Audit and Assurance: Risk Assessment, Planning, and Execution

VerifiedAdded on 2019/10/30

|7

|2386

|55

Report

AI Summary

This report provides a comprehensive overview of audit and assurance, delving into its fundamental concepts and significance in financial reporting. It examines the ethical requirements for auditors, emphasizing integrity, confidentiality, objectivity, professional competence, and behavior. The report analyzes risk assessment, audit planning, execution, and the formulation of opinions. It discusses the content necessary for providing assurance and audit services, including general ledgers, trial balances, payroll reports, and minutes of board meetings. The report also highlights weaknesses in internal control procedures, such as electronic security and monitoring controls, and explores the role of audit-related technologies and tools like audit enquiry, management representation, and audit sampling. The conclusion underscores the critical role of auditing and the essential tools required for accurate financial reporting.

Name:

Student Number:

Resident Campus:

Assessment Title:

Lecturer Name:

Submitted On:

Sources:

Student Number:

Resident Campus:

Assessment Title:

Lecturer Name:

Submitted On:

Sources:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

In this assignment we are going to discuss in detail the concept of audit and its technologies and

about the assurance. Audit means the inspection of the record of an organization about its

financial or non financial transactions by a qualified team or an individual accountant. Audit is

important for an organization because if the firms do not conduct an audit then it will not be able

to produce correct financial reports for its employees and clients or for potential buyers (Joey

2014). Now if talk about assurance then it is a process or a service that is provided to firm by a

certified accountant (C L 2017). In assurance service the chartered accountant provides financial

information to the organization through which the firm makes better decisions. This information

provided by the accountant helps the firm to access the risk that are on the way of the firm and

the firm then avoid these risks by planning against them. Hence assurance is a service provided

by a certified accountant in order to let firm know what risks they might face in the coming

future.

Critical Analysis

A) This part of the assignment contains deep discussion about the audit and assurance.

Ethics play an important role whether in a business or in any other profession. Ethics

means a belief of understanding that what is wrong and what is right, ethics are the moral

standards, moral principles of a person. There is a very important role of ethics in

auditing and assurance, No single activity or profession can work without ethics. In the

business world business ethics are everything, they are the moral structure of the

organization that how the business entity will deal with its client, suppliers etc. Ethics are

put into things to make the things more transparent and genuine (Ajay 2013). When an

organization wants to conduct auditing and assurance activities, they take the services of

the certified chartered accountants, and these accountants then are required to prepare and

submit their audit or assurance report with full honesty by keeping in mind their ethics.

The ethical requirements in completing and submitting the audit and assurance report are

as following (Accountant 2017):

Integrity: An accountant must have the basic ethic of integrity. Integrity means being

honest towards something. The certified accountant do not hide, anything whether it may

result in a loss to the organization, he must disclose all the hidden and wrongly done

transactions of the organization, so that the firm can use this information in order to make

the operation of the business successful.

Confidentiality: This is the most important ethic that an accountant must have.

Confidentiality means keeping a secret. An accountant is a person that has all the

important and confidential financial information of a company. This information, if used

In this assignment we are going to discuss in detail the concept of audit and its technologies and

about the assurance. Audit means the inspection of the record of an organization about its

financial or non financial transactions by a qualified team or an individual accountant. Audit is

important for an organization because if the firms do not conduct an audit then it will not be able

to produce correct financial reports for its employees and clients or for potential buyers (Joey

2014). Now if talk about assurance then it is a process or a service that is provided to firm by a

certified accountant (C L 2017). In assurance service the chartered accountant provides financial

information to the organization through which the firm makes better decisions. This information

provided by the accountant helps the firm to access the risk that are on the way of the firm and

the firm then avoid these risks by planning against them. Hence assurance is a service provided

by a certified accountant in order to let firm know what risks they might face in the coming

future.

Critical Analysis

A) This part of the assignment contains deep discussion about the audit and assurance.

Ethics play an important role whether in a business or in any other profession. Ethics

means a belief of understanding that what is wrong and what is right, ethics are the moral

standards, moral principles of a person. There is a very important role of ethics in

auditing and assurance, No single activity or profession can work without ethics. In the

business world business ethics are everything, they are the moral structure of the

organization that how the business entity will deal with its client, suppliers etc. Ethics are

put into things to make the things more transparent and genuine (Ajay 2013). When an

organization wants to conduct auditing and assurance activities, they take the services of

the certified chartered accountants, and these accountants then are required to prepare and

submit their audit or assurance report with full honesty by keeping in mind their ethics.

