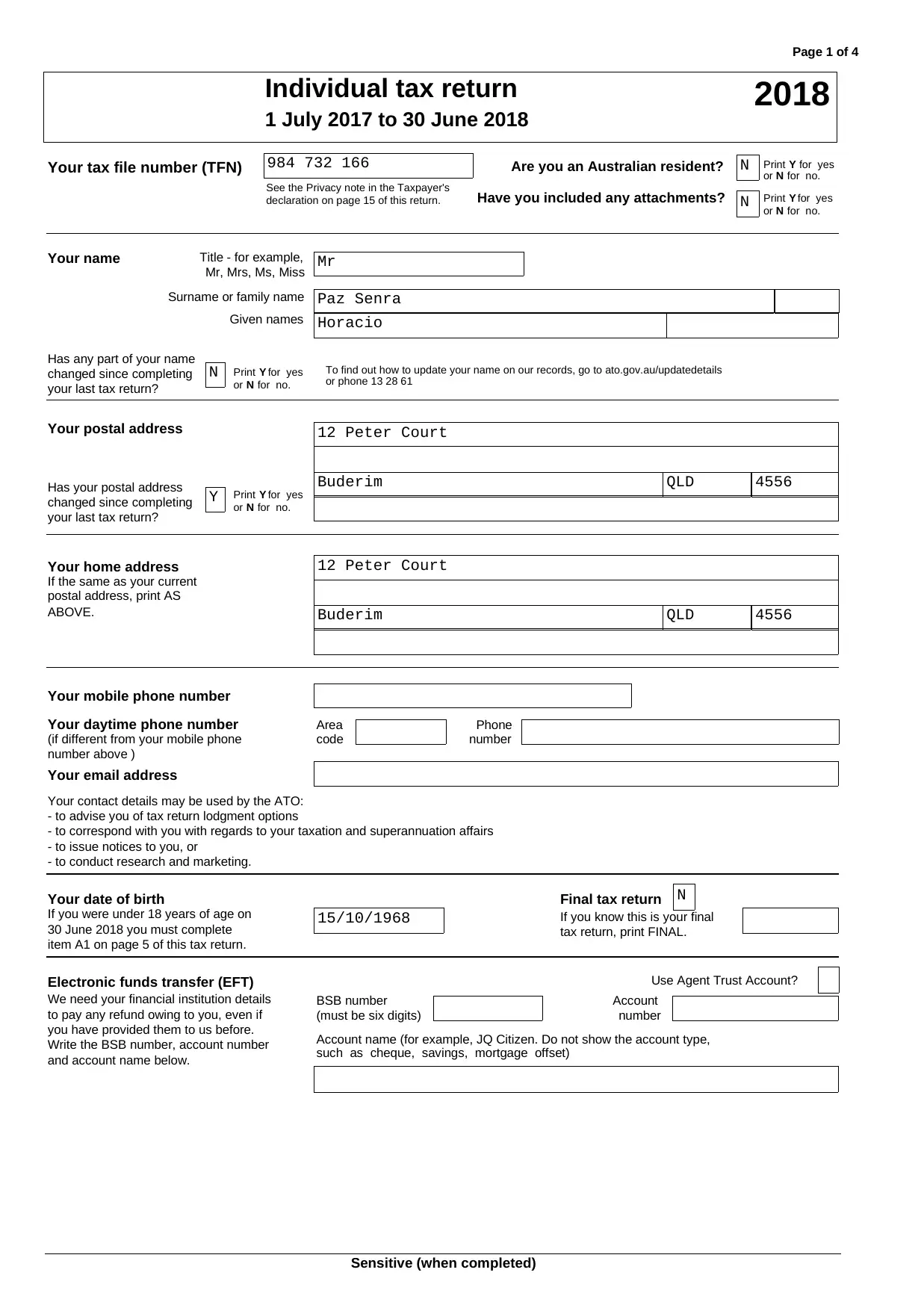

Page 1 of 4

2018

declaration on page 15 of this return.

See the Privacy note in the Taxpayer's

Given names

Surname or family name

Mr, Mrs, Ms, Miss

Title - for example,Your name

Y for yesPrintYour tax file number (TFN)

for no.Nor

for yesYPrintHave you included any attachments?

for no.Nor

Are you an Australian resident?

1 July 2017 to 30 June 2018

Individual tax return

Horacio

Paz Senra

Mr

984 732 166

N

N

or phone 13 28 61

To find out how to update your name on our records, go to ato.gov.au/updatedetails

for no.Nor

for yesYPrint

your last tax return?

changed since completing

Has any part of your name

N

Print

for no.Nor

for yesY

your last tax return?

changed since completing

Has your postal address

Your postal address

4556QLDBuderim

12 Peter Court

Y

ABOVE.

postal address, print AS

If the same as your current

Your home address

4556QLDBuderim

12 Peter Court

- to conduct research and marketing.

