Financial Analysis of Nestle: Accounting and Reporting

VerifiedAdded on 2023/06/17

|20

|3659

|260

AI Summary

This report provides a detailed analysis of Nestle's financial statements including consolidated statements of financial position, income statements, and cash flow statements for the year 2020. It also includes a discussion on the company's corporate governance mechanisms and ethics. The report covers topics such as the company's background, board of directors, committees, financial position, profitability, solvency, financial performance, and corporate governance mechanisms. The report is relevant for students studying accounting and finance courses in universities and colleges.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounting and Reporting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK ..............................................................................................................................................3

A. General assessment: Background detailing:...........................................................................3

B. Consolidated Statements of Financial Position 2020:............................................................8

C. Income Statements for 2020: (In appendices)......................................................................12

D. Cash Flow Statements for 2020:..........................................................................................12

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDICES...............................................................................................................................19

INTRODUCTION ..........................................................................................................................3

TASK ..............................................................................................................................................3

A. General assessment: Background detailing:...........................................................................3

B. Consolidated Statements of Financial Position 2020:............................................................8

C. Income Statements for 2020: (In appendices)......................................................................12

D. Cash Flow Statements for 2020:..........................................................................................12

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDICES...............................................................................................................................19

INTRODUCTION

The financial fundamentals are the recordance of organization's overall data collecting,

organising, classifying, analysing and communiting information about accountancy occasions

(Al-Ani, (2018)). This report has the inclusion of the all the commercial fiscal statements which

covers balance sheet, income portfolio, cashflow assessment, common-size, trend analysis and

ratios performance which shows the organizations performance, valuation and social

responsibility towards the nation. This also covers corporate governance mechanism of the

enterprises.

TASK

A. General assessment: Background detailing:

NESTLE is the UK based company, headquarters in United Kingdom (registered office), 1 City

place, Beehive Ring Road, London Gatwick Airport, west Sussex, RH6 0PA. The Nature of the

concern, it is a Food Business which contains the healthcare nutrition, milk & catering products

for the beverages, chocolates & confectionery items (Allen & Spialek, (2018)). The Income

Source for the company is to create loyal & trustworthy customers by providing them good

quality products and high valuation into the market share. The major Driven partners of its

Revenue are baby food, water & animal meal.

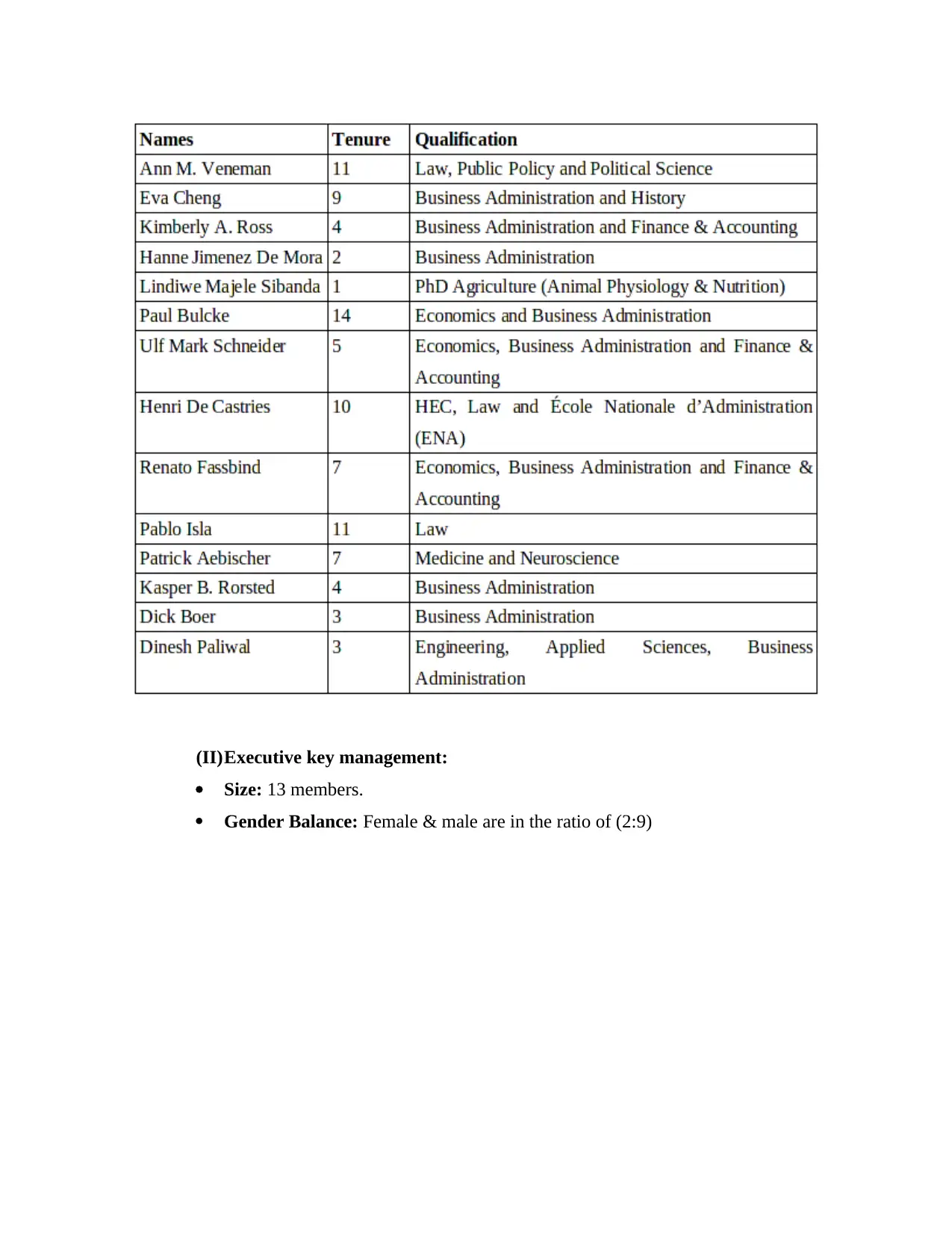

(I) Board of Directors:

→ Size: There are in total of 14 members with inclusion of males as well as females in the

company.

→ Gender Balance: There are gender imbalancement in the firm because females & males

directors are in the ratio of (5 : 9).

The financial fundamentals are the recordance of organization's overall data collecting,

organising, classifying, analysing and communiting information about accountancy occasions

(Al-Ani, (2018)). This report has the inclusion of the all the commercial fiscal statements which

covers balance sheet, income portfolio, cashflow assessment, common-size, trend analysis and

ratios performance which shows the organizations performance, valuation and social

responsibility towards the nation. This also covers corporate governance mechanism of the

enterprises.

TASK

A. General assessment: Background detailing:

NESTLE is the UK based company, headquarters in United Kingdom (registered office), 1 City

place, Beehive Ring Road, London Gatwick Airport, west Sussex, RH6 0PA. The Nature of the

concern, it is a Food Business which contains the healthcare nutrition, milk & catering products

for the beverages, chocolates & confectionery items (Allen & Spialek, (2018)). The Income

Source for the company is to create loyal & trustworthy customers by providing them good

quality products and high valuation into the market share. The major Driven partners of its

Revenue are baby food, water & animal meal.

(I) Board of Directors:

→ Size: There are in total of 14 members with inclusion of males as well as females in the

company.

→ Gender Balance: There are gender imbalancement in the firm because females & males

directors are in the ratio of (5 : 9).