The ethical requirements in completing and submitting the audit and assurance report are

as following (Accountant 2017):

Integrity: An accountant must have the basic ethic of integrity. Integrity means being

honest towards something. The certified accountant do not hide, anything whether it may

result in a loss to the organization, he must disclose all the hidden and wrongly done

transactions of the organization, so that the firm can use this information in order to make

the operation of the business successful.

Confidentiality: This is the most important ethic that an accountant must have.

Confidentiality means keeping a secret. An accountant is a person that has all the

important and confidential financial information of a company. This information, if used

wrongly can adversely affect the public image of the organization. An accountant must

keep the confidential information of the organization safe and secure and should respect

the ethical requirement of confidentiality and must not use this information for personal

benefits.

Objectivity: The meaning of objectivity is being impartial or unbiased. A certified

accountant must be unbiased towards the judgments. Any conflict of him with any

organization must not affect the objectivity of his auditing and assurance report.

Professional Competence: The responsibility of an accountant is to provide continuous

financial services to his clients. It is his ethical duty to be up to date in terms of having

knowledge about any new thing in accounts.

Professional Behavior: An accountant must always behave with his client in a

professional manner and must complies himself according to the laws and regulations

that are formed by the associations of the accountants.

Above are the ethical requirements and responsibilities that must be fulfilled before submitting

the audit and assurance report. An accountant with the understanding of all these ethical

requirements will always make sure that the client organization achieves favorable results and

the accountant will also help in assessing the risk and providing other useful information to the

client (Singhania 2009).

B) Now we will discuss about the purpose, content, format & methodologies that are

necessary to provide assurance and audit services especially in the areas of risk

assessment, audit planning, audit execution and formulations of opinions. The idea of risk

assessment in audit planning is not a new concept, it is two decades old. It is a process of

focusing on those parts of the organization that are most at risk of material misstatement.

Material misstatement refers to those statements that if entered wrong in the financial

information of the organization then it will affect the decision of the user of that financial

information (Karkol 2011). This is the reason why auditing in risk assessment is

important. An internal control system is a process in which it is ensures that the

organization is compiling up with all the laws and regulations and which keeps the

organization away from risks. If we now talk about the content that is necessary to

provide an assurance and audit service are, the general ledger, trail balance, copies of

loans, record of the purchase of fixed assets, depreciation schedule, payroll reports etc are

the content that is audited at the time of audit and assurance (Brian 2000).

General Ledger: General ledger or in simpler words the main accounts of the company,

the organization in this advance era of technology can use various accounting information

systems that will maintain their general ledger (Investopedia 2015), the general ledger

then can be sent to the auditor, this main account will let know the auditor that how much

to audit.

keep the confidential information of the organization safe and secure and should respect

the ethical requirement of confidentiality and must not use this information for personal

benefits.

Objectivity: The meaning of objectivity is being impartial or unbiased. A certified

accountant must be unbiased towards the judgments. Any conflict of him with any

organization must not affect the objectivity of his auditing and assurance report.

Professional Competence: The responsibility of an accountant is to provide continuous

financial services to his clients. It is his ethical duty to be up to date in terms of having

knowledge about any new thing in accounts.

Professional Behavior: An accountant must always behave with his client in a

professional manner and must complies himself according to the laws and regulations

that are formed by the associations of the accountants.

Above are the ethical requirements and responsibilities that must be fulfilled before submitting

the audit and assurance report. An accountant with the understanding of all these ethical

requirements will always make sure that the client organization achieves favorable results and

the accountant will also help in assessing the risk and providing other useful information to the

client (Singhania 2009).

B) Now we will discuss about the purpose, content, format & methodologies that are

necessary to provide assurance and audit services especially in the areas of risk

assessment, audit planning, audit execution and formulations of opinions. The idea of risk

assessment in audit planning is not a new concept, it is two decades old. It is a process of

focusing on those parts of the organization that are most at risk of material misstatement.