- to issue notices to you, or

- to correspond with you with regards to your taxation and superannuation affairs

- to advise you of tax return lodgment options

Your contact details may be used by the ATO:

Your email address

Your mobile phone number

number above )

(if different from your mobile phone numbercode

Your daytime phone number PhoneArea

tax return, print FINAL.

item A1 on page 5 of this tax return.

If you know this is your finalIf you were under 18 years of age on

Final tax returnYour date of birth

30 June 2018 you must complete

N

15/10/1968

and account name below.

Write the BSB number, account number

number

such as cheque, savings, mortgage offset)

you have provided them to us before.

(must be six digits)

Use Agent Trust Account?

Account name (for example, JQ Citizen. Do not show the account type,

AccountBSB number

to pay any refund owing to you, even if

Electronic funds transfer (EFT)

We need your financial institution details

Sensitive (when completed)

2018

declaration on page 15 of this return.

See the Privacy note in the Taxpayer's

Given names

Surname or family name

Mr, Mrs, Ms, Miss

Title - for example,Your name

Y for yesPrintYour tax file number (TFN)

for no.Nor

for yesYPrintHave you included any attachments?

for no.Nor

Are you an Australian resident?

1 July 2017 to 30 June 2018

Individual tax return

Horacio

Paz Senra

Mr

984 732 166

N

N

or phone 13 28 61

To find out how to update your name on our records, go to ato.gov.au/updatedetails

for no.Nor

for yesYPrint

your last tax return?

changed since completing

Has any part of your name

N

for no.Nor

for yesY

your last tax return?

changed since completing

Has your postal address

Your postal address

4556QLDBuderim

12 Peter Court

Y

ABOVE.

postal address, print AS

If the same as your current

Your home address

4556QLDBuderim

12 Peter Court

- to conduct research and marketing.

- to issue notices to you, or

- to correspond with you with regards to your taxation and superannuation affairs

- to advise you of tax return lodgment options

Your contact details may be used by the ATO:

Your email address

Your mobile phone number

number above )

(if different from your mobile phone numbercode

Your daytime phone number PhoneArea

tax return, print FINAL.

item A1 on page 5 of this tax return.

If you know this is your finalIf you were under 18 years of age on

Final tax returnYour date of birth

30 June 2018 you must complete

N

15/10/1968

and account name below.

Write the BSB number, account number

number

such as cheque, savings, mortgage offset)

you have provided them to us before.

(must be six digits)

Use Agent Trust Account?

Account name (for example, JQ Citizen. Do not show the account type,

AccountBSB number

to pay any refund owing to you, even if

Electronic funds transfer (EFT)

We need your financial institution details

Sensitive (when completed)