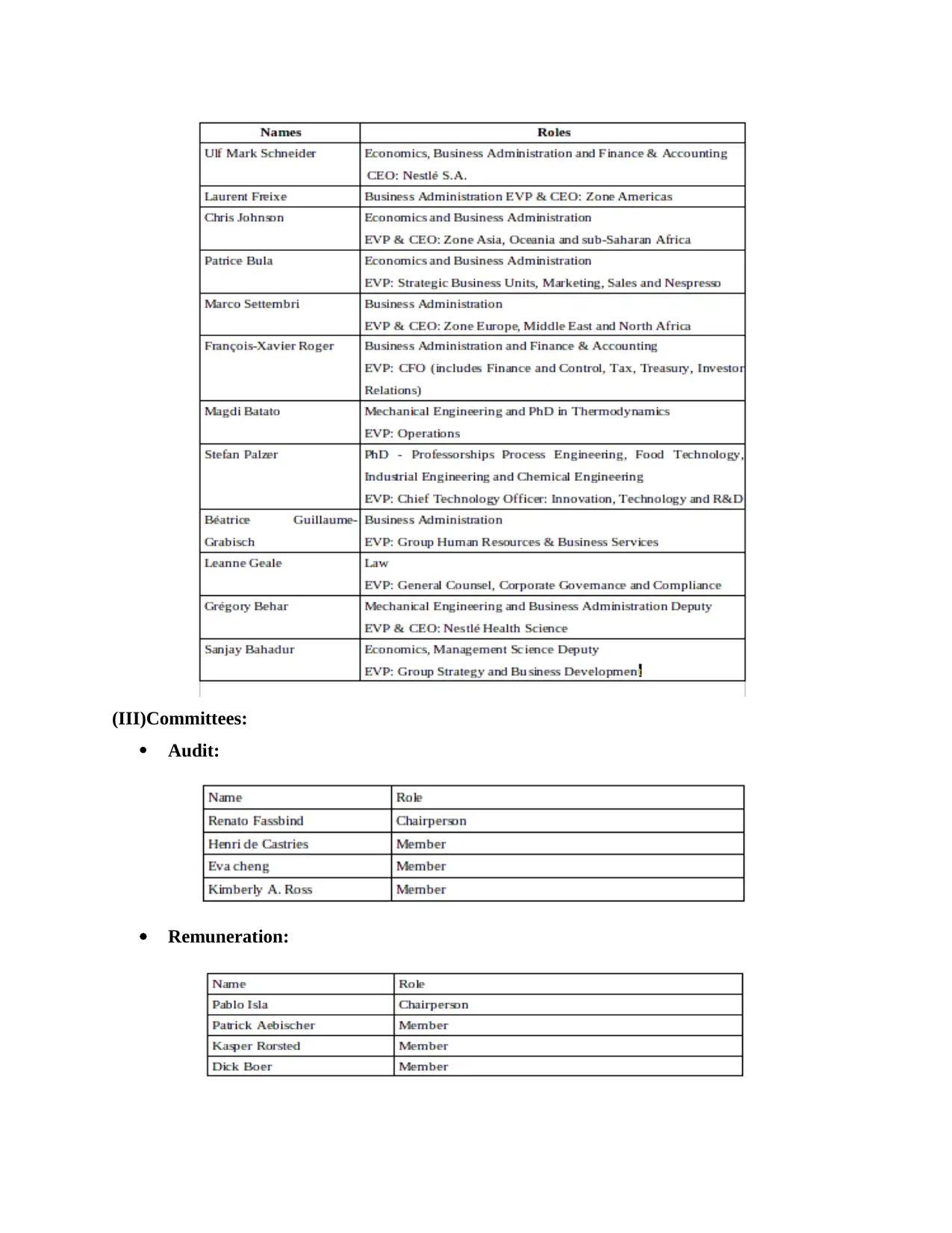

(II)Executive key management:

Size: 13 members.

Gender Balance: Female & male are in the ratio of (2:9)

Size: 13 members.

Gender Balance: Female & male are in the ratio of (2:9)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

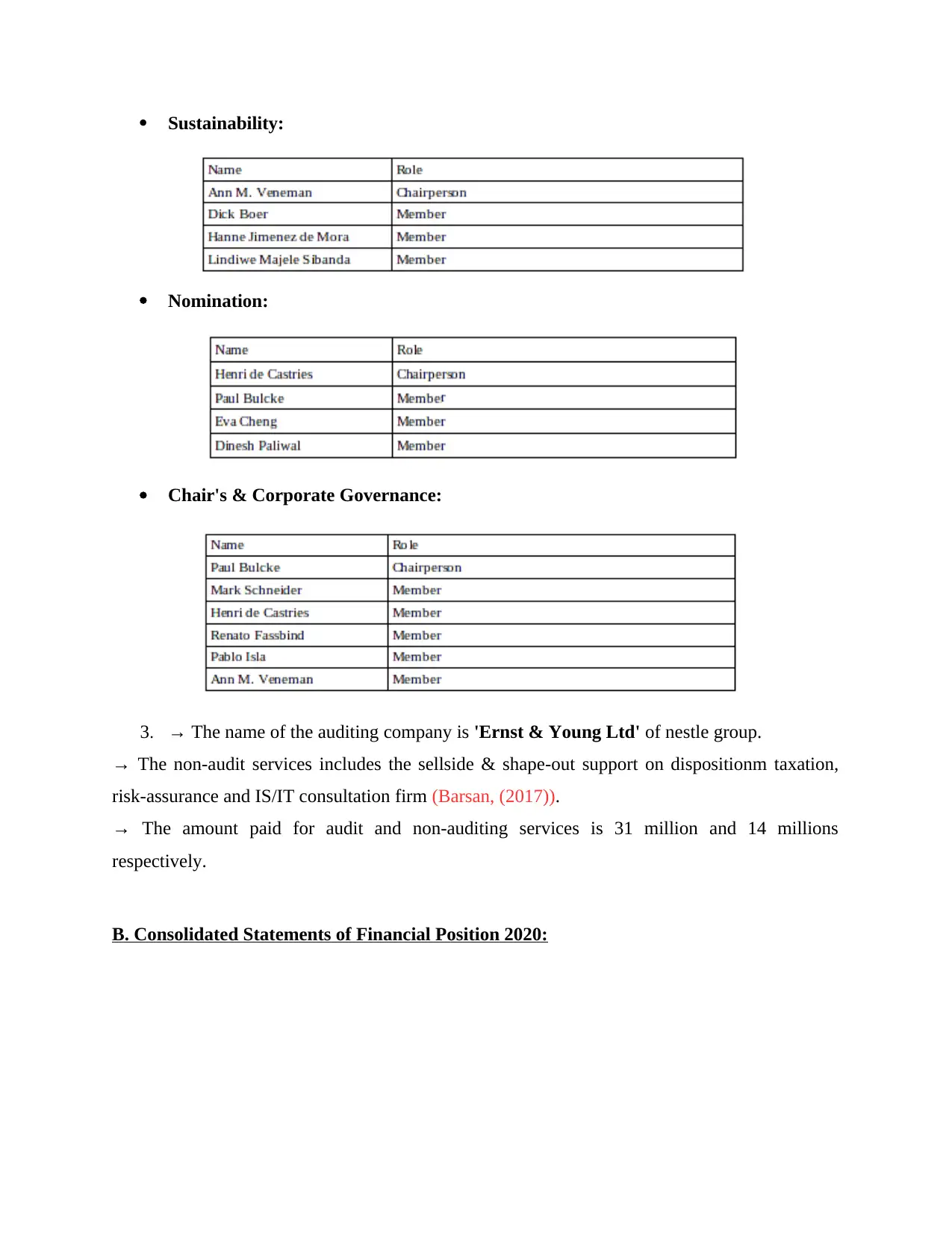

(III)Committees:

Audit:

Remuneration:

Audit:

Remuneration:

Sustainability:

Nomination:

Chair's & Corporate Governance:

3. → The name of the auditing company is 'Ernst & Young Ltd' of nestle group.

→ The non-audit services includes the sellside & shape-out support on dispositionm taxation,

risk-assurance and IS/IT consultation firm (Barsan, (2017)).

→ The amount paid for audit and non-auditing services is 31 million and 14 millions

respectively.

B. Consolidated Statements of Financial Position 2020:

Nomination:

Chair's & Corporate Governance:

3. → The name of the auditing company is 'Ernst & Young Ltd' of nestle group.

→ The non-audit services includes the sellside & shape-out support on dispositionm taxation,

risk-assurance and IS/IT consultation firm (Barsan, (2017)).

→ The amount paid for audit and non-auditing services is 31 million and 14 millions

respectively.

