Business Accounting: Ledger, Trial Balance, and Final Account Prep

VerifiedAdded on 2024/05/17

|28

|3579

|493

Report

AI Summary

This report provides a comprehensive overview of business accounting, covering essential concepts such as double-entry bookkeeping, sales and purchase transactions, and the preparation of a trial balance. It explains how to record sales and purchases in the general ledger and how to analyze these transactions to compile a trial balance effectively. The report further demonstrates the application of the balance-off rule to complete the ledger and prepares final accounts from the trial balance, adjusting for accruals, depreciation, and prepayments. It also produces final accounts for sole traders and limited companies and applies the bank reconciliation process. The report concludes with an explanation of the process for reconciling control accounts and clearing suspense accounts, demonstrating an understanding of different account types. Desklib offers a wealth of similar solved assignments and study resources for students.

NANA BUSINESS ACCOUNTING

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

[P1] Explain the double entry book-keeping sys debits and credits. Record Sales and Purchases

transactions in the general ledger [D1]............................................................................................4

[M1] Analyze the sales and the purchase transactions to compile a trial balance using the double-

entry bookkeeping appropriately and effectively............................................................................9

[P2] Produce a Trial Balance applying the use of the Balance Off rule to complete the ledger

[D1]................................................................................................................................................10

[P3] Prepare Final Accounts from the given trial balance figures adjusting for accruals,

depreciation, and prepayments [M2, D2]......................................................................................13

[P4] Produce Final Accounts for a range of examples that include sole-traders and limited

companies [D2]..............................................................................................................................17

[P5] Apply the bank reconciliation process to prepare a number of bank reconciliations............22

[P6] Explain the process taken to reconcile control accounts and clears suspense accounts........25

[M4, D4] Demonstrate an understanding of the different types of accounts.................................26

Conclusion.....................................................................................................................................27

References......................................................................................................................................28

2

Introduction......................................................................................................................................3

[P1] Explain the double entry book-keeping sys debits and credits. Record Sales and Purchases

transactions in the general ledger [D1]............................................................................................4

[M1] Analyze the sales and the purchase transactions to compile a trial balance using the double-

entry bookkeeping appropriately and effectively............................................................................9

[P2] Produce a Trial Balance applying the use of the Balance Off rule to complete the ledger

[D1]................................................................................................................................................10

[P3] Prepare Final Accounts from the given trial balance figures adjusting for accruals,

depreciation, and prepayments [M2, D2]......................................................................................13

[P4] Produce Final Accounts for a range of examples that include sole-traders and limited

companies [D2]..............................................................................................................................17

[P5] Apply the bank reconciliation process to prepare a number of bank reconciliations............22

[P6] Explain the process taken to reconcile control accounts and clears suspense accounts........25

[M4, D4] Demonstrate an understanding of the different types of accounts.................................26

Conclusion.....................................................................................................................................27

References......................................................................................................................................28

2

Introduction

The report aims to cover the various aspects relating to business accounting or more probably

financial accounting. As such, all the concepts are covered under this report. This accounting

process will facilitate the reader of the report to gain a better understanding of the scope and

ambit of the financial accounting. Accordingly, all the basic and fundamental tools of financial

accounting namely, sale and purchase transactions, statement depicting reconciliation of bank

balance with the cash book and similar ledgers and accounts. Besides, a brief understanding of

the preparation of different types of final accounts also known as financial statements. These

financial statements help the stakeholders to take various crucial decisions. As such these play a

major and prominent role for the prospective and existing investors. Recording correct

transactions and their preparation of trial balance will help to achieve the objective of preparation

of these financial statements.

3

The report aims to cover the various aspects relating to business accounting or more probably

financial accounting. As such, all the concepts are covered under this report. This accounting

process will facilitate the reader of the report to gain a better understanding of the scope and

ambit of the financial accounting. Accordingly, all the basic and fundamental tools of financial

accounting namely, sale and purchase transactions, statement depicting reconciliation of bank

balance with the cash book and similar ledgers and accounts. Besides, a brief understanding of

the preparation of different types of final accounts also known as financial statements. These

financial statements help the stakeholders to take various crucial decisions. As such these play a

major and prominent role for the prospective and existing investors. Recording correct

transactions and their preparation of trial balance will help to achieve the objective of preparation

of these financial statements.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

[P1] Explain the double entry book-keeping sys debits and credits. Record Sales and Purchases

transactions in the general ledger [D1].

Double entry book-keeping system is a system where every transaction has its debit and credit in

a corresponding manner and hence the two accounts are affected. The one account will be

debited along with the credit of the other account (Averkamp, 2018). The golden rule of the

accounting says ‘debit the receiver and credit the giver’. The double entry system was used

earlier in the middle ages and in the today’s scenario, the system has become the detailed system.