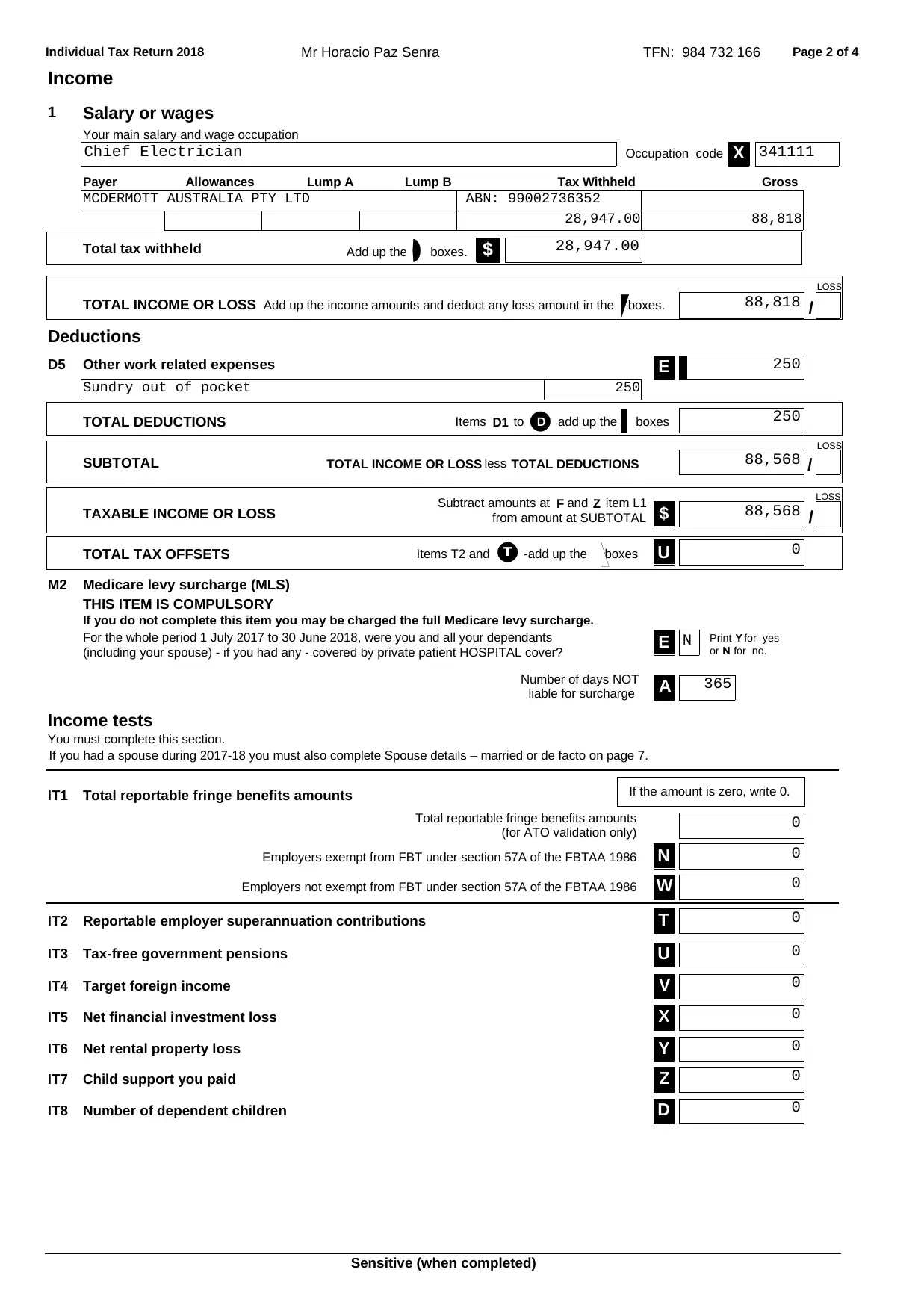

Page 2 of 4Individual Tax Return 2018 Mr Horacio Paz Senra TFN: 984 732 166

Income

Occupation code X

Your main salary and wage occupation

Salary or wages1

341111Chief Electrician

Payer Allowances Lump A Lump B Tax Withheld Gross

MCDERMOTT AUSTRALIA PTY LTD ABN: 99002736352

28,947.00 88,818

$boxes.Add up theTotal tax withheld 28,947.00

LOSS

/Add up the income amounts and deduct any loss amount in the boxes.TOTAL INCOME OR LOSS 88,818

Deductions

D5 EOther work related expenses 250

Sundry out of pocket 250

boxesadd up thetoD1ItemsTOTAL DEDUCTIONS D 250

LOSS

/TOTAL DEDUCTIONSlessTOTAL INCOME OR LOSSSUBTOTAL 88,568

from amount at SUBTOTAL

item L1and ZF LOSS

/$

Subtract amounts at

TAXABLE INCOME OR LOSS 88,568

U-add up the boxesItems T2 andTOTAL TAX OFFSETS T 0

Medicare levy surcharge (MLS)

(including your spouse) - if you had any - covered by private patient HOSPITAL cover?

liable for surcharge

Number of days NOT A

for no.Nor

for yesYPrint

E

If you do not complete this item you may be charged the full Medicare levy surcharge.

THIS ITEM IS COMPULSORY

M2

For the whole period 1 July 2017 to 30 June 2018, were you and all your dependants

365

N

(for ATO validation only)

Total reportable fringe benefits amounts

Employers not exempt from FBT under section 57A of the FBTAA 1986

Employers exempt from FBT under section 57A of the FBTAA 1986

W

If the amount is zero, write 0.

TReportable employer superannuation contributionsIT2

If you had a spouse during 2017-18 you must also complete Spouse details – married or de facto on page 7.

You must complete this section.

Income tests

N

Total reportable fringe benefits amountsIT1

0

0

0

0

Tax-free government pensions UIT3 0

Target foreign income VIT4 0

XNet financial investment lossIT5 0

YNet rental property lossIT6 0

Child support you paid ZIT7 0

Number of dependent children DIT8 0

Sensitive (when completed)

Income

Occupation code X

Your main salary and wage occupation

Salary or wages1

341111Chief Electrician

Payer Allowances Lump A Lump B Tax Withheld Gross

MCDERMOTT AUSTRALIA PTY LTD ABN: 99002736352

28,947.00 88,818

$boxes.Add up theTotal tax withheld 28,947.00

LOSS

/Add up the income amounts and deduct any loss amount in the boxes.TOTAL INCOME OR LOSS 88,818

Deductions

D5 EOther work related expenses 250

Sundry out of pocket 250

boxesadd up thetoD1ItemsTOTAL DEDUCTIONS D 250

LOSS

/TOTAL DEDUCTIONSlessTOTAL INCOME OR LOSSSUBTOTAL 88,568

from amount at SUBTOTAL

item L1and ZF LOSS

/$

Subtract amounts at

TAXABLE INCOME OR LOSS 88,568

U-add up the boxesItems T2 andTOTAL TAX OFFSETS T 0

Medicare levy surcharge (MLS)

(including your spouse) - if you had any - covered by private patient HOSPITAL cover?

liable for surcharge

Number of days NOT A

for no.Nor

for yesYPrint

E

If you do not complete this item you may be charged the full Medicare levy surcharge.