B. Consolidated Statements of Financial Position 2020:

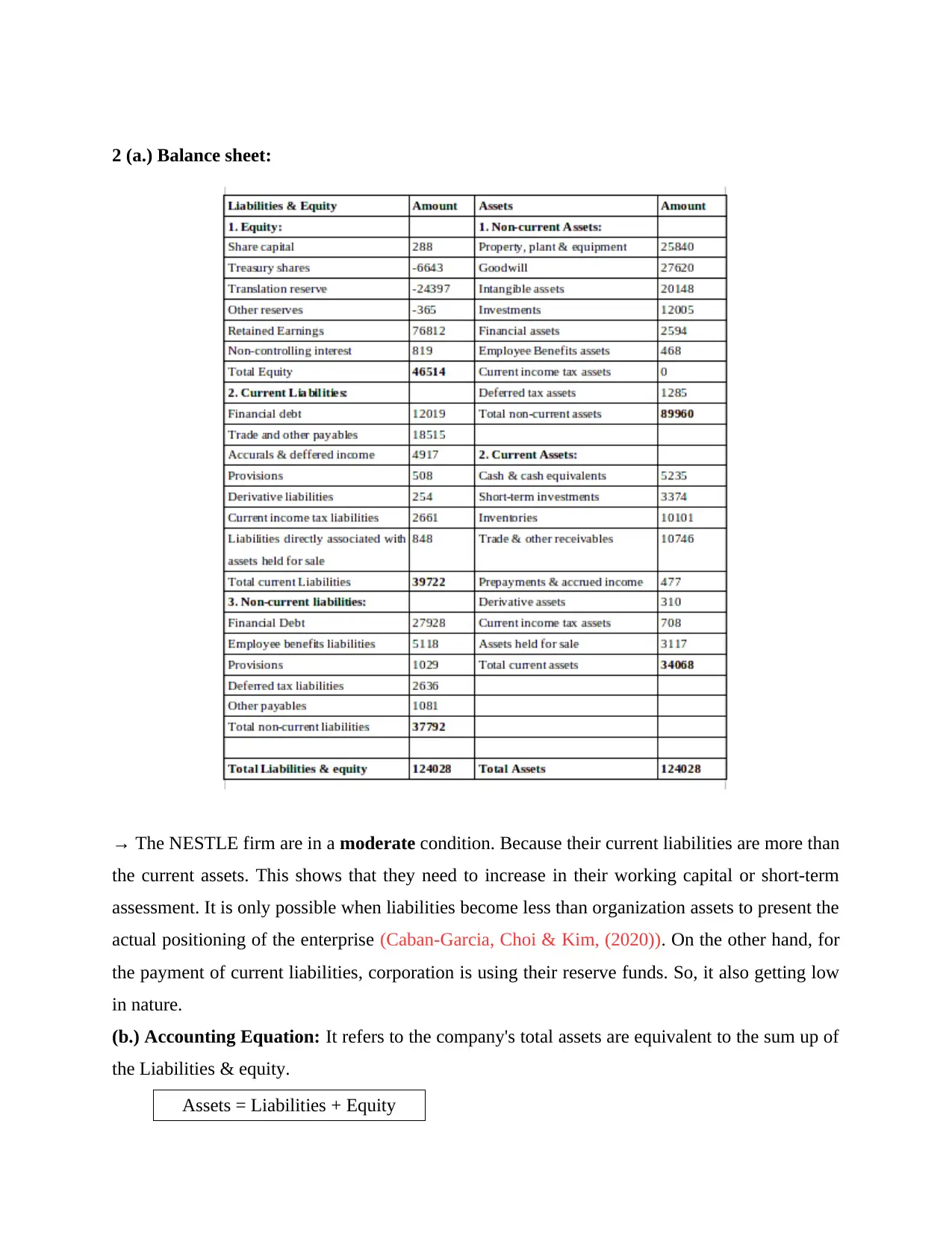

2 (a.) Balance sheet:

→ The NESTLE firm are in a moderate condition. Because their current liabilities are more than

the current assets. This shows that they need to increase in their working capital or short-term

assessment. It is only possible when liabilities become less than organization assets to present the

actual positioning of the enterprise (Caban-Garcia, Choi & Kim, (2020)). On the other hand, for

the payment of current liabilities, corporation is using their reserve funds. So, it also getting low

in nature.

(b.) Accounting Equation: It refers to the company's total assets are equivalent to the sum up of

the Liabilities & equity.

Assets = Liabilities + Equity

→ The NESTLE firm are in a moderate condition. Because their current liabilities are more than

the current assets. This shows that they need to increase in their working capital or short-term

assessment. It is only possible when liabilities become less than organization assets to present the

actual positioning of the enterprise (Caban-Garcia, Choi & Kim, (2020)). On the other hand, for

the payment of current liabilities, corporation is using their reserve funds. So, it also getting low

in nature.

(b.) Accounting Equation: It refers to the company's total assets are equivalent to the sum up of

the Liabilities & equity.

Assets = Liabilities + Equity

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

124028 = 77514 + 46514

3 (a.) → Current means things happened with short-term period and Non-current is not stated

or belonging with the present time scenario.

→ Major components:

Current Assets: It is the short-run items which can be transacted or sold or consumed

within the year or nearby financial year (Dimitras, Gaganis & Pasiouras, (2018)).

Current Liabilities: It is the estimation of any concern that are to be paid or settled in cash

to creditors within one year.

Non-current assets: It is the company's long-term investments which is not released with

the financial period.

Non-current liabilities: It is the considered to be long term debts which are not being

paid-off in shorter period or one year.

Equity Shareholder's: It represents the owner's investing power into the business which

shows the exact financing position of the company. It replicts the three main categories

that are: share capital, preferred shares and retained earnings.

→ The largest item of this balance sheet is 'Non-current assets' which give sense to the company

because they are obtaining huge investments and setting up the high standards of the

environment. They are illiquid in nature means cannot easily convertible into working capital.

(b.) → Working Capital: It is indicating the actual range between the short-term assets &

Liabilities of the organization and measure the overall efficiency (Fu and Su, 2021).

→Receivables:

The amount which will be receiving in future through Trade & other receivales is 10746.

→ Payables:

The amount which will be paid after some time by Trade & other payables is 18515.

→ Nature of the short & long term amount receivables & payables:

3 (a.) → Current means things happened with short-term period and Non-current is not stated

or belonging with the present time scenario.

→ Major components:

Current Assets: It is the short-run items which can be transacted or sold or consumed

within the year or nearby financial year (Dimitras, Gaganis & Pasiouras, (2018)).

Current Liabilities: It is the estimation of any concern that are to be paid or settled in cash

to creditors within one year.

Non-current assets: It is the company's long-term investments which is not released with

the financial period.

Non-current liabilities: It is the considered to be long term debts which are not being

paid-off in shorter period or one year.

Equity Shareholder's: It represents the owner's investing power into the business which

shows the exact financing position of the company. It replicts the three main categories

that are: share capital, preferred shares and retained earnings.

→ The largest item of this balance sheet is 'Non-current assets' which give sense to the company

because they are obtaining huge investments and setting up the high standards of the

environment. They are illiquid in nature means cannot easily convertible into working capital.

(b.) → Working Capital: It is indicating the actual range between the short-term assets &

Liabilities of the organization and measure the overall efficiency (Fu and Su, 2021).

→Receivables:

The amount which will be receiving in future through Trade & other receivales is 10746.

→ Payables:

The amount which will be paid after some time by Trade & other payables is 18515.

→ Nature of the short & long term amount receivables & payables:

The main characteristics of the account receives is that when it is due within the 12

months period, it is known as short-term and when it receives after 12 months or some other

time, it can be measure as the long-term assets. The major source of the business is to cover

Credit sales of products & services.

→ The important point of the amount payee is that when it pay-off by the firm within the

12 months, known as short-period and when it is paying after twelve months or a year, it

conductes as a long-period liabilities of the nature. It has induction of Credit purchase

(Giannarakis, Andronikidis & Sariannidis, (2020)).

The firm cannot pay its fully debt due to less availability of current assets or receivables

in the concern which causes inefficiency of funds and shows negative impact.

→ Net working capitalization:

Net Working Capital = Current Assets – Current Liabilities

NWC = 34068 – 39722 = -5654

Right now, it is showing negative impact of the financial health of the company. But if

the firm wants to keep improving this, they should do reservation of more cash amount and also

delay in the payments to suppliers to maintain & improvement in the working capital.

(c.)

→ Non-current Borrowings: By the sum up of financial debt, employee benefits liabilities,

provisions, deferred tax liabilities and other payable.

→ Current Borrowings: These are the total amount of financial debt, trade & other payables,

accurals & deferred income, provisions, derivative liabilities, current income tax liabilities,

associated with assets held for sale.

→ Relativity of the borrowing:

Current : 39722 / 77514 * 100 = 51.245%

Non-Current : 37792 / 77514 * 100 = 48.755%

The short-period borrrows are quiet higher than long-term.

(d.) Average Interest Rate: interest payments / Total debt * 100

= 1634 / 77514 * 100 = 2.11%

months period, it is known as short-term and when it receives after 12 months or some other

time, it can be measure as the long-term assets. The major source of the business is to cover

Credit sales of products & services.