The system includes the entries for the sales, purchases, cash, etc. and then the two accounts are

affected, the journal entries are passed to the transactions. The posting in the ledger has been

done and afterward, the trial balance is prepared. The income statement and the balance sheet are

the last steps for the preparation of the financial accounts.

The case study:

On 1st April 2016, John started the business of selling the air conditioners with a capital of £ 30

lakhs. The entire capital was deposited in the bank after keeping the amount for the petty cashier.

On the same date, he entered into an agreement with The Air Conditioning Company to sell the

Air conditioners, bought them on a one-month credit basis.

During the year, he purchased the following assets making the payments through the bank:

Building- £ 2,500,000

Office Equipment’s- £ 200,000

Furniture- £ 150,000

Air Conditioners were to be sold for cash only and the cash proceeds were to be deposited in the

bank on the same day. All expenses except petty expenses were to be paid only by the bank. The

petty cashier was given £ 2,500 on 1st April 2016 under ‘Imprest System’. The petty cashier

would be reimbursed the actual expenses of the month on the first day of the next month before

depositing the sale proceeds of the day.

4

transactions in the general ledger [D1].

Double entry book-keeping system is a system where every transaction has its debit and credit in

a corresponding manner and hence the two accounts are affected. The one account will be

debited along with the credit of the other account (Averkamp, 2018). The golden rule of the

accounting says ‘debit the receiver and credit the giver’. The double entry system was used

earlier in the middle ages and in the today’s scenario, the system has become the detailed system.

The system includes the entries for the sales, purchases, cash, etc. and then the two accounts are

affected, the journal entries are passed to the transactions. The posting in the ledger has been

done and afterward, the trial balance is prepared. The income statement and the balance sheet are

the last steps for the preparation of the financial accounts.

The case study:

On 1st April 2016, John started the business of selling the air conditioners with a capital of £ 30

lakhs. The entire capital was deposited in the bank after keeping the amount for the petty cashier.

On the same date, he entered into an agreement with The Air Conditioning Company to sell the

Air conditioners, bought them on a one-month credit basis.

During the year, he purchased the following assets making the payments through the bank:

Building- £ 2,500,000

Office Equipment’s- £ 200,000

Furniture- £ 150,000

Air Conditioners were to be sold for cash only and the cash proceeds were to be deposited in the

bank on the same day. All expenses except petty expenses were to be paid only by the bank. The

petty cashier was given £ 2,500 on 1st April 2016 under ‘Imprest System’. The petty cashier

would be reimbursed the actual expenses of the month on the first day of the next month before

depositing the sale proceeds of the day.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