THIS ITEM IS COMPULSORY

M2

For the whole period 1 July 2017 to 30 June 2018, were you and all your dependants

365

N

(for ATO validation only)

Total reportable fringe benefits amounts

Employers not exempt from FBT under section 57A of the FBTAA 1986

Employers exempt from FBT under section 57A of the FBTAA 1986

W

If the amount is zero, write 0.

TReportable employer superannuation contributionsIT2

If you had a spouse during 2017-18 you must also complete Spouse details – married or de facto on page 7.

You must complete this section.

Income tests

N

Total reportable fringe benefits amountsIT1

0

0

0

0

Tax-free government pensions UIT3 0

Target foreign income VIT4 0

XNet financial investment lossIT5 0

YNet rental property lossIT6 0

Child support you paid ZIT7 0

Number of dependent children DIT8 0

Sensitive (when completed)

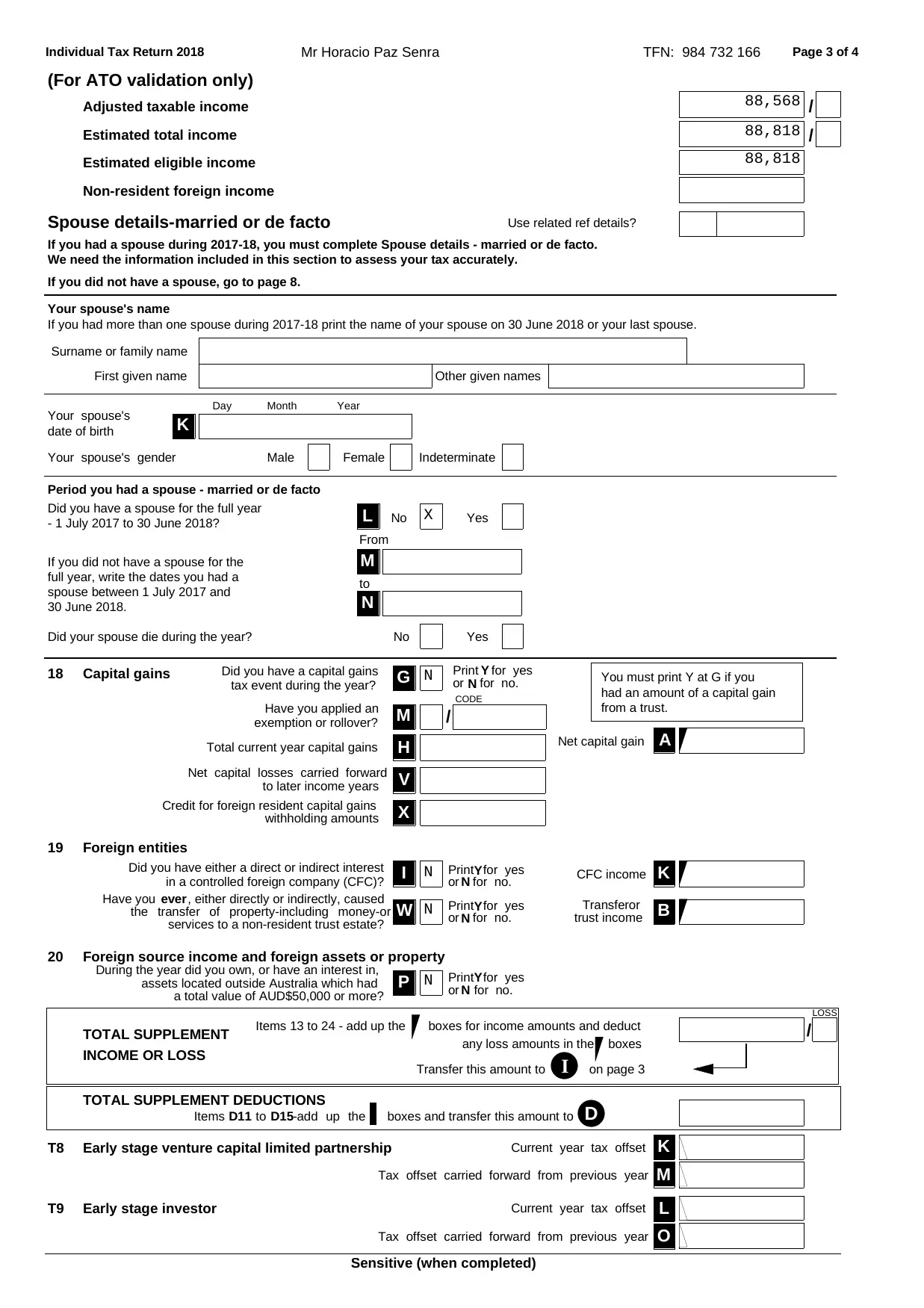

Page 3 of 4Individual Tax Return 2018 Mr Horacio Paz Senra TFN: 984 732 166

Non-resident foreign income

/

(For ATO validation only)

/

Estimated eligible income

Estimated total income

Adjusted taxable income 88,568

88,818

88,818

Indeterminate

30 June 2018.

No YesDid your spouse die during the year?

YesNo- 1 July 2017 to 30 June 2018?

Did you have a spouse for the full year

If you had more than one spouse during 2017-18 print the name of your spouse on 30 June 2018 or your last spouse.

Your spouse's name

If you did not have a spouse, go to page 8.

Your spouse's gender

Period you had a spouse - married or de facto

K

FemaleMale

date of birth

Your spouse's YearMonthDay

Other given names

Surname or family name

First given name

We need the information included in this section to assess your tax accurately.

If you had a spouse during 2017-18, you must complete Spouse details - married or de facto.

Use related ref details?

From

to

N

spouse between 1 July 2017 and

full year, write the dates you had a

MIf you did not have a spouse for the

L

Spouse details-married or de facto

X

Xwithholding amounts

Credit for foreign resident capital gains

/

CODE

exemption or rollover? MHave you applied an from a trust.

tax event during the year?

A

V

H

G

Net capital gain

had an amount of a capital gain

You must print Y at G if you

Total current year capital gains

to later income years

Net capital losses carried forward

Did you have a capital gains for no.Nor

for yesYPrintCapital gains18 N

K

BW

Iin a controlled foreign company (CFC)?

Did you have either a direct or indirect interest