→ The important point of the amount payee is that when it pay-off by the firm within the

12 months, known as short-period and when it is paying after twelve months or a year, it

conductes as a long-period liabilities of the nature. It has induction of Credit purchase

(Giannarakis, Andronikidis & Sariannidis, (2020)).

The firm cannot pay its fully debt due to less availability of current assets or receivables

in the concern which causes inefficiency of funds and shows negative impact.

→ Net working capitalization:

Net Working Capital = Current Assets – Current Liabilities

NWC = 34068 – 39722 = -5654

Right now, it is showing negative impact of the financial health of the company. But if

the firm wants to keep improving this, they should do reservation of more cash amount and also

delay in the payments to suppliers to maintain & improvement in the working capital.

(c.)

→ Non-current Borrowings: By the sum up of financial debt, employee benefits liabilities,

provisions, deferred tax liabilities and other payable.

→ Current Borrowings: These are the total amount of financial debt, trade & other payables,

accurals & deferred income, provisions, derivative liabilities, current income tax liabilities,

associated with assets held for sale.

→ Relativity of the borrowing:

Current : 39722 / 77514 * 100 = 51.245%

Non-Current : 37792 / 77514 * 100 = 48.755%

The short-period borrrows are quiet higher than long-term.

(d.) Average Interest Rate: interest payments / Total debt * 100

= 1634 / 77514 * 100 = 2.11%

Interest pay = 819 + 815 = 1634

Total debt = 39722+37792 = 77514

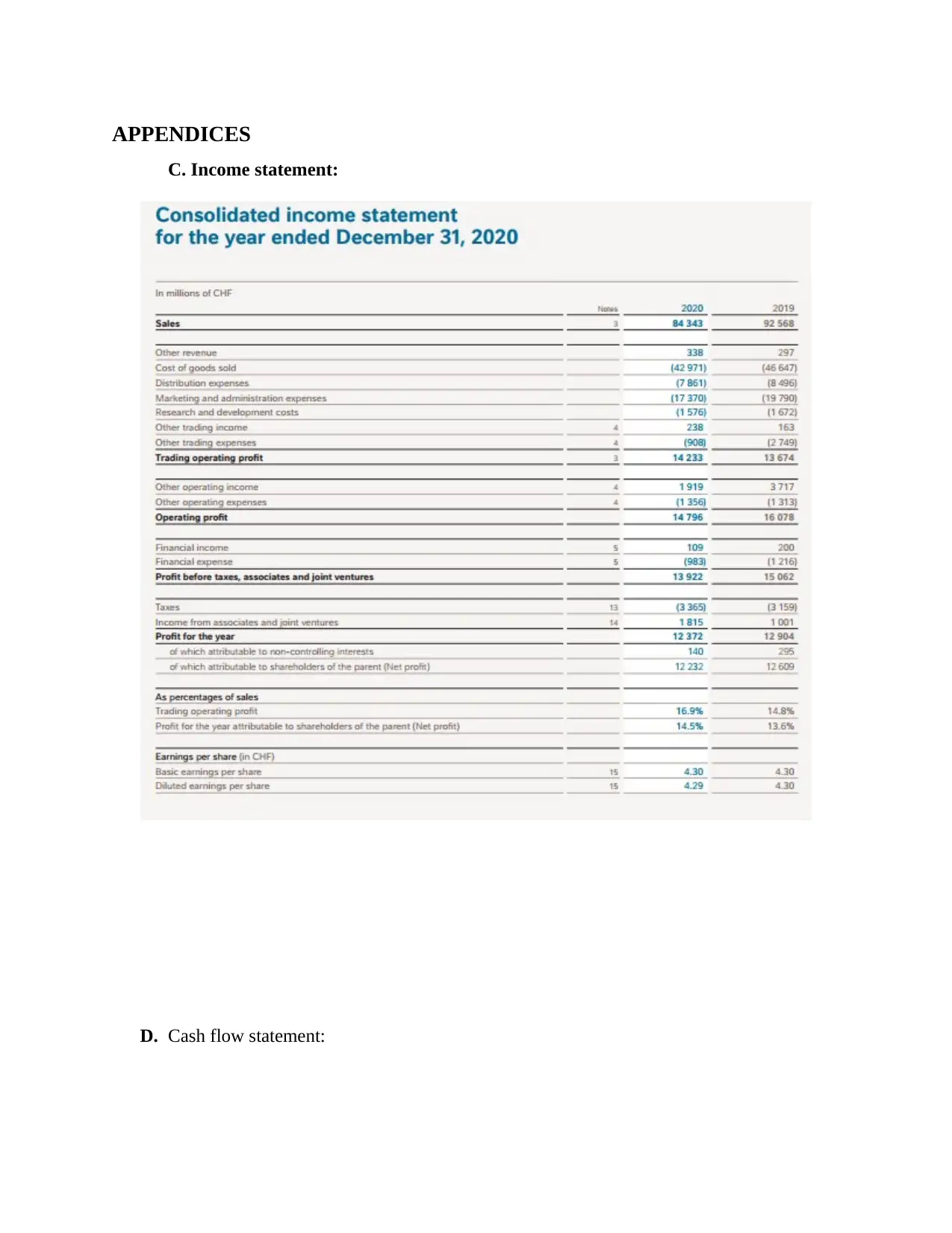

C. Income Statements for 2020: (In appendices)

1. Total revenue from business operations: 84343 + 338 = 84681 million

→ These are derived from the operation of Sales & Other Revenue.

2. Profit for the year: 12372 million

There are different types of profits available which are:

a. → Non-controlling interest = 140 millions

→ Net profit (shareholder's attribution) = 12232 millions

Note: These are different because they are generated after diminution of overall expenses.

b. Trading Operating Profit: This income is vary in nature because they are only occurring from

the drop-off of all functional criteria.

c. Operating Profit: This occurs only from the administration changes in the company.

→ The best one to use is the Net profit attributed to the shareholders funding because they are

showing the actual performance of the organization.

3. The NESTLE firm is less profitable from the previous year which is in (2020 – 12372

million & 2019 – 12904 million)

→ Majority of the earning in the year used:

Sales is the highest contributing portion of this period which is 84343 million.

After revenue, the second highest contribution in the net-earning is other operating

income which is 1919 million.