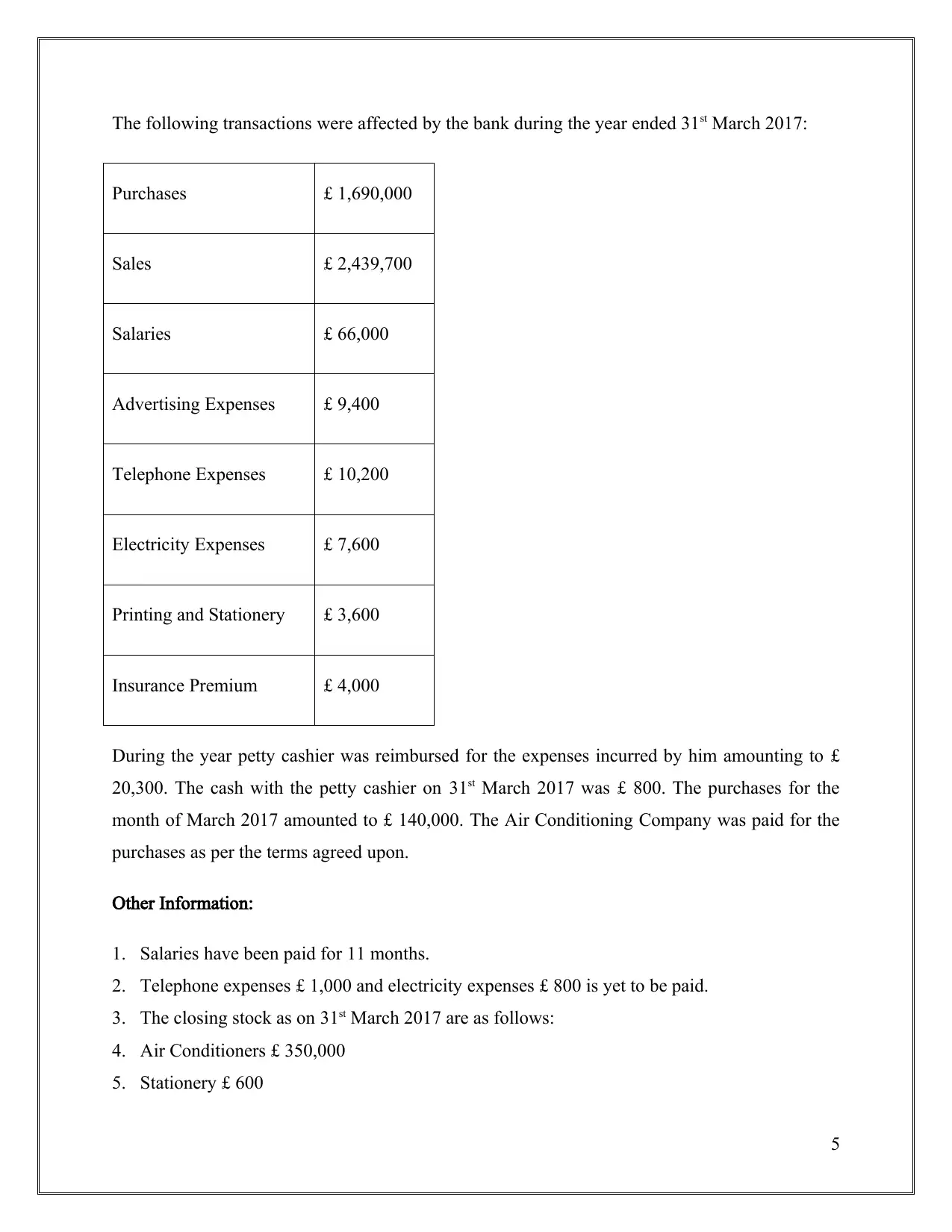

The following transactions were affected by the bank during the year ended 31st March 2017:

Purchases £ 1,690,000

Sales £ 2,439,700

Salaries £ 66,000

Advertising Expenses £ 9,400

Telephone Expenses £ 10,200

Electricity Expenses £ 7,600

Printing and Stationery £ 3,600

Insurance Premium £ 4,000

During the year petty cashier was reimbursed for the expenses incurred by him amounting to £

20,300. The cash with the petty cashier on 31st March 2017 was £ 800. The purchases for the

month of March 2017 amounted to £ 140,000. The Air Conditioning Company was paid for the

purchases as per the terms agreed upon.

Other Information:

1. Salaries have been paid for 11 months.

2. Telephone expenses £ 1,000 and electricity expenses £ 800 is yet to be paid.

3. The closing stock as on 31st March 2017 are as follows:

4. Air Conditioners £ 350,000

5. Stationery £ 600

5

Purchases £ 1,690,000

Sales £ 2,439,700

Salaries £ 66,000

Advertising Expenses £ 9,400

Telephone Expenses £ 10,200

Electricity Expenses £ 7,600

Printing and Stationery £ 3,600

Insurance Premium £ 4,000

During the year petty cashier was reimbursed for the expenses incurred by him amounting to £

20,300. The cash with the petty cashier on 31st March 2017 was £ 800. The purchases for the

month of March 2017 amounted to £ 140,000. The Air Conditioning Company was paid for the

purchases as per the terms agreed upon.

Other Information:

1. Salaries have been paid for 11 months.

2. Telephone expenses £ 1,000 and electricity expenses £ 800 is yet to be paid.

3. The closing stock as on 31st March 2017 are as follows:

4. Air Conditioners £ 350,000

5. Stationery £ 600

5

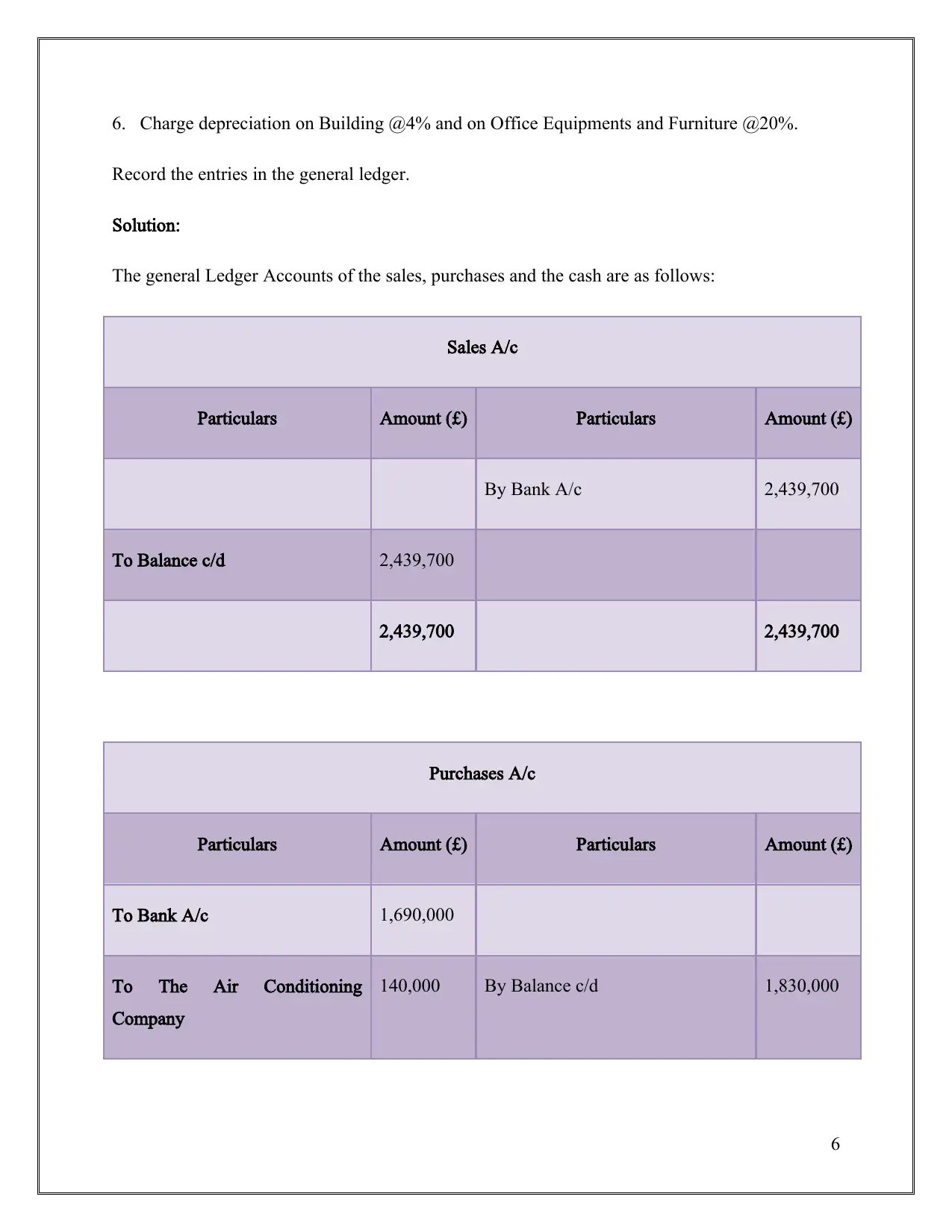

6. Charge depreciation on Building @4% and on Office Equipments and Furniture @20%.

Record the entries in the general ledger.

Solution:

The general Ledger Accounts of the sales, purchases and the cash are as follows:

Sales A/c

Particulars Amount (£) Particulars Amount (£)

By Bank A/c 2,439,700

To Balance c/d 2,439,700

2,439,700 2,439,700

Purchases A/c

Particulars Amount (£) Particulars Amount (£)

To Bank A/c 1,690,000

To The Air Conditioning

Company

140,000 By Balance c/d 1,830,000

6

Record the entries in the general ledger.

Solution:

The general Ledger Accounts of the sales, purchases and the cash are as follows:

Sales A/c

Particulars Amount (£) Particulars Amount (£)

By Bank A/c 2,439,700

To Balance c/d 2,439,700

2,439,700 2,439,700

Purchases A/c

Particulars Amount (£) Particulars Amount (£)