trust income

Transferor

services to a non-resident trust estate?

the transfer of property-including money-or

, either directly or indirectly, causedeverHave you

for no.Nor for yesYPrint

CFC income

for no.Nor for yesYPrint

Foreign entities19

N

N

P

a total value of AUD$50,000 or more?

assets located outside Australia which had

During the year did you own, or have an interest in,

for no.Nor for yesYPrint

Foreign source income and foreign assets or property20

N

boxes for income amounts and deduct

LOSS

Transfer this amount to

/

any loss amounts in the boxes

Items 13 to 24 - add up the

on page 3

INCOME OR LOSS

TOTAL SUPPLEMENT

I

boxes and transfer this amount to-add up theD15toD11Items

TOTAL SUPPLEMENT DEDUCTIONS

D

Tax offset carried forward from previous year

Current year tax offset

M

KEarly stage venture capital limited partnershipT8

OTax offset carried forward from previous year

Current year tax offset LEarly stage investorT9

Sensitive (when completed)

Non-resident foreign income

/

(For ATO validation only)

/

Estimated eligible income

Estimated total income

Adjusted taxable income 88,568

88,818

88,818

Indeterminate

30 June 2018.

No YesDid your spouse die during the year?

YesNo- 1 July 2017 to 30 June 2018?

Did you have a spouse for the full year

If you had more than one spouse during 2017-18 print the name of your spouse on 30 June 2018 or your last spouse.

Your spouse's name

If you did not have a spouse, go to page 8.

Your spouse's gender

Period you had a spouse - married or de facto

K

FemaleMale

date of birth

Your spouse's YearMonthDay

Other given names

Surname or family name

First given name

We need the information included in this section to assess your tax accurately.

If you had a spouse during 2017-18, you must complete Spouse details - married or de facto.

Use related ref details?

From

to

N

spouse between 1 July 2017 and

full year, write the dates you had a

MIf you did not have a spouse for the

L

Spouse details-married or de facto

X

Xwithholding amounts

Credit for foreign resident capital gains

/

CODE

exemption or rollover? MHave you applied an from a trust.

tax event during the year?

A

V

H

G

Net capital gain

had an amount of a capital gain

You must print Y at G if you

Total current year capital gains

to later income years

Net capital losses carried forward

Did you have a capital gains for no.Nor

for yesYPrintCapital gains18 N

K

BW

Iin a controlled foreign company (CFC)?