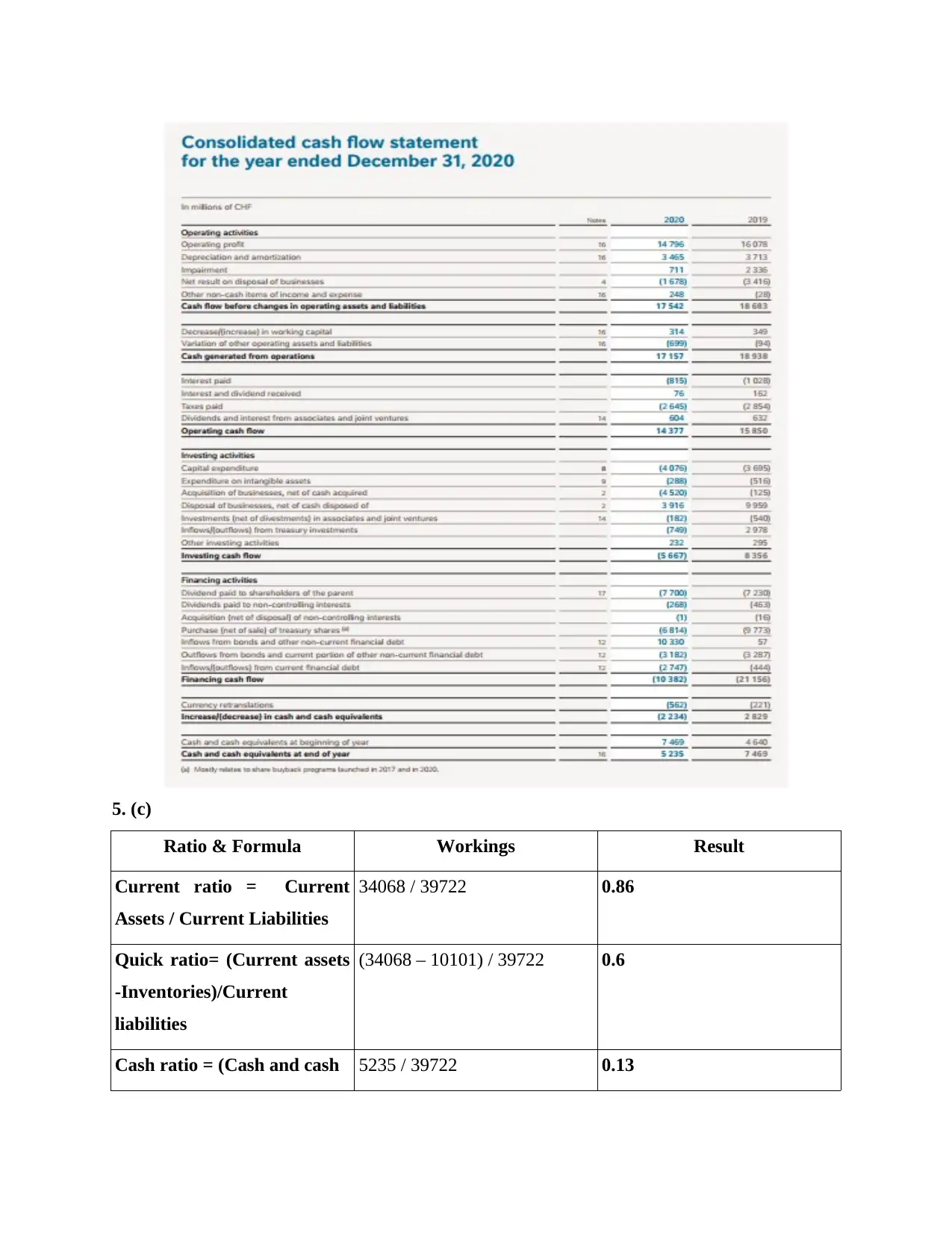

D. Cash Flow Statements for 2020:

A. 1. Net cash flows:

Operating Cash-flow = 14377 million

Investing Cash-flow = -5667 million

Financing Cash-flow = -10382 million

→ Total of these flows = (14377 – 5667 – 10382 ) = -1672 million

2. Majority in cash-inflow = Cash flow generated from Operating activity.

Total debt = 39722+37792 = 77514

C. Income Statements for 2020: (In appendices)

1. Total revenue from business operations: 84343 + 338 = 84681 million

→ These are derived from the operation of Sales & Other Revenue.

2. Profit for the year: 12372 million

There are different types of profits available which are:

a. → Non-controlling interest = 140 millions

→ Net profit (shareholder's attribution) = 12232 millions

Note: These are different because they are generated after diminution of overall expenses.

b. Trading Operating Profit: This income is vary in nature because they are only occurring from

the drop-off of all functional criteria.

c. Operating Profit: This occurs only from the administration changes in the company.

→ The best one to use is the Net profit attributed to the shareholders funding because they are

showing the actual performance of the organization.

3. The NESTLE firm is less profitable from the previous year which is in (2020 – 12372

million & 2019 – 12904 million)

→ Majority of the earning in the year used:

Sales is the highest contributing portion of this period which is 84343 million.

After revenue, the second highest contribution in the net-earning is other operating

income which is 1919 million.

D. Cash Flow Statements for 2020:

A. 1. Net cash flows:

Operating Cash-flow = 14377 million

Investing Cash-flow = -5667 million

Financing Cash-flow = -10382 million

→ Total of these flows = (14377 – 5667 – 10382 ) = -1672 million

2. Majority in cash-inflow = Cash flow generated from Operating activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. Greatest outflow from organization = Financing Activity.

4. It is not a healthy picture because investing & financial activity shows the higher outflow

of cash valuation which is impacted negatively.

B. → The primary cash-inflows for the company:

Operating profits: 14796 million which shows the highest inward of cash.

Inflows from Bonds and other non-current financial debt: 10330 million is the second

maximised inflow of the concern.

Note: We did not expected to see inflow from bonds & other debt from company because there

are many other options which can generate more earnings along with operating income (Handorf,

(2018)).

→ The Prime cash-outflow for the organization:

Dividend paid to shareholders: 7700 million is the highest outward supply going out of

the entity.

Purchase of Treasury shares: 6814 million is the 2nd highest outgoing money.

Note: Yes, we did expect dividend pay-outs to shareholder's is going high because their

expectation towards the conpany is also on top level. But we did not expected from treasury

shares buying scenario.

C. Cash recevied from sale of property, plant & equipment during the period is 3916 million.

D. → Profit make during the year = 12372 million

→ Availability of cash at the year-end = 5235 million

→ Relationship between profit and cash flow:

In operating activity, depreciation value is less compared to previous year transaction

which maximise the proft scenario,

In investing activity, other investment are showing inflow that means company is earning

from them.

In financing activity, inward supply of bonds & other debt doing well so that profit

automatically increases.

→ Reasons for differences:

4. It is not a healthy picture because investing & financial activity shows the higher outflow

of cash valuation which is impacted negatively.

B. → The primary cash-inflows for the company:

Operating profits: 14796 million which shows the highest inward of cash.

Inflows from Bonds and other non-current financial debt: 10330 million is the second

maximised inflow of the concern.

Note: We did not expected to see inflow from bonds & other debt from company because there

are many other options which can generate more earnings along with operating income (Handorf,

(2018)).

→ The Prime cash-outflow for the organization:

Dividend paid to shareholders: 7700 million is the highest outward supply going out of

the entity.

Purchase of Treasury shares: 6814 million is the 2nd highest outgoing money.

Note: Yes, we did expect dividend pay-outs to shareholder's is going high because their

expectation towards the conpany is also on top level. But we did not expected from treasury

shares buying scenario.

C. Cash recevied from sale of property, plant & equipment during the period is 3916 million.

D. → Profit make during the year = 12372 million

→ Availability of cash at the year-end = 5235 million

→ Relationship between profit and cash flow:

In operating activity, depreciation value is less compared to previous year transaction

which maximise the proft scenario,

In investing activity, other investment are showing inflow that means company is earning

from them.

In financing activity, inward supply of bonds & other debt doing well so that profit

automatically increases.

→ Reasons for differences:

In investing actions, inflow of previous year is good for the profitable situation but

current year, it is showing the huge outward supply.

In financing activity, present year situation is far better than previous year but still shows

the outwards supply in the firm.