To Bank A/c 1,690,000

To The Air Conditioning

Company

140,000 By Balance c/d 1,830,000

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

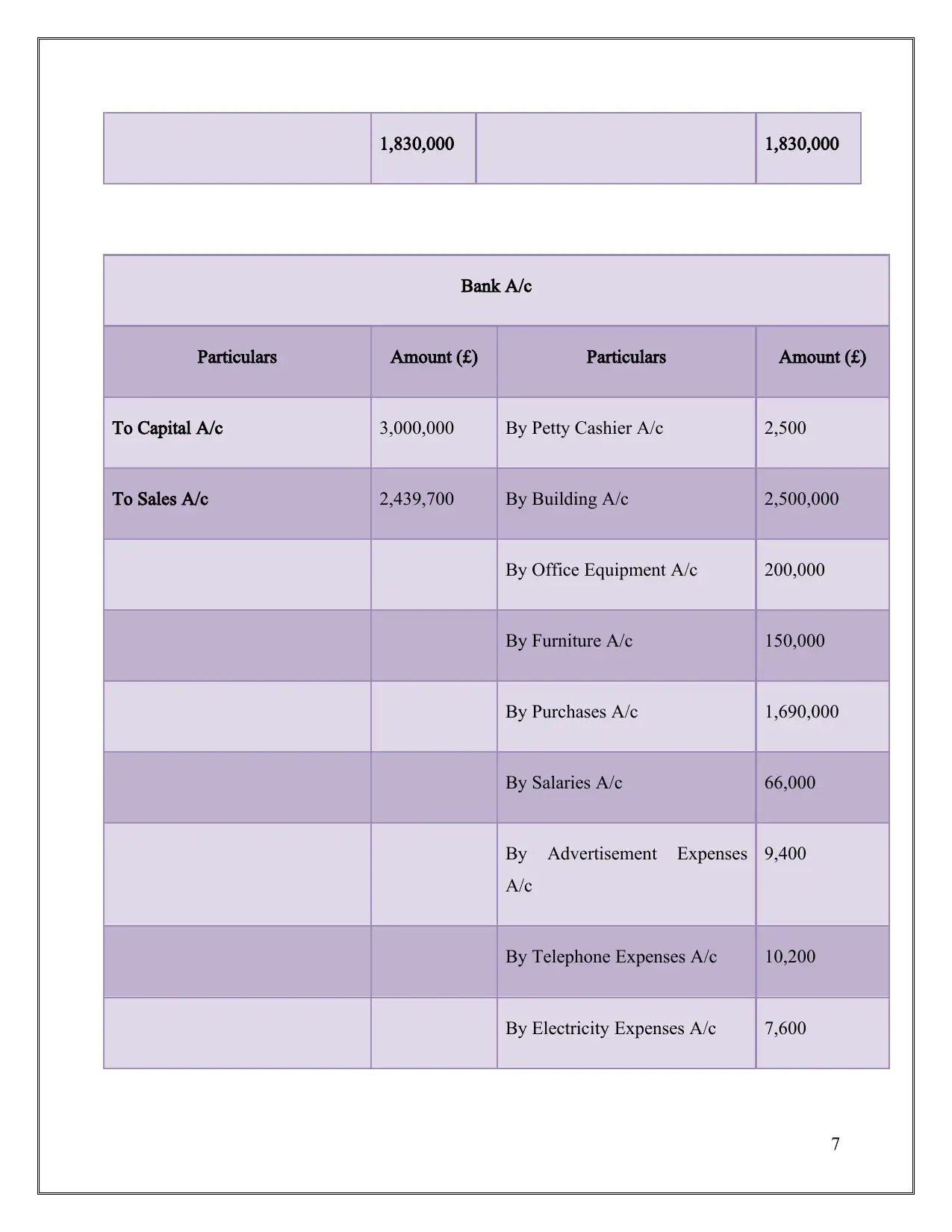

1,830,000 1,830,000

Bank A/c

Particulars Amount (£) Particulars Amount (£)

To Capital A/c 3,000,000 By Petty Cashier A/c 2,500

To Sales A/c 2,439,700 By Building A/c 2,500,000

By Office Equipment A/c 200,000

By Furniture A/c 150,000

By Purchases A/c 1,690,000

By Salaries A/c 66,000

By Advertisement Expenses

A/c

9,400

By Telephone Expenses A/c 10,200

By Electricity Expenses A/c 7,600

7

Bank A/c

Particulars Amount (£) Particulars Amount (£)