Did you have either a direct or indirect interest

trust income

Transferor

services to a non-resident trust estate?

the transfer of property-including money-or

, either directly or indirectly, causedeverHave you

for no.Nor for yesYPrint

CFC income

for no.Nor for yesYPrint

Foreign entities19

N

N

P

a total value of AUD$50,000 or more?

assets located outside Australia which had

During the year did you own, or have an interest in,

for no.Nor for yesYPrint

Foreign source income and foreign assets or property20

N

boxes for income amounts and deduct

LOSS

Transfer this amount to

/

any loss amounts in the boxes

Items 13 to 24 - add up the

on page 3

INCOME OR LOSS

TOTAL SUPPLEMENT

I

boxes and transfer this amount to-add up theD15toD11Items

TOTAL SUPPLEMENT DEDUCTIONS

D

Tax offset carried forward from previous year

Current year tax offset

M

KEarly stage venture capital limited partnershipT8

OTax offset carried forward from previous year

Current year tax offset LEarly stage investorT9

Sensitive (when completed)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

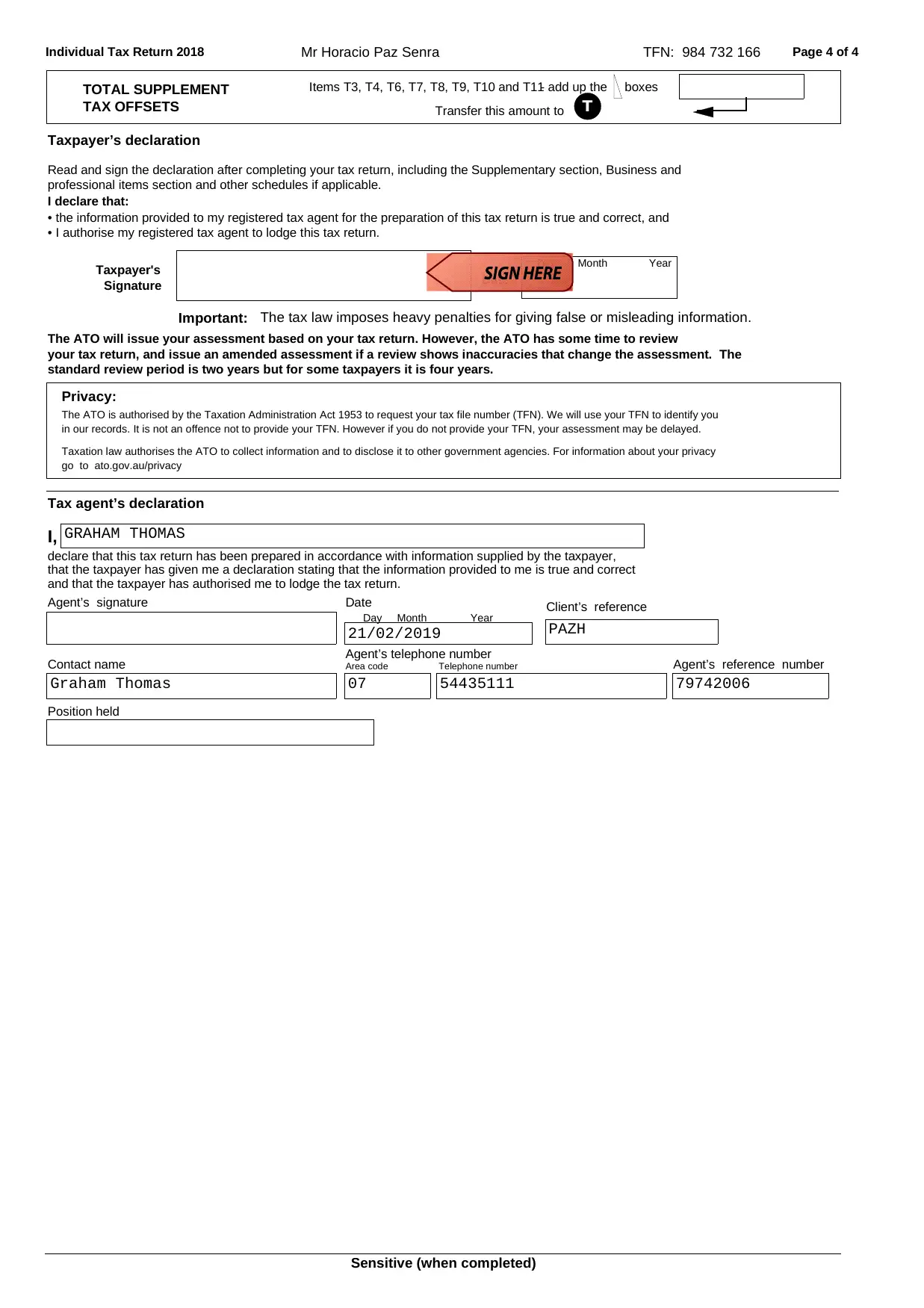

Page 4 of 4Individual Tax Return 2018 Mr Horacio Paz Senra TFN: 984 732 166

Transfer this amount to

- add up the boxesItems T3, T4, T6, T7, T8, T9, T10 and T11

TAX OFFSETS

TOTAL SUPPLEMENT

T

Position held

standard review period is two years but for some taxpayers it is four years.

your tax return, and issue an amended assessment if a review shows inaccuracies that change the assessment. The

The ATO will issue your assessment based on your tax return. However, the ATO has some time to review

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

go to ato.gov.au/privacy

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy

Privacy:

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

Taxpayer's

• I authorise my registered tax agent to lodge this tax return.