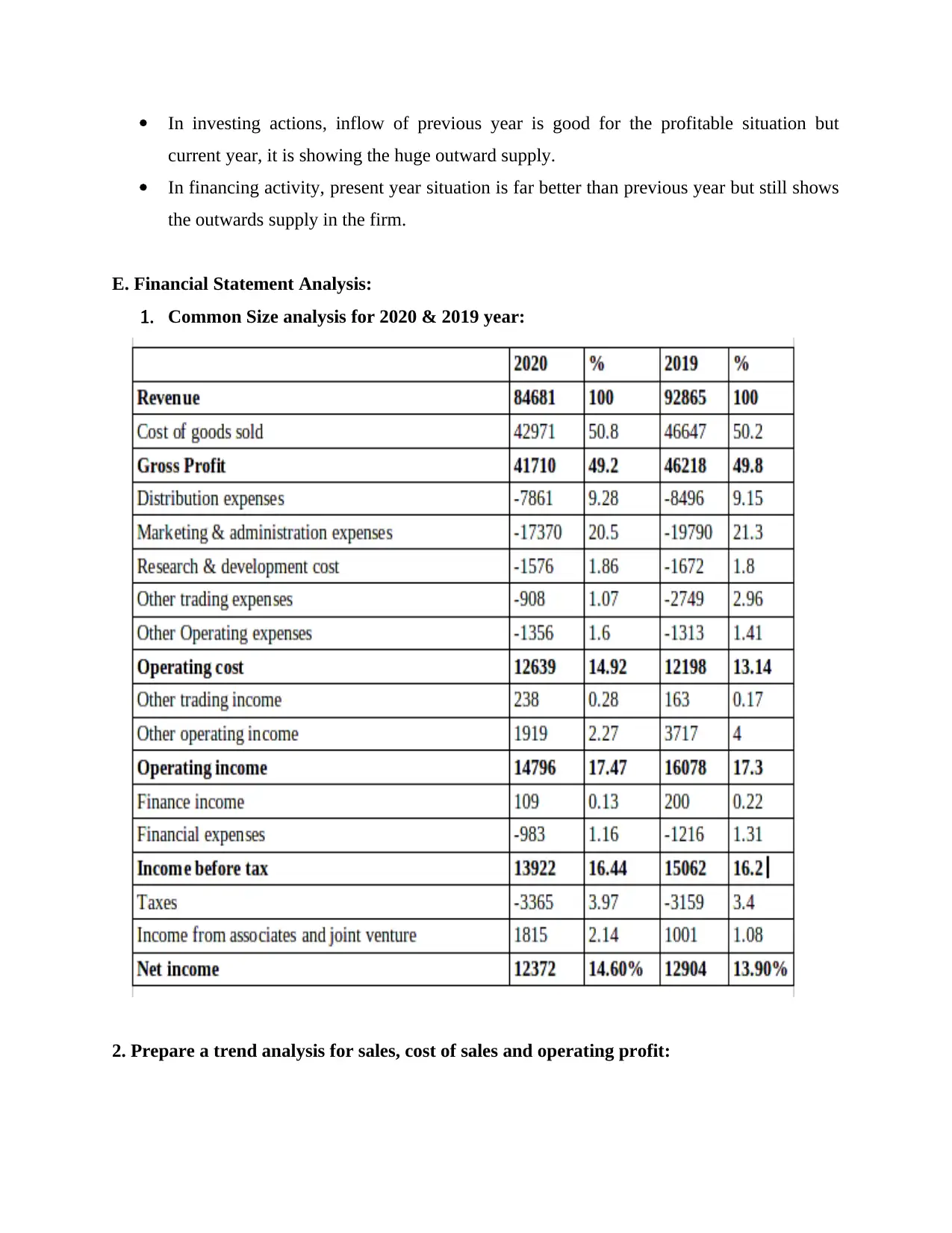

E. Financial Statement Analysis:

1. Common Size analysis for 2020 & 2019 year:

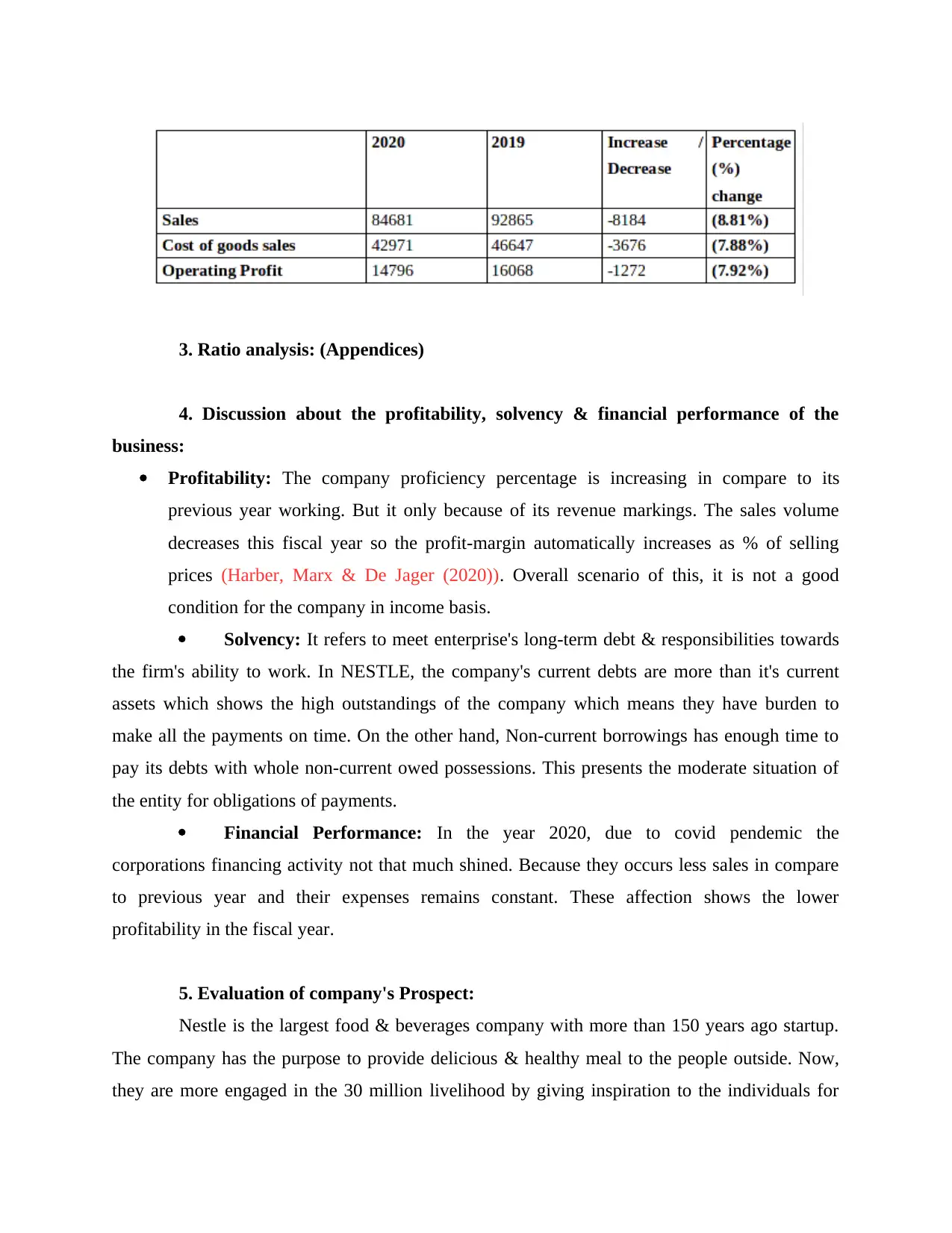

2. Prepare a trend analysis for sales, cost of sales and operating profit:

current year, it is showing the huge outward supply.

In financing activity, present year situation is far better than previous year but still shows

the outwards supply in the firm.

E. Financial Statement Analysis:

1. Common Size analysis for 2020 & 2019 year:

2. Prepare a trend analysis for sales, cost of sales and operating profit:

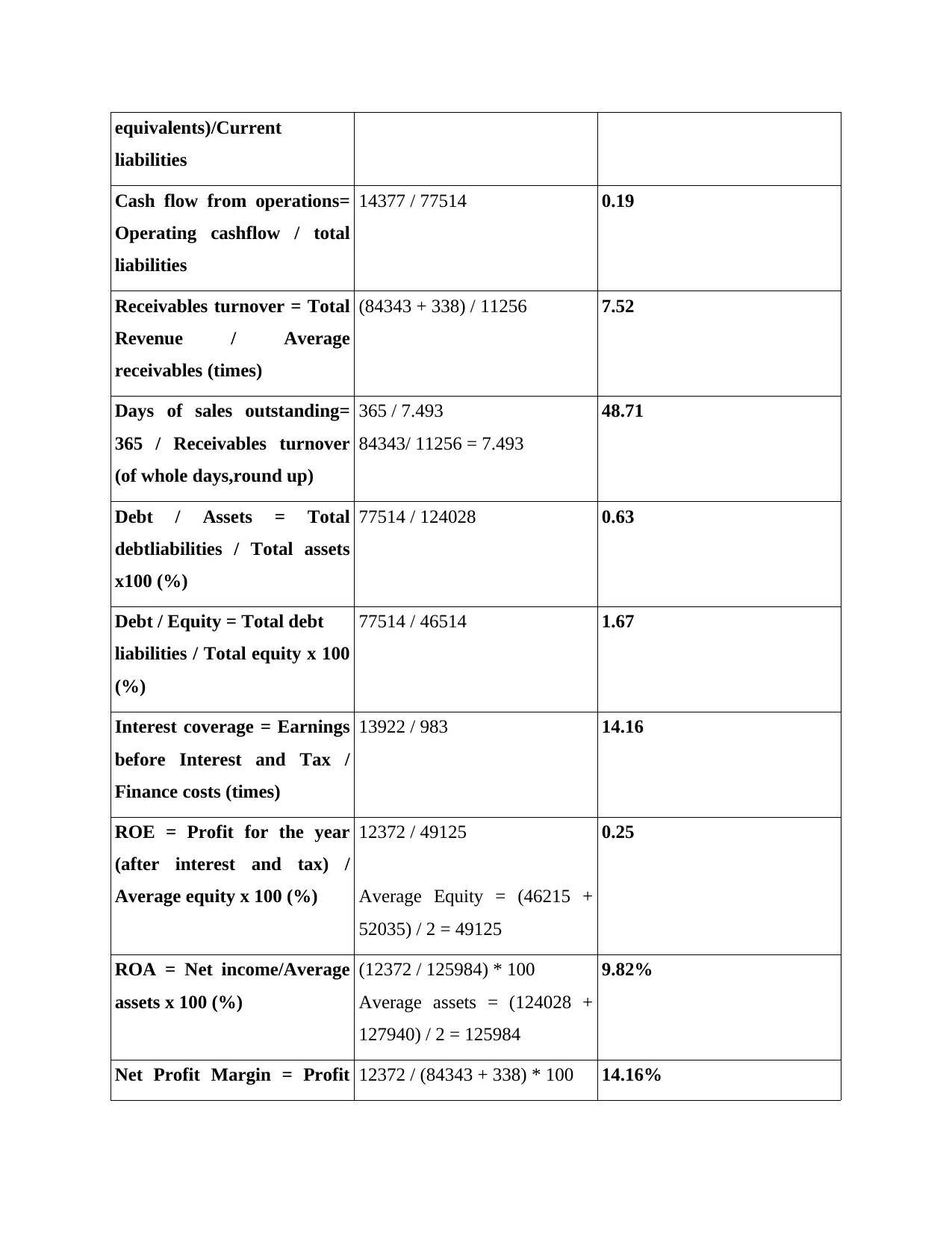

3. Ratio analysis: (Appendices)

4. Discussion about the profitability, solvency & financial performance of the

business:

Profitability: The company proficiency percentage is increasing in compare to its

previous year working. But it only because of its revenue markings. The sales volume

decreases this fiscal year so the profit-margin automatically increases as % of selling

prices (Harber, Marx & De Jager (2020)). Overall scenario of this, it is not a good

condition for the company in income basis.

Solvency: It refers to meet enterprise's long-term debt & responsibilities towards

the firm's ability to work. In NESTLE, the company's current debts are more than it's current

assets which shows the high outstandings of the company which means they have burden to

make all the payments on time. On the other hand, Non-current borrowings has enough time to

pay its debts with whole non-current owed possessions. This presents the moderate situation of

the entity for obligations of payments.

Financial Performance: In the year 2020, due to covid pendemic the

corporations financing activity not that much shined. Because they occurs less sales in compare

to previous year and their expenses remains constant. These affection shows the lower

profitability in the fiscal year.

5. Evaluation of company's Prospect:

Nestle is the largest food & beverages company with more than 150 years ago startup.

The company has the purpose to provide delicious & healthy meal to the people outside. Now,

they are more engaged in the 30 million livelihood by giving inspiration to the individuals for

4. Discussion about the profitability, solvency & financial performance of the

business:

Profitability: The company proficiency percentage is increasing in compare to its

previous year working. But it only because of its revenue markings. The sales volume

decreases this fiscal year so the profit-margin automatically increases as % of selling

prices (Harber, Marx & De Jager (2020)). Overall scenario of this, it is not a good

condition for the company in income basis.

Solvency: It refers to meet enterprise's long-term debt & responsibilities towards

the firm's ability to work. In NESTLE, the company's current debts are more than it's current

assets which shows the high outstandings of the company which means they have burden to

make all the payments on time. On the other hand, Non-current borrowings has enough time to

pay its debts with whole non-current owed possessions. This presents the moderate situation of

the entity for obligations of payments.

Financial Performance: In the year 2020, due to covid pendemic the

corporations financing activity not that much shined. Because they occurs less sales in compare

to previous year and their expenses remains constant. These affection shows the lower

profitability in the fiscal year.

5. Evaluation of company's Prospect:

Nestle is the largest food & beverages company with more than 150 years ago startup.

The company has the purpose to provide delicious & healthy meal to the people outside. Now,

they are more engaged in the 30 million livelihood by giving inspiration to the individuals for

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

their healthier & better life persona. Due to covid, their performance have some ups & downs but

they have sustainability & regular valued growth in the marketplace so they cover up all the

losses by hardly efforts. As the most leading business, they will be doing more attracted work

with teamwork for the benefit of the general as well as organizations interest.

F. Ethics & corporate governance:

1. Discussing and analysing the corporate governance structures and mechanisms in

place for nestle.

→ Corporate Governance deals with the management which has guidance & controllable

business strategies involved.

A. Strengths:

Good governance ensures the market performance & shares and economic development.

They have also done CSR activities for outside world (Nugroho & Ayem, (2021)).

The Nestle also have opportunity taking ability which shows higher capabilities of doing

things.

It has the most sustainable quality after so many ups & downs because of their workforce

environment.

B. Weaknesses:

Being a brand, they have numerous of controversies related to products quality. This

affects the regulation of the company.

Competitive marketplaces and new entrants fear of working.

C. Compliance with CG:

The organization have all the compilation with government of nation for the assests &

liability management, quality check-outs, cyber-risking and other legal matters which

shows the security and safety side of the firm.

2. Critisism about the sustainability of the business:

A. No, I do not agree with this critics because every organization wants sustainable nature at

present time. Because they eagerly want earnings, growth and great market share.

they have sustainability & regular valued growth in the marketplace so they cover up all the

losses by hardly efforts. As the most leading business, they will be doing more attracted work

with teamwork for the benefit of the general as well as organizations interest.

F. Ethics & corporate governance:

1. Discussing and analysing the corporate governance structures and mechanisms in

place for nestle.

→ Corporate Governance deals with the management which has guidance & controllable

business strategies involved.

A. Strengths:

Good governance ensures the market performance & shares and economic development.

They have also done CSR activities for outside world (Nugroho & Ayem, (2021)).

The Nestle also have opportunity taking ability which shows higher capabilities of doing

things.

It has the most sustainable quality after so many ups & downs because of their workforce

environment.

B. Weaknesses:

Being a brand, they have numerous of controversies related to products quality. This

affects the regulation of the company.

Competitive marketplaces and new entrants fear of working.

C. Compliance with CG:

The organization have all the compilation with government of nation for the assests &

liability management, quality check-outs, cyber-risking and other legal matters which

shows the security and safety side of the firm.

2. Critisism about the sustainability of the business:

A. No, I do not agree with this critics because every organization wants sustainable nature at

present time. Because they eagerly want earnings, growth and great market share.

B. The Nestle enterprises is hugely committed with the sustainability principles because so many

controversies did not affect it for grow and overcome with that. Example: Maggi, it had banned

previously but they show all the transparency about quality-checking and outcome with the

100% positive results and it again started with huge sales.

C. In my opinion, the large companies managers can reinforce good sustain practices because

they have all the facilities of promoting, using updated techniques and huge domestic & global

marketplace to shown up their products & services (Rashchupkina & Polenova, (2019)).

D. By recent complications & events, stakeholders may have changed view about sustainability

because of their unnotifies terminations, demotions, give less opportunity to them, high-cost &

low-qualitative production and have up-down share clearly shows the stakeholders have some

doubt upon it. But some companies have different scenarios after such events because they have

extreme growth in the marketing.

CONCLUSION

In the above scenarios, it can be concluded that Nestle firm has facing many positive &

negative impact in 2020. But by this sustainable, extreme hardwork and regular growth makes

them worth to sustain in the marketplace. In this report, we are engaged with financial

performances through various techniques and their corporate governance coding. This proves the

exact and doing well situation for the organization.

controversies did not affect it for grow and overcome with that. Example: Maggi, it had banned

previously but they show all the transparency about quality-checking and outcome with the

100% positive results and it again started with huge sales.

C. In my opinion, the large companies managers can reinforce good sustain practices because

they have all the facilities of promoting, using updated techniques and huge domestic & global

marketplace to shown up their products & services (Rashchupkina & Polenova, (2019)).

D. By recent complications & events, stakeholders may have changed view about sustainability

because of their unnotifies terminations, demotions, give less opportunity to them, high-cost &

low-qualitative production and have up-down share clearly shows the stakeholders have some

doubt upon it. But some companies have different scenarios after such events because they have

extreme growth in the marketing.

CONCLUSION

In the above scenarios, it can be concluded that Nestle firm has facing many positive &

negative impact in 2020. But by this sustainable, extreme hardwork and regular growth makes

them worth to sustain in the marketplace. In this report, we are engaged with financial

performances through various techniques and their corporate governance coding. This proves the

exact and doing well situation for the organization.

REFERENCES

Books and Journals

Al-Ani, M. K. S. (2018). Application of RODRIGO Model for the Preparation of Income

Statement on the Bases of the Structural-Secondary Profits: Field Study of the Published

Financial Reports of the National Bank of Bahrain 2009-2010. TANMIAT AL-

RAFIDAIN. 37(117).

Allen, M. W., & Spialek, M. L. (2018). Young millennials, environmental orientation, food

company sustainability, and green word-of-mouth recommendations. Journal of food

products marketing. 24(7). 803-829.