Material misstatement refers to those statements that if entered wrong in the financial

information of the organization then it will affect the decision of the user of that financial

information (Karkol 2011). This is the reason why auditing in risk assessment is

important. An internal control system is a process in which it is ensures that the

organization is compiling up with all the laws and regulations and which keeps the

organization away from risks. If we now talk about the content that is necessary to

provide an assurance and audit service are, the general ledger, trail balance, copies of

loans, record of the purchase of fixed assets, depreciation schedule, payroll reports etc are

the content that is audited at the time of audit and assurance (Brian 2000).

General Ledger: General ledger or in simpler words the main accounts of the company,

the organization in this advance era of technology can use various accounting information

systems that will maintain their general ledger (Investopedia 2015), the general ledger

then can be sent to the auditor, this main account will let know the auditor that how much

to audit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Trail Balance: A book showing all the debit and credit entries of the transactions of an

organization will be known as trail balance. Mostly it has been seen that auditors usually

likes to audit trail balances as it is an important key that shows any mismatching or fraud

or error in the financial report of the organization.

Payroll reports: Payroll reports are those reports which are prepared to record the

amount that is paid to the employees or to the workers of the firm. An audit will inspect

these records to see if there is any liability that is not paid or wrongly recorded.

Board meetings minutes: When an auditor conducts audit, he looks up for the board

meetings minutes as these meetings of board of directors contains information about the

financial condition of the organization (kallis 2003).

Purchase of fixed assets: When a new fixed asset is purchased by an organization, all

the details regarding it even its invoices should be given to the auditor so that he can

include it in the financial reports. This will show a true and a right condition of the

organization’s financial stand.