YearMonthDay

DateSignature

The tax law imposes heavy penalties for giving false or misleading information.Important:

I,

• the information provided to my registered tax agent for the preparation of this tax return is true and correct, and

I declare that:

professional items section and other schedules if applicable.

Read and sign the declaration after completing your tax return, including the Supplementary section, Business and

Taxpayer’s declaration

YearDay Month

Telephone numberArea code

Date Client’s referenceAgent’s signature

Agent’s reference number

Agent’s telephone number

Contact name

and that the taxpayer has authorised me to lodge the tax return.

that the taxpayer has given me a declaration stating that the information provided to me is true and correct

declare that this tax return has been prepared in accordance with information supplied by the taxpayer,

Tax agent’s declaration

21/02/2019

5443511107 79742006Graham Thomas

GRAHAM THOMAS

PAZH

Sensitive (when completed)

Transfer this amount to

- add up the boxesItems T3, T4, T6, T7, T8, T9, T10 and T11

TAX OFFSETS

TOTAL SUPPLEMENT

T

Position held

standard review period is two years but for some taxpayers it is four years.

your tax return, and issue an amended assessment if a review shows inaccuracies that change the assessment. The

The ATO will issue your assessment based on your tax return. However, the ATO has some time to review

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

go to ato.gov.au/privacy

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy

Privacy:

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

Taxpayer's

• I authorise my registered tax agent to lodge this tax return.

YearMonthDay

DateSignature

The tax law imposes heavy penalties for giving false or misleading information.Important:

I,

• the information provided to my registered tax agent for the preparation of this tax return is true and correct, and

I declare that:

professional items section and other schedules if applicable.

Read and sign the declaration after completing your tax return, including the Supplementary section, Business and

Taxpayer’s declaration

YearDay Month

Telephone numberArea code

Date Client’s referenceAgent’s signature

Agent’s reference number

Agent’s telephone number

Contact name

and that the taxpayer has authorised me to lodge the tax return.

that the taxpayer has given me a declaration stating that the information provided to me is true and correct

declare that this tax return has been prepared in accordance with information supplied by the taxpayer,

Tax agent’s declaration

21/02/2019

5443511107 79742006Graham Thomas

GRAHAM THOMAS

PAZH

Sensitive (when completed)