Barsan, I. (2017). Corporate accountability: non-financial disclosure and liability–A French

perspective. European Company and Financial Law Review. 14(3). 399-433.

Caban-Garcia, M. T., Choi, H., & Kim, M. (2020). The effects of operating cash flow disclosure

on earnings comparability, analysts' forecasts, and firms’ investment decisions during

the Pre-IFRS era. The British Accounting Review. 52(4). 100883.

Dimitras, A. I., Gaganis, C., & Pasiouras, F. (2018). Financial reporting standards' change and

the efficiency measures of EU banks. International Review of Financial Analysis. 59.

223-233.

Giannarakis, G., Andronikidis, A., & Sariannidis, N. (2020). Determinants of environmental

disclosure: investigating new and conventional corporate governance

characteristics. Annals of Operations Research. 294(1). 87-105.

Handorf, W. C. (2018). Implications of the Current Expected Credit Loss accounting

model. Journal of Banking Regulation. 19(3). 211-221.

Harber, M., Marx, B., & De Jager, P. (2020). The perceived financial effects of mandatory audit

firm rotation. Journal of International Financial Management & Accounting. 31(2).

215-234.

Nugroho, A. V., & Ayem, S. (2021). THE EFFECT OF THE IMPLEMENTATION OF E-

BUDGETING, FINANCIAL STATEMENT DISCLOSURE, AND INTERNAL

CONTROL ON REGIONAL FINANCIAL MANAGEMENT

TRANSPARENCY. ACCRUALS (Accounting Research Journal of Sutaatmadja). 5(02).

Rashchupkina, V. A., & Polenova, S. N. (2019). FEATURES OF THE ACCOUNTING IN

SOUTH KOREA. Форум молодых ученых. (1-1). 99-102.

Shu, P. G., & Chiang, S. J. (2020). The impact of corporate governance on corporate social

performance: Cases from listed firms in Taiwan. Pacific-Basin Finance Journal. 61.

101332.

West, S., Powell, D., & Fabian, I. (2021, September). Service Shop Performance Insights from

ERP Data. In IFIP International Conference on Advances in Production Management

System. (pp. 162-171). Springer, Cham.

Witjara, E. and et. al., (2019). The implication of business partnership, company asset and

strategic innovation to business valuation of digital industry in indonesia. Academy of

Strategic Management Journal. 18(1). 1-13.

Yoshikawa, E. and et. al., (2021). Role of resilience for the association between trait hostility

and depressive symptoms in Japanese company workers. Current Psychology. 40(5).

2301-2308.

Books and Journals

Al-Ani, M. K. S. (2018). Application of RODRIGO Model for the Preparation of Income

Statement on the Bases of the Structural-Secondary Profits: Field Study of the Published

Financial Reports of the National Bank of Bahrain 2009-2010. TANMIAT AL-

RAFIDAIN. 37(117).

Allen, M. W., & Spialek, M. L. (2018). Young millennials, environmental orientation, food

company sustainability, and green word-of-mouth recommendations. Journal of food

products marketing. 24(7). 803-829.

Barsan, I. (2017). Corporate accountability: non-financial disclosure and liability–A French

perspective. European Company and Financial Law Review. 14(3). 399-433.

Caban-Garcia, M. T., Choi, H., & Kim, M. (2020). The effects of operating cash flow disclosure

on earnings comparability, analysts' forecasts, and firms’ investment decisions during

the Pre-IFRS era. The British Accounting Review. 52(4). 100883.

Dimitras, A. I., Gaganis, C., & Pasiouras, F. (2018). Financial reporting standards' change and

the efficiency measures of EU banks. International Review of Financial Analysis. 59.

223-233.

Giannarakis, G., Andronikidis, A., & Sariannidis, N. (2020). Determinants of environmental

disclosure: investigating new and conventional corporate governance

characteristics. Annals of Operations Research. 294(1). 87-105.

Handorf, W. C. (2018). Implications of the Current Expected Credit Loss accounting

model. Journal of Banking Regulation. 19(3). 211-221.

Harber, M., Marx, B., & De Jager, P. (2020). The perceived financial effects of mandatory audit

firm rotation. Journal of International Financial Management & Accounting. 31(2).

215-234.

Nugroho, A. V., & Ayem, S. (2021). THE EFFECT OF THE IMPLEMENTATION OF E-

BUDGETING, FINANCIAL STATEMENT DISCLOSURE, AND INTERNAL

CONTROL ON REGIONAL FINANCIAL MANAGEMENT

TRANSPARENCY. ACCRUALS (Accounting Research Journal of Sutaatmadja). 5(02).

Rashchupkina, V. A., & Polenova, S. N. (2019). FEATURES OF THE ACCOUNTING IN

SOUTH KOREA. Форум молодых ученых. (1-1). 99-102.

Shu, P. G., & Chiang, S. J. (2020). The impact of corporate governance on corporate social

performance: Cases from listed firms in Taiwan. Pacific-Basin Finance Journal. 61.

101332.

West, S., Powell, D., & Fabian, I. (2021, September). Service Shop Performance Insights from

ERP Data. In IFIP International Conference on Advances in Production Management

System. (pp. 162-171). Springer, Cham.

Witjara, E. and et. al., (2019). The implication of business partnership, company asset and

strategic innovation to business valuation of digital industry in indonesia. Academy of

Strategic Management Journal. 18(1). 1-13.

Yoshikawa, E. and et. al., (2021). Role of resilience for the association between trait hostility

and depressive symptoms in Japanese company workers. Current Psychology. 40(5).

2301-2308.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDICES

C. Income statement:

D. Cash flow statement:

C. Income statement:

D. Cash flow statement:

5. (c)

Ratio & Formula Workings Result

Current ratio = Current

Assets / Current Liabilities

34068 / 39722 0.86

Quick ratio= (Current assets

-Inventories)/Current

liabilities

(34068 – 10101) / 39722 0.6

Cash ratio = (Cash and cash 5235 / 39722 0.13

Ratio & Formula Workings Result

Current ratio = Current

Assets / Current Liabilities

34068 / 39722 0.86

Quick ratio= (Current assets

-Inventories)/Current

liabilities

(34068 – 10101) / 39722 0.6

Cash ratio = (Cash and cash 5235 / 39722 0.13

equivalents)/Current

liabilities

Cash flow from operations=

Operating cashflow / total

liabilities

14377 / 77514 0.19

Receivables turnover = Total

Revenue / Average

receivables (times)

(84343 + 338) / 11256 7.52

Days of sales outstanding=

365 / Receivables turnover

(of whole days,round up)

365 / 7.493

84343/ 11256 = 7.493

48.71

Debt / Assets = Total

debtliabilities / Total assets

x100 (%)

77514 / 124028 0.63

Debt / Equity = Total debt

liabilities / Total equity x 100

(%)

77514 / 46514 1.67

Interest coverage = Earnings

before Interest and Tax /

Finance costs (times)

13922 / 983 14.16

ROE = Profit for the year

(after interest and tax) /

Average equity x 100 (%)

12372 / 49125

Average Equity = (46215 +

52035) / 2 = 49125

0.25

ROA = Net income/Average

assets x 100 (%)

(12372 / 125984) * 100

Average assets = (124028 +

127940) / 2 = 125984

9.82%

Net Profit Margin = Profit 12372 / (84343 + 338) * 100 14.16%

liabilities

Cash flow from operations=

Operating cashflow / total

liabilities

14377 / 77514 0.19

Receivables turnover = Total

Revenue / Average

receivables (times)

(84343 + 338) / 11256 7.52

Days of sales outstanding=

365 / Receivables turnover

(of whole days,round up)

365 / 7.493

84343/ 11256 = 7.493

48.71

Debt / Assets = Total

debtliabilities / Total assets

x100 (%)

77514 / 124028 0.63

Debt / Equity = Total debt

liabilities / Total equity x 100

(%)

77514 / 46514 1.67

Interest coverage = Earnings

before Interest and Tax /

Finance costs (times)

13922 / 983 14.16

ROE = Profit for the year

(after interest and tax) /

Average equity x 100 (%)

12372 / 49125

Average Equity = (46215 +

52035) / 2 = 49125

0.25

ROA = Net income/Average

assets x 100 (%)

(12372 / 125984) * 100

Average assets = (124028 +

127940) / 2 = 125984

9.82%

Net Profit Margin = Profit 12372 / (84343 + 338) * 100 14.16%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

for the year (after interest

and tax) / Total revenue x

100 (%)

and tax) / Total revenue x

100 (%)

1 out of 20

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)