To Capital A/c 3,000,000 By Petty Cashier A/c 2,500

To Sales A/c 2,439,700 By Building A/c 2,500,000

By Office Equipment A/c 200,000

By Furniture A/c 150,000

By Purchases A/c 1,690,000

By Salaries A/c 66,000

By Advertisement Expenses

A/c

9,400

By Telephone Expenses A/c 10,200

By Electricity Expenses A/c 7,600

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

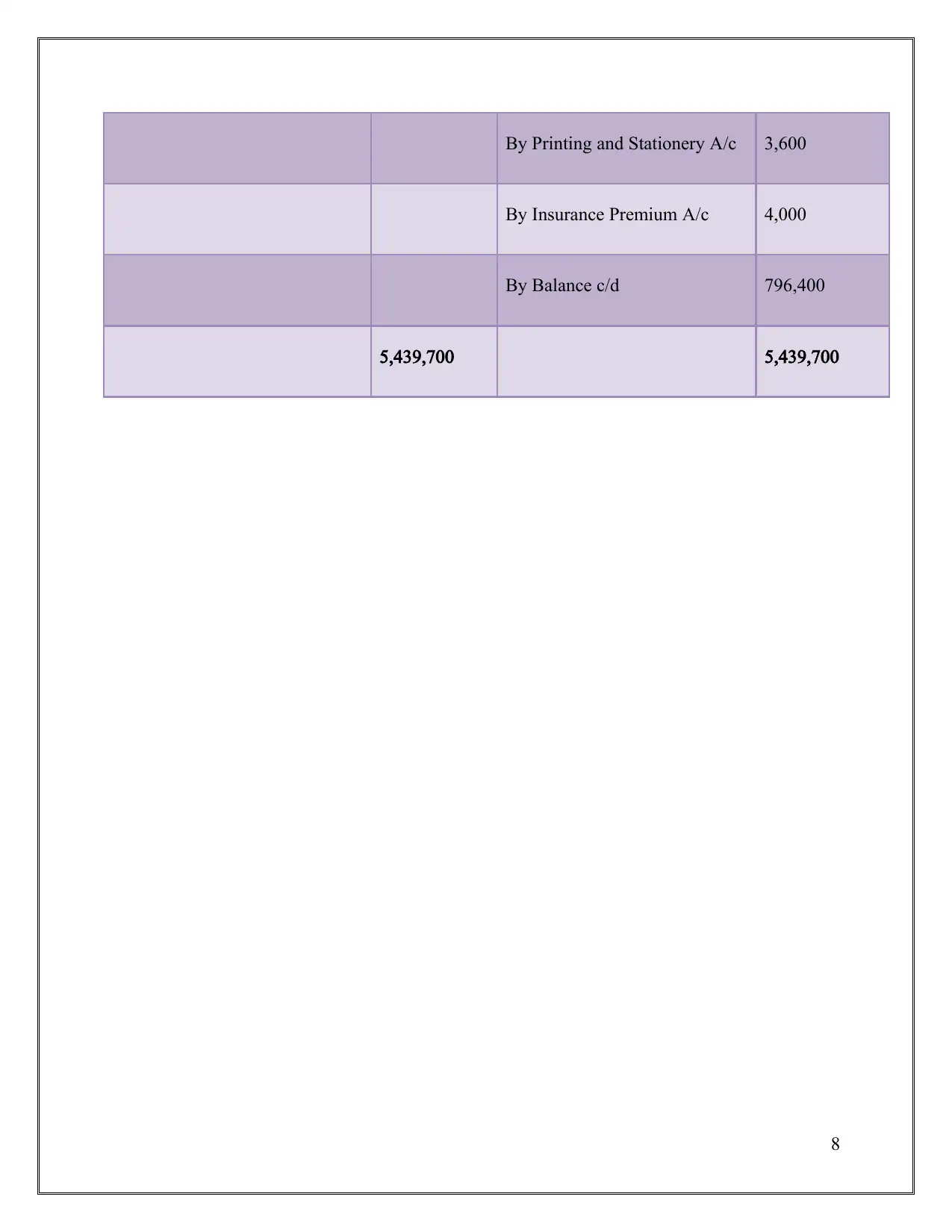

By Printing and Stationery A/c 3,600

By Insurance Premium A/c 4,000

By Balance c/d 796,400

5,439,700 5,439,700

8

By Insurance Premium A/c 4,000

By Balance c/d 796,400

5,439,700 5,439,700

8

[M1] Analyze the sales and the purchase transactions to compile a trial balance using the double-

entry bookkeeping appropriately and effectively.

The sales and the purchases account are prepared for the year and the balances are extracted from

the case study specified above. The sales and the purchases which have been done directly

through the bank are posted in the bank account and the sales and purchases which have been

done on credit basis have been posted in the sales and the purchase account respectively. The

double effect will be through the credit sales and the purchase since they will be posted to the

respective account along with the debtor and creditor account respectively.

9

entry bookkeeping appropriately and effectively.

The sales and the purchases account are prepared for the year and the balances are extracted from

the case study specified above. The sales and the purchases which have been done directly

through the bank are posted in the bank account and the sales and purchases which have been

done on credit basis have been posted in the sales and the purchase account respectively. The

double effect will be through the credit sales and the purchase since they will be posted to the

respective account along with the debtor and creditor account respectively.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