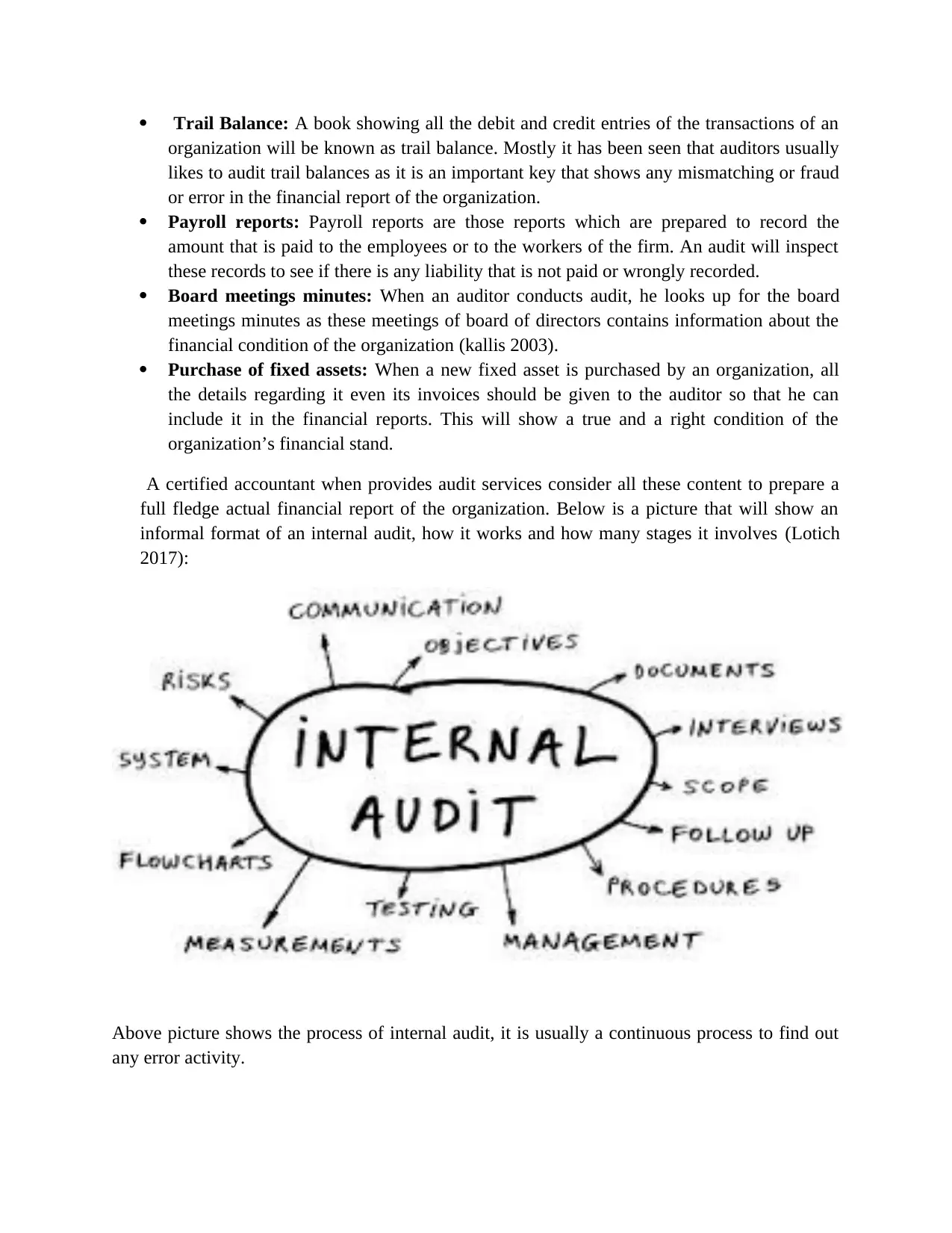

A certified accountant when provides audit services consider all these content to prepare a

full fledge actual financial report of the organization. Below is a picture that will show an

informal format of an internal audit, how it works and how many stages it involves (Lotich

2017):

Above picture shows the process of internal audit, it is usually a continuous process to find out

any error activity.

organization will be known as trail balance. Mostly it has been seen that auditors usually

likes to audit trail balances as it is an important key that shows any mismatching or fraud

or error in the financial report of the organization.

Payroll reports: Payroll reports are those reports which are prepared to record the

amount that is paid to the employees or to the workers of the firm. An audit will inspect

these records to see if there is any liability that is not paid or wrongly recorded.

Board meetings minutes: When an auditor conducts audit, he looks up for the board

meetings minutes as these meetings of board of directors contains information about the

financial condition of the organization (kallis 2003).

Purchase of fixed assets: When a new fixed asset is purchased by an organization, all

the details regarding it even its invoices should be given to the auditor so that he can

include it in the financial reports. This will show a true and a right condition of the

organization’s financial stand.

A certified accountant when provides audit services consider all these content to prepare a

full fledge actual financial report of the organization. Below is a picture that will show an

informal format of an internal audit, how it works and how many stages it involves (Lotich

2017):

Above picture shows the process of internal audit, it is usually a continuous process to find out

any error activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C) In section C of this assignment we will discuss the weakness that could or that occurs in

internal control procedures and potential risk factors. Below are few weaknesses that

occurs in internal control procedures (Canada 2004):

Electronic security controls: Electronic control systems if are not in adequate or proper

form then it can lead to unauthorized access by a person or any third party that might

steal or fill any discrepancies with the actual financial statement.

Monitoring controls: Monitoring controls means the control of the senior and the middle

management over the different activities and operations of the organization. Poor

monitoring controls will let the errors occur continuously, which will result in frauds and

errors to make a room for themselves in the accounts of the organization.

New financial systems: Many accounting firms are developing various new systems or

software of financial nature that helps the firm in recording analyzing different monetary

or non monetary transactions (Barbasor 2012). Sometimes the management is not that

much train to practice such systems properly, which results in the occurrence of errors,

which further leads to frauds and wrong recording of financial condition of the company.

Manual control: When financial or non financial data of the organization is checked

manually, the chances of errors increases as it the chances of un checking of few

transactions increases because of the confusion or fatigue, which is another weakness that

occurs in the internal control procedure.

D) Here we will discuss the role of audit related technologies or tools. Before we discuss

their role we will discuss different types of audit tools (Arif 2015):

Audit Enquiry: Enquiry is usually done by the auditor to enquire about previous records

or audits of the organization and these enquiries are generally helpful in other audit

procedures. In enquiry audit, the auditor gains information financial or non financial from

within or outside the firm.

Management Representation: Management representation is a conformational letter by

the organization to the auditor of the firm stating that the firm has provided the auditor

with all the true and clear information for the audit (Winston 2000).