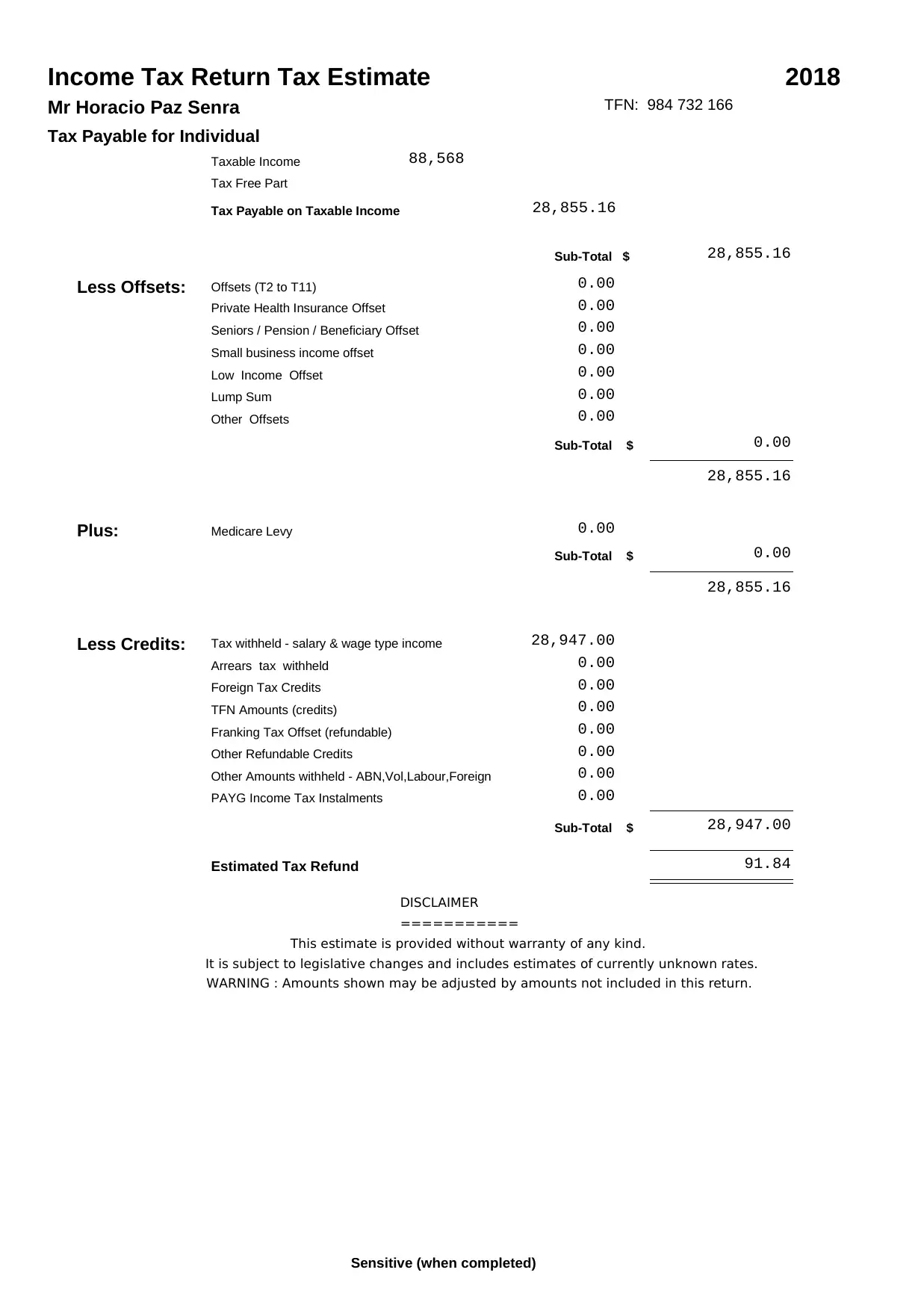

2018

TFN: 984 732 166Mr Horacio Paz Senra

Income Tax Return Tax Estimate

Sub-Total $

Tax Free Part

Tax Payable on Taxable Income

Taxable Income

Tax Payable for Individual

28,855.16

28,855.16

88,568

Small business income offset

Private Health Insurance Offset

Sub-Total $

Other Offsets

Lump Sum

Low Income Offset

Seniors / Pension / Beneficiary Offset

Offsets (T2 to T11)Less Offsets:

0.00

0.00

28,855.16

0.00

0.00

0.00

0.00

0.00

0.00

Sub-Total $

Medicare LevyPlus:

28,855.16

0.00

0.00

PAYG Income Tax Instalments

Other Amounts withheld - ABN,Vol,Labour,Foreign

Franking Tax Offset (refundable)

Estimated Tax Refund

Sub-Total $

Other Refundable Credits

Foreign Tax Credits

TFN Amounts (credits)

Arrears tax withheld

Tax withheld - salary & wage type incomeLess Credits:

0.00

0.00

0.00

91.84

28,947.00

0.00

0.00

0.00

0.00

28,947.00

DISCLAIMER

===========

This estimate is provided without warranty of any kind.

It is subject to legislative changes and includes estimates of currently unknown rates.

WARNING : Amounts shown may be adjusted by amounts not included in this return.

Sensitive (when completed)

TFN: 984 732 166Mr Horacio Paz Senra

Income Tax Return Tax Estimate

Sub-Total $

Tax Free Part

Tax Payable on Taxable Income

Taxable Income

Tax Payable for Individual

28,855.16

28,855.16

88,568

Small business income offset

Private Health Insurance Offset

Sub-Total $

Other Offsets

Lump Sum

Low Income Offset

Seniors / Pension / Beneficiary Offset

Offsets (T2 to T11)Less Offsets:

0.00

0.00

28,855.16

0.00

0.00

0.00

0.00

0.00

0.00

Sub-Total $

Medicare LevyPlus:

28,855.16

0.00

0.00

PAYG Income Tax Instalments

Other Amounts withheld - ABN,Vol,Labour,Foreign

Franking Tax Offset (refundable)

Estimated Tax Refund

Sub-Total $

Other Refundable Credits

Foreign Tax Credits

TFN Amounts (credits)

Arrears tax withheld

Tax withheld - salary & wage type incomeLess Credits:

0.00

0.00

0.00

91.84

28,947.00

0.00

0.00

0.00

0.00

28,947.00

DISCLAIMER

===========

This estimate is provided without warranty of any kind.

It is subject to legislative changes and includes estimates of currently unknown rates.

WARNING : Amounts shown may be adjusted by amounts not included in this return.

Sensitive (when completed)

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.