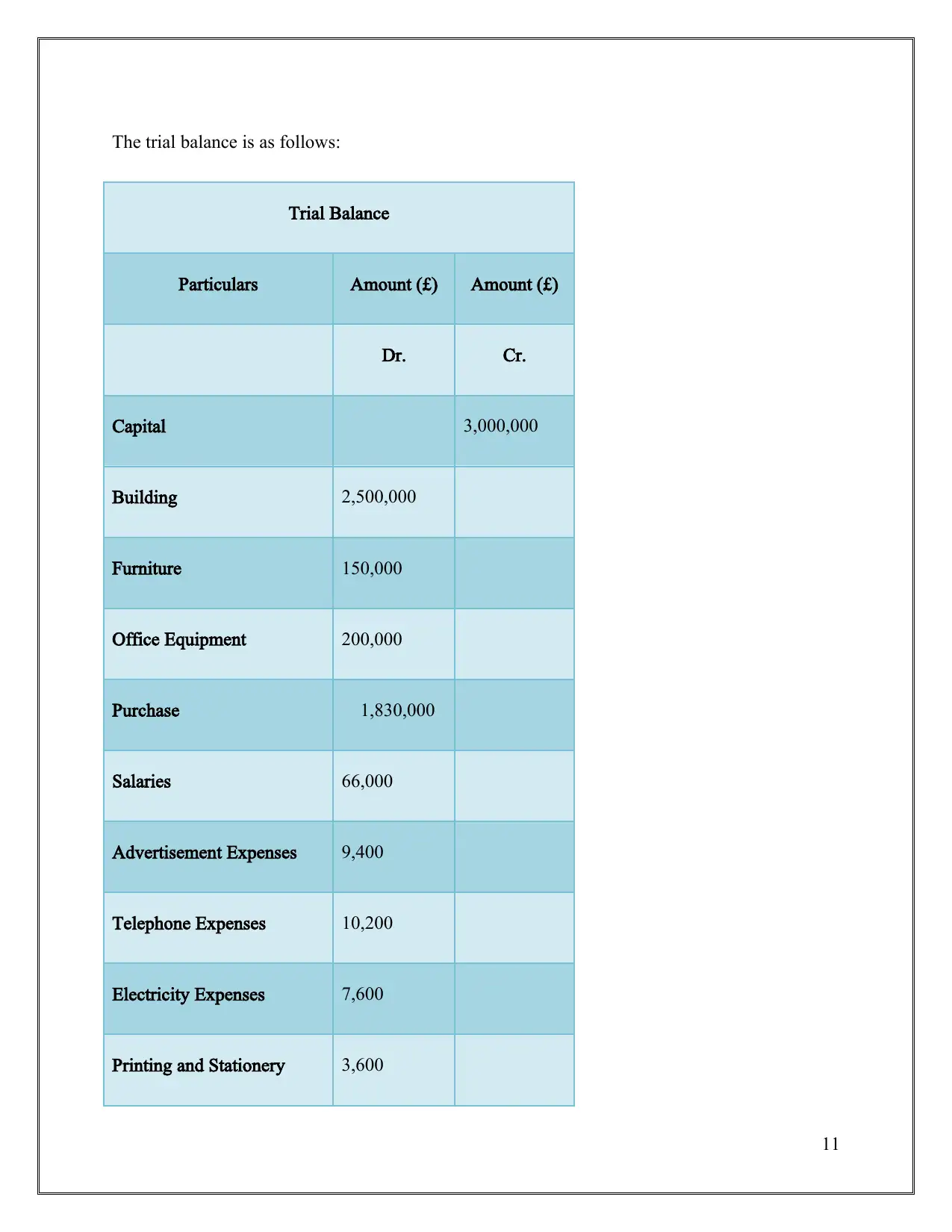

[P2] Produce a Trial Balance applying the use of the Balance Off rule to complete the ledger

[D1].

The trial balance is the presentation of the closing accounts of the ledger accounts on the

particular date. It is the first step which is used for the preparation of the financial accounts

which is prepared at the end of the year. It is a list of items which are prepared and the items of

debit and credit are recorded separately. If all the balances are recorded correctly then the trial

balance will be reconciled otherwise there will be a difference in the debit and credit amount.

The arithmetical accuracy of the general ledger has been checked with the preparation of the trial

balance and the rule of double entry system is verified if the balance of the trial balance is

reconciled. The importance of the trial balance is as follows:

Ensures that the amount of debit and credit are identical.

Ensures that the posting is correct and the trial balance has been prepared based on the

transactions.

The financial statements are prepared.

Ensures the balance is correct.

The prima facie evidence for the accuracy of the general ledger accounts.

The balance off rule is the process of totaling the debit and credit side of the account and the

difference amount is the balance which is posted on the trial balance. The difference amount is

shown as the amount carried down which will be carried forward to the next year (Leng &

Zhang, 2014). The amount is carried down for the permanent accounts like the asset, liability,

etc. and for the temporary accounts, the balances are carried forward to the profit and loss

account respectively like the income or the expenses account.

10

[D1].

The trial balance is the presentation of the closing accounts of the ledger accounts on the

particular date. It is the first step which is used for the preparation of the financial accounts

which is prepared at the end of the year. It is a list of items which are prepared and the items of

debit and credit are recorded separately. If all the balances are recorded correctly then the trial

balance will be reconciled otherwise there will be a difference in the debit and credit amount.

The arithmetical accuracy of the general ledger has been checked with the preparation of the trial

balance and the rule of double entry system is verified if the balance of the trial balance is

reconciled. The importance of the trial balance is as follows:

Ensures that the amount of debit and credit are identical.

Ensures that the posting is correct and the trial balance has been prepared based on the

transactions.

The financial statements are prepared.

Ensures the balance is correct.

The prima facie evidence for the accuracy of the general ledger accounts.

The balance off rule is the process of totaling the debit and credit side of the account and the

difference amount is the balance which is posted on the trial balance. The difference amount is

shown as the amount carried down which will be carried forward to the next year (Leng &

Zhang, 2014). The amount is carried down for the permanent accounts like the asset, liability,

etc. and for the temporary accounts, the balances are carried forward to the profit and loss

account respectively like the income or the expenses account.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The trial balance is as follows:

Trial Balance

Particulars Amount (£) Amount (£)

Dr. Cr.