Audit Sampling: Audit sampling is another tool that is used by the auditor in inspecting

the organization. In audit sampling the auditor applies the process to all the units under

100% in way that all the units have an equal chance of getting selected. There are

different methods of audit sampling, few of them are: 1) Haphazard sampling 2)

Stratified sampling 3) Systematic sampling 4) Block sampling

internal control procedures and potential risk factors. Below are few weaknesses that

occurs in internal control procedures (Canada 2004):

Electronic security controls: Electronic control systems if are not in adequate or proper

form then it can lead to unauthorized access by a person or any third party that might

steal or fill any discrepancies with the actual financial statement.

Monitoring controls: Monitoring controls means the control of the senior and the middle

management over the different activities and operations of the organization. Poor

monitoring controls will let the errors occur continuously, which will result in frauds and

errors to make a room for themselves in the accounts of the organization.

New financial systems: Many accounting firms are developing various new systems or

software of financial nature that helps the firm in recording analyzing different monetary

or non monetary transactions (Barbasor 2012). Sometimes the management is not that

much train to practice such systems properly, which results in the occurrence of errors,

which further leads to frauds and wrong recording of financial condition of the company.

Manual control: When financial or non financial data of the organization is checked

manually, the chances of errors increases as it the chances of un checking of few

transactions increases because of the confusion or fatigue, which is another weakness that

occurs in the internal control procedure.

D) Here we will discuss the role of audit related technologies or tools. Before we discuss

their role we will discuss different types of audit tools (Arif 2015):

Audit Enquiry: Enquiry is usually done by the auditor to enquire about previous records

or audits of the organization and these enquiries are generally helpful in other audit

procedures. In enquiry audit, the auditor gains information financial or non financial from

within or outside the firm.

Management Representation: Management representation is a conformational letter by

the organization to the auditor of the firm stating that the firm has provided the auditor

with all the true and clear information for the audit (Winston 2000).

Audit Sampling: Audit sampling is another tool that is used by the auditor in inspecting

the organization. In audit sampling the auditor applies the process to all the units under

100% in way that all the units have an equal chance of getting selected. There are

different methods of audit sampling, few of them are: 1) Haphazard sampling 2)

Stratified sampling 3) Systematic sampling 4) Block sampling

Above are few tools that are being used in the process of auditing, the role of these tools are

highly important in the process of auditing as without these tools an auditor will not be able to

perform the inspection (Trinton 2017). Audit is done to prepare a true and clear financial report

of an organization and in absence of these technologies or tools an organization and an auditor

can’t prepare any financial report of the firm (Gurton 2000). These tools of auditing are widely

accepted because of their reliability in the world of auditing. Results given these tools and

techniques never disappoint anyone.

Conclusion

Above is all what the audience wants to know about auditing procedure and its tools. After

observing all the relevant information about auditing process, tools etc, a thorough and a concise

conclusion has been prepared here. Auditing is a process that is really important for a firm to

conduct with a help of an auditor. Auditing is not possible, if proper tools of auditing are not

available. An auditor inspects all the accounts, transactions whether financial or of non financial

nature and after conducting a proper inspection, an auditor prepares a final true and clear

financial report about the firm that can be used by its owners, clients, or potential customers to

know the profitability of the organization.

Bibliography

Accountant, C 2017, ICAS, viewed 12 July 2017, <https://www.icas.com/ethics/ethical-standards-for-

auditors>.

Ajay, T 2013, 'Importance of ethics in Auditing ', Ph.D, Business Management, Panjab University, Kalyani

Publishers, Punjab.

Arif, R 2015, SlideShare, viewed 15th March 2015, <https://www.slideshare.net/osamarizvi/6-audit-

techniques>.

Barbasor 2012, 'The Best Accounting Information Systems', Sunday Business world, vol 1, no. 45, p. 1.

Brian, B 2000, Things to be inlcuded in auditing, 2nd edn, Cournet, France.

C L, CS 2017, 'Assurance & Auditing', Business & Tax liabilities , vol 1, no. 10, p. 5.

Canada, OOTAGO 2004, OAGC Canada, viewed 10th feburary 2015,

<http://www.oag-bvg.gc.ca/internet/English/att_20040306xe05_e_13231.html>.

