MG670-144: Corporate Finance - Net Present Value Analysis

VerifiedAdded on 2022/08/24

|4

|514

|17

Homework Assignment

AI Summary

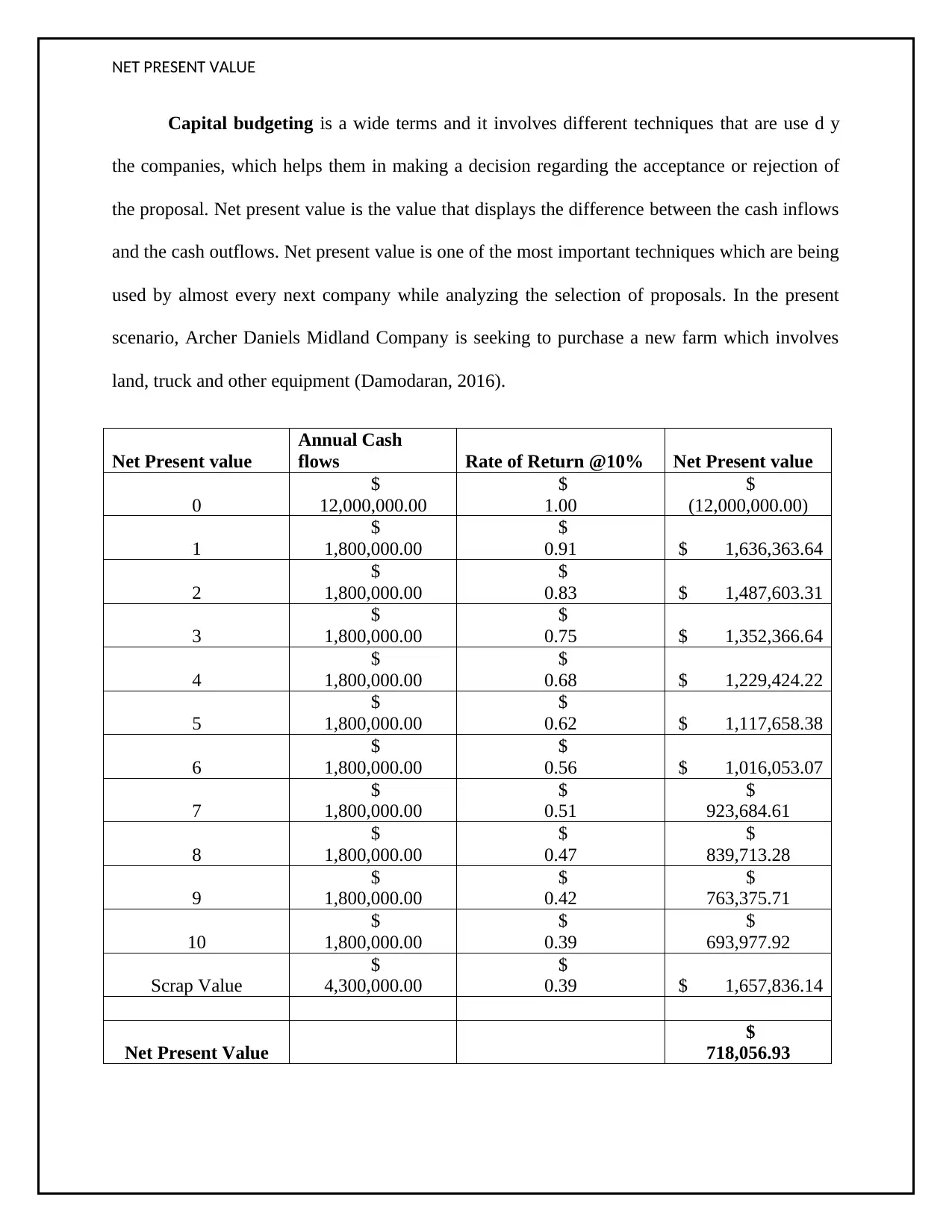

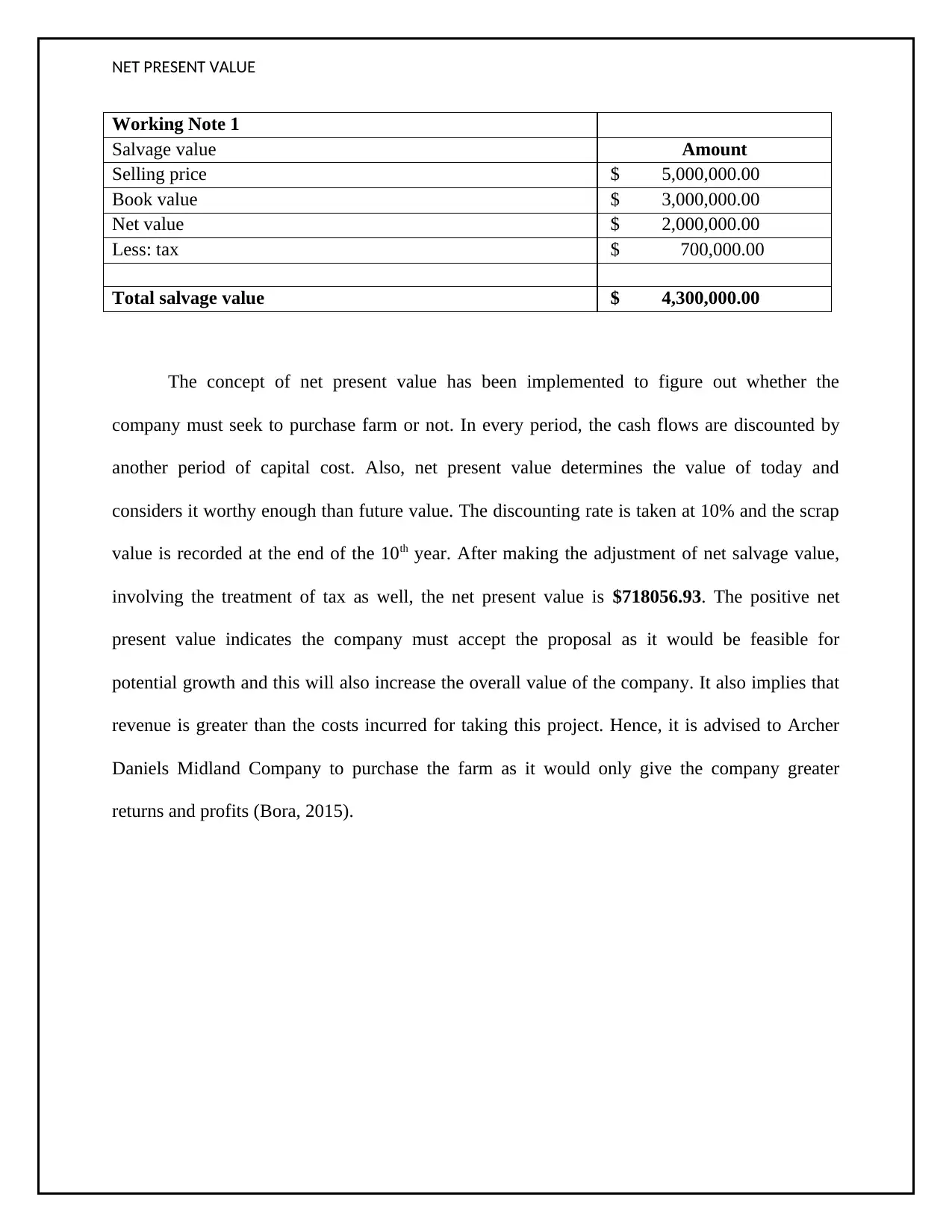

This assignment presents a Net Present Value (NPV) analysis for Archer Daniels Midland Company, evaluating the potential purchase of a new farm. The analysis calculates the present value of annual cash flows, considering a 10% discount rate and a scrap value at the end of the tenth year. The detailed calculations include the present value of each year's cash flow and the scrap value, resulting in a positive NPV of $718,056.93. The positive NPV suggests the company should accept the proposal as it indicates that the project is financially viable and will increase the overall value of the company. The document also references key concepts from corporate finance, including incremental after-tax free cash flows, and provides references to relevant academic sources.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)