Capital 3,000,000

Building 2,500,000

Furniture 150,000

Office Equipment 200,000

Purchase 1,830,000

Salaries 66,000

Advertisement Expenses 9,400

Telephone Expenses 10,200

Electricity Expenses 7,600

Printing and Stationery 3,600

11

Trial Balance

Particulars Amount (£) Amount (£)

Dr. Cr.

Capital 3,000,000

Building 2,500,000

Furniture 150,000

Office Equipment 200,000

Purchase 1,830,000

Salaries 66,000

Advertisement Expenses 9,400

Telephone Expenses 10,200

Electricity Expenses 7,600

Printing and Stationery 3,600

11

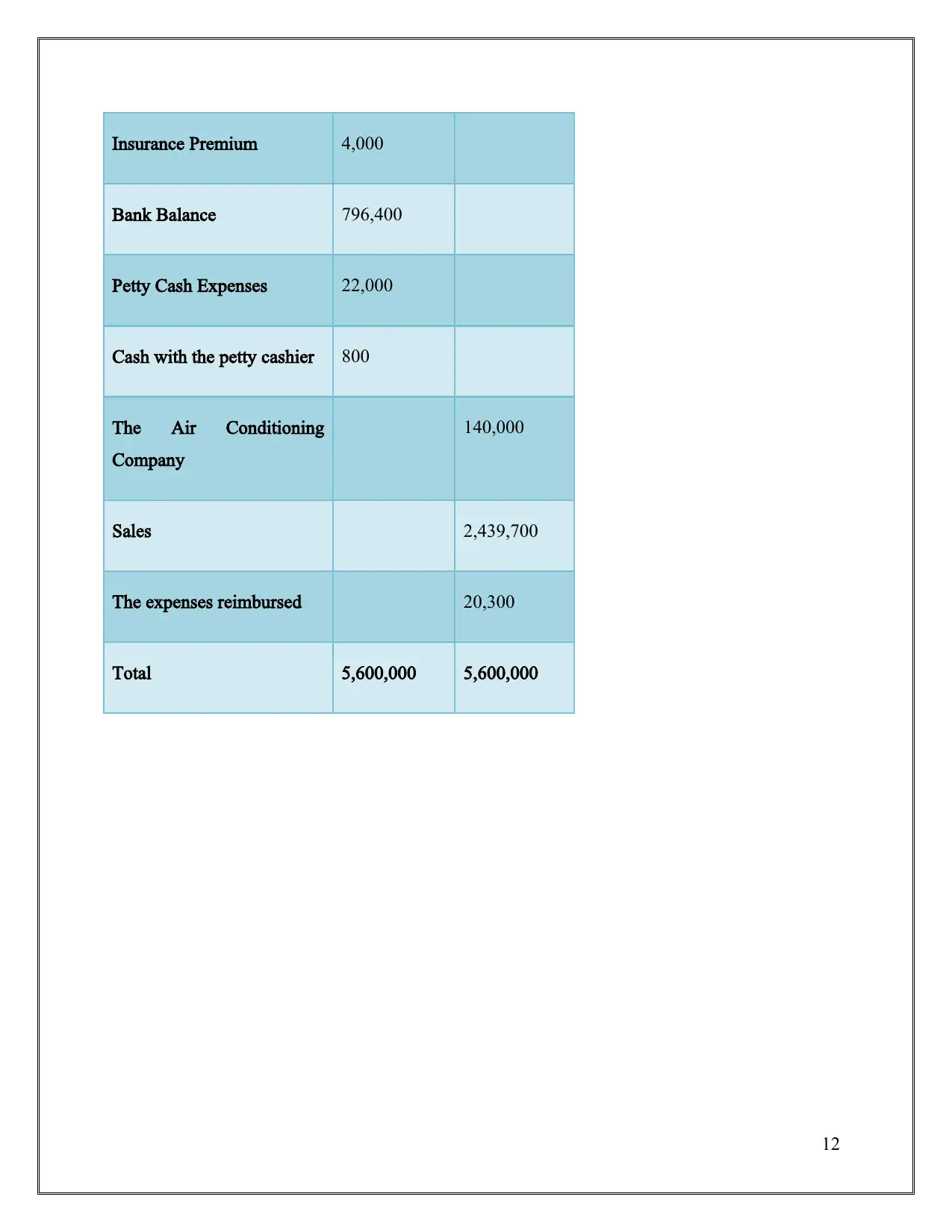

Insurance Premium 4,000

Bank Balance 796,400

Petty Cash Expenses 22,000

Cash with the petty cashier 800

The Air Conditioning

Company

140,000

Sales 2,439,700

The expenses reimbursed 20,300

Total 5,600,000 5,600,000

12

Bank Balance 796,400

Petty Cash Expenses 22,000

Cash with the petty cashier 800

The Air Conditioning

Company

140,000

Sales 2,439,700

The expenses reimbursed 20,300

Total 5,600,000 5,600,000

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.