Gurton, M 2000, 'Inspection Tools', in K Shimmon (ed.), Deep understandings of Audits and Assurance,

2nd edn, Becky Publishers, London.

highly important in the process of auditing as without these tools an auditor will not be able to

perform the inspection (Trinton 2017). Audit is done to prepare a true and clear financial report

of an organization and in absence of these technologies or tools an organization and an auditor

can’t prepare any financial report of the firm (Gurton 2000). These tools of auditing are widely

accepted because of their reliability in the world of auditing. Results given these tools and

techniques never disappoint anyone.

Conclusion

Above is all what the audience wants to know about auditing procedure and its tools. After

observing all the relevant information about auditing process, tools etc, a thorough and a concise

conclusion has been prepared here. Auditing is a process that is really important for a firm to

conduct with a help of an auditor. Auditing is not possible, if proper tools of auditing are not

available. An auditor inspects all the accounts, transactions whether financial or of non financial

nature and after conducting a proper inspection, an auditor prepares a final true and clear

financial report about the firm that can be used by its owners, clients, or potential customers to

know the profitability of the organization.

Bibliography

Accountant, C 2017, ICAS, viewed 12 July 2017, <https://www.icas.com/ethics/ethical-standards-for-

auditors>.

Ajay, T 2013, 'Importance of ethics in Auditing ', Ph.D, Business Management, Panjab University, Kalyani

Publishers, Punjab.

Arif, R 2015, SlideShare, viewed 15th March 2015, <https://www.slideshare.net/osamarizvi/6-audit-

techniques>.

Barbasor 2012, 'The Best Accounting Information Systems', Sunday Business world, vol 1, no. 45, p. 1.

Brian, B 2000, Things to be inlcuded in auditing, 2nd edn, Cournet, France.

C L, CS 2017, 'Assurance & Auditing', Business & Tax liabilities , vol 1, no. 10, p. 5.

Canada, OOTAGO 2004, OAGC Canada, viewed 10th feburary 2015,

<http://www.oag-bvg.gc.ca/internet/English/att_20040306xe05_e_13231.html>.

Gurton, M 2000, 'Inspection Tools', in K Shimmon (ed.), Deep understandings of Audits and Assurance,

2nd edn, Becky Publishers, London.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Investopedia 2015, viewed 28th April 2017,

<http://www.investopedia.com/terms/g/generalledger.asp>.

Joey, B 2014, 'How important is auditing', Property & Business, vol 3, no. 100, p. 20.

kallis, S 2003, 'Contents of Auditors report', City Entrepreanuer, vol 3, no. 5, pp. 4-5.

Karkol, K 2011, Risk Assessment in Auditing, 5th edn, U.K european piublishers, London.

Lotich, P 2017, Internal Audit Procedure, MB TV, Dhaka, viewed 15 june 2015,

<https://thethrivingsmallbusiness.com/internal-audit-8-step-process/>.

Singhania, V 2009, '45 different ethics of an auditors ', Mails Recovery, 5 july 2009, p. 2.

Trinton, M 2017, 'Sampling Techniques in Auditing', Business & Property, vol 32, no. 100, p. 2.

Winston, S 2000, 'Different Technologies & Tools of Auditing', Chartered Accountants Associations , vol

5, no. 100, pp. 50-60.

<http://www.investopedia.com/terms/g/generalledger.asp>.

Joey, B 2014, 'How important is auditing', Property & Business, vol 3, no. 100, p. 20.

kallis, S 2003, 'Contents of Auditors report', City Entrepreanuer, vol 3, no. 5, pp. 4-5.

Karkol, K 2011, Risk Assessment in Auditing, 5th edn, U.K european piublishers, London.

Lotich, P 2017, Internal Audit Procedure, MB TV, Dhaka, viewed 15 june 2015,

<https://thethrivingsmallbusiness.com/internal-audit-8-step-process/>.

Singhania, V 2009, '45 different ethics of an auditors ', Mails Recovery, 5 july 2009, p. 2.

Trinton, M 2017, 'Sampling Techniques in Auditing', Business & Property, vol 32, no. 100, p. 2.

Winston, S 2000, 'Different Technologies & Tools of Auditing', Chartered Accountants Associations , vol

5, no. 100, pp. 50-